Europe Genetic Testing Market

Taille du marché en milliards USD

TCAC :

%

USD

4,344.02 Billion

USD

12,730.46 Billion

2021

2029

USD

4,344.02 Billion

USD

12,730.46 Billion

2021

2029

| 2022 –2029 | |

| USD 4,344.02 Billion | |

| USD 12,730.46 Billion | |

|

|

|

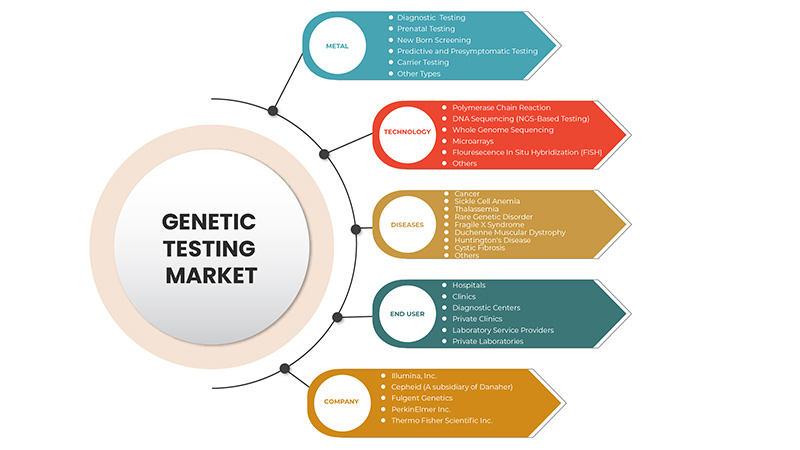

Europe Genetic Testing Market, By Type (Carrier Testing, Diagnostic Testing, Prenatal Testing, New Born Screening, Predictive And Presymptomatic Testing, Other Types), Technology (DNA Sequencing (NGS-Based Testing), Polymerase Chain Reaction, Microarrays, Whole Genome Sequencing, Fluorescence In Situ Hybridization (FISH), Others), Diseases (Rare Genetic Disorder, Cancer, Cystic Fibrosis, Sickle Cell Anemia, Duchenne Muscular Dystrophy, Thalassemia, Huntington’s Disease, Fragile X Syndrome, Duchenne Muscular Dystrophy, Others) End User (Hospitals, Clinics, Diagnostic Centres, Private Clinics, Laboratory Service Providers, Private Laboratories) Industry Trends and Forecast to 2029

Market Analysis and Insights

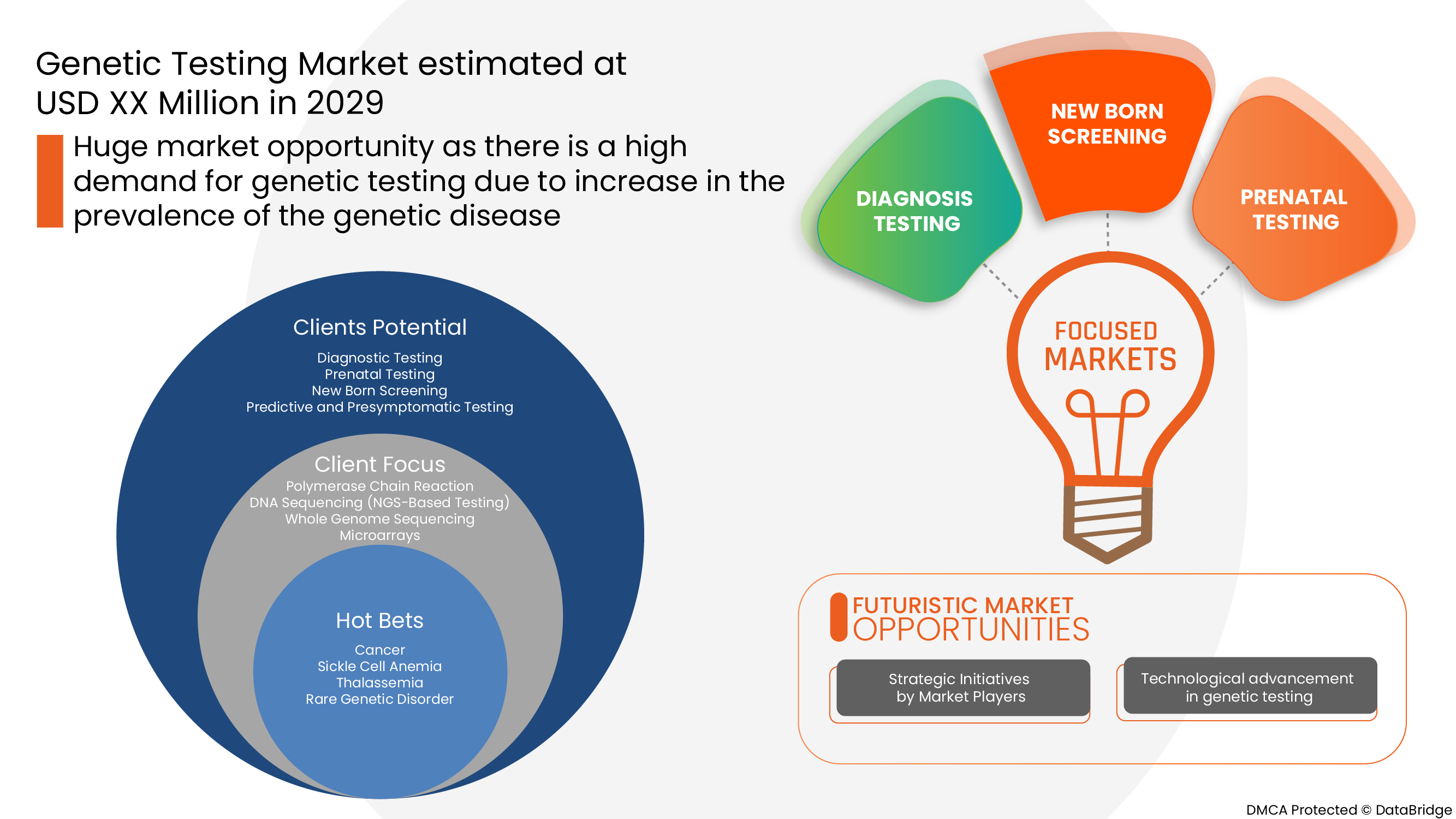

Europe genetic testing market is driven by the factors such as the high prevalence of genetic disorders, growing technological advancements in the genetic testing market which enhance its demand, as well as increasing investment in research and development, which leads to market growth. Currently, healthcare expenditure has increased across developed and emerging countries which are expected to create a competitive advantage for manufacturers to develop new and innovative genetic testing markets. However, the high cost associated with genetic testing and stringent regulatory frameworks for genetic testing.

Europe genetic testing market report provides details of market share, new developments, and product pipeline analysis, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an analyst brief, our team will help you create a revenue impact solution to achieve your desired goal. The scalability and business expansion of the retail units in the developing countries of various region and partnership with suppliers for safe distribution of machine and drugs products are the major drivers which propelled the demand of the market in the forecast period.

Market Definition

Genetic testing is a kind of medical test that identifies changes in genes, chromosomes, or proteins. The outcome of a genetic test can confirm or rule out a suspected genetic condition or aid in determining a person’s chance of developing or passing on a genetic disorder. Over 77,000 genetic tests are currently in use, and others are being developed.

The increasing innovations and technologies and rising number of players in the market, and novel product launches are also propelling the growth of the Europe genetic testing market.

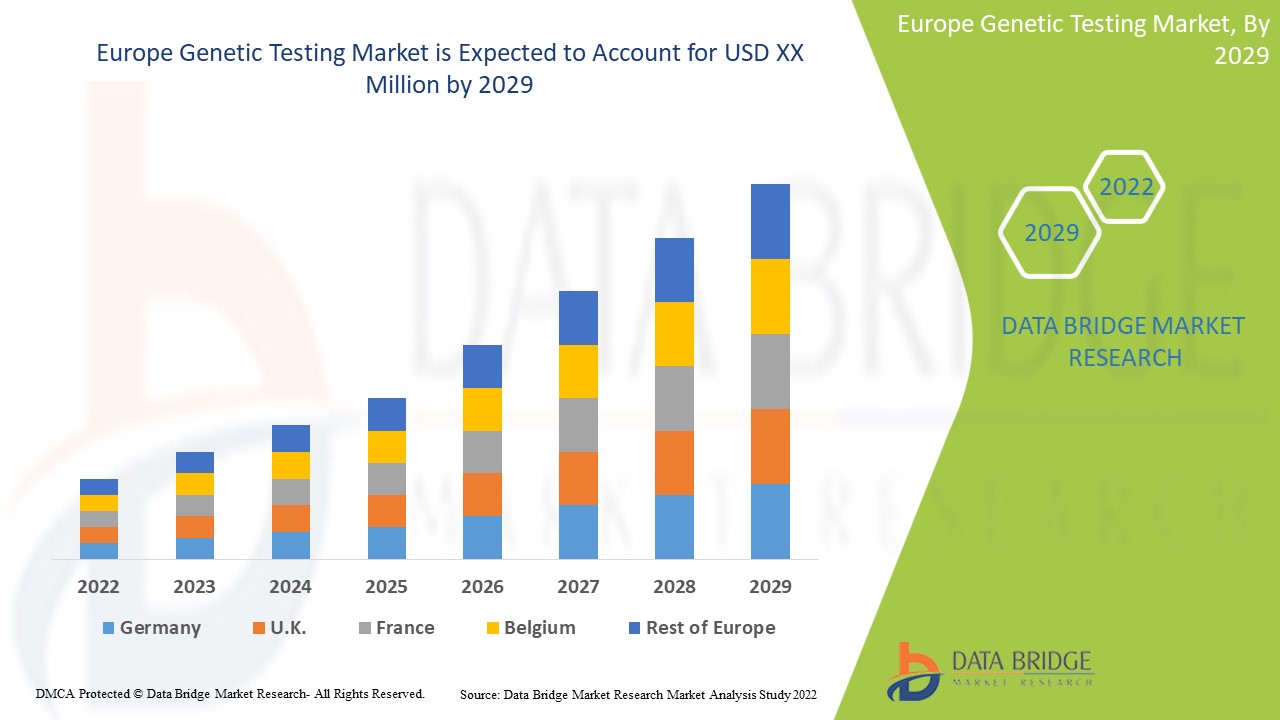

Le marché européen des tests génétiques devrait connaître une croissance du marché au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 14,6 % au cours de la période de prévision de 2022 à 2029 et devrait atteindre 12 730,46 millions USD d'ici 2029 contre 4 344,02 millions USD en 2021.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par type (tests de porteurs, tests de diagnostic, tests prénatals, dépistage des nouveau-nés, tests prédictifs et présymptomatiques, autres types), technologie (séquençage de l'ADN (tests basés sur le NGS), réaction en chaîne par polymérase , microarrays, séquençage du génome entier, hybridation in situ en fluorescence (FISH), autres), maladies (maladie génétique rare, cancer, fibrose kystique, anémie falciforme, dystrophie musculaire de Duchenne, thalassémie, maladie de Huntington, syndrome de l'X fragile, dystrophie musculaire de Duchenne, autres), utilisateur final (hôpitaux, cliniques, centres de diagnostic, cliniques privées, prestataires de services de laboratoire, laboratoires privés) |

|

Pays couverts |

Allemagne, France, Royaume-Uni, Italie, Espagne, Russie, Turquie, Belgique, Pays-Bas, Suisse, Reste de l'Europe |

|

Acteurs du marché couverts |

Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., PerkinElmer Inc., Illumina, Inc., QIAGEN, F. Hoffmann-La Roche Ltd., Myriad Genetics, Inc., Abbott, Eurofins Scientific, Biocartis, Cepheid (une filiale de Danaher), PacBio, BioReference, Natera, Inc. entre autres |

Dynamique du marché des tests génétiques en Europe

Conducteurs

- Prévalence croissante des maladies génétiques

Par exemple,

- Conformément à la publication de janvier 2019 intitulée « Manifeste 2018 du Conseil européen du cancer du sein : tests de prédiction du risque génétique dans le cancer du sein », il a été indiqué que les tests BRCA1/2 sont largement répandus au Royaume-Uni et dans d'autres régions européennes indiqués pour les tests de dépistage du cancer.

- Des programmes organisés de tests génétiques sont proposés dans l'Union européenne, ce qui garantit que des services de dépistage de haute qualité sont fournis à la population.

Par conséquent, cela augmente la demande pour le marché des tests génétiques.

- Augmentation de l'adoption du séquençage de nouvelle génération

Alors que la pharmacologie axée sur la génomique continue de jouer un rôle plus important dans le traitement de diverses maladies chroniques, en particulier le cancer, le séquençage de nouvelle génération (NGS) évolue comme un outil puissant pour fournir un aperçu plus approfondi et plus précis des fondements moléculaires des tumeurs individuelles et des récepteurs spécifiques.

Le NGS offre des avantages en termes de précision, de sensibilité et de rapidité par rapport aux méthodes traditionnelles, qui ont le potentiel d'avoir un impact significatif dans le domaine de l'oncologie. Étant donné que le NGS peut évaluer plusieurs gènes dans un seul test, il n'est plus nécessaire de commander plusieurs tests pour identifier la mutation causale.

Par exemple,

- Le NGS a également été exploré pour le profilage complet de la pharmacogénétique en rapport avec la pharmacocinétique et la pharmacodynamique des médicaments. Les premiers rapports de 2017 suggèrent que cette technologie peut représenter un outil fiable et efficace pour découvrir les variations génétiques courantes et rares dans ces gènes.

Cela devrait donc servir de moteur à la croissance du marché des tests génétiques.

Opportunités

-

Accroître la recherche et le développement

Par exemple,

-

Selon la publication de 2020 intitulée « Disponibilité et financement du séquençage génomique clinique à l'échelle mondiale », il a été indiqué que de nombreux pays européens autres que le Royaume-Uni disposent d'une disponibilité croissante de tests génétiques pour promouvoir la croissance du NGS (séquençage de nouvelle génération) et de la médecine génomique.

-

Hausse du revenu disponible

Les dépenses consacrées par un pays aux soins de santé et son taux de croissance au fil du temps sont influencés par une grande variété de facteurs économiques et sociaux, notamment les modalités de financement et la structure de l'organisation du système de santé. En particulier, il existe une forte corrélation entre le niveau de revenu global d'un pays et le montant que la population de ce pays dépense en soins de santé.

En outre, les initiatives stratégiques prises par les principaux acteurs du marché assureront l’intégrité structurelle et les opportunités futures du marché des tests génétiques au cours de la période de prévision 2022-2029.

Contraintes/Défis

- Coût élevé des tests génétiques

Les tests génétiques peuvent être coûteux et ne pas être couverts par certains régimes d'assurance maladie. Les nombreux tests génétiques varient en termes de coût en fonction de la maladie ciblée.

Selon Breastcancer.org, le coût des tests génétiques pour le cancer peut varier considérablement et peut se situer entre 300 et 5 000 dollars. Le coût des tests génétiques peut dépendre du type de test ainsi que de sa complexité.

Les tests génétiques peuvent coûter entre 100 et plus de 2 000 dollars, selon la nature et la complexité du test. Si plusieurs tests sont nécessaires ou si de nombreux membres de la famille doivent être testés pour obtenir un résultat significatif, le coût augmente. Le coût du dépistage néonatal varie selon les États.

Impact du Covid-19 sur le marché européen des tests génétiques

Le COVID-19 a eu un impact positif sur le marché car de nombreux tests génétiques et sérologiques ont été effectués pour le COVID-19, ce qui augmente la demande de tests génétiques pendant cette période.

Développement récent

- En décembre 2021, Thermo Fisher Scientific Inc. a annoncé avoir finalisé l'acquisition de PPD, Inc., l'un des principaux fournisseurs mondiaux de services de recherche clinique pour l'industrie biopharmaceutique et biotechnologique, pour 17,4 milliards de dollars. Cette acquisition a permis de générer davantage de revenus et de stimuler la croissance du marché.

Portée du marché européen des tests génétiques

Le marché européen des tests génétiques est segmenté en type, technologie, maladies et utilisateur final. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Taper

- Tests diagnostiques

- Test prénatal

- Dépistage des nouveau-nés

- Tests prédictifs et présymptomatiques

- Tests de transporteur

- Autres types

Sur la base du type, le marché européen des tests génétiques est segmenté en tests de diagnostic, tests prénatals, dépistage néonatal, tests prédictifs et présymptomatiques, tests de porteur et autres types.

Technologie

- Réaction en chaîne par polymérase

- Séquençage de l'ADN (test basé sur NGS)

- Séquençage du génome entier

- Microarrays

- Hybridation in situ en fluorescence (FISH)

- Autres

Sur la base de la technologie, le marché européen des tests génétiques est segmenté en séquençage de l'ADN (tests basés sur NGS), réaction en chaîne par polymérase, microarrays, séquençage du génome entier, hybridation in situ par fluorescence (FISH), autres.

Maladies

- Cancer

- Anémie falciforme

- Thalassémie

- Maladie génétique rare

- Syndrome de l'X fragile

- Dystrophie musculaire de Duchenne

- Maladie de Huntington

- Fibrose kystique

- Autres

Sur la base des maladies, le marché européen des tests génétiques est segmenté en maladies génétiques rares, cancer, fibrose kystique, anémie falciforme, dystrophie musculaire de Duchenne, thalassémie, maladie de Huntington, syndrome de l'X fragile, autres.

Utilisateur final

- Hôpitaux

- Cliniques

- Centres de diagnostic

- Cliniques privées

- Prestataires de services de laboratoire

- Laboratoires privés

Sur la base des utilisateurs finaux, le marché européen des tests génétiques est segmenté en hôpitaux, cliniques, centres de diagnostic, cliniques privées, prestataires de services de laboratoire et laboratoires privés.

Analyse/perspectives régionales du marché des tests génétiques

Le marché des tests génétiques est analysé et des informations sur la taille et les tendances du marché sont fournies par pays, type, technologie, maladies et utilisateur final, comme référencé ci-dessus.

L'Allemagne est le principal pays dominant sur le marché en raison de la prévalence croissante des troubles génétiques au sein de la population de ces pays. Et ils dominent le marché des tests génétiques en termes de part de marché et de chiffre d'affaires et continueront à accroître leur domination au cours de la période de prévision. Cela est dû aux défauts génétiques et aux aberrations chromosomiques dans la population de ces régions et au développement rapide de la recherche qui stimule le marché.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché qui ont un impact sur les tendances actuelles et futures du marché. Les points de données, tels que les ventes de produits neufs et de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation, sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la forte concurrence des marques locales et nationales, ainsi que l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des tests génétiques

Le paysage concurrentiel du marché des tests génétiques fournit des détails sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises sur le marché des tests génétiques.

Certains des principaux acteurs opérant sur le marché des tests génétiques sont Thermo Fisher Scientific Inc., Illumina, Inc., QIAGEN, F. Hoffmann-La Roche Ltd., Myriad Genetics, Inc., Abbott, Eurofins Scientific, Biocartis, Cepheid (une filiale de Danaher), PacBio, BioReference, Natera, Inc. entre autres

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement de l'entreprise, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport aux régions et la part des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE GENETIC TESTING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

4.3 STRATEGIC INITIATIVES:

4.4 CONCLUSION:

4.5 INDUSTRY INSIGHTS

4.5.1 CANCER GENETICS RISK ASSESSMENT AND COUNSELING

4.5.2 GENETIC TESTS PRICING

4.5.3 KEY INSIGHTS

5 EPIDERMIOLOGY

6 EUROPE GENETIC TESTING MARKET: REGULATIONS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 GROWING PREVALENCE OF GENETIC DISORDERS

7.1.2 INCREASE IN THE ADOPTION OF NEXT GENERATION SEQUENCING

7.1.3 WIDE PRODUCT PORTFOLIO OFFERED BY A MAJOR PLAYER

7.1.4 INCREASE TREND TOWARD PERSONALIZED MEDICATION

7.2 RESTRAINTS

7.2.1 HIGH COST OF GENETIC TESTING

7.2.2 CYBER SECURITY CONCERNS IN GENOMICS

7.3 OPPORTUNITIES

7.3.1 STRATEGIC INITIATIVES BY THE KEY MARKET PLAYER

7.3.2 TECHNOLOGICAL ADVANCEMENT

7.3.3 INCREASING RESEARCH AND DEVELOPMENT

7.3.4 RISING DISPOSABLE INCOME

7.4 CHALLENGES

7.4.1 LACK OF SKILLED PROFESSIONALS TO PERFORM GENETIC TESTING

7.4.2 STRINGENT REGULATION POLICY

8 EUROPE GENETIC TESTING MARKET, BY TYPE

8.1 OVERVIEW

8.2 DIAGNOSTIC TESTING

8.3 PRENATAL TESTING

8.3.1 NON-INVASIVE SCREENING

8.3.1.1 BY SCREENING METHOD

8.3.1.1.1 WHOLE GENOME SEQUENCING

8.3.1.1.2 COUNTING OF CFDNA FRAGMENTS

8.3.1.1.3 OTHERS

8.3.1.2 BY CONDITION

8.3.1.2.1 TRISOMY 21

8.3.1.2.2 KLINEFELTER SYNDROME

8.3.1.2.3 JACOBS SYNDROME

8.3.1.2.4 CYSTIC FIBROSIS

8.3.1.2.5 TURNER SYNDROME

8.3.1.2.6 TRISOMY 18

8.3.1.2.7 HEMOPHILIA

8.3.1.2.8 TRISOMY 13

8.3.1.2.9 MICRODELETION SYNDROME

8.3.1.2.10 FETAL GENDER

8.3.1.2.11 OTHERS

8.3.1.3 BY SCREENING TYPE

8.3.1.3.1 CARRIER SEQUENCING

8.3.1.3.2 SEQUENTIAL SEQUENCING

8.3.2 MATERNAL SERUM QUAD SCREENING

8.4 NEW BORN SCREENING

8.4.1.1 SICKLE CELL DISEASE

8.4.1.2 CONGENITAL HYPOTHYROIDISM

8.4.1.3 PHENYLKETONURIA (PKU)

8.4.1.4 GALACTOSEMIA

8.4.1.5 MAPLE SYRUP URINE DISEASE

8.4.1.6 OTHERS

8.5 PREDICTIVE AND PRESYMPTOMATIC TESTING

8.6 CARRIER TESTING

8.6.1 BY TEST TYPE

8.6.1.1 MOLECULAR SCREENING TEST

8.6.1.2 BIOCHEMICAL SCREENING TEST

8.6.2 BY TYPE

8.6.2.1 EXPANDED CARRIER SCREENING

8.6.2.1.1 PREDESIGNED PANEL TESTING

8.6.2.1.2 CUSTOM-MADE PANEL TESTING

8.6.2.2 TARGETED DISEASE CARRIER SCREENING

8.6.2.2.1 BY MEDICAL CONDITION

8.6.2.2.2 HEMATOLOGICAL CONDITIONS

8.6.2.2.3 PULMONARY CONDITIONS

8.6.2.2.4 NEUROLOGICAL CONDITIONS

8.6.2.2.5 OTHER CONDITIONS

8.7 OTHER TYPES

9 EUROPE GENETIC TESTING MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 POLYMERASE CHAIN REACTION

9.2.1 REAL-TIME PCR (QPCR)

9.2.2 DIGITAL PCR (DPCR)

9.2.3 REVERSE TRANSCRIPTION PCR (RT-PCR)

9.2.4 HOT-START PCR

9.2.5 MULTIPLEX PCR

9.2.6 OTHER PCR

9.3 DNA SEQUENCING (NGS-BASED TESTING)

9.3.1 NEXT GENERATION SEQUENCING (NGS)

9.3.2 SANGER SEQUENCING (SINGLE GENE)

9.3.3 OTHER

9.4 WHOLE GENOME SEQUENCING

9.5 MICROARRAYS

9.5.1 DNA MICROARRAYS

9.5.2 PROTEIN MICROARRAYS

9.5.3 OTHER MICROARRAYS

9.6 FLUORESCENCE IN SITU HYBRIDIZATION (FISH)

9.7 OTHERS

10 EUROPE GENETIC TESTING MARKET, BY DISEASES

10.1 OVERVIEW

10.2 CANCER

10.2.1 BREAST

10.2.2 COLON

10.2.3 LUNG

10.2.4 PROSTATE

10.2.5 OTHERS

10.3 SICKLE CELL ANEMIA

10.4 THALASSEMIA

10.5 RARE GENETIC DISORDER

10.5.1 TRISOMY 21

10.5.2 MONOSOMY X

10.5.3 TRISOMY 13

10.5.4 MICRODELETION SYNDROME

10.5.5 TRISOMY 18

10.5.6 OTHERS

10.6 FRAGILE X SYNDROME

10.7 DUCHENNE MUSCULAR DYSTROPHY

10.8 HUNTINGTON'S DISEASE

10.9 CYSTIC FIBROSIS

10.1 OTHERS

11 EUROPE GENETIC TESTING MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS

11.3 CLINICS

11.4 DIAGNOSTIC CENTERS

11.5 PRIVATE CLINICS

11.6 LABORATORY SERVICE PROVIDERS

11.7 PRIVATE LABORATORIES

12 EUROPE GENETIC TESTING MARKET, BY REGION

12.1 EUROPE

12.1.1 GERMANY

12.1.2 FRANCE

12.1.3 U.K.

12.1.4 RUSSIA

12.1.5 ITALY

12.1.6 SPAIN

12.1.7 TURKEY

12.1.8 NETHERLANDS

12.1.9 SWITZERLAND

12.1.10 BELGIUM

12.1.11 REST OF EUROPE

13 EUROPE GENETIC TESTING MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: EUROPE

14 WOT ANALYSIS

15 COMPANY PROFILE

15.1 ILLUMINA, INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 COMPANY SHARE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENT

15.1.4.1 ACQUISITION

15.1.4.2 COLLABORATION

15.2 CEPHEID

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.2.5.1 BUSINEES EXPANSION

15.3 FULGENT GENETICS

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.3.5.1 ACQUISITION

15.4 PERKINELMER INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.4.5.1 PRODUCT LAUNCH

15.5 THERMO FISHER SCIENTIFIC INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.5.5.1 COLLABORATION

15.6 ABBOTT

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 BIOCARTIS

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.7.4.1 PARTNERSHIP

15.7.4.2 AGREEMENT

15.8 BIO-HELIX

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 BIO-RAD LABORATORIES, INC.

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.9.4.1 ACQUISITION

15.9.4.2 PARTNERSHIP

15.1 BIOREFERENCE

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.10.4.1 ACQUISITION

15.11 ELITECHGROUP

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.11.3.1 PRODUCT LAUNCH

15.11.3.2 BUSINESS EXPANSION

15.12 EUROFINS SCIENTIFIC

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.12.4.1 PRODUCT LAUNCH

15.13 EUGENE LABS

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 F. HOFFMANN-LA ROCHE LTD)

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS (PARENT COMPANY)

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENTS

15.14.4.1 PRODUCT LAUNCH

15.15 GENES2ME

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 INVITAE CORPORATION

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENTS

15.17 MAPMYGENOME

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 MEDGENOME

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 MYRIAD GENETICS

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENT

15.2 NATERA, INC.

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.20.3.1 PARTNERSHIP

15.21 OTOGENRTICS

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.22 PACBIO

15.22.1 COMPANY SNAPSHOT

15.22.2 REVENUE ANALYSIS

15.22.3 PRODUCT PORTFOLIO

15.22.4 RECENT DEVELOPMENT

15.23 QIAGEN

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENTS

15.23.3.1 PARTNERSHIP

15.23.3.2 PRODUCT LAUNCH

15.24 SEMA4 OPCO, INC.

15.24.1 COMPANY SNAPSHOT

15.24.2 REVENUE ANALYSIS

15.24.3 PRODUCT PORTFOLIO

15.24.4 RECENT DEVELOPMENT

15.25 SORENSON GENOMICS

15.25.1 COMPANY SNAPSHOT

15.25.2 PRODUCT PORTFOLIO

15.25.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 EUROPE GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 2 EUROPE GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 3 EUROPE GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 4 EUROPE DIAGNOSTIC TESTING IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 EUROPE PRENATAL TESTING IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 EUROPE PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 EUROPE PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 8 EUROPE PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 9 EUROPE NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (USD MILLION)

TABLE 10 EUROPE NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (UNITS)

TABLE 11 EUROPE NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (ASP)

TABLE 12 EUROPE NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY CONDITION, 2020-2029 (USD MILLION)

TABLE 13 EUROPE NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (USD MILLION)

TABLE 14 EUROPE NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (UNITS)

TABLE 15 EUROPE NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (ASP)

TABLE 16 EUROPE NEW BORN SCREENING IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE NEW-BORN SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 18 EUROPE PREDICTIVE AND PRESYMPTOMATIC TESTING IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE CARRIER TESTING IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 EUROPE CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 21 EUROPE CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (UNITS)

TABLE 22 EUROPE CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (ASP)

TABLE 23 EUROPE CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 EUROPE CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 25 EUROPE CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 26 EUROPE EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 EUROPE EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 28 EUROPE EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 29 EUROPE CARRIER TESTING IN GENETIC TESTING MARKET, BY MEDICAL CONDITION, 2020-2029 (USD MILLION)

TABLE 30 EUROPE OTHER TYPES IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 EUROPE GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 32 EUROPE POLYMERASE CHAIN REACTION IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 EUROPE POLYMERASE CHAIN REACTION IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 34 EUROPE DNA SEQUENCING (NGS-BASED TESTING) IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 EUROPE DNA SEQUENCING (NGS-BASED TESTING) IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 36 EUROPE WHOLE GENOME SEQUENCING IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 EUROPE MICROARRAYS IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 EUROPE MICROARRAYS IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 39 EUROPE FLUORESCENCE IN SITU HYBRIDIZATION (FISH) IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 EUROPE OTHERS IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 EUROPE GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 42 EUROPE CANCER IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 EUROPE CANCER IN GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 44 EUROPE SICKLE CELL ANEMIA IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 EUROPE THALASSEMIA IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 EUROPE RARE GENETIC DISORDER IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 EUROPE RARE GENETIC DISORDER IN GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 48 EUROPE FRAGILE X SYNDROME IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 EUROPE DUCHENNE MUSCULAR DYSTROPHY IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 EUROPE HUNTINGTON'S DISEASE IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 EUROPE CYSTIC FIBROSIS IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 EUROPE OTHERS IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 EUROPE GENETIC TESTING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 54 EUROPE HOSPITALS IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 EUROPE CLINICS IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 56 EUROPE DIAGNOSTIC CENTERS IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 57 EUROPE PRIVATE CLINICS IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 58 EUROPE LABORATORY SERVICE PROVIDERS IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 59 EUROPE PRIVATE LABORATORIES IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 60 EUROPE GENETIC TESTING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 61 EUROPE GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 EUROPE GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 63 EUROPE GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 64 EUROPE PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 EUROPE PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 66 EUROPE PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 67 EUROPE NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (USD MILLION)

TABLE 68 EUROPE NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (UNITS)

TABLE 69 EUROPE NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (ASP)

TABLE 70 EUROPE NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY CONDITION, 2020-2029 (USD MILLION)

TABLE 71 EUROPE NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (USD MILLION)

TABLE 72 EUROPE NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (UNITS)

TABLE 73 EUROPE NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (ASP)

TABLE 74 EUROPE NEW-BORN SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 EUROPE CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 76 EUROPE CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (UNITS)

TABLE 77 EUROPE CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (ASP)

TABLE 78 EUROPE CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 EUROPE CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 80 EUROPE CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 81 EUROPE EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 EUROPE EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 83 EUROPE EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 84 EUROPE CARRIER TESTING IN GENETIC TESTING MARKET, BY MEDICAL CONDITION, 2020-2029 (USD MILLION)

TABLE 85 EUROPE GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 86 EUROPE POLYMERASE CHAIN REACTION IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 87 EUROPE DNA SEQUENCING IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 88 EUROPE MICROARRAYS IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 89 EUROPE GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 90 EUROPE RARE GENETIC DISORDER IN GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 91 EUROPE CANCER IN GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 92 EUROPE GENETIC TESTING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 93 GERMANY GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 GERMANY GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 95 GERMANY GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 96 GERMANY PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 GERMANY PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 98 GERMANY PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 99 GERMANY NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (USD MILLION)

TABLE 100 GERMANY NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (UNITS)

TABLE 101 GERMANY NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (ASP)

TABLE 102 GERMANY NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY CONDITION, 2020-2029 (USD MILLION)

TABLE 103 GERMANY NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (USD MILLION)

TABLE 104 GERMANY NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (UNITS)

TABLE 105 GERMANY NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (ASP)

TABLE 106 GERMANY NEW-BORN SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 GERMANY CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 108 GERMANY CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (UNITS)

TABLE 109 GERMANY CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (ASP)

TABLE 110 GERMANY CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 GERMANY CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 112 GERMANY CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 113 GERMANY EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 GERMANY EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 115 GERMANY EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 116 GERMANY CARRIER TESTING IN GENETIC TESTING MARKET, BY MEDICAL CONDITION, 2020-2029 (USD MILLION)

TABLE 117 GERMANY GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 118 GERMANY POLYMERASE CHAIN REACTION IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 119 GERMANY DNA SEQUENCING IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 120 GERMANY MICROARRAYS IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 121 GERMANY GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 122 GERMANY RARE GENETIC DISORDER IN GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 123 GERMANY CANCER IN GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 124 GERMANY GENETIC TESTING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 125 FRANCE GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 FRANCE GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 127 FRANCE GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 128 FRANCE PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 FRANCE PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 130 FRANCE PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 131 FRANCE NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (USD MILLION)

TABLE 132 FRANCE NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (UNITS)

TABLE 133 FRANCE NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (ASP)

TABLE 134 FRANCE NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY CONDITION, 2020-2029 (USD MILLION)

TABLE 135 FRANCE NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (USD MILLION)

TABLE 136 FRANCE NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (UNITS)

TABLE 137 FRANCE NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (ASP)

TABLE 138 FRANCE NEW-BORN SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 FRANCE CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 140 FRANCE CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (UNITS)

TABLE 141 FRANCE CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (ASP)

TABLE 142 FRANCE CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 143 FRANCE CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 144 FRANCE CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 145 FRANCE EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 146 FRANCE EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 147 FRANCE EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 148 FRANCE CARRIER TESTING IN GENETIC TESTING MARKET, BY MEDICAL CONDITION, 2020-2029 (USD MILLION)

TABLE 149 FRANCE GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 150 FRANCE POLYMERASE CHAIN REACTION IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 151 FRANCE DNA SEQUENCING IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 152 FRANCE MICROARRAYS IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 153 FRANCE GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 154 FRANCE RARE GENETIC DISORDER IN GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 155 FRANCE CANCER IN GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 156 FRANCE GENETIC TESTING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 157 U.K. GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 158 U.K. GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 159 U.K. GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 160 U.K. PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 161 U.K. PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 162 U.K. PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 163 U.K. NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (USD MILLION)

TABLE 164 U.K. NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (UNITS)

TABLE 165 U.K. NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (ASP)

TABLE 166 U.K. NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY CONDITION, 2020-2029 (USD MILLION)

TABLE 167 U.K. NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (USD MILLION)

TABLE 168 U.K. NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (UNITS)

TABLE 169 U.K. NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (ASP)

TABLE 170 U.K. NEW-BORN SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 171 U.K. CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 172 U.K. CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (UNITS)

TABLE 173 U.K. CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (ASP)

TABLE 174 U.K. CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 175 U.K. CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 176 U.K. CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 177 U.K. EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 178 U.K. EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 179 U.K. EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 180 U.K. CARRIER TESTING IN GENETIC TESTING MARKET, BY MEDICAL CONDITION, 2020-2029 (USD MILLION)

TABLE 181 U.K. GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 182 U.K. POLYMERASE CHAIN REACTION IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 183 U.K. DNA SEQUENCING IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 184 U.K. MICROARRAYS IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 185 U.K. GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 186 U.K. RARE GENETIC DISORDER IN GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 187 U.K. CANCER IN GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 188 U.K. GENETIC TESTING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 189 RUSSIA GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 190 RUSSIA GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 191 RUSSIA GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 192 RUSSIA PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 193 RUSSIA PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 194 RUSSIA PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 195 RUSSIA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (USD MILLION)

TABLE 196 RUSSIA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (UNITS)

TABLE 197 RUSSIA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (ASP)

TABLE 198 RUSSIA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY CONDITION, 2020-2029 (USD MILLION)

TABLE 199 RUSSIA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (USD MILLION)

TABLE 200 RUSSIA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (UNITS)

TABLE 201 RUSSIA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (ASP)

TABLE 202 RUSSIA NEW-BORN SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 203 RUSSIA CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 204 RUSSIA CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (UNITS)

TABLE 205 RUSSIA CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (ASP)

TABLE 206 RUSSIA CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 207 RUSSIA CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 208 RUSSIA CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 209 RUSSIA EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 210 RUSSIA EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 211 RUSSIA EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 212 RUSSIA CARRIER TESTING IN GENETIC TESTING MARKET, BY MEDICAL CONDITION, 2020-2029 (USD MILLION)

TABLE 213 RUSSIA GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 214 RUSSIA POLYMERASE CHAIN REACTION IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 215 RUSSIA DNA SEQUENCING IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 216 RUSSIA MICROARRAYS IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 217 RUSSIA GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 218 RUSSIA RARE GENETIC DISORDER IN GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 219 RUSSIA CANCER IN GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 220 RUSSIA GENETIC TESTING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 221 ITALY GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 222 ITALY GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 223 ITALY GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 224 ITALY PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 225 ITALY PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 226 ITALY PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 227 ITALY NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (USD MILLION)

TABLE 228 ITALY NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (UNITS)

TABLE 229 ITALY NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (ASP)

TABLE 230 ITALY NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY CONDITION, 2020-2029 (USD MILLION)

TABLE 231 ITALY NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (USD MILLION)

TABLE 232 ITALY NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (UNITS)

TABLE 233 ITALY NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (ASP)

TABLE 234 ITALY NEW-BORN SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 235 ITALY CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 236 ITALY CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (UNITS)

TABLE 237 ITALY CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (ASP)

TABLE 238 ITALY CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 239 ITALY CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 240 ITALY CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 241 ITALY EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 242 ITALY EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 243 ITALY EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 244 ITALY CARRIER TESTING IN GENETIC TESTING MARKET, BY MEDICAL CONDITION, 2020-2029 (USD MILLION)

TABLE 245 ITALY GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 246 ITALY POLYMERASE CHAIN REACTION IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 247 ITALY DNA SEQUENCING IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 248 ITALY MICROARRAYS IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 249 ITALY GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 250 ITALY RARE GENETIC DISORDER IN GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 251 ITALY CANCER IN GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 252 ITALY GENETIC TESTING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 253 SPAIN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 254 SPAIN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 255 SPAIN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 256 SPAIN PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 257 SPAIN PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 258 SPAIN PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 259 SPAIN NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (USD MILLION)

TABLE 260 SPAIN NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (UNITS)

TABLE 261 SPAIN NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (ASP)

TABLE 262 SPAIN NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY CONDITION, 2020-2029 (USD MILLION)

TABLE 263 SPAIN NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (USD MILLION)

TABLE 264 SPAIN NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (UNITS)

TABLE 265 SPAIN NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (ASP)

TABLE 266 SPAIN NEW-BORN SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 267 SPAIN CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 268 SPAIN CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (UNITS)

TABLE 269 SPAIN CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (ASP)

TABLE 270 SPAIN CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 271 SPAIN CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 272 SPAIN CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 273 SPAIN EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 274 SPAIN EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 275 SPAIN EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 276 SPAIN CARRIER TESTING IN GENETIC TESTING MARKET, BY MEDICAL CONDITION, 2020-2029 (USD MILLION)

TABLE 277 SPAIN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 278 SPAIN POLYMERASE CHAIN REACTION IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 279 SPAIN DNA SEQUENCING IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 280 SPAIN MICROARRAYS IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 281 SPAIN GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 282 SPAIN RARE GENETIC DISORDER IN GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 283 SPAIN CANCER IN GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 284 SPAIN GENETIC TESTING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 285 TURKEY GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 286 TURKEY GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 287 TURKEY GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 288 TURKEY PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 289 TURKEY PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 290 TURKEY PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 291 TURKEY NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (USD MILLION)

TABLE 292 TURKEY NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (UNITS)

TABLE 293 TURKEY NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (ASP)

TABLE 294 TURKEY NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY CONDITION, 2020-2029 (USD MILLION)

TABLE 295 TURKEY NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (USD MILLION)

TABLE 296 TURKEY NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (UNITS)

TABLE 297 TURKEY NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (ASP)

TABLE 298 TURKEY NEW-BORN SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 299 TURKEY CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 300 TURKEY CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (UNITS)

TABLE 301 TURKEY CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (ASP)

TABLE 302 TURKEY CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 303 TURKEY CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 304 TURKEY CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 305 TURKEY EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 306 TURKEY EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 307 TURKEY EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 308 TURKEY CARRIER TESTING IN GENETIC TESTING MARKET, BY MEDICAL CONDITION, 2020-2029 (USD MILLION)

TABLE 309 TURKEY GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 310 TURKEY POLYMERASE CHAIN REACTION IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 311 TURKEY DNA SEQUENCING IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 312 TURKEY MICROARRAYS IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 313 TURKEY GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 314 TURKEY RARE GENETIC DISORDER IN GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 315 TURKEY CANCER IN GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 316 TURKEY GENETIC TESTING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 317 NETHERLANDS GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 318 NETHERLANDS GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 319 NETHERLANDS GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 320 NETHERLANDS PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 321 NETHERLANDS PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 322 NETHERLANDS PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 323 NETHERLANDS NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (USD MILLION)

TABLE 324 NETHERLANDS NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (UNITS)

TABLE 325 NETHERLANDS NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (ASP)

TABLE 326 NETHERLANDS NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY CONDITION, 2020-2029 (USD MILLION)

TABLE 327 NETHERLANDS NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (USD MILLION)

TABLE 328 NETHERLANDS NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (UNITS)

TABLE 329 NETHERLANDS NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (ASP)

TABLE 330 NETHERLANDS NEW-BORN SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 331 NETHERLANDS CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 332 NETHERLANDS CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (UNITS)

TABLE 333 NETHERLANDS CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (ASP)

TABLE 334 NETHERLANDS CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 335 NETHERLANDS CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 336 NETHERLANDS CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 337 NETHERLANDS EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 338 NETHERLANDS EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 339 NETHERLANDS EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 340 NETHERLANDS CARRIER TESTING IN GENETIC TESTING MARKET, BY MEDICAL CONDITION, 2020-2029 (USD MILLION)

TABLE 341 NETHERLANDS GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 342 NETHERLANDS POLYMERASE CHAIN REACTION IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 343 NETHERLANDS DNA SEQUENCING IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 344 NETHERLANDS MICROARRAYS IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 345 NETHERLANDS GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 346 NETHERLANDS RARE GENETIC DISORDER IN GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 347 NETHERLANDS CANCER IN GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 348 NETHERLANDS GENETIC TESTING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 349 SWITZERLAND GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 350 SWITZERLAND GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 351 SWITZERLAND GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 352 SWITZERLAND PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 353 SWITZERLAND PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 354 SWITZERLAND PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 355 SWITZERLAND NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (USD MILLION)

TABLE 356 SWITZERLAND NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (UNITS)

TABLE 357 SWITZERLAND NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (ASP)

TABLE 358 SWITZERLAND NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY CONDITION, 2020-2029 (USD MILLION)

TABLE 359 SWITZERLAND NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (USD MILLION)

TABLE 360 SWITZERLAND NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (UNITS)

TABLE 361 SWITZERLAND NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (ASP)

TABLE 362 SWITZERLAND NEW-BORN SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 363 SWITZERLAND CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 364 SWITZERLAND CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (UNITS)

TABLE 365 SWITZERLAND CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (ASP)

TABLE 366 SWITZERLAND CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 367 SWITZERLAND CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 368 SWITZERLAND CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 369 SWITZERLAND EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 370 SWITZERLAND EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 371 SWITZERLAND EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 372 SWITZERLAND CARRIER TESTING IN GENETIC TESTING MARKET, BY MEDICAL CONDITION, 2020-2029 (USD MILLION)

TABLE 373 SWITZERLAND GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 374 SWITZERLAND POLYMERASE CHAIN REACTION IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 375 SWITZERLAND DNA SEQUENCING IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 376 SWITZERLAND MICROARRAYS IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 377 SWITZERLAND GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 378 SWITZERLAND RARE GENETIC DISORDER IN GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 379 SWITZERLAND CANCER IN GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 380 SWITZERLAND GENETIC TESTING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 381 BELGIUM GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 382 BELGIUM GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 383 BELGIUM GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 384 BELGIUM PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 385 BELGIUM PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 386 BELGIUM PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 387 BELGIUM NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (USD MILLION)

TABLE 388 BELGIUM NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (UNITS)

TABLE 389 BELGIUM NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (ASP)

TABLE 390 BELGIUM NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY CONDITION, 2020-2029 (USD MILLION)

TABLE 391 BELGIUM NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (USD MILLION)

TABLE 392 BELGIUM NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (UNITS)

TABLE 393 BELGIUM NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (ASP)

TABLE 394 BELGIUM NEW-BORN SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 395 BELGIUM CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 396 BELGIUM CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (UNITS)

TABLE 397 BELGIUM CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (ASP)

TABLE 398 BELGIUM CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 399 BELGIUM CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 400 BELGIUM CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 401 BELGIUM EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 402 BELGIUM EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 403 BELGIUM EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 404 BELGIUM CARRIER TESTING IN GENETIC TESTING MARKET, BY MEDICAL CONDITION, 2020-2029 (USD MILLION)

TABLE 405 BELGIUM GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 406 BELGIUM POLYMERASE CHAIN REACTION IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 407 BELGIUM DNA SEQUENCING IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 408 BELGIUM MICROARRAYS IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 409 BELGIUM GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 410 BELGIUM RARE GENETIC DISORDER IN GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 411 BELGIUM CANCER IN GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 412 BELGIUM GENETIC TESTING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 413 REST OF EUROPE GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 414 REST OF EUROPE GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 415 REST OF EUROPE GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

Liste des figures

FIGURE 1 EUROPE GENETIC TESTING MARKET: SEGMENTATION

FIGURE 2 EUROPE GENETIC TESTING MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE GENETIC TESTING MARKET: DROC ANALYSIS

FIGURE 4 EUROPE GENETIC TESTING MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE GENETIC TESTING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE GENETIC TESTING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE GENETIC TESTING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE GENETIC TESTING MARKET: APPLICATION COVERAGE GRID

FIGURE 9 EUROPE GENETIC TESTING MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE GENETIC TESTING MARKET: SEGMENTATION

FIGURE 11 INCREASING PREVALENCE OF LYMPHEDEMA AND RISING HEALTHCARE EXPENDITURE ARE EXPECTED TO DRIVE THE EUROPE GENETIC TESTING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 DIAGNOSTIC TESTING SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE GENETIC TESTING MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE THE EUROPE GENETIC TESTING MARKET AND ASIA-PACIFIC EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF EUROPE GENETIC TESTING MARKET

FIGURE 15 EUROPE GENETIC TESTING MARKET: BY TYPE, 2021

FIGURE 16 EUROPE GENETIC TESTING MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 17 EUROPE GENETIC TESTING MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 18 EUROPE GENETIC TESTING MARKET: BY TYPE, LIFELINE CURVE

FIGURE 19 EUROPE GENETIC TESTING MARKET: BY TECHNOLOGY, 2021

FIGURE 20 EUROPE GENETIC TESTING MARKET: BY TECHNOLOGY, 2022-2029 (USD MILLION)

FIGURE 21 EUROPE GENETIC TESTING MARKET: BY TECHNOLOGY, CAGR (2022-2029)

FIGURE 22 EUROPE GENETIC TESTING MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 23 EUROPE GENETIC TESTING MARKET: BY DISEASES, 2021

FIGURE 24 EUROPE GENETIC TESTING MARKET: BY DISEASES, 2022-2029 (USD MILLION)

FIGURE 25 EUROPE GENETIC TESTING MARKET: BY DISEASES, CAGR (2022-2029)

FIGURE 26 EUROPE GENETIC TESTING MARKET: BY DISEASES, LIFELINE CURVE

FIGURE 27 EUROPE GENETIC TESTING MARKET: BY END USER, 2021

FIGURE 28 EUROPE GENETIC TESTING MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 29 EUROPE GENETIC TESTING MARKET: BY END USER, CAGR (2022-2029)

FIGURE 30 EUROPE GENETIC TESTING MARKET: BY END USER, LIFELINE CURVE

FIGURE 31 EUROPE GENETIC TESTING MARKET: SNAPSHOT (2021)

FIGURE 32 EUROPE GENETIC TESTING MARKET: BY COUNTRY (2021)

FIGURE 33 EUROPE GENETIC TESTING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 34 EUROPE GENETIC TESTING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 35 EUROPE GENETIC TESTING MARKET: BY TYPE (2022-2029)

FIGURE 36 EUROPE GENETIC TESTING MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.