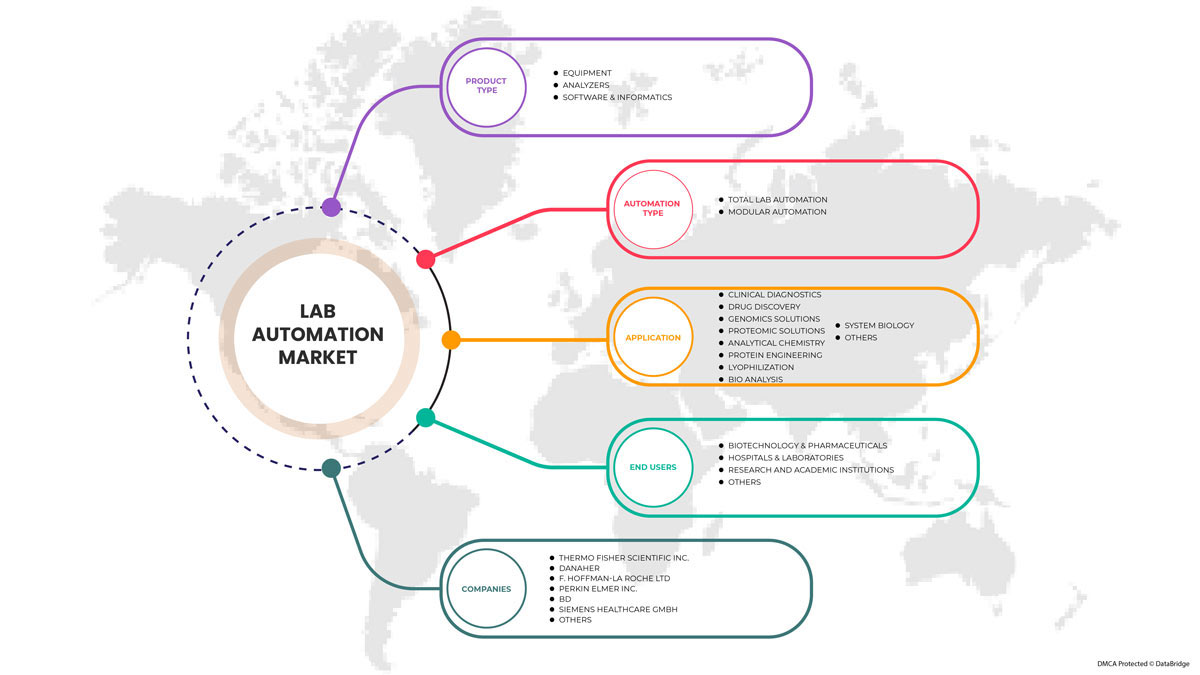

Marché européen de l'automatisation des laboratoires, par type de produit (équipement, logiciel et informatique et analyseur), type d'automatisation (automatisation modulaire et automatisation totale des laboratoires), application (découverte de médicaments, diagnostics cliniques, solutions génomiques, solutions protéomiques, bio-analyse, ingénierie des protéines, lyophilisation, biologie des systèmes, chimie analytique et autres), utilisateurs finaux (biotechnologie et produits pharmaceutiques, hôpitaux et laboratoires, institutions de recherche et universitaires et autres) - Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et perspectives du marché de l'automatisation des laboratoires en Europe

La demande pour le marché de l'automatisation des laboratoires augmente en raison des progrès technologiques partout dans le monde. Pour le secteur de la santé, des équipements et des outils d'automatisation des laboratoires sont utilisés. Les dépenses de santé étant devenues plus élevées en raison de plusieurs facteurs, les principales sociétés pharmaceutiques et de soins de santé doivent automatiser les laboratoires pour fournir des services de santé avancés à domicile dans des délais plus courts.

La demande croissante de soins de santé sur le marché est la principale cause de la concurrence entre les principales sociétés pharmaceutiques et de soins de santé dans le domaine de l'amélioration de l'automatisation des laboratoires dans le monde entier. L'utilisation croissante d'équipements, d'analyseurs et de logiciels pour les laboratoires a été utilisée. L'objectif des acteurs du marché est de fournir une variabilité d'outils, d'équipements, de machines et de techniques pour soutenir le développement et la fabrication d'infrastructures de laboratoire automatisées. Les acteurs du marché proposent davantage d'investissements et de financements pour développer des technologies et des méthodes avancées.

Les dépenses de santé augmentent en raison de plusieurs facteurs, tels que le vieillissement de la population, la prévalence des maladies chroniques, la hausse des prix des médicaments, les coûts des services de santé et les coûts administratifs, entre autres. De plus, les hôpitaux, les laboratoires privés, les centres de recherche clinique et de diagnostic sont en pleine croissance, ce qui accroît la demande du marché de l'automatisation des laboratoires.

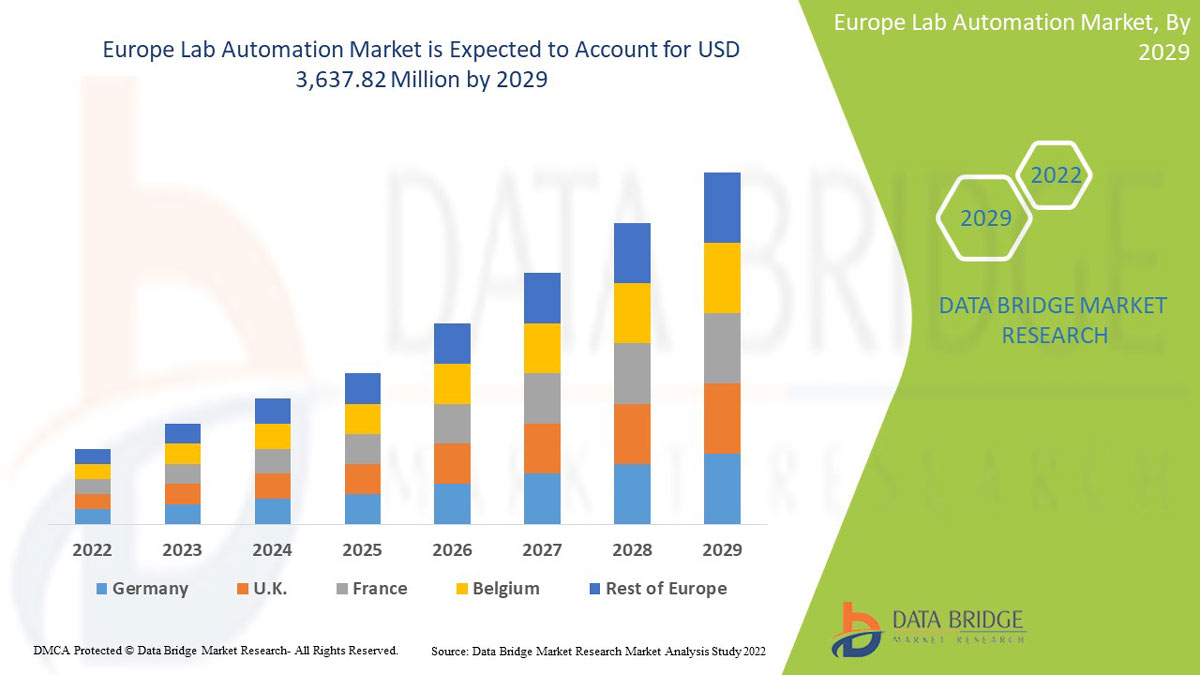

Le marché européen de l'automatisation des laboratoires devrait connaître une croissance de marché au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 6,0 % au cours de la période de prévision de 2022 à 2029 et devrait atteindre 3 637,82 millions USD d'ici 2029.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable pour 2019-2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par type de produit (équipement, logiciel et informatique et analyseur), type d'automatisation (automatisation modulaire et automatisation totale de laboratoire), application (découverte de médicaments, diagnostics cliniques, solutions génomiques, solutions protéomiques, bio-analyse, ingénierie des protéines , lyophilisation, biologie des systèmes, chimie analytique et autres), utilisateurs finaux ( biotechnologie et produits pharmaceutiques, hôpitaux et laboratoires, institutions de recherche et universitaires et autres) |

|

Pays couverts |

Allemagne, France, Royaume-Uni, Italie, Espagne, Pays-Bas, Russie, Belgique, Suisse, Turquie, Reste de l'Europe |

|

Acteurs du marché couverts |

QIAGEN, Siemens Healthcare, F. Hoffman Roche, Hamilton Company, Hudson Robotics, LabVantage Solutions Inc., Abbott, BD, BIOMERIEUX, Aurora Biomed Inc., Danaher, Tecan Trading AG, PerkinElmer Inc, Thermo Fisher Scientific, Agilent Technologies, Azenta US Inc, Eppendorf SE et Labware, entre autres |

Définition du marché

L'automatisation de laboratoire est la combinaison de technologies automatisées dans le laboratoire pour permettre des processus nouveaux et améliorés. Elle est utilisée comme stratégie pour rechercher, développer, optimiser et capitaliser sur les technologies en laboratoire. Elle est spécialement utilisée pour automatiser les processus de laboratoire nécessitant une intervention humaine minimale et éliminant les erreurs humaines. L'automatisation de laboratoire est utilisée dans le but de fournir des tests et des diagnostics plus efficaces.

L'automatisation des laboratoires permet aux chercheurs et aux techniciens de produire efficacement et en moins de temps, ce qui devrait stimuler le marché de l'automatisation des laboratoires. En outre, la propagation rapide des maladies, ainsi que les nouvelles découvertes dans le domaine des soins de santé, augmentent la demande de diagnostics et de traitements, ce qui devrait alimenter le marché de l'automatisation des laboratoires. Le financement public et privé élevé de la recherche et de la recherche exploratoire ainsi que la présence d'acteurs majeurs du marché contribuent également à la croissance du marché.

Dynamique du marché de l'automatisation des laboratoires

Conducteurs

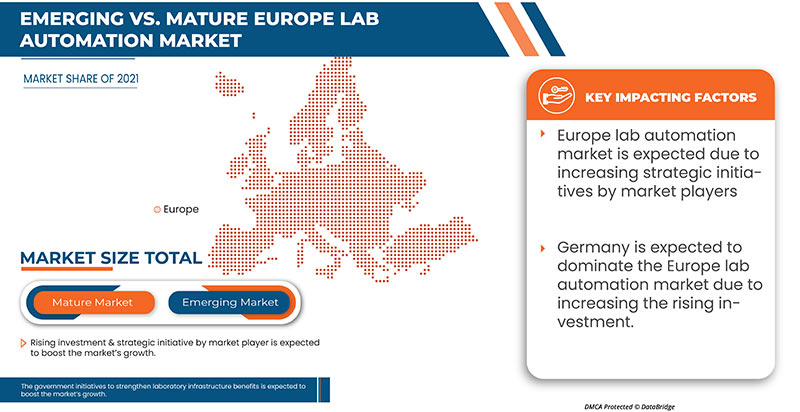

- Augmentation des investissements et des initiatives stratégiques des acteurs du marché

Le marché de l'automatisation des laboratoires est en pleine croissance, car il existe une forte demande de services automatisés avancés spécialisés qui éliminent les erreurs humaines. L'objectif des acteurs du marché et des entreprises est de fournir une variabilité d'outils, d'équipements, de machines et de techniques pour soutenir le développement et la fabrication d'infrastructures de laboratoire automatisées. Le marché de l'automatisation des laboratoires est en pleine croissance, car il existe une forte demande de services automatisés avancés spécialisés qui éliminent les erreurs humaines. Afin de conquérir des parts de marché, les acteurs du marché proposent davantage d'investissements et de financements pour développer des technologies et des méthodes avancées. Ces acteurs se concentrent davantage sur la réduction des efforts manuels et du temps de manipulation pour les processus traditionnellement à forte intensité de main-d'œuvre. Cela devrait stimuler la croissance du marché.

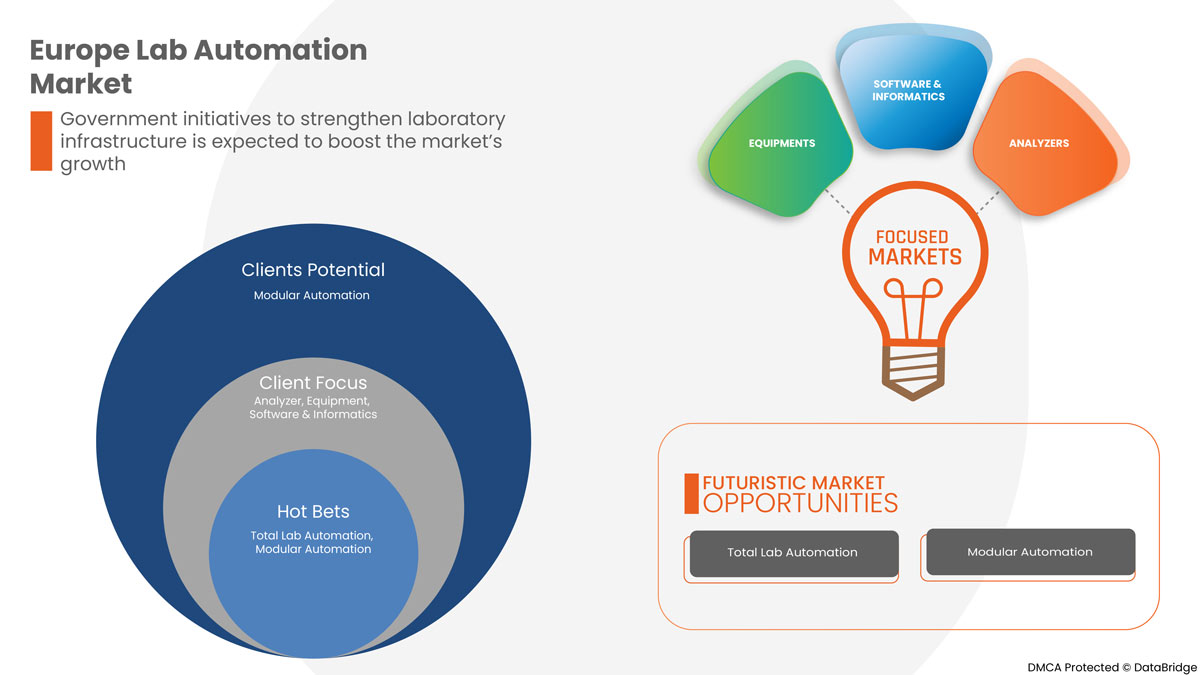

- Initiatives gouvernementales pour renforcer les infrastructures de laboratoire

Afin de renforcer davantage le secteur de la santé et l'infrastructure des laboratoires, les organismes gouvernementaux jouent un rôle important. Le financement et l'initiative du gouvernement visant à étendre l'automatisation des laboratoires contribueront à la croissance du marché et à l'augmentation du nombre d'acteurs sur le marché. Les collaborations et accords du gouvernement avec les principaux acteurs du marché renforceront encore davantage l'infrastructure des laboratoires.

- Dépenses croissantes en outils et équipements d'automatisation de laboratoire

Les dépenses consacrées aux outils et équipements d'automatisation des laboratoires sont en constante augmentation. Cela est principalement dû à la demande croissante d'examens de laboratoire pour diverses raisons, telles que le vieillissement de la population, la croissance des maladies chroniques, la découverte de nouveaux biomarqueurs plus efficaces et l'augmentation des exigences en matière de santé générale ou de diagnostic.

- Réduire les efforts humains et éliminer les erreurs humaines

Il existe plusieurs méthodes traditionnelles pour réduire les erreurs humaines, mais le développement d'un système visant à minimiser le risque d'erreur humaine contribuera à garantir que vous ne répéterez pas les mêmes erreurs. Les installations de fabrication se concentrent sur la création de systèmes avancés afin d'utiliser la technologie de l'intelligence artificielle pour reconnaître et corriger les problèmes avant qu'ils ne surviennent.

Opportunités

-

Augmentation des dépenses de santé

Les dépenses de santé ont augmenté en raison de plusieurs facteurs, tels que le vieillissement de la population, la prévalence des maladies chroniques, la hausse des prix des médicaments, les coûts des services de santé et les coûts administratifs, entre autres. Cependant, 2020 a été l'année où les dépenses ont atteint le niveau le plus élevé en raison de la pandémie de COVID-19. Il a été constaté qu'en 2020, les dépenses de santé ont augmenté au rythme le plus rapide depuis 2002 en raison de la pandémie .

-

Initiatives stratégiques des acteurs clés

Les principales sociétés pharmaceutiques et de soins de santé ont pris diverses initiatives pour automatiser les laboratoires afin de fournir des services de santé avancés à domicile dans un délai plus court. La demande croissante de soins de santé sur le marché est la principale cause de concurrence entre les principales sociétés pharmaceutiques et de soins de santé dans l'amélioration de l'automatisation des laboratoires à l'échelle mondiale. Par conséquent, les initiatives stratégiques des acteurs du marché devraient constituer une opportunité pour la croissance du marché de l'automatisation des laboratoires.

-

Augmentation du nombre de sociétés pharmaceutiques

L'industrie pharmaceutique a connu une croissance significative au cours des deux dernières décennies. L'augmentation des revenus disponibles, l'accès accru aux établissements de santé, la sensibilisation croissante des citoyens aux soins de santé et la pénétration accrue des services médicaux incitent les sociétés pharmaceutiques à se multiplier pour répondre à la demande.

La pandémie de COVID-19 a eu un impact considérable sur l'industrie pharmaceutique en raison de la demande accrue de services médicaux et de fournitures de médicaments. Les industries pharmaceutiques se développent rapidement dans le monde entier pour répondre à la forte demande de l'humanité et, par conséquent, le service doit être fourni le plus tôt possible. Ainsi, pour parvenir à un service rapide et sans erreur dans les établissements de santé de pointe en moins de temps, l'automatisation des laboratoires est nécessaire. Ainsi, l'augmentation du nombre d'entreprises pharmaceutiques devrait constituer une opportunité pour la croissance du marché de l'automatisation des laboratoires.

Contraintes/Défis

- Limite de l'analyse d'un nouveau produit complexe

Différents facteurs contribuent à la complexité des nouveaux produits utilisés dans les laboratoires automatisés. L'engagement continu entre le personnel et les fabricants d'appareils dès le début du processus de développement est indispensable et devient obligatoire pour comprendre comment faire fonctionner la pièce ou la configuration globale. Les limites dans la détection et l'analyse de nouveaux produits complexes tels que les machines, les outils et les équipements entravent l'installation et le fonctionnement des laboratoires automatisés sur le marché.

- Coût élevé d'installation et de configuration

L'installation et la configuration d'un laboratoire automatisé sont des procédures beaucoup plus laborieuses et complexes. La mise en place de laboratoires automatisés nécessite beaucoup de temps, d'efforts, de planification, de mise en œuvre et d'approbations de divers services gouvernementaux. De plus, l'essentiel pour la mise en place d'un nouveau laboratoire nécessite un investissement critique dans l'infrastructure en raison du coût élevé des machines, des outils et des équipements de pointe.

- Mise à niveau, maintenance et contrôles périodiques

L'exploitation efficace des laboratoires est la principale préoccupation après leur mise en place. L'entretien, la mise à niveau et les contrôles périodiques des équipements sont nécessaires à leur fonctionnement. Les dépenses nécessaires à cet effet constituent l'un des principaux facteurs de restriction pour les acteurs du marché. Les titulaires de laboratoires sont tenus par la réglementation ou le contrôle qualité de tester leurs produits, indépendamment des entreprises de fabrication, afin de fonctionner sans problème et d'éviter les situations qui peuvent freiner la croissance du marché.

Impact post-COVID-19 sur le marché européen de l'automatisation des laboratoires

La COVID-19 a eu un impact positif sur le marché de l'automatisation. En raison de la pandémie, la santé des personnes a été affectée, ce qui a entraîné une augmentation du nombre de tests de diagnostic et de la demande. Les laboratoires privés, les hôpitaux et la recherche clinique ont augmenté en raison de la pandémie. Ainsi, la COVID-19 a fait augmenter positivement le marché de l'automatisation des laboratoires.

Développements récents

- En juin 2022, BD a annoncé avoir finalisé l'acquisition de Straub Medical AG, une société privée. Avec cette acquisition, l'entreprise a ajouté l'expertise et l'expérience précieuses de Straub Medical AG et a élargi son portefeuille de produits

- En janvier 2022, QIAGEN a annoncé avoir conclu de nouvelles collaborations avec Atlia Biosystems pour fournir des solutions de tests prénatals non invasifs.

Portée du marché européen de l'automatisation des laboratoires

Le marché européen de l'automatisation des laboratoires est segmenté en types de produits, systèmes automatisés, applications et utilisateurs finaux. La croissance de ces segments vous aidera à analyser les segments de croissance limités dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Type de produit

- Équipement

- Analyseur

- Logiciels et informatique

En fonction du type de produit, le marché de l'automatisation de laboratoire est segmenté en équipement, analyseur, logiciel et informatique.

Systèmes automatisés

- Automatisation totale du laboratoire

- Automatisation modulaire de laboratoire

Basé sur des systèmes automatisés, le marché de l’automatisation de laboratoire est segmenté en automatisation totale de laboratoire et automatisation de laboratoire modulaire.

Application

- Diagnostic clinique

- Découverte de médicaments

- Solutions génomiques

- Solutions protéomiques

- Chimie analytique

- Ingénierie des protéines

- Lyophilisation

- Analyse biologique

- Biologie des systèmes

- Autres

En fonction des applications, le marché de l'automatisation des laboratoires est segmenté en découverte de médicaments, diagnostics cliniques, solutions génomiques, solutions protéomiques, bioanalyse, ingénierie des protéines, lyophilisation, biologie des systèmes, chimie analytique et autres.

Utilisateur final

- Biotechnologie et produits pharmaceutiques

- Hôpitaux et laboratoires

- Instituts de recherche et d'enseignement

- Autres

En fonction de l'utilisateur final, le marché de l'automatisation des laboratoires est segmenté en biotechnologie et produits pharmaceutiques, hôpitaux et laboratoires, institutions de recherche et universitaires et autres.

Analyse/perspectives régionales du marché de l'automatisation des laboratoires en Europe

Le marché européen de l’automatisation des laboratoires est analysé et des informations sur la taille du marché et les tendances sont fournies par pays, type de produit, systèmes automatisés, application et utilisateur final.

Les pays couverts par le marché sont l'Allemagne, la France, le Royaume-Uni, l'Italie, l'Espagne, les Pays-Bas, la Russie, la Belgique, la Suisse, la Turquie et le reste de l'Europe. L'Allemagne devrait dominer le marché européen de l'automatisation des laboratoires en raison d'une augmentation de la demande d'équipements, d'analyseurs et de logiciels sur le marché régional.

La section régionale du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché qui ont un impact sur les tendances actuelles et futures du marché. Les points de données, tels que les ventes de produits neufs et de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation, sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques d'Amérique centrale et les défis auxquels elles sont confrontées en raison de la forte concurrence des marques locales et nationales, ainsi que l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché de l'automatisation des laboratoires

Le paysage concurrentiel du marché européen de l'automatisation des laboratoires fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Europe, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que les entreprises se concentrant sur le marché européen de l'automatisation des laboratoires.

Certains des principaux acteurs opérant sur le marché européen de l'automatisation des laboratoires sont QIAGEN, Siemens Healthcare, F. Hoffman Roche, Hamilton Company, Hudson Robotics, LabVantage Solutions Inc., Abbott, BD, BIOMERIEUX, Aurora Biomed Inc., Danaher, Tecan Trading AG, PerkinElmer Inc, Thermo Fisher Scientific, Agilent Technologies, Azenta US Inc, Eppendorf SE et Labware, entre autres.

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent une grille de positionnement des fournisseurs, une analyse de la chronologie du marché, un aperçu et un guide du marché, une grille de positionnement des entreprises, une analyse des parts de marché des entreprises, des normes de mesure, une analyse des parts de marché Europe vs. Région et des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE LAB AUTOMATION MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

5 REGULATION

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING INVESTMENT & STRATEGIC INITIATIVES BY MARKET PLAYERS

6.1.2 GOVERNMENT INITIATIVES TO STRENGTHEN LABORATORY INFRASTRUCTURES

6.1.3 GROWING EXPENDITURE ON LAB AUTOMATION TOOLS AND EQUIPMENT

6.1.4 REDUCING HUMAN EFFORTS AND ELIMINATING HUMAN ERROR

6.2 RESTRAINTS

6.2.1 LIMITATION ANALYZING NOVEL COMPLEX PRODUCT

6.2.2 HIGH COST FOR INSTALLATION AND SETUP

6.2.3 UPGRADATION, MAINTENANCE, AND PERIODICAL CHECKUPS

6.3 OPPORTUNITIES

6.3.1 RISING HEALTHCARE EXPENDITURE

6.3.2 STRATEGIC INITIATIVES BY KEY PLAYERS

6.3.3 RISE IN THE NUMBER OF PHARMA COMPANIES

6.4 CHALLENGES

6.4.1 SLOW ADOPTION OF AUTOMATION AMONG SMALL AND MEDIUM SIZED LABORATORIES

6.4.2 LIMITED FEASIBILITY WITH TECHNOLOGY INTEGRATION IN ANALYTICAL LABS

7 EUROPE LAB AUTOMATION MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 EQUIPMENT

7.2.1 AUTOMATED WORKSTATIONS

7.2.1.1 AUTOMATED LIQUID HANDLING SYSTEMS

7.2.1.2 AUTOMATED INTEGRATED WORKSTATIONS

7.2.1.3 PIPETTING SYSTEMS

7.2.1.4 MICROPLATE WASHERS

7.2.1.5 REAGENT DISPENSERS

7.2.2 MICROPLATE READERS

7.2.2.1 MULTI-MODE MICROPLATE READERS

7.2.2.2 SINGLE-MODE MICROPLATE READERS

7.2.2.3 AUTOMATED NUCLEIC ACID PURIFICATION SYSTEMS

7.2.2.4 AUTOMATED ELISA SYSTEMS

7.2.3 OFF-THE-SHELF AUTOMATED WORKCELLS

7.2.4 ROBOTIC SYSTEMS

7.2.4.1 ROBOTIC ARMS

7.2.4.2 TRACK ROBOTS

7.2.5 AUTOMATE STORAGE & RETRIEVALS (ASRS)

7.2.6 OTHERS

7.3 ANALYZER

7.3.1 BIO CHEMISTRY ANALYZERS

7.3.2 HAEMATOLOGY ANALYZERS

7.3.3 IMMUNO-BASED ANALYZERS

7.4 SOFTWARE & INFORMATICS

7.4.1 LABORATORY INFORMATION MANAGEMENT SYSTEM (LIMS)

7.4.2 ELECTRONIC LABORATORY NOTEBOOK (ELN)

7.4.3 LABORATORY EXECUTION SYSTEMS (LES)

7.4.4 SCIENTIFIC DATA MANAGEMENT SYSTEMS (SDMS)

8 EUROPE LAB AUTOMATION MARKET, BY AUTOMATION TYPE

8.1 OVERVIEW

8.2 TOTAL LAB AUTOMATION

8.3 MODULAR AUTOMATION

9 EUROPE LAB AUTOMATION MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 CLINICAL DIAGNOSTICS

9.3 DRUG DISCOVERY

9.4 GENOMICS SOLUTIONS

9.5 PROTEOMIC SOLUTIONS

9.6 ANALYTICAL CHEMISTRY

9.7 PROTEIN ENGINEERING

9.8 BIO ANALYSIS

9.9 SYSTEM BIOLOGY

9.1 OTHERS

10 EUROPE LAB AUTOMATION MARKET, BY END USER

10.1 OVERVIEW

10.2 BIOTECHNOLOGY & PHARMACEUTICALS

10.3 HOSPITALS & LABORATORIES

10.4 RESEARCH & ACADEMIC INSTITUTES

10.5 OTHERS

11 EUROPE LAB AUTOMATION MARKET, BY REGION

11.1 EUROPE

11.1.1 GERMANY

11.1.2 FRANCE

11.1.3 U.K.

11.1.4 ITALY

11.1.5 RUSSIA

11.1.6 SPAIN

11.1.7 NETHERLANDS

11.1.8 SWITZERLAND

11.1.9 TURKEY

11.1.10 BELGIUM

11.1.11 REST OF EUROPE

12 EUROPE LAB AUTOMATION MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: EUROPE

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 THERMO FISHER SCIENTIFIC INC.

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 DANAHER

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 F. HOFFMANN- LA ROCHE LTD

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 PERKINELMER INC

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 BD

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 ABBOTT

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 AGILENT TECHNOLOGIES

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENTS

14.8 AURORA BIOMED INC.

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 AZENTA US INC

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENTS

14.1 BIOMERIEUX

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 EPPENDORF SE

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 HAMILTON COMPANY

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 HUDSON ROBOTICS

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 LABLYNX LIMS

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENTS

14.15 LABVANTAGE SOLUTIONS INC.

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 LABWARE

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

14.17 QIAGEN

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENTS

14.18 SIEMENS HEALTHCARE GMBH

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENTS

14.19 TECAN TRADING AG

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 EUROPE LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 EUROPE EQUIPMENT IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 EUROPE AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 4 EUROPE MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 5 EUROPE ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 6 EUROPE ANALYZER IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 EUROPE ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 8 EUROPE SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 EUROPE SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 10 EUROPE LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 11 EUROPE TOTAL LAB AUTOMATION IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE MODULAR AUTOMATION IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 EUROPE LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE CLINICAL DIAGNOSTICS IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 EUROPE DRUG DISCOVERY IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE GENOMICS SOLUTIONS IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE PROTEOMIC SOLUTIONS IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 EUROPE ANALYTICAL CHEMISTRY IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE PROTEIN ENGINEERING IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 EUROPE BIO ANALYSIS IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 EUROPE SYSTEM BIOLOGY IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 EUROPE OTHERS IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 EUROPE LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 24 EUROPE BIOTECHNOLOGY & PHARMACEUTICALS IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 EUROPE HOSPITALS & LABORATORIES IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 EUROPE RESEARCH & ACADEMIC INSTITUTES IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 EUROPE OTHERS IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 EUROPE LAB AUTOMATION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 29 EUROPE LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 30 EUROPE EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 31 EUROPE AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 32 EUROPE MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 33 EUROPE ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 34 EUROPE ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 35 EUROPE SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 36 EUROPE LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 37 EUROPE LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 38 EUROPE LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 39 GERMANY LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 40 GERMANY EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 41 GERMANY AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 42 GERMANY MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 43 GERMANY ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 44 GERMANY ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 45 GERMANY SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 46 GERMANY LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 47 GERMANY LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 48 GERMANY LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 49 FRANCE LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 50 FRANCE EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 51 FRANCE AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 52 FRANCE MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 53 FRANCE ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 54 FRANCE ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 55 FRANCE SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 56 FRANCE LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 57 FRANCE LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 58 FRANCE LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 59 U.K. LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 60 U.K. EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 61 U.K. AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 62 U.K. MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 63 U.K. ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 64 U.K. ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 65 U.K. SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 66 U.K. LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 67 U.K. LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 68 U.K. LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 69 ITALY LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 70 ITALY EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 71 ITALY AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 72 ITALY MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 73 ITALY ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 74 ITALY ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 75 ITALY SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 76 ITALY LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 77 ITALY LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 78 ITALY LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 79 RUSSIA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 80 RUSSIA EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 81 RUSSIA AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 82 RUSSIA MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 83 RUSSIA ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 84 RUSSIA ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 85 RUSSIA SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 86 RUSSIA LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 87 RUSSIA LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 88 RUSSIA LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 89 SPAIN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 90 SPAIN EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 91 SPAIN AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 92 SPAIN MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 93 SPAIN ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 94 SPAIN ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 95 SPAIN SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 96 SPAIN LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 97 SPAIN LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 SPAIN LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 99 NETHERLANDS LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 100 NETHERLANDS EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 101 NETHERLANDS AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 102 NETHERLANDS MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 103 NETHERLANDS ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 104 NETHERLANDS ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 105 NETHERLANDS SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 106 NETHERLANDS LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 107 NETHERLANDS LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 108 NETHERLANDS LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 109 SWITZERLAND LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 110 SWITZERLAND EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 111 SWITZERLAND AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 112 SWITZERLAND MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 113 SWITZERLAND ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 114 SWITZERLAND ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 115 SWITZERLAND SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 116 SWITZERLAND LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 117 SWITZERLAND LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 118 SWITZERLAND LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 119 TURKEY LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 120 TURKEY EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 121 TURKEY AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 122 TURKEY MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 123 TURKEY ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 124 TURKEY ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 125 TURKEY SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 126 TURKEY LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 127 TURKEY LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 128 TURKEY LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 129 BELGIUM LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 130 BELGIUM EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 131 BELGIUM AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 132 BELGIUM MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 133 BELGIUM ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 134 BELGIUM ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 135 BELGIUM SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 136 BELGIUM LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 137 BELGIUM LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 138 BELGIUM LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 139 REST OF EUROPE LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 EUROPE LAB AUTOMATION MARKET: SEGMENTATION

FIGURE 2 EUROPE LAB AUTOMATION MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE LAB AUTOMATION MARKET: DROC ANALYSIS

FIGURE 4 EUROPE LAB AUTOMATION MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE LAB AUTOMATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE LAB AUTOMATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE LAB AUTOMATION MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE LAB AUTOMATION MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 EUROPE LAB AUTOMATION MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE LAB AUTOMATION MARKET: SEGMENTATION

FIGURE 11 GROWING EXPENDITURE ON LAB AUTOMATION TOOLS AND EQUIPMENT IS EXPECTED TO DRIVE THE EUROPE LAB AUTOMATION MARKET GROWTH IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 EQUIPMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE LAB AUTOMATION MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE LAB AUTOMATION MARKET

FIGURE 14 EUROPE LAB AUTOMATION MARKET: BY PRODUCT TYPE, 2021

FIGURE 15 EUROPE LAB AUTOMATION MARKET: BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 16 EUROPE LAB AUTOMATION MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 17 EUROPE LAB AUTOMATION MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 18 EUROPE LAB AUTOMATION MARKET: BY AUTOMATION TYPE, 2021

FIGURE 19 EUROPE LAB AUTOMATION MARKET: BY AUTOMATION TYPE, 2022-2029 (USD MILLION)

FIGURE 20 EUROPE LAB AUTOMATION MARKET: BY AUTOMATION TYPE, CAGR (2022-2029)

FIGURE 21 EUROPE LAB AUTOMATION MARKET: BY AUTOMATION TYPE, LIFELINE CURVE

FIGURE 22 EUROPE LAB AUTOMATION MARKET: BY APPLICATION, 2021

FIGURE 23 EUROPE LAB AUTOMATION MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 24 EUROPE LAB AUTOMATION MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 25 EUROPE LAB AUTOMATION MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 26 EUROPE LAB AUTOMATION MARKET: BY END USER, 2021

FIGURE 27 EUROPE LAB AUTOMATION MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 28 EUROPE LAB AUTOMATION MARKET: BY END USER, CAGR (2022-2029)

FIGURE 29 EUROPE LAB AUTOMATION MARKET: BY END USER, LIFELINE CURVE

FIGURE 30 EUROPE LAB AUTOMATION MARKET: SNAPSHOT (2021)

FIGURE 31 EUROPE LAB AUTOMATION MARKET: BY COUNTRY (2021)

FIGURE 32 EUROPE LAB AUTOMATION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 33 EUROPE LAB AUTOMATION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 34 EUROPE LAB AUTOMATION MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 35 EUROPE LAB AUTOMATION MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.