Europe Lipid Market

Taille du marché en milliards USD

TCAC :

%

USD

3,392.06 Million

USD

6,708.58 Million

2021

2029

USD

3,392.06 Million

USD

6,708.58 Million

2021

2029

| 2022 –2029 | |

| USD 3,392.06 Million | |

| USD 6,708.58 Million | |

|

|

|

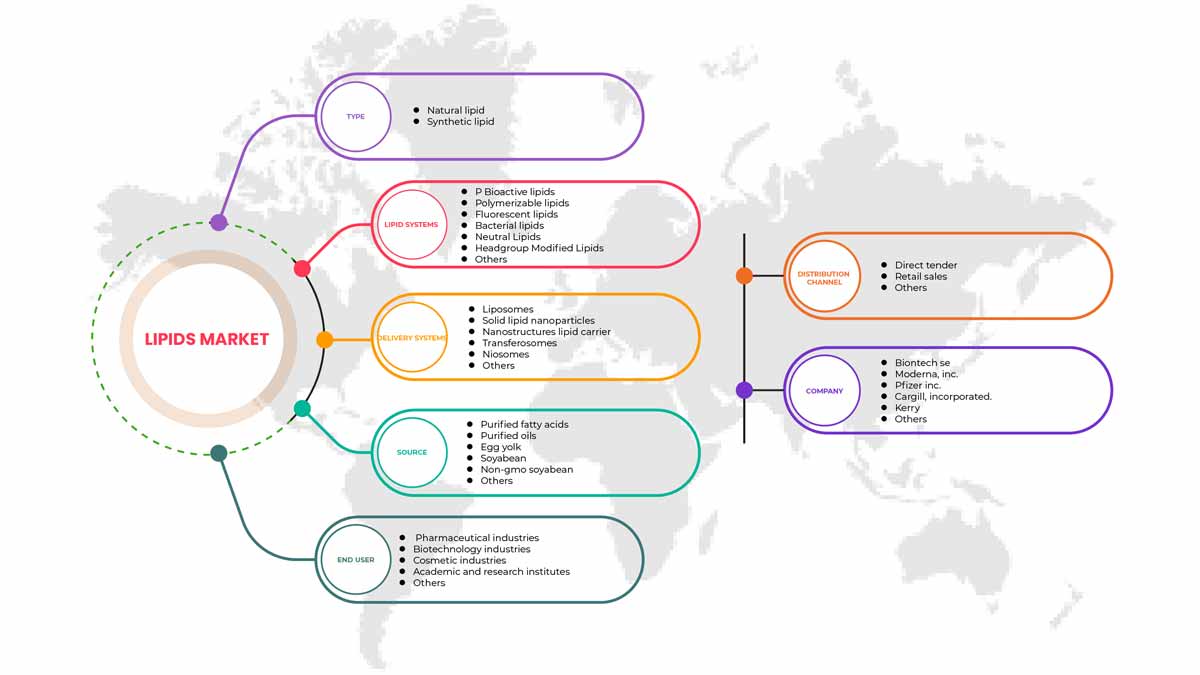

Marché européen des lipides, par type (lipides naturels et lipides synthétiques), système lipidique (lipides neutres, lipides bactériens, lipides fluorescents, lipides bioactifs, lipides polymérisables, lipides modifiés par groupe de tête et autres), système de distribution (lipides, nanoparticules lipidiques solides , transporteurs lipidiques nanostructurés, niosomes, transférosomes et autres), source (jaune d'œuf, soja, soja non OGM, huiles purifiées, acides gras purifiés et autres), utilisateur final (industries pharmaceutiques, industries biotechnologiques, instituts universitaires et de recherche, industries cosmétiques et autres), canal de distribution (appel d'offres direct, ventes au détail et autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

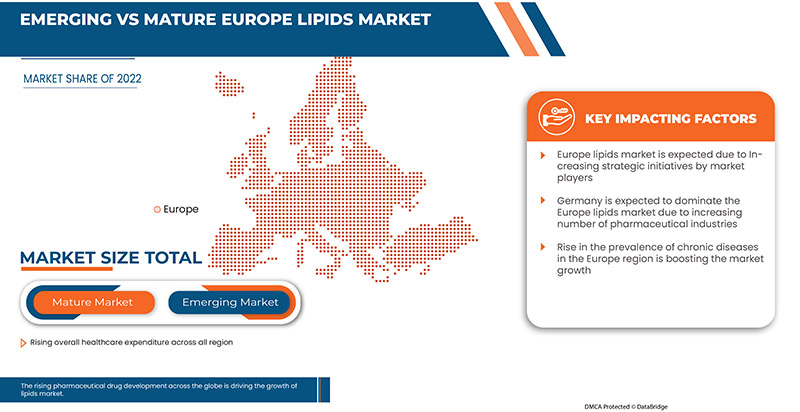

Analyse et perspectives du marché des lipides en Europe

La prévalence croissante des maladies chroniques à l'échelle mondiale a accru la demande du marché. L'augmentation des dépenses de santé pour de meilleurs services de santé contribue également à la croissance du marché. Les principaux acteurs du marché se concentrent fortement sur divers lancements de produits et approbations de médicaments au cours de cette période cruciale. En outre, la demande croissante de lipides dans diverses autres industries telles que l'industrie alimentaire et des boissons, l'industrie cosmétique et d'autres, contribue également à la demande croissante du marché des lipides.

L'augmentation des dépenses de santé et les initiatives stratégiques des acteurs du marché offrent des opportunités au marché. Cependant, les différents défis de fabrication pour la production de nanoparticules lipidiques et le manque d'établissements de santé dans les économies émergentes constituent des défis majeurs pour la croissance du marché.

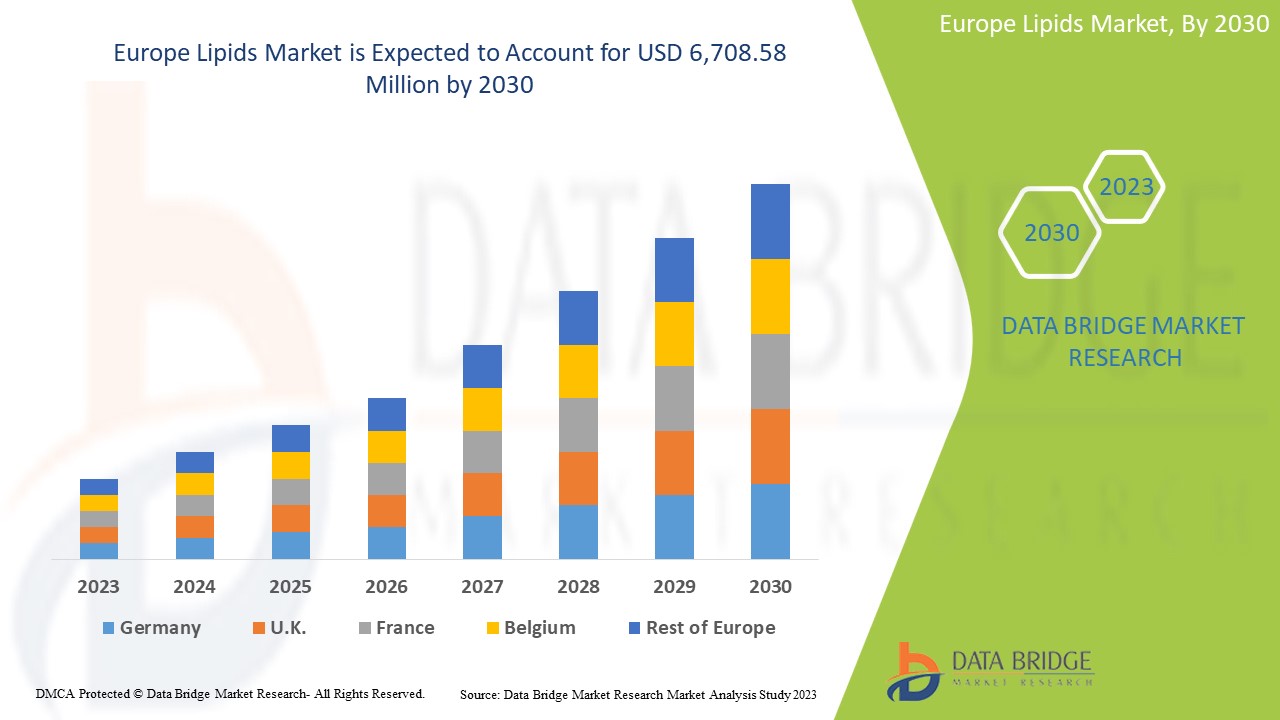

Le marché européen des lipides devrait connaître une croissance du marché au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 8,9 % au cours de la période de prévision de 2023 à 2030 et devrait atteindre 6 708,58 millions USD d'ici 2030 contre 3 392,06 millions USD en 2022.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable pour 2020-2015) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par type (lipides naturels et lipides synthétiques), système lipidique (lipides neutres, lipides bactériens, lipides fluorescents, lipides bioactifs, lipides polymérisables, lipides modifiés par groupe de tête et autres), système de distribution (liposomes, nanoparticules lipidiques solides , transporteurs lipidiques nanostructurés, niosomes, transférosomes et autres), source (jaune d'œuf, soja, soja non OGM, huiles purifiées, acides gras purifiés et autres), utilisateur final (industries pharmaceutiques, industries biotechnologiques, instituts universitaires et de recherche, industries cosmétiques et autres), canal de distribution (appel d'offres direct, ventes au détail et autres) |

|

Pays couverts |

Allemagne, France, Royaume-Uni, Italie, Espagne, Pays-Bas, Russie, Belgique, Suisse, Turquie et reste de l'Europe. |

|

Acteurs du marché couverts |

Alnylam Pharmaceutical, Inc., Croda International Plc., Moderna Inc., BioNTech SE., Pfizer Inc., Evonik Industries AG, Lipoid GmbH, Matreya LLC, VAV Life Sciences Pvt Ltd., Curia Europe Inc., Cargill, Incorporated, Gattefossé, CD Bioparticles, Merck KGaA, NOF EUROPE GmbH, ABITEC, Cayman Chemical, CordenPharma International, CHEMI SpA, DSM, BASF SE, Tokyo Chemical Industry Co., Ltd., ADMSIO, Stepan Company et Kerry |

Définition du marché

Les lipides peuvent être définis comme un groupe de composés organiques présents dans les animaux, les plantes et les micro-organismes. Ils comprennent les stérols, les cires, les graisses et les vitamines liposolubles. Les lipides ont la capacité d'exécuter diverses activités. En même temps, ils sont connus pour avoir de faibles niveaux de toxicité. Ces qualités des lipides contribuent à l'administration efficace des médicaments. Par conséquent, ils sont de plus en plus utilisés comme excipients dans la production de médicaments. Ce facteur alimente la croissance du marché européen des lipides pharmaceutiques.

Ces derniers temps, le secteur mondial de la santé connaît des changements considérables. Le développement des technologies d'administration de médicaments ainsi que l'intégration de formulaires de médicaments sont des moteurs de la croissance du marché des lipides pharmaceutiques. La croissance des problèmes de santé chroniques rapides et l'administration rapide de médicaments au patient sont l'un des facteurs clés de la croissance du marché européen des lipides pharmaceutiques.

Dynamique du marché des lipides

Conducteurs

-

Augmentation de la prévalence des maladies chroniques

Le nombre de maladies chroniques augmente rapidement dans le monde entier. Selon l'OMS (Organisation mondiale de la santé), en 2021, la contribution des maladies chroniques était d'environ 60 %, ce qui représentait le nombre de décès. Dans la plupart des pays occidentaux, la principale raison de l'augmentation du nombre de maladies chroniques est l'augmentation continue de la population âgée. L'augmentation du nombre de maladies chroniques telles que les maladies cardiovasculaires, les troubles neurologiques et diverses autres maladies chroniques a entraîné une augmentation de la demande de divers médicaments qui stimuleront la croissance du marché européen des lipides dans les années à venir.

-

Demande croissante de lipides dans l'industrie alimentaire et des boissons ainsi que dans l'industrie cosmétique

La demande en lipides dans les produits pharmaceutiques est très élevée, car ils sont utilisés dans le développement de divers médicaments sur le marché. En outre, la demande en lipides a augmenté dans diverses autres industries, telles que l'industrie agroalimentaire et les produits cosmétiques.

Les lipides sont un ingrédient essentiel dans la formulation de compléments alimentaires en raison de leur teneur élevée en énergie et en vitamines liposolubles. Les préoccupations croissantes des citoyens en matière de santé liées à la COVID-19 ont propulsé la demande européenne de compléments alimentaires. En outre, la disponibilité de compléments alimentaires sous de multiples formes et saveurs les a rendus plus acceptables socialement pour tous les groupes d'âge. La consommation croissante de compléments alimentaires devrait stimuler la demande de lipides au cours des années prévues.

-

Augmentation du développement de médicaments

Dans l'industrie pharmaceutique, les lipides et les polymères sont considérés comme des excipients essentiels pour la formulation de divers médicaments. Ils sont utilisés comme stabilisants, solubilisants, activateurs de perméation et agents de transfection. L'adoption croissante d'une large gamme de lipides et de polymères naturels, synthétiques, semi-synthétiques ou entièrement artificiels dans la formulation de diverses formes posologiques devrait stimuler le marché au cours de la période de prévision.

Opportunités

-

Hausse des dépenses de santé

Les dépenses de santé ont augmenté dans le monde entier à mesure que le revenu disponible des citoyens de divers pays augmentait. De plus, pour répondre aux besoins de la population, les organismes gouvernementaux et les organisations de santé prennent des initiatives pour accélérer les dépenses de santé. L'augmentation des dépenses de santé aide simultanément les établissements de santé à améliorer leurs installations de traitement pour diverses maladies qui sont très répandues ces dernières années.

-

Initiatives stratégiques des principaux acteurs

L’augmentation des taux de divers types de maladies et de leur gravité est largement observée dans le monde entier. L’augmentation spectaculaire de la qualité de la recherche et des opportunités de recherche est due à diverses initiatives stratégiques prises par les acteurs du marché. Ils prennent des initiatives telles que le lancement de produits, des collaborations, des fusions, des acquisitions et bien d’autres au fil des ans et devraient être à la pointe et créer davantage d’opportunités sur le marché. Evonik a investi dans la croissance à court terme de sa production de lipides spécialisés sur ses sites de Hanau et de Dossenheim en Allemagne, qui ont fourni deux des quatre lipides du vaccin Pfizer/BioNTech. Selon Spencer, les premiers lots ont été livrés à BioNTech en avril 2021, des mois avant la date prévue.

Contraintes/Défis

- Coût élevé de la synthèse des lipides et augmentation du coût des matières premières

Le développement de médicaments à base de lipides est très coûteux. Le concept doit être défini, les matériaux doivent être trouvés et il est important de tenir compte des délais de mise au point. De plus, le processus prend du temps car le médicament a besoin de suffisamment de temps pour réaliser tous les essais cliniques avant d'être commercialisé.

De plus, tout changement devant être revérifié aura un impact sur le temps. Les progrès croissants dans les formats d'analyse des biocapteurs et d'autres technologies complémentaires ont exigé un investissement efficace pour des opérations réussies et un plan de gestion des risques du projet. La mise en place de R&D pour mener des recherches entraîne des coûts élevés, conduisant à des médicaments coûteux. Ainsi, ce facteur constitue un frein majeur pour le marché européen des lipides.

- Différents défis de fabrication pour la production de nanoparticules lipidiques

Les nanoparticules lipidiques ont eu un impact majeur sur l'industrie pharmaceutique. À la base, les nanoparticules lipidiques (LNP) sont des vecteurs qui protègent les acides nucléiques. En tant que partie intégrante des récents vaccins à ARNm, elles sont injectées et transportées vers le site prévu dans la cellule. Malgré les nombreux avantages des nanoparticules lipidiques en tant que systèmes de distribution, l'industrie pharmaceutique doit relever des défis de fabrication importants.

Ces défis incluent :

- Taille/distributions granulométriques contrôlées avec précision

- Problèmes de stérilisation

- Répétabilité et évolutivité des processus

- Exigences réglementaires (telles que les réglementations cGMP)

Impact post-COVID-19 sur le marché des lipides

Le COVID-19 a eu un impact positif sur le marché. La demande de vaccin contre le COVID-19 était très forte et le point positif ici est que les lipides sont principalement utilisés dans la production de vaccins. Ainsi, le COVID-19 a eu un impact positif sur le marché des lipides.

Développements récents

- En novembre 2022, BioNTech SE a annoncé que sa filiale singapourienne BioNTech Pharmaceuticals Asia Pacific Pte. Ltd. avait conclu un accord avec Novartis Singapore Pharmaceutical Manufacturing Pte. Ltd. pour acquérir l'une de ses installations de fabrication certifiées GMP. Cette acquisition fait partie de la stratégie d'expansion de BioNTech visant à renforcer sa présence européenne en Asie.

- En septembre 2021, le fournisseur américain d'ingrédients ABITEC Corporation a signé un accord modifié avec DKSH pour distribuer ses lipides de spécialité sur de nouveaux marchés et dans de nouvelles régions d'Europe. Cela a aidé l'entreprise à développer ses activités dans diverses régions.

Portée du marché européen des lipides

Le marché européen des lipides est segmenté en types, systèmes lipidiques, systèmes de distribution, source, utilisateur final et canal de distribution. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Taper

- Lipides naturels

- Lipides synthétiques

Sur la base du type, le marché européen des lipides est segmenté en lipides naturels et lipides synthétiques.

Systèmes lipidiques

- Lipides bioactifs

- Lipides polymérisables

- Lipides fluorescents

- Lipides bactériens

- Lipides neutres

- Lipides modifiés par groupe de tête

- Autres

Sur la base des systèmes lipidiques, le marché européen des lipides est segmenté en lipides neutres, lipides bactériens, lipides fluorescents, lipides bioactifs, lipides polymérisables, lipides modifiés par groupe de tête et autres.

Systèmes de livraison

- Liposomes

- Nanoparticules lipidiques solides

- Nanostructures transporteuses de lipides

- Transférosomes

- Niosomes

- Autres

Sur la base des systèmes de distribution, le marché européen des lipides est segmenté en liposomes, nanoparticules lipidiques solides, nanostructures porteuses de lipides, niosomes, transférosomes et autres.

Source

- Acides gras purifiés

- Huiles purifiées

- Jaune d'oeuf

- Soja

- Soja sans OGM

- Autres

En fonction de la source, le marché européen des lipides est segmenté en jaune d’œuf, soja, soja non OGM, huiles purifiées, acides gras purifiés et autres.

Utilisateur final

- Industries pharmaceutiques

- Industries de la biotechnologie

- Industrie cosmétique

- Instituts universitaires et de recherche

- Autres

En fonction de l’utilisateur final, le marché européen des lipides est segmenté en industries pharmaceutiques, industries biotechnologiques, instituts universitaires et de recherche, industries cosmétiques et autres.

Canal de distribution

- Appel d'offres direct

- Ventes au détail

- Autres

En fonction du canal de distribution, le marché européen des lipides est segmenté en appels d'offres directs, ventes au détail et autres.

Analyse/perspectives régionales du marché des lipides

Le marché des lipides est analysé et des informations sur la taille et les tendances du marché sont fournies par pays, type, systèmes lipidiques, systèmes de distribution, source, utilisateur final et canal de distribution.

Les pays couverts par le marché des lipides sont l'Allemagne, la France, le Royaume-Uni, l'Italie, l'Espagne, les Pays-Bas, la Russie, la Belgique, la Suisse, la Turquie et le reste de l'Europe. L'Allemagne domine le marketing des lipides en termes de part de marché et de chiffre d'affaires et continuera à accroître sa domination au cours de la période de prévision.

L'Allemagne devrait connaître une croissance en raison de l'augmentation des maladies chroniques due à la forte demande de médicaments pharmaceutiques et à la demande croissante de lipides dans différentes industries qui devraient stimuler le marché régional au cours de la période prévue.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques d'Asie-Pacifique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données par pays.

Analyse du paysage concurrentiel et des parts de marché des lipides

Le paysage concurrentiel du marché des lipides fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Europe, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises sur le marché des lipides.

Certains des principaux acteurs opérant sur le marché des lipides sont Alnylam Pharmaceutical, Inc., Croda International Plc., Moderna Inc., BioNTech SE., Pfizer Inc., Evonik Industries AG, Lipoid GmbH, Matreya LLC, VAV Life Sciences Pvt Ltd., Curia Europe Inc., Cargill, Incorporated, Gattefossé, CD Bioparticles, Merck KGaA, NOF EUROPE GmbH, ABITEC, Cayman Chemical, CordenPharma International, CHEMI SpA, DSM, BASF SE, Tokyo Chemical Industry Co., Ltd., ADMSIO, Stepan Company et Kerry, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE LIPIDS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

4.3 MERGER AND ACQUISITION, EUROPE LIPIDS MARKET

4.4 PATENT ANALYSIS, EUROPE LIPIDS MARKET

4.5 DRUG TREATMENT RATE BY MATURED MARKETS

4.6 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATE

4.7 KEY PRICING STRATEGIES

4.8 KEY PATIENT ENROLLMENT STRATEGIES

4.9 PRICE ANALYSIS, EUROPE LIPIDS MARKET

4.1 EUROPE LIPIDS MARKET, CLINICAL TRIALS

4.11 EUROPE LIPIDS MARKET, DISTRIBUTION OF PRODUCTS BY PHASE

4.12 EUROPE LIPIDS MARKET, PIPELINE ANALYSIS

4.13 PHASE I CANDIDATES

4.14 PHASE I/II CANDIDATES

4.15 PHASE II CANDIDATES

4.16 PHASE III CANDIDATES

5 EUROPE LIPIDS MARKET, REGULATORY FRAMEWORK

5.1 REGULATION IN THE U.S.:

5.2 REGULATION IN EUROPE:

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASE IN THE PREVALENCE OF CHRONIC DISEASES

6.1.2 RISE IN DEMAND FOR LIPIDS IN FOOD AND BEVERAGE AS WELL AS THE COSMETIC INDUSTRY

6.1.3 INCREASE IN DRUG DEVELOPMENT

6.2 RESTRAINTS

6.2.1 HIGH COST OF LIPID SYNTHESIS AND INCREASING COST OF RAW MATERIALS

6.2.2 STRICT GOVERNMENT REGULATIONS

6.3 OPPORTUNITIES

6.3.1 RISE IN HEALTHCARE EXPENDITURE

6.3.2 STRATEGIC INITIATIVES BY MARKET PLAYERS

6.4 CHALLENGES

6.4.1 DIFFERENT MANUFACTURING CHALLENGES FOR LIPID NANOPARTICLE PRODUCTION

6.4.2 LACK OF HEALTHCARE FACILITIES IN EMERGING ECONOMIES

7 EUROPE LIPIDS MARKET, BY TYPE

7.1 OVERVIEW

7.2 NATURAL LIPID

7.2.1 UNSATURATED PHOSPHOLIPID

7.2.2 HYDROGENATED PHOSPHOLIPID

7.2.3 SPHINGOMYELIN

7.2.4 GLYCEROLPHOSPHOCHOLINE

7.3 SYNTHETIC LIPID

7.3.1 PEGYLATED PHOSPHOLIPIDS

7.3.2 PHOSPHATIDYLSERINE

7.3.3 PHOSPHATIDYGLYCEROLS

7.3.4 PHOSPHATIDYLETHANOLAMINE

7.3.5 PHOSPHATIDYLCHOLINE

7.3.6 PHOSPHATIDIC ACIDS

8 EUROPE LIPIDS MARKET, BY LIPID SYSTEMS

8.1 OVERVIEW

8.2 BIOACTIVE LIPIDS

8.2.1 PLANT LIPIDS

8.2.2 LIPID ACTIVATORS

8.2.3 LIPID INHIBITORS

8.2.4 AGONISTS

8.2.5 BIOACTIVE CERAMIDES

8.2.6 ACYL CARNITINE LIPIDS

8.2.7 ENDOCANNABINOIDS

8.2.8 LIPO-NUCLEOTIDES

8.2.9 LYSYL-PHOSPHATIDYLGLYCEROL

8.2.10 DIACYLGLYCEROL PYROPHOSPHATE (DGPP)

8.3 POLYMERIZABLE LIPIDS

8.3.1 FUNCTIONAL PEG LIPIDS

8.3.2 MPEG STEROLS

8.3.3 MPEG CERAMIDES

8.3.4 MPEG PHOSPHOLIPIDS

8.3.5 MPEG GLYCERIDES

8.4 FLUORESCENT LIPIDS

8.4.1 FLUORESCENT SPHINGOLIPIDS

8.4.2 FLUORESCENT GLYCEROLIPIDS

8.4.3 FLUORESCENT PEG LIPIDS

8.4.4 FLUORESCENT PHOSPHOLIPIDS

8.4.5 FLUORESCENT STEROLS

8.4.6 OTHERS

8.5 BACTERIAL LIPIDS

8.5.1 MYCOLIC LIPIDS

8.5.2 N-ACYLHOMOSERINE LIPIDS

8.5.3 BRANCHED LIPIDS

8.5.4 CYCLOPROPYL LIPIDS

8.6 NEUTRAL LIPIDS

8.6.1 PRENOLS

8.6.2 VERY LONG CHAIN FATTY ACIDS

8.6.3 GLYCERIDES

8.6.4 EICSANOIDS

8.6.5 OXYGENATED FATTY ACIDS

8.6.6 GLYCOSYLATED DIACYL GLYCEROLS

8.6.7 PROSTAGLANDINS

8.7 HEADGROUP MODIFIED LIPIDS

8.7.1 FUNCTIONAL LIPIDS

8.7.2 ANTIGENIC LIPIDS

8.7.3 GLYCOSYLATED LIPIDS

8.7.4 CHELATORS

8.7.5 ADHESIVE LIPIDS

8.7.6 SNAP-TAG REACTING LIPIDS

8.7.7 ALKYL PHOSPHATES

8.8 OTHERS

9 EUROPE LIPIDS MARKET, BY DELIVERY SYSTEMS

9.1 OVERVIEW

9.2 LIPOSOMES

9.2.1 LIPOSOMES FOR DNA/RNA

9.2.1.1 DOTAP LIPOSOMES FOR DNA/RNA DELIVERY

9.2.1.2 DDAB LIPOSOMES FOR DNA/RNA DELIVERY

9.2.1.3 GL-67 LIPOSOMES FOR DNA/RNA DELIVERY

9.2.1.4 DC-CHOLESTEROL LIPOSOMES FOR DNA/RNA DELIVERY

9.2.1.5 DOTMA LIPOSOMES FOR DNA/RNA DELIVERY

9.2.1.6 DODAP LIPOSOMES FOR DNA/RNA DELIVERY

9.2.2 REACTIVE LIPOSOMES

9.2.2.1 SUCCINYL LIPOSOMES

9.2.2.2 DBCO LIPOSOMES

9.2.2.3 BIOTINYLATED LIPOSOMES

9.2.2.4 CARBOXYLIC ACID LIPOSOMES

9.2.2.5 AMINE LIPOSOMES

9.2.2.6 CYANUR LIPOSOMES

9.2.2.7 AZIDE LIPOSOMES

9.2.2.8 FOLATE LIPOSOMES

9.2.2.9 DODECANYL LIPOSOMES

9.2.2.10 NI REACTIVE LIPOSOMES

9.2.2.11 PDP LIPOSOMES

9.2.2.12 GLUTARYL LIPOSOMES

9.2.2.13 OTHERS

9.2.3 DRUG LOADED LIPOSOMES

9.2.4 PLAIN LIPOSOMES

9.2.4.1 CARDIOLIPIN LIPIDS LIPOSOMES

9.2.4.2 DOTAP LIPOSOMES

9.2.4.3 PHOSPHATIDYLSERINE LIPOSOMES

9.2.4.4 PHOSPHATIDYLCHOLINE LIPOSOMES

9.2.4.5 PHOSPHATIDYL GLYCEROL LIPOSOMES

9.2.4.6 OTHERS

9.3 SOLID LIPID NANOPARTICLES

9.4 NANOSTRUCTURES LIPID CARRIER

9.5 TRANSFEROSOMES

9.6 NIOSOMES

9.7 OTHERS

10 EUROPE LIPIDS MARKET, BY SOURCE

10.1 OVERVIEW

10.2 PURIFIED FATTY ACIDS

10.3 PURIFIED OILS

10.4 EGG YOLK

10.5 SOYABEAN

10.6 NON-GMO SOYABEAN

10.7 OTHERS

11 EUROPE LIPIDS MARKET, BY END USER

11.1 OVERVIEW

11.2 PHARMACEUTICAL INDUSTRIES

11.3 BIOTECHNOLOGY INDUSTRIES

11.4 COSMETIC INDUSTRIES

11.5 ACADEMIC AND RESEARCH INSTITUTES

11.6 OTHERS

12 EUROPE LIPIDS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDER

12.3 RETAIL SALES

12.4 OTHERS

13 EUROPE LIPIDS MARKET, BY REGION

13.1 EUROPE

13.1.1 GERMANY

13.1.2 U.K.

13.1.3 ITALY

13.1.4 SPAIN

13.1.5 FRANCE

13.1.6 SWITZERLAND

13.1.7 BELGIUM

13.1.8 NETHERLANDS

13.1.9 RUSSIA

13.1.10 TURKEY

13.1.11 REST OF EUROPE

14 EUROPE LIPIDS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: EUROPE

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 BIONTECH SE.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 MODERNA, INC.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 PFIZER INC.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 CARGILL, INCORPORATED.

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 KERRY.

16.5.1 COMPANY SNAPSHOT

16.5.2 COMPANY SHARE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENTS

16.6 ABITEC

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 ADMSIO

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 ALNYLAM PHARMACEUTICALS, INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENT

16.9 BASF SE

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENTS

16.1 CAYMAN CHEMICAL

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 CD BIOPARTCLES.

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 CHEMI S.P.A.

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENTS

16.13 CORDENPHARMA INTERNATIONAL

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 CRODA INTERNATIONAL PLC.

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 CURIA EUROPE, INC.

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 DSM

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 EVONIK INDUSTRIES AG

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 GATTEFOSSÉ

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 LIPOID GMBH

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 MATREYA, LLC

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

16.21 MERCK KGAA

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENTS

16.22 NOF EUROPE GMBH

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENTS

16.23 STEPAN COMPANY

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENTS

16.24 TOKYO CHEMICAL INDUSTRY CO., LTD.

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENTS

16.25 VAV LIFE SCIENCES PVT LTD

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 ASP FOR MAJOR DRUGS IN LIPIDS MARKET (PRICE IN USD)

TABLE 2 LIPID BASED NANO PARTICLE FOR COVID-19 VACCINES

TABLE 3 LIPID BASED NANO PARTICLE FOR CANCER VACCINES

TABLE 4 RNA ENCAPSULATED LIPID NANOPARTICLES

TABLE 5 LIPOSOMAL FORMULATIONS

TABLE 6 LIPID BASED NANO PARTICLE FOR COVID VACCINES

TABLE 7 LIPOSOMAL FORMULATION

TABLE 8 LIPID BASED NANO PARTICLE FOR CANCER VACCINES

TABLE 9 RNA ENCAPSULATED LIPID NANOPARTICLES

TABLE 10 LIPOSOME FORMULATIONS

TABLE 11 LIPID BASED NANO PARTICLE FOR COVID VACCINES

TABLE 12 LIPID BASED NANO PARTICLE FOR CANCER VACCINES

TABLE 13 LIPOSOMAL FORMULATION

TABLE 14 EUROPE LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 EUROPE NATURAL LIPID IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 EUROPE NATURAL LIPIDS IN LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 17 EUROPE SYNTHETIC LIPID IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 EUROPE SYNTHETIC LIPIDS IN LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 19 EUROPE LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 20 EUROPE BIOACTIVE LIPIDS IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 EUROPE BIOACTIVE LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 22 EUROPE POLYMERIZABLE LIPIDS IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 EUROPE POLYMERIZABLE LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 24 EUROPE FLUORESCENT LIPIDS IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 EUROPE FLUORESCENT LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 26 EUROPE BACTERIAL LIPIDS IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 EUROPE BACTERIAL LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 28 EUROPE NEUTRAL LIPIDS IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 EUROPE NEUTRAL LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 30 EUROPE HEADGROUP MODIFIED LIPIDS IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 EUROPE HEADGROUP MODIFIED LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 32 EUROPE OTHERS IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 EUROPE LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 34 EUROPE LIPOSOMES IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 35 EUROPE LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 36 EUROPE LIPOSOMES FOR DNA/RNA IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 37 EUROPE REACTIVE LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 38 EUROPE PLAIN LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 39 EUROPE SOLID LIPID NANOPARTICLES IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 40 EUROPE NANOSTRUCTURES LIPID CARRIER IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 41 EUROPE TRANSFEROSOMES IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 42 EUROPE NIOSOMES IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 43 EUROPE OTHERS IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 44 EUROPE LIPIDS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 45 EUROPE PURIFIED FATTY ACIDS IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 46 EUROPE PURIFIED OILS IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 47 EUROPE EGG YOLK IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 48 EUROPE SOYABEAN IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 49 EUROPE NON-GMO SOYABEAN IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 50 EUROPE OTHERS IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 51 EUROPE LIPIDS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 52 EUROPE PHARMACEUTICAL INDUSTRIES IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 53 EUROPE BIOTECHNOLOGY INDUSTRIES IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 54 EUROPE COSMETIC INDUSTRIES IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 55 EUROPE ACADEMIC AND RESEARCH INSTITUTES IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 56 EUROPE OTHERS IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 57 EUROPE LIPIDS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 58 EUROPE DIRECT TENDER IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 59 EUROPE RETAIL SALES IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 60 EUROPE OTHERS IN LIPIDS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 61 EUROPE LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 62 EUROPE NATURAL LIPIDS IN LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 63 EUROPE SYNTHETIC LIPIDS IN LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 64 EUROPE LIPIDS MARKET, BY LIPIDS SYSTEMS, 2021-2030 (USD MILLION)

TABLE 65 EUROPE NEUTRAL LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 66 EUROPE BACTERIAL LIPIDS IN LIPIDS MARKET, BY LIPIDS SYSTEMS, 2021-2030 (USD MILLION)

TABLE 67 EUROPE FLUORESCENT LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 68 EUROPE BIOACTIVE LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 69 EUROPE POLYMERIZABLE LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 70 EUROPE HEADGROUP MODIFIED LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 71 EUROPE LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 72 EUROPE LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 73 EUROPE LIPOSOMES FOR DNA/RNA IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 74 EUROPE REACTIVE LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 75 EUROPE PLAIN LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 76 EUROPE LIPIDS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 77 EUROPE LIPIDS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 78 EUROPE LIPIDS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 79 GERMANY LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 80 GERMANY NATURAL LIPIDS IN LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 81 GERMANY SYNTHETIC LIPIDS IN LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 82 GERMANY LIPIDS MARKET, BY LIPIDS SYSTEMS, 2021-2030 (USD MILLION)

TABLE 83 GERMANY NEUTRAL LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 84 GERMANY BACTERIAL LIPIDS IN LIPIDS MARKET, BY LIPIDS SYSTEMS, 2021-2030 (USD MILLION)

TABLE 85 GERMANY FLUORESCENT LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 86 GERMANY BIOACTIVE LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 87 GERMANY POLYMERIZABLE LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 88 GERMANY HEADGROUP MODIFIED LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 89 GERMANY LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 90 GERMANY LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 91 GERMANY LIPOSOMES FOR DNA/RNA IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 92 GERMANY REACTIVE LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 93 GERMANY PLAIN LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 94 GERMANY LIPIDS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 95 GERMANY LIPIDS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 96 GERMANY LIPIDS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 97 U.K. LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 98 U.K. NATURAL LIPIDS IN LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 U.K. SYNTHETIC LIPIDS IN LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 100 U.K. LIPIDS MARKET, BY LIPIDS SYSTEMS, 2021-2030 (USD MILLION)

TABLE 101 U.K. NEUTRAL LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 102 U.K. BACTERIAL LIPIDS IN LIPIDS MARKET, BY LIPIDS SYSTEMS, 2021-2030 (USD MILLION)

TABLE 103 U.K. FLUORESCENT LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 104 U.K. BIOACTIVE LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 105 U.K. POLYMERIZABLE LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 106 U.K. HEADGROUP MODIFIED LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 107 U.K. LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 108 U.K. LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 109 U.K. LIPOSOMES FOR DNA/RNA IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 110 U.K. REACTIVE LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 111 U.K. PLAIN LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 112 U.K. LIPIDS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 113 U.K. LIPIDS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 114 U.K. LIPIDS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 115 ITALY LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 116 ITALY NATURAL LIPIDS IN LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 117 ITALY SYNTHETIC LIPIDS IN LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 118 ITALY LIPIDS MARKET, BY LIPIDS SYSTEMS, 2021-2030 (USD MILLION)

TABLE 119 ITALY NEUTRAL LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 120 ITALY BACTERIAL LIPIDS IN LIPIDS MARKET, BY LIPIDS SYSTEMS, 2021-2030 (USD MILLION)

TABLE 121 ITALY FLUORESCENT LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 122 ITALY BIOACTIVE LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 123 ITALY POLYMERIZABLE LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 124 ITALY HEADGROUP MODIFIED LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 125 ITALY LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 126 ITALY LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 127 ITALY LIPOSOMES FOR DNA/RNA IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 128 ITALY REACTIVE LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 129 ITALY PLAIN LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 130 ITALY LIPIDS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 131 ITALY LIPIDS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 132 ITALY LIPIDS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 133 SPAIN LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 134 SPAIN NATURAL LIPIDS IN LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 135 SPAIN SYNTHETIC LIPIDS IN LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 136 SPAIN LIPIDS MARKET, BY LIPIDS SYSTEMS, 2021-2030 (USD MILLION)

TABLE 137 SPAIN NEUTRAL LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 138 SPAIN BACTERIAL LIPIDS IN LIPIDS MARKET, BY LIPIDS SYSTEMS, 2021-2030 (USD MILLION)

TABLE 139 SPAIN FLUORESCENT LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 140 SPAIN BIOACTIVE LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 141 SPAIN POLYMERIZABLE LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 142 SPAIN HEADGROUP MODIFIED LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 143 SPAIN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 144 SPAIN LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 145 SPAIN LIPOSOMES FOR DNA/RNA IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 146 SPAIN REACTIVE LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 147 SPAIN PLAIN LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 148 SPAIN LIPIDS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 149 SPAIN LIPIDS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 150 SPAIN LIPIDS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 151 FRANCE LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 152 FRANCE NATURAL LIPIDS IN LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 153 FRANCE SYNTHETIC LIPIDS IN LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 154 FRANCE LIPIDS MARKET, BY LIPIDS SYSTEMS, 2021-2030 (USD MILLION)

TABLE 155 FRANCE NEUTRAL LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 156 FRANCE BACTERIAL LIPIDS IN LIPIDS MARKET, BY LIPIDS SYSTEMS, 2021-2030 (USD MILLION)

TABLE 157 FRANCE FLUORESCENT LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 158 FRANCE BIOACTIVE LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 159 FRANCE POLYMERIZABLE LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 160 FRANCE HEADGROUP MODIFIED LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 161 FRANCE LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 162 FRANCE LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 163 FRANCE LIPOSOMES FOR DNA/RNA IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 164 FRANCE REACTIVE LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 165 FRANCE PLAIN LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 166 FRANCE LIPIDS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 167 FRANCE LIPIDS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 168 FRANCE LIPIDS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 169 SWITZERLAND LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 170 SWITZERLAND NATURAL LIPIDS IN LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 171 SWITZERLAND SYNTHETIC LIPIDS IN LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 172 SWITZERLAND LIPIDS MARKET, BY LIPIDS SYSTEMS, 2021-2030 (USD MILLION)

TABLE 173 SWITZERLAND NEUTRAL LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 174 SWITZERLAND BACTERIAL LIPIDS IN LIPIDS MARKET, BY LIPIDS SYSTEMS, 2021-2030 (USD MILLION)

TABLE 175 SWITZERLAND FLUORESCENT LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 176 SWITZERLAND BIOACTIVE LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 177 SWITZERLAND POLYMERIZABLE LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 178 SWITZERLAND HEADGROUP MODIFIED LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 179 SWITZERLAND LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 180 SWITZERLAND LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 181 SWITZERLAND LIPOSOMES FOR DNA/RNA IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 182 SWITZERLAND REACTIVE LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 183 SWITZERLAND PLAIN LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 184 SWITZERLAND LIPIDS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 185 SWITZERLAND LIPIDS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 186 SWITZERLAND LIPIDS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 187 BELGIUM LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 188 BELGIUM NATURAL LIPIDS IN LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 189 BELGIUM SYNTHETIC LIPIDS IN LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 190 BELGIUM LIPIDS MARKET, BY LIPIDS SYSTEMS, 2021-2030 (USD MILLION)

TABLE 191 BELGIUM NEUTRAL LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 192 BELGIUM BACTERIAL LIPIDS IN LIPIDS MARKET, BY LIPIDS SYSTEMS, 2021-2030 (USD MILLION)

TABLE 193 BELGIUM FLUORESCENT LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 194 BELGIUM BIOACTIVE LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 195 BELGIUM POLYMERIZABLE LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 196 BELGIUM HEADGROUP MODIFIED LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 197 BELGIUM LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 198 BELGIUM LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 199 BELGIUM LIPOSOMES FOR DNA/RNA IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 200 BELGIUM REACTIVE LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 201 BELGIUM PLAIN LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 202 BELGIUM LIPIDS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 203 BELGIUM LIPIDS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 204 BELGIUM LIPIDS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 205 NETHERLANDS LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 206 NETHERLANDS NATURAL LIPIDS IN LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 207 NETHERLANDS SYNTHETIC LIPIDS IN LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 208 NETHERLANDS LIPIDS MARKET, BY LIPIDS SYSTEMS, 2021-2030 (USD MILLION)

TABLE 209 NETHERLANDS NEUTRAL LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 210 NETHERLANDS BACTERIAL LIPIDS IN LIPIDS MARKET, BY LIPIDS SYSTEMS, 2021-2030 (USD MILLION)

TABLE 211 NETHERLANDS FLUORESCENT LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 212 NETHERLANDS BIOACTIVE LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 213 NETHERLANDS POLYMERIZABLE LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 214 NETHERLANDS HEADGROUP MODIFIED LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 215 NETHERLANDS LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 216 NETHERLANDS LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 217 NETHERLANDS LIPOSOMES FOR DNA/RNA IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 218 NETHERLANDS REACTIVE LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 219 NETHERLANDS PLAIN LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 220 NETHERLANDS LIPIDS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 221 NETHERLANDS LIPIDS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 222 NETHERLANDS LIPIDS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 223 RUSSIA LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 224 RUSSIA NATURAL LIPIDS IN LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 225 RUSSIA SYNTHETIC LIPIDS IN LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 226 RUSSIA LIPIDS MARKET, BY LIPIDS SYSTEMS, 2021-2030 (USD MILLION)

TABLE 227 RUSSIA NEUTRAL LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 228 RUSSIA BACTERIAL LIPIDS IN LIPIDS MARKET, BY LIPIDS SYSTEMS, 2021-2030 (USD MILLION)

TABLE 229 RUSSIA FLUORESCENT LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 230 RUSSIA BIOACTIVE LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 231 RUSSIA POLYMERIZABLE LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 232 RUSSIA HEADGROUP MODIFIED LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 233 RUSSIA LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 234 RUSSIA LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 235 RUSSIA LIPOSOMES FOR DNA/RNA IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 236 RUSSIA REACTIVE LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 237 RUSSIA PLAIN LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 238 RUSSIA LIPIDS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 239 RUSSIA LIPIDS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 240 RUSSIA LIPIDS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 241 TURKEY LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 242 TURKEY NATURAL LIPIDS IN LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 243 TURKEY SYNTHETIC LIPIDS IN LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 244 TURKEY LIPIDS MARKET, BY LIPIDS SYSTEMS, 2021-2030 (USD MILLION)

TABLE 245 TURKEY NEUTRAL LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 246 TURKEY BACTERIAL LIPIDS IN LIPIDS MARKET, BY LIPIDS SYSTEMS, 2021-2030 (USD MILLION)

TABLE 247 TURKEY FLUORESCENT LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 248 TURKEY BIOACTIVE LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 249 TURKEY POLYMERIZABLE LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 250 TURKEY HEADGROUP MODIFIED LIPIDS IN LIPIDS MARKET, BY LIPID SYSTEMS, 2021-2030 (USD MILLION)

TABLE 251 TURKEY LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 252 TURKEY LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 253 TURKEY LIPOSOMES FOR DNA/RNA IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 254 TURKEY REACTIVE LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 255 TURKEY PLAIN LIPOSOMES IN LIPIDS MARKET, BY DELIVERY SYSTEMS, 2021-2030 (USD MILLION)

TABLE 256 TURKEY LIPIDS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 257 TURKEY LIPIDS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 258 TURKEY LIPIDS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 259 REST OF EUROPE LIPIDS MARKET, BY TYPE, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 EUROPE LIPIDS MARKET: SEGMENTATION

FIGURE 2 EUROPE LIPIDS MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE LIPIDS MARKET: DROC ANALYSIS

FIGURE 4 EUROPE LIPIDS MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE LIPIDS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE LIPIDS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE LIPIDS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE LIPIDS MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 EUROPE LIPIDS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE LIPIDS MARKET: SEGMENTATION

FIGURE 11 THE GROWING PRVALENCE OF CHRONIC DISEASES AND RISING DEMAND FOR LIPIDS IN VARIOUS INDUSTRIES ARE EXPECTED TO DRIVE THE EUROPE LIPIDS MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 12 TESTING SERVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE LIPIDS MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE LIPIDS MARKET

FIGURE 14 EUROPE LIPIDS MARKET: BY TYPE, 2022

FIGURE 15 EUROPE LIPIDS MARKET: BY TYPE, 2023-2030 (USD MILLION)

FIGURE 16 EUROPE LIPIDS MARKET: BY TYPE, CAGR (2023-2030)

FIGURE 17 EUROPE LIPIDS MARKET: BY TYPE, LIFELINE CURVE

FIGURE 18 EUROPE LIPIDS MARKET: BY LIPID SYSTEMS, 2022

FIGURE 19 EUROPE LIPIDS MARKET: BY LIPID SYSTEMS, 2023-2030 (USD MILLION)

FIGURE 20 EUROPE LIPIDS MARKET: BY LIPID SYSTEMS, CAGR (2023-2030)

FIGURE 21 EUROPE LIPIDS MARKET: BY LIPID SYSTEMS, LIFELINE CURVE

FIGURE 22 EUROPE LIPIDS MARKET: BY DELIVERY SYSTEMS, 2022

FIGURE 23 EUROPE LIPIDS MARKET: BY DELIVERY SYSTEMS, 2023-2030 (USD MILLION)

FIGURE 24 EUROPE LIPIDS MARKET: BY DELIVERY SYSTEMS, CAGR (2023-2030)

FIGURE 25 EUROPE LIPIDS MARKET: BY DELIVERY SYSTEMS, LIFELINE CURVE

FIGURE 26 EUROPE LIPIDS MARKET: BY SOURCE, 2022

FIGURE 27 EUROPE LIPIDS MARKET: BY SOURCE, 2023-2030 (USD MILLION)

FIGURE 28 EUROPE LIPIDS MARKET: BY SOURCE, CAGR (2023-2030)

FIGURE 29 EUROPE LIPIDS MARKET: BY SOURCE, LIFELINE CURVE

FIGURE 30 EUROPE LIPIDS MARKET: BY END USER, 2022

FIGURE 31 EUROPE LIPIDS MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 32 EUROPE LIPIDS MARKET: BY END USER, CAGR (2023-2030)

FIGURE 33 EUROPE LIPIDS MARKET: BY END USER, LIFELINE CURVE

FIGURE 34 EUROPE LIPIDS MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 35 EUROPE LIPIDS MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 36 EUROPE LIPIDS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 37 EUROPE LIPIDS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 38 EUROPE LIPIDS MARKET: SNAPSHOT (2022)

FIGURE 39 EUROPE LIPIDS MARKET: BY COUNTRY (2022)

FIGURE 40 EUROPE LIPIDS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 41 EUROPE LIPIDS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 42 EUROPE LIPIDS MARKET: BY TYPE (2023 & 2030)

FIGURE 43 EUROPE LIPIDS MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.