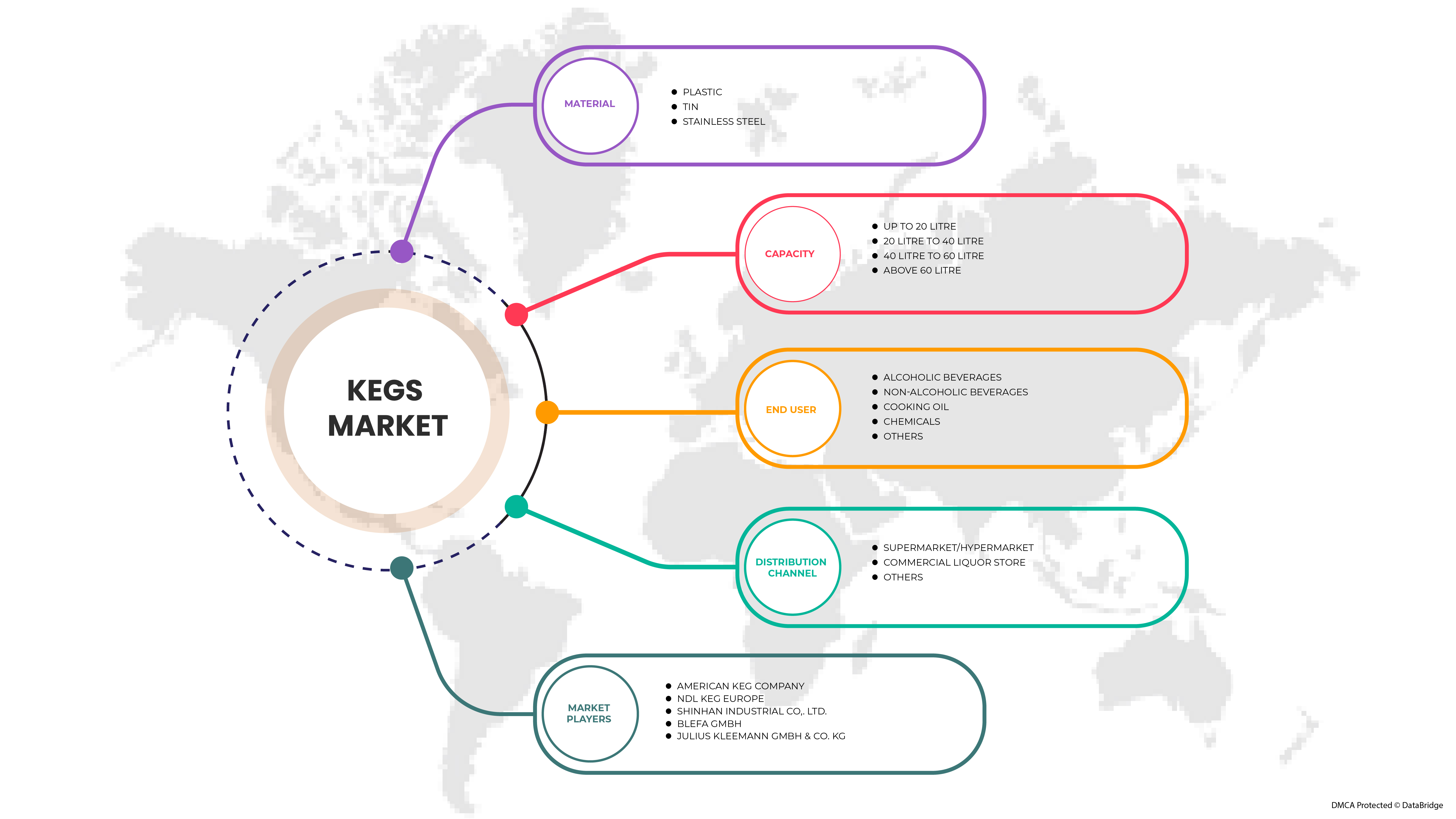

Marché européen des fûts, par matériau ( plastique , étain et acier inoxydable), capacité (jusqu'à 20 litres, de 20 litres à 40 litres, de 40 litres à 60 litres et plus de 60 litres), utilisateur final ( boissons alcoolisées , boissons non alcoolisées , huile de cuisson, produits chimiques et autres), canal de distribution (supermarché/hypermarché, magasin d'alcools commercial et autres) Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et taille du marché des fûts en Europe

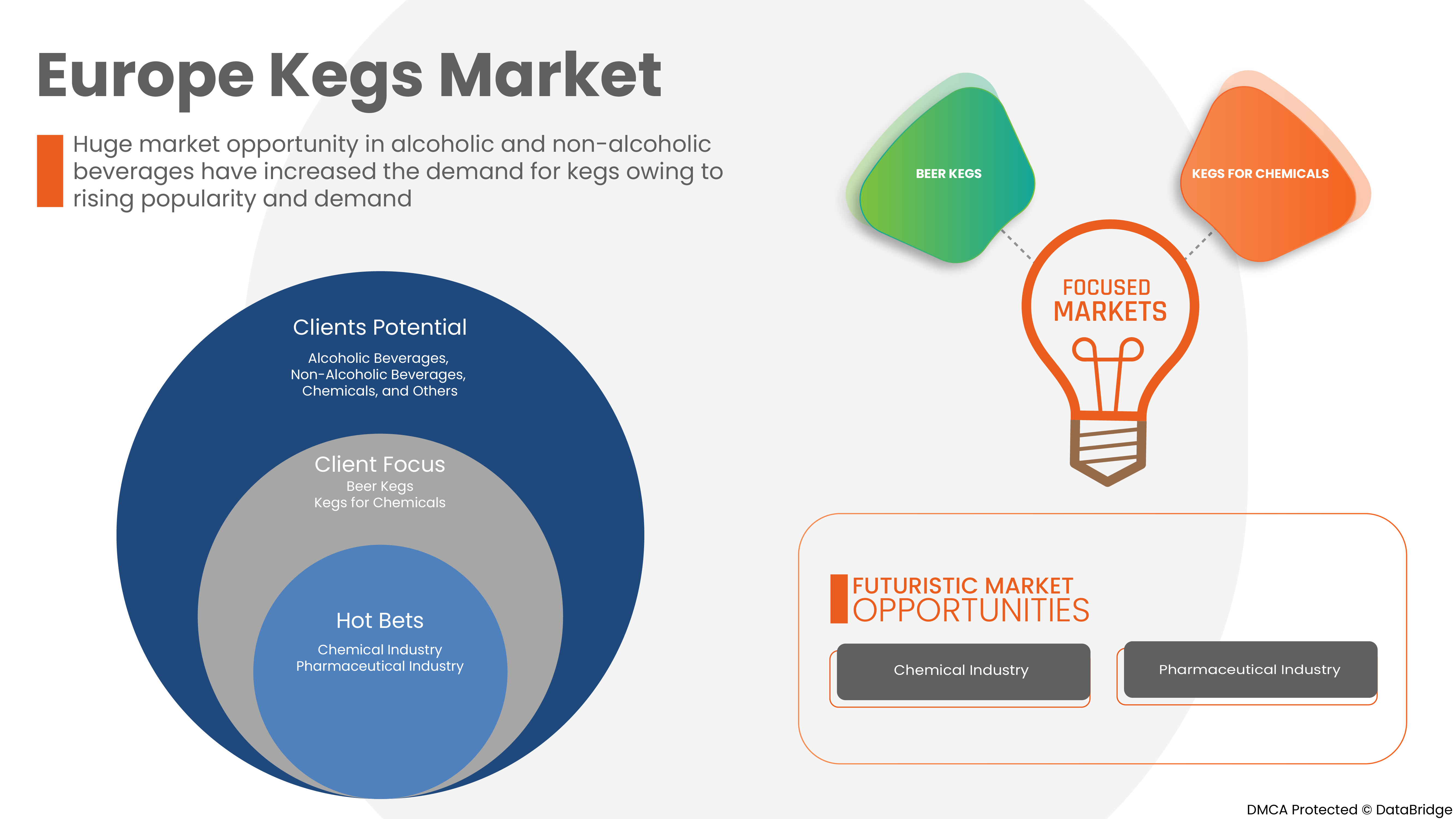

Le marché européen des fûts est stimulé par l'augmentation des applications des fûts dans tous les secteurs. En outre, la croissance du marché est alimentée par la demande croissante de boissons alcoolisées et non alcoolisées. Cependant, les principaux facteurs limitant la croissance du marché sont les coûts élevés associés aux fûts commerciaux. En raison de la demande croissante de fûts, les fabricants s'efforcent de lancer de nouveaux produits dotés d'une technologie de pointe et certifiés par des instituts agréés. L'expansion du marché est finalement favorisée par ces choix.

Certains des facteurs à l'origine de la croissance du marché sont l'utilisation croissante des fûts dans le secteur chimique et dans le secteur de l'alimentation et des boissons, ainsi que l'augmentation de la consommation de boissons en raison des changements progressifs de mode de vie. Cependant, les limitations en termes de remplacement lent des fûts en raison de leur durée de vie prolongée devraient entraver la croissance du marché.

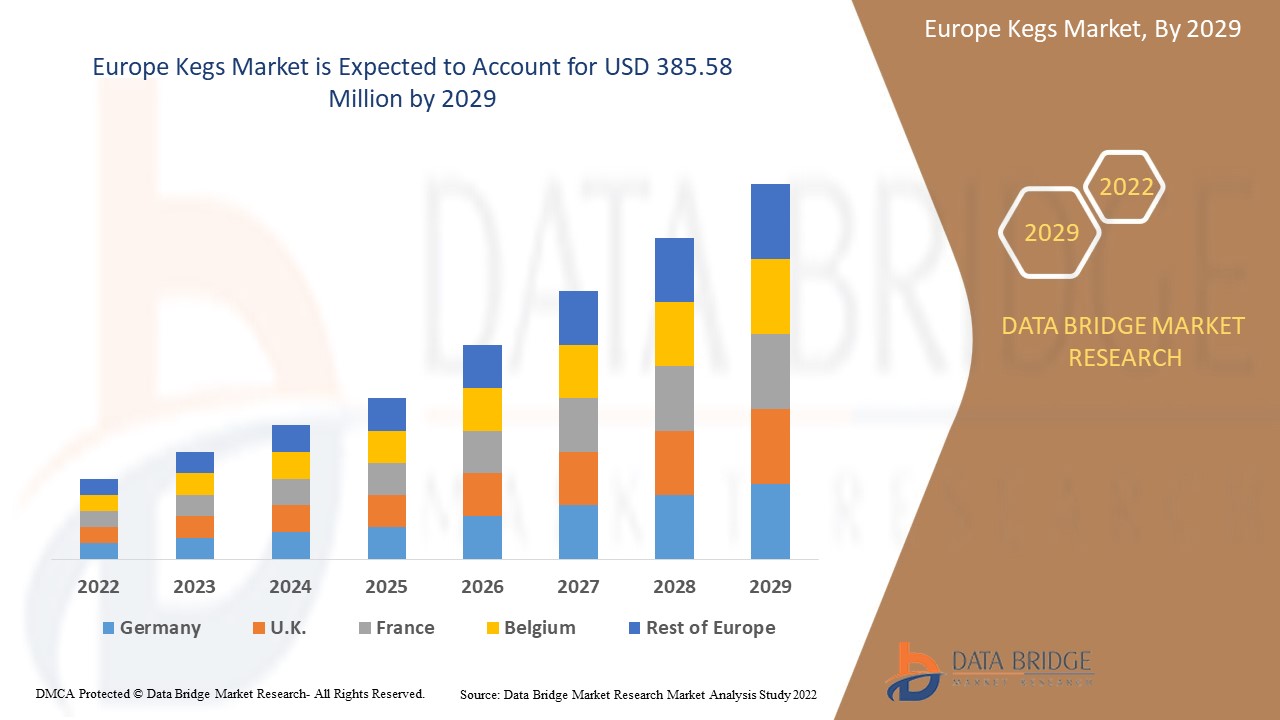

Data Bridge Market Research analyse que le marché européen des fûts devrait atteindre une valeur de 385,58 millions USD d'ici 2029, à un TCAC de 4,2 % au cours de la période de prévision.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Année historique |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volume en millions d'unités et prix en USD |

|

Segments couverts |

Par matériau (plastique, étain et acier inoxydable), capacité (jusqu'à 20 litres, de 20 litres à 40 litres, de 40 litres à 60 litres et plus de 60 litres), utilisateur final (boissons alcoolisées, boissons non alcoolisées, huile de cuisson, produits chimiques et autres), canal de distribution (supermarché/hypermarché, magasin d'alcools commercial et autres). |

|

Pays couverts |

Royaume-Uni, Allemagne, France, Pays-Bas, Belgique, Espagne, Suisse, Italie, Russie, Turquie et reste de l'Europe. |

|

Acteurs du marché couverts |

NDL Keg Europe, BLEFA GmbH, Julius Kleemann GmbH & Co.KG, The Metal Drum Company, Petainer Ltd., NEW MAISONNEUVE KEG, Schaefer Container Systems, Supermonte Group Italy, Inc. et KeyKeg |

Définition du marché

Les fûts sont de petits tonneaux. Les boissons, les produits chimiques, les huiles et divers liquides sont transportés et stockés dans des fûts construits avec diverses matières premières. Un fût est généralement souvent fabriqué en acier inoxydable, mais l'aluminium peut également être utilisé s'il est recouvert de plastique à l'intérieur. La bière y est fréquemment transportée, servie et stockée. Un fût peut également contenir des boissons alcoolisées et non alcoolisées supplémentaires, gazeuses ou non. Il est courant de maintenir la pression des boissons gazeuses pour conserver le dioxyde de carbone dans la solution et empêcher la boisson de devenir plate.

Dynamique du marché des fûts en Europe

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

CONDUCTEURS

- Utilisation croissante des fûts dans le secteur chimique

Un fût de stockage de produits chimiques est un récipient de stockage de haute qualité utilisé par un large éventail d'industries pour contenir divers types de substances chimiques. Ils sont disponibles dans une gamme de formes et de tailles et ont toujours été populaires. Un fût de stockage de produits chimiques industriels est un système de stockage de produits chimiques important. Les produits chimiques étant corrosifs, ils doivent être stockés dans un endroit sûr. Les fûts de produits chimiques sont des conteneurs de stockage de produits chimiques fréquemment utilisés dans l'industrie chimique. Ils sont disponibles dans une gamme de tailles et de formes et sont utilisés pour le stockage statique, le traitement, le mélange et le transport des matières premières et des produits chimiques finis.

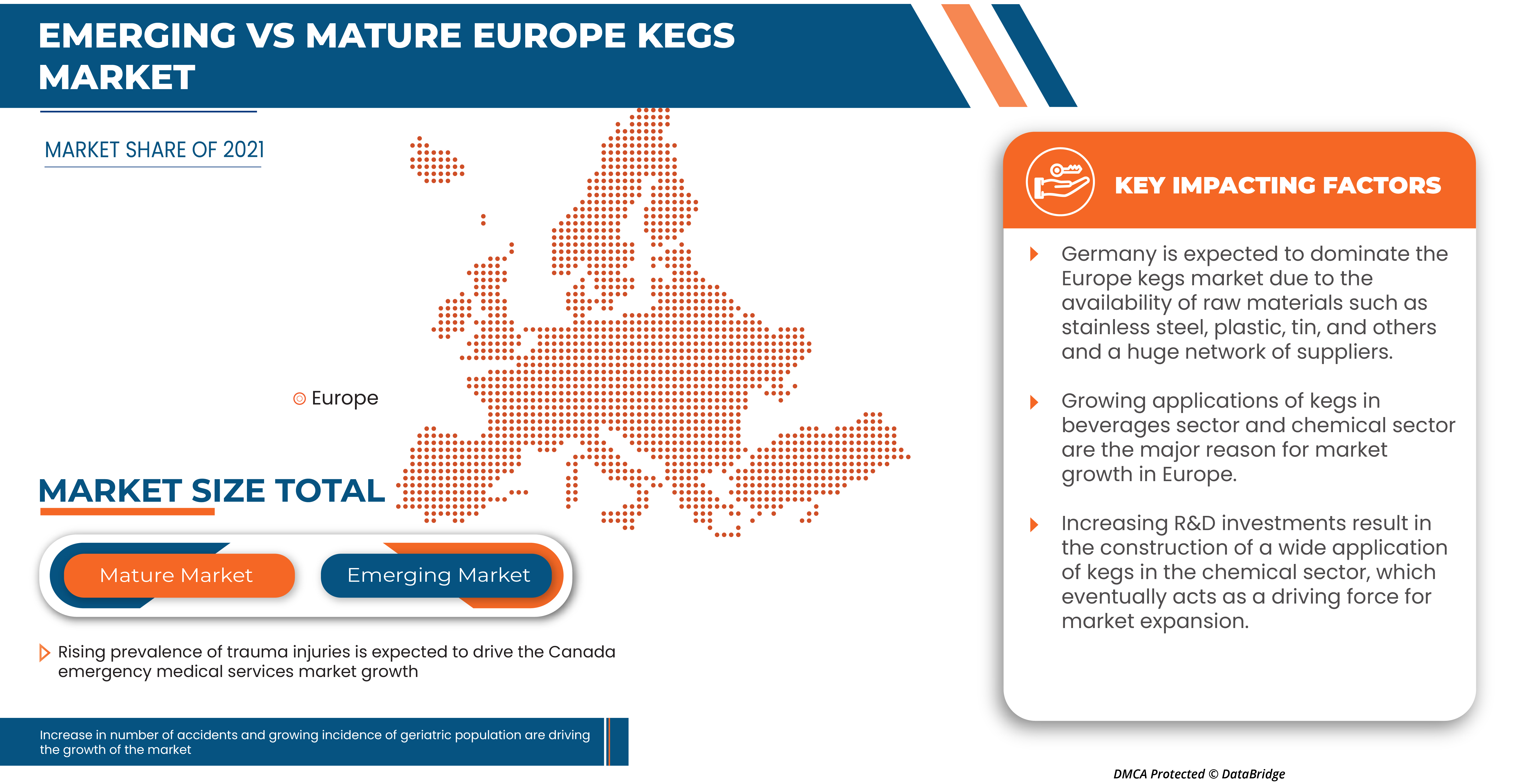

De nos jours, la plupart des entreprises de fûts et de produits chimiques investissent dans la R&D, ce qui entraîne une augmentation des applications des fûts dans le secteur chimique.

L’augmentation des investissements en R&D se traduit par la construction d’une large application de fûts dans le secteur chimique, ce qui agit à terme comme une force motrice pour l’expansion du marché.

- Tendance croissante des solutions d'emballage et de conservation à long terme

L’utilisation de fûts comme solution d’emballage dans l’industrie des boissons devrait connaître un avenir prometteur. Les fûts en plastique peuvent être recyclés et coûtent moins cher à renvoyer. D’autre part, l’adoption des fûts s’est étendue en raison de la popularité des fûts, ce qui a encouragé les fabricants à proposer des fûts à la location. Les fûts à usage unique sont une alternative plus économique et plus efficace aux fûts en acier traditionnels, et on prévoit qu’ils seront largement utilisés dans un avenir proche. De plus, le secteur de la microbrasserie se développe en raison de l’enthousiasme des consommateurs pour les bières artisanales, ce qui a soutenu l’industrie mondiale des fûts. L’utilisation des fûts devrait être encouragée par les contraintes législatives qui favorisent des limites de poids d’emballage plus basses. Les fûts sont également utilisés pour conserver des solutions telles que des boissons, de l’huile et des produits chimiques afin de préserver la qualité et la saveur du produit.

Par exemple,

- En septembre 2021, Newsmatics Inc. a publié un article intitulé « Les fûts sont devenus plus populaires en tant que solution d'emballage prometteuse à long terme » et indique qu'en tant qu'option d'emballage pour les boissons, les fûts devraient avoir un avenir prometteur.

- En septembre 2020, Hospitality Net™ a publié un article intitulé « Keg Wine On Tap : une innovation durable suisse » et explique qu'une chose était le vin en fût, qui protège parfaitement la qualité du vin tout en étant pratique, écologique et rentable

La sensibilisation croissante des utilisateurs finaux aux applications en fût, telles que les solutions d’emballage et de conservation à long terme, stimule la croissance du marché.

RESTRICTIONS

- Remplacement lent des fûts en raison de leur durée de vie prolongée

Les fûts ont une durée de vie plus longue, ce qui fait que les clients achètent le produit moins fréquemment. Comme il faut beaucoup de temps pour passer d'un vieux fût à un nouveau, ce décalage pourrait constituer un obstacle à l'expansion du marché.

Par exemple,

- En mars 2020, Keg Works a publié un article intitulé « Combien de temps un fût reste-t-il frais ? » Il mentionnait qu'un fût de bière pasteurisée avait une durée de conservation d'environ 90 à 120 jours (ou 3 à 4 mois) et que la bière pression non pasteurisée avait une durée de conservation d'environ 45 à 60 jours (ou 6 à 8 semaines) lorsqu'elle était conservée à la bonne température.

La durée de vie de différents fûts est mentionnée dans le tableau ci-dessous :

|

Nom du produit |

Durée de vie |

|

Fût de vin |

6-8 semaines |

|

Fût de bière non pasteurisée |

6-8 semaines |

|

Fût pasteurisé |

3-4 semaines |

|

Fûts à cocktail |

Environ 2 mois |

|

Fûts de cidre |

6-8 semaines |

Bien que les fûts ayant une durée de vie plus longue puissent aider les utilisateurs finaux, le ralentissement du remplacement des fûts peut constituer un obstacle à la croissance du marché.

- Coût élevé associé aux fûts commerciaux

Une baisse des prix se traduira presque certainement par de nouveaux consommateurs ou par des ventes de fûts. Un prix élevé, en revanche, encourage les acheteurs à acheter moins de produits, ce qui entraîne une perte de ventes pour l'entreprise. Le coût élevé des fûts commerciaux constitue un obstacle au marché, car les utilisateurs finaux ne peuvent pas se permettre de continuer à investir dans ces fûts commerciaux. Il constitue à terme un obstacle à la croissance du marché.

Par exemple,

|

Nom du produit |

Prix |

|

Distributeur de bière commercial Kegerator - Magasin à 4 robinets pour 4 fûts |

44 000 INR |

|

Ball Lock Corny Keg : Fermenteur de bière maison |

5 824 INR |

|

Fût de bière commercial en acier inoxydable 50 litres norme européenne |

55-65 USD/pièce |

|

Fût de bière de brassage commercial de 1 gallon, 30 litres avec régulateur de CO2 |

54,59-56,69 USD/pièce |

|

Fût de bière personnalisé vide en acier inoxydable de 30 l Fût de bière de 30 l |

44,48-57,65 USD/pièce |

Les prix des fûts commerciaux indiqués ci-dessus sont plus élevés et ils sont hors de portée des consommateurs finaux. Par conséquent, l'expansion du marché finira par ralentir.

OPPORTUNITÉ

- Des progrès croissants dans les technologies des fûts, comme la technologie de pointe

L'automatisation et les progrès technologiques ont rendu la fabrication de fûts plus efficace. Ces installations peuvent mieux gérer leurs coûts et leurs systèmes clés, grâce à des capteurs de suivi de fûts intelligents liés à l'Internet des objets (IoT) utilisant à la fois la technologie GPS et RFID, et des contrôles de température, entre autres. Les technologies d'automatisation des fûts comprennent des capteurs intelligents, des tablettes et des smartphones mobiles, des logiciels, des API et des bases de données cloud. L'automatisation des fûts basée sur la technologie, entre autres, améliore le traitement des commandes et améliore le stockage et le transport des boissons alcoolisées ou non alcoolisées, gazeuses ou non, et d'autres boissons.

L’augmentation rapide de la R&D et des progrès technologiques dans la fabrication de fûts contribuera à offrir une opportunité de croissance et d’expansion du marché.

Par conséquent, des opportunités sur le marché devraient naître des développements technologiques en cours dans la fabrication de fûts.

DÉFI

- Une concurrence de plus en plus rude entre les acteurs

Étant donné la concurrence intense entre les acteurs actuels de l'industrie des fûts, cela entraînera une baisse des prix et une moindre rentabilité globale du secteur. Les fûts sont un marché d'emballage et de conteneurs très concurrentiel. La rentabilité totale à long terme de l'organisation est affectée par cette concurrence. En raison de cette rivalité intense, les entreprises se concentrent principalement sur l'augmentation du nombre de lancements de produits, de campagnes et de marketing pour attirer les consommateurs. Cette concurrence entre les acteurs constituera donc un défi pour le marché.

Les entreprises qui produisent et fournissent des biens comparables sont plus compétitives entre elles, ce qui pourrait menacer le marché en raison d’une offre importante et d’une faible demande.

Impact post-COVID-19 sur le marché européen des fûts

Après la pandémie, la demande de fûts a augmenté car il n'y avait aucune restriction de mouvement, donc l'approvisionnement en produits était facile. La persistance de la COVID-19 pendant une période plus longue a affecté la chaîne d'approvisionnement car elle a été perturbée, et il est devenu difficile de fournir les produits alimentaires aux consommateurs, ce qui a initialement augmenté la demande de produits. Cependant, après la COVID-19, la demande de fûts a augmenté de manière significative en raison de la bonne teneur en nutriments et d'autres disponibilités nutritionnelles.

Développements récents

- En juin 2022, Ara Partners (« Ara »), une société de capital-investissement spécialisée dans les investissements dans la décarburation industrielle, a annoncé l'acquisition de Petainer Ltd. (« Petainer » ou la « Société »), un producteur mondial basé au Royaume-Uni de solutions d'emballage de boissons durables. Ara a acquis Petainer en collaboration avec Petainer Management et les filiales de Next Wave Partners LLP.

- En mai 2022, BLEFA s'est associée à d'autres sociétés leaders mondiales de la chaîne d'approvisionnement en fûts pour lancer la nouvelle Steel Keg Association (SKA) afin de donner aux brasseries et aux entreprises de boissons, ainsi qu'aux bars et restaurants, les avantages des fûts en acier, d'une voix unifiée.

Portée du marché des fûts en Europe

Le marché européen des fûts est segmenté en quatre segments notables en fonction du matériau, de la capacité, de l'utilisateur final et du canal de distribution. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Matériel

- Plastique

- Étain

- Acier inoxydable

En fonction du matériau, le marché est segmenté en plastique, étain et acier inoxydable.

Capacité

- Jusqu'à 20 litres

- 20 litres à 40 litres

- 40 litres à 60 litres

- Plus de 60 litres

En fonction de la capacité, le marché est segmenté en jusqu'à 20 litres, de 20 litres à 40 litres, de 40 litres à 60 litres et plus de 60 litres.

Utilisateur final

- Boissons alcoolisées

- Boissons non alcoolisées

- Huile de cuisson

- Produits chimiques

- Autres

Based on end user, the market is segmented into alcoholic beverages, non-alcoholic beverages, cooking oil, chemicals, and others.

Distribution Channel

- Supermarket/Hypermarket

- Commercial Liquor Store

- Others

Based on distribution channel, the market is segmented into supermarket/hypermarket, commercial liquor store, and others.

Europe Kegs Market Regional Analysis/Insights

The Europe kegs market is analyzed and market size insights and trends are provided by country, material, capacity, end user, and distribution channel as referenced above.

The countries covered in this market report are U.K., Germany, France, Netherlands, Belgium, Spain, Switzerland, Italy, Russia, Turkey, and rest of Europe.

Germany is dominating the kegs market in Europe. Growing demand for beverages is the major reason for market growth in Europe. Moreover, the beverages market is growing progressively in the Europe region. The growth of this market will directly impact the growth of kegs market. However, high cost of commercial kegs is likely to restrict market growth.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends and porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Europe brands and their challenges faced due to large or scarce competition from local and domestic brands, and the impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Europe Kegs Market Share Analysis

The Europe kegs market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, Europe presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on the market.

Some of the major players operating in the market are NDL Keg Europe, BLEFA GmbH, Julius Kleemann GmbH & Co.KG, The Metal Drum Company, Petainer Ltd., NEW MAISONNEUVE KEG, Schaefer Container Systems, Supermonte Group Italy, Inc., and KeyKeg among others.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE KEGS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 MATERIAL LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES ANALYSIS

4.3 IMPORT-EXPORT ANALYSIS

4.4 LIST OF KEY BUYERS

4.5 PRODUCTION CONSUMPTION ANALYSIS

4.6 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.7 RAW MATERIAL PRODUCTION COVERAGE

5 REGULATION COVERAGE

6 CLIMATE CHANGE SCENARIO

7 SUPPLY CHAIN ANALYSIS

7.1 RAW MATERIAL

7.2 SUPPLYING/MANUFACTURING

7.3 DISTRIBUTION

7.4 END-USERS

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 RISING TREND OF LONG-TERM PACKAGING AND PRESERVING SOLUTIONS

8.1.2 INCREASING CONSUMPTION OF BEVERAGES DUE TO CHANGE IN GRADUAL LIFESTYLE

8.1.3 GROWING APPLICATION OF KEGS IN CHEMICAL SECTORS

8.2 RESTRAINTS

8.2.1 HIGH COST ASSOCIATED WITH COMMERCIAL KEGS

8.2.2 SLOW REPLACEMENT OF KEGS DUE TO THEIR PROLONGED LIFESPAN

8.3 OPPORTUNITIES

8.3.1 INCREASED DEMAND FOR ECO-FRIENDLY KEGS AS A RESULT OF THE SUSTAINABILITY TREND

8.3.2 INCREASING ADVANCEMENTS IN TECHNOLOGIES IN KEGS SUCH AS CUTTING-EDGE TECHNOLOGY

8.4 CHALLENGES

8.4.1 WIDE FLUCTUATIONS IN PRICE OF RAW MATERIAL

8.4.2 GROWING STIFF COMPETITION AMONG PLAYERS

9 EUROPE KEGS MARKET, BY MATERIAL

9.1 OVERVIEW

9.2 STAINLESS STEEL

9.3 PLASTIC

9.4 TIN

10 EUROPE KEGS MARKET, BY CAPACITY

10.1 OVERVIEW

10.2 40 LITRE TO 60 LITRE

10.3 20 LITRE TO 40 LITRE

10.4 ABOVE 60 LITRE

10.5 UP TO 20 LITRE

11 EUROPE KEGS MARKET, BY END USER

11.1 OVERVIEW

11.2 ALCOHOLIC BEVERAGES

11.2.1 BEER

11.2.2 WINE

11.2.3 SPIRITS

11.2.4 CIDER

11.3 NON-ALCOHOLIC BEVERAGES

11.3.1 SOFT-DRINKS

11.3.2 RTD-BEVERAGES

11.3.3 JUICES

11.3.4 OTHERS

11.4 CHEMICALS

11.5 COOKING OIL

11.6 OTHERS

12 EUROPE KEGS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 COMMERCIAL LIQUOR STORE

12.3 SUPERMARKET / HYPERMARKET

12.4 OTHERS

13 EUROPE KEGS MARKET, BY REGION

13.1 EUROPE

13.1.1 GERMANY

13.1.2 SPAIN

13.1.3 U.K.

13.1.4 ITALY

13.1.5 FRANCE

13.1.6 NETHERLANDS

13.1.7 BELGIUM

13.1.8 SWITZERLAND

13.1.9 RUSSIA

13.1.10 TURKEY

13.1.11 REST OF EUROPE

14 COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: EUROPE

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 BLEFA GMBH

16.1.1 COMPANY SNAPSHOT

16.1.2 COMPANY SHARE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 PETAINER LTD.

16.2.1 COMPANY SNAPSHOT

16.2.2 COMPANY SHARE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 JULIUS KLEEMANN GMBH & CO. KG

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENT

16.4 NDL KEG EUROPE

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 NEW MAISONNEUVE KEG

16.5.1 COMPANY SNAPSHOT

16.5.2 COMPANY SHARE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENT

16.6 AMERICAN KEG COMPANY

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 KEYKEG

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 SCHAEFER CONTAINER SYSTEMS

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 SHINHAN INDUSTRIAL CO,. LTD.

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 SUPERMONTE GROUP ITALY, INC

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 THE METAL DRUM COMPANY

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT OF KEGS, 2020-2021, IN USD MILLION

TABLE 2 EXPORT OF KEGS (CASKS, BARRELS, VATS, TUBS AND OTHER COOPERS' PRODUCTS PARTS THEREOF, OF WOOD, INCL. STAVES), 2020-2021, IN USD MILLION

TABLE 3 EUROPE KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 4 EUROPE KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 5 EUROPE STAINLESS STEEL IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 EUROPE STAINLESS STEEL IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 7 EUROPE PLASTIC IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 EUROPE PLASTIC IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 9 EUROPE TIN IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE TIN IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 11 EUROPE KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 12 EUROPE KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 13 EUROPE 40 LITRE TO 60 LITRE IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE 40 LITRE TO 60 LITRE IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 15 EUROPE 20 LITRE TO 40 LITRE IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE 20 LITRE TO 40 LITRE IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 17 EUROPE ABOVE 60 LITRE IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 EUROPE ABOVE 60 LITRE IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 19 EUROPE UP TO 20 LITRE IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 EUROPE UP TO 20 LITRE IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 21 EUROPE KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 22 EUROPE KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 23 EUROPE ALCOHOLIC BEVERAGES IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE ALCOHOLIC BEVERAGES IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 25 EUROPE ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 26 EUROPE ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 27 EUROPE NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 EUROPE NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 29 EUROPE NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 30 EUROPE NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 31 EUROPE CHEMICALS IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 EUROPE CHEMICALS IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 33 EUROPE COOKING OIL IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 EUROPE COOKING OIL IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 35 EUROPE OTHERS IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 EUROPE OTHERS IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 37 EUROPE KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 38 EUROPE KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 39 EUROPE COMMERCIAL LIQUOR STORE IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 EUROPE COMMERCIAL LIQUOR STORE IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 41 EUROPE SUPERMARKET / HYPERMARKET IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 EUROPE SUPERMARKET / HYPERMARKET IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 43 EUROPE OTHERS IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 EUROPE OTHERS IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 45 EUROPE KEGS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 46 EUROPE KEGS MARKET, BY COUNTRY, 2020-2029 (THOUSAND UNITS)

TABLE 47 EUROPE KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 48 EUROPE KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 49 EUROPE KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 50 EUROPE KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 51 EUROPE KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 52 EUROPE KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 53 EUROPE ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 54 EUROPE ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 55 EUROPE NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 56 EUROPE NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 57 EUROPE KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 58 EUROPE KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 59 GERMANY KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 60 GERMANY KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 61 GERMANY KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 62 GERMANY KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 63 GERMANY KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 64 GERMANY KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 65 GERMANY ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 66 GERMANY ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 67 GERMANY NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 68 GERMANY NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 69 GERMANY KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 70 GERMANY KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 71 SPAIN KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 72 SPAIN KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 73 SPAIN KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 74 SPAIN KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 75 SPAIN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 76 SPAIN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 77 SPAIN ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 78 SPAIN ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 79 SPAIN NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 80 SPAIN NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 81 SPAIN KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 82 SPAIN KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 83 U.K. KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 84 U.K. KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 85 U.K. KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 86 U.K. KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 87 U.K. KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 88 U.K. KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 89 U.K. ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 90 U.K. ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 91 U.K. NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 92 U.K. NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 93 U.K. KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 94 U.K. KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 95 ITALY KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 96 ITALY KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 97 ITALY KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 98 ITALY KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 99 ITALY KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 100 ITALY KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 101 ITALY ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 102 ITALY ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 103 ITALY NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 104 ITALY NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 105 ITALY KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 106 ITALY KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 107 FRANCE KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 108 FRANCE KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 109 FRANCE KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 110 FRANCE KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 111 FRANCE KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 112 FRANCE KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 113 FRANCE ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 114 FRANCE ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 115 FRANCE NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 116 FRANCE NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 117 FRANCE KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 118 FRANCE KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 119 NETHERLANDS KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 120 NETHERLANDS KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 121 NETHERLANDS KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 122 NETHERLANDS KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 123 NETHERLANDS KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 124 NETHERLANDS KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 125 NETHERLANDS ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 126 NETHERLANDS ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 127 NETHERLANDS NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 128 NETHERLANDS NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 129 NETHERLANDS KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 130 NETHERLANDS KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 131 BELGIUM KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 132 BELGIUM KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 133 BELGIUM KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 134 BELGIUM KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 135 BELGIUM KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 136 BELGIUM KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 137 BELGIUM ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 138 BELGIUM ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 139 BELGIUM NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 140 BELGIUM NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 141 BELGIUM KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 142 BELGIUM KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 143 SWITZERLAND KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 144 SWITZERLAND KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 145 SWITZERLAND KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 146 SWITZERLAND KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 147 SWITZERLAND KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 148 SWITZERLAND KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 149 SWITZERLAND ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 150 SWITZERLAND ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 151 SWITZERLAND NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 152 SWITZERLAND NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 153 SWITZERLAND KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 154 SWITZERLAND KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 155 RUSSIA KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 156 RUSSIA KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 157 RUSSIA KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 158 RUSSIA KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 159 RUSSIA KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 160 RUSSIA KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 161 RUSSIA ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 162 RUSSIA ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 163 RUSSIA NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 164 RUSSIA NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 165 RUSSIA KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 166 RUSSIA KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 167 TURKEY KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 168 TURKEY KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 169 TURKEY KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 170 TURKEY KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 171 TURKEY KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 172 TURKEY KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 173 TURKEY ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 174 TURKEY ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 175 TURKEY NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 176 TURKEY NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 177 TURKEY KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 178 TURKEY KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 179 REST OF EUROPE KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 EUROPE KEGS MARKET: SEGMENTATION

FIGURE 2 EUROPE KEGS MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE KEGS MARKET : DROC ANALYSIS

FIGURE 4 EUROPE KEGS MARKET: EUROPE VS REGIONAL ANALYSIS

FIGURE 5 EUROPE KEGS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE KEGS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE KEGS MARKET: DBMR POSITION GRID

FIGURE 8 EUROPE KEGS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE KEGS MARKET: SEGMENTATION

FIGURE 10 RISING TREND OF LONG-TERM PAKAGING&PRESERVING SOLUTIONS IS EXPECTED TO DRIVE THE EUROPE KEGS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 STAINLESS STEEL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE KEGS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SUPPLY CHAIN OF EUROPE KEGS MARKET

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF EUROPE KEGS MARKET

FIGURE 14 EUROPE KEGS MARKET, BY MATERIAL, 2021

FIGURE 15 EUROPE KEGS MARKET, BY CAPACITY, 2021

FIGURE 16 EUROPE KEGS MARKET, BY END USER, 2021

FIGURE 17 EUROPE KEGS MARKET, BY DISTRIBUTION CHANNEL, 2021

FIGURE 18 EUROPE KEGS MARKET: SNAPSHOT (2021)

FIGURE 19 EUROPE KEGS MARKET: BY COUNTRY (2021)

FIGURE 20 EUROPE KEGS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 21 EUROPE KEGS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 22 EUROPE KEGS MARKET: BY MATERIAL (2022-2029)

FIGURE 23 EUROPE KEGS MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.