Europe Needle Biopsy Market

Taille du marché en milliards USD

TCAC :

%

USD

283.34 Million

USD

461.93 Million

2025

2033

USD

283.34 Million

USD

461.93 Million

2025

2033

| 2026 –2033 | |

| USD 283.34 Million | |

| USD 461.93 Million | |

|

|

|

|

Segmentation du marché européen des biopsies à l'aiguille, par type d'aiguille (aiguilles de biopsie tréphine, aiguille sternale de Klima, aiguille d'aspiration de Salah, aiguille de Jamshidi et autres), ergonomie (aiguilles pointues, à bout rond, de Quincke, de Chiba, de Franseen et autres), procédure (biopsie par aspiration à l'aiguille fine, biopsie à l'aiguille à cœur, biopsie assistée par le vide et biopsie guidée par l'image), site de prélèvement (muscles, os et autres organes), usage (jetable et réutilisable), application (tumeur, infection, inflammation et autres), utilisateur final (hôpitaux, centres de diagnostic, laboratoires de biopsie, centres de chirurgie ambulatoire, organismes universitaires et de recherche et autres), canal de distribution (appels d'offres directs et vente au détail) - Tendances du secteur et prévisions jusqu'en 2033

Taille du marché européen des biopsies à l'aiguille

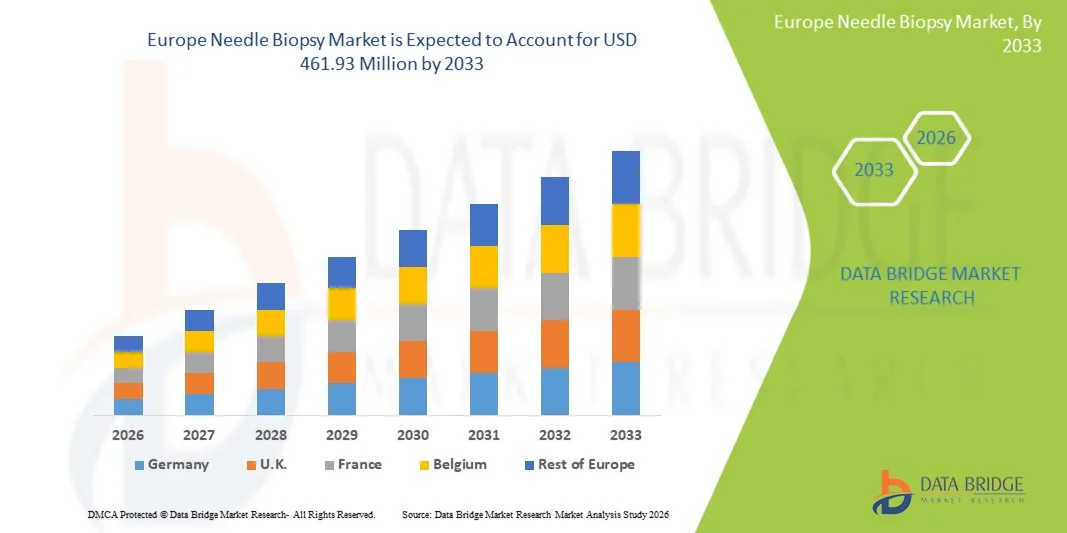

- Le marché européen des biopsies à l'aiguille était évalué à 283,34 millions de dollars en 2025 et devrait atteindre 461,93 millions de dollars d'ici 2033 , soit un TCAC de 6,30 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la prévalence croissante du cancer et d'autres maladies chroniques dans la région, ainsi que par une sensibilisation accrue et une adoption plus large des procédures de diagnostic minimalement invasives.

- De plus, les progrès des technologies d'imagerie, comme l'échographie, la tomodensitométrie et les systèmes de biopsie guidée par IRM, conjugués à la demande croissante de détection précoce et précise des maladies, font de la biopsie à l'aiguille un outil de diagnostic privilégié dans les hôpitaux et les centres de diagnostic. L'ensemble de ces facteurs favorise l'adoption des solutions de biopsie à l'aiguille, stimulant ainsi considérablement la croissance du secteur.

Analyse du marché européen des biopsies à l'aiguille

- La biopsie à l'aiguille, qui consiste en l'extraction mini-invasive d'échantillons de tissus à des fins diagnostiques, devient un outil essentiel dans les flux de travail modernes d'oncologie et d'anatomopathologie des hôpitaux, des centres de diagnostic et des cliniques spécialisées en Europe, en raison de sa précision, de sa sécurité et du temps de récupération réduit qu'elle permet par rapport aux biopsies chirurgicales.

- La demande croissante de biopsies à l'aiguille est principalement due à la prévalence accrue du cancer et des maladies chroniques, à une meilleure sensibilisation au diagnostic précoce et à une préférence pour les solutions diagnostiques minimalement invasives qui réduisent l'inconfort du patient et les risques liés à l'intervention.

- L'Allemagne a dominé le marché européen de la biopsie à l'aiguille en 2025, avec la plus grande part de revenus (38,1 %), grâce à une infrastructure de santé bien établie, à une forte adoption des techniques de biopsie guidées par imagerie et à la présence d'acteurs clés du marché spécialisés dans les systèmes de biopsie innovants et précis.

- La Pologne devrait connaître la croissance la plus rapide sur le marché européen des biopsies à l'aiguille au cours de la période de prévision, grâce à l'augmentation des investissements dans les soins de santé, au développement des centres de diagnostic et à une sensibilisation accrue aux procédures mini-invasives.

- Le segment de la biopsie à l'aiguille a dominé le marché européen de la biopsie à l'aiguille avec une part de marché de 45,8 % en 2025, grâce à sa précision, sa fiabilité dans la détection du cancer et son adéquation à une large gamme de types de tissus.

Portée du rapport et segmentation du marché européen des biopsies à l'aiguille

|

Attributs |

Aperçu du marché européen de la biopsie à l'aiguille |

|

Segments couverts |

|

|

Pays couverts |

Europe

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research incluent également une analyse approfondie par des experts, des données épidémiologiques sur les patients, une analyse des projets en développement, une analyse des prix et un aperçu du cadre réglementaire. |

Tendances du marché européen des biopsies à l'aiguille

« Progrès dans les systèmes de biopsie guidée par imagerie et assistée par l’IA »

- L'intégration de modalités d'imagerie avancées telles que l'échographie, la tomodensitométrie et l'IRM aux systèmes de guidage assistés par intelligence artificielle constitue une tendance majeure et en pleine accélération sur le marché européen des biopsies à l'aiguille, améliorant ainsi la précision et l'exactitude des prélèvements tissulaires.

- Par exemple, le système de biopsie Visumax associe l'imagerie haute résolution à des algorithmes d'IA pour aider les radiologues à cibler les lésions de manière minimalement invasive, réduisant ainsi les erreurs d'échantillonnage et les procédures répétées.

- Les systèmes de biopsie dotés d'intelligence artificielle peuvent analyser les données historiques des patients afin de suggérer des trajectoires d'aiguille optimales, de prédire les caractéristiques des tissus et de fournir un retour d'information en temps réel aux opérateurs, améliorant ainsi l'efficacité des procédures et la fiabilité du diagnostic.

- L'intégration transparente des dispositifs de biopsie à l'aiguille aux systèmes PACS hospitaliers et aux plateformes de pathologie numérique permet une gestion centralisée des flux de travail diagnostiques, notamment l'analyse d'images en temps réel, la rédaction de rapports de biopsie et la tenue des dossiers, rationalisant ainsi le processus diagnostique global.

- Cette tendance vers des systèmes de biopsie intelligents, précis et intégrés améliore fondamentalement la fiabilité du diagnostic et les résultats pour les patients. Par conséquent, des entreprises comme Becton Dickinson développent des dispositifs de biopsie assistés par IA capables de détecter automatiquement les lésions et de guider la procédure en temps réel.

- La demande de solutions de biopsie à l'aiguille intégrant l'imagerie assistée par IA connaît une croissance rapide dans les hôpitaux et les centres de diagnostic, les cliniciens privilégiant de plus en plus la précision diagnostique et l'efficacité des flux de travail.

- La collaboration entre les fabricants de dispositifs de biopsie et les fournisseurs de logiciels pour proposer des plateformes d'analyse IA intégrées se développe, permettant un diagnostic plus rapide et une meilleure planification du traitement.

Dynamique du marché européen des biopsies à l'aiguille

Conducteur

« Prévalence croissante des cancers et des maladies chroniques »

- L'incidence croissante du cancer et d'autres maladies chroniques au sein des populations européennes, associée à une importance accrue accordée au diagnostic précoce, est un facteur majeur de la demande de procédures de biopsie à l'aiguille.

- Par exemple, en mars 2025, Hologic, Inc. a lancé un système de biopsie à l'aiguille de pointe conçu pour le prélèvement mini-invasif de cellules du sein et de la prostate, mettant l'accent sur la précision et le confort du patient.

- Les cliniciens privilégient la biopsie à l'aiguille en raison de son caractère peu invasif, de son taux de complications plus faible et de sa récupération plus rapide par rapport aux biopsies chirurgicales, ce qui en fait une option diagnostique de choix dans les établissements de santé modernes.

- De plus, la sensibilisation croissante aux programmes de dépistage précoce et aux initiatives nationales de dépistage du cancer favorise l'adoption de la biopsie à l'aiguille dans les hôpitaux et les centres de diagnostic.

- La facilité d'intégration des procédures de biopsie à l'aiguille dans les flux de travail d'imagerie existants, associée à une meilleure acceptation par les patients, stimule la croissance du marché dans les établissements de santé publics et privés.

- L'augmentation des investissements dans les infrastructures hospitalières et les centres de diagnostic en Europe facilite un accès plus large aux procédures de biopsie à l'aiguille.

- La multiplication des collaborations entre les fabricants de dispositifs médicaux et les prestataires de soins de santé pour développer des solutions de biopsie personnalisées pour des types de cancer spécifiques stimule davantage la demande du marché.

Retenue/Défi

« Coûts élevés des procédures et obstacles réglementaires »

- Le coût relativement élevé des systèmes de biopsie à l'aiguille et des consommables de pointe peut limiter leur adoption, notamment dans les petites cliniques ou dans les pays où les coûts sont un facteur déterminant, ce qui constitue un obstacle à une pénétration plus large du marché.

- Par exemple, les informations faisant état de prix élevés pour les systèmes de biopsie assistés par l'IA ont rendu certains hôpitaux hésitants à investir dans les dispositifs de nouvelle génération malgré leurs avantages cliniques.

- Les exigences réglementaires strictes en matière d'homologation des dispositifs médicaux, notamment le marquage CE et la conformité au règlement européen relatif aux dispositifs médicaux (MDR), peuvent retarder la mise sur le marché des nouvelles technologies de biopsie et impacter les délais d'adoption.

- De plus, le besoin en personnel qualifié pour faire fonctionner les systèmes de biopsie sophistiqués guidés par imagerie et assistés par l'IA peut constituer un obstacle pour les établissements qui manquent de personnel formé, en particulier dans les zones moins urbanisées.

- Surmonter ces défis grâce à l'optimisation des coûts, à la simplification des procédures d'approbation réglementaire et à des programmes de formation des cliniciens sera crucial pour une croissance durable du marché européen de la biopsie à l'aiguille.

- Les politiques de remboursement limitées en vigueur dans certains pays européens pour les procédures de biopsie avancées peuvent freiner leur adoption par les prestataires de soins de santé privés.

- Les préoccupations relatives à l'inconfort du patient et aux risques liés à la procédure dans certains cas à haut risque peuvent limiter le recours à la biopsie à l'aiguille, notamment chez les patients de petite taille ou âgés.

Étendue du marché européen des biopsies à l'aiguille

Le marché est segmenté en fonction du type d'aiguille, de l'ergonomie, de la procédure, du site de prélèvement, de l'utilité, de l'application, de l'utilisateur final et du canal de distribution.

- Par type d'aiguille

Le marché européen des biopsies à l'aiguille est segmenté selon le type d'aiguille : aiguilles de biopsie trépanées, aiguilles sternales de Klima, aiguilles d'aspiration de Salah, aiguilles de Jamshidi et autres. En 2025, le segment des aiguilles à biopsie à l'aiguille centrale dominait le marché, générant la plus grande part de revenus grâce à leur haute précision, leur fiabilité dans la détection du cancer et leur compatibilité avec de nombreux types de tissus. Les hôpitaux et les centres de diagnostic privilégient ces aiguilles pour les examens oncologiques de routine en raison des complications minimales et de la qualité constante des échantillons. Leur compatibilité avec les procédures guidées par l'image renforce la fiabilité du diagnostic et la sécurité des interventions. Leur utilisation croissante pour les biopsies du sein, de la prostate, du foie et de la thyroïde consolide leur position dominante. La formation généralisée des cliniciens et les protocoles cliniques établis favorisent également leur adoption continue.

Le segment des aiguilles de Jamshidi devrait connaître la croissance la plus rapide au cours de la période de prévision, grâce à leur utilisation spécifique dans les biopsies de moelle osseuse et orthopédiques. Leur conception permet une pénétration précise avec un minimum d'inconfort pour le patient, garantissant ainsi une meilleure intégrité des échantillons. La prévalence croissante des hémopathies malignes et des procédures de diagnostic orthopédique stimule la demande. Les établissements universitaires et de recherche utilisent de plus en plus les aiguilles de Jamshidi pour leurs études expérimentales. Les améliorations technologiques qui optimisent leur utilisation et leur sécurité accélèrent leur adoption. La sensibilisation croissante des cliniciens aux alternatives mini-invasives contribue également à la croissance du marché.

- Par l'ergonomie

Sur la base de critères ergonomiques, le marché est segmenté en aiguilles pointues, à bout rond, Quincke, Chiba, Franseen et autres. Le segment des aiguilles Franseen a dominé le marché en 2025 grâce à son extrémité unique à trois branches, qui permet une meilleure acquisition tissulaire et un rendement diagnostique supérieur. Les cliniciens privilégient les aiguilles Franseen pour les procédures de cytoponction à l'aiguille fine et de biopsie à l'aiguille épaisse. Leur conception minimise les complications procédurales et préserve l'intégrité de l'échantillon. Leur utilisation répandue dans les biopsies du foie, du pancréas, du sein et de la thyroïde renforce encore leur position dominante. L'intégration aux systèmes d'imagerie guidée améliore la précision et le succès des procédures. La familiarité établie avec ces aiguilles par les cliniciens assure leur adoption continue dans les hôpitaux et les centres de diagnostic.

Le segment des aiguilles de Chiba devrait connaître la croissance la plus rapide entre 2026 et 2033 grâce à leur finesse et à leur polyvalence dans les procédures mini-invasives. Elles sont de plus en plus utilisées pour le ciblage de petites lésions sous guidage d'imagerie. La demande croissante de techniques à faible risque et bien tolérées par les patients en milieu ambulatoire alimente cette croissance. Leur conception réduit les saignements et l'inconfort lié à l'intervention, ce qui séduit autant les cliniciens que les patients. Leur adoption sur les marchés émergents de la santé en Europe, soutenue par des programmes de formation, accélère encore leur expansion. L'intégration avec des outils de planification assistée par l'IA contribue également à une adoption plus rapide.

- Par procédure

Selon la procédure utilisée, le marché est segmenté en biopsie par aspiration à l'aiguille fine, biopsie à l'aiguille épaisse, biopsie assistée par le vide et biopsie guidée par imagerie. Le segment de la biopsie à l'aiguille épaisse dominait en 2025 avec une part de marché de 45,8 % grâce à sa grande précision, sa reproductibilité et son adéquation à de nombreux types de tissus. Elle est largement utilisée pour le diagnostic des cancers du sein, de la prostate, du foie et de la thyroïde. L'intégration de l'échographie, de la tomodensitométrie (TDM) et de l'imagerie par résonance magnétique (IRM) améliore la précision de la procédure. Les cliniciens apprécient sa capacité à fournir suffisamment de tissu pour les analyses histopathologiques et moléculaires. Des protocoles cliniques établis et des formations favorisent son adoption généralisée. La forte acceptation par les patients, due à son caractère mini-invasif, renforce sa position dominante.

Le segment des biopsies guidées par l'image devrait connaître la croissance la plus rapide au cours de la période prévisionnelle, grâce à l'adoption croissante de modalités d'imagerie avancées pour un ciblage précis des lésions. La prévalence croissante du cancer et la demande accrue de procédures mini-invasives sont les principaux moteurs de cette croissance. Les hôpitaux et les centres de diagnostic investissent dans des systèmes de guidage par l'image afin d'améliorer la précision diagnostique. La sensibilisation des cliniciens et des patients à la réduction des risques liés aux procédures alimente également cette croissance. L'intégration d'outils de planification et de détection des lésions assistés par l'IA renforce encore l'attrait de ces techniques. Les centres de chirurgie ambulatoire et de soins externes adoptent de plus en plus les procédures guidées par l'image.

- Par site d'exemple

En fonction du site de prélèvement, le marché est segmenté en muscles, os et autres organes. Le segment des autres organes a dominé en 2025 en raison du volume élevé de biopsies réalisées sur le foie, le pancréas, les reins et la thyroïde. Ces procédures sont essentielles au diagnostic précoce des cancers et des maladies chroniques. Les hôpitaux privilégient les aiguilles de pointe et le guidage par imagerie pour les biopsies d'organes afin d'en garantir la précision. Les taux de réussite élevés et la réduction des risques de complications expliquent cette domination. Les recommandations cliniques et les programmes de dépistage gouvernementaux encourageant les biopsies d'organes soutiennent la croissance du marché. La préférence croissante des patients pour les procédures mini-invasives renforce encore davantage leur adoption.

Le segment osseux devrait connaître la croissance la plus rapide au cours de la période prévisionnelle, en raison de l'augmentation de l'incidence des hémopathies malignes et des affections orthopédiques nécessitant une évaluation de la moelle osseuse ou du tissu squelettique. L'utilisation d'aiguilles spécialisées, telles que les aiguilles Jamshidi et Klima sternales, est en constante augmentation. Les centres de recherche et les établissements universitaires stimulent également la demande par le biais d'études expérimentales. Les progrès technologiques, qui améliorent la précision, la facilité d'utilisation et le confort du patient, accélèrent l'adoption de ces techniques. La sensibilisation croissante aux techniques mini-invasives contribue également à cette croissance. Les hôpitaux et les centres de diagnostic développent leurs services de biopsie osseuse afin de répondre à la demande.

- Par utilité

En fonction de leur utilité, le marché est segmenté en aiguilles jetables et réutilisables. Le segment des aiguilles jetables dominait en 2025 grâce aux protocoles de contrôle des infections, à leur facilité d'utilisation et à la réduction des risques de contamination croisée. Les hôpitaux et les centres de diagnostic privilégient les aiguilles à usage unique pour se conformer aux normes d'hygiène strictes. La sensibilisation croissante à la sécurité des patients et les directives réglementaires expliquent cette domination. Les interventions ambulatoires et en milieu externe privilégient les aiguilles jetables pour leur praticité. La disponibilité de différentes tailles et types d'aiguilles favorise leur adoption. Un soutien important des fabricants en matière de formation et d'approvisionnement garantit une croissance soutenue du marché.

Le segment des dispositifs réutilisables devrait connaître la croissance la plus rapide au cours de la période de prévision, grâce à sa rentabilité dans les hôpitaux et les centres de recherche à forte activité. Les progrès technologiques facilitent la stérilisation et améliorent la durabilité. Les aiguilles réutilisables sont privilégiées pour les interventions spécialisées ou complexes exigeant une grande précision. Les données cliniques à long terme démontrant leur fiabilité confortent leur adoption. Les marchés émergents de la santé en Europe privilégient les solutions réutilisables en raison des contraintes budgétaires. L'intégration aux systèmes d'imagerie médicale contribue également à améliorer l'efficacité des procédures.

- Sur demande

Selon l'application, le marché est segmenté en tumeurs, infections, inflammations et autres. Le segment des tumeurs a dominé en 2025 en raison de la prévalence croissante des cancers et du recours accru aux techniques de biopsie mini-invasives pour un diagnostic précoce. Les hôpitaux et les centres de diagnostic privilégient la biopsie à l'aiguille pour la détection des tumeurs en raison de sa grande précision et de ses risques procéduraux moindres. L'intégration du guidage par imagerie et des outils d'intelligence artificielle renforce la fiabilité du diagnostic. Les recommandations cliniques et les programmes de dépistage favorisant la détection précoce des tumeurs contribuent également à cette domination. La préférence des patients pour les procédures moins invasives soutient la croissance du marché.

Le segment des infections devrait connaître la croissance la plus rapide au cours de la période de prévision, en raison de l'utilisation croissante de la biopsie à l'aiguille pour le diagnostic des infections localisées, des abcès et des affections inflammatoires. La sensibilisation accrue des cliniciens aux procédures mini-invasives favorise leur adoption. Les consultations externes et les soins ambulatoires stimulent cette croissance grâce à leur commodité pour les patients. La conception améliorée des aiguilles, qui optimise la qualité des échantillons pour les analyses microbiologiques, accélère l'adoption de cette technique. L'intégration aux systèmes d'information de laboratoire améliore l'efficacité des flux de travail. Les établissements universitaires et de recherche utilisent de plus en plus la biopsie à l'aiguille pour les études liées aux infections.

- Par l'utilisateur final

En fonction de l'utilisateur final, le marché est segmenté en hôpitaux, centres de diagnostic, laboratoires de biopsie, centres de chirurgie ambulatoire, établissements d'enseignement et de recherche, et autres. Le segment hospitalier dominait en 2025 grâce au volume important de diagnostics en oncologie et maladies chroniques réalisés en milieu hospitalier. La disponibilité d'équipements d'imagerie de pointe, de personnel qualifié et le respect des protocoles cliniques expliquent cette domination. Les hôpitaux investissent dans des systèmes de biopsie assistés par intelligence artificielle afin d'améliorer la précision des diagnostics. L'intégration aux dossiers médicaux électroniques et aux flux de travail en anatomopathologie favorise l'adoption de ces systèmes. La préférence croissante des patients pour les interventions mini-invasives stimule la croissance du marché. Les hôpitaux demeurent des moteurs essentiels du marché en raison du volume élevé d'interventions et de la demande de consultations répétées.

Le segment des organismes universitaires et de recherche devrait connaître la croissance la plus rapide au cours de la période prévisionnelle, en raison de l'utilisation croissante de la biopsie à l'aiguille dans les essais cliniques, la recherche translationnelle et les études expérimentales. Les aiguilles spécialisées et guidées par imagerie sont de plus en plus utilisées à des fins de recherche. Les collaborations avec les fabricants de dispositifs pour des solutions personnalisées stimulent la croissance. L'augmentation des financements publics et privés favorise l'adoption de cette technique. L'intégration aux flux de travail de recherche en laboratoire et en pathologie améliore l'efficacité. Les centres universitaires contribuent également à la formation des futurs cliniciens, accélérant ainsi l'adoption de cette technique sur le marché.

- Par canal de distribution

Selon le canal de distribution, le marché se divise en appels d'offres et ventes au détail. Le segment des appels d'offres a dominé en 2025 grâce aux achats groupés effectués par les hôpitaux et les grands réseaux de diagnostic, garantissant ainsi la maîtrise des coûts et la fiabilité de l'approvisionnement. Les hôpitaux privilégient les achats par appel d'offres pour les contrats à long terme et le support technique. La disponibilité de services après-vente et de formations dispensées par les fabricants renforce cette position dominante. Les accords d'approvisionnement à long terme et les exigences de conformité réglementaire soutiennent également ce segment. Les achats groupés assurent un niveau de stock constant et réduisent les risques opérationnels. Les hôpitaux et les grandes chaînes de diagnostic continuent de privilégier les appels d'offres pour les équipements majeurs et les aiguilles à usage unique.

Le segment des ventes au détail devrait connaître la croissance la plus rapide au cours de la période prévisionnelle, en raison de la demande croissante des petits centres de diagnostic, des cliniques ambulatoires et des établissements universitaires. La facilité de commande via les portails en ligne et les distributeurs accélère l'adoption de cette technique. La sensibilisation croissante des petits professionnels de santé aux avantages de la biopsie à l'aiguille stimule la demande. Les circuits de distribution offrent une flexibilité pour l'approvisionnement en aiguilles spécialisées ou jetables. Les fabricants s'associent de plus en plus aux distributeurs afin d'étendre leur réseau de distribution. L'adoption croissante de cette technique sur les marchés émergents européens contribue également à la croissance du segment.

Analyse régionale du marché européen des biopsies à l'aiguille

- L'Allemagne a dominé le marché européen de la biopsie à l'aiguille en 2025, avec la plus grande part de revenus (38,1 %), grâce à une infrastructure de santé bien établie, à une forte adoption des techniques de biopsie guidées par imagerie et à la présence d'acteurs clés du marché spécialisés dans les systèmes de biopsie innovants et précis.

- Les hôpitaux et les centres de diagnostic de la région privilégient les procédures minimalement invasives telles que la biopsie à l'aiguille pour le dépistage précoce du cancer, le diagnostic des maladies chroniques et les applications de recherche, contribuant ainsi à une adoption généralisée.

- Cette domination est en outre confortée par des dépenses de santé élevées, des initiatives gouvernementales fortes en faveur des programmes de dépistage du cancer et une préférence croissante pour les biopsies guidées par l'image et assistées par l'IA.

Analyse du marché allemand des biopsies à l'aiguille

En 2025, le marché allemand des biopsies à l'aiguille a généré la plus grande part de revenus en Europe, porté par une forte prévalence du cancer, des infrastructures de santé performantes et l'adoption croissante des procédures mini-invasives. Les hôpitaux et les centres de diagnostic privilégient de plus en plus les systèmes de biopsie à l'aiguille épaisse, à l'aiguille fine et guidée par l'image pour leur précision, leur sécurité et leur reproductibilité. L'intégration de l'imagerie assistée par l'IA et des plateformes de pathologie numérique améliore l'efficacité des flux de travail et la fiabilité des diagnostics. Les initiatives gouvernementales et les programmes nationaux de dépistage, qui encouragent la détection précoce du cancer, stimulent également l'adoption de ces techniques. L'accent mis par le pays sur l'innovation et la recherche favorise le développement de dispositifs de biopsie de nouvelle génération. La préférence des patients pour des procédures moins invasives renforce la croissance du marché dans les hôpitaux et les centres spécialisés.

Analyse du marché français de la biopsie à l'aiguille

Le marché français de la biopsie à l'aiguille est en pleine expansion, porté par la hausse de la prévalence du cancer, les programmes de dépistage précoce et l'adoption croissante des procédures diagnostiques mini-invasives. Les hôpitaux et les centres de diagnostic privilégient les techniques de biopsie à l'aiguille épaisse et à l'aiguille fine pour un prélèvement tissulaire précis et une réduction des risques de complications. L'intégration de modalités d'imagerie telles que l'échographie et la tomodensitométrie (TDM) améliore la sécurité et la précision des procédures. Les politiques gouvernementales et les programmes de remboursement favorisent une large adoption dans les secteurs de la santé publique et privée. Les instituts de recherche contribuent à l'expansion du marché par le biais d'essais cliniques et du développement de technologies de biopsie innovantes. La préférence croissante des patients pour des procédures moins invasives, notamment en oncologie, stimule également l'adoption de ces techniques.

Analyse du marché britannique des biopsies à l'aiguille

Le marché britannique des biopsies à l'aiguille devrait connaître une croissance annuelle composée (TCAC) remarquable au cours de la période de prévision, portée par les programmes nationaux de dépistage du cancer et la préférence croissante des patients pour les procédures minimalement invasives. Les hôpitaux et les centres de diagnostic privilégient les biopsies à l'aiguille fine et les biopsies à l'aiguille épaisse guidées par imagerie pour un diagnostic fiable et une meilleure efficacité des flux de travail. L'intégration de la planification assistée par l'IA et des systèmes de pathologie numérique améliore la précision du diagnostic. Des politiques de santé favorables, des cadres de remboursement adaptés et la disponibilité de personnel qualifié encouragent également l'adoption de ces techniques. Les organismes de recherche contribuent au développement technologique et aux études cliniques. Les campagnes de sensibilisation promouvant le dépistage précoce des maladies renforcent la croissance du marché dans les établissements de santé publics et privés.

Analyse du marché polonais des biopsies à l'aiguille

Le marché polonais de la biopsie à l'aiguille est celui qui connaît la croissance la plus rapide en Europe, porté par une sensibilisation accrue aux procédures diagnostiques mini-invasives et par l'augmentation de la prévalence du cancer. Les hôpitaux et les centres de diagnostic adoptent rapidement les systèmes de biopsie à l'aiguille épaisse, à l'aiguille fine et guidée par l'image en raison de leur précision, de leur sécurité et de leur efficacité. Les initiatives gouvernementales et les programmes nationaux de dépistage précoce favorisent leur adoption dans les secteurs de la santé publics et privés. L'intégration avec les plateformes d'imagerie assistée par l'IA et les systèmes de pathologie numérique améliore le flux de travail, la précision et la qualité des comptes rendus. Les instituts de recherche et les centres universitaires contribuent au développement et à la validation de technologies de biopsie innovantes. La préférence des patients pour des procédures moins invasives et réalisables en ambulatoire accélère encore la croissance du marché.

Part de marché européenne des biopsies à l'aiguille

Le secteur européen de la biopsie à l'aiguille est principalement dominé par des entreprises bien établies, notamment :

- BD (États-Unis)

- Boston Scientific Corporation (États-Unis)

- Dispositifs médicaux Argon (États-Unis)

- Hologic, Inc. (États-Unis)

- Cook (États-Unis)

- Medtronic (Irlande)

- B. Braun SE (Allemagne)

- FUJIFILM Holdings Corporation (Japon)

- Danaher (États-Unis)

- CONMED Corporation (États-Unis)

- Leica Biosystems (Allemagne)

- Stryker (États-Unis)

- Merit Medical Systems, Inc. (États-Unis)

- Olympus Corporation (Japon)

- INRAD, Inc. (États-Unis)

- SOMATEX Medical Technologies GmbH (Allemagne)

- Zamar Care (Europe)

- MDL SRL. (Italie)

- UROMED (Suisse)

- BIOPSYBELL SRL (Italie)

Quels sont les développements récents sur le marché européen de la biopsie à l'aiguille ?

- En octobre 2025, Olympus Corporation a annoncé le lancement du dispositif de biopsie à l'aiguille fine à usage unique SecureFlex, qui sera commercialisé en Europe et au Japon à l'automne 2025, en mettant l'accent sur son caractère jetable et sa facilité d'utilisation.

- En octobre 2025, un nouveau lancement clinique européen (ou introduction sur le marché) du dispositif Olympus SecureFlex a marqué un tournant vers les dispositifs de biopsie à aiguille fine à usage unique en Europe, répondant aux exigences d'hygiène et de flux de travail dans les centres de diagnostic.

- En mars 2025, l'ISUOG (Société internationale d'échographie obstétricale et gynécologique) et l'ESGO ont publié une déclaration de consensus sur la biopsie guidée par échographie en oncologie gynécologique. Ce document contribue à l'harmonisation des procédures de biopsie en Europe, favorisant ainsi des diagnostics mini-invasifs plus sûrs et de meilleure qualité.

- En novembre 2024, Mammotome a lancé le système de biopsie à l'aiguille unique AutoCore™, le premier dispositif automatisé à ressort pour aiguille à biopsie, simplifiant les biopsies du sein guidées par échographie grâce à une commande par simple pression d'un bouton et une gestion automatique des échantillons.

- En août 2022, Mammotome a lancé le système de biopsie mammaire sous vide Mammotome Revolve™ EX Dual, le premier dispositif sous vide conçu spécifiquement pour l'excision des lésions bénignes. Il offre une cadence d'échantillonnage plus rapide (un échantillon de tissu toutes les 5 secondes), une cupule de prélèvement agrandie (jusqu'à 75 échantillons), une pièce à main ergonomique et un manchon stérile EZ-Sleeve pour réduire le temps de préparation.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.