Europe Molecular Diagnostics Market

Taille du marché en milliards USD

TCAC :

%

USD

11.60 Billion

USD

17.80 Billion

2025

2033

USD

11.60 Billion

USD

17.80 Billion

2025

2033

| 2026 –2033 | |

| USD 11.60 Billion | |

| USD 17.80 Billion | |

|

|

|

|

Segmentation du marché européen du diagnostic moléculaire, par produits (réactifs et kits, instruments et services et logiciels), technologies (spectrométrie de masse (SM), électrophorèse capillaire, séquençage de nouvelle génération (SNG), puces et microarrays, méthodes basées sur la réaction en chaîne par polymérase (PCR), cytogénétique, hybridation in situ (ISH ou FISH), imagerie moléculaire et autres), applications (oncologie, pharmacogénomique, microbiologie, tests prénataux, typage tissulaire, dépistage sanguin, maladies cardiovasculaires, maladies neurologiques, maladies infectieuses et autres) - Tendances du secteur et prévisions jusqu'en 2033

Taille du marché européen du diagnostic moléculaire

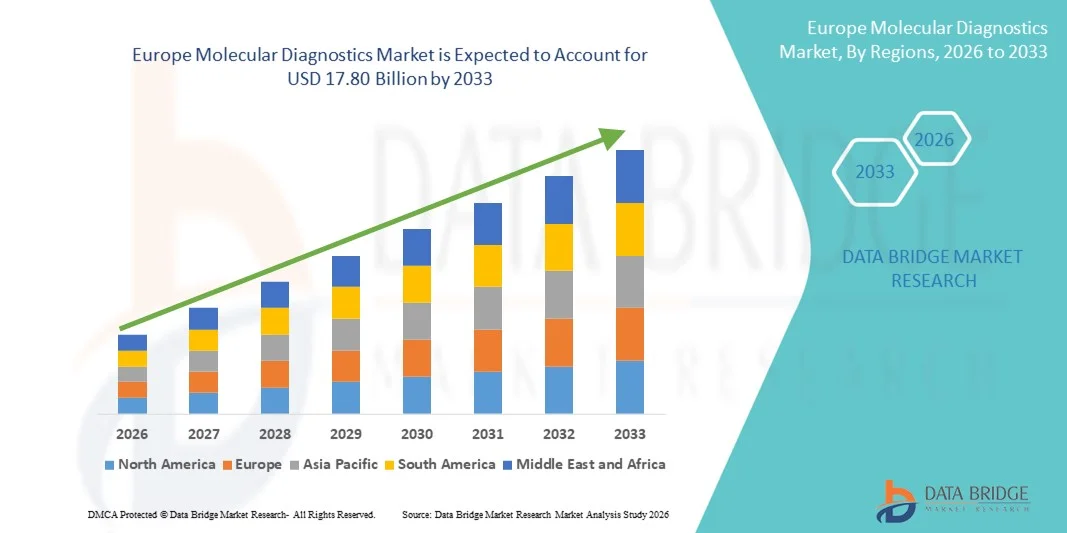

- Le marché européen du diagnostic moléculaire était évalué à 11,60 milliards de dollars en 2025 et devrait atteindre 17,80 milliards de dollars d'ici 2033 , avec un TCAC de 5,50 % au cours de la période de prévision.

- La croissance du marché est principalement due aux progrès technologiques rapides des techniques de diagnostic moléculaire, notamment la PCR, le séquençage de nouvelle génération (SNG) et les tests au point de service, qui améliorent considérablement la précision, la rapidité et l'extensibilité de la détection des maladies dans les contextes cliniques et de recherche.

- De plus, la demande croissante de diagnostics précoces et précis des maladies infectieuses, du cancer et des troubles génétiques, ainsi que l'adoption croissante de la médecine personnalisée et l'expansion des infrastructures de santé, positionnent le diagnostic moléculaire comme une composante essentielle des soins de santé modernes, accélérant ainsi considérablement la croissance du marché du diagnostic moléculaire.

Analyse du marché européen du diagnostic moléculaire

- Le diagnostic moléculaire, qui permet la détection et l'analyse des marqueurs biologiques du génome et du protéome, joue un rôle essentiel dans les soins de santé modernes en favorisant le dépistage précoce des maladies, un diagnostic précis et des approches thérapeutiques personnalisées dans les domaines des maladies infectieuses, de l'oncologie et des tests génétiques.

- La demande croissante de solutions de diagnostic précises et rapides est principalement due à la prévalence accrue des maladies chroniques et infectieuses, à l'adoption croissante de la médecine de précision, aux progrès technologiques en matière de PCR et de séquençage de nouvelle génération (SNG), ainsi qu'à l'utilisation croissante des tests moléculaires au point de soins.

- Le Royaume-Uni a dominé le marché du diagnostic moléculaire avec la plus grande part de revenus, soit environ 39,4 %, en 2025, grâce à une infrastructure de santé avancée, des initiatives gouvernementales fortes en faveur du dépistage précoce des maladies, une adoption importante des technologies de diagnostic de nouvelle génération et la présence d'entreprises leaders dans le domaine du diagnostic.

- L'Allemagne devrait être le pays connaissant la croissance la plus rapide sur le marché du diagnostic moléculaire au cours de la période de prévision, avec un TCAC d'environ 13,5 %, grâce à l'augmentation des investissements dans le diagnostic médical, l'expansion des infrastructures de laboratoire, la sensibilisation croissante à la médecine de précision et des cadres réglementaires favorables aux tests moléculaires.

- Le segment des réactifs et des kits a dominé le marché du diagnostic moléculaire avec la plus grande part de revenus, soit environ 58,4 % en 2025, grâce à leur consommation récurrente et à leur rôle indispensable dans les flux de travail de routine des tests moléculaires.

Portée du rapport et segmentation du marché du diagnostic moléculaire

|

Attributs |

Principaux enseignements du marché du diagnostic moléculaire |

|

Segments couverts |

|

|

Pays couverts |

Europe

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

En plus des informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, l'épidémiologie des patients, l'analyse du pipeline, l'analyse des prix et le cadre réglementaire. |

Tendances du marché européen du diagnostic moléculaire

Progrès en matière d'automatisation et de tests moléculaires à haut débit

- L'adoption croissante de plateformes de diagnostic automatisées et à haut débit constitue une tendance majeure et en pleine accélération sur le marché européen du diagnostic moléculaire. Ces plateformes permettent d'améliorer l'efficacité, la précision et les délais d'obtention des résultats.

- Les laboratoires européens se tournent rapidement vers des flux de travail moléculaires automatisés pour gérer le volume croissant de tests liés aux maladies infectieuses, à l'oncologie et aux maladies génétiques.

- Par exemple, plusieurs laboratoires de diagnostic européens ont étendu l'utilisation de systèmes PCR et d'analyse d'échantillons entièrement automatisés pour soutenir le dépistage à grande échelle et les tests décentralisés, permettant une prise de décision clinique plus rapide et de meilleurs résultats pour les patients.

- L'automatisation des diagnostics moléculaires permet de réduire l'intervention manuelle, de minimiser les erreurs humaines et d'améliorer la reproductibilité des résultats, ce qui est particulièrement important pour des applications telles que le diagnostic du cancer, les tests prénataux et la détection des agents pathogènes.

- L'intégration des plateformes de diagnostic moléculaire aux systèmes de gestion de l'information de laboratoire (LIMS) contribue à rationaliser davantage le traitement des données, la communication des résultats et l'optimisation des flux de travail dans les laboratoires hospitaliers et de référence.

- Cette tendance vers des solutions de tests moléculaires évolutives, efficaces et standardisées remodèle les pratiques de diagnostic en Europe, incitant les fabricants à développer des instruments compacts à haut débit adaptés aussi bien aux laboratoires centralisés qu'aux environnements de test au chevet du patient.

- La demande croissante de tests moléculaires rapides, fiables et économiques stimule l'innovation continue dans les réactifs, les instruments et les consommables, renforçant ainsi le rôle du diagnostic moléculaire dans les systèmes de santé modernes.

Dynamique du marché européen du diagnostic moléculaire

Conducteur

Augmentation du fardeau des maladies infectieuses et chroniques

- La prévalence croissante des maladies infectieuses, des cancers et des maladies génétiques en Europe est un facteur majeur qui alimente la demande en matière de diagnostic moléculaire, car ces technologies offrent une sensibilité et une spécificité élevées pour la détection précoce et précise des maladies.

- Par exemple, le besoin constant de tests moléculaires pour les infections respiratoires, les biomarqueurs oncologiques et la surveillance de la résistance aux antimicrobiens a considérablement augmenté le volume des tests dans les systèmes de santé européens.

- Le diagnostic moléculaire joue un rôle essentiel dans la médecine personnalisée en permettant la sélection de thérapies ciblées, le suivi de la maladie et l'évaluation de la réponse au traitement, notamment en oncologie et dans le domaine des maladies génétiques rares.

- De plus, la multiplication des initiatives gouvernementales visant à renforcer les programmes de surveillance des maladies et à améliorer la préparation en matière de diagnostic accélère l'adoption de solutions de tests moléculaires avancées.

- L'expansion des laboratoires hospitaliers, des laboratoires de référence et des réseaux de diagnostic à travers l'Europe, conjuguée à la hausse des dépenses de santé, continue de stimuler la croissance du marché.

Retenue/Défi

Coûts élevés et complexité réglementaire

- Le coût élevé des instruments de diagnostic moléculaire, des réactifs et des consommables demeure un défi majeur, en particulier pour les petits laboratoires et les établissements de santé disposant de budgets limités.

- Par exemple, les plateformes de PCR avancée et de séquençage de nouvelle génération nécessitent un investissement initial important, ainsi que des coûts récurrents liés aux réactifs, à la maintenance et au personnel qualifié.

- De plus, les exigences réglementaires strictes et les longs processus d'approbation prévus par les cadres réglementaires européens peuvent retarder le lancement des produits et augmenter les coûts de mise en conformité pour les fabricants.

- Le besoin d'infrastructures spécialisées et de professionnels qualifiés limite davantage l'adoption dans les contextes aux ressources limitées.

- Le dépassement de ces défis grâce au développement de tests rentables, à la simplification des flux de travail, à la formation du personnel et à l'harmonisation réglementaire sera essentiel pour assurer une croissance durable du marché du diagnostic moléculaire en Europe.

Portée du marché européen du diagnostic moléculaire

Le marché du diagnostic moléculaire est segmenté en fonction du produit, de la technologie et de l'application.

- Sous-produit

Le marché du diagnostic moléculaire est segmenté, selon le type de produit, en réactifs et kits, instruments, et services et logiciels. Le segment des réactifs et kits a dominé ce marché en 2025, représentant la plus grande part de revenus (environ 58,4 %). Cette domination s'explique par la consommation récurrente de ces produits et leur rôle indispensable dans les flux de travail de routine des tests moléculaires. Les réactifs et les kits sont nécessaires à chaque test de diagnostic, notamment les tests PCR, de séquençage et d'hybridation, garantissant une demande constante dans les laboratoires, les hôpitaux et les instituts de recherche. La prévalence croissante des maladies infectieuses, des cancers et des maladies génétiques a considérablement augmenté le volume des tests, soutenant directement les ventes de réactifs. Par ailleurs, l'innovation continue en matière de sensibilité des tests, de capacités de multiplexage et de délais d'exécution plus courts a favorisé leur adoption. Les autorisations réglementaires pour les tests compagnons et les kits spécifiques à une maladie confortent également la position de leader du marché. L'expansion des tests moléculaires dans les économies émergentes contribue également à une demande soutenue de réactifs. L'ensemble de ces facteurs positionne fermement les réactifs et les kits comme le principal contributeur aux revenus.

Le segment Services et Logiciels devrait connaître le taux de croissance annuel composé (TCAC) le plus rapide, d'environ 13,9 %, entre 2026 et 2033, porté par la complexité croissante des données moléculaires et le besoin accru d'analyses avancées. Les laboratoires externalisent de plus en plus l'interprétation des données, la bio-informatique et les solutions de gestion des données dans le cloud afin d'améliorer leur efficacité et la précision de leurs analyses. L'adoption rapide du séquençage de nouvelle génération a encore accentué la demande de plateformes logicielles spécialisées capables de traiter de vastes ensembles de données génomiques. Par ailleurs, l'évolution vers la médecine personnalisée et les tests compagnons exige des solutions numériques intégrées pour la prise de décision clinique. L'adoption croissante de l'automatisation des laboratoires et des analyses basées sur l'IA contribue également à cette croissance. Alors que les laboratoires privilégient l'évolutivité et la conformité, les services et les logiciels émergent comme un segment à forte croissance.

- Par la technologie

Le marché du diagnostic moléculaire est segmenté, selon la technologie utilisée, en spectrométrie de masse (SM), électrophorèse capillaire, séquençage de nouvelle génération (SNG), puces et microarrays, méthodes basées sur la PCR, cytogénétique, hybridation in situ (ISH/FISH), imagerie moléculaire et autres. Le segment des méthodes basées sur la PCR représentait la plus grande part de marché en termes de revenus, soit environ 41,6 % en 2025, grâce à son utilisation clinique généralisée, sa haute sensibilité et sa rapidité d'exécution. La PCR demeure la méthode de référence pour la détection des maladies infectieuses, les tests oncologiques et le dépistage génétique. Son utilisation intensive pendant la pandémie de COVID-19 a renforcé les infrastructures de laboratoire et favorisé son adoption à long terme. Les plateformes PCR sont rentables, évolutives et compatibles avec les environnements de test centralisés et décentralisés. Les progrès constants, tels que la PCR en temps réel et la PCR digitale, ont élargi les applications cliniques. Une validation réglementaire solide et une bonne connaissance de la technique par les cliniciens contribuent également à sa position dominante.

Le segment du séquençage de nouvelle génération (SNG) devrait connaître la croissance annuelle composée la plus rapide, de près de 14,7 %, entre 2026 et 2033, portée par le développement de ses applications en oncologie, dans le diagnostic des maladies rares et en médecine de précision. La baisse des coûts et l'amélioration du débit ont facilité l'accès au SNG pour les laboratoires cliniques. Ce dernier permet un profilage génomique complet, ce qui le rend essentiel pour les tests compagnons et les thérapies ciblées. L'adoption croissante des biopsies liquides et des études génomiques à grande échelle contribue également à accélérer la demande. Les progrès technologiques en bio-informatique et en automatisation réduisent les obstacles liés à la complexité. Avec l'essor de la médecine personnalisée, le SNG devrait connaître une forte croissance.

- Sur demande

Le marché du diagnostic moléculaire est segmenté, selon l'application, en oncologie, pharmacogénomique, microbiologie, diagnostic prénatal, typage tissulaire, dépistage sanguin, maladies cardiovasculaires, maladies neurologiques, maladies infectieuses et autres. Le segment des maladies infectieuses dominait le marché en 2025, avec une part de revenus d'environ 33,8 %, portée par la forte prévalence mondiale des infections virales et bactériennes. Le diagnostic moléculaire permet une détection rapide et précise des agents pathogènes, essentielle à une gestion efficace des maladies et au contrôle des épidémies. La sensibilisation accrue au diagnostic précoce, l'augmentation des hospitalisations et l'amélioration de l'accès aux tests ont favorisé son adoption. Les initiatives gouvernementales de surveillance des maladies infectieuses jouent également un rôle majeur. L'intégration des tests moléculaires dans les flux de travail cliniques de routine renforce encore la position de leader du segment. Les investissements continus dans les infrastructures de santé publique soutiennent la demande à long terme.

Le segment de l'oncologie devrait enregistrer le taux de croissance annuel composé (TCAC) le plus rapide, d'environ 15,2 %, entre 2026 et 2033, porté par l'adoption croissante de l'oncologie de précision et des tests compagnons. Le diagnostic moléculaire joue un rôle essentiel dans l'identification des mutations génétiques, la prédiction de la réponse au traitement et le suivi de la progression de la maladie. L'augmentation de l'incidence du cancer à l'échelle mondiale et le recours accru aux thérapies ciblées soutiennent significativement cette croissance. Les progrès des technologies de séquençage de nouvelle génération (NGS) et de biopsie liquide élargissent encore les applications des tests en oncologie. Des collaborations solides entre les secteurs pharmaceutique et du diagnostic, ainsi que les approbations réglementaires, accélèrent également l'expansion du marché. L'oncologie devrait demeurer le principal moteur de croissance du diagnostic moléculaire.

Analyse régionale du marché européen du diagnostic moléculaire

- Le marché européen du diagnostic moléculaire devrait connaître une croissance annuelle composée (TCAC) substantielle tout au long de la période de prévision, principalement sous l'effet de la demande croissante de détection précoce et précise des maladies, des initiatives gouvernementales fortes en faveur de la prévention et de l'adoption croissante des technologies de diagnostic de nouvelle génération.

- L'infrastructure de santé avancée de la région, associée à des investissements importants dans la recherche et le développement, soutient le développement et la commercialisation de tests de diagnostic moléculaire innovants.

- La croissance est également alimentée par un réseau croissant de laboratoires, d'hôpitaux et de centres de recherche clinique qui intègrent de plus en plus les diagnostics moléculaires dans les pratiques de soins de santé courantes.

Analyse du marché britannique du diagnostic moléculaire :

Le marché britannique du diagnostic moléculaire a dominé le marché du diagnostic moléculaire en 2025, avec une part de revenus d'environ 39,4 %. Cette domination s'explique par des infrastructures de santé performantes, des initiatives gouvernementales fortes en faveur du dépistage précoce des maladies, une adoption rapide des technologies de diagnostic de nouvelle génération et la présence d'entreprises leaders dans ce domaine. L'accent mis par le pays sur la médecine de précision, le diagnostic en oncologie et les programmes de dépistage en santé publique stimule l'adoption de ces technologies dans les hôpitaux, les laboratoires d'analyses et les instituts de recherche. Par ailleurs, la collaboration entre les entreprises de biotechnologie, les fabricants de dispositifs de diagnostic et les établissements universitaires continue d'accélérer l'innovation et la croissance du marché au Royaume-Uni.

Aperçu du marché allemand du diagnostic moléculaire :

Le marché allemand du diagnostic moléculaire devrait connaître la croissance la plus rapide au cours de la période de prévision, avec un TCAC d'environ 13,5 %. Cette croissance est portée par l'augmentation des investissements dans le diagnostic médical, le développement des laboratoires d'analyses moléculaires, la sensibilisation croissante à la médecine de précision et un cadre réglementaire favorable aux tests moléculaires. L'écosystème de santé allemand, bien établi, son fort engagement en faveur de l'innovation technologique et ses initiatives visant à améliorer l'accès aux diagnostics avancés contribuent à une adoption rapide des plateformes de diagnostic moléculaire dans les contextes cliniques et de recherche.

Part de marché du diagnostic moléculaire en Europe

L'industrie du diagnostic moléculaire est principalement dominée par des entreprises bien établies, notamment :

- Roche Diagnostics (Suisse)

- Abbott (États-Unis)

- Thermo Fisher Scientific (États-Unis)

- QIAGEN (Pays-Bas)

- Laboratoires Bio-Rad (États-Unis)

- Danaher Corporation (États-Unis)

- Siemens Healthineers (Allemagne)

- Becton, Dickinson and Company (BD) (États-Unis)

- Hologic, Inc. (États-Unis)

- F. Hoffmann-La Roche AG (Suisse)

- Illumina, Inc. (États-Unis)

- PerkinElmer, Inc. (États-Unis)

- Agilent Technologies, Inc. (États-Unis)

- Qiagen NV (Pays-Bas)

- BioMérieux SA (France)

- Cépheid (États-Unis)

- Genomic Health, Inc. (États-Unis)

- Guardant Health, Inc. (États-Unis)

- Myriad Genetics, Inc. (États-Unis)

- Grail, Inc. (États-Unis)

Dernières évolutions du marché européen du diagnostic moléculaire

- En juillet 2024, Abbott a annoncé des améliorations apportées à ses tests de diagnostic moléculaire de la COVID-19, confirmant que ses tests antigéniques et PCR détectent systématiquement les nouveaux variants, notamment KP.2, KP.3 et KP.1.1, répondant ainsi à la demande croissante de méthodes robustes de détection des agents pathogènes dans les laboratoires de diagnostic moléculaire du monde entier. L'entreprise a également lancé en janvier 2025 le test PCR numérique en gouttelettes interprétable (I2ddPCR), qui combine un traitement d'image avancé basé sur l'IA pour des tests PCR numériques de haute précision sur des cibles faiblement exprimées, améliorant ainsi la sensibilité diagnostique pour la recherche et les applications cliniques.

- En février 2024, Metropolis Healthcare Limited a inauguré à Dehradun, en Inde, un centre de diagnostic moléculaire de pointe capable de traiter 200 à 250 échantillons par jour et proposant une large gamme de services de tests moléculaires, notamment la PCR et les analyses génétiques, élargissant ainsi l'accès régional à des diagnostics moléculaires de haute qualité. Cette inauguration témoigne de l'investissement croissant dans les infrastructures de tests moléculaires sur les marchés émergents.

- En avril 2025, Roche Diagnostics a lancé en Europe sa plateforme de tests moléculaires à haut débit « cobas omni Utility Channel », conçue pour regrouper plusieurs analyses sur un seul système. Cette plateforme permet aux laboratoires d’optimiser leurs flux de travail et d’améliorer l’efficacité des tests pour diverses applications cliniques. Ce lancement favorise le développement des tests moléculaires automatisés dans les laboratoires centralisés.

- En février 2025, Abbott a obtenu l'autorisation de la FDA américaine pour son test « Alinity m Respiratory Panel 2 », un test moléculaire multiplex capable de détecter la COVID-19, la grippe A/B et le VRS, renforçant ainsi le rôle des panels de pathogènes combinés dans le diagnostic moléculaire clinique et améliorant la détection rapide des maladies respiratoires dans les établissements de santé.

- En mars 2025, Illumina, Inc. a lancé la plateforme de séquençage de nouvelle génération « NovaSeq X Series », conçue pour augmenter considérablement le débit de séquençage et réduire les coûts, permettant ainsi le profilage génomique pour la recherche et les applications de médecine de précision dans les laboratoires de diagnostic moléculaire du monde entier.

- En avril 2025, Seegene a présenté son système automatisé de tests PCR « CURECA » lors du congrès de la Société européenne de microbiologie clinique et des maladies infectieuses (ESCMID) à Vienne, en Autriche. Ce système vise à automatiser les étapes de prétraitement et de PCR en aval afin d'améliorer la productivité des laboratoires et la précision des diagnostics.

- En juin 2025, Gencurix a conclu un accord de développement et de commercialisation avec QIAGEN afin de faire progresser conjointement les produits de diagnostic oncologique basés sur la PCR numérique, reflétant une tendance à l'innovation collaborative dans le diagnostic moléculaire du cancer de haute précision.

- En juin 2025, Gene Solutions et Shenzhen USK Bioscience ont conclu un partenariat stratégique pour établir un laboratoire de séquençage de nouvelle génération à la pointe de la technologie dans le sud de la Chine, facilitant ainsi l'accès local à des diagnostics moléculaires oncologiques avancés et renforçant l'infrastructure régionale de tests génomiques.

- En avril 2025, Vgenomics et Meril Genomics ont annoncé un partenariat visant à élargir l'accès aux services génomiques, notamment le dépistage prénatal non invasif (DPNI) et le séquençage ciblé de nouvelle génération (SNG) pour le diagnostic des maladies infectieuses et des maladies rares, illustrant ainsi la collaboration intersectorielle pour diversifier les applications des tests moléculaires.

- En février 2025, Agilus Diagnostics et Lucence ont conclu un accord de collaboration visant à intégrer des technologies de pointe en matière de tests moléculaires, axées sur la détection du cancer, le choix des traitements et le suivi des maladies, illustrant ainsi leurs efforts continus pour améliorer les capacités de diagnostic grâce à des partenariats stratégiques.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.