Marché européen des barres de céréales et de noix , par type de produit (barres de céréales et barres de noix), allégation (régulière, sans gluten, végétalienne, sans lactose, sans colorant ni conservateur artificiels et autres), catégorie (régulière, barre de remplacement de repas , barres avant l'entraînement, barres après l'entraînement, barres de yoga et autres), nature (conventionnelle et biologique), saveur (régulière et saveur), type d'emballage (emballage individuel, emballage familial/multipack et autres), emballage (emballage, sachets, boîte en carton et autres), marque (de marque et de distributeur), canal de distribution (détaillants en magasin et détaillants hors magasin) - Tendances et prévisions de l'industrie jusqu'en 2029.

De nos jours, diverses barres de céréales et de noix sont disponibles sur le marché dans de nombreuses saveurs telles que le chocolat, le caramel, la fraise, la myrtille et d'autres. La demande croissante de collations de remplacement de repas et la forte demande de collations à emporter et en petites portions parmi les consommateurs européens devraient propulser la demande pour le marché européen des barres de céréales et de noix. Cependant, une augmentation de la prévalence des allergies aux noix et la présence d'herbicides dans les produits à base de granola pourraient entraver la croissance du marché.

De nombreuses entreprises prennent des décisions stratégiques, comme le lancement de barres de céréales et de noix innovantes et l'acquisition d'autres entreprises pour améliorer leur part de marché. En conséquence, le marché européen des barres de céréales et de noix pourrait connaître une croissance rapide.

Le rapport sur le marché des barres de collation aux noix et aux céréales en Europe fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et localisé, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste ; notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité. La demande croissante de barres de collation sans sucre parmi les consommateurs devrait stimuler la croissance du marché au cours de la période de prévision.

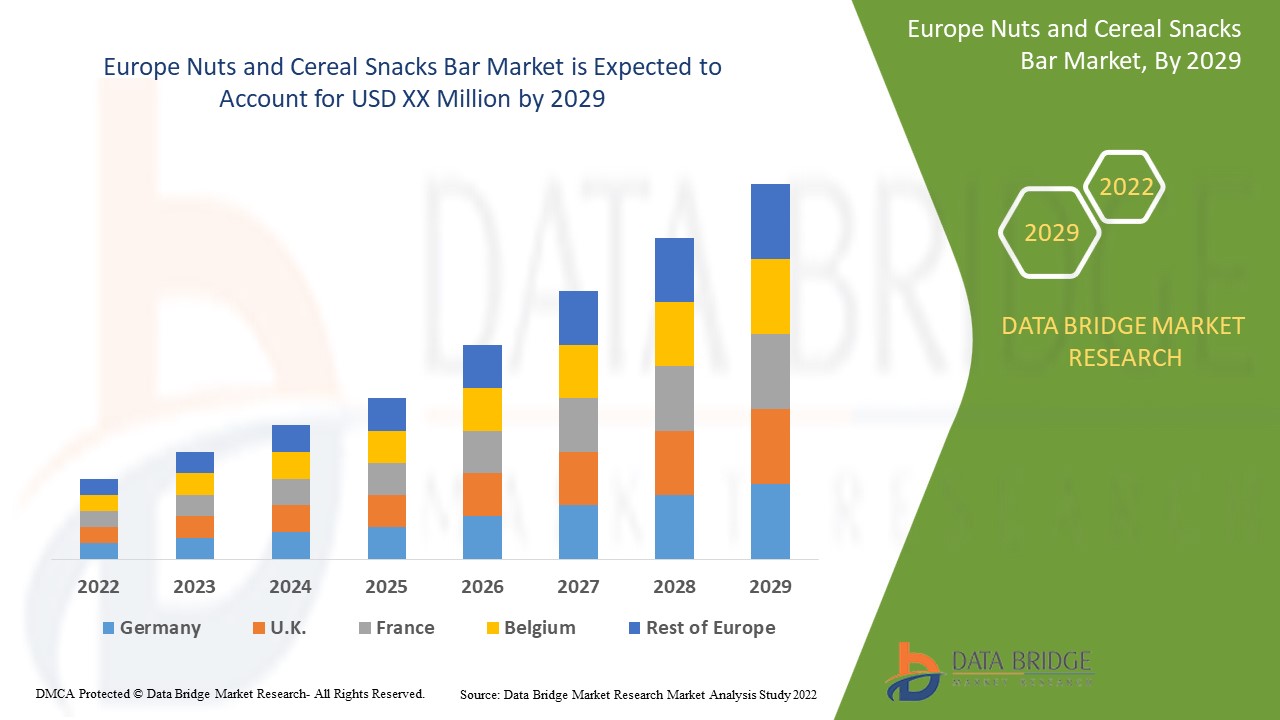

Le marché européen des barres de céréales et de noix est favorable et vise à réduire la progression de la maladie. Data Bridge Market Research analyse que le marché européen des barres de céréales et de noix devrait croître à un TCAC de 5,2 % au cours de la période de prévision de 2022 à 2029.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Type de produit (barres de céréales et barres de noix), allégation (ordinaire, sans gluten, végétalien, sans lactose, sans colorant ni conservateur artificiels, et autres), catégorie (ordinaire, barre de remplacement de repas, barres avant l'entraînement, barres après l'entraînement, barres de yoga, et autres), nature (conventionnelle et biologique ), saveur (ordinaire et saveur), type d'emballage (emballage individuel, emballage familial/multipack, et autres), emballage (emballage, sachets, boîte en carton, et autres), marque (marque de marque et marque privée), canal de distribution (détaillants en magasin et détaillants hors magasin), pays (Royaume-Uni, Allemagne, France, Belgique, Pays-Bas, Italie, Danemark, Suède, Russie, Espagne, Suisse, Pologne, Turquie et reste de l'Europe) |

|

Pays couverts |

Royaume-Uni, Allemagne, France, Belgique, Pays-Bas, Italie, Danemark, Suède, Russie, Espagne, Suisse, Pologne, Turquie et le reste de l'Europe |

|

Acteurs du marché couverts |

Mondelez International, General Mills Inc., Kellogg's Company, The Simply Good Foods Company, Associated British Foods plc, Nestlé, The Quaker Oats Company, Clif Bar and Company, Cerealto Siro Foods, Danone, Bühler, Mars, Incorporated et ses sociétés affiliées, Eat Naturals, Healthy Bars, Hero Group, entre autres |

Définition du marché :

Les barres de collation sont des produits polyvalents, souvent fabriqués à partir de noix, de céréales et d'autres ingrédients, pour fournir des nutriments sains et des fibres alimentaires aux consommateurs. Les barres de collation aux céréales ou aux noix peuvent être consommées dans le cadre d'un repas (au déjeuner, au petit-déjeuner ou au dîner), en dessert et en remplacement d'un repas. Les barres de collation sont conçues comme des barres nutritionnelles pour offrir une nutrition aux consommateurs. C'est une alternative saine aux collations conventionnelles car elles sont riches en fibres, en protéines et en autres ingrédients nutritionnels. De plus, les fabricants proposent des barres de collation hypocaloriques ou à faible teneur en sucre, des barres végétaliennes, des barres sans lactose ou sans gluten, sans conservateurs ni colorants artificiels pour attirer les consommateurs.

Dynamique du marché européen des barres de céréales et de noix

Conducteurs

- Lancement croissant d'une variété de noix et de barres de collation aux compositions variées

Le rythme de vie de plus en plus rapide et effréné a entraîné de nombreux problèmes de santé chez les consommateurs au cours des dernières années. Ainsi, les gens optent pour un mode de vie plus sain et maintiennent le contrôle de leur apport en nutriments tels que le sucre, les glucides et autres.

Les fabricants de noix et de snacks ont mis au point de nouveaux produits sans sucre, qui réduisent l'absorption de sucre par l'organisme. De nombreuses entreprises lancent de nouvelles barres de noix et de snacks aux compositions très diverses.

- Forte demande de snacks et de barres-collations

La sensibilisation croissante aux questions de santé et l’évolution du mode de vie des consommateurs européens sont les principaux facteurs de croissance du marché.

Différents pays d'Europe optent pour une alimentation saine et des tendances en matière de snacking. Au Royaume-Uni, les consommateurs se tournent davantage vers les barres de snacking pratiques qui offrent de nombreux avantages pour la santé, tandis que l'Allemagne est le vaste marché des snacks bio. En Allemagne, la culture alimentaire devient de plus en plus végétalienne. À mesure que les consommateurs sont de plus en plus sensibilisés à la nutrition, les industries alimentaires s'adaptent pour produire des snacks sains.

Le mode de vie des citoyens de la plupart des pays européens est devenu très frénétique. Dans des pays comme le Royaume-Uni, l'Allemagne et les Pays-Bas, les gens optent pour le petit-déjeuner, qui prend moins de temps et offre divers avantages nutritionnels pour la santé. Environ un quart des consommateurs prennent leur petit-déjeuner en moins de cinq minutes pendant les jours ouvrables. Cela augmente la demande de plats préparés et stimule les ventes de barres de céréales dans toute l'Europe.

Opportunité

- Forte demande de barres de collation sans sucre et à faible teneur en sucre

La consommation excessive de sucre entraîne le diabète et l’obésité. L’Europe dispose déjà d’une base de consommateurs décente de personnes atteintes de diabète qui préfèrent les produits sans sucre. Selon la British Diabetic Association, la population diagnostiquée de diabète au Royaume-Uni est passée de 3 millions de personnes en 2012 à 3,9 millions de personnes en 2019.

Ce facteur aide les fabricants de barres de noix sans sucre à pénétrer davantage le marché. Ils positionnent et commercialisent leur produit comme étant sans sucre pour attirer les patients diabétiques. Ils se concentrent également sur l'augmentation de l'offre de produits, afin que les consommateurs diabétiques ne soient pas limités dans leur choix de produits.

De nos jours, les consommateurs sont de plus en plus attentifs à leur santé, en particulier les plus jeunes. Ils sont pleinement conscients des effets néfastes de l'obésité. C'est pourquoi ils évitent les produits alimentaires à base de sucre par mesure de sécurité et de précaution. Ce facteur a également accru les possibilités pour les fabricants de noix et de barres de collation de répondre non seulement aux besoins des consommateurs diabétiques, mais aussi aux consommateurs non diabétiques. Des initiatives gouvernementales sont également observées pour réduire la consommation de sucre en Europe.

Contraintes/Défis

Les arachides et les fruits à coque sont des allergènes naturels pour de nombreux consommateurs européens. Les symptômes comprennent un nez qui coule, des démangeaisons cutanées, des éruptions cutanées, des problèmes digestifs tels que des douleurs d'estomac, des crampes, des nausées ou des vomissements, des picotements dans la gorge et la bouche, et bien d'autres. Ce facteur peut freiner la croissance du marché car les consommateurs sont sceptiques avant d'acheter les produits.

L'Europe connaît également un nombre élevé de cas de maladie cœliaque. En 2014, des recherches approfondies basées sur le dépistage sérologique ont confirmé que 0,5 à 1 % de la population de l'Union européenne souffre d'une maladie cœliaque non diagnostiquée. Cependant, l'estimation la plus élevée rapportée dans les études basées sur la population liées à la maladie cœliaque est d'environ 1 %. De plus, en considérant les données de diverses périodes, l'incidence de la maladie cœliaque semble varier de 0,1 à 3,7/1000 naissances vivantes dans la population infantile, tandis que dans la population adulte, elle est de 1,3 à 39/100 000/an.

Selon le Pharmaceutical Services Negotiating Committee, en 2015, « environ 1 % de la population britannique souffre de la maladie cœliaque, mais seulement 24 % d'entre elles sont diagnostiquées. Cela signifie qu'environ 500 000 personnes au Royaume-Uni ne sont pas diagnostiquées ». Ce facteur affecte également les ventes du segment des barres de céréales et freine la croissance du marché.

De plus, ce marché connaît une croissance rapide. Avec l'augmentation de la demande de barres de noix et de snacks, de nombreux nouveaux fabricants ont émergé sur le marché européen. Les fabricants développent de nombreux nouveaux produits pour répondre à la demande croissante de barres.

Ces fabricants internationaux de noix et de barres de collation ont des produits d'une popularité mondiale, ce qui pèse sur les fabricants locaux de noix et de barres de collation.

En raison de la forte demande de barres de collation, de nombreux acteurs locaux ont été introduits sur le marché. De plus, ces fabricants locaux proposent des barres de collation et de noix à un prix inférieur par rapport aux autres grands acteurs. Ces fabricants locaux peuvent créer une forte concurrence pour les grands fabricants de barres de collation et de noix, car les entreprises obtiennent les mêmes produits des fabricants locaux à des prix très bas.

Les acteurs locaux du secteur des snack-bars incluent Gutschermühle Traismauer Gmbh, Pataza Pty Ltd, Skinni Snax, Levom Grup Gida Ürünler et bien d'autres. Mais en raison de l'augmentation du coût des noix et des barres de snacking des entreprises internationales, les acteurs locaux ont relativement réduit leurs produits pour obtenir un avantage concurrentiel sur le marché, ce qui constitue un défi pour les acteurs mondiaux.

Le COVID-19 a eu un impact majeur sur le marché européen des barres de céréales et de noix

Pendant la pandémie, la demande volatile du marché pour les produits finis à base de noix appartenant à des catégories telles que les collations, les produits laitiers, la boulangerie et la confiserie a eu un impact négatif sur la chaîne d'approvisionnement des produits à base de noix. Une projection de croissance décente est attendue dans la dynamique de consommation des produits à base de noix en tant qu'ingrédient majeur. Les acteurs de la chaîne d'approvisionnement du marché des produits à base de noix se préparent à répondre à des pics inattendus après une demande tiède de noix et de leurs produits à valeur ajoutée. Pendant le confinement du COVID-19 dans tous les pays, les perturbations de la chaîne d'approvisionnement ont été un défi pour le marché. Le COVID-19 a eu un impact sur diverses industries de fabrication et de prestation de services au cours de l'année 2020-2021, car il a entraîné la fermeture de lieux de travail, la perturbation des chaînes d'approvisionnement et des restrictions sur les transports. Le déséquilibre entre l'offre et la demande et son impact sur les prix sont considérés comme à court terme et devraient se rétablir à la fin de cette pandémie. En raison de l'épidémie de COVID-19 dans le monde entier, la demande de produits de petit-déjeuner sains comme les barres de céréales a considérablement augmenté. De plus, les personnes infectées avaient besoin d’un régime alimentaire protéiné naturel et sain, ce qui a contribué à la croissance du marché européen des barres de céréales et de noix pendant la pandémie.

Le rapport sur le marché européen des barres de céréales et de noix fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l’analyse des importations et des exportations, l’analyse de la production, l’optimisation de la chaîne de valeur, la part de marché, l’impact des acteurs du marché national et localisé, les opportunités d’analyse en termes de poches de revenus émergentes, les changements dans la réglementation du marché, l’analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d’application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d’informations sur le marché européen des barres de céréales et de noix, contactez Data Bridge Market Research pour un briefing d’analyste ; notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Développement récent

- En décembre 2020, le groupe Ferrero a acquis Eat Natural pour enrichir son portefeuille mondial de snacks avec « Eat Natural ». Il prévoit de conserver la direction et les employés actuels de l'entreprise. Les conditions financières ont été gardées confidentielles. Il s'agit d'une solution stratégique pour l'entreprise, car elle étendra son empreinte globale sur le marché des snacks sains. Elle améliorera la distribution et s'étendra sur de nouveaux marchés pour toutes ses gammes de produits.

Marché européen des snacks à base de noix et de céréales

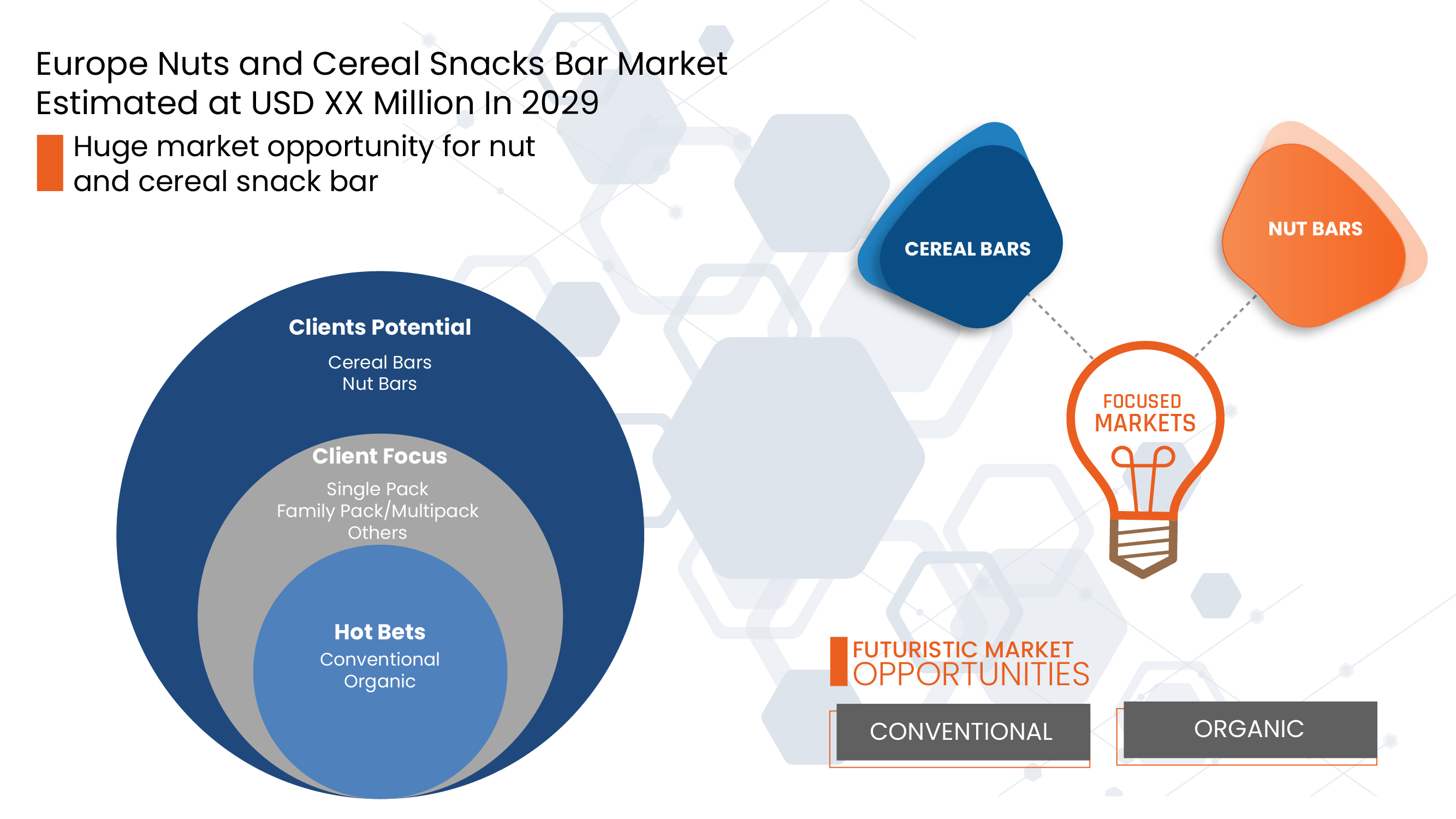

Le marché européen des barres de céréales et de noix est segmenté en neuf segments notables en fonction du type de produit, de l'allégation, de la catégorie, de la nature, de la saveur, du type d'emballage, de l'emballage, de la marque et du canal de distribution. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

Type de produit

- Barres de céréales

- Barres de noix

Sur la base du type de produit, le marché européen des barres de céréales et de noix est segmenté en barres de céréales et en barres de noix.

Réclamer

- Régulier

- Sans gluten

- Végétalien

- Sans lactose

- Sans colorants artificiels ni conservateurs

- Autres

Sur la base d'une revendication, le marché européen des barres de collation à base de noix et de céréales est segmenté en barres régulières, sans gluten, végétaliennes, sans lactose, sans colorants ni conservateurs artificiels, et autres.

- Catégorie

- Régulier

- Barre de remplacement de repas

- Barres pré-entraînement

- Barres post-entraînement

- Barres de yoga

- Autres

Sur la base de la catégorie, le marché européen des barres de collation à base de noix et de céréales est segmenté en barres régulières, barres de remplacement de repas, barres pré-entraînement, barres post-entraînement, barres de yoga et autres.

- Nature

- Conventionnel

- Organique

Sur la base de la nature, le marché européen des barres de céréales et de noix est segmenté en conventionnel et biologique.

- Saveur

- Régulier

- Saveur

Sur la base de la saveur, le marché européen des barres de céréales et de noix est segmenté en barres régulières et aromatisées.

- Type de paquet

- Paquet individuel

- Pack familial/Multipack

- Autres

Sur la base du type d'emballage, le marché européen des barres de céréales et de noix est segmenté en emballage unique, emballage familial/multipack et autres.

- Conditionnement

- Envelopper

- Boîte à cartes

- Pochettes

- Autres

Sur la base de l'emballage, le marché européen des barres de céréales et de noix est segmenté en emballages, boîtes en carton, sachets et autres.

- Marque

- De marque

- Marque privée

On the basis of brand, the Europe nuts and cereal snacks bar market is segmented into branded and private label.

- Distribution Channel

- Store-Based Retailing

- Non-Store Retailing

On the basis of distribution channel, the Europe nuts and cereal snacks bar market is segmented into store-based retailers and non-store retailers.

Europe Nuts and Cereal Snacks Bar Market Country Analysis/Insights

Europe nuts and cereal snacks bar market is analyzed, and market size insights and trends are provided by country, product type, claim, category, nature, flavor, pack type, packaging, brand and distribution channel, as referenced above.

Some of the countries covered in the Europe nuts and cereal snacks bar market report are the U.K., Germany, France, Belgium, Netherlands, Italy, Denmark, Sweden, Russia, Spain, Switzerland, Poland, Turkey and the Rest of Europe.

The U.K. in the Europe nuts and cereal snacks bar market is expected to grow with the most promising growth rate in the forecast period due to increasing demand for organic products among consumers. Germany stands in the second position because of various product launches by manufacturers in the country, and France is the third-highest growing country in the Europe nuts and cereal snacks bar market as there is high demand for fortified nuts and cereal bars.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of European brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Europe Nuts And Cereal Snacks Bar Market Share Analysis

Europe nuts and cereal snacks bar market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on the Europe nuts and cereal snacks bar market.

Certains des principaux acteurs du marché européen des barres de céréales et de noix sont Mondelez International, General Mills Inc., Kellogg's Company, The Simply Good Foods Company, Associated British Foods plc, Nestlé, The Quaker Oats Company, Clif Bar and Company., Cerealto Siro Foods, Danone, Bühler, Mars, Incorporated et ses sociétés affiliées, Eat Naturals, Healthy Bars, Hero Group, entre autres.

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement de l'entreprise, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse mondiale contre régionale et l'analyse des parts des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE NUTS AND CEREAL SNACKS BAR MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 AVERAGE GROSS MARGINS

4.2 BRAND COMPETITIVE ANALYSIS

4.3 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, CONSUMER DISPOSABLE INCOME DYNAMICS/SPEND DYNAMICS

4.3.1 OVERVIEW

4.3.2 SOCIAL FACTORS

4.3.3 CULTURAL FACTORS

4.3.4 PSYCHOLOGICAL FACTORS

4.3.5 PERSONAL FACTORS

4.3.6 ECONOMIC FACTORS

4.3.7 PRODUCT TRAITS

4.3.8 MARKET ATTRIBUTES

4.4 EUROPEAN CONSUMERS DISPOSABLE INCOME/SPEND DYNAMICS

4.5 FASTEST GROWING NEW ENTRANTS

4.6 EUROPE NUTS AND CEREAL SNACKS BAR MARKET- IMPORT & EXPORT ANALYSIS OF RAW MATERIAL

4.6.1 IMPORT OF CASHEW NUTS

4.6.2 IMPORT OF ALMONDS IN EU-28 BY ORIGIN IN MT (SHELLED BASIS)

4.6.3 IMPORT OF NUTS, EDIBLE; ALMONDS, FRESH OR DRIED, IN SHELL IN EU- 2018

4.6.4 EU-28 IMPORTS OF WALNUTS BY ORIGIN IN METRIC TONS (IN-SHELL BASIS)

4.6.5 FRANCE IMPORT OF OATS BY COUNTRY- 2019

4.6.6 EU-28 EXPORTS OF ALMONDS BY DESTINATION IN METRIC TONS (SHELLED BASIS)

4.6.7 EU-28 EXPORT OF WALNUTS BY ORIGIN IN METRIC TONS (IN-SHELL BASIS)

4.7 MACROECONOMIC TRENDS AFFECTING THE MARKET GROWTH

4.7.1 INFLATION

4.7.2 DISPOSABLE INCOME

4.7.3 SOCIAL FACTORS

4.8 EUROPE NUTS AND CEREAL SNACKS BAR MARKET: MARKETING STRATEGY

4.8.1 LAUNCHING ORGANIC AND PLANT-BASED PRODUCTS FOR THE VEGAN POPULATION

4.8.2 THOUGHTFUL PACKAGING AND CAMPAIGN

4.8.3 PARTNERSHIP WITH POPULAR BRANDS

4.8.4 A VAST NETWORK OF DISTRIBUTION

4.9 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, NEW PRODUCT LAUNCH STRATEGY

4.9.1 OVERVIEW

4.9.2 NUMBER OF PRODUCT LAUNCHES

4.9.3 LINE EXTENSION

4.9.4 NEW PACKAGING

4.9.5 RE-LAUNCHED

4.9.6 NEW FORMULATION

4.9.7 DIFFERENTIAL PRODUCT OFFERING

4.9.8 MEETING CONSUMER REQUIREMENT

4.9.9 PACKAGE DESIGNING

4.9.10 PRICING ANALYSIS

4.9.11 PRODUCT POSITIONING

4.9.12 CONCLUSION

4.1 PATENT ANALYSIS OF EUROPE NUTS AND CEREAL SNACKS BAR MARKET

4.10.1 PROMOTIONAL ACTIVITIES

4.10.2 PUBLIC RELATIONS

4.10.3 GEO-LOCATIONAL MARKETING

4.10.4 UNIQUE MARKETING CAMPAIGNS

4.11 EUROPE NUTS AND CEREAL SNACKS BAR MARKET: SHOPPING BEHAVIOUR

4.11.1 BUYING STRATEGIES

4.11.1.1 RECOMMENDATIONS FROM FAMILY & FRIENDS

4.11.1.2 RESEARCH

4.11.1.3 IMPULSIVE

4.11.2 ADVERTISEMENT

4.11.2.1 TELEVISION ADVERTISEMENT

4.11.2.2 ONLINE ADVERTISEMENT

4.11.2.3 IN-STORE ADVERTISEMENT

4.11.2.4 OUTDOOR ADVERTISEMENT

4.12 SUPPLY CHAIN OF EUROPE NUTS AND CEREAL SNACKS BAR MARKET

4.12.1 RAW MATERIAL PROCUREMENT

4.12.2 CEREAL AND NUTS BAR PRODUCTION/PROCESSING

4.12.3 MARKETING AND DISTRIBUTION

4.12.4 END USERS

4.13 VALUE CHAIN OF NUTS AND CEREAL SNACK BARS MARKET

5 REGIONAL SUMMARY

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING DEMAND FOR MEAL REPLACEMENT SNACKS

6.1.2 SURGE IN DEMAND FOR ON-THE-GO AND SMALL-PORTION SNACKING

6.1.3 RISE IN NUMBER OF HEALTH-CONSCIOUS CONSUMERS AND CHANGING LIFESTYLE

6.1.4 INCREASE IN DISPOSABLE INCOME

6.2 RESTRAINTS

6.2.1 INCREASE IN PREVALENCE OF NUT ALLERGY

6.2.2 HIGH PRICES OF RAW MATERIAL

6.2.3 PRESENCE OF HERBICIDES IN GRANOLA-BASED PRODUCTS

6.3 OPPORTUNITIES

6.3.1 HIGH DEMAND FOR SUGAR-FREE AND LOW SUGAR SNACK BARS

6.3.2 INCREASING DEMAND FOR ORGANIC PRODUCTS FROM CONSUMERS

6.3.3 GROWING NUMBER OF NEW PRODUCT LAUNCH

6.3.4 HIGH DEMAND FOR FORTIFIED NUTS BARS AND CEREAL BARS

6.3.5 GROWING POPULARITY OF SPORTS AND ATHLETIC ACTIVITIES

6.4 CHALLENGES

6.4.1 AVAILABILITY OF ALTERNATIVE BARS

6.4.2 STRINGENT GOVERNMENT REGULATION

6.4.3 INCREASING PRODUCTION COST OF GLUTEN-FREE PRODUCTS

7 IMPACT OF COVID-19 PANDEMIC ON THE EUROPE NUTS AND CEREAL SNACKS BAR MARKET

7.1 COVID-19 IMPACT ON MARKET

7.2 IMPACT ON PRICE

7.3 IMPACT ON DEMAND

7.4 IMPACT ON SUPPLY CHAIN

7.5 STRATEGIC DECISIONS FOR MANUFACTURERS

7.6 CONCLUSION

8 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 CEREAL BAR

8.2.1 GRANOLA BAR

8.2.2 MIXED CEREAL BAR

8.2.3 OAT BAR

8.2.4 RICE BAR

8.2.5 OTHERS

8.3 NUTS BAR

8.3.1 ALMOND

8.3.2 PEANUT

8.3.3 CASHEW

8.3.4 HAZELNUT

8.3.5 OTHERS

9 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY CLAIM

9.1 OVERVIEW

9.2 REGULAR

9.3 GLUTEN FREE

9.4 VEGAN

9.5 ARTIFICIAL COLOR AND PRESERVATIVE FREE

9.6 LACTOSE FREE

9.7 OTHERS

10 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY CATEGORY

10.1 OVERVIEW

10.2 REGULAR

10.3 MEAL REPLACEMENT BAR

10.4 PRE WORK OUT BAR

10.5 POST WORK OUT BAR

10.6 YOGA BAR

10.7 OTHERS

11 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY NATURE

11.1 OVERVIEW

11.2 CONVENTIONAL

11.3 ORGANIC

12 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR

12.1 OVERVIEW

12.2 FLAVOR

12.2.1 CHOCOLATES

12.2.2 NUTS

12.2.3 BLUEBERRY

12.2.4 COCONUT

12.2.5 STRAWBERRY

12.2.6 BANANA

12.2.7 CARAMEL

12.2.8 VANILLA

12.2.9 BLACKBERRY

12.2.10 HONEY

12.2.11 PEPPERMINT

12.2.12 BLACK CURRENT

12.2.13 BLACK BERRY

12.2.14 BLUE BERRY

12.2.15 CHEERY

12.2.16 PEACH

12.2.17 MOCHA

12.2.18 AMARETTO

12.2.19 GREEN TEA

12.2.20 OTHERS

12.3 REGULAR

13 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY PACK TYPE

13.1 OVERVIEW

13.2 FAMILY PACK/MULTIPACK

13.3 SINGLE PACK

13.4 OTHERS

14 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY PACKAGING

14.1 OVERVIEW

14.2 WRAP IN

14.3 CARD BOX

14.4 POUCHES

14.5 OTHERS

15 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY BRAND

15.1 OVERVIEW

15.2 BRANDED

15.3 PRIVATE LABEL

16 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL

16.1 OVERVIEW

16.2 STORE-BASED RETAILER

16.2.1 SUPERMARKETS/HYPERMARKETS

16.2.2 CONVENIENCE STORES

16.2.3 SPECIALTY RETAILERS

16.2.4 GROCERY RETAILERS

16.2.5 WHOLESALERS

16.2.6 OTHERS

16.3 NON-STORE RETAILER

16.3.1 ONLINE

16.3.2 VENDING MACHINE

17 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY COUNTRY

17.1 EUROPE

17.1.1 U.K.

17.1.2 GERMANY

17.1.3 FRANCE

17.1.4 BELGIUM

17.1.5 NETHERLANDS

17.1.6 ITALY

17.1.7 DENMARK

17.1.8 SWEDEN

17.1.9 RUSSIA

17.1.10 SPAIN

17.1.11 SWITZERLAND

17.1.12 POLAND

17.1.13 TURKEY

17.1.14 REST OF EUROPE

18 EUROPE NUTS AND CEREAL SNACKS BAR MARKET: COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: EUROPE

19 SWOT ANALYSIS

20 COMPANY PROFILE

20.1 KELLOGG'S COMPANY

20.1.1 COMPANY SNAPSHOT

20.1.2 RECENT FINANCIALS

20.1.3 PRODUCT PORTFOLIO

20.1.4 RECENT DEVELOPMENT

20.2 MONDELĒZ INTERNATIONAL

20.2.1 COMPANY SNAPSHOT

20.2.2 RECENT FINANCIALS

20.2.3 PRODUCT PORTFOLIO

20.2.4 RECENT DEVELOPMENTS

20.3 CLIF BAR & COMPANY.

20.3.1 COMPANY SNAPSHOT

20.3.2 PRODUCT PORTFOLIO

20.3.3 RECENT DEVELOPMENT

20.4 THE QUAKER OATS COMPANY

20.4.1 COMPANY SNAPSHOT

20.4.2 RECENT FINANCIALS

20.4.3 PRODUCT PORTFOLIO

20.4.4 RECENT DEVELOPMENTS

20.5 GENERAL MILLS INC.

20.5.1 COMPANY SNAPSHOT

20.5.2 RECENT FINANCIALS

20.5.3 PRODUCT PORTFOLIO

20.5.4 RECENT DEVELOPMENT

20.6 ASSOCIATED BRITISH FOODS PLC

20.6.1 COMPANY SNAPSHOT

20.6.2 RECENT FINANCIALS

20.6.3 PRODUCT PORTFOLIO

20.6.4 RECENT DEVELOPMENTS

20.7 BÜHLER

20.7.1 COMPANY SNAPSHOT

20.7.2 PRODUCT PORTFOLIO

20.7.3 RECENT DEVELOPMENTS

20.8 CEREALTO SIRO FOODS

20.8.1 COMPANY SNAPSHOT

20.8.2 RECENT FINANCIALS

20.8.3 PRODUCT PORTFOLIO

20.8.4 RECENT DEVELOPMENTS

20.9 DANONE

20.9.1 COMPANY SNAPSHOT

20.9.2 RECENT FINANCIALS

20.9.3 PRODUCT PORTFOLIO

20.9.4 RECENT DEVELOPMENTS

20.1 EAT NATURALS

20.10.1 COMPANY SNAPSHOT

20.10.2 PRODUCT PORTFOLIO

20.10.3 RECENT DEVELOPMENT

20.11 HEALTHY BAR

20.11.1 COMPANY SNAPSHOT

20.11.2 PRODUCT PORTFOLIO

20.11.3 RECENT DEVELOPMENTS

20.12 HERO GROUP

20.12.1 COMPANY SNAPSHOT

20.12.2 RECENT FINANCIALS

20.12.3 PRODUCT PORTFOLIO

20.12.4 RECENT DEVELOPMENT

20.13 MARS, INCORPORATED AND ITS AFFILIATES

20.13.1 COMPANY SNAPSHOT

20.13.2 PRODUCT PORTFOLIO

20.13.3 RECENT DEVELOPMENTS

20.14 NESTLÉ

20.14.1 COMPANY SNAPSHOT

20.14.2 RECENT FINANCIALS

20.14.3 PRODUCT PORTFOLIO

20.14.4 RECENT DEVELOPMENTS

20.15 THE SIMPLY GOOD FOODS COMPANY

20.15.1 COMPANY SNAPSHOT

20.15.2 RECENT FINANCIALS

20.15.3 PRODUCT PORTFOLIO

20.15.4 RECENT DEVELOPMENTS

21 QUESTIONARE

22 RELATED REPORTS

Liste des tableaux

TABLE 1 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 EUROPE CEREAL BAR IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 3 EUROPE NUT BAR IN BAR IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 4 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY CLAIM, 2020-2029 (USD MILLION)

TABLE 5 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 6 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 7 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 8 EUROPE FLAVOR IN NUTS AND CEREAL SNACKS BAR MARKETS MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 9 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY PACK TYPE, 2020-2029 (USD MILLION)

TABLE 10 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 11 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 12 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 13 EUROPE STORE-BASED RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 14 EUROPE NON-STORE RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 15 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 16 U.K. NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 17 U.K. CEREAL BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 18 U.K. NUTS BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 19 U.K. NUTS AND CEREAL SNACKS BAR MARKET, BY CLAIM, 2020-2029 (USD MILLION)

TABLE 20 U.K. NUTS AND CEREAL SNACKS BAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 21 U.K. NUTS AND CEREAL SNACKS BAR MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 22 U.K. NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 23 U.K. FLAVOR IN NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 24 U.K. NUTS AND CEREAL SNACKS BAR MARKET, BY PACK TYPE, 2020-2029 (USD MILLION)

TABLE 25 U.K. NUTS AND CEREAL SNACKS BAR MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 26 U.K. NUTS AND CEREAL SNACKS BAR MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 27 U.K. NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 28 U.K. STORE-BASED RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 29 U.K. NON-STORE RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 30 GERMANY NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 31 GERMANY CEREAL BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 32 GERMANY NUTS BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 33 GERMANY NUTS AND CEREAL SNACKS BAR MARKET, BY CLAIM, 2020-2029 (USD MILLION)

TABLE 34 GERMANY NUTS AND CEREAL SNACKS BAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 35 GERMANY NUTS AND CEREAL SNACKS BAR MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 36 GERMANY NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 37 GERMANY FLAVOR IN NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 38 GERMANY NUTS AND CEREAL SNACKS BAR MARKET, BY PACK TYPE, 2020-2029 (USD MILLION)

TABLE 39 GERMANY NUTS AND CEREAL SNACKS BAR MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 40 GERMANY NUTS AND CEREAL SNACKS BAR MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 41 GERMANY NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 42 GERMANY STORE-BASED RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 43 GERMANY NON-STORE RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 44 FRANCE NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 45 FRANCE CEREAL BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 46 FRANCE NUTS BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 47 FRANCE NUTS AND CEREAL SNACKS BAR MARKET, BY CLAIM, 2020-2029 (USD MILLION)

TABLE 48 FRANCE NUTS AND CEREAL SNACKS BAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 49 FRANCE NUTS AND CEREAL SNACKS BAR MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 50 FRANCE NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 51 FRANCE FLAVOR IN NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 52 FRANCE NUTS AND CEREAL SNACKS BAR MARKET, BY PACK TYPE, 2020-2029 (USD MILLION)

TABLE 53 FRANCE NUTS AND CEREAL SNACKS BAR MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 54 FRANCE NUTS AND CEREAL SNACKS BAR MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 55 FRANCE NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 56 FRANCE STORE-BASED RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 57 FRANCE NON-STORE RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 58 BELGIUM NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 59 BELGIUM CEREAL BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 60 BELGIUM NUTS BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 61 BELGIUM NUTS AND CEREAL SNACKS BAR MARKET, BY CLAIM, 2020-2029 (USD MILLION)

TABLE 62 BELGIUM NUTS AND CEREAL SNACKS BAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 63 BELGIUM NUTS AND CEREAL SNACKS BAR MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 64 BELGIUM NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 65 BELGIUM FLAVOR IN NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 66 BELGIUM NUTS AND CEREAL SNACKS BAR MARKET, BY PACK TYPE, 2020-2029 (USD MILLION)

TABLE 67 BELGIUM NUTS AND CEREAL SNACKS BAR MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 68 BELGIUM NUTS AND CEREAL SNACKS BAR MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 69 BELGIUM NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 70 BELGIUM STORE-BASED RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 71 BELGIUM NON-STORE RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 72 NETHERLANDS NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 73 NETHERLANDS CEREAL BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 74 NETHERLANDS NUTS BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 75 NETHERLANDS NUTS AND CEREAL SNACKS BAR MARKET, BY CLAIM, 2020-2029 (USD MILLION)

TABLE 76 NETHERLANDS NUTS AND CEREAL SNACKS BAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 77 NETHERLANDS NUTS AND CEREAL SNACKS BAR MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 78 NETHERLANDS NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 79 NETHERLANDS FLAVOR IN NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 80 NETHERLANDS NUTS AND CEREAL SNACKS BAR MARKET, BY PACK TYPE, 2020-2029 (USD MILLION)

TABLE 81 NETHERLANDS NUTS AND CEREAL SNACKS BAR MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 82 NETHERLANDS NUTS AND CEREAL SNACKS BAR MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 83 NETHERLANDS NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 84 NETHERLANDS STORE-BASED RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 85 NETHERLANDS NON-STORE RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 86 ITALY NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 87 ITALY CEREAL BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 88 ITALY NUTS BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 89 ITALY NUTS AND CEREAL SNACKS BAR MARKET, BY CLAIM, 2020-2029 (USD MILLION)

TABLE 90 ITALY NUTS AND CEREAL SNACKS BAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 91 ITALY NUTS AND CEREAL SNACKS BAR MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 92 ITALY NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 93 ITALY FLAVOR IN NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 94 ITALY NUTS AND CEREAL SNACKS BAR MARKET, BY PACK TYPE, 2020-2029 (USD MILLION)

TABLE 95 ITALY NUTS AND CEREAL SNACKS BAR MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 96 ITALY NUTS AND CEREAL SNACKS BAR MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 97 ITALY NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 98 ITALY STORE-BASED RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 99 ITALY NON-STORE RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 100 DENMARK NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 101 DENMARK CEREAL BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 102 DENMARK NUTS BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 103 DENMARK NUTS AND CEREAL SNACKS BAR MARKET, BY CLAIM, 2020-2029 (USD MILLION)

TABLE 104 DENMARK NUTS AND CEREAL SNACKS BAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 105 DENMARK NUTS AND CEREAL SNACKS BAR MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 106 DENMARK NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 107 DENMARK FLAVOR IN NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 108 DENMARK NUTS AND CEREAL SNACKS BAR MARKET, BY PACK TYPE, 2020-2029 (USD MILLION)

TABLE 109 DENMARK NUTS AND CEREAL SNACKS BAR MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 110 DENMARK NUTS AND CEREAL SNACKS BAR MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 111 DENMARK NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 112 DENMARK STORE-BASED RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 113 DENMARK NON-STORE RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 114 SWEDEN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 115 SWEDEN CEREAL BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 116 SWEDEN NUTS BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 117 SWEDEN NUTS AND CEREAL SNACKS BAR MARKET, BY CLAIM, 2020-2029 (USD MILLION)

TABLE 118 SWEDEN NUTS AND CEREAL SNACKS BAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 119 SWEDEN NUTS AND CEREAL SNACKS BAR MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 120 SWEDEN NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 121 SWEDEN FLAVOR IN NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 122 SWEDEN NUTS AND CEREAL SNACKS BAR MARKET, BY PACK TYPE, 2020-2029 (USD MILLION)

TABLE 123 SWEDEN NUTS AND CEREAL SNACKS BAR MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 124 SWEDEN NUTS AND CEREAL SNACKS BAR MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 125 SWEDEN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 126 SWEDEN STORE-BASED RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 127 SWEDEN NON-STORE RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 128 RUSSIA NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 129 RUSSIA CEREAL BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 130 RUSSIA NUTS BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 131 RUSSIA NUTS AND CEREAL SNACKS BAR MARKET, BY CLAIM, 2020-2029 (USD MILLION)

TABLE 132 RUSSIA NUTS AND CEREAL SNACKS BAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 133 RUSSIA NUTS AND CEREAL SNACKS BAR MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 134 RUSSIA NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 135 RUSSIA FLAVOR IN NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 136 RUSSIA NUTS AND CEREAL SNACKS BAR MARKET, BY PACK TYPE, 2020-2029 (USD MILLION)

TABLE 137 RUSSIA NUTS AND CEREAL SNACKS BAR MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 138 RUSSIA NUTS AND CEREAL SNACKS BAR MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 139 RUSSIA NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 140 RUSSIA STORE-BASED RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 141 RUSSIA NON-STORE RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 142 SPAIN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 143 SPAIN CEREAL BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 144 SPAIN NUTS BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 145 SPAIN NUTS AND CEREAL SNACKS BAR MARKET, BY CLAIM, 2020-2029 (USD MILLION)

TABLE 146 SPAIN NUTS AND CEREAL SNACKS BAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 147 SPAIN NUTS AND CEREAL SNACKS BAR MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 148 SPAIN NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 149 SPAIN FLAVOR IN NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 150 SPAIN NUTS AND CEREAL SNACKS BAR MARKET, BY PACK TYPE, 2020-2029 (USD MILLION)

TABLE 151 SPAIN NUTS AND CEREAL SNACKS BAR MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 152 SPAIN NUTS AND CEREAL SNACKS BAR MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 153 SPAIN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 154 SPAIN STORE-BASED RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 155 SPAIN NON-STORE RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 156 SWITZERLAND NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 157 SWITZERLAND CEREAL BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 158 SWITZERLAND NUTS BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 159 SWITZERLAND NUTS AND CEREAL SNACKS BAR MARKET, BY CLAIM, 2020-2029 (USD MILLION)

TABLE 160 SWITZERLAND NUTS AND CEREAL SNACKS BAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 161 SWITZERLAND NUTS AND CEREAL SNACKS BAR MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 162 SWITZERLAND NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 163 SWITZERLAND FLAVOR IN NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 164 SWITZERLAND NUTS AND CEREAL SNACKS BAR MARKET, BY PACK TYPE, 2020-2029 (USD MILLION)

TABLE 165 SWITZERLAND NUTS AND CEREAL SNACKS BAR MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 166 SWITZERLAND NUTS AND CEREAL SNACKS BAR MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 167 SWITZERLAND NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 168 SWITZERLAND STORE-BASED RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 169 SWITZERLAND NON-STORE RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 170 POLAND NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 171 POLAND CEREAL BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 172 POLAND NUTS BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 173 POLAND NUTS AND CEREAL SNACKS BAR MARKET, BY CLAIM, 2020-2029 (USD MILLION)

TABLE 174 POLAND NUTS AND CEREAL SNACKS BAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 175 POLAND NUTS AND CEREAL SNACKS BAR MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 176 POLAND NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 177 POLAND FLAVOR IN NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 178 POLAND NUTS AND CEREAL SNACKS BAR MARKET, BY PACK TYPE, 2020-2029 (USD MILLION)

TABLE 179 POLAND NUTS AND CEREAL SNACKS BAR MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 180 POLAND NUTS AND CEREAL SNACKS BAR MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 181 POLAND NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 182 POLAND STORE-BASED RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 183 POLAND NON-STORE RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 184 TURKEY NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 185 TURKEY CEREAL BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 186 TURKEY NUTS BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 187 TURKEY NUTS AND CEREAL SNACKS BAR MARKET, BY CLAIM, 2020-2029 (USD MILLION)

TABLE 188 TURKEY NUTS AND CEREAL SNACKS BAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 189 TURKEY NUTS AND CEREAL SNACKS BAR MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 190 TURKEY NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 191 TURKEY FLAVOR IN NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 192 TURKEY NUTS AND CEREAL SNACKS BAR MARKET, BY PACK TYPE, 2020-2029 (USD MILLION)

TABLE 193 TURKEY NUTS AND CEREAL SNACKS BAR MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 194 TURKEY NUTS AND CEREAL SNACKS BAR MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 195 TURKEY NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 196 TURKEY STORE-BASED RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 197 TURKEY NON-STORE RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 198 REST OF EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 EUROPE NUTS AND CEREAL SNACKS BAR MARKET: SEGMENTATION

FIGURE 2 EUROPE NUTS AND CEREAL SNACKS BAR MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE NUTS AND CEREAL SNACKS BAR MARKET: DROC ANALYSIS

FIGURE 4 EUROPE NUTS AND CEREAL SNACKS BAR MARKET: EUROPE VS COUNTRY MARKET ANALYSIS

FIGURE 5 EUROPE NUTS AND CEREAL SNACKS BAR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE NUTS AND CEREAL SNACKS BAR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE NUTS AND CEREAL SNACKS BAR MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE NUTS AND CEREAL SNACKS BAR MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE NUTS AND CEREAL SNACKS BAR MARKET: SEGMENTATION

FIGURE 10 INCREASING DEMAND FOR MEAL REPLACEMENT SNACKS IS EXPECTED TO DRIVE THE EUROPE NUTS AND CEREAL SNACKS BAR MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 CEREAL BARS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE NUTS AND CEREAL SNACKS BAR MARKET IN 2022 & 2029

FIGURE 12 EUROPE NUTS AND CEREAL SNACKS BAR MARKET: FACTORS AFFECTING DISPOSABLE INCOME OR SPEND DYNAMICS OF THE CONSUMERS

FIGURE 13 EUROPE NUTS AND CEREAL SNACKS BAR MARKET: FACTORS AFFECTING NEW PRODUCT LAUNCHES STRATEGY

FIGURE 14 SUPPLY CHAIN OF EUROPE NUTS AND CEREAL SNACKS BAR MARKET

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE NUTS AND CEREAL SNACKS BAR MARKET

FIGURE 16 EUROPE: COUNTRIES WITH HIGHEST ORGANIC LAND IN 2019 (DATA IN PERCENTAGE)

FIGURE 17 EUROPE NUTS AND CEREAL SNACKS BAR, BY PRODUCT TYPE, 2021

FIGURE 18 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY CLAIM, 2021

FIGURE 19 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY CATEGORY, 2021

FIGURE 20 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY NATURE, 2021

FIGURE 21 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2021

FIGURE 22 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, PACK TYPE, 2021

FIGURE 23 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY PACKAGING, 2021

FIGURE 24 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY BRAND, 2021

FIGURE 25 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2021

FIGURE 26 EUROPE NUTS AND CEREAL SNACKS BAR MARKET: SNAPSHOT (2021)

FIGURE 27 EUROPE NUTS AND CEREAL SNACKS BAR MARKET: BY COUNTRY (2021)

FIGURE 28 EUROPE NUTS AND CEREAL SNACKS BAR MARKET: BY COUNTRY (2022 & 2029)

FIGURE 29 EUROPE NUTS AND CEREAL SNACKS BAR MARKET: BY COUNTRY (2022 & 2029)

FIGURE 30 EUROPE NUTS AND CEREAL SNACKS BAR MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 31 EUROPE NUTS AND CEREAL SNACKS BAR MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.