Europe Bioactive Ingredient Market

Taille du marché en milliards USD

TCAC :

%

USD

10.34 Billion

USD

17.90 Billion

2025

2033

USD

10.34 Billion

USD

17.90 Billion

2025

2033

| 2026 –2033 | |

| USD 10.34 Billion | |

| USD 17.90 Billion | |

|

|

|

|

Segmentation du marché européen des ingrédients bioactifs, par type d'ingrédient (prébiotiques, probiotiques, acides aminés, peptides, oméga-3 et lipides structurés, composés phytochimiques et extraits végétaux, minéraux, vitamines, fibres et glucides spéciaux, caroténoïdes et antioxydants, et autres), application (aliments fonctionnels, compléments alimentaires, compléments gélifiés, nutrition animale, soins personnels, et autres) et source (végétale, animale et microbienne) - Tendances du secteur et prévisions jusqu'en 2033

Taille du marché européen des ingrédients bioactifs

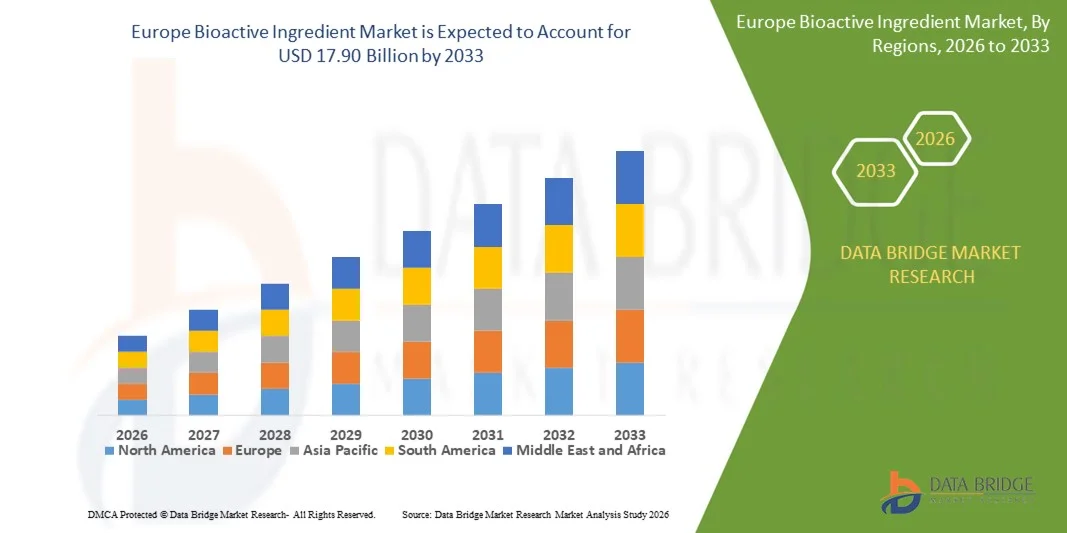

- Le marché européen des ingrédients bioactifs était évalué à 10,34 milliards de dollars en 2025 et devrait atteindre 17,90 milliards de dollars d'ici 2033 , avec un TCAC de 7,10 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la sensibilisation croissante des consommateurs à la santé préventive, à la nutrition fonctionnelle et au rôle des composés bioactifs dans la gestion des troubles liés au mode de vie.

- L'incorporation croissante d'ingrédients bioactifs dans les aliments fonctionnels, les compléments alimentaires, les nutraceutiques et les formulations de soins personnels soutient davantage l'expansion soutenue du marché.

Analyse du marché européen des ingrédients bioactifs

- Le marché connaît une forte dynamique grâce à l'innovation continue dans les technologies d'extraction, de formulation et d'administration qui améliorent la biodisponibilité, la stabilité et l'efficacité des composés bioactifs.

- De plus, la préférence croissante pour les ingrédients naturels, végétaux et à étiquetage clair, associée à l'expansion des applications dans les industries alimentaires, des boissons, pharmaceutiques et cosmétiques, renforce l'attractivité globale du marché.

- Le marché allemand des ingrédients bioactifs a occupé une position dominante en 2025, porté par une forte sensibilisation des consommateurs à la santé et à la nutrition. Des industries agroalimentaires, nutraceutiques et pharmaceutiques bien établies soutiennent une demande constante en composés bioactifs.

- Le Royaume-Uni devrait connaître le taux de croissance annuel composé (TCAC) le plus élevé du marché européen des ingrédients bioactifs, en raison d'une sensibilisation accrue à la santé, d'une demande croissante de compléments alimentaires et d'aliments fonctionnels, d'une préférence grandissante pour les produits d'origine végétale et les produits à étiquetage clair, ainsi que du développement des circuits de distribution en magasin et en ligne.

- Le segment des vitamines a représenté la plus grande part de revenus du marché en 2025, grâce à leur utilisation généralisée dans les aliments fonctionnels, les compléments alimentaires et les boissons enrichies, ainsi qu'à l'intérêt croissant des consommateurs pour l'immunité, l'énergie et le bien-être général. Les vitamines sont largement utilisées en raison de leurs bienfaits reconnus pour la santé, de leur facilité de formulation et de la forte notoriété qu'elles suscitent auprès des consommateurs de tous âges.

Portée du rapport et segmentation du marché européen des ingrédients bioactifs

|

Attributs |

Aperçu du marché européen des ingrédients bioactifs |

|

Segments couverts |

|

|

Pays couverts |

Europe

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

En plus des informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une analyse des prix, une analyse des parts de marché des marques, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Tendances du marché européen des ingrédients bioactifs

Demande croissante de soins de santé préventifs et de nutrition fonctionnelle

- L'intérêt croissant pour le maintien de la santé et la prévention des maladies influence fortement le marché des ingrédients bioactifs, les consommateurs recherchant de plus en plus des ingrédients offrant des bienfaits physiologiques au-delà de la simple nutrition. Les ingrédients bioactifs gagnent en popularité grâce à leur rôle avéré dans le soutien de l'immunité, la santé digestive, le bien-être cardiovasculaire et les performances cognitives. Cette tendance favorise leur intégration dans les aliments fonctionnels, les compléments alimentaires, les nutraceutiques et les produits de soins personnels, incitant les fabricants à développer des formulations innovantes en phase avec les nouvelles habitudes de consommation axées sur la santé.

- La prise de conscience croissante des troubles liés au mode de vie, du vieillissement de la population et du bien-être à long terme a accéléré la demande en ingrédients bioactifs dans les aliments fonctionnels, les boissons enrichies, les compléments alimentaires et les produits de nutrition sportive. Les consommateurs soucieux de leur santé recherchent activement des produits enrichis en antioxydants, probiotiques, acides gras oméga, polyphénols et extraits de plantes, incitant les marques à privilégier la validation scientifique, une formulation transparente et l'efficacité fonctionnelle dans le développement de leurs produits.

- Les tendances en matière de santé préventive et de bien-être influencent les décisions d'achat, les fabricants mettant en avant les bienfaits cliniquement prouvés, l'origine naturelle des ingrédients et l'amélioration de la biodisponibilité. Un étiquetage transparent, des allégations de santé étayées par la recherche et des engagements en matière de développement durable aident les marques à différencier leurs produits et à instaurer la confiance des consommateurs, tout en stimulant les investissements dans la R&D et les systèmes d'administration avancés.

- Par exemple, en 2024, les principales marques de nutrition et de bien-être ont élargi leur gamme en lançant des aliments fonctionnels et des compléments alimentaires enrichis en composés bioactifs tels que les probiotiques, les acides gras oméga-3 et les antioxydants d'origine végétale. Ces lancements ont été motivés par la demande croissante des consommateurs pour des produits renforçant l'immunité, la santé intestinale et l'énergie, et ont rencontré un vif succès dans les circuits de distribution traditionnels, en ligne et auprès des acteurs du secteur de la santé.

- Alors que la demande en ingrédients bioactifs continue de croître, la croissance durable du marché repose sur la recherche continue, le respect des réglementations et la garantie d'une efficacité constante des différentes formulations. Les fabricants s'attachent à améliorer la biodisponibilité, la stabilité et la facilité de production à grande échelle, tout en équilibrant les coûts, la qualité et les preuves scientifiques afin de favoriser une adoption plus large.

Dynamique du marché européen des ingrédients bioactifs

Conducteur

L'intérêt croissant pour les soins de santé préventifs et la consommation d'aliments fonctionnels

- L'intérêt croissant des consommateurs pour la prévention en matière de santé est un moteur essentiel du marché des ingrédients bioactifs. Ils se tournent de plus en plus vers les aliments fonctionnels, les compléments alimentaires et les nutraceutiques enrichis en composés bioactifs pour préserver leur santé à long terme, gérer les maladies chroniques et améliorer leur bien-être général. Cette tendance incite les fabricants à remplacer les ingrédients conventionnels par des bioactifs fonctionnels dont l'efficacité est scientifiquement prouvée.

- L'élargissement des applications aux aliments fonctionnels, aux boissons, aux compléments alimentaires, aux produits pharmaceutiques et aux produits de soins personnels contribue à la croissance du marché. Les ingrédients bioactifs contribuent à améliorer la valeur nutritionnelle, les performances fonctionnelles et le positionnement santé, permettant ainsi aux fabricants de répondre aux attentes changeantes des consommateurs en matière de produits axés sur le bien-être.

- Les fabricants de produits alimentaires, de compléments alimentaires et de produits de soins personnels promeuvent activement les formulations à base d'ingrédients bioactifs grâce à l'innovation produit, la recherche clinique et des campagnes marketing axées sur la santé. Ces efforts sont soutenus par la préférence croissante des consommateurs pour les ingrédients naturels, scientifiquement validés et multifonctionnels, ce qui encourage les partenariats entre les fournisseurs d'ingrédients, les instituts de recherche et les marques.

- Par exemple, en 2023, les principales entreprises mondiales de nutrition et de compléments alimentaires ont fait état d'une incorporation accrue de probiotiques, d'extraits de plantes et d'acides gras oméga dans leurs formulations d'aliments fonctionnels et de compléments. Cette expansion faisait suite à une demande accrue des consommateurs pour des solutions renforçant l'immunité, la santé digestive et les fonctions cognitives, ce qui a favorisé la différenciation des produits et les achats répétés.

- Bien que les tendances en matière de santé préventive soutiennent fortement la croissance du marché, le succès à long terme dépend de l'harmonisation des réglementations, de la constance de la qualité des ingrédients et d'investissements continus dans la recherche et les technologies de formulation afin de répondre à la demande mondiale et de maintenir une position concurrentielle.

Retenue/Défi

Coûts de développement élevés et complexité réglementaire

- Le coût relativement élevé associé au développement et à la commercialisation des ingrédients bioactifs demeure un défi majeur, notamment en raison des exigences importantes en matière de recherche, de validation clinique et de procédés de fabrication avancés. Les processus d'extraction, de purification et de stabilisation augmentent souvent les coûts de production, ce qui limite leur adoption par les fabricants sensibles aux prix.

- La complexité réglementaire et la variabilité des exigences d'approbation relatives aux allégations de santé et aux ingrédients fonctionnels constituent des défis supplémentaires. Les fabricants doivent se conformer à des normes strictes en matière de sécurité, d'efficacité et d'étiquetage, ce qui peut retarder le lancement des produits et accroître les coûts de mise en conformité. Le manque de clarté réglementaire concernant certains nouveaux composés bioactifs limite davantage l'accès au marché.

- Les difficultés liées à la chaîne d'approvisionnement et à la formulation ont également un impact sur la croissance du marché, car certains ingrédients bioactifs sont sensibles à la chaleur, à la lumière et à l'oxydation. Garantir la stabilité, la biodisponibilité et des performances constantes pour différents formats de produits accroît la complexité de la formulation et les coûts opérationnels.

- Par exemple, les fabricants qui ont lancé de nouveaux aliments fonctionnels et compléments alimentaires à base de produits bioactifs en 2024 ont signalé des retards dus à l'allongement des délais d'approbation et à la nécessité de fournir une documentation clinique supplémentaire pour étayer les allégations de santé. Ces facteurs ont allongé les délais de mise sur le marché et freiné les cycles d'innovation.

- Pour relever ces défis, il faudra simplifier les cadres réglementaires, mettre en œuvre des technologies d'extraction rentables et poursuivre les investissements dans la recherche scientifique. La collaboration entre les producteurs d'ingrédients, les organismes de réglementation et les fabricants de produits sera essentielle pour exploiter les opportunités de croissance à long terme et assurer une expansion durable du marché mondial des ingrédients bioactifs.

Étendue du marché européen des ingrédients bioactifs

Le marché est segmenté en fonction du type d'ingrédient, de l'application et de la source.

- Par type d'ingrédient

Le marché européen des ingrédients bioactifs est segmenté, selon leur type, en prébiotiques, probiotiques, acides aminés, peptides, oméga-3 et lipides structurés, composés phytochimiques et extraits végétaux, minéraux, vitamines, fibres et glucides spécifiques, caroténoïdes et antioxydants, et autres. En 2025, le segment des vitamines détenait la plus grande part de chiffre d'affaires, grâce à leur utilisation généralisée dans les aliments fonctionnels, les compléments alimentaires et les boissons enrichies, ainsi qu'à l'intérêt croissant des consommateurs pour l'immunité, l'énergie et le bien-être général. Les vitamines sont largement utilisées en raison de leurs bienfaits reconnus pour la santé, de leur facilité de formulation et de la forte notoriété qu'elles jouissent auprès des consommateurs de tous âges.

Le segment des probiotiques devrait connaître la croissance la plus rapide entre 2026 et 2033, porté par une sensibilisation accrue à la santé intestinale, au bien-être digestif et au soutien du système immunitaire. La consommation croissante d'aliments fermentés, de boissons fonctionnelles et de compléments probiotiques favorise une adoption rapide, les fabricants investissant dans l'innovation des souches et l'amélioration de leur stabilité pour une utilisation plus large.

- Sur demande

Selon leur application, le marché européen des ingrédients bioactifs se segmente en aliments fonctionnels, compléments alimentaires, gommes à mâcher, nutrition animale, soins personnels et autres. Le segment des compléments alimentaires détenait la plus grande part de marché en 2025, porté par une prise de conscience accrue en matière de santé, l'essor des soins préventifs et la demande croissante de formats nutritionnels pratiques. Les ingrédients bioactifs sont largement utilisés dans les gélules, les comprimés et les poudres pour répondre aux besoins immunitaires, énergétiques et aux préoccupations de santé liées au mode de vie.

Le segment des aliments fonctionnels devrait enregistrer le taux de croissance le plus élevé entre 2026 et 2033, porté par la consommation croissante d'aliments et de boissons enrichis offrant des bienfaits supplémentaires pour la santé. Les fabricants s'attachent à intégrer des ingrédients bioactifs dans les produits alimentaires courants afin de répondre à l'évolution des préférences des consommateurs pour une alimentation riche en nutriments et axée sur le bien-être.

- Par source

Selon leur origine, le marché européen des ingrédients bioactifs se divise en trois segments : végétaux, animaux et microbiens. Le segment végétal a dominé le marché en 2025, porté par une forte préférence des consommateurs pour les ingrédients naturels, à la composition claire et issus de sources durables. Les bioactifs d'origine végétale, tels que les polyphénols, les fibres et les extraits végétaux, sont largement utilisés dans l'alimentation, les compléments alimentaires et les produits de soins personnels en raison de leur innocuité perçue et de leurs bienfaits fonctionnels.

Le segment microbien devrait enregistrer le taux de croissance le plus élevé entre 2026 et 2033, grâce à l'utilisation croissante de probiotiques, d'enzymes et d'ingrédients issus de la fermentation. Les progrès réalisés en biotechnologie et dans les procédés de fermentation permettent une production à grande échelle et une qualité constante, rendant les sources microbiennes de plus en plus attractives pour les fabricants d'ingrédients bioactifs.

Analyse régionale du marché européen des ingrédients bioactifs

- Le marché allemand des ingrédients bioactifs a occupé une position dominante en 2025, porté par une forte sensibilisation des consommateurs à la santé et à la nutrition. Des industries agroalimentaires, nutraceutiques et pharmaceutiques bien établies soutiennent une demande constante en composés bioactifs.

- Les consommateurs privilégient la qualité, la sécurité et la conformité réglementaire des produits fonctionnels. L'utilisation massive de vitamines, de minéraux et d'ingrédients d'origine végétale est manifeste. L'investissement continu dans la recherche et le développement permet de maintenir le leadership sur le marché.

Aperçu du marché britannique des ingrédients bioactifs

Le marché britannique des ingrédients bioactifs devrait connaître la croissance la plus rapide entre 2026 et 2033, porté par une prise de conscience accrue des enjeux de santé et l'essor des tendances bien-être liées au mode de vie. La demande croissante de compléments alimentaires et d'aliments fonctionnels accélère la croissance du marché. Les consommateurs privilégient de plus en plus les produits d'origine végétale et les produits à étiquetage clair. Le développement des canaux de distribution en ligne et en magasin améliore l'accessibilité des produits. L'innovation produit et un marketing ciblé favorisent également leur adoption.

Part de marché des ingrédients bioactifs en Europe

L'industrie européenne des ingrédients bioactifs est principalement dominée par des entreprises bien établies, parmi lesquelles :

• BASF SE (Allemagne)

• DSM-Firmenich AG (Pays-Bas)

• Evonik Industries AG (Allemagne)

• Symrise AG (Allemagne)

• Kerry Group plc (Irlande)

• Chr. Hansen Holding A/S (Danemark)

• Arla Foods Ingredients Group P/S (Danemark)

• Roquette Frères (France)

• Lesaffre Group (France)

• Tate & Lyle plc (Royaume-Uni)

• Croda International Plc (Royaume-Uni)

• Glanbia plc (Irlande)

• Novozymes A/S (Danemark)

• Biosearch Life SA (Espagne)

• Südzucker AG (Allemagne)

Dernières évolutions du marché européen des ingrédients bioactifs

- En mai 2021, Chr. Hansen Holding A/S a lancé une nouvelle solution probiotique conçue pour améliorer la santé et les performances des bovins laitiers et de boucherie. Ce probiotique flexible peut être intégré à diverses formulations d'aliments pour animaux, favorisant ainsi une meilleure digestion, une immunité renforcée et une croissance animale optimale. Grâce à sa grande polyvalence d'utilisation, cette solution permet aux éleveurs et aux fabricants d'aliments d'optimiser la productivité de leur cheptel tout en préservant le bien-être animal. Le lancement de ce probiotique consolide la position de Chr. Hansen sur le marché de la nutrition animale et devrait stimuler l'adoption de solutions d'alimentation fonctionnelle sur les marchés mondiaux des produits laitiers et de la viande bovine.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.