Marché européen des navires de pêche congelés, par système (congélation par air pulsé, congélation par plaques, saumure, IQF (congélation rapide individuelle)), type ( navires de pêche commerciale , navires de pêche artisanale et navires de pêche récréative), longueur du navire (moins de 20 m, 21 m-30 m, plus de 40 m et 31 m-40 m), capacité de congélation (50 tonnes à 150 tonnes, 150 tonnes à 300 tonnes, moins de 50 tonnes et plus de 300 tonnes) – Tendances et prévisions de l'industrie jusqu'en 2029

Analyse et taille du marché

Un bateau de pêche est un ponton ou un navire utilisé pour attraper du poisson dans l'océan, sur un lac ou un ruisseau. Une large gamme de bateaux de pêche est utilisée dans la pêche commerciale, récréative et artisanale. Les ressources et la production agricoles sont collectées soit dans la nature, soit dans des situations contrôlées en aquaculture. La demande croissante de produits de la mer crée une demande de solutions de congélation pour les bateaux de pêche. Le marché européen des bateaux de pêche congelés connaît une croissance rapide en raison des bienfaits des fruits de mer pour la santé et de la nécessité d'une productivité plus élevée. Les entreprises lancent même de nouveaux produits pour gagner une plus grande part de marché.

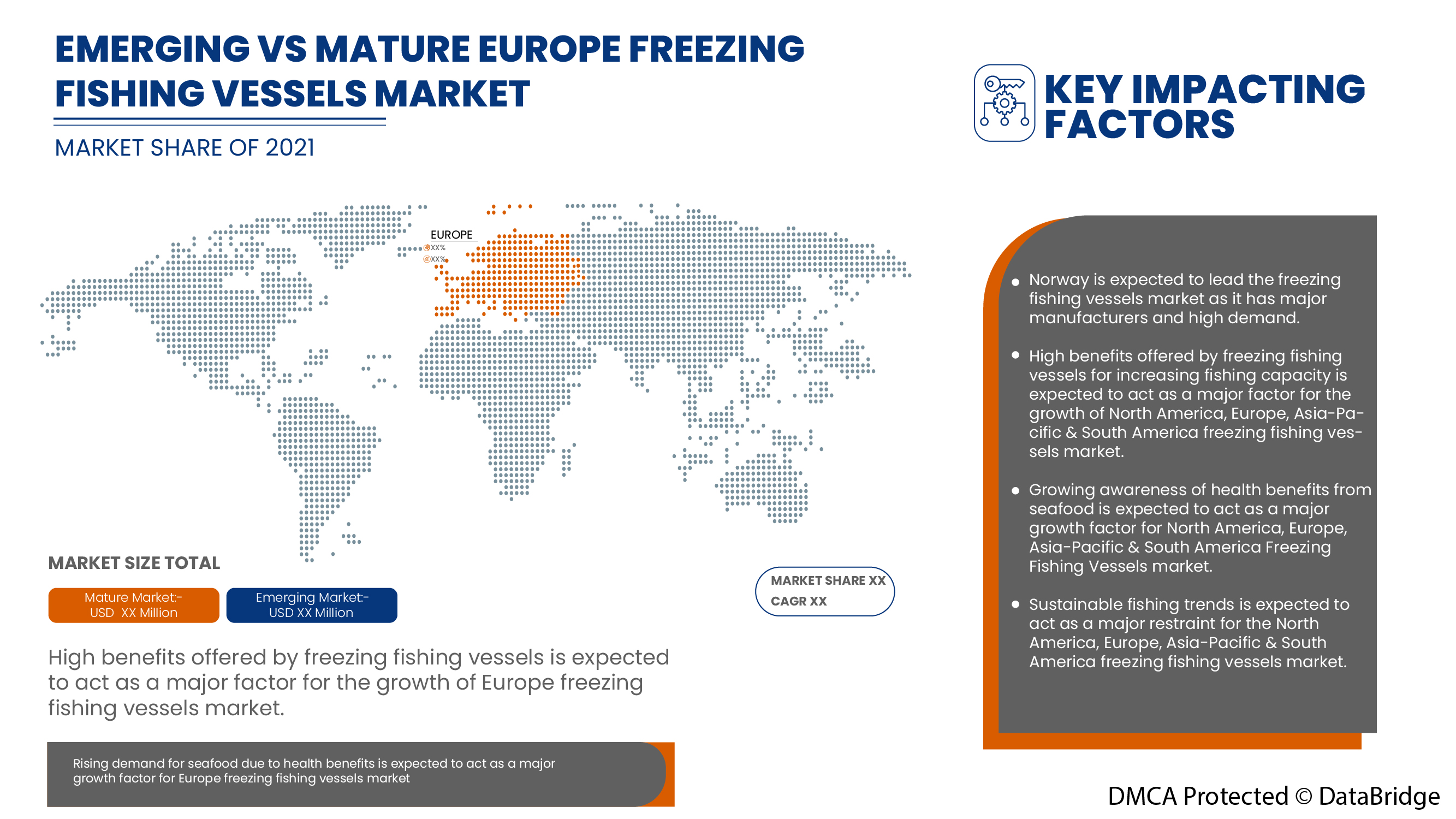

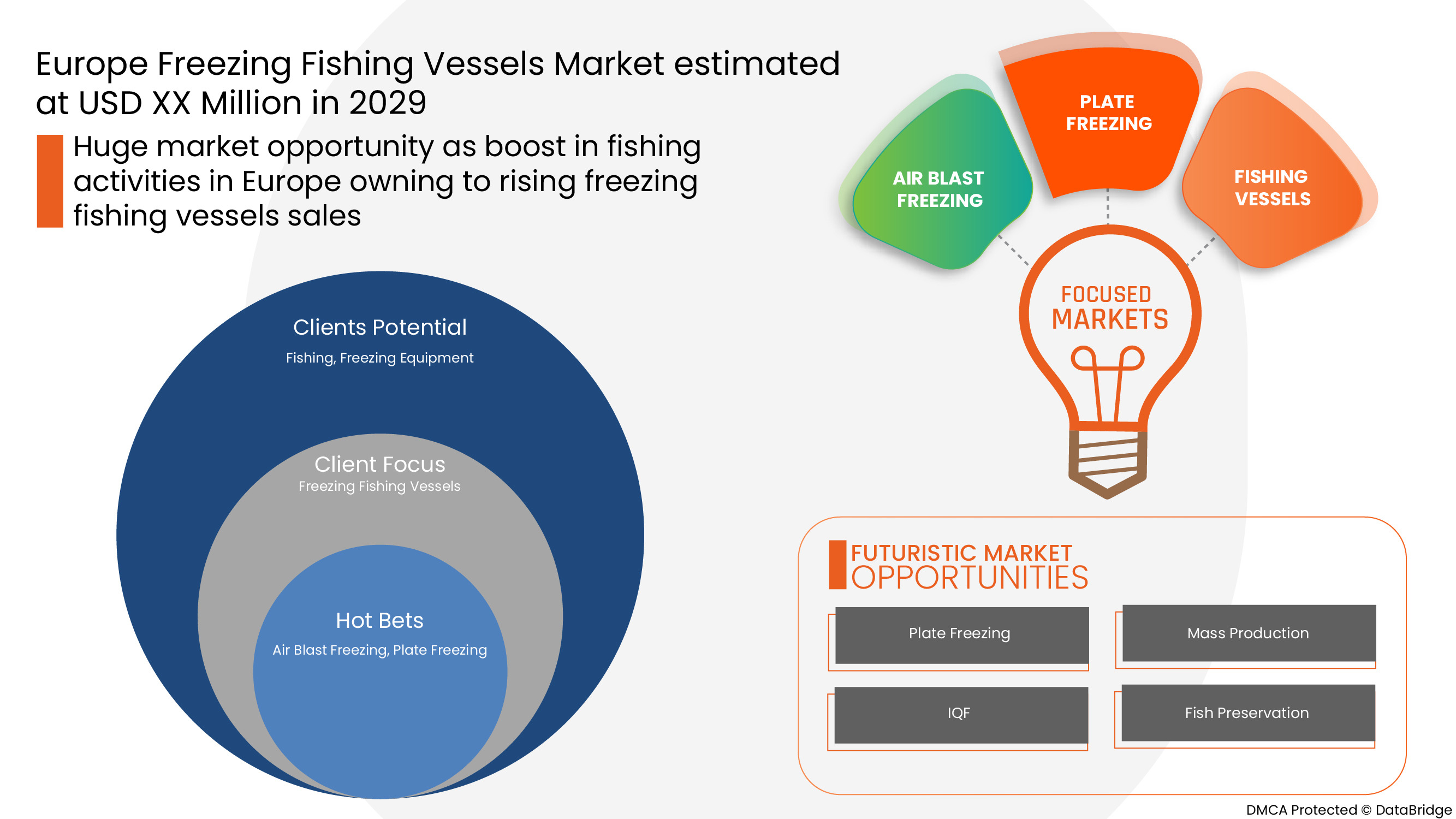

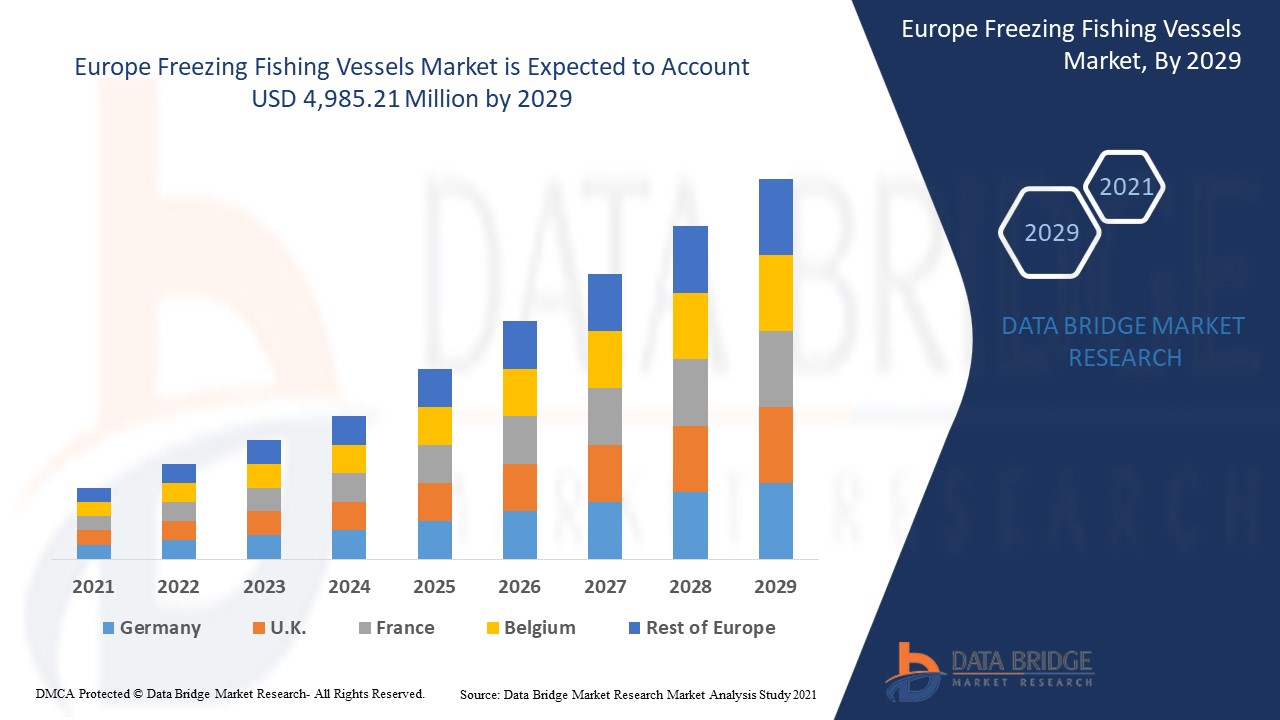

Selon les analyses de Data Bridge Market Research, le marché européen des navires de pêche surgelés devrait atteindre 4 985,21 millions USD d'ici 2029, à un TCAC de 4,3 % au cours de la période de prévision. La « congélation par air comprimé » représente le segment de mode de modules le plus important. Le rapport sur le marché des navires de pêche surgelés couvre également en profondeur l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Année historique |

2020 |

|

Unités quantitatives |

Millions de dollars américains |

|

Segments couverts |

Par système (congélation par air pulsé, congélation par plaques, saumure, IQF (congélation rapide individuelle)), par type (bateaux de pêche commerciale, bateaux de pêche artisanale et bateaux de pêche récréative), par longueur de navire (moins de 20 m, 21 m-30 m, plus de 40 m et 31 m-40 m), par capacité de congélation (50 tonnes à 150 tonnes, 150 tonnes à 300 tonnes, moins de 50 tonnes et plus de 300 tonnes) |

|

Pays couverts |

Norvège, Espagne, Royaume-Uni, Groenland, Islande, Allemagne, Danemark et le reste de l'Europe |

|

Acteurs du marché couverts |

Nordic Wildfish, Lerøy Havfisk, Nichols Bros Boat Builders, Master Boat Builders, Inc., Chantier de constructions navales Martinez, Astilleros Armon, Karstensens Skibsværft A/S, Green Yard Kleven, Ulstein Group ASA, HEINEN & HOPMAN, Marefsol BV, Integrated Marine Systems, Inc., MMC FIRST PROCESS AS., Teknotherm, Damen Shipyards Group, Damen Shipyards Group, Wärtsilä, Kongsberg Gruppen ASA, Thoma-Sea Ship Builders, LLC, Rolls-Royce plc, MAURICE, ELLIOTT BAY DESIGN GROUP, Aresa Shipyard, entre autres |

Définition du marché

Un bateau de pêche est un ponton ou un navire utilisé pour attraper du poisson dans l'océan, sur un lac ou un ruisseau. Une large gamme de types de bateaux de pêche est utilisée dans la pêche commerciale, récréative et artisanale. Les ressources et la production agricoles sont collectées soit dans la nature, soit dans des situations contrôlées en aquaculture . Les deux utilisent une formidable combinaison d'innovations distinctives à hautement industrielles, incorporant des navires et des équipements ainsi que des appareils et des méthodes de pêche. Pour la pêche de capture et l'aquaculture, l'utilisation de technologies innovantes telles que les bateaux de pêche et les filaments techniques, les équipements hydrauliques et la manipulation du poisson est dans les tendances actuelles du marché des bateaux de pêche. En outre, la récolte du poisson dans un bateau de pêche intègre également des gadgets pour la recherche de poissons, une innovation basée sur les satellites pour les itinéraires et les correspondances, la conservation installée et l'utilisation accrue de moteurs détachables. La demande croissante d'équipements de pêche dans la technologie de la pêche devrait stimuler le marché mondial des bateaux de pêche.

Dynamique du marché des navires de pêche gelés en Europe

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

- La popularité croissante des activités récréatives

Les activités récréatives, telles que la pêche et la navigation de plaisance, ont connu une augmentation dans le monde entier, ce qui a entraîné une hausse de la demande de bateaux de pêche. Les caractéristiques avancées des bateaux de pêche, telles que la longue durée de vie, la durabilité, la personnalisation et le respect de l'environnement, attirent encore plus de clients. Par conséquent, la demande de bateaux de pêche devrait encore augmenter au cours de la période de prévision.

- Croissance de la sensibilisation aux bienfaits pour la santé associés aux fruits de mer

L’augmentation de la demande mondiale de produits de la pêche et la prise de conscience croissante des bienfaits pour la santé des fruits de mer, tels que le thon, le poisson de fond et le saumon, créent une demande accrue pour ce produit. La pratique de la pêche en plein air, ainsi que la demande de fruits de mer, ont considérablement stimulé le marché des bateaux de pêche, et il est prévu qu’il continue de croître au cours de la période de prévision.

- Demande de développement durable

La demande croissante de développement durable pourrait constituer un frein à la croissance de ce marché. Les bateaux de pêche prélèvent souvent dans les plans d’eau plus de ressources que ce qu’ils peuvent reconstituer en peu de temps, ce qui épuise rapidement les réserves de poissons. Mais cet effet peut être atténué par la mise en place de réglementations maritimes et de pêche strictes à l’échelle mondiale qui garantissent un approvisionnement régulier en poisson.

- Le coût initial élevé de l’investissement

Le marché des navires de pêche réfrigérés offre plusieurs avantages, tels que des avantages pour la santé et une capacité accrue, avec un coût d'investissement élevé. L' industrie de la construction navale est une affaire coûteuse et le projet peut s'étendre sur plusieurs années. Cela peut freiner la croissance du marché des navires de pêche réfrigérés.

Impact de la pandémie de COVID-19 sur le marché des bateaux de pêche congelés

La COVID-19 a eu un impact majeur sur le marché des navires de pêche congelés, car presque tous les pays ont opté pour la fermeture de toutes les installations de production, à l'exception de celles qui produisent les biens essentiels. Le gouvernement a pris des mesures strictes telles que l'arrêt de la production et de la vente de biens non essentiels, le blocage du commerce international et bien d'autres pour empêcher la propagation de la COVID-19. Les seules entreprises confrontées à cette situation de pandémie sont les services essentiels qui sont autorisés à ouvrir et à exécuter les processus.

La croissance du marché des navires de pêche congelés augmente en raison des politiques gouvernementales visant à stimuler le commerce international après le COVID. En outre, les avantages offerts par le marché des navires de pêche congelés pour le marché de la pêche et la demande de fruits de mer augmentent la demande sur le marché des navires de pêche congelés. Cependant, des facteurs tels que la congestion associée aux routes commerciales et les restrictions commerciales entre certains pays freinent la croissance du marché. La fermeture des installations de production pendant la pandémie a eu un impact significatif sur le marché.

Les fabricants prennent diverses décisions stratégiques pour rebondir après la COVID-19. Les acteurs mènent de multiples activités de recherche et développement pour améliorer la technologie impliquée dans le marché des navires de pêche réfrigérés. Grâce à cela, les entreprises apporteront au marché des solutions avancées et précises. En outre, les initiatives gouvernementales visant à stimuler le commerce international ont conduit à la croissance du marché.

Développement récent

- En août 2021, Wärtsilä a proposé des solutions de propulsion pour les bateaux de pêche au chantier naval Karstensens Shipyard. La caractéristique principale de ce système de propulsion était le système de réduction des émissions NOx Reducer, le réducteur, l'hélice à pas variable et le système de commande à distance de la propulsion ProTouch. Le lancement de cette solution a aidé l'entreprise à élargir son marché

- En juin 2019, Rolls-Royce plc a reçu le contrat de construction d'un chalutier arrière de 70 mètres de long pour Engenes fiskeriselskap AS. L'entreprise a proposé la conception du navire et de nombreux équipements tels que l'alimentation et la propulsion, les machines de pont et les systèmes électriques et d'automatisation. Grâce à ce contrat, l'entreprise a élargi son marché et sa présence mondiale

Portée du marché européen des navires de pêche congélateurs

Le marché des navires de pêche réfrigérés est segmenté en fonction du système, du type, de la longueur du navire et de la capacité de congélation. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Par système

- Congélation par air comprimé

- Congélation des plaques

- Saumure

- IQF (surgélation rapide individuelle)

Sur la base du système, le marché des navires de pêche surgelés d'Amérique du Nord, d'Europe, d'Asie-Pacifique et d'Amérique du Sud est segmenté en congélation par air pulsé, congélation par plaques, saumure et IQF (Individual Quick Frozen).

Par type

- Navires de pêche commerciale

- Les bateaux de pêche artisanale

- Bateaux de pêche récréative

En fonction du type, le marché des navires de pêche congelés d'Amérique du Nord, d'Europe, d'Asie-Pacifique et d'Amérique du Sud a été segmenté en navires de pêche commerciale, navires de pêche artisanale et navires de pêche récréative.

Par longueur de navire

- Moins de 20 M

- 21 M-30 M

- Au dessus de 40 M

- 31 M-40 M

En fonction de la longueur du navire, le marché des navires de pêche congelés d'Amérique du Nord, d'Europe, d'Asie-Pacifique et d'Amérique du Sud a été segmenté en moins de 20 M, 21 M-30 M, plus de 40 M et 31 M-40 M.

Par capacité de congélation

- 50 tonnes à 150 tonnes

- 150 tonnes à 300 tonnes

- Moins de 50 tonnes

- Plus de 300 tonnes

Sur la base de la capacité de congélation, le marché des navires de pêche surgelés d'Amérique du Nord, d'Europe, d'Asie-Pacifique et d'Amérique du Sud a été segmenté en 50 tonnes à 150 tonnes, 150 tonnes à 300 tonnes, moins de 50 tonnes et plus de 300 tonnes.

Analyse/perspectives régionales du marché des navires de pêche réfrigérés

Le marché des navires de pêche congelés est analysé et des informations sur la taille du marché et les tendances sont fournies par pays, système, type, longueur du navire et capacité de congélation, comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché des navires de pêche congelés sont la Norvège, l’Espagne, le Royaume-Uni, le Groenland, l’Islande, l’Allemagne, le Danemark et l’Europe.

La Norvège domine le marché européen des navires de pêche surgelés. La Norvège est susceptible d'être le marché européen des navires de pêche surgelés qui connaît la croissance la plus rapide. La demande croissante de produits de la mer dans les pays émergents tels que la Norvège, l'Espagne et le Royaume-Uni est à l'origine de la domination du marché. La Norvège domine la région Europe en raison de ses activités de pêche et de construction navale importantes.

La section par pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances technologiques, l'analyse des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques européennes et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et des routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des navires de pêche réfrigérés

Le paysage concurrentiel du marché des navires de pêche surgelés fournit des détails sur le concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Europe, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination de l'application. Les points de données ci-dessus ne concernent que l'accent mis par les entreprises sur le marché des navires de pêche surgelés.

Français Certains des principaux acteurs opérant sur le marché des navires de pêche congelés sont Nordic Wildfish, Lerøy Havfisk, Nichols Bros Boat Builders, Master Boat Builders, Inc., Chantier de constructions navales Martinez, Astilleros Armon, Karstensens Skibsværft A/S, Green Yard Kleven, Ulstein Group ASA, HEINEN & HOPMAN, Marefsol BV, Integrated Marine Systems, Inc., MMC FIRST PROCESS AS., Teknotherm, Damen Shipyards Group, Damen Shipyards Group, Wärtsilä, Kongsberg Gruppen ASA, Thoma-Sea Ship Builders, LLC, Rolls-Royce plc, MAURICE, ELLIOTT BAY DESIGN GROUP, Aresa Shipyard.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE FREEZING FISHING VESSELS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 PREMIUM INSIGHTS:

2.1 FISHING VESSEL CONSTRUCTION

2.2 OTHER DETAILS REGARDING FISHING VESSEL

2.2.1 FISHING VESSEL AVERAGE OPERATIONAL YEARS

2.2.2 TOTAL NUMBER OF FISHING VESSEL

3 EUROPE FREEZING FISHING VESSELS MARKET, BY SYSTEM

3.1 OVERVIEW

3.2 AIR BLAST FREEZING

3.3 PLATE FREEZING

3.3.1 VERTICAL PLATE FREEZING

3.3.2 HORIZONTAL PLATE FREEZING

3.4 BRINE

3.5 IQF (INDIVIDUAL QUICK FROZEN)

4 EUROPE FREEZING FISHING VESSELS MARKET, BY TYPE

4.1 OVERVIEW

4.2 COMMERCIAL FISHING VESSELS

4.3 ARTISANAL FISHING VESSELS

4.4 RECREATIONAL FISHING VESSELS

5 EUROPE FREEZING FISHING VESSELS MARKET, BY VESSEL LENGTH

5.1 OVERVIEW

5.2 LESS THAN 20 M

5.3 21 M-30 M

5.4 ABOVE 40 M

5.5 31 M-40 M

6 EUROPE FREEZING FISHING VESSELS MARKET, BY FREEZING CAPACITY

6.1 OVERVIEW

6.2 50 TONS TO 150 TONS

6.3 150 TONS TO 300 TONS

6.4 LESS THAN 50 TONS

6.5 MORE THAN 300 TONS

7 EUROPE FREEZING FISHING VESSELS MARKET, BY REGION

7.1 EUROPE

7.1.1 NORWAY

7.1.2 SPAIN

7.1.3 U.K.

7.1.4 GREENLAND

7.1.5 ICELAND

7.1.6 GERMANY

7.1.7 DENMARK

7.1.8 REST OF EUROPE

8 EUROPE FREEZING FISHING VESSELS MARKET, COMPANY LANDSCAPE

8.1 COMPANY SHARE ANALYSIS: EUROPE

9 SWOT ANALYSIS

10 COMPANY PROFILE

10.1 ROLLS-ROYCE PLC

10.1.1 COMPANY SNAPSHOT

10.1.2 REVENUE ANALYSIS

10.1.3 COMPANY SHARE ANALYSIS

10.1.4 PRODUCTS PORTFOLIO

10.1.5 RECENT DEVELOPMENTS

10.2 WÄRTSILÄ

10.2.1 COMPANY SNAPSHOT

10.2.2 REVENUE ANALYSIS

10.2.3 COMPANY SAHRE ANALYSIS

10.2.4 PRODUCTS PORTFOLIO

10.2.5 RECENT DEVELOPMENTS

10.3 DAMEN SHIPYARDS GROUP

10.3.1 COMPANY SNAPSHOT

10.3.2 COMPANY SHARE ANALYSIS

10.3.3 PRODUCTS PORTFOLIO

10.3.4 RECENT DEVELOPMENT

10.4 ULSTEIN GROUP ASA

10.4.1 COMPANY SNAPSHOT

10.4.2 COMPANY SHARE ANALYSIS

10.4.3 PRODUCTS PORTFOLIO

10.4.4 RECENT DEVELOPMENTS

10.5 KONGSBERG GRUPPEN ASA

10.5.1 COMPANY SNAPSHOT

10.5.2 REVENUE ANALYSIS

10.5.3 COMPANY SHARE ANALYSIS

10.5.4 PRODUCTS PORTFOLIO

10.5.5 RECENT DEVELOPMENTS

10.6 ARESA SHIPYARD

10.6.1 COMPANY SNAPSHOT

10.6.2 PRODUCTS PORTFOLIO

10.6.3 RECENT DEVELOPMENTS

10.7 ASTILLEROS ARMON

10.7.1 COMPANY SNAPSHOT

10.7.2 PRODUCTS PORTFOLIO

10.7.3 RECENT DEVELOPMENTS

10.8 CHANTIER DE CONSTRUCTIONS NAVALES MARTINEZ

10.8.1 COMPANY SNAPSHOT

10.8.2 PRODUCTS PORTFOLIO

10.8.3 RECENT DEVELOPMENTS

10.9 ELLIOTT BAY DESIGN GROUP

10.9.1 COMPANY SNAPSHOT

10.9.2 PRODUCTS PORTFOLIO

10.9.3 RECENT DEVELOPMENTS

10.1 GREEN YARD KLEVEN

10.10.1 COMPANY SNAPSHOT

10.10.2 SERVICES PORTFOLIO

10.10.3 RECENT DEVELOPMENTS

10.11 HEINEN & HOPMAN

10.11.1 COMPANY SNAPSHOT

10.11.2 PRODUCTS PORTFOLIO

10.11.3 RECENT DEVELOPMENTS

10.12 INTEGRATED MARINE SYSTEMS, INC.

10.12.1 COMPANY SNAPSHOT

10.12.2 PRODUCTS PORTFOLIO

10.12.3 RECENT DEVELOPMENTS

10.13 KARSTENSENS SKIBSVÆRFT A/S

10.13.1 COMPANY SNAPSHOT

10.13.2 PRODUCTS PORTFOLIO

10.13.3 RECENT DEVELOPMENTS

10.14 LERØY HAVFISK

10.14.1 COMPANY SNAPSHOT

10.14.2 PRODUCTS PORTFOLIO

10.14.3 RECENT DEVELOPMENTS

10.15 MAREFSOL B.V.

10.15.1 COMPANY SNAPSHOT

10.15.2 PRODUCTS PORTFOLIO

10.15.3 RECENT DEVELOPMENTS

10.16 MASTER BOAT BUILDERS, INC.

10.16.1 COMPANY SNAPSHOT

10.16.2 PRODUCTS PORTFOLIO

10.16.3 RECENT DEVELOPMENTS

10.17 MAURICE

10.17.1 COMPANY SNAPSHOT

10.17.2 PRODUCTS PORTFOLIO

10.17.3 RECENT DEVELOPMENTS

10.18 MMC FIRST PROCESS AS.

10.18.1 COMPANY SNAPSHOT

10.18.2 PRODUCTS PORTFOLIO

10.18.3 RECENT DEVELOPMENT

10.19 NICHOLS BROS BOAT BUILDERS

10.19.1 COMPANY SNAPSHOT

10.19.2 PRODUCTS PORTFOLIO

10.19.3 RECENT DEVELOPMENTS

10.2 NORDIC WILDFISH

10.20.1 COMPANY SNAPSHOT

10.20.2 PRODUCTS PORTFOLIO

10.20.3 RECENT DEVELOPMENTS

10.21 TEKNOTHERM

10.21.1 COMPANY SNAPSHOT

10.21.2 PRODUCTS PORTFOLIO

10.21.3 RECENT DEVELOPMENTS

10.22 THOMA-SEA SHIP BUILDERS, LLC

10.22.1 COMPANY SNAPSHOT

10.22.2 PRODUCTS PORTFOLIO

10.22.3 RECENT DEVELOPMENTS

11 QUESTIONNAIRE

12 RELATED REPORTS

Liste des tableaux

TABLE 1 FISHING VESSEL CONSTRUCTION DETAILS

TABLE 2 FISHING VESSEL AVERAGE OPERATIONAL YEARS WITH RESPECT TO THE TYPE

TABLE 3 FISHING VESSEL OWNERS REQUIRING FREEZING SYSTEMS

TABLE 4 EUROPE FREEZING FISHING VESSELS MARKET, BY SYSTEM, 2020-2029 (USD MILLION)

TABLE 5 EUROPE AIR BLAST FREEZING IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 EUROPE PLATE FREEZING IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 EUROPE PLATE FREEZING IN FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 EUROPE BRINE IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 EUROPE IQF (INDIVIDUAL QUICK FROZEN) IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 11 EUROPE COMMERCIAL FISHING VESSELS IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE ARTISANAL FISHING VESSELS IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 EUROPE RECREATIONAL FISHING VESSELS IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE FREEZING FISHING VESSELS MARKET, BY VESSEL LENGTH, 2020-2029 (USD MILLION)

TABLE 15 EUROPE LESS THAN 20 M IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE 21 M-30 M IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE ABOVE 40 M IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 EUROPE 31 M-40 M IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE FREEZING FISHING VESSELS MARKET, BY FREEZING CAPACITY, 2020-2029 (USD MILLION)

TABLE 20 EUROPE 50 TONS TO 150 TONS IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 EUROPE 150 TONS TO 300 TONS IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 EUROPE LESS THAN 50 TONS IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 EUROPE MORE THAN 300 TONS IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE FREEZING FISHING VESSELS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 25 EUROPE FREEZING FISHING VESSELS MARKET, BY SYSTEM, 2020-2029 (USD MILLION)

TABLE 26 EUROPE PLATE FREEZING IN FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 EUROPE FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 28 EUROPE FREEZING FISHING VESSELS MARKET, BY VESSEL LENGTH, 2020-2029 (USD MILLION)

TABLE 29 EUROPE FREEZING FISHING VESSELS MARKET, BY FREEZING CAPACITY, 2020-2029 (USD MILLION)

TABLE 30 NORWAY FREEZING FISHING VESSELS MARKET, BY SYSTEM, 2020-2029 (USD MILLION)

TABLE 31 NORWAY PLATE FREEZING IN FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 NORWAY FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 NORWAY FREEZING FISHING VESSELS MARKET, BY VESSEL LENGTH, 2020-2029 (USD MILLION)

TABLE 34 NORWAY FREEZING FISHING VESSELS MARKET, BY FREEZING CAPACITY, 2020-2029 (USD MILLION)

TABLE 35 SPAIN FREEZING FISHING VESSELS MARKET, BY SYSTEM, 2020-2029 (USD MILLION)

TABLE 36 SPAIN PLATE FREEZING IN FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 SPAIN FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 SPAIN FREEZING FISHING VESSELS MARKET, BY VESSEL LENGTH, 2020-2029 (USD MILLION)

TABLE 39 SPAIN FREEZING FISHING VESSELS MARKET, BY FREEZING CAPACITY, 2020-2029 (USD MILLION)

TABLE 40 U.K. FREEZING FISHING VESSELS MARKET, BY SYSTEM, 2020-2029 (USD MILLION)

TABLE 41 U.K. PLATE FREEZING IN FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 U.K. FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 U.K. FREEZING FISHING VESSELS MARKET, BY VESSEL LENGTH, 2020-2029 (USD MILLION)

TABLE 44 U.K. FREEZING FISHING VESSELS MARKET, BY FREEZING CAPACITY, 2020-2029 (USD MILLION)

TABLE 45 GREENLAND FREEZING FISHING VESSELS MARKET, BY SYSTEM, 2020-2029 (USD MILLION)

TABLE 46 GREENLAND PLATE FREEZING IN FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 GREENLAND FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 GREENLAND FREEZING FISHING VESSELS MARKET, BY VESSEL LENGTH, 2020-2029 (USD MILLION)

TABLE 49 GREENLAND FREEZING FISHING VESSELS MARKET, BY FREEZING CAPACITY, 2020-2029 (USD MILLION)

TABLE 50 ICELAND FREEZING FISHING VESSELS MARKET, BY SYSTEM, 2020-2029 (USD MILLION)

TABLE 51 ICELAND PLATE FREEZING IN FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 ICELAND FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 ICELAND FREEZING FISHING VESSELS MARKET, BY VESSEL LENGTH, 2020-2029 (USD MILLION)

TABLE 54 ICELAND FREEZING FISHING VESSELS MARKET, BY FREEZING CAPACITY, 2020-2029 (USD MILLION)

TABLE 55 GERMANY FREEZING FISHING VESSELS MARKET, BY SYSTEM, 2020-2029 (USD MILLION)

TABLE 56 GERMANY PLATE FREEZING IN FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 GERMANY FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 GERMANY FREEZING FISHING VESSELS MARKET, BY VESSEL LENGTH, 2020-2029 (USD MILLION)

TABLE 59 GERMANY FREEZING FISHING VESSELS MARKET, BY FREEZING CAPACITY, 2020-2029 (USD MILLION)

TABLE 60 DENMARK FREEZING FISHING VESSELS MARKET, BY SYSTEM, 2020-2029 (USD MILLION)

TABLE 61 DENMARK PLATE FREEZING IN FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 DENMARK FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 DENMARK FREEZING FISHING VESSELS MARKET, BY VESSEL LENGTH, 2020-2029 (USD MILLION)

TABLE 64 DENMARK FREEZING FISHING VESSELS MARKET, BY FREEZING CAPACITY, 2020-2029 (USD MILLION)

TABLE 65 REST OF EUROPE FREEZING FISHING VESSELS MARKET, BY SYSTEM, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 EUROPE FREEZING FISHING VESSELS MARKET: BY SYSTEM, 2021

FIGURE 2 EUROPE FREEZING FISHING VESSELS MARKET: BY TYPE, 2021

FIGURE 3 EUROPE FREEZING FISHING VESSELS MARKET: BY VESSEL LENGTH, 2021

FIGURE 4 EUROPE FREEZING FISHING VESSELS MARKET: BY FREEZING CAPACITY, 2021

FIGURE 5 EUROPE FREEZING FISHING VESSELS MARKET: SNAPSHOT (2021)

FIGURE 6 EUROPE FREEZING FISHING VESSELS MARKET: BY COUNTRY (2021)

FIGURE 7 EUROPE FREEZING FISHING VESSELS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 8 EUROPE FREEZING FISHING VESSELS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 9 EUROPE FREEZING FISHING VESSELS MARKET: BY SYSTEM (2022-2029)

FIGURE 10 EUROPE FREEZING FISHING VESSELS MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.