Marché européen des ingrédients de soins personnels, par type (extraits marins, extraits minéraux, peptides, extraits botaniques , produits biotechnologiques et actifs synthétiques), application (soins de la peau, soins capillaires et autres), tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché des ingrédients de soins personnels en Europe

Les matières premières utilisées pour fabriquer des produits de soins de la peau dans le monde entier sont des ingrédients de soins personnels. Ces composants peuvent agir comme antifongiques, anti-âge, revitalisants pour la peau et autres composés dans les produits de soins de la peau. De plus, ils peuvent être divisés en composants actifs et inactifs. Les ingrédients actifs comprennent les exfoliants, les agents de protection UV, les agents anti-âge et les agents revitalisants, tandis que les ingrédients inactifs comprennent les colorants, les conservateurs, les tensioactifs et les ingrédients polymères.

Le rapport sur le marché européen des ingrédients de soins personnels fournit des détails sur la part de marché, les nouveaux développements et l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste. Notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

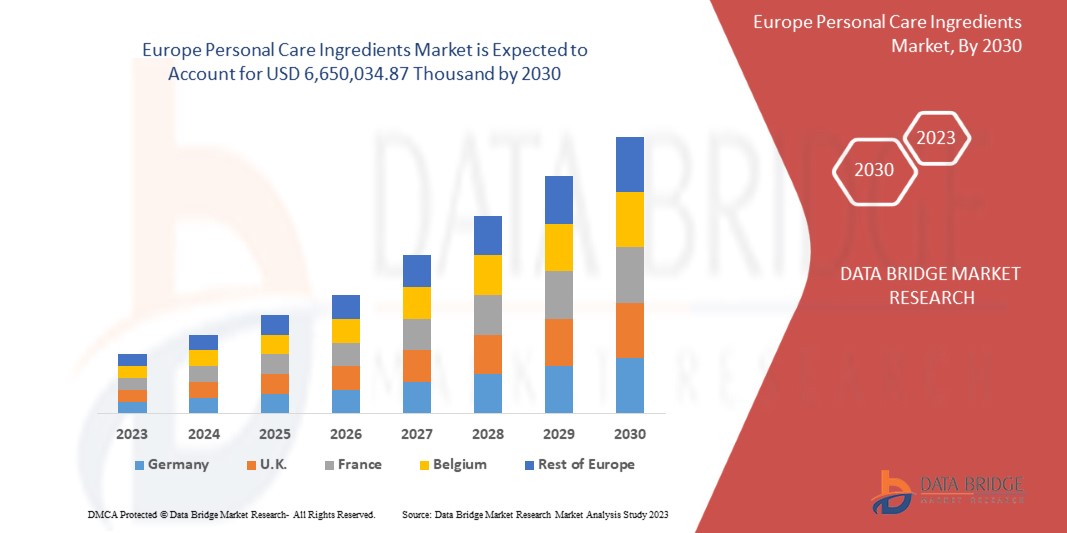

Le marché européen des ingrédients de soins personnels devrait croître considérablement au cours de la période de prévision de 2023 à 2030. Data Bridge Market Research analyse que le marché croît avec un TCAC de 6,3 % au cours de la période de prévision de 2023 à 2030 et devrait atteindre 6 650 034,87 milliers USD d'ici 2030. Le principal facteur à l'origine de la croissance du marché est la popularité croissante des produits de soins personnels parmi les milléniaux et la sensibilisation croissante aux propriétés des produits de soins personnels.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Année historique |

2021 (personnalisable pour 2020-2016) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains |

|

Segments couverts |

Type (extraits marins, extraits minéraux, peptides, extraits botaniques, produits biotechnologiques et actifs synthétiques), application (soins de la peau, soins capillaires et autres). |

|

Pays couverts |

Royaume-Uni, Russie, France, Espagne, Italie, Allemagne, Turquie, Pays-Bas, Suisse, Belgique et reste de l'Europe |

|

Acteurs du marché couverts |

Ashland, BASF SE, Bio-Botanica, BIOLANDES, Clariant, CODIF Technologie naturelle, Croda International Plc, DSM, Evonik Industries AG, Laboratoires Expanscience, Gattefossé, Givaudan, GREENTECH, Hallstar, Lipoid-Kosmetik, The Lubrizol Corporation, Naolys, mibelle GROUP biochemistry, LUCASMEYER COSMETICS, Nutri-Woods Bio-tech (Beijing) Co., Ltd., Provital, RAHN AG., Sabinsa., SEPPIC, SEQENS, Silab, Solabia Group, Symrise et Vytrus Biotech, entre autres |

Définition du marché

Les ingrédients de soins personnels sont les matières premières utilisées dans la fabrication de produits de soins de la peau dans le monde entier. Les ingrédients utilisés dans les produits de soins de la peau sont des agents antifongiques, des agents anti-âge, des agents revitalisants pour la peau et autres. Les ingrédients de soins personnels peuvent être classés en ingrédients actifs et inactifs. Les ingrédients actifs comprennent les agents anti-âge, les exfoliants, les agents revitalisants et les agents de protection UV, tandis que les ingrédients inactifs comprennent les tensioactifs, les conservateurs, les colorants et les ingrédients polymères. Les facteurs moteurs de la croissance du marché comprennent la sensibilisation croissante des consommateurs aux ingrédients de soins personnels.

Dynamique du marché européen des ingrédients de soins personnels

Conducteurs

- Augmentation de la sensibilisation des consommateurs aux ingrédients des soins personnels

Les ingrédients de soins personnels sont les matières premières utilisées dans la fabrication de produits de soins de la peau dans le monde entier. Les ingrédients utilisés dans les produits de soins de la peau sont des agents antifongiques, des agents anti-âge, des agents revitalisants pour la peau et d'autres. Les ingrédients de soins personnels peuvent être classés en ingrédients actifs et inactifs. Les ingrédients actifs comprennent les agents anti-âge, les exfoliants, les agents revitalisants et les agents de protection UV, tandis que les ingrédients inactifs comprennent les tensioactifs, les conservateurs, les colorants et les ingrédients polymères. La demande croissante de produits de soins personnels pour lutter contre le stress et l'anxiété, et la tendance des consommateurs à accroître leur engagement dans des routines de soins personnels comme moyen de se sentir bien et d'avoir une meilleure apparence, ont été le principal moteur de la croissance du marché. L'intérêt pour les ingrédients naturels et biologiques a encore accru la sensibilisation et la demande de produits de soins de la peau tels que les masques pour le visage, les gommages corporels, les toniques et les sérums parmi les utilisateurs, car il met l'accent sur le changement de leurs soins de la peau existants.

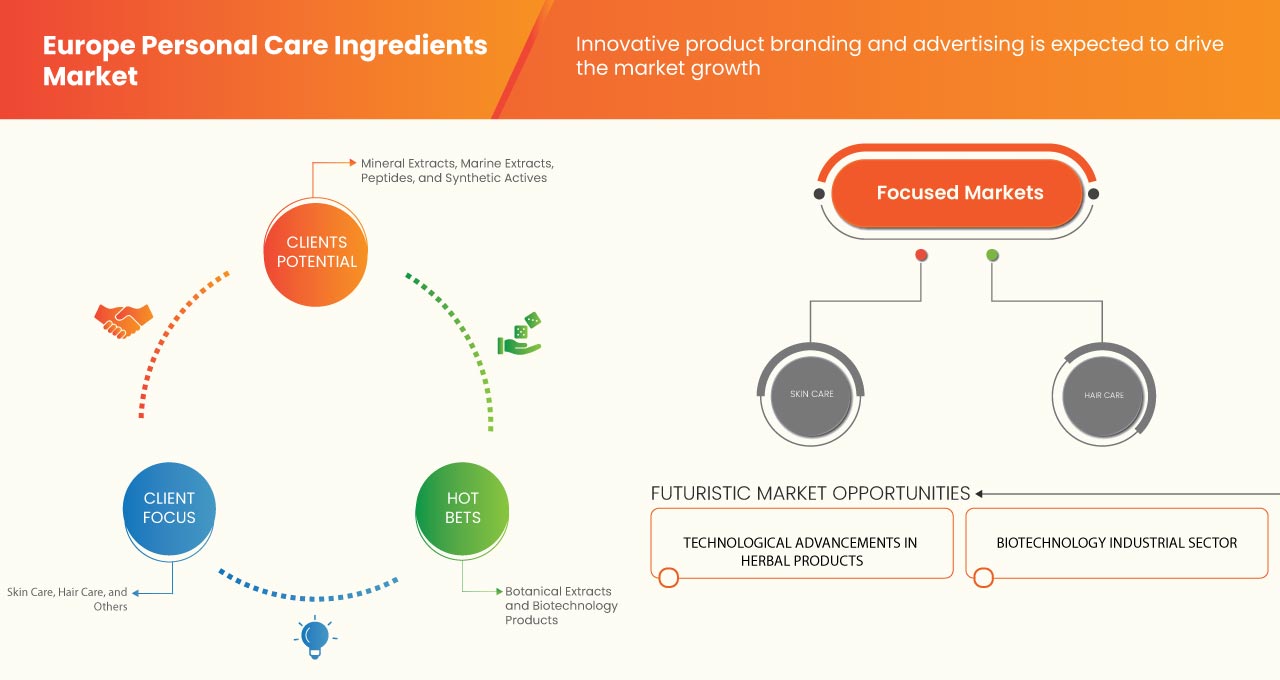

- Image de marque et publicité de produits innovants

Une stratégie de marque innovante permet aux clients de reconnaître immédiatement le produit. La stratégie de marque d'un produit est une combinaison stratégique de design et d'expérience qui identifie de manière unique un produit et le distingue des autres produits de la catégorie. L'essor des technologies numériques a influencé le comportement d'achat des consommateurs sur le marché des produits de soins personnels à travers le monde. Les principales marques de soins personnels du marché augmentent leurs technologies numériques pour permettre aux consommateurs de découvrir les marques d'une manière entièrement nouvelle. Les progrès technologiques, la stratégie de marque innovante et les stratégies publicitaires ont facilité l'accès aux soins personnels et à l'hygiène. Les grandes entreprises et marques de beauté s'impliquent en permanence dans l'innovation de leurs stratégies de marque et de publicité pour atteindre une base d'audience plus large et accroître l'engagement des clients. De nombreuses marques ont utilisé les plateformes de médias sociaux comme stratégie majeure pour améliorer la portée de la marque ces dernières années.

- Augmentation du revenu disponible et augmentation de la population urbaine

L'industrie des soins personnels joue un rôle très important dans toutes les économies développées et en développement. L'augmentation des revenus disponibles a renforcé le pouvoir d'achat des consommateurs. L'urbanisation accélérée et l'augmentation de la population urbaine avec des exigences de style de vie changeantes sont des moteurs importants de la demande croissante de produits de soins personnels sur le marché. La croissance de l'économie européenne a augmenté le revenu disponible de la population européenne dans les zones urbaines. Cela a augmenté la capacité de dépense de la population urbaine. Les millennials constituent une part importante de la population urbaine et des dépenses de consommation. Ils sont à l'avant-garde de la tendance beauté athleisure. Cela constitue un facteur majeur de dépenses en produits de beauté et cosmétiques. Les tendances croissantes des médias sociaux et le besoin de bien paraître devraient stimuler la demande du marché.

Opportunités

- Changement de préférence vers les produits durables

Les ingrédients écologiques et durables sont de plus en plus populaires dans le secteur des soins personnels. La durabilité devient une priorité absolue pour de nombreuses marques, car les entreprises s'efforcent constamment de mettre en œuvre des initiatives plus écologiques sans compromettre la qualité du produit et de répondre à la demande d'une population croissante de consommateurs soucieux de l'environnement. Les entreprises se concentrent sur la réduction des ingrédients synthétiques, l'utilisation d'énergies renouvelables pour la fabrication et la refonte des produits pour inclure moins d'eau dans leur composition.

- Disponibilité de la personnalisation dans le secteur des soins personnels

Les avancées technologiques dans le secteur conduisent les consommateurs vers un produit conçu uniquement pour leur type de peau. Les consommateurs sont de plus en plus attentifs à choisir le produit en fonction de leur type de peau. En conséquence, les entreprises de beauté se concentrent sur la satisfaction de ces consommateurs avec des produits idéaux pour leur utilisation, leur permettant d'accroître l'engagement des consommateurs sur le marché. Les entreprises et fabricants de produits de beauté introduisent en permanence la personnalisation et la numérisation dans les produits de soins personnels, attribuées à la demande croissante de gammes de soins personnels personnalisés. Les consommateurs prennent conscience des produits de beauté et de soins de la peau sur le marché. L'attrait de la personnalisation permet aux consommateurs d'adapter leur routine de soins et d'exprimer leur caractère unique.

Contraintes/Défis

- Augmentation de la sensibilisation des citoyens aux effets nocifs des produits chimiques contenus dans les produits de soins personnels

Les produits de soins personnels ou les produits associés à des ingrédients sont fabriqués à l'aide de divers produits chimiques organiques et synthétiques comme matières premières. La majorité des ingrédients de soins personnels contiennent une longue liste de produits chimiques comme matières premières pour prolonger leur durée de conservation jusqu'à plusieurs mois. Malgré une large préférence et des avantages pour les ingrédients de soins personnels, des problèmes importants associés à la présence de produits chimiques nocifs et toxiques dans le produit sont présents sur le marché. Les produits chimiques toxiques utilisés dans les produits constituent le goulot d'étranglement du processus de croissance du marché. Dans ce scénario de produits de soins personnels, la majorité des fabricants tentent d'améliorer leur qualité et d'utiliser moins de produits chimiques. La sensibilisation des consommateurs augmente de jour en jour grâce à Internet, aux actualités et à la numérisation du monde. Ils sont beaucoup plus conscients et ont plus de connaissances sur les effets de ces produits chimiques mortels.

- Augmentation des effets secondaires des ingrédients de soins personnels

Les produits de soins personnels ou les produits associés à des ingrédients sont fabriqués à partir de divers produits chimiques organiques et synthétiques comme matières premières. Les produits chimiques utilisés dans les ingrédients de soins personnels peuvent provoquer des effets secondaires mortels qui peuvent se transformer en maladies à court terme ou chroniques. La pandémie de COVID-19 a sensibilisé le public et le gouvernement à la nécessité de prendre des mesures de santé dans les pays développés comme les États-Unis, le Japon, la Chine, le Brésil et l'Arabie saoudite, entre autres. Certains incidents se sont produits avec des symptômes croissants qui sont mauvais pour la santé. Cela devrait freiner la croissance du marché au cours de la période de prévision.

- Règles et réglementations strictes formulées par les agences gouvernementales

Les ingrédients de soins personnels étant un nouveau besoin des consommateurs, il est difficile d'atteindre tous les utilisateurs finaux potentiels en raison de certaines raisons réglementaires spécifiques. Étant donné que tous les produits ne sont pas à la hauteur, ils peuvent faire face à des problèmes et à des poursuites judiciaires de la part des organismes de réglementation. L'utilisation d'ingrédients et de produits de soins personnels présente des avantages. Cependant, elle présente certains inconvénients, notamment la présence de produits chimiques nocifs tels que les parabènes et les sulfates, qui peuvent limiter la croissance du marché et constituer un défi pour les fabricants. De plus, les produits de soins personnels associés à la beauté sont toujours l'un des matériaux les plus utilisés sur le marché européen des ingrédients de soins personnels. Différents types de produits chimiques nocifs sont utilisés dans la fabrication de produits. En raison de l'application de produits chimiques, les organismes de réglementation émettent des réglementations et des directives qui peuvent limiter la croissance du marché.

- Fluctuations des prix des matières premières

Différents types de matières premières sont utilisés pour fabriquer des ingrédients de soins personnels tels que les huiles, les graisses, les esters de cire et les huiles d'ester, et les agents tensioactifs sont utilisés comme émulsifiants et agents solubilisants, entre autres. Le prix des matières premières est volatile. En raison de cette hausse des prix, les fabricants peuvent être confrontés à des défis en cascade tout au long des chaînes d'approvisionnement. Alors que les prix continuent de grimper, les livraisons des fournisseurs et la disponibilité de la main-d'œuvre ralentissent.

Par conséquent, les fluctuations des prix des matières premières utilisées dans la fabrication d’ingrédients de soins personnels devraient remettre en cause la croissance du marché.

Développement récent

- En novembre 2022, Ashland a lancé la sclaréolide naturelle biofonctionnelle Sclareance grâce à la biotechnologie qui aide à réduire et à limiter l'apparition des pellicules. Cela a aidé l'entreprise à élargir son portefeuille, ce qui contribue à augmenter ses revenus.

Portée du marché européen des ingrédients de soins personnels

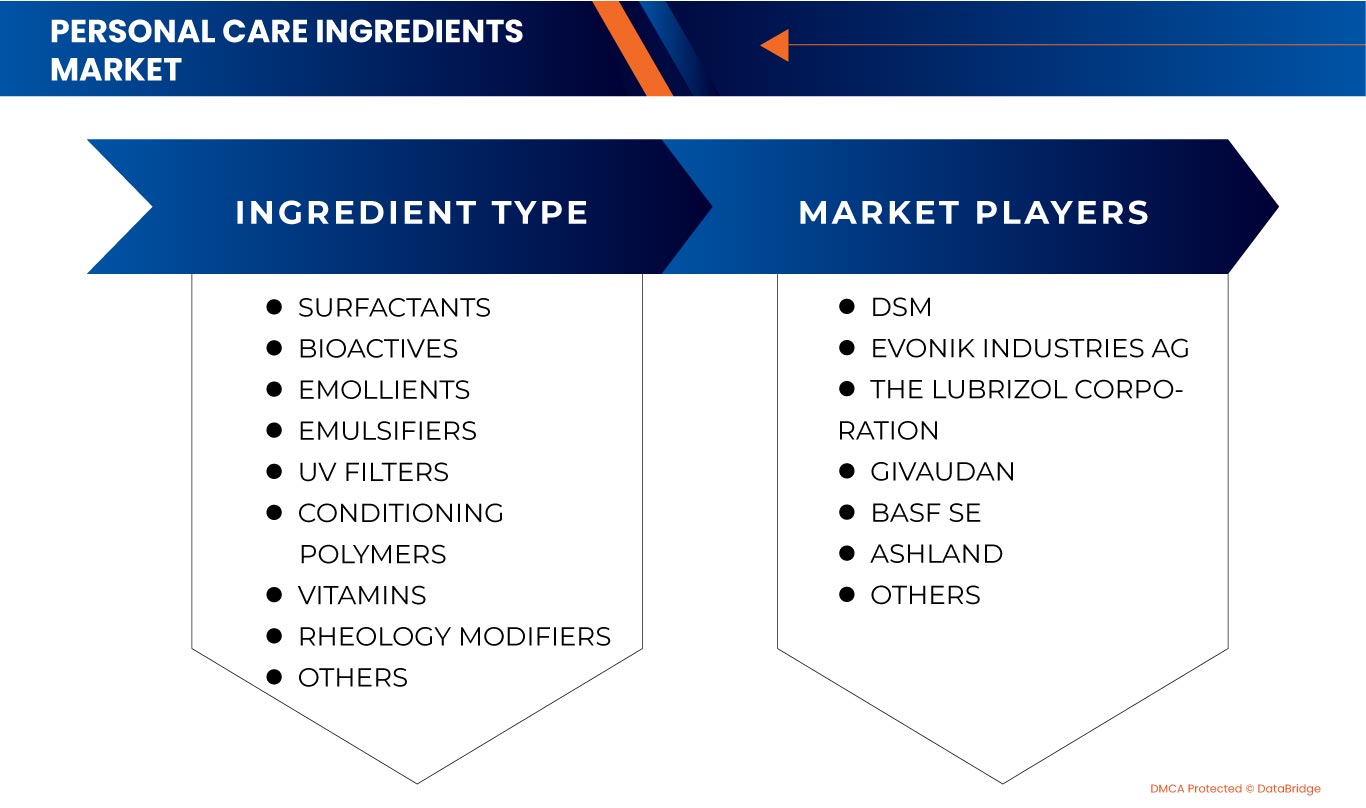

Le marché européen des ingrédients de soins personnels est divisé en deux segments en fonction du type et de l'application. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Taper

- Extraits marins

- Extraits minéraux

- Peptides

- Extraits botaniques

- Produits issus de la biotechnologie

- Actifs synthétiques

En fonction du type, le marché est segmenté en six segments, à savoir les extraits marins, les extraits minéraux, les peptides, les extraits botaniques, les produits biotechnologiques et les actifs synthétiques.

Application

- Soins de la peau

- Soins capillaires

- Autres

En fonction des applications, le marché est segmenté en trois segments, à savoir les soins de la peau, les soins capillaires et autres.

Analyse/perspectives régionales du marché des ingrédients de soins personnels en Europe

Le marché européen des ingrédients de soins personnels est segmenté en fonction du type et de l’application.

Les pays du marché européen des ingrédients de soins personnels sont le Royaume-Uni, la Russie, la France, l'Espagne, l'Italie, l'Allemagne, la Turquie, les Pays-Bas, la Suisse, la Belgique et le reste de l'Europe. L'Allemagne domine la région Europe en raison des caractéristiques croissantes des produits de soins personnels.

La section pays du rapport fournit également des facteurs individuels d'impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. L'analyse des points de données en aval et en amont de la chaîne de valeur, l'analyse des tendances techniques des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques européennes et les défis rencontrés en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Paysage concurrentiel et analyse des parts de marché des ingrédients de soins personnels en Europe

Le paysage concurrentiel du marché européen des ingrédients de soins personnels fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications et la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises par rapport au marché.

Français Certains des principaux acteurs opérant sur le marché européen des ingrédients de soins personnels sont Ashland, BASF SE, Bio-Botanica, BIOLANDES, Clariant, CODIF Technologie naturelle, Croda International Plc, DSM, Evonik Industries AG, Laboratoires Expanscience, Gattefossé, Givaudan, GREENTECH, Hallstar, Lipoid-Kosmetik, The Lubrizol Corporation, Naolys, mibelle GROUP biochemistry, LUCASMEYER COSMETICS, Nutri-Woods Bio-tech (Beijing) Co., Ltd., Provital, RAHN AG., Sabinsa., SEPPIC, SEQENS, Silab, Solabia Group, Symrise et Vytrus Biotech entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE PERSONAL CARE INGREDIENTS MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MATERIAL LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 EUROPE PERSONAL CARE INGREDIENTS MARKET PRODUCT LIFELINE CURVE

2.9 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.1 DBMR MARKET POSITION GRID

2.11 MARKET APPLICATION COVERAGE GRID

2.12 DBMR MARKET CHALLENGE MATRIX

2.13 DBMR VENDOR SHARE ANALYSIS

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 IMPORT-EXPORT SCENARIO

4.2 PESTLE ANALYSIS

4.2.1 POLITICAL FACTORS

4.2.2 ECONOMIC FACTORS

4.2.3 SOCIAL FACTORS

4.2.4 TECHNOLOGICAL FACTORS

4.2.5 LEGAL FACTORS

4.2.6 ENVIRONMENTAL FACTORS

4.3 PORTER'S FIVE FORCES:

4.3.1 THREAT OF NEW ENTRANTS

4.3.2 THREAT OF SUBSTITUTES

4.3.3 BARGAINING POWER OF BUYERS

4.3.4 BARGAINING POWER OF SUPPLIERS

4.3.5 INDUSTRIAL RIVALRY

4.4 PRODUCTION CONSUMPTION ANALYSIS

4.5 RAW MATERIAL SOURCING ANALYSIS

4.6 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.7 VENDOR SELECTION CRITERIA

5 REGULATION COVERAGE

6 LIST OF MOST SOLD PRODUCTS & TRENDING PRODUCTS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 GROWTH IN THE AWARENESS AMONG CONSUMERS REGARDING PERSONAL CARE INGREDIENTS

7.1.2 INNOVATIONAL PRODUCT BRANDING AND ADVERTISING

7.1.3 RISE IN DISPOSABLE INCOME AND INCREASE IN URBAN POPULATION

7.2 RESTRAINT

7.2.1 INCREASE IN THE AWARENESS AMONG PEOPLE ABOUT THE HARMFUL EFFECTS OF CHEMICALS IN PERSONAL CARE PRODUCTS

7.2.2 RISE IN THE SIDE-EFFECTS OF PERSONAL CARE INGREDIENTS

7.3 OPPORTUNITIES

7.3.1 SHIFT IN THE PREFERENCE TOWARD SUSTAINABLE PRODUCTS

7.3.2 AVAILABILITY OF CUSTOMIZATION IN THE PERSONAL CARE INDUSTRY

7.4 CHALLENGES

7.4.1 STRINGENT RULES AND REGULATIONS FORMULATED BY GOVERNMENT AGENCIES

7.4.2 FLUCTUATIONS IN PRICES OF RAW MATERIAL

8 EUROPE PERSONAL CARE INGREDIENTS MARKET, BY TYPE

8.1 OVERVIEW

8.2 MARINE EXTRACTS

8.2.1 SUBSTANTIATED ACTIVES

8.2.2 UNSUBSTANTIATED ACTIVES

8.3 MINERAL EXTRACTS

8.3.1 SUBSTANTIATED ACTIVES

8.3.2 UNSUBSTANTIATED ACTIVES

8.4 PEPTIDES

8.4.1 SUBSTANTIATED ACTIVES

8.4.2 UNSUBSTANTIATED ACTIVES

8.5 BOTANICAL EXTRACTS

8.5.1 SUBSTANTIATED ACTIVES

8.5.2 UNSUBSTANTIATED ACTIVES

8.6 BIOTECHNOLOGY PRODUCTS

8.6.1 SUBSTANTIATED ACTIVES

8.6.2 UNSUBSTANTIATED ACTIVES

8.7 SYNTHETICS ACTIVES

8.7.1 SUBSTANTIATED ACTIVES

8.7.2 UNSUBSTANTIATED ACTIVES

9 EUROPE PERSONAL CARE INGREDIENTS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 SKIN CARE

9.2.1 MOISTURIZERS AND GELS

9.2.2 CREAMS

9.2.2.1 ANTI-AGEING

9.2.2.2 FAIRNESS

9.2.2.3 NIGHT

9.2.2.4 ACNE

9.2.2.5 OTHERS

9.2.3 SUNSCREENS

9.3 HAIR CARE

9.3.1 SHAMPOOS

9.3.2 CONDITIONERS

9.3.3 SCALP TREATMENT

9.4 OTHERS

10 EUROPE PERSONAL CARE INGREDIENTS MARKET, BY REGION

10.1 EUROPE

10.1.1 GERMANY

10.1.2 FRANCE

10.1.3 ITALY

10.1.4 U.K.

10.1.5 SPAIN

10.1.6 RUSSIA

10.1.7 SWITZERLAND

10.1.8 TURKEY

10.1.9 BELGIUM

10.1.10 NETHERLANDS

10.1.11 REST OF EUROPE

11 EUROPE PERSONAL CARE INGREDIENTS MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: EUROPE

11.2 NEW LAUNCH

11.3 ALLIANCE

11.4 AWARD

11.5 RECOGNITION

11.6 PARTNERSHIP

11.7 APPROVAL

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 DSM (2022)

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT UPDATES

13.2 EVONIK INDUSTRIES AG (2022)

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT UPDATES

13.3 THE LUBRIZOL CORPORATION

13.3.1 COMPANY SNAPSHOT

13.3.2 COMPANY SHARE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT UPDATES

13.4 GIVAUDAN (2022)

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT UPDATES

13.5 BASF SE (2022)

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT UPDATES

13.6 ASHLAND(2022)

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT UPDATES

13.7 BIO-BOTANICA

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT UPDATES

13.8 BIOLANDES

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT UPDATES

13.9 CLARIANT (2022)

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 PRODUCT PORTFOLIO

13.9.4 RECENT UPDATES

13.1 CODIF TECHNOLOGIE NATURELLE

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT UPDATES

13.11 CRODA INTERNATIONAL PLC(2022)

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT UPDATES

13.12 GATTEFOSSÉ

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT UPDATES

13.13 GREENTECH

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT UPDATE

13.14 HALLSTAR.

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT UPDATE

13.15 LABORATOIRES EXPANSCIENCE

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT UPDATES

13.16 LIPOID-KOSMETIK

13.16.1 COMPANY SNAPSHOT

13.16.2 PRODUCT PORTFOLIO

13.16.3 RECENT UPDATES

13.17 LUCASMEYERCOSMETICS

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT UPDATES

13.18 MIBELLE GROUP

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT UPDATES

13.19 NAOLYS

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT UPDATES

13.2 NUTRI-WOODS BIO-TECH (BEIJING) CO.,LTD.

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT UPDATES

13.21 PROVITAL

13.21.1 COMPANY SNAPSHOT

13.21.2 PRODUCT PORTFOLIO

13.21.3 RECENT UPDATES

13.22 RAHN AG.

13.22.1 COMPANY SNAPSHOT

13.22.2 PRODUCT PORTFOLIO

13.22.3 RECENT UPDATES

13.23 SABINSA.

13.23.1 COMPANY SNAPSHOT

13.23.2 PRODUCT PORTFOLIO

13.23.3 RECENT UPDATES

13.24 SEPPIC

13.24.1 COMPANY SNAPSHOT

13.24.2 PRODUCT PORTFOLIO

13.24.3 RECENT UPDATES

13.25 SEQENS

13.25.1 COMPANY SNAPSHOT

13.25.2 PRODUCT PORTFOLIO

13.25.3 RECENT UPDATES

13.26 SILAB

13.26.1 COMPANY SNAPSHOT

13.26.2 PRODUCT PORTFOLIO

13.26.3 RECENT UPDATES

13.27 SOLABIA GROUP

13.27.1 COMPANY SNAPSHOT

13.27.2 PRODUCT PORTFOLIO

13.27.3 RECENT UPDATES

13.28 SYMRISE(2022)

13.28.1 COMPANY SNAPSHOT

13.28.2 REVENUE ANALYSIS

13.28.3 PRODUCT PORTFOLIO

13.28.4 RECENT UPDATES

13.29 VYTRUS BIOTECH (2022)

13.29.1 COMPANY SNAPSHOT

13.29.2 REVENUE ANALYSIS

13.29.3 PRODUCT PORTFOLIO

13.29.4 RECENT UPDATES

14 QUESTIONNAIRE

15 RELATED REPORTS

Liste des tableaux

TABLE 1 REGULATORY FRAMEWORK

TABLE 2 EUROPE PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 3 EUROPE MARINE EXTRACTS IN PERSONAL CARE INGREDIENTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 4 EUROPE MARINE EXTRACTS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 5 EUROPE MINERAL EXTRACTS IN PERSONAL CARE INGREDIENTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 EUROPE MINERAL EXTRACTS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 7 EUROPE PEPTIDES IN PERSONAL CARE INGREDIENTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 EUROPE PEPTIDES IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 9 EUROPE BOTANICAL EXTRACTS IN PERSONAL CARE INGREDIENTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 EUROPE BOTANICAL EXTRACTS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 11 EUROPE BIOTECHNOLOGY PRODUCTS IN PERSONAL CARE INGREDIENTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 EUROPE BIOTECHNOLOGY PRODUCTS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 13 EUROPE SYNTHETICS ACTIVES IN PERSONAL CARE INGREDIENTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 EUROPE SYNTHETICS ACTIVES IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 15 EUROPE PERSONAL CARE INGREDIENTS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 16 EUROPE MORE THAN 8KG IN PERSONAL CARE INGREDIENTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 EUROPE SKIN CARE IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 18 EUROPE CREAMS IN PERSONAL CARE INGREDIENTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 EUROPE HAIR CARE IN PERSONAL CARE INGREDIENTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 EUROPE HAIR CARE IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 21 EUROPE OTHERS IN PERSONAL CARE INGREDIENTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 EUROPE PERSONAL CARE INGREDIENTS MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 23 EUROPE PERSONAL CARE INGREDIENTS MARKET, BY COUNTRY, 2021-2030 (THOUSAND TONS)

TABLE 24 EUROPE PERSONAL CARE INGREDIENTS MARKET, BY COUNTRY, 2021-2030 (PRICE/KG)

TABLE 25 EUROPE PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 26 EUROPE PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (THOUSAND TONS)

TABLE 27 EUROPE PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (PRICE/KG)

TABLE 28 EUROPE MARINE EXTRACTS SKIN CARE IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 29 EUROPE MINERAL EXTRACTS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 30 EUROPE PEPTIDES IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 EUROPE BOTANICAL EXTRACTS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 32 EUROPE BIOTECHNOLOGY PRODUCTS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 33 EUROPE SYNTHETIC ACTIVES IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 34 EUROPE PERSONAL CARE INGREDIENTS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 35 EUROPE SKIN CARE IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 36 EUROPE HAIR CARE IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 EUROPE HAIR CARE IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 38 GERMANY PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 39 GERMANY PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (THOUSAND TONS)

TABLE 40 GERMANY PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (PRICE/KG)

TABLE 41 GERMANY MARINE EXTRACTS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 42 GERMANY MINERAL EXTRACTS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 43 GERMANY PEPTIDES IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 44 GERMANY BOTANICAL EXTRACTS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 GERMANY BIOTECHNOLOGY PRODUCTS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 GERMANY SYNTHETIC ACTIVES IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 47 GERMANY PERSONAL CARE INGREDIENTS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 48 GERMANY SKIN CARE IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 49 GERMANY CREAMS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 50 GERMANY HAIR CARE PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 51 FRANCE PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 52 FRANCE PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (THOUSAND TONS)

TABLE 53 FRANCE PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (THOUSAND TONS)

TABLE 54 FRANCE MARINE EXTRACTS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 55 FRANCE MINERAL EXTRACTS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 FRANCE PEPTIDES EXTRACTS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 57 FRANCE BOTANICAL EXTRACTS PRODUCTS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 58 FRANCE BIOTECHNOLOGY PRODUCTS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 59 FRANCE SYNTHETIC ACTIVES IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 60 FRANCE PERSONAL CARE INGREDIENTS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 61 FRANCE SKIN CARE IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 62 FRANCE CREAMS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 63 FRANCE HAIR CARE PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 ITALY PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 65 ITALY PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (THOUSAND TONS)

TABLE 66 ITALY PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (PRICE/KG)

TABLE 67 ITALY MARINE EXTRACTS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 68 ITALY MINERAL EXTRACTS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 69 ITALY PEPTIDES IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 70 ITALY BOTANICAL EXTRACTS PRODUCTS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 71 ITALY BIOTECHNOLOGY PRODUCTS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 72 ITALY SYNTHETIC ACTIVES IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 73 ITALY PERSONAL CARE INGREDIENTS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 74 ITALY SKIN CARE IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 75 ITALY CREAMS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 76 ITALY HAIR CARE PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 77 U.K. PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 78 U.K. PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (THOUSAND TONS)

TABLE 79 U.K. PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (PRICE/KG)

TABLE 80 U.K. MARINE EXTRACTS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 81 U.K. MINERAL EXTRACTS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 82 U.K. PEPTIDES IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 83 U.K. BOTANICAL EXTRACTS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 84 U.K. BIOTECHNOLOGY PRODUCTS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 85 U.K. SYNTHETIC ACTIVES IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 86 U.K. PERSONAL CARE INGREDIENTS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 87 U.K. SKIN CARE IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 88 U.K. CREAMS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 89 U.K. HAIR CARE PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 90 SPAIN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 91 SPAIN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (THOUSAND TONS)

TABLE 92 SPAIN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (PRICE/KG)

TABLE 93 SPAIN MARINE EXTRACTS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 94 SPAIN MINERAL EXTRACTS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 95 SPAIN PEPTIDES IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 96 SPAIN BOTANICAL EXTRACTS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 97 SPAIN BIOTECHNOLOGY PRODUCTS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 98 SPAIN SYNTHETIC ACTIVES IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 99 SPAIN PERSONAL CARE INGREDIENTS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 100 SPAIN SKIN CARE IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 101 SPAIN CREAMS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 102 SPAIN HAIR CARE PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 103 RUSSIA PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 104 RUSSIA PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (THOUSAND TONS)

TABLE 105 RUSSIA PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (PRICE/KG)

TABLE 106 RUSSIA MARINE EXTRACTS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 107 RUSSIA MINERAL EXTRACTS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 108 RUSSIA PEPTIDES IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 109 RUSSIA BOTANICAL EXTRACTS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 110 RUSSIA BIOTECHNOLOGY PRODUCTS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 111 RUSSIA SYNTHETIC ACTIVES IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 112 RUSSIA PERSONAL CARE INGREDIENTS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 113 RUSSIA SKIN CARE IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 114 RUSSIA CREAMS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 115 RUSSIA HAIR CARE PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 116 SWITZERLAND PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 117 SWITZERLAND PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (THOUSAND TONS)

TABLE 118 SWITZERLAND PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (PRICE/KG)

TABLE 119 SWITZERLAND MARINE EXTRACTS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 120 SWITZERLAND MINERAL EXTRACTS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 121 SWITZERLAND PEPTIDES IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 122 SWITZERLAND BOTANICAL EXTRACTS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 123 SWITZERLAND BIOTECHNOLOGY PRODUCTS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 124 SWITZERLAND SYNTHETIC ACTIVES IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 125 SWITZERLAND PERSONAL CARE INGREDIENTS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 126 SWITZERLAND SKIN CARE IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 127 SWITZERLAND CREAMS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 128 SWITZERLAND HAIR CARE PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 129 TURKEY PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 130 TURKEY PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (THOUSAND TONS)

TABLE 131 TURKEY PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (PRICE/KG)

TABLE 132 TURKEY MARINE EXTRACTS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 133 TURKEY MINERAL EXTRACTS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 134 TURKEY PEPTIDES IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 135 TURKEY BOTANICAL EXTRACTS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 136 TURKEY BIOTECHNOLOGY PRODUCTS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 137 TURKEY SYNTHETIC ACTIVES IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 138 TURKEY PERSONAL CARE INGREDIENTS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 139 TURKEY SKIN CARE IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 140 TURKEY CREAMS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 141 TURKEY HAIR CARE PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 142 BELGIUM PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 143 BELGIUM PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (THOUSAND TONS)

TABLE 144 BELGIUM PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (PRICE/KG)

TABLE 145 BELGIUM MARINE EXTRACTS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 146 BELGIUM MINERAL EXTRACTS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 147 BELGIUM PEPTIDES IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 148 BELGIUM BOTANICAL EXTRACTS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 149 BELGIUM BIOTECHNOLOGY PRODUCTS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 150 BELGIUM SYNTHETIC ACTIVES IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 151 BELGIUM PERSONAL CARE INGREDIENTS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 152 BELGIUM SKIN CARE IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 153 BELGIUM CREAMS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 154 BELGIUM HAIR CARE PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 155 NETHERLANDS PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 156 NETHERLANDS PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (THOUSAND TONS)

TABLE 157 NETHERLANDS PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (PRICE/KG)

TABLE 158 NETHERLANDS MARINE EXTRACTS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 159 NETHERLANDS MINERAL EXTRACTS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 160 NETHERLANDS PEPTIDES IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 161 NETHERLANDS BOTANICAL EXTRACTS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 162 NETHERLANDS BIOTECHNOLOGY PRODUCTS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 163 NETHERLANDS SYNTHETIC ACTIVES IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 164 NETHERLANDS PERSONAL CARE INGREDIENTS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 165 NETHERLANDS SKIN CARE IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 166 NETHERLANDS CREAMS IN PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 167 NETHERLANDS HAIR CARE PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 168 REST OF EUROPE PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 169 REST OF EUROPE PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (THOUSAND TONS)

TABLE 170 REST OF EUROPE PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2021-2030 (PRICE/KG)

Liste des figures

FIGURE 1 EUROPE PERSONAL CARE INGREDIENTS MARKET

FIGURE 2 EUROPE PERSONAL CARE INGREDIENTS MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE PERSONAL CARE INGREDIENTS MARKET: DROC ANALYSIS

FIGURE 4 EUROPE PERSONAL CARE INGREDIENTS MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE PERSONAL CARE INGREDIENTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE PERSONAL CARE INGREDIENTS MARKET: THE MATERIAL LIFE LINE CURVE

FIGURE 7 EUROPE PERSONAL CARE INGREDIENTS MARKET: MULTIVARIATE MODELLING

FIGURE 8 PRODUCT LIFELINE CURVE

FIGURE 9 EUROPE PERSONAL CARE INGREDIENTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 10 EUROPE PERSONAL CARE INGREDIENTS MARKET: DBMR MARKET POSITION GRID

FIGURE 11 EUROPE PERSONAL CARE INGREDIENTS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 12 EUROPE PERSONAL CARE INGREDIENTS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 13 EUROPE PERSONAL CARE INGREDIENTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 14 EUROPE PERSONAL CARE INGREDIENTS MARKET: SEGMENTATION

FIGURE 15 GROWING AWARENESS AMONG CONSUMERS REGARDING PERSONAL CARE INGREDIENTS IS EXPECTED TO DRIVE THE EUROPE PERSONAL CARE INGREDIENTS MARKET IN THE FORECAST PERIOD

FIGURE 16 MARINE EXTRACTS IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE PERSONAL CARE INGREDIENTS MARKET IN 2023 & 2030

FIGURE 17 IMPORT-EXPORT SCENARIO (USD THOUSAND)

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE PERSONAL CARE INGREDIENTS MARKET-

FIGURE 19 EUROPE PERSONAL CARE INGREDIENTS MARKET: BY TYPE, 2022

FIGURE 20 EUROPE PERSONAL CARE INGREDIENTS MARKET, BY APPLICATION, 2022

FIGURE 21 EUROPE PERSONAL CARE INGREDIENTS MARKET: SNAPSHOT (2022)

FIGURE 22 EUROPE PERSONAL CARE INGREDIENTS MARKET: BY COUNTRY (2022)

FIGURE 23 EUROPE PERSONAL CARE INGREDIENTS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 24 EUROPE PERSONAL CARE INGREDIENTS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 25 EUROPE PERSONAL CARE INGREDIENTS MARKET: BY TYPE (2023-2030)

FIGURE 26 EUROPE PERSONAL CARE INGREDIENTS MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.