Tubes thermorétractables pour le marché automobile en Europe, par application (tuyaux, connecteurs, cosses à anneau, épissures en ligne, conduites de frein , groupes d'injection diesel, protection de câble sous le capot, conduites de gaz, épissures miniatures), matériau (polyoléfine, chlorure de polyvinyle, polytétrafluoroéthylène, éthylène-propylène fluoré, perfluoroalkoxy alcane, éthylène-tétrafluoroéthylène et autres), couleur (rouge, jaune et autres), type ( tube thermorétractable à simple paroi et tube thermorétractable à double paroi), tension (faible, moyenne et élevée), type de carburant (essence, diesel/GNC et électrique ), canal de vente (OEM et marché secondaire), type de véhicule (voitures particulières, VLC, VHC et véhicules électriques), pays (Allemagne, France, Royaume-Uni, Italie, Espagne, Suisse, Pays-Bas, Russie, Turquie, Belgique, reste de l'Europe) Tendances et prévisions de l'industrie jusqu'en 2028

Analyse et perspectives du marché : marché européen des gaines thermorétractables pour l'automobile

Analyse et perspectives du marché : marché européen des gaines thermorétractables pour l'automobile

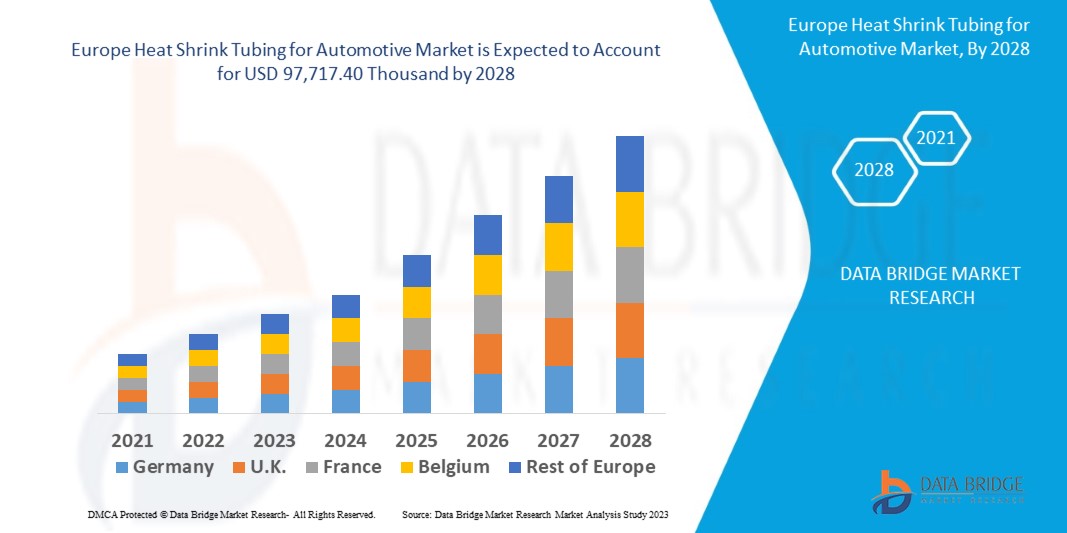

Le marché européen des gaines thermorétractables pour l'automobile devrait connaître une croissance du marché au cours de la période de prévision de 2021 à 2028. Data Bridge Market Research analyse que le marché croît avec un TCAC de 6,1 % au cours de la période de prévision de 2021 à 2028 et devrait atteindre 97 717,40 milliers USD d'ici 2028. La demande croissante de faisceaux de câbles pour véhicules pour les systèmes de sécurité automobile devrait stimuler considérablement la croissance du marché.

Les gaines thermorétractables sont utilisées pour isoler les fils et offrir une résistance à l'abrasion et une protection environnementale aux conducteurs toronnés solides avec connexions, joints et bornes dans les travaux électriques . En général, un tube avec une température de rétraction plus basse rétrécit plus rapidement. Lorsque la gaine thermorétractable est enroulée autour de réseaux de fils et de composants électriques, elle s'affaisse radialement pour épouser les contours de l'équipement, formant ainsi une couche protectrice. Elle peut protéger contre l'abrasion, les faibles impacts, les coupures, l'humidité et la poussière en recouvrant des fils individuels ou en enfermant des réseaux entiers. Les fabricants de plastique commencent par extruder un tube thermoplastique pour créer une gaine thermorétractable. Les matériaux des gaines thermorétractables varient en fonction de l'application prévue.

L'augmentation de la demande pour une large gamme de matériaux isolants pour la maintenance préventive est le principal facteur moteur du marché européen des gaines thermorétractables pour l'automobile. Le manque d'expertise des opérateurs sur l'installation de gaines thermorétractables peut s'avérer être un défi. Cependant, l'automatisation du processus de fabrication des gaines thermorétractables peut être une opportunité pour le marché. Les réglementations gouvernementales strictes sur l'émission de gaz toxiques limitent le marché européen des gaines thermorétractables pour l'automobile.

Le rapport sur le marché européen des tubes thermorétractables pour l'automobile fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché européen des tubes thermorétractables pour l'automobile, contactez Data Bridge Market Research pour un briefing d'analyste ; notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

Portée et taille du marché des gaines thermorétractables pour l'automobile en Europe

Portée et taille du marché des gaines thermorétractables pour l'automobile en Europe

Le marché européen des gaines thermorétractables pour l'automobile est segmenté en huit segments notables en fonction de l'application, du matériau, du type, du canal de vente, de la couleur, de la tension, du type de carburant et du type de véhicule. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

- En fonction de l'application, le marché des gaines thermorétractables pour l'automobile est segmenté en tuyaux, connecteurs, cosses à anneau, épissures en ligne, conduites de frein, groupes d'injection diesel, protection de câble sous le capot, conduites de gaz, épissures miniatures. En 2021, le segment des tuyaux devrait dominer le marché car de meilleures mesures d'isolation et de sécurité sont nécessaires pour les tuyaux.

- En fonction du matériau, le marché des gaines thermorétractables pour l'automobile est segmenté en polyoléfine, polychlorure de vinyle, polytétrafluoroéthylène, éthylène-propylène fluoré, perfluoroalcoxy alcane, éthylène-tétrafluoroéthylène et autres. En 2021, le segment des polyoléfines devrait dominer le marché en raison de ses propriétés non corrosives.

- En fonction de la couleur, les gaines thermorétractables pour le marché automobile sont segmentées en rouge, jaune et autres. En 2021, le segment rouge devrait dominer le marché car il est très utilisé dans les applications majeures comme le câblage du circuit principal.

- En fonction du type, le marché des gaines thermorétractables pour l'automobile est segmenté en gaines thermorétractables à simple paroi et gaines thermorétractables à double paroi. En 2021, le segment des gaines thermorétractables à simple paroi devrait dominer le marché en raison de leur coût moins élevé et de leurs performances équivalentes à celles des gaines thermorétractables à double paroi.

- Sur la base de la tension, le marché des gaines thermorétractables pour l'automobile est segmenté en basse, moyenne et haute tension. En 2021, le segment basse tension devrait dominer le marché en raison du nombre actuellement plus élevé de véhicules basse tension disponibles en raison des réglementations gouvernementales.

- En fonction du type de carburant, le marché des gaines thermorétractables pour l'automobile est segmenté en essence, diesel/GNC et électrique. En 2021, le segment de l'essence devrait dominer le marché car il s'agit de l'un des carburants les plus anciens utilisés pour l'automobile avec d'excellentes caractéristiques de combustion.

- Sur la base du canal de vente, le marché des gaines thermorétractables pour l'automobile est segmenté en OEM et en marché secondaire. En 2021, le segment OEM devrait dominer le marché car les consommateurs préfèrent la meilleure qualité et un ajustement précis.

- En fonction du type de véhicule, le marché des gaines thermorétractables pour l'automobile est segmenté en voitures particulières, véhicules utilitaires légers, véhicules utilitaires lourds et véhicules électriques. En 2021, le segment des voitures particulières devrait dominer le marché en raison de la demande croissante de véhicules particuliers à mesure que la population augmente.

Analyse du marché des gaines thermorétractables pour l'automobile en Europe

Le marché européen des gaines thermorétractables pour l'automobile est analysé et des informations sur la taille du marché sont fournies par pays, application, matériau, type, canal de vente, couleur, tension, type de carburant et type de véhicule comme référencé ci-dessus.

Les pays couverts par le rapport sur le marché européen des gaines thermorétractables pour l'automobile sont l'Allemagne, la France, le Royaume-Uni, l'Italie, l'Espagne, la Suisse, les Pays-Bas, la Russie, la Turquie, la Belgique et le reste de l'Europe. L'Allemagne domine la région européenne en raison de l'augmentation des avancées technologiques et de la technologie de câblage à des fins de sécurité des véhicules.

La section par pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario du marché pour les différents pays. En outre, la présence et la disponibilité des marques européennes et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

L'augmentation des progrès technologiques visant à accroître les performances des véhicules stimule la croissance du marché européen des tubes thermorétractables pour le marché automobile

Le marché européen des gaines thermorétractables pour l'automobile vous fournit également une analyse de marché détaillée pour chaque croissance nationale sur un marché particulier. En outre, il fournit des informations détaillées sur la stratégie des acteurs du marché et leur présence géographique. Les données sont disponibles pour la période historique de 2010 à 2019.

Analyse du paysage concurrentiel et des parts de marché des tubes thermorétractables pour l'automobile en Europe

Le paysage concurrentiel du marché européen des gaines thermorétractables pour l'automobile fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise par rapport au marché européen des gaines thermorétractables pour l'automobile.

Certains des principaux acteurs opérant sur le marché européen des gaines thermorétractables pour l'automobile sont ABB, IS-Rayfast Ltd, SHAWCOR, Sumitomo Electric Industries, Ltd., Zeus Industrial Products, Inc., HellermannTyton, Autosparks, 3M, Dasengh, Inc., Huizhou Guanghai Electronic Insulation Materials Co., Ltd., Alpha Wire, GREMCO GmbH, The Zippertubing Company, RADPOL SA, Molex, TE Connectivity, Panduit, entre autres.

De nombreux contrats et accords sont également initiés par les entreprises du monde entier, ce qui accélère également le marché européen des gaines thermorétractables pour l'automobile.

Par exemple,

- En juillet 2021, Molex accélère son chemin vers l'Industrie 4.0 avec des solutions d'automatisation industrielle étendues (IAS4.0) et de nouveaux modules d'automatisation flexibles (FAM). Cette expansion permet aux acteurs de la chaîne d'approvisionnement de créer des machines, des robots et des lignes de production définis par logiciel qui répondent aux demandes croissantes d'opérations connectées, sécurisées, évolutives et efficaces. Cette expansion a contribué à développer le portefeuille de produits et à augmenter les revenus de l'entreprise

- En janvier 2021, Panduit a annoncé avoir signé un partenariat avec Cailabs, une société française de haute technologie et leader mondial de la mise en forme du faisceau lumineux, pour les droits mondiaux d'intégration de la technologie Cailabs dans le portefeuille de produits innovants One Mode de Panduit, ce qui contribue à améliorer le portefeuille de produits de l'entreprise.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELING

2.8 APPLICATION TIMELINE CURVE

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING DEMAND FOR VEHICLE WIRING HARNESS FOR AUTOMOTIVE SAFETY SYSTEMS

5.1.2 RISE IN TECHNOLOGICAL ADVANCEMENT TO INCREASE VEHICLE PERFORMANCE

5.1.3 INCREASING VEHICLE SALES AND DEMAND FOR PREMIUM VEHICLES

5.1.4 INCREASING DEMAND FOR WIDE RANGE OF INSULATING MATERIAL FOR PREVENTIVE MAINTENANCE

5.2 RESTARINTS

5.2.1 STRINGENT GOVERNMENT REGULATION ON EMISSION OF TOXIC GASES

5.2.2 TRADE BARRIERS IN LEAST DEVELOPED COUNTRIES

5.3 OPPORTUNITIES

5.3.1 INCREASE IN STRATEGIC ACQUISITIONS & PARTNERSHIPS BETWEEN ORGANIZATIONS

5.3.2 INVOLVEMENT OF AUTOMATION IN HEAT SHRINK TUBING PROCESS

5.3.3 INCREASE IN PENETRATION OF ELECTRIC VEHICLE ACROSS THE GLOBE

5.3.4 EASY PRODUCTION OF HEAT SHRINK TUBING PRODUCTS

5.4 CHALLENGES

5.4.1 INCREASE IN PRICES OF RAW MATERIALS FOR TUBING

5.4.2 AVAILABILITY OF DUPLICATE & INEXPENSIVE PRODUCTS IN THE MARKET

5.4.3 LACK OF OPERATOR EXPERTISE FOR INSTALLATION OF HEAT SHRINKING TUBE

6 IMPACT ANALYSIS OF COVID-19 ON EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET

6.1 AFTERMATH OF EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET

6.2 OPPORTUNITIES FOR THE MARKET POST-COVID-19 PANDEMIC

6.3 IMPACT ON SUPPLY, DEMAND, AND PRICES

6.4 CONCLUSION

7 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 HOSES

7.2.1 HEATING AND COOLING SYSTEM HOSES

7.2.2 FUEL DELIVERY SYSTEM HOSES

7.2.3 BRAKING SYSTEM HOSES

7.2.4 TURBOCHARGER HOSES

7.2.5 POWER STEERING SYSTEM HOSES

7.3 CONNECTORS

7.3.1 BY TYPE

7.3.1.1 WIRE TO WIRE

7.3.1.2 WIRE TO BOARD

7.3.1.3 BOARD TO BOARD

7.3.2 BY SYSTEM TYPE

7.3.2.1 UNSEALED

7.3.2.2 SEALED

7.3.3 BY APPLICATION

7.3.3.1 HTAT

7.3.3.2 ATUM

7.3.3.3 CGPT

7.3.3.4 LSTT<150 C

7.3.3.5 OTHERS

7.4 RING TERMINAL

7.4.1 12-10 GAUGE HEAT SHRINK RING TERMINALS

7.4.2 14-16 GAUGE HEAT SHRINK RING TERMINALS

7.4.3 18-20 GAUGE HEAT SHRINK RING TERMINALS

7.5 IN-LINE SPLICES

7.6 BRAKE PIPES

7.7 DIESEL INJECTION CLUSTERS

7.8 UNDER BONNET CABLE PROTECTION

7.9 GAS PIPES

7.1 MINIATURE SPLICES

8 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL

8.1 OVERVIEW

8.2 POLYOLEFIN

8.3 POLYVINYL CHLORIDE

8.4 POLYTETRAFLUOROETHYLENE

8.5 FLOURINATED ETHYLENE PROPYLENE

8.6 PERFLUOROALKOXY ALKANES

8.7 ETHYLENE TETRAFLUORO ETHYLENE

8.8 OTHERS

9 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR

9.1 OVERVIEW

9.2 RED

9.3 YELLOW

9.4 OTHERS

10 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE

10.1 OVERVIEW

10.2 SINGLE WALL SHRINK TUBING

10.3 DUAL WALL SHRINK TUBING

11 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE

11.1 OVERVIEW

11.2 LOW VOLTAGE

11.3 MEDIUM VOLTAGE

11.4 HIGH VOLTAGE

12 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE

12.1 OVERVIEW

12.2 PETROL

12.3 DIESEL/CNG

12.4 ELECTRIC

13 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL

13.1 OVERVIEW

13.2 OEM

13.3 AFTERMARKET

14 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE

14.1 OVERVIEW

14.2 PASSENGER CARS

14.2.1 BY TYPE

14.2.1.1 SUV

14.2.1.2 SEDAN

14.2.1.3 CROSSOVER

14.2.1.4 COUPE

14.2.1.5 HATCHBACK

14.2.1.6 MPV

14.2.1.7 CONVERTIBLE

14.2.1.8 OTHERS

14.2.2 BY APPLICATION

14.2.2.1 HOSES

14.2.2.2 CONNECTORS

14.2.2.3 RING TERMINALS

14.2.2.4 IN-LINE SPLICES

14.2.2.5 BRAKING PIPES

14.2.2.6 DIESEL INJECTION CLUSTERS

14.2.2.7 UNDER BONNET CABLE PROTECTION

14.2.2.8 GAS PIPES

14.2.2.9 MINIATURE SPLICES

14.3 LCV

14.3.1 BY TYPE

14.3.1.1 PICKUP TRUCKS

14.3.1.2 VANS

14.3.1.2.1 CARGO VANS

14.3.1.2.2 PASSENGER VANS

14.3.1.3 MINI BUS

14.3.1.4 COACHES

14.3.1.5 OTHERS

14.3.2 BY APPLICATION

14.3.2.1 HOSES

14.3.2.2 CONNECTORS

14.3.2.3 RING TERMINALS

14.3.2.4 IN-LINE SPLICES

14.3.2.5 BRAKE PIPES

14.3.2.6 DIESEL INJECTION CLUSTERS

14.3.2.7 UNDER BONNET CABLE PROTECTION

14.3.2.8 GAS PIPES

14.3.2.9 MINIATURE SPLICES

14.4 ELECTRIC VEHICLE

14.4.1 BY TYPE

14.4.1.1 BATTERY OPERATED VEHICLES

14.4.1.2 PLUGIN VEHICLES

14.4.1.3 HYBRID VEHICLES

14.4.1.4 FUEL CELL ELECTRIC VEHICLES

14.4.2 BY APPLICATION

14.4.2.1 HOSES

14.4.2.2 CONNECTORS

14.4.2.3 RING TERMINALS

14.4.2.4 IN-LINE SPLICES

14.4.2.5 BRAKING PIPES

14.4.2.6 DIESEL INJECTION CLUSTERS

14.4.2.7 UNDER BONNET CABLE PROTECTION

14.4.2.8 GAS PIPES

14.4.2.9 MINIATURE SPLICES

14.5 HCV

14.5.1 BY TYPE

14.5.1.1 TRUCKS

14.5.1.1.1 DUMP TRUCKS

14.5.1.1.2 TOW TRUCKS

14.5.1.1.3 CEMENT TRUCKS

14.5.1.2 BUSES

14.5.2 BY APPLICATION

14.5.2.1 HOSES

14.5.2.2 CONNECTORS

14.5.2.3 RING TERMINALS

14.5.2.4 IN-LINE SPLICES

14.5.2.5 BRAKING PIPES

14.5.2.6 DIESEL INJECTION CLUSTERS

14.5.2.7 UNDER BONNET CABLE PROTECTION

14.5.2.8 GAS PIPES

14.5.2.9 MINIATURE SPLICES

15 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION

15.1 EUROPE

15.1.1 GERMANY

15.1.2 FRANCE

15.1.3 U.K.

15.1.4 ITALY

15.1.5 RUSSIA

15.1.6 SPAIN

15.1.7 NETHERLANDS

15.1.8 BELGIUM

15.1.9 TURKEY

15.1.10 SWITZERLAND

15.1.11 REST OF EUROPE

16 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: EUROPE

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 SUMITOMO ELECTRIC INDUSTRIES, LTD.

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 TE CONNECTIVITY

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 SHAWCOR

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 ABB

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE AANLYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 HELLERMANNTYTON

18.5.1 COMPANY SNAPSHOT

18.5.2 COMPANY SHARE ANALYSIS

18.5.3 PRODUCT PORTFOILIO

18.5.4 RECENT DEVELOPMENT

18.6 AUTOSPARKS

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENT

18.7 ALPHA WIRE

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENT

18.8 DEE FIVE SHRINK INSULATION PVT. LTD.

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENTS

18.9 DASENGH, INC.

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENT

18.1 FLEX WIRES INC.

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENT

18.11 GREMCO GMBH

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENTS

18.12 HUIZHOU GUANGHAI ELECTRONIC INSULATION MATERIALS CO.,LTD.

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVLOPMENT

18.13 INSULTAB, PEXCO

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENTS

18.14 IS-RAYFAST LTD

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENT

18.15 3M

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENT

18.16 MOLEX

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENTS

18.17 NELCO

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT DEVELOPMENT

18.18 PARAS ENTERPRISES

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENT

18.19 PANDUIT

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT DEVELOPMENTS

18.2 QUALTEK ELECTRONICS CORP.

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENT

18.21 RADPOL S.A.

18.21.1 COMPANY SNAPSHOT

18.21.2 REVENUE ANALYSIS

18.21.3 PRODUCT PORTFOLIO

18.21.4 RECENT DEVELOPMENTS

8.22 SHENZHEN WOER HEAT - SHRINKABLE MATERIAL CO., LTD.

18.22.1 COMPANY SNAPSHOT

18.22.2 PRODUCT PORTFOLIO

18.22.3 RECENT DEVELOPMENTS

18.23 SUZHOU FEIBO COLD AND HEAT SHRINKING CO., LTD.

18.23.1 COMPANY SNAPSHOT

18.23.2 PRODUCT PORTFOLIO

18.23.3 RECENT DEVELOPMENTS

18.24 TECHFLEX, INC.

18.24.1 COMPANY SNAPSHOT

18.24.2 PRODUCT PORTFOLIO

18.24.3 RECENT DEVELOPMENT

18.25 THERMOSLEEVE USA

18.25.1 COMPANY SNAPSHOT

18.25.2 PRODUCT PORTFOLIO

18.25.3 RECENT DEVELOPMENTS

18.26 THE ZIPPERTUBING COMPANY

18.26.1 COMPANY SNAPSHOT

18.26.2 PRODUCT PORTFOLIO

18.26.3 RECENT DEVELOPMENTS

18.27 TEXCAN

18.27.1 COMPANY SNAPSHOT

18.27.2 PRODUCT PORTFOLIO

18.27.3 RECENT DEVELOPMENT

18.28 ZEUS INDUSTRIAL PRODUCTS, INC.

18.28.1 COMPANY SNAPSHOT

18.28.2 PRODUCT PORTFOLIO

18.28.3 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

Liste des tableaux

TABLE 1 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 2 EUROPE HOSES IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 3 EUROPE HOSES IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 4 EUROPE CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 5 EUROPE CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 6 EUROPE CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 7 EUROPE CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 8 EUROPE RING TERMINAL IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 9 EUROPE RING TERMINAL IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 10 EUROPE IN-LINE SPLICES IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 11 EUROPE BRAKE PIPES IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 12 EUROPE DIESEL INJECTION CLUSTERS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 13 EUROPE UNDER BONNET CABLE PROTECTION IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 14 EUROPE GAS PIPES IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 15 EUROPE MINIATURE SPLICES IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 16 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL, 2019-2028 (USD THOUSAND)

TABLE 17 EUROPE POLYOLEFIN IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 18 EUROPE POLYVINYL CHLORIDE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 19 EUROPE POLYTETRAFLUOROETHYLENE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 20 EUROPE FLUORINATED ETHYLENE PROPYLENE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 21 EUROPE PERFLUOROALKOXY ALKANES IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 22 EUROPE ETHYLENE TETRAFLUORO ETHYLENE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 23 EUROPE OTHERS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 24 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 25 EUROPE RED IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 26 EUROPE YELLOW IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 27 EUROPE OTHERS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 28 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 29 EUROPE SINGLE WALL SHRINK TUBING IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 30 EUROPE DUAL WALL SHRINK TUBING IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 31 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 32 EUROPE LOW VOLTAGE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 33 EUROPE MEDIUM VOLTAGE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 34 EUROPE HIGH VOLTAGE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 35 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 36 EUROPE PETROL IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 37 EUROPE DIESEL/CNG IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 38 EUROPE ELECTRIC IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 39 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 40 EUROPE OEM IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 41 EUROPE AFTERMARKET IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 42 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 43 EUROPE PASSENGER CARS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 44 EUROPE PASSENGER CARS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 45 EUROPE PASSENGER CARS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 46 EUROPE LCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 47 EUROPE LCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 48 EUROPE VANS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 49 EUROPE LCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 50 EUROPE ELECTRIC VEHICLE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 51 EUROPE ELECTRIC VEHICLE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 52 EUROPE ELECTRIC VEHICLE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 53 EUROPE HCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 54 EUROPE HCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 55 EUROPE TRUCKS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 56 EUROPE HCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 57 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COUNTRY, 2019-2028 (USD THOUSAND)

TABLE 58 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 59 EUROPE HOSES FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 60 EUROPE CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 61 EUROPE CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 62 EUROPE CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 63 EUROPE RING TERMINAL FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 64 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL 2019-2028 (USD THOUSAND)

TABLE 65 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 66 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 67 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 68 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 69 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 70 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 71 EUROPE PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 72 EUROPE PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 73 EUROPE LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 74 EUROPE VANS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 75 EUROPE LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 76 EUROPE HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 77 EUROPE TRUCKS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 78 EUROPE HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 79 EUROPE ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 80 EUROPE ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 81 GERMANY HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 82 GERMANY HOSES FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 83 GERMANY CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 84 GERMANY CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 85 GERMANY CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 86 GERMANY RING TERMINAL FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 87 GERMANY HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL 2019-2028 (USD THOUSAND)

TABLE 88 GERMANY HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 89 GERMANY HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 90 GERMANY HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 91 GERMANY HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 92 GERMANY HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 93 GERMANY HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 94 GERMANY PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 95 GERMANY PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 96 GERMANY LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 97 GERMANY VANS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 98 GERMANY LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 99 GERMANY HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 100 GERMANY TRUCKS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 101 GERMANY HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 102 GERMANY ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 103 GERMANY ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 104 FRANCE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 105 FRANCE HOSES FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 106 FRANCE CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 107 FRANCE CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 108 FRANCE CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 109 FRANCE RING TERMINAL FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 110 FRANCE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL 2019-2028 (USD THOUSAND)

TABLE 111 FRANCE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 112 FRANCE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 113 FRANCE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 114 FRANCE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 115 FRANCE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 116 FRANCE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 117 FRANCE PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 118 FRANCE PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 119 FRANCE LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 120 FRANCE VANS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 121 FRANCE LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 122 FRANCE HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 123 FRANCE TRUCKS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 124 FRANCE HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 125 FRANCE ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 126 FRANCE ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 127 U.K. HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 128 U.K. HOSES FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 129 U.K. CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 130 U.K. CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 131 U.K. CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 132 U.K. RING TERMINAL FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 133 U.K. HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL 2019-2028 (USD THOUSAND)

TABLE 134 U.K. HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 135 U.K. HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 136 U.K. HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 137 U.K. HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 138 U.K. HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 139 U.K. HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 140 U.K. PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 141 U.K. PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 142 U.K. LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 143 U.K. VANS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 144 U.K. LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 145 U.K. HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 146 U.K. TRUCKS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 147 U.K. HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 148 U.K. ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 149 U.K. ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 150 ITALY HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 151 ITALY HOSES FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 152 ITALY CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 153 ITALY CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 154 ITALY CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 155 ITALY RING TERMINAL FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 156 ITALY HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL 2019-2028 (USD THOUSAND)

TABLE 157 ITALY HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 158 ITALY HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 159 ITALY HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 160 ITALY HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 161 ITALY HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 162 ITALY HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 163 ITALY PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 164 ITALY PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 165 ITALY LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 166 ITALY VANS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 167 ITALY LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 168 ITALY HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 169 ITALY TRUCKS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 170 ITALY HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 171 ITALY ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 172 ITALY ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 173 RUSSIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 174 RUSSIA HOSES FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 175 RUSSIA CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 176 RUSSIA CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 177 RUSSIA CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 178 RUSSIA RING TERMINAL FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 179 RUSSIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL 2019-2028 (USD THOUSAND)

TABLE 180 RUSSIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 181 RUSSIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 182 RUSSIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 183 RUSSIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 184 RUSSIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 185 RUSSIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 186 RUSSIA PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 187 RUSSIA PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 188 RUSSIA LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 189 RUSSIA VANS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 190 RUSSIA LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 191 RUSSIA HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 192 RUSSIA TRUCKS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 193 RUSSIA HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 194 RUSSIA ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 195 RUSSIA ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 196 SPAIN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 197 SPAIN HOSES FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 198 SPAIN CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 199 SPAIN CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 200 SPAIN CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 201 SPAIN RING TERMINAL FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 202 SPAIN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL 2019-2028 (USD THOUSAND)

TABLE 203 SPAIN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 204 SPAIN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 205 SPAIN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 206 SPAIN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 207 RUSSIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 208 SPAIN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 209 SPAIN PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 210 SPAIN PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 211 SPAIN LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 212 SPAIN VANS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 213 SPAIN LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 214 SPAIN HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 215 SPAIN TRUCKS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 216 SPAIN HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 217 SPAIN ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 218 SPAIN ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 219 NETHERLANDS HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 220 NETHERLANDS HOSES FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 221 NETHERLANDS CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 222 NETHERLANDS CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 223 NETHERLANDS CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 224 NETHERLANDS RING TERMINAL FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 225 NETHERLANDS HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL 2019-2028 (USD THOUSAND)

TABLE 226 NETHERLANDS HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 227 NETHERLANDS HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 228 NETHERLANDS HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 229 NETHERLANDS HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 230 RUSSIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 231 NETHERLANDS HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 232 NETHERLANDS PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 233 NETHERLANDS PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 234 NETHERLANDS LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 235 NETHERLANDS VANS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 236 NETHERLANDS LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 237 NETHERLANDS HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 238 NETHERLANDS TRUCKS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 239 NETHERLANDS HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 240 NETHERLANDS ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 241 NETHERLANDS ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 242 BELGIUM HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 243 BELGIUM HOSES FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 244 BELGIUM CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 245 BELGIUM CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 246 BELGIUM CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 247 BELGIUM RING TERMINAL FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 248 BELGIUM HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL 2019-2028 (USD THOUSAND)

TABLE 249 BELGIUM HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 250 BELGIUM HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 251 BELGIUM HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 252 BELGIUM HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 253 RUSSIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 254 BELGIUM HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 255 BELGIUM PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 256 BELGIUM PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 257 BELGIUM LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 258 BELGIUM VANS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 259 BELGIUM LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 260 BELGIUM HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 261 BELGIUM TRUCKS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 262 BELGIUM HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 263 BELGIUM ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 264 BELGIUM ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 265 TURKEY HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 266 TURKEY HOSES FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 267 TURKEY CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 268 TURKEY CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 269 TURKEY CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 270 TURKEY RING TERMINAL FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 271 TURKEY HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL 2019-2028 (USD THOUSAND)

TABLE 272 TURKEY HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 273 TURKEY HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 274 TURKEY HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 275 TURKEY HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 276 RUSSIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 277 TURKEY HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 278 TURKEY PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 279 TURKEY PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 280 TURKEY LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 281 TURKEY VANS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 282 TURKEY LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 283 TURKEY HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 284 TURKEY TRUCKS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 285 TURKEY HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 286 TURKEY ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 287 TURKEY ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 288 SWITZERLAND HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 289 SWITZERLAND HOSES FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 290 SWITZERLAND CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 291 SWITZERLAND CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 292 SWITZERLAND CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 293 SWITZERLAND RING TERMINAL FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 294 SWITZERLAND HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL 2019-2028 (USD THOUSAND)

TABLE 295 SWITZERLAND HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 296 SWITZERLAND HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 297 SWITZERLAND HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 298 SWITZERLAND HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 299 RUSSIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 300 SWITZERLAND HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 301 SWITZERLAND PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 302 SWITZERLAND PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 303 SWITZERLAND LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 304 SWITZERLAND VANS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 305 SWITZERLAND LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 306 SWITZERLAND HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 307 SWITZERLAND TRUCKS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 308 SWITZERLAND HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 309 SWITZERLAND ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 310 SWITZERLAND ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 311 REST OF EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

Liste des figures

FIGURE 1 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: SEGMENTATION

FIGURE 2 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: DROC ANALYSIS

FIGURE 4 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: SEGMENTATION

FIGURE 10 GROWING DEMAND FOR VEHICLE WIRING HARNESS FOR AUTOMOTIVE SAFETY SYSTEMS & RISE IN TECHNOLOGICAL ADVANCEMENTS TO IMPROVE VEHICLE PERFORMANCE IS EXPECTED TO DRIVE EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 11 HOSES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET IN 2021 & 2028

FIGURE 12 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST-GROWING REGION IN THE EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, CHALLENGES FOR EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET

FIGURE 14 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY APPLICATION, 2020

FIGURE 15 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY MATERIAL, 2020

FIGURE 16 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY COLOUR, 2020

FIGURE 17 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY TYPE, 2020

FIGURE 18 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY VOLTAGE, 2020

FIGURE 19 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY FUEL TYPE, 2020

FIGURE 20 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY SALES CHANNEL, 2020

FIGURE 21 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY VEHICLE TYPE, 2020

FIGURE 22 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: SNAPSHOT (2020)

FIGURE 23 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY COUNTRY (2020)

FIGURE 24 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY COUNTRY (2021 & 2028)

FIGURE 25 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY COUNTRY (2020 & 2028)

FIGURE 26 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY APPLICATION (2021-2028)

FIGURE 27 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: COMPANY SHARE 2020 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.