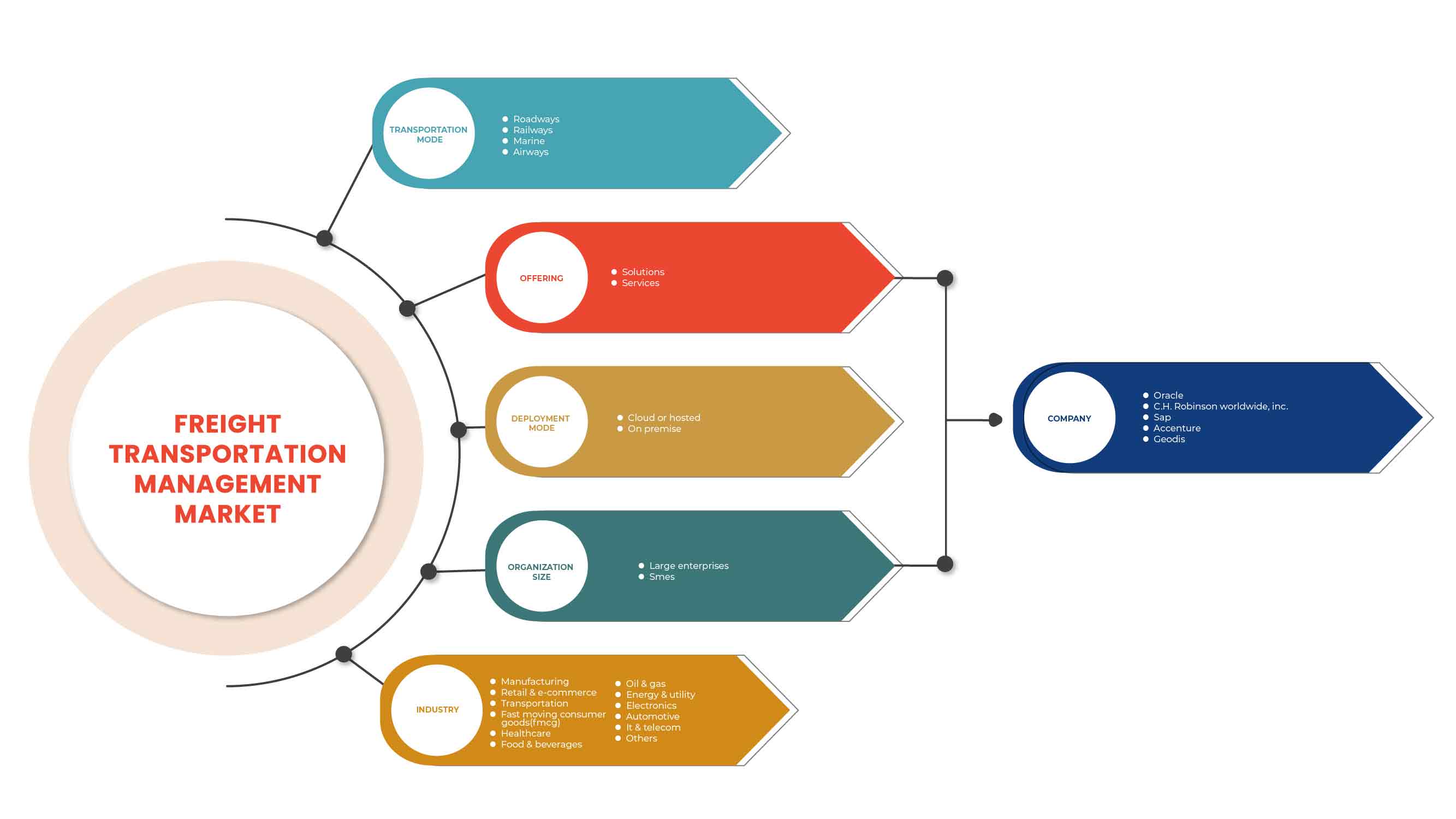

Marché européen de la gestion du transport de marchandises , par mode de transport (routes, chemins de fer, voies maritimes et aériennes), offre (solutions et services), mode de déploiement (cloud ou hébergé et sur site), taille de l'organisation (grandes entreprises et PME), secteur (fabrication, vente au détail et commerce électronique, transport, biens de consommation courante (FMCG), soins de santé, alimentation et boissons, pétrole et gaz, énergie et services publics, électronique, automobile, informatique et télécommunications et autres) - Tendances et prévisions du secteur jusqu'en 2029.

Analyse et taille du marché de la gestion du transport de marchandises en Europe

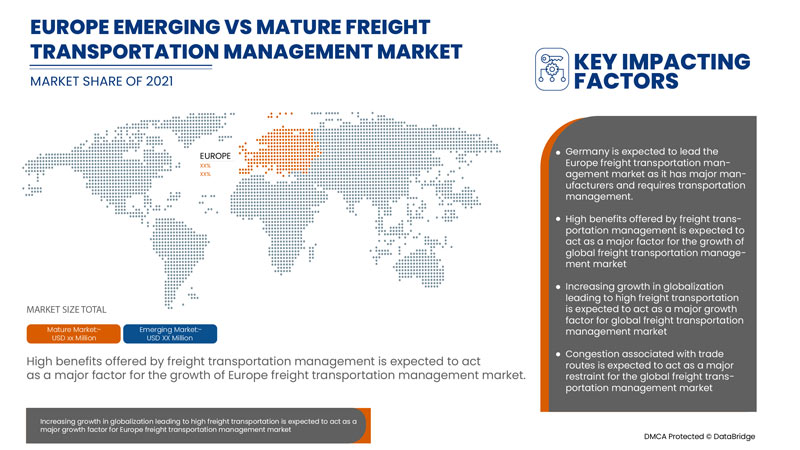

La gestion du transport de marchandises comprend la mise en place de diverses stratégies visant à accroître l'efficacité du transport de marchandises et du transport commercial. La gestion du transport de marchandises se concentre sur la réduction des coûts de l'expéditeur tout en tenant compte des coûts sociaux tels que les embouteillages ou les impacts de la pollution. Les avantages considérables offerts par la gestion du transport de marchandises entraînent une augmentation de la demande de solutions de gestion du transport de marchandises sur le marché. Le marché mondial de la gestion du transport de marchandises connaît une croissance rapide en raison de la mondialisation croissante qui entraîne un transport de marchandises élevé. Les entreprises lancent même de nouveaux produits pour gagner une plus grande part de marché.

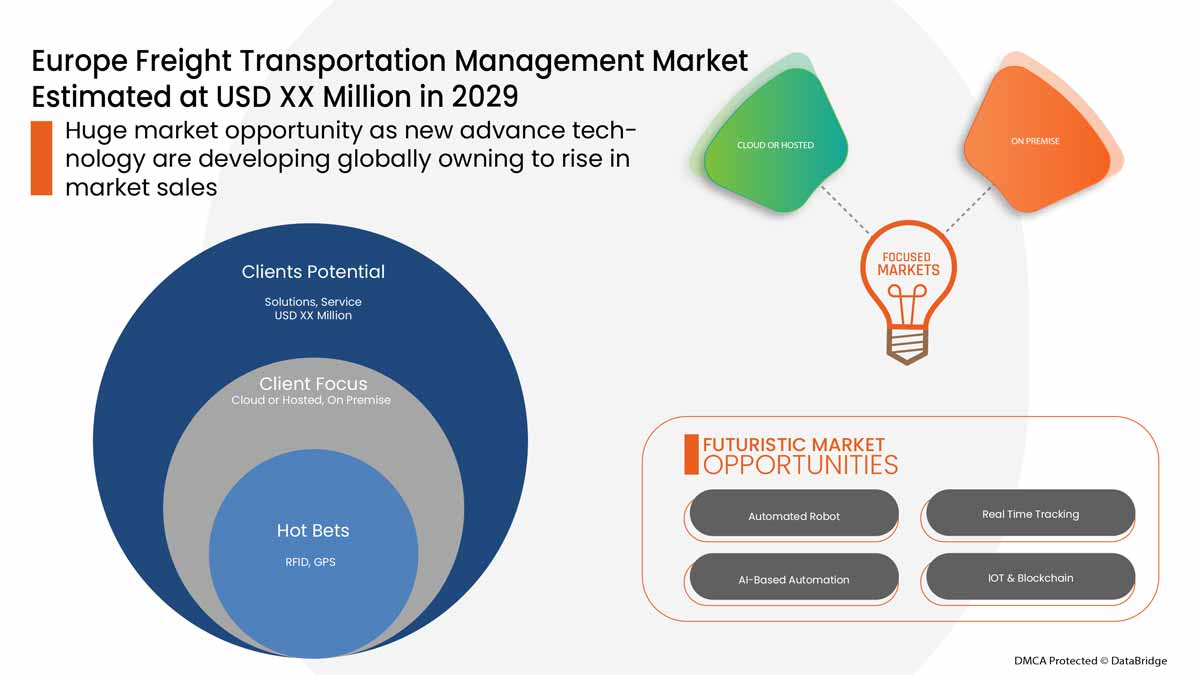

Selon les analyses de Data Bridge Market Research, le marché de la gestion du transport de marchandises devrait atteindre la valeur de 14 164,76 millions USD d'ici 2029, à un TCAC de 8,6 % au cours de la période de prévision. Les « routes » représentent le segment de mode de transport le plus important car elles nécessitent moins d'investissements en capital et peuvent fournir une gestion fragmentée de porte à porte. Le rapport sur le marché de la gestion du transport de marchandises couvre également en profondeur l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 |

|

Unités quantitatives |

Millions de dollars américains |

|

Segments couverts |

Par mode de transport (routes, chemins de fer, voies maritimes et aériennes), par offre (solutions et services), par mode de déploiement (cloud ou hébergé et sur site), par taille d'organisation (grandes entreprises et PME), par secteur (fabrication, vente au détail et commerce électronique, transport, biens de consommation courante (FMCG), santé, alimentation et boissons, pétrole et gaz, énergie et services publics, électronique, automobile, informatique et télécommunications et autres) |

|

Pays couverts |

Allemagne, France, Italie, Royaume-Uni, Espagne, Pays-Bas, Suisse, Belgique, Russie, Turquie, Reste de l'Europe |

|

Acteurs du marché couverts |

CTSI-GLOBAL, GEODIS, THE DESCARTES SYSTEMS GROUP INC., Manhattan Associates, Transplace, Softeon, GlobalTranz, Oracle, SAP SE, Accenture, Blue Yonder Group, Inc., E2open, LLC., Trimble Inc., DSV, Werner Enterprises, Supply Chain Solutions, CH Robinson Worldwide, Inc., TRANSPOREON GmbH, MercuryGate, entre autres |

Définition du marché

La gestion du transport de marchandises comprend la mise en place de diverses stratégies visant à accroître l'efficacité du transport de marchandises et du transport commercial. La gestion du transport de marchandises se concentre sur la réduction des coûts pour les expéditeurs tout en tenant compte des coûts sociaux tels que les embouteillages ou les impacts de la pollution. Elle aide les expéditeurs à utiliser le bon mode de transport. Par exemple, le transport ferroviaire et maritime est très efficace sur les longues distances par rapport à l'utilisation de camions pour les mêmes distances. Elle permet d'améliorer l'itinéraire et la planification afin d'augmenter les facteurs de charge et de réduire le kilométrage des véhicules de transport de marchandises. Elle permet de mettre en œuvre des programmes de gestion de flotte qui permettent d'utiliser des véhicules de taille optimale pour chaque voyage, de réduire le kilométrage des véhicules et de garantir que les véhicules de la flotte sont exploités et entretenus de manière à réduire les coûts externes.

La gestion du transport de marchandises est utilisée pour divers modes de transport tels que les routes, les chemins de fer, les voies maritimes et aériennes. Le transport de marchandises effectué par la route est appelé segment. Il s'agit du type de mode de transport le plus courant car il nécessite un processus de document douanier unique. Le mode de transport ferroviaire est très économe en carburant et peut être qualifié de mode de transport « vert ». Les expéditions maritimes sont utilisées pour le transport de produits en vrac tels que le charbon, les produits agricoles, le minerai de fer et les produits en vrac humides tels que le pétrole brut et le gaz. Les voies aériennes sont le mode de transport le plus rapide et sont très utilisées pour réaliser un réapprovisionnement des stocks « juste à temps » (JIT).

Dynamique du marché de la gestion du transport de marchandises

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

- Avantages considérables offerts par la gestion du transport de marchandises

Au fil des ans, il est devenu extrêmement nécessaire de disposer d'une chaîne d'approvisionnement hautement efficace. Cette exigence est satisfaite par la gestion du transport de marchandises. Le système de gestion du transport de marchandises aide les entreprises à déplacer les produits d'une destination à une autre de manière rentable, fiable et efficace. Le système offre une meilleure visibilité et une meilleure analyse des données, augmentant ainsi la croissance du marché mondial de la gestion du transport de marchandises.

- Demande croissante de transport de marchandises par chemin de fer

Le transport ferroviaire de marchandises utilise les chemins de fer pour le transport de marchandises sur terre. Il est utilisé pour transporter diverses marchandises telles que des produits chimiques, des matières premières de construction, des produits agricoles, automobiles, énergétiques (charbon, pétrole et éoliennes) et des produits forestiers. Les chemins de fer peuvent transporter rapidement des marchandises lourdes par les voies ferrées. Les chemins de fer sont l'un des moyens de transport les plus utilisés et disposent d'une énorme infrastructure bâtie dans le monde entier. L'utilisation croissante des chemins de fer pour le transport augmente la croissance de la gestion du transport de marchandises pour la gestion du transport de marchandises par rail.

- Utilisation intensive de la gestion du transport de marchandises sur les routes

La numérisation croissante a entraîné une transformation dans divers secteurs et a donné naissance au commerce électronique. La croissance du commerce électronique a obligé les entreprises à rendre leur chaîne d'approvisionnement très efficace, à réduire le temps de transit et à fournir les produits aux clients sans délai. Cela a augmenté le flux de transport intérieur par les routes, et un grand nombre de camions sont utilisés pour cela. La croissance croissante de la technologie routière accroît la croissance du marché mondial de la gestion du transport de marchandises.

- Congestion associée aux routes commerciales

À mesure que le trafic routier et les embouteillages augmentent, les opérateurs de services de transport et de fret doivent de plus en plus mettre au défi de maintenir des horaires fiables. Cela affecte les chaînes d'approvisionnement et les entreprises dépendantes des camions, qui revêtent toutes deux une importance croissante pour les opérateurs publics et privés du secteur. De plus, de nombreux accidents sur les routes ou déversements d'hydrocarbures en mer peuvent constituer un défi inattendu pour les systèmes de transport, ce qui rend la gestion du système difficile. Le récent COVID-19 a également interrompu plusieurs opérations logistiques, causant de graves dommages à l'ensemble des opérations de la chaîne d'approvisionnement. Ces paramètres constituent un frein majeur à la croissance du marché mondial de la gestion du transport de marchandises.

- Restrictions et réglementations gouvernementales sur le commerce

Le commerce international a connu plusieurs restrictions et des réglementations changeantes en raison de la guerre commerciale entre les États-Unis et la Chine et de la pandémie de COVID-19. Le transport transfrontalier est limité et les coûts augmentent, ce qui n'est pas prévisible par le système de gestion des transports et conduit à une inefficacité de la chaîne d'approvisionnement et des stocks, agissant ainsi comme un frein majeur pour le marché mondial de la gestion du transport de marchandises.

Impact post-COVID-19 sur le marché de la gestion du transport de marchandises

La COVID-19 a eu un impact majeur sur le marché de la gestion du transport de marchandises, car presque tous les pays ont opté pour la fermeture de toutes les installations de production, à l'exception de celles qui produisent les biens essentiels. Le gouvernement a pris des mesures strictes telles que l'arrêt de la production et de la vente de biens non essentiels, le blocage du commerce international et bien d'autres pour empêcher la propagation de la COVID-19. Les seules entreprises qui font face à cette situation de pandémie sont les services essentiels qui sont autorisés à ouvrir et à exécuter les processus.

La croissance du marché de la gestion du transport de marchandises est en hausse en raison des politiques gouvernementales visant à stimuler le commerce international après la pandémie. De plus, les avantages offerts par la gestion du transport de marchandises pour optimiser les coûts et les itinéraires augmentent la demande de gestion du transport de marchandises sur le marché. Cependant, des facteurs tels que la congestion associée aux routes commerciales et les restrictions commerciales entre certains pays freinent la croissance du marché. La fermeture des installations de production pendant la situation de pandémie a eu un impact significatif sur le marché.

Les fabricants prennent diverses décisions stratégiques pour rebondir après la COVID-19. Les acteurs mènent de nombreuses activités de recherche et développement pour améliorer la technologie impliquée dans la gestion du transport de marchandises. Grâce à cela, les entreprises apporteront au marché des solutions avancées et précises. En outre, les initiatives gouvernementales visant à stimuler le commerce international ont entraîné la croissance du marché.

Développement récent

- En mars 2021, SAP SE a annoncé son partenariat avec Sedna Systems. Dans le cadre de ce partenariat, les entreprises intégreront SAP TMS à la solution de collaboration d'équipe et de gestion des e-mails de Sedna Systems, ce qui peut aider les clients à obtenir un contrôle total sur les données liées à la gestion des transports. Ainsi, l'entreprise sera en mesure de consolider sa position sur le marché.

- En février 2022, Oracle a annoncé l'introduction de nouvelles fonctionnalités de gestion logistique au sein d'Oracle Fusion Cloud Supply Chain & Manufacturing (SCM). L'entreprise a mis à jour son Oracle Fusion Cloud Transportation Management qui peut aider les organisations à réduire les coûts et les risques, à améliorer l'expérience client et à devenir plus adaptables aux perturbations de l'activité. Ainsi, l'entreprise sera en mesure d'attirer davantage de clients sur le marché.

Portée du marché de la gestion du transport de marchandises en Europe

Le marché de la gestion du transport de marchandises est segmenté en fonction du mode de transport, de l'offre, du mode de déploiement, de la taille de l'organisation et du secteur d'activité. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Par mode de transport

- Les routes

- Chemins de fer

- Marin

- Voies aériennes

Sur la base du mode de transport, le marché mondial de la gestion du transport de marchandises est segmenté en routes, chemins de fer, marines et aériennes.

En offrant

- Solutions

- Services

Sur la base de l’offre, le marché mondial de la gestion du transport de marchandises a été segmenté en solutions et services.

Par mode de déploiement

- Cloud ou hébergé

- Sur place

Sur la base du mode de déploiement, le marché mondial de la gestion du transport de marchandises a été segmenté en cloud ou hébergé et sur site.

Par taille d'organisation

- Grandes entreprises

- PME

On the basis of organization size, the global freight transportation management market has been segmented into large enterprises and SMES.

By Industry

- Manufacturing

- Retail & E-Commerce

- Transportation

- Fast Moving Consumer Goods (FMCG)

- Healthcare

- Food & Beverages

- Oil & Gas

- Energy & Utility

- Electronics

- Automotive

- It & Telecom

- Others

On the basis of industry, the global freight transportation management market has been segmented into manufacturing, retail & e-commerce, transportation, fast moving consumer goods (FMCG), healthcare, food & beverages, oil & gas, energy & utility, electronics, automotive, IT & telecom and others.

Freight Transportation Management Market Regional Analysis/Insights

The freight transportation management market is analysed and market size insights and trends are provided by country, transportation mode, offering, deployment mode, organization size and industry as referenced above.

The countries covered in the freight transportation management market report are Germany, France, Italy, U.K., Spain, Netherlands, Switzerland, Belgium, Russia, Turkey and Rest of Europe.

Germany dominates the Europe freight transportation management market. Germany is likely to be the fastest-growing in Europe Freight Transportation Management market. The region has major manufacturers from automotive sector and related industries leading to exports from the region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Europe brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Freight Transportation Management Market Share Analysis

Freight transportation management market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to freight transportation management market.

Certains des principaux acteurs opérant sur le marché de la gestion du transport de marchandises sont : CTSI-GLOBAL, GEODIS, THE DESCARTES SYSTEMS GROUP INC, Manhattan Associates, Transplace, Softeon, Global Tranz, Oracle, SAP SE, Accenture, Blue Yonder Group, Inc., E2open, LLC., Trimble Inc., DSV, Werner Enterprises, Supply Chain Solutions, CH Robinson Worldwide, Inc, TRANSPOREON GmbH, MercuryGate.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW of Europe freight transportation management market

- Currency and Pricing

- LIMITATIONS

- MARKETS COVERED

- MARKET SEGMENTATION

- MARKETS COVERED

- geographicAL scope

- years considered for the study

- DBMR TRIPOD DATA VALIDATION MODEL

- primary interviews with key opinion leaders

- DBMR MARKET POSITION GRID

- vendor share analysis

- Multivariate Modeling

- Transportation Modetimeline curve

- MARKET Industry COVERAGE GRID

- secondary sourcEs

- assumptions

- EXECUTIVE SUMMARY

- premium insights

- market overview

- drivers

- Increasing growth in globalization leading to high freight transportation

- high benefits offered by freight transportation management

- Surging demand for rail freight transports

- Increasing growth of logistics through airways and water ways

- High use of freight transportation management in roadways

- RESTRAINTS

- Congestion Associated with Trade Routes

- several government regulations and restrictions

- OPPoRTUNITies

- growing inclination towards digitalization

- Increasing growth in e-commerce

- Increasing use of Green Freight

- Emergence of new advanced technologies

- CHALLENGES

- Lack of Training and Education

- risk associated with cyber-attacks

- LACK OF DIGITAL LITERACY IN VARIOUS REGIONS

- COVID-19 IMPACT ON EUROPE FREIGHT TRANSPORTATION MANAGEMENT MARKET IN INFORMATION & COMMUNICATION TECHNOLOGY

- ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

- AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

- STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

- IMPACT ON DEMAND

- IMPACT ON SUPPLY CHAIN

- CONCLUSION

- Europe freight transportation management market, BY Transportation Mode

- overview

- Roadways

- Railways

- Marine

- Airways

- Europe freight transportation management market, BY Offering

- overview

- Solutions

- Freight 3PL Solutions

- CROSS DOCK OPERATION

- LOAD OPTIMIZATION PLATFORM

- FREIGHT ORDER MANAGEMENT

- BROKERAGE OPERATIONAL MANAGEMENT

- BUSINESS INTELLIGENCE SOLUTION

- OTHERS

- Freight Transportation Cost Management System

- Freight Mobility Solution

- GPS

- RFID

- Freight Security Solutions

- CARGO TRACKING

- INTRUSION DETECTION

- VIDEO SURVEILLANCE

- Freight information Management System

- Fleet Tracking Solution

- Fleet Maintenance Solution

- Freight Operation Management Solution

- AUDIT AND PAYMENT SOLUTION

- SUPPLIER AND VENDOR MANAGEMENT

- CRM

- OTHERS

- Warehouse Management System

- Services

- Integration Services

- Managed Services

- Business Services

- Europe freight transportation management market, BY Deployment Mode

- overview

- Cloud or Hosted

- Subscription Based

- Transaction Based

- On Premise

- Europe freight transportation management market, BY Organization Size

- overview

- Large Enterprises

- SME's

- Europe freight transportation management market, BY Industry

- overview

- Manufacturing

- Retail & E-commerce

- Transportation

- Fast Moving Consumer Goods (FMCG)

- Healthcare

- Food & Beverages

- Oil & Gas

- Energy & Utility

- Electronics

- Automotive

- IT & Telecom

- Others

- Europe freight transportation management market, by country

- EUROPE

- GERMANY

- FRANCE

- Italy

- U.K.

- Spain

- Netherlands

- Switzerland

- Belgium

- Russia

- Turkey

- Rest of Europe

- Europe freight transportation management market, COMPANY landscape

- company share analysis: EUROPE

- swot analysis

- company profile

- SAP SE

- COMPANY snapshot

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- recent DEVELOPMENTS

- Oracle

- COMPANY snapshot

- REVENUE ANALYSIS

- Application PORTFOLIO

- recent DEVELOPMENTS

- C.H. Robinson Worldwide, Inc.

- COMPANY snapshot

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- recent DEVELOPMENTS

- Accenture

- COMPANY snapshot

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- recent DEVELOPMENTS

- GEODIS

- COMPANY snapshot

- PRODUCT PORTFOLIO

- recent DEVELOPMENTS

- Blue Yonder Group, Inc.

- COMPANY snapshot

- PRODUCT PORTFOLIO

- recent DEVELOPMENTS

- BluJay Solutions Ltd.

- COMPANY snapshot

- PRODUCT PORTFOLIO

- recent DEVELOPMENTS

- TRANSPOREON GmbH

- COMPANY snapshot

- Platform PORTFOLIO

- recent DEVELOPMENTS

- Manhattan Associates

- COMPANY snapshot

- REVENUE ANALYSIS

- solution PORTFOLIO

- recent DEVELOPMENT

- CTSI-GLOBAL

- COMPANY snapshot

- PRODUCT PORTFOLIO

- recent DEVELOPMENT

- 3Gtms

- COMPANY snapshot

- Platform PORTFOLIO

- recent DEVELOPMENTS

- Cloud Logistics

- COMPANY snapshot

- PRODUCT PORTFOLIO

- recent DEVELOPMENT

- MercuryGate

- COMPANY snapshot

- Solutions PORTFOLIO

- recent DEVELOPMENT

- THE DESCARTES SYSTEMS GROUP INC

- COMPANY snapshot

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- recent DEVELOPMENTS

- Transplace

- COMPANY snapshot

- solution PORTFOLIO

- recent DEVELOPMENTS

- questionnaire

- related reports

Liste des tableaux

TABLE 1 Europe freight transportation management market, By TRANSPORTATION MODE, Market Forecast 2021-2028 (USD Million)

TABLE 2 Europe freight transportation management market, By Offering, Market Forecast 2021-2028 (USD Million)

TABLE 3 Europe Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 4 Europe 3PL in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 5 Europe Freight Mobility Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 6 Europe Freight Security Solutions in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 7 Europe Freight Operation Management Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 8 Europe Services in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 9 Europe freight transportation management market, By deployment mode, Market Forecast 2021-2028 (USD Million)

TABLE 10 Europe Cloud or Hosted in Freight Transportation Management Market, By Pricing, 2019-2028 (USD Million)

TABLE 11 Europe freight transportation management market, By organization size, Market Forecast 2021-2028 (USD Million)

TABLE 12 Europe freight transportation management market, By industry, Market Forecast 2021-2028 (USD Million)

TABLE 13 Europe Freight Transportation Management Market, By Country, 2019-2028 (USD Million)

TABLE 14 Europe Freight Transportation Management Market, By Transportation MODE, 2019-2028 (USD Million)

TABLE 15 Europe Freight Transportation Management Market, By Offering, 2019-2028 (USD Million)

TABLE 16 Europe Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 17 Europe 3PL in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 18 Europe Freight Mobility Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 19 Europe Freight Security Solutions in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 20 Europe Freight Operation Management Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 21 Europe Services in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 22 Europe Freight Transportation Management Market, By Deployment Mode, 20189-2028 (USD Million)

TABLE 23 Europe Cloud or Hosted in Freight Transportation Management Market, By Pricing, 2019-2028 (USD Million)

TABLE 24 Europe Freight Transportation Management Market, By Organization Size, 2019-2028 (USD Million)

TABLE 25 Europe Freight Transportation Management Market, By Industry, 2019-2028 (USD Million)

TABLE 26 GERMANY Freight Transportation Management Market, By Transportation MODE, 2019-2028 (USD Million)

TABLE 27 GERMANY Freight Transportation Management Market, By Offering, 2019-2028 (USD Million)

TABLE 28 GERMANY Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 29 GERMANY 3PL in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 30 GERMANY Freight Mobility Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 31 GERMANY Freight Security Solutions in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 32 GERMANY Freight Operation Management Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 33 GERMANY Services in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 34 GERMANY Freight Transportation Management Market, By Deployment Mode, 20189-2028 (USD Million)

TABLE 35 GERMANY Cloud or Hosted in Freight Transportation Management Market, By Pricing, 2019-2028 (USD Million)

TABLE 36 GERMANY Freight Transportation Management Market, By Organization Size, 2019-2028 (USD Million)

TABLE 37 GERMANY Freight Transportation Management Market, By Industry, 2019-2028 (USD Million)

TABLE 38 FRANCE Freight Transportation Management Market, By Transportation MODE, 2019-2028 (USD Million)

TABLE 39 FRANCE Freight Transportation Management Market, By Offering, 2019-2028 (USD Million)

TABLE 40 FRANCE Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 41 FRANCE 3PL in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 42 FRANCE Freight Mobility Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 43 FRANCE Freight Security Solutions in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 44 fRANCE Freight Operation Management Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 45 FRANCE Services in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 46 FRANCE Freight Transportation Management Market, By Deployment Mode, 20189-2028 (USD Million)

TABLE 47 FRANCE Cloud or Hosted in Freight Transportation Management Market, By Pricing, 2019-2028 (USD Million)

TABLE 48 FRANCE Freight Transportation Management Market, By Organization Size, 2019-2028 (USD Million)

TABLE 49 FRANCE Freight Transportation Management Market, By Industry, 2019-2028 (USD Million)

TABLE 50 Italy Freight Transportation Management Market, By Transportation MODE, 2019-2028 (USD Million)

TABLE 51 ITALY Freight Transportation Management Market, By Offering, 2019-2028 (USD Million)

TABLE 52 iTALY Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 53 ITALY 3PL in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 54 ITALY Freight Mobility Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 55 ITALY Freight Security Solutions in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 56 ITALY Freight Operation Management Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 57 ITALY Services in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 58 ITALY Freight Transportation Management Market, By Deployment Mode, 20189-2028 (USD Million)

TABLE 59 ITALY Cloud or Hosted in Freight Transportation Management Market, By Pricing, 2019-2028 (USD Million)

TABLE 60 ITALY Freight Transportation Management Market, By Organization Size, 2019-2028 (USD Million)

TABLE 61 ITALY Freight Transportation Management Market, By Industry, 2019-2028 (USD Million)

TABLE 62 U.K. Freight Transportation Management Market, By Transportation MODE, 2019-2028 (USD Million)

TABLE 63 U.K. Freight Transportation Management Market, By Offering, 2019-2028 (USD Million)

TABLE 64 U.K. Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 65 U.K. 3PL in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 66 U.K. Freight Mobility Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 67 U.K. Freight Security Solutions in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 68 U.K. Freight Operation Management Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 69 U.K. Services in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 70 U.K. Freight Transportation Management Market, By Deployment Mode, 20189-2028 (USD Million)

TABLE 71 U.K. Cloud or Hosted in Freight Transportation Management Market, By Pricing, 2019-2028 (USD Million)

TABLE 72 U.K. Freight Transportation Management Market, By Organization Size, 2019-2028 (USD Million)

TABLE 73 U.K. Freight Transportation Management Market, By Industry, 2019-2028 (USD Million)

TABLE 74 Spain Freight Transportation Management Market, By Transportation MODE, 2019-2028 (USD Million)

TABLE 75 SPAIN Freight Transportation Management Market, By Offering, 2019-2028 (USD Million)

TABLE 76 SPAIN Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 77 SPAIN 3PL in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 78 SPAIN Freight Mobility Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 79 SPAIN Freight Security Solutions in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 80 SPAIN Freight Operation Management Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 81 SPAIN Services in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 82 SPAIN Freight Transportation Management Market, By Deployment Mode, 20189-2028 (USD Million)

TABLE 83 SPAIN Cloud or Hosted in Freight Transportation Management Market, By Pricing, 2019-2028 (USD Million)

TABLE 84 SPAIN Freight Transportation Management Market, By Organization Size, 2019-2028 (USD Million)

TABLE 85 SPAIN Freight Transportation Management Market, By Industry, 2019-2028 (USD Million)

TABLE 86 Netherlands Freight Transportation Management Market, By Transportation MODE, 2019-2028 (USD Million)

TABLE 87 NETHERLANDS Freight Transportation Management Market, By Offering, 2019-2028 (USD Million)

TABLE 88 NETHERLANDS Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 89 NETHERLANDS 3PL in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 90 NETHERLANDS Freight Mobility Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 91 NETHERLANDS Freight Security Solutions in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 92 NETHERLANDS Freight Operation Management Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 93 NETHERLANDS Services in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 94 NETHERLANDS Freight Transportation Management Market, By Deployment Mode, 20189-2028 (USD Million)

TABLE 95 NETHERLANDS Cloud or Hosted in Freight Transportation Management Market, By Pricing, 2019-2028 (USD Million)

TABLE 96 NETHERLANDS Freight Transportation Management Market, By Organization Size, 2019-2028 (USD Million)

TABLE 97 NETHERLANDS Freight Transportation Management Market, By Industry, 2019-2028 (USD Million)

TABLE 98 Switzerland Freight Transportation Management Market, By Transportation MODE, 2019-2028 (USD Million)

TABLE 99 SWITZERLAND Freight Transportation Management Market, By Offering, 2019-2028 (USD Million)

TABLE 100 SWITZERLAND Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 101 SWITZERLAND 3PL in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 102 SWITZERLAND Freight Mobility Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 103 sWITZERLAND Freight Security Solutions in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 104 SWITZERLAND Freight Operation Management Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 105 SWITZERLAND Services in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 106 SWITZERLAND Freight Transportation Management Market, By Deployment Mode, 20189-2028 (USD Million)

TABLE 107 SWITZERLAND Cloud or Hosted in Freight Transportation Management Market, By Pricing, 2019-2028 (USD Million)

TABLE 108 SWITZERLAND Freight Transportation Management Market, By Organization Size, 2019-2028 (USD Million)

TABLE 109 SWITZERLAND Freight Transportation Management Market, By Industry, 2019-2028 (USD Million)

TABLE 110 Belgium Freight Transportation Management Market, By Transportation MODE, 2019-2028 (USD Million)

TABLE 111 BELGIUM Freight Transportation Management Market, By Offering, 2019-2028 (USD Million)

TABLE 112 BELGIUM Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 113 BELGIUM 3PL in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 114 BELGIUM Freight Mobility Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 115 BELGIUM Freight Security Solutions in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 116 BELGIUM Freight Operation Management Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 117 BELGIUM Services in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 118 BELGIUM Freight Transportation Management Market, By Deployment Mode, 20189-2028 (USD Million)

TABLE 119 BELGIUM Cloud or Hosted in Freight Transportation Management Market, By Pricing, 2019-2028 (USD Million)

TABLE 120 BELGIUM Freight Transportation Management Market, By Organization Size, 2019-2028 (USD Million)

TABLE 121 BELGIUM Freight Transportation Management Market, By Industry, 2019-2028 (USD Million)

TABLE 122 Russia Freight Transportation Management Market, By Transportation MODE, 2019-2028 (USD Million)

TABLE 123 RUSSIA Freight Transportation Management Market, By Offering, 2019-2028 (USD Million)

TABLE 124 RUSSIA Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 125 RUSSIA 3PL in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 126 RUSSIA Freight Mobility Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 127 RUSSIA Freight Security Solutions in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 128 RUSSIA Freight Operation Management Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 129 RUSSIA Services in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 130 RUSSIA Freight Transportation Management Market, By Deployment Mode, 20189-2028 (USD Million)

TABLE 131 RUSSIA Cloud or Hosted in Freight Transportation Management Market, By Pricing, 2019-2028 (USD Million)

TABLE 132 RUSSIA Freight Transportation Management Market, By Organization Size, 2019-2028 (USD Million)

TABLE 133 RUSSIA Freight Transportation Management Market, By Industry, 2019-2028 (USD Million)

TABLE 134 Turkey Freight Transportation Management Market, By Transportation MODE, 2019-2028 (USD Million)

TABLE 135 TURKEY Freight Transportation Management Market, By Offering, 2019-2028 (USD Million)

TABLE 136 TURKEY Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 137 TURKEY 3PL in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 138 TURKEY Freight Mobility Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 139 TURKEY Freight Security Solutions in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 140 TURKEY Freight Operation Management Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 141 TURKEY Services in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 142 TURKEY Freight Transportation Management Market, By Deployment Mode, 20189-2028 (USD Million)

TABLE 143 TURKEY Cloud or Hosted in Freight Transportation Management Market, By Pricing, 2019-2028 (USD Million)

TABLE 144 TURKEY Freight Transportation Management Market, By Organization Size, 2019-2028 (USD Million)

TABLE 145 TURKEY Freight Transportation Management Market, By Industry, 2019-2028 (USD Million)

TABLE 146 Rest of Europe Freight Transportation Management Market, By Transportation MODE, 2019-2028 (USD Million)

Liste des figures

FIGURE 1 Europe freight transportation management market: segmentation

FIGURE 2 Europe freight transportation management market: data triangulation

FIGURE 3 Europe freight transportation management market: DROC ANALYSIS

FIGURE 4 Europe freight transportation management market: REGIONAL VS. GLOBAL MARKET ANALYSIS

FIGURE 5 Europe freight transportation management market: COMPANY RESEARCH ANALYSIS

FIGURE 6 Europe freight transportation management market: INTERVIEW DEMOGRAPHICS

FIGURE 7 Europe freight transportation management market: DBMR MARKET POSITION GRID

FIGURE 8 Europe freight transportation management market: vendor share analysis

FIGURE 9 Europe freight transportation management MARKET: MARKET IndustryCOVERAGE GRID

FIGURE 10 Europe freight transportation management market: SEGMENTATION

FIGURE 11 Increasing growth in globalization leading to high freight transportation is EXPECTED TO DRIVE Europe freight transportation management market IN THE FORECAST PERIOD OF 2021 to 2028

FIGURE 12 Roadways is expected to account for the largest share of Europe freight transportation management market in 2021 & 2028

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF Europe freight transportation management market

FIGURE 14 Europe freight transportation management market: BY Transportation Mode, 2020

FIGURE 15 Europe freight transportation management market: BY Offering, 2020

FIGURE 16 Europe freight transportation management market: BY deployment mode, 2020

FIGURE 17 Europe freight transportation management market: BY organization size, 2020

FIGURE 18 Europe freight transportation management market: BY industry, 2020

FIGURE 19 Europe Freight transportation management MARKET: SNAPSHOT (2020)

FIGURE 20 Europe Freight transportation management MARKET: by Country (2020)

FIGURE 21 Europe Freight transportation management MARKET: by Country (2021 & 2028)

FIGURE 22 Europe Freight transportation management MARKET: by Country (2021 & 2028)

FIGURE 23 Europe Freight transportation management MARKET: by type (2021-2028)

FIGURE 24 Europe Freight Transportation Management Market: company share 2020 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.