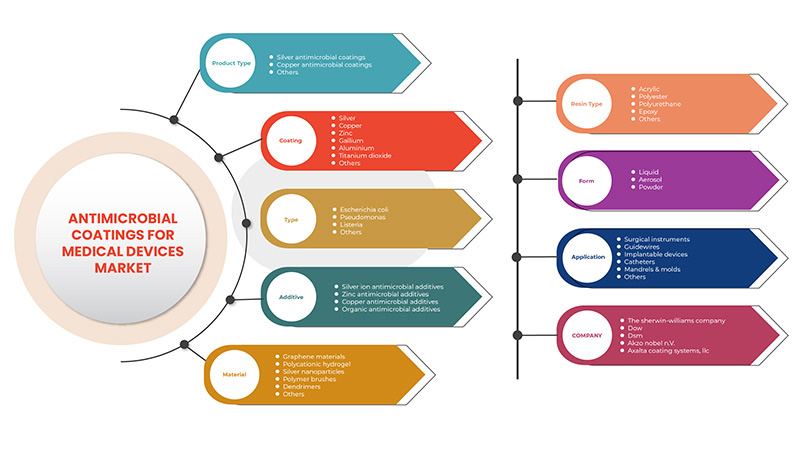

Europe Antimicrobial Coating for Medical Devices Market, By Product Type (Silver Antimicrobial Coating, Copper Antimicrobial Coating, Others), Coating (Silver, Chitosan, Titanium Dioxide, Aluminium, Copper, Zinc, Gallium, Others), Type (Escherichia Coli, Pseudomonas, Listeria, Others), Additives (Silver Ion Antimicrobial Additives, Organic Antimicrobial Additives, Copper Antimicrobial Additives, Zinc Antimicrobial Additives), Material (Graphene Materials, Silver Nanoparticles, Polycationic Hydrogel, Polymer Brushes, Dendrimers, Others), Resin Type (Epoxy, Acrylic, Polyurethane, Polyester, Others), Form (Liquid, Powder, Aerosol), Application (Surgical Instruments, Implantable Devices, Guidewires, Mandrels & Molds, Catheters, Others), Industry Trends and Forecast to 2029.

Market Analysis and Insights

Nowadays, healthcare providers are continually tasked with improving patient health while reducing the risk of infection. The prominence of hospital acquired infections has fuelled the need for strategies and products that actively reduce the risk of patient infections. As such, the incorporation of antimicrobial additives into healthcare furnishings and medical equipment is increasingly being viewed as part of the solution to infection prevention and control in healthcare environments. Moreover, the rising demand for implantable devices has surged also surged the demand for antimicrobial coating for medical devices. However, the limitations of silver ion coating may hamper the growth of market to some extent.

Growing technological advancement in antimicrobial coating are creating an opportunity for the growth of Europe antimicrobial coating for medical devices market whereas adverse effect of antimicrobial coating on human health may create challenge for the growth of the market.

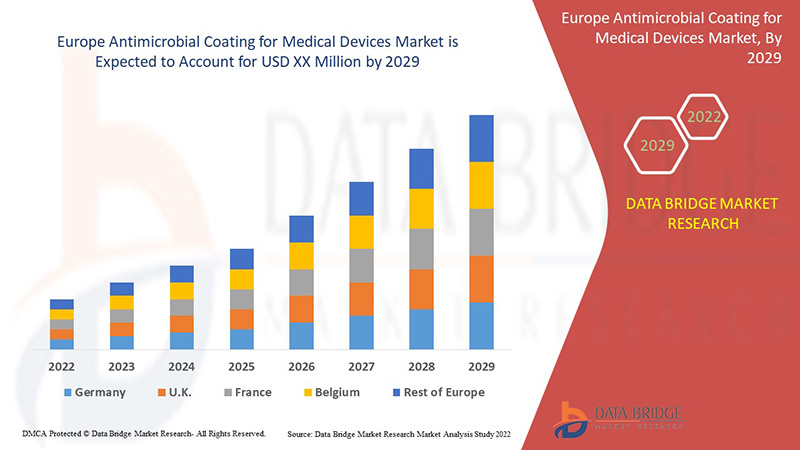

Increasing use of antimicrobial coating for medical devices coupled with growing awareness regarding hospital acquired infections has surged its demand. Data Bridge Market Research analyses that the antimicrobial coating for medical devices market will grow at a CAGR of 12.4% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2020 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Kilo Tons, Pricing in USD |

|

Segments Covered |

Par type de produit (revêtement antimicrobien à base d'argent, revêtement antimicrobien à base de cuivre, autres), revêtement (argent, chitosane, dioxyde de titane, aluminium, cuivre, zinc, gallium, autres), type (Escherichia coli, Pseudomonas, Listeria, autres), additifs (additifs antimicrobiens à base d'ions argent, additifs antimicrobiens organiques, additifs antimicrobiens à base de cuivre, additifs antimicrobiens à base de zinc), matériau (matériaux à base de graphène, nanoparticules d'argent, hydrogel polycationique, brosses en polymère, dendrimères, autres), type de résine (époxy, acrylique, polyuréthane, polyester, autres), forme (liquide, poudre, aérosol), application (instruments chirurgicaux, dispositifs implantables, fils-guides, mandrins et moules, cathéters, autres) |

|

Pays couverts |

Allemagne, Royaume-Uni, Italie, France, Espagne, Russie, Turquie, Suisse, Belgique, Pays-Bas, Luxembourg, reste de l'Europe |

|

Acteurs du marché couverts |

DSM, PPG Industries, Inc., Akzo Nobel NV, Specialty Coating Systems Inc, Covalon Technologies Ltd., AST Products, Inc., Hydromer, Sciessent LLC, Microban International, Axalta Coating Systems, LLC, Biointeractions Ltd, Sika, Harland Medical Systems, Inc., Biomerics, BioCote Limited, entre autres |

Dynamique du marché des revêtements antimicrobiens pour dispositifs médicaux

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Sensibilisation accrue aux infections contractées à l’hôpital

L'augmentation des cas d'infections nosocomiales a accru la charge pesant sur le système de santé, ce qui suscite des inquiétudes croissantes pour le secteur de la santé. Le nombre croissant de maladies nosocomiales a relativement augmenté la charge pesant sur le secteur de la santé. Les revêtements antimicrobiens aident à réduire les infections nosocomiales car ils possèdent diverses propriétés telles que la biocompatibilité

- Hausse de la demande de dispositifs implantables en Europe

La demande de dispositifs implantables augmente en raison de la prévalence croissante des maladies chroniques, du vieillissement rapide de la population, de la hausse des accidents de la route et des améliorations apportées aux dispositifs médicaux implantés actifs. Selon l'Association pour la sécurité des déplacements routiers internationaux, environ 4,4 millions de personnes sont blessées suffisamment gravement pour nécessiter des soins médicaux.

Opportunités

- L’essor du secteur de la santé dans les économies émergentes

L'essor du secteur de la santé dans les économies émergentes telles que l'Inde et la Chine devrait créer une opportunité pour la demande de produits de revêtement antimicrobiens dans les dispositifs médicaux. Des facteurs tels que la croissance démographique, l'évolution des modes de vie, l'augmentation de la population âgée, en particulier en Chine, et l'augmentation du tourisme médical sont quelques-uns des principaux facteurs à l'origine de la croissance du secteur de la santé. Selon l'article publié par l'India Brand Equity Foundation (IBEF), en mars 2022, environ 6 97 300 touristes étrangers sont venus en Inde pour un traitement médical en 2019 et ont également révélé que l'Inde occupe le 10e rang sur 46 destinations dans l'indice du tourisme médical (MTI) pour l'année 2020-2021.

Contraintes/Défis

Cependant, les limitations du revêtement aux ions argent et les réformes sanitaires défavorables aux États-Unis freinent la croissance du marché. La faible capacité de production des économies émergentes posera également un défi majeur.

Ce rapport sur le marché des revêtements antimicrobiens pour dispositifs médicaux fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et localisé, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans la réglementation du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché des revêtements antimicrobiens pour dispositifs médicaux, contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Impact post-COVID-19 sur le marché des revêtements antimicrobiens pour dispositifs médicaux

La maladie à coronavirus (COVID-19) est une maladie infectieuse causée par un virus SARS-CoV-2 récemment découvert. Une grande partie de la population est touchée par le virus COVID-19. Les personnes atteintes du virus COVID-19 souffriront d'une maladie respiratoire légère à modérée et se rétabliront sans nécessiter de traitement particulier. Cependant, la propagation du coronavirus (COVID-19) s'étend à l'échelle européenne depuis quelques mois et la population de patients est en forte augmentation.

Par exemple,

- Selon l'Organisation mondiale de la santé (OMS), jusqu'au 31 mars 2022, 481 756 671 cas confirmés de COVID-19 ont été détectés, dont 6 127 981 décès. Or, l'Europe connaît un rythme de propagation du COVID-19 élevé par rapport aux autres régions. Jusqu'au 31 mars 2022, il y a eu 199 889 200 cas confirmés de COVID-19 en Europe

La pandémie de COVID-19 a eu des répercussions négatives sur la chaîne d’approvisionnement et les activités de fabrication. De plus, alors que le monde était à l’arrêt et que les services de transport étaient interrompus dans le monde entier, les frontières ont été fermées pour empêcher la propagation du virus. Les pratiques commerciales ont également été confrontées à des défis importants pendant la pandémie. Par conséquent, l’approvisionnement en implants, leur importation, leur exportation et leur transport local, ainsi que l’approvisionnement en matières premières ont été gravement affectés.

Développements récents

- En septembre 2021, BioCote Limited a présenté une technologie de revêtement antimicrobien innovante, notamment ses derniers développements en matière de produits de revêtement antimicrobien en plastique. Cela a permis d'améliorer le chiffre d'affaires annuel de l'entreprise

- En janvier 2022, la société a inauguré sa deuxième usine de fabrication située au Costa Rica. L'usine sera dédiée à la fabrication de solutions de dispositifs médicaux pour l'extrusion, le moulage par injection, le traitement des métaux par micro-usinage et les processus d'assemblage final en salles blanches. Cette mesure a été prise pour répondre à la demande croissante de solutions de dispositifs médicaux sur le marché

- En mai 2021, Hydromer a annoncé avoir été sélectionné comme partenaire clé en matière de revêtement et de services pour la société Avinger, Inc. Cette décision aide l'entreprise à propulser sa croissance sur le marché.

Portée du marché européen des revêtements antimicrobiens pour dispositifs médicaux

Le marché des revêtements antimicrobiens pour dispositifs médicaux est segmenté en type de produit, revêtement, type, additifs, matériaux, type de résine, forme et application. La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance des industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Type de produit

- Revêtements antimicrobiens à base d'argent

- Revêtements antimicrobiens en cuivre

- Autres

Sur la base du type de produit, le marché européen des revêtements antimicrobiens pour dispositifs médicaux est segmenté en revêtements antimicrobiens en argent, revêtements antimicrobiens en cuivre et autres.

Revêtement

- Argent

- Cuivre

- Zinc

- Gallium

- Aluminium

- Dioxyde de titane

- Autres

Sur la base du revêtement, le marché européen des revêtements antimicrobiens pour dispositifs médicaux est segmenté en argent, cuivre, zinc, gallium, aluminium, dioxyde de titane et autres.

Taper

- Escherichia coli

- Pseudomonas

- Listeria

- Autres

Sur la base du type, le marché européen des revêtements antimicrobiens pour dispositifs médicaux est segmenté en Escherichia coli, Pseudomonas, Listeria et autres.

Additif

- Additifs antimicrobiens à base d'ions d'argent de petite taille

- Additifs antimicrobiens à base de zinc

- Additifs antimicrobiens à base de cuivre

- Additifs antimicrobiens organiques

Sur la base des additifs, le marché européen des revêtements antimicrobiens pour dispositifs médicaux est segmenté en additifs antimicrobiens aux ions argent, additifs antimicrobiens au zinc, additifs antimicrobiens au cuivre et additifs antimicrobiens organiques.

Matériel

- Matériaux à base de graphène

- Hydrogel polycationique

- Nanoparticules d'argent

- Brosses en polymère

- Dendrimères

- Autres

Sur la base du matériau, le marché européen des revêtements antimicrobiens pour dispositifs médicaux est segmenté en matériaux à base de graphène, d'hydrogel polycationique, de nanoparticules d'argent, de brosses polymères, dendrimères et autres.

Type de résine

- Acrylique

- Polyester

- Polyuréthane

- Époxy

- Autres

Sur la base du type de résine, le marché européen des revêtements antimicrobiens pour dispositifs médicaux est segmenté en acrylique, polyester, polyuréthane, époxy et autres.

Formulaire

- Liquide

- Aérosol

- Poudre

Sur la base de la forme, le marché européen des revêtements antimicrobiens pour dispositifs médicaux est segmenté en liquide, aérosol et poudre.

Application

- Instruments chirurgicaux

- Fils guides

- Dispositifs implantables

- Cathéters

- Mandrins et moules

- Autres

Sur la base de l'application, le marché européen des revêtements antimicrobiens pour dispositifs médicaux est segmenté en instruments chirurgicaux, fils-guides, dispositifs implantables, cathéters, mandrins et moules, et autres.

Analyse/perspectives régionales du marché des revêtements antimicrobiens pour dispositifs médicaux

Le marché des revêtements antimicrobiens pour dispositifs médicaux est analysé et des informations et tendances sur la taille du marché sont fournies par pays, type de produit, revêtement, matériau, additifs, type, type de résine, type et application.

Les pays couverts par le rapport sur le marché européen des revêtements antimicrobiens pour dispositifs médicaux sont l'Allemagne, le Royaume-Uni, l'Italie, la France, l'Espagne, la Russie, la Suisse, la Turquie, la Belgique, les Pays-Bas, le Luxembourg et le reste de l'Europe.

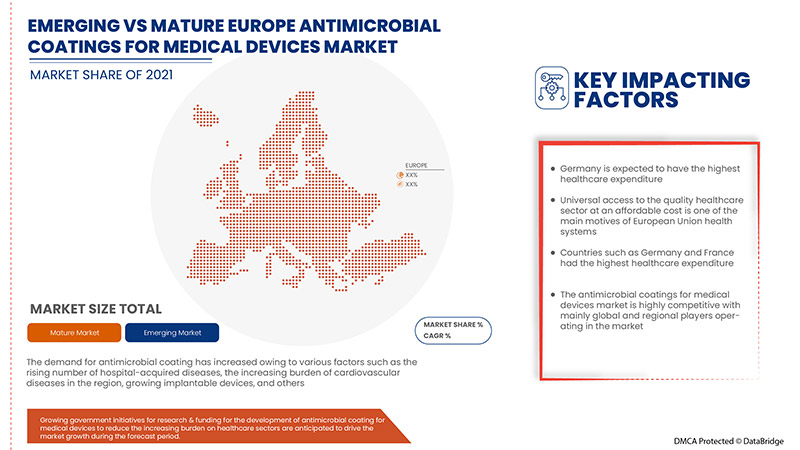

L'Allemagne domine le marché européen des revêtements antimicrobiens pour dispositifs médicaux en termes de part de marché et de chiffre d'affaires et continuera de renforcer sa domination au cours de la période de prévision. Cela est dû au fait que des pays comme l'Allemagne et la France ont les dépenses de santé les plus élevées. L'accès universel à un secteur de santé de qualité à un coût abordable est l'une des principales motivations des systèmes de santé de l'Union européenne. La croissance de la population âgée, associée à l'augmentation des cas de maladies chroniques, devrait stimuler la demande de dispositifs médicaux, ce qui devrait stimuler la demande de revêtements antimicrobiens dans les dispositifs médicaux.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données, tels que les ventes de produits neufs et de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation, sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques européennes et les défis auxquels elles sont confrontées en raison de la forte concurrence des marques locales et nationales, ainsi que l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du revêtement antimicrobien pour dispositifs médicaux

Le paysage concurrentiel du marché des revêtements antimicrobiens pour dispositifs médicaux fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence du CCG, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises sur le marché des revêtements antimicrobiens pour dispositifs médicaux.

Certains des principaux acteurs opérant sur le marché des revêtements antimicrobiens pour dispositifs médicaux sont DSM, PPG Industries, Inc., Akzo Nobel NV, Specialty Coating Systems Inc, Covalon Technologies Ltd., AST Products, Inc., Hydromer, Sciessent LLC, Microban International, Axalta Coating Systems, LLC, Biointeractions Ltd, Sika, Harland Medical Systems, Inc., Biomerics, BioCote Limited, et entre autres.

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement de l'entreprise, l'analyse des parts de marché des entreprises, les normes de mesure, les GCCVsRegional et l'analyse des parts des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CLIMATE CHANGE

4.2 PESTEL ANALYSIS

4.2.1 POLITICS

4.2.2 ECONOMY

4.2.3 SOCIAL

4.2.4 TECHNOLOGY

4.2.5 ENVIRONMENTAL:

4.2.6 LEGAL

4.3 PORTER ANALYSIS

4.3.1 THREATS OF NEW ENTRANTS

4.3.2 POWER OF SUPPLIERS

4.3.3 BARGAINING POWER OF BUYERS

4.3.4 THREATS OF SUBSTITUTE PRODUCTS

4.3.5 RIVALRY AMONG THE EXISTING COMPETITORS

4.4 REGULATION

4.4.1 FDA

4.5 PRODUCTION AND CONSUMPTION ANALYSIS

4.6 RAW MATERIAL ANALYSIS

4.7 SUPPLY CHAIN ANALYSIS

4.7.1 OVERVIEW

4.7.2 LOGISTIC COST SCENARIO

4.7.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.8 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.9 VENDOR SELECTION CRITERIA

4.1 PRICE TREND ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN AWARENESS REGARDING HOSPITAL-ACQUIRED INFECTIONS (HAI)

5.1.2 RISE IN GOVERNMENT INITIATIVES FOR RESEARCH & FUNDING

5.1.3 RISE IN DEMAND FOR IMPLANTABLE DEVICES EUROPELY

5.1.4 INCREASE IN THE BURDEN OF CARDIOVASCULAR DISEASES ACROSS THE GLOBE

5.2 RESTRAINTS

5.2.1 LIMITATIONS OF SILVER ION COATING

5.2.2 UNFAVORABLE HEALTHCARE REFORMS IN THE U.S.

5.3 OPPORTUNITIES

5.3.1 THE RISING HEALTHCARE SECTOR IN EMERGING ECONOMIES

5.3.2 TECHNOLOGICAL ADVANCEMENTS IN THE ANTIMICROBIAL COATING

5.3.3 ANTIMICROBIAL COATINGS HAVE SHOWN GREAT POTENTIAL AGAINST NOSOCOMIAL INFECTIONS

5.4 CHALLENGES

5.4.1 SUPPLY CHAIN DISRUPTION DUT TO COVID-19 PANDEMIC OUTBREAK

5.4.2 THE ADVERSE EFFECTS OF ANTIMICROBIAL COATINGS ON THE ENVIRONMENT

6 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 SILVER ANTIMICROBIAL COATING

6.3 COPPER ANTIMICROBIAL COATING

6.4 OTHERS

7 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING

7.1 OVERVIEW

7.2 SILVER

7.3 CHITOSAN

7.4 TITANIUM DIOXIDE

7.5 ALUMINUM

7.6 COPPER

7.7 ZINC

7.8 GALLIUM

7.9 OTHERS

8 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE

8.1 OVERVIEW

8.2 ESCHERICHIA COLI

8.3 PSEUDOMONAS

8.4 LISTERIA

8.5 OTHERS

9 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVE

9.1 OVERVIEW

9.2 SILVER ION ANTIMICROBIAL ADDITIVES

9.3 ORGANIC ANTIMICROBIAL ADDITIVES

9.4 COPPER ANTIMICROBIAL ADDITIVES

9.5 ZINC ANTIMICROBIAL ADDITIVES

10 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL

10.1 OVERVIEW

10.2 GRAPHENE MATERIALS

10.3 SILVER NANOPARTICLES

10.4 POLYCATIONIC HYDROGEL

10.5 POLYMER BRUSHES

10.5.1 FUNCTIONALIZED POLYMER BRUSHES

10.5.2 FUNCTIONALIZED POLYMER BRUSHES

10.5.3 BRUSHES COMPRISING BACTERIAL POLYMERS

10.6 DENDRIMERS

10.7 OTHERS

11 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE

11.1 OVERVIEW

11.2 EPOXY

11.3 ACRYLIC

11.4 POLYURETHANE

11.5 POLYESTER

11.6 OTHERS

12 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM

12.1 OVERVIEW

12.2 LIQUID

12.3 POWDER

12.4 AEROSOL

13 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 SURGICAL INSTRUMENTS

13.3 IMPLANTABLE DEVICES

13.4 GUIDEWIRES

13.5 MANDRELS & MOLDS

13.6 CATHETERS

13.7 OTHERS

14 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION

14.1 EUROPE

14.1.1 GERMANY

14.1.2 U.K

14.1.3 FRANCE

14.1.4 SPAIN

14.1.5 ITALY

14.1.6 SWITZERLAND

14.1.7 NETHERLANDS

14.1.8 RUSSIA

14.1.9 BELGIUM

14.1.10 TURKEY

14.1.11 LUXEMBURG

14.1.12 REST OF EUROPE

15 EUROPE ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: EUROPE

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 PPG INDUSTRIES, INC.

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUS ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 SIKA

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT UPDATE

17.3 AKZO NOBEL N.V

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUS ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENT

17.4 DSM

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUS ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 AXALTA COATING SYSTEMS, LLC

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUS ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENT

17.6 AST PRODUCTS, INC

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENTS

17.7 BIOCOTE LIMITED

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT

17.8 BIOINTERACTIONS LTD.

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT UPDATES

17.9 BIOMERICS

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 COVALON TECHNOLOGIES LTD

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUS ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENTS

17.11 HARLAND MEDICAL SYSTEMS, INC.

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENTS

17.12 HYDROMER

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENTS

17.13 MICROBAN INTERNATIONAL

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 SCIESSENT LLC

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 SPECIALTY COATING SYSTEMS INC.

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Liste des tableaux

TABLE 1 PRODUCTION OF COPPER FROM 2017-TO 2021, THOUSAND METRIC TONS

TABLE 2 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 3 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONS)

TABLE 4 EUROPE SILVER ANTIMICROBIAL COATING IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 EUROPE COPPER ANTIMICROBIAL COATING IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 EUROPE OTHERS IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING, 2020-2029 (USD MILLION)

TABLE 8 EUROPE SILVER IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 EUROPE CHITOSAN IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE TITANIUM DIOXIDE IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 EUROPE ALUMINUM IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE COPPER IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 EUROPE ZINC IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE GALLIUM IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 EUROPE OTHERS IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 EUROPE ESCHERICHIA COLI IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 EUROPE PSEUDOMONAS IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE LISTERIA IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 EUROPE OTHERS IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVE, 2020-2029 (USD MILLION)

TABLE 22 EUROPE SILVER ION ANTIMICROBIAL ADDITIVES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 EUROPE ORGANIC ANTIMICROBIAL ADDITIVES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE COPPER ANTIMICROBIAL ADDITIVES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 EUROPE ZINC ANTIMICROBIAL ADDITIVES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 27 EUROPE GRAPHENE MATERIALS IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 EUROPE SILVER NANOPARTICLES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 EUROPE POLYCATIONIC HYDROGEL IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 EUROPE POLYMER BRUSHES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 EUROPE POLYMER BRUSHES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 32 EUROPE DENDRIMERS IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 EUROPE OTHERS IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 35 EUROPE EPOXY IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 EUROPE ACRYLIC IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 EUROPE POLYURETHANE IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 EUROPE POLYESTER IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 EUROPE OTHERS IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 41 EUROPE LIQUID IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 EUROPE POWDER IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 EUROPE AEROSOL IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 45 EUROPE SURGICAL INSTRUMENTS IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 EUROPE IMPLANTABLE DEVICES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 EUROPE GUIDEWIRES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 48 EUROPE MANDRELS & MOLDS IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 EUROPE CATHETERS IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 50 EUROPE OTHERS IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 52 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 53 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 54 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONS)

TABLE 55 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING, 2020-2029 (USD MILLION)

TABLE 56 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVES, 2020-2029 (USD MILLION)

TABLE 58 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 59 EUROPE POLYMER BRUSHES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 60 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 61 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 62 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 63 GERMANY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 64 GERMANY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONS)

TABLE 65 GERMANY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING, 2020-2029 (USD MILLION)

TABLE 66 GERMANY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 GERMANY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVES, 2020-2029 (USD MILLION)

TABLE 68 GERMANY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 69 GERMANY POLYMER BRUSHES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 70 GERMANY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 71 GERMANY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 72 GERMANY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 73 U.K ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 74 U.K ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONS)

TABLE 75 U.K ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING, 2020-2029 (USD MILLION)

TABLE 76 U.K ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 U.K ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVES, 2020-2029 (USD MILLION)

TABLE 78 U.K ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 79 U.K POLYMER BRUSHES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 80 U.K ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 81 U.K ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 82 U.K ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 83 FRANCE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 84 FRANCE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONS)

TABLE 85 FRANCE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING, 2020-2029 (USD MILLION)

TABLE 86 FRANCE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 FRANCE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVES, 2020-2029 (USD MILLION)

TABLE 88 FRANCE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 89 FRANCE POLYMER BRUSHES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 90 FRANCE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 91 FRANCE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 92 FRANCE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 93 SPAIN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 94 SPAIN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONS)

TABLE 95 SPAIN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING, 2020-2029 (USD MILLION)

TABLE 96 SPAIN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 SPAIN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVES, 2020-2029 (USD MILLION)

TABLE 98 SPAIN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 99 SPAIN POLYMER BRUSHES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 100 SPAIN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 101 SPAIN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 102 SPAIN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 103 ITALY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 104 ITALY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONS)

TABLE 105 ITALY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING, 2020-2029 (USD MILLION)

TABLE 106 ITALY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 ITALY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVES, 2020-2029 (USD MILLION)

TABLE 108 ITALY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 109 ITALY POLYMER BRUSHES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 110 ITALY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 111 ITALY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 112 ITALY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 113 SWITZERLAND ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 114 SWITZERLAND ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONS)

TABLE 115 SWITZERLAND ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING, 2020-2029 (USD MILLION)

TABLE 116 SWITZERLAND ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 117 SWITZERLAND ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVES, 2020-2029 (USD MILLION)

TABLE 118 SWITZERLAND ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 119 SWITZERLAND POLYMER BRUSHES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 120 SWITZERLAND ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 121 SWITZERLAND ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 122 SWITZERLAND ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 123 NETHERLANDS ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 124 NETHERLANDS ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONS)

TABLE 125 NETHERLANDS ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING, 2020-2029 (USD MILLION)

TABLE 126 NETHERLANDS ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 127 NETHERLANDS ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVES, 2020-2029 (USD MILLION)

TABLE 128 NETHERLANDS ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 129 NETHERLANDS POLYMER BRUSHES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 130 NETHERLANDS ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 131 NETHERLANDS ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 132 NETHERLANDS ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 133 RUSSIA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 134 RUSSIA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONS)

TABLE 135 RUSSIA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING, 2020-2029 (USD MILLION)

TABLE 136 RUSSIA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 137 RUSSIA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVES, 2020-2029 (USD MILLION)

TABLE 138 RUSSIA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 139 RUSSIA POLYMER BRUSHES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 140 RUSSIA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 141 RUSSIA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 142 RUSSIA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 143 BELGIUM ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 144 BELGIUM ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONS)

TABLE 145 BELGIUM ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING, 2020-2029 (USD MILLION)

TABLE 146 BELGIUM ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 147 BELGIUM ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVES, 2020-2029 (USD MILLION)

TABLE 148 BELGIUM ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 149 BELGIUM POLYMER BRUSHES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 150 BELGIUM ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 151 BELGIUM ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 152 BELGIUM ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 153 TURKEY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 154 TURKEY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONS)

TABLE 155 TURKEY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING, 2020-2029 (USD MILLION)

TABLE 156 TURKEY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 157 TURKEY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVES, 2020-2029 (USD MILLION)

TABLE 158 TURKEY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 159 TURKEY POLYMER BRUSHES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 160 TURKEY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 161 TURKEY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 162 TURKEY ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 163 LUXEMBURG ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 164 LUXEMBURG ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONS)

TABLE 165 LUXEMBURG ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING, 2020-2029 (USD MILLION)

TABLE 166 LUXEMBURG ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 167 LUXEMBURG ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVES, 2020-2029 (USD MILLION)

TABLE 168 LUXEMBURG ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 169 LUXEMBURG POLYMER BRUSHES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 170 LUXEMBURG ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 171 LUXEMBURG ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 172 LUXEMBURG ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 173 REST OF EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 174 REST OF EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONS)

Liste des figures

FIGURE 1 EUROPE ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET: SEGMENTATION

FIGURE 2 EUROPE ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET: DROC ANALYSIS

FIGURE 4 EUROPE ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET: EUROPE VS REGIONAL ANALYSIS

FIGURE 5 EUROPE ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET: SEGMENTATION

FIGURE 10 NORTH AMERICA IS EXPECTED TO DOMINATE THE EUROPE ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET AND ASIA-PACIFIC GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 RISING AWARENESS REGARDING HOSPITAL ACQUIRED INFECTION IS DRIVING THE EUROPE ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SILVER ANTIMICROBIAL COATING SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET IN 2022 & 2029

FIGURE 13 EUROPE ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET, BY PRODUCTION (USD MILLION)

FIGURE 14 CONSUMPTION OF ANTIMICROBIAL COATING IN MEDICAL DEVICES, BY REGION (USD MILLION)

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF EUROPE ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET

FIGURE 16 GROWTH TREND OF HEALTHCARE SECTOR IN INDIA, USD BILLION

FIGURE 17 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2021

FIGURE 18 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING, 2021

FIGURE 19 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE, 2021

FIGURE 20 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVE, 2021

FIGURE 21 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2021

FIGURE 22 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE, 2021

FIGURE 23 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM, 2021

FIGURE 24 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION, 2021

FIGURE 25 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET: SNAPSHOT (2021)

FIGURE 26 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET: BY COUNTRY (2021)

FIGURE 27 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 28 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 29 EUROPE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET: BY PRODUCT TYPE (2022 & 2029)

FIGURE 30 EUROPE ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.