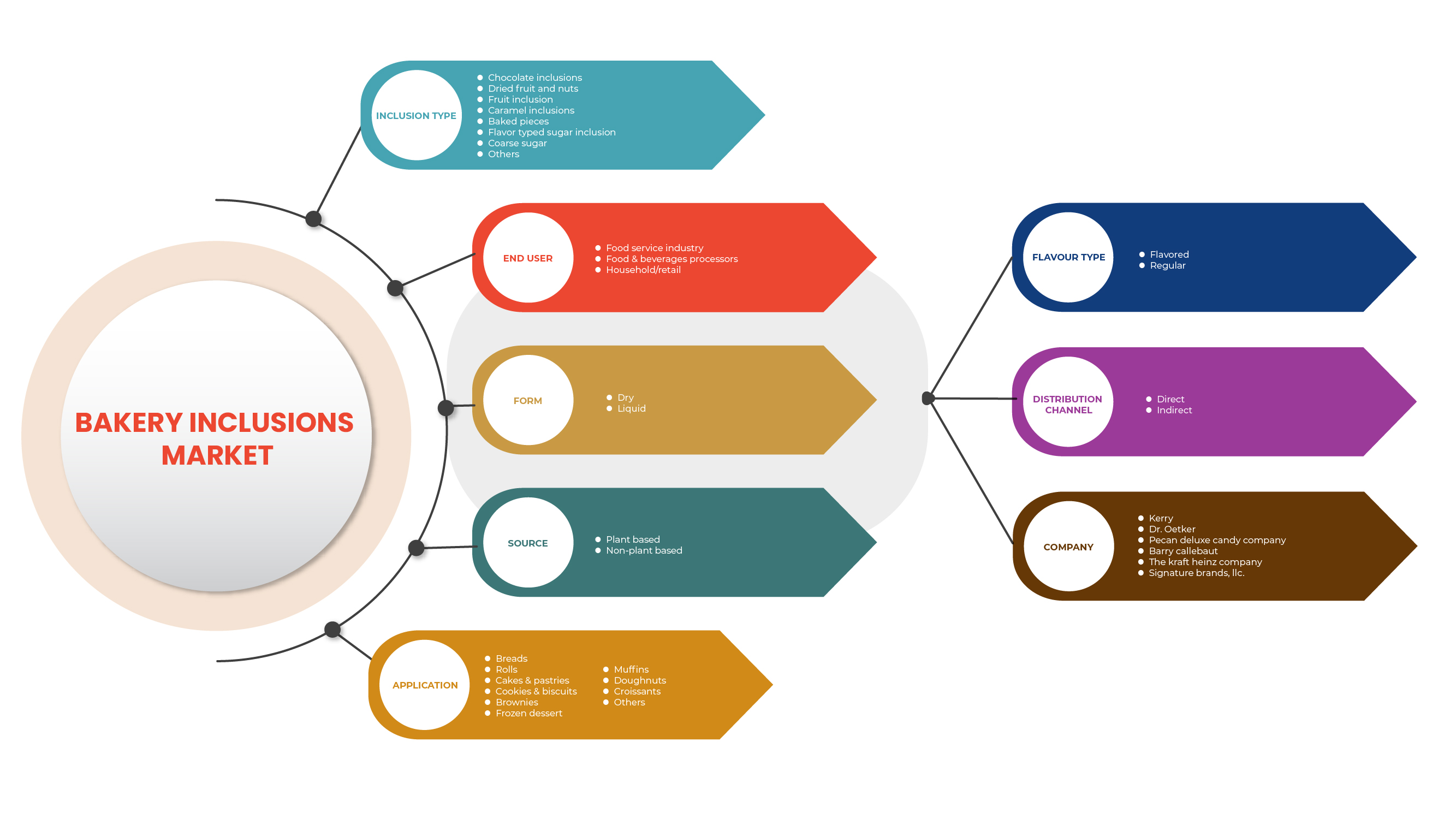

Europe Bakery Inclusions Market, By Inclusion Type (Chocolate Inclusions, Caramel Inclusions, Dried Fruits and Nuts, Coarse Sugar, Baked Pieces, Fruit Inclusion Flavored Sugar Inclusion, and Others), End User (Food & Beverages Processors, Food Service Industry, and Household/Retail), Form (Dry and Liquid), Source (Plant Based and Non-Plant Based), Application (Breads, Muffins, Doughnuts, Croissants, Rolls, Cakes & Pastries, Cookies & Biscuits, and Others), Flavor (Flavor and Regular), Distribution Channel (Direct and Indirect) - Industry Trends and Forecast to 2029.

Market Analysis and Insights

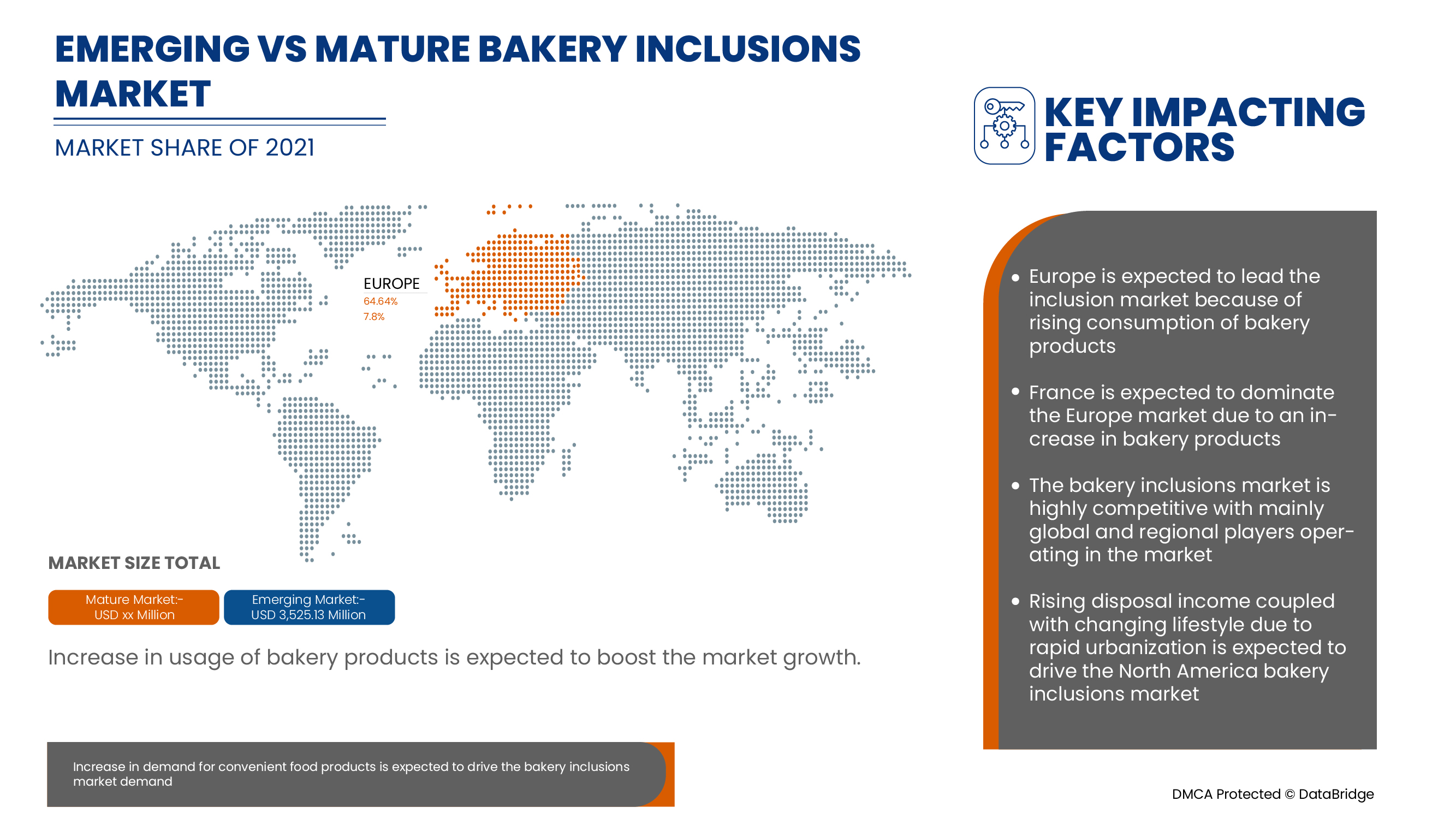

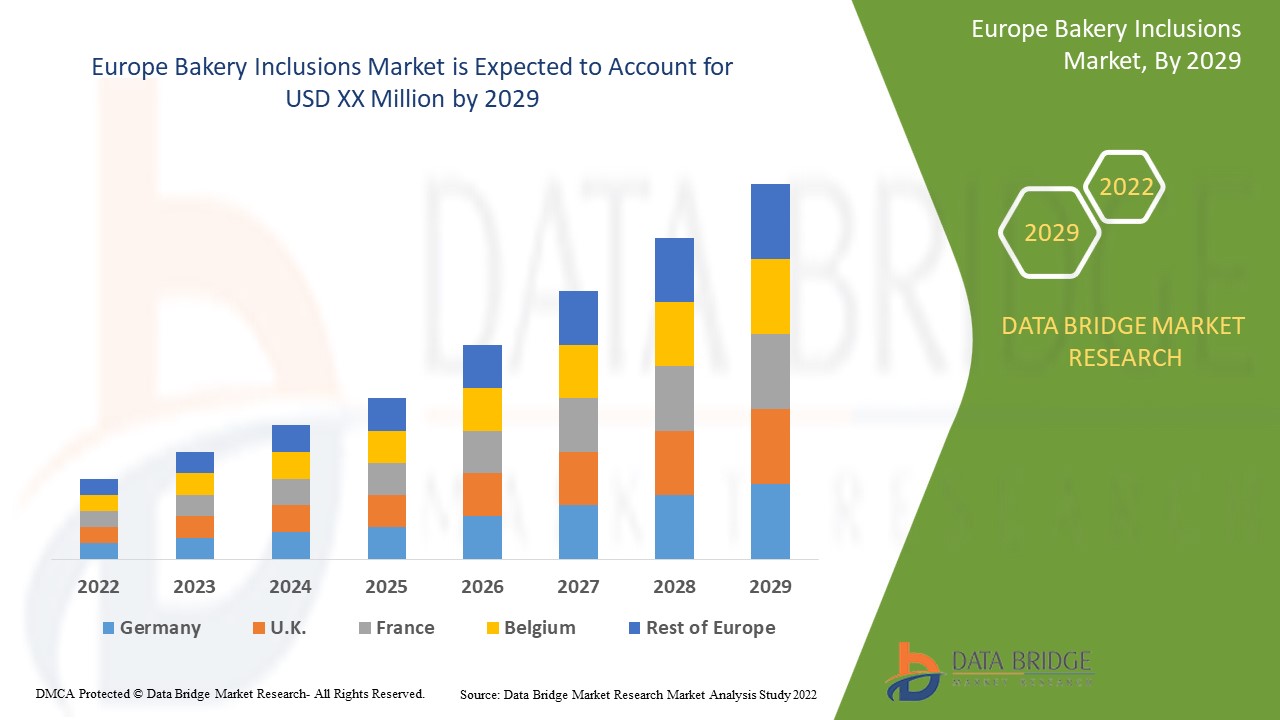

The major growth factor in the bakery inclusions market is rapidly changing lifestyle as well as an increase in the working population. The prime factor driving the demand for bakery inclusions is the increasing demand for processed food with some sort of value addition. Furthermore, the rising disposable incomes, rapid urbanization as well as the growing demand for convenience snacks and confectionaries are also heightening the overall demand for bakery inclusions market over the forecast period. Moreover, the various functional properties offered by inclusions and the increasing demand for bakery and confectionery products also serve as the foremost drivers for increasing the demand for bakery inclusions market. In addition, the presence of a large number of applications in the food and beverages sector is also lifting the growth of the bakery inclusion market. Data Bridge Market Research analyses that the Europe bakery inclusions market will grow at a CAGR of 7.8% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2020 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

By Inclusion Type (Chocolate Inclusions, Caramel Inclusions, Dried Fruits and Nuts, Coarse Sugar, Baked Pieces, Fruit Inclusion Flavored Sugar Inclusion, and Others), End User (Food & Beverages Processors, Food Service Industry, and Household/Retail), Form (Dry and Liquid), Source (Plant Based and Non-Plant Based), Application (Breads, Muffins, Doughnuts, Croissants, Rolls, Cakes & Pastries, Cookies & Biscuits, and Others), Flavor (Flavor and Regular), Distribution Channel (Direct and Indirect) |

|

Countries Covered |

France, Germany, Italy, U.K., Spain, Belgium, Netherlands, Switzerland, Russia, Turkey, Luxembourg and Rest of the Europe |

|

Market Players Covered |

Kerry, Dr. Oetker, Pecan Deluxe Candy Company, Hanns G. Werner GmbH + Co. KG, AMERICAN SPRINKLE COMPANY, Girrbach Süßwarendekor GmbH, Nimbus Foods Ltd, Cacau Foods do Brasil., Britannia Superfine, Shantou Hehe Technology Co., Ltd, Barry Callebaut, The Kraft Heinz Company, Cape Foods, GÜNTHART & Co. KG, entre autres |

Définition du marché :

Les inclusions sont le type de petits panachures qui sont ajoutées aux aliments et aux préparations de boulangerie pour conférer des saveurs, des textures et des couleurs uniques ainsi que diverses autres propriétés souhaitables. Elles sont disponibles sous forme de tranches, de flocons, de pépites, de granulés ou d'autres formes. Les inclusions sont ajoutées aux produits de boulangerie pour un certain nombre de raisons. Les inclusions telles que les noix, les bonbons et les fruits secs peuvent améliorer la texture. Les inclusions telles que les épices, les paillettes et les paillettes améliorent l'esthétique et les propriétés sensorielles. Les inclusions telles que les morceaux de chocolat et les noix de macadamia ajoutent de la gourmandise au produit final. Les inclusions contribuent également à augmenter la valeur nutritionnelle des produits de boulangerie. Les inclusions peuvent fournir des concentrations élevées de protéines, de fibres, de vitamines et d'acides gras essentiels, entre autres, aux produits de boulangerie.

Dynamique du marché des inclusions dans la boulangerie en Europe

Conducteurs

- Augmentation de la consommation de produits de boulangerie

Les produits de boulangerie comprennent le pain de mie levé à la levure, le pain de seigle, les pains plats, les biscuits, les gâteaux, les muffins, les cookies, les petits pains, les feuilletés et les tortillas de farine. Ils sont fabriqués à partir de différentes farines telles que la farine de blé, la farine de sorgho et de nombreux mélanges de différentes farines, avec différentes compositions de mélangeurs, d'émulsifiants, d'exhausteurs de goût, de conservateurs et de nombreux autres ingrédients pour améliorer la texture, la couleur, le goût et les arômes souhaités. Différentes inclusions sont utilisées dans les produits de boulangerie, telles que les inclusions de chocolat, les inclusions de caramel, les fruits secs et les noix, le sucre grossier, les morceaux cuits au four, les inclusions de fruits et les inclusions de sucre aromatisé, entre autres. Ces inclusions apportent du goût et de la texture aux produits de boulangerie.

- Des bienfaits pour la santé alliés au goût dans des inclusions de pâtisserie à base de fruits et de noix

Les inclusions de fruits secs sont des inclusions préférées à l'échelle mondiale en raison de l'augmentation de la demande de produits moins sucrés en raison de la prévalence croissante de l'obésité. Ces inclusions de fruits confèrent une douceur naturelle aux produits. Les inclusions de fruits les plus courantes utilisées sur le marché sont la pomme, l'abricot, la banane, la cerise, le cassis, le rig, le raisin, la mangue, l'ananas et la pêche, entre autres.

Les inclusions de fruits offrent des bienfaits pour la santé tels que des antioxydants, des vitamines, des minéraux et d'autres bienfaits fonctionnels pour la santé. De plus, en raison de l'évolution de la tendance à l'utilisation de sources naturelles de sucre dans les inclusions et de l'abandon du sucre transformé, la demande d'inclusions de fruits augmente. Cela attire également l'attention des consommateurs soucieux de leur santé dans le monde entier.

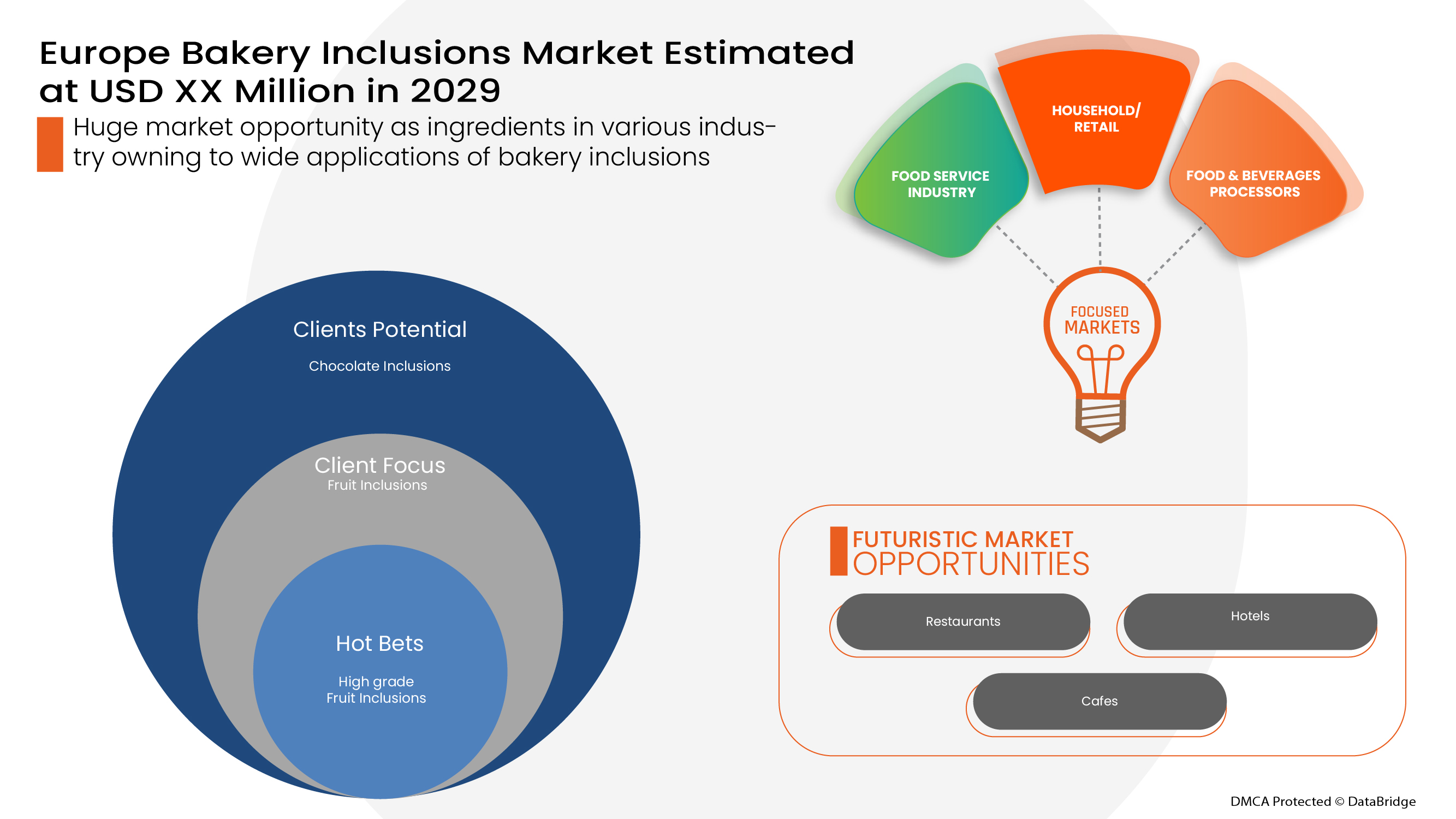

Opportunité

- Augmentation de la demande de produits alimentaires pratiques

La demande de solutions de restauration rapide par les clients d'aujourd'hui augmente rapidement, car le comportement de consommation des repas des clients évolue considérablement. Alors que les individus manquent de plus en plus de temps et de compétences pour préparer la nourriture pour leur maison, de nombreux consommateurs sont prêts à dépenser de l'argent sur le marché des plats préparés. Ce facteur a accru la demande de vente au détail de produits alimentaires prêts à consommer.

La pandémie de coronavirus modifie le mode de vie des consommateurs, qui se tournent désormais vers la consommation d'aliments réconfortants, car la plupart des pays sont contraints de restreindre leurs déplacements et de verrouiller leurs frontières. Le besoin de plats préparés est primordial en cette période, en particulier aux États-Unis, où la pandémie frappe durement le pays.

Retenue/Défi

- Durée de conservation limitée des produits de boulangerie

La principale préoccupation des produits de boulangerie est de conserver leur fraîcheur en termes de goût, de texture et d'arôme. Les produits de boulangerie ont une durée de conservation limitée. Diverses enzymes sont génétiquement modifiées pour améliorer la fraîcheur des produits de boulangerie en préservant la texture, la stabilité, la fraîcheur, le volume et l'arôme appropriés des produits de boulangerie. Ces enzymes ont des effets nocifs sur la santé humaine, ce qui devrait restreindre le marché des produits de boulangerie.

Impact post-COVID-19 sur le marché européen des inclusions de produits de boulangerie

Le COVID-19 a affecté dans une certaine mesure le marché européen des inclusions de boulangerie. En raison du confinement, le processus de fabrication a été interrompu et la demande des utilisateurs finaux a également diminué, ce qui a affecté le marché. Après le COVID, la demande d'inclusions de boulangerie a augmenté en raison des changements dans les habitudes d'achat des consommateurs et d'une évolution progressive vers une augmentation de la demande d'inclusions de boulangerie parmi divers utilisateurs finaux tels que l'automobile, l'aérospatiale et la défense, l'électronique et l'électricité, le bâtiment et la construction, et autres.

Développements récents

- En janvier 2022, Pecan Deluxe Candy Company a reçu le prix de la grande entreprise Food Quality and Safety Award 2021. Ce prix a aidé l'entreprise à attirer davantage de clients

- En avril 2021, Pecan Deluxe Candy Company a lancé Popping Boba. Ce lancement de produit a aidé l'entreprise à élargir son portefeuille de produits

- En septembre 2021, Dr. Oetker a acquis Kuppies, forays. Cette acquisition a permis à l'entreprise d'élargir sa présence et son portefeuille

- En avril 2021, Pecan Deluxe Candy Company a lancé Popping Boba. Ce lancement de produit a aidé l'entreprise à élargir son portefeuille de produits

- En septembre 2021, Nimbus Foods Ltd a conclu un partenariat stratégique avec Herza. Herza est un producteur leader de chocolat fonctionnel et de composés destinés à la fabrication de produits alimentaires. Ce partenariat a aidé l'entreprise à élargir sa gamme de produits

Portée du marché européen des inclusions dans la boulangerie

Le marché européen des inclusions de boulangerie est segmenté en type d'inclusion, saveur, forme, utilisateur final, source, application et canal de distribution. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

TYPE D'INCLUSION

- Inclusions de chocolat

- Fruits secs et noix

- inclusion de fruits

- Inclusions de caramel

- Morceaux cuits au four

- Inclusion de sucre typé saveur

- Sucre grossier

- Autres

Sur la base du type d'inclusion, le marché européen des inclusions de boulangerie est segmenté en inclusions de chocolat, inclusions de caramel, fruits secs et noix, sucre grossier, morceaux cuits au four, inclusion de fruits, inclusion de sucre aromatisé et autres.

UTILISATEUR FINAL

- Secteur de la restauration

- Transformateurs d'aliments et de boissons

- Ménage/Commerce de détail

Sur la base de l'utilisateur final, le marché européen des inclusions de boulangerie est segmenté en transformateurs d'aliments et de boissons, industrie de la restauration et ménages/vente au détail.

FORMULAIRE

- Sec

- Liquide

Sur la base de la forme, le marché européen des inclusions de boulangerie est segmenté en sec et liquide.

SOURCE

- À base de plantes

- Non d'origine végétale

Sur la base de la source, le marché européen des inclusions de boulangerie est segmenté en produits d'origine végétale et non végétale.

APPLICATION

- Pains

- Rouleaux

- Gâteaux et pâtisseries

- Biscuits et biscuits

- Brownies

- Dessert glacé

- Muffins

- Beignets

- Croissants

- Autres

Sur la base des applications, le marché européen des inclusions de boulangerie est segmenté en pains, muffins, beignets, croissants, petits pains, gâteaux et pâtisseries, biscuits et biscuits, et autres.

TYPE DE SAVEUR

- Parfumé

- Régulier

Sur la base de la saveur, le marché européen des inclusions de boulangerie est segmenté en saveur et en régulier.

CANAL DE DISTRIBUTION

- Direct

- Indirect

Sur la base du canal de distribution, le marché européen des inclusions de boulangerie est segmenté en direct et indirect.

Analyse/perspectives régionales du marché des inclusions de boulangerie en Europe

Le marché européen des inclusions de boulangerie est analysé et des informations sur la taille du marché et les tendances sont fournies par type d’inclusion, saveur, forme, utilisateur final, source, application et canal de distribution.

Les régions couvertes par le rapport sur le marché de l’inclusion de la boulangerie en Europe sont la France, l’Allemagne, l’Italie, le Royaume-Uni, l’Espagne, la Belgique, les Pays-Bas, la Suisse, la Russie, la Turquie, le Luxembourg et le reste de l’Europe.

La France devrait dominer le marché européen des inclusions de boulangerie au cours de la période de prévision en raison d'une augmentation de l'utilisation des produits de boulangerie.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché qui ont un impact sur les tendances actuelles et futures du marché. Les points de données, tels que les ventes de produits neufs et de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation, sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la forte concurrence des marques locales et nationales et l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des boulangeries européennes

Le paysage concurrentiel du marché européen des inclusions de boulangerie fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Europe, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises sur le marché européen des inclusions de boulangerie.

Certains des principaux acteurs opérant sur le marché des inclusions de boulangerie sont Kerry, Dr. Oetker, Pecan Deluxe Candy Company, Hanns G. Werner GmbH + Co. KG, AMERICAN SPRINKLE COMPANY, Girrbach Süßwarendekor GmbH, Nimbus Foods Ltd, Cacau Foods do Brasil., Britannia Superfine, Shantou Hehe Technology Co., Ltd, Barry Callebaut, The Kraft Heinz Company, Cape Foods, GÜNTHART & Co. KG, entre autres.

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse des parts de marché Europe vs. Région et fournisseur. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE BAKERY INCLUSIONS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND COMPETITIVE ANALYSIS

4.2 BRAND LEVEL VS PRIVATE LABEL

4.3 FUTURE TRENDS

4.3.1 TASTE

4.3.2 LOW SUGAR, LOW CALORIE, AND CLEAN LABEL DEMAND

4.4 HOW FLAVORS ARE DELIVERED TO BAKERY PRODUCERS

4.4.1 INTERNAL FLAVORING

4.4.2 FILLINGS AND ICING

4.5 IMPORT & EXPORT ANALYSIS OF EUROPE BAKERY INCLUSION MARKET

4.5.1 IMPORT-EXPORT ANALYSIS OF CHOCOLATE

4.5.2 IMPORT-EXPORT ANALYSIS OF EDIBLE FRUIT AND NUTS

4.6 MARKETING STRATEGIES

4.7 PATENT ANALYSIS OF EUROPE BAKERY INCLUSIONS MARKET

4.7.1 DBMR ANALYSIS

4.7.2 COUNTRY-LEVEL ANALYSIS

4.7.3 YEARWISE ANALYSIS

4.8 EUROPE BAKERY INCLUSION MARKET PRODUCTION AND CONSUMPTION

5 SUPPLY CHAIN OF EUROPE BAKERY INCLUSIONS MARKET

5.1 RAW MATERIAL PROCUREMENT

5.2 MANUFACTURING

5.3 PROCESSED INCLUSIONS:

5.4 MARKETING AND DISTRIBUTION

5.5 END USERS

6 EUROPE BAKERY INCLUSION MARKET: REGULATIONS

6.1 COMMISSION REGULATION (EU)

6.2 EUROPEAN UNION

6.3 REGULATIONS BY USFDA

6.4 GOVERNMENT OF CANADA

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISE IN CONSUMPTION OF BAKERY PRODUCTS

7.1.2 HEALTH BENEFITS COMBINED WITH TASTE IN FRUIT- AND NUT-BASED BAKERY INCLUSIONS

7.1.3 QUALITY CLAIMS AND CERTIFICATIONS FOR INCLUSIONS LEND CREDIBILITY TO END PRODUCTS

7.1.4 RISING DISPOSABLE INCOME COUPLED WITH CHANGING LIFESTYLES DUE TO RAPID URBANIZATION

7.2 RESTRAINTS

7.2.1 LIMITED SHELF LIFE OF BAKERY PRODUCTS

7.2.2 DECREASE IN ADOPTION OF BAKERY PRODUCTS DUE TO INCREASED HEALTH CONSCIOUSNESS

7.3 OPPORTUNITIES

7.3.1 INCREASE IN DEMAND FOR CONVENIENT FOOD PRODUCTS

7.3.2 GROW IN DEMAND FOR VEGAN AND PLANT-BASED BAKERY PRODUCTS

7.3.3 TECHNOLOGY INTERVENTION IN INCLUSIONS PROPELLING UTILIZATION IN DIFFERENT APPLICATIONS

7.4 CHALLENGES

7.4.1 DISTURBANCE IN SUPPLY CHAIN DUE TO COVID-19 PANDEMIC

7.4.2 STRINGENT GOVERNMENT REGULATIONS

8 EUROPE BAKERY INCLUSIONS MARKET, BY INCLUSION TYPE

8.1 OVERVIEW

8.2 CHOCOLATE INCLUSIONS

8.2.1 CHOCOLATE CHUNKS

8.2.1.1 DARK

8.2.1.2 MILK

8.2.1.3 WHITE

8.2.2 CHOCOLATE FLAKES

8.2.2.1 DARK

8.2.2.2 MILK

8.2.2.3 WHITE

8.2.3 CHOCOLATE SYRUPS

8.2.3.1 DARK

8.2.3.2 MILK

8.2.3.3 WHITE

8.2.4 OTHERS

8.2.4.1 DARK

8.2.4.2 MILK

8.2.4.3 WHITE

8.3 DRIED FRUITS AND NUTS

8.3.1 ALMOND

8.3.2 WALNUTS

8.3.3 HAZELNUTS

8.3.4 CASHEW

8.3.5 CHESTNUTS

8.3.6 BRAZIL NUTS

8.3.7 MACADAMIA NUTS

8.3.8 HICKORY NUTS

8.3.9 RESINS

8.3.10 OTHERS

8.4 FRUIT INCLUSION

8.4.1 BERRIES

8.4.1.1 STRAWBERRY

8.4.1.2 BLACKBERRY

8.4.1.3 CRANBERRY

8.4.1.4 BLUEBERRY

8.4.1.5 RASPBERRY

8.4.1.6 OTHERS

8.4.2 CHERRY

8.4.3 APPLE

8.4.4 BANANA

8.4.5 CITRUS FRUITS

8.4.5.1 LEMON

8.4.5.2 LIME

8.4.5.3 ORANGE

8.4.5.4 GRAPE FRUIT

8.4.5.5 OTHERS

8.4.6 BLACKCURRANT

8.4.7 MANGO

8.4.8 APRICOT

8.4.9 PINEAPPLE

8.4.10 PEACH

8.4.11 GRAPE

8.4.12 RIG

8.4.13 OTHERS

8.5 CARAMEL INCLUSIONS

8.5.1 NUTS SABLAGE

8.5.2 CARAMEL CRISPY BITES

8.5.3 CARAMEL CRUNCHES

8.6 BAKED PIECES

8.7 FLAVOR TYPED SUGAR INCLUSION

8.8 COARSE SUGAR

8.9 OTHERS

9 EUROPE BAKERY INCLUSIONS MARKET, BY END USER

9.1 OVERVIEW

9.2 FOOD SERVICE INDUSTRY

9.2.1 RESTAURANTS

9.2.2 HOTELS

9.2.3 CAFES

9.2.4 SHAKES AND SMOOTHIES PARLORS

9.2.5 OTHERS

9.3 FOOD & BEVERAGES PROCESSORS

9.4 HOUSEHOLD/RETAIL

10 EUROPE BAKERY INCLUSIONS MARKET, BY FORM

10.1 OVERVIEW

10.2 DRY

10.2.1 FLAKES & CRUNCHES

10.2.2 CHIPS & NIBS

10.2.3 POWDER

10.2.4 CUBES/PIECES

10.2.5 GRANULES

10.3 LIQUID

10.3.1 CONCENTRATES

10.3.2 PUREE

11 EUROPE BAKERY INCLUSIONS MARKET, BY SOURCE

11.1 OVERVIEW

11.2 PLANT BASED

11.3 NON-PLANT BASED

12 EUROPE BAKERY INCLUSIONS MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 BREADS

12.3 ROLLS

12.4 CAKES & PASTRIES

12.5 COOKIES & BISCUITS

12.6 BROWNIES

12.7 FROZEN DESSERT

12.8 MUFFINS

12.9 DOUGHNUTS

12.1 CROISSANTS

12.11 OTHERS

13 EUROPE BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE

13.1 OVERVIEW

13.2 FLAVORED

13.2.1 CARAMEL

13.2.2 BUTTERSCOTCH

13.2.3 STRAWBERRY

13.2.4 VANILLA

13.2.5 BLUEBERRY

13.2.6 MOCHA

13.2.7 BANANA

13.2.8 CHERRY

13.2.9 PEPPERMINT

13.2.10 OTHERS

13.3 REGULAR

14 EUROPE BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 INDIRECT

14.2.1 STORE-BASED RETAILING

14.2.1.1 SUPERMARKETS/HYPERMARKETS

14.2.1.2 SPECIALTY STORES

14.2.1.3 CONVENIENCE STORES

14.2.1.4 WHOLESALERS

14.2.1.5 GROCERY STORES

14.2.1.6 OTHERS

14.2.2 NON-STORE RETAILING

14.2.2.1 ONLINE

14.2.2.2 VENDING

14.3 DIRECT

15 EUROPE BAKERY INCLUSIONS MARKET

15.1 EUROPE

15.1.1 FRANCE

15.1.2 GERMANY

15.1.3 ITALY

15.1.4 U.K.

15.1.5 SPAIN

15.1.6 BELGIUM

15.1.7 NETHERLAND

15.1.8 SWITZERLAND

15.1.9 RUSSIA

15.1.10 TURKEY

15.1.11 LUXEMBOURG

15.1.12 REST OF EUROPE

16 COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: EUROPE

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 DR. OETKER

18.1.1 COMPANY SNAPSHOT

18.1.2 PRODUCT PORTFOLIO

18.1.3 RECENT DEVELOPMENT

18.1.4 SWOT ANALYSIS

18.2 KERRY

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUS ANALYSIS

18.2.3 PRODUCT PORTFOLIO

18.2.4 RECENT DEVELOPMENTS

18.2.5 SWOT ANALYSIS

18.3 BARRY CALLEBAUT

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUS ANALYSIS

18.3.3 PRODUCT PORTFOLIO

18.3.4 RECENT DEVELOPMENT

18.3.5 SWOT ANALYSIS

18.4 THE KRAFT HEINZ COMPANY

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUS ANALYSIS

18.4.3 PRODUCT PORTFOLIO

18.4.4 RECENT DEVELOPMENT

18.4.5 SWOT ANALYSIS

18.5 PECAN DELUXE CANDY COMPANY

18.5.1 COMPANY SNAPSHOT

18.5.2 PRODUCT PORTFOLIO

18.5.3 RECENT DEVELOPMENTS

18.5.4 SWOT ANALYSIS

18.6 AMERICAN SPRINKLE COMPANY

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENT

18.7 BRITANNIA SUPERFINE

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENTS

18.8 CACAU FOODS DO BRASIL.

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENTS

18.9 CAPE FOODS

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENTS

18.1 GIRRBACH SÜßWARENDEKOR GMBH

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENTS

18.11 GÜNTHART & CO. KG

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENTS

18.12 HANNS G. WERNER GMBH + CO. KG

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENTS

18.13 NIMBUS FOODS LTD

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENT

18.14 PAULAUR CORPORATION

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENT

18.15 SHANTOU HEHE TECHNOLOGY CO.,LTD

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 RECENT DEVELOPMENTS

18.16 SIGNATURE BRANDS, LLC.

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF PRODUCT: CHOCOLATE (USD THOUSAND)

TABLE 2 EXPORT DATA OF PRODUCT: CHOCOLATE (USD THOUSAND)

TABLE 3 IMPORT DATA OF PRODUCT: EDIBLE FRUIT AND NUTS (USD THOUSAND)

TABLE 4 EXPORT DATA OF PRODUCT: EDIBLE FRUIT AND NUTS (USD THOUSAND)

TABLE 5 CANADA'S BAKERY PRODUCTS, MARKET SIZE BY RETAIL VALUE SALES

TABLE 6 PRODUCTION AND CONSUMPTION OF BREAD 2020

TABLE 7 EUROPE BAKERY INCLUSIONS MARKET, BY INCLUSION TYPE, 2020-2029 (USD MILLION)

TABLE 8 EUROPE CHOCOLATE INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 EUROPE CHOCOLATE CHUNKS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 EUROPE CHOCOLATE FLAKES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 11 EUROPE CHOCOLATE SYRUPS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 EUROPE OTHERS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 EUROPE DRIED FRUITS AND NUTS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 EUROPE FRUIT INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 EUROPE BERRIES INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 EUROPE CITRUS FRUITS INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 EUROPE CARAMEL INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 18 EUROPE BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 19 EUROPE FOOD SERVICE INDUSTRY IN BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 20 EUROPE BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 21 EUROPE DRY IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 22 EUROPE LIQUID IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 23 EUROPE BAKERY INCLUSIONS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 24 EUROPE BAKERY INCLUSIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 25 EUROPE BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 26 EUROPE FLAVORED IN BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 27 EUROPE BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 28 EUROPE INDIRECT IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 29 EUROPE STORE-BASED RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 30 EUROPE NON-STORE RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 31 EUROPE BAKERY INCLUSIONS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 32 EUROPE BAKERY INCLUSIONS MARKET, BY INCLUSION TYPE, 2020-2029 (USD MILLION)

TABLE 33 EUROPE CHOCOLATE CHUNKS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 EUROPE CHOCOLATE CHUNKS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 EUROPE CHOCOLATE FLAKES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 EUROPE CHOCOLATE SYRUPS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 EUROPE OTHERS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 EUROPE CARAMEL INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 EUROPE DRIED FRUITS AND NUTS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 EUROPE FRUIT INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 EUROPE BERRIES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 EUROPE CITRUS FRUITS INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 EUROPE BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 44 EUROPE FOOD SERVICE INDUSTRY IN BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 45 EUROPE BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 46 EUROPE DRY IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 47 EUROPE LIQUID IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 48 EUROPE BAKERY INCLUSIONS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 49 EUROPE BAKERY INCLUSIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 EUROPE BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 51 EUROPE FLAVORED IN BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 52 EUROPE BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 53 EUROPE INDIRECT IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 54 EUROPE STORE-BASED RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 55 EUROPE NON-STORE RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 56 FRANCE BAKERY INCLUSIONS MARKET, BY INCLUSION TYPE, 2020-2029 (USD MILLION)

TABLE 57 FRANCE CHOCOLATE INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 FRANCE CHOCOLATE CHUNKS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 FRANCE CHOCOLATE FLAKES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 FRANCE CHOCOLATE SYRUPS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 FRANCE OTHERS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 FRANCE CARAMEL INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 FRANCE DRIED FRUITS AND NUTS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 FRANCE FRUIT INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 FRANCE BERRIES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 FRANCE CITRUS FRUITS INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 FRANCE BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 68 FRANCE FOOD SERVICE INDUSTRY IN BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 69 FRANCE BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 70 FRANCE DRY IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 71 FRANCE LIQUID IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 72 FRANCE BAKERY INCLUSIONS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 73 FRANCE BAKERY INCLUSIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 FRANCE BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 75 FRANCE FLAVORED IN BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 76 FRANCE BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 77 FRANCE INDIRECT IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 78 FRANCE STORE-BASED RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 79 FRANCE NON-STORE RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 80 GERMANY BAKERY INCLUSIONS MARKET, BY INCLUSION TYPE, 2020-2029 (USD MILLION)

TABLE 81 GERMANY CHOCOLATE INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 GERMANY CHOCOLATE CHUNKS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 GERMANY CHOCOLATE FLAKES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 GERMANY CHOCOLATE SYRUPS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 GERMANY OTHERS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 GERMANY CARAMEL INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 GERMANY DRIED FRUITS AND NUTS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 GERMANY FRUIT INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 GERMANY BERRIES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 GERMANY CITRUS FRUITS INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 GERMANY BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 92 GERMANY FOOD SERVICE INDUSTRY IN BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 93 GERMANY BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 94 GERMANY DRY IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 95 GERMANY LIQUID IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 96 GERMANY BAKERY INCLUSIONS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 97 GERMANY BAKERY INCLUSIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 GERMANY BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 99 GERMANY FLAVORED IN BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 100 GERMANY BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 101 GERMANY INDIRECT IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 102 GERMANY STORE-BASED RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 103 GERMANY NON-STORE RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 104 ITALY BAKERY INCLUSIONS MARKET, BY INCLUSION TYPE, 2020-2029 (USD MILLION)

TABLE 105 ITALY CHOCOLATE INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 ITALY CHOCOLATE CHUNKS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 ITALY CHOCOLATE FLAKES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 ITALY CHOCOLATE SYRUPS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 ITALY OTHERS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 ITALY CARAMEL INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 ITALY DRIED FRUITS AND NUTS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 ITALY FRUIT INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 ITALY BERRIES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 ITALY CITRUS FRUITS INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 115 ITALY BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 116 ITALY FOOD SERVICE INDUSTRY IN BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 117 ITALY BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 118 ITALY DRY IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 119 ITALY LIQUID IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 120 ITALY BAKERY INCLUSIONS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 121 ITALY BAKERY INCLUSIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 122 ITALY BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 123 ITALY FLAVORED IN BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 124 ITALY BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 125 ITALY INDIRECT IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 126 ITALY STORE-BASED RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 127 ITALY NON-STORE RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 128 U.K. BAKERY INCLUSIONS MARKET, BY INCLUSION TYPE, 2020-2029 (USD MILLION)

TABLE 129 U.K. CHOCOLATE CHUNKS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 U.K. CHOCOLATE CHUNKS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 131 U.K. CHOCOLATE FLAKES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 U.K. CHOCOLATE SYRUPS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 133 U.K. OTHERS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 U.K. CARAMEL INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 135 U.K. DRIED FRUITS AND NUTS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 136 U.K. FRUIT INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 137 U.K. BERRIES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 U.K. CITRUS FRUITS INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 U.K. BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 140 U.K. FOOD SERVICE INDUSTRY IN BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 141 U.K. BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 142 U.K. DRY IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 143 U.K. LIQUID IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 144 U.K. BAKERY INCLUSIONS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 145 U.K. BAKERY INCLUSIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 146 U.K. BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 147 U.K. FLAVORED IN BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 148 U.K. BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 149 U.K. INDIRECT IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 150 U.K. STORE-BASED RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 151 U.K. NON-STORE RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 152 SPAIN BAKERY INCLUSIONS MARKET, BY INCLUSION TYPE, 2020-2029 (USD MILLION)

TABLE 153 SPAIN CHOCOLATE INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 154 SPAIN CHOCOLATE CHUNKS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 155 SPAIN CHOCOLATE FLAKES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 156 SPAIN CHOCOLATE SYRUPS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 157 SPAIN OTHERS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 158 SPAIN CARAMEL INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 159 SPAIN DRIED FRUITS AND NUTS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 160 SPAIN FRUIT INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 161 SPAIN BERRIES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 162 SPAIN CITRUS FRUITS INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 163 SPAIN BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 164 SPAIN FOOD SERVICE INDUSTRY IN BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 165 SPAIN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 166 SPAIN DRY IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 167 SPAIN LIQUID IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 168 SPAIN BAKERY INCLUSIONS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 169 SPAIN BAKERY INCLUSIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 170 SPAIN BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 171 SPAIN FLAVORED IN BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 172 SPAIN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 173 SPAIN INDIRECT IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 174 SPAIN STORE-BASED RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 175 SPAIN NON-STORE RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 176 BELGIUM BAKERY INCLUSIONS MARKET, BY INCLUSION TYPE, 2020-2029 (USD MILLION)

TABLE 177 BELGIUM CHOCOLATE INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 178 BELGIUM CHOCOLATE CHUNKS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 179 BELGIUM CHOCOLATE FLAKES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 180 BELGIUM CHOCOLATE SYRUPS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 181 BELGIUM OTHERS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 182 BELGIUM CARAMEL INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 183 BELGIUM DRIED FRUITS AND NUTS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 184 BELGIUM FRUIT INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 185 BELGIUM BERRIES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 186 BELGIUM CITRUS FRUITS INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 187 BELGIUM BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 188 BELGIUM FOOD SERVICE INDUSTRY IN BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 189 BELGIUM BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 190 BELGIUM DRY IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 191 BELGIUM LIQUID IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 192 BELGIUM BAKERY INCLUSIONS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 193 BELGIUM BAKERY INCLUSIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 194 BELGIUM BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 195 BELGIUM FLAVORED IN BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 196 BELGIUM BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 197 BELGIUM INDIRECT IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 198 BELGIUM STORE-BASED RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 199 BELGIUM NON-STORE RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 200 NETHERLAND BAKERY INCLUSIONS MARKET, BY INCLUSION TYPE, 2020-2029 (USD MILLION)

TABLE 201 NETHERLAND CHOCOLATE INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 202 NETHERLAND CHOCOLATE CHUNKS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 203 NETHERLAND CHOCOLATE FLAKES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 204 NETHERLAND CHOCOLATE SYRUPS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 205 NETHERLAND OTHERS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 206 NETHERLAND CARAMEL INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 207 NETHERLAND DRIED FRUITS AND NUTS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 208 NETHERLAND FRUIT INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 209 NETHERLAND BERRIES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 210 NETHERLAND CITRUS FRUITS INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 211 NETHERLAND BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 212 NETHERLAND FOOD SERVICE INDUSTRY IN BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 213 NETHERLAND BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 214 NETHERLAND DRY IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 215 NETHERLAND LIQUID IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 216 NETHERLAND BAKERY INCLUSIONS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 217 NETHERLAND BAKERY INCLUSIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 218 NETHERLAND BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 219 NETHERLAND FLAVORED IN BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 220 NETHERLAND BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 221 NETHERLAND INDIRECT IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 222 NETHERLAND STORE-BASED RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 223 NETHERLAND NON-STORE RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 224 SWITZERLAND BAKERY INCLUSIONS MARKET, BY INCLUSION TYPE, 2020-2029 (USD MILLION)

TABLE 225 SWITZERLAND CHOCOLATE INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 226 SWITZERLAND CHOCOLATE CHUNKS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 227 SWITZERLAND CHOCOLATE FLAKES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 228 SWITZERLAND CHOCOLATE SYRUPS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 229 SWITZERLAND OTHERS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 230 SWITZERLAND CARAMEL INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 231 SWITZERLAND DRIED FRUITS AND NUTS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 232 SWITZERLAND FRUIT INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 233 SWITZERLAND BERRIES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 234 SWITZERLAND CITRUS FRUITS INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 235 SWITZERLAND BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 236 SWITZERLAND FOOD SERVICE INDUSTRY IN BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 237 SWITZERLAND BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 238 SWITZERLAND DRY IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 239 SWITZERLAND LIQUID IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 240 SWITZERLAND BAKERY INCLUSIONS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 241 SWITZERLAND BAKERY INCLUSIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 242 SWITZERLAND BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 243 SWITZERLAND FLAVORED IN BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 244 SWITZERLAND BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 245 SWITZERLAND INDIRECT IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 246 SWITZERLAND STORE-BASED RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 247 SWITZERLAND NON-STORE RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 248 RUSSIA BAKERY INCLUSIONS MARKET, BY INCLUSION TYPE, 2020-2029 (USD MILLION)

TABLE 249 RUSSIA CHOCOLATE INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 250 RUSSIA CHOCOLATE CHUNKS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 251 RUSSIA CHOCOLATE FLAKES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 252 RUSSIA CHOCOLATE SYRUPS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 253 RUSSIA OTHERS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 254 RUSSIA CARAMEL INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 255 RUSSIA DRIED FRUITS AND NUTS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 256 RUSSIA FRUIT INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 257 RUSSIA BERRIES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 258 RUSSIA CITRUS FRUITS INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 259 RUSSIA BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 260 RUSSIA FOOD SERVICE INDUSTRY IN BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 261 RUSSIA BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 262 RUSSIA DRY IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 263 RUSSIA LIQUID IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 264 RUSSIA BAKERY INCLUSIONS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 265 RUSSIA BAKERY INCLUSIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 266 RUSSIA BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 267 RUSSIA FLAVORED IN BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 268 RUSSIA BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 269 RUSSIA INDIRECT IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 270 RUSSIA STORE-BASED RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 271 RUSSIA NON-STORE RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 272 TURKEY BAKERY INCLUSIONS MARKET, BY INCLUSION TYPE, 2020-2029 (USD MILLION)

TABLE 273 TURKEY CHOCOLATE INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 274 TURKEY CHOCOLATE CHUNKS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 275 TURKEY CHOCOLATE FLAKES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 276 TURKEY CHOCOLATE SYRUPS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 277 TURKEY OTHERS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 278 TURKEY CARAMEL INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 279 TURKEY DRIED FRUITS AND NUTS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 280 TURKEY FRUIT INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 281 TURKEY BERRIES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 282 TURKEY CITRUS FRUITS INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 283 TURKEY BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 284 TURKEY FOOD SERVICE INDUSTRY IN BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 285 TURKEY BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 286 TURKEY DRY IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 287 TURKEY LIQUID IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 288 TURKEY BAKERY INCLUSIONS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 289 TURKEY BAKERY INCLUSIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 290 TURKEY BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 291 TURKEY FLAVORED IN BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 292 TURKEY BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 293 TURKEY INDIRECT IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 294 TURKEY STORE-BASED RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 295 TURKEY NON-STORE RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 296 LUXEMBOURG BAKERY INCLUSIONS MARKET, BY INCLUSION TYPE, 2020-2029 (USD MILLION)

TABLE 297 LUXEMBOURG CHOCOLATE INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 298 LUXEMBOURG CHOCOLATE CHUNKS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 299 LUXEMBOURG CHOCOLATE FLAKES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 300 LUXEMBOURG CHOCOLATE SYRUPS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 301 LUXEMBOURG OTHERS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 302 LUXEMBOURG CARAMEL INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 303 LUXEMBOURG DRIED FRUITS AND NUTS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 304 LUXEMBOURG FRUIT INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 305 LUXEMBOURG BERRIES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 306 LUXEMBOURG CITRUS FRUITS INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 307 LUXEMBOURG BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 308 LUXEMBOURG FOOD SERVICE INDUSTRY IN BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 309 LUXEMBOURG BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 310 LUXEMBOURG DRY IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 311 LUXEMBOURG LIQUID IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 312 LUXEMBOURG BAKERY INCLUSIONS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 313 LUXEMBOURG BAKERY INCLUSIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 314 LUXEMBOURG BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 315 LUXEMBOURG FLAVORED IN BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 316 LUXEMBOURG BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 317 LUXEMBOURG INDIRECT IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 318 LUXEMBOURG STORE-BASED RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 319 LUXEMBOURG NON-STORE RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 320 REST OF EUROPE BAKERY INCLUSIONS MARKET, BY INCLUSION TYPE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 EUROPE BAKERY INCLUSIONS MARKET: SEGMENTATION

FIGURE 2 EUROPE BAKERY INCLUSIONS MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE BAKERY INCLUSIONS MARKET : DROC ANALYSIS

FIGURE 4 EUROPE BAKERY INCLUSIONS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 EUROPE BAKERY INCLUSIONS MARKET : COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE BAKERY INCLUSIONS MARKET : INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE BAKERY INCLUSIONS MARKET : DBMR MARKET POSITION GRID

FIGURE 8 EUROPE BAKERY INCLUSIONS MARKET : VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE BAKERY INCLUSIONS MARKET: SEGMENTATION

FIGURE 10 INCREASING DEMAND OF BAKERY PRODUCTS AND INCREASE IN DEMAND OF READY TO EAT PRODUCTS ARE LEADING THE GROWTH OF THE EUROPE BAKERY INCLUSIONS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 INCLUSION TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE BAKERY INCLUSIONS MARKETIN 2022 & 2029

FIGURE 12 PATENT REGISTERED FOR BAKERY INCLUSIONS, BY COUNTRY

FIGURE 13 PATENT REGISTERED YEAR (2018 - 2022)

FIGURE 14 SUPPLY CHAIN OF EUROPE BAKERY INCLUSIONS MARKET

FIGURE 15 VALUE CHAIN OF EUROPE BAKERY INCLUSIONS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF EUROPE BAKERY INCLUSIONS MARKET

FIGURE 17 AVERAGE ANNUAL EXPENDITURE BY BAKERY PRODUCTS (2017-2020)

FIGURE 18 WORLDWIDE GDP PER CAPITA INCOME (2015-2020)

FIGURE 19 U.S. BAKERY PRODUCTS SALES SHARED IN 2021

FIGURE 20 GLOBAL NUMBER OF PEOPLE SIGNING TO 'VEGANUARY' CAMPAIGN, (2014-2019)

FIGURE 21 EUROPE BAKERY INCLUSIONS MARKET: BY INCLUSION TYPE, 2021

FIGURE 22 EUROPE BAKERY INCLUSIONS MARKET: BY END USER, 2021

FIGURE 23 EUROPE BAKERY INCLUSIONS MARKET: BY FORM, 2021

FIGURE 24 EUROPE BAKERY INCLUSIONS MARKET: BY SOURCE, 2021

FIGURE 25 EUROPE BAKERY INCLUSIONS MARKET: BY APPLICATION, 2021

FIGURE 26 EUROPE BAKERY INCLUSIONS MARKET: BY FLAVOR TYPE, 2021

FIGURE 27 EUROPE BAKERY INCLUSIONS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 28 EUROPE BAKERY INCLUSIONS MARKET: SNAPSHOT (2021)

FIGURE 29 EUROPE BAKERY INCLUSIONS MARKET: BY COUNTRY (2021)

FIGURE 30 EUROPE BAKERY INCLUSIONS MARKET: BY COUNTRY (2022 & 2029

FIGURE 31 EUROPE BAKERY INCLUSIONS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 32 EUROPE BAKERY INCLUSIONS MARKET: BY INCLUSION TYPE (2022-2029)

FIGURE 33 EUROPE BAKERY INCLUSIONS MARKET: SNAPSHOT (2021)

FIGURE 34 EUROPE BAKERY INCLUSIONS MARKET: BY COUNTRY (2021)

FIGURE 35 EUROPE BAKERY INCLUSIONS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 36 EUROPE BAKERY INCLUSIONS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 37 EUROPE BAKERY INCLUSIONS MARKET: BY INCLUSION TYPE (2022-2029)

FIGURE 38 EUROPE BAKERY INCLUSIONS MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.