Marché européen de la fabrication sous contrat, par produit (fabrication de produits pharmaceutiques et fabrication de dispositifs médicaux), par utilisateur final (sociétés pharmaceutiques, sociétés de biotechnologie, sociétés biopharmaceutiques, sociétés de dispositifs médicaux, fabricants d'équipements d'origine et instituts de recherche), par canal de distribution (ventes au détail, appels d'offres directs et autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché de la fabrication sous contrat en Europe

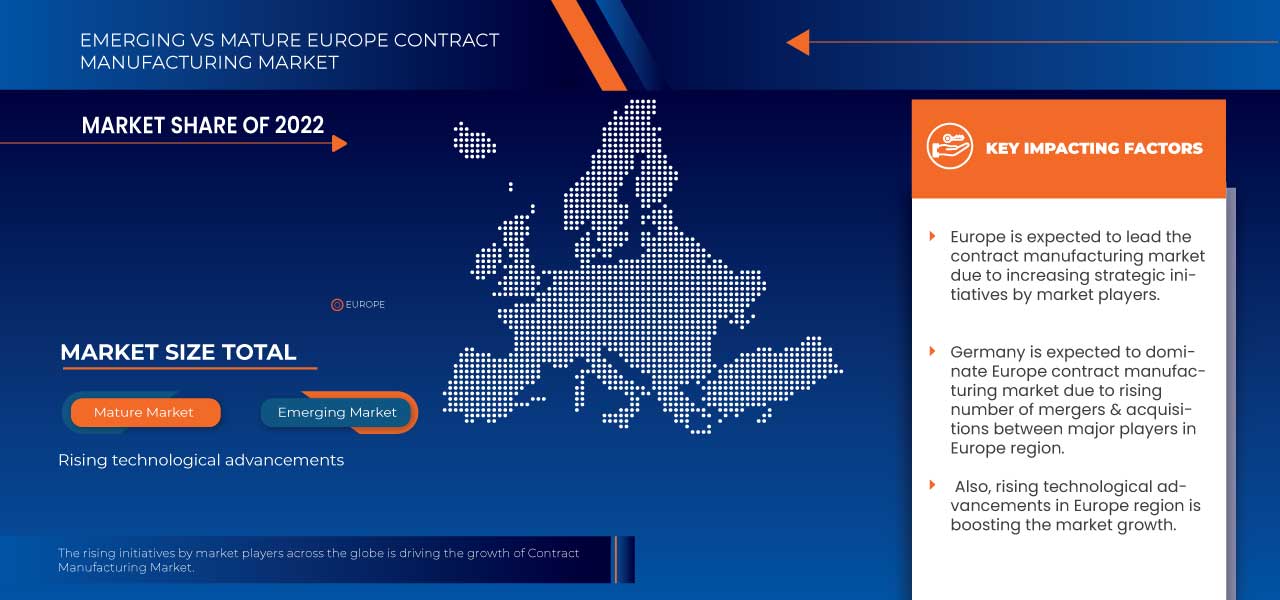

Le marché européen de la fabrication sous contrat est porté par des facteurs tels que les progrès techniques croissants et la rentabilité des produits pharmaceutiques et des produits en cours de développement, ce qui accroît la demande, ainsi que l'augmentation des investissements dans la recherche et le développement, qui entraînent la croissance du marché. Actuellement, les dépenses de santé ont augmenté dans les pays développés et émergents, ce qui devrait créer un avantage concurrentiel pour les fabricants afin de développer des produits nouveaux et innovants.

La fabrication sous contrat est un contrat entre une entreprise et un fabricant pour fabriquer un certain nombre de composants ou de produits pour l'entreprise dans un délai déterminé. Les biens créés seront sous la marque de l'entreprise. On parle alors de fabrication sous marque privée. On parle aussi souvent d'externalisation si elle est réalisée au-delà des frontières. Les fabricants fournissent leurs services sur la base de leurs propres conceptions, formules et spécifications, à moins que le client ne fournisse les siennes. Ils créeront ces produits pour quiconque aura conclu un contrat, même pour des entreprises concurrentes.

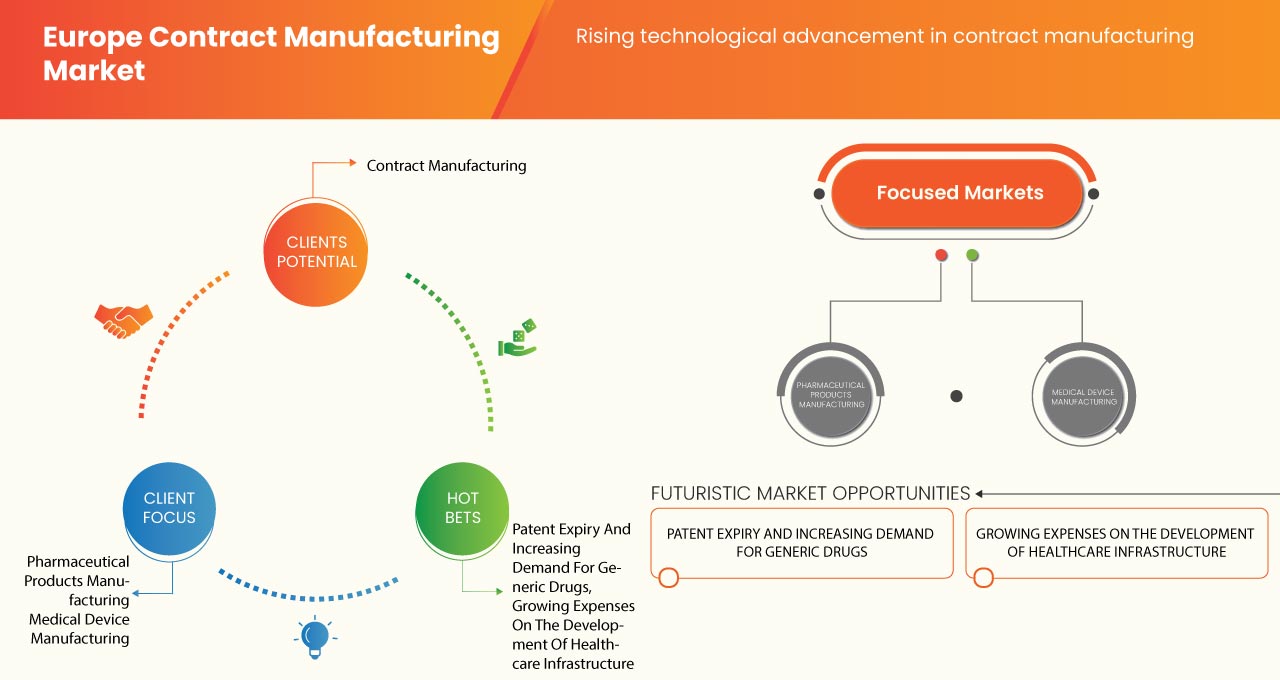

L'un des principaux facteurs à l'origine de la croissance du marché de la fabrication sous contrat est la demande croissante dans le secteur des dispositifs médicaux et pharmaceutiques. Les recherches continues sur les essais cliniques menées par plusieurs entreprises pour un meilleur diagnostic conduisent à l'expansion du marché. Le marché est également influencé par les progrès technologiques croissants et la rentabilité. Cependant, le risque d'informations confidentielles et les réglementations strictes peuvent constituer des facteurs restrictifs pour le marché européen de la fabrication sous contrat au cours de la période de prévision

D'un autre côté, l'expiration des brevets et la demande croissante de médicaments génériques, les dépenses croissantes en infrastructures de santé et les initiatives stratégiques des principaux acteurs du marché constituent des opportunités pour la croissance du marché. Cependant, le risque de propriété intellectuelle et le nombre croissant de sociétés pharmaceutiques souhaitant créer leurs propres unités de fabrication peuvent créer des défis pour le marché européen de la fabrication sous contrat.

La demande de fabrication sous contrat va augmenter en Europe en raison d'une tendance croissante vers le diagnostic au point d'intervention . Diverses entreprises prennent des initiatives qui conduisent progressivement à la croissance du marché.

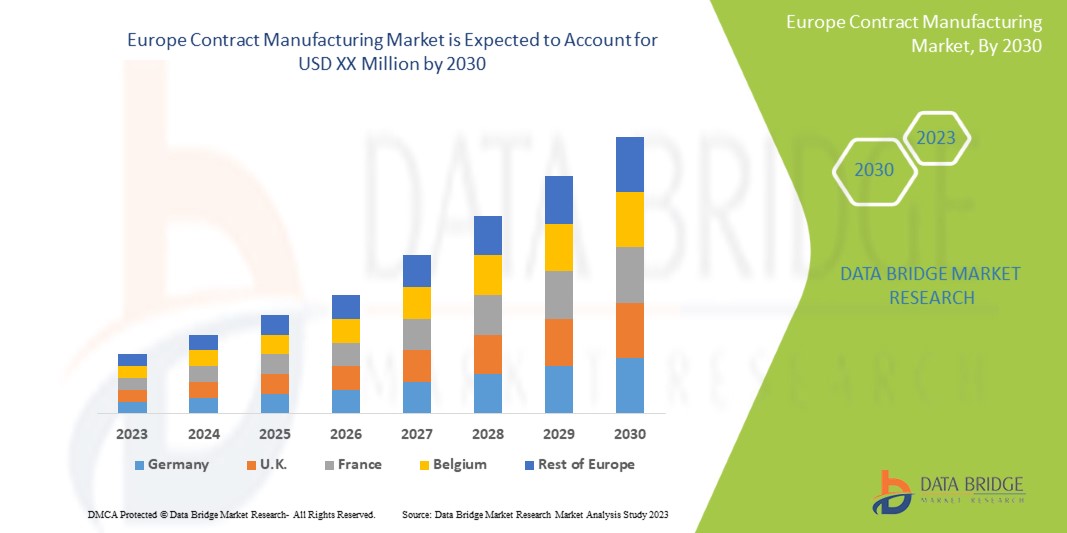

Le marché européen de la fabrication sous contrat est favorable et vise à réduire les efforts de fabrication des organisations de soins de santé. Data Bridge Market Research analyse que le marché européen de la fabrication sous contrat connaîtra un TCAC de 6,0 % au cours de la période de prévision de 2023 à 2030.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Par produit (fabrication de produits pharmaceutiques et fabrication de dispositifs médicaux), par utilisateur final (sociétés pharmaceutiques, sociétés de biotechnologie, sociétés biopharmaceutiques, sociétés de dispositifs médicaux, fabricants d'équipements d'origine et instituts de recherche), par canal de distribution (ventes au détail, appels d'offres directs et autres) |

|

Pays couverts |

Allemagne, France, Italie, Royaume-Uni, Espagne, Pays-Bas, Russie, Suisse, Turquie, Autriche, Norvège, Hongrie, Lituanie, Irlande, Pologne, Luxembourg, Reste de l'Europe |

|

Acteurs du marché couverts |

Aenova Group, Thermo Fisher Scientific Inc., EVONIK INDUSTRIES AG, Lonza, Boehringer Ingelheim Biopharmaceuticals GmbH. et Catalent, Inc. entre autres |

Dynamique de la fabrication sous contrat en Europe

Définition du marché

La sous-traitance de fabrication sur les marchés internationaux est utilisée dans les situations où une entreprise confie la fabrication de ses produits à une autre entreprise d'un autre pays. On parle alors de sous-traitance internationale ou d'externalisation internationale. L'entreprise fournit au fabricant toutes les spécifications et, le cas échéant, les matériaux nécessaires au processus de production. Ce type de contrat définit les exigences auxquelles le fabricant doit satisfaire en matière de qualité des produits, de certification, de quantités, de conditions et de dates de livraison, etc. Il établit également les directives pour l'inspection et les tests des produits, établies par l'entreprise qui sous-traite la fabrication ou par ses propres clients. Il décrit également les modifications des commandes, ainsi que les garanties et les indemnités en cas de rupture de contrat. Étant donné que le processus consiste essentiellement à sous-traiter la production sur les marchés étrangers à un partenaire qui fabrique le produit final sous sa propre marque, un certain nombre d'entreprises et de secteurs différents peuvent recourir à ce type de contrat.

Conducteurs

- Rentabilité pour les entreprises manufacturières

La fabrication chronophage et la production inefficace de plusieurs produits et services constituent des fardeaux majeurs pour les organisations des secteurs public et privé. Elles sont également essentielles pour relever des défis complexes, car une seule organisation est moins efficace pour conduire le changement et parfois les résultats requis. Les entreprises de fabrication sous contrat constitueront des opportunités croissantes pour les secteurs public et privé

La demande croissante de sous-traitance de fabrication avec une précision améliorée et moins de contraintes de temps pousse les principaux acteurs à prendre des initiatives stratégiques. La sous-traitance de fabrication libère les frais généraux nécessaires pour investir dans des machines, du matériel et une main-d'œuvre supplémentaire, simplifiant ainsi le processus de production et rationalisant la chaîne d'approvisionnement en réduisant le coût global.

Cependant, les principaux acteurs du marché investissent des capitaux importants dans la fabrication pour répondre aux demandes de leurs utilisateurs finaux. Les acteurs de la fabrication sous contrat participent à l'élaboration des stratégies et à leur mise en œuvre en réduisant les coûts de production de ces acteurs. Les services de fabrication sous contrat à d'autres entreprises garantissent également l'efficacité et l'utilisation optimale des ressources en utilisant une main-d'œuvre efficace, des renseignements stratégiques ou des ressources de travail nécessaires au cycle de production.

- L'essor des avancées technologiques dans la fabrication sous contrat

L'introduction rapide d'un nouveau médicament sur le marché nécessite des investissements considérables dans la fabrication en raison de la forte demande de l'industrie pharmaceutique. Des technologies et des compétences avancées sont indispensables car certains médicaments ont des formules complexes et nécessitent des équipements et des techniques spécifiques lors de leur production en masse.

L'utilisation de technologies innovantes telles que l'apprentissage automatique, le big data et l'intelligence artificielle pour développer des médicaments pharmaceutiques ou fabriquer des dispositifs médicaux est envisagée pour une fabrication rapide et efficace. Ces avancées techniques contribuent également à la production de masse et à l'évolutivité dans un court laps de temps.

Cependant, les entreprises pharmaceutiques auditent ou supervisent traditionnellement les processus de production et de livraison de leurs organisations de fabrication sous contrat afin de surveiller le processus de fabrication à l'aide d'un traçage à distance en temps réel.

Opportunités

- Dépenses croissantes pour le développement des infrastructures de santé

L’infrastructure est un pilier essentiel qui soutient l’objectif fondamental de promouvoir de meilleures normes de soins et de bien-être pour tous les patients, ainsi qu’une bonne expérience du système de santé. En parallèle, le système de santé et le personnel doivent soutenir une promotion de la santé efficace, la prévention et l’auto-prise en charge de l’ensemble de la population. L’infrastructure doit intégrer l’hôpital, en tant que centre de soins actifs et hospitaliers, dans le système de santé plus large et doit faciliter les sept domaines que sont la qualité de l’expérience du patient, l’efficacité, l’efficience, la rapidité, la sécurité, l’équité et la durabilité. L’infrastructure comprend l’environnement bâti et les éléments de soutien : l’équipement, l’accès, les technologies de l’information (TI), les systèmes et processus, les initiatives de durabilité et le personnel.

Cependant, les dépenses croissantes liées au développement des infrastructures de santé propulsent la croissance du marché européen de la fabrication sous contrat au cours de la période de prévision.

Contraintes/Défis

- Augmentation du nombre de sociétés pharmaceutiques implantant leurs sites de production

La plupart des sociétés pharmaceutiques construisent des sites de fabrication pour produire des produits pharmaceutiques afin de réduire les coûts. Les fabricants se concentrent davantage sur l'introduction de technologies avancées et le processus de numérisation. L'industrie pharmaceutique est également confrontée à des perturbations dues à de nouveaux modèles commerciaux et à une population plus axée sur les médicaments et les traitements personnalisés. Par conséquent, la demande de soins personnalisés est élevée. Les profils professionnels évoluent également : certains emplois disparaissent en raison de l'automatisation tandis que des emplois entièrement nouveaux émergent.

Par conséquent, le nombre croissant de sociétés pharmaceutiques créant leurs unités de fabrication pourrait remettre en cause la croissance du marché européen de la fabrication sous contrat au cours de la période de prévision.

Développements récents

- En octobre 2021, Boehringer Ingelheim International gmbh. a inauguré son usine de production biopharmaceutique de pointe Large Scale Cell Culture (LSCC) à Vienne, en Autriche, avec un volume d'investissement de plus de 700 millions d'euros, ce qui constitue le plus gros investissement de l'histoire de l'entreprise.

- En mars 2023, Evonik Industries AG a annoncé l'ouverture d'une nouvelle usine GMP pour la fabrication de lipides destinés à des applications avancées d'administration de médicaments pharmaceutiques. L'usine de lancement de lipides est située sur le site de la société à Hanau, en Allemagne, et fournit aux clients les quantités de lipides nécessaires à la fabrication clinique et commerciale à petite échelle

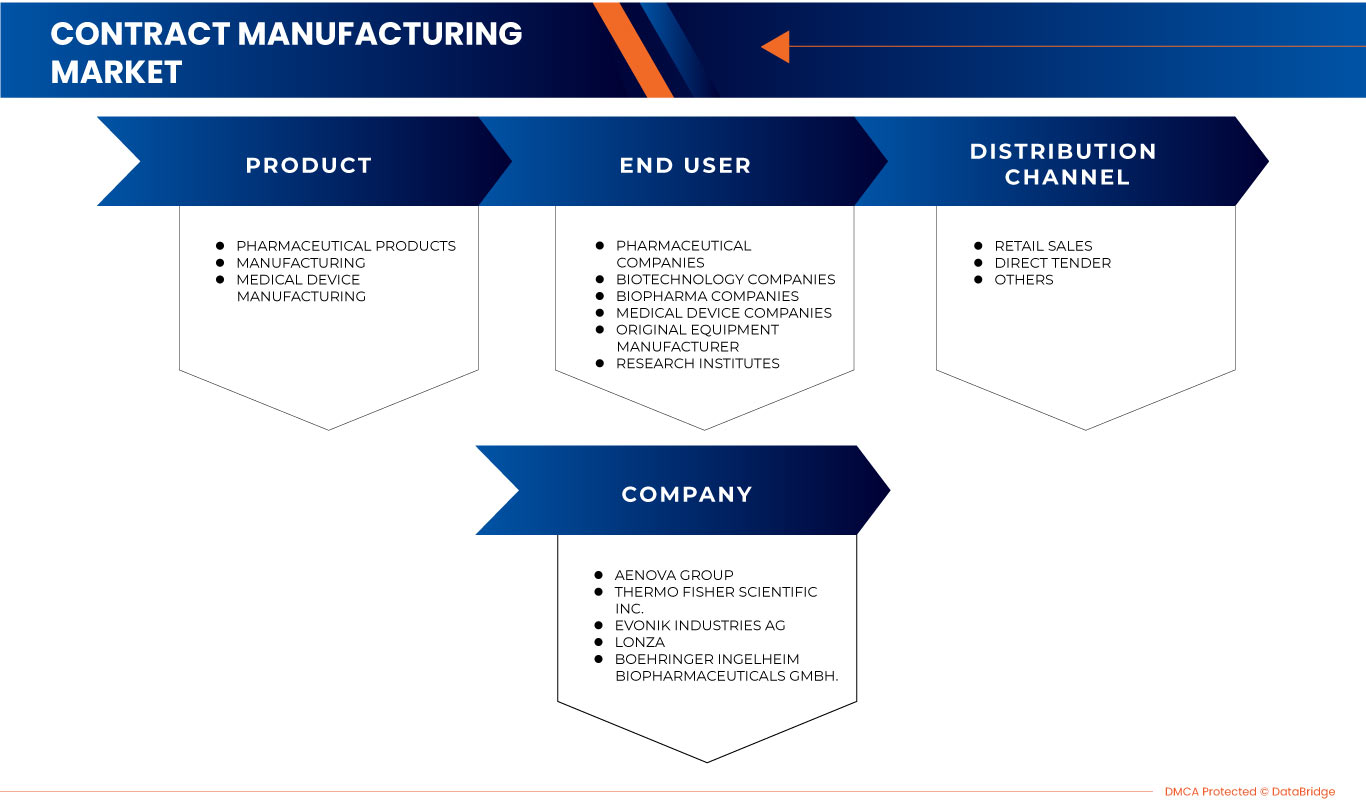

Segmentation du marché de la fabrication sous contrat en Europe

Le marché européen de la fabrication sous contrat est divisé en trois segments notables en fonction du produit, de l'utilisateur final et du canal de distribution. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

Produit

- Fabrication de dispositifs médicaux

- Fabrication de produits pharmaceutiques

Sur la base du produit, le marché européen de la fabrication sous contrat est segmenté en fabrication de dispositifs médicaux et en fabrication de produits pharmaceutiques.

Utilisateur final

- Sociétés pharmaceutiques

- Sociétés de biotechnologie

- Sociétés biopharmaceutiques

- Entreprises de dispositifs médicaux

- Fabricant d'équipement d'origine

- Instituts de recherche

Sur la base de l'utilisateur final, le marché européen de la fabrication sous contrat est segmenté en fabricants d'équipements d'origine, sociétés de dispositifs médicaux, sociétés pharmaceutiques, sociétés de biotechnologie, sociétés biopharmaceutiques et instituts de recherche.

Canal de distribution

- Ventes au détail

- Appel d'offres direct

- Autres

Sur la base du canal de distribution, le marché européen de la fabrication sous contrat est segmenté en appels d'offres directs, ventes au détail et autres.

Analyse/perspectives régionales du marché de la fabrication sous contrat en Europe

Le marché européen de la fabrication sous contrat est analysé et des informations sur la taille du marché et les tendances sont fournies par produit, utilisateur final et canal de distribution, comme référencé ci-dessus.

Certains pays couverts dans le rapport sur la fabrication sous contrat en Europe sont l'Allemagne, la France, l'Italie, le Royaume-Uni, l'Espagne, les Pays-Bas, la Russie, la Suisse, la Turquie, l'Autriche, la Norvège, la Hongrie, la Lituanie, l'Irlande, la Pologne, le Luxembourg et le reste de l'Europe.

Le Royaume-Uni devrait dominer le marché en raison des progrès technologiques croissants dans les régions en développement.

La section par pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces du porteur, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques européennes et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et des routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du secteur de la fabrication sous contrat en Europe

Le paysage concurrentiel du marché européen de la fabrication sous contrat fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Europe, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement de produits, la largeur et l'étendue des produits et la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises sur le marché européen de la fabrication sous contrat.

Certains acteurs du marché sont Aenova Group, Thermo Fisher Scientific Inc., EVONIK INDUSTRIES AG, Lonza, Boehringer Ingelheim Biopharmaceuticals GmbH. et Catalent, Inc entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE CONTRACT MANUFACTURING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT SEGMENT LIFELINE CURVE

2.8 MARKET END USER COVERAGE GRID

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES

4.3 STRATEGIC INITIATIVES:

5 REGULATORY FRAMEWORK

5.1 REGULATORY SCENARIO BY FDA

5.2 REGULATORY SCENARIO IN AUSTRALIA

5.3 REGULATORY SCENARIO IN EUROPE FOR MEDICINES

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 COST-EFFECTIVENESS FOR THE MANUFACTURING COMPANIES

6.1.2 RISE OF TECHNOLOGICAL ADVANCEMENTS IN CONTRACT MANUFACTURING

6.1.3 EUROPE PRESENCE AND CONNECTED NETWORK

6.2 RESTRAINTS

6.2.1 STRINGENT REGULATIONS AMONG VARIOUS JURISDICTIONS

6.2.2 RISK OF CONFIDENTIAL INFORMATION

6.3 OPPORTUNITIES

6.3.1 PATENT EXPIRY AND INCREASING DEMAND FOR GENERIC DRUGS

6.3.2 GROWING EXPENSES ON THE DEVELOPMENT OF HEALTHCARE INFRASTRUCTURE

6.3.3 INCREASE IN NUMBER OF STRATEGIC INITIATIVES BY KEY MARKET PLAYERS

6.4 CHALLENGES

6.4.1 INTELLECTUAL PROPERTY RISKS

6.4.2 INCREASE IN NUMBER OF PHARMACEUTICAL COMPANIES TO SET UP THEIR MANUFACTURING SITES

7 EUROPE CONTRACT MANUFACTURING MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 PHARMACEUTICAL PRODUCTS MANUFACTURING

7.2.1 TYPES OF PRODUCTS

7.2.1.1 TABLETS

7.2.1.2 CAPSULES

7.2.1.3 BIOLOGICS

7.2.1.4 SMALL MOLECULE

7.2.1.5 CELL & GENES MANUFACTURING

7.2.1.6 NUTRACEUTICALS

7.2.1.7 OTHERS

7.2.2 TYPE OF SERVICES

7.2.2.1 DRUG DEVELOPMENT SERVICES

7.2.2.2 TABLET MANUFACTURING SERVICES

7.2.2.3 BIOLOGICS API MANUFACTURING

7.2.2.4 BIOLOGICS FDF MANUFACTURING SERVICES

7.2.2.5 OTHERS

7.2.3 BY DOSAGE FORM

7.2.3.1 SOLID FORMULATIONS

7.2.3.2 LIQUID FORMULATIONS

7.2.3.2.1 INJECTABLE

7.2.3.2.2 SYRUPS

7.2.3.3 SEMI-SOLID FORMULATIONS

7.2.3.4 TOPICAL DRUG FORMULATIONS

7.2.3.5 OTHERS

7.3 MEDICAL DEVICE MANUFACTURING

7.3.1 TYPE OF DEVICES

7.3.1.1 SYRINGES AND NEEDLES

7.3.1.2 INFUSION DEVICES & ADMINISTRATION SETS

7.3.1.3 MEDICAL ACCESSORIES, COMPONENTS & CONSUMABLES

7.3.1.4 DISPOSABLES

7.3.1.5 IVD DEVICES

7.3.1.6 CARDIOVASCULAR DEVICES

7.3.1.7 DIABETES CARE DEVICES

7.3.1.8 GENERAL SURGERY DEVICES

7.3.1.9 ORTHOPEDIC DEVICES

7.3.1.10 RESPIRATORY DEVICES

7.3.1.11 OPHTHALMIC DEVICES

7.3.1.12 DENTAL DEVICES

7.3.1.13 GYNECOLOGY/UROLOGY DEVICES

7.3.1.14 LABORATORY EQUIPMENT

7.3.2 TYPE OF SERVICES

7.3.2.1 MEDICAL DEVICE DESIGN AND DEVELOPMENT

7.3.2.2 DEVICE ASSEMBLY

7.3.2.3 REGULATORY ASSISTANCE

7.3.2.4 PACKAGING & LABELLING

7.3.2.5 STERILIZATION SERVICES

7.3.2.6 TRAINING AND VALIDATION

7.3.2.7 QUALITY ASSURANCE

7.3.2.8 OTHERS

7.3.3 BY DEVICE CLASS

7.3.3.1 CLASS I MEDICAL DEVICES

7.3.3.2 CLASS IIA MEDICAL DEVICES

7.3.3.3 CLASS IIB MEDICAL DEVICES

7.3.3.4 CLASS III MEDICAL DEVICES

8 EUROPE CONTRACT MANUFACTURING MARKET, BY END USER

8.1 OVERVIEW

8.2 PHARMACEUTICAL COMPANIES

8.3 BIOTECHNOLOGY COMPANIES

8.4 BIOPHARMA COMPANIES

8.5 MEDICAL DEVICES COMPANIES

8.6 ORIGINAL EQUIPMENT MANUFACTURER

8.7 RESEARCH INSTITUTES

9 EUROPE CONTRACT MANUFACTURING MARKET, BY DISTRIBUTION CHANNEL

9.1 OVERVIEW

9.2 RETAIL SALES

9.3 DIRECT TENDER

9.4 OTHERS

10 EUROPE CONTRACT MANUFACTURING MARKET, BY REGION

10.1 EUROPE

10.1.1 GERMANY

10.1.2 FRANCE

10.1.3 U.K.

10.1.4 ITALY

10.1.5 SPAIN

10.1.6 RUSSIA

10.1.7 TURKEY

10.1.8 BELGIUM

10.1.9 NETHERLANDS

10.1.10 SWITZERLAND

10.1.11 REST OF EUROPE

11 EUROPE CONTRACT MANUFACTURING MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: EUROPE

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 AENOVA GROUP

13.1.1 COMPANY SNAPSHOT

13.1.2 COMPANY SHARE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT DEVELOPMENTS

13.2 THERMO FISHER SCIENTIFIC INC.

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 EVONIK INDUSTRIES AG

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 LONZA

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 BOEHRINGER INGELHEIM INTERNATIONAL GMBH.

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 ABBVIE INC.

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENT

13.7 ALMAC GROUP

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENTS

13.8 AVID BIOSERVICES, INC.

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENT

13.9 BAXTER

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 PRODUCT PORTFOLIO

13.9.4 RECENT DEVELOPMENTS

13.1 CATALENT, INC

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT DEVELOPMENT

13.11 FAMAR HEALTH CARE SERVICES

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENTS

13.12 JUBILANT PHARMA LIMITED

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 PRODUCT PORTFOLIO

13.12.4 RECENT DEVELOPMENT

13.13 KIMBALL INTERNATIONAL

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENT

13.14 MERCK KGAA

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT DEVELOPMENTS

13.15 NIPR0

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 PRODUCT PORTFOLIO

13.15.4 RECENT DEVELOPMENT

13.16 PFIZER INC

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENT

13.17 RECIPHARM AB.

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 PRODUCT PORTFOLIO

13.17.4 RECENT DEVELOPMENT

13.18 SIEGFRIED HOLDING AG

13.18.1 COMPANY SNAPSHOT

13.18.2 REVENUE ANALYSIS

13.18.3 PRODUCT PORTFOLIO

13.18.4 RECENT DEVELOPMENTS

13.19 SUN PHARMACEUTICAL INDUSTRIES LTD

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 PRODUCT PORTFOLIO

13.19.4 RECENT DEVELOPMENT

13.2 TE CONNECTIVITY

13.20.1 COMPANY SNAPSHOT

13.20.2 REVENUE ANALYSIS

13.20.3 PRODUCT PORTFOLIO

13.20.4 RECENT DEVELOPMENT

13.21 VETTER PHARMA-FERTIGUNG GMBH & CO. KG

13.21.1 COMPANY SNAPSHOT

13.21.2 PRODUCT PORTFOLIO

13.21.3 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

Liste des tableaux

TABLE 1 EUROPE CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 2 EUROPE PHARMACEUTICAL PRODUCTS MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 EUROPE PHARMACEUTICAL PRODUCTS MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 4 EUROPE TYPES OF PRODUCTS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 5 EUROPE BY SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 6 EUROPE BY DOSAGE FORM IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 7 EUROPE LIQUID FORMULATIONS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 8 EUROPE MEDICAL DEVICE MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 EUROPE CONSUMABLES AND ACCESSORIES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 10 EUROPE TYPE OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 11 EUROPE TYPE OF SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 12 EUROPE BY DEVICE CLASS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 13 EUROPE CONTRACT MANUFACTURING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 14 EUROPE PHARMACEUTICAL COMPANIES IN CONTRACT MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 EUROPE BIOTECHNOLOGY COMPANIES IN CONTRACT MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 EUROPE BIOPHARMA COMPANIES IN CONTRACT MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 EUROPE AMBULATORY SURGICAL CENTERS IN CONTRACT MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 EUROPE ORIGINAL EQUIPMENT MANUFACTURER IN CONTRACT MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 EUROPE RESEARCH INSTITUTES IN CONTRACT MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 EUROPE CONTRACT MANUFACTURING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 21 EUROPE RETAIL SALES IN CONTRACT MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 EUROPE DIRECT TENDER IN CONTRACT MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 EUROPE OTHERS IN CONTRACT MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 EUROPE CONTRACT MANUFACTURING MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 25 EUROPE CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 26 EUROPE PHARMACEUTICAL PRODUCTS MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 27 EUROPE TYPES OF PRODUCTS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 28 EUROPE TYPES OF PRODUCTS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030, 2021-2030 (UNIT)

TABLE 29 EUROPE TYPES OF PRODUCTS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030, 2021-2030 (ASP)

TABLE 30 EUROPE TYPE OF SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 31 EUROPE BY DOSAGE FORM IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 32 EUROPE LIQUID FORMULATIONS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 33 EUROPE MEDICAL DEVICES MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 34 EUROPE TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 35 EUROPE TYPES OF DEVICES IN MEDICAL DEVICES MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 36 EUROPE TYPES OF DEVICES IN MEDICAL DEVICES MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 37 EUROPE TYPE OF SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 38 EUROPE BY DEVICE CLASS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 39 EUROPE CONTRACT MANUFACTURING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 40 EUROPE CONTRACT MANUFACTURING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 41 GERMANY CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 42 GERMANY PHARMACEUTICAL PRODUCTS MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 43 GERMANY TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 44 GERMANY TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 45 GERMANY TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 46 GERMANY BY SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 47 GERMANY BY DOSAGE FORM IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 48 GERMANY LIQUID FORMULATIONS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 49 GERMANY MEDICAL DEVICES MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 50 GERMANY TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 51 GERMANY TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 52 GERMANY TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 53 GERMANY TYPE OF SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 54 GERMANY BY DEVICE CLASS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 55 GERMANY CONTRACT MANUFACTURING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 56 GERMANY CONTRACT MANUFACTURING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 57 FRANCE CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 58 FRANCE PHARMACEUTICAL PRODUCTS MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 59 FRANCE TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 60 FRANCE TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 61 FRANCE TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 62 FRANCE BY SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 63 FRANCE BY DOSAGE FORM IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 64 FRANCE LIQUID FORMULATIONS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 65 FRANCE MEDICAL DEVICES MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 66 FRANCE TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 67 FRANCE TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 68 FRANCE TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 69 FRANCE TYPE OF SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 70 FRANCE BY DEVICE CLASS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 71 FRANCE CONTRACT MANUFACTURING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 72 FRANCE CONTRACT MANUFACTURING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 73 U.K. CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 74 U.K. PHARMACEUTICAL PRODUCTS MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 75 U.K. TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 76 U.K. TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 77 U.K. TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 78 U.K. BY SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 79 U.K. BY DOSAGE FORM IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 80 U.K. LIQUID FORMULATIONS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 81 U.K. MEDICAL DEVICES MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 82 U.K. TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 83 U.K. TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 84 U.K. TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 85 U.K. TYPE OF SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 86 U.K. BY DEVICE CLASS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 87 U.K. CONTRACT MANUFACTURING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 88 U.K. CONTRACT MANUFACTURING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 89 ITALY CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 90 ITALY PHARMACEUTICAL PRODUCTS MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 91 ITALY TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 92 ITALY TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 93 ITALY TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 94 ITALY BY SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 95 ITALY BY DOSAGE FORM IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 96 ITALY LIQUID FORMULATIONS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 97 ITALY MEDICAL DEVICES MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 98 ITALY TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 99 ITALY TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 100 ITALY TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 101 ITALY TYPE OF SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 102 ITALY BY DEVICE CLASS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 103 ITALY CONTRACT MANUFACTURING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 104 ITALY CONTRACT MANUFACTURING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 105 SPAIN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 106 SPAIN PHARMACEUTICAL PRODUCTS MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 107 SPAIN TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 108 SPAIN TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 109 SPAIN TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 110 SPAIN BY SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 111 SPAIN BY DOSAGE FORM IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 112 SPAIN LIQUID FORMULATIONS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 113 SPAIN MEDICAL DEVICES MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 114 SPAIN TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 115 SPAIN TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 116 SPAIN TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 117 SPAIN TYPE OF SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 118 SPAIN BY DEVICE CLASS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 119 SPAIN CONTRACT MANUFACTURING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 120 SPAIN CONTRACT MANUFACTURING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 121 RUSSIA CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 122 RUSSIA PHARMACEUTICAL PRODUCTS MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 123 RUSSIA TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 124 RUSSIA TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 125 RUSSIA TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 126 RUSSIA BY SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 127 RUSSIA BY DOSAGE FORM IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 128 RUSSIA LIQUID FORMULATIONS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 129 RUSSIA MEDICAL DEVICES MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 130 RUSSIA TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 131 RUSSIA TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 132 RUSSIA TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 133 RUSSIA TYPE OF SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 134 RUSSIA BY DEVICE CLASS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 135 RUSSIA CONTRACT MANUFACTURING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 136 RUSSIA CONTRACT MANUFACTURING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 137 TURKEY CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 138 TURKEY PHARMACEUTICAL PRODUCTS MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 139 TURKEY TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 140 TURKEY TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 141 TURKEY TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 142 TURKEY BY SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 143 TURKEY BY DOSAGE FORM IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 144 TURKEY LIQUID FORMULATIONS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 145 TURKEY MEDICAL DEVICES MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 146 TURKEY TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 147 TURKEY TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 148 TURKEY TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 149 TURKEY TYPE OF SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 150 TURKEY BY DEVICE CLASS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 151 TURKEY CONTRACT MANUFACTURING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 152 TURKEY CONTRACT MANUFACTURING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 153 BELGIUM CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 154 BELGIUM PHARMACEUTICAL PRODUCTS MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 155 BELGIUM TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 156 BELGIUM TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 157 BELGIUM TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 158 BELGIUM BY SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 159 BELGIUM BY DOSAGE FORM IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 160 BELGIUM LIQUID FORMULATIONS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 161 BELGIUM MEDICAL DEVICES MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 162 BELGIUM TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 163 BELGIUM TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 164 BELGIUM TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 165 BELGIUM TYPE OF SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 166 BELGIUM BY DEVICE CLASS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 167 BELGIUM CONTRACT MANUFACTURING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 168 BELGIUM CONTRACT MANUFACTURING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 169 NETHERLANDS CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 170 NETHERLANDS PHARMACEUTICAL PRODUCTS MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 171 NETHERLANDS TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 172 NETHERLANDS TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 173 NETHERLANDS TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 174 NETHERLANDS BY SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 175 NETHERLANDS BY DOSAGE FORM IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 176 NETHERLANDS LIQUID FORMULATIONS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 177 NETHERLANDS MEDICAL DEVICES MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 178 NETHERLANDS TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 179 NETHERLANDS TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 180 NETHERLANDS TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 181 NETHERLANDS TYPE OF SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 182 NETHERLANDS BY DEVICE CLASS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 183 NETHERLANDS CONTRACT MANUFACTURING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 184 NETHERLANDS CONTRACT MANUFACTURING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 185 SWITZERLAND CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 186 SWITZERLAND PHARMACEUTICAL PRODUCTS MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 187 SWITZERLAND TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 188 SWITZERLAND TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 189 SWITZERLAND TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 190 SWITZERLAND BY SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 191 SWITZERLAND BY DOSAGE FORM IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 192 SWITZERLAND LIQUID FORMULATIONS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 193 SWITZERLAND MEDICAL DEVICES MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 194 SWITZERLAND TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 195 SWITZERLAND TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 196 SWITZERLAND TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 197 SWITZERLAND TYPE OF SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 198 SWITZERLAND BY DEVICE CLASS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 199 SWITZERLAND CONTRACT MANUFACTURING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 200 SWITZERLAND CONTRACT MANUFACTURING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 201 REST OF EUROPE CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 EUROPE CONTRACT MANUFACTURING MARKET: SEGMENTATION

FIGURE 2 EUROPE CONTRACT MANUFACTURING MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE CONTRACT MANUFACTURING MARKET: DROC ANALYSIS

FIGURE 4 EUROPE CONTRACT MANUFACTURING MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE CONTRACT MANUFACTURING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE CONTRACT MANUFACTURING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE CONTRACT MANUFACTURING MARKET: MARKET END USER COVERAGE GRID

FIGURE 8 EUROPE CONTRACT MANUFACTURING MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE CONTRACT MANUFACTURING MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE CONTRACT MANUFACTURING MARKET: SEGMENTATION

FIGURE 11 RISING TECHNOLOGICAL ADVANCEMENTS AND COST-EFFECTIVENESS OF PHARMACEUTICAL AND MEDICAL PRODUCTS ARE EXPECTED TO DRIVE THE GROWTH OF THE EUROPE CONTRACT MANUFACTURING MARKET

FIGURE 12 THE PHARMACEUTICAL PRODUCTS MANUFACTURING SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE CONTRACT MANUFACTURING MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE CONTRACT MANUFACTURING MARKET

FIGURE 14 EUROPE CONTRACT MANUFACTURING MARKET: BY PRODUCT, 2022

FIGURE 15 EUROPE CONTRACT MANUFACTURING MARKET: BY PRODUCT, 2023-2030 (USD MILLION)

FIGURE 16 EUROPE CONTRACT MANUFACTURING MARKET: BY PRODUCT, CAGR (2023-2030)

FIGURE 17 EUROPE CONTRACT MANUFACTURING MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 18 EUROPE CONTRACT MANUFACTURING MARKET: BY END USER, 2022

FIGURE 19 EUROPE CONTRACT MANUFACTURING MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 20 EUROPE CONTRACT MANUFACTURING MARKET: BY END USER, CAGR (2023-2030)

FIGURE 21 EUROPE CONTRACT MANUFACTURING MARKET: BY END USER, LIFELINE CURVE

FIGURE 22 EUROPE CONTRACT MANUFACTURING MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 23 EUROPE CONTRACT MANUFACTURING MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 24 EUROPE CONTRACT MANUFACTURING MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 25 EUROPE CONTRACT MANUFACTURING MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 26 EUROPE CONTRACT MANUFACTURING MARKET: SNAPSHOT (2022)

FIGURE 27 EUROPE CONTRACT MANUFACTURING MARKET: BY COUNTRY (2022)

FIGURE 28 EUROPE CONTRACT MANUFACTURING MARKET: BY COUNTRY (2023 & 2030)

FIGURE 29 EUROPE CONTRACT MANUFACTURING MARKET: BY COUNTRY (2022 & 2030)

FIGURE 30 EUROPE CONTRACT MANUFACTURING MARKET: BY PRODUCT (2023-2030)

FIGURE 31 EUROPE CONTRACT MANUFACTURING MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.