Europe Poct Market

Taille du marché en milliards USD

TCAC :

%

USD

16.43 Billion

USD

33.65 Billion

2025

2033

USD

16.43 Billion

USD

33.65 Billion

2025

2033

| 2026 –2033 | |

| USD 16.43 Billion | |

| USD 33.65 Billion | |

|

|

|

|

Marché européen des tests de diagnostic au point de soins (POCT), par type de produit (produits de surveillance de la glycémie, produits de dépistage des maladies infectieuses, produits de surveillance cardiométabolique, produits de dépistage de la grossesse et de la fertilité, produits d'hématologie, produits de surveillance de la coagulation, produits de dépistage des drogues (DOA), produits d'analyse d'urine, produits de dosage du cholestérol, produits de dépistage des marqueurs tumoraux/cancer, produits de recherche de sang occulte dans les selles et autres), par plateforme (tests à flux latéral/tests immunochromatographiques, immunoessais, bandelettes réactives, diagnostic moléculaire, analyses de chimie clinique, microfluidique, hématologie et autres), par application (glycémie, maladies infectieuses, surveillance des signes vitaux, surveillance cardiaque, coagulation, hématologie, surveillance non invasive de la SpO2, transfusion sanguine, surveillance non invasive de la PCO2, analyse du sang total et autres). Par mode de prescription (tests sur ordonnance et tests en vente libre), par utilisateur final (hôpitaux, soins à domicile, cliniques, laboratoires, centres de diagnostic, laboratoires d'anatomopathologie, centres de chirurgie ambulatoire, établissements pour personnes âgées et autres), par canal de distribution (vente directe, vente au détail, vente en ligne et autres), par pays (Italie, Allemagne, France, Espagne, Royaume-Uni, Russie, Turquie, Belgique, Pays-Bas, Suisse, Suède, Danemark, Norvège, Finlande et reste de l'Europe) - Tendances du secteur et prévisions jusqu'en 2033

Taille du marché européen des tests au point de soins (POCT)

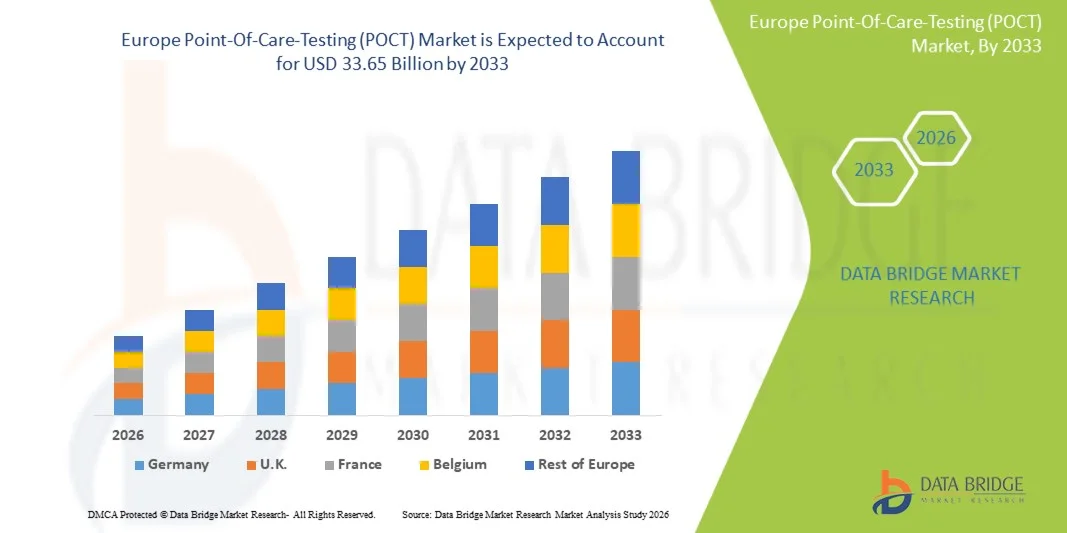

- Le marché européen des tests de diagnostic au point de soins (POCT) était évalué à 16,43 milliards de dollars en 2025 et devrait atteindre 33,65 milliards de dollars d'ici 2033 , avec un TCAC de 9,4 % au cours de la période de prévision.

- La croissance du marché européen des tests de diagnostic au point de soins (POCT) est principalement tirée par la demande croissante de solutions de diagnostic rapide permettant une prise de décision clinique immédiate et réduisant la dépendance aux analyses de laboratoire centralisées. Les dispositifs POCT permettent des délais d'obtention de résultats plus courts, une détection précoce des maladies et une amélioration des résultats pour les patients, autant d'éléments essentiels dans les soins d'urgence, la télémédecine et le suivi à domicile.

- La prévalence croissante de maladies chroniques telles que le diabète, les troubles cardiovasculaires, les maladies infectieuses et les affections respiratoires favorise l'adoption des dispositifs de diagnostic au point de soins (POCT) pour la surveillance et la prise en charge en temps réel. Par ailleurs, les progrès réalisés dans les technologies de diagnostic, la microfluidique, les biocapteurs et les plateformes de santé connectées améliorent la précision, la portabilité et les capacités d'intégration des données, stimulant ainsi la croissance du marché.

Analyse du marché européen des tests au point de soins (POCT)

- Le marché européen des tests au point de soins (POCT) est un segment en pleine expansion de l'industrie du diagnostic. Il offre des résultats de tests immédiats directement auprès des patients, notamment dans les cliniques, les hôpitaux, les ambulances et à domicile. Les dispositifs POCT permettent un dépistage et un suivi rapides de pathologies telles que le diabète, les maladies infectieuses, la grossesse, les marqueurs cardiaques, les déséquilibres électrolytiques et les paramètres de coagulation, ce qui améliore l'efficacité clinique et allège la charge pesant sur le système de santé.

- La demande croissante de technologies de diagnostic portables et conviviales est principalement due à la hausse de la prévalence des maladies chroniques, aux besoins en soins d'urgence et au développement du suivi des patients à domicile. Par ailleurs, l'intégration des plateformes de santé numérique, des diagnostics sur smartphone, de la détection par intelligence artificielle et de la connectivité sans fil améliore la traçabilité des données et la gestion à distance des patients, contribuant ainsi à la croissance du marché.

- L'Allemagne devrait dominer le marché européen des tests au point de soins (POCT) avec la plus grande part de revenus d'environ 28,50 % en 2026, grâce à la forte présence d'acteurs clés du marché, aux dépenses de santé élevées, à une infrastructure médicale avancée et à l'adoption croissante de technologies de diagnostic innovantes dans les hôpitaux et les environnements de soins à domicile.

- Le segment des produits de surveillance de la glycémie devrait dominer le marché européen des tests de diagnostic au point de soins (POCT) avec une part importante de plus de 39,44 % en 2026, sous l'effet de la hausse de la population diabétique, de la préférence pour les dispositifs de surveillance en temps réel et de l'utilisation croissante des glucomètres portables et des outils de surveillance continue de la glycémie chez les patients bénéficiant de soins à domicile.

Portée du rapport et segmentation du marché européen des tests au point de service (POCT)

|

Attributs |

Aperçu du marché européen des tests au point de soins (POCT) |

|

Segments couverts |

|

|

Pays couverts |

Europe

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également un suivi de l'innovation et une analyse stratégique, les avancées technologiques, le scénario du changement climatique, l'analyse de la chaîne d'approvisionnement, l'analyse de la chaîne de valeur, les critères de sélection des fournisseurs, l'analyse PESTLE, l'analyse de Porter, l'analyse des brevets, l'analyse de l'écosystème industriel, la couverture des matières premières, les droits de douane et leur impact sur le marché, la couverture réglementaire, le comportement d'achat des consommateurs, les perspectives de la marque, une analyse détaillée des coûts et le cadre réglementaire. |

Tendances du marché européen des tests au point de soins (POCT)

« Progrès technologiques et expansion fonctionnelle grâce à la R&D et à l’intégration numérique »

- L'une des principales tendances du marché européen des tests de diagnostic au point de soins (POCT) est l'accent mis sur l'innovation, la recherche et le développement, ainsi que sur les technologies de diagnostic avancées visant à améliorer la précision, la rapidité, la portabilité et la prise de décision en temps réel. Face à la demande croissante de tests décentralisés et centrés sur le patient, les établissements de santé, les entreprises de diagnostic et les fabricants de dispositifs médicaux investissent massivement dans les plateformes POCT de nouvelle génération. Ces plateformes favorisent un diagnostic de précision et une connectivité renforcée entre les différents contextes de soins.

- Des acteurs majeurs tels qu'Abbott, Roche, Siemens Healthineers, Danaher et Thermo Fisher Scientific accélèrent leurs efforts de recherche pour développer des dispositifs miniaturisés, des technologies de laboratoire sur puce et des systèmes de test basés sur l'IA, capables de fournir des résultats de qualité laboratoire directement sur le lieu d'utilisation. Ces avancées technologiques comprennent également la manipulation automatisée des échantillons, une sensibilité accrue des biocapteurs et des capacités de tests multiplex, permettant la détection simultanée de plusieurs biomarqueurs.

- Dans le domaine du diagnostic des maladies infectieuses, d'importants efforts de recherche et développement sont consacrés à la mise au point de solutions de tests moléculaires rapides, très précises, avec des délais d'exécution réduits et adaptées aux situations d'urgence et d'épidémie. Les dispositifs de diagnostic au point de soins (POCT) conçus pour la grippe, la COVID-19, les infections respiratoires, le VIH et la septicémie sont améliorés grâce aux technologies de microfluidique et d'amplification isotherme, permettant ainsi des tests fiables en dehors des laboratoires centralisés.

- Dans la prise en charge des maladies chroniques, les innovations en matière de surveillance de la glycémie, d'analyse des biomarqueurs cardiaques, de tests de coagulation et d'analyse de la fonction rénale favorisent un suivi continu et fournissent des données en temps réel pour une intervention clinique efficace. Les entreprises intègrent des applications mobiles, des systèmes de reporting en nuage et des dispositifs de diagnostic portables afin de permettre une surveillance à domicile simplifiée et une télémédecine efficace.

- Le marché connaît également une expansion dans le domaine du diagnostic personnalisé, avec le développement de solutions de diagnostic au point de soins (POCT) destinées au dépistage en oncologie, fertilité, troubles gastro-intestinaux et maladies métaboliques. Ces innovations visent à permettre une détection plus précoce, des décisions thérapeutiques plus rapides et de meilleurs résultats cliniques, notamment en ambulatoire et à domicile.

- De plus, l'intégration des dispositifs connectés, l'analyse des données numériques et l'interprétation pilotée par l'IA permettent de créer des écosystèmes de tests au point de soins (POCT) plus intelligents, qui optimisent l'automatisation des flux de travail et réduisent les erreurs humaines. Ces avancées transforment les POCT en un outil de diagnostic multifonctionnel et intelligent, capable de soutenir la prévention, la médecine de précision et la gestion de la santé des populations.

- Ce contexte d'innovation en constante évolution redéfinit le marché des tests au point de soins (POCT), orientant le secteur vers des systèmes de diagnostic portables, intégrés et centrés sur le patient. Alors que les systèmes de santé européens privilégient l'efficacité, l'accessibilité et la durabilité, la transformation numérique, portée par la R&D, devrait permettre de nouvelles applications et d'accroître la part de marché dans les régions développées comme émergentes.

Dynamique du marché européen des tests au point de soins (POCT)

Conducteur

« Demande croissante de solutions de diagnostic rapides, décentralisées et centrées sur le patient »

- Un facteur important de la croissance du marché européen des tests de diagnostic au point de soins (POCT) est le besoin croissant d'outils de diagnostic rapides, accessibles et décentralisés, capables d'améliorer la prise de décision clinique et les résultats pour les patients. Alors que les systèmes de santé évoluent vers des modèles axés sur la valeur et centrés sur le patient, les tests POCT offrent des résultats immédiats sur le lieu de soins ou à proximité, réduisant ainsi la dépendance aux laboratoires centralisés et permettant un diagnostic précoce et des interventions thérapeutiques opportunes.

- Des acteurs majeurs du secteur, tels qu'Abbott, Roche, Siemens Healthineers et Danaher, investissent massivement dans la R&D afin de développer des dispositifs de diagnostic au point de soins (POCT) portables, ultra-précis et connectés, capables de faciliter les diagnostics en temps réel dans les hôpitaux, les cliniques, les services d'urgence et à domicile. Ces innovations répondent à la demande croissante de solutions de santé numériques intégrées, au développement de la télémédecine et à l'interprétation des résultats assistée par l'IA.

- Dans la prise en charge des maladies chroniques, les dispositifs de diagnostic au point de service (POCT) pour la surveillance de la glycémie, les biomarqueurs cardiaques, les tests de coagulation et l'évaluation de la fonction rénale connaissent une croissance rapide en raison de la prévalence croissante du diabète, des maladies cardiovasculaires et des troubles liés au mode de vie en Europe. De même, les systèmes POCT pour les maladies infectieuses telles que la COVID-19, la grippe, la septicémie, le paludisme et le VIH deviennent des outils essentiels pour la lutte contre les épidémies, notamment dans les régions aux ressources limitées.

- L'intérêt croissant porté à la surveillance des patients à domicile et à distance favorise également l'adoption de ces technologies, grâce au développement de diagnostics via smartphone, de solutions de test portables, de plateformes cloud et de capacités de signalement à distance qui améliorent la connectivité clinique et la continuité des soins.

- Avec la modernisation des infrastructures de santé, l'importance croissante accordée à la rapidité des diagnostics et d'importants investissements publics et privés, les tests de diagnostic au point de soins (POCT) s'imposent comme un élément essentiel des futurs soins de santé. L'efficacité et l'accessibilité étant devenues des enjeux majeurs de la réforme du système de santé européen, la demande de systèmes POCT innovants, précis et centrés sur le patient devrait croître significativement.

Retenue/Défi

« Coûts élevés, complexités réglementaires et problèmes de précision et de normalisation »

- Malgré une forte croissance, le marché européen des tests de diagnostic au point de soins (POCT) est confronté à des défis importants liés aux coûts élevés des équipements et des tests, aux procédures d'homologation réglementaires strictes et à la variabilité de la précision diagnostique selon les différentes plateformes. Garantir des performances analytiques constantes, comparables aux normes des laboratoires centralisés, demeure un obstacle majeur, notamment avec l'expansion des POCT dans les soins intensifs et les segments de tests de haute complexité.

- L’obtention des autorisations des organismes de réglementation tels que la FDA, l’EMA et autres autorités nationales exige une validation clinique approfondie, le respect des normes de qualité et une surveillance post-commercialisation. Ces processus peuvent considérablement ralentir le lancement des produits et augmenter les coûts de développement pour les fabricants, notamment pour les technologies de diagnostic émergentes comme les tests moléculaires au point de soins et les tests multiplex.

- Les contraintes budgétaires limitent également l'adoption de ces technologies dans les régions en développement, où les budgets de santé restreints et les systèmes de remboursement inadéquats freinent leur déploiement à grande échelle. De plus, des difficultés opérationnelles telles que les exigences de maintenance, les besoins de formation des utilisateurs et l'intégration aux flux de travail peuvent entraver leur mise en œuvre à grande échelle dans les hôpitaux et les centres de diagnostic.

- Les préoccupations relatives à l'exactitude, à la fiabilité et à la standardisation des résultats — notamment pour les tests de haute sensibilité destinés au dépistage des maladies infectieuses et des marqueurs cardiaques — peuvent susciter des hésitations chez les cliniciens et accroître leur recours à des tests de confirmation centralisés. Les enjeux liés à l'intégration des données et à la cybersécurité des plateformes numériques de diagnostic au point de soins exigent également des infrastructures technologiques et des investissements plus importants.

- L'évolution des technologies de diagnostic au point de soins (POCT) nécessitera, pour surmonter les obstacles financiers, réglementaires et techniques, d'importants financements en recherche et développement, une meilleure harmonisation des normes de diagnostic en Europe et une collaboration stratégique entre les fabricants de dispositifs, les professionnels de santé et les agences gouvernementales de santé. Dans l'attente de ces résultats, ces barrières pourraient continuer à freiner l'adoption de ces technologies sur certains segments de marché et dans certaines régions.

Étendue du marché européen des tests au point de service (POCT)

Le marché est segmenté en fonction du type de produit, de la plateforme, de l'application, du mode de prescription, de l'utilisateur final et du canal de distribution.

- Par type de produit

Le marché européen des tests de diagnostic au point de soins (POCT) est segmenté, selon le type de produit, en produits de surveillance de la glycémie, de dépistage des maladies infectieuses, de surveillance cardiométabolique, de diagnostic de grossesse et de fertilité, d'hématologie, de surveillance de la coagulation, de dépistage de drogues, d'analyse d'urine, de dosage du cholestérol, de dépistage des marqueurs tumoraux/cancers, de recherche de sang occulte dans les selles et autres. Le segment des produits de surveillance de la glycémie devrait représenter la plus grande part de marché (39,44 %) en 2026, portée par l'augmentation du nombre de cas de diabète en Europe, la demande croissante d'autosurveillance à domicile et les progrès technologiques constants des glucomètres et des plateformes de santé numérique connectées.

- Par plateforme

Le marché européen des tests de diagnostic au point de soins (POCT) est segmenté, selon la plateforme utilisée, en tests de flux latéral/immunochromatographie, immunoessais, bandelettes réactives, diagnostics moléculaires, analyses de chimie clinique, microfluidique, hématologie et autres. Les tests de flux latéral/immunochromatographie devraient dominer le marché en 2026, grâce à leur large adoption pour le dépistage des maladies infectieuses, leur facilité d'utilisation, la rapidité des résultats, leur faible coût et leur utilisation intensive lors d'épidémies telles que la COVID-19, la grippe, le paludisme et la dengue. Leur adéquation aux contextes de soins décentralisés et à distance contribue également à la croissance de ce segment.

- Sur demande

Selon l'application, le marché européen des tests au point de soins (POCT) est segmenté en glycémie, maladies infectieuses, surveillance des signes vitaux, surveillance cardiaque, coagulation, hématologie, surveillance non invasive de la SpO2, transfusion sanguine, surveillance non invasive de la PCO2, analyse du sang total et autres. Le segment de la glycémie devrait dominer le marché en 2026, avec la plus grande part de revenus, grâce à la prévalence croissante du diabète, à la préférence grandissante des patients pour les dispositifs de surveillance portables et à la disponibilité de glucomètres et de technologies de surveillance continue du glucose (SCG) très précis et faciles d'utilisation, permettant une gestion du diabète en temps réel.

- Par prescription

Selon le mode de prescription, le marché européen des tests de diagnostic au point de soins (POCT) se divise en tests en vente libre et tests sur ordonnance. Le segment des tests en vente libre représentait la plus grande part de revenus en 2026, grâce à la préférence croissante des consommateurs pour les solutions d'autotest, à la disponibilité accrue de kits de diagnostic rapide et à l'intérêt grandissant pour la médecine préventive. Les dispositifs POCT en vente libre permettent aux particuliers de surveiller des paramètres de santé tels que la glycémie, la grossesse, la fertilité, les maladies infectieuses et les indicateurs cardiovasculaires sans supervision médicale.

- Par l'utilisateur final

Selon l'utilisateur final, le marché européen des tests de diagnostic au point de soins (POCT) se segmente en hôpitaux, soins à domicile, cliniques, laboratoires, centres de diagnostic, laboratoires d'anatomopathologie, centres de chirurgie ambulatoire, établissements de soins pour personnes âgées et autres. Le segment des hôpitaux représentait la plus grande part de revenus en 2026, porté par la forte demande de tests de diagnostic rapide pour les urgences, les soins intensifs et les évaluations cliniques de routine. Les dispositifs POCT, tels que les glucomètres, les analyseurs de marqueurs cardiaques, les tests rapides de dépistage des maladies infectieuses, les moniteurs de coagulation et les analyseurs de gaz du sang, sont de plus en plus utilisés en milieu hospitalier pour accélérer la prise de décision clinique, réduire le temps d'attente des patients et optimiser les flux de travail.

- Par canal de distribution

Selon le canal de distribution, le marché européen des tests de diagnostic au point de soins (POCT) se divise en appels d'offres, ventes au détail, ventes en ligne et autres. Le segment des appels d'offres représentait la plus grande part de chiffre d'affaires en 2026, grâce aux achats massifs de dispositifs POCT par les hôpitaux, les laboratoires de diagnostic et les agences de santé publique. Ces appels d'offres garantissent un approvisionnement constant en outils de diagnostic essentiels – tels que les glucomètres, les tests de dépistage rapide des maladies infectieuses, les analyseurs de biomarqueurs cardiaques et les appareils de test de coagulation – nécessaires aux examens de routine et aux soins d'urgence.

Analyse du marché européen des tests au point de soins (POCT)

Le marché européen des tests de diagnostic au point de soins (POCT) devrait connaître une croissance soutenue au cours de la période de prévision, portée par la demande croissante de diagnostics rapides aux urgences, à domicile et en consultation externe. L'accent mis sur la qualité des soins, le diagnostic précoce et la réduction de la charge hospitalière accélère l'adoption des POCT pour les maladies infectieuses, les biomarqueurs cardiaques, les troubles métaboliques et le suivi de la coagulation. Les cadres réglementaires favorisant des dispositifs de diagnostic sûrs et fiables, associés aux progrès des tests microfluidiques, soutiennent la croissance du marché. Par ailleurs, l'intérêt croissant de l'Europe pour la santé numérique, la télésurveillance et les diagnostics intégrés continue de stimuler l'adoption des POCT dans les principaux pays.

Analyse du marché des tests de diagnostic au point de soins (POCT) au Royaume-Uni et en Europe

Le marché britannique des tests de diagnostic au point de service (POCT) devrait connaître une croissance annuelle composée (TCAC) significative, soutenue par la numérisation croissante du système de santé, l'augmentation de la prévalence des maladies chroniques et la forte demande de solutions de tests rapides à domicile et en soins primaires. La sensibilisation accrue à la prévention et au diagnostic précoce a favorisé l'adoption généralisée des POCT pour le suivi de la glycémie, le dépistage des maladies infectieuses, les tests de grossesse/fertilité et les marqueurs cardiovasculaires. L'investissement croissant du Royaume-Uni dans la télésanté, l'intégration des données de santé numériques et les services de diagnostic décentralisés accélère encore cette adoption.

Analyse du marché des tests de diagnostic au point de soins (POCT) en Allemagne et en Europe

Le marché allemand des tests de diagnostic au point de soins (POCT) est en passe de connaître une expansion considérable, portée par les solides capacités de production du pays en matière de dispositifs médicaux, son infrastructure de diagnostic très développée et son souci d'une prise en charge efficace des patients. L'adoption croissante des tests rapides en Allemagne, dans les hôpitaux, les centres de soins ambulatoires et à domicile, est favorisée par la hausse des cas de diabète, de maladies cardiovasculaires et d'infections. Les progrès réalisés dans les technologies de capteurs, le respect des réglementations et l'accent mis sur la qualité des dispositifs médicaux continuent de stimuler le développement et la commercialisation des plateformes POCT de nouvelle génération. Par ailleurs, l'intérêt porté par l'Allemagne au diagnostic numérique et à la télésurveillance contribue à la croissance du marché à long terme.

Part de marché des tests au point de soins (POCT) en Europe

Le secteur des tests au point de service (POCT) est principalement dominé par des entreprises bien établies, notamment :

- Abbott Point of Care Inc. (États-Unis)

- Sinocare Inc. (Chine)

- F. Hoffmann-La Roche Ltd (Suisse)

- Danaher Corporation (États-Unis)

- Hologic, Inc. (États-Unis)

- bioMérieux SA (France)

- Siemens Healthineers AG (Allemagne)

- Thermo Fisher Scientific Inc. (États-Unis)

- BD Veritor (Becton, Dickinson and Company) (États-Unis)

- QuidelOrtho Corporation (États-Unis)

- Laboratoires Bio-Rad, Inc. (États-Unis)

- Werfen (Espagne)

- Sekisui Diagnostics (Japon)

- Trividia Health, Inc. (États-Unis)

- Nova Biomedical Corporation (États-Unis)

- Meridian Bioscience, Inc. (États-Unis)

- Pfizer Inc. (États-Unis)

- Shenzhen New Industry Biomedical Engineering Co., Ltd. (Chine)

- Sysmex Corporation (Japon)

- Wondfo (Guangzhou Wondfo Biotech Co., Ltd.) (Chine)

- QIAGEN NV (Allemagne)

- Abaxis, Inc. (États-Unis)

- Autobio Diagnostics Co., Ltd. (Chine)

- Getein Biotech, Inc. (Chine)

- Chembio Diagnostics, Inc. (États-Unis)

- EKF Diagnostics Holdings plc (Royaume-Uni)

- Trinity Biotech plc (Irlande)

- PTS Diagnostics (États-Unis)

- QuantuMDx Group Ltd. (Royaume-Uni)

- Binx Santé (États-Unis)

- Xiamen Boson Biotech Co., Ltd. (Chine)

- Accubiotech Co., Ltd. (Chine)

- Sienco, Inc. (États-Unis)

- LambdaGen Corporation (États-Unis)

Dernières évolutions du marché européen des tests au point de service (POCT)

- En mai 2020, le test ID NOW COVID-19 d'Abbott a fourni des résultats rapides et fiables en quelques minutes, contribuant à un diagnostic précoce et à la réduction du risque d'infection. Des études ont démontré son excellente performance en milieu hospitalier d'urgence, avec une sensibilité ≥ 94,7 % et une spécificité ≥ 98,6 %. Malgré les réserves émises par une étude de l'Université de New York, les données en vie réelle confirment son efficacité. Autorisé par la FDA dans le cadre d'une autorisation d'utilisation d'urgence, ce test joue un rôle crucial dans le dépistage de la COVID-19.

- En septembre 2025, Dongguan E-Test Technology, filiale de Sinocare, a obtenu l'autorisation 510(k) de la FDA pour ses tensiomètres intelligents Multi-Series, attestant de leur précision, de leur sécurité et de leurs fonctionnalités sans fil. Ces appareils offrent une surveillance de qualité médicale, une connectivité Bluetooth et des alertes intelligentes, renforçant ainsi la stratégie d'expansion de Sinocare en Europe et son écosystème de gestion des maladies chroniques sur les marchés internationaux, notamment aux États-Unis et en Europe.

- En janvier 2025, Danaher Corporation a conclu un partenariat d'investissement avec Innovaccer Inc., une entreprise spécialisée dans l'intelligence artificielle appliquée à la santé. Cette collaboration vise à accélérer l'adoption des diagnostics de précision et des soins axés sur la valeur en fournissant aux professionnels de santé des données patient unifiées et des analyses avancées, afin d'améliorer les résultats pour les patients grâce à des interventions personnalisées et opportunes.

- En novembre 2023, Binx Health s'est associée à Fisher Healthcare pour étendre la distribution de binx io, une plateforme de diagnostic moléculaire au point de soins, approuvée par la FDA, permettant la détection de la chlamydiose et de la gonorrhée. Ce système fournit des résultats de qualité laboratoire en une trentaine de minutes, améliorant ainsi la rapidité du diagnostic et permettant aux cliniciens de tester et de traiter les patients lors d'une seule consultation, facilitant l'accès aux soins.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE POINT-OF-CARE-TESTING (POCT) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 MULTIVARIATE MODELLING

2.6 TYPE LIFELINE CURVE

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END USER COVERAGE GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.3 HEALTHCARE ECONOMY

4.3.1 HEALTHCARE EXPENDITURE

4.3.2 CAPITAL EXPENDITURE

4.3.3 CAPEX TRENDS

4.3.4 CAPEX ALLOCATION

4.3.5 FUNDING SOURCES

4.3.6 INDUSTRY BENCHMARKS

4.3.7 GDP RATIO IN OVERALL GDP

4.3.8 HEALTHCARE SYSTEM STRUCTURE

4.3.9 GOVERNMENT POLICIES

4.3.10 ECONOMIC DEVELOPMENT

4.4 REIMBURSEMENT FRAMEWORK

4.5 OPPORTUNITY MAP ANALYSIS

4.6 VALUE CHAIN ANALYSIS

4.7 MICRO AND MACRO ECONOMIC FACTORS

4.7.1 CURRENT MARKET PENETRATION

4.7.2 GROWTH PROSPECTS

4.7.3 KEY PRICING STRATEGIES

4.8 TECHNOLOGY ROADMAP: EUROPE POINT OF CARE TESTING

5 EUROPE POINT-OF-CARE TESTING (POCT) MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING USE OF POC TESTING IN HEALTHCARE FACILITIES

6.1.2 RISING INCIDENCE OF SUBSTANCE ABUSE

6.1.3 INCREASED ADOPTION OF TELEMEDICINE

6.1.4 ADVANCEMENTS TECHNOLOGIES ENHANCING POC TESTING WITH BIOSENSORS AND MOBILE INTEGRATION

6.2 RESTRAINTS

6.2.1 DATA SECURITY AND PRIVACY CONCERNS

6.2.2 LACK OF ACCURACY AND TECHNICAL CHALLENGES

6.3 OPPORTUNITIES

6.3.1 RISING AWARENESS AND ADVOCACY FOR POINT-OF-CARE TESTING

6.3.2 STRATEGIC INITIATION AND DECISION TAKEN BY THE MARKET PLAYERS

6.3.3 EXPANDING PRODUCT RANGE FOR POINT-OF-CARE TESTING

6.4 CHALLENGES

6.4.1 LIMITED AWARENESS AND ACCEPTANCE

6.4.2 IMPACT OF HIGH MAINTENANCE COSTS THREATENING POINT-OF-CARE TESTING (POCT) SUSTAINABILITY IN LOW-RESOURCE SETTINGS

7 EUROPE POINT-OF-CARE TESTING (POCT) MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 GLUCOSE MONITORING PRODUCTS

7.2.1 SELF-MONITORING OF BLOOD GLUCOSE (SMBG) DEVICES

7.2.1.1 Strips

7.2.1.2 Meters

7.2.1.3 Lancets and Lancing Devices

7.2.2 CONTINUOUS GLUCOSE MONITORING (CGM) SYSTEMS

7.3 INFECTIOUS DISEASE TESTING PRODUCTS

7.3.1 COVID-19

7.3.2 HIV TESTING PRODUCTS

7.3.2.1 Testing Reagents

7.3.2.2 Testing Equipment

7.3.3 RESPIRATORY INFECTION TESTING PRODUCTS

7.3.4 SEXUALLY TRANSMITTED DISEASES (STD) TESTING

7.3.4.1 NAAT-Based Systems

7.3.4.2 NON–NAAT-Based Systems

7.3.5 HEPATITIS C TESTING PRODUCTS

7.3.5.1 HCV Antibody Tests

7.3.5.2 HCV Viral Load Tests

7.3.6 INFLUENZA TESTING PRODUCTS

7.3.6.1 Traditional Diagnostic Test

7.3.6.2 Molecular Diagnostic Assay

7.3.6.2.1 Rapid Influenza Diagnostic Test (RIDT)

7.3.6.2.2 Direct Fluorescent Antibody Test (DFAT)

7.3.6.2.3 Viral Culture

7.3.6.2.4 Serological Assay

7.3.6.3 RT-PCR

7.3.6.4 Loop-Mediated Isothermal Amplification-Based Assay (LAMP)

7.3.6.5 Nucleic Acid Sequence-Based Amplification Test (NASBAT)

7.3.6.6 Simple Amplification-Based Assay (SAMBA)

7.3.6.7 Healthcare Associated Infection (HAI) Testing

7.3.6.8 Tropical Disease Testing Products

7.3.6.9 Other Infectious Disease Testing Products

7.4 CARDIOMETABOLIC MONITORING PRODUCTS

7.4.1 CARDIAC MARKER TESTING PRODUCTS

7.4.1.1 HSTNL

7.4.1.2 BNP

7.4.1.3 D-DIMER

7.4.1.4 CK-MB

7.4.1.5 Myoglobin

7.4.2 BLOOD GAS/ELECTROLYTE TESTING PRODUCTS

7.4.2.1 Blood Gas/Electrolyte Testing Consumables

7.4.2.2 Blood Gas/Electrolyte Testing Instruments

7.4.3 CARTRIDGES

7.4.4 REAGENTS

7.4.4.1 Portable

7.4.4.2 Benchtop

7.4.4.3 Combined Analyzers

7.4.4.4 Blood Gas Analyzers

7.4.4.5 Electrolyte Analyzers

7.4.4.6 Combined Analyzers

7.4.4.7 Blood Gas Analyzers

7.4.4.8 Electrolyte Analyzers

7.4.5 HBA1C TESTING PRODUCTS

7.4.5.1 HBA1C Testing Instruments

7.4.5.2 HBA1C Testing Consumables

7.4.5.3 POC Analyzer

7.4.5.4 ECG Device

7.4.5.5 Resting ECG Devices

7.4.5.6 Stress ECG Devices

7.4.5.7 Holter Monitors

7.5 PREGNANCY AND FERTILITY TESTING PRODUCTS

7.5.1 PREGNANCY TESTING PRODUCTS

7.5.1.1 Strips/ Dip Sticks and Cards

7.5.1.2 Mid Stream Devices

7.5.1.3 Cassettes

7.5.1.4 Digital Devices

7.5.1.5 Line-Indicator Devices

7.5.2 FERTILITY TESTING PRODUCTS

7.5.2.1 Luteinizing Hormone (LH) Urine Test

7.5.2.2 FSH Test

7.5.2.3 others

7.6 HAEMATOLOGY TESTING PRODUCTS

7.7 COAGULATION MONITORING PRODUCTS

7.7.1 ANTICOAGULATION MONITORING DEVICES

7.7.1.1 Prothrombin Time/International Normalized Ratio (PT-INR) Testing Devices

7.7.1.2 Activated Clotting Time (ACT)

7.7.1.3 Activated Partial Thromboplastin Time (APPT)

7.7.1.4 Platelet Function Monitoring Devices

7.7.1.5 Viscoelastic Coagulation Monitoring Devices

7.7.1.6 Rotational Thromboelastometry (ROTEM)

7.7.1.7 Thromboelastography (TEG)

7.7.1.8 Drug-Of-Abuse (DOA) Testing Products

7.7.2 DOA ANALYSERS

7.7.2.1 Immunoassays

7.7.2.2 Chromatographic Devices

7.7.2.3 Breath Analysers

7.7.3 RAPID TESTING DEVICES

7.7.3.1 Urine Testing Devices

7.7.3.2 Oral Fluid Testing Devices

7.7.3.4 Others

7.8 URINALYSIS TESTING PRODUCTS

7.8.1.1 POC Urine Strip Self-Testing

7.8.1.2 POC Urine Test Strip Professional Testing

7.9 CHOLESTEROL TESTING PRODUCTS

7.9.1.1 Testing Kits

7.9.1.2 Instruments

7.9.1.3 Table-Top Analyzers

7.9.1.4 Hand-Held Analyzers

7.1 TUMOR/CANCER MARKER TESTING PRODUCTS

7.11 FECAL OCCULT TESTING PRODUCTS

7.11.1.1 Guaiac FOB Stool Test

7.11.1.2 Lateral Flow Immuno-FOB Test

7.11.1.3 Immuno-FOB Agglutination Test

7.11.1.4 Immuno-FOB ELISA Test

7.12 OTHERS

8 EUROPE POINT-OF-CARE TESTING (POCT) MARKET, BY PLATFORM

8.1 OVERVIEW

8.2 LATERAL FLOW ASSAYS/IMMUNOCHROMATOGRAPHY TESTS

8.3 IMMUNOASSAYS

8.4 DIPSTICKS

8.5 MOLECULAR DIAGNOSTICS

8.6 CLINICAL CHEMISTRY ASSAYS

8.7 MICROFLUIDICS

8.8 HEMATOLOGY

8.9 OTHERS

9 EUROPE POINT-OF-CARE-TESTING (POCT) MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 BLOOD GLUCOSE

9.3 INFECTIOUS DISEASES

9.3.1 COVID-19 TESTING

9.3.2 HIV TESTING

9.3.3 HEPATITIS C TESTING

9.3.4 INFLUENZA TESTING

9.3.5 TUBERCULOSIS TESTING

9.3.6 OTHERS

9.4 VITAL SIGN MONITORING

9.5 CARDIAC MONITORING

9.6 COAGULATION

9.7 HAEMATOLOGY

9.8 NON- INVASIVE SPO2 MONITORING

9.9 BLOOD TRANSFUSION

9.1 NON- INVASIVE PCO2 MONITORING

9.11 WHOLE BLOOD ANALYSIS

9.12 OTHERS

10 EUROPE POINT-OF-CARE TESTING (POCT) MARKET, BY PRESCRIPTION MODE

10.1 OVERVIEW

10.2 OTC TESTING

10.3 PRESCRIPTION-BASED TESTING

11 EUROPE POINT-OF-CARE-TESTING (POCT) MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT TENDER

11.3 RETAIL SALES

11.4 ONLINE SALES

11.5 OTHERS

12 EUROPE POINT-OF-CARE TESTING (POCT) MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITALS

12.2.1 PRIVATE

12.2.1.1 Tier 1

12.2.1.2 Tier 2

12.2.1.3 Tier 3

12.2.2 PUBLIC

12.2.2.1 Tier 1

12.2.2.2 Tier 2

12.2.2.3 Tier 3

12.3 HOME CARE

12.4 CLINICS

12.5 LABORATORIES

12.6 DIAGNOSTIC CENTERS

12.7 PATHOLOGY LABS

12.8 AMBULATORY SURGERY CENTERS

12.9 ELDERLY CARE CENTERS

12.1 OTHERS

13 EUROPE POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION

13.1 EUROPE

13.1.1 GERMANY

13.1.2 FRANCE

13.1.3 U.K.

13.1.4 ITALY

13.1.5 SPAIN

13.1.6 RUSSIA

13.1.7 TURKEY

13.1.8 NETHERLANDS

13.1.9 SWITZERLAND

13.1.10 NORWAY

13.1.11 POLAND

13.1.12 REST OF EUROPE

14 EUROPE POINT-OF-CARE TESTING (POCT) MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 ABBOTT POINT OF CARE INC(ABBOTT)

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 SINOCARE.

16.2.1 COMPANY SNAPSHOT

16.2.2 COMPANY SHARE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 F. HOFFMANN-LA ROCHE LTD

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 DANAHER

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 HOLOGIC, INC

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 ACCUBIOTECH CO., LTD.

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 ABAXIS (ABAXIS IS A PART OF ZOETIS)

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 AUTOBIO

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENT

16.9 BD VERITOR(BD)

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENT

16.1 BINX HEALTH

16.10.1 COMPANY SNAPSHOT

16.10.2 SOLUTION PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 BIOMERIEUX

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENT

16.12 BIO- RAD LABORATORIES, INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENT

16.13 CHEMBIO DIAGNOSTICS, INC.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 EKF DIAGNOSTICS HOLDINGS PLC

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 GETEIN BIOTECH, INC.

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENT

16.16 LAMDAGEN CORPORATION

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 MERIDIAN BIOSCIENCE

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 NOVA BIOMEDICAL

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 PFIZER INC.

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 PTS DIAGNOSTICS

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 QIAGEN

16.21.1 COMPANY SNAPSHOT

16.21.2 REVENUE ANALYSIS

16.21.3 PRODUCT PORTFOLIO

16.21.4 RECENT DEVELOPMENT

16.22 QUIDELORTHO CORPORATION

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 PRODUCT PORTFOLIO

16.22.4 RECENT DEVELOPMENT

16.23 QUANTUMDX GROUP LTD.

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENT

16.24 SEKISUI DIAGNOSTICS

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT. DEVELOPMENT

16.25 SHENZHEN NEW INDUSTRY BIOMEDICAL ENGINEERING CO., LTD.

16.25.1 COMPANY SNAPSHOT

16.25.2 REVENUE ANALYSIS

16.25.3 PRODUCT PORTFOLIO

16.25.4 RECENT DEVELOPMENT

16.26 SIEMENS HEALTHINEERS AG

16.26.1 COMPANY SNAPSHOT

16.26.2 REVENUE ANALYSIS

16.26.3 PRODUCT PORTFOLIO

16.26.4 RECENT DEVELOPMENT

16.27 SIENCO, INC.

16.27.1 COMPANY SNAPSHOT

16.27.2 PRODUCT PORTFOLIO

16.27.3 RECENT UPDATES

16.28 SYSMEX CORPORATION

16.28.1 COMPANY SNAPSHOT

16.28.2 REVENUE ANALYSIS

16.28.3 PRODUCT PORTFOLIO

16.28.4 RECENT DEVELOPMENT

16.29 TRINITY BIOTECH

16.29.1 COMPANY SNAPSHOT

16.29.2 REVENUE ANALYSIS

16.29.3 PR.ODUCT PORTFOLIO

16.29.4 RECENT DEVELOPMENT

16.3 TRIVIDIA HEALTH, INC.

16.30.1 COMPANY SNAPSHOT

16.30.2 PRODUCT PORTFOLIO

16.30.3 RECENT UPDATES

16.31 THERMO FISHER SCIENTIFIC INC.

16.31.1 COMPANY SNAPSHOT

16.31.2 REVENUE ANALYSIS

16.31.3 PRODUCT PORTFOLIO

16.31.4 RECENT DEVELOPMENT

16.32 WERFEN

16.32.1 COMPANY SNAPSHOT

16.32.2 PRODUCT PORTFOLIO

16.32.3 RECENT DEVELOPMENT

16.33 WONDFO

16.33.1 COMPANY SNAPSHOT

16.33.2 REVENUE ANALYSIS

16.33.3 PRODUCT PORTFOLIO

16.33.4 RECENT DEVELOPMENT

16.34 XIAMEN BOSON BIOTECH CO., LTD.

16.34.1 COMPANY SNAPSHOT

16.34.2 PRODUCT PORTFOLIO

16.34.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 EUROPE POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 2 EUROPE POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 3 EUROPE POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 4 EUROPE GLUCOSE MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 5 EUROPE GLUCOSE MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 6 EUROPE GLUCOSE MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 7 EUROPE GLUCOSE MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 8 EUROPE SELF-MONITORING OF BLOOD GLUCOSE (SMBG) DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 9 EUROPE SELF-MONITORING OF BLOOD GLUCOSE (SMBG) DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 10 EUROPE SELF-MONITORING OF BLOOD GLUCOSE (SMBG) DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 11 EUROPE INFECTIOUS DISEASE TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 12 EUROPE INFECTIOUS DISEASE TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSANDS)

TABLE 13 EUROPE INFECTIOUS DISEASE TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSANDS UNITS)

TABLE 14 EUROPE INFECTIOUS DISEASE TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 15 EUROPE HIV TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 16 EUROPE HIV TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 17 EUROPE HIV TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 18 EUROPE SEXUALLY TRANSMITTED DISEASES (STD) TESTING IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 19 EUROPE SEXUALLY TRANSMITTED DISEASES (STD) TESTING IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 20 EUROPE SEXUALLY TRANSMITTED DISEASES (STD) TESTING IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 21 EUROPE HEPATITIS C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSANDS)

TABLE 22 EUROPE HEPATITIS C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 23 EUROPE HEPATITIS C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 24 EUROPE INFLUENZA TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 25 EUROPE TRADITIONAL DIAGNOSTIC TEST IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 26 EUROPE TRADITIONAL DIAGNOSTIC TEST IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 27 EUROPE TRADITIONAL DIAGNOSTIC TEST IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 28 EUROPE MOLECULAR DIAGNOSTIC ASSAY IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 29 EUROPE MOLECULAR DIAGNOSTIC ASSAY IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 30 EUROPE MOLECULAR DIAGNOSTIC ASSAY IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 31 EUROPE CARDIOMETABOLIC MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 32 EUROPE CARDIOMETABOLIC MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 33 EUROPE POC ANALYZER IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 34 EUROPE POC ANALYZER IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 35 EUROPE CARDIAC MARKER TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 36 EUROPE CARDIAC MARKER TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 37 EUROPE CARDIAC MARKER TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 38 EUROPE BLOOD GAS/ELECTROLYTE TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 39 EUROPE BLOOD GAS/ELECTROLYTE TESTING CONSUMABLES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 40 EUROPE BLOOD GAS/ELECTROLYTE TESTING CONSUMABLES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 41 EUROPE BLOOD GAS/ELECTROLYTE TESTING CONSUMABLES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 42 EUROPE BLOOD GAS/ELECTROLYTE TESTING INSTRUMENTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 43 EUROPE PORTABLE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 44 EUROPE PORTABLE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 45 EUROPE PORTABLE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 46 EUROPE BENCHTOP IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSANDS)

TABLE 47 EUROPE BENCHTOP IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 48 EUROPE BENCHTOP IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 49 EUROPE HBA1C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 50 EUROPE HBA1C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 51 EUROPE HBA1C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 52 EUROPE ECG DEVICE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 53 EUROPE ECG DEVICE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 54 EUROPE ECG DEVICE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 55 EUROPE PREGNANCY AND FERTILITY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 56 EUROPE PREGNANCY AND FERTILITY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 57 EUROPE PREGNANCY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 58 EUROPE PREGNANCY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSANDS UNITS)

TABLE 59 EUROPE PREGNANCY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 60 EUROPE FERTILITY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 61 EUROPE FERTILITY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 62 EUROPE FERTILITY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 63 EUROPE HAEMATOLOGY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 64 EUROPE COAGULATION MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSANDS)

TABLE 65 EUROPE COAGULATION MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSANDS)

TABLE 66 EUROPE ANTICOAGULATION MONITORING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 67 EUROPE ANTICOAGULATION MONITORING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 68 EUROPE ANTICOAGULATION MONITORING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 69 EUROPE VISCOELASTIC COAGULATION MONITORING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY METHOD, 2018-2033 (USD THOUSANDS)

TABLE 70 EUROPE DRUGS-OF-ABUSE (DOA) TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 71 EUROPE DRUG-OF-ABUSE (DOA) TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 72 EUROPE DOA ANALYZERS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSANDS)

TABLE 73 EUROPE DOA ANALYZERS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 74 EUROPE DOA ANALYZERS MONITORING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 75 EUROPE RAPID TESTING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 76 EUROPE RAPID TESTING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 77 EUROPE RAPID TESTING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 78 EUROPE URINALYSIS TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 79 EUROPE URINALYSIS TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 80 EUROPE URINALYSIS TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 81 EUROPE URINALYSIS TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 82 EUROPE CHOLESTEROL TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 83 EUROPE CHOLESTEROL TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 84 EUROPE CHOLESTEROL TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSANDS UNITS)

TABLE 85 EUROPE CHOLESTEROL TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 86 EUROPE INSTRUMENTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSANDS)

TABLE 87 EUROPE INSTRUMENTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 88 EUROPE INSTRUMENTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 89 EUROPE TUMOR/CANCER MARKER TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 90 EUROPE FECAL OCCULT TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 91 EUROPE FECAL OCCULT TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 92 EUROPE FECAL OCCULT TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSANDS UNITS)

TABLE 93 EUROPE FECAL OCCULT TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 94 EUROPE OTHERS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 95 EUROPE POINT-OF-CARE-TESTING (POCT) MARKET, BY PLATFORM, 2018-2033 (USD THOUSAND)

TABLE 96 EUROPE LATERAL FLOW ASSAYS/IMMUNOCHROMATOGRAPHY TESTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSANDS)

TABLE 97 EUROPE IMMUNOASSAYS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSANDS)

TABLE 98 EUROPE DIPSTICKS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSANDS)

TABLE 99 EUROPE MOLECULAR DIAGNOSTICS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSANDS)

TABLE 100 EUROPE CLINICAL CHEMISTRY ASSAYS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 101 EUROPE MICROFLUIDICS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSANDS)

TABLE 102 EUROPE HEMATOLOGY IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSANDS)

TABLE 103 EUROPE OTHERS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSANDS)

TABLE 104 EUROPE POINT-OF-CARE-TESTING (POCT) MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 105 EUROPE BLOOD GLUCOSE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 106 EUROPE INFECTIOUS DISEASES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 107 EUROPE INFECTIOUS DISEASES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 108 EUROPE VITAL SIGN MONITORING IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 109 EUROPE CARDIAC MONITORING IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 110 EUROPE COAGULATION IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 111 EUROPE HAEMATOLOGY IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 112 EUROPE NON- INVASIVE SPO2 MONITORING IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 113 EUROPE BLOOD TRANSFUSION IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 114 EUROPE NON- INVASIVE PCO2 MONITORING IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 115 EUROPE WHOLE BLOOD ANALYSIS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 116 EUROPE OTHERS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 117 EUROPE POINT-OF-CARE-TESTING (POCT) MARKET, BY PRESCRIPTION MODE, 2018-2033 (USD THOUSANDS)

TABLE 118 EUROPE OTC TESTING IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 119 EUROPE PRESCRIPTION-BASED TESTING IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSANDS)

TABLE 120 EUROPE POINT-OF-CARE-TESTING (POCT) MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD MILLION)

TABLE 121 EUROPE DIRECT TENDER IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD MILLIONS)

TABLE 122 EUROPE RETAIL SALES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD MILLIONS)

TABLE 123 EUROPE ONLINE SALES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD MILLIONS)

TABLE 124 EUROPE OTHERS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD MILLIONS)

TABLE 125 EUROPE POINT-OF-CARE-TESTING (POCT) MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 126 EUROPE HOSPITALS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2032 (USD THOUSANDS)

TABLE 127 EUROPE HOSPITALS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY TYPE, 2018-2032 (USD THOUSANDS)

TABLE 128 EUROPE PRIVATE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY LEVEL, 2018-2032 (USD THOUSANDS)

TABLE 129 EUROPE PUBLIC IN POINT-OF-CARE-TESTING (POCT) MARKET, BY LEVEL, 2018-2032 (USD THOUSANDS)

TABLE 130 EUROPE HOME CARE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 131 EUROPE CLINICS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 132 EUROPE LABORATORIES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 133 EUROPE DIAGNOSTIC CENTERS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 134 EUROPE PATHOLOGY LABS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 135 EUROPE AMBULATORY SURGERY CENTERS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 136 EUROPE ELDERLY CARE CENTERS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 137 EUROPE OTHERS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 138 EUROPE POINT-OF-CARE-TESTING (POCT) MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 139 EUROPE POINT-OF-CARE-TESTING (POCT) MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 140 EUROPE

TABLE 141 EUROPE POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 142 EUROPE POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 143 EUROPE POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 144 EUROPE GLUCOSE MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 145 EUROPE GLUCOSE MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 146 EUROPE GLUCOSE MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 147 EUROPE SELF-MONITORING OF BLOOD GLUCOSE (SMBG) DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 148 EUROPE SELF-MONITORING OF BLOOD GLUCOSE (SMBG) DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 149 EUROPE SELF-MONITORING OF BLOOD GLUCOSE (SMBG) DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 150 EUROPE INFECTIOUS DISEASE TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 151 EUROPE INFECTIOUS DISEASE TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 152 EUROPE INFECTIOUS DISEASE TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 153 EUROPE HIV TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 154 EUROPE HIV TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 155 EUROPE HIV TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 156 EUROPE SEXUALLY TRANSMITTED DISEASES (STD) TESTING IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 157 EUROPE SEXUALLY TRANSMITTED DISEASES (STD) TESTING IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 158 EUROPE SEXUALLY TRANSMITTED DISEASES (STD) TESTING IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 159 EUROPE HEPATITIS C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 160 EUROPE HEPATITIS C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 161 EUROPE HEPATITIS C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 162 EUROPE INFLUENZA TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 163 EUROPE TRADITIONAL DIAGNOSTIC TEST IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 164 EUROPE TRADITIONAL DIAGNOSTIC TEST IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 165 EUROPE TRADITIONAL DIAGNOSTIC TEST IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 166 EUROPE MOLECULAR DIAGNOSTIC ASSAY IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 167 EUROPE MOLECULAR DIAGNOSTIC ASSAY IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 168 EUROPE MOLECULAR DIAGNOSTIC ASSAY IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 169 EUROPE CARDIOMETABOLIC MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 170 EUROPE POC ANALYZER IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 171 EUROPE POC ANALYZER IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 172 EUROPE CARDIAC MARKER TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 173 EUROPE CARDIAC MARKER TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 174 EUROPE CARDIAC MARKER TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 175 EUROPE BLOOD GAS/ELECTROLYTE TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 176 EUROPE BLOOD GAS/ELECTROLYTE TESTING CONSUMABLES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 177 EUROPE BLOOD GAS/ELECTROLYTE TESTING CONSUMABLES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 178 EUROPE BLOOD GAS/ELECTROLYTE TESTING CONSUMABLES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 179 EUROPE BLOOD GAS/ELECTROLYTE TESTING INSTRUMENTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 180 EUROPE PORTABLE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 181 EUROPE PORTABLE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 182 EUROPE PORTABLE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 183 EUROPE BENCHTOP IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 184 EUROPE BENCHTOP IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 185 EUROPE BENCHTOP IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 186 EUROPE HBA1C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 187 EUROPE HBA1C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 188 EUROPE HBA1C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 189 EUROPE ECG DEVICE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 190 EUROPE ECG DEVICE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 191 EUROPE ECG DEVICE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 192 EUROPE PREGNANCY AND FERTILITY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 193 EUROPE PREGNANCY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 194 EUROPE PREGNANCY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 195 EUROPE PREGNANCY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 196 EUROPE FERTILITY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 197 EUROPE FERTILITY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 198 EUROPE FERTILITY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 199 EUROPE COAGULATION MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 200 EUROPE ANTICOAGULATION MONITORING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 201 EUROPE ANTICOAGULATION MONITORING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 202 EUROPE ANTICOAGULATION MONITORING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 203 EUROPE VISCOELASTIC COAGULATION MONITORING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY METHOD, 2018-2033 (USD THOUSAND)

TABLE 204 EUROPE DRUG-OF-ABUSE (DOA) TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 205 EUROPE DOA ANALYZERS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 206 EUROPE DOA ANALYZERS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 207 EUROPE DOA ANALYZERS MONITORING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 208 EUROPE RAPID TESTING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 209 EUROPE RAPID TESTING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 210 EUROPE RAPID TESTING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 211 EUROPE URINALYSIS TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 212 EUROPE URINALYSIS TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 213 EUROPE URINALYSIS TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 214 EUROPE CHOLESTEROL TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 215 EUROPE CHOLESTEROL TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 216 EUROPE CHOLESTEROL TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 217 EUROPE INSTRUMENTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 218 EUROPE INSTRUMENTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 219 EUROPE INSTRUMENTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 220 EUROPE FECAL OCCULT TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 221 EUROPE FECAL OCCULT TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 222 EUROPE FECAL OCCULT TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 223 EUROPE POINT-OF-CARE-TESTING (POCT) MARKET, BY PLATFORM, 2018-2033 (USD THOUSAND)

TABLE 224 EUROPE POINT-OF-CARE-TESTING (POCT) MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 225 EUROPE INFECTIOUS DISEASES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 226 EUROPE POINT-OF-CARE-TESTING (POCT) MARKET, BY PRESCRIPTION MODE, 2018-2033 (USD THOUSAND)

TABLE 227 EUROPE POINT-OF-CARE-TESTING (POCT) MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 228 EUROPE HOSPITALS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 229 EUROPE PRIVATE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY LEVEL, 2018-2033 (USD THOUSAND)

TABLE 230 EUROPE PUBLIC IN POINT-OF-CARE-TESTING (POCT) MARKET, BY LEVEL, 2018-2033 (USD THOUSAND)

TABLE 231 EUROPE POINT-OF-CARE-TESTING (POCT) MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 232 GERMANY POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 233 GERMANY POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 234 GERMANY POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 235 GERMANY GLUCOSE MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 236 GERMANY GLUCOSE MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 237 GERMANY GLUCOSE MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 238 GERMANY SELF-MONITORING OF BLOOD GLUCOSE (SMBG) DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 239 GERMANY SELF-MONITORING OF BLOOD GLUCOSE (SMBG) DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 240 GERMANY SELF-MONITORING OF BLOOD GLUCOSE (SMBG) DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 241 GERMANY INFECTIOUS DISEASE TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 242 GERMANY INFECTIOUS DISEASE TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 243 GERMANY INFECTIOUS DISEASE TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 244 GERMANY HIV TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 245 GERMANY HIV TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 246 GERMANY HIV TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 247 GERMANY SEXUALLY TRANSMITTED DISEASES (STD) TESTING IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 248 GERMANY SEXUALLY TRANSMITTED DISEASES (STD) TESTING IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 249 GERMANY SEXUALLY TRANSMITTED DISEASES (STD) TESTING IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 250 GERMANY HEPATITIS C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 251 GERMANY HEPATITIS C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 252 GERMANY HEPATITIS C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 253 GERMANY INFLUENZA TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 254 GERMANY TRADITIONAL DIAGNOSTIC TEST IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 255 GERMANY TRADITIONAL DIAGNOSTIC TEST IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 256 GERMANY TRADITIONAL DIAGNOSTIC TEST IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 257 GERMANY MOLECULAR DIAGNOSTIC ASSAY IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 258 GERMANY MOLECULAR DIAGNOSTIC ASSAY IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 259 GERMANY MOLECULAR DIAGNOSTIC ASSAY IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 260 GERMANY CARDIOMETABOLIC MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 261 GERMANY POC ANALYZER IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 262 GERMANY POC ANALYZER IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 263 GERMANY CARDIAC MARKER TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 264 GERMANY CARDIAC MARKER TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 265 GERMANY CARDIAC MARKER TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 266 GERMANY BLOOD GAS/ELECTROLYTE TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 267 GERMANY BLOOD GAS/ELECTROLYTE TESTING CONSUMABLES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 268 GERMANY BLOOD GAS/ELECTROLYTE TESTING CONSUMABLES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 269 GERMANY BLOOD GAS/ELECTROLYTE TESTING CONSUMABLES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 270 GERMANY BLOOD GAS/ELECTROLYTE TESTING INSTRUMENTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 271 GERMANY PORTABLE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 272 GERMANY PORTABLE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 273 GERMANY PORTABLE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 274 GERMANY BENCHTOP IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 275 GERMANY BENCHTOP IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 276 GERMANY BENCHTOP IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 277 GERMANY HBA1C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 278 GERMANY HBA1C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 279 GERMANY HBA1C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 280 GERMANY ECG DEVICE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 281 GERMANY ECG DEVICE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 282 GERMANY ECG DEVICE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 283 GERMANY PREGNANCY AND FERTILITY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 284 GERMANY PREGNANCY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)