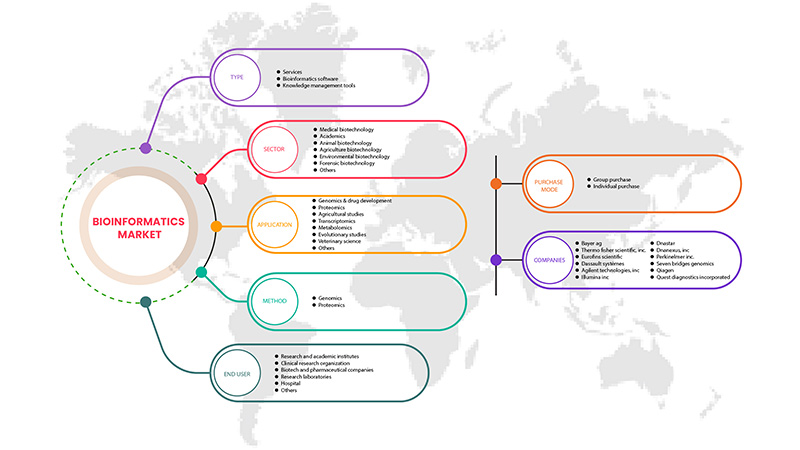

Marché européen de la bioinformatique, par type (outils de gestion des connaissances, logiciels et services de bioinformatique), secteur (biotechnologie médicale, universitaires, biotechnologie animale, biotechnologie agricole, biotechnologie environnementale, biotechnologie médico-légale et autres), application (génomique et développement de médicaments, protéomique, études évolutives, études agricoles, sciences vétérinaires, métabolomique , transcriptomique et autres), mode d'achat (achat groupé et achat individuel), méthode (génomique et protéomique), utilisateur final (instituts de recherche et universitaires, organismes de recherche clinique, sociétés de biotechnologie et pharmaceutiques, laboratoires de recherche, hôpitaux et autres) - Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et perspectives du marché européen de la bioinformatique

Les facteurs responsables de la croissance du marché de la bioinformatique sont le moindre coût du séquençage génétique par base, le besoin croissant en bioinformatique, le large portefeuille de produits proposé par les principaux acteurs du marché et l'utilisation de la bioinformatique dans la médecine personnalisée ainsi que l'augmentation du financement public-privé de la bioinformatique. Cependant, les facteurs qui devraient freiner la croissance du marché sont l'augmentation du coût de l'instrumentation, la difficulté de l'analyse bioinformatique clinique et la cybersécurité en bioinformatique.

D'un autre côté, les initiatives stratégiques des acteurs du marché, le développement de produits, les avancées technologiques en bioinformatique et l'augmentation des dépenses de santé peuvent constituer une opportunité pour la croissance du marché de la bioinformatique. Cependant, le besoin d'expertise qualifiée, les défis liés à la mise en œuvre de la technologie bioinformatique dans les laboratoires cliniques et l'approbation réglementaire peuvent créer des défis pour le marché de la bioinformatique. Des développements récents liés au marché mondial de la bioinformatique ont été observés.

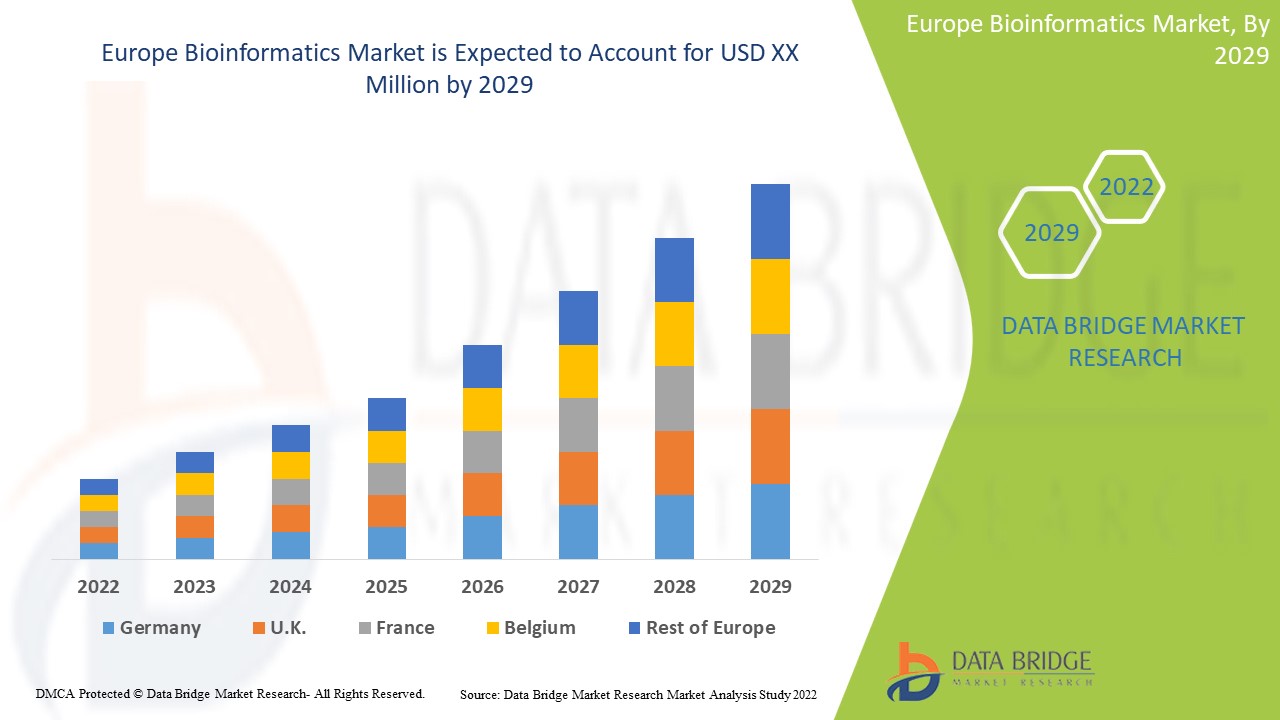

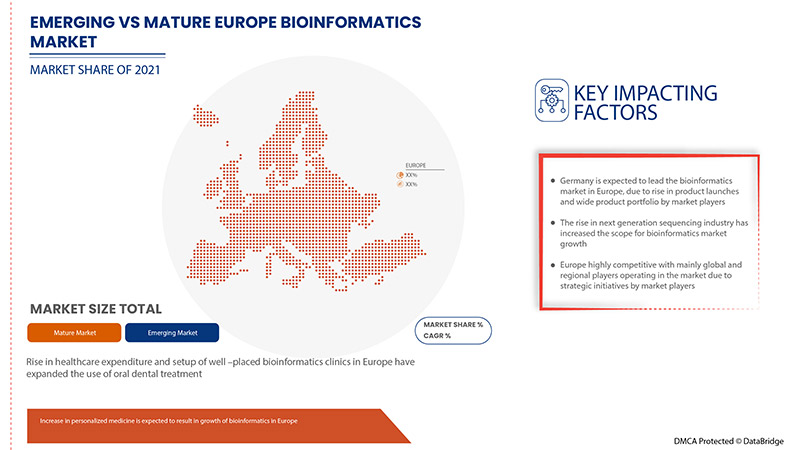

L'augmentation des activités de recherche et développement en bioinformatique en Europe devrait stimuler la croissance du marché. Data Bridge Market Research analyse que le marché européen de la bioinformatique connaîtra un TCAC de 19,5 % au cours de la période de prévision de 2022 à 2029.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Par type (outils de gestion des connaissances, logiciels et services de bioinformatique), secteur (biotechnologie médicale, universitaires, biotechnologie animale, biotechnologie agricole, biotechnologie environnementale, biotechnologie médico-légale et autres), application (génomique et développement de médicaments, protéomique, études évolutives, études agricoles, sciences vétérinaires, métabolomique, transcriptomique et autres), mode d'achat (achat groupé et achat individuel), méthode (génomique et protéomique), utilisateur final (instituts de recherche et universitaires, organismes de recherche clinique, sociétés biotechnologiques et pharmaceutiques, laboratoires de recherche, hôpitaux et autres) |

|

Pays couverts |

Allemagne, France, Royaume-Uni, Italie, Russie, Espagne, Suisse, Pays-Bas, Belgique, Turquie, Reste de l'Europe |

|

Acteurs du marché couverts |

Français Thermo Fisher Scientific Inc., Illumina, Inc., Agilent Technologies, Inc., QIAGEN, SOPHiA GENETICS., BGI, Eurofins Scientific, Waters Corporation, Dassault Systèmes, Bayer AG, PerkinElmer Inc., Seven Bridges Genomics, Quest Diagnostics Incorporated., AstridBio Technologies Inc., BioBam et GenoFAB, Inc. |

Définition du marché

La bioinformatique combine la programmation informatique, le big data et la biologie moléculaire, ce qui permet aux scientifiques de comprendre et d'identifier des modèles dans les données biologiques. Elle est particulièrement utile dans l'étude des génomes et du séquençage de l'ADN, car elle permet aux scientifiques d'organiser de grandes quantités de données.

De la génétique à la toxicologie en passant par la mycologie et la radiobiologie, il existe de nombreuses branches de la biologie dans lesquelles se spécialiser. Et parmi toutes ces branches, la bioinformatique est l'un des domaines fascinants qui vous permet d'identifier, d'évaluer, de stocker et de récupérer des informations biologiques. En tant que domaine d'étude interdisciplinaire, il intègre diverses applications de l'informatique, des statistiques et de la biologie pour développer des applications logicielles permettant de comprendre les données biologiques telles que le séquençage de l'ADN, l'analyse des protéines, la génétique évolutive, etc.

- Dans un avenir proche, les décisions importantes liées à la bioinformatique sur la découverte de médicaments seront prises par des personnes qui non seulement comprennent la biologie, mais peuvent également utiliser les outils bioinformatiques et les connaissances qu'ils libèrent pour développer des hypothèses et identifier des cibles de qualité.

Dynamique du marché européen de la bioinformatique

Conducteurs

- Large gamme de produits proposés par les principaux acteurs

Les avancées et les recherches croissantes dans le domaine de la bioinformatique proposées par les principaux acteurs leur permettent de développer et de lancer de nouveaux produits sur le marché. Les différents instruments de séquençage sont présents sur le marché de la bioinformatique.

Par exemple,

- Le portefeuille de produits de QIAGEN comprend des produits et services bioinformatiques tels que des flux de travail automatisés personnalisés, des services de conservation et des services bioinformatiques évolutifs.

- BGI comprend des services de séquençage et de spectrométrie de masse tels que la protéomique, la métabolomique, la multiomique et la caractérisation biologique

- La synthèse génétique et la biologie moléculaire d'Eurofins Scientific fournissent des produits de synthèse génétique et de biologie moléculaire

Par conséquent, le portefeuille de produits des entreprises travaillant sur ce marché est vaste, ce qui a permis aux revenus des entreprises d'augmenter continuellement par rapport à l'année dernière. Cela devrait propulser la taille du marché et agir comme un moteur pour le marché de la bioinformatique au cours de la période de prévision

- Besoin croissant en bioinformatique

Alors que la pharmacologie axée sur la génomique continue de jouer un rôle croissant dans le traitement de diverses maladies chroniques, en particulier le cancer, le séquençage de nouvelle génération (NGS) évolue en tant qu'outil puissant pour fournir une vision plus approfondie et plus précise des fondements moléculaires des tumeurs individuelles et des récepteurs spécifiques. L'informatique est essentielle dans la recherche biologique impliquant des biologistes qui apprennent la programmation, des programmeurs informatiques, des mathématiciens ou des gestionnaires de bases de données qui apprennent les bases de la biologie

Par exemple,

- La NGS a également été explorée pour établir un profilage complet de la pharmacogénétique en rapport avec la pharmacocinétique et la pharmacodynamie des médicaments. Un premier rapport publié en 2017 suggérait que cette technologie pourrait représenter un outil fiable et efficace pour découvrir des variations génétiques courantes et rares dans ces gènes

- La bioinformatique est l'application d'outils de calcul et d'analyse à la capture et à l'interprétation de données biologiques.

La bioinformatique a le pouvoir de transformer les perspectives de l'oncologie et de faire avancer la vision de la médecine de précision en adoptant une pharmacologie axée sur le génome pour traiter les maladies chroniques. Ainsi, l'augmentation de l'adoption de la pharmacologie axée sur le génome pour le traitement des maladies chroniques agit comme un moteur pour le marché de la bioinformatique.

Opportunités

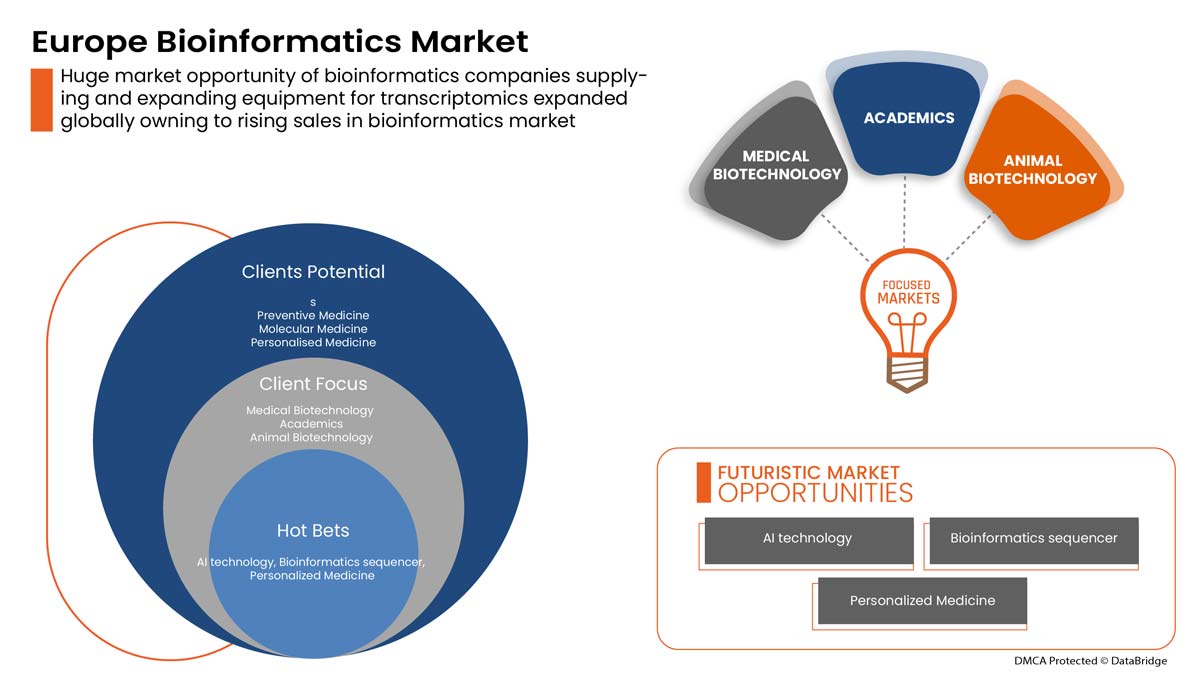

- Utilisation de la bioinformatique dans la médecine personnalisée

La courbe de croissance des applications cliniques du marché de la bioinformatique suit une tendance à la hausse, les applications établies prenant de l'ampleur et de nouvelles s'implantant. Le développement de produits au cours des dernières années a contribué à la croissance du marché. Cela montre également le soutien de l'agence de réglementation pour autoriser ces produits sur le marché.

- Initiatives stratégiques des acteurs du marché

La bioinformatique fournit des informations biologiques utiles, car elle fait partie des sciences de la vie qui traitent de la compréhension et de la planification des génomes. Un génome est l'agencement complexe d'ensembles génétiques présents dans une cellule ou un être vivant entier. La médecine personnalisée est une manière combinatoire de traiter les soins de santé spécifiques à chaque individu. Le développement de médicaments spécifiques au patient a progressé grâce aux outils bioinformatiques.

Par exemple-

- En décembre 2020, Quest Diagnostics Incorporated a investi dans Structural Bioinformatics, un leader en protéomique computationnelle et en pharmacogénomique structurelle. L'investissement a permis le développement conjoint d'une série de modules de base de données de nouvelles protéines structurellement variantes et la commercialisation de ces produits directement auprès de l'industrie pharmaceutique et biotechnologique pour une utilisation dans le développement de la médecine personnalisée

- En 2019, BGI a annoncé que Flow Pharma avait sélectionné BGI (une filiale du groupe BGI) pour développer l'utilisation du NSG dans le développement de médicaments

La prévalence croissante des maladies chroniques et l'augmentation des problèmes de résistance aux médicaments traditionnels ont généré une demande croissante de bioinformatique dans le développement de médicaments. Cela devrait être l'un des principaux facteurs qui devraient stimuler la croissance du marché au cours de la période de prévision.

Contraintes/Défis

- Difficulté dans l'analyse bioinformatique clinique

Le potentiel largement inexploité de l’analyse des big data est un sujet de discussion qui a été exacerbé par la production de nombreux ensembles de données de nouvelle génération qui cherchent à répondre à des questions de longue date sur la biologie des maladies humaines. Bien que ces approches soient susceptibles d’être un moyen puissant de dévoiler de nouvelles connaissances biologiques, plusieurs défis importants entravent actuellement les efforts visant à exploiter la puissance des big data. Les défis typiques incluent l’évaluation efficace des outils logiciels d’analyse, l’accélération du processus global à l’aide de la technologie de parallélisation et d’accélération du calcul parallèle hybride (HPC), l’avancement des stratégies d’automatisation, les alternatives de stockage des données et, enfin, le développement de nouvelles méthodes pour l’exploitation complète des résultats dans de multiples conditions expérimentales.

Compte tenu de l'incertitude entourant l'importance de certains tests bioinformatiques, ils ne peuvent pas être utilisés comme substitut à une évaluation clinique minutieuse. Cela pourrait grandement améliorer l'analyse des variantes génétiques en facilitant le partage des données et l'échange simple de variantes sélectionnées associées au phénotype. Ainsi, la difficulté de la bioinformatique clinique devrait freiner la croissance du marché.

- Préoccupations en matière de cybersécurité dans le domaine de la bioinformatique

Les logiciels Era sont connus pour contenir des vulnérabilités causées par un code imparfait et une mauvaise configuration. Les logiciels liés au NGS utilisés pour faire fonctionner les équipements de séquençage et de laboratoire ou pour effectuer des analyses bioinformatiques ne font pas exception. Les vulnérabilités logicielles sont exploitées pour obtenir un accès non autorisé aux systèmes informatiques ou aux réseaux, divulguer des données, planter ou perturber de toute autre manière divers services.

Cependant, l'informatisation croissante des technologies de l'ADN et de la biotechnologie soulève de nouvelles préoccupations en matière de sécurité bio-cyber. Les vulnérabilités généralement associées aux systèmes informatiques traditionnels – comme le traitement d'entrées non fiables, les fuites par canal auxiliaire, l'authentification médiocre, les données falsifiées et les vulnérabilités des systèmes cyber-physiques – existent désormais dans la biotechnologie. Les menaces émergentes en matière de sécurité bio-cyber ont menacé les systèmes d'information ADN en bioinformatique.

Par exemple;

- En 2020, le groupe de ransomware REvil ou Sodinokibi s'attribuera le mérite du piratage et du vol de 1 téraoctet (To) de données de 10x Genomics destinées à la recherche sur le COVID-19

- En 2018, Genomics England a transféré les données de son projet 100 000 génomes après avoir été la cible de cyberattaques de la part de parties étrangères. Cela permet la violation des données et peut conduire à une utilisation abusive du génome individuel

Impact du COVID-19 sur le marché européen de la bioinformatique

En cette période de pandémie, le secteur européen de la bioinformatique s’est concentré sur l’utilisation d’une combinaison de biologie et de technologies de l’information. Au cœur de l’industrie se trouvent les données biologiques, qui sont analysées et transformées à l’aide de techniques informatiques. La bioinformatique a toujours eu un énorme potentiel pour fournir un soutien essentiel à de nombreux domaines de la recherche scientifique. Les outils que la bioinformatique peut fournir permettent aux scientifiques de se familiariser avec des ensembles de données plus volumineux et de les exploiter et de les analyser pour découvrir des informations cruciales qui pourraient conduire à des découvertes clés. La génétique et les génomes ont été au cœur des préoccupations de la bioinformatique ces dernières années, notamment la génomique comparative, les puces à ADN et la génomique fonctionnelle.

Développement récent

- En mars 2022, Thermo Fisher Scientific Inc a lancé l'instrument de séquençage de nouvelle génération (NGS) marqué CE-IVD destiné à être utilisé dans les laboratoires cliniques. L'instrument de séquençage de nouvelle génération marqué CE-IVD est utilisé pour effectuer des tests de diagnostic et des recherches cliniques sur un seul instrument. Le lancement de l'instrument a donné lieu à l'ajout d'un nouveau produit dans la gamme de produits et à la distribution de l'instrument NGS, ce qui devrait augmenter les revenus du produit.

Portée du marché européen de la bioinformatique

Le marché européen de la bioinformatique est segmenté en six segments : type, secteur, application, mode d'achat, génomique et utilisateur final. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Taper

- Outils de gestion des connaissances

- Logiciel de bioinformatique

- Services

Sur la base du type, le marché européen de la bioinformatique est segmenté en outils de gestion des connaissances, logiciels de bioinformatique et services.

Secteur

- Biotechnologie médicale

- Universitaires

- Biotechnologie animale

- Biotechnologie agricole

- Biotechnologie environnementale

- Biotechnologie médico-légale

- Autres

Sur la base du secteur, le marché européen de la bioinformatique est segmenté en biotechnologie médicale, universitaire, biotechnologie animale, biotechnologie agricole, biotechnologie environnementale, biotechnologie médico-légale et autres.

Application

- Génomique et développement de médicaments

- Protéomique

- Études évolutives

- Études agricoles

- Sciences vétérinaires

- Métabolomique

- Transcriptomique

- Autres

Sur la base des applications, le marché européen de la bioinformatique est segmenté en génomique et développement de médicaments, protéomique, études évolutives, études agricoles, sciences vétérinaires, métabolomique, transcriptomique et autres.

Mode d'achat

- Achat groupé

- Achat individuel

Sur la base du mode d’achat, le marché européen de la bioinformatique est segmenté en achats groupés et achats individuels.

Méthode

- Génomique

- Protéomique

Sur la base de la méthode, le marché européen de la bioinformatique est segmenté en génomique et protéomique.

Utilisateur final

- Instituts de recherche et d'enseignement

- Organisation de recherche clinique

- Sociétés de biotechnologie et pharmaceutiques

- Laboratoires de recherche

- Hôpital

- Autres

Sur la base de l'utilisateur final, le marché européen de la bioinformatique est segmenté en instituts de recherche et universitaires, organismes de recherche clinique, sociétés biotechnologiques et pharmaceutiques, laboratoires de recherche, hôpitaux et autres.

Analyse/perspectives régionales du marché européen de la bioinformatique

Le marché européen de la bioinformatique est analysé et des informations sur la taille et les tendances du marché sont fournies par régions, type, secteur, application, mode d'achat, génomique et utilisateur final. comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché européen de la bioinformatique sont l'Allemagne, la France, le Royaume-Uni, l'Italie, la Russie, l'Espagne, la Suisse, les Pays-Bas, la Belgique, la Turquie et le reste de l'Europe.

L'Allemagne devrait dominer le marché en raison de la sensibilisation croissante au séquençage bioinformatique et de l'augmentation du nombre de collaborations entre les entreprises et les instituts de recherche en bioinformatique en Allemagne, qui devraient stimuler la croissance du marché.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales ont un impact sur les canaux de vente et sont prises en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché de la bioinformatique en Europe

Le paysage concurrentiel du marché européen de la bioinformatique fournit des détails sur le concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Europe, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché européen de la bioinformatique.

Certains des principaux acteurs opérant sur le marché européen de la bioinformatique sont Thermo Fisher Scientific Inc., Illumina, Inc., Agilent Technologies, Inc., QIAGEN, SOPHiA GENETICS., BGI, Eurofins Scientific, Waters Corporation, Dassault Systèmes, Bayer AG, PerkinElmer Inc., Seven Bridges Genomics, Quest Diagnostics Incorporated., AstridBio Technologies Inc., BioBam et GenoFAB, Inc.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE BIOINFORMATICS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHIC SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 RESEARCH METHODOLOGY

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 MULTIVARIATE MODELLING

2.8 TYPE SEGMENT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 MARKET APPLICATION COVERAGE GRID

2.12 THE CATEGORY VS TIME GRID

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL

4.2 PORTER'S FIVE FORCES MODEL

5 REGULATIONS OF THE EUROPE BIOINFORMATICS MARKET

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 DECREASE IN THE COST OF GENETIC SEQUENCING PER BASE

6.1.2 GROWING NEED FOR BIOINFORMATICS

6.1.3 WIDE PRODUCT PORTFOLIO OFFERED BY MAJOR PLAYERS

6.1.4 USE OF BIOINFORMATICS IN PERSONALIZED MEDICINE

6.1.5 INCREASING PUBLIC-PRIVATE SECTOR FUNDING FOR BIOINFORMATICS

6.2 RESTRAINTS

6.2.1 HIGH COST OF INSTRUMENTATION

6.2.2 DIFFICULTY IN CLINICAL BIOINFORMATICS ANALYSIS

6.2.3 CYBER SECURITY CONCERNS IN BIOINFORMATICS

6.3 OPPORTUNITIES

6.3.1 STRATEGIC INITIATIVES BY THE KEY MARKET PLAYER

6.3.2 PRODUCT DEVELOPMENT IN RECENT YEARS

6.3.3 ADVANCEMENT IN BIOINFORMATICS TECHNOLOGY

6.4 CHALLENGES

6.4.1 LACK OF SKILLED PROFESSIONALS TO PERFORM BIOINFORMATICS TECHNOLOGY

6.4.2 CHALLENGES TO IMPLEMENTING BIOINFORMATICS TECHNOLOGY IN THE CLINICAL LABS

7 EUROPE BIOINFORMATICS MARKET, BY TYPE

7.1 OVERVIEW

7.2 SERVICES

7.2.1 DIAGNOSTICS CONSULTATION

7.2.2 DATA ANALYSIS

7.2.2.1 STRUCTURAL

7.2.2.2 FUNCTIONAL

7.3 BIOINFORMATICS SOFTWARE

7.3.1 INFORMATICS INFRASTRUCTURE AND PIPELINE SETUP

7.3.2 SAMPLE AND EXPERIMENT MANAGEMENT

7.3.3 SEQUENCING DATA ANALYSIS

7.3.3.1 SEQUENCE ANALYSIS PLATFORM

7.3.3.2 SEQUENCE ALIGNMENT PLATFORM

7.3.3.3 SEQUENCE MANIPULATION PLATFORM

7.3.3.4 STRUCTURAL ANALYSIS PLATFORM

7.3.3.5 OTHERS

7.3.4 BIOLOGICAL DATA INTERPRETATION

7.3.5 SPECIALIZED BIOINFORMATICS APPLICATIONS

7.3.5.1 SINGLE CELL GENE EXPRESSION

7.3.5.2 GENE EXPRESSION

7.3.5.3 VARIANT DETECTION

7.3.5.4 CNV ANALYSIS

7.3.5.5 METAGENOMICS

7.3.5.6 METHYLATION

7.3.5.7 CHIP-SEQ

7.3.5.8 NON-CODING RNA EXPRESSION

7.3.5.9 OTHERS

7.3.6 OTHERS

7.4 KNOWLEDGE MANAGEMENT TOOLS

7.4.1 GENERALIZED KNOWLEDGE MANAGEMENT TOOLS

7.4.2 SPECIALIZED KNOWLEDGE MANAGEMENT TOOLS

8 EUROPE BIOINFORMATICS MARKET, BY SECTOR

8.1 OVERVIEW

8.2 MEDICAL BIOTECHNOLOGY

8.3 ACADEMICS

8.4 ANIMAL BIOTECHNOLOGY

8.5 AGRICULTURAL BIOTECHNOLOGY

8.6 ENVIRONMENTAL BIOTECHNOLOGY

8.7 FORENSIC BIOTECHNOLOGY

8.8 OTHERS

9 EUROPE BIOINFORMATICS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 GENOMICS & DRUG DEVELOPMENT

9.2.1 SERVICES

9.2.2 SEQUENCING PLATFORMS

9.2.3 KNOWLEDGE MANAGEMENT TOOLS

9.2.4 GENOMICS & DRUG DEVELOPMENT BY TYPE

9.2.4.1 PREVENTIVE MEDICINE

9.2.4.2 MOLECULAR MEDICINE

9.2.4.3 PERSONALIZED MEDICINE

9.2.4.4 CHEMOINFORMATICS AND DRUG DESIGN

9.2.4.5 ANTIBIOTIC RESISTANCE

9.3 PROTEOMICS

9.3.1 SERVICES

9.3.2 SERVICES SEQUENCING PLATFORMS

9.3.3 KNOWLEDGE MANAGEMENT TOOLS

9.4 AGRICULTURAL STUDIES

9.4.1 SERVICES

9.4.2 SERVICES SEQUENCING PLATFORMS

9.4.3 KNOWLEDGE MANAGEMENT TOOLS

9.5 TRANSCRIPTOMICS

9.5.1 SERVICES

9.5.2 SERVICES SEQUENCING PLATFORMS

9.5.3 KNOWLEDGE MANAGEMENT TOOLS

9.6 METABOLOMICS

9.6.1 SERVICES

9.6.2 SERVICES SEQUENCING PLATFORMS

9.6.3 KNOWLEDGE MANAGEMENT TOOLS

9.7 EVOLUTIONARY STUDIES

9.7.1 SERVICES

9.7.2 SERVICES SEQUENCING PLATFORMS

9.7.3 KNOWLEDGE MANAGEMENT TOOLS

9.8 VETERINARY SCIENCE

9.8.1 SERVICES

9.8.2 SERVICES SEQUENCING PLATFORMS

9.8.3 KNOWLEDGE MANAGEMENT TOOLS

9.9 OTHERS

9.9.1 SERVICES

9.9.2 SERVICES SEQUENCING PLATFORMS

9.9.3 KNOWLEDGE MANAGEMENT TOOLS

10 EUROPE BIOINFORMATICS MARKET, BY PURCHASE MODE

10.1 OVERVIEW

10.2 GROUP PURCHASE

10.3 INDIVIDUAL PURCHASE

11 EUROPE BIOINFORMATICS MARKET, BY METHOD

11.1 OVERVIEW

11.2 GENOMICS

11.2.1 DNA

11.2.2 RNA

11.3 PROTEOMICS

12 EUROPE BIOINFORMATICS MARKET, BY END USER

12.1 OVERVIEW

12.2 RESEARCH AND ACADEMIC INSTITUTES

12.3 CLINICAL RESEARCH ORGANIZATION

12.4 BIOTECH AND PHARMACEUTICAL COMPANIES

12.5 RESEARCH LABORATORIES

12.6 HOSPITALS

12.7 OTHERS

13 EUROPE BIOINFORMATICS MARKET, BY REGION

13.1 EUROPE

13.1.1 GERMANY

13.1.2 FRANCE

13.1.3 U.K.

13.1.4 ITALY

13.1.5 RUSSIA

13.1.6 SPAIN

13.1.7 SWITZERLAND

13.1.8 NETHERLANDS

13.1.9 BELGIUM

13.1.10 TURKEY

13.1.11 REST OF EUROPE

14 EUROPE BIOINFORMATICS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: EUROPE

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 BAYER AG

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 THERMO FISHER SCIENTIFIC INC

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 EUROFINS SCIENTIFIC

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 DASSAULT SYSTÈMES

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 AGILENT TECHNOLOGIES, INC

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 ASTRIDBIO TECHNOLOGIES INC.

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 BGI (A SUBSIDIARY OF BGI GROUP)

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 BIOBAM

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 DNANEXUS INC.

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 DNASTAR

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 GENOFAB, INC

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 ILLUMINA, INC

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 PARTEK INCORPORATED

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 PERKINELMER INC.

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 QIAGEN

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 QUEST DIAGNOSTICS INCORPORATED (2021)

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 SEVEN BRIDGES GENOMICS

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 SOPHIA GENETICS

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENTS

16.19 STRAND LIFE SCIENCES

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 WATERS CORPORATION

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 BIOINFORMATICSCOST PER SAMPLE

TABLE 2 EUROPE BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 3 EUROPE SERVICES IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 EUROPE SERVICES IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 EUROPE DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 EUROPE BIOINFORMATICS SOFTWARE IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 EUROPE BIOINFORMATICS SOFTWARE IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 EUROPE SEQUENCING DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 EUROPE SPECIALIZED BIOINFORMATICS APPLICATIONS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 EUROPE KNOWLEDGE MANAGEMENT TOOLS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 EUROPE KNOWLEDGE MANAGEMENT TOOLS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 EUROPE BIOINFORMATICS MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 13 EUROPE MEDICAL BIOTECHNOLOGY IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE ACADEMICS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 EUROPE ANIMAL TECHNOLOGY IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE AGRICULTURAL BIOTECHNOLOGY IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE ENVIRONMENTAL BIOTECHNOLOGY IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 EUROPE FORENSIC BIOTECHNOLOGY IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE OTHERS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 EUROPE BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 21 EUROPE GENOMICS & DRUG DEVELOPMENT IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 EUROPE GENOMICS & DRUG DEVELOPMENT IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 23 EUROPE GENOMICS & DRUG DEVELOPMENT BY TYPE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE PROTEOMICS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 EUROPE PROTEOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 EUROPE AGRICULTURAL STUDIES IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 EUROPE AGRICULTURAL STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 28 EUROPE TRANSCRIPTOMICS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 EUROPE TRANSCRIPTOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 30 EUROPE METABOLOMICS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 EUROPE METABOLOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 32 EUROPE EVOLUTIONARY STUDIES IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 EUROPE EVOLUTIONARY STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 34 EUROPE VETERINARY SCIENCE IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 EUROPE VETERINARY SCIENCE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 36 EUROPE OTHERS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 EUROPE OTHERS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 38 EUROPE BIOINFORMATICS MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 39 EUROPE GROUP PURCHASE IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 EUROPE INDIVIDUAL PURCHASE IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 EUROPE BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 42 EUROPE GENOMICS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 EUROPE GENOMICS IN BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 44 EUROPE PROTEOMICS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 EUROPE BIOINFORMATICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 46 EUROPE RESEARCH AND ACADEMIC INSTITUTES IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 EUROPE CLINICAL RESEARCH ORGANIZATION IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 EUROPE BIOTECH AND PHARMACEUTICAL COMPANIES IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 EUROPE RESEARCH LABORATORIES IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 EUROPE HOSPITALS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 EUROPE OTHERS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 EUROPE BIOINFORMATICS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 53 EUROPE BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 EUROPE SERVICES IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 EUROPE DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 EUROPE BIOINFORMATICS SOFTWARE IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 EUROPE SEQUENCING DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 EUROPE SPECIALIZED BIOINFORMATICS APPLICATIONS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 EUROPE KNOWLEDGE MANAGEMENT TOOLS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 EUROPE BIOINFORMATICS MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 61 EUROPE BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 EUROPE GENOMICS & DRUG DEVELOPMENT IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 63 EUROPE GENOMICS & DRUG DEVELOPMENT BY TYPE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 EUROPE PROTEOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 65 EUROPE AGRICULTURAL STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 EUROPE TRANSCRIPTOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 EUROPE METABOLOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 68 EUROPE EVOLUTIONARY STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 69 EUROPE VETERINARY SCIENCE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 EUROPE OTHERS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 71 EUROPE BIOINFORMATICS MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 72 EUROPE BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 73 EUROPE GENOMICS IN BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 74 EUROPE BIOINFORMATICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 75 GERMANY BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 GERMANY SERVICES IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 GERMANY DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 GERMANY BIOINFORMATICS SOFTWARE IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 GERMANY SEQUENCING DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 GERMANY SPECIALIZED BIOINFORMATICS APPLICATIONS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 GERMANY KNOWLEDGE MANAGEMENT TOOLS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 GERMANY BIOINFORMATICS MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 83 GERMANY BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 84 GERMANY GENOMICS & DRUG DEVELOPMENT IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 85 GERMANY GENOMICS & DRUG DEVELOPMENT BY TYPE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 86 GERMANY PROTEOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 87 GERMANY AGRICULTURAL STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 88 GERMANY TRANSCRIPTOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 89 GERMANY METABOLOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 90 GERMANY EVOLUTIONARY STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 91 GERMANY VETERINARY SCIENCE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 92 GERMANY OTHERS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 93 GERMANY BIOINFORMATICS MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 94 GERMANY BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 95 GERMANY GENOMICS IN BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 96 GERMANY BIOINFORMATICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 97 FRANCE BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 FRANCE SERVICES IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 FRANCE DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 FRANCE BIOINFORMATICS SOFTWARE IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 FRANCE SEQUENCING DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 FRANCE SPECIALIZED BIOINFORMATICS APPLICATIONS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 FRANCE KNOWLEDGE MANAGEMENT TOOLS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 FRANCE BIOINFORMATICS MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 105 FRANCE BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 106 FRANCE GENOMICS & DRUG DEVELOPMENT IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 107 FRANCE GENOMICS & DRUG DEVELOPMENT BY TYPE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 108 FRANCE PROTEOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 109 FRANCE AGRICULTURAL STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 110 FRANCE TRANSCRIPTOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 111 FRANCE METABOLOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 112 FRANCE EVOLUTIONARY STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 113 FRANCE VETERINARY SCIENCE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 114 FRANCE OTHERS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 115 FRANCE BIOINFORMATICS MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 116 FRANCE BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 117 FRANCE GENOMICS IN BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 118 FRANCE BIOINFORMATICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 119 U.K. BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 U.K. SERVICES IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 U.K. DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 U.K. BIOINFORMATICS SOFTWARE IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 U.K. SEQUENCING DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 U.K. SPECIALIZED BIOINFORMATICS APPLICATIONS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 U.K. KNOWLEDGE MANAGEMENT TOOLS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 U.K. BIOINFORMATICS MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 127 U.K. BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 128 U.K. GENOMICS & DRUG DEVELOPMENT IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 129 U.K. GENOMICS & DRUG DEVELOPMENT BY TYPE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 130 U.K. PROTEOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 131 U.K. AGRICULTURAL STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 132 U.K. TRANSCRIPTOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 133 U.K. METABOLOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 134 U.K. EVOLUTIONARY STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 135 U.K. VETERINARY SCIENCE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 136 U.K. OTHERS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 137 U.K. BIOINFORMATICS MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 138 U.K. BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 139 U.K GENOMICS IN BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 140 U.K. BIOINFORMATICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 141 ITALY BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 ITALY SERVICES IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 143 ITALY DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 ITALY BIOINFORMATICS SOFTWARE IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 145 ITALY SEQUENCING DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 146 ITALY SPECIALIZED BIOINFORMATICS APPLICATIONS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 147 ITALY KNOWLEDGE MANAGEMENT TOOLS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 ITALY BIOINFORMATICS MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 149 ITALY BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 150 ITALY GENOMICS & DRUG DEVELOPMENT IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 151 ITALY GENOMICS & DRUG DEVELOPMENT BY TYPE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 152 ITALY PROTEOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 153 ITALY AGRICULTURAL STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 154 ITALY TRANSCRIPTOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 155 ITALY METABOLOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 156 ITALY EVOLUTIONARY STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 157 ITALY VETERINARY SCIENCE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 158 ITALY OTHERS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 159 ITALY BIOINFORMATICS MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 160 ITALY BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 161 ITALY GENOMICS IN BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 162 ITALY BIOINFORMATICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 163 RUSSIA BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 164 RUSSIA SERVICES IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 165 RUSSIA DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 166 RUSSIA BIOINFORMATICS SOFTWARE IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 167 RUSSIA SEQUENCING DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 168 RUSSIA SPECIALIZED BIOINFORMATICS APPLICATIONS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 169 RUSSIA KNOWLEDGE MANAGEMENT TOOLS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 170 RUSSIA BIOINFORMATICS MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 171 RUSSIA BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 172 RUSSIA GENOMICS & DRUG DEVELOPMENT IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 173 RUSSIA GENOMICS & DRUG DEVELOPMENT BY TYPE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 174 RUSSIA PROTEOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 175 RUSSIA AGRICULTURAL STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 176 RUSSIA TRANSCRIPTOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 177 RUSSIA METABOLOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 178 RUSSIA EVOLUTIONARY STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 179 RUSSIA VETERINARY SCIENCE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 180 RUSSIA OTHERS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 181 RUSSIA BIOINFORMATICS MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 182 RUSSIA BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 183 RUSSIA GENOMICS IN BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 184 RUSSIA BIOINFORMATICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 185 SPAIN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 186 SPAIN SERVICES IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 187 SPAIN DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 188 SPAIN BIOINFORMATICS SOFTWARE IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 189 SPAIN SEQUENCING DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 190 SPAIN SPECIALIZED BIOINFORMATICS APPLICATIONS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 191 SPAIN KNOWLEDGE MANAGEMENT TOOLS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 192 SPAIN BIOINFORMATICS MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 193 SPAIN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 194 SPAIN GENOMICS & DRUG DEVELOPMENT IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 195 SPAIN GENOMICS & DRUG DEVELOPMENT BY TYPE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 196 SPAIN PROTEOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 197 SPAIN AGRICULTURAL STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 198 SPAIN TRANSCRIPTOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 199 SPAIN METABOLOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 200 SPAIN EVOLUTIONARY STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 201 SPAIN VETERINARY SCIENCE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 202 SPAIN OTHERS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 203 SPAIN BIOINFORMATICS MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 204 SPAIN BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 205 SPAIN GENOMICS IN BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 206 SPAIN BIOINFORMATICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 207 SWITZERLAND BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 208 SWITZERLAND SERVICES IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 209 SWITZERLAND DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 210 SWITZERLAND BIOINFORMATICS SOFTWARE IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 211 SWITZERLAND SEQUENCING DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 212 SWITZERLAND SPECIALIZED BIOINFORMATICS APPLICATIONS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 213 SWITZERLAND KNOWLEDGE MANAGEMENT TOOLS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 214 SWITZERLAND BIOINFORMATICS MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 215 SWITZERLAND BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 216 SWITZERLAND GENOMICS & DRUG DEVELOPMENT IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 217 SWITZERLAND GENOMICS & DRUG DEVELOPMENT BY TYPE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 218 SWITZERLAND PROTEOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 219 SWITZERLAND AGRICULTURAL STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 220 SWITZERLAND TRANSCRIPTOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 221 SWITZERLAND METABOLOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 222 SWITZERLAND EVOLUTIONARY STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 223 SWITZERLAND VETERINARY SCIENCE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 224 SWITZERLAND OTHERS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 225 SWITZERLAND BIOINFORMATICS MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 226 SWITZERLAND BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 227 SWITZERLAND GENOMICS IN BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 228 SWITZERLAND BIOINFORMATICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 229 NETHERLANDS BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 230 NETHERLANDS SERVICES IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 231 NETHERLANDS DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 232 NETHERLANDS BIOINFORMATICS SOFTWARE IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 233 NETHERLANDS SEQUENCING DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 234 NETHERLANDS SPECIALIZED BIOINFORMATICS APPLICATIONS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 235 NETHERLANDS KNOWLEDGE MANAGEMENT TOOLS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 236 NETHERLANDS BIOINFORMATICS MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 237 NETHERLANDS BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 238 NETHERLANDS GENOMICS & DRUG DEVELOPMENT IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 239 NETHERLANDS GENOMICS & DRUG DEVELOPMENT BY TYPE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 240 NETHERLANDS PROTEOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 241 NETHERLANDS AGRICULTURAL STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 242 NETHERLANDS TRANSCRIPTOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 243 NETHERLANDS METABOLOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 244 NETHERLANDS EVOLUTIONARY STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 245 NETHERLANDS VETERINARY SCIENCE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 246 NETHERLANDS OTHERS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 247 NETHERLANDS BIOINFORMATICS MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 248 NETHERLANDS BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 249 NETHERLANDS GENOMICS IN BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 250 NETHERLANDS BIOINFORMATICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 251 BELGIUM BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 252 BELGIUM SERVICES IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 253 BELGIUM DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 254 BELGIUM BIOINFORMATICS SOFTWARE IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 255 BELGIUM SEQUENCING DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 256 BELGIUM SPECIALIZED BIOINFORMATICS APPLICATIONS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 257 BELGIUM KNOWLEDGE MANAGEMENT TOOLS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 258 BELGIUM BIOINFORMATICS MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 259 BELGIUM BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 260 BELGIUM GENOMICS & DRUG DEVELOPMENT IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 261 BELGIUM GENOMICS & DRUG DEVELOPMENT BY TYPE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 262 BELGIUM PROTEOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 263 BELGIUM AGRICULTURAL STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 264 BELGIUM TRANSCRIPTOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 265 BELGIUM METABOLOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 266 BELGIUM EVOLUTIONARY STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 267 BELGIUM VETERINARY SCIENCE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 268 BELGIUM OTHERS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 269 BELGIUM BIOINFORMATICS MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 270 BELGIUM BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 271 BELGIUM GENOMICS IN BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 272 BELGIUM BIOINFORMATICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 273 TURKEY BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 274 TURKEY SERVICES IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 275 TURKEY DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 276 TURKEY BIOINFORMATICS SOFTWARE IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 277 TURKEY SEQUENCING DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 278 TURKEY SPECIALIZED BIOINFORMATICS APPLICATIONS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 279 TURKEY KNOWLEDGE MANAGEMENT TOOLS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 280 TURKEY BIOINFORMATICS MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 281 TURKEY BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 282 TURKEY GENOMICS & DRUG DEVELOPMENT IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 283 TURKEY GENOMICS & DRUG DEVELOPMENT BY TYPE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 284 TURKEY PROTEOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 285 TURKEY AGRICULTURAL STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 286 TURKEY TRANSCRIPTOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 287 TURKEY METABOLOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 288 TURKEY EVOLUTIONARY STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 289 TURKEY VETERINARY SCIENCE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 290 TURKEY OTHERS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 291 TURKEY BIOINFORMATICS MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 292 TURKEY BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 293 TURKEY GENOMICS IN BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 294 TURKEY BIOINFORMATICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 295 REST OF EUROPE BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 EUROPE BIOINFORMATICS MARKET: SEGMENTATION

FIGURE 2 EUROPE BIOINFORMATICS MARKET: GEOGRAPHIC SCOPE

FIGURE 3 EUROPE BIOINFORMATICS MARKET: DATA TRIANGULATION

FIGURE 4 EUROPE BIOINFORMATICS MARKET: SNAPSHOT

FIGURE 5 EUROPE BIOINFORMATICS MARKET: BOTTOM-UP APPROACH

FIGURE 6 EUROPE BIOINFORMATICS MARKET: TOP-DOWN APPROACH

FIGURE 7 EUROPE BIOINFORMATICS MARKET: INTERVIEWS BY REGION AND DESIGNATION

FIGURE 8 EUROPE BIOINFORMATICS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE BIOINFORMATICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE BIOINFORMATICS MARKET: APPLICATION COVERAGE GRID

FIGURE 11 EUROPE BIOINFORMATICS MARKET: THE CATEGORY VS TIME GRID

FIGURE 12 EUROPE BIOINFORMATICS MARKET SEGMENTATION

FIGURE 13 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE EUROPE DENTAL LABMARKET AND IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 GROWING APPLICATIONS OF BIOINFORMATICS AND LOW COST OF BIOINFORMATICS SEQUENCING ARE EXPECTED TO DRIVE THE MARKET FOR EUROPE BIOINFORMATICS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 SERVICES SEGMENT ARE EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE BIOINFORMATICS MARKET IN 2019 & 2026

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE BIOINFORMATICS MARKET

FIGURE 17 DECREASE IN COST OF PER BASE SEQUENCING

FIGURE 18 GROWING NEED FOR BIOINFORMATICS IN VITAL APPLICATIONS

FIGURE 19 EUROPE BIOINFORMATICS MARKET: BY TYPE, 2021

FIGURE 20 EUROPE BIOINFORMATICS MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 21 EUROPE BIOINFORMATICS MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 22 EUROPE BIOINFORMATICS MARKET: BY TYPE, LIFELINE CURVE

FIGURE 23 EUROPE BIOINFORMATICS MARKET: BY SECTOR, 2021

FIGURE 24 EUROPE BIOINFORMATICS MARKET: BY SECTOR, 2022-2029 (USD MILLION)

FIGURE 25 EUROPE BIOINFORMATICS MARKET: BY SECTOR, CAGR (2022-2029)

FIGURE 26 EUROPE BIOINFORMATICS MARKET: BY SECTOR, LIFELINE CURVE

FIGURE 27 EUROPE BIOINFORMATICS MARKET: BY APPLICATION, 2021

FIGURE 28 EUROPE BIOINFORMATICS MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 29 EUROPE BIOINFORMATICS MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 30 EUROPE BIOINFORMATICS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 31 EUROPE BIOINFORMATICS MARKET: BY PURCHASE MODE, 2021

FIGURE 32 EUROPE BIOINFORMATICS MARKET: BY PURCHASE MODE, 2022-2029 (USD MILLION)

FIGURE 33 EUROPE BIOINFORMATICS MARKET: BY PURCHASE MODE, CAGR (2022-2029)

FIGURE 34 EUROPE BIOINFORMATICS MARKET: BY PURCHASE MODE, LIFELINE CURVE

FIGURE 35 EUROPE BIOINFORMATICS MARKET: BY METHOD, 2021

FIGURE 36 EUROPE BIOINFORMATICS MARKET: BY METHOD, 2022-2029 (USD MILLION)

FIGURE 37 EUROPE BIOINFORMATICS MARKET: BY METHOD, CAGR (2022-2029)

FIGURE 38 EUROPE BIOINFORMATICS MARKET: BY METHOD, LIFELINE CURVE

FIGURE 39 EUROPE BIOINFORMATICS MARKET: BY END USER, 2021

FIGURE 40 EUROPE BIOINFORMATICS MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 41 EUROPE BIOINFORMATICS MARKET: BY END USER, CAGR (2022-2029)

FIGURE 42 EUROPE BIOINFORMATICS MARKET: BY END USER, LIFELINE CURVE

FIGURE 43 EUROPE BIOINFORMATICS MARKET: SNAPSHOT (2021)

FIGURE 44 EUROPE BIOINFORMATICS MARKET: BY COUNTRY (2021)

FIGURE 45 EUROPE BIOINFORMATICS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 46 EUROPE BIOINFORMATICS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 47 EUROPE BIOINFORMATICS MARKET: BY TYPE (2022-2029)

FIGURE 48 EUROPE BIOINFORMATICS MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.