Europe Closed System Transfer Devices Market

Taille du marché en milliards USD

TCAC :

%

USD

302.78 Million

USD

1,169.33 Million

2025

2033

USD

302.78 Million

USD

1,169.33 Million

2025

2033

| 2026 –2033 | |

| USD 302.78 Million | |

| USD 1,169.33 Million | |

|

|

|

|

Segmentation du marché européen des dispositifs de transfert en système clos, par type (systèmes membrane-membrane et dispositifs de transfert en système clos sans aiguille), composant (dispositifs et accessoires), mécanisme de fermeture (systèmes à pression et rotation, systèmes d'alignement couleur-couleur, système Luer-Lock et systèmes à verrouillage par clic), technologie (dispositifs à diaphragme, dispositifs compartimentés et dispositifs de purification/filtration de l'air), utilisateur final (hôpitaux, centres et cliniques d'oncologie, centres de chirurgie ambulatoire, établissements d'enseignement et de recherche), canal de distribution (appels d'offres directs et vente au détail) - Tendances du secteur et prévisions jusqu'en 2033

Taille du marché européen des dispositifs de transfert en système fermé

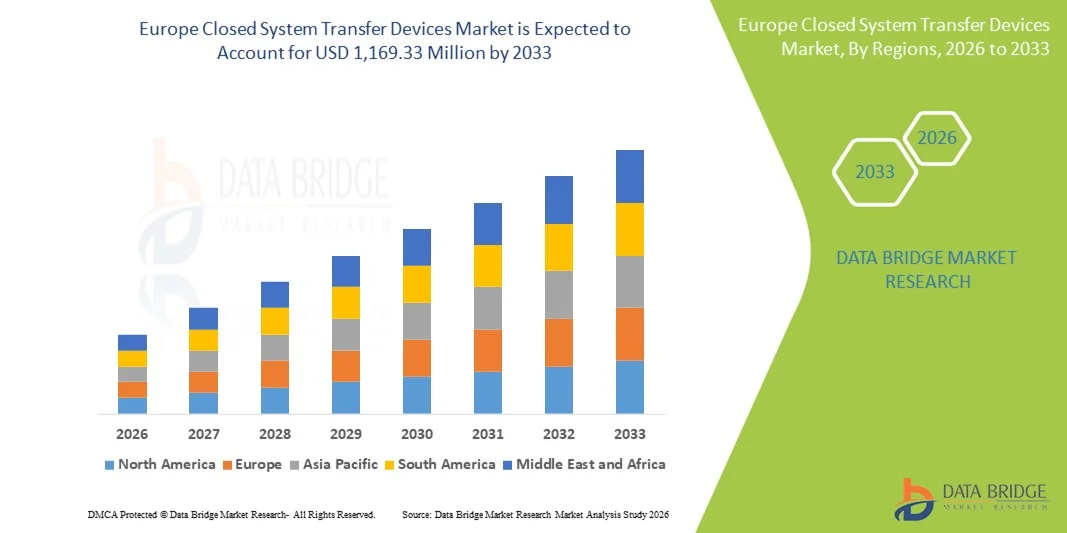

- Le marché européen des dispositifs de transfert en système fermé était évalué à 302,78 millions de dollars en 2025 et devrait atteindre 1 169,33 millions de dollars d’ici 2033 , soit un TCAC de 18,4 % au cours de la période de prévision.

- La croissance du marché est largement due à l'importance accrue accordée à la sécurité au travail dans les établissements de santé et à l'adoption croissante des dispositifs de transfert en système clos afin de prévenir l'exposition aux médicaments dangereux chez les professionnels de santé.

- De plus, des directives réglementaires strictes, l'utilisation croissante de médicaments oncologiques et une sensibilisation accrue aux bonnes pratiques de manipulation des médicaments positionnent les dispositifs de transfert en système clos comme un élément essentiel de l'infrastructure moderne des soins de santé, stimulant ainsi considérablement la croissance du marché.

Analyse du marché européen des dispositifs de transfert en système fermé

- Les dispositifs de transfert en système clos (DSTC), conçus pour empêcher la fuite de médicaments dangereux et protéger les professionnels de santé contre l'exposition lors de la préparation et de l'administration des médicaments, sont des éléments de plus en plus essentiels des protocoles de sécurité en oncologie et en pharmacie dans les hôpitaux et les établissements de santé en Europe.

- La demande croissante de dispositifs de transfert en système clos est principalement due à la prévalence croissante du cancer, à l'utilisation accrue de médicaments injectables dangereux et à une sensibilisation accrue des professionnels de la santé à la sécurité au travail.

- L'Allemagne a dominé le marché européen des dispositifs de transfert en système clos avec la plus grande part de revenus (28,4 %) en 2025, grâce à une réglementation stricte en matière de sécurité au travail, des dépenses de santé élevées et une adoption généralisée des technologies avancées de manipulation des médicaments.

- La Pologne devrait connaître la croissance la plus rapide sur le marché européen des dispositifs de transfert en système clos au cours de la période de prévision, grâce au développement de ses infrastructures de soins oncologiques, à l'augmentation des investissements dans le secteur de la santé et au renforcement du respect des directives de sécurité et de manipulation en vigueur dans l'UE.

- Le segment des systèmes membrane-membrane a dominé le marché européen des dispositifs de transfert en système clos avec une part de marché de 46,8 % en 2025, grâce à son efficacité de confinement élevée, à sa forte acceptation réglementaire et à sa large compatibilité avec les systèmes de préparation et d'administration de médicaments couramment utilisés.

Portée du rapport et segmentation du marché européen des dispositifs de transfert en système fermé

|

Attributs |

Dispositifs de transfert en système fermé en Europe : principaux enseignements du marché |

|

Segments couverts |

|

|

Pays couverts |

Europe

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research incluent également une analyse approfondie par des experts, des données épidémiologiques sur les patients, une analyse des projets en développement, une analyse des prix et un aperçu du cadre réglementaire. |

Tendances du marché européen des dispositifs de transfert en système fermé

Application plus stricte des normes de sécurité au travail et de manipulation des drogues dangereuses

- Une tendance importante et croissante sur le marché européen des dispositifs de transfert en système clos (DSTC) est le renforcement de l'application des réglementations en matière de sécurité au travail visant à réduire l'exposition des professionnels de santé aux médicaments dangereux lors de leur préparation et de leur administration.

- Par exemple, plusieurs systèmes de santé européens alignent de plus en plus les pratiques des pharmacies hospitalières sur les directives européennes en matière de sécurité au travail et les lignes directrices internationales, ce qui conduit à une adoption accrue des dispositifs de transfert de médicaments en milieu hospitalier (CSTD) dans les services d'oncologie et les pharmacies de préparation magistrale.

- L'importance croissante accordée à la réduction de la contamination des surfaces, de la génération d'aérosols et des déversements accidentels stimule la demande pour des modèles CSTD avancés dotés de mécanismes d'étanchéité et de capacités de contrôle de la contamination améliorés.

- Les fabricants se concentrent de plus en plus sur le développement de dispositifs de transfert de médicaments (CSTD) compatibles avec une large gamme de flacons de médicaments, de seringues et de systèmes de perfusion, permettant une intégration plus fluide dans les flux de travail hospitaliers existants.

- La tendance à la centralisation et à l'automatisation de la préparation des médicaments en pharmacie dans les hôpitaux européens encourage davantage l'adoption de solutions de transfert standardisées en système clos afin de garantir des pratiques de sécurité uniformes.

- La collaboration croissante entre les fabricants de dispositifs et les pharmacies hospitalières pour co-développer des solutions CSTD optimisées pour les flux de travail améliore l'acceptation des produits et leur utilisation clinique.

- L'importance croissante accordée à la conformité réglementaire, à la sécurité des travailleurs et aux processus normalisés de manipulation des médicaments redéfinit les décisions d'approvisionnement, les hôpitaux privilégiant les solutions CSTD validées cliniquement et approuvées par les autorités réglementaires.

Dynamique du marché européen des dispositifs de transfert en système fermé

Conducteur

Augmentation de la prévalence du cancer et exigences obligatoires en matière de sécurité des travailleurs de la santé

- L'augmentation de l'incidence du cancer en Europe, associée à la hausse des volumes d'administration de médicaments injectables dangereux, est un facteur majeur alimentant la demande de dispositifs de transfert en système clos.

- Par exemple, les autorités sanitaires nationales de pays comme l'Allemagne et la France renforcent les directives qui recommandent ou imposent l'utilisation de dispositifs de transfert de médicaments en milieu clos (CSTD) lors de la préparation de médicaments oncologiques afin de réduire les risques d'exposition professionnelle.

- Alors que les hôpitaux et les centres d'oncologie cherchent à protéger les pharmaciens, les infirmières et les autres professionnels de la santé, les systèmes de transfert de médicaments en circuit fermé (CSTD) offrent des solutions efficaces en prévenant les fuites de médicaments, les dégagements de vapeurs et la contamination de l'environnement.

- De plus, la sensibilisation accrue des administrateurs de soins de santé aux risques sanitaires à long terme associés à l'exposition à des médicaments dangereux accélère les investissements dans les technologies de pointe en matière de sécurité des médicaments.

- L'augmentation de la population gériatrique en Europe contribue à une prévalence plus élevée du cancer, ce qui accroît le volume de manipulation de médicaments dangereux et la demande de systèmes de transfert de médicaments dangereux (CSTD).

- La hausse des préoccupations médico-légales liées aux accidents d'exposition professionnelle incite les prestataires de soins de santé à adopter de manière proactive les dispositifs de transfert de médicaments en milieu de travail (CTTD) afin d'atténuer les risques de responsabilité et de conformité.

- L'expansion des services de chimiothérapie hospitaliers et des cliniques d'oncologie ambulatoires contribue également à l'adoption accrue des dispositifs de transfert de chimiothérapie en milieu hospitalier (CSTD) à travers l'Europe.

Retenue/Défi

Coûts élevés des produits et complexité de l'intégration des flux de travail

- Le coût relativement élevé des dispositifs de transfert en système clos par rapport aux méthodes de transfert de médicaments classiques constitue un frein important à la croissance du marché, notamment pour les petits hôpitaux et les établissements de santé aux budgets limités.

- Par exemple, certains prestataires de soins de santé retardent l'adoption à grande échelle du CSTD en raison de l'impact cumulatif des coûts sur l'administration de volumes importants de médicaments oncologiques.

- L'intégration des systèmes de transfert de médicaments en continu (CSTD) dans les flux de travail établis en pharmacie et en soins infirmiers peut nécessiter une formation supplémentaire du personnel et des ajustements de processus, ce qui peut réduire temporairement l'efficacité opérationnelle.

- La variabilité des politiques d'approvisionnement hospitalières et l'application incohérente des réglementations de sécurité dans les pays européens peuvent également limiter une pénétration uniforme du marché.

- L'absence de politiques de remboursement standardisées pour les dispositifs de transfert de médicaments (DTM) dans les systèmes de santé européens peut freiner leur adoption rapide, notamment dans les hôpitaux publics sensibles aux coûts.

- La résistance au changement du personnel clinique habitué aux méthodes traditionnelles de transfert de médicaments peut ralentir la mise en œuvre, nécessitant des efforts de formation soutenus et des initiatives de gestion du changement pour garantir une utilisation efficace du dispositif.

- Le dépassement de ces défis grâce à l'optimisation des coûts, à la simplification de la conception des dispositifs et à une démonstration claire des avantages à long terme en matière de sécurité et de réduction des responsabilités sera essentiel à la croissance durable du marché européen des dispositifs de transfert en système fermé.

Portée du marché européen des dispositifs de transfert en système fermé

Le marché est segmenté en fonction du type, du composant, du mécanisme de fermeture, de la technologie, de l'utilisateur final et du canal de distribution.

- Par type

Le marché européen des dispositifs de transfert en système clos est segmenté, selon le type, en systèmes membrane-membrane et dispositifs de transfert en système clos sans aiguille. En 2025, le segment des systèmes membrane-membrane dominait le marché, représentant 46,8 % des revenus. Cette domination s'explique par leur efficacité prouvée pour prévenir les fuites de médicaments dangereux lors de la préparation et de l'administration. Ces systèmes offrent une étanchéité optimale, minimisant ainsi les émissions de vapeurs et la contamination des surfaces en oncologie. Les hôpitaux européens adoptent largement les systèmes membrane-membrane grâce à leur solide validation clinique et à leur acceptation réglementaire. Leur compatibilité avec les flacons, seringues et systèmes de perfusion couramment utilisés garantit une intégration fluide aux flux de travail. Les professionnels de santé privilégient ces systèmes pour leur fiabilité dans les services de chimiothérapie à haut volume. Des données de sécurité exhaustives et une longue expérience d'utilisation confortent leur position dominante.

Le segment des dispositifs de transfert en système clos sans aiguille devrait connaître la croissance la plus rapide au cours de la période de prévision, portée par les préoccupations croissantes liées aux piqûres d'aiguilles chez les professionnels de santé. Ces systèmes éliminent les risques associés aux objets tranchants, améliorant ainsi la sécurité au travail dans les pharmacies et cliniques d'oncologie. La sensibilisation accrue du personnel aux réglementations en matière de sécurité accélère leur adoption en Europe. La conception sans aiguille réduit également les piqûres accidentelles et simplifie la manipulation. Leur facilité d'utilisation contribue à accélérer la préparation des médicaments. L'innovation produit continue stimule davantage la croissance rapide du marché.

- Par composant

Le marché est segmenté, selon les composants, en dispositifs et accessoires. Le segment des dispositifs représentait la plus grande part de chiffre d'affaires en 2025, car ces composants constituent les principaux éléments fonctionnels des dispositifs de transfert en système clos. Les hôpitaux privilégient les dispositifs de transfert en système clos (DSSC) essentiels afin de se conformer aux normes strictes de sécurité au travail. L'augmentation des volumes de chimiothérapie entraîne directement une hausse de la demande de dispositifs. Ces produits font l'objet d'une validation réglementaire approfondie, ce qui justifie des prix plus élevés et une contribution accrue au chiffre d'affaires. Leur rôle essentiel dans le confinement des médicaments dangereux garantit un approvisionnement régulier. De ce fait, les dispositifs représentent le segment de composants dominant.

Le segment des accessoires devrait connaître la croissance la plus rapide au cours de la période prévisionnelle, portée par leur remplacement fréquent et leur utilisation récurrente dans les établissements de santé. Les accessoires tels que les adaptateurs et connecteurs pour flacons sont souvent à usage unique, ce qui engendre une demande continue. L'augmentation des procédures de chimiothérapie en Europe contribue à l'accroissement des volumes de consommation. Les hôpitaux standardisent l'utilisation des accessoires afin de garantir la conformité aux normes de sécurité. Une meilleure compatibilité entre les différentes plateformes d'appareils favorise leur adoption. Cette demande récurrente accélère la croissance du segment.

- Par mécanisme de fermeture

En fonction du mécanisme de fermeture, le marché se segmente en systèmes à verrouillage par rotation, systèmes d'alignement couleur-à-couleur, systèmes Luer-Lock et systèmes à verrouillage par clic. Le segment des systèmes Luer-Lock dominait le marché en 2025, grâce à sa large diffusion auprès des professionnels de santé. Les mécanismes Luer-Lock garantissent des connexions sûres et étanches lors du transfert de médicaments. Leur compatibilité avec les connecteurs médicaux standard facilite leur utilisation. La formation minimale requise améliore l'efficacité opérationnelle. Les hôpitaux privilégient ces systèmes pour leur fiabilité et leur constance. Leur présence établie en Europe assure une position dominante durable.

Le segment des systèmes de verrouillage par clic devrait connaître la croissance la plus rapide au cours de la période prévisionnelle, grâce à leur conception intuitive et leur simplicité d'utilisation. Ces systèmes offrent une confirmation sonore et tactile de la sécurité des connexions, renforçant ainsi la confiance des utilisateurs. Les mécanismes de verrouillage par clic contribuent à minimiser les erreurs humaines lors du transfert de médicaments. Leur adoption croissante dans les pharmacies d'oncologie à haut débit soutient cette croissance. Leurs avantages ergonomiques s'inscrivent dans les initiatives d'optimisation des flux de travail. Face à la recherche de connexions plus sûres et plus rapides par les hôpitaux, la demande de systèmes de verrouillage par clic est en hausse.

- Par la technologie

Sur la base de la technologie, le marché est segmenté en dispositifs à membrane, dispositifs compartimentés et dispositifs de purification/filtration de l'air. Le segment des dispositifs à membrane représentait la part la plus importante en 2025, grâce à leurs performances supérieures en matière d'étanchéité et de confinement. Ces dispositifs empêchent efficacement la fuite des vapeurs de médicaments dangereux. Leur compatibilité avec les systèmes à membrane favorise leur adoption à grande échelle. Les hôpitaux font confiance aux dispositifs à membrane pour leur sécurité éprouvée. La validation réglementaire renforce encore cette confiance. Ceci positionne la technologie à membrane comme le segment dominant.

Le segment des dispositifs de purification et de filtration de l'air devrait connaître la croissance la plus rapide au cours de la période de prévision, porté par une prise de conscience accrue des risques de contamination aéroportée. Ces systèmes filtrent activement les aérosols dangereux lors du transfert de médicaments. L'attention croissante portée à la sécurité environnementale stimule la demande. Les progrès technologiques améliorent l'efficacité de la filtration. Leur adoption se généralise dans les pharmacies de préparation magistrale centralisées. Le renforcement des exigences en matière de protection soutient cette croissance rapide. Cette priorité accordée à une protection accrue positionne les dispositifs de filtration de l'air comme un segment à forte croissance.

- Par l'utilisateur final

En fonction de l'utilisateur final, le marché est segmenté en hôpitaux, centres et cliniques d'oncologie, centres de chirurgie ambulatoire et instituts de recherche et d'enseignement. Le segment des hôpitaux dominait le marché en 2025, porté par d'importants volumes de préparation de chimiothérapie . Les hôpitaux sont soumis à des réglementations strictes en matière de sécurité au travail. La centralisation des services de pharmacie favorise l'utilisation des conteneurs de transfert de médicaments. Des budgets conséquents soutiennent les achats. Les hôpitaux sont à la pointe des pratiques de sécurité standardisées, ce qui leur assure une position dominante.

Le segment des centres et cliniques d'oncologie devrait connaître la croissance la plus rapide au cours de la période prévisionnelle, grâce à l'expansion des établissements spécialisés dans le traitement du cancer. L'augmentation des chimiothérapies ambulatoires favorise leur adoption. Les cliniques accordent une priorité à la sécurité du personnel face à l'augmentation des volumes de médicaments manipulés. Les structures de plus petite taille privilégient les solutions CSTD conviviales. La croissance des centres d'oncologie privés soutient la demande, ce qui accélère l'expansion du segment. Le développement des réseaux d'oncologie privés contribue également à cette croissance. Ce segment bénéficie d'une expansion ciblée des soins contre le cancer.

- Par canal de distribution

En fonction du canal de distribution, le marché est segmenté en appels d'offres directs et ventes au détail. Le segment des appels d'offres directs a dominé le marché en 2025, les dispositifs de transfert de médicaments (DSM) étant principalement acquis par le biais des systèmes d'achat centralisés des hôpitaux. Les appels d'offres des hôpitaux publics et gouvernementaux génèrent des commandes importantes. Les contrats fournisseurs à long terme garantissent un approvisionnement régulier. Les achats par appel d'offres favorisent la conformité réglementaire. La maîtrise des coûts renforce cette position dominante. Ce canal demeure prépondérant. Les achats en gros volumes consolident encore davantage sa domination. La maîtrise des coûts reste un atout majeur.

Le segment des ventes au détail devrait connaître la croissance la plus rapide au cours de la période prévisionnelle, portée par l'adoption croissante de ces services par les cliniques privées. Les circuits de distribution offrent une plus grande flexibilité d'approvisionnement. Le développement des services d'oncologie ambulatoires soutient la demande. L'amélioration des réseaux de distribution facilite l'accès aux soins. Des cycles d'achat plus courts profitent aux établissements de plus petite taille. Ces facteurs contribuent à une croissance rapide. Les plateformes de commande en ligne soutiennent également cette croissance. Ce canal bénéficie de l'expansion décentralisée des soins de santé.

Analyse régionale du marché européen des dispositifs de transfert en système fermé

- L'Allemagne a dominé le marché européen des dispositifs de transfert en système clos avec la plus grande part de revenus (28,4 %) en 2025, grâce à une réglementation stricte en matière de sécurité au travail, des dépenses de santé élevées et une adoption généralisée des technologies avancées de manipulation des médicaments.

- En Allemagne, les établissements de santé accordent une grande importance au respect des consignes de sécurité, au confinement efficace des médicaments cytotoxiques et à l'utilisation de dispositifs de transfert en système clos validés cliniquement au sein des pharmacies hospitalières et des services d'oncologie.

- Cette adoption généralisée est également favorisée par l'infrastructure de santé avancée de l'Allemagne, ses dépenses de santé élevées et une sensibilisation accrue aux risques d'exposition professionnelle à long terme, faisant des dispositifs de transfert en système clos une solution de sécurité essentielle dans les hôpitaux et les cliniques du pays.

Analyse du marché allemand des dispositifs de transfert en système fermé

Le marché allemand des dispositifs de transfert en système clos (DSTC) a dominé l'Europe en 2025, porté par une application rigoureuse des normes de sécurité au travail, d'importants volumes de préparation de médicaments oncologiques et une infrastructure pharmaceutique hospitalière bien établie. Les établissements de santé allemands privilégient le respect des réglementations européennes et nationales en matière de sécurité, ce qui favorise l'adoption généralisée des DSTC. La priorité accordée à la protection des professionnels de santé contre l'exposition aux cytotoxiques encourage le choix de dispositifs à confinement élevé, validés cliniquement. Les hôpitaux et les centres d'oncologie intègrent de plus en plus les DSTC dans leurs flux de travail quotidiens afin d'améliorer la sécurité et l'efficacité opérationnelle. L'innovation dans la conception des dispositifs et leur compatibilité avec de multiples systèmes d'administration de médicaments contribuent également à la croissance du marché. Les dépenses de santé élevées et le contrôle réglementaire strict dont bénéficie l'Allemagne en font le leader du marché en Europe.

Analyse du marché polonais des dispositifs de transfert en système fermé

Le marché polonais des dispositifs de transfert en système clos (DSTC) devrait connaître la croissance la plus rapide d'Europe au cours de la période de prévision, portée par le développement rapide des infrastructures de soins oncologiques et la sensibilisation accrue aux normes de sécurité au travail. Les hôpitaux et les cliniques adoptent de plus en plus les DSTC pour se conformer aux directives européennes et protéger le personnel soignant contre l'exposition aux médicaments dangereux. L'augmentation des investissements dans les centres d'oncologie ambulatoires et la modernisation des pharmacies hospitalières soutiennent la demande. Le faible taux d'adoption historique de ces dispositifs offre un potentiel de croissance important pour les nouvelles installations. L'attention accrue portée par le gouvernement à la sécurité du personnel soignant et aux initiatives de formation accélère encore leur adoption. L'utilisation des systèmes à membrane et sans aiguille devrait fortement progresser dans tout le pays.

Analyse du marché britannique des dispositifs de transfert en système fermé

Le marché britannique des dispositifs de transfert en système clos (DSTC) devrait connaître une croissance annuelle composée (TCAC) remarquable au cours de la période de prévision, portée par une sensibilisation accrue à la sécurité des professionnels de santé et l'augmentation des volumes d'administration de chimiothérapie. Les hôpitaux et les centres d'oncologie adoptent les DSTC pour se conformer aux normes strictes de santé au travail. L'investissement croissant dans les infrastructures d'oncologie et les consultations externes favorise la pénétration du marché. L'accent mis au Royaume-Uni sur des processus modernes et sûrs de préparation des médicaments soutient l'adoption de ces dispositifs dans les établissements de santé publics et privés. Le renforcement de la formation du personnel et la standardisation des pratiques pharmaceutiques stimulent davantage la demande. L'intégration des DSTC dans les protocoles de sécurité hospitaliers demeure un facteur clé de croissance.

Analyse du marché français des dispositifs de transfert en système fermé

Le marché français des dispositifs de transfert en système clos (DSTC) devrait connaître une croissance soutenue, portée par une réglementation stricte en matière de sécurité des médicaments et l'augmentation du nombre de traitements contre le cancer. Les hôpitaux et les centres d'oncologie français insistent sur la réduction de l'exposition professionnelle, ce qui stimule la demande de DSTC membrane-à-membrane et sans aiguille. Leur intégration dans les flux de travail des pharmacies et leur conformité aux recommandations nationales garantissent une large adoption. La sensibilisation croissante des professionnels de santé aux risques à long terme d'une exposition aux cytotoxiques contribue à la croissance du marché. L'innovation continue en matière de sécurité des dispositifs favorise la confiance et encourage leur adoption. Le soutien gouvernemental à la modernisation des protocoles de sécurité hospitaliers accélère encore l'expansion du marché.

Part de marché des dispositifs de transfert en système fermé en Europe

Le secteur européen des dispositifs de transfert en système clos est principalement dominé par des entreprises bien établies, notamment :

- EQUASHIELD (États-Unis)

- Simplivia (Israël)

- ICU Medical, Inc. (États-Unis)

- B. Braun SE (Allemagne)

- Vygon (France)

- BD (États-Unis)

- Baxter (États-Unis)

- Terumo Corporation (Japon)

- CODAN Medizinische Geräte GmbH & Co KG (Allemagne)

- Corning Incorporated (États-Unis)

- West Pharmaceutical Services, Inc. (États-Unis)

- Yukon Medical LLC (États-Unis)

- Corvida Medical Inc. (États-Unis)

- Cardinal Health (États-Unis)

- Caragen Ltd. (Irlande)

- JMS Co., Ltd. (Japon)

- Practivet, Inc. (États-Unis)

- Amsino International, Inc. (États-Unis)

- NIPRO CORPORATION (Japon)

- VICTUS Inc. (États-Unis)

Quels sont les développements récents sur le marché européen des dispositifs de transfert en système clos ?

- En juin 2025, une analyse sectorielle a noté que la croissance du marché européen des dispositifs de transfert en système clos était fortement stimulée par l'application de la directive européenne 2004/37/CE relative aux limites d'exposition aux médicaments dangereux. L'Allemagne et la France représentaient une part importante du marché régional des dispositifs de transfert en système clos, les hôpitaux privilégiant le respect des normes de sécurité.

- En mai 2025, EQUASHIELD® a annoncé que son système de transfert de médicaments à confinement élevé (CSTD) avait démontré cliniquement son efficacité pour protéger les professionnels de santé contre l'exposition aux médicaments dangereux et qu'il avait été classé comme la meilleure solution CSTD, renforçant ainsi sa position sur les principaux marchés européens et mondiaux. Cette reconnaissance souligne les efforts continus de validation clinique et l'acceptation par l'industrie des systèmes de transfert à confinement élevé.

- En novembre 2024, une étude a été menée pour évaluer l'impact de l'utilisation de dispositifs de transfert en système clos sur la contamination environnementale et la sécurité de manipulation lors de la préparation de chimiothérapies, soulignant l'intérêt académique et clinique pour la validation de l'efficacité de ces dispositifs au-delà des avantages théoriques.

- En septembre 2024, une étude de cas a rapporté que plusieurs hôpitaux allemands avaient mis en œuvre avec succès les dispositifs de transfert en système clos EQUASHIELD afin d'améliorer la sécurité de la manipulation des médicaments dangereux. Cette étude a mis en évidence des impacts positifs sur la contamination des lieux de travail et la protection du personnel, notamment dans les services de pharmacie oncologique. Ceci témoigne d'une adoption clinique plus large et d'une évaluation de la performance en matière de sécurité des systèmes de transfert en système clos (CSTD) au sein d'établissements de santé européens de premier plan.

- En juin 2024, la Commission européenne a mis en avant de nouvelles exigences en matière de protection des travailleurs au titre de la directive relative aux agents chimiques (CMD 2022), imposant à tous les États membres de l'UE d'adopter des mesures techniques telles que les dispositifs de transfert de médicaments en système clos (DSMC) afin de minimiser l'exposition aux médicaments dangereux chez les professionnels de santé, ce qui aura un impact significatif sur les pratiques de sécurité dans les établissements de santé européens.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.