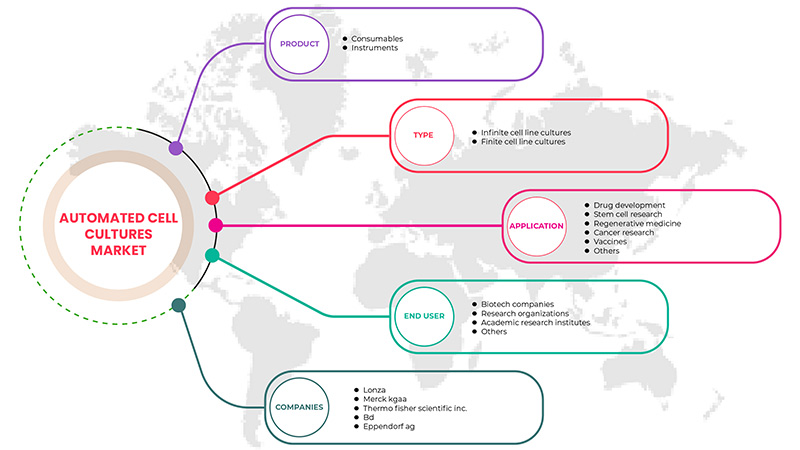

Marché européen des cultures cellulaires automatisées, par produit (consommables, instruments), type (cultures de lignées cellulaires infinies, cultures de lignées cellulaires finies), application (développement de médicaments, recherche sur les cellules souches, médecine régénérative , recherche sur le cancer, vaccins , autres), utilisateur final (sociétés de biotechnologie, organismes de recherche, instituts de recherche universitaires, autres) Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et perspectives du marché des cultures cellulaires automatisées en Europe

Le rapport sur le marché des cultures cellulaires automatisées fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste, notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

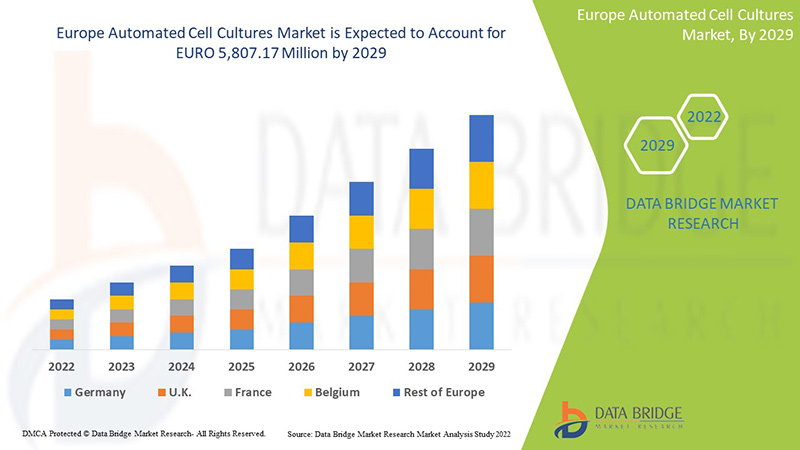

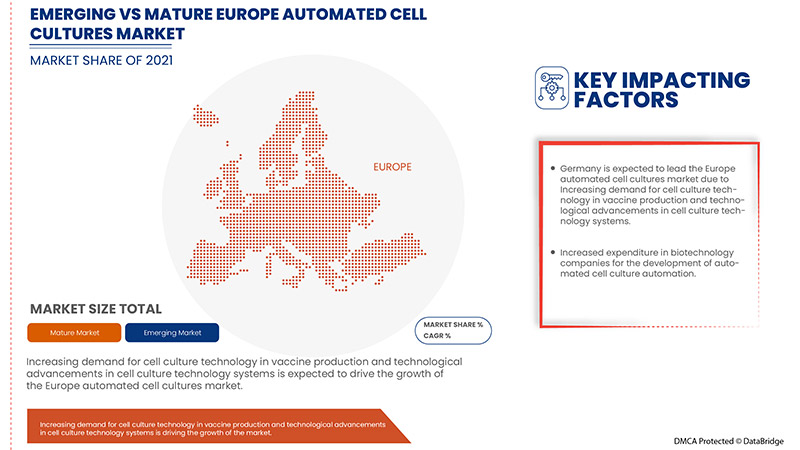

Le marché européen des cultures cellulaires automatisées devrait connaître une croissance du marché au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 8,2 % au cours de la période de prévision de 2022 à 2029 et devrait atteindre 5 807,17 millions d'euros d'ici 2029. La demande croissante de technologie de culture cellulaire dans la production de vaccins et la large acceptation des techniques de culture cellulaire dans diverses applications sont les principaux moteurs qui ont propulsé la demande du marché au cours de la période de prévision.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions d'euros, volumes en unités, prix en euros |

|

Segments couverts |

Par produit (consommables, instruments), type (cultures de lignées cellulaires infinies, cultures de lignées cellulaires finies), application (développement de médicaments, recherche sur les cellules souches, médecine régénérative , recherche sur le cancer, vaccins , autres), utilisateur final (sociétés de biotechnologie, organismes de recherche, instituts de recherche universitaire, autres) |

|

Pays couverts |

Allemagne, Royaume-Uni, France, Russie, Italie, Turquie, Pays-Bas, Suisse, Espagne, Belgique et reste de l'Europe |

|

Acteurs du marché couverts |

Lonza, Merck KGaA, Thermo Fisher Scientific Inc., BD, Eppendorf AG et autres |

Définition du marché européen des cultures cellulaires automatisées

Les systèmes automatisés de culture cellulaire sont des instruments qui exécutent mécaniquement les étapes impliquées dans la croissance et le maintien d'une culture cellulaire. Utile dans tout laboratoire qui travaille avec la biologie cellulaire, la signalisation cellulaire, l'expression des protéines ou la découverte de médicaments, un système automatisé de culture cellulaire aide à cultiver des cultures cellulaires tout en économisant du temps de travail et en réduisant les erreurs. Les systèmes automatisés de culture cellulaire peuvent être capables de diluer des échantillons, de cultiver des cultures dans un liquide avec un tourbillon constant, de plaquer des cultures ou de placer des cultures dans des puits. L'augmentation de la demande de cultures cellulaires 3D , l'augmentation de la collaboration entre les acteurs du marché et l'augmentation des installations d'externalisation devraient offrir une opportunité de croissance lucrative pour le marché. Cependant, le coût élevé des systèmes automatisés de culture cellulaire et les limitations associées aux cultures cellulaires automatisées sont les facteurs qui devraient freiner la croissance du marché au cours de la période de prévision.

Dynamique du marché des cultures cellulaires automatisées en Europe

Cette section traite de la compréhension des moteurs du marché, des opportunités, des contraintes et des défis. Tout cela est discuté en détail ci-dessous :

- Conducteurs

Demande croissante de technologie de culture cellulaire dans la production de vaccins

La culture cellulaire est un outil essentiel pour la recherche en biologie moléculaire et cellulaire. Aujourd'hui, la plupart des produits biotechnologiques reposent principalement sur la culture massive de lignées cellulaires. Les cultures cellulaires ont des applications dans divers domaines et servent de système modèle pour de nombreux efforts de recherche.

L'augmentation du financement gouvernemental pour la recherche sur les cellules stimule considérablement la croissance du marché. En outre, les techniques de culture cellulaire sont largement utilisées comme alternative aux stratégies actuelles basées sur les œufs pour développer des vaccins à base de cellules. La culture cellulaire a des applications potentielles dans le développement de vaccins viraux présentant un risque accru de maladies transmissibles et de pandémie. Ainsi, la technologie de la culture cellulaire est largement utilisée dans le développement de vaccins sous licence aux États-Unis, tels que les vaccins contre la rubéole, la variole, la varicelle, l'hépatite, le rotavirus et la polio.

Progrès technologiques dans les systèmes de culture cellulaire

Alors que la demande en technologies avancées de culture cellulaire dans la production de vaccins, la recherche sur le cancer et la virologie, entre autres, augmente, certains développements technologiques ont lieu dans la culture cellulaire automatisée.

Ainsi, les acteurs du marché opérant sur le marché adoptent divers développements technologiques dans les équipements de culture cellulaire pour stimuler leurs activités dans diverses dimensions et conduire à la croissance du marché. Ce facteur pourrait stimuler la croissance du marché européen des cultures cellulaires automatisées .

- Retenue

Coût élevé des systèmes automatisés de culture cellulaire

Le coût du produit est le principal obstacle pour le marché, car il devrait entraîner une baisse de la demande en raison du coût élevé. Dans le cas des systèmes automatisés de culture cellulaire, le prix est également élevé et le prix du produit sera indiqué ci-dessous.

Les instruments et produits consommables tels que les compteurs de cellules, les réactifs, les tampons et autres ont des prix élevés, ce qui montre que le coût des cultures cellulaires automatisées est le principal facteur qui devrait restreindre le marché européen des cultures cellulaires automatisées au cours de la période prévue.

- Opportunité

Lancements de nouveaux produits et développements technologiques

Les entreprises pharmaceutiques et biotechnologiques travaillent au développement et au lancement de nouveaux produits et technologies pour l'avancement de la culture cellulaire automatisée et pour rendre les méthodes de traitement et de diagnostic plus accessibles. Cela a également augmenté la demande pour un marché de culture cellulaire automatisée pour les cultures cellulaires 3D . Le développement de nouveaux bioréacteurs, plates-formes et logiciels a conduit à une avancée du marché de la culture cellulaire automatisée et à sa croissance.

Les nouveaux produits et technologies lancés et développés créent de bonnes opportunités pour le marché européen des cultures cellulaires automatisées. Les nouvelles plateformes dotées de technologies avancées constituent un pas de plus vers l'avancement du marché.

- Défi

Développement et maintien de l'expertise

Le recrutement et la rétention d'un personnel formé et qualifié, le perfectionnement du personnel, les budgets d'investissement pour l'achat d'équipement, la gestion du budget de fonctionnement, l'infrastructure des installations et la gestion du changement sont autant de facteurs qui nécessitent une attention particulière pour la croissance et le succès de tout marché. L'incapacité à répondre aux besoins dans l'un de ces domaines peut entraîner une faiblesse grave qui, si elle n'est pas corrigée, peut compromettre la crédibilité d'un laboratoire et créer une situation difficile à corriger à court terme.

Tester et maintenir le niveau d'expertise dans les laboratoires de test est une tâche difficile et nécessite une grande expérience, qui n'est parfois pas accessible, ce qui entrave le processus de développement d'une entreprise particulière. On s'attend donc à ce que la croissance du marché européen des cultures cellulaires automatisées soit remise en cause au cours de la période prévue.

Développements récents

- En juillet 2021, le groupe des sciences de la vie Sartorius, sous-groupe Sartorius Stadium Biotech, a acquis une participation majoritaire dans le fabricant de réactifs CellGenix GmbH.

- En décembre 2020, Eppendorf a présenté le nouveau système de contrôle de bioréacteur modulaire SciVario twin à ses clients du secteur des bioprocédés. Conçu pour offrir plus de flexibilité en laboratoire, il permet aux utilisateurs de contrôler deux bioréacteurs en verre d'un volume de 0,2 à 40 litres individuellement ou en parallèle à partir d'un ordinateur ou d'une tablette à l'aide du logiciel VisioNize d'Eppendorf - sans avoir à modifier la configuration du matériel.

Portée du marché européen des cultures cellulaires automatisées

Le marché européen des cultures cellulaires automatisées est segmenté en produits, types, applications et utilisateurs finaux. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

Marché européen des cultures cellulaires automatisées, par produit

- Consommables

- Instruments

Sur la base du produit, le marché européen des cultures cellulaires automatisées est segmenté en consommables et instruments

Marché européen des cultures cellulaires automatisées, par type

- Cultures de lignées cellulaires infinies

- Cultures de lignées cellulaires finies

Sur la base du type, le marché européen des cultures cellulaires automatisées est segmenté en cultures de lignées cellulaires infinies et cultures de lignées cellulaires finies

Marché européen des cultures cellulaires automatisées, par application

- Développement de médicaments

- Recherche sur les cellules souches

- Médecine régénérative

- Recherche sur le cancer

- Vaccins

- Autre

Sur la base des applications, le marché européen des cultures cellulaires automatisées est segmenté en développement de médicaments, recherche sur les cellules souches, médecine régénérative, recherche sur le cancer, vaccins et autres.

Marché européen des cultures cellulaires automatisées, par utilisateur final

- Sociétés de biotechnologie

- Organismes de recherche

- Instituts de recherche universitaire

- Autre

Sur la base de l'utilisateur final, le marché européen des cultures cellulaires automatisées est segmenté en sociétés de biotechnologie, organismes de recherche, instituts de recherche universitaires et autres.

Analyse/perspectives régionales du marché des cultures cellulaires automatisées en Europe

Le marché européen des cultures cellulaires automatisées est analysé et des informations sur la taille du marché sont fournies par produit, type, application et utilisateur final.

Les pays couverts dans ce rapport de marché sont l’Allemagne, le Royaume-Uni, la France, la Russie, l’Italie, la Turquie, les Pays-Bas, la Suisse, l’Espagne, la Belgique et le reste de l’Europe.

- En 2022, le marché européen des cultures cellulaires automatisées devrait croître en raison de l'augmentation des applications dans la recherche sur les cellules souches, la production de vaccins, la production de médicaments régénératifs et la découverte de médicaments.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques européennes et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, ainsi que l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des cultures cellulaires automatisées en Europe

Le paysage concurrentiel du marché européen des cultures cellulaires automatisées fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'ampleur du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise vers le marché européen des cultures cellulaires automatisées.

Français Les principaux acteurs du marché européen des cultures cellulaires automatisées sont Lonza, Merck KGaA, Thermo Fisher Scientific Inc., BD, Eppendorf AG, Advanced Instruments, Benchmark scientific, Inc., BioSpherix, Ltd., Biotron Healthcare, Bulldog Bio, Cell Culture Company, LLC, CellGenix GmbH, ChemoMetec, Corning Incorporated, Cytiva (filiale de Danahar Corporation), FUJIFILM Holdings America Corporation, Hemilton Company, Hitachi, Ltd., Kawasaki Heavy Industries, ltd., HiMedia Laboratories, NanoEntek America, Inc., Nexcelom Bioscience LLC., PromoCell GmbH, RWD Life Science Co., LTD, Sartorius AG, Scientica Instrumentation, Inc., SHIBUYA CORPORATION, Sphere Fluidics Limited, Tecan Trading AG, Thrive Bioscience, Inc., et autres.

-

Méthodologie de recherche : Marché européen des cultures cellulaires automatisées

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement de l'entreprise, l'analyse des parts de marché des entreprises, les normes de mesure, l'Europe par rapport aux régions et l'analyse des parts des fournisseurs. Veuillez demander un appel à l'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 REGULATORY FRAMEWORK FOR EUROPE AUTOMATED CELL CULTURES MARKET

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING DEMAND FOR CELL CULTURE TECHNOLOGY IN VACCINE PRODUCTION

6.1.2 TECHNOLOGICAL ADVANCEMENTS IN CELL CULTURE TECHNOLOGY SYSTEMS

6.1.3 WIDE ACCEPTANCE OF CELL CULTURE TECHNIQUES IN VARIOUS APPLICATIONS

6.1.4 GROWING BIOTECHNOLOGY SECTOR, ALONG WITH RISING HEALTHCARE EXPENDITURE

6.1.5 ADVANTAGES OF AUTOMATED CELL CULTURE SYSTEMS OVER MANUAL METHODS

6.2 RESTRAINTS

6.2.1 HIGH COST OF AUTOMATED CELL CULTURE SYSTEMS

6.2.2 LIMITATIONS ASSOCIATED WITH AUTOMATED CELL CULTURES

6.2.3 MAINTENANCE AND UPDATING OF EQUIPMENT

6.2.4 LACK OF SKILLED AND CERTIFIED PROFESSIONALS

6.3 OPPORTUNITIES

6.3.1 NEW PRODUCT LAUNCHES AND TECHNOLOGY DEVELOPMENTS

6.3.2 INCREASING COLLABORATION AMONG MARKET PLAYERS

6.3.3 INCREASING OUTSOURCING FACILITIES

6.3.4 INCREASE IN DEMAND FOR 3D CELL CULTURE

6.4 CHALLENGES

6.4.1 DEVELOPMENT AND MAINTENANCE OF EXPERTISE

6.4.2 LACK OF INFRASTRUCTURE FOR CELL-BASED RESEARCH IN EMERGING ECONOMIES

7 EUROPE AUTOMATED CELL CULTURES MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 CONSUMABLES

7.2.1 MEDIA

7.2.1.1 SERUM FREE MEDIA

7.2.1.2 CLASSICAL MEDIA & SALTS

7.2.1.3 STEM CELL CULTURE MEDIA

7.2.1.4 SPECIALTY MEDIA

7.2.2 BUFFERS AND SUPPLEMENTS

7.2.2.1 PLASMA

7.2.2.2 SERA

7.2.2.3 FETAL BOVINE SERA

7.2.2.4 ADULT BOVINE SERA

7.2.2.5 OTHERS ANIMAL SERA

7.2.3 REAGENTS

7.2.3.1 SUPPLEMENTS & GROWTH FACTORS

7.2.3.2 BUFFERS & CHEMICALS

7.2.3.3 CELL DISASSOCIATION REAGENTS

7.2.3.4 BALANCED SALT SOLUTIONS

7.2.3.5 ATTACHMENT & MATRIX FACTORS

7.2.3.6 ANTIBIOTICS/ANTIMYCOTICS

7.2.3.7 CONTAMINATION DETECTION KITS

7.2.3.8 CRYOPROTECTIVE REAGENTS

7.2.3.9 OTHERS CELL CULTURE REAGENTS

7.2.4 ACCESSORIES

7.3 INSTRUMENTS

7.3.1 SUPPORTING EQUIPMENTS

7.3.1.1 CELL COUNTERS

7.3.1.2 IMAGE BASED CELL COUNTERS

7.3.1.3 FLOW CYTOMETERS

7.3.1.4 COULTER COUNTERS

7.3.1.5 CELL EXPANSION

7.3.1.6 LIQUID HANDLERS

7.3.1.7 OTHERS

7.3.2 BIOREACTORS

7.3.2.1 SINGLE USE BIOREACTORS

7.3.2.2 CONVENTIONAL BIOREACTORS

7.3.2.3 OTHERS

7.3.3 STORAGE EQUIPMENTS

7.3.3.1 REFRIGERATORS & FREEZERS

7.3.3.2 CRYOSTORAGE SYSTEMS

7.3.3.3 OTHERS

8 EUROPE AUTOMATED CELL CULTURES MARKET, BY TYPE

8.1 OVERVIEW

8.2 INFINITE CELL LINE CULTURES

8.3 FINITE CELL LINE CULTURES

9 EUROPE AUTOMATED CELL CULTURES MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 DRUG DEVELOPMENT

9.3 STEM CELL RESEARCH

9.3.1 EMBRYONIC STEM CELLS

9.3.2 TISSUE-SPECIFIC STEM CELLS

9.3.3 MESENCHYMAL STEM CELLS

9.3.4 INDUCED PLURIPOTENT STEM CELLS

9.4 REGENERATIVE MEDICINE

9.4.1 STEM CELL THERAPY

9.4.2 PLATELET-RICH PLASMA THERAPY (OR PRP INJECTIONS)

9.4.3 TISSUE ENGINEERING

9.4.4 AMNIOTIC-MEMBRANE DERIVED STEM CELLS

9.5 CANCER RESEARCH

9.6 VACCINES

9.7 OTHERS

10 EUROPE AUTOMATED CELL CULTURES MARKET, BY END USER

10.1 OVERVIEW

10.2 BIOTECH COMPANIES

10.3 RESEARCH ORGANIZATIONS

10.4 ACADEMIC RESEARCH INSTITUTES

10.5 OTHERS

11 EUROPE AUTOMATED CELL CULTURES MARKET, BY REGION

11.1 EUROPE

11.1.1 GERMANY

11.1.2 U.K.

11.1.3 FRANCE

11.1.4 RUSSIA

11.1.5 ITALY

11.1.6 TURKEY

11.1.7 NETHERLANDS

11.1.8 SWITZERLAND

11.1.9 SPAIN

11.1.10 BELGIUM

11.1.11 REST OF EUROPE

12 EUROPE AUTOMATED CELL CULTURES MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: EUROPE

13 COMPANY PROFILE

13.1 LONZA

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.1.6 SWOT ANALYSIS

13.2 MERCK KGAA

13.2.1 COMPANY SNAPSHOT

13.2.2 RECENT FINANCIALS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.2.6 SWOT ANALYSIS

13.3 THERMO FISHER SCIENTIFIC INC.

13.3.1 COMPANY SNAPSHOT

13.3.2 RECENT FINANCIALS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.3.6 SWOT ANALYSIS

13.4 BD

13.4.1 COMPANY SNAPSHOT

13.4.2 RECENT FINANCIALS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.4.6 SWOT ANALYSIS

13.5 EPPENDORF AG

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.5.6 SWOT ANALYSIS

13.6 ADVANCED INSTRUMENTS

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENTS

13.7 BENCHMARK SCIENTIFIC INC.

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENTS

13.8 BIOSPHERIX LTD.

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENTS

13.9 BIOTRON HEALTHCARE

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENTS

13.1 BULLDOG-BIO, INC.

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.11 CELL CULTURE COMPANY, LLC

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENT

13.12 CELLGENIX GMBH

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENTS

13.13 CHEMOMETEC

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENT

13.14 CORNING INCORPORATED

13.14.1 COMPANY SNAPSHOT

13.14.2 RECENT FINANCIALS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT DEVELOPMENTS

13.15 CYTIVA (SUBSIDIARY OF DANAHER CORPORATION)

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 PRODUCT PORTFOLIO

13.15.4 RECENT DEVELOPMENTS

13.16 FUJIFILM HOLDINGS AMERICA CORPORATION

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENTS

13.17 HAMILTON COMPANY

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENTS

13.18 HITACHI, LTD.

13.18.1 COMPANY SNAPSHOT

13.18.2 REVENUE ANALYSIS

13.18.3 PRODUCT PORTFOLIO

13.18.4 RECENT DEVELOPMENTS

13.19 KAWASAKI HEAVY INDUSTRIES, LTD.

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 PRODUCT PORTFOLIO

13.19.4 RECENT DEVELOPMENTS

13.2 HIMEDIA LABORATORIES

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENTS

13.21 NANOENTEK AMERICA INC. (A SUBSIDIARY OF NANOENTEK)

13.21.1 COMPANY SNAPSHOT

13.21.2 PRODUCT PORTFOLIO

13.21.3 RECENT DEVELOPMENTS

13.22 NEXCELOM BIOSCIENCE LLC.

13.22.1 COMPANY SNAPSHOT

13.22.2 PRODUCT PORTFOLIO

13.22.3 RECENT DEVELOPMENTS

13.23 PROMOCELL GMBH

13.23.1 COMPANY SNAPSHOT

13.23.2 PRODUCT PORTFOLIO

13.23.3 RECENT DEVELOPMENTS

13.24 RWD LIFE SCIENCE CO LTD.

13.24.1 COMPANY SNAPSHOT

13.24.2 PRODUCT PORTFOLIO

13.24.3 RECENT DEVELOPMENTS

13.25 SARTORIUS AG

13.25.1 COMPANY SNAPSHOT

13.25.2 REVENUE ANALYSIS

13.25.3 PRODUCT PORTFOLIO

13.25.4 RECENT DEVELOPMENTS

13.26 SCIENTICA INSTRUMENTATION, INC.

13.26.1 COMPANY SNAPSHOT

13.26.2 PRODUCT PORTFOLIO

13.26.3 RECENT DEVELOPMENTS

13.27 SHIBUYA CORPORATION

13.27.1 COMPANY SNAPSHOT

13.27.2 RECENT FINANCIALS

13.27.3 PRODUCT PORTFOLIO

13.27.4 RECENT DEVELOPMENTS

13.28 SPHERE FLUIDICS LIMITED

13.28.1 COMPANY SNAPSHOT

13.28.2 PRODUCT PORTFOLIO

13.28.3 RECENT DEVELOPMENTS

13.29 TECAN TRADING AG

13.29.1 COMPANY SNAPSHOT

13.29.2 RECENT FINANCIALS

13.29.3 PRODUCT PORTFOLIO

13.29.4 RECENT DEVELOPMENT

13.3 THRIVE BIOSCIENCE, INC.

13.30.1 COMPANY SNAPSHOT

13.30.2 PRODUCT PORTFOLIO

13.30.3 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

Liste des tableaux

TABLE 1 EUROPE AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 2 EUROPE CONSUMABLES IN AUTOMATED CELL CULTURES MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 3 EUROPE CONSUMABLES IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 4 EUROPE MEDIA IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 5 EUROPE BUFFERS & SUPPLEMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 6 EUROPE REAGENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCTS, 2020-2029 (EURO MILLION)

TABLE 7 EUROPE INSTRUMENTS IN AUTOMATED CELL CULTURES MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 8 EUROPE INSTRUMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 9 EUROPE SUPPORTING EQUIPMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 10 EUROPE BIOREACTORS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 11 EUROPE STORAGE EQUIPMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 12 EUROPE AUTOMATED CELL CULTURES MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 13 EUROPE INFINITE CELL LINE CULTURES IN AUTOMATED CELL CULTURES MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 14 EUROPE FINITE CELL LINE CULTURES IN AUTOMATED CELL CULTURES MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 15 EUROPE AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 16 EUROPE DRUG DEVELOPMENT IN AUTOMATED CELL CULTURES MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 17 EUROPE STEM CELL RESEARCH IN AUTOMATED CELL CULTURES MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 18 EUROPE STEM CELL RESEARCH IN AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 19 EUROPE REGENERATIVE MEDICINE IN AUTOMATED CELL CULTURES MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 20 EUROPE REGENERATIVE MEDICINE IN AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 21 EUROPE CANCER RESEARCH IN AUTOMATED CELL CULTURES MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 22 EUROPE VACCINES IN AUTOMATED CELL CULTURES MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 23 EUROPE OTHERS IN AUTOMATED CELL CULTURES MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 24 EUROPE AUTOMATED CELL CULTURES MARKET, BY END USER, 2020-2029 (EURO MILLION)

TABLE 25 EUROPE BIOTECH COMPANIES IN AUTOMATED CELL CULTURES MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 26 EUROPE RESEARCH ORGANIZATIONS IN AUTOMATED CELL CULTURES MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 27 EUROPE ACADEMIC RESEARCH INSTITUTES IN AUTOMATED CELL CULTURES MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 28 EUROPE OTHERS IN AUTOMATED CELL CULTURES MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 29 EUROPE AUTOMATED CELL CULTURES MARKET, BY COUNTRY, 2020-2029 (EURO MILLION)

TABLE 30 EUROPE AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 31 EUROPE CONSUMABLES IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 32 EUROPE MEDIA IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 33 EUROPE BUFFERS & SUPPLEMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 34 EUROPE REAGENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 35 EUROPE INSTRUMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 36 EUROPE SUPPORTING EQUIPMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 37 EUROPE BIOREACTORS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 38 EUROPE STORAGE EQUIPMENT IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 39 EUROPE AUTOMATED CELL CULTURES MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 40 EUROPE AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 41 EUROPE STEM CELL RESEARCH IN AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 42 EUROPE REGENERATIVE MEDICINE IN AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 43 EUROPE AUTOMATED CELL CULTURES MARKET, BY END USER, 2020-2029 (EURO MILLION)

TABLE 44 GERMANY AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 45 GERMANY CONSUMABLES IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 46 GERMANY MEDIA IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 47 GERMANY BUFFERS & SUPPLEMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 48 GERMANY REAGENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 49 GERMANY INSTRUMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 50 GERMANY SUPPORTING EQUIPMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 51 GERMANY BIOREACTORS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 52 GERMANY STORAGE EQUIPMENT IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 53 GERMANY AUTOMATED CELL CULTURES MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 54 GERMANY AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 55 GERMANY STEM CELL RESEARCH IN AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 56 GERMANY REGENERATIVE MEDICINE IN AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 57 GERMANY AUTOMATED CELL CULTURES MARKET, BY END USER, 2020-2029 (EURO MILLION)

TABLE 58 U.K. AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 59 U.K. CONSUMABLES IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 60 U.K. MEDIA IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 61 U.K. BUFFERS & SUPPLEMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 62 U.K. REAGENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 63 U.K. INSTRUMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 64 U.K. SUPPORTING EQUIPMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 65 U.K. BIOREACTORS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 66 U.K. STORAGE EQUIPMENT IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 67 U.K. AUTOMATED CELL CULTURES MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 68 U.K. AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 69 U.K. STEM CELL RESEARCH IN AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 70 U.K. REGENERATIVE MEDICINE IN AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 71 U.K. AUTOMATED CELL CULTURES MARKET, BY END USER, 2020-2029 (EURO MILLION)

TABLE 72 FRANCE AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 73 FRANCE CONSUMABLES IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 74 FRANCE MEDIA IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 75 FRANCE BUFFERS & SUPPLEMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 76 FRANCE REAGENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 77 FRANCE INSTRUMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 78 FRANCE SUPPORTING EQUIPMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 79 FRANCE BIOREACTORS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 80 FRANCE STORAGE EQUIPMENT IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 81 FRANCE AUTOMATED CELL CULTURES MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 82 FRANCE AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 83 FRANCE STEM CELL RESEARCH IN AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 84 FRANCE REGENERATIVE MEDICINE IN AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 85 FRANCE AUTOMATED CELL CULTURES MARKET, BY END USER, 2020-2029 (EURO MILLION)

TABLE 86 RUSSIA AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 87 RUSSIA CONSUMABLES IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 88 RUSSIA MEDIA IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 89 RUSSIA BUFFERS & SUPPLEMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 90 RUSSIA REAGENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 91 RUSSIA INSTRUMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 92 RUSSIA SUPPORTING EQUIPMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 93 RUSSIA BIOREACTORS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 94 RUSSIA STORAGE EQUIPMENT IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 95 RUSSIA AUTOMATED CELL CULTURES MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 96 RUSSIA AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 97 RUSSIA STEM CELL RESEARCH IN AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 98 RUSSIA REGENERATIVE MEDICINE IN AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 99 RUSSIA AUTOMATED CELL CULTURES MARKET, BY END USER, 2020-2029 (EURO MILLION)

TABLE 100 ITALY AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 101 ITALY CONSUMABLES IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 102 ITALY MEDIA IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 103 ITALY BUFFERS & SUPPLEMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 104 ITALY REAGENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 105 ITALY INSTRUMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 106 ITALY SUPPORTING EQUIPMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 107 ITALY BIOREACTORS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 108 ITALY STORAGE EQUIPMENT IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 109 ITALY AUTOMATED CELL CULTURES MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 110 ITALY AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 111 ITALY STEM CELL RESEARCH IN AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 112 ITALY REGENERATIVE MEDICINE IN AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 113 ITALY AUTOMATED CELL CULTURES MARKET, BY END USER, 2020-2029 (EURO MILLION)

TABLE 114 TURKEY AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 115 TURKEY CONSUMABLES IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 116 TURKEY MEDIA IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 117 TURKEY BUFFERS & SUPPLEMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 118 TURKEY REAGENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 119 TURKEY INSTRUMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 120 TURKEY SUPPORTING EQUIPMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 121 TURKEY BIOREACTORS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 122 TURKEY STORAGE EQUIPMENT IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 123 TURKEY AUTOMATED CELL CULTURES MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 124 TURKEY AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 125 TURKEY STEM CELL RESEARCH IN AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 126 TURKEY REGENERATIVE MEDICINE IN AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 127 TURKEY AUTOMATED CELL CULTURES MARKET, BY END USER, 2020-2029 (EURO MILLION)

TABLE 128 NETHERLANDS AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 129 NETHERLANDS CONSUMABLES IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 130 NETHERLANDS MEDIA IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 131 NETHERLANDS BUFFERS & SUPPLEMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 132 NETHERLANDS REAGENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 133 NETHERLANDS INSTRUMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 134 NETHERLANDS SUPPORTING EQUIPMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 135 NETHERLANDS BIOREACTORS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 136 NETHERLANDS STORAGE EQUIPMENT IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 137 NETHERLANDS AUTOMATED CELL CULTURES MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 138 NETHERLANDS AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 139 NETHERLANDS STEM CELL RESEARCH IN AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 140 NETHERLANDS REGENERATIVE MEDICINE IN AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 141 NETHERLANDS AUTOMATED CELL CULTURES MARKET, BY END USER, 2020-2029 (EURO MILLION)

TABLE 142 SWITZERLAND AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 143 SWITZERLAND CONSUMABLES IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 144 SWITZERLAND MEDIA IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 145 SWITZERLAND BUFFERS & SUPPLEMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 146 SWITZERLAND REAGENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 147 SWITZERLAND INSTRUMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 148 SWITZERLAND SUPPORTING EQUIPMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 149 SWITZERLAND BIOREACTORS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 150 SWITZERLAND STORAGE EQUIPMENT IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 151 SWITZERLAND AUTOMATED CELL CULTURES MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 152 SWITZERLAND AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 153 SWITZERLAND STEM CELL RESEARCH IN AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 154 SWITZERLAND REGENERATIVE MEDICINE IN AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 155 SWITZERLAND AUTOMATED CELL CULTURES MARKET, BY END USER, 2020-2029 (EURO MILLION)

TABLE 156 SPAIN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 157 SPAIN CONSUMABLES IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 158 SPAIN MEDIA IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 159 SPAIN BUFFERS & SUPPLEMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 160 SPAIN REAGENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 161 SPAIN INSTRUMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 162 SPAIN SUPPORTING EQUIPMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 163 SPAIN BIOREACTORS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 164 SPAIN STORAGE EQUIPMENT IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 165 SPAIN AUTOMATED CELL CULTURES MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 166 SPAIN AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 167 SPAIN STEM CELL RESEARCH IN AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 168 SPAIN REGENERATIVE MEDICINE IN AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 169 SPAIN AUTOMATED CELL CULTURES MARKET, BY END USER, 2020-2029 (EURO MILLION)

TABLE 170 BELGIUM AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 171 BELGIUM CONSUMABLES IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 172 BELGIUM MEDIA IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 173 BELGIUM BUFFERS & SUPPLEMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 174 BELGIUM REAGENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 175 BELGIUM INSTRUMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 176 BELGIUM SUPPORTING EQUIPMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 177 BELGIUM BIOREACTORS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 178 BELGIUM STORAGE EQUIPMENT IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 179 BELGIUM AUTOMATED CELL CULTURES MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 180 BELGIUM AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 181 BELGIUM STEM CELL RESEARCH IN AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 182 BELGIUM REGENERATIVE MEDICINE IN AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 183 BELGIUM AUTOMATED CELL CULTURES MARKET, BY END USER, 2020-2029 (EURO MILLION)

TABLE 184 REST OF EUROPE AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

Liste des figures

FIGURE 1 EUROPE AUTOMATED CELL CULTURES MARKET: SEGMENTATION

FIGURE 2 EUROPE AUTOMATED CELL CULTURES MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE AUTOMATED CELL CULTURES MARKET: DROC ANALYSIS

FIGURE 4 EUROPE AUTOMATED CELL CULTURES MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE AUTOMATED CELL CULTURES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE AUTOMATED CELL CULTURES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE AUTOMATED CELL CULTURES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE AUTOMATED CELL CULTURES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 EUROPE AUTOMATED CELL CULTURES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE AUTOMATED CELL CULTURES MARKET: SEGMENTATION

FIGURE 11 WIDE ACCEPTANCE OF CELL CULTURE TECHNIQUES IN VARIOUS APPLICATIONS AND THE GROWING BIOTECHNOLOGY SECTOR ARE EXPECTED TO DRIVE THE EUROPE AUTOMATED CELL CULTURES MARKET IN THE FORECAST PERIOD

FIGURE 12 CONSUMABLES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE AUTOMATED CELL CULTURES MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF EUROPE AUTOMATED CELL CULTURES MARKET

FIGURE 14 EUROPE AUTOMATED CELL CULTURES MARKET: BY PRODUCT, 2021

FIGURE 15 EUROPE AUTOMATED CELL CULTURES MARKET: BY PRODUCT, 2022-2029 (EURO MILLION)

FIGURE 16 EUROPE AUTOMATED CELL CULTURES MARKET: BY PRODUCT, CAGR (2022-2029)

FIGURE 17 EUROPE AUTOMATED CELL CULTURES MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 18 EUROPE AUTOMATED CELL CULTURES MARKET: BY TYPE, 2021

FIGURE 19 EUROPE AUTOMATED CELL CULTURES MARKET: BY TYPE, 2022-2029 (EURO MILLION)

FIGURE 20 EUROPE AUTOMATED CELL CULTURES MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 21 EUROPE AUTOMATED CELL CULTURES MARKET: BY TYPE, LIFELINE CURVE

FIGURE 22 EUROPE AUTOMATED CELL CULTURES MARKET: BY APPLICATION, 2021

FIGURE 23 EUROPE AUTOMATED CELL CULTURES MARKET: BY APPLICATION, 2022-2029 (EURO MILLION)

FIGURE 24 EUROPE AUTOMATED CELL CULTURES MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 25 EUROPE AUTOMATED CELL CULTURES MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 26 EUROPE AUTOMATED CELL CULTURES MARKET: BY END USER, 2021

FIGURE 27 EUROPE AUTOMATED CELL CULTURES MARKET: BY END USER, 2022-2029 (EURO MILLION)

FIGURE 28 EUROPE AUTOMATED CELL CULTURES MARKET: BY END USER, CAGR (2022-2029)

FIGURE 29 EUROPE AUTOMATED CELL CULTURES MARKET: BY END USER, LIFELINE CURVE

FIGURE 30 EUROPE AUTOMATED CELL CULTURES MARKET : SNAPSHOT (2021)

FIGURE 31 EUROPE AUTOMATED CELL CULTURES MARKET: BY COUNTRY (2021)

FIGURE 32 EUROPE AUTOMATED CELL CULTURES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 33 EUROPE AUTOMATED CELL CULTURES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 34 EUROPE AUTOMATED CELL CULTURES MARKET : BY PRODUCT (2022-2029)

FIGURE 35 EUROPE AUTOMATED CELL CULTURES MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.