Marché européen des appareils d'interphonie, par type d'appareil (systèmes d'entrée de porte, appareils portables et moniteurs vidéo pour bébé), contrôle d'accès (lecteurs d'empreintes digitales, accès par mot de passe, cartes de proximité et accès sans fil), technologie (analogique et IP), utilisation finale (automobile, commerciale, gouvernementale, résidentielle et autres), type de communication (audio/vidéo et audio uniquement), tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et taille du marché des interphones en Europe

Les interphones sont des systèmes de communication électroniques constitués d'unités microphone/haut-parleur fixes qui se connectent à un dispositif de commande central. Il existe deux types de produits de base : câblés et sans fil. Les interphones câblés sont connectés par des câbles et sont installés dans les bâtiments, les appartements, les bureaux et les installations de fabrication. Les interphones sans fil s'appuient sur la transmission par radiofréquence (RF) et sont utilisés dans les stations de télévision, les véhicules de contrôle de diffusion, les centrales électriques et les installations de communication.

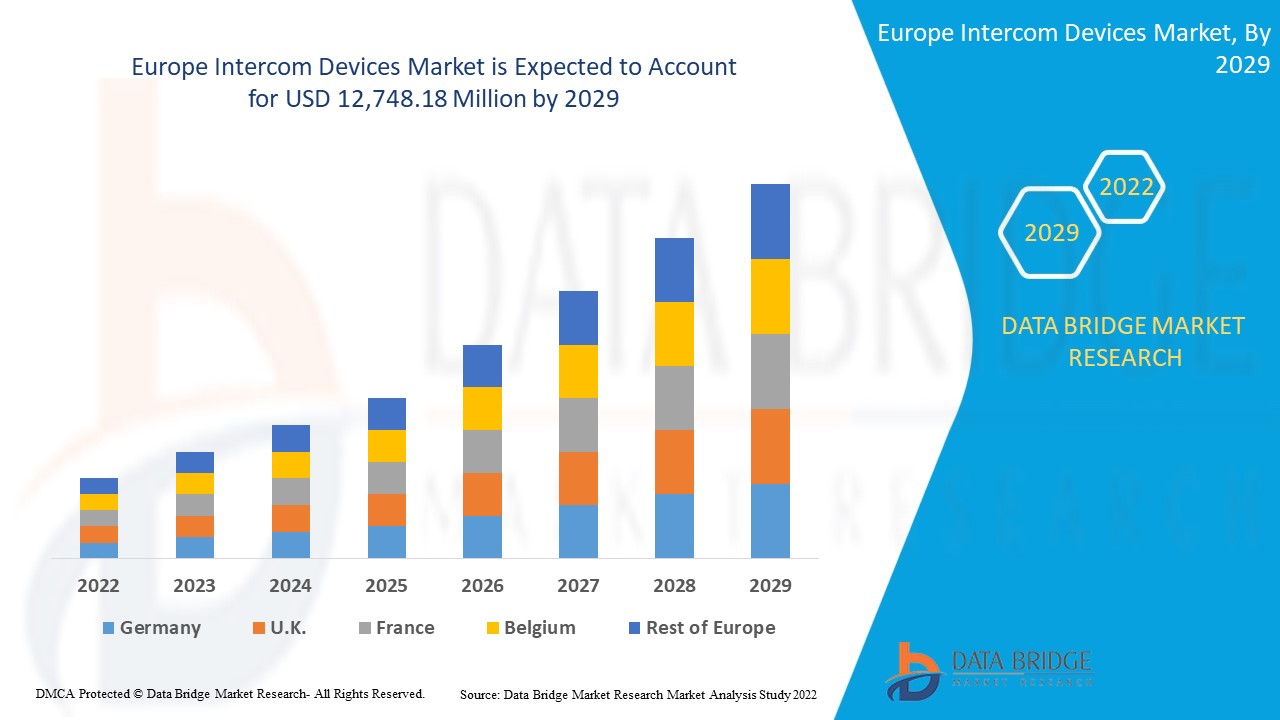

Selon les analyses de Data Bridge Market Research, le marché européen des interphones devrait atteindre une valeur de 12 748,18 millions USD d'ici 2029, à un TCAC de 11,9 % au cours de la période de prévision. « Audio/Vidéo » représente le segment de communication le plus important, car ce type de communication est très demandé et constitue la meilleure option pour accroître la sécurité. Le rapport sur le marché européen des interphones couvre également en profondeur l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2015) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Par type d'appareil (systèmes d'entrée de porte, appareils portables et moniteurs vidéo pour bébé), contrôle d'accès (lecteurs d'empreintes digitales, accès par mot de passe, cartes de proximité et accès sans fil), technologie (analogique et IP), utilisation finale (automobile, commerciale, gouvernementale, résidentielle et autres), type de communication (audio/vidéo et audio uniquement) |

|

Pays couverts |

Allemagne, France, Italie, Royaume-Uni, Turquie, Suisse, Espagne, Russie, Pays-Bas, Belgique, Reste de l'Europe |

|

Acteurs du marché couverts |

Comelit Group SpA, Fujian Aurine Technology Co., Ltd., Xiamen Leelen Technology Co., Ltd., Aiphone Corporation, Panasonic Holdings Corporation, Honeywell International Inc., Commend International GmbH. (Une marque du groupe TKH), Legrand Group, FERMAX INTERNATIONAL, SAU, Zhuhai Taichuan Cloud Technology Co., LTD., 2N TELEKOMUNIKACE as (Une marque d'Axis Communications Inc.), Competition Electronic(zhuhai) co., ltd., Jiale Group, Hangzhou Hikvision Digital Technology Co., Ltd., Dahua Technology Co., Ltd, SAMSUNG ELECTRONICS CO., LTD., TCS TürControlSysteme AG, COMMAX, Siedle, Akuvox (Xiamen) Networks Co., Ltd., DoorKing, TOA Corporation, Barix.com, URMET SpA, Bird Home Automation GmbH, entre autres |

Définition du marché

Un système d'interphone est un type avancé de système d'entrée de porte avec une caméra pour gérer l'accès à un bâtiment. Comme d'autres types de systèmes d'interphone, un interphone vidéo avec caméra prend également en charge la communication entre les visiteurs et les occupants. Plutôt que de se fier uniquement à la voix, les occupants peuvent visualiser des images en direct ou enregistrées à partir d'un lecteur d'entrée de porte équipé d'une caméra pour vérifier l'identité d'un visiteur avant d'accorder l'accès.

La technologie d'interphonie prend en charge de nombreuses autres fonctionnalités avancées pour renforcer la sécurité du contrôle d'accès et améliorer le confort des occupants et des visiteurs. Des fonctionnalités telles que le déverrouillage à distance, la gestion basée sur le cloud, l'intégration avec les systèmes de gestion des bâtiments , l'intelligence artificielle et les technologies de reconnaissance faciale offrent aux entreprises et aux gestionnaires immobiliers une plus grande efficacité et une plus grande flexibilité dans la gestion de l'accès aux propriétés.

Dynamique du marché des interphones en Europe

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- L'avènement des systèmes audiovisuels de sécurité avancés

L'écosphère de l'IoT a connu une évolution progressive. Cette écosphère est desservie par divers composants électroniques standard qui sont du matériel intégré à divers logiciels. L'utilisation de services audiovisuels personnalisés à l'ère de l'IoT est nécessaire pour faire avancer la technologie audiovisuelle de l'IoT. Étant donné que les appareils compatibles IoT peuvent se connecter au réseau plus large et avancé, ils atteignent des fonctionnalités étendues. Les appareils d'interphone vidéo compatibles IoT tels que les serrures de porte et les écrans interactifs avec des lignes directrices sont largement adoptés dans divers secteurs tels que l'automobile, le commerce, le gouvernement, le résidentiel et autres.

- Augmentation des cas de vols et de vols à travers le monde

Le vol est l'acte de voler, notamment par la force brute ou par des menaces de violence. Les voleurs peuvent voler une personne ou un lieu, comme une maison ou un commerce. En raison de l'augmentation des cas de vol, l'utilisation des interphones augmente dans diverses institutions telles que les écoles et les hôpitaux, entre autres.

Retenue/Défi

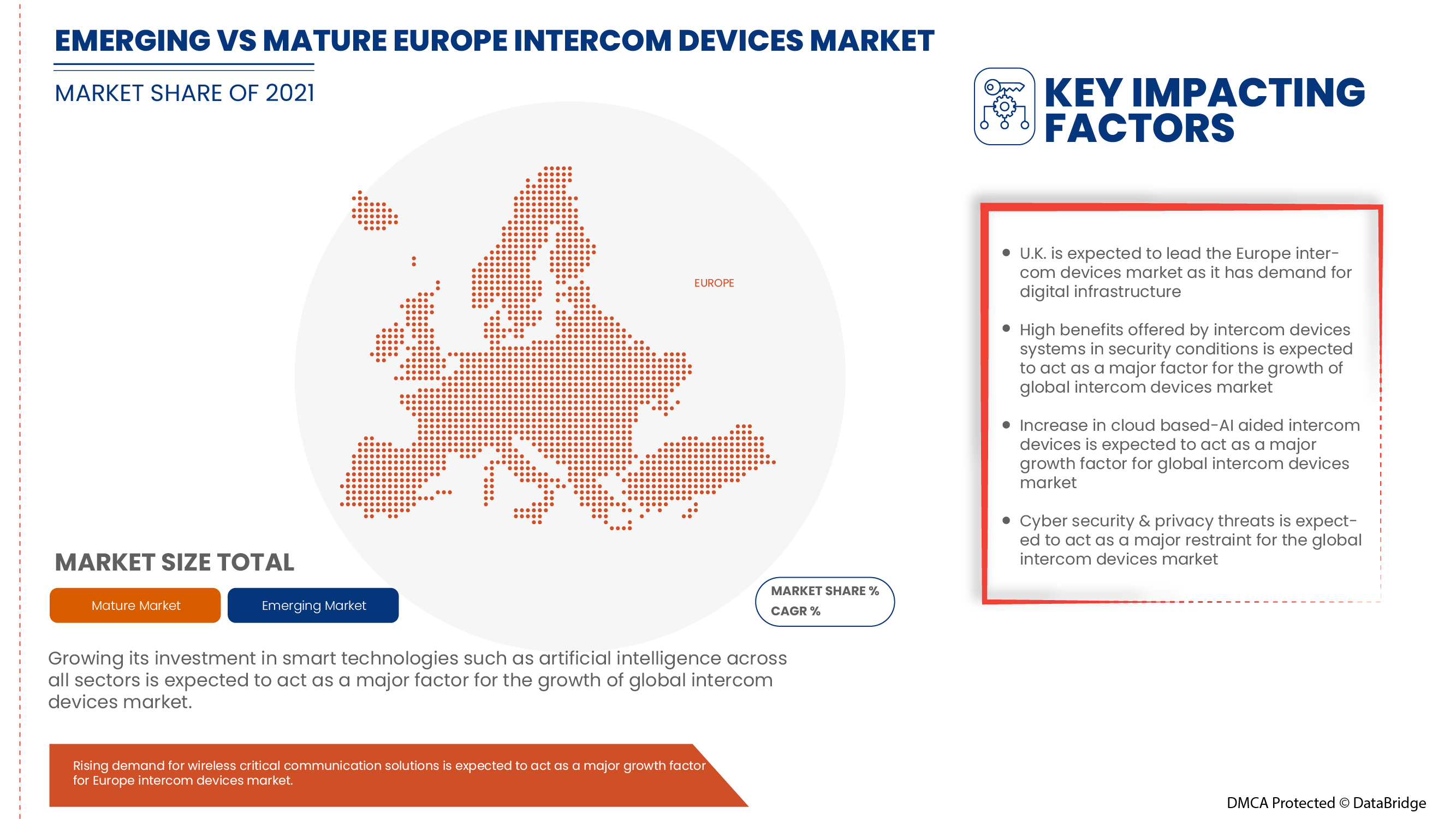

- La montée de la cybersécurité et les menaces fragilisent les solutions d'interphonie

Les problèmes de cybercriminalité/piratage informatique et de cybersécurité ont augmenté de 600 % pendant la pandémie dans tous les secteurs. Les failles de sécurité des réseaux ou des logiciels sont des faiblesses que les pirates exploitent pour effectuer des actions non autorisées au sein d'un système. Selon Purple Sec LLC, en 2018, les variantes de logiciels malveillants pour mobiles ont augmenté de 54 %, dont 98 % ciblent les appareils Android. On estime que 25 % des entreprises ont été victimes de crypto-jacking, y compris dans le secteur de la sécurité.

Opportunités

- Initiatives gouvernementales croissantes en faveur du développement des villes intelligentes

Les initiatives prises par le gouvernement dans les villes et communautés intelligentes sont menées par deux organes de gouvernance : un groupe de haut niveau conseillant la Commission européenne (CE) composé de hauts représentants des industries, des villes et de la société civile, ainsi que la plateforme des parties prenantes des villes intelligentes. La plateforme se concentre sur l'identification des solutions et des besoins des différents développeurs. La plateforme des parties prenantes des villes intelligentes vise essentiellement à promouvoir les innovations. Elle vise à accélérer le développement et le déploiement sur le marché des applications d'efficacité énergétique et de technologies à faible émission de carbone dans l'environnement urbain.

- Contrôle renforcé pour dissuader les cambrioleurs, surveillance des bébés et garantie de la sécurité de la propriété

Les activités des cambrioleurs augmentent de jour en jour dans divers pays comme le Royaume-Uni. La plupart des criminels essaient d'éviter les situations à risque et préfèrent les cibles faciles avec un faible rapport risque-récompense. Des interphones sont utilisés pour assurer et augmenter la sécurité des propriétés dans différentes villes. Les interphones câblés sont connectés par des câbles et installés dans les bâtiments, les appartements et les usines.

Impact post-COVID-19 sur le marché européen des interphones

La COVID-19 a eu un impact majeur sur le marché européen des appareils d'interphonie, car presque tous les pays ont opté pour la fermeture de toutes les installations de production, à l'exception de celles qui produisent les biens essentiels. Le gouvernement a pris des mesures strictes, telles que l'arrêt de la production et de la vente de biens non essentiels, le blocage du commerce international et bien d'autres, pour empêcher la propagation de la COVID-19. Les seules entreprises qui ont fait face à cette situation de pandémie étaient les services essentiels qui ont été autorisés à ouvrir et à exécuter les processus.

La croissance du marché des interphones est en hausse en raison des systèmes audiovisuels de sécurité avancés post-COVID. De plus, l'ouverture du confinement stimule l'industrie des interphones, ce qui augmente la demande d'interphones sur le marché. Cependant, des facteurs tels que l'augmentation de la cybersécurité et les menaces affaiblissant les solutions d'interphone freinent la croissance du marché. La fermeture des installations de production pendant la situation de pandémie a eu un impact significatif sur le marché.

Les fabricants prennent diverses décisions stratégiques pour rebondir après la COVID-19. Les acteurs mènent de nombreuses activités de recherche et développement pour améliorer la technologie impliquée dans les appareils d'interphonie. Grâce à cela, les entreprises apporteront au marché des solutions avancées et précises. En outre, les initiatives gouvernementales visant à stimuler le commerce international ont conduit à la croissance du marché.

Développement récent

- En juillet 2021, Hangzhou Hikvision Digital Technology Co., Ltd a dévoilé son gadget de tablette All-in-One Indoor Station, qui combine des solutions de sécurité dans les maisons et les bureaux. Avec ce produit, l'entreprise a réussi à s'imposer dans une application de gestion d'appareils basée sur le cloud pour les utilisateurs du monde entier.

- En mai 2018, Panasonic Holdings Corporation a lancé une gamme de solutions de systèmes d'interphone vidéo. Des fonctionnalités telles que des technologies de pointe sans fil et interactives ont été utilisées dans la série VL-VM du système d'interphone vidéo analogique. Cela a aidé l'entreprise à améliorer encore son portefeuille de produits et à proposer des solutions innovantes pour le consommateur

Portée du marché des appareils d'interphonie en Europe

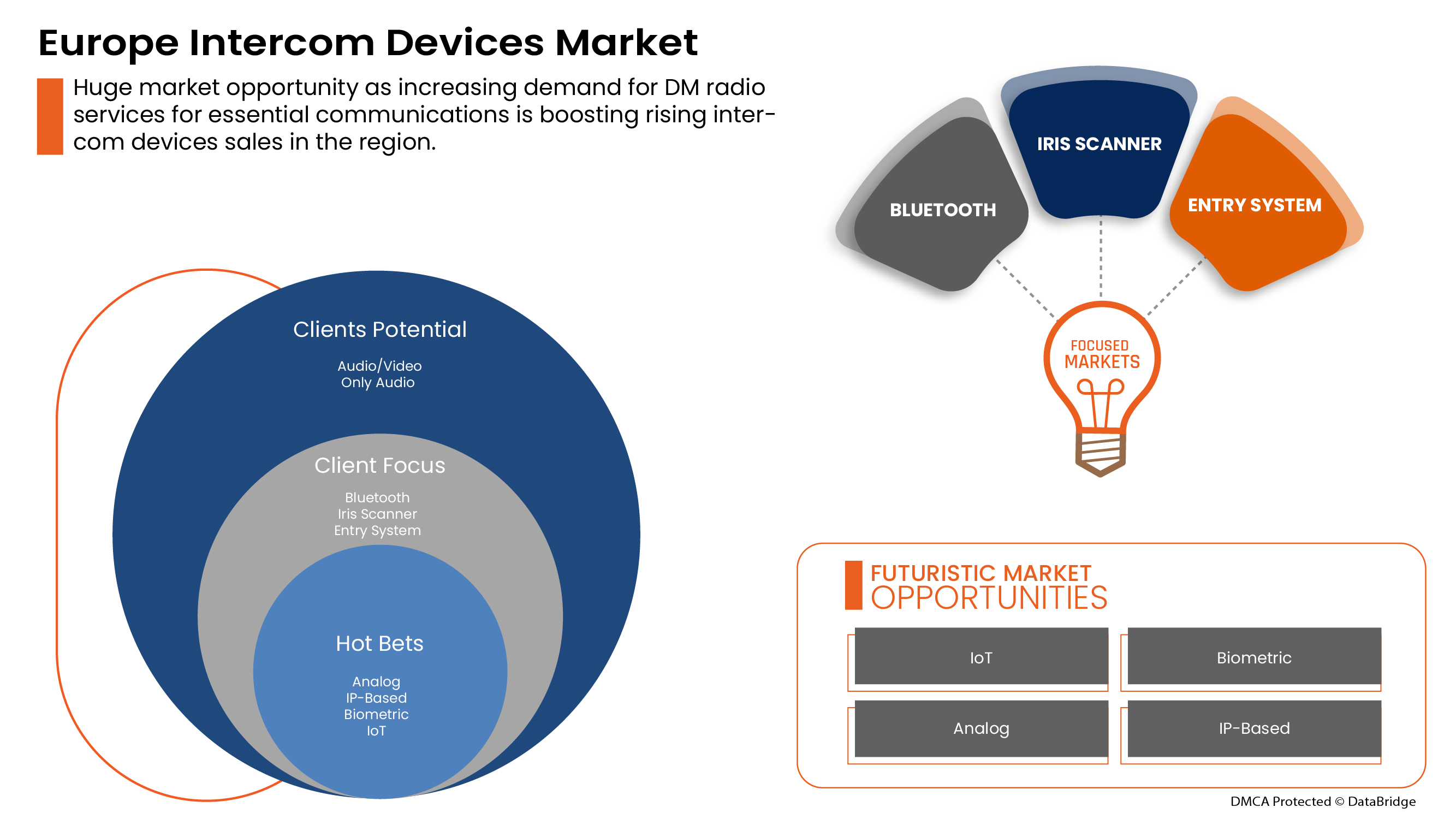

Le marché européen des interphones est segmenté en fonction du type de communication, du type d'appareil, du contrôle d'accès, de la technologie et de l'utilisation finale. La croissance de ces segments vous aidera à analyser les segments de croissance limités dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Le marché européen des interphones est segmenté en fonction du type de communication, du type d'appareil, du contrôle d'accès, de la technologie et de l'utilisation finale. La croissance de ces segments vous aidera à analyser les segments de croissance limités dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Par type de communication

- Audio/vidéo

- Audio uniquement

Sur la base du type de communication, le marché européen des appareils d'interphonie est segmenté en audio/vidéo et audio uniquement.

Par type d'appareil

- Systèmes d'entrée de porte

- Appareils portables

- Moniteurs vidéo pour bébé

Sur la base du type d'appareil, le marché européen des interphones a été segmenté en systèmes d'entrée de porte, appareils portables et moniteurs vidéo pour bébé.

Par contrôle d'accès

- Lecteurs d'empreintes digitales

- Accès par mot de passe

- Cartes de proximité

- Accès sans fil

Sur la base du contrôle d'accès, le marché européen des appareils d'interphonie a été segmenté en lecteurs d'empreintes digitales, accès par mot de passe, cartes de proximité et accès sans fil.

Par technologie

- Analogique

- Basé sur IP

Sur la base de la technologie, le marché européen des appareils d'interphonie a été segmenté en analogique et IP.

Par utilisation finale

- Automobile

- Commercial

- Gouvernement

- Résidentiel

- Autres

Sur la base de l'utilisation finale, le marché européen des appareils d'interphonie a été segmenté en automobile, commercial, gouvernemental, résidentiel et autres.

Analyse/perspectives régionales du marché des interphones en Europe

Le marché européen des appareils d’interphonie est analysé et des informations et tendances sur la taille du marché sont fournies par pays, type de communication, type d’appareil, contrôle d’accès, technologie et utilisation finale, comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché des appareils d'interphonie en Europe sont l'Allemagne, la France, l'Italie, le Royaume-Uni, la Turquie, la Suisse, l'Espagne, la Russie, les Pays-Bas, la Belgique et le reste de l'Europe.

En 2022, l'Allemagne devrait dominer le marché européen des appareils d'interphonie en raison du développement accru d'appareils d'interphonie basés sur le cloud conçus pour améliorer la sécurité et apporter de nouveaux niveaux d'intelligence opérationnelle aux gouvernements, aux entreprises, aux transports et aux communautés.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, l'analyse des tendances techniques des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario du marché pour chaque pays. En outre, la présence et la disponibilité des marques européennes et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des appareils d'interphonie en Europe

Le paysage concurrentiel du marché des interphones en Europe fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Europe, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché des interphones en Europe.

Français Certains des principaux acteurs opérant sur le marché européen des appareils d'interphonie sont Comelit Group SpA, Fujian Aurine Technology Co., Ltd., Xiamen Leelen Technology Co., Ltd., Aiphone Corporation, Panasonic Holdings Corporation, Honeywell International Inc., Commend International GmbH. (Une marque du groupe TKH), Legrand Group, FERMAX INTERNATIONAL, SAU, Zhuhai Taichuan Cloud Technology Co., LTD., 2N TELEKOMUNIKACE as (Une marque d'Axis Communications Inc.), Competition Electronic(zhuhai) co., ltd., Jiale Group, Hangzhou Hikvision Digital Technology Co., Ltd., Dahua Technology Co., Ltd, SAMSUNG ELECTRONICS CO., LTD., TCS TürControlSysteme AG, COMMAX, Siedle, Akuvox (Xiamen) Networks Co., Ltd., DoorKing, TOA Corporation, Barix.com, URMET SpA, Bird Home Automation GmbH, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE INTERCOM DEVICES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 COMMUNICATION TYPE TIMELINE CURVE

2.1 MARKET END-USE COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 AUDIO AND AUDIO/VIDEO INTERNAL UNIT

4.2 U.S. COMPETITORS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 ADVENT OF ADVANCED SECURITY AUDIOVISUAL SYSTEMS

5.1.2 INCREASE IN ROBBERY, BURGLARY, AND THIEF CASES ACROSS THE GLOBE

5.1.3 INCREASE IN CLOUD BASED-AI AIDED INTERCOM DEVICES

5.1.4 GROWING IMPORTANCE OF SMART HOMES AND SMART BUILDINGS

5.2 RESTRAINT

5.2.1 RISE IN CYBER SECURITY & THREATS WEAKENING INTERCOM SOLUTIONS

5.3 OPPORTUNITIES

5.3.1 GROWING GOVERNMENT INITIATIVES TOWARD THE DEVELOPMENT OF SMART CITIES

5.3.2 INCREASED CHECK ON DETER BURGLARS, BABY MONITORING AND ENSURING SAFETY OF PROPERTY

5.3.3 RISE IN DEMAND FOR WIRELESS AUDIO/VIDEO INTERCOM DEVICES

5.3.4 RISING STRATEGIC PARTNERSHIP AND ACQUISITION AMONG ORGANIZATIONS FOR AUDIO/VIDEO INTERCOM DEVICES

5.4 CHALLENGE

5.4.1 MALFUNCTION ISSUES ASSOCIATED WITH THE AUDIO/VIDEO INTERCOM DEVICES

6 EUROPE INTERCOM DEVICE MARKET, BY COMMUNICATION TYPE

6.1 OVERVIEW

6.2 AUDIO/VIDEO

6.3 ONLY AUDIO

7 EUROPE INTERCOM DEVICE MARKET, BY DEVICE TYPE

7.1 OVERVIEW

7.2 DOOR ENTRY SYSTEMS

7.3 HANDHELD DEVICES

7.4 VIDEO BABY MONITORS

8 EUROPE INTERCOM DEVICE MARKET, BY ACCESS CONTROL

8.1 OVERVIEW

8.2 FINGERPRINT READERS

8.3 PROXIMITY CARDS

8.4 PASSWORD ACCESS

8.5 WIRELESS ACCESS

9 EUROPE INTERCOM DEVICE MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 ANALOG

9.3 IP-BASED

10 EUROPE INTERCOM DEVICE MARKET, BY END-USE

10.1 OVERVIEW

10.2 COMMERCIAL

10.3 RESIDENTIAL

10.4 GOVERNMENT

10.5 AUTOMOTIVE

10.6 OTHERS

11 EUROPE INTERCOM DEVICES MARKET, BY REGION

11.1 EUROPE

11.1.1 U.K.

11.1.2 GERMANY

11.1.3 FRANCE

11.1.4 ITALY

11.1.5 SPAIN

11.1.6 RUSSIA

11.1.7 NETHERLANDS

11.1.8 SWITZERLAND

11.1.9 TURKEY

11.1.10 BELGIUM

11.1.11 REST OF EUROPE

12 EUROPE INTERCOM DEVICES MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: EUROPE

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 PANASONIC HOLDINGS CORPORATION

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCTS PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 SAMSUNG ELECTRONICS CO., LTD. ELECTRONICS CO., LTD.

14.3.1 COMPANY PROFILE

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 LEGRAND GROUP

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCTS PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 HONEYWELL INTERNATIONAL INC.

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCTS PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 DAHUA TECHNOLOGY CO., LTD

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCTS PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 AIPHONE CORPORATION.

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCTS PORTFOLIO

14.7.4 RECENT DEVELOPMENTS

14.8 SIEDLE

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCTS PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 COMMAX.

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCTS PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 2N TELEKOMUNIKACE A.S

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCTS PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 AKUVOX (XIAMEN) NETWORKS CO., LTD.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 ALPHA COMMUNICATIONS

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 BARIX.COM

14.13.1 COMPANY SNAPSHOT

14.13.2 SOLUTION PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 BIRD HOME AUTOMATION GMBH.

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCTS PORTFOLIO

14.14.3 RECENT DEVELOPMENTS

14.15 BUTTERFLYMX, INC.

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT & SOLUTION PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 COMELIT GROUP S.P.A.

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCTS PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

14.17 COMMEND INTERNATIONAL GMBH.

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCTS PORTFOLIO

14.17.4 RECENT DEVELOPMENTS

14.18 COMPETITION ELECTRONIC (ZHUHAI) CO., LTD.

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCTS PORTFOLIO

14.18.3 RECENT DEVELOPMENTS

14.19 DOORKING

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENT

14.2 FERMAX ELECTRÓNICA, S.A.U.

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCTS PORTFOLIO

14.20.3 RECENT DEVELOPMENTS

14.21 FUJIAN AURINE TECHNOLOGY CO., LTD.

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCTS PORTFOLIO

14.21.3 RECENT DEVELOPMENT

14.22 JIALE GROUP

14.22.1 COMPANY SNAPSHOT

14.22.2 SOLUTION PORTFOLIO

14.22.3 RECENT DEVELOPMENT

14.23 SWIFTLANE.

14.23.1 COMPANY SNAPSHOT

14.23.2 PRODUCTS PORTFOLIO

14.23.3 RECENT DEVELOPMENTS

14.24 TCS TÜRCONTROLSYSTEME AG

14.24.1 COMPANY SNAPSHOT

14.24.2 PRODUCTS PORTFOLIO

14.24.3 RECENT DEVELOPMENTS

14.25 TOA CORPORATION.

14.25.1 COMPANY SNAPSHOT

14.25.2 REVENUE ANALYSIS

14.25.3 PRODUCT PORTFOLIO

14.25.4 RECENT DEVELOPMENT

14.26 URMET S.P.A.

14.26.1 COMPANY SNAPSHOT

14.26.2 PRODUCTS PORTFOLIO

14.26.3 RECENT DEVELOPMENT

14.27 WRT INTELLIGENT TECHNOLOGY COMPANY LIMITED

14.27.1 COMPANY SNAPSHOT

14.27.2 PRODUCT & SOLUTION PORTFOLIO

14.27.3 RECENT DEVELOPMENT

14.28 XIAMEN LEELEN TECHNOLOGY CO., LTD.

14.28.1 COMPANY SNAPSHOT

14.28.2 PRODUCTS PORTFOLIO

14.28.3 RECENT DEVELOPMENTS

14.29 ZHUHAI TAICHUAN CLOUD TECHNOLOGY CO., LTD.

14.29.1 COMPANY SNAPSHOT

14.29.2 PRODUCT & SOLUTION PORTFOLIO

14.29.3 RECENT DEVELOPMENTS

14.3 ZICOM

14.30.1 COMPANY SNAPSHOT

14.30.2 PRODUCT PORTFOLIO

14.30.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 LIST OF U.S. COMPETITORS

TABLE 2 EUROPE INTERCOM DEVICES MARKET, BY COMMUNICATION TYPE, 2020-2029 (USD MILLION)

TABLE 3 EUROPE AUDIO/VIDEO IN INTERCOM DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 EUROPE ONLY AUDIO IN INTERCOM DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 EUROPE INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 6 EUROPE DOOR ENTRY SYSTEMS IN INTERCOM DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 EUROPE HANDHELD DEVICES IN INTERCOM DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 EUROPE VIDEO BABY MONITORS IN INTERCOM DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 EUROPE INTERCOM DEVICES MARKET, BY ACCESS CONTROL, 2020-2029 (USD MILLION)

TABLE 10 EUROPE FINGERPRINT READERS IN INTERCOM DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 EUROPE PROXIMITY CARDS IN INTERCOM DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE PASSWORD ACCESS IN INTERCOM DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 EUROPE WIRELESS ACCESS IN INTERCOM DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE INTERCOM DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 15 EUROPE ANALOG IN INTERCOM DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE IP-BASED IN INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 17 EUROPE INTERCOM DEVICES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 18 EUROPE COMMERCIAL IN INTERCOM DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE RESIDENTIAL IN INTERCOM DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 EUROPE GOVERNMENT IN INTERCOM DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 EUROPE AUTOMOTIVE IN INTERCOM DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 EUROPE OTHERS IN INTERCOM DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 EUROPE INTERCOM DEVICES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 24 EUROPE INTERCOM DEVICES MARKET, BY COMMUNICATION TYPE, 2020-2029 (USD MILLION)

TABLE 25 EUROPE INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 26 EUROPE INTERCOM DEVICES MARKET, BY ACCESS CONTROL, 2020-2029 (USD MILLION)

TABLE 27 EUROPE INTERCOM DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 28 EUROPE INTERCOM DEVICES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 29 U.K. INTERCOM DEVICES MARKET, BY COMMUNICATION TYPE, 2020-2029 (USD MILLION)

TABLE 30 U.K. INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 31 U.K. INTERCOM DEVICES MARKET, BY ACCESS CONTROL, 2020-2029 (USD MILLION)

TABLE 32 U.K. INTERCOM DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 33 U.K. INTERCOM DEVICES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 34 GERMANY INTERCOM DEVICES MARKET, BY COMMUNICATION TYPE, 2020-2029 (USD MILLION)

TABLE 35 GERMANY INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 36 GERMANY INTERCOM DEVICES MARKET, BY ACCESS CONTROL, 2020-2029 (USD MILLION)

TABLE 37 GERMANY INTERCOM DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 38 GERMANY INTERCOM DEVICES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 39 FRANCE INTERCOM DEVICES MARKET, BY COMMUNICATION TYPE, 2020-2029 (USD MILLION)

TABLE 40 FRANCE INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 41 FRANCE INTERCOM DEVICES MARKET, BY ACCESS CONTROL, 2020-2029 (USD MILLION)

TABLE 42 FRANCE INTERCOM DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 43 FRANCE INTERCOM DEVICES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 44 ITALY INTERCOM DEVICES MARKET, BY COMMUNICATION TYPE, 2020-2029 (USD MILLION)

TABLE 45 ITALY INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 46 ITALY INTERCOM DEVICES MARKET, BY ACCESS CONTROL, 2020-2029 (USD MILLION)

TABLE 47 ITALY INTERCOM DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 48 ITALY INTERCOM DEVICES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 49 SPAIN INTERCOM DEVICES MARKET, BY COMMUNICATION TYPE, 2020-2029 (USD MILLION)

TABLE 50 SPAIN INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 51 SPAIN INTERCOM DEVICES MARKET, BY ACCESS CONTROL, 2020-2029 (USD MILLION)

TABLE 52 SPAIN INTERCOM DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 53 SPAIN INTERCOM DEVICES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 54 RUSSIA INTERCOM DEVICES MARKET, BY COMMUNICATION TYPE, 2020-2029 (USD MILLION)

TABLE 55 RUSSIA INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 56 RUSSIA INTERCOM DEVICES MARKET, BY ACCESS CONTROL, 2020-2029 (USD MILLION)

TABLE 57 RUSSIA INTERCOM DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION))

TABLE 58 RUSSIA INTERCOM DEVICES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 59 NETHERLANDS INTERCOM DEVICES MARKET, BY COMMUNICATION TYPE, 2020-2029 (USD MILLION)

TABLE 60 NETHERLANDS INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 61 NETHERLANDS INTERCOM DEVICES MARKET, BY ACCESS CONTROL, 2020-2029 (USD MILLION)

TABLE 62 NETHERLANDS INTERCOM DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 63 NETHERLANDS INTERCOM DEVICES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 64 SWITZERLAND INTERCOM DEVICES MARKET, BY COMMUNICATION TYPE, 2020-2029 (USD MILLION)

TABLE 65 SWITZERLAND INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 66 SWITZERLAND INTERCOM DEVICES MARKET, BY ACCESS CONTROL, 2020-2029 (USD MILLION)

TABLE 67 SWITZERLAND INTERCOM DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 68 SWITZERLAND INTERCOM DEVICES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 69 TURKEY INTERCOM DEVICES MARKET, BY COMMUNICATION TYPE, 2020-2029 (USD MILLION)

TABLE 70 TURKEY INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 71 TURKEY INTERCOM DEVICES MARKET, BY ACCESS CONTROL, 2020-2029 (USD MILLION)

TABLE 72 TURKEY INTERCOM DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 73 TURKEY INTERCOM DEVICES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 74 BELGIUM INTERCOM DEVICES MARKET, BY COMMUNICATION TYPE, 2020-2029 (USD MILLION)

TABLE 75 BELGIUM INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 76 BELGIUM INTERCOM DEVICES MARKET, BY ACCESS CONTROL, 2020-2029 (USD MILLION)

TABLE 77 BELGIUM INTERCOM DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 78 BELGIUM INTERCOM DEVICES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 79 REST OF EUROPE INTERCOM DEVICES MARKET, BY COMMUNICATION TYPE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 EUROPE INTERCOM DEVICES MARKET: SEGMENTATION

FIGURE 2 EUROPE INTERCOM DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE INTERCOM DEVICES MARKET: DROC ANALYSIS

FIGURE 4 EUROPE INTERCOM DEVICES MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE INTERCOM DEVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE INTERCOM DEVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE INTERCOM DEVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE INTERCOM DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE INTERCOM DEVICES MARKET: MARKET VERTICAL COVERAGE GRID

FIGURE 10 EUROPE INTERCOM DEVICES MARKET: SEGMENTATION

FIGURE 11 INCREASE IN CLOUD BASED-AI AIDED INTERCOM DEVICES IS EXPECTED TO DRIVE THE EUROPE INTERCOM DEVICES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 AUDIO/VIDEO SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE INTERCOM DEVICES MARKET IN 2022 & 2029

FIGURE 13 ADVANTAGES OFFERED BY VIDEO SYSTEM OVER AUDIO ONLY SYSTEMS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF EUROPE INTERCOM DEVICES MARKET

FIGURE 15 VIDEO SYSTEMS

FIGURE 16 STATS RELATED TO ROBBERY AND BURGLARY

FIGURE 17 TECHNOLOGY AMALGAMATION IN SMART HOME/ BUILDINGS

FIGURE 18 IMPACT OF CYBER SECURITY THREAT

FIGURE 19 EUROPE INTERCOM DEVICE MARKET: BY COMMUNICATION TYPE, 2021

FIGURE 20 EUROPE INTERCOM DEVICE MARKET: BY DEVICE TYPE, 2021

FIGURE 21 EUROPE INTERCOM DEVICE MARKET: BY ACCESS CONTROL, 2021

FIGURE 22 EUROPE INTERCOM DEVICE MARKET: BY TECHNOLOGY, 2021

FIGURE 23 EUROPE INTERCOM DEVICE MARKET: BY END-USE, 2021

FIGURE 24 EUROPE INTERCOM DEVICES MARKET: SNAPSHOT (2021)

FIGURE 25 EUROPE INTERCOM DEVICES MARKET: BY COUNTRY (2021)

FIGURE 26 EUROPE INTERCOM DEVICES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 27 EUROPE INTERCOM DEVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 28 EUROPE INTERCOM DEVICES MARKET: BY COMMUNICATION TYPE (2022-2029)

FIGURE 29 EUROPE INTERCOM DEVICES MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.