Marché européen des caillebotis en plastique renforcé de fibre de verre moulé (FRP), par type (polyester, ester vinylique, époxy, phénoliques, polyuréthanes et autres), type de produit (couvercles de tranchées, angles, carrés, bandes plates, poutres en I, profilés en U, tubes ronds, poutres à larges ailes, tiges pleines, anneaux cannelés/en échelle, plaques de protection/plaques d'orteil et autres), greffons (31-50 mm, 10-30 mm et plus de 50 mm), applications (plates-formes, passerelles, quais, escaliers, rampes, murs et autres), utilisateurs finaux ( pétrochimie , pâte et papier, alimentation et boissons, pétrole et gaz, exploitation minière, produits pharmaceutiques, électricité et électronique, gestion de l'eau, bâtiment et construction, marine, défense, sports et loisirs et autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché des caillebotis en plastique renforcé de fibre de verre moulé (FRP) en Europe

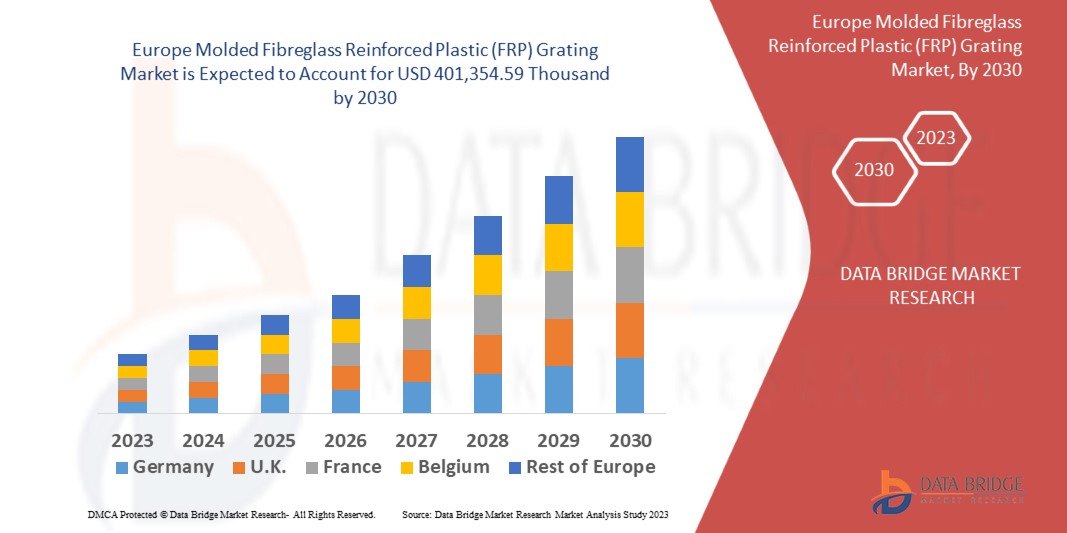

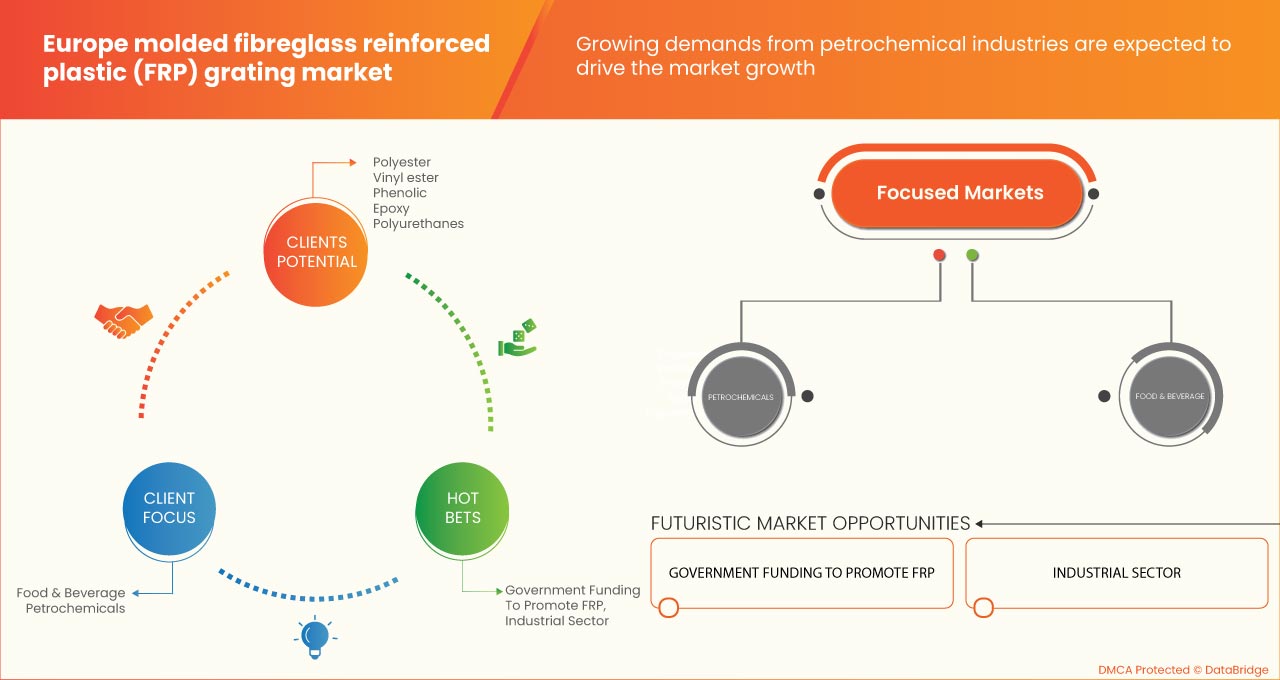

Le marché européen des caillebotis en plastique renforcé de fibre de verre (FRP) moulés devrait connaître une croissance significative au cours de la période de prévision de 2023 à 2030. Data Bridge Market Research analyse que le marché croît avec un TCAC de 5,2 % au cours de la période de prévision de 2023 à 2030 et devrait atteindre 401 354,59 milliers de dollars d'ici 2030. Le principal facteur à l'origine de la croissance du marché des caillebotis en PRF moulés est la demande croissante de caillebotis en plastique renforcé de fibres (FRP) en raison de l'augmentation des investissements dans le secteur des infrastructures et les caillebotis en PRF sont très résistants à la corrosion et ignifuges par nature.

Les caillebotis en plastique renforcé de fibre de verre (FRP) sont un matériau composite fabriqué en combinant une matrice de résine et de fibre de verre. Les caillebotis en plastique renforcé de fibre de verre (FRP) offrent des propriétés telles que la résistance à la corrosion, un rapport résistance/poids élevé, une résistance aux UV, une dilatation thermique minimale, une faible conductivité électrique et thermique et une surface antidérapante. Les caillebotis en PRF sont considérés comme très durables dans les environnements les plus difficiles, avec une capacité de charge élevée, une installation facile et un entretien à faible coût. Les facteurs moteurs de la croissance du marché sont la fourniture d'une alternative plus sûre à l'acier.

Le rapport sur le marché européen des caillebotis en plastique renforcé de fibre de verre moulé (FRP) fournit des détails sur la part de marché, les nouveaux développements et l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste, notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2020 à 2015) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains |

|

Segments couverts |

Par type (polyester, ester vinylique, époxy, phénoliques, polyuréthanes et autres), type de produit (couvertures de tranchées, angles, carrés, bandes plates, poutres en I, profilés en U, tubes ronds, poutres à larges ailes, tiges pleines, anneaux cannelés/en échelle, plaques de protection/plaques d'orteil et autres), greffes (31-50 mm, 10-30 mm et plus de 50 mm), applications (plates-formes, passerelles, quais, escaliers, rampes, murs et autres), utilisateurs finaux (produits pétrochimiques, pâtes et papiers, aliments et boissons, pétrole et gaz, exploitation minière, produits pharmaceutiques, électricité et électronique, gestion de l'eau, bâtiment et construction, marine, défense, sports et loisirs et autres) |

|

Pays couverts |

Allemagne, Royaume-Uni, Italie, France, Espagne, Russie, Suisse, Turquie, Belgique, Pays-Bas, Danemark, Suède, Pologne, Norvège, Finlande et reste de l'Europe |

|

Acteurs du marché couverts |

Structures composites Fibergrate, TECHNO COMPOSITES, Fibrolux GmbH, Lionweld Kennedy, Eurograte, Locker Group Ltd, Exel Composites |

Définition du marché

Les caillebotis en plastique renforcé de fibre de verre (FRP) sont un matériau composite fabriqué en combinant une matrice de résine et de fibre de verre. Les caillebotis en plastique renforcé de fibre de verre (FRP) offrent des propriétés telles que la résistance à la corrosion, un rapport résistance/poids élevé, une résistance aux UV, une dilatation thermique minimale, une faible conductivité électrique et thermique et une surface antidérapante. Les caillebotis en PRF sont considérés comme très durables dans les environnements les plus difficiles, avec une capacité de charge élevée, une installation facile et un entretien à faible coût. Les facteurs moteurs de la croissance du marché sont la fourniture d'une alternative plus sûre à l'acier.

Dynamique du marché européen des caillebotis en plastique renforcé de fibre de verre moulé (FRP)

Conducteurs

- Augmenter les investissements dans le secteur des infrastructures

Les caillebotis FRP offrent une résistance à la corrosion, un rapport résistance/poids élevé, une résistance aux UV, une dilatation thermique minimale, une faible conductivité électrique et thermique et une surface antidérapante. Ces propriétés devraient alimenter la demande de caillebotis FRP pour diverses utilisations finales, notamment dans les secteurs des infrastructures tels que le bâtiment et la construction.

La demande de caillebotis FRP augmente dans le secteur des infrastructures en raison du faible coût du cycle de vie des caillebotis FRP. La prise de conscience croissante des avantages des caillebotis FRP par rapport aux caillebotis conventionnels. Le FRP offre un rapport résistance/poids optimal ainsi qu'une durabilité et un prix abordables supérieurs. Le FRP est composé d'un polymère protecteur renforcé de fibre de verre à haute résistance. Ces matériaux créent ensemble un composite haut de gamme avec de nombreuses applications de construction potentielles. Le FRP surpasse le bois et le béton pour les ponts, les voies piétonnes et d'autres structures, tout en résistant à des décennies d'usure. De plus, extrêmement polyvalent par nature, le FRP est facilement disponible, facile à installer et sans entretien, ce qui le rend idéal pour le secteur des infrastructures. Toutes les caractéristiques et avantages susmentionnés font des caillebotis FRP le choix le plus judicieux pour les projets d'infrastructure, contribuant à la croissance du marché des caillebotis en plastique renforcé de fibre de verre moulé (FRP).

- Offrir une alternative plus sûre à l'acier

Le PRF (plastique renforcé de fibre de verre) est considéré comme 70 % plus léger que l'acier avec un rapport résistance/poids exceptionnel. Le PRF est non conducteur et antidérapant, considéré comme une alternative plus sûre à l'acier. La fibre de verre apporte résistance et rigidité, et la résine donne forme et protège les fibres. Les composites PRF ont une plus grande résistance à la flexion et, livre pour livre, ils sont souvent plus résistants que l'acier et l'aluminium dans le sens de la longueur. Le renforcement PRF peut avoir une résistance à la traction plus de deux fois supérieure à celle de l'acier. Les produits PRF ne sont pas conducteurs et ont un facteur de friction plus élevé que l'acier, ce qui réduit le risque de chocs électriques et de blessures causées par des glissades. Ils deviennent donc le choix évident pour des produits structurels plus sûrs. De plus, la rigidité et le rapport résistance/poids sont des paramètres importants lors de la sélection du bon matériau pour les travaux de construction et d'infrastructure. Le rapport résistance/poids du PRF est supérieur à celui de l'acier, ce qui en fait le bon choix. Cela peut conduire le marché à la croissance au cours de la période de prévision.

Opportunités

- Augmentation des applications et des progrès dans les domaines de l'aérospatiale, de l'automobile, de la construction, du transport ferroviaire et des conteneurs

Le plastique renforcé de fibres de verre (FRP) appartient à la catégorie des matériaux composites, qui comprennent une matrice polymère et d'autres matériaux fibreux de support. Les matériaux sont généralement constitués de résine thermodurcissable dure et résistent aux dommages chimiques ou abrasifs. En raison de ces propriétés, le FRP offre d'énormes opportunités dans les industries suivantes : aérospatiale, automobile, construction et infrastructures maritimes. Dans l'industrie aérospatiale, les fibres de carbone dans les FRP réduisent le poids de 25 % mais assurent une résistance égale ou supérieure à celle des tôles d'aluminium. Elles offrent également une résistance à la traction et sont plus tolérantes aux environnements difficiles et aux températures extrêmes, ce qui est crucial pour les industries aérospatiales. Dans l'industrie automobile, un rapport résistance/poids élevé est le Saint Graal de l'industrie automobile. Cela contribuera à réduire le poids et à réduire la consommation de carburant, et grâce à ses propriétés de légèreté, il contribuera également à augmenter la vitesse. Dans l'industrie de la construction, le FRP est utilisé pour fortifier les structures existantes (telles que les dalles, les colonnes ou les poutres) afin d'améliorer leur capacité de charge ou de réparer les dommages. C'est extrêmement rentable et utile lorsqu'il s'agit d'équiper des structures plus anciennes. Le PRF est également utilisé pour fabriquer des structures routières telles que des garde-corps, des panneaux de signalisation, des systèmes de drainage et des tabliers de pont, des passerelles pour automobiles, des poteaux électriques, des pipelines, des huiles, du gaz et des eaux usées. Il est également utilisé pour construire des maisons préfabriquées, des meubles de maison, des appareils électroménagers, des piscines et des équipements de salle de bain. Par conséquent, il existe une énorme opportunité pour l'entreprise de se développer sur le marché au cours de la période de prévision avec des opportunités dans diverses industries manufacturières telles que l'aérospatiale, l'automobile, la marine et la construction.

Retenue/Défi

- Difficultés dans la réutilisation ou le recyclage des produits de caillebotis FRP

Les grilles en plastique renforcé de fibre de verre moulées sont produites à partir de résine, de fibre de verre et d'autres matières auxiliaires comme matières premières. La plupart des grilles en PRF ont une longue durée de vie pouvant aller jusqu'à plusieurs années et sont destinées à résister à de nombreuses conditions difficiles. Malgré une large préférence et des avantages des grilles en PRF, des problèmes importants associés à la réutilisation ou à la recyclabilité du produit sont présents sur le marché des grilles en PRF moulées. Le recyclage signifie que de l'énergie doit être dépensée pour convertir les déchets en quelque chose de précieux. Dans ce scénario, le PRF moulé et presque tous les autres produits n'ont aucune valeur pour le recyclage ou la réutilisation. Les méthodes existantes pour recycler ces produits sont soit trop coûteuses, soit non conformes aux normes de l'industrie. Le processus disponible de recyclage des grilles en PRF comprend trois principaux types : le recyclage physique, le recyclage énergétique et le recyclage chimique. Toutes ces méthodes sont très coûteuses à appliquer. De plus, l'absence de méthodologies de recyclage appropriées disponibles sur le marché fait que le marché des grilles en PRF moulées est confronté à des défis de la part des organismes de réglementation en raison d'une sensibilisation croissante aux objectifs de durabilité. En outre, l’indisponibilité d’applications appropriées aux produits commercialisés devrait entraîner une baisse significative des ventes de produits de caillebotis moulés en PRF et constituer un goulot d’étranglement dans la croissance du marché européen des caillebotis moulés en plastique renforcé de fibre de verre (PRF).

Développements récents

- En février 2022, Fibrolux GmbH a annoncé ses nouveaux produits. Dans cette annonce, ils ont mentionné que tous les produits en plastique renforcé de fibres de verre et les tiges en carbone seront disponibles sous forme de tiges de terre. Cela sera basé sur les besoins des consommateurs. Cela les aidera à élargir leur portefeuille de produits et pourrait attirer une nouvelle base de consommateurs.

- En avril 2019, Eurograte a célébré les quarante ans de collaboration entre ticomm et promaco. Ce partenariat a posé le professionnalisme, les investissements et la passion comme fondements du groupe et de l'équipe.

Portée du marché européen des caillebotis en plastique renforcé de fibre de verre moulé (FRP)

Le marché européen des caillebotis en plastique renforcé de fibre de verre moulé (FRP) est classé en fonction du type, du type de produit, de la hauteur de greffage, de l'application et du commerçant. La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance des industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Taper

- Polyester

- Ester vinylique

- Phénolique

- Époxy

- Polyuréthanes

- Autres

En fonction du type, le marché européen des caillebotis en plastique renforcé de fibre de verre (FRP) moulés est classé en polyester, ester vinylique, phénolique, époxy, polyuréthanes et autres.

Type de produit

- Angles

- Carrés

- Bandes plates

- Poutres en I

- Chaîne U

- Tube rond

- Poutres à larges ailes

- Couvertures de tranchées

- Tiges solides

- Barreaux cannelés/échelle

- Plaque de protection/plaque d'orteils

- Autres

En fonction du type de produit, le marché européen des caillebotis en plastique renforcé de fibre de verre (FRP) moulés est classé en angles, carrés, bandes plates, poutres en I, canaux en U, tubes ronds, poutres à larges ailes, couvercles de tranchées, tiges pleines, échelons cannelés/échelle, plaque de protection/plaque d'orteil et autres.

Hauteur de greffe

- 10-30 mm

- 31-50 mm

- Au-dessus de 50 mm

En fonction de la hauteur de greffe, le marché européen des caillebotis en plastique renforcé de fibre de verre (FRP) moulés est classé en 10-30 mm, 31-50 mm et plus de 50 mm.

Application

- Tendances en matière d'escaliers

- Les évasions

- Plateformes

- Quais

- Mains courantes

- Murs

- Autres

En fonction de l'application, le marché européen des caillebotis en plastique renforcé de fibre de verre (FRP) moulés est classé en tendances d'escaliers, passerelles, plates-formes, quais, mains courantes, murs et autres.

Utilisateur final

- Produits pétrochimiques

- Pâte à papier et papier

- Bâtiment et construction

- Alimentation et boissons

- Exploitation minière

- Pharmaceutique

- Pétrole et gaz

- Électricité et électronique

- Gestion de l'eau

- Marin

- Défense

- Sports et loisirs

- Autres

En fonction de l'utilisateur final, le marché européen des caillebotis en plastique renforcé de fibre de verre (FRP) moulés est classé en produits pétrochimiques, pâtes et papiers, bâtiment et construction, aliments et boissons, mines, produits pharmaceutiques, pétrole et gaz, électricité et électronique, gestion de l'eau, marine, défense, sports et loisirs et autres.

Analyse/perspectives régionales du marché des caillebotis en plastique renforcé de fibre de verre moulé (FRP) en Europe

Le marché européen des caillebotis en plastique renforcé de fibre de verre (FRP) moulés est segmenté en fonction du type, du type de produit, de la hauteur de greffage, de l'application et du commerçant.

Les pays du marché européen des caillebotis en plastique renforcé de fibre de verre (FRP) moulés sont l'Allemagne, le Royaume-Uni, l'Italie, la France, l'Espagne, la Russie, la Suisse, la Turquie, la Belgique, les Pays-Bas, le Danemark, la Suède, la Pologne, la Norvège, la Finlande et le reste de l'Europe. L'Allemagne domine le marché européen des caillebotis en plastique renforcé de fibre de verre (FRP) moulés en termes de part de marché et de chiffre d'affaires en raison de l'application croissante du marché des caillebotis en PRF dans l'industrie pharmaceutique et de traitement de l'eau dans la région.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Les points de données, l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces du porteur et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario du marché pour chaque pays. En outre, la présence et la disponibilité des marques européennes et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Paysage concurrentiel et analyse des parts de marché des caillebotis en plastique renforcé de fibre de verre moulé (FRP) en Europe

Le paysage concurrentiel du marché européen des caillebotis en plastique renforcé de fibre de verre (FRP) moulés fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement du produit, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination de l'application, la courbe de durée de vie du produit. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché européen des caillebotis en plastique renforcé de fibre de verre (FRP) moulés.

Certains des principaux acteurs opérant sur le marché européen des caillebotis en plastique renforcé de fibre de verre (FRP) moulés sont Fibergrate Composite Structures, TECHNO COMPOSITES, Fibrolux GmbH, Lionweld Kennedy, Eurograte, Locker Group Ltd et Exel Composites, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE MOLDED FIBRE REINFORCED PLASTIC (FRP) GRATING MARKET

1.4 LIMITATIONS

1.5 MARKET COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MATERIAL LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) MARKET PRODUCT LIFE LINE CURVE

2.9 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.1 DBMR MARKET POSITION GRID

2.11 MARKET APPLICATION COVERAGE GRID

2.12 DBMR MARKET CHALLENGE MATRIX

2.13 DBMR VENDOR SHARE ANALYSIS

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER'S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS:

4.2.2 THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 PRODUCTION CONSUMPTION ANALYSIS

4.4 SUPPLY CHAIN ANALYSIS

4.4.1 OVERVIEW

4.4.2 LOGISTIC COST SCENARIO

4.4.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.5 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.6 VENDOR SELECTION CRITERIA

5 REGULATIONS

6 PRICE INDEX

7 IMPORT EXPORT SCENARIO

8 REGIONAL SUMMARY

8.1 EUROPE

9 CLIMATE CHANGE SCENARIO

9.1 ENVIRONMENTAL CONCERNS

9.2 INDUSTRY RESPONSE

9.3 GOVERNMENT'S ROLE

9.4 ANALYST RECOMMENDATION

10 MARKET OVERVIEW

10.1 DRIVERS

10.1.1 INCREASING THE INVESTMENTS IN THE INFRASTRUCTURE SECTOR

10.1.2 PROVIDING A SAFER ALTERNATIVE TO STEEL

10.1.3 FRP GRATINGS ARE HIGHLY CORROSION RESISTANT AND FIRE RETARDANT.

10.2 RESTRAINT

10.2.1 DIFFICULTIES IN THE REUSE OR RECYCLING OF FRP GRATING PRODUCT

10.3 OPPORTUNITIES

10.3.1 INCREASE IN APPLICATION AND ADVANCEMENT IN AEROSPACE, AUTOMOTIVE, CONSTRUCTION, RAIL, AND CONTAINER TRANSPORT

10.3.2 GOVERNMENT FUNDING TO PROMOTE THE PRODUCTION AND USE OF FRP (FIBREGLASS REINFORCED PLASTIC)

10.4 CHALLENGES

10.4.1 COMPETITIVE SCENARIO WITH THE TRADITIONAL STEEL AND ALUMINIUM

10.4.2 LACK OF AWARENESS OF FIBREGLASS REINFORCED PLASTIC

11 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE

11.1 OVERVIEW

11.2 POLYESTER

11.3 VINYL ESTER

11.4 EPOXY

11.5 PHENOLIC

11.6 POLYURETHANES

11.7 OTHERS

12 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE

12.1 OVERVIEW

12.2 TRENCH COVERS

12.3 ANGLES

12.4 SQUARES

12.5 FLAT STRIPS

12.6 I BEAMS

12.7 U CHANNEL

12.8 ROUND TUBE

12.9 WIDE FLANGE BEAMS

12.1 SOLID RODS

12.11 FLUTED/LADDER RING

12.12 KICK PLATE/TOE PLATE

12.13 OTHERS

13 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT

13.1 OVERVIEW

13.2 31-50 MM

13.3 10-30 MM

13.4 ABOVE 50 MM

14 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION

14.1 OVERVIEW

14.2 PLATFORMS

14.3 WALKAWAYS

14.4 DOCKS

14.5 STAIR TRENDS

14.6 HAND RAILS

14.7 WALLS

14.8 OTHERS

15 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER

15.1 OVERVIEW

15.2 PETROCHEMICALS

15.3 PULP AND PAPER

15.4 FOOD AND BEVERAGES

15.5 OIL AND GAS

15.6 MINING

15.7 PHARMACEUTICAL

15.8 ELECTRICAL AND ELECTRONICS

15.9 WATER MANAGEMENT

15.1 BUILDING AND CONSTRUCTION

15.11 MARINE

15.12 DEFENSE

15.13 SPORTS AND LEISURE

15.14 OTHERS

16 EUROPE MOLDED FIBERGLASS REINFORCED PLASTIC (FRP) MARKET, BY COUNTRY

16.1 GERMANY

16.2 SPAIN

16.3 ITALY

16.4 U.K.

16.5 FRANCE

16.6 FRANCE

16.7 BELGIUM

16.8 TURKEY

16.9 DENMARK

16.1 SWITZERLAND

16.11 SWEDEN

16.12 NETHERLANDS

16.13 POLAND

16.14 NORWAY

16.15 FINLAND

16.16 REST OF EUROPE

17 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: EUROPE

17.2 ANNOUNCEMENT

17.3 EXHIBITION

17.4 NEW LAUNCHES

17.5 PARTNERSHIP

18 SWOT ANALYSIS

19 COMPANY PROFILES

19.1 EXEL COMPOSITES

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 SWOT

19.1.4 PRODUCT PORTFOLIO

19.1.5 RECENT UPDATES

19.2 LIONWELD KENNEDY

19.2.1 COMPANY SNAPSHOT

19.2.2 PRODUCT PORTFOLIO

19.2.3 SWOT

19.2.4 RECENT UPDATES

19.3 LOCKER GROUP LTD

19.3.1 COMPANY SNAPSHOT

19.3.2 PRODUCT PORTFOLIO

19.3.4 RECENT UPDATE

19.4 EUROGRATE

19.4.1 COMPANY SNAPSHOT

19.4.2 PRODUCT PORTFOLIO

19.4.3 SWOT

19.4.4 RECENT UPDATE

19.5 FIBROLUX GMBH

19.5.1 COMPANY SNAPSHOT

19.5.2 PRODUCT PORTFOLIO

19.5.3 SWOT

19.5.4 RECENT UPDATE

19.6 FIBERGRATE COMPOSITE STRUCTURES

19.6.1 COMPANY SNAPSHOT

19.6.2 PRODUCT PORTFOLIO

19.6.4 RECENT UPDATES

19.7 TECHNO COMPOSITES

19.7.1 COMPANY SNAPSHOT

19.7.2 PRODUCT PORTFOLIO

19.7.3 SWOT

19.7.4 RECENT UPDATE

20 QUESTIONNAIRE

21 RELATED REPORTS

Liste des tableaux

TABLE 1 REGULATORY FRAMEWORK

TABLE 2 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY COUNTRY, 2021-2030 (PRICE/SQUARE METER)

TABLE 3 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET : BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 4 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET : BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 5 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET : BY GRAFTING HEIGHT, 2021-2030 (USD THOUSAND)

TABLE 6 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET : BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 7 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET : BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 8 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 9 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY COUNTRY, 2021-2030 (THOUSAND SQUARE METER)

TABLE 10 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY COUNTRY, 2021-2030 (PRICE/SQUARE METER)

TABLE 11 GERMANY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 12 GERMANY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 13 GERMANY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (PRICE/SQUARE METER)

TABLE 14 GERMANY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 15 GERMANY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 16 GERMANY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (USD THOUSAND)

TABLE 17 GERMANY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (THOUSAND SQUARE METER)

TABLE 18 GERMANY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 19 GERMANY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (THOUSAND SQUARE METER)

TABLE 20 GERMANY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 21 GERMANY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (THOUSAND SQUARE METER)

TABLE 22 SPAIN MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 23 SPAIN MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 24 SPAIN MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (PRICE/SQUARE METER)

TABLE 25 SPAIN MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 26 SPAIN MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 27 SPAIN MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (USD THOUSAND)

TABLE 28 SPAIN MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (THOUSAND SQUARE METER)

TABLE 29 SPAIN MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 30 SPAIN MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (THOUSAND SQUARE METER)

TABLE 31 SPAIN MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 32 SPAIN MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (THOUSAND SQUARE METER)

TABLE 33 ITALY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 34 ITALY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 35 ITALY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (PRICE/SQUARE METER)

TABLE 36 ITALY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 ITALY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 38 ITALY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (USD THOUSAND)

TABLE 39 ITALY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (THOUSAND SQUARE METER)

TABLE 40 ITALY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 41 ITALY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (THOUSAND SQUARE METER)

TABLE 42 ITALY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 43 ITALY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (THOUSAND SQUARE METER)

TABLE 44 U.K. MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 U.K. MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 46 U.K. MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (PRICE/SQUARE METER)

TABLE 47 U.K. MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 U.K. MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 49 U.K. MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (USD THOUSAND)

TABLE 50 U.K. MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (THOUSAND SQUARE METER)

TABLE 51 U.K. MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 52 U.K. MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (THOUSAND SQUARE METER)

TABLE 53 U.K. MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 54 U.K. MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (THOUSAND SQUARE METER)

TABLE 55 FRANCE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 FRANCE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 57 FRANCE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (PRICE/SQUARE METER)

TABLE 58 FRANCE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 59 FRANCE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 60 FRANCE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (USD THOUSAND)

TABLE 61 FRANCE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (THOUSAND SQUARE METER)

TABLE 62 FRANCE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 63 FRANCE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (THOUSAND SQUARE METER)

TABLE 64 FRANCE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 65 FRANCE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (THOUSAND SQUARE METER)

TABLE 66 RUSSIA MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 67 RUSSIA MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 68 RUSSIA MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (PRICE/SQUARE METER)

TABLE 69 RUSSIA MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 70 RUSSIA MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 71 RUSSIA MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (USD THOUSAND)

TABLE 72 RUSSIA MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (THOUSAND SQUARE METER)

TABLE 73 RUSSIA MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 74 RUSSIA MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (THOUSAND SQUARE METER)

TABLE 75 RUSSIA MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 76 RUSSIA MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (THOUSAND SQUARE METER)

TABLE 77 BELGIUM MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 78 BELGIUM MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 79 BELGIUM MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (PRICE/SQUARE METER)

TABLE 80 BELGIUM MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 81 BELGIUM MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 82 BELGIUM MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (USD THOUSAND)

TABLE 83 BELGIUM MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (THOUSAND SQUARE METER)

TABLE 84 BELGIUM MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 85 BELGIUM MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (THOUSAND SQUARE METER)

TABLE 86 BELGIUM MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 87 BELGIUM MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (THOUSAND SQUARE METER)

TABLE 88 TURKEY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 89 TURKEY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 90 TURKEY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (PRICE/SQUARE METER)

TABLE 91 TURKEY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 92 TURKEY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 93 TURKEY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (USD THOUSAND)

TABLE 94 TURKEY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (THOUSAND SQUARE METER)

TABLE 95 TURKEY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 96 TURKEY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (THOUSAND SQUARE METER)

TABLE 97 TURKEY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 98 TURKEY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (THOUSAND SQUARE METER)

TABLE 99 DENMARK MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 100 DENMARK MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 101 DENMARK MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (PRICE/SQUARE METER)

TABLE 102 DENMARK MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 103 DENMARK MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 104 DENMARK MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (USD THOUSAND)

TABLE 105 DENMARK MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (THOUSAND SQUARE METER)

TABLE 106 DENMARK MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 107 DENMARK MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (THOUSAND SQUARE METER)

TABLE 108 DENMARK MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 109 DENMARK MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (THOUSAND SQUARE METER)

TABLE 110 SWITZERLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 111 SWITZERLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 112 SWITZERLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (PRICE/SQUARE METER)

TABLE 113 SWITZERLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 114 SWITZERLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 115 SWITZERLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (USD THOUSAND)

TABLE 116 SWITZERLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (THOUSAND SQUARE METER)

TABLE 117 SWITZERLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 118 SWITZERLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (THOUSAND SQUARE METER)

TABLE 119 SWITZERLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 120 SWITZERLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (THOUSAND SQUARE METER)

TABLE 121 SWEDEN MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 122 SWEDEN MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 123 SWEDEN MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (PRICE/SQUARE METER)

TABLE 124 SWEDEN MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 125 SWEDEN MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 126 SWEDEN MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (USD THOUSAND)

TABLE 127 SWEDEN MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (THOUSAND SQUARE METER)

TABLE 128 SWEDEN MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 129 SWEDEN MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (THOUSAND SQUARE METER)

TABLE 130 SWEDEN MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 131 SWEDEN MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (THOUSAND SQUARE METER)

TABLE 132 NETHERLANDS MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 133 NETHERLANDS MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 134 NETHERLANDS MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (PRICE/SQUARE METER)

TABLE 135 NETHERLANDS MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 136 NETHERLANDS MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 137 NETHERLANDS MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (USD THOUSAND)

TABLE 138 NETHERLANDS MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (THOUSAND SQUARE METER)

TABLE 139 NETHERLANDS MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 140 NETHERLANDS MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (THOUSAND SQUARE METER)

TABLE 141 NETHERLANDS MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 142 NETHERLANDS MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (THOUSAND SQUARE METER)

TABLE 143 POLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 144 POLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 145 POLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (PRICE/SQUARE METER)

TABLE 146 POLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 147 POLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 148 POLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (USD THOUSAND)

TABLE 149 POLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (THOUSAND SQUARE METER)

TABLE 150 POLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 151 POLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (THOUSAND SQUARE METER)

TABLE 152 POLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 153 POLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (THOUSAND SQUARE METER)

TABLE 154 NORWAY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 155 NORWAY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 156 NORWAY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (PRICE/SQUARE METER)

TABLE 157 NORWAY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 158 NORWAY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 159 NORWAY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (USD THOUSAND)

TABLE 160 NORWAY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (THOUSAND SQUARE METER)

TABLE 161 NORWAY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 162 NORWAY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (THOUSAND SQUARE METER)

TABLE 163 NORWAY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 164 NORWAY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (THOUSAND SQUARE METER)

TABLE 165 FINLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 166 FINLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 167 FINLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (PRICE/SQUARE METER)

TABLE 168 FINLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 169 FINLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 170 FINLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (USD THOUSAND)

TABLE 171 FINLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (THOUSAND SQUARE METER)

TABLE 172 FINLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 173 FINLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (THOUSAND SQUARE METER)

TABLE 174 FINLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 175 FINLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (THOUSAND SQUARE METER)

TABLE 176 REST OF EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 177 REST OF EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 178 REST OF EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (PRICE/SQUARE METER)

Liste des figures

FIGURE 1 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC(FRP) GRATING MARKET-

FIGURE 2 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) MARKET: DROC ANALYSIS

FIGURE 4 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) MARKET: THE MATERIAL LIFE LINE CURVE

FIGURE 7 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) MARKET: MULTIVARIATE MODELLING

FIGURE 8 PRODUCT LIFE LINE CURVE

FIGURE 9 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 10 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) MARKET: DBMR MARKET POSITION GRID

FIGURE 11 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 12 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 13 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) MARKET: VENDOR SHARE ANALYSIS

FIGURE 14 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) MARKET: SEGMENTATION

FIGURE 15 BEING A SAFER ALTERNATIVE TO STEEL IS EXPECTED TO DRIVE EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) MARKET IN THE FORECAST PERIOD

FIGURE 16 POLYESTER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) MARKET IN 2022 & 2030

FIGURE 17 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 18 DRIVERS, RESTRAINT, OPPORTUNITIES, AND CHALLENGES OF EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET

FIGURE 19 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET : BY TYPE, 2022

FIGURE 20 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET : BY PRODUCT TYPE, 2022

FIGURE 21 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET : BY GRATFTSING HEIGHT, 2022

FIGURE 22 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET : BY APPLICATION, 2022

FIGURE 23 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET : BY END-USER, 2022

FIGURE 24 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) MARKET: SNAPSHOT (2022)

FIGURE 25 EUROPE MOLDED FIBERGLASS REINFORCED PLASTIC (FRP) MARKET: BY COUNTRY (2022)

FIGURE 26 EUROPE MOLDED FIBERGLASS REINFORCED PLASTIC (FRP) MARKET: BY COUNTRY (2023 & 2030)

FIGURE 27 EUROPE MOLDED FIBERGLASS REINFORCED PLASTIC (FRP)E MARKET: BY COUNTRY (2022 & 2030)

FIGURE 28 EUROPE MOLDED FIBERGLASS REINFORCED PLASTIC (FRP) MARKET: BY TYPE (2023-2030)

FIGURE 29 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.