Marché européen des cours en ligne ouverts et massifs (MOOC), par composante (plateforme, services), étudiants desservis (études supérieures, entreprises, premier cycle, lycée et collège), matières (gestion d'entreprise, informatique et programmation, sciences, sociologie et philosophie, sciences humaines, éducation et formation, santé et médecine, arts et design, mathématiques, apprentissage des langues étrangères et autres) - Tendances et prévisions du secteur jusqu'en 2029

Analyse et taille du marché

Au cours des dernières années, notamment pendant la pandémie, des millions de personnes à travers le monde ont choisi les MOOC pour se former. Ils ont utilisé les MOOC pour divers objectifs tels que le changement de carrière, l'apprentissage complémentaire, l'apprentissage en ligne et la formation en entreprise, le développement de carrière et la préparation à l'université, entre autres.

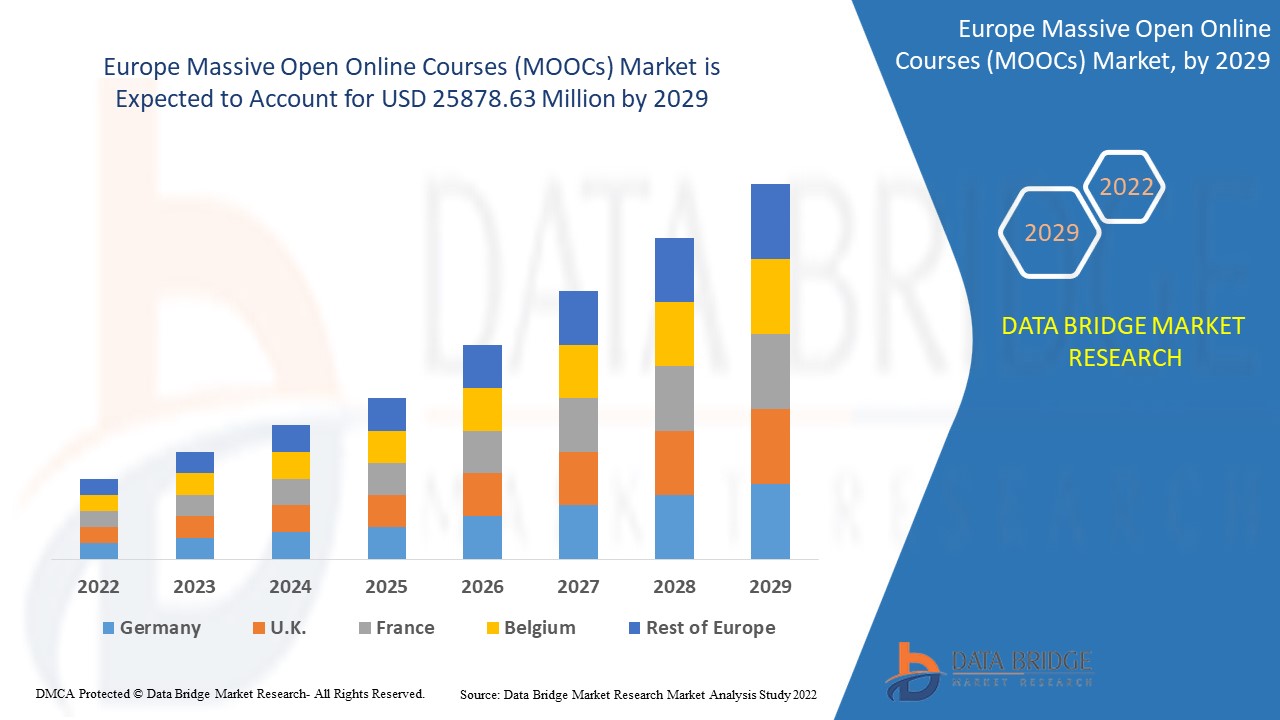

Le marché européen des cours en ligne ouverts et massifs (MOOC) était évalué à 497,15 millions USD en 2021 et devrait atteindre 25 878,63 millions USD d'ici 2029, enregistrant un TCAC de 37,70 % au cours de la période de prévision 2022-2029. Les services représentent le segment de composants le plus important du marché respectif en raison de l'adoption accrue. En plus des informations sur le marché telles que la valeur marchande, le taux de croissance, les segments de marché, la couverture géographique, les acteurs du marché et le scénario du marché, le rapport de marché organisé par l'équipe de recherche sur le marché de Data Bridge comprend également une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et une analyse du pilon.

Définition du marché

Les cours en ligne ouverts et massifs (MOOC) sont définis comme des cours en ligne qui disposent d'une plateforme d'enseignement ouverte et peuvent atteindre un nombre illimité de participants. Les MOOC contiennent les vidéos des formes traditionnelles de cours avec l'intégralité du matériel de cours et favorisent les interactions communautaires entre les professionnels et les apprenants. Les cours en ligne ouverts et massifs (MOOC) sont la solution ultime en matière d'enseignement à distance, car ils offrent des ressources éducatives ouvertes aux étudiants du monde entier.

Portée du rapport et segmentation du marché

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2014 à 2019) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en unités, prix en USD |

|

Segments couverts |

Composante (plateforme, services), étudiants servis (études supérieures, entreprises, premier cycle, lycée et collège), matières (gestion d'entreprise, informatique et programmation, sciences, sociologie et philosophie, sciences humaines, éducation et formation, santé et médecine, arts et design, mathématiques, apprentissage des langues étrangères et autres) |

|

Pays couverts |

Allemagne, France, Royaume-Uni, Pays-Bas, Suisse, Belgique, Russie, Italie, Espagne, Turquie, Reste de l'Europe en Europe |

|

Acteurs du marché couverts |

Udacity, Inc. (États-Unis), Federica Web Learning (Italie), edX Inc. (États-Unis), Coursera Inc (États-Unis), Udemy, Inc. (États-Unis), Pluralsight LLC (États-Unis), Alison (Irlande), FutureLearn (Royaume-Uni), XuetangX (Chine), Skillshare, Inc. (États-Unis), OpenupEd (Royaume-Uni), Kadenze, Inc. (États-Unis) et 360training (États-Unis), entre autres |

|

Opportunités de marché |

|

Dynamique du marché des cours en ligne ouverts et massifs (MOOC) en Europe

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Progrès numériques dans les cours en ligne

L'essor des cours en ligne au fil du temps est l'un des principaux facteurs qui stimulent le marché des cours en ligne ouverts et massifs (MOOC). En outre, la demande de cours en ligne ouverts et massifs (MOOC) augmente en raison des avantages tels que la disponibilité dans différentes langues, une attention particulière à chaque étudiant, un coût moindre et la disponibilité de cours de démonstration, entre autres.

- L'avènement de divers outils

L'avènement de divers outils tels que Zoom et Microsoft Teams pour aider les camarades de classe à se connecter entre eux et à leurs tuteurs accélère la croissance du marché. Pendant l'épidémie de COVID-19, l'apprentissage numérique a été largement adopté pour rester en contact les uns avec les autres via un support en ligne.

- Passage à l'apprentissage numérique

L'essor de l'apprentissage numérique pour acquérir une éducation personnalisée influence encore davantage le marché. Les développements continus qui aident les étudiants à définir à la fois le rythme et le chemin de leur apprentissage contribuent à l'expansion du marché.

De plus, l’urbanisation rapide, le changement de mode de vie, l’augmentation des investissements et des dépenses de consommation ont un impact positif sur le marché des cours en ligne ouverts et massifs (MOOC).

Opportunités

En outre, diverses initiatives et programmes lancés aux États-Unis pour renforcer les systèmes MOOC offrent des opportunités rentables aux acteurs du marché au cours de la période de prévision de 2022 à 2029. La mobilité et la facilité d'utilisation élargiront encore le marché.

Contraintes/Défis

D'autre part, le faible taux d'achèvement et l'inefficacité du suivi et de la validation des progrès devraient entraver la croissance du marché. En outre, le manque d'orientation et de mentorat personnalisés devrait constituer un défi pour le marché des cours en ligne ouverts et massifs (MOOC) au cours de la période de prévision 2022-2029.

Ce rapport sur le marché des cours en ligne ouverts à tous (MOOC) fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et localisé, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans la réglementation du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché des cours en ligne ouverts à tous (MOOC), contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Impact du COVID-19 sur le marché européen des cours en ligne ouverts et massifs (MOOC)

La COVID-19 a eu un impact positif sur le marché des cours en ligne ouverts et massifs (MOOC) en raison de l'augmentation du nombre de cours en ligne ouverts et massifs (MOOC) dans les secteurs verticaux de l'industrie pendant l'épidémie de COVID-19. Une augmentation du nombre de personnes déployant des MOOC a été constatée à diverses fins telles que l'apprentissage numérique, le changement de carrière, l'apprentissage complémentaire, l'apprentissage et la formation en entreprise, le développement de carrière et la préparation à l'université, entre autres. Le marché des technologies de diffusion et des médias devrait connaître une forte croissance dans le scénario post-pandémique en raison de l'augmentation de l'utilisation de diverses plateformes médiatiques par les consommateurs.

Développements récents

- En mai 2020, edX Inc. a lancé une initiative mondiale pour aider les universités à relever le défi de mettre en œuvre un enseignement et un apprentissage en ligne convaincants. L'entreprise offre un accès gratuit aux compétences et au contenu, edX fait la différence, les universités planifient le semestre à venir, alors que la grande majorité des campus sont susceptibles d'être fermés ou presque fermés. Ce lancement aidera l'entreprise à renforcer sa marque sur le marché des MOOC.

- En mars 2020, Udacity, Inc. a conclu un partenariat avec Nutanix (NASDAQ : NTNX), une entreprise spécialisée dans le cloud computing. Grâce à ce partenariat, l'entreprise propose un programme moderne de nanodiplôme en cloud hybride. Ce programme améliorera les opportunités d'apprentissage dans le marché en développement des innovations cloud qui sont essentielles pour les organisations afin d'améliorer leur base informatique. Ce partenariat aide l'entreprise à élargir sa gamme de cours pour le cloud computing.

Portée et taille du marché des cours en ligne ouverts et massifs (MOOC) en Europe

Le marché des cours en ligne ouverts à tous (MOOC) est segmenté en fonction des composants, des étudiants et des matières. La croissance de ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Composant

- Plate-forme

- Services

Étudiant servi

- Diplôme d'études supérieures

- Entreprise

- Premier cycle

- Lycée

- Collège

Sujets

- Gestion d'entreprise

- Informatique et programmation

- Science

- Sociologie et philosophie

- Sciences humaines

- Éducation et formation

- Santé et médecine

- Arts et Design

- Mathématiques

- Apprentissage des langues étrangères

- Autres

Analyse/perspectives régionales du marché des cours en ligne ouverts et massifs (MOOC) en Europe

Le marché des cours en ligne ouverts et massifs (MOOC) est analysé et des informations sur la taille du marché et les tendances sont fournies par pays, composant, étudiant servi et matières comme indiqué ci-dessus.

Les pays couverts dans le rapport sur le marché des cours en ligne ouverts et massifs (MOOC) sont l'Allemagne, la France, le Royaume-Uni, les Pays-Bas, la Suisse, la Belgique, la Russie, l'Italie, l'Espagne, la Turquie et le reste de l'Europe.

L'Espagne représente la plus grande part de marché en raison de la pénétration croissante d'Internet dans les pays en développement et de la tendance à la hausse du marché des MOOC.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces de Porter, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Paysage concurrentiel et marché européen des cours en ligne ouverts et massifs (MOOC)

Le paysage concurrentiel du marché des cours en ligne ouverts et massifs (MOOC) fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché des cours en ligne ouverts et massifs (MOOC).

Certains des principaux acteurs opérant sur le marché des cours en ligne ouverts et massifs (MOOC) sont

- Udacity, Inc. (États-Unis)

- Federica Web Learning (Italie)

- edX Inc. (États-Unis)

- Coursera Inc (États-Unis)

- Udemy, Inc. (États-Unis)

- Pluralsight LLC (États-Unis)

- Alison (Irlande)

- FutureLearn (Royaume-Uni)

- XuetangX (Chine)

- Skillshare, Inc. (États-Unis)

- OpenupEd (Royaume-Uni)

- Kadenze, Inc. (États-Unis)

- Formation 360 (États-Unis)

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PRODUCT(COMPONENT) TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 COVID-19 IMPACT ON EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) IN INFORMATION & COMMUNICATION TECHNOLOGY INDUSTRY

5.1 AFTERMATH OF THE NETWORK INDUSTRY AND GOVERNMENT ROLE

5.2 STRATEGIC DECISIONS FOR MARKET PLAYERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

5.2.1 COURSE LAUNCHES

5.2.2 PARTNERSHIPS

5.3 IMPACT ON DEMAND & SUPPLY CHAIN

5.4 CONCLUSION

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 NEED FOR SCALABLE OPEN EDUCATION

6.1.2 NECESSITY FOR COST-EFFECTIVE EDUCATION PLATFORMS

6.1.3 INCREASING REQUIREMENT FOR EUROPE TRAINING

6.1.4 INCREASING ADOPTION OF DIGITAL LEARNING

6.1.5 EXTENSIVE GOVERNMENT INITIATIVES FOR GROWTH OF MOOC

6.2 RESTRAINTS

6.2.1 LOW COMPLETION RATE

6.2.2 LOW MOTIVATION AND ENGAGEMENT TO ADOPT MOOC SOLUTIONS

6.3 OPPORTUNITIES

6.3.1 INCREASE IN DEMAND FOR GAMIFICATION IN MOOCS

6.3.2 RISING NEED FOR TECHNOLOGY SUBJECTS

6.3.3 GROWING DEMAND FOR MOOC IN ASIA-PACIFIC REGION

6.3.4 MOBILITY AND EASE OF USE OF MOOCS

6.4 CHALLENGES

6.4.1 LACK OF PERSONALIZED GUIDANCE AND MENTORSHIP

6.4.2 INEFFICIENCY IN TRACKING AND VALIDATING THE PROGRESS

6.4.3 LACK OF TECHNICAL SUPPORT POST IMPLEMENTATION OF MOOCS

7 EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS)MARKET, BY COMPONENT

7.1 OVERVIEW

7.2 PLATFORM

7.2.1 XMOOC

7.2.2 CMOOC

7.3 SERVICES

7.3.1 TRAINING & CONSULTING

7.3.2 IMPLEMENTATION

7.3.3 SUPPORT & MAINTENANCE

8 EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY STUDENT SERVED

8.1 OVERVIEW

8.1.1 POST GRADUATE

8.1.2 CORPORATE

8.1.3 UNDERGRADUATE

8.1.4 HIGH SCHOOL

8.1.5 JUNIOR HIGH SCHOOL

9 EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY SUBJECTS

9.1 OVERVIEW

9.1.1 BUSINESS MANAGEMENT

9.1.2 COMPUTER SCIENCE & PROGRAMMING

9.1.3 SCIENCE

9.1.4 SOCIOLOGY & PHILOSOPHY

9.1.5 HUMANITIES

9.1.6 EDUCATION & TRAINING

9.1.7 HEALTHCARE & MEDICINE

9.1.8 ARTS & DESIGN

9.1.9 MATHEMATICS

9.1.10 FOREIGN LANGUAGE LEARNING

9.1.11 OTHERS

10 EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY GEOGRAPHY

10.1 EUROPE

10.1.1 SPAIN

10.1.2 U.K

10.1.3 FRANCE

10.1.4 GERMANY

10.1.5 RUSSIA

10.1.6 NETHERLANDS

10.1.7 ITALY

10.1.8 SWITZERLAND

10.1.9 BELGIUM

10.1.10 TURKEY

10.1.11 REST OF EUROPE

11 EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: EUROPE

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 COURSERA INC.

13.1.1 COMPANY SNAPSHOT

13.1.2 COMPANY SHARE ANALYSIS

13.1.3 COURSE PORTFOLIO

13.1.4 RECENT DEVELOPMENTS

13.2 EDX INC.

13.2.1 COMPANY SNAPSHOT

13.2.2 COMPANY SHARE ANALYSIS

13.2.3 COURSE PORTFOLIO

13.2.4 RECENT DEVELOPMENTS

13.3 UDACITY, INC.

13.3.1 COMPANY SNAPSHOT

13.3.2 COMPANY SHARE ANALYSIS

NOTE:- THE COMPANY SHARE ANALYSIS DECIDED ON THE BASIS OF THE LEARNERS FOR DIFFERENT REGION.

13.3.3 PROGRAM PORTFOLIO

13.3.4 RECENT DEVELOPMENTS

13.4 FUTURELEARN (A SUBSIDIARY OF SEEK)

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

NOTE:- THE COMPANY SHARE ANALYSIS DECIDED ON THE BASIS OF THE LEARNERS FOR DIFFERENT REGION.

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 SWAYAM

13.5.1 COMPANY SNAPSHOT

13.5.2 COMPANY SHARE ANALYSIS

NOTE:- THE COMPANY SHARE ANALYSIS DECIDED ON THE BASIS OF THE LEARNERS FOR DIFFERENT REGION.

13.5.3 PROGRAM PORTFOLIO

13.5.4 RECENT DEVELOPMENT

13.6 ALISON

13.6.1 COMPANY SNAPSHOT

13.6.2 COURSE PORTFOLIO

13.6.3 RECENT DEVELOPMENTS

13.7 D2L CORPORATION

13.7.1 COMPANY SNAPSHOT

13.7.2 PROGRAM PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 EWANT

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENT

13.9 FEDERICA WEB LEARNING

13.9.1 COMPANY SNAPSHOT

13.9.2 MOOC PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 IVERSITY LEARNING SOLUTIONS GMBH

13.10.1 COMPANY SNAPSHOT

13.10.2 COURSE PORTFOLIO

13.10.3 RECENT DEVELOPMENT

13.11 KADENZE, INC.

13.11.1 COMPANY SNAPSHOT

13.11.2 COURSE PORTFOLIO

13.11.3 RECENT DEVELOPMENT

13.12 MIRÍADAX

13.12.1 COMPANY SNAPSHOT

13.12.2 COURSE PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 NOVOED, INC.

13.13.1 COMPANY SNAPSHOT

13.13.2 SOLUTION PORTFOLIO

13.13.3 RECENT DEVELOPMENTS

13.14 OPENUPED

13.14.1 COMPANY SNAPSHOT

13.14.2 COURSE PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 PLURALSIGHT LLC.(A SUBSIDIARY OF PLURALSIGHT)

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 PRODUCT PORTFOLIO

13.15.4 RECENT DEVELOPMENTS

13.16 SIMPLILEARN SOLUTIONS

13.16.1 COMPANY SNAPSHOT

13.16.2 COURSE PORTFOLIO

13.16.3 RECENT DEVELOPMENTS

13.17 SKILLSHARE, INC

13.17.1 COMPANY SNAPSHOT

13.17.2 PROGRAM PORTFOLIO

13.17.3 RECENT DEVELOPMENT

13.18 UDEMY, INC.

13.18.1 COMPANY SNAPSHOT

13.18.2 COURSE PORTFOLIO

13.18.3 RECENT DEVELOPMENTS

13.19 XUETANGX

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT DEVELOPMENT

13.20TRAINING

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

Liste des tableaux

LIST OF TABLES

TABLE 1 EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 2 EUROPE PLATFROM IN MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 3 EUROPE PLATFROM IN MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY REGION,2018-2027 (USD MILLION)

TABLE 4 EUROPE SERVICES IN MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 5 EUROPE SERVICES IN MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY REGION,2018-2027 (USD MILLION)

TABLE 6 EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY STUDENT SERVED, 2018-2027 (USD MILLION)

TABLE 7 EUROPE POST GRADUATE IN MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY REGION, 2018-2027, (USD MILLION)

TABLE 8 EUROPE CORPORATE IN MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY REGION, 2018-2027, (USD MILLION)

TABLE 9 EUROPE UNDERGRADUATE IN MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY REGION, 2018-2027, (USD MILLION)

TABLE 10 EUROPE HIGHSCHOOL IN MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY REGION, 2018-2027, (USD MILLION)

TABLE 11 EUROPE JUNIOR HIGHSCHOOL IN MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY REGION, 2018-2027, (USD MILLION)

TABLE 12 EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY SUBJECTS, 2018-2027 (USD MILLION)

TABLE 13 EUROPE BUSINESS MANAGEMENT IN MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY REGION, 2018-2027, (USD MILLION)

TABLE 14 EUROPE COMPUTER SCIENCE & PROGRAMMING IN MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY REGION, 2018-2027, (USD MILLION)

TABLE 15 EUROPE SCIENCE IN MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY REGION, 2018-2027, (USD MILLION)

TABLE 16 EUROPE SOCIOLOGY & PHILOSOPHY IN MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY REGION, 2018-2027, (USD MILLION)

TABLE 17 EUROPE HUMANITIES IN MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY REGION, 2018-2027, (USD MILLION)

TABLE 18 EUROPE EDUCATION & TRAINING IN MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY REGION, 2018-2027, (USD MILLION)

TABLE 19 EUROPE HEALTHCARE & MEDICINE IN MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY REGION, 2018-2027, (USD MILLION)

TABLE 20 EUROPE ARTS & DESIGN IN MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY REGION, 2018-2027, (USD MILLION)

TABLE 21 EUROPE MATHEMATICS IN MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY REGION, 2018-2027, (USD MILLION)

TABLE 22 EUROPE FOREIGN LANGUAGE LEARNING IN MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY REGION, 2018-2027, (USD MILLION)

TABLE 23 EUROPE OTHERS IN MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET, BY REGION, 2018-2027, (USD MILLION)

TABLE 24 EUROPE MASSIVE OPEN ONLINE COURSES(MOOCS)MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 25 EUROPE MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 26 EUROPE PLATFORM IN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 27 EUROPE SERVICES IN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 28 EUROPE MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY STUDENT SERVED, 2018-2027 (USD MILLION)

TABLE 29 EUROPE MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY SUBJECT, 2018-2027 (USD MILLION)

TABLE 30 SPAIN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 31 SPAIN PLATFORM IN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 32 SPAIN SERVICES IN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 33 SPAIN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY STUDENT SERVED, 2018-2027 (USD MILLION)

TABLE 34 SPAIN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY SUBJECT, 2018-2027 (USD MILLION)

TABLE 35 U.K MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 36 U.K PLATFORM IN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 37 U.K SERVICES IN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 38 U.K MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY STUDENT SERVED, 2018-2027 (USD MILLION)

TABLE 39 U.K MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY SUBJECT, 2018-2027 (USD MILLION)

TABLE 40 FRANCE MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 41 FRANCE PLATFORM IN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 42 FRANCE SERVICES IN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 43 FRANCE MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY STUDENT SERVED, 2018-2027 (USD MILLION)

TABLE 44 FRANCE MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY SUBJECT, 2018-2027 (USD MILLION)

TABLE 45 GERMANY MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 46 GERMANY PLATFORM IN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 47 GERMANY SERVICES IN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 48 GERMANY MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY STUDENT SERVED, 2018-2027 (USD MILLION)

TABLE 49 GERMANY MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY SUBJECT, 2018-2027 (USD MILLION)

TABLE 50 RUSSIA MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 51 RUSSIA PLATFORM IN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 52 RUSSIA SERVICES IN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 53 RUSSIA MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY STUDENT SERVED, 2018-2027 (USD MILLION)

TABLE 54 RUSSIA MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY SUBJECT, 2018-2027 (USD MILLION)

TABLE 55 NETHERLANDS MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 56 NETHERLANDS PLATFORM IN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 57 NETHERLANDS SERVICES IN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 58 NETHERLANDS MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY STUDENT SERVED, 2018-2027 (USD MILLION)

TABLE 59 NETHERLANDS MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY SUBJECT, 2018-2027 (USD MILLION)

TABLE 60 ITALY MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 61 ITALY PLATFORM IN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 62 ITALY SERVICES IN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 63 ITALY MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY STUDENT SERVED, 2018-2027 (USD MILLION)

TABLE 64 ITALY MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY SUBJECT, 2018-2027 (USD MILLION)

TABLE 65 SWITZERLAND MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 66 SWITZERLAND PLATFORM IN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 67 SWITZERLAND SERVICES IN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 68 SWITZERLAND MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY STUDENT SERVED, 2018-2027 (USD MILLION)

TABLE 69 SWITZERLAND MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY SUBJECT, 2018-2027 (USD MILLION)

TABLE 70 BELGIUM MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 71 BELGIUM PLATFORM IN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 72 BELGIUM SERVICES IN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 73 BELGIUM MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY STUDENT SERVED, 2018-2027 (USD MILLION)

TABLE 74 BELGIUM MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY SUBJECT, 2018-2027 (USD MILLION)

TABLE 75 TURKEY MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 76 TURKEY PLATFORM IN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 77 TURKEY SERVICES IN MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 78 TURKEY MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY STUDENT SERVED, 2018-2027 (USD MILLION)

TABLE 79 TURKEY MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY SUBJECT, 2018-2027 (USD MILLION)

TABLE 80 REST OF EUROPE MASSIVE OPEN ONLINE COURSES(MOOCS) MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

Liste des figures

LIST OF FIGURES

FIGURE 1 EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET: SEGMENTATION

FIGURE 2 EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET: DROC ANALYSIS

FIGURE 4 EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET: EUROPE VS. REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET: SEGMENTATION

FIGURE 10 NECESSITY FOR COST-EFFECTIVE EDUCATION PLATFORMS WILL BOOST THE EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET IN THE FORECAST PERIOD 2020 TO 2027

FIGURE 11 PLATFORM IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET IN 2020 & 2027

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET

FIGURE 13 EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET: BY COMPONENT, 2019

FIGURE 14 EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET: BY STUDENT SERVED, 2019

FIGURE 15 EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET: BY SUBJECTS, 2019

FIGURE 16 EUROPE MASSIVE OPEN ONLINE COURSES(MOOCS)MARKET: SNAPSHOT (2019)

FIGURE 17 EUROPE MASSIVE OPEN ONLINE COURSES(MOOCS)MARKET: BY COUNTRY (2019)

FIGURE 18 EUROPE MASSIVE OPEN ONLINE COURSES(MOOCS)MARKET: BY COUNTRY (2020 & 2027)

FIGURE 19 EUROPE MASSIVE OPEN ONLINE COURSES(MOOCS)MARKET: BY COUNTRY (2019 & 2027)

FIGURE 20 EUROPE MASSIVE OPEN ONLINE COURSES(MOOCS)MARKET: BY COMPONENT(2020-2027)

FIGURE 21 EUROPE MASSIVE OPEN ONLINE COURSES (MOOCS) MARKET: COMPANY SHARE 2019(%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.