Europe Medical Device Warehouse And Logistics Market

Taille du marché en milliards USD

TCAC :

%

USD

9.74 Billion

USD

13.86 Billion

2024

2032

USD

9.74 Billion

USD

13.86 Billion

2024

2032

| 2025 –2032 | |

| USD 9.74 Billion | |

| USD 13.86 Billion | |

|

|

|

|

Segmentation du marché européen des entrepôts et de la logistique de dispositifs médicaux, par offres (services, matériel et logiciels), température (ambiante, réfrigérée, congelée et autres), mode de transport (logistique maritime, aérienne et terrestre), application (dispositifs de diagnostic, dispositifs thérapeutiques, dispositifs de surveillance, dispositifs chirurgicaux et autres dispositifs), utilisation finale (hôpitaux et cliniques, fabricants de dispositifs médicaux, instituts universitaires et de recherche, laboratoires de référence et de diagnostic, entreprises de services médicaux d'urgence et autres), canal de distribution (logistique conventionnelle et tierce partie) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché européen des entrepôts et de la logistique des dispositifs médicaux

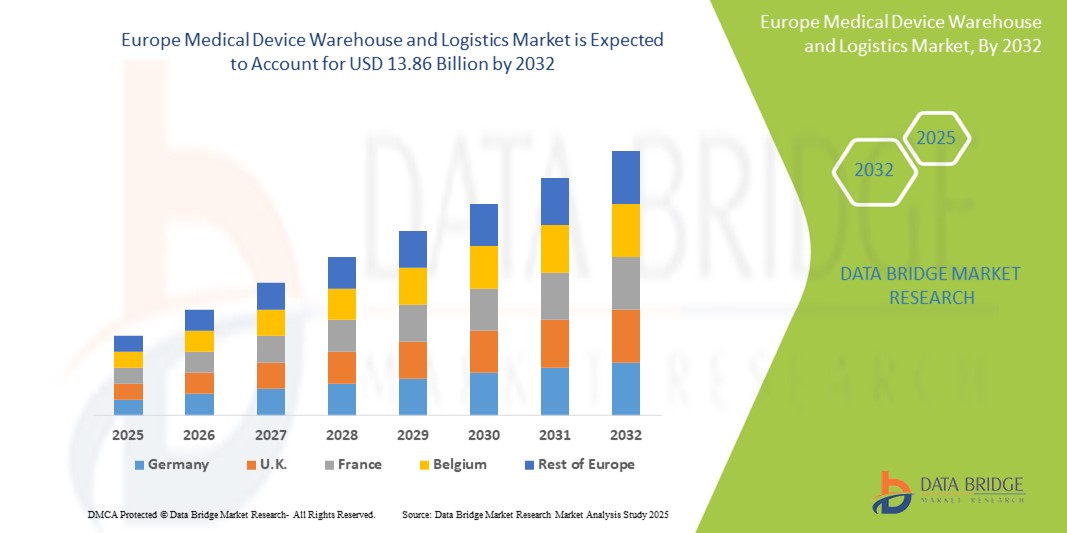

- La taille du marché européen des entrepôts et de la logistique des dispositifs médicaux était évaluée à 9,74 milliards USD en 2024 et devrait atteindre 13,86 milliards USD d'ici 2032 , à un TCAC de 4,50 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par l'adoption croissante de technologies avancées de chaîne d'approvisionnement et la transformation numérique de la logistique des soins de santé, conduisant à une efficacité accrue du stockage et de la distribution des dispositifs médicaux à travers l'Europe.

- Par ailleurs, la demande croissante d'équipements médicaux thermosensibles et de grande valeur, conjuguée à une conformité réglementaire stricte en matière de traçabilité et de sécurité des dispositifs médicaux, favorise l'adoption de solutions européennes d'entreposage et de logistique pour dispositifs médicaux. Ces facteurs convergents accélèrent l'adoption de plateformes logistiques technologiques, stimulant ainsi considérablement la croissance du secteur.

Analyse du marché européen des entrepôts et de la logistique des dispositifs médicaux

- Les services d'entreposage et de logistique des dispositifs médicaux sont de plus en plus essentiels aux infrastructures de santé européennes, notamment en milieu hospitalier, ambulatoire et à domicile, en raison de la demande croissante de livraisons ponctuelles, conformes et thermosensibles de technologies médicales complexes. Ces services jouent un rôle crucial pour garantir la disponibilité, la traçabilité et l'harmonisation réglementaire des dispositifs dans toute la région.

- La demande croissante d'une logistique efficace des dispositifs médicaux en Europe est principalement alimentée par la base croissante de fabrication de dispositifs médicaux, les progrès des technologies de la chaîne du froid, l'expansion du commerce électronique des fournitures médicales et les réglementations européennes strictes telles que les directives MDR et GDP.

- L'Allemagne a dominé le marché européen des entrepôts et de la logistique de dispositifs médicaux, avec la plus grande part de chiffre d'affaires (28,3 %) en 2024, grâce à son infrastructure de santé de pointe, ses plateformes de distribution centralisées et son leadership dans la production et l'exportation de dispositifs médicaux. Les investissements du pays dans l'automatisation, le suivi RFID et l'entreposage à température contrôlée accélèrent la maturité du marché, notamment chez les grands prestataires logistiques.

- La France devrait être la région connaissant la croissance la plus rapide sur le marché des entrepôts et de la logistique des dispositifs médicaux au cours de la période de prévision, avec un TCAC de 5,8 %, soutenu par les réformes des soins de santé soutenues par le gouvernement, la présence de prestataires de services logistiques de premier plan, l'intégration de solutions de chaîne du froid et la demande croissante de dispositifs de soins chroniques.

- Le segment ambiant a dominé le marché européen de l'entreposage et de la logistique des dispositifs médicaux, avec une part de marché de 52,3 % en 2024, grâce à la large gamme de dispositifs médicaux ne nécessitant pas de contrôle de température. Sa rentabilité, sa facilité de manipulation et sa compatibilité avec les conditions de stockage et de transport standard en font le choix privilégié pour l'entreposage et la distribution de produits tels que les instruments chirurgicaux, les kits de diagnostic et les équipements médicaux durables en Europe.

Portée du rapport et segmentation du marché européen des entrepôts et de la logistique des dispositifs médicaux

|

Attributs |

Aperçu du marché européen des entrepôts et de la logistique des dispositifs médicaux |

|

Segments couverts |

|

|

Pays couverts |

Europe

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché européen des entrepôts et de la logistique des dispositifs médicaux

« Opérations rationalisées grâce à l'automatisation et au suivi numérique »

- L'adoption de technologies avancées d'automatisation et de suivi numérique constitue une tendance majeure et croissante sur le marché européen de l'entreposage et de la logistique des dispositifs médicaux . Ces innovations améliorent l'efficacité opérationnelle, réduisent les erreurs manuelles et permettent une visibilité des stocks en temps réel sur l'ensemble de la chaîne d'approvisionnement.

- Par exemple, de nombreux prestataires logistiques tiers (3PL) intègrent des systèmes de gestion d'entrepôt numérique (WMS) avec des technologies RFID et de lecture de codes-barres pour optimiser le stockage, la récupération et la distribution des dispositifs médicaux. Cela garantit la conformité réglementaire, minimise les écarts de stock et accélère l'exécution des commandes.

- En outre, la mise en œuvre de plateformes logistiques basées sur le cloud permet aux parties prenantes de surveiller l'état des expéditions en temps réel, de recevoir des alertes automatisées et de rationaliser la documentation douanière et réglementaire, réduisant ainsi les retards et améliorant la satisfaction des clients.

- L'automatisation des systèmes de surveillance de la température et de contrôle de l'humidité dans les entrepôts est particulièrement cruciale pour les dispositifs médicaux thermosensibles et de grande valeur, tels que les kits de diagnostic, les dispositifs implantables et les instruments chirurgicaux. Ces systèmes garantissent des conditions environnementales constantes pour préserver l'intégrité des produits.

- La préférence croissante pour les stocks juste à temps (JIT) et la logistique axée sur la demande encourage les fabricants et les distributeurs à collaborer étroitement avec des partenaires logistiques capables de proposer des solutions d'entreposage évolutives et flexibles.

- Par conséquent, des acteurs clés tels que DB Schenker, CEVA Logistics et Kuehne+Nagel investissent dans des entrepôts de dispositifs médicaux spécialement conçus et conformes aux BPD, dotés d'une infrastructure spécialisée pour répondre aux besoins évolutifs des fabricants et des prestataires de soins de santé à travers l'Europe.

Dynamique du marché européen des entrepôts et de la logistique des dispositifs médicaux

Conducteur

« Besoin croissant dû à la demande croissante d'une chaîne du froid efficace et d'une conformité réglementaire »

- La demande croissante de dispositifs médicaux sensibles à la température, ainsi que les réglementations strictes en matière de manipulation et de distribution de dispositifs médicaux à travers l'Europe, constituent un moteur majeur de l'expansion du marché européen des entrepôts et de la logistique des dispositifs médicaux.

- Par exemple, en avril 2024, UPS Healthcare a annoncé l'extension de ses capacités logistiques de chaîne du froid en Europe afin de répondre à la demande croissante de transport conforme et à température régulée de dispositifs médicaux et de produits biologiques. Ces investissements de la part d'acteurs clés devraient stimuler la croissance du marché sur la période de prévision.

- Alors que les prestataires de soins de santé accordent la priorité à la livraison rapide et sécurisée des dispositifs de diagnostic et thérapeutiques, les partenaires logistiques améliorent leurs capacités en matière de traçabilité, de sérialisation et de surveillance de l'état, garantissant ainsi la conformité avec les directives MDR et GDP de l'UE.

- De plus, l'évolution vers des dispositifs mini-invasifs et des solutions de soins de santé à domicile augmente le besoin de livraison au dernier kilomètre, de gestion efficace des stocks et d'emballages spécialisés, faisant des services d'entreposage et de logistique un maillon essentiel de la chaîne d'approvisionnement des dispositifs médicaux.

- La prévalence croissante des maladies chroniques et des interventions chirurgicales, ainsi que le nombre croissant d'essais cliniques et de services de diagnostic, accélèrent encore le besoin de solutions d'entreposage agiles et évolutives adaptées aux conditions de stockage spécifiques et aux délais d'exécution requis par les technologies médicales.

Retenue/Défi

« Coûts opérationnels élevés et paysage réglementaire complexe »

- Le marché européen de l'entreposage et de la logistique des dispositifs médicaux est confronté à des défis en raison des coûts élevés liés aux infrastructures de la chaîne du froid, à la formation spécialisée du personnel et à la conformité réglementaire. La construction et l'entretien d'installations et de réseaux de transport conformes aux BPD, notamment pour les segments réfrigéré et congelé, nécessitent des investissements importants.

- De plus, la gestion des cadres réglementaires complexes et évolutifs de plusieurs pays européens présente des difficultés opérationnelles. Les fabricants et les prestataires logistiques doivent s'adapter à des exigences nationales variables tout en garantissant une visibilité et une conformité centralisées.

- Par exemple, les retards dans le transport transfrontalier dus à des erreurs de documentation ou à des différences dans les protocoles douaniers peuvent affecter les délais de livraison et l'intégrité du produit, en particulier pour les appareils sensibles à la température.

- De plus, les fabricants de dispositifs médicaux de petite et moyenne taille peinent souvent à respecter ces exigences de coût et de conformité, ce qui les conduit à dépendre fortement des prestataires logistiques tiers (3PL). Si cela améliore leur portée, cela peut également réduire le contrôle direct sur la qualité et les délais.

- Pour surmonter ces contraintes, les acteurs du secteur doivent investir dans l'automatisation, les systèmes de suivi numérique et la formation du personnel, tout en favorisant une collaboration plus étroite avec les organismes de réglementation. Le développement des plateformes d'entreposage régionales et l'adoption de plateformes numériques standardisées seront également essentiels pour rationaliser les opérations et soutenir la croissance à long terme.

Portée du marché européen des entrepôts et de la logistique de dispositifs médicaux

Le marché est segmenté en fonction des offres, de la température, du mode de transport, de l’application, de l’utilisation finale et du canal de distribution.

• Par offrandes

Sur la base des offres, le marché européen de l'entreposage et de la logistique des dispositifs médicaux est segmenté en services, matériel et logiciels. Le segment des services a dominé avec la plus grande part de chiffre d'affaires (48,6 %) en 2024, porté par l'externalisation croissante des fonctions logistiques et la demande de manutention spécialisée.

Le segment des logiciels devrait connaître le TCAC le plus rapide de 23,5 % au cours de la période de prévision, attribué à l'utilisation croissante d'outils logistiques numériques tels que les plateformes WMS et TMS.

• Par température

En fonction de la température, le marché européen de l'entreposage et de la logistique des dispositifs médicaux est segmenté en deux catégories : température ambiante, température réfrigérée, température congelée et autres. Le segment température ambiante détenait la plus grande part de marché, avec 52,3 % en 2024, grâce à la large gamme de dispositifs ne nécessitant pas de contrôle de température.

Le segment des produits réfrigérés devrait connaître le TCAC le plus rapide, soit 21,1 %, entre 2025 et 2032, grâce à la demande croissante de logistique de la chaîne du froid pour les dispositifs médicaux sensibles.

• Par mode de transport

En fonction du mode de transport, le marché européen de l'entreposage et de la logistique des dispositifs médicaux est segmenté en logistique de fret maritime, logistique de fret aérien et logistique terrestre. Le segment de la logistique terrestre a dominé le marché avec 45,7 % de parts de chiffre d'affaires en 2024, grâce à des réseaux routiers et ferroviaires bien établis en Europe.

Le segment de la logistique du fret aérien devrait connaître un TCAC maximal de 19,4 % au cours de la période de prévision, soutenu par la demande croissante d'expéditions médicales rapides et de grande valeur.

• Sur demande

En fonction des applications, le marché européen de l'entreposage et de la logistique des dispositifs médicaux est segmenté en dispositifs de diagnostic, dispositifs thérapeutiques, dispositifs de surveillance, dispositifs chirurgicaux et autres dispositifs. Le segment des dispositifs de diagnostic représentait la part la plus importante (34,2 %) en 2024, grâce à un volume d'utilisation élevé et à des cycles de réapprovisionnement récurrents.

Le segment des dispositifs chirurgicaux devrait connaître une croissance annuelle composée (TCAC) rapide de 20,2 % au cours de la période de prévision, soutenue par l'augmentation des volumes de procédures et les exigences de manipulation de dispositifs de précision.

• Par utilisation finale

En fonction de l'utilisation finale, le marché européen de l'entreposage et de la logistique des dispositifs médicaux est segmenté entre hôpitaux et cliniques, fabricants de dispositifs médicaux, instituts universitaires et de recherche, laboratoires de référence et de diagnostic, entreprises de services médicaux d'urgence, etc. Le segment des hôpitaux et cliniques a enregistré la plus forte part de chiffre d'affaires, soit 39,6 % en 2024, grâce à une consommation élevée de dispositifs et à des achats centralisés.

Le segment des entreprises de dispositifs médicaux devrait connaître le TCAC le plus rapide, soit 22,8 %, au cours de la période de prévision, car elles externalisent de plus en plus la logistique à des fournisseurs tiers spécialisés.

• Par canal de distribution

En fonction du canal de distribution, le marché européen de l'entreposage et de la logistique des dispositifs médicaux est segmenté en deux catégories : la logistique conventionnelle et la logistique tierce. Le segment de la logistique tierce a représenté la plus grande part de marché en 2024, avec 61,2 %, les fabricants de dispositifs adoptant des modèles de distribution rentables et flexibles.

Le segment de la logistique conventionnelle devrait connaître une croissance TCAC très rapide de 13,9 % au cours de la période de prévision, conservant ainsi sa pertinence dans les régions dotées de systèmes de distribution internes ou spécifiques à la réglementation.

Analyse régionale du marché européen des entrepôts et de la logistique des dispositifs médicaux

- L'Europe a dominé le marché de l'entreposage et de la logistique des dispositifs médicaux avec la plus grande part de revenus de 38,7 % en 2024, grâce à l'infrastructure de soins de santé bien établie de la région, à un solide réseau de pôles logistiques et à des normes réglementaires strictes qui soutiennent un stockage et une distribution sûrs et conformes des dispositifs médicaux.

- L'accent mis par la région sur l'intégrité de la chaîne du froid, les systèmes de suivi numérique et la durabilité de la logistique a considérablement contribué à la demande de solutions avancées d'entreposage et de distribution médicales.

- La présence de grandes entreprises pharmaceutiques et de technologies médicales, combinée à l'adoption croissante de l'automatisation, de la robotique et de la surveillance des stocks en temps réel dans les opérations logistiques, stimule encore la croissance du marché.

Aperçu du marché allemand des entrepôts et de la logistique des dispositifs médicaux

Le marché allemand de l'entreposage et de la logistique des dispositifs médicaux a dominé le marché européen avec une part de chiffre d'affaires de 28,3 % en 2024, grâce à son infrastructure de santé de pointe, à son solide réseau logistique et à l'adoption généralisée de l'automatisation dans la manutention des dispositifs médicaux. La position stratégique du pays en Europe et son souci de conformité réglementaire en font un pôle privilégié pour l'entreposage et la distribution.

Aperçu du marché français des entrepôts et de la logistique de dispositifs médicaux

La France devrait connaître une croissance régulière du marché des entrepôts et de la logistique des dispositifs médicaux au cours de la période de prévision, avec un TCAC de 5,8 % de 2025 à 2032, soutenu par les réformes des soins de santé soutenues par le gouvernement, la présence de prestataires de services logistiques de premier plan, l'intégration de solutions de chaîne du froid et la demande croissante de dispositifs de soins chroniques.

Aperçu du marché britannique des entrepôts et de la logistique des dispositifs médicaux

Le marché britannique de l'entreposage et de la logistique des dispositifs médicaux devrait connaître une forte croissance, porté par les innovations en matière de livraison du dernier kilomètre, la restructuration de la chaîne d'approvisionnement liée au Brexit et la demande croissante d'appareils de diagnostic. Le pays met l'accent sur l'entreposage numérique et les solutions logistiques durables.

Aperçu du marché européen des entrepôts et de la logistique de dispositifs médicaux aux Pays-Bas

Le marché néerlandais de l'entreposage et de la logistique des dispositifs médicaux s'impose comme un pôle logistique incontournable grâce à son excellente connectivité portuaire et aéroportuaire. Le marché européen de l'entreposage et de la logistique des dispositifs médicaux s'appuie sur de solides partenariats public-privé, l'efficacité des douanes et une forte concentration de prestataires logistiques.

Part de marché des entrepôts et de la logistique des dispositifs médicaux en Europe

Le secteur européen de l'entreposage et de la logistique des dispositifs médicaux est principalement dirigé par des entreprises bien établies, notamment :

- Deutsche Post AG (Allemagne)

- FedEx (États-Unis)

- United Parcel Service of America, Inc. (États-Unis)

- Kuehne+Nagel (Royaume-Uni)

- DB SCHENKER (Allemagne)

- Alloga (Royaume-Uni)

- CH Robinson Worldwide, Inc. (États-Unis)

- CEVA (France)

- Dimerco (Taïwan)

- DSV (Danemark)

- FM Logistic (France)

- Hellmann Worldwide Logistics SE & Co. KG (Allemagne)

- Impérial (Afrique du Sud)

- Movianto (Pays-Bas)

- OIA Global (États-Unis)

- Omni Logistics, LLC (États-Unis)

- puracon GmbH (Allemagne)

- Groupe Rhenus (Allemagne)

- SEKO (États-Unis)

- TIBA (Espagne)

- Toll Holdings Limited (Australie)

- XPO, Inc. (États-Unis)

Derniers développements sur le marché européen des entrepôts et de la logistique des dispositifs médicaux

- En novembre 2023, DHL Express a officiellement inauguré son hub d'Asie centrale agrandi à Hong Kong, investissant 562 millions d'euros pour renforcer ses capacités dans un contexte de croissance du commerce mondial. Ce hub, essentiel pour relier l'Asie au reste du monde, a vu sa capacité de traitement des expéditions de pointe augmenter de près de 70 % et peut désormais gérer un volume six fois supérieur à celui de sa création en 2004. Cette expansion souligne l'engagement de DHL à soutenir la croissance de ses clients et à consolider le statut de Hong Kong comme plaque tournante internationale incontournable de l'aviation.

- En décembre 2022, DHL Supply Chain a annoncé un investissement de 10,93 millions de dollars américains pour étendre ses capacités d'entreposage dans le nord de Taïwan, en se concentrant notamment sur les secteurs des semi-conducteurs, des sciences de la vie et de la santé. Le nouveau centre de distribution de Taoyuan-Jian Guo ajoute 10 000 mètres carrés à la surface d'entreposage totale de DHL à Taoyuan, la portant à 37 000 mètres carrés. Cette installation améliore la connectivité pour des opérations logistiques efficaces et soutient l'objectif de l'entreprise d'atteindre 200 000 mètres carrés d'empreinte totale à Taïwan d'ici 2027.

- En septembre 2024, FedEx a lancé la plateforme fdx, une solution commerciale basée sur les données, désormais accessible aux entreprises américaines. Cette plateforme s'appuie sur le réseau FedEx pour améliorer l'expérience client en améliorant la croissance de la demande, les taux de conversion et l'optimisation du traitement des commandes. Parmi ses fonctionnalités notables figurent les estimations de livraison prédictives, les analyses de durabilité, le suivi des commandes personnalisé et la simplification des processus de retour. Raj Subramaniam, PDG de FedEx, a souligné le rôle de la plateforme dans des chaînes d'approvisionnement plus intelligentes lors de l'événement Dreamforce 2024.

- En mars 2024, UPS Healthcare a lancé UPS Supply Chain Symphony R, une plateforme cloud conçue pour intégrer et gérer les données de la chaîne d'approvisionnement des soins de santé issues de divers systèmes opérationnels. Cet outil offre aux clients du secteur de la santé une visibilité complète sur leur logistique, leur permettant de prendre des décisions éclairées, d'améliorer leur planification et d'établir des prévisions précises. En améliorant le contrôle, l'efficacité et la transparence, cette plateforme répond au besoin crucial de rationalisation des chaînes d'approvisionnement dans le secteur de la santé. Kate Gutmann a souligné son potentiel transformateur pour optimiser les opérations mondiales et les soins aux patients.

- En septembre 2024, Kuehne+Nagel, prestataire logistique de premier plan, a inauguré un nouveau centre de traitement des commandes à température contrôlée pour Medtronic à Milton, en Ontario, à seulement 50 km de Toronto. D'une superficie de 25 000 m², ce centre distribuera des dispositifs médicaux aux hôpitaux et abritera les centres d'entretien, de réparation et de maintenance préventive de Medtronic pour ses équipements.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END USE COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTES

4.2.5 INDUSTRY RIVALRY

4.3 COST ANALYSIS BREAKDOWN

4.4 COST BENCHMARK ANALYSIS

4.4.1 COST METRICS OVERVIEW:

4.4.1.1 AVERAGE WAREHOUSE COST PER SQ FT (USD)

4.4.1.2 AVERAGE WAREHOUSE COST PER ORDER:

4.4.1.3 AVERAGE TRANSPORT COST PER SHIPMENT (USD)

4.5 HEALTHCARE ECONOMY

4.6 INDUSTRY INSIGHT

4.6.1 MICRO AND MACRO ECONOMIC FACTORS

4.6.2 PENETRATION AND GROWTH PROSPECT MAPPING

4.6.3 KEY PRICING STRATEGIES

4.6.4 INTERVIEWS WITH SPECIALISTS

4.6.5 ANALYSIS AND RECOMMENDATIONS

4.7 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.7.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.7.1.1 JOINT VENTURES

4.7.1.2 MERGERS AND ACQUISITIONS

4.7.1.3 LICENSING AND PARTNERSHIP

4.7.1.4 TECHNOLOGY COLLABORATIONS

4.7.1.5 STRATEGIC DIVESTMENTS

4.7.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.7.3 STAGE OF DEVELOPMENT

4.7.4 TIMELINES AND MILESTONES

4.7.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.7.6 RISK ASSESSMENT AND MITIGATION

4.7.7 FUTURE OUTLOOK

4.7.8 CONCLUSION

4.8 OPPORTUNITY MAP ANALYSIS

4.9 REIMBURSEMENT FRAMEWORK

4.1 TECHNOLOGICAL ROADMAP

4.11 VALUE CHAIN ANALYSIS

5 REGULATORY

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING DEMAND FOR MEDICAL DEVICES

6.1.2 TECHNOLOGICAL ADVANCEMENTS AND INNOVATIONS IN MEDICAL TECHNOLOGY

6.1.3 INCREASED SPENDING ON HEALTHCARE INFRASTRUCTURE BY GOVERNMENTS AND PRIVATE SECTORS

6.2 RESTRAINTS

6.2.1 SUPPLY CHAIN DISRUPTIONS

6.2.2 HIGH OPERATIONAL COSTS OF MEDICAL DEVICE LOGISTICS AND WAREHOUSING

6.3 OPPORTUNITIES

6.3.1 ADOPTION OF ADVANCED TECHNOLOGIES IN LOGISTICS MANAGEMENT

6.3.2 STRATEGIC PARTNERSHIPS AND MERGERS BETWEEN MEDICAL DEVICE MANUFACTURERS AND LOGISTICS AND E-COMMERCE COMPANIES

6.4 CHALLENGES

6.4.1 COMPLEX REGULATORY REQUIREMENTS FOR LOGISTICS PROVIDERS TO ENSURE COMPLIANCE

6.4.2 SHORTAGE OF SKILLED LABOR IN LOGISTICS AND WAREHOUSE OPERATIONS CAN CREATE INEFFICIENCIES AND DELAYS

7 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS

7.1 OVERVIEW

7.2 SERVICES

7.3 HARDWARE

7.4 SOFTWARE

8 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION

8.1 OVERVIEW

8.2 SEA FREIGHT LOGISTICS

8.3 AIR FREIGHT LOGISTICS

8.4 OVERLAND LOGISTICS

9 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE

9.1 OVERVIEW

9.2 AMBIENT

9.3 CHILLED/REFRIGERATED

9.4 FROZEN

9.5 OTHERS

10 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 DIAGNOSTIC DEVICES

10.3 THERAPEUTIC DEVICES

10.4 MONITORING DEVICES

10.5 SURGICAL DEVICES

10.6 OTHERS DEVICES

11 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE

11.1 OVERVIEW

11.2 HOSPITALS & CLINICS

11.3 MEDICAL DEVICES COMPANIES

11.4 ACADEMIC & RESEARCH INSTITUTES

11.5 REFERENCE & DIAGNOSTIC LABORATORIES

11.6 EMERGENCY MEDICAL SERVICES COMPANIES

11.7 OTHERS

12 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 CONVENTIONAL LOGISTICS

12.3 THIRD PARTY

13 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION

13.1 EUROPE

13.1.1 GERMANY

13.1.2 U.K.

13.1.3 FRANCE

13.1.4 SPAIN

13.1.5 SWITZERLAND

13.1.6 NETHERLANDS

13.1.7 RUSSIA

13.1.8 BELGIUM

13.1.9 FINLAND

13.1.10 DENMARK

13.1.11 POLAND

13.1.12 NORWAY

13.1.13 HUNGARY

13.1.14 SWEDEN

13.1.15 REST OF EUROPE

14 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: EUROPE

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 DEUTSCHE POST AG

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 SERVICE PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 FEDEX

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 SERVICE PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 UNITED PARCEL SERVICE OF AMERICA, INC.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 SERVICE PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 KUEHNE+NAGEL

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 SERVICE PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 DB SCHENKER

16.5.1 COMPANY SNAPSHOT

16.5.2 COMPANY SHARE ANALYSIS

16.5.3 SERVICE PORTFOLIO

16.5.4 RECENT DEVELOPMENT

16.6 ALLOGA

16.6.1 COMPANY SNAPSHOT

16.6.2 SERVICE PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 AWL INDIA PRIVATE LIMITED

16.7.1 COMPANY SNAPSHOT

16.7.2 SERVICE PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 C.H. ROBINSON WORLDWIDE, INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 SERVICE PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 CAVALIER LOGISTICS

16.9.1 COMPANY SNAPSHOT

16.9.2 SERVICE PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 CEVA

16.10.1 COMPANY SNAPSHOT

16.10.2 SERVICE PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 CROWN LSP GROUP

16.11.1 COMPANY SNAPSHOT

16.11.2 SERVICE PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 DIMERCO

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 SERVICE PORTFOLIO

16.12.4 RECENT DEVELOPMENT

16.13 DSV

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 SERVICE PORTFOLIO

16.13.4 RECENT DEVELOPMENT

16.14 FM LOGISTIC

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 SERVICE PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 HANSA INTERNATIONAL

16.15.1 COMPANY SNAPSHOT

16.15.2 SERVICE PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 HELLMANN WORLDWIDE LOGISTICS SE & CO. KG

16.16.1 COMPANY SNAPSHOT

16.16.2 SERVICE PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 IMPERIAL

16.17.1 COMPANY SNAPSHOT

16.17.2 SERVICE PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 MERCURY BUSINESS SERVICES

16.18.1 COMPANY SNAPSHOT

16.18.2 SERVICE PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 MOVIANTO

16.19.1 COMPANY SNAPSHOT

16.19.2 SERVICE PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 MURPHY LOGISTICS

16.20.1 COMPANY SNAPSHOT

16.20.2 SERVICE PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 OIA EUROPE

16.21.1 COMPANY SNAPSHOT

16.21.2 SERVICE PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 OMNI LOGISTICS, LLC

16.22.1 COMPANY SNAPSHOT

16.22.2 SERVICE PORTFOLIO

16.22.3 RECENT DEVELOPMENT

16.23 PURACON GMBH

16.23.1 COMPANY SNAPSHOT

16.23.2 SERVICE PORTFOLIO

16.23.3 RECENT DEVELOPMENT

16.24 RHENUS GROUP

16.24.1 COMPANY SNAPSHOT

16.24.2 SERVICE PORTFOLIO

16.24.3 RECENT DEVELOPMENTS

16.25 SEKO

16.25.1 COMPANY SNAPSHOT

16.25.2 SERVICE PORTFOLIO

16.25.3 RECENT DEVELOPMENTS

16.26 TIBA

16.26.1 COMPANY SNAPSHOT

16.26.2 SERVICE PORTFOLIO

16.26.3 RECENT DEVELOPMENTS

16.27 TOLL HOLDINGS LIMITED

16.27.1 COMPANY SNAPSHOT

16.27.2 SERVICE PORTFOLIO

16.27.3 RECENT DEVELOPMENTS

16.28 WAREHOUSE ANYWHERE

16.28.1 COMPANY SNAPSHOT

16.28.2 SERVICE PORTFOLIO

16.28.3 RECENT DEVELOPMENTS

16.29 XPO, INC.

16.29.1 COMPANY SNAPSHOT

16.29.2 REVENUE ANALYSIS

16.29.3 SERVICE PORTFOLIO

16.29.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 2 EUROPE SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 3 EUROPE SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 4 EUROPE LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 5 EUROPE COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 6 EUROPE STORAGE AND WAREHOUSE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 7 EUROPE STORAGE AND WAREHOUSE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 8 EUROPE PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 9 EUROPE HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 10 EUROPE HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 11 EUROPE SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 12 EUROPE SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 13 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 14 EUROPE SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 15 EUROPE SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 16 EUROPE COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 17 EUROPE AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 18 EUROPE AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 19 EUROPE COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 20 EUROPE OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 21 EUROPE OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 22 EUROPE COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 23 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 24 EUROPE AMBIENT IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 25 EUROPE CHILLED/REFRIGERATED IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 26 EUROPE FROZEN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 27 EUROPE OTHERS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 28 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 29 EUROPE DIAGNOSTIC DEVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 30 EUROPE THERAPEUTIC DEVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 31 EUROPE MONITORING DEVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 32 EUROPE SURGICAL DEVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 33 EUROPE OTHERS DEVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 34 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY END USE, 2022-2031 (USD THOUSAND)

TABLE 35 EUROPE HOSPITALS & CLINICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 36 EUROPE MEDICAL DEVICES COMPANIES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 37 EUROPE ACADEMIC & RESEARCH INSTITUTES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 38 EUROPE REFERENCE & DIAGNOSTIC LABORATORIES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 39 EUROPE EMERGENCY MEDICAL SERVICES COMPANIES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 40 EUROPE OTHERS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 41 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY END USE, 2022-2031 (USD THOUSAND)

TABLE 42 EUROPE CONVENTIONAL LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 43 EUROPE THIRD PARTY IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 44 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 45 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 46 EUROPE SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 47 EUROPE LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 48 EUROPE COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 49 EUROPE STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 50 EUROPE STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 51 EUROPE PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 52 EUROPE HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 53 EUROPE SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 54 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 55 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 56 EUROPE SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 57 EUROPE COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 58 EUROPE AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 59 EUROPE COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 60 EUROPE OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 61 EUROPE COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 62 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 63 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 64 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 65 GERMANY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 66 GERMANY SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 67 GERMANY LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 68 GERMANY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 69 GERMANY STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 70 GERMANY STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 71 GERMANY PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 72 GERMANY HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 73 GERMANY SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 74 GERMANY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 75 GERMANY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 76 GERMANY SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 77 GERMANY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 78 GERMANY AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 79 GERMANY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 80 GERMANY OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 81 GERMANY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 82 GERMANY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 83 GERMANY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 84 GERMANY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 85 U.K. MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 86 U.K. SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 87 U.K. LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 88 U.K. COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 89 U.K. STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 90 U.K. STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 91 U.K. PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 92 U.K. HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 93 U.K. SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 94 U.K. MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 95 U.K. MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 96 U.K. SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 97 U.K. COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 98 U.K. AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 99 U.K. COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 100 U.K. OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 101 U.K. COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 102 U.K. MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 103 U.K. MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 104 U.K. MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 105 FRANCE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 106 FRANCE SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 107 FRANCE LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 108 FRANCE COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 109 FRANCE STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 110 FRANCE STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 111 FRANCE PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 112 FRANCE HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 113 FRANCE SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 114 FRANCE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 115 FRANCE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 116 FRANCE SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 117 FRANCE COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 118 FRANCE AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 119 FRANCE COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 120 FRANCE OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 121 FRANCE COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 122 FRANCE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 123 FRANCE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 124 FRANCE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 125 ITALY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 126 ITALY SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 127 ITALY LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 128 ITALY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 129 ITALY STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 130 ITALY STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 131 ITALY PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 132 ITALY HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 133 ITALY SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 134 ITALY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 135 ITALY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 136 ITALY SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 137 ITALY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 138 ITALY AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 139 ITALY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 140 ITALY OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 141 ITALY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 142 ITALY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 143 ITALY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 144 ITALY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 145 SPAIN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 146 SPAIN SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 147 SPAIN LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 148 SPAIN COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 149 SPAIN STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 150 SPAIN STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 151 SPAIN PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 152 SPAIN HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 153 SPAIN SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 154 SPAIN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 155 SPAIN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 156 SPAIN SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 157 SPAIN COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 158 SPAIN AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 159 SPAIN COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 160 SPAIN OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 161 SPAIN COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 162 SPAIN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 163 SPAIN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 164 SPAIN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 165 SWITZERLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 166 SWITZERLAND SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 167 SWITZERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 168 SWITZERLAND COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 169 SWITZERLAND STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 170 SWITZERLAND STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 171 SWITZERLAND PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 172 SWITZERLAND HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 173 SWITZERLAND SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 174 SWITZERLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 175 SWITZERLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 176 SWITZERLAND SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 177 SWITZERLAND COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 178 SWITZERLAND AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 179 SWITZERLAND COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 180 SWITZERLAND OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 181 SWITZERLAND COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 182 SWITZERLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 183 SWITZERLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 184 SWITZERLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 185 NETHERLANDS MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 186 NETHERLANDS SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 187 NETHERLANDS LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 188 NETHERLANDS COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 189 NETHERLANDS STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 190 NETHERLANDS STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 191 NETHERLANDS PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 192 NETHERLANDS HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 193 NETHERLANDS SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 194 NETHERLANDS MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 195 NETHERLANDS MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 196 NETHERLANDS SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 197 NETHERLANDS COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 198 NETHERLANDS AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 199 NETHERLANDS COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 200 NETHERLANDS OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 201 NETHERLANDS COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 202 NETHERLANDS MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 203 NETHERLANDS MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 204 NETHERLANDS MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 205 RUSSIA MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 206 RUSSIA SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 207 RUSSIA LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 208 RUSSIA COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 209 RUSSIA STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 210 RUSSIA STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 211 RUSSIA PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 212 RUSSIA HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 213 RUSSIA SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 214 RUSSIA MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 215 RUSSIA MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 216 RUSSIA SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 217 RUSSIA COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 218 RUSSIA AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 219 RUSSIA COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 220 RUSSIA OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 221 RUSSIA COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 222 RUSSIA MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 223 RUSSIA MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 224 RUSSIA MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 225 BELGIUM MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 226 BELGIUM SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 227 BELGIUM LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 228 BELGIUM COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 229 BELGIUM STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 230 BELGIUM STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 231 BELGIUM PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 232 BELGIUM HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 233 BELGIUM SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 234 BELGIUM MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 235 BELGIUM MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 236 BELGIUM SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 237 BELGIUM COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 238 BELGIUM AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 239 BELGIUM COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 240 BELGIUM OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 241 BELGIUM COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 242 BELGIUM MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 243 BELGIUM MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 244 BELGIUM MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 245 FINLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 246 FINLAND SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 247 FINLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 248 FINLAND COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 249 FINLAND STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 250 FINLAND STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 251 FINLAND PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 252 FINLAND HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 253 FINLAND SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 254 FINLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 255 FINLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 256 FINLAND SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 257 FINLAND COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 258 FINLAND AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 259 FINLAND COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 260 FINLAND OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 261 FINLAND COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 262 FINLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 263 FINLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 264 FINLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 265 DENMARK MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 266 DENMARK SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 267 DENMARK LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 268 DENMARK COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 269 DENMARK STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 270 DENMARK STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 271 DENMARK PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 272 DENMARK HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 273 DENMARK SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 274 DENMARK MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 275 DENMARK MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 276 DENMARK SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 277 DENMARK COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 278 DENMARK AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 279 DENMARK COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 280 DENMARK OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 281 DENMARK COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 282 DENMARK MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 283 DENMARK MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 284 DENMARK MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 285 POLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 286 POLAND SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 287 POLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 288 POLAND COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 289 POLAND STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 290 POLAND STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 291 POLAND PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 292 POLAND HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 293 POLAND SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 294 POLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 295 POLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 296 POLAND SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 297 POLAND COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 298 POLAND AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 299 POLAND COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 300 POLAND OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 301 POLAND COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 302 POLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 303 POLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 304 POLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 305 NORWAY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 306 NORWAY SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 307 NORWAY LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 308 NORWAY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 309 NORWAY STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 310 NORWAY STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 311 NORWAY PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 312 NORWAY HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 313 NORWAY SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 314 NORWAY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 315 NORWAY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 316 NORWAY SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 317 NORWAY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 318 NORWAY AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 319 NORWAY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 320 NORWAY OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 321 NORWAY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 322 NORWAY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 323 NORWAY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 324 NORWAY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 325 HUNGARY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 326 HUNGARY SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 327 HUNGARY LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 328 HUNGARY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 329 HUNGARY STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 330 HUNGARY STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 331 HUNGARY PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 332 HUNGARY HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 333 HUNGARY SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 334 HUNGARY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 335 HUNGARY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 336 HUNGARY SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 337 HUNGARY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 338 HUNGARY AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 339 HUNGARY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 340 HUNGARY OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 341 HUNGARY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 342 HUNGARY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 343 HUNGARY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 344 HUNGARY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 345 SWEDEN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 346 SWEDEN SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 347 SWEDEN LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 348 SWEDEN COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 349 SWEDEN STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 350 SWEDEN STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 351 SWEDEN PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 352 SWEDEN HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 353 SWEDEN SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 354 SWEDEN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 355 SWEDEN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 356 SWEDEN SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 357 SWEDEN COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 358 SWEDEN AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 359 SWEDEN COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 360 SWEDEN OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 361 SWEDEN COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 362 SWEDEN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 363 SWEDEN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 364 SWEDEN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 365 REST OF EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

Liste des figures

FIGURE 1 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET

FIGURE 2 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: DROC ANALYSIS

FIGURE 4 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: MULTIVARIATE MODELLING

FIGURE 7 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: MARKET END USE COVERAGE GRID

FIGURE 10 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: SEGMENTATION

FIGURE 12 STRATEGIC DECISIONS