Europe Molecular Point Of Care Testing Using Naat Market

Taille du marché en milliards USD

TCAC :

%

USD

2.16 Billion

USD

4.91 Billion

2024

2032

USD

2.16 Billion

USD

4.91 Billion

2024

2032

| 2025 –2032 | |

| USD 2.16 Billion | |

| USD 4.91 Billion | |

|

|

|

|

Segmentation du marché européen des tests moléculaires au point de service (par TAAN), par produit (instruments, consommables et réactifs), indication (tests d'infections respiratoires, tests d'infections sexuellement transmissibles (IST), tests d'infections gastro-intestinales et autres), utilisateur final (laboratoires, hôpitaux, cliniques, centres ambulatoires, soins à domicile, résidences services, etc.), mode de test (tests sur ordonnance et tests en vente libre), canal de distribution (pharmacies hospitalières, pharmacies de détail et pharmacies en ligne) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché européen des tests moléculaires au point de service (utilisant le TAAN)

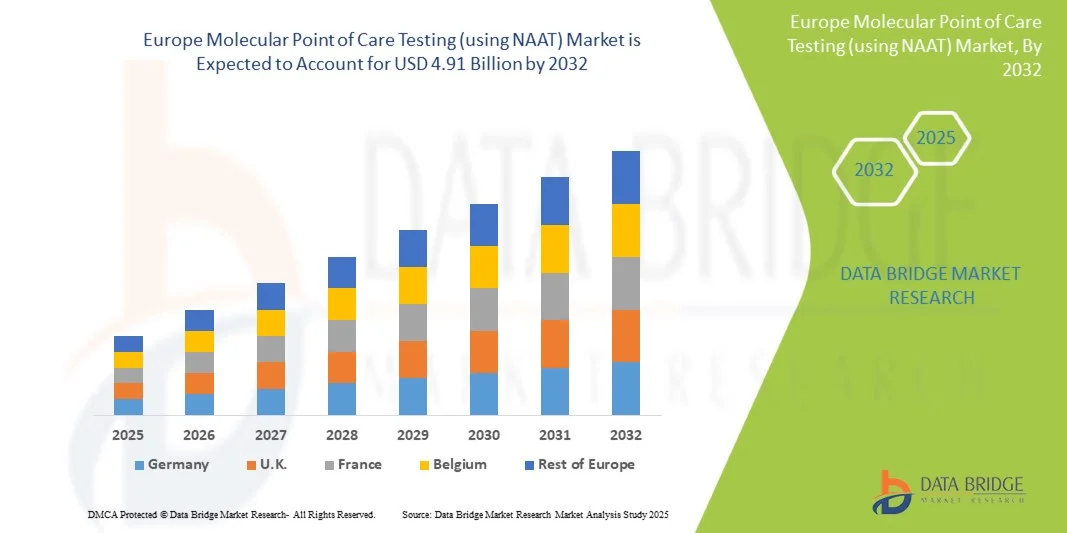

- La taille du marché européen des tests moléculaires au point de service (utilisant NAAT) était évaluée à 2,16 milliards USD en 2024 et devrait atteindre 4,91 milliards USD d'ici 2032 , à un TCAC de 10,8 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par les progrès des technologies NAAT, telles que la PCR et la LAMP, et par la demande croissante de solutions de diagnostic rapides et précises dans les environnements de soins de santé décentralisés.

- En outre, la prévalence croissante des maladies infectieuses, le vieillissement croissant de la population et les approbations réglementaires pour les dispositifs de point de service basés sur le NAAT stimulent l'adoption, faisant des tests moléculaires au point de service le choix de diagnostic préféré dans les environnements cliniques et non cliniques, stimulant ainsi considérablement la croissance du secteur.

Analyse du marché européen des tests moléculaires au point de service (par TAAN)

- Les tests moléculaires au point de service (POCT) utilisant le TAAN, permettant une détection rapide et très précise des maladies infectieuses , deviennent de plus en plus un élément essentiel des systèmes de santé modernes dans les contextes cliniques et décentralisés en raison de leur rapidité, de leur fiabilité et de leur facilité d'intégration avec les flux de travail de diagnostic existants.

- L’adoption croissante du POCT basé sur le NAAT est principalement alimentée par la prévalence croissante des maladies infectieuses, la demande croissante de diagnostics rapides et une préférence pour les tests décentralisés en dehors des laboratoires traditionnels.

- L'Allemagne a dominé le marché européen du POCT moléculaire avec la plus grande part de revenus de 35 % en 2024, caractérisée par une infrastructure de soins de santé bien établie, des dépenses de santé élevées et une forte présence d'acteurs clés de l'industrie, l'Allemagne connaissant une croissance substantielle de l'adoption, tirée par les innovations des sociétés de diagnostic établies et des sociétés de biotechnologie émergentes axées sur les dispositifs NAAT portables et automatisés

- La France devrait être le pays connaissant la croissance la plus rapide sur le marché européen du POCT moléculaire au cours de la période de prévision, en raison de l'augmentation des investissements dans les soins de santé, de la sensibilisation croissante aux diagnostics rapides et de l'expansion des installations de soins de santé.

- Le segment des infections respiratoires a dominé le marché européen des POCT moléculaires avec une part de marché de 42 % en 2024, grâce à la forte demande de tests rapides lors des épidémies saisonnières et à l'efficacité prouvée du NAAT dans la détection des agents pathogènes avec une sensibilité et une spécificité élevées.

Portée du rapport et segmentation du marché européen des tests moléculaires au point de service (à l'aide du TAAN)

|

Attributs |

Analyses moléculaires au point de service (tests NAAT) : principales perspectives du marché européen |

|

Segments couverts |

|

|

Pays couverts |

Europe

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché européen des tests moléculaires au point de service (par TAAN)

Diagnostics rapides et précis au point de service

- Une tendance significative et croissante sur le marché européen du POCT moléculaire est l'adoption croissante de dispositifs basés sur le NAAT capables de fournir des diagnostics rapides et très précis pour les maladies infectieuses, réduisant ainsi la dépendance aux laboratoires centralisés.

- Par exemple, le système Cepheid GeneXpert fournit des résultats pour les infections respiratoires en une heure, permettant des décisions cliniques rapides et une meilleure gestion des patients.

- L'intégration des appareils NAAT aux plateformes de santé numériques permet la création de rapports de résultats en temps réel, la surveillance à distance et l'analyse des données pour suivre les tendances en matière d'infection et optimiser les stratégies de traitement, améliorant ainsi l'efficacité du flux de travail dans les hôpitaux et les cliniques.

- L'adoption d'appareils NAAT portables et automatisés facilite les tests décentralisés dans les cliniques, les pharmacies et les unités de soins d'urgence, rendant les diagnostics accessibles même dans les environnements éloignés ou aux ressources limitées.

- Cette tendance vers des diagnostics moléculaires plus rapides, précis et connectés remodèle les attentes en matière de rapidité et de fiabilité des tests cliniques, avec des entreprises telles que Qiagen développant des plateformes NAAT automatisées avec des capacités de reporting basées sur le cloud et de tests multiplex.

- La demande de solutions POCT moléculaires hautement sensibles, rapides et connectées augmente dans les hôpitaux, les cliniques et les centres de soins d'urgence, car les prestataires de soins de santé privilégient un diagnostic rapide et des soins centrés sur le patient.

Dynamique du marché européen des tests moléculaires au point de service (par TAAN)

Conducteur

Augmentation de la charge des maladies infectieuses et demande de tests décentralisés

- La prévalence croissante des maladies infectieuses telles que les infections respiratoires, les IST et les agents pathogènes gastro-intestinaux, associée au besoin de capacités de diagnostic décentralisées, est un facteur clé de l'adoption du POCT moléculaire basé sur le NAAT.

- Par exemple, en mars 2024, Roche a lancé une plateforme NAAT rapide pour la détection de la grippe et du VRS dans les cliniques externes, visant à améliorer l'accès aux tests et les délais d'exécution.

- Les prestataires de soins de santé recherchent de plus en plus des outils de diagnostic rapides, sensibles et faciles à utiliser, capables de fournir des résultats exploitables au point de service, réduisant ainsi les délais associés aux tests de laboratoire centralisés.

- En outre, la croissance des soins ambulatoires, des cliniques de soins d'urgence et des services de soins de santé à domicile augmente la demande d'appareils NAAT portables et conviviaux qui peuvent être déployés dans divers contextes de soins de santé.

- La capacité à détecter rapidement les agents pathogènes, à suivre les schémas d'infection et à intégrer les résultats des tests aux dossiers médicaux électroniques favorise une gestion efficace des patients et une surveillance des maladies, favorisant ainsi l'adoption du POCT moléculaire dans les hôpitaux et les cliniques.

Retenue/Défi

Coûts élevés des appareils et obstacles à la conformité réglementaire

- Les coûts initiaux élevés des systèmes POCT moléculaires basés sur le NAAT, associés aux dépenses récurrentes pour les cartouches et la maintenance, constituent un défi important pour une adoption plus large, en particulier dans les petites cliniques ou les environnements aux ressources limitées.

- Par exemple, des considérations de coût ont limité le déploiement de certaines plateformes NAAT automatisées Cepheid et Thermo Fisher dans des établissements ambulatoires plus petits, malgré leurs avantages cliniques.

- Le respect des normes réglementaires européennes strictes, notamment le marquage CE et les certifications ISO, ajoute de la complexité et peut retarder l'entrée sur le marché de nouveaux dispositifs moléculaires POCT, créant ainsi des obstacles pour les fabricants.

- En outre, la nécessité de disposer d’un personnel qualifié pour exploiter certaines plateformes NAAT et assurer le contrôle de la qualité peut limiter l’adoption dans les contextes décentralisés ou au point de service.

- Surmonter ces défis grâce à la réduction des coûts, à la simplification du fonctionnement des appareils et à la rationalisation des approbations réglementaires est essentiel pour une croissance soutenue du marché et une adoption plus large du POCT moléculaire à travers l'Europe.

Portée du marché européen des tests moléculaires au point de service (utilisant le TAAN)

Le marché est segmenté en fonction du type, du protocole de communication, du mécanisme de déverrouillage et de l'application.

- Par produit

Sur la base des produits, le marché européen des scanners moléculaires POCT est segmenté en instruments et en consommables et réactifs. Le segment des instruments a dominé le marché avec la plus grande part de chiffre d'affaires (54,3 %) en 2024, porté par la forte demande de dispositifs TAAN automatisés et portables offrant des diagnostics rapides et précis. Les hôpitaux et les laboratoires privilégient les instruments de pointe en raison de leur capacité à réaliser des tests multiplex et à réduire les délais d'exécution, améliorant ainsi la prise en charge des patients. La compatibilité de ces instruments avec les plateformes de santé numérique et les systèmes de reporting cloud favorise leur adoption. La robustesse, la fiabilité et la réputation des principaux fabricants d'instruments renforcent également la confiance des clients, confortant ainsi leur position dominante sur le marché. Le dépistage de routine et la gestion des épidémies d'infections respiratoires et d'IST reposent fortement sur ces instruments pour un flux de travail efficace. L'augmentation des investissements des gouvernements et des prestataires de soins de santé privés dans les instruments de diagnostic avancés contribue également à une croissance soutenue.

Le segment des Consommables et Réactifs devrait connaître la croissance la plus rapide, soit 12,5 % entre 2025 et 2032, grâce à la demande récurrente de cartouches TAAN, de kits de test et de réactifs nécessaires aux tests de diagnostic continus. Les consommables sont essentiels au fonctionnement quotidien des cliniques, des hôpitaux et des centres de soins ambulatoires, garantissant une capacité de test constante. Leur croissance est également stimulée par la multiplication des centres de test décentralisés et l'adoption de plateformes TAAN portables. Les fabricants innovent pour proposer des réactifs conviviaux et prêts à l'emploi, réduisant ainsi les erreurs de procédure. L'intensification de la surveillance des maladies et des cycles saisonniers de dépistage des infections stimulent également la demande. La rentabilité, la durée de conservation réduite et les réapprovisionnements fréquents créent des opportunités de revenus récurrents pour les fournisseurs, favorisant une croissance rapide.

- Par indication

Sur la base des indications, le marché est segmenté en tests d'infections respiratoires, tests d'infections sexuellement transmissibles (IST), tests d'infections gastro-intestinales et autres. Le segment des tests d'infections respiratoires a dominé le marché avec une part de chiffre d'affaires de 42 % en 2024, stimulé par la forte prévalence de la grippe, du VRS et de la COVID-19, nécessitant un diagnostic rapide. Les prestataires de soins privilégient les tests TAAN en raison de leur sensibilité et de leur spécificité élevées, garantissant une prise en charge précise des patients. La surveillance des épidémies dans les hôpitaux et les établissements de santé publique renforce encore l'adoption de ces tests. Les dispositifs TAAN au point d'intervention offrent une rapidité d'exécution, essentielle aux urgences et en soins intensifs. Les fluctuations saisonnières de la demande créent des cycles de tests récurrents, renforçant la domination du marché. Les initiatives de dépistage soutenues par les gouvernements pendant les épidémies renforcent également le leadership du segment.

Le segment des tests d'IST devrait connaître la croissance la plus rapide, soit 13,1 % entre 2025 et 2032, grâce à une sensibilisation accrue, à l'intensification des programmes de dépistage et à l'adoption de diagnostics discrets au point de service. Le test TAAN rapide pour la chlamydia, la gonorrhée et la syphilis améliore l'observance du traitement par les patients et réduit le besoin de visites de suivi. La prévalence croissante chez les jeunes adultes et les programmes de santé communautaire ciblés stimulent la demande. Les kits d'auto-prélèvement innovants et l'intégration aux plateformes de télésanté améliorent l'accessibilité. L'augmentation des investissements dans les cliniques de santé sexuelle et les unités de dépistage mobiles accélère la croissance. L'innovation continue dans les panels d'IST multiplexés stimule également l'expansion du marché.

- Par utilisateur final

En fonction de l'utilisateur final, le marché est segmenté en laboratoires, hôpitaux, cliniques, centres ambulatoires, soins à domicile, résidences services et autres. Le segment des hôpitaux a dominé le marché avec une part de chiffre d'affaires de 48,2 % en 2024, en raison de la forte fréquentation des patients et de la demande de diagnostics rapides aux urgences, en soins intensifs et en consultations externes. Les hôpitaux ont besoin d'instruments et de consommables basés sur le TAAN pour prendre des décisions thérapeutiques rapides et contrôler les infections. L'intégration aux systèmes d'information hospitaliers et aux dossiers médicaux électroniques améliore l'efficacité. Les achats à grande échelle des hôpitaux garantissent une demande constante, tandis que l'expertise clinique favorise l'adoption. Les épidémies saisonnières d'infections respiratoires et les initiatives de préparation aux pandémies augmentent encore les volumes de tests. Les hôpitaux bénéficient également de contrats de formation et de maintenance soutenus par les fournisseurs, renforçant ainsi leur domination du marché.

Le segment des soins à domicile devrait connaître la croissance la plus rapide, soit 14,2 % entre 2025 et 2032, grâce à la demande croissante de kits de dépistage TAAN à domicile, à la télésurveillance et à des modèles de soins centrés sur le patient. La praticité de l'autotest et de l'intégration de la télésanté séduit les patients atteints de maladies chroniques et les personnes âgées. La sensibilisation et l'adoption croissantes des tests en vente libre pour les IST et les infections respiratoires renforcent la pénétration du marché. L'augmentation des investissements dans les infrastructures et la logistique des soins à domicile soutient l'expansion de ce segment. Les innovations en matière d'appareils compacts et faciles à utiliser et d'interprétation rapide des résultats facilitent l'adoption. Les tests à domicile allègent également la charge de travail des hôpitaux et des cliniques, soutenant ainsi la croissance globale du marché.

- Par mode de test

Selon le mode de test, le marché est segmenté en tests sur ordonnance et tests en vente libre. Le segment des tests sur ordonnance a dominé le marché avec une part de chiffre d'affaires de 62,7 % en 2024, car la supervision clinique garantit un diagnostic précis, un reporting approprié et un suivi thérapeutique. Les hôpitaux, les laboratoires et les cliniques s'appuient sur les tests TAAN guidés par un médecin pour le dépistage des infections respiratoires, des IST et des pathogènes gastro-intestinaux. Les tests sur ordonnance permettent le remboursement des assurances et la conformité réglementaire. Ils garantissent également une manipulation professionnelle des échantillons et leur intégration aux dossiers patients. L'importance cruciale d'un diagnostic rapide et fiable en soins intensifs renforce sa domination sur le marché. Les protocoles de diagnostic établis privilégient les tests guidés par ordonnance aux approches auto-administrées.

Le segment des tests en vente libre devrait connaître la croissance la plus rapide, soit 15,3 % entre 2025 et 2032, grâce à la disponibilité croissante des kits TAAN à domicile pour les IST et les infections respiratoires. La praticité, la confidentialité et l'accès immédiat aux résultats favorisent l'adoption par les patients. L'intégration aux applications mobiles et aux services de télésanté améliore la convivialité et l'engagement des patients. La multiplication des campagnes de sensibilisation du public et le marketing direct auprès des consommateurs accélèrent la pénétration. Les améliorations technologiques en termes de précision et de simplicité d'utilisation des tests favorisent une croissance rapide. Les tests en vente libre s'inscrivent également dans les tendances en matière de soins préventifs et de décentralisation des soins.

- Par canal de distribution

En fonction du canal de distribution, le marché est segmenté en pharmacies hospitalières, pharmacies de détail et pharmacies en ligne. Le segment des pharmacies hospitalières a dominé le marché avec une part de chiffre d'affaires de 51,9 % en 2024, grâce à l'approvisionnement direct des hôpitaux, garantissant une disponibilité rapide des instruments, cartouches et réactifs NAAT. Les hôpitaux privilégient l'approvisionnement interne afin de maintenir les stocks nécessaires à la continuité des soins aux patients. Les partenariats stratégiques entre les fournisseurs et les réseaux hospitaliers renforcent l'efficacité de la distribution. Les achats en gros et les contrats à long terme créent une demande stable. L'intégration aux systèmes de gestion de la chaîne d'approvisionnement des hôpitaux améliore l'efficacité opérationnelle. Les pharmacies hospitalières proposent également une formation et un support de maintenance pour les systèmes moléculaires POCT, renforçant ainsi leur adoption.

Le segment des pharmacies en ligne devrait connaître la croissance la plus rapide, soit 16,4 % entre 2025 et 2032, grâce à la pénétration croissante du e-commerce, à la vente directe de kits TAAN à domicile et à l'acceptation croissante des services de santé en ligne. Les consommateurs privilégient de plus en plus les solutions de test pratiques et livrées à domicile. L'intégration avec les applications mobiles et les plateformes de télésanté facilite la commande et l'interprétation des résultats. Les pharmacies en ligne réduisent les contraintes logistiques dans les régions éloignées ou mal desservies. Les campagnes marketing et les modèles d'approvisionnement par abonnement soutiennent une croissance rapide. Le développement des initiatives de e-santé par les gouvernements et les acteurs privés accélère encore l'adoption.

Analyse régionale du marché européen des tests moléculaires au point de service (par TAAN)

- L'Allemagne a dominé le marché européen du POCT moléculaire avec la plus grande part de revenus de 35 % en 2024, caractérisée par une infrastructure de soins de santé bien établie, des dépenses de santé élevées et une forte présence d'acteurs clés de l'industrie.

- Les prestataires de soins de santé en Allemagne apprécient grandement la précision, la rapidité et la fiabilité offertes par les tests de dépistage au point de service basés sur le TAAN pour les maladies infectieuses telles que les infections respiratoires, les IST et les agents pathogènes gastro-intestinaux.

- Cette adoption généralisée est également soutenue par les initiatives gouvernementales favorisant la détection précoce des maladies, la sensibilisation accrue aux diagnostics rapides et la présence d'acteurs clés de l'industrie développant des dispositifs NAAT automatisés et portables, établissant le POCT moléculaire comme une solution de diagnostic privilégiée pour les hôpitaux, les cliniques et les laboratoires à travers le pays.

Analyse du marché des tests moléculaires au point de service (par TAAN) en France et en Europe

Le marché français des tests moléculaires POCT devrait connaître la croissance la plus rapide au cours de la période de prévision, porté par la sensibilisation croissante aux diagnostics rapides et la demande croissante de tests décentralisés dans les hôpitaux, les cliniques et les structures de soins ambulatoires. Le pays connaît une forte adoption des tests TAAN pour les infections respiratoires, les IST et les maladies gastro-intestinales. Les politiques de santé françaises favorisant la détection précoce, l'intégration de la télémédecine et les programmes de santé communautaire stimulent la croissance du marché. Les dispositifs TAAN portables et conviviaux gagnent en popularité, permettant des tests plus rapides en ambulatoire et à domicile. L'augmentation des investissements dans les infrastructures de santé, combinée à des modèles de soins centrés sur le patient, accélère leur adoption. De plus, l'innovation continue des principaux acteurs et la disponibilité de solutions de tests multiplexées contribuent à l'expansion rapide du marché.

Analyse du marché des tests moléculaires au point de service (par TAAN) au Royaume-Uni et en Europe

Le marché britannique des tests moléculaires au point d'intervention (POCT) connaît une croissance soutenue grâce à la demande croissante de diagnostics rapides dans les hôpitaux, les cliniques et les centres de diagnostic. L'adoption des tests basés sur le TAAN est stimulée par la forte prévalence des infections respiratoires et des infections sexuellement transmissibles, ainsi que par les initiatives gouvernementales en faveur du dépistage précoce et des soins préventifs. Les professionnels de santé investissent de plus en plus dans des plateformes TAAN automatisées et portables afin de réduire les délais d'exécution et d'améliorer la prise en charge des patients. L'intégration aux services de télésanté et aux dossiers médicaux électroniques améliore encore l'efficacité et l'accessibilité. La sensibilisation croissante des patients et des cliniciens aux avantages des tests au point d'intervention favorise l'expansion du marché. Par ailleurs, les entreprises de diagnostic britanniques développent des solutions innovantes, renforçant ainsi l'adoption des tests moléculaires au point d'intervention.

Analyse du marché des tests moléculaires au point de service (tests NAAT) en Italie et en Europe

Le marché italien des tests moléculaires au point de service (POCT) devrait connaître une croissance annuelle moyenne (TCAC) considérable au cours de la période de prévision, stimulé par l'augmentation des investissements dans les infrastructures de santé et la modernisation des installations de diagnostic. Les hôpitaux, les cliniques et les résidences services adoptent de plus en plus les plateformes TAAN pour la détection rapide des maladies infectieuses. L'intégration d'appareils automatisés et portables aux systèmes d'information hospitaliers et la génération de rapports en temps réel améliorent l'efficacité opérationnelle. La sensibilisation croissante des professionnels de santé aux avantages des tests au point de service favorise leur adoption. Les programmes gouvernementaux de promotion des soins préventifs et de la surveillance des maladies accélèrent encore la croissance. L'innovation continue des produits et les partenariats avec des entreprises internationales de diagnostic contribuent également à l'expansion du marché.

Part de marché des tests moléculaires au point de service (à l'aide du TAAN) en Europe

L'industrie européenne des tests moléculaires au point de service (utilisant le TAAN) est principalement dirigée par des entreprises bien établies, notamment :

- Abbott (États-Unis)

- F. Hoffmann-La Roche SA (Suisse)

- Céphéide (États-Unis)

- Thermo Fisher Scientific Inc. (États-Unis)

- BIOMÉRIEUX (France)

- QIAGEN (Pays-Bas)

- BD (États-Unis)

- Hologic, Inc. (États-Unis)

- PerkinElmer (États-Unis)

- QuidelOrtho Corporation (États-Unis)

- GenMark Diagnostics, Inc. (États-Unis)

- Seegene, Inc. (Corée du Sud)

- Cue Health Inc. (États-Unis)

- Novacyt (Royaume-Uni)

- Molbio Diagnostics Limited (Inde)

- Randox Laboratories Ltd (Royaume-Uni)

- Oxford Nanopore Technologies Ltd (Royaume-Uni)

- Binx Health, Inc. (États-Unis)

- SD Biosensor, INC. (Corée du Sud)

- Bio-Rad Laboratories, Inc. (États-Unis)

Quels sont les développements récents sur le marché européen des tests moléculaires au point de service (utilisant le NAAT) ?

- En mars 2025, l'Agence exécutive européenne pour la santé et le numérique (HaDEA) a publié un appel d'offres dans le cadre du programme EU4Health. L'objectif est d'accélérer le développement d'un dispositif médical de diagnostic rapide de sensibilité aux antimicrobiens (TAA) au point de service (POC). L'appel vise un dispositif capable de fournir des résultats de TAA sur des bactéries ou des champignons en une heure ou moins à partir du prélèvement de l'échantillon, ce qui constituerait une avancée significative dans la lutte contre la résistance aux antimicrobiens directement au point de service.

- En janvier 2025, Novus Diagnostics, une entreprise développant une plateforme de diagnostic rapide au point d'intervention, a annoncé avoir reçu un financement en fonds propres de 4,6 millions d'euros. Ce financement servira à accélérer le développement de sa technologie, notamment un test de sepsis au point d'intervention en 15 minutes. Cette nouvelle souligne l'investissement et l'innovation continus dans le secteur européen du diagnostic au point d'intervention.

- En juillet 2024, Roche a annoncé la finalisation de l'acquisition de la technologie innovante Point of Care de LumiraDx. Cette acquisition est importante car elle permet à Roche d'élargir son portefeuille de diagnostics, notamment dans les établissements de santé décentralisés. L'intégration de la plateforme LumiraDx devrait permettre des tests plus rapides et plus abordables dans de nombreux domaines thérapeutiques.

- En avril 2023, bioMérieux a annoncé un partenariat stratégique avec Oxford Nanopore Technologies afin d'explorer les possibilités d'introduire le séquençage nanopore dans le marché du diagnostic des maladies infectieuses. Cette collaboration vise à exploiter la technologie nanopore pour une caractérisation rapide et économique des agents pathogènes, s'inscrivant ainsi dans une tendance majeure vers des outils de diagnostic moléculaire plus avancés.

- En octobre 2021, Hologic a lancé Novodiag, sa plateforme de diagnostic moléculaire entièrement automatisée et à la demande, en Europe. Ce lancement fait suite à l'acquisition de Mobidiag et a considérablement renforcé la présence d'Hologic sur le marché européen du diagnostic. La plateforme Novodiag fournit des résultats rapides et de haute qualité pour les maladies infectieuses et la résistance aux antimicrobiens, directement au point de service.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.