Europe Automotive Level Sensor Market

Taille du marché en milliards USD

TCAC :

%

USD

208.84 Million

USD

261.49 Million

2024

2032

USD

208.84 Million

USD

261.49 Million

2024

2032

| 2025 –2032 | |

| USD 208.84 Million | |

| USD 261.49 Million | |

|

|

|

|

Segmentation du marché européen des capteurs de niveau automobile, par type de produit (capteur de niveau de carburant, capteur de niveau d'huile moteur, capteur de niveau de liquide de refroidissement, capteur de niveau de liquide de frein, capteur de niveau de liquide de direction assistée, capteur magnétique, etc.), type (capacitif, film résistif, ultrasonique, résistances discrètes, optique, etc.), type de surveillance (surveillance continue et ponctuelle), application (surveillance du ravitaillement et de la vidange du réservoir, prévention du vol de carburant et surveillance de la consommation de carburant), type de véhicule (véhicule de tourisme et véhicule utilitaire), canal de vente (fabricant d'équipement d'origine (OEM) et marché secondaire), canal de distribution (en ligne et hors ligne) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché européen des capteurs de niveau automobiles

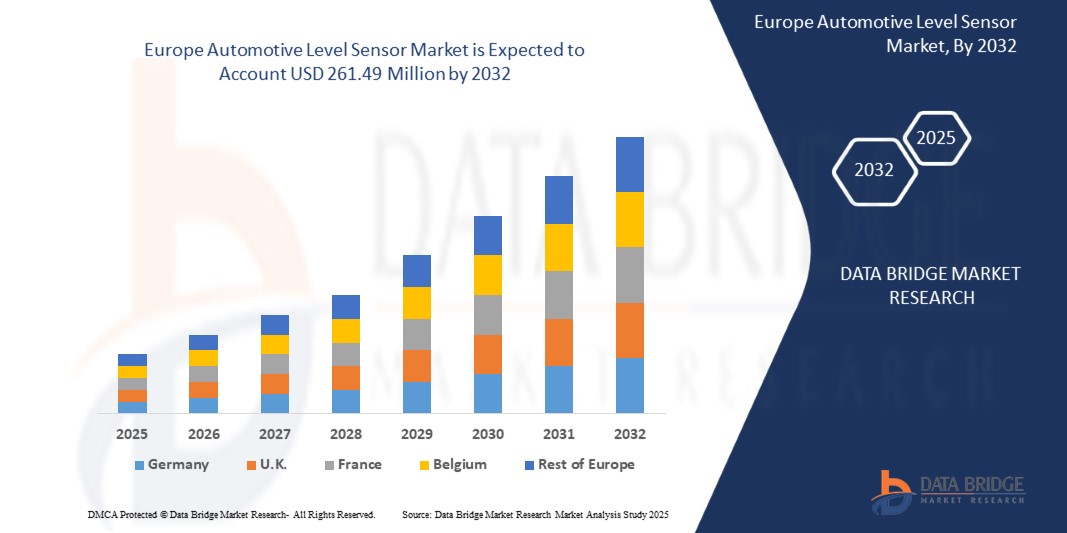

- La taille du marché européen des capteurs de niveau automobiles était évaluée à 208,84 millions USD en 2024 et devrait atteindre 261,49 millions USD d'ici 2032 , à un TCAC de 2,85 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par l'adoption croissante de technologies automobiles avancées, l'importance croissante accordée à la consommation de carburant et les réglementations gouvernementales strictes en matière de contrôle des émissions. Les capteurs de niveau automobiles jouent un rôle essentiel dans la surveillance des fluides critiques tels que le carburant, l'huile moteur et le liquide de refroidissement, garantissant ainsi les performances, la sécurité et la conformité des véhicules aux normes environnementales en constante évolution.

- Par ailleurs, la demande croissante de véhicules connectés et électriques, conjuguée à l'intégration de systèmes de diagnostic intelligents, accélère l'adoption de solutions innovantes de détection de niveau. Ces facteurs convergents favorisent une adoption rapide, tant pour les véhicules particuliers que pour les véhicules utilitaires, stimulant ainsi considérablement la croissance du secteur.

Analyse du marché européen des capteurs de niveau automobiles

- Les capteurs de niveau automobiles sont des dispositifs de précision conçus pour détecter et surveiller les niveaux de liquides dans les véhicules, notamment le carburant, l'huile moteur, le liquide de frein, le liquide de refroidissement et le liquide de direction assistée. Ces capteurs sont essentiels pour maintenir le rendement du moteur, prévenir les pannes mécaniques et garantir la sécurité du véhicule dans diverses conditions de conduite.

- La demande croissante de capteurs de niveau pour l'automobile est principalement due à l'augmentation de la production automobile, au durcissement des normes de sécurité et d'émissions, et à la préférence croissante des consommateurs pour des véhicules à la pointe de la technologie et économes en carburant. Le rôle croissant des capteurs dans les véhicules hybrides et électriques souligne leur importance, faisant d'eux un élément clé de la transformation de l'industrie automobile.

- L'Allemagne a dominé le marché des capteurs de niveau automobiles en 2024, grâce à son industrie automobile bien établie, à ses infrastructures de R&D de pointe et à son adoption massive de véhicules à la pointe de la technologie. La forte présence de constructeurs automobiles et l'importance accordée aux normes de sécurité et d'efficacité des véhicules ont largement contribué à l'intégration des capteurs dans les véhicules particuliers et utilitaires.

- Le Royaume-Uni devrait être le pays connaissant la croissance la plus rapide sur le marché des capteurs de niveau automobiles au cours de la période de prévision en raison de la demande croissante de véhicules économes en carburant, connectés et électriques.

- Le segment de la surveillance continue des niveaux a dominé le marché avec une part de marché de 62 % en 2024, grâce à sa capacité à fournir une mesure précise et en temps réel des fluides automobiles critiques tels que le carburant, l'huile moteur et le liquide de refroidissement. Les constructeurs automobiles privilégient de plus en plus les systèmes de surveillance continue pour améliorer l'efficacité des véhicules, prévenir les pannes et garantir la conformité réglementaire. L'intégration de capteurs avancés aux systèmes de diagnostic embarqués renforce encore son adoption, ce qui en fait un choix privilégié pour les véhicules particuliers et utilitaires.

Portée du rapport et segmentation du marché européen des capteurs de niveau automobile

|

Attributs |

Analyses clés du marché des capteurs de niveau automobiles en Europe |

|

Segments couverts |

|

|

Pays couverts |

Europe

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur le marché telles que la valeur marchande, le taux de croissance, les segments de marché, la couverture géographique, les acteurs du marché et le scénario du marché, le rapport de marché organisé par l'équipe de recherche sur le marché de Data Bridge comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et une analyse du pilon. |

Tendances du marché européen des capteurs de niveau pour automobiles

Demande croissante des consommateurs en matière de sécurité et de confort

- L'importance croissante accordée à la sécurité des véhicules et à un confort de conduite supérieur alimente la demande de capteurs de niveau automobiles avancés sur les marchés mondiaux. Ces capteurs deviennent des composants essentiels des véhicules, assurant une surveillance précise des niveaux de liquide et permettant l'utilisation de systèmes améliorant l'expérience du conducteur, l'efficacité du véhicule et la protection des passagers.

- Par exemple, Bosch a développé une gamme avancée de capteurs de niveau de carburant et d'huile moteur intégrés à des systèmes d'alerte, permettant aux constructeurs automobiles d'améliorer les normes de sécurité et le confort d'utilisation. De même, HELLA GmbH propose des capteurs de liquide de lave-glace et de liquide de frein conçus pour alerter les conducteurs à temps, prévenir les pannes et préserver le confort de conduite.

- Les capteurs de niveau automobiles contribuent directement à la sécurité en permettant une détection précise des niveaux bas d'huile, de liquide de frein ou de liquide de refroidissement, prévenant ainsi les dommages au moteur, les pannes de freins et la surchauffe. Leur rôle, en garantissant des alertes rapides, réduit les risques pendant la conduite et prolonge la durée de vie des composants du véhicule, renforçant ainsi leur valeur dans les systèmes automobiles modernes.

- La demande croissante des consommateurs pour des expériences haut de gamme encourage également l'adoption de capteurs de niveau dans les voitures de luxe et de milieu de gamme. Des applications telles que les systèmes avancés de surveillance du carburant intégrés aux tableaux de bord numériques améliorent le confort de conduite en fournissant des informations précises en temps réel, répondant ainsi aux attentes des consommateurs férus de technologie.

- De plus, les tendances d'électrification du secteur automobile poussent les constructeurs à adopter des capteurs sophistiqués de niveau de liquide de refroidissement et d'électrolyte pour garantir des performances et une sécurité optimales des véhicules électriques. Cela montre comment les attentes des consommateurs en matière de confort et de sécurité influencent directement l'évolution des technologies de capteurs de niveau.

- Globalement, la préférence croissante des consommateurs pour des véhicules alliant performance, confort et sécurité garantit que les capteurs de niveau automobiles resteront indispensables. Cette tendance incite les constructeurs à privilégier l'innovation et l'intégration des capteurs, remodelant ainsi le paysage global du design automobile et de l'expérience client.

Dynamique du marché européen des capteurs de niveau automobiles

Conducteur

L'industrie automobile en pleine expansion

- La croissance rapide de l'industrie automobile mondiale, notamment dans les économies émergentes, entraîne une forte demande de capteurs de niveau pour l'automobile. Face à l'augmentation de la production automobile et à l'adoption croissante des véhicules particuliers et utilitaires, les constructeurs intègrent des capteurs avancés pour répondre aux normes réglementaires et aux attentes des consommateurs.

- Par exemple, DENSO Corporation fournit une large gamme de capteurs de niveau de liquide aux constructeurs automobiles mondiaux, contribuant ainsi au développement des véhicules à moteur à combustion interne et des modèles hybrides. Le développement des partenariats de l'entreprise avec les constructeurs automobiles souligne le rôle croissant des capteurs de niveau dans la croissance du secteur.

- L'essor du marché automobile accroît les besoins en matière de surveillance du carburant, du liquide de refroidissement et du liquide de frein afin de maintenir les performances des véhicules dans diverses conditions de conduite. Ces marchés en plein essor deviennent des pôles de croissance importants pour l'adoption de solutions de capteurs de niveau économiques et fiables.

- De plus, la transition vers les véhicules électriques et hybrides a donné un nouvel élan à l'adoption des capteurs de niveau. La gestion des batteries, les systèmes de contrôle thermique et l'optimisation énergétique des véhicules électriques dépendent de technologies de détection de niveau de haute précision, rendant les capteurs essentiels à la transition vers une mobilité durable.

- En conclusion, l'expansion de l'industrie automobile, avec sa complexité croissante et sa dépendance aux performances pilotées par capteurs, alimente une croissance constante du marché des capteurs de niveau. L'adéquation entre la demande des consommateurs, l'innovation technologique et la production automobile garantit que ce moteur soutiendra le développement à long terme de l'industrie.

Retenue/Défi

Coût élevé des capteurs avancés

- Les coûts élevés associés aux capteurs de niveau automobiles avancés constituent un frein majeur à la croissance du marché, notamment dans les segments sensibles aux coûts et les régions en développement. Les capteurs sophistiqués, tels que ceux équipés de technologies ultrasoniques et capacitives, impliquent des coûts de production plus élevés en raison de l'utilisation de composants de précision et d'une électronique avancée.

- Par exemple, Continental AG propose des solutions avancées de détection de niveau multi-fluides qui assurent une surveillance très précise des véhicules modernes, mais à un coût supérieur à celui des capteurs à flotteur traditionnels. Cet écart de prix rend les constructeurs réticents à intégrer des capteurs avancés dans les catégories de véhicules d'entrée de gamme où les marges sont serrées.

- Le défi est encore aggravé par la nécessité d'un étalonnage, d'une maintenance et de remplacements réguliers, ce qui alourdit les dépenses à long terme des fabricants et des consommateurs. Ces coûts récurrents limitent l'adoption dans les régions où l'accessibilité financière est un critère d'achat primordial.

- De plus, la complexité croissante des véhicules, notamment électriques et hybrides, nécessite l'intégration de multiples capteurs spécialisés, ce qui augmente considérablement le contenu électronique global et le coût du véhicule. Les constructeurs automobiles sont souvent confrontés à des compromis entre le maintien d'un prix abordable et l'intégration de technologies de capteurs avancées sur tous les modèles.

- Par conséquent, les coûts élevés demeurent un obstacle à la pénétration généralisée des capteurs de niveau avancé dans tous les segments de véhicules. Pour combler ce fossé, les constructeurs devront privilégier des conceptions optimisées en termes de coûts, des économies d'échelle et l'innovation dans les procédés de fabrication des capteurs afin de garantir leur accessibilité et leur adoption généralisée dans les années à venir.

Portée du marché européen des capteurs de niveau automobile

Le marché est segmenté en fonction du type de produit, du type, du type de surveillance, de l'application, du type de véhicule, du canal de vente et du canal de distribution.

- Par type de produit

Selon le type de produit, le marché des capteurs de niveau automobile est segmenté en capteurs de niveau de carburant, d'huile moteur, de liquide de refroidissement, de liquide de frein, de direction assistée et magnétiques, entre autres. En 2024, le segment des capteurs de niveau de carburant a dominé la plus grande part de marché, grâce à son rôle essentiel dans la surveillance en temps réel du carburant, l'amélioration de l'efficacité de conduite et la prévention du calage du moteur. Les constructeurs automobiles privilégient de plus en plus les capteurs de niveau de carburant avancés pour optimiser la consommation, se conformer aux normes d'émissions strictes et améliorer l'expérience de conduite, ce qui les rend indispensables pour les véhicules particuliers et utilitaires.

Le segment des capteurs de niveau d'huile moteur devrait connaître la croissance la plus rapide entre 2025 et 2032, porté par une prise de conscience croissante de l'état des moteurs et la nécessité de prévenir les dommages causés par un manque d'huile. Les véhicules modernes intègrent des capteurs de niveau d'huile moteur à des systèmes de diagnostic embarqués, fournissant des alertes en temps réel aux conducteurs et réduisant les coûts d'entretien. L'adoption croissante de ces capteurs dans les véhicules haut de gamme et milieu de gamme, conjuguée à la préférence des consommateurs pour des équipements de sécurité et d'efficacité énergétique avancés, accélère la demande sur ce segment.

- Par type

Le marché des capteurs de niveau automobiles est segmenté en fonction de leur type : capacitifs, à film résistif, à ultrasons, à résistances discrètes, optiques, etc. En 2024, le segment des capteurs capacitifs représentait la plus grande part de chiffre d'affaires du marché, grâce à sa grande précision, sa fiabilité et sa polyvalence dans la détection des niveaux de liquides dans les fluides automobiles. Les capteurs capacitifs sont largement privilégiés en raison de leur durabilité, de leur faible maintenance et de leur capacité à fonctionner efficacement dans des environnements difficiles, ce qui en fait un choix standard pour les constructeurs automobiles.

Le segment des capteurs à ultrasons devrait enregistrer la croissance la plus rapide entre 2025 et 2032, les constructeurs automobiles adoptant de plus en plus les technologies de détection sans contact. Les capteurs à ultrasons assurent une détection précise des niveaux, sans être affectés par les variations de température ni la contamination des fluides, offrant ainsi une précision supérieure dans les applications critiques. Leur intégration aux systèmes avancés d'aide à la conduite (ADAS) et aux plateformes de surveillance IoT renforce encore leur adoption dans les véhicules de nouvelle génération.

- Par type de surveillance

Selon le type de surveillance, le marché des capteurs de niveau automobile se divise en deux catégories : la surveillance continue et la surveillance ponctuelle. Le segment de la surveillance continue a dominé le marché avec une part de marché de 62 % en 2024, grâce à sa capacité à fournir une mesure précise et en temps réel des fluides automobiles critiques tels que le carburant, l'huile moteur et le liquide de refroidissement. Les constructeurs automobiles privilégient de plus en plus les systèmes de surveillance continue pour améliorer l'efficacité des véhicules, prévenir les pannes et garantir la conformité réglementaire. L'intégration de capteurs avancés aux systèmes de diagnostic embarqués renforce encore son adoption, en faisant un choix privilégié pour les véhicules particuliers et utilitaires.

Le segment de la surveillance des niveaux de liquide devrait connaître le TCAC le plus élevé entre 2025 et 2032, grâce à sa rentabilité et à sa large utilisation pour la détection des seuils minimaux et maximaux de liquide. La demande croissante de véhicules d'entrée de gamme et d'installations de rechange pour une détection fiable des seuils renforce sa croissance. Ce segment gagne particulièrement du terrain dans les régions où l'adoption de véhicules économiques est forte, où l'accessibilité financière reste un facteur clé.

- Par application

En fonction des applications, le marché est segmenté en deux catégories : surveillance du ravitaillement et de la vidange des réservoirs, prévention du vol de carburant et surveillance de la consommation de carburant. Le segment de la surveillance de la consommation de carburant détenait la plus grande part de marché en 2024, la hausse des prix du carburant et le durcissement des réglementations en matière d'émissions poussant les consommateurs et les gestionnaires de flottes à optimiser leur consommation. Les constructeurs intègrent des capteurs avancés de surveillance de la consommation de carburant pour améliorer l'efficacité, réduire l'empreinte carbone et respecter les exigences environnementales.

Le segment de la prévention du vol de carburant devrait connaître sa plus forte croissance entre 2025 et 2032, porté par les préoccupations croissantes des flottes commerciales et des opérations logistiques. La multiplication des cas de vol de carburant sur les marchés émergents encourage l'adoption de capteurs de niveau antivol avancés avec intégration GPS. La combinaison de fonctions de surveillance en temps réel et de sécurité garantit une meilleure gestion de flotte et des économies de coûts, accélérant ainsi la demande dans ce segment.

- Par type de véhicule

Selon le type de véhicule, le marché se divise en véhicules particuliers et véhicules utilitaires. Le segment des véhicules particuliers a dominé le marché en termes de chiffre d'affaires en 2024, grâce à des volumes de production élevés et à l'intégration croissante de systèmes de capteurs avancés dans les modèles milieu et haut de gamme. La préférence des consommateurs pour les améliorations en matière de sécurité, de performance et d'efficacité continue de stimuler la demande dans cette catégorie.

Le segment des véhicules utilitaires devrait connaître la croissance la plus rapide entre 2025 et 2032, grâce à l'adoption croissante de capteurs de niveau pour la gestion de flotte, la détection des vols de carburant et l'optimisation de la maintenance. Les pressions réglementaires sur la consommation de carburant et les émissions, conjuguées à la croissance du secteur de la logistique et des transports, renforcent encore l'intégration de solutions avancées de surveillance de niveau dans les flottes commerciales.

- Par canal de vente

En fonction des canaux de vente, le marché est segmenté entre équipementiers d'origine (OEM) et marché de la rechange. Le segment OEM a représenté la plus grande part de chiffre d'affaires en 2024, grâce à la tendance croissante à intégrer des capteurs avancés directement dans les véhicules pendant la production. Les constructeurs automobiles privilégient les capteurs de niveau installés en usine pour renforcer la fiabilité de la marque et respecter les exigences gouvernementales strictes en matière d'émissions et de sécurité.

Le marché des pièces de rechange devrait connaître sa plus forte croissance entre 2025 et 2032, porté par la demande croissante de remplacement et l'adoption de capteurs améliorés dans les flottes de véhicules vieillissantes. Les consommateurs soucieux des coûts des régions en développement investissent dans des installations de pièces de rechange pour prolonger la durée de vie de leurs véhicules et améliorer leur efficacité, ce qui en fait un secteur de croissance lucratif.

- Par canal de distribution

En fonction du canal de distribution, le marché est segmenté en ligne et hors ligne. En 2024, le segment hors ligne a dominé le marché, les composants automobiles étant largement distribués par des réseaux de concessionnaires, des ateliers de réparation et des centres de service établis. La distribution hors ligne offre fiabilité, inspection physique et services d'installation professionnels, ce qui en fait le choix privilégié des consommateurs.

Le segment en ligne devrait connaître son taux de croissance annuel composé le plus élevé entre 2025 et 2032, soutenu par la croissance rapide des plateformes de commerce électronique et des places de marché numériques pour les composants automobiles. Les consommateurs privilégient de plus en plus les achats en ligne pour leurs avantages en termes de coût, la variété des produits et la livraison à domicile. La disponibilité de guides d'intégration de capteurs et la simplification des politiques de retour encouragent encore davantage cette transition vers les canaux en ligne.

Analyse régionale du marché européen des capteurs de niveau automobile

- L'Allemagne a dominé le marché des capteurs de niveau automobiles, enregistrant la plus grande part de chiffre d'affaires en 2024, grâce à son industrie automobile bien établie, à ses infrastructures de R&D de pointe et à l'adoption massive de véhicules à la pointe de la technologie. La forte présence de constructeurs automobiles et l'importance accordée aux normes de sécurité et d'efficacité des véhicules ont largement contribué à l'intégration des capteurs dans les véhicules particuliers et utilitaires.

- Le leadership de l'Allemagne est renforcé par l'adoption croissante de véhicules connectés et électriques, des réglementations strictes en matière d'émissions et de sécurité et des chaînes d'approvisionnement bien développées pour des composants de capteurs de haute qualité tels que des capteurs de niveau capacitifs et à ultrasons.

- La position de l'Allemagne est encore renforcée par des investissements continus dans des technologies de capteurs innovantes, des collaborations avec des fournisseurs automobiles mondiaux et une expansion continue des systèmes avancés d'assistance à la conduite (ADAS) et des solutions de surveillance intelligentes.

Aperçu du marché britannique des capteurs de niveau automobiles

Le marché britannique devrait enregistrer le TCAC le plus rapide d'Europe entre 2025 et 2032, porté par la demande croissante de véhicules économes en carburant, connectés et électriques. L'adoption croissante de systèmes de surveillance continue et ponctuelle, la préférence des consommateurs pour les véhicules à la pointe de la technologie et la forte pénétration de l'électronique automobile accélèrent le déploiement des capteurs. Le développement des initiatives de mobilité électrique, les collaborations entre équipementiers et fournisseurs de technologies, ainsi que les investissements dans les capteurs automobiles de haute précision, contribuent également à la croissance du marché.

Analyse du marché français des capteurs de niveau pour l'automobile

La France devrait connaître une croissance soutenue entre 2025 et 2032, soutenue par un solide tissu industriel automobile, une attention croissante portée à la réduction des émissions et une réglementation axée sur la sécurité des véhicules et la conformité environnementale. L'intégration croissante des systèmes de surveillance des niveaux de fluides dans les véhicules particuliers et utilitaires, les investissements dans les technologies de véhicules intelligents et la promotion de solutions de capteurs innovantes pour les véhicules hybrides et électriques redéfinissent la demande du marché. La R&D localisée, les partenariats avec les fabricants de capteurs et l'accent mis sur des composants automobiles fiables et de haute qualité soutiennent l'expansion du marché.

Part de marché des capteurs de niveau automobiles

L'industrie des capteurs de niveau automobiles est principalement dirigée par des entreprises bien établies, notamment :

- Continental AG (Allemagne)

- Littelfuse, Inc. (États-Unis)

- Bosch Rexroth Sp. Z OO (Pologne)

- Elobau Gmbh & Co. KG.C (Allemagne),

- Pricol Limited (Inde)

- Bourns Inc (États-Unis)

- Guangdong Zhengyang Sensing Technology Co., Ltd. (Chine)

- Misensor Tech Co., Ltd. (Chine)

- Omnicomm (Estonie)

- Soway Tech Limited (Chine)

- Spark Minda (Inde)

- Standex Electronics, Inc (États-Unis)

- Technoton (République tchèque)

- Wema UK (Royaume-Uni)

Derniers développements sur le marché européen des capteurs de niveau automobiles

- En août 2024, Littelfuse, Inc. a dévoilé ses séries de diodes TVS haute fiabilité et faible capacité SMBLCEHR HRA, SMCLCE-HR/HRA et SMDLCE-HR/HRA, spécialement conçues pour protéger les systèmes avioniques contre la foudre et les surtensions sévères. Ce développement établit une nouvelle référence industrielle en matière de protection haute fiabilité, renforçant ainsi le leadership de Littelfuse dans l'électronique aérospatiale. En établissant des normes de sécurité et de durabilité plus strictes, l'entreprise renforce son avantage concurrentiel et étend sa présence dans le secteur aéronautique, où la résilience et la fiabilité sont essentielles.

- En août 2024, le directoire de Continental AG a annoncé l'étude d'une éventuelle scission de son secteur Automobile en une société indépendante. Cette revue stratégique vise à accroître la création de valeur, à améliorer l'agilité opérationnelle et à maximiser les opportunités de croissance dans un marché automobile en constante évolution. Si elle est approuvée par le directoire et le conseil de surveillance, puis par les actionnaires en avril 2025, la scission pourrait être finalisée d'ici fin 2025. Cette opération devrait remodeler la structure opérationnelle de Continental, lui permettant de se concentrer davantage sur ses secteurs Pneumatiques et ContiTech, tout en permettant à la nouvelle entité de poursuivre une innovation accélérée et de nouer des partenariats dans le secteur automobile.

- En juillet 2024, Continental AG a présenté son portefeuille de produits élargi au salon Automechanika de Francfort, avec des innovations telles que des capteurs ADAS avancés, des courroies multi-V durables et le pneu UltracContact NXT contenant jusqu'à 65 % de matériaux durables. Cette démonstration a renforcé le leadership technologique de Continental et a également souligné son engagement fort en faveur du développement durable. En s'alignant sur les tendances du secteur en matière de mobilité verte et de sécurité avancée, l'entreprise a renforcé son positionnement mondial, attiré des clients potentiels et renforcé ses partenariats avec des équipementiers spécialisés dans les solutions automobiles écologiques et performantes.

- En avril 2024, Littelfuse, Inc. a lancé le circuit intégré de protection de supercondensateur monocellulaire LS0502SCD33S, un ajout avancé à sa gamme de circuits intégrés de protection eFuse. Cette innovation améliore la sécurité et la fiabilité des sources d'alimentation de secours fonctionnant dans des conditions extrêmes, une exigence critique dans les applications automobiles, industrielles et énergétiques. En établissant une nouvelle norme en matière de performance et de protection, Littelfuse a renforcé sa présence sur le marché des circuits intégrés de protection, répondant ainsi à la demande croissante de dispositifs de protection électronique robustes dans les secteurs des infrastructures critiques.

- En mars 2024, Continental AG a annoncé une collaboration stratégique avec Ambarella, Inc., leader du silicium de vision IA, pour co-développer des solutions ADAS et de conduite automatisée de nouvelle génération. Ce partenariat associe le traitement IA haute performance d'Ambarella à la vaste expertise de Continental en matière d'intégration de capteurs et de systèmes. Cette collaboration devrait accélérer le déploiement de technologies de conduite automatisée intelligentes, sûres et évolutives, renforçant ainsi le rôle de Continental dans l'avenir de la mobilité tout en répondant à la demande croissante de systèmes avancés d'aide à la conduite.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.