Marché européen des équipements d'aquaculture, par type (équipement de purification de l'eau, dispositifs d'aération, équipement de circulation et d'aération de l'eau, distributeur automatique de poissons, équipement de pêche, équipement de confinement, moulinets de senne, équipement d'entretien et de réparation, dispositif de contrôle de la température de l'eau, instrument de test de la qualité de l'eau, équipement pour étang transparent et autres), application (aquaculture en plein air, aquaculture en intérieur), utilisation finale (animaux aquatiques, plantes aquatiques), canal de distribution (direct, indirect), tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et perspectives du marché européen des équipements d'aquaculture

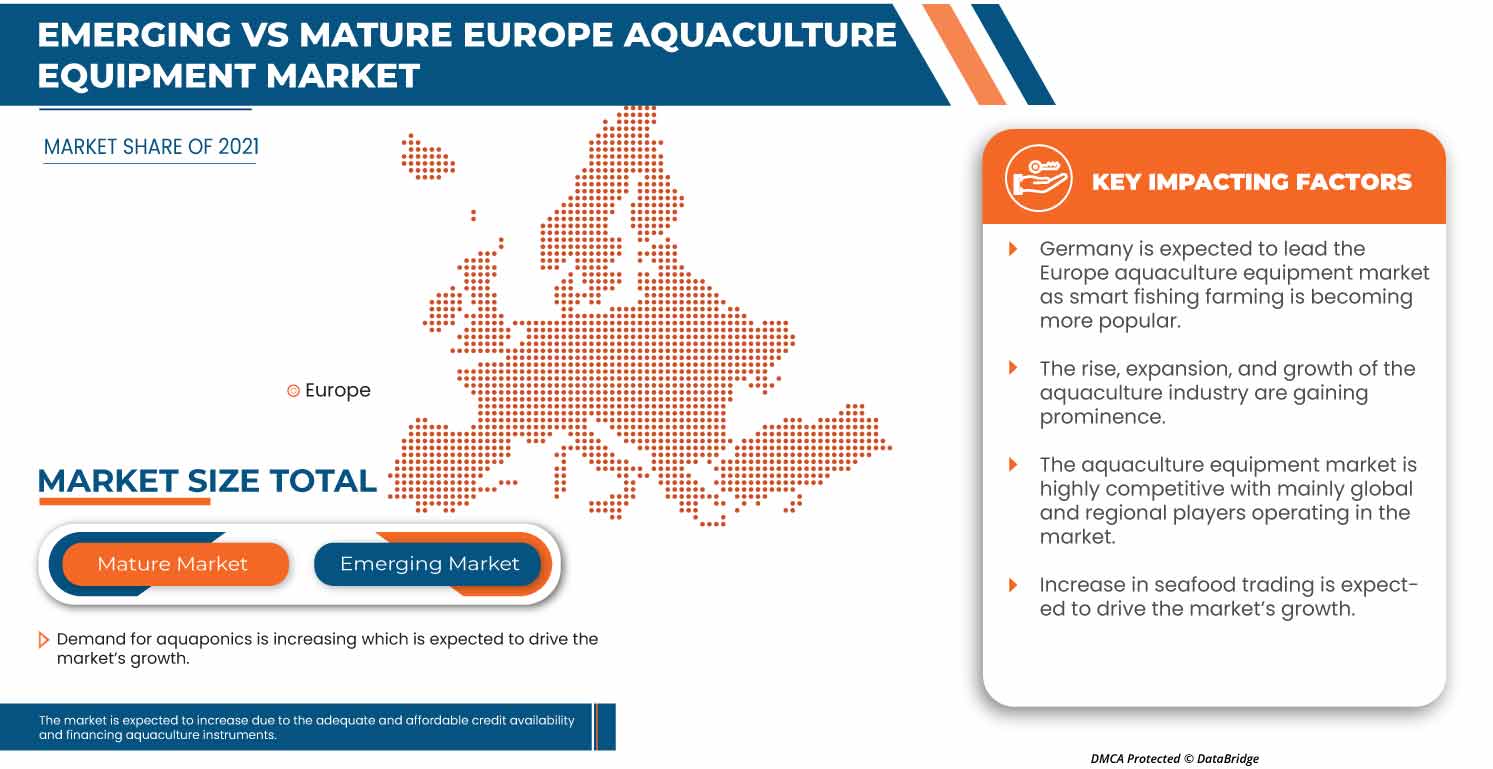

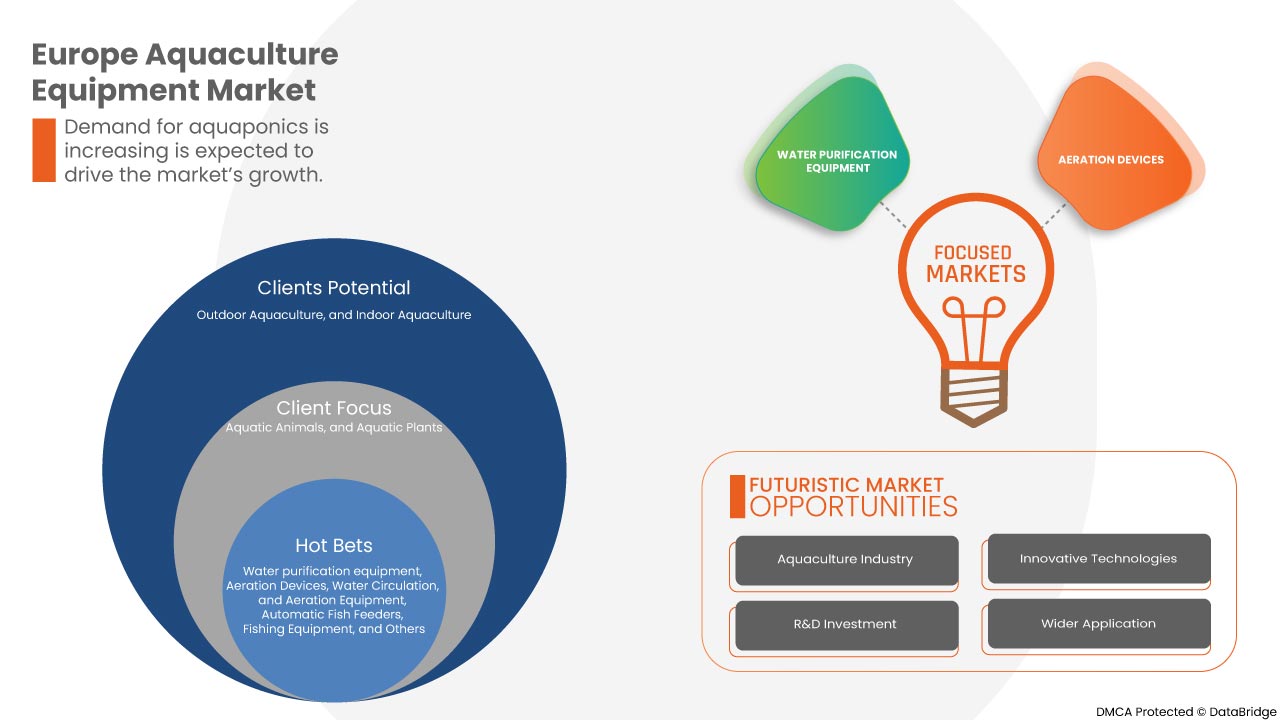

L'augmentation du commerce des produits de la mer et la demande croissante en aquaponie devraient stimuler la demande sur le marché européen des équipements d'aquaculture. Cependant, les préoccupations concernant la sécurité alimentaire dans l'aquaculture et la propagation de maladies et de parasites mortels pourraient encore limiter la croissance du marché.

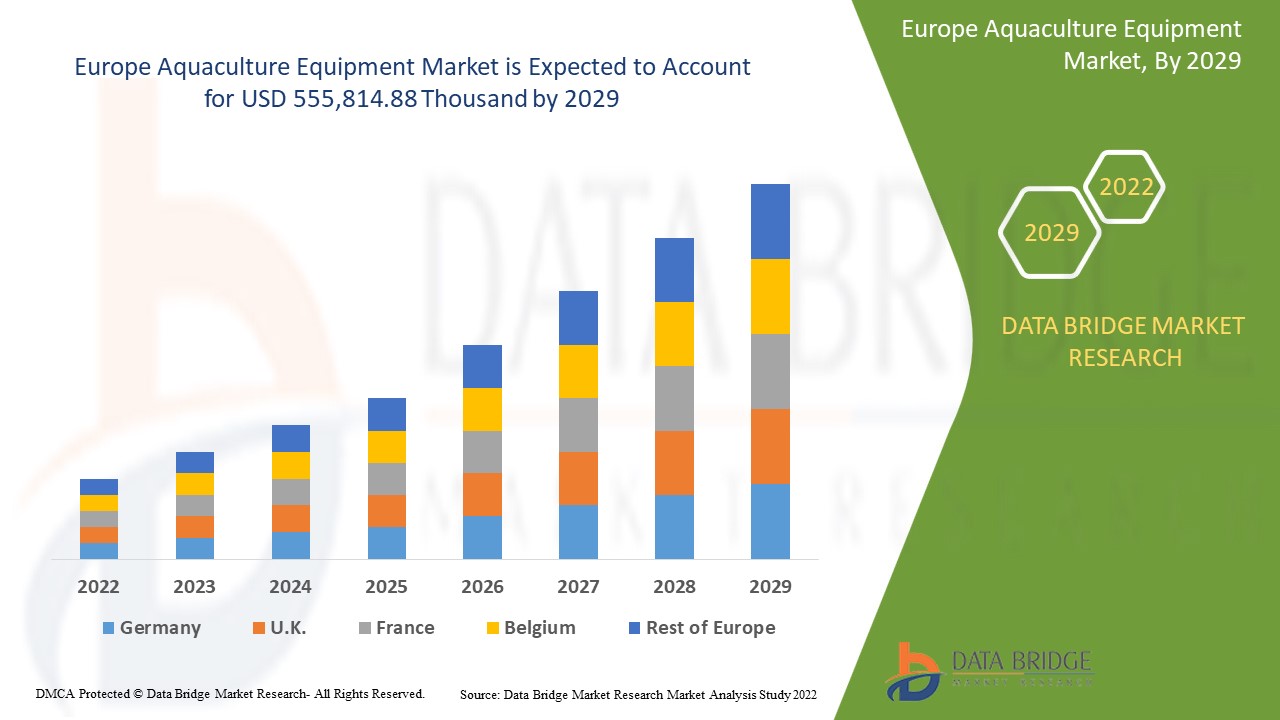

Data Bridge Market Research analyse que le marché européen des équipements d'aquaculture devrait atteindre la valeur de 555 814,88 milliers de dollars d'ici 2029, à un TCAC de 4,0 % au cours de la période de prévision. Les équipements de purification de l'eau représentent le segment de type le plus important sur le marché européen des équipements d'aquaculture. Le rapport sur le marché européen des équipements d'aquaculture couvre également en profondeur l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains |

|

Segments couverts |

Par type (équipement de purification de l'eau, dispositifs d'aération, équipement de circulation et d'aération de l'eau, distributeur automatique de nourriture pour poissons, équipement de pêche, équipement de confinement, moulinets de senne, équipement d'entretien et de réparation, dispositif de contrôle de la température de l'eau, instrument de test de la qualité de l'eau, équipement pour étang transparent et autres), application (aquaculture en plein air, aquaculture en intérieur), utilisation finale (animaux aquatiques, plantes aquatiques), canal de distribution (direct, indirect). |

|

Pays couverts |

Allemagne, Royaume-Uni, France, Italie, Espagne, Russie, Suisse, Turquie, Belgique, Pays-Bas, Danemark, Pologne, Suède et le reste de l'Europe. |

|

Acteurs du marché couverts |

Aquaculture Equipment Ltd, SKAGINN 3X, Haosail, Norfab Equipment Ltd., Sino-Aqua Corporation, BAADER, FAIVRE Ets, Rastaquaculture, Cflow, FishFarmFeeeder, FREA SOLUTIONS et Aquamof Aquaculture Technologies Ltd. Entre autres. |

Définition du marché

L'aquaculture est l'élevage de plantes aquatiques, d'animaux aquatiques et d'autres organismes aquatiques. Il s'agit de l'élevage, de l'élevage et de la récolte d'organismes dans des milieux aquatiques. Par conséquent, l'équipement d'aquaculture fait référence à l'équipement utilisé dans le processus d'élevage aquacole. Au cours de l'année, l'industrie de l'aquaculture a pris un élan significatif dans son taux de croissance et a montré un grand potentiel de croissance. En conséquence, de plus en plus d'acteurs entrent dans ce domaine.

Dynamique du marché européen des équipements d'aquaculture

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

-

L’essor, l’expansion et la croissance de l’industrie de l’aquaculture

L'aquaculture, ou l'élevage de poissons et de fruits de mer, est le secteur qui connaît la croissance la plus rapide dans le secteur de l'alimentation animale. La croissance de l'aquaculture a été alimentée par l'expansion du commerce européen, la diminution de la disponibilité des poissons sauvages, les prix compétitifs des produits, la hausse des revenus et l'urbanisation, qui contribuent tous à la hausse de la consommation de fruits de mer par habitant dans le monde. En outre, les développements techniques créatifs, les investissements dans la R&D et la coopération avec les principaux acteurs de l'industrie permettront d'étendre et d'élargir la portée mondiale de l'industrie de l'aquaculture. Cela augmentera également la croissance des équipements d'aquaculture tels que les aérateurs, les pompes, les mangeoires, les filtres et autres qui dépendent des industries de l'aquaculture. Ainsi, en raison de la croissance de l'activité aquacole, la demande d'équipements d'aquaculture augmentera. Dans un avenir prévisible, cela devrait stimuler le marché européen des équipements d'aquaculture.

-

Augmentation du commerce des produits de la mer

Grâce à des décennies de rendements accrus dans le secteur de la pêche et de l'aquaculture et à une demande européenne croissante, les produits de la mer sont aujourd'hui l'une des catégories alimentaires les plus commercialisées au monde. Le taux de croissance le plus rapide du commerce des produits aquatiques révèle qu'une proportion plus élevée des volumes d'échanges de produits de la mer comprend diverses espèces. Les pays en développement jouent un rôle majeur dans les exportations de produits de la mer, car les pays développés dépendent de plus en plus des pays en développement pour les importations d'espèces à forte valeur ajoutée. Ainsi, l'augmentation du commerce des produits de la mer accroît la croissance des industries de l'aquaculture, ce qui entraînera une augmentation de la demande d'équipements d'aquaculture. Cela devrait stimuler le marché des équipements d'aquaculture dans un avenir proche.

Opportunités

-

Des mesures gouvernementales renforcées pour stimuler l'aquaculture

La pêche et l'aquaculture fournissent chaque jour de la nourriture à des centaines de millions de personnes dans le monde. Elles contribuent à la production alimentaire et aident les animaux en voie de disparition en remplissant diverses fonctions. Les initiatives des gouvernements, telles que les réglementations et les programmes qui favorisent l'expansion du secteur de l'aquaculture, ne servent qu'à préparer le terrain pour le développement futur, parallèlement aux solutions technologiques. Cette expansion créera des opportunités supplémentaires pour les acteurs importants de l'industrie et les agriculteurs dans un avenir proche, faisant de l'aquaculture un secteur à surveiller. En conséquence, les mesures gouvernementales croissantes visant à stimuler l'aquaculture devraient offrir une opportunité de croissance du marché des équipements d'aquaculture

Contraintes/Défis

- Préoccupations concernant la sécurité alimentaire dans l’aquaculture

Les données épidémiologiques sur les infections d’origine alimentaire montrent que les poissons pêchés en haute mer sont généralement des aliments sûrs et sains s’ils sont réfrigérés rapidement et manipulés de manière appropriée. Les produits de l’aquaculture, en revanche, ont été liés à certains problèmes de sécurité alimentaire, car le risque de contamination par des agents chimiques et biologiques est plus élevé dans les habitats d’eau douce et côtiers que dans les océans ouverts. En conséquence, le manque d’infrastructures et les restrictions gouvernementales constantes peuvent limiter l’expansion du marché. La production aquacole deviendra certainement un moyen de plus en plus important de produire des produits aquatiques destinés à la consommation humaine, mais le risque lié à la sécurité alimentaire concernant l’aquaculture sera durement touché dans l’économie. Cette préoccupation de sécurité alimentaire dans l’aquaculture entravera la croissance de l’industrie aquacole et, par conséquent, limitera la croissance du marché des équipements d’aquaculture.

- Les difficultés de la surpêche

Alors que 90 % des stocks de poissons sauvages du monde sont entièrement pêchés, surexploités ou épuisés, l'aquaculture est en pleine expansion. Pourtant, la question de savoir si l'aquaculture est une solution à la surpêche reste controversée. La surpêche est en hausse, car les fruits de mer sont devenus l'une des denrées alimentaires les plus commercialisées de la planète. Lorsque les populations de poissons sont surexploitées, les écosystèmes marins fragiles dont dépend notre planète sont perturbés. L'aquaculture, qui couvre à la fois les espèces d'eau salée et d'eau douce, est la technique d'élevage de poissons dans des conditions contrôlées. C'est l'industrie de production alimentaire qui connaît la croissance la plus rapide au monde, représentant environ 44 % de tout le poisson consommé, mais pour maintenir son expansion, elle dépend principalement de la capture de poissons sauvages. Ainsi, les difficultés liées à la surpêche peuvent constituer un défi pour l'industrie de l'aquaculture, ce qui peut mettre à mal la croissance du marché des équipements d'aquaculture.

Impact post-COVID-19 sur le marché européen des équipements d'aquaculture

La COVID-19 a eu un impact sur plusieurs secteurs de la fabrication au cours de l'année 2020-2021, car elle a entraîné la fermeture de lieux de travail, la perturbation des chaînes d'approvisionnement et des restrictions sur les transports. En raison du confinement, le marché a connu une baisse des ventes en raison de la fermeture des points de vente au détail et des restrictions d'accès des clients au cours des dernières années.

Cependant, la croissance du marché après la pandémie est due à une plus grande sensibilisation des consommateurs à la santé et à une demande croissante de fruits de mer sains et nutritifs. Cela a conduit à une popularité croissante de l'aquaculture auprès des gens en raison des divers avantages pour la santé et de la popularité croissante des aliments riches en protéines. Les principaux acteurs du marché prennent diverses décisions stratégiques pour rebondir après la COVID-19. Les acteurs mènent de nombreuses activités de R&D pour améliorer leurs offres. Ils augmentent leur part de marché en explorant différents canaux de vente au détail et en s'étendant dans de nouvelles régions.

Développements récents

- En août 2022, SKAGINN 3X a signé un contrat avec BlueWild, Norvège, pour fournir une usine complète de transformation du poisson à bord du nouveau chalutier innovant de l'entreprise. Le chalutier est conçu pour offrir durabilité, qualité et efficacité à tous les niveaux. Il s'agit d'un accord historique pour l'organisation.

- En avril 2022, Cflow AS a participé au Nor-Shipping du 4 au 7 avril. Nor-Shipping est au cœur des océans. C'est là que les industries maritimes et océaniques se rencontrent tous les deux ans - un centre naturel pour les principaux décideurs du monde entier pour se connecter, collaborer et conclure des accords afin de débloquer de nouvelles opportunités commerciales.

Portée du marché européen des équipements d'aquaculture

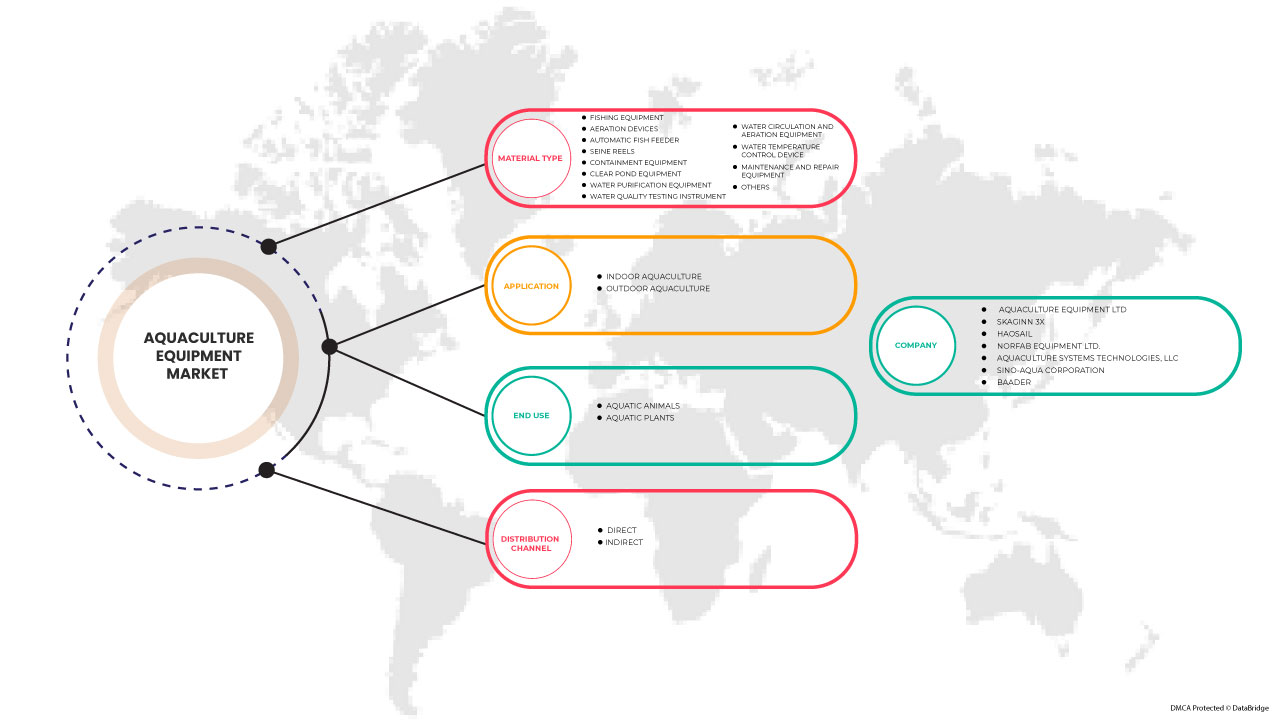

Le marché européen des équipements d'aquaculture est segmenté en fonction du type, de l'application, de l'utilisation finale et du canal de distribution. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Taper

- Équipement de purification de l'eau

- Dispositifs d'aération

- Équipement de circulation et d'aération de l'eau

- Distributeur automatique de nourriture pour poissons

- Matériel de pêche

- Équipement de confinement

- Moulinets à senne

- Équipement d'entretien et de réparation

- Dispositif de contrôle de la température de l'eau

- Instrument de test de la qualité de l'eau

- Équipement pour bassin transparent

- Autres

En fonction du type, le marché européen des équipements d'aquaculture est segmenté en équipements de purification de l'eau, dispositifs d'aération, équipements de circulation et d'aération de l'eau, distributeur automatique de poissons, équipement de pêche, équipement de confinement, moulinets de senne, équipement d'entretien et de réparation, dispositif de contrôle de la température de l'eau, instrument de test de la qualité de l'eau, équipement d'étang clair et autres.

Application

- Aquaculture en plein air

- Aquaculture intérieure

En fonction des applications, le marché européen des équipements d’aquaculture est segmenté en aquaculture de plein air et aquaculture d’intérieur.

Utilisation finale

- Animaux aquatiques

- Plantes aquatiques

En fonction de l’utilisation finale, le marché européen des équipements d’aquaculture est segmenté en animaux aquatiques et plantes aquatiques.

Canal de distribution

- Direct

- Indirect

En fonction du canal de distribution, le marché européen des équipements d’aquaculture est segmenté en direct et indirect.

Analyse/perspectives régionales du marché des équipements d'aquaculture en Europe

Le marché européen des équipements d’aquaculture est analysé et des informations sur la taille du marché et les tendances sont fournies par pays, type, application, utilisation finale et canal de distribution, comme référencé ci-dessus.

Le marché européen des équipements d’aquaculture couvre des pays tels que l’Allemagne, le Royaume-Uni, la France, l’Italie, l’Espagne, la Russie, la Suisse, la Turquie, la Belgique, les Pays-Bas, le Danemark, la Pologne, la Suède et le reste de l’Europe.

L'Allemagne devrait dominer le marché européen des équipements d'aquaculture en raison de la sensibilisation croissante des consommateurs aux questions de santé et de la demande d'aliments riches en protéines. Cela est également dû à l'intérêt croissant pour l'aquaculture. L'Allemagne domine le marché avec la part de marché la plus élevée, suivie du Royaume-Uni et de la France. L'Italie et l'Espagne sont deux autres pays où la demande augmente en raison de l'adoption croissante de l'aquaculture et de la popularité croissante des fruits de mer auprès des consommateurs.

La section par pays du rapport sur le marché européen des équipements d'aquaculture fournit également des facteurs d'impact individuels sur le marché et des changements de réglementation nationale qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation sont quelques-uns des indicateurs importants utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques européennes et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales et de l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des équipements d'aquaculture en Europe

Le paysage concurrentiel du marché européen des équipements d'aquaculture fournit des détails sur le concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Europe, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement de la solution, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus ne concernent que les entreprises qui se concentrent sur le marché européen des équipements d'aquaculture.

Certains des principaux acteurs opérant sur le marché européen des équipements d'aquaculture sont Aquaculture Equipment Ltd, SKAGINN 3X, Haosail, Norfab Equipment Ltd., Sino-Aqua Corporation, BAADER, FAIVRE Ets, Rastaquaculture, Cflow, FishFarmFeeeder, FREA SOLUTIONS et Aquamof Aquaculture Technologies Ltd. entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE AQUACULTURE EQUIPMENT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USE COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND OUTLOOK

4.1.1 COMPARATIVE BRAND ANALYSIS

4.1.2 PRODUCT VS BRAND OVERVIEW

4.2 FACTORS INFLUENCING PURCHASING DECISION OF CUSTOMER

4.2.1 ECONOMIC FACTOR

4.2.2 FUNCTIONAL FACTOR

4.3 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.4 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.4.1 INDUSTRY TRENDS FOR NORTHERN EUROPE

4.5 NEW PRODUCT LAUNCH STRATEGY

4.5.1 OVERVIEW

4.5.2 NUMBER OF NEW PRODUCT LAUNCHES

4.5.3 MEETING CONSUMER REQUIREMENT

4.6 IMPACT OF ECONOMIC SLOWDOWN

4.7 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.7.1 TECHNOLOGICAL ADVANCMENTS IN NORTHERN EUROPE

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 RAW MATERIAL PROCUREMENT

4.8.2 MANUFACTURING AND PACKING

4.8.3 MARKETING AND DISTRIBUTION

4.8.4 END USERS

4.9 VALUE CHAIN ANALYSIS

5 REGULATORY FRAMEWORK AND GUIDELINES

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 THE RISE, EXPANSION, AND GROWTH OF THE AQUACULTURE INDUSTRY

6.1.2 INCREASE IN SEAFOOD TRADING

6.1.3 DEMAND FOR AQUAPONICS IS INCREASING

6.1.4 SMART FISH FARMING IS BECOMING MORE POPULAR

6.2 RESTRAINTS

6.2.1 CONCERNS ABOUT FOOD SAFETY IN AQUACULTURE

6.2.2 THE SPREAD OF DEADLY DISEASES AND PARASITES

6.3 OPPORTUNITIES

6.3.1 RISING GOVERNMENT MEASURES TO BOOST AQUACULTURE

6.3.2 CONCENTRATING ON THE DEVELOPMENT OF INNOVATIVE TECHNOLOGY SOLUTIONS

6.3.3 ADEQUATE AND AFFORDABLE CREDIT AVAILABILITY AND FINANCING INSTRUMENTS

6.4 CHALLENGES

6.4.1 OVERFISHING DIFFICULTIES

6.4.2 AQUACULTURE'S ENVIRONMENTAL DIFFICULTIES AND CONCERNS

7 EUROPE AQUACULTURE EQUIPMENT MARKET, BY TYPE

7.1 OVERVIEW

7.2 WATER PURIFICATION EQUIPMENT

7.2.1 WATER PUMPS AND FILTERS

7.2.2 AERATORS

7.2.3 FEEDERS

7.2.4 PROTEIN SKIMMER

7.3 AERATION DEVICES

7.4 WATER CIRCULATION AND AERATION EQUIPMENT

7.5 AUTOMATIC FISH FEEDER

7.6 FISHING EQUIPMENT

7.7 CONTAINMENT EQUIPMENT

7.8 SEINE REELS

7.9 MAINTENANCE AND REPAIR EQUIPMENT

7.9.1 DIGGING TOOLS

7.9.2 LEVELLING TOOLS

7.9.3 DESILTING EQUIPMENT

7.9.4 OTHERS

7.1 WATER TEMPERATURE CONTROL DEVICES

7.11 WATER QUALITY TESTING INSTRUMENT

7.12 CLEAR POND EQUIPMENT

7.13 OTHERS

8 EUROPE AQUACULTURE EQUIPMENT MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 OUTDOOR AQUACULTURE

8.2.1 BRACKISH WATER

8.2.2 MARINE

8.3 INDOOR AQUACULTURE

9 EUROPE AQUACULTURE EQUIPMENT MARKET, BY END USE

9.1 OVERVIEW

9.2 AQUATIC ANIMALS

9.2.1 FISH

9.2.2 MOLLUSKS

9.2.3 CRUSTACEAN

9.2.4 OTHERS

9.3 AQUATIC PLANTS

9.3.1 SUBMERGED (SEAWEED)

9.3.2 FLOATING (ALGAE)

9.3.3 EMERGED

10 EUROPE AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 DIRECT

10.3 INDIRECT

11 EUROPE AQUACULTURE EQUIPMENT MARKET, BY GEOGRAPHY

11.1 EUROPE

11.1.1 GERMANY

11.1.2 U.K.

11.1.3 FRANCE

11.1.4 ITALY

11.1.5 SPAIN

11.1.6 RUSSIA

11.1.7 SWITZERLAND

11.1.8 TURKEY

11.1.9 BELGIUM

11.1.10 NETHERLANDS

11.1.11 DENMARK

11.1.12 POLAND

11.1.13 SWEDEN

11.1.14 REST OF EUROPE

12 EUROPE AQUACULTURE EQUIPMENT MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: EUROPE

12.1.1 NEW PRODUCTION FACILITY

12.1.2 EVENT

12.1.3 NEW PRODUCT LAUNCH

12.1.4 COLLABORATION

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 BAADER

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT UPDATES

14.2 SKAGINN 3X

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PORTFOLIO

14.2.4 RECENT UPDATES

14.3 AQUAMAOF AQUACULTURE TECHNOLOGIES LTD.

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT UPDATES

14.4 NANRONG SHANGHAI CO., LTD.

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT UPDATES

14.5 CFLOW

14.5.1 COMPANY SNAPSHOT

14.5.2 COMPANY SHARE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT UPDATES

14.6 AQUACULTURE EQUIPMENT LTD

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT UPDATES

14.7 AQUACULTURE SYSTEMS TECHNOLOGIES, LLC

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT UPDATES

14.8 AQUANEERING INCORPORATED

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT UPDATES

14.9 DURA-TECH

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT UPDATES

14.1 FAIVRE ETS

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT UPDATES

14.11 FISHFARMFEEDER

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT UPDATES

14.12 FREA SOLUTIONS

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT UPDATES

14.13 HAOSAIL

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT UPDATES

14.14 HUNG STAR ENTERPRISE CORP.

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT UPDATES

14.15 NORFAB EQUIPMENT LTD.

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT UPDATES

14.16 PIONEER GROUP

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT UPDATES

14.17 RASTAQUACULTURE

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT UPDATES

14.18 SAGAR AQUACULTURE PVT LTD

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT UPDATES

14.19 SINO-AQUA CORPORATION

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT UPDATES

14.2 SRR AQUA SUPPLIERS LLP

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT UPDATES

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF AIR PUMPS, AIR OR OTHER GAS COMPRESSORS AND VENTILATING OR RECYCLING HOODS, AND OTHER AQUACULTURE EQUIPMENT; HS CODE – 841480 (USD THOUSAND)

TABLE 2 EXPORT DATA OF AIR PUMPS, AIR OR OTHER GAS COMPRESSORS AND VENTILATING OR RECYCLING HOODS AND OTHER AQUACULTURE EQUIPMENT; HS CODE – 841480 (USD THOUSAND)

TABLE 3 REGULATORY FRAMEWORK

TABLE 4 EUROPE AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 5 EUROPE AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 6 EUROPE WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 EUROPE WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 8 EUROPE AERATION DEVICES IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 EUROPE WATER CIRCULATION AND AERATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 EUROPE AUTOMATIC FISH FEEDER IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 EUROPE FISHING EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 EUROPE CONTAINMENT EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 EUROPE SEINE REELS IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 EUROPE MAINTENANCE AND REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 EUROPE MAINTENANCE AND REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 16 EUROPE WATER TEMPERATURE CONTROL DEVICES IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 EUROPE WATER QUALITY TESTING INSTRUMENT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 EUROPE CLEAR POND EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 EUROPE OTHERS IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 EUROPE AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 21 EUROPE OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 EUROPE OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 23 EUROPE INDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 EUROPE AQUACULTURE EQUIPMENT MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 25 EUROPE AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 EUROPE AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 27 EUROPE AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 EUROPE AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 29 EUROPE AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 30 EUROPE DIRECT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 EUROPE INDIRECT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 EUROPE AQUACULTURE EQUIPMENT MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 33 EUROPE AQUACULTURE EQUIPMENT MARKET, BY COUNTRY, 2020-2029 (THOUSAND UNITS)

TABLE 34 EUROPE AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 35 EUROPE AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 36 EUROPE WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 37 EUROPE MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 38 EUROPE AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 39 EUROPE OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 40 EUROPE AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 41 EUROPE AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 42 EUROPE AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 43 EUROPE AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 44 GERMANY AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 45 GERMANY AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 46 GERMANY WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 47 GERMANY MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 48 GERMANY AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 49 GERMANY OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 50 GERMANY AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 51 GERMANY AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 52 GERMANY AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 53 GERMANY AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 54 U.K AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 U.K AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 56 U.K WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 U.K MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 58 U.K AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 59 U.K OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 60 U.K AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 61 U.K AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 62 U.K AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 63 U.K AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 64 FRANCE AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 65 FRANCE AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 66 FRANCE WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 67 FRANCE MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 68 FRANCE AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 69 FRANCE OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 70 FRANCE AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 71 FRANCE AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 72 FRANCE AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 73 FRANCE AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 74 ITALY AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 75 ITALY AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 76 ITALY WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 77 ITALY MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 78 ITALY AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 79 ITALY OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 80 ITALY AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 81 ITALY AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 82 ITALY AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 83 ITALY AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 84 SPAIN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 85 SPAIN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 86 SPAIN WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 87 SPAIN MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 88 SPAIN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 89 SPAIN OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 90 SPAIN AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 91 SPAIN AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 92 SPAIN AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 93 SPAIN AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 94 RUSSIA AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 95 RUSSIA AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 96 RUSSIA WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 97 RUSSIA MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 98 RUSSIA AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 99 RUSSIA OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 100 RUSSIA AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 101 RUSSIA AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 102 RUSSIA AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 103 RUSSIA AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 104 SWITZERLAND AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 105 SWITZERLAND AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 106 SWITZERLAND WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 107 SWITZERLAND MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 108 SWITZERLAND AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 109 SWITZERLAND OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 110 SWITZERLAND AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 111 SWITZERLAND AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 112 SWITZERLAND AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 113 SWITZERLAND AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 114 TURKEY AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 115 TURKEY AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 116 TURKEY WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 117 TURKEY MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 118 TURKEY AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 119 TURKEY OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 120 TURKEY AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 121 TURKEY AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 122 TURKEY AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 123 TURKEY AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 124 BELGIUM AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 125 BELGIUM AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 126 BELGIUM WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 127 BELGIUM MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 128 BELGIUM AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 129 BELGIUM OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 130 BELGIUM AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 131 BELGIUM AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 132 BELGIUM AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 133 BELGIUM AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 134 NETHERLANDS AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 135 NETHERLANDS AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 136 NETHERLANDS WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 137 NETHERLANDS MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 138 NETHERLANDS AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 139 NETHERLANDS OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 140 NETHERLANDS AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 141 NETHERLANDS AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 142 NETHERLANDS AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 143 NETHERLANDS AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 144 DENMARK AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 145 DENMARK AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 146 DENMARK WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 147 DENMARK MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 148 DENMARK AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 149 DENMARK OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 150 DENMARK AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 151 DENMARK AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 152 DENMARK AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 153 DENMARK AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 154 POLAND AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 155 POLAND AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 156 POLAND WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 157 POLAND MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 158 POLAND AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 159 POLAND OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 160 POLAND AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 161 POLAND AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 162 POLAND AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 163 POLAND AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 164 SWEDEN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 165 SWEDEN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 166 SWEDEN WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 167 SWEDEN MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 168 SWEDEN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 169 SWEDEN OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 170 SWEDEN AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 171 SWEDEN AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 172 SWEDEN AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 173 SWEDEN AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 174 REST OF EUROPE AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 175 REST OF EUROPE AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

Liste des figures

FIGURE 1 EUROPE AQUACULTURE EQUIPMENT MARKET

FIGURE 2 EUROPE AQUACULTURE EQUIPMENT MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE AQUACULTURE EQUIPMENT MARKET: DROC ANALYSIS

FIGURE 4 EUROPE AQUACULTURE EQUIPMENT MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE AQUACULTURE EQUIPMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE AQUACULTURE EQUIPMENT MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 EUROPE AQUACULTURE EQUIPMENT MARKET: MULTIVARIATE MODELLING

FIGURE 8 EUROPE AQUACULTURE EQUIPMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 EUROPE AQUACULTURE EQUIPMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE AQUACULTURE EQUIPMENT MARKET: MARKET END USE COVERAGE GRID

FIGURE 11 EUROPE AQUACULTURE EQUIPMENT MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 EUROPE AQUACULTURE EQUIPMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 EUROPE AQUACULTURE EQUIPMENT MARKET: SEGMENTATION

FIGURE 14 RISING, EXPANSION, AND GROWTH OF THE AQUACULTURE INDUSTRY IS EXPECTED TO DRIVE THE EUROPE AQUACULTURE EQUIPMENT MARKET GROWTH IN THE FORECAST PERIOD OF 2022 -2029

FIGURE 15 WATER PURIFICATION EQUIPMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE AQUACULTURE EQUIPMENT MARKET IN 2022 & 2029

FIGURE 16 SUPPLY CHAIN ANALYSIS- EUROPE AQUACULTURE EQUIPMENT MARKET

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE AQUACULTURE EQUIPMENT MARKET

FIGURE 18 EUROPE AQUACULTURE EQUIPMENT MARKET: BY TYPE, 2021

FIGURE 19 EUROPE AQUACULTURE EQUIPMENT MARKET: BY APPLICATION, 2021

FIGURE 20 EUROPE AQUACULTURE EQUIPMENT MARKET: BY END-USE, 2021

FIGURE 21 EUROPE AQUACULTURE EQUIPMENT MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 22 EUROPE AQUACULTURE EQUIPMENT MARKET: SNAPSHOT (2021)

FIGURE 23 EUROPE AQUACULTURE EQUIPMENT MARKET: BY COUNTRY (2021)

FIGURE 24 EUROPE AQUACULTURE EQUIPMENT MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 EUROPE AQUACULTURE EQUIPMENT MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 EUROPE AQUACULTURE EQUIPMENT MARKET: BY TYPE (2022-2029)

FIGURE 27 EUROPE AQUACULTURE EQUIPMENT MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.