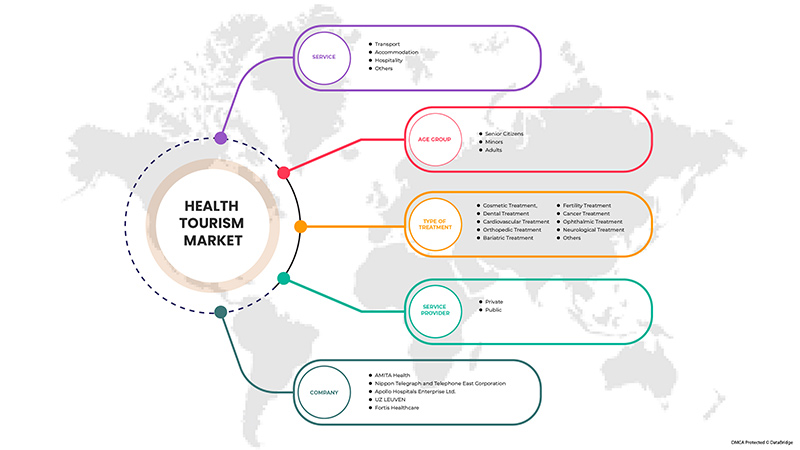

Marché européen du tourisme de santé, par service (transport, hébergement, hospitalité et autres), type de traitement (traitement cosmétique, traitement dentaire , traitement cardiovasculaire, traitement orthopédique, traitement bariatrique, traitement de fertilité, traitement du cancer , traitement ophtalmique, traitement neurologique et autres), groupe d'âge (personnes âgées, mineurs et adultes), par prestataire de services (privé et public), tendances et prévisions du secteur jusqu'en 2029.

Analyse et taille du marché

Le tourisme médical est une version modifiée du secteur de la santé qui se concentre principalement sur les besoins des patients voyageant à l'étranger pour des interventions chirurgicales et des traitements médicaux complexes . Le tourisme médical est très demandé par les patients du monde entier, notamment en raison du faible coût des traitements médicaux dans les pays en développement par rapport aux pays développés. L'accessibilité à des services et traitements médicaux à faible coût auprès de différents services touristiques et gouvernements locaux constitue un facteur majeur de la croissance du marché mondial du tourisme médical.

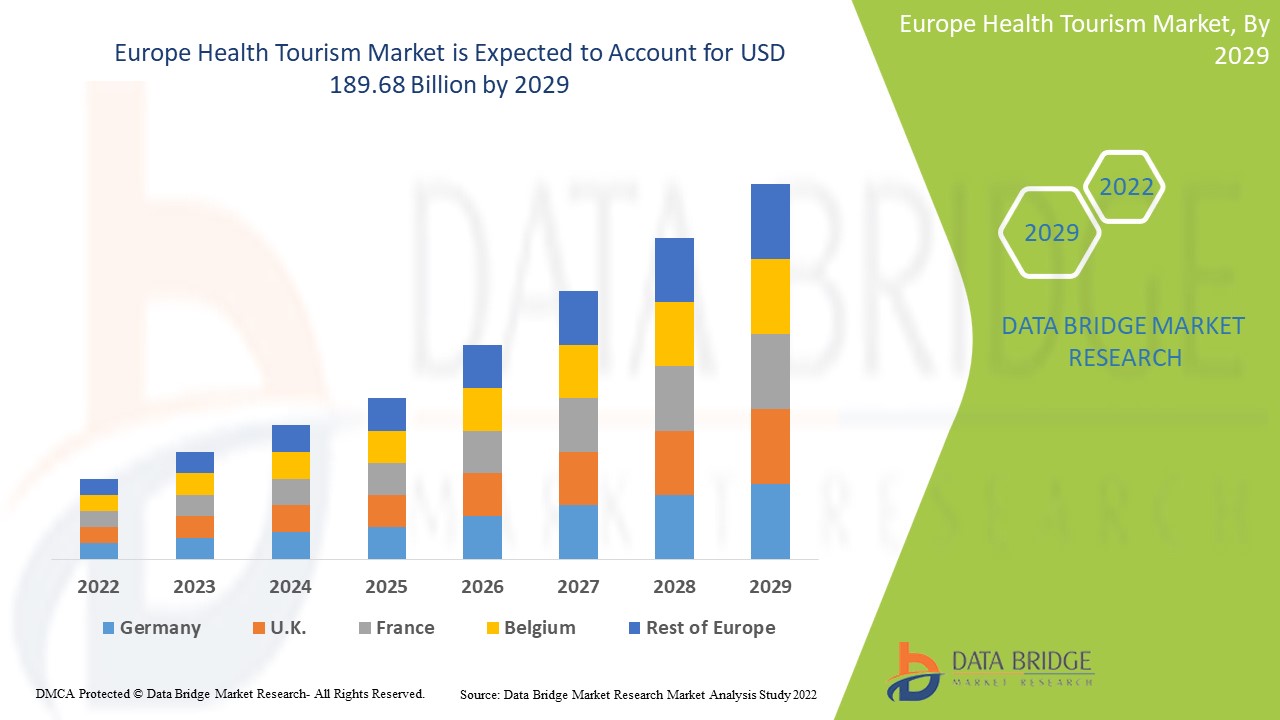

Selon les analyses de Data Bridge Market Research, le marché européen du tourisme de santé devrait atteindre une valeur de 189,68 milliards USD d'ici 2029, à un TCAC de 34,4 % au cours de la période de prévision. « Europe Transport » représente le segment de services le plus important sur le marché du tourisme de santé. Le transport mondial fournit des installations de base et répond à un besoin majeur des consommateurs du tourisme médical.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

20202020 (personnalisable pour 2019-2014) |

|

Unités quantitatives |

Chiffre d'affaires en milliards USD, prix en USD |

|

Segments couverts |

Par service (transport, hébergement, hospitalité et autres), type de traitement (traitement esthétique, traitement dentaire, traitement cardiovasculaire, traitement orthopédique, traitement bariatrique, traitement de fertilité, traitement contre le cancer, traitement ophtalmique, traitement neurologique et autres), groupe d'âge (personnes âgées, mineurs et adultes), par prestataire de services (privé et public) |

|

Pays couverts |

Allemagne, France, Royaume-Uni, Pays-Bas, Suisse, Belgique, Russie, Italie, Espagne, Turquie, Autriche, Luxembourg, reste de l'Europe |

|

Acteurs du marché couverts |

UZ LEUVEN, AMTA Health, MEDICINE PARK UNITED KINGDOM, Apollo Hospitals Enterprise Ltd., Centro Médico ABC, Seoul National University Hospital, Samitivej PCL, Berkalp Co-Limited, Medica Sur, BB Healthcare Solutions, Allen Medical International, MEDIC ABROAD et Med Tourism Co, LLC entre autres. |

Définition du marché

Le tourisme médical est généralement considéré comme une procédure de voyage des patients médicaux vers les frontières internationales pour des interventions chirurgicales et des traitements médicaux complexes, conformément aux exigences et recommandations des médecins des hôpitaux du pays d'origine du patient. Les traitements peuvent inclure des services médicaux tels que le traitement orthopédique, le traitement du cancer, la chirurgie cardiaque, la chirurgie esthétique, les traitements de fertilité et de reproduction, la neurochirurgie et différents types de traitements. Le tourisme médical est une version improvisée des systèmes de santé qui fournit aux patients des traitements et des services médicaux de haute qualité.

Dynamique du marché du tourisme de santé

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Tendance croissante à la mondialisation

La mondialisation est un facteur moteur majeur du tourisme médical, aidant de nombreux consommateurs à obtenir des soins de santé de la meilleure qualité et de la meilleure valeur. Ainsi, la mondialisation à 75 % offre de meilleurs soins de santé et permet d'économiser de 25 à 75 % des dépenses, en particulier pour les Américains et les citoyens des pays développés. Par conséquent, la tendance à la mondialisation permet aux consommateurs de se faire soigner avec des traitements peu coûteux et avancés au-delà des frontières internationales et devrait stimuler le marché mondial du tourisme de santé.

- Augmentation de la demande d'agences médicales en ligne (OMA)

La plupart des pays ont développé des stratégies pour promouvoir la numérisation des services de santé, ce qui crée une demande pour rechercher le meilleur traitement et le plus apprécié quelle que soit la région ; ainsi, la collaboration avec les organisations étrangères s'améliore et si les diagnostics et les traitements chirurgicaux augmentent, cela stimulera la demande de tourisme médical. Ainsi, l'adoption des technologies de connectivité, des plateformes numériques et de la télémédecine devrait stimuler la croissance du marché.

- Probabilité plus élevée de longues listes d'attente dans les pays développés

Les longues listes d'attente dans les pays développés et le taux de change surévalué par rapport aux pays en développement peuvent constituer un autre avantage pour les patients des pays développés qui souhaitent se rendre dans les pays en développement pour contourner les listes d'attente et se faire soigner à temps à un prix très bas. Ainsi, les longues listes d'attente dans les pays développés devraient stimuler le marché mondial du tourisme de santé.

Restrictions

- Complications dans le transfert des dossiers médicaux

Le problème du transfert des dossiers médicaux divise le système de santé en plusieurs niveaux, tuant chaque jour un nombre incalculable de patients. Les médecins doivent comprendre qu'il ne s'agit pas d'un marché libre de la santé dont les patients peuvent profiter alors qu'ils sont déjà malades et ont besoin de soins d'urgence. Un tel problème devrait freiner le marché mondial du tourisme médical.

- Augmentation des complexités liées à la gestion des visas

La confirmation des informations relatives au visa et le traitement des demandes de visa prennent plus de temps, ce qui empêche les patients de bénéficier du traitement adéquat au bon moment. Les retards de traitement peuvent également entraîner de graves conséquences sur la santé du patient.

Les activités frauduleuses, les retards et les dépenses liés à la gestion des visas restreindront les procédures de voyage des patients, ce qui devrait limiter la croissance du marché.

- Conséquences des restrictions de voyage

La propagation internationale de l'épidémie de COVID-19 a contraint tous les pays du monde à mettre en place des mesures de confinement et de restriction. Dans ce contexte, la plupart des grands pays développés tels que les États-Unis, le Royaume-Uni, l'Allemagne, l'Australie, l'Inde, le Japon et bien d'autres imposent des restrictions de voyage depuis plusieurs mois, même après que l'OMS a dénoncé les restrictions sur les voyages internationaux.

De même, la pandémie n’est pas la seule à avoir un impact sur le secteur du tourisme. Toute situation majeure, telle qu’une guerre ou une crise, aura également un impact sur le secteur. Les restrictions imposées ou le changement d’itinéraire de voyage auront un impact majeur sur l’augmentation du coût du voyage, ce qui devrait restreindre le marché mondial du tourisme de santé.

Impact post-COVID-19 sur le marché du tourisme médical

La COVID-19 a eu un impact majeur sur le marché du tourisme de santé, car presque tous les pays ont opté pour la fermeture de toutes les installations de production, à l'exception de celles qui produisent des biens essentiels. Le gouvernement a pris des mesures strictes telles que l'arrêt de la production et de la vente de biens non essentiels, le blocage du commerce international et bien d'autres pour empêcher la propagation de la COVID-19. Les seules entreprises qui ont fait face à cette situation de pandémie étaient les services essentiels qui ont été autorisés à ouvrir et à exécuter leurs processus.

Le marché du tourisme médical est impacté par l'augmentation des restrictions de voyage dans de nombreux pays, ce qui a entraîné l'arrêt des déplacements. De plus, les guerres commerciales dues au déclin des conditions économiques dans de nombreux pays en développement ont été provoquées par la fermeture du marché de nombreuses industries majeures. Cependant, le COVID-19 a eu un effet négatif sur le marché du tourisme médical car il n'y avait pas de moyens de transport entre les pays pour les consommateurs et la plupart des entreprises ont dû fermer temporairement leurs activités de tourisme médical pendant quelques mois.

Développements récents

- En mars 2019, Apollo Hospitals Enterprise Ltd. a annoncé avoir remporté les Times Health Icons Awards 2019 dans cinq catégories. Ce prix a aidé l'entreprise à accroître la valeur de sa marque sur le marché et à attirer de nouveaux clients, ce qui a permis l'expansion de ses activités dans diverses villes et pays

- En octobre 2021, l'UZ LEUVEN a ouvert un centre de dépistage COVID dans différents endroits, notamment pour les voyageurs. Cela a permis à l'entreprise d'atteindre de nouveaux consommateurs et de développer son activité, notamment lors de la Ligue de hockey de l'Ontario, organisée par l'association GP Khobra.

Portée du marché européen du tourisme de santé

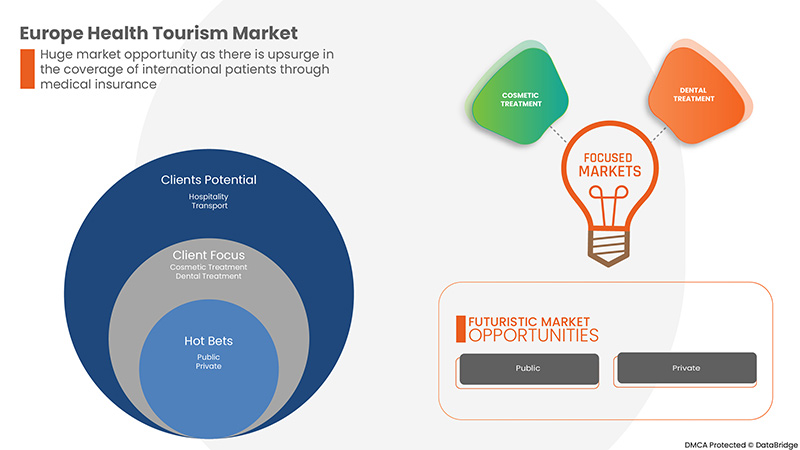

Le marché du tourisme de santé est segmenté en fonction du service, du type de traitement, de la tranche d'âge et du prestataire de services. La croissance de ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Service

- Transport

- Hébergement

- Hospitalité

- Autres

Sur la base du service, le marché européen du tourisme de santé est segmenté en transport, hébergement, hôtellerie et autres.

Type de traitement

- Traitement cosmétique

- Traitement dentaire

- Traitement cardiovasculaire

- Traitement orthopédique

- Traitement bariatrique

- Traitement de fertilité

- Traitement du cancer

- Traitement ophtalmique

- Traitement neurologique

- Autres

Sur la base du type de traitement, le marché européen du tourisme de santé est segmenté en traitement cosmétique, traitement dentaire, traitement cardiovasculaire, traitement orthopédique, traitement bariatrique, traitement de fertilité, traitement du cancer, traitement ophtalmique, traitement neurologique et autres.

Groupe d'âge

- Personnes agées

- Mineurs

- Adultes

Sur la base de la tranche d’âge, le marché européen du tourisme de santé est segmenté en personnes âgées, mineurs et adultes.

Fournisseur de services

- Privé

- Publique

Sur la base du prestataire de services, le marché européen du tourisme de santé est segmenté en privé et public.

Analyse/perspectives régionales du marché du tourisme de santé

Le marché du tourisme de santé est analysé et des informations sur la taille et les tendances du marché sont fournies par pays, service, tranche d'âge, type de traitement et prestataires de services comme référencé ci-dessus.

Les pays couverts par le rapport sur le marché du tourisme de santé sont l'Allemagne, la France, le Royaume-Uni, les Pays-Bas, la Suisse, la Belgique, la Russie, l'Italie, l'Espagne, la Turquie, l'Autriche, le Luxembourg et le reste de l'Europe.

Le Royaume-Uni domine la région Europe en raison de la prise de conscience croissante de l’importance des services de santé parmi les consommateurs.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces du porteur, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques européennes et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et des routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du tourisme de santé

Le paysage concurrentiel du marché du tourisme de santé fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Europe, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination de l'application. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché du tourisme de santé.

Certains des principaux acteurs opérant sur le marché du tourisme de santé sont UZ LEUVEN, AMTA Health, MEDICINE PARK UNITED KINGDOM, Apollo Hospitals Enterprise Ltd., Centro Médico ABC, Seoul National University Hospital, Samitivej PCL, Berkalp Co-Limited, Medica Sur, BB Healthcare Solutions, Allen Medical International, MEDIC ABROAD et Med Tourism Co, LLC entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE HEALTH TOURISM MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL

4.2 PORTER’S FIVE FORCE ANALYSIS

4.3 CONSUMER BEHAVIOUR PATTERNS

4.4 PRODUCT ADOPTION SCENARIO

4.5 FACTORS INFLUENCING BUYING DECISION

4.6 VENDOR SELECTION CRITERIA

4.7 REGULATION COVERAGE

5 SUPPLY CHAIN ANALYSIS

5.1 OVERVIEW

5.2 LOGISTIC COSTS SCENARIO AND IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISE IN EUROPEIZATION TREND

6.1.2 RISE IN THE DEMAND FOR ONLINE MEDICAL AGENCIES (OMA)

6.1.3 INCREASE IN PENETRATION OF TELEMEDICINE AND DIGITAL PLATFORMS

6.1.4 HIGHER PROBABILITY OF LONG WAITING LISTS IN DEVELOPED COUNTRIES

6.2 RESTRAINTS

6.2.1 COMPLICATIONS IN THE TRANSFER OF MEDICAL RECORDS

6.2.2 UPSURGE IN COMPLEXITIES DUE TO VISA MANAGEMENT

6.2.3 IMPLICATION OF TRAVELING RESTRICTIONS

6.3 OPPORTUNITIES

6.3.1 UPSURGE IN THE COVERAGE TO INTERNATIONAL PATIENTS THROUGH MEDICAL INSURANCE

6.3.2 RISE IN THE STRATEGIC PARTNERSHIP WITH MEDICAL ORGANIZATIONS

6.3.3 THE HUGE COST DIFFERENCE BETWEEN DEVELOPED AND DEVELOPING COUNTRIES

6.4 CHALLENGES

6.4.1 LACK OF HEALTHCARE PROFESSIONALISM

6.4.2 LACK OF RULES AND REGULATIONS SUPPORTING THE MEDICAL TOURISM

7 EUROPE HEALTH TOURISM MARKET, BY SERVICE

7.1 OVERVIEW

7.2 TRANSPORT

7.3 ACCOMMODATION

7.4 HOSPITALITY

7.5 OTHERS

8 EUROPE HEALTH TOURISM MARKET, BY TYPE OF TREATMENT

8.1 OVERVIEW

8.2 COSMETIC TREATMENT

8.3 DENTAL TREATMENT

8.4 CARDIOVASCULAR TREATMENT

8.5 ORTHOPEDIC TREATMENT

8.6 BARIATRIC TREATMENT

8.7 FERTILITY TREATMENT

8.8 CANCER TREATMENT

8.9 OPHTHALMIC TREATMENT

8.1 NEUROLOGICAL TREATMENT

8.11 OTHERS

9 EUROPE HEALTH TOURISM MARKET, BY AGE GROUP

9.1 OVERVIEW

9.2 SENIOR CITIZENS

9.3 MINORS

9.4 ADULTS

10 EUROPE HEALTH TOURISM MARKET, BY SERVICE PROVIDER

10.1 OVERVIEW

10.2 PRIVATE

10.3 PUBLIC

11 EUROPE HEALTH TOURISM MARKET, BY REGION

11.1 EUROPE

11.1.1 U.K.

11.1.2 GERMANY

11.1.3 FRANCE

11.1.4 ITALY

11.1.5 SPAIN

11.1.6 TURKEY

11.1.7 SWITZERLAND

11.1.8 RUSSIA

11.1.9 NETHERLANDS

11.1.10 BELGIUM

11.1.11 AUSTRIA

11.1.12 LUXEMBURG

11.1.13 REST OF EUROPE

12 EUROPE HEALTH TOURISM MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: EUROPE

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 AMTA HEALTH

14.1.1 COMPANY SNAPSHOT

14.1.2 SERVICE PORTFOLIO

14.1.3 RECENT DEVELOPMENT

14.2 NIPPON TELEGRAPH AND TELEPHONE EAST CORPORATION

14.2.1 COMPANY SNAPSHOT

14.2.2 SERVICE PORTFOLIO

14.2.3 RECENT DEVELOPMENT

14.3 APOLLO HOSPITALS ENTERPRISE LTD.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 SERVICE PORTFOLIO

14.3.4 RECENT DEVELOPMENTS

14.4 UZ LEUVEN

14.4.1 COMPANY SNAPSHOT

14.4.2 SERVICE PORTFOLIO

14.4.3 RECENT DEVELOPMENT

14.5 FORTIS HEALTHCARE

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 SERVICE PORTFOLIO

14.5.4 RECENT DEVELOPMENT

14.6 CENTRO MEDICO ABC

14.6.1 COMPANY SNAPSHOT

14.6.2 SERVICE PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 KPJ HEALTHCARE BERHAD

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 SERVICE PORTFOLIO

14.7.4 RECENT DEVELOPMENTS

14.8 MEDICINE PARK UNITED KINGDOM

14.8.1 COMPANY SNAPSHOT

14.8.2 SERVICE PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 ADITYA BIRLA HEALTH SERVICES LTD

14.9.1 COMPANY SNAPSHOT

14.9.2 SERVICE PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 ALLEN MEDICAL INTERNATIONAL

14.10.1 COMPANY SNAPSHOT

14.10.2 SERVICE PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 AMERICAN MEDICAL CARE

14.11.1 COMPANY SNAPSHOT

14.11.2 SERVICE PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 BARBADOSIVH.COM

14.12.1 COMPANY SNAPSHOT

14.12.2 SERVICE PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 BB HEALTHCARE SOLUTIONS

14.13.1 COMPANY SNAPSHOT

14.13.2 SERVICE PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 BERKALP CO-LIMITED

14.14.1 COMPANY SNAPSHOT

14.14.2 SERVICE PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 HOSPITAL GALENIA

14.15.1 COMPANY SNAPSHOT

14.15.2 SERVICE PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 MED TOURISM CO, LLC

14.16.1 COMPANY SNAPSHOT

14.16.2 SERVICE PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 MEDIC ABROAD

14.17.1 COMPANY SNAPSHOT

14.17.2 SERVICE PORTFOLIO

14.17.3 RECENT DEVELOPMENT

14.18 MEDICA SUR

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 SERVICE PORTFOLIO

14.18.4 RECENT DEVELOPMENT

14.19 SAMITIVEJ PCL

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 SERVICE PORTFOLIO

14.19.4 RECENT DEVELOPMENT

14.2 SEOUL NATIONAL UNIVERSITY HOSPITAL

14.20.1 COMPANY SNAPSHOT

14.20.2 SERVICE PORTFOLIO

14.20.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 EUROPE HEALTH TOURISM MARKET, BY SERVICE, 2020-2029 (USD BILLION)

TABLE 2 EUROPE TRANSPORT IN HEALTH TOURISM MARKET, BY REGION, 2020-2029 (USD BILLION)

TABLE 3 EUROPE ACCOMMODATION IN HEALTH TOURISM MARKET, BY REGION, 2020-2029 (USD BILLION)

TABLE 4 EUROPE HOSPITALITY IN HEALTH TOURISM MARKET, BY REGION, 2020-2029 (USD BILLION)

TABLE 5 EUROPE OTHERS IN HEALTH TOURISM MARKET, BY REGION, 2020-2029 (USD BILLION)

TABLE 6 EUROPE HEALTH TOURISM MARKET, BY TYPE OF TREATMENT, 2020-2029 (USD BILLION)

TABLE 7 EUROPE COSMETIC TREATMENT IN HEALTH TOURISM MARKET, BY REGION, 2020-2029 (USD BILLION)

TABLE 8 EUROPE DENTAL TREATMENT IN HEALTH TOURISM MARKET, BY REGION, 2020-2029 (USD BILLION)

TABLE 9 EUROPE CARDIOVASCULAR TREATMENT IN HEALTH TOURISM MARKET, BY REGION, 2020-2029 (USD BILLION)

TABLE 10 EUROPE ORTHOPEDIC TREATMENT IN HEALTH TOURISM MARKET, BY REGION, 2020-2029 (USD BILLION)

TABLE 11 EUROPE BARIATRIC TREATMENT IN HEALTH TOURISM MARKET, BY REGION, 2020-2029 (USD BILLION)

TABLE 12 EUROPE FERTILITY TREATMENT IN HEALTH TOURISM MARKET, BY REGION, 2020-2029 (USD BILLION)

TABLE 13 EUROPE CANCER TREATMENT IN HEALTH TOURISM MARKET, BY REGION, 2020-2029 (USD BILLION)

TABLE 14 EUROPE OPHTHALMIC TREATMENT IN HEALTH TOURISM MARKET, BY REGION, 2020-2029 (USD BILLION)

TABLE 15 EUROPE NEUROLOGICAL TREATMENT IN HEALTH TOURISM MARKET, BY REGION, 2020-2029 (USD BILLION)

TABLE 16 EUROPE OTHERS IN HEALTH TOURISM MARKET, BY REGION, 2020-2029 (USD BILLION)

TABLE 17 EUROPE HEALTH TOURISM MARKET, BY AGE GROUP, 2020-2029 (USD BILLION)

TABLE 18 EUROPE SENIOR CITIZENS IN HEALTH TOURISM MARKET, BY REGION, 2020-2029 (USD BILLION)

TABLE 19 EUROPE MINORS IN HEALTH TOURISM MARKET, BY REGION, 2020-2029 (USD BILLION)

TABLE 20 EUROPE ADULTS IN HEALTH TOURISM MARKET, BY REGION, 2020-2029 (USD BILLION)

TABLE 21 EUROPE HEALTH TOURISM MARKET, BY SERVICE PROVIDER, 2020-2029 (USD BILLION)

TABLE 22 EUROPE PRIVATE IN HEALTH TOURISM MARKET, BY REGION, 2020-2029 (USD BILLION)

TABLE 23 EUROPE PUBLIC IN HEALTH TOURISM MARKET, BY REGION, 2020-2029 (USD BILLION)

TABLE 24 EUROPE HEALTH TOURISM MARKET, BY COUNTRY, 2020-2029 (USD BILLION)

TABLE 25 EUROPE HEALTH TOURISM MARKET, BY SERVICE, 2020-2029 (USD BILLION)

TABLE 26 EUROPE HEALTH TOURISM MARKET, BY TYPE OF TREATMENT, 2020-2029 (USD BILLION)

TABLE 27 EUROPE HEALTH TOURISM MARKET, BY AGE GROUP, 2020-2029 (USD BILLION)

TABLE 28 EUROPE HEALTH TOURISM MARKET, BY SERVICE PROVIDER, 2020-2029 (USD BILLION)

TABLE 29 U.K. HEALTH TOURISM MARKET, BY SERVICE, 2020-2029 (USD BILLION)

TABLE 30 U.K. HEALTH TOURISM MARKET, BY TYPE OF TREATMENT, 2020-2029 (USD BILLION)

TABLE 31 U.K. HEALTH TOURISM MARKET, BY AGE GROUP, 2020-2029 (USD BILLION)

TABLE 32 U.K. HEALTH TOURISM MARKET, BY SERVICE PROVIDER, 2020-2029 (USD BILLION)

TABLE 33 GERMANY HEALTH TOURISM MARKET, BY SERVICE, 2020-2029 (USD BILLION)

TABLE 34 GERMANY HEALTH TOURISM MARKET, BY TYPE OF TREATMENT, 2020-2029 (USD BILLION)

TABLE 35 GERMANY HEALTH TOURISM MARKET, BY AGE GROUP, 2020-2029 (USD BILLION)

TABLE 36 GERMANY HEALTH TOURISM MARKET, BY SERVICE PROVIDER, 2020-2029 (USD BILLION)

TABLE 37 FRANCE HEALTH TOURISM MARKET, BY SERVICE, 2020-2029 (USD BILLION)

TABLE 38 FRANCE HEALTH TOURISM MARKET, BY TYPE OF TREATMENT, 2020-2029 (USD BILLION)

TABLE 39 FRANCE HEALTH TOURISM MARKET, BY AGE GROUP, 2020-2029 (USD BILLION)

TABLE 40 FRANCE HEALTH TOURISM MARKET, BY SERVICE PROVIDER, 2020-2029 (USD BILLION)

TABLE 41 ITALY HEALTH TOURISM MARKET, BY SERVICE, 2020-2029 (USD BILLION)

TABLE 42 ITALY HEALTH TOURISM MARKET, BY TYPE OF TREATMENT, 2020-2029 (USD BILLION)

TABLE 43 ITALY HEALTH TOURISM MARKET, BY AGE GROUP, 2020-2029 (USD BILLION)

TABLE 44 ITALY HEALTH TOURISM MARKET, BY SERVICE PROVIDER, 2020-2029 (USD BILLION)

TABLE 45 SPAIN HEALTH TOURISM MARKET, BY SERVICE, 2020-2029 (USD BILLION)

TABLE 46 SPAIN HEALTH TOURISM MARKET, BY TYPE OF TREATMENT, 2020-2029 (USD BILLION)

TABLE 47 SPAIN HEALTH TOURISM MARKET, BY AGE GROUP, 2020-2029 (USD BILLION)

TABLE 48 SPAIN HEALTH TOURISM MARKET, BY SERVICE PROVIDER, 2020-2029 (USD BILLION)

TABLE 49 TURKEY HEALTH TOURISM MARKET, BY SERVICE, 2020-2029 (USD BILLION)

TABLE 50 TURKEY HEALTH TOURISM MARKET, BY TYPE OF TREATMENT, 2020-2029 (USD BILLION)

TABLE 51 TURKEY HEALTH TOURISM MARKET, BY AGE GROUP, 2020-2029 (USD BILLION)

TABLE 52 TURKEY HEALTH TOURISM MARKET, BY SERVICE PROVIDER, 2020-2029 (USD BILLION)

TABLE 53 SWITZERLAND HEALTH TOURISM MARKET, BY SERVICE, 2020-2029 (USD BILLION)

TABLE 54 SWITZERLAND HEALTH TOURISM MARKET, BY TYPE OF TREATMENT, 2020-2029 (USD BILLION)

TABLE 55 SWITZERLAND HEALTH TOURISM MARKET, BY AGE GROUP, 2020-2029 (USD BILLION)

TABLE 56 SWITZERLAND HEALTH TOURISM MARKET, BY SERVICE PROVIDER, 2020-2029 (USD BILLION)

TABLE 57 RUSSIA HEALTH TOURISM MARKET, BY SERVICE, 2020-2029 (USD BILLION)

TABLE 58 RUSSIA HEALTH TOURISM MARKET, BY TYPE OF TREATMENT, 2020-2029 (USD BILLION)

TABLE 59 RUSSIA HEALTH TOURISM MARKET, BY AGE GROUP, 2020-2029 (USD BILLION)

TABLE 60 RUSSIA HEALTH TOURISM MARKET, BY SERVICE PROVIDER, 2020-2029 (USD BILLION)

TABLE 61 NETHERLANDS HEALTH TOURISM MARKET, BY SERVICE, 2020-2029 (USD BILLION)

TABLE 62 NETHERLANDS HEALTH TOURISM MARKET, BY TYPE OF TREATMENT, 2020-2029 (USD BILLION)

TABLE 63 NETHERLANDS HEALTH TOURISM MARKET, BY AGE GROUP, 2020-2029 (USD BILLION)

TABLE 64 NETHERLANDS HEALTH TOURISM MARKET, BY SERVICE PROVIDER, 2020-2029 (USD BILLION)

TABLE 65 BELGIUM HEALTH TOURISM MARKET, BY SERVICE, 2020-2029 (USD BILLION)

TABLE 66 BELGIUM HEALTH TOURISM MARKET, BY TYPE OF TREATMENT, 2020-2029 (USD BILLION)

TABLE 67 BELGIUM HEALTH TOURISM MARKET, BY AGE GROUP, 2020-2029 (USD BILLION)

TABLE 68 BELGIUM HEALTH TOURISM MARKET, BY SERVICE PROVIDER, 2020-2029 (USD BILLION)

TABLE 69 AUSTRIA HEALTH TOURISM MARKET, BY SERVICE, 2020-2029 (USD BILLION)

TABLE 70 AUSTRIA HEALTH TOURISM MARKET, BY TYPE OF TREATMENT, 2020-2029 (USD BILLION)

TABLE 71 AUSTRIA HEALTH TOURISM MARKET, BY AGE GROUP, 2020-2029 (USD BILLION)

TABLE 72 AUSTRIA HEALTH TOURISM MARKET, BY SERVICE PROVIDER, 2020-2029 (USD BILLION)

TABLE 73 LUXEMBURG HEALTH TOURISM MARKET, BY SERVICE, 2020-2029 (USD BILLION)

TABLE 74 LUXEMBURG HEALTH TOURISM MARKET, BY TYPE OF TREATMENT, 2020-2029 (USD BILLION)

TABLE 75 LUXEMBURG HEALTH TOURISM MARKET, BY AGE GROUP, 2020-2029 (USD BILLION)

TABLE 76 LUXEMBURG HEALTH TOURISM MARKET, BY SERVICE PROVIDER, 2020-2029 (USD BILLION)

TABLE 77 REST OF EUROPE HEALTH TOURISM MARKET, BY SERVICE, 2020-2029 (USD BILLION)

Liste des figures

FIGURE 1 EUROPE HEALTH TOURISM MARKET: SEGMENTATION

FIGURE 2 EUROPE HEALTH TOURISM MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE HEALTH TOURISM MARKET: DROC ANALYSIS

FIGURE 4 EUROPE HEALTH TOURISM MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE HEALTH TOURISM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE HEALTH TOURISM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE HEALTH TOURISM MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE HEALTH TOURISM MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE HEALTH TOURISM MARKET: SEGMENTATION

FIGURE 10 HIGHER PROBABILITY OF LONG WAITING LISTS FOR HEALTHCARE SERVICES IN DEVELOPED COUNTRIES IS EXPECTED TO DRIVE THE EUROPE HEALTH TOURISM MARKET IN THE FORECAST PERIOD

FIGURE 11 TRANSPORT SERVICE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE HEALTH TOURISM MARKET IN 2022 & 2029

FIGURE 12 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST-GROWING REGION IN THE EUROPE HEALTH TOURISM MARKET IN THE FORECAST PERIOD

FIGURE 13 PESTEL ANALYSIS

FIGURE 14 PORTER’S FIVE FORCE ANALYSIS

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE HEALTH TOURISM MARKET

FIGURE 16 EUROPE HEALTH TOURISM MARKET: BY SERVICE, 2021

FIGURE 17 EUROPE HEALTH TOURISM MARKET: BY TYPE OF TREATMENT, 2021

FIGURE 18 EUROPE HEALTH TOURISM MARKET: BY AGE GROUP, 2021

FIGURE 19 EUROPE HEALTH TOURISM MARKET: BY SERVICE PROVIDER, 2021

FIGURE 20 EUROPE HEALTH TOURISM MARKET: SNAPSHOT (2021)

FIGURE 21 EUROPE HEALTH TOURISM MARKET: BY COUNTRY (2021)

FIGURE 22 EUROPE HEALTH TOURISM MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 EUROPE HEALTH TOURISM MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 EUROPE HEALTH TOURISM MARKET: BY SERVICE (2022-2029)

FIGURE 25 EUROPE HEALTH TOURISM MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.