Marché européen du houmous, par type (houmous classique, houmous au poivron rouge, houmous à l'ail rôti, houmous aux olives noires, houmous aux lentilles, houmous à l'edamame, houmous aux haricots blancs et autres), matière première (pois chiches, haricots, pois verts, lentilles rouges, aubergines et autres), emballage (pots / tasses, sachets, bouteilles, bocaux et autres), origine (conventionnelle et biologique), type d'émulsion (permanente, semi-permanente et temporaire), teneur en matières grasses (ordinaire, faible en matières grasses et sans matières grasses), matériau d'emballage (polymères, métal, verre et autres), application (pâtes et tartinades, sauces et trempettes, desserts, confiseries et autres), canal de distribution (B2C et B2B), utilisateur final (ménage / détail, commercial et industriel) Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché du houmous en Europe

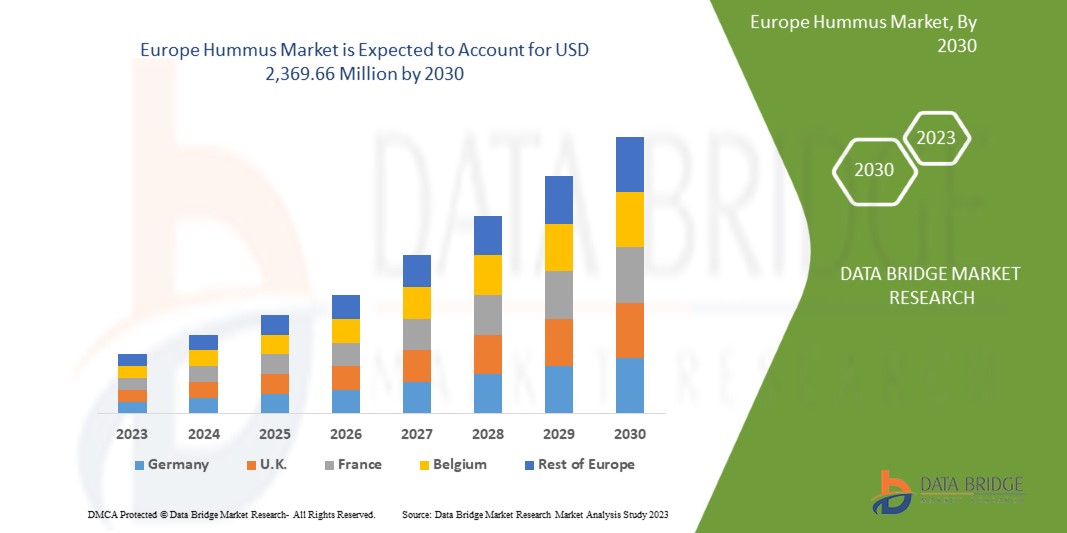

Le marché européen du houmous devrait connaître une croissance significative au cours de la période de prévision de 2023 à 2030. Data Bridge Market Research analyse que le marché croît avec un TCAC de 7,4 % au cours de la période de prévision de 2023 à 2030 et devrait atteindre 2 369,66 millions USD d'ici 2030. Le principal facteur à l'origine de la croissance du marché européen du houmous est l'augmentation de la prévalence croissante du véganisme, qui stimule la demande de houmous.

Le houmous est connu pour être un plat sain et sain. Aux États-Unis et dans d'autres pays occidentaux, le houmous est disponible dans une variété de saveurs. On le trouve dans des versions de base avec simplement des pois chiches et peut-être un ou deux légumes pour la saveur, ou dans des houmous de type « multicouches » avec des composants supplémentaires comme de l'huile d'olive et des épices.

Le rapport sur le marché du houmous en Europe fournit des détails sur la part de marché, les nouveaux développements et l'impact des acteurs du marché national et local, des opportunités d'analyse en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste, notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Type (houmous classique, houmous au poivron rouge, houmous à l'ail rôti, houmous aux olives noires, houmous aux lentilles, houmous à l'edamame, houmous aux haricots blancs et autres), matière première (pois chiches, haricots, pois verts, lentilles rouges, aubergines et autres), emballage (pots/tasses, sachets, bouteilles, bocaux et autres), origine (conventionnelle et biologique), type d'émulsion (permanente, semi-permanente et temporaire), teneur en matières grasses (ordinaire, faible en matières grasses et sans matières grasses), matériau d'emballage (polymères, métal, verre et autres), application (pâtes et tartinades, sauces et trempettes, desserts, confiseries et autres), canal de distribution (B2C et B2B), utilisateur final (ménage/vente au détail, (commercial et industriel) |

|

Région couverte |

Royaume-Uni, Allemagne, France, Italie, Pologne, Espagne, Pays-Bas, Suisse, Suède, Turquie, Belgique, Russie, Danemark, Reste de l'Europe |

|

Acteurs du marché couverts |

Lancaster Colony Corporation (États-Unis), Bakkavor Group plc (Royaume-Uni), SAVENCIA SA (France), Hannah Foods (États-Unis), PELOPAC INC. (Grèce) et Sevan AB (Suède) |

Définition du marché

Le plat méditerranéen et moyen-oriental le plus connu est le houmous. Il est principalement composé de pois chiches en purée, de citron, de pâte de tahini, d'huile d'olive et d'épices telles que l'ail rôti, les poivrons rouges rôtis et l'oignon. Le persil, les tomates ou les concombres hachés, les pignons de pin sont également parfois inclus dans la production de houmous. Le houmous se compose principalement de pois chiches qui sont une bonne source de protéines, d'amidon résistant, d'acides gras polyinsaturés, de fibres alimentaires et de divers minéraux et vitamines tels que la thiamine, la riboflavine, le phosphore, l'acide folique, la niacine, le calcium et le potassium. La teneur élevée en protéines du houmous en fait une option incontournable pour les végétaliens qui l'utilisent comme trempette ou tartinade avec du pain et des chips. Le houmous a également un faible indice glycémique, il n'augmente donc pas le taux de sucre dans le sang par rapport à d'autres aliments riches en glucides.

Dynamique du marché du houmous en Europe

Conducteurs

- AUGMENTATION DU NOMBRE DE LANCEMENTS DE NOUVEAUX PRODUITS AVEC DIFFÉRENTES COMBINAISON DE SAVEURS

Le houmous est une célèbre pâte à tartiner méditerranéenne et, en trempette, il est riche en vitamines, minéraux, fibres et protéines. Les ingrédients du houmous tels que les pois chiches, le tahini et l'huile d'olive sont des superaliments bien connus. En raison de sa valeur nutritionnelle et de ses bienfaits élevés, la popularité du houmous augmente dans le monde entier. On constate également une augmentation des dépenses de consommation pour les produits à base de houmous emballés. Les végétaliens se tournent également vers le houmous comme option de collation, car il constitue une bonne source de protéines végétales.

Le houmous est principalement utilisé comme trempette de légumes avec du céleri, des carottes, des poivrons, des tranches de concombre, des pois mange-tout ou du brocoli. Il est également utilisé comme trempette ou tartinade avec du pain pita, des chips de bretzel, des craquelins, des petits pains et des garnitures de sandwich. En outre, la tendance des snacks prêts à manger est également une force motrice des ventes de houmous sur le marché européen. Pour attirer de nouveaux consommateurs, les fabricants tentent de lancer différentes saveurs. Les saveurs traditionnelles sont trop célèbres, mais pour attirer de nouveaux clients, les fabricants développent de nouveaux types de houmous aromatisés. De plus, pour atteindre de nouveaux marchés, les producteurs développent du houmous au goût régional.

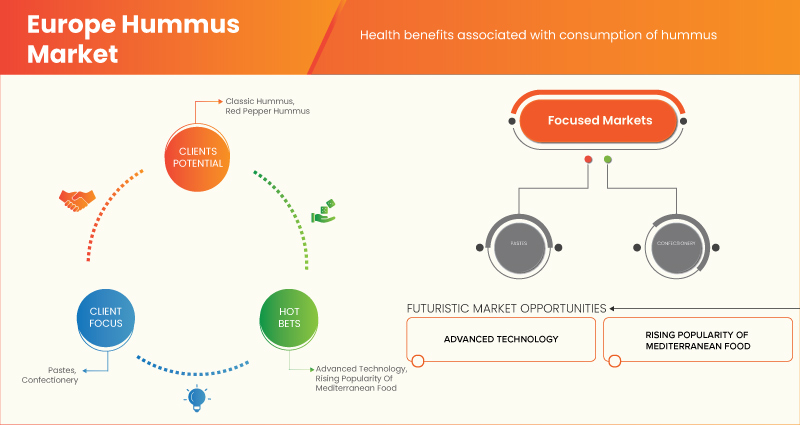

- BIENFAITS POUR LA SANTÉ ASSOCIÉS À LA CONSOMMATION DE HOUMOUS

Le houmous est un plat traditionnel du Moyen-Orient, préparé à partir de pois chiches cuits et réduits en purée. On y ajoute souvent des arômes supplémentaires, comme du tahini, du jus de citron, du sel et de l'huile d'olive. Le houmous est un aliment de base dans les régions méditerranéennes, du Moyen-Orient et d'Afrique du Nord. Le houmous est principalement composé de pois chiches, qui sont une bonne source de protéines, d'amidon résistant, d'acides gras polyinsaturés, de fibres alimentaires et de divers minéraux et vitamines tels que la thiamine, la riboflavine, le phosphore, l'acide folique, la niacine, le calcium et le potassium. Avec les pois chiches, le tahini est également l'un des ingrédients de la fabrication du houmous. Il s'agit d'une pâte à base de sésame moulu grillé qui est composée de lignanes antioxydantes, d'acides gras insaturés, de tocophérols et de minéraux constitués de phosphore et de calcium.

- LA PRÉVALENCE CROISSANTE DU VÉGANISME STIMULE LA DEMANDE DE HOUMOUS

Au cours des dernières années, la popularité du véganisme a augmenté, ce qui élimine de l'alimentation les aliments d'origine animale tels que les produits laitiers, les œufs et la viande. Les gens adoptent le véganisme et incluent dans leur alimentation les aliments d'origine végétale. Un régime végétalien sain se compose d'aliments végétaux peu transformés et contient des éléments tels que des fruits, des céréales complètes, des noix, des graines, des légumes et des légumineuses. Comme la population se tourne vers le véganisme ou les régimes à base de plantes, la popularité du houmous augmente dans le monde entier.

Le houmous est une pâte à tartiner ou une trempette à base de pois chiches cuits à base de plantes, de jus de citron, d'épices, de tahini et d'huile d'olive. Le houmous traditionnel est composé d'ingrédients d'origine végétalienne. Le houmous est riche en protéines, en fibres et en autres vitamines et minéraux essentiels. La teneur élevée en protéines du houmous en fait une option incontournable pour les végétaliens. La trempette est meilleure avec les repas et collations végétaliens tels que les wraps, les légumes crus, les salades et les sandwichs. En plus de cela, différentes entreprises proposent une gamme de produits à base de houmous végétaliens. Les restaurants et les fabricants ont également commencé à ajouter de la saveur au houmous

- AUGMENTATION DES DÉPENSES DE CONSOMMATION EN PRODUITS ALIMENTAIRES EMBALLÉS

Ces dernières années, les dépenses de consommation en produits alimentaires emballés ont augmenté dans le monde entier. L'européanisation et l'urbanisation rapides ont stimulé la demande d'aliments emballés et transformés. En outre, l'augmentation du revenu disponible et le secteur de la vente au détail de produits alimentaires en Europe moderne se développent considérablement, ce qui stimule encore la croissance des produits alimentaires emballés, y compris le houmous. Le houmous présente de nombreux avantages pour la santé, car il est une bonne source de protéines végétales, de fibres alimentaires et de divers minéraux et vitamines qui stimulent encore davantage la consommation et les ventes de houmous.

Le houmous peut être facilement emballé dans des contenants alimentaires. Ces contenants contenant du houmous peuvent être trouvés et vendus facilement dans les supermarchés et les magasins de proximité. Le houmous est également vendu sous forme de trempettes ou de tartinades avec d'autres produits alimentaires tels que les chips. Le secteur du commerce électronique a également connu un boom en matière de livraison de produits alimentaires, en particulier après la pandémie de COVID-19. Les consommateurs ont tendance à acheter les produits alimentaires emballés dans les magasins en ligne, y compris le houmous. La disponibilité du houmous dans différentes saveurs est également l'un des facteurs qui incitent les consommateurs à acheter du houmous via le mode de commerce électronique.

Opportunités

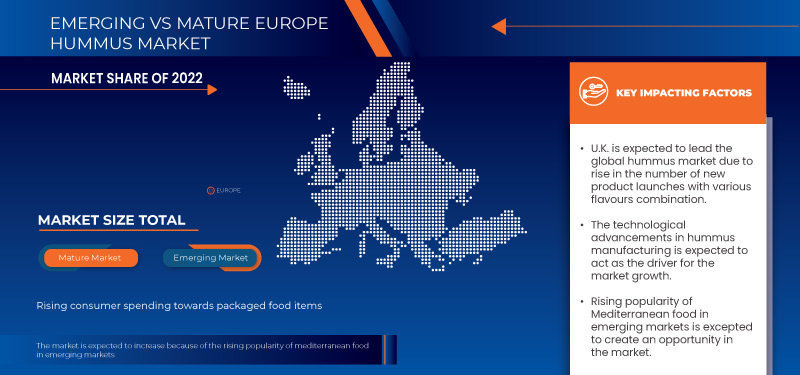

- POPULARITÉ CROISSANTE DE LA CUISINE MÉDITERRANÉENNE SUR LES MARCHÉS ÉMERGENTS

Ces dernières années, la cuisine méditerranéenne est devenue populaire dans le monde entier. La cuisine méditerranéenne est composée d'aliments à base de plantes, notamment d'huile d'olive, de céréales complètes, de haricots et d'autres légumineuses, de légumes, d'épices, de noix et d'herbes. Diverses études ont montré que le régime méditerranéen a le potentiel de réduire le risque de maladies cardiovasculaires et d'autres maladies chroniques. Le régime méditerranéen est également recommandé par les professionnels de la santé en raison de la quantité limitée de gras trans et de gras saturés, d'acides gras oméga-3, de sodium plus faible, de glucides raffinés moins nombreux et d'une grande quantité de fibres alimentaires. Des aliments comme le pain pita, le houmous, la salade fattoush et le baklava font partie des aliments méditerranéens célèbres dans le monde entier.

Le houmous présente également des avantages pour la santé car il est composé de divers ingrédients sains tels que les pois chiches, l'huile d'olive, le jus de citron et le tahini. C'est une bonne source de protéines pour la population qui suit un régime végétalien. Le houmous est également pratique pour être emballé dans de petits contenants et constitue une option de collation saine. Dans les régions en pleine croissance économique comme l'Asie et l'Afrique, le marché de la cuisine méditerranéenne est également en pleine croissance, ce qui offre un large éventail d'opportunités de croissance pour le marché européen du houmous.

- PROGRÈS TECHNOLOGIQUES DANS LA FABRICATION DU HOUMOUS

Le houmous a gagné en popularité dans le monde entier. Les bienfaits pour la santé et l'augmentation de la population végétalienne ont stimulé la demande de houmous. Ces dernières années, les progrès technologiques dans la fabrication du houmous se sont multipliés. L'essor des progrès technologiques a encore augmenté la qualité et la quantité du houmous produit. La production de houmous, depuis l'épluchage des pois chiches, la torréfaction, le broyage, le mélange et le remplissage du houmous dans les sachets, se fait automatiquement dans des machines sans aucune intervention humaine.

De plus, la conservation du houmous est l'un des domaines les plus étudiés en ce qui concerne les avancées technologiques. Le traitement à haute pression est l'une des méthodes les plus étudiées pour conserver et stériliser le houmous sous pression sans utiliser de conservateurs. En outre, des progrès ont été réalisés dans la technologie d'emballage. Les fabricants s'orientent également vers des applications d'emballage durables, recyclables, plus respectueuses de l'environnement et flexibles pour le stockage du houmous.

Contraintes/Défis

- FLUCTUATION DES PRIX DES MATIÈRES PREMIÈRES

Le houmous est une pâte à tartiner ou une trempette préparée avec de la purée de pois chiches, du jus de citron, des haricots, de l'ail, du tahini, de l'huile d'olive et du sel. D'autres ingrédients, comme des pignons de pin ou du poivron rouge, peuvent être ajoutés à la nourriture pour la rendre plus savoureuse. Le houmous est une cuisine populaire du Moyen-Orient, de la Méditerranée, de l'Europe et de l'Europe. C'est un ingrédient de base dans la plupart des régimes végétaliens et végétariens. Les gens choisissent des aliments prêts à l'emploi dans les magasins et les supermarchés. Cependant, les acheteurs ont récemment constaté une augmentation du prix du houmous.

La demande croissante de houmous et la pénurie de pois chiches ont entraîné une hausse des prix. Les pois chiches nécessitent beaucoup d'eau pour pousser. La sécheresse aurait réduit d'environ 40 % le rendement mondial des légumineuses. Le prix des pois chiches est influencé par deux facteurs majeurs : le conflit entre la Russie et l'Ukraine et les conditions météorologiques. Selon la Confédération européenne des légumineuses, l'offre mondiale de cette légumineuse devrait diminuer d'environ 20 % en 2022. Les conditions météorologiques et les conflits ont nui à l'approvisionnement en cette légumineuse riche en protéines, augmentant les coûts des denrées alimentaires et causant des problèmes aux producteurs.

- L’ADULTÉRATION CROISSANTE DANS LES PRODUITS À BASE DE HOUMOUS

Un aliment est considéré comme frelaté lorsqu'il contient un composant « toxique ou nocif » susceptible de mettre en danger la santé. La falsification peut être intentionnelle ou non, mais elle entraîne des difficultés majeures tant pour les clients que pour les producteurs. Il y a eu des cas de falsification de produits à base de houmous, qui ont donné lieu à des rappels par les utilisateurs finaux, comme les magasins de détail ou les supermarchés, ainsi qu'à des avertissements aux consommateurs de ne pas utiliser les produits frelatés. Cela crée une impression négative auprès des consommateurs et les fabricants perdent des clients et des revenus en conséquence.

Développements récents

- En juin 2021, CEDAR'S MEDITERRANEAN FOODS, INC., premier producteur et co-fabricant de houmous du pays, a élargi sa distribution pour inclure Amazon Fresh. Avec plus de 8 000 points de vente dans tout le pays, dont Whole Foods Market, Sprouts, Kroger et Publix, Cedar's est une marque alimentaire méditerranéenne de premier plan dans le secteur des produits d'épicerie naturels et biologiques. Cela aidera l'entreprise à développer ses activités et à atteindre une clientèle plus large.

- En novembre 2019, Hannah Foods a lancé un nouveau produit appelé hommus au chou-fleur et poivrons rouges rôtis, qui a connu un énorme succès dans la région du Sud-Est de Costco. Ils sont heureux d'annoncer que le hommus au chou-fleur et poivrons rouges rôtis sera disponible dans tous les magasins Costco de la région du Sud-Est à partir de janvier. Cela permet à l'entreprise d'attirer plus de clients qui préfèrent les aliments prêts à manger, augmentant ainsi la production et les revenus.

- En septembre 2019, la marque Boar's Head a lancé son nouveau houmous dessert à la tarte à la citrouille FallSpice Selection. Le houmous est préparé avec du sucre biologique, de la vraie citrouille, des pois chiches, des gousses de vanille et d'agréables épices d'automne comme la cannelle et la muscade. Le lancement du produit contribuera à attirer les clients qui souhaitent essayer différentes saveurs de houmous.

Portée du marché du houmous en Europe

Le marché européen du houmous est classé en fonction du type, de la matière première, de l'emballage, de l'origine, du type d'émulsion, de la teneur en matières grasses, du matériau d'emballage, de l'application, du canal de distribution et de l'utilisateur final. La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Taper

- Houmous classique

- Houmous au poivron rouge

- Houmous à l'ail rôti

- Houmous aux olives noires

- Houmous aux lentilles

- Houmous d'Edamame

- Houmous aux haricots blancs

- Autres

En fonction du type, le marché européen du houmous est segmenté en houmous classique, houmous au poivron rouge, houmous à l'ail rôti, houmous aux olives noires, houmous aux lentilles, houmous aux edamames, houmous aux haricots blancs et autres.

Matière première

- Pois chiches

- Haricots

- Petits pois

- Lentilles rouges

- Aubergine

- Autres

Sur la base des matières premières, le marché européen du houmous est segmenté en pois chiches, haricots, pois verts, lentilles rouges, aubergines et autres.

Conditionnement

- Bacs / Tasses

- Poche

- En bouteille

- Pots

- Autres

En fonction de l'emballage, le marché européen du houmous est segmenté en pots/tasses, sachets, bouteilles, pots et autres.

Origine

- Conventionnel

- Organique

En fonction de l’origine, le marché européen du houmous est segmenté en conventionnel et biologique.

Type d'émulsion

- Permanent

- Semi-permanent

- Temporaire

En fonction du type d’émulsion, le marché européen du houmous est segmenté en permanent, semi-permanent et temporaire.

Teneur en matières grasses

- Régulier

- Faible en gras

- Sans gras

En fonction de la teneur en matières grasses, le marché européen du houmous est segmenté en houmous ordinaire, faible en matières grasses et sans matières grasses.

Matériau d'emballage

- Polymères

- Métal

- Verre

- Autres

En fonction du matériau d’emballage, le marché européen du houmous est segmenté en polymères, métal, verre et autres.

Application

- Pâtes et pâtes à tartiner

- Sauces et trempettes

- Desserts

- Confiserie

- Autres

En fonction des applications, le marché européen du houmous est segmenté en pâtes et tartinades, sauces et trempettes, desserts, confiseries et autres.

Canal de distribution

- B2C

- B2B

En fonction du canal de distribution, le marché européen du houmous est segmenté en B2C et B2B.

Utilisateur final

- Ménage/Commerce de détail

- Publicités

- Industriel

En fonction de l'utilisateur final, le marché européen du houmous est segmenté en produits ménagers/de détail, commerciaux et industriels.

Analyse/perspectives régionales du marché du houmous en Europe

Le marché européen du houmous est segmenté en fonction du type, de la matière première, de l’emballage, de l’origine, du type d’émulsion, de la teneur en matières grasses, du matériau d’emballage, de l’application, du canal de distribution et de l’utilisateur final.

Les pays du marché européen du houmous sont le Royaume-Uni, l'Allemagne, la France, l'Italie, la Pologne, l'Espagne, les Pays-Bas, la Suisse, la Suède, la Turquie, la Belgique, la Russie, le Danemark et le reste de l'Europe. Le Royaume-Uni domine le marché européen du houmous en termes de part de marché et de chiffre d'affaires en raison de la hausse de la prévalence du véganisme qui stimule la demande de houmous.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Les points de données, l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces du porteur et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour chaque pays. En outre, la présence et la disponibilité de nouvelles marques et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du houmous en Europe

Le paysage concurrentiel du marché du houmous en Europe fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de durée de vie du produit. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché du houmous en Europe.

Certains des principaux acteurs opérant sur le marché européen du houmous sont Lancaster Colony Corporation (États-Unis), Bakkavor Group plc (Royaume-Uni), SAVENCIA SA (France), Hannah Foods (États-Unis), PELOPAC INC. (Grèce) et Sevan AB (Suède).

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE HUMMUS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TREATMENT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND ANALYSIS

4.2 COMPARATIVE ANALYSIS WITH THE PARENT MARKET

4.2.1 OVERVIEW

4.2.1.1 SALSA

4.2.1.2 MAYONNAISE

4.2.1.3 FRUIT PRESERVES

4.2.1.4 GUACAMOLE

4.3 CONSUMER BUYING BEHAVIOR

4.3.1 OVERVIEW

4.3.1.1 COMPLEX BUYING BEHAVIOR

4.3.1.2 DISSONANCE-REDUCING BUYING BEHAVIOR

4.3.1.3 HABITUAL BUYING BEHAVIOR

4.3.1.4 VARIETY SEEKING BEHAVIOR

4.3.2 CONCLUSION

4.4 PATENT ANALYSIS OF THE EUROPE HUMMUS MARKET

4.5 SUPPLY CHAIN ANALYSIS

4.5.1 OVERVIEW

4.5.2 LOGISTIC COST SCENARIO

4.5.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.6 UPCOMING TECHNOLOGY AND TRENDS

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISE IN THE NUMBER OF NEW PRODUCT LAUNCHES WITH VARIOUS FLAVORS COMBINATION

6.1.2 HEALTH BENEFITS ASSOCIATED WITH THE CONSUMPTION OF HUMMUS

6.1.3 THE INCREASING PREVALENCE OF VEGANISM BOOSTS HUMMUS DEMAND

6.1.4 RISING CONSUMER SPENDING TOWARD PACKAGED FOOD ITEMS

6.2 RESTRAINTS

6.2.1 FLUCTUATION IN RAW MATERIAL PRICES

6.2.2 AVAILABILITY OF OTHER TYPES OF DIPS

6.3 OPPORTUNITIES

6.3.1 RISING POPULARITY OF MEDITERRANEAN FOOD IN EMERGING MARKETS

6.3.2 TECHNOLOGICAL ADVANCEMENTS IN HUMMUS MANUFACTURING

6.4 CHALLENGES

6.4.1 SIDE EFFECTS ASSOCIATED WITH THE CONSUMPTION OF HUMMUS

6.4.2 INCREASING ADULTERATION IN HUMMUS PRODUCTS

7 EUROPE HUMMUS MARKET, BY REGION

7.1 EUROPE

7.1.1 U.K.

7.1.2 GERMANY

7.1.3 FRANCE

7.1.4 ITALY

7.1.5 POLAND

7.1.6 SPAIN

7.1.7 NETHERLANDS

7.1.8 SWITZERLAND

7.1.9 SWEDEN

7.1.10 TURKEY

7.1.11 BELGIUM

7.1.12 RUSSIA

7.1.13 DENMARK

7.1.14 REST OF EUROPE

8 EUROPE HUMMUS MARKET, COMPANY LANDSCAPE

8.1 COMPANY SHARE ANALYSIS: EUROPE

9 SWOT ANALYSIS

10 COMPANY PROFILES

10.1 LANCASTER COLONY CORPORATION

10.1.1 COMPANY SNAPSHOT

10.1.2 REVENUE ANALYSIS

10.1.3 COMPANY SHARE ANALYSIS

10.1.4 PRODUCT PORTFOLIO

10.1.5 RECENT DEVELOPMENTS

10.2 SABRA DIPPING CO., LLC

10.2.1 COMPANY SNAPSHOT

10.2.2 COMPANY SHARE ANALYSIS

10.2.3 PRODUCT PORTFOLIO

10.2.4 RECENT DEVELOPMENT

10.3 BAKKAVOR GROUP PLC

10.3.1 COMPANY SNAPSHOT

10.3.2 REVENUE ANALYSIS

10.3.3 COMPANY SHARE ANALYSIS

10.3.4 PRODUCT PORTFOLIO

10.3.5 RECENT DEVELOPMENTS

10.4 BOAR'S HEAD BRAND

10.4.1 COMPANY SNAPSHOT

10.4.2 COMPANY SHARE ANALYSIS

10.4.3 PRODUCT PORTFOLIO

10.4.4 RECENT DEVELOPMENT

10.5 TRIBE MEDITERRANEAN FOODS, INC.

10.5.1 COMPANY SNAPSHOT

10.5.2 COMPANY SHARE ANALYSIS

10.5.3 PRODUCT PORTFOLIO

10.5.4 RECENT DEVELOPMENT

10.6 ABRAHAM'S NATURAL FOODS

10.6.1 COMPANY SNAPSHOT

10.6.2 PRODUCT PORTFOLIO

10.6.3 RECENT DEVELOPMENT

10.7 CEDAR'S MEDITERRANEAN FOODS, INC.

10.7.1 COMPANY SNAPSHOT

10.7.2 PRODUCT PORTFOLIO

10.7.3 RECENT DEVELOPMENTS

10.8 ELMA FARMS

10.8.1 COMPANY SNAPSHOT

10.8.2 PRODUCT PORTFOLIO

10.8.3 RECENT DEVELOPMENT

10.9 ESTI FOODS

10.9.1 COMPANY SNAPSHOT

10.9.2 PRODUCT PORTFOLIO

10.9.3 RECENT DEVELOPMENTS

10.1 HAIG'S DELICACIES

10.10.1 COMPANY SNAPSHOT

10.10.2 PRODUCT PORTFOLIO

10.10.3 RECENT DEVELOPMENTS

10.11 HALIBURTON INTERNATIONAL FOODS, INC.

10.11.1 COMPANY SNAPSHOT

10.11.2 PRODUCT PORTFOLIO

10.11.3 RECENT DEVELOPMENTS

10.12 HANNAH FOODS

10.12.1 COMPANY SNAPSHOT

10.12.2 PRODUCT PORTFOLIO

10.12.3 RECENT DEVELOPMENTS

10.13 ITHACA HUMMUS

10.13.1 COMPANY SNAPSHOT

10.13.2 PRODUCT PORTFOLIO

10.13.3 RECENT DEVELOPMENT

10.14 KASIH FOOD

10.14.1 COMPANY SNAPSHOT

10.14.2 PRODUCT PORTFOLIO

10.14.3 RECENT DEVELOPMENT

10.15 LANTANA FOODS

10.15.1 COMPANY SNAPSHOT

10.15.2 PRODUCT PORTFOLIO

10.15.3 RECENT DEVELOPMENTS

10.16 LILLY'S FOODS

10.16.1 COMPANY SNAPSHOT

10.16.2 PRODUCT PORTFOLIO

10.16.3 RECENT DEVELOPMENTS

10.17 PELOPAC INC.

10.17.1 COMPANY SNAPSHOT

10.17.2 PRODUCT PORTFOLIO

10.17.3 RECENT DEVELOPMENTS

10.18 ROOTS HUMMUS

10.18.1 COMPANY SNAPSHOT

10.18.2 PRODUCT PORTFOLIO

10.18.3 RECENT DEVELOPMENT

10.19 SAVENCIA SA

10.19.1 COMPANY SNAPSHOT

10.19.2 COMPANY SHARE ANALYSIS

10.19.3 PRODUCT PORTFOLIO

10.19.4 RECENT DEVELOPMENT

10.2 SEVAN AB

10.20.1 COMPANY SNAPSHOT

10.20.2 PRODUCT PORTFOLIO

10.20.3 RECENT DEVELOPMENTS

11 QUESTIONNAIRE

12 RELATED REPORTS

Liste des tableaux

TABLE 1 REGULATORY FRAMEWORK

TABLE 2 EUROPE HUMMUS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 3 EUROPE HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 4 EUROPE HUMMUS MARKET, BY RAW MATERIAL, 2021-2030 (USD MILLION)

TABLE 5 EUROPE HUMMUS MARKET, BY PACKAGING, 2021-2030 (USD MILLION)

TABLE 6 EUROPE HUMMUS MARKET, BY ORIGIN, 2021-2030 (USD MILLION)

TABLE 7 EUROPE HUMMUS MARKET, BY EMULSION TYPE, 2021-2030 (USD MILLION)

TABLE 8 EUROPE HUMMUS MARKET, BY FAT CONTENT, 2021-2030 (USD MILLION)

TABLE 9 EUROPE HUMMUS MARKET, BY PACKAGING MATERIAL, 2021-2030 (USD MILLION)

TABLE 10 EUROPE HUMMUS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 11 EUROPE PASTE & SPREADS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 EUROPE SAUCES & DIPS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 13 EUROPE DESSERTS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 14 EUROPE CONFECTIONERY IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 EUROPE OTHERS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 16 EUROPE HUMMUS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 17 EUROPE B2B IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 18 EUROPE B2C IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 19 EUROPE HUMMUS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 20 EUROPE COMMERCIALS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 21 EUROPE INDUSTRIAL IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 22 U.K. HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 23 U.K. HUMMUS MARKET, BY RAW MATERIAL, 2021-2030 (USD MILLION)

TABLE 24 U.K. HUMMUS MARKET, BY PACKAGING, 2021-2030 (USD MILLION)

TABLE 25 U.K. HUMMUS MARKET, BY ORIGIN, 2021-2030 (USD MILLION)

TABLE 26 U.K. HUMMUS MARKET, BY EMULSION TYPE, 2021-2030 (USD MILLION)

TABLE 27 U.K. HUMMUS MARKET, BY FAT CONTENT, 2021-2030 (USD MILLION)

TABLE 28 U.K. HUMMUS MARKET, BY PACKAGING MATERIAL, 2021-2030 (USD MILLION)

TABLE 29 U.K. HUMMUS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 30 U.K. PASTE & SPREADS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 U.K. SAUCES & DIPS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 32 U.K. DESSERTS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 33 U.K. CONFECTIONERY IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 34 U.K. OTHERS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 U.K. HUMMUS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 36 U.K. B2B IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 37 U.K. B2C IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 38 U.K. HUMMUS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 39 U.K. COMMERCIALS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 U.K. INDUSTRIAL IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 41 GERMANY HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 42 GERMANY HUMMUS MARKET, BY RAW MATERIAL, 2021-2030 (USD MILLION)

TABLE 43 GERMANY HUMMUS MARKET, BY PACKAGING, 2021-2030 (USD MILLION)

TABLE 44 GERMANY HUMMUS MARKET, BY ORIGIN, 2021-2030 (USD MILLION)

TABLE 45 GERMANY HUMMUS MARKET, BY EMULSION TYPE, 2021-2030 (USD MILLION)

TABLE 46 GERMANY HUMMUS MARKET, BY FAT CONTENT, 2021-2030 (USD MILLION)

TABLE 47 GERMANY HUMMUS MARKET, BY PACKAGING MATERIAL, 2021-2030 (USD MILLION)

TABLE 48 GERMANY HUMMUS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 49 GERMANY PASTE & SPREADS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 GERMANY SAUCES & DIPS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 GERMANY DESSERTS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 52 GERMANY CONFECTIONERY IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 53 GERMANY OTHERS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 GERMANY HUMMUS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 55 GERMANY B2B IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 56 GERMANY B2C IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 57 GERMANY HUMMUS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 58 GERMANY COMMERCIALS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 59 GERMANY INDUSTRIAL IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 60 FRANCE HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 61 FRANCE HUMMUS MARKET, BY RAW MATERIAL, 2021-2030 (USD MILLION)

TABLE 62 FRANCE HUMMUS MARKET, BY PACKAGING, 2021-2030 (USD MILLION)

TABLE 63 FRANCE HUMMUS MARKET, BY ORIGIN, 2021-2030 (USD MILLION)

TABLE 64 FRANCE HUMMUS MARKET, BY EMULSION TYPE, 2021-2030 (USD MILLION)

TABLE 65 FRANCE HUMMUS MARKET, BY FAT CONTENT, 2021-2030 (USD MILLION)

TABLE 66 FRANCE HUMMUS MARKET, BY PACKAGING MATERIAL, 2021-2030 (USD MILLION)

TABLE 67 FRANCE HUMMUS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 68 FRANCE PASTE & SPREADS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 69 FRANCE SAUCES & DIPS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 70 FRANCE DESSERTS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 71 FRANCE CONFECTIONERY IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 72 FRANCE OTHERS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 73 FRANCE HUMMUS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 74 FRANCE B2B IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 75 FRANCE B2C IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 76 FRANCE HUMMUS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 77 FRANCE COMMERCIALS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 78 FRANCE INDUSTRIAL IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 79 ITALY HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 80 ITALY HUMMUS MARKET, BY RAW MATERIAL, 2021-2030 (USD MILLION)

TABLE 81 ITALY HUMMUS MARKET, BY PACKAGING, 2021-2030 (USD MILLION)

TABLE 82 ITALY HUMMUS MARKET, BY ORIGIN, 2021-2030 (USD MILLION)

TABLE 83 ITALY HUMMUS MARKET, BY EMULSION TYPE, 2021-2030 (USD MILLION)

TABLE 84 ITALY HUMMUS MARKET, BY FAT CONTENT, 2021-2030 (USD MILLION)

TABLE 85 ITALY HUMMUS MARKET, BY PACKAGING MATERIAL, 2021-2030 (USD MILLION)

TABLE 86 ITALY HUMMUS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 87 ITALY PASTE & SPREADS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 88 ITALY SAUCES & DIPS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 89 ITALY DESSERTS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 90 ITALY CONFECTIONERY IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 91 ITALY OTHERS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 92 ITALY HUMMUS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 93 ITALY B2B IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 94 ITALY B2C IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 95 ITALY HUMMUS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 96 ITALY COMMERCIALS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 97 ITALY INDUSTRIAL IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 98 POLAND HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 POLAND HUMMUS MARKET, BY RAW MATERIAL, 2021-2030 (USD MILLION)

TABLE 100 POLAND HUMMUS MARKET, BY PACKAGING, 2021-2030 (USD MILLION)

TABLE 101 POLAND HUMMUS MARKET, BY ORIGIN, 2021-2030 (USD MILLION)

TABLE 102 POLAND HUMMUS MARKET, BY EMULSION TYPE, 2021-2030 (USD MILLION)

TABLE 103 POLAND HUMMUS MARKET, BY FAT CONTENT, 2021-2030 (USD MILLION)

TABLE 104 POLAND HUMMUS MARKET, BY PACKAGING MATERIAL, 2021-2030 (USD MILLION)

TABLE 105 POLAND HUMMUS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 106 POLAND PASTE & SPREADS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 107 POLAND SAUCES & DIPS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 108 POLAND DESSERTS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 109 POLAND CONFECTIONERY IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 110 POLAND OTHERS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 111 POLAND HUMMUS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 112 POLAND B2B IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 113 POLAND B2C IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 114 POLAND HUMMUS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 115 POLAND COMMERCIALS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 116 POLAND INDUSTRIAL IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 117 SPAIN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 118 SPAIN HUMMUS MARKET, BY RAW MATERIAL, 2021-2030 (USD MILLION)

TABLE 119 SPAIN HUMMUS MARKET, BY PACKAGING, 2021-2030 (USD MILLION)

TABLE 120 SPAIN HUMMUS MARKET, BY ORIGIN, 2021-2030 (USD MILLION)

TABLE 121 SPAIN HUMMUS MARKET, BY EMULSION TYPE, 2021-2030 (USD MILLION)

TABLE 122 SPAIN HUMMUS MARKET, BY FAT CONTENT, 2021-2030 (USD MILLION)

TABLE 123 SPAIN HUMMUS MARKET, BY PACKAGING MATERIAL, 2021-2030 (USD MILLION)

TABLE 124 SPAIN HUMMUS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 125 SPAIN PASTE & SPREADS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 126 SPAIN SAUCES & DIPS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 127 SPAIN DESSERTS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 128 SPAIN CONFECTIONERY IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 129 SPAIN OTHERS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 130 SPAIN HUMMUS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 131 SPAIN B2B IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 132 SPAIN B2C IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 133 SPAIN HUMMUS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 134 SPAIN COMMERCIALS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 135 SPAIN INDUSTRIAL IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 136 NETHERLANDS HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 137 NETHERLANDS HUMMUS MARKET, BY RAW MATERIAL, 2021-2030 (USD MILLION)

TABLE 138 NETHERLANDS HUMMUS MARKET, BY PACKAGING, 2021-2030 (USD MILLION)

TABLE 139 NETHERLANDS HUMMUS MARKET, BY ORIGIN, 2021-2030 (USD MILLION)

TABLE 140 NETHERLANDS HUMMUS MARKET, BY EMULSION TYPE, 2021-2030 (USD MILLION)

TABLE 141 NETHERLANDS HUMMUS MARKET, BY FAT CONTENT, 2021-2030 (USD MILLION)

TABLE 142 NETHERLANDS HUMMUS MARKET, BY PACKAGING MATERIAL, 2021-2030 (USD MILLION)

TABLE 143 NETHERLANDS HUMMUS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 144 NETHERLANDS PASTE & SPREADS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 145 NETHERLANDS SAUCES & DIPS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 146 NETHERLANDS DESSERTS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 147 NETHERLANDS CONFECTIONERY IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 148 NETHERLANDS OTHERS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 149 NETHERLANDS HUMMUS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 150 NETHERLANDS B2B IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 151 NETHERLANDS B2C IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 152 NETHERLANDS HUMMUS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 153 NETHERLANDS COMMERCIALS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 154 NETHERLANDS INDUSTRIAL IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 155 SWITZERLAND HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 156 SWITZERLAND HUMMUS MARKET, BY RAW MATERIAL, 2021-2030 (USD MILLION)

TABLE 157 SWITZERLAND HUMMUS MARKET, BY PACKAGING, 2021-2030 (USD MILLION)

TABLE 158 SWITZERLAND HUMMUS MARKET, BY ORIGIN, 2021-2030 (USD MILLION)

TABLE 159 SWITZERLAND HUMMUS MARKET, BY EMULSION TYPE, 2021-2030 (USD MILLION)

TABLE 160 SWITZERLAND HUMMUS MARKET, BY FAT CONTENT, 2021-2030 (USD MILLION)

TABLE 161 SWITZERLAND HUMMUS MARKET, BY PACKAGING MATERIAL, 2021-2030 (USD MILLION)

TABLE 162 SWITZERLAND HUMMUS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 163 SWITZERLAND PASTE & SPREADS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 164 SWITZERLAND SAUCES & DIPS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 165 SWITZERLAND DESSERTS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 166 SWITZERLAND CONFECTIONERY IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 167 SWITZERLAND OTHERS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 168 SWITZERLAND HUMMUS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 169 SWITZERLAND B2B IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 170 SWITZERLAND B2C IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 171 SWITZERLAND HUMMUS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 172 SWITZERLAND COMMERCIALS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 173 SWITZERLAND INDUSTRIAL IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 174 SWEDEN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 175 SWEDEN HUMMUS MARKET, BY RAW MATERIAL, 2021-2030 (USD MILLION)

TABLE 176 SWEDEN HUMMUS MARKET, BY PACKAGING, 2021-2030 (USD MILLION)

TABLE 177 SWEDEN HUMMUS MARKET, BY ORIGIN, 2021-2030 (USD MILLION)

TABLE 178 SWEDEN HUMMUS MARKET, BY EMULSION TYPE, 2021-2030 (USD MILLION)

TABLE 179 SWEDEN HUMMUS MARKET, BY FAT CONTENT, 2021-2030 (USD MILLION)

TABLE 180 SWEDEN HUMMUS MARKET, BY PACKAGING MATERIAL, 2021-2030 (USD MILLION)

TABLE 181 SWEDEN HUMMUS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 182 SWEDEN PASTE & SPREADS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 183 SWEDEN SAUCES & DIPS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 184 SWEDEN DESSERTS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 185 SWEDEN CONFECTIONERY IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 186 SWEDEN OTHERS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 187 SWEDEN HUMMUS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 188 SWEDEN B2B IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 189 SWEDEN B2C IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 190 SWEDEN HUMMUS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 191 SWEDEN COMMERCIALS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 192 SWEDEN INDUSTRIAL IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 193 TURKEY HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 194 TURKEY HUMMUS MARKET, BY RAW MATERIAL, 2021-2030 (USD MILLION)

TABLE 195 TURKEY HUMMUS MARKET, BY PACKAGING, 2021-2030 (USD MILLION)

TABLE 196 TURKEY HUMMUS MARKET, BY ORIGIN, 2021-2030 (USD MILLION)

TABLE 197 TURKEY HUMMUS MARKET, BY EMULSION TYPE, 2021-2030 (USD MILLION)

TABLE 198 TURKEY HUMMUS MARKET, BY FAT CONTENT, 2021-2030 (USD MILLION)

TABLE 199 TURKEY HUMMUS MARKET, BY PACKAGING MATERIAL, 2021-2030 (USD MILLION)

TABLE 200 TURKEY HUMMUS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 201 TURKEY PASTE & SPREADS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 202 TURKEY SAUCES & DIPS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 203 TURKEY DESSERTS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 204 TURKEY CONFECTIONERY IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 205 TURKEY OTHERS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 206 TURKEY HUMMUS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 207 TURKEY B2B IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 208 TURKEY B2C IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 209 TURKEY HUMMUS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 210 TURKEY COMMERCIALS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 211 TURKEY INDUSTRIAL IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 212 BELGIUM HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 213 BELGIUM HUMMUS MARKET, BY RAW MATERIAL, 2021-2030 (USD MILLION)

TABLE 214 BELGIUM HUMMUS MARKET, BY PACKAGING, 2021-2030 (USD MILLION)

TABLE 215 BELGIUM HUMMUS MARKET, BY ORIGIN, 2021-2030 (USD MILLION)

TABLE 216 BELGIUM HUMMUS MARKET, BY EMULSION TYPE, 2021-2030 (USD MILLION)

TABLE 217 BELGIUM HUMMUS MARKET, BY FAT CONTENT, 2021-2030 (USD MILLION)

TABLE 218 BELGIUM HUMMUS MARKET, BY PACKAGING MATERIAL, 2021-2030 (USD MILLION)

TABLE 219 BELGIUM HUMMUS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 220 BELGIUM PASTE & SPREADS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 221 BELGIUM SAUCES & DIPS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 222 BELGIUM DESSERTS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 223 BELGIUM CONFECTIONERY IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 224 BELGIUM OTHERS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 225 BELGIUM HUMMUS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 226 BELGIUM B2B IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 227 BELGIUM B2C IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 228 BELGIUM COMMERCIALS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 229 BELGIUM INDUSTRIAL IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 230 RUSSIA HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 231 RUSSIA HUMMUS MARKET, BY RAW MATERIAL, 2021-2030 (USD MILLION)

TABLE 232 RUSSIA HUMMUS MARKET, BY PACKAGING, 2021-2030 (USD MILLION)

TABLE 233 RUSSIA HUMMUS MARKET, BY ORIGIN, 2021-2030 (USD MILLION)

TABLE 234 RUSSIA HUMMUS MARKET, BY EMULSION TYPE, 2021-2030 (USD MILLION)

TABLE 235 RUSSIA HUMMUS MARKET, BY FAT CONTENT, 2021-2030 (USD MILLION)

TABLE 236 RUSSIA HUMMUS MARKET, BY PACKAGING MATERIAL, 2021-2030 (USD MILLION)

TABLE 237 RUSSIA HUMMUS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 238 RUSSIA SAUCES & DIPS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 239 RUSSIA DESSERTS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 240 RUSSIA CONFECTIONERY IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 241 RUSSIA OTHERS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 242 RUSSIA HUMMUS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 243 RUSSIA B2B IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 244 RUSSIA B2C IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 245 RUSSIA HUMMUS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 246 RUSSIA COMMERCIALS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 247 RUSSIA INDUSTRIAL IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 248 DENMARK HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 249 DENMARK HUMMUS MARKET, BY RAW MATERIAL, 2021-2030 (USD MILLION)

TABLE 250 DENMARK HUMMUS MARKET, BY PACKAGING, 2021-2030 (USD MILLION)

TABLE 251 DENMARK HUMMUS MARKET, BY ORIGIN, 2021-2030 (USD MILLION)

TABLE 252 DENMARK HUMMUS MARKET, BY EMULSION TYPE, 2021-2030 (USD MILLION)

TABLE 253 DENMARK HUMMUS MARKET, BY FAT CONTENT, 2021-2030 (USD MILLION)

TABLE 254 DENMARK HUMMUS MARKET, BY PACKAGING MATERIAL, 2021-2030 (USD MILLION)

TABLE 255 DENMARK HUMMUS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 256 DENMARK PASTE & SPREADS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 257 DENMARK SAUCES & DIPS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 258 DENMARK DESSERTS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 259 DENMARK CONFECTIONERY IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 260 DENMARK OTHERS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 261 DENMARK HUMMUS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 262 DENMARK B2B IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 263 DENMARK B2C IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 264 DENMARK HUMMUS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 265 DENMARK COMMERCIALS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 266 DENMARK INDUSTRIAL IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 267 REST OF EUROPE HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 EUROPE HUMMUS MARKET: SEGMENTATION

FIGURE 2 EUROPE HUMMUS MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE HUMMUS MARKET: DROC ANALYSIS

FIGURE 4 EUROPE HUMMUS MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE HUMMUS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE HUMMUS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE HUMMUS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE HUMMUS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 EUROPE HUMMUS MARKET VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE HUMMUS MARKET: SEGMENTATION

FIGURE 11 RISE IN THE NUMBER OF NEW PRODUCT LAINCHES WITH VARIOUS FLAVOURS COMBINATION IS DRIVING THE GROWTH OF THE EUROPE HUMMUS MARKET IN THE FORECAST PERIOD

FIGURE 12 THE CLASSIC HUMMUS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE HUMMUS MARKET IN 2023 & 2030

FIGURE 13 EUROPE HUMMUS MARKET: TYPES OF CONSUMER BUYING BEHAVIOUR

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE HUMMUS MARKET

FIGURE 15 EUROPE HUMMUS MARKET: SNAPSHOT (2022)

FIGURE 16 EUROPE HUMMUS MARKET: BY COUNTRY (2022)

FIGURE 17 EUROPE HUMMUS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 18 EUROPE HUMMUS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 19 EUROPE HUMMUS MARKET: BY TYPE (2023-2030)

FIGURE 20 EUROPE HUMMUS MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.