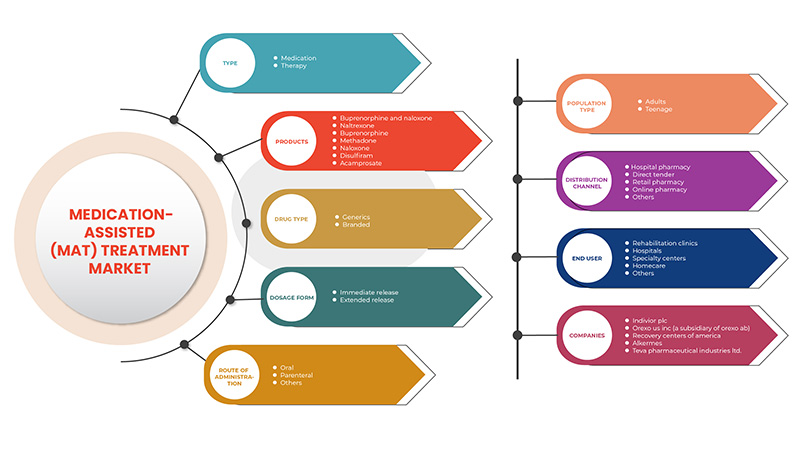

Europe Medication-Assisted Treatment (MAT) Market, By Type (Medication and Therapy), Products (Buprenorphine and Naloxone, Naltrexone, Buprenorphine, Methadone, Naloxone, Disulfiram and Acamprosate), Drug Type (Generics and Branded), Dosage Form (Immediate Release and Extended Release), Route of Administration (Oral, Parenteral and Others), Population Type (Adults and Teenage), End User (Rehabilitation Clinics, Hospitals, Specialty Centres, Homecare and Others) Distribution Channel (Hospital Pharmacy, Direct Tender, Retail Pharmacy, Online Pharmacy and Others), Industry Trends and Forecast to 2029

Market Analysis and Insights

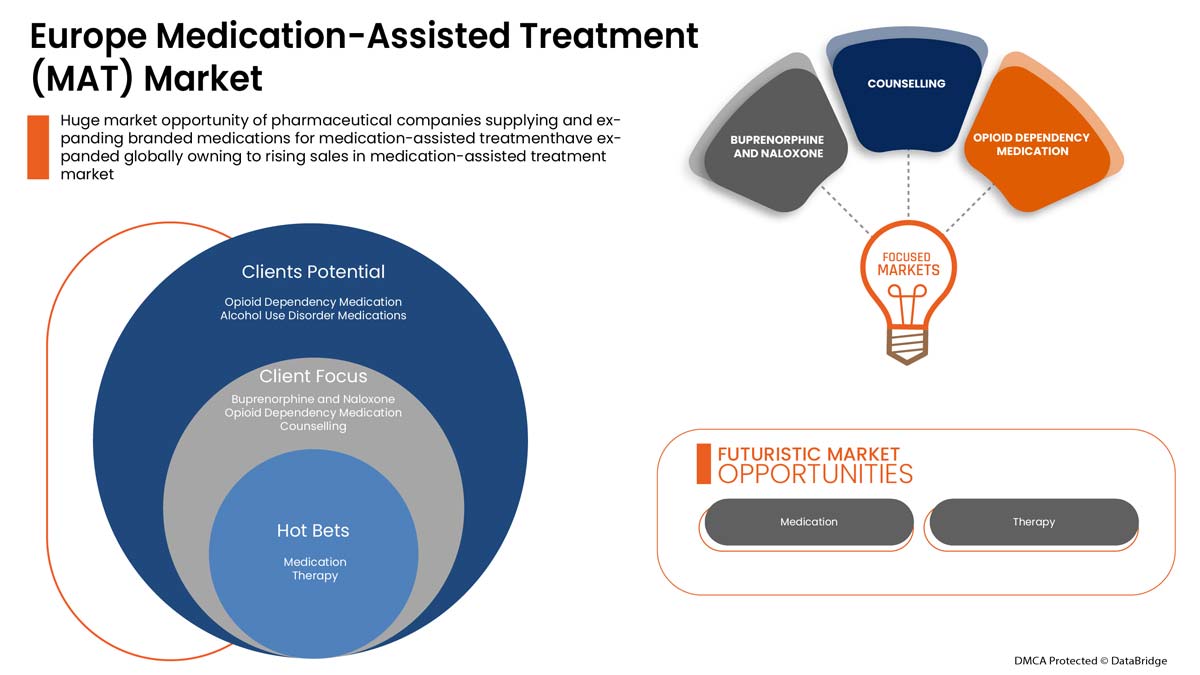

The Food and Drug Administration (FDA) approved three clinical drugs: buprenorphine, methadone, and naltrexone. Medication-assisted treatment (MAT) is applied to cure alcohol use disorder, opioid dependency medication, and opioid overdose prevention medication. Alcohol use disorder (AUD) is a medical condition characterized by an impaired ability to stop alcohol use despite adverse social, occupational, or health consequences. Acamprosate, disulfiram, and naltrexone are the most common medications used to treat alcohol use disorder (AUD). The opioid dependency medication, rise in addiction for opioids among patients. Buprenorphine, methadone, and naltrexone are used to treat opioid use disorders to short-acting opioids such as heroin, morphine, and codeine, as well as semi-synthetic opioids like oxycodone and hydrocodone. These MAT medications are safe for months, years, or even a lifetime.

Market Definition

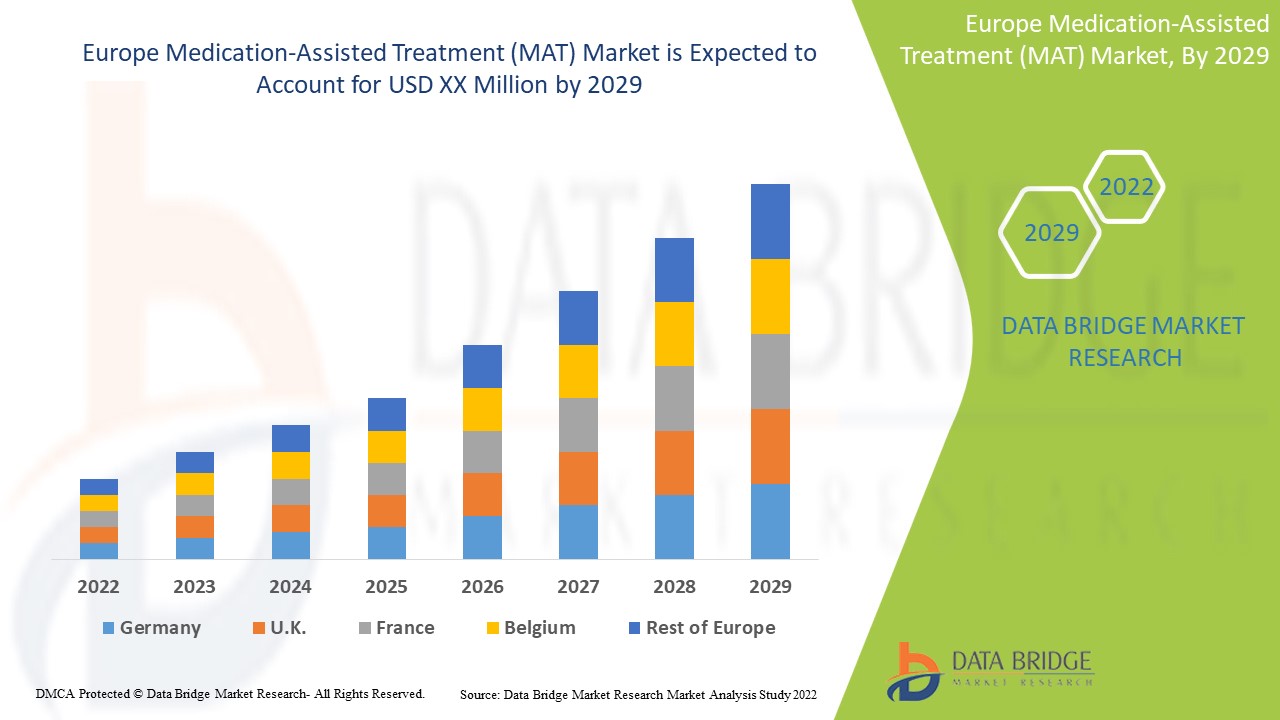

Medication-assisted treatment (MAT) involves using medications, combined with counselling and behavioural therapies, to provide a complete patient approach for treating substance use disorders. The aim of MAT is proper recovery, which includes improved patient survival, increased treatment retention, reduced illicit response, and a rise in pregnancy outcomes among women. For opioid overdose prevention medication, naloxone is used to prevent opioid overdose by reversing the toxic effects of the overdose. According to the World Health Organization (WHO) and Substance Abuse and Mental Health Services Administration (SAMHSA) naloxone is one of many medications considered essential to a functioning health care system. The Europe medication-assisted treatment is supportive and aims to reduce the severity of the symptoms. Data Bridge Market Research analyses that the medication-assisted treatment (MAT) market will grow at a CAGR of 8.7% from 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

Par type (médicament et thérapie), produits (buprénorphine et naloxone, naltrexone, buprénorphine, méthadone, naloxone, disulfirame et acamprosate), type de médicament (génériques et de marque), forme posologique (libération immédiate et à libération prolongée), voie d'administration (orale, parentérale et autres), type de population (adultes et adolescents), utilisateur final (cliniques de réadaptation, hôpitaux, centres spécialisés, soins à domicile et autres), canal de distribution (pharmacie hospitalière, appel d'offres direct, pharmacie de détail, pharmacie en ligne et autres) |

|

Pays couverts |

Allemagne, France, Royaume-Uni, Italie, Espagne, Russie, Turquie, Pays-Bas, Suisse, Norvège, Pologne, Hongrie, Lituanie, Autriche, Irlande et reste de l'Europe. |

|

Acteurs du marché couverts |

Indivior PLC, Alkermes. Sun Pharmaceutical Industries Ltd., Taj Pharmaceuticals Limited, Hikma Pharmaceuticals PLC, Pfizer Inc., Accord Healthcare (une filiale d'Intas Pharmaceuticals), Glenmark Pharmaceutical Inc. Viatris Inc., Mallinckrodt, Alvogen, Teva Pharmaceutical Industries Ltd. Dr. Reddy's Laboratories Ltd. Amneal Pharmaceuticals LLC. |

Dynamique du marché européen des traitements assistés par médicaments (TAM)

Conducteurs

- . L'augmentation de l'incidence des troubles liés à l'utilisation d'opioïdes (médicaments contre la dépendance aux opioïdes)

Le traitement assisté par médicaments (MAT) consiste à utiliser des médicaments en combinaison avec des conseils et des thérapies comportementales pour proposer une approche « globale » du patient pour traiter les troubles liés à la consommation de substances. Les médicaments utilisés dans le cadre du MAT sont approuvés par la Food and Drug Administration (FDA), et les programmes MAT sont axés sur la clinique et adaptés aux besoins de chaque patient.

Par exemple,

- La prévalence de la consommation d’opioïdes à haut risque (par injection ou utilisation de longue durée/régulière) chez les adultes (âgés de 15 à 64 ans) en Europe est relativement stable depuis de nombreuses années, les estimations des utilisateurs s’élevant à environ 0,35 % de la population de l’UE.

Les entreprises étant constamment engagées dans des activités de recherche et de développement, les connaissances sur l'incidence des troubles liés à la consommation d'alcool et aux opioïdes aideraient à trouver de nouvelles solutions et à favoriser davantage de collaborations et de partenariats avec les acteurs du marché dans des pays tels que les États-Unis, l'Europe et la région Asie-Pacifique. Cela signifie une augmentation des investissements liés à la recherche et au développement pour le lancement de médicaments génériques dans le traitement assisté par médicament (MAT), ce qui devrait stimuler la croissance du marché.

- Le financement par le gouvernement du traitement assisté par médicaments (MAT)

Malgré l’efficacité avérée des pharmacothérapies pour traiter les troubles liés à la consommation d’opioïdes et à l’alcool, des limites ont été observées dans la mise en œuvre de médicaments pour le traitement de la toxicomanie (MAT) par des programmes de traitement spécialisés. Une attention particulière doit être accordée aux sources spécifiques de financement, à la structure organisationnelle et aux ressources humaines, en réalisant un investissement à long terme qui aligne le paiement sur les futurs bénéficiaires potentiels.

Par exemple,

- En février 2021, le Programme intégré de formation sur les troubles liés à la consommation de substances (ISTP) a été financé pour planifier, développer et exploiter un programme de formation de 12 mois à temps plein ou de 24 mois à mi-temps pour les infirmières praticiennes et les assistants médicaux pour le traitement assisté par médicaments (MAT). Le financement permet d'élargir la main-d'œuvre formée pour fournir des soins aux personnes ayant besoin de soins de santé mentale et de prévention des troubles liés à la consommation d'opioïdes

Le financement par le gouvernement permettrait d'assurer la sécurité des patients et de réaliser des économies. De plus, les hôpitaux et les organismes de santé pourraient administrer ce traitement à un prix inférieur grâce à la collaboration avec les organismes gouvernementaux. Par conséquent, les progrès dans les activités de recherche et développement et le financement par le gouvernement devraient stimuler la croissance du marché.

Opportunité

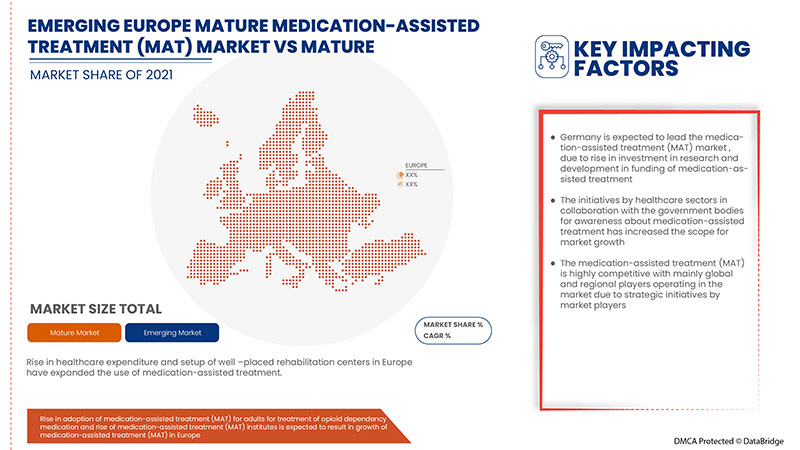

- Hausse des dépenses de santé

De plus, l'augmentation des activités de recherche et développement et l'augmentation des investissements des organisations gouvernementales et privées stimuleront de nouvelles opportunités pour le taux de croissance du marché.

Par exemple,

- En décembre 2021, selon Eurostat, les dépenses de santé dans l'Union européenne s'élevaient à 1 309,6 millions USD

L'augmentation des dépenses de santé est également bénéfique pour le développement économique et la croissance du secteur de la santé. En outre, l'augmentation du revenu disponible de la population est un facteur favorable. Ces facteurs devraient créer des opportunités lucratives pour le marché des traitements assistés par médicaments (MAT).

Retenue/Défi

- Des réglementations strictes

Les entreprises doivent examiner attentivement les spécifications et les certifications des produits avant de classer leur produit selon la Food and Drug Administration (FDA) et l'Union européenne (UE). Chaque pays dispose de son autorité de réglementation chargée de faire respecter les règles et réglementations relatives au développement, à l'homologation, à l'enregistrement, à la fabrication, à la commercialisation et à l'étiquetage des produits pharmaceutiques.

Par exemple,

- En Allemagne, le gouvernement fédéral, l'Agence de réglementation des médicaments et des produits de santé (MHRA), réglemente et fournit des lignes directrices pour le traitement des troubles liés à l'alcool et des troubles liés aux surdoses d'opioïdes lorsque le traitement assisté par médicament (MAT) est considéré comme un médicament (MP), pour les réglementations relatives aux tests de qualité et de sécurité (Q et S)

Les organismes de réglementation doivent travailler plus étroitement avec les scientifiques et, même s’ils sont impliqués dans des entreprises commerciales, ils doivent travailler plus rapidement et plus efficacement sur le traitement et l’approbation de tout ce qu’ils réglementent. Les fabricants doivent s’assurer qu’ils disposent de toutes les données d’efficacité du produit avant de soumettre les demandes d’approbation de produit aux autorités réglementaires. Par conséquent, un cadre réglementaire strict entraîne des lancements tardifs de produits sur le marché. Cela implique que le cadre réglementaire rigide devrait constituer un défi à la croissance du marché.

Le rapport sur le marché du traitement assisté par médicaments (MAT) fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et localisé, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans la réglementation du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché du traitement assisté par médicaments (MAT), contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Impact du Covid-19 sur le marché des traitements assistés par médicaments (MAT)

Pendant la pandémie, le traitement assisté par médicaments réduit considérablement la mortalité et la morbidité des patients atteints de COVID-19. D'autres études à grande échelle sont nécessaires pour valider ces résultats. Un protocole de traitement assisté par médicaments dans l'infection à COVID-19 doit être défini pour obtenir les meilleurs résultats cliniques possibles. Des essais cliniques ont été menés pendant la pandémie de Covid-19. Les services de traitement des troubles liés à l'utilisation d'opioïdes (MOUD) sont essentiels pour faire face à la crise des opioïdes, et la COVID-19 a eu un impact significatif sur la prestation de ces services.

Développement récent

- En avril 2021, Adamis Pharmaceuticals Corporation et USWM ont annoncé le lancement et la disponibilité d'un produit injectable à base de naloxone ZIMHI à haute dose pour aider à lutter contre les décès par surdose d'opioïdes. Le lancement devrait augmenter les revenus du segment de produits, ce qui stimulera la croissance du marché, et le ZIMHI sera disponible à un tarif réduit pour les premiers intervenants et les organismes de santé communautaire.

Portée du marché européen des traitements assistés par médicaments (TAM)

Le marché du traitement assisté par médicament (MAT) est segmenté sur la base de huit segments : type, produits, type de médicament et forme posologique, voie d'administration, type de population, utilisateur final et canal de distribution. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Taper

- Médicament

- Thérapie

Sur la base du type, le marché européen des traitements assistés par médicaments (MAT) est segmenté en médicaments et en thérapie.

Produits

- Buprénorphine et naloxone

- Naltrexone

- Buprénorphine

- Méthadone

- Naloxone

- Disulfirame

- Acamprosate

Sur la base des produits, le marché européen du traitement assisté par médicaments (MAT) est segmenté en buprénorphine et naloxone, naltrexone, buprénorphine, méthadone, naloxone, disulfirame et acamprosate.

Type de médicament

- Génériques

- De marque

Sur la base du type de médicament, le marché européen des traitements assistés par médicaments (MAT) est segmenté en génériques et en produits de marque.

Forme posologique

- Diffusion immédiate

- Version étendue

Sur la base de la forme posologique, le marché européen des traitements assistés par médicaments (MAT) est segmenté en libération immédiate et libération prolongée.

Voie d'administration

- Oral

- Parentérale

- Autres

Sur la base de la voie d'administration, le marché européen des traitements assistés par médicaments (MAT) est segmenté en voie orale , parentérale et autres.

Type de population

- Adultes

- Adolescent

Sur la base du type de population, le marché européen des traitements assistés par médicaments (MAT) est segmenté en adultes et adolescents.

Utilisateur final

- Cliniques de réadaptation

- Hôpitaux

- Centres spécialisés

- Soins à domicile

- Autres

Sur la base de l'utilisateur final, le marché européen des traitements assistés par médicaments (MAT) est segmenté en cliniques de réadaptation, hôpitaux, centres spécialisés, soins à domicile et autres.

Canal de distribution

- Pharmacie de l'hôpital

- Appel d'offres direct

- Pharmacie de détail

- Pharmacie en ligne

- Autres

Sur la base du canal de distribution, le marché européen du traitement assisté par médicaments (MAT) est segmenté en pharmacie hospitalière, appel d'offres direct, pharmacie de détail, pharmacie en ligne et autres

Analyse/perspectives régionales du marché du traitement assisté par médicaments (TAM)

Le marché européen du traitement assisté par médicaments (MAT) est analysé et des informations sur la taille du marché et les tendances sont fournies par régions, type de produit, type, application, flux de travail, utilisateur final et canal de distribution comme référencé ci-dessus.

Les pays couverts par le rapport sur le marché du traitement assisté par médicaments (MAT) sont l'Allemagne, la France, le Royaume-Uni, l'Italie, l'Espagne, la Russie, la Turquie, les Pays-Bas, la Suisse, la Norvège, la Pologne, la Hongrie, la Lituanie, l'Autriche, l'Irlande et le reste de l'Europe.

L'Allemagne devrait dominer le marché en raison de la présence de centres de réadaptation pour la MAT, de l'augmentation du remboursement et de la montée en puissance des sociétés pharmaceutiques.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et les changements de réglementation nationale qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales et de l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du traitement assisté par médicaments (TAM)

Le paysage concurrentiel du marché européen du traitement assisté par médicaments (MAT) fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Europe, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché du traitement assisté par médicaments (MAT).

Certains des principaux acteurs opérant sur le marché du traitement assisté par médicaments (MAT) sont Indivior PLC, Alkermes. Sun Pharmaceutical Industries Ltd., Taj Pharmaceuticals Limited, Hikma Pharmaceuticals PLC, Pfizer Inc., Accord Healthcare (une filiale d'Intas Pharmaceuticals), Glenmark Pharmaceutical Inc. Viatris Inc., Mallinckrodt, Alvogen, Teva Pharmaceutical Industries Ltd. Dr. Reddy's Laboratories Ltd. Amneal Pharmaceuticals LLC.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT SEGMENT LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 EPIDEMIOLOGY

4.2 PESTEL

4.3 PORTER'S FIVE FORCES MODEL

4.4 ANNUAL INCIDENCE OF SUBJECTS ENTERING MEDICATION-ASSISTED TREATMENT IN ALCOHOL, OPIOID USE DISORDER, AND OPIOID OVERDOSE PREVENTION (2021)

4.5 ANNUAL NUMBER OF TREATMENTS WITH CLONIDINE AND WITH LOFEXIDINE IN OPIOID USE DISORDER AND OPIOID OVERDOSE PREVENTION (2021)

4.6 ANNUAL INCIDENCE OF INDIVIDUALS RE-ENTERING MEDICATION-ASSISTED TREATMENT. FOR EXAMPLE, SOMEONE MAY DROP OUT OF TREATMENT AND RESTART TREATMENT LATER (2021)

4.7 ANNUAL USE OF NALTREXONE INJECTION AS PART OF TREATMENT FOR THE INITIAL WITHDRAWAL FROM OPIOIDS, AND ANNUAL MAINTENANCE THERAPY USING NALTREXONE INJECTION (2021)

4.8 PIPELINE ANALYSIS FOR MEDICATION-ASSISTED TREATMENT (MAT) MARKET

5 EUROPE MEDICATION-ASSISTED TREATMENT MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 THE RISE IN INCIDENCE OF ALCOHOL USE DISORDER AND OPIOID USE DISORDERS

6.1.2 THE FUNDING BY THE GOVERNMENT FOR MEDICATION-ASSISTED TREATMENT (MAT)

6.1.3 THE RISE IN THE POPULATION RECEIVING MEDICATION-ASSISTED TREATMENT (MAT) AND MEDICATION-ASSISTED AWARENESS PROGRAMMESMEDICATION-ASSISTED TREATMENT (MAT)

6.1.4 USE OF REIMBURSEMENT FOR MEDICATION-ASSISTED TREATMENT (MAT)

6.2 RESTRAINTS

6.2.1 SIDE EFFECTS OF DRUGS USED IN MEDICATION-ASSISTED TREATMENT (MAT)

6.2.2 ETHICAL ISSUES RELATED TO USE OF MEDICATION-ASSISTED TREATMENTMEDICATION-ASSISTED TREATMENT (MAT)

6.2.3 RISE IN PRODUCT RECALLS

6.3 OPPORTUNITIES

6.3.1 STRATEGIC INITIATIVE BY MARKET PLAYERS

6.3.2 RISE IN HEALTHCARE EXPENDITURE

6.4 CHALLENGES

6.4.1 THE LACK OF SKILLED PROFESSIONALS, REQUIRED FOR MEDICATION-ASSISTED TREATMENT

6.4.2 STRINGENT REGULATIONS

6.4.3 DISCONTINUATION OF MEDICATION-ASSISTED TREATMENT (MAT)

7 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE

7.1 OVERVIEW

7.2 MEDICATION

7.2.1 OPIOID DEPENDENCY MEDICATION

7.2.1.1 BUPRENORPHINE AND NALOXONE

7.2.1.2 BUPRENORPHINE

7.2.1.3 METHADONE

7.2.1.4 NALTREXONE

7.2.2 ALCOHOL USE DISORDER MEDICATIONS

7.2.2.1 NALTREXONE

7.2.2.2 DISULFIRAM

7.2.2.3 ACAMPROSATE

7.2.3 OPIOID OVERDOSE PREVENTION MEDICATION

7.2.3.1 NALOXONE

7.3 THERAPY

7.3.1 BEHAVIORAL THERAPY

7.3.2 EDUCATIONAL THERAPY

7.3.3 COUNSELLING

7.3.4 VOCATIONAL THERAPY

7.3.5 OTHERS

8 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY PRODUCTS

8.1 OVERVIEW

8.2 BUPRENORPHINE AND NALOXONE

8.3 NALTREXONE

8.4 BUPRENORPHINE

8.5 METHADONE

8.6 NALOXONE

8.7 DISULFIRAM

8.8 ACAMPROSATE

9 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE

9.1 OVERVIEW

9.2 GENERICS

9.3 BRANDED

9.3.1 SUBOXONE

9.3.2 VIVITROL

9.3.3 BUTRANS

9.3.4 ZUBSOLV

9.3.5 PROBUPHINE

9.3.6 OTHERS

10 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DOSAGE FORM

10.1 OVERVIEW

10.2 IMMEDIATE RELEASE

10.3 EXTENDED RELEASE

11 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION

11.1 OVERVIEW

11.2 ORAL

11.2.1 TABLET

11.2.2 SUBLINGUAL FILM

11.2.3 OTHERS

11.3 PARENTERAL

11.3.1 SOLUTION

11.3.2 SUSPENSION

11.4 OTHERS

12 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY POPULATION TYPE

12.1 OVERVIEW

12.2 ADULTS

12.3 TEENAGE

13 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY END USER

13.1 OVERVIEW

13.2 REHABILITATION CLINICS

13.3 HOSPITALS

13.4 SPECIALTY CENTERS

13.5 HOMECARE

13.6 OTHERS

14 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 HOSPITAL PHARMACY

14.3 DIRECT TENDER

14.4 RETAIL PHARMACY

14.5 ONLINE PHARMACY

14.6 OTHERS

15 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION

15.1 EUROPE

15.1.1 GERMANY

15.1.2 FRANCE

15.1.3 U.K.

15.1.4 ITALY

15.1.5 RUSSIA

15.1.6 SPAIN

15.1.7 NETHERLANDS

15.1.8 SWITZERLAND

15.1.9 NORWAY

15.1.10 POLAND

15.1.11 HUNGARY

15.1.12 LITHUANIA

15.1.13 AUSTRIA

15.1.14 IRELAND

15.1.15 TURKEY

15.1.16 REST OF EUROPE

16 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: EUROPE

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 TEVA PHARMACEUTICAL INDUSTRIES LTD. (2021)

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 INDIVOR PLC (2021)

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 VIATRIS INC (2021)

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 SUN PHARMACEUTICAL INDUSTRIES LTD (2021)

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 ALKERMES (2021)

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.6 PURDUE PHARMA L.P. (2021)

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENTS

18.7 PFIZER (2021)

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT DEVELOPMENTS

18.8 GLENMARK PHARMACEUTICAL INC (2021)

18.8.1 COMPANY SNAPSHOT

18.8.2 REVENUE ANALYSIS

18.8.3 PRODUCT PORTFOLIO

18.8.4 RECENT DEVELOPMENTS

18.9 DR. REDDY’S LABORATORIES LTD (2021)

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENTS

18.1 ALVOGEN (2021)

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENTS

18.11 ADAMIS PHARMACEUTICALS CORPORATION (2021)

18.11.1 COMPANY SNAPSHOT

18.11.2 REVENUE ANALYSIS

18.11.3 PRODUCT PORTFOLIO

18.11.4 RECENT DEVELOPMENTS

18.12 ACCORD HEALTHCARE (A SUBSIDIARY OF INTAS PHARMACEUTICALS)

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENTS

18.13 AMNEAL PHARMACEUTICALS LLC (2021)

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENTS

18.14 AMERICAN ADDICTION CENTERS (2021)

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENTS

18.15 HIKMA PHARMACEUTICALS PLC (2021)

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENTS

18.16 LANNETT (2021)

18.16.1 COMPANY SNAPSHOT

18.16.2 REVENUE ANALYSIS

18.16.3 PRODUCT PORTFOLIO

18.16.4 RECENT DEVELOPMENT

18.17 MALLINCKRODT (2021)

18.17.1 COMPANY SNAPSHOT

18.17.2 REVENUE ANALYSIS

18.17.3 PRODUCT PORTFOLIO

18.17.4 RECENT DEVELOPMENT

18.18 OREXO US INC (A SUBSIDIARY OF OREXO, INC) (2021)

18.18.1 COMPANY SNAPSHOT

18.18.2 REVENUE ANALYSIS

18.18.3 PRODUCT PORTFOLIO

18.18.4 RECENT DEVELOPMENT

18.19 PINNACLE TREATMENT CENTERS

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT DEVELOPMENT

18.2 RECOVERY CENTERS OF AMERICA

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENTS

18.21 TAJ PHARMACEUTICALS LIMITED

18.21.1 COMPANY SNAPSHOT

18.21.2 PRODUCT PORTFOLIO

18.21.3 RECENT DEVELOPMENTS

18.22 TITAN PHARMACEUTICALS (2021)

18.22.1 COMPANY SNAPSHOT

18.22.2 REVENUE ANALYSIS

18.22.3 PRODUCT PORTFOLIO

18.22.4 RECENT DEVELOPMENTS

18.23 VISTAPHARM, INC (A SUBSIDIARY OF VERTICE PHARMA, LLC. (2021))

18.23.1 COMPANY SNAPSHOT

18.23.2 PRODUCT PORTFOLIO

18.23.3 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

Liste des tableaux

TABLE 1 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 2 EUROPE MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 EUROPE MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 EUROPE OPIOID DEPENDENCY MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 EUROPE ALCOHOL USE DISORDER MEDICATIONS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 EUROPE OPIOID OVERDOSE PREVENTION MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 EUROPE THERAPY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 EUROPE THERAPY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 10 EUROPE BUPRENORPHINE AND NALOXONE IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 EUROPE NALTREXONE IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE BUPRENORPHINE IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 EUROPE METHADONE IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE NALOXONE IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 EUROPE DISULFIRAM IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE ACAMPROSATE IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 18 EUROPE GENERICS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE BRANDED IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 EUROPE BRANDED IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 21 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DOSAGE FORM, 2020-2029 (USD MILLION)

TABLE 22 EUROPE IMMEDIATE RELEASE IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 EUROPE EXTENDED RELEASE IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 25 EUROPE ORAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 EUROPE ORAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 27 EUROPE PARENTERAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 EUROPE PARENTERAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 29 EUROPE OTHERS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY POPULATION TYPE, 2020-2029 (USD MILLION)

TABLE 31 EUROPE ADULTS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 EUROPE TEENAGE IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 34 EUROPE REHABILITATION CLINICS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 EUROPE HOSPITALS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 EUROPE SPECIALTY CENTERS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 EUROPE HOMECARE IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 EUROPE OTHERS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 40 EUROPE HOSPITAL PHARMACY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 EUROPE DIRECT TENDER IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 EUROPE RETAIL PHARMACY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 EUROPE ONLINE PHARMACY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 EUROPE OTHERS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 46 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 EUROPE MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 EUROPE OPIOID DEPENDENCY MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 EUROPE ALCOHOL USE DISORDER MEDICATIONS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 EUROPE OPIOID OVERDOSE PREVENTION MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 EUROPE THERAPY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 53 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 54 EUROPE BRANDED IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 55 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DOSAGE FORM, 2020-2029 (USD MILLION)

TABLE 56 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 57 EUROPE ORAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 58 EUROPE PARENTERAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 59 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY POPULATION TYPE, 2020-2029 (USD MILLION)

TABLE 60 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 61 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 62 GERMANY MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 GERMANY MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 GERMANY OPIOID DEPENDENCY MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 GERMANY ALCOHOL USE DISORDER MEDICATIONS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 GERMANY OPIOID OVERDOSE PREVENTION MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 GERMANY THERAPY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 GERMANY MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 69 GERMANY MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 70 GERMANY BRANDED IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 71 GERMANY MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DOSAGE FORM, 2020-2029 (USD MILLION)

TABLE 72 GERMANY MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 73 GERMANY ORAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 74 GERMANY PARENTERAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 75 GERMANY MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY POPULATION TYPE, 2020-2029 (USD MILLION)

TABLE 76 GERMANY MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 77 GERMANY MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 78 FRANCE MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 FRANCE MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 FRANCE OPIOID DEPENDENCY MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 FRANCE ALCOHOL USE DISORDER MEDICATIONS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 FRANCE OPIOID OVERDOSE PREVENTION MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 FRANCE THERAPY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 FRANCE MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 85 FRANCE MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 86 FRANCE BRANDED IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 87 FRANCE MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DOSAGE FORM, 2020-2029 (USD MILLION)

TABLE 88 FRANCE MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 89 FRANCE ORAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 90 FRANCE PARENTERAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 91 FRANCE MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY POPULATION TYPE, 2020-2029 (USD MILLION)

TABLE 92 FRANCE MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 93 FRANCE MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 94 U.K. MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 95 U.K. MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 U.K. OPIOID DEPENDENCY MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 U.K. ALCOHOL USE DISORDER MEDICATIONS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 U.K. OPIOID OVERDOSE PREVENTION MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 U.K. THERAPY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 U.K. MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 101 U.K. MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 102 U.K. BRANDED IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 103 U.K. MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DOSAGE FORM, 2020-2029 (USD MILLION)

TABLE 104 U.K. MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 105 U.K. ORAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 106 U.K. PARENTERAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 107 U.K. MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY POPULATION TYPE, 2020-2029 (USD MILLION)

TABLE 108 U.K. MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 109 U.K. MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 110 ITALY MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 ITALY MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 ITALY OPIOID DEPENDENCY MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 ITALY ALCOHOL USE DISORDER MEDICATIONS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 ITALY OPIOID OVERDOSE PREVENTION MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 115 ITALY THERAPY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 ITALY MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 117 ITALY MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 118 ITALY BRANDED IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 119 ITALY MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DOSAGE FORM, 2020-2029 (USD MILLION)

TABLE 120 ITALY MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 121 ITALY ORAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 122 ITALY PARENTERAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 123 ITALY MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY POPULATION TYPE, 2020-2029 (USD MILLION)

TABLE 124 ITALY MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 125 ITALY MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 126 RUSSIA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 127 RUSSIA MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 RUSSIA OPIOID DEPENDENCY MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 RUSSIA ALCOHOL USE DISORDER MEDICATIONS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 RUSSIA OPIOID OVERDOSE PREVENTION MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 131 RUSSIA THERAPY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 RUSSIA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 133 RUSSIA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 134 RUSSIA BRANDED IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 135 RUSSIA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DOSAGE FORM, 2020-2029 (USD MILLION)

TABLE 136 RUSSIA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 137 RUSSIA ORAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 138 RUSSIA PARENTERAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 139 RUSSIA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY POPULATION TYPE, 2020-2029 (USD MILLION)

TABLE 140 RUSSIA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 141 RUSSIA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 142 SPAIN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 143 SPAIN MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 SPAIN OPIOID DEPENDENCY MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 145 SPAIN ALCOHOL USE DISORDER MEDICATIONS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 146 SPAIN OPIOID OVERDOSE PREVENTION MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 147 SPAIN THERAPY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 SPAIN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 149 SPAIN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 150 SPAIN BRANDED IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 151 SPAIN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DOSAGE FORM, 2020-2029 (USD MILLION)

TABLE 152 SPAIN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 153 SPAIN ORAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 154 SPAIN PARENTERAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 155 SPAIN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY POPULATION TYPE, 2020-2029 (USD MILLION)

TABLE 156 SPAIN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 157 SPAIN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 158 NETHERLANDS MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 159 NETHERLANDS MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 160 NETHERLANDS OPIOID DEPENDENCY MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 161 NETHERLANDS ALCOHOL USE DISORDER MEDICATIONS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 162 NETHERLANDS OPIOID OVERDOSE PREVENTION MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 163 NETHERLANDS THERAPY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 164 NETHERLANDS MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 165 NETHERLANDS MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 166 NETHERLANDS BRANDED IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 167 NETHERLANDS MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DOSAGE FORM, 2020-2029 (USD MILLION)

TABLE 168 NETHERLANDS MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 169 NETHERLANDS ORAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 170 NETHERLANDS PARENTERAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 171 NETHERLANDS MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY POPULATION TYPE, 2020-2029 (USD MILLION)

TABLE 172 NETHERLANDS MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 173 NETHERLANDS MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 174 SWITZERLAND MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 175 SWITZERLAND MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 176 SWITZERLAND OPIOID DEPENDENCY MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 177 SWITZERLAND ALCOHOL USE DISORDER MEDICATIONS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 178 SWITZERLAND OPIOID OVERDOSE PREVENTION MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 179 SWITZERLAND THERAPY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 180 SWITZERLAND MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 181 SWITZERLAND MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 182 SWITZERLAND MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 183 SWITZERLAND MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DOSAGE FORM, 2020-2029 (USD MILLION)

TABLE 184 SWITZERLAND MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 185 SWITZERLAND ORAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 186 SWITZERLAND PARENTERAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 187 SWITZERLAND MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY POPULATION TYPE, 2020-2029 (USD MILLION)

TABLE 188 SWITZERLAND MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 189 SWITZERLAND MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 190 NORWAY MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 191 NORWAY MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 192 NORWAY OPIOID DEPENDENCY MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 193 NORWAY ALCOHOL USE DISORDER MEDICATIONS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 194 NORWAY OPIOID OVERDOSE PREVENTION MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 195 NORWAY THERAPY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 196 NORWAY MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 197 NORWAY MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 198 NORWAY BRANDED IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 199 NORWAY MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DOSAGE FORM, 2020-2029 (USD MILLION)

TABLE 200 NORWAY MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 201 NORWAY ORAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 202 NORWAY PARENTERAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 203 NORWAY MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY POPULATION TYPE, 2020-2029 (USD MILLION)

TABLE 204 NORWAY MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 205 NORWAY MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 206 POLAND MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 207 POLAND MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 208 POLAND OPIOID DEPENDENCY MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 209 POLAND ALCOHOL USE DISORDER MEDICATIONS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 210 POLAND OPIOID OVERDOSE PREVENTION MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 211 POLAND THERAPY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 212 POLAND MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 213 POLAND MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 214 POLAND BRANDED IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 215 POLAND MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DOSAGE FORM, 2020-2029 (USD MILLION)

TABLE 216 POLAND MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 217 POLAND ORAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 218 POLAND PARENTERAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 219 POLAND MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY POPULATION TYPE, 2020-2029 (USD MILLION)

TABLE 220 POLAND MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 221 POLAND MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 222 HUNGARY MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 223 HUNGARY MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 224 HUNGARY OPIOID DEPENDENCY MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 225 HUNGARY ALCOHOL USE DISORDER MEDICATIONS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 226 HUNGARY OPIOID OVERDOSE PREVENTION MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 227 HUNGARY THERAPY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 228 HUNGARY MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 229 HUNGARY MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 230 HUNGARY BRANDED IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 231 HUNGARY MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DOSAGE FORM, 2020-2029 (USD MILLION)

TABLE 232 HUNGARY MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 233 HUNGARY ORAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 234 HUNGARY PARENTERAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 235 HUNGARY MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY POPULATION TYPE, 2020-2029 (USD MILLION)

TABLE 236 HUNGARY MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 237 HUNGARY MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 238 LITHUANIA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 239 LITHUANIA MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 240 LITHUANIA OPIOID DEPENDENCY MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 241 LITHUANIA ALCOHOL USE DISORDER MEDICATIONS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 242 LITHUANIA OPIOID OVERDOSE PREVENTION MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 243 LITHUANIA THERAPY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 244 LITHUANIA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 245 LITHUANIA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 246 LITHUANIA BRANDED IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 247 LITHUANIA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DOSAGE FORM, 2020-2029 (USD MILLION)

TABLE 248 LITHUANIA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 249 LITHUANIA ORAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 250 LITHUANIA PARENTERAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 251 LITHUANIA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY POPULATION TYPE, 2020-2029 (USD MILLION)

TABLE 252 LITHUANIA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 253 LITHUANIA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 254 AUSTRIA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 255 AUSTRIA MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 256 AUSTRIA OPIOID DEPENDENCY MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 257 AUSTRIA ALCOHOL USE DISORDER MEDICATIONS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 258 AUSTRIA OPIOID OVERDOSE PREVENTION MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 259 AUSTRIA THERAPY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 260 AUSTRIA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 261 AUSTRIA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 262 AUSTRIA BRANDED IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 263 AUSTRIA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DOSAGE FORM, 2020-2029 (USD MILLION)

TABLE 264 AUSTRIA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 265 AUSTRIA ORAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 266 AUSTRIA PARENTERAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 267 AUSTRIA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY POPULATION TYPE, 2020-2029 (USD MILLION)

TABLE 268 AUSTRIA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 269 AUSTRIA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 270 IRELAND MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 271 IRELAND MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 272 IRELAND OPIOID DEPENDENCY MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 273 IRELAND ALCOHOL USE DISORDER MEDICATIONS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 274 IRELAND OPIOID OVERDOSE PREVENTION MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 275 IRELAND THERAPY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 276 IRELAND MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 277 IRELAND MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 278 IRELAND BRANDED IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 279 IRELAND MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DOSAGE FORM, 2020-2029 (USD MILLION)

TABLE 280 IRELAND MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 281 IRELAND ORAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 282 IRELAND PARENTERAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 283 IRELAND MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY POPULATION TYPE, 2020-2029 (USD MILLION)

TABLE 284 IRELAND MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 285 IRELAND MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 286 TURKEY MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 287 TURKEY MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 288 TURKEY OPIOID DEPENDENCY MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 289 TURKEY ALCOHOL USE DISORDER MEDICATIONS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 290 TURKEY OPIOID OVERDOSE PREVENTION MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 291 TURKEY THERAPY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 292 TURKEY MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 293 TURKEY MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 294 TURKEY BRANDED IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 295 TURKEY MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DOSAGE FORM, 2020-2029 (USD MILLION)

TABLE 296 TURKEY MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 297 TURKEY ORAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 298 TURKEY PARENTERAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 299 TURKEY MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY POPULATION TYPE, 2020-2029 (USD MILLION)

TABLE 300 TURKEY MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 301 TURKEY MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 302 REST OF EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET : SEGMENTATION

FIGURE 2 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: DROC ANALYSIS

FIGURE 4 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: DBMR POSITION GRID

FIGURE 8 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: END USER COVERAGE GRID

FIGURE 10 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET AND ASIA-PACIFIC IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 INCREASED INCIDENCE OF ALCOHOL USE DISORDERS AND RISE IN PRODUCT APPROVALS IS EXPECTED TO DRIVE EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET FROM 2022 TO 2029

FIGURE 13 TYPE SEGMENT IS EXPECTED TO HAVE THE LARGEST SHARE OF THE EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET FROM 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET

FIGURE 15 INCIDENCE OF ALCOHOL CONSUMPTION IN 2019

FIGURE 16 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY TYPE, 2021

FIGURE 17 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 18 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 19 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY TYPE, LIFELINE CURVE

FIGURE 20 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY PRODUCTS, 2021

FIGURE 21 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY PRODUCTS, 2022-2029 (USD MILLION)

FIGURE 22 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY PRODUCTS, CAGR (2022-2029)

FIGURE 23 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY PRODUCTS, LIFELINE CURVE

FIGURE 24 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY DRUG TYPE, 2021

FIGURE 25 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY DRUG TYPE, 2022-2029 (USD MILLION)

FIGURE 26 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY DRUG TYPE, CAGR (2022-2029)

FIGURE 27 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY DRUG TYPE, LIFELINE CURVE

FIGURE 28 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY DOSAGE FORM, 2021

FIGURE 29 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY DOSAGE FORM, 2022-2029 (USD MILLION)

FIGURE 30 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY DOSAGE FORM, CAGR (2022-2029)

FIGURE 31 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY DOSAGE FORM, LIFELINE CURVE

FIGURE 32 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY ROUTE OF ADMINISTRATION, 2021

FIGURE 33 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY ROUTE OF ADMINISTRATION, 2022-2029 (USD MILLION)

FIGURE 34 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY ROUTE OF ADMINISTRATION, CAGR (2022-2029)

FIGURE 35 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY ROUTE OF ADMINISTRATION, LIFELINE CURVE

FIGURE 36 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY POPULATION TYPE, 2021

FIGURE 37 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY POPULATION TYPE, 2022-2029 (USD MILLION)

FIGURE 38 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY POPULATION TYPE, CAGR (2022-2029)

FIGURE 39 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY POPULATION TYPE, LIFELINE CURVE

FIGURE 40 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY END USER, 2021

FIGURE 41 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 42 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY END USER, CAGR (2022-2029)

FIGURE 43 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY END USER, LIFELINE CURVE

FIGURE 44 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 45 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 46 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 47 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 48 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: SNAPSHOT (2021)

FIGURE 49 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY COUNTRY (2021)

FIGURE 50 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 51 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 52 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY TYPE (2022-2029)

FIGURE 53 EUROPE MEDICATION-ASSISTED TREATMENT (MAT) MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.