Marché européen des logiciels de lutte contre le blanchiment d'argent, par offre (solution et services), fonction (gestion de la conformité, rapports sur les transactions en devises, gestion de l'identité des clients, surveillance des transactions et autres), mode de déploiement (cloud et sur site), taille de l'entreprise (grandes entreprises, petites et moyennes entreprises), type de jeu (loterie, paris sportifs, bingo, tombolas/pools et casino), application (hors ligne/terrestre et divertissement en direct/en ligne), entité de jeu (organisations, commerçant individuel/partenariat et autres) Tendances et prévisions de l'industrie jusqu'en 2029

Analyse et perspectives du marché

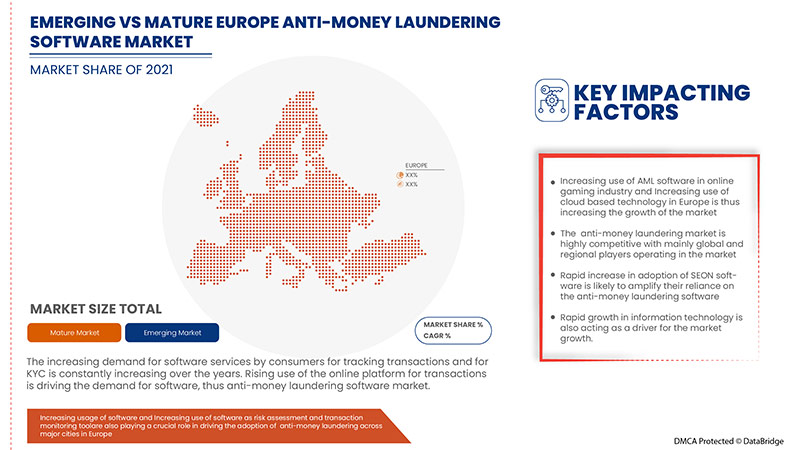

Les données des clients sont filtrées par des systèmes anti-blanchiment, classées selon un niveau de suspicion et inspectées pour détecter les anomalies. La lutte contre le blanchiment d'argent fait référence à un ensemble de lois, de législations et de procédures visant à empêcher les criminels de déguiser des fonds illicites en revenus légitimes. Bien que les lois anti-blanchiment d'argent (AML) couvrent une gamme relativement limitée de transactions et de comportements criminels, elles ont des implications de grande portée. En outre, des agents chargés de l'application de la loi AML sont nommés pour superviser les politiques de lutte contre le blanchiment d'argent et garantir le respect des banques et autres institutions financières. Ainsi, la réglementation de plus en plus stricte et la conformité liée à la lutte contre le blanchiment d'argent augmentent la demande de logiciels de lutte contre le blanchiment d'argent sur le marché. Cependant, les problèmes de compatibilité des appareils des logiciels AML entravent la croissance du marché.

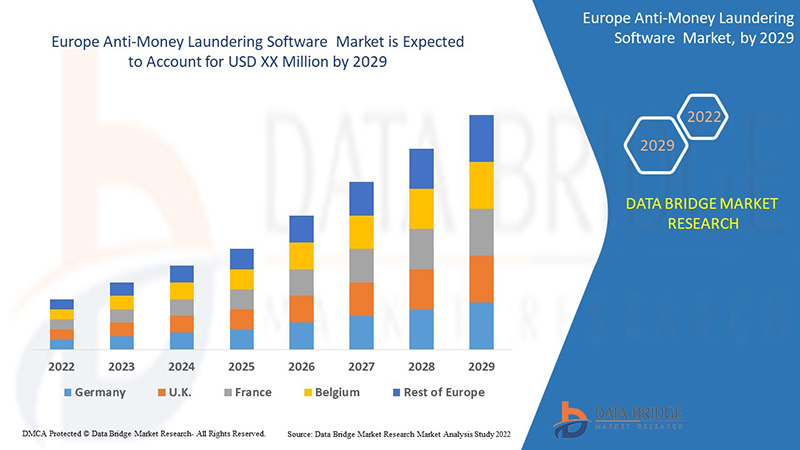

Data Bridge Market Research analyse que le marché des logiciels de lutte contre le blanchiment d'argent connaîtra un TCAC de 14,7 % entre 2022 et 2029.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Année historique |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par offre (solution et services), fonction (gestion de la conformité, rapports sur les transactions en devises, gestion de l'identité des clients, surveillance des transactions et autres), mode de déploiement (cloud et sur site), taille de l'entreprise (grandes entreprises, petites et moyennes entreprises), type de jeu (loterie, paris sportifs, bingo, tombolas/pools et casino), application (hors ligne/terrestre et divertissement en direct/en ligne), entité de jeu (organisations, commerçant individuel/partenariat et autres) |

|

Pays couverts |

Royaume-Uni, Allemagne, France, Italie, Espagne, Russie, Pays-Bas, Suisse, Turquie, Belgique, Irlande, Autriche, Tchéquie, Hongrie, Slovaquie et reste de l'Europe |

|

Acteurs du marché couverts |

Microsoft, Intel Corporation, Fiserv, Inc., BAE Systems, Wolters Kluwer NV, Experian Information Solutions, Inc., SAS Institute Inc., IBM, Temenos, Comarch SA, Open Text Corporation, FICO, ACI Worldwide, NICE, Acuant, Inc., Featurespace Limited, Protiviti Inc., Actico GmbH, Caseware International Inc., Sanction Scanner |

Définition du marché

Les solutions de lutte contre le blanchiment d'argent (LBC) sont utilisées pour détecter et avertir les institutions en cas de blanchiment d'argent, de financement du terrorisme, de fraude, de cybercriminalité, de corruption, d'évasion fiscale, de détournement de fonds, de sécurité de l'information, de transactions transfrontalières illégales, entre autres, qui ont un impact considérable sur l'économie du pays et peuvent nuire à sa réputation. LBC est un terme généralement utilisé pour décrire la lutte contre le blanchiment d'argent et les crimes financiers. Les solutions de lutte contre le blanchiment d'argent (LBC) sont conformes à diverses politiques, lois et réglementations qui contribuent à prévenir les crimes financiers. Les régulateurs mondiaux et locaux définissent ces lignes directrices, politiques et lois présentes dans le monde entier, qui visent à renforcer le fonctionnement des solutions LBC.

Dynamique du marché des logiciels de lutte contre le blanchiment d'argent

Conducteurs

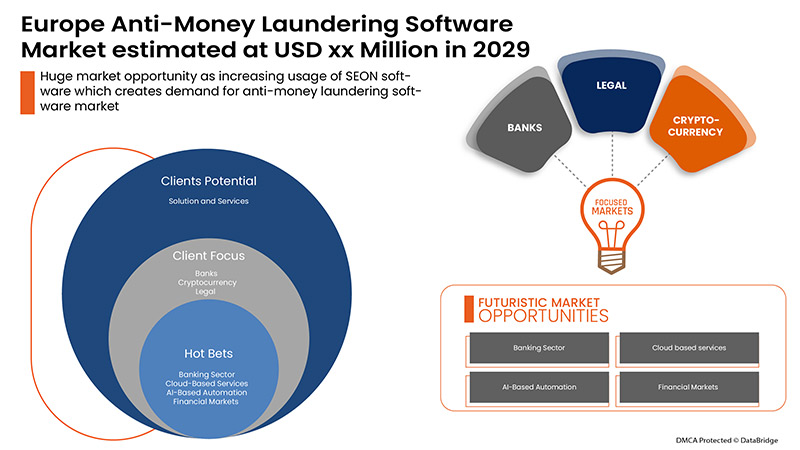

- Augmentation de l'utilisation du logiciel seon

Le blanchiment d'argent est le processus de conversion d'argent illégal en argent légal. Le but des criminels qui blanchissent de l'argent est de gagner de l'argent. Le blanchiment d'argent est devenu un problème financier et un crime majeur aujourd'hui. Chaque année, des milliards de dollars sont introduits illégalement aux frontières internationales par divers moyens. Le blanchiment d'argent est devenu un problème financier critique que les autorités financières tentent de mettre un terme.

- Augmentation des réglementations et de la conformité strictes liées à la LBC

Un programme de conformité en matière de lutte contre le blanchiment d'argent est un ensemble de réglementations ou de règles qu'une institution financière doit suivre pour prévenir et détecter les activités de blanchiment d'argent et de financement du terrorisme. Ces derniers temps, la criminalité financière contre les institutions financières telles que les banques et les coopératives de crédit a considérablement augmenté. On a constaté une augmentation d'environ 50 à 60 % des cas de fraude financière en 2019 par rapport à 2018 et on s'attend à ce qu'elle augmente dans les années à venir. Les pertes subies par les banques à travers l'Europe sont assez importantes.

- Croissance de la demande de logiciels AML

Les institutions financières telles que les banques centrales, les banques de détail et commerciales, les banques en ligne, les coopératives de crédit, les associations d'épargne et de crédit, les banques d'investissement, entre autres, sont obligées par la loi gouvernementale de s'attaquer à divers problèmes tels que le blanchiment d'argent, les activités de financement du terrorisme, entre autres, en utilisant une réglementation conçue pour renforcer la solution AML. Des institutions telles que le groupe d'action financière, l'Union européenne - cinquième directive anti-blanchiment d'argent ont établi des lignes directrices réglementaires. Les technologies de lutte contre le blanchiment d'argent (AML) peuvent également être utilisées pour la vérification d'identité et la solution AML est plus simple et plus précise que les processus manuels de vérification d'identité. Les solutions AML offrent une vérification d'identité dans les institutions financières à l'aide de la vérification KYC. KYC est plus spécifique à la vérification de l'identité des clients avant d'autoriser une transaction. Ainsi, il aide à valider l'identité et est l'un des critères utilisés par les solutions AML.

- Croissance de la demande de systèmes de surveillance des transactions dans le secteur des technologies de l'information (TI)

La surveillance des transactions est devenue essentielle aux systèmes de lutte contre le blanchiment d'argent (AML). Toutes les institutions financières doivent disposer de systèmes de surveillance des transactions pour surveiller toute transaction suspecte et tout délit financier de la part des clients. La surveillance des transactions comprend l'évaluation des informations historiques/actuelles des clients afin de fournir une image complète de l'activité des clients. Cela peut inclure les virements, les dépôts et les retraits. La plupart des entreprises de technologie de l'information (TI) utilisent automatiquement des outils logiciels. Il est très difficile de surveiller ces données acquises car il s'agit d'une tâche difficile à réaliser manuellement. Par conséquent, de nombreuses entreprises informatiques ont adopté des systèmes automatisés tels que les systèmes de lutte contre le blanchiment d'argent.

Opportunité

-

Augmentation de l'adoption de l'analyse avancée dans la lutte contre le blanchiment d'argent

L'analyse avancée est un système autonome ou semi-autonome qui analyse des données ou du contenu à l'aide de techniques et d'outils sophistiqués, ce qui est assez différent de la veille stratégique traditionnelle. Ces analyses fournissent des données que le système prédit et génère une analyse plus approfondie à l'aide de laquelle le système prédit et génère des recommandations. L'analyse avancée dans les solutions AML peut jouer un rôle essentiel dans la détection du blanchiment d'argent, des crimes économiques, du vol d'identité et des transactions transfrontalières.

Retenue/Défi

- Changement du cadre réglementaire et des lignes directrices pour la solution de lutte contre le blanchiment d'argent

Les pratiques de conformité en matière de lutte contre le blanchiment d'argent visent à établir des politiques et des normes qui empêchent les contrevenants potentiels de se livrer à des fraudes liées au blanchiment d'argent et à des délits financiers. De cette façon, les criminels ne peuvent pas dissimuler l'origine illicite de l'argent dans une transaction.

Impact du COVID-19 sur le marché des logiciels de lutte contre le blanchiment d'argent

La période de confinement et de confinement pendant la crise du Covid-19 a montré l'importance d'une bonne connectivité Internet fiable à domicile. Une connexion haut débit à domicile a ouvert la possibilité d'un télétravail efficace, de maintenir des habitudes de divertissement et de garder des contacts étroits. Le trafic de données sur tous les réseaux a considérablement augmenté pendant la période de pandémie. Le COVID-19 a accru la demande de lutte contre le blanchiment d'argent sur le marché. Les réseaux fixes à haut débit ont gagné en popularité pour maintenir le monde connecté. Le trafic a augmenté de 30 à 40 % du jour au lendemain, principalement grâce au travail à domicile (visioconférence et collaboration, VPN), à l'apprentissage à domicile (visioconférence et collaboration, plateformes d'apprentissage en ligne) et au divertissement (jeux en ligne, streaming vidéo, médias sociaux). De plus, l'offre limitée et la pénurie de logiciels ont considérablement affecté la lutte contre le blanchiment d'argent sur le marché. Le flux de nouveaux équipements, tels que les ordinateurs, les serveurs, les commutateurs et les équipements sur site client (CPE) s'est complètement arrêté ou est retardé, avec des délais de livraison allant jusqu'à 12 mois pour différents articles.

Les fabricants prennent diverses décisions stratégiques pour rebondir après la COVID-19. Les acteurs mènent de multiples activités de recherche et développement pour améliorer la technologie impliquée dans les logiciels de lutte contre le blanchiment d'argent. Grâce à cela, les entreprises mettront sur le marché des solutions avancées de lutte contre le blanchiment d'argent.

Par exemple,

- En juin 2021, Microsoft s'est associé à Morgan Stanley pour renforcer le secteur des services financiers. Les principaux objectifs de ce partenariat étaient la transformation numérique, la conception de nouvelles applications et l'amélioration de l'expérience des employés et des développeurs dans le secteur des services financiers. Grâce à ce partenariat, les deux entreprises souhaitent renforcer leur secteur des services financiers basés sur le cloud en proposant des solutions innovantes pour les consommateurs.

Ainsi, le COVID-19 a augmenté la demande de lutte contre le blanchiment d’argent sur le marché, mais l’offre limitée et la pénurie de logiciels ont considérablement affecté le processus de lutte contre le blanchiment d’argent sur le marché.

Développements récents

- En avril 2022, Experian Information Solutions, Inc. a lancé une nouvelle solution de prévention de la fraude. La principale caractéristique de cette solution était de renforcer la vérification de l'identité des clients en renforçant les exigences telles que les mesures anti-fraude, Know Your Customer (KYC) et la lutte contre le blanchiment d'argent (AML). L'entreprise a bénéficié de cette solution car elle a contribué à créer un processus d'intégration transparent et a facilité le processus d'authentification d'une personne pour de nombreuses entreprises.

- En février 2021, NICE Systems Ltd a lancé une solution de dépistage basée sur l'IA pour améliorer les capacités de gestion des risques. La principale caractéristique de cette solution était les capacités de dépistage en temps réel et par lots, l'accès transparent, l'utilisation de technologies de correspondance floue, la biométrie faciale et la surveillance continue de la chaîne de valeur AML. Cette solution aide l'entreprise à offrir une gestion des données supérieure, des capacités de dépistage avancées et la satisfaction des clients.

Portée du marché européen des logiciels de lutte contre le blanchiment d'argent

Le marché des logiciels de lutte contre le blanchiment d'argent est segmenté par offre, fonction, mode de déploiement, taille de l'entreprise, type de jeu, application et entité de jeu. La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

En offrant

- Solution

- Services

Sur la base de l’offre, le marché européen des logiciels de lutte contre le blanchiment d’argent est segmenté en solutions et services.

Fonction

- Gestion de la conformité

- Déclaration des transactions en devises

- Gestion de l'identité des clients

- Surveillance des transactions

- Autres

Sur la base de la fonction, le marché européen des logiciels de lutte contre le blanchiment d'argent a été segmenté en gestion de la conformité, reporting des transactions monétaires, gestion de l'identité des clients, surveillance des transactions et autres.

Mode de déploiement

- Nuage

- Sur site

Sur la base du mode de déploiement, le marché européen des logiciels de lutte contre le blanchiment d’argent a été segmenté en cloud et sur site.

Taille de l'entreprise

- Large Enterprises

- Small & Medium Enterprises

On the basis of enterprise size, the Europe anti-money laundering software market has been segmented into large enterprises, small & medium enterprises.

Gambling Type

- Lottery

- Sports Betting

- Bingo

- Raffles/Pools

- Casino

On the basis of gambling type, the Europe anti-money laundering software market has been segmented into lottery, sports betting, bingo, raffles/pools and casino.

Application

- Offline/Land Based Medium

- Live Entertainment/Online

On the basis of application, the Europe anti-money laundering software market has been segmented into to offline/land based medium and live entertainment/online.

Gambling Entity

- Organizations

- Sole Trader/Partnership

- Others

On the basis of gambling entity, the Europe anti-money laundering software market has been segmented into organizations, sole trader/partnership and others.

Europe Anti-Money Laundering Software Market

The anti-money laundering software market is analyzed, and market size insights and trends are provided by the offering, function, deployment mode, enterprise size, gambling type, application, gambling entity and countries as referenced above.

Europe anti-money laundering software market is covers countries such as U.K., Germany, France, Italy, Spain, Russia, Netherlands, Switzerland, Turkey, Belgium , Ireland , Austria , Czechia , Hungary, Slovakia and Rest of Europe.

U.K. is expected to dominate the Europe anti-money laundering software market as the country is witnessing increasing government's support for "KYC/CDD and Watchlist" networks, Money laundering is a type of financial crime. It involves taking criminally obtained proceeds (dirty money) and disguising their origins so they'll appear to be from a legitimate source. Anti-money laundering (A.M.L.) refers to the activities financial institutions perform to comply with legal requirements to monitor for actively and report suspicious activities and the growth of the country in the Europe anti-money laundering software market.

The country section of the anti-money laundering software market report also provides individual market impacting factors and domestic regulation changes that impact the market's current and future trends. Data points such as new sales, replacement sales, country demographics, disease epidemiology and import-export tariffs are some of the significant pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Anti-Money Laundering Software Market Share Analysis

Le paysage concurrentiel du marché des logiciels de lutte contre le blanchiment d'argent fournit des détails sur le concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement de la solution, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus ne concernent que l'accent mis par les entreprises sur le marché des logiciels de lutte contre le blanchiment d'argent.

Certains des principaux acteurs opérant sur le marché européen des logiciels de lutte contre le blanchiment d'argent sont Microsoft, Intel Corporation, Fiserv, Inc., BAE Systems., Wolters Kluwer NV, Experian Information Solutions, Inc., SAS Institute Inc., IBM, Temenos, Comarch SA., Open Text Corporation, FICO, ACI Worldwide., NICE, Acuant, Inc., Featurespace Limited., Protiviti Inc., Actico GmbH, Caseware International Inc., Sanction Scanner, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 OFFERING TYPE TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE FORCE ANALYSIS

4.2 PRICING ANALYSIS

5 REGULATIONS

5.1 OVERVIEW

5.2 THE FINANCIAL ACTION TASK FORCE (FATF)

5.3 THE ANTI-MONEY LAUNDERING DIRECTIVES

5.4 5AMLD – IMPLEMENTED 10 JANUARY 2020

5.5 6AMLD – IMPLEMENTED ON 3 JUNE 2021:

5.5.1 UK

5.5.2 SWITZERLAND

5.5.3 NORDIC STATES

5.6 CASE STUDIES

6 REGIONAL SUMMARY

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING USE OF SEON SOFTWARE

7.1.2 INCREASING STRINGENT REGULATIONS AND COMPLIANCE RELATED TO AML

7.1.3 GROWING DEMAND FOR AML SOFTWARES

7.1.4 GROWING DEMAND FOR TRANSACTION MONITORING SYSTEMS IN INFORMATION TECHNOLOGY (I.T.) SECTOR

7.2 RESTRAINTS

7.2.1 HIGH DEVICE COMPATIBILITY ISSUES OF AML SOFTWARE

7.2.2 DEPLOYING AML SOFTWARE IS EXPENSIVE

7.3 OPPORTUNITIES

7.3.1 INCREASING ADOPTION OF ADVANCED ANALYTICS IN AML

7.3.2 INTEGRATION OF AI AND ML IN DEVELOPING AML SOLUTIONS

7.4 CHALLENGES

7.4.1 CHANGING REGULATION FRAMEWORK AND GUIDELINES FOR AML SOLUTION

7.4.2 LACK OF SKILLED AML PROFESSIONALS

8 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY OFFERING

8.1 OVERVIEW

8.2 SOLUTION

8.3 KYC/CDD AND WATCHLIST

8.4 CASE MANAGEMENT

8.5 REGULATORY REPORTING

8.6 TRANSACTION SCREENING AND MONITORING

8.7 RISK-BASED APPROACH

8.8 OTHERS

8.9 SERVICES

8.1 PROFESSIONAL SERVICES

8.11 CONSULTING SERVICES

8.12 TRAINING AND CONSULTING

8.13 INTEGRATION

8.14 SUPPORT AND MAINTENANCE

8.15 MANAGED SERVICES

9 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY FUNCTION

9.1 OVERVIEW

9.2 COMPLIANCE MANAGEMENT

9.3 CUSTOMER IDENTITY MANAGEMENT

9.4 TRANSACTION MONITORING

9.5 CURRENCY TRANSACTION REPORTING

9.6 OTHERS

10 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY DEPLOYMENT MODE

10.1 OVERVIEW

10.2 CLOUD

10.3 ON-PREMISE

11 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY ENTERPRISE SIZE

11.1 OVERVIEW

11.2 LARGE ENTERPRISES

11.3 SMALL & MEDIUM ENTERPRISES

12 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING TYPE

12.1 OVERVIEW

12.2 LOTTERY

12.3 SPORTS BETTING

12.4 FOOTBALL

12.5 HORSE RACING

12.6 E-SPORTS

12.7 OTHERS

12.8 CASINO

12.9 LIVE CASINOS

12.1 POKER

12.11 BLACKJACK

12.12 BACCARAT

12.13 SLOTS

12.14 OTHERS

12.15 RAFFLES/POOLS

12.16 BINGO

13 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 OFFLINE/LAND BASED

13.3 HOTELS

13.4 MULTIPLE DINING OPTIONS

13.5 OTHERS

13.6 LIVE ENTERTAINMENT/ONLINE

13.7 MOBILE

13.8 DESKTOP

14 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING ENTITY

14.1 OVERVIEW

14.2 ORGANIZATIONS

14.3 SOLE TRADES/PARTNERSHIP

14.4 OTHERS

15 EUROPE

15.1 U.K.

15.2 GERMANY

15.3 FRANCE

15.4 ITALY

15.5 SPAIN

15.6 NETHERLANDS

15.7 SWITZERLAND

15.8 RUSSIA

15.9 BELGIUM

15.1 TURKEY

15.11 IRELAND

15.12 AUSTRIA

15.13 CZECHIA

15.14 HUNGARY

15.15 SLOVAKIA

15.16 REST OF EUROPE

16 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: EUROPE

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 MICROSOFT

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 SOLUTION PORTFOLIO

18.1.4 RECENT DEVELOPMENTS

18.2 INTEL CORPORATION

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 PRODUCT PORTFOLIO

18.2.4 RECENT DEVELOPMENTS

18.3 FISERV, INC.

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 SOLUTION PORTFOLIO

18.3.4 RECENT DEVELOPMENTS

18.4 BAE SYSTEMS

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 SOLUTION PORTFOLIO

18.4.4 RECENT DEVELOPMENTS

18.5 WOLTERS KLUWER N.V.

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 SOLUTION & PRODUCT PORTFOLIO

18.5.4 RECENT DEVELOPMENT

18.6 ACUANT, A GBG COMPANY

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT & SOLUTION PORTFOLIO

18.6.3 RECENT DEVELOPMENT

18.7 ACTICO GMBH

18.7.1 COMPANY SNAPSHOT

18.7.2 SOLUTION PORTFOLIO

18.7.3 RECENT DEVELOPMENT

18.8 ACI WORLDWIDE, INC.

18.8.1 COMPANY SNAPSHOT

18.8.2 REVENUE ANALYSIS

18.8.3 SOLUTION PORTFOLIO

18.8.4 RECENT DEVELOPMENTS

18.9 COMARCH SA

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 SOLUTION & PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENT

18.1 CASEWARE INTERNATIONAL INC.

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT & SOLUTION PORTFOLIO

18.10.3 RECENT DEVELOPMENT

18.11 EXPERIAN INFORMATION SOLUTIONS, INC.

18.11.1 COMPANY SNAPSHOT

18.11.2 REVENUE ANALYSIS

18.11.3 SOLUTION PORTFOLIO

18.11.4 RECENT DEVELOPMENTS

18.12 FEATURESPACE LIMITED

18.12.1 COMPANY SNAPSHOT

18.12.2 SOLUTION PORTFOLIO

18.12.3 RECENT DEVELOPMENT

18.13 FICO

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 SOLUTION & PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENT

18.14 IBM CORPORATION

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUE ANALYSIS

18.14.3 SOLUTION PORTFOLIO

18.14.4 RECENT DEVELOPMENT

18.15 NICE SYSTEMS LTD

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 SOLUTION PORTFOLIO

18.15.4 RECENT DEVELOPMENTS

18.16 OPEN TEXT CORPORATION

18.16.1 COMPANY SNAPSHOT

18.16.2 REVENUE ANALYSIS

18.16.3 SOLUTION PORTFOLIO

18.16.4 RECENT DEVELOPMENTS

18.17 PROTIVITI INC.

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT & SOLUTION PORTFOLIO

18.17.3 RECENT DEVELOPMENT

18.18 SAS INSTITUTE INC.

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT & SOLUTION PORTFOLIO

18.18.3 RECENT DEVELOPMENTS

18.19 SANCTION SCANNER

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT & SOLUTION PORTFOLIO

18.19.3 RECENT DEVELOPMENT

18.2 TEMENOS HEADQUARTERS SA

18.20.1 COMPANY SNAPSHOT

18.20.2 REVENUE ANALYSIS

18.20.3 SOLUTION & PRODUCT PORTFOLIO

18.20.4 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

Liste des tableaux

TABLE 1 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY COUNTRY PRICE/PERSON/DAY/SERVICE, 2020-2029 (USD DOLLAR)

TABLE 2 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY COUNTRY MINIMUM AVERAGE (PRICE/PERSON/DAY/SERVICE) OFFERING, 2020-2029 (USD DOLLAR)

TABLE 3 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY COUNTRY MAXIMUM AVERAGE (PRICE/PERSON/DAY/SERVICE) , 2020-2029 (USD DOLLAR)

TABLE 4 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY COUNTRY AVERAGE (PRICE/PERSON/MONTH/SERVICE), 2020-2029 (USD DOLLAR)

TABLE 5 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY COUNTRY MINIMUM AVERAGE (PRICE/PERSON/MONTH/SERVICE), 2020-2029 (USD DOLLAR)

TABLE 6 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY COUNTRY AVERAGE MAXIMUM (PRICE/PERSON/MONTH/SERVICE), 2020-2029 (USD DOLLAR)

TABLE 7 EUROPEAN COUNTRIES FINANCIAL INTELLIGENCE UNITS (FIUS) RECEIVED SEVERAL SUSPICIOUS TRANSACTIONS LARGER THAN 20,000 IN 2018 OR 2019.

TABLE 8 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 9 EUROPE SOLUTION IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 EUROPE SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 11 EUROPE CONSULTING SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 13 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 14 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 15 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING TYPE, 2020-2029 (USD MILLION)

TABLE 16 EUROPE SPORTS BETTING IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 EUROPE CASINO IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 18 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE OFFLINE/LAND BASED IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 EUROPE LIVE ENTERTAINMENT/ONLINE IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 21 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GABLING ENTITY, 2020-2029 (USD MILLION)

TABLE 22 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 23 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 24 EUROPE SOLUTION IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 EUROPE SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 EUROPE CONSULTING SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 28 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 29 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 30 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING TYPE, 2020-2029 (USD MILLION)

TABLE 31 EUROPE SPORTS BETTING IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 EUROPE CASINO IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 34 EUROPE OFFLINE/LAND BASED IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 EUROPE LIVE ENTERTAINMENT/ONLINE IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING ENTITY, 2020-2029 (USD MILLION)

TABLE 37 U.K. ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 38 U.K. SOLUTION IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 U.K. SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 U.K. CONSULTING SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 U.K. ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 42 U.K. ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 43 U.K. ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 44 U.K. ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING TYPE, 2020-2029 (USD MILLION)

TABLE 45 U.K. SPORTS BETTING IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 U.K. CASINO IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 U.K. ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 48 U.K. OFFLINE/LAND BASED IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 U.K. LIVE ENTERTAINMENT/ONLINE IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 U.K. ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING ENTITY, 2020-2029 (USD MILLION)

TABLE 51 GERMANY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 52 GERMANY SOLUTION IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 GERMANY SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 GERMANY CONSULTING SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 GERMANY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 56 GERMANY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 57 GERMANY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 58 GERMANY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING TYPE, 2020-2029 (USD MILLION)

TABLE 59 GERMANY SPORTS BETTING IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 GERMANY CASINO IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 GERMANY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 GERMANY OFFLINE/LAND BASED IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 GERMANY LIVE ENTERTAINMENT/ONLINE IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 GERMANY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING ENTITY, 2020-2029 (USD MILLION)

TABLE 65 FRANCE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 66 FRANCE SOLUTION IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 FRANCE SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 FRANCE CONSULTING SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 FRANCE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 70 FRANCE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 71 FRANCE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 72 FRANCE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING TYPE, 2020-2029 (USD MILLION)

TABLE 73 FRANCE SPORTS BETTING IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 FRANCE CASINO IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 FRANCE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 76 FRANCE OFFLINE/LAND BASED IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 FRANCE LIVE ENTERTAINMENT/ONLINE IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 FRANCE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING ENTITY, 2020-2029 (USD MILLION)

TABLE 79 ITALY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 80 ITALY SOLUTION IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 ITALY SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 ITALY CONSULTING SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 ITALY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 84 ITALY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 85 ITALY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 86 ITALY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING TYPE, 2020-2029 (USD MILLION)

TABLE 87 ITALY SPORTS BETTING IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 ITALY CASINO IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 ITALY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 90 ITALY OFFLINE/LAND BASED IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 ITALY LIVE ENTERTAINMENT/ONLINE IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 ITALY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING ENTITY, 2020-2029 (USD MILLION)

TABLE 93 SPAIN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 94 SPAIN SOLUTION IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 95 SPAIN SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 SPAIN CONSULTING SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 SPAIN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 98 SPAIN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 99 SPAIN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 100 SPAIN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING TYPE, 2020-2029 (USD MILLION)

TABLE 101 SPAIN SPORTS BETTING IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 SPAIN CASINO IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 SPAIN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 104 SPAIN OFFLINE/LAND BASED IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 SPAIN LIVE ENTERTAINMENT/ONLINE IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 SPAIN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING ENTITY, 2020-2029 (USD MILLION)

TABLE 107 NETHERLANDS ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 108 NETHERLANDS SOLUTION IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 NETHERLANDS SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 NETHERLANDS CONSULTING SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 NETHERLANDS ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 112 NETHERLANDS ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 113 NETHERLANDS ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 114 NETHERLANDS ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING TYPE, 2020-2029 (USD MILLION)

TABLE 115 NETHERLANDS SPORTS BETTING IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 NETHERLANDS CASINO IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 117 NETHERLANDS ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 118 NETHERLANDS OFFLINE/LAND BASED IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 NETHERLANDS LIVE ENTERTAINMENT/ONLINE IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 NETHERLANDS ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING ENTITY, 2020-2029 (USD MILLION)

TABLE 121 SWITZERLAND ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 122 SWITZERLAND SOLUTION IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 SWITZERLAND SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 SWITZERLAND CONSULTING SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 SWITZERLAND ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 126 SWITZERLAND ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 127 SWITZERLAND ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 128 SWITZERLAND ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING TYPE, 2020-2029 (USD MILLION)

TABLE 129 SWITZERLAND SPORTS BETTING IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 SWITZERLAND CASINO IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 131 SWITZERLAND ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 132 SWITZERLAND OFFLINE/LAND BASED IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 133 SWITZERLAND LIVE ENTERTAINMENT/ONLINE IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 SWITZERLAND ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING ENTITY, 2020-2029 (USD MILLION)

TABLE 135 RUSSIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 136 RUSSIA SOLUTION IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 137 RUSSIA SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 RUSSIA CONSULTING SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 RUSSIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 140 RUSSIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 141 RUSSIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 142 RUSSIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING TYPE, 2020-2029 (USD MILLION)

TABLE 143 RUSSIA SPORTS BETTING IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 RUSSIA CASINO IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 145 RUSSIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 146 RUSSIA OFFLINE/LAND BASED IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 147 RUSSIA LIVE ENTERTAINMENT/ONLINE IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 RUSSIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING ENTITY, 2020-2029 (USD MILLION)

TABLE 149 BELGIUM ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 150 BELGIUM SOLUTION IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 151 BELGIUM SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 152 BELGIUM CONSULTING SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 153 BELGIUM ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 154 BELGIUM ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 155 BELGIUM ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 156 BELGIUM ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING TYPE, 2020-2029 (USD MILLION)

TABLE 157 BELGIUM SPORTS BETTING IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 158 BELGIUM CASINO IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 159 BELGIUM ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 160 BELGIUM OFFLINE/LAND BASED IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 161 BELGIUM LIVE ENTERTAINMENT/ONLINE IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 162 BELGIUM ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING ENTITY, 2020-2029 (USD MILLION)

TABLE 163 TURKEY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 164 TURKEY SOLUTION IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 165 TURKEY SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 166 TURKEY CONSULTING SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 167 TURKEY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 168 TURKEY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 169 TURKEY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 170 TURKEY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING TYPE, 2020-2029 (USD MILLION)

TABLE 171 TURKEY SPORTS BETTING IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 172 TURKEY CASINO IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 173 TURKEY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 174 TURKEY OFFLINE/LAND BASED IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 175 TURKEY LIVE ENTERTAINMENT/ONLINE IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 176 TURKEY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING ENTITY, 2020-2029 (USD MILLION)

TABLE 177 IRELANDS ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 178 IRELANDS SOLUTION IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 179 IRELANDS SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 180 IRELANDS CONSULTING SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 181 IRELANDS ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 182 IRELANDS ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 183 IRELANDS ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 184 IRELANDS ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING TYPE, 2020-2029 (USD MILLION)

TABLE 185 IRELANDS SPORTS BETTING IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 186 IRELANDS CASINO IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 187 IRELANDS ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 188 IRELANDS OFFLINE/LAND BASED IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 189 IRELANDS LIVE ENTERTAINMENT/ONLINE IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 190 IRELANDS ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING ENTITY, 2020-2029 (USD MILLION)

TABLE 191 AUSTRIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 192 AUSTRIA SOLUTION IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 193 AUSTRIA SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 194 AUSTRIA CONSULTING SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 195 AUSTRIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 196 AUSTRIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 197 AUSTRIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 198 AUSTRIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING TYPE, 2020-2029 (USD MILLION)

TABLE 199 AUSTRIA SPORTS BETTING IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 200 AUSTRIA CASINO IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 201 AUSTRIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 202 AUSTRIA OFFLINE/LAND BASED IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 203 AUSTRIA LIVE ENTERTAINMENT/ONLINE IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 204 AUSTRIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING ENTITY, 2020-2029 (USD MILLION)

TABLE 205 CZECHIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 206 CZECHIA SOLUTION IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 207 CZECHIA SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 208 CZECHIA CONSULTING SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 209 CZECHIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 210 CZECHIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 211 CZECHIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 212 CZECHIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING TYPE, 2020-2029 (USD MILLION)

TABLE 213 CZECHIA SPORTS BETTING IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 214 CZECHIA CASINO IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 215 CZECHIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 216 CZECHIA OFFLINE/LAND BASED IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 217 CZECHIA LIVE ENTERTAINMENT/ONLINE IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 218 CZECHIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING ENTITY, 2020-2029 (USD MILLION)

TABLE 219 HUNGARY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 220 HUNGARY SOLUTION IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 221 HUNGARY SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 222 HUNGARY CONSULTING SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 223 HUNGARY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 224 HUNGARY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 225 HUNGARY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 226 HUNGARY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING TYPE, 2020-2029 (USD MILLION)

TABLE 227 HUNGARY SPORTS BETTING IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 228 HUNGARY CASINO IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 229 HUNGARY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 230 HUNGARY OFFLINE/LAND BASED IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 231 HUNGARY LIVE ENTERTAINMENT/ONLINE IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 232 HUNGARY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING ENTITY, 2020-2029 (USD MILLION)

TABLE 233 SLOVAKIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 234 SLOVAKIA SOLUTION IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 235 SLOVAKIA SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 236 SLOVAKIA CONSULTING SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 237 SLOVAKIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 238 SLOVAKIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 239 SLOVAKIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 240 SLOVAKIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING TYPE, 2020-2029 (USD MILLION)

TABLE 241 SLOVAKIA SPORTS BETTING IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 242 SLOVAKIA CASINO IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 243 SLOVAKIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 244 SLOVAKIA OFFLINE/LAND BASED IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 245 SLOVAKIA LIVE ENTERTAINMENT/ONLINE IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 246 SLOVAKIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING ENTITY, 2020-2029 (USD MILLION)

TABLE 247 REST OF EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET : SEGMENTATION

FIGURE 2 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET : DATA TRIANGULATION

FIGURE 3 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET : DROC ANALYSIS

FIGURE 4 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET : GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET : COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET : INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET : DBMR MARKET POSITION GRID

FIGURE 8 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET : VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET : SEGMENTATION

FIGURE 10 INCREASE IN DEMAND FOR SOLUTION FOR OFFERING IS EXPECTED TO DRIVE EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 OFFERING TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET IN 2022 & 2029

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET

FIGURE 13 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET: BY OFFERING, 2021

FIGURE 14 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET: BY FUNCTION, 2021

FIGURE 15 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET: BY DEPLOYMENT MODE, 2021

FIGURE 16 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET: BY ENTERPRISE SIZE, 2021

FIGURE 17 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET: BY GAMBLING TYPE, 2021

FIGURE 18 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET: BY APPLICATION, 2021

FIGURE 19 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET: BY GAMBLING ENTITY, 2021

FIGURE 20 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET: SNAPSHOT (2021)

FIGURE 21 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET: BY COUNTRY (2021)

FIGURE 22 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET: BY OFFERING (2022-2029)

FIGURE 25 EUROPE ANTI MONEY LAUNDERING MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.