Europe Oil Refining Catalyst Market

Taille du marché en milliards USD

TCAC :

%

USD

967.60 Million

USD

1,581.04 Million

2025

2033

USD

967.60 Million

USD

1,581.04 Million

2025

2033

| 2026 –2033 | |

| USD 967.60 Million | |

| USD 1,581.04 Million | |

|

|

|

|

Europe Oil Refining Catalyst Market Segmentation, By Type (Hydrotreating, Fluidized Catalytic Cracking (FCC), Residue Fluidized Catalytic Cracking (RFCC), Hydrocracking, and Others), Catalyst (Zeolites, Metals, and Chemicals), Distribution Channel (Direct Sales/B2B, Distributors/Third-Party Distributors/Traders, E-Commerce, and Others), Application (Diesel, Kerosene, Distillate Dewax, and Others) - Industry Trends and Forecast to 2033

What is the Europe Oil Refining Catalyst Market Size and Growth Rate?

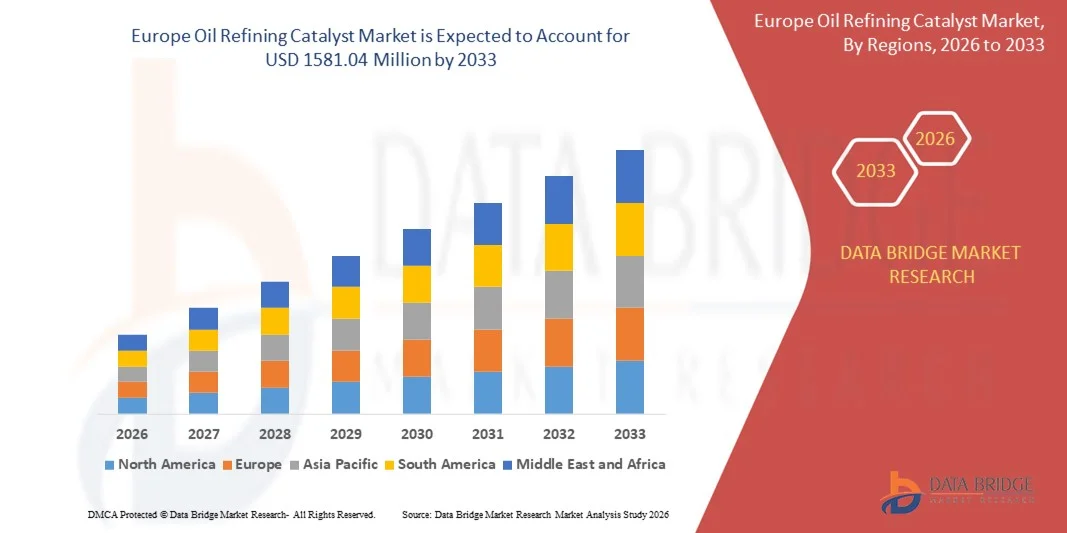

- The Europe oil refining catalyst market size was valued at USD 967.60 million in 2025 and is expected to reach USD 1581.04 million by 2033, at a CAGR of 6.33% during the forecast period

- Market growth is primarily driven by the rising demand for cleaner fuels, stricter environmental regulations, and increased adoption of advanced catalytic processes across petroleum refining operations

- The hydrotreating segment dominated the market in 2024, accounting for over 38% of the total revenue share, driven by stringent sulfur emission regulations and the widespread need for producing ultra-low sulfur diesel and gasoline

What are the Major Takeaways of Oil Refining Catalyst Market?

- Oil refining catalysts are critical materials used to enhance chemical reactions during refining processes, enabling higher conversion efficiency, improved fuel quality, and reduced sulfur and emissions, supporting compliance with environmental standards

- The growing demand for oil refining catalysts is largely driven by the need for high-performance, cost-effective, and environmentally compliant refining solutions, supported by increasing fuel consumption, refinery modernization, and sustained investments in process optimization and catalyst innovation

- Germany dominated the Europe oil refining catalyst market with an estimated 38.60% revenue share in 2025, supported by strong demand from petroleum refining, fuel upgrading, petrochemical production, and residue processing applications

- France is projected to register the fastest CAGR of around 7.5% during the forecast period, driven by increasing adoption of oil refining catalysts in clean fuel production, hydroprocessing units, and refinery modernization projects

- 1000nm-1500nm segment dominated the market with a market share of 45.8% in 2024, due to strong demand in optical communications, LiDAR, and remote sensing. Lasers in this range provide optimal transmission through fiber optic networks, high sensitivity for sensing applications, and reliable performance for industrial processing. Their compatibility with widely used photonic systems and instrumentation enhances their adoption across research, industrial, and telecommunication sectors

Report Scope and Oil Refining Catalyst Market Segmentation

|

Attributes |

Oil Refining Catalyst Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Oil Refining Catalyst Market?

Shift Toward Cleaner Fuels and Advanced Refining Processes

- The oil refining catalyst market is witnessing strong momentum due to the growing shift toward cleaner fuel production and advanced refining technologies. Oil refining catalysts play a crucial role in enabling refiners to meet stringent fuel quality standards by improving conversion efficiency and reducing sulfur and emissions

- For instance, BASF SE and Johnson Matthey are continuously enhancing their hydrotreating and hydrocracking catalyst portfolios to support the production of ultra-low sulfur fuels. Similarly, Honeywell UOP offers advanced FCC and hydroprocessing catalysts that help refineries improve yields while complying with environmental regulations

- In fuel processing operations, oil refining catalysts enable refiners to maximize output from heavier crude feeds while maintaining high product quality. Their ability to improve reaction selectivity supports higher yields of gasoline, diesel, and jet fuel, reducing operational waste

- Within upgrading and conversion units, oil refining catalysts enhance processing flexibility by allowing refiners to adapt to varying crude qualities. This capability is increasingly important as refineries shift toward processing heavier and unconventional feedstocks

- Oil refining catalysts also demonstrate growing importance in residue upgrading and biofuel co-processing, supporting refiners’ efforts to align with sustainability goals and energy transition strategies

- Overall, the increasing adoption of oil refining catalysts for cleaner fuel production highlights their essential role in modern refining operations. Their efficiency, adaptability, and regulatory compliance firmly position them as a cornerstone of next-generation refinery technologies

What are the Key Drivers of Oil Refining Catalyst Market?

- The rising need for higher refining efficiency and environmental compliance is a major driver accelerating the oil refining catalyst market. These catalysts enable improved conversion rates, lower emissions, and enhanced fuel quality across refining processes

- For instance, Clariant and Axens provide advanced catalyst solutions that support sulfur removal and octane enhancement while reducing energy consumption. Companies such as Haldor Topsoe are also developing high-performance catalysts designed for long operational lifetimes and improved feedstock flexibility

- The ability of oil refining catalysts to improve yield optimization helps refiners reduce operational costs while maintaining compliance with evolving fuel standards. This balance between performance and efficiency strengthens their long-term economic value

- Growing investments in refinery modernization and capacity expansions further support catalyst demand, particularly in hydroprocessing and FCC units where catalysts are critical to operational performance

- The market’s emphasis on combining productivity, compliance, and cost efficiency reinforces oil refining catalysts as indispensable components of modern petroleum refining, ensuring sustained adoption across global refining infrastructures

Which Factor is Challenging the Growth of the Oil Refining Catalyst Market?

- The high cost of oil refining catalysts presents a key challenge to market growth, as advanced formulations require rare metals, complex chemical compositions, and precision manufacturing techniques, increasing overall expenses

- For instance, premium catalyst solutions offered by companies such as Johnson Matthey and Haldor Topsoe involve higher upfront costs, making them less accessible for smaller or cost-sensitive refineries

- The technical complexity associated with catalyst selection, handling, and regeneration further limits adoption, as refiners require specialized expertise to optimize catalyst performance and lifecycle management

- Catalyst deactivation due to contaminants and harsh operating conditions can also increase replacement frequency, adding to operational costs and impacting refinery profitability

- To address these challenges, manufacturers are focusing on longer catalyst lifespans, regeneration technologies, and cost-optimized formulations, which will be critical in enabling broader adoption of oil refining catalysts across diverse refinery configurations

How is the Oil Refining Catalyst Market Segmented?

The market is segmented on the basis of type, catalyst, distribution channel, and application.

- By Type

On the basis of type, the oil refining catalyst market is segmented into Hydrotreating, Fluidized Catalytic Cracking (FCC), Residue Fluidized Catalytic Cracking (RFCC), Hydrocracking, and Others. The hydrotreating segment dominated the market in 2024, accounting for over 38% of the total revenue share, driven by stringent sulfur emission regulations and the widespread need for producing ultra-low sulfur diesel and gasoline. Hydrotreating catalysts are extensively used to remove sulfur, nitrogen, and other impurities, making them essential across nearly all refinery configurations.

The hydrocracking segment is expected to witness the fastest growth during the forecast period, supported by increasing demand for high-quality middle distillates and the ability to process heavy and unconventional crude oils. Hydrocracking catalysts enable higher conversion efficiency, improved yield flexibility, and superior fuel quality. Growing refinery upgrades and rising consumption of diesel and jet fuel are further accelerating adoption, positioning hydrocracking as a key growth engine in the market.

- By Catalyst

Based on catalyst composition, the market is segmented into Zeolites, Metals, and Chemicals. The zeolites segment dominated the oil refining catalyst market in 2024, capturing approximately 45% of the market share, owing to their superior acidity, thermal stability, and shape-selective properties. Zeolite catalysts are extensively used in FCC and hydrocracking processes to enhance conversion efficiency and maximize gasoline and olefin yields. Their ability to handle heavy feedstocks and improve reaction selectivity makes them a preferred choice among refiners.

The metals segment is projected to grow at the fastest CAGR, driven by increasing demand for hydrotreating and reforming catalysts used in sulfur removal and octane enhancement. Metal-based catalysts, including nickel, molybdenum, platinum, and cobalt, offer high activity and durability under severe operating conditions. Rising environmental regulations and the need for cleaner fuels are further accelerating the adoption of metal-based catalysts across modern refinery operations.

- By Distribution Channel

On the basis of distribution channel, the oil refining catalyst market is segmented into Direct Sales/B2B, Distributors/Third-Party Distributors/Traders, E-Commerce, and Others. The direct sales/B2B segment dominated the market in 2024, accounting for nearly 60% of total revenue, as major refiners prefer direct procurement from catalyst manufacturers to ensure technical support, customized formulations, and long-term supply agreements. Direct sales channels enable close collaboration between catalyst suppliers and refinery operators, optimizing catalyst performance and lifecycle management.

The distributors and third-party distributors segment is expected to grow at the fastest rate, driven by the rising number of small and mid-sized refineries seeking flexible procurement options. These channels offer quicker delivery, localized support, and cost-effective sourcing, particularly in emerging markets. The growing role of traders and regional distributors is enhancing market accessibility and expanding catalyst adoption beyond large-scale refinery networks.

- By Application

By application, the oil refining catalyst market is segmented into Diesel, Kerosene, Distillate Dewax, and Others. The diesel segment dominated the market in 2024, holding over 40% of the total market share, supported by strong global demand for transportation fuels and stringent regulations for low-sulfur diesel. Oil refining catalysts used in diesel production play a critical role in sulfur removal, cetane improvement, and yield optimization, making them indispensable for refinery operations.

The distillate dewax segment is anticipated to witness the fastest growth, driven by increasing demand for high-performance lubricants and low-temperature fuels. Dewaxing catalysts improve cold-flow properties and enhance fuel stability, supporting applications in automotive, industrial, and aviation sectors. Growing emphasis on fuel quality, performance optimization, and specialty petroleum products is accelerating catalyst demand across emerging distillate applications.

Which Region Holds the Largest Share of the Oil Refining Catalyst Market?

- Germany dominated the Europe oil refining catalyst market with an estimated 38.60% revenue share in 2025, supported by strong demand from petroleum refining, fuel upgrading, petrochemical production, and residue processing applications. The country’s advanced refining infrastructure, presence of major integrated oil and chemical companies, and continuous investments in refinery efficiency improvements and catalyst-intensive processes such as hydrotreating, FCC, and hydrocracking continue to drive market leadership

- A strong base of refining and chemical R&D centers, close collaboration between refiners, technology licensors, and catalyst manufacturers, and ongoing advancements in catalyst formulation, regeneration technologies, and feedstock flexibility are further strengthening Germany’s leadership in the Europe oil refining catalyst market

- Growing emphasis on ultra-low sulfur fuel production, processing of heavier crude slates, and strict compliance with European Union environmental regulations is sustaining long-term growth of the oil refining catalyst market across Germany and neighboring European countries

France Oil Refining Catalyst Market Insight

France is projected to register the fastest CAGR of around 7.5% during the forecast period, driven by increasing adoption of oil refining catalysts in clean fuel production, hydroprocessing units, and refinery modernization projects. Rising investments in energy efficiency, emissions reduction, and advanced refining technologies are accelerating market expansion.

Italy Oil Refining Catalyst Market Insight

Italy is witnessing steady growth in the oil refining catalyst market, supported by rising demand from refinery upgrades, residue conversion projects, and capacity optimization initiatives. Increasing focus on improving fuel quality, meeting EU emission standards, and enhancing refinery operational efficiency continues to support consistent market development.

Which are the Top Companies in Oil Refining Catalyst Market?

The oil refining catalyst industry is primarily led by well-established companies, including:

- Royal Dutch Shell plc (Netherlands)

- Exxon Mobil Corporation (U.S.)

- BASF SE (Germany)

- Honeywell International Inc. (UOP LLC) (U.S.)

- Johnson Matthey (U.K.)

- 3M (U.S.)

- Dow (U.S.)

- W. R. Grace & Co.-Conn (U.S.)

- Anten Chemical Co., Ltd (China)

- Clariant (Switzerland)

- China Petrochemical Corporation (Sinopec) (China)

- Albemarle Corporation (U.S.)

- Haldor Topsoe A/S (Denmark)

- Arkema (France)

- Kuwait Catalyst Company (Kuwait)

- JGC C&C (Japan)

- Axens (France)

- Gazpromneft-Catalytic Systems (Russia)

- UNICAT Catalyst Technologies, LLC (U.S.)

- TAIYO KOKO Co., Ltd (Japan)

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.