Europe And Us Rehabilitation Equipment Market

Taille du marché en milliards USD

TCAC :

%

USD

6.02 Billion

USD

10.11 Billion

2024

2032

USD

6.02 Billion

USD

10.11 Billion

2024

2032

| 2025 –2032 | |

| USD 6.02 Billion | |

| USD 10.11 Billion | |

|

|

|

Marché des équipements de rééducation en Europe et aux États-Unis, par produit (équipement de mobilité, équipement d'exercice, aides à la vie quotidienne, dispositifs de soutien corporel, produits de thérapie électromédicale, dispositifs de thérapie par le jeu et autres), thérapie (physiothérapie, ergothérapie, orthophonie, thérapie cognitive et autres), application (rééducation orthopédique, rééducation neurologique, rééducation oncologique et autres), méthode (conventionnelle et télé-rééducation), utilisateur final (hôpitaux, centres de rééducation, établissements de soins infirmiers et de soins de longue durée, centres de sport et de remise en forme, soins à domicile et autres), canal de distribution (hors ligne et en ligne) - Tendances et prévisions de l'industrie jusqu'en 2031.

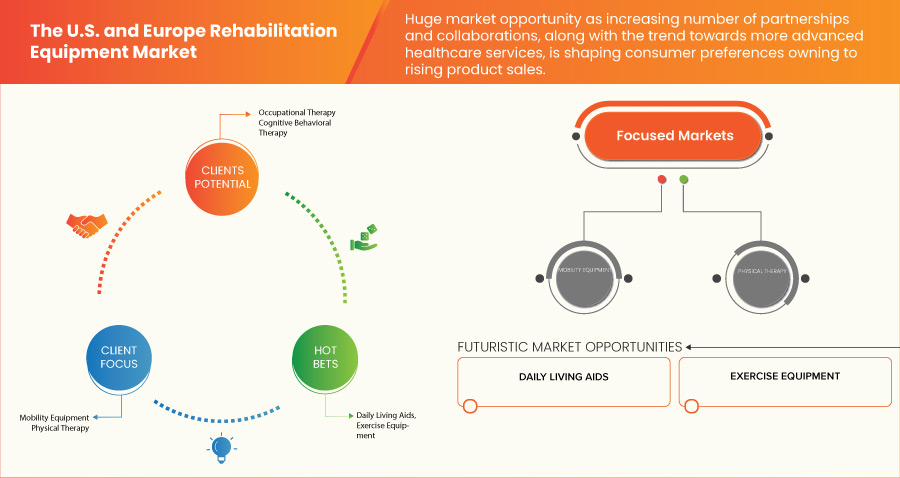

Analyse et perspectives du marché des équipements de rééducation en Europe et aux États-Unis

En janvier 2023, selon la Bibliothèque nationale de médecine, la population totale âgée de 50 ans ou plus associée à au moins une maladie chronique devrait augmenter de 99,5 %, passant de 71,522 millions en 2020 à 142,66 millions en 2050.

Data Bridge Market Research analyse que le marché américain des équipements de rééducation devrait croître à un TCAC de 6,7 % au cours de la période de prévision de 2024 à 2031 et devrait atteindre 9,34 milliards USD d'ici 2031 contre 5,64 milliards USD en 2023.

Le marché européen des équipements de rééducation devrait croître à un TCAC de 7,2 % au cours de la période de prévision de 2024 à 2031 et devrait atteindre 7,45 milliards USD d'ici 2031 contre 4,34 milliards USD en 2023. Le segment des solutions clients d'entreprise devrait propulser la croissance du marché en raison de l'adoption croissante des équipements de rééducation.

|

Rapport métrique |

Détails |

|

Période de prévision |

2024 à 2031 |

|

Année de base |

2023 |

|

Années historiques |

2022 (personnalisable pour 2016-2021) |

|

Unités quantitatives |

Chiffre d'affaires en milliards USD |

|

Segments couverts |

Par produit (équipement de mobilité, équipement d'exercice, aides à la vie quotidienne, dispositifs de soutien corporel, produits de thérapie électromédicale, dispositifs de thérapie par le jeu et autres), thérapie ( physiothérapie , ergothérapie , orthophonie, thérapie cognitive et autres), application (rééducation orthopédique, rééducation neurologique, rééducation oncologique et autres), méthode (rééducation conventionnelle et à distance), utilisateur final (hôpitaux, centres de rééducation, établissements de soins infirmiers spécialisés et de soins de longue durée, centres de sport et de remise en forme, soins à domicile et autres), canal de distribution (hors ligne et en ligne) |

|

Pays couverts |

États-Unis, Allemagne, Royaume-Uni, France, Italie, Pays-Bas, Espagne, Russie, Suisse, Turquie et reste de l'Europe |

|

Acteurs du marché couverts |

Drive Devilbiss Healthcare, Dynatronics Corporation, Baxter International Inc. (Hill- rom Services Inc.), Enovis (DJO Global, Inc.), ETAC AB, Joerns Healthcare, Prism Medical, EZ Way Inc., Technobody, Handicare, Sunrise Medical, Enraf- nonius, Antano Group, Proxomed, Spine Care Technologies Inc., entre autres |

Définition du marché

Le marché des équipements de réadaptation en Europe et aux États-Unis désigne l'industrie qui produit, distribue et vend des dispositifs médicaux , des équipements et des technologies conçus pour faciliter la récupération, le traitement et la gestion des patients souffrant de déficiences physiques, de handicaps ou de personnes en cours de réadaptation. Ce marché englobe une large gamme de produits, notamment des appareils orthopédiques et prothétiques, des équipements de physiothérapie, des fauteuils roulants et des technologies d'assistance.

Dynamique du marché des équipements de rééducation en Europe et aux États-Unis

Cette section traite de la compréhension des moteurs, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteur

- Sensibilisation et autonomisation croissantes des patients

Les patients, les soignants et les professionnels de la santé sont de plus en plus conscients de l’importance de la réadaptation pour améliorer les résultats fonctionnels et le bien-être général, ce qui entraîne une demande accrue d’équipements et de services de réadaptation.

Le marché des équipements de réadaptation est stimulé par des facteurs tels que l'autonomisation croissante des patients et la prise de conscience croissante du rôle essentiel que joue la réadaptation dans l'amélioration du bien-être général et des résultats fonctionnels des patients, des soignants et des professionnels de la santé. À mesure que les gens deviennent plus conscients, il existe un besoin accru de technologies de réadaptation de pointe qui accélèrent la guérison et favorisent l'indépendance. Les solutions innovantes pour soutenir leur processus de réadaptation sont activement prises en charge par des patients autonomes, ce qui a accru l'utilisation de technologies de pointe et de plans de réadaptation individualisés. Cette tendance encourage les patients et les professionnels de la santé à travailler ensemble pour développer des plans de réadaptation personnalisés et une approche plus globale des soins aux patients, ce qui stimule l'expansion du marché dans le secteur des équipements de réadaptation.

Retenue

- Coût élevé de l'équipement

Le coût des équipements de réadaptation avancés peut être prohibitif pour certains établissements de santé et certains patients, ce qui limite leur adoption, en particulier dans les régions où les budgets de santé sont limités.

Le marché des équipements de réadaptation est fortement limité par le coût élevé de ces équipements, qui empêche les patients et les établissements de santé de les utiliser. Les technologies de réadaptation de haute technologie sont souvent coûteuses, de sorte que de nombreux prestataires de soins de santé aux ressources limitées ne peuvent pas se les permettre. De plus, les patients peuvent ne pas avoir assez d'argent pour acheter ou obtenir des équipements de réadaptation coûteux, en particulier si la couverture d'assurance ou les directives de remboursement sont insuffisantes. En raison de leur coût élevé, les solutions de réadaptation innovantes peuvent ne pas être largement adoptées, ce qui peut entraver la croissance du marché et éventuellement réduire le nombre de personnes ayant besoin de services de réadaptation.

Par exemple,

- En septembre 2022, un article intitulé « Achat d’équipements et de dispositifs médicaux coûteux dans les hôpitaux : une revue systématique » a souligné l’importance des équipements et des technologies médicales pour préserver la fonctionnalité du système de santé. Une mauvaise distribution et une mauvaise sélection des technologies peuvent entraîner des gaspillages et des inefficacités, ainsi que mettre en péril la qualité des services de santé, comme l’a montré l’épidémie actuelle de COVID-19. La sécurité des dispositifs médicaux est assurée par des principes de conception et des critères réglementaires, qui fonctionnent ensemble pour prévenir ces risques et garantir que les dispositifs sont suffisamment sûrs pour être mis sur le marché.

Opportunité

- Augmentation de la demande de réadaptation à domicile

Grâce aux progrès technologiques, de plus en plus de personnes optent pour la rééducation à domicile en raison de sa commodité, de son confort et de sa rentabilité. Cette évolution a créé un besoin d'équipements de rééducation portables et faciles à utiliser, pouvant être utilisés dans le confort de son domicile. La demande croissante de rééducation à domicile est motivée par plusieurs facteurs, notamment la commodité, le confort, la rentabilité et les progrès technologiques. En comprenant ces facteurs, les fabricants et les prestataires de soins de santé peuvent développer et proposer des équipements et des services de rééducation qui répondent à ce marché en pleine croissance.

La réadaptation à domicile permet aux patients de suivre un traitement sans avoir à se rendre à l'hôpital ou à la clinique. Cela permet d'économiser du temps et des efforts, en particulier pour les personnes ayant des problèmes de mobilité ou celles vivant dans des régions éloignées. Le facteur de commodité a fait de la réadaptation à domicile une option attrayante pour les patients à la recherche d'une expérience de traitement plus flexible et plus accessible. Recevoir un traitement de réadaptation dans le confort de son domicile peut aider les patients à se sentir plus détendus et à l'aise. Cela peut conduire à un meilleur bien-être mental, ce qui est crucial pour le processus de rétablissement global. De plus, les patients peuvent créer un environnement personnalisé adapté à leurs besoins spécifiques, rendant l'expérience de réadaptation plus confortable et agréable.

Par exemple,

En octobre 2020, selon un article de presse publié, un nouvel appareil portable de rééducation du bras a été lancé pour aider les patients à effectuer une thérapie assistée par robot à domicile. Ce lancement a aidé les patients à effectuer des exercices intensifs qui, à leur tour, les protègent du contact avec des maladies infectieuses.

Défi

- Conformité réglementaire

Le marché des équipements de réadaptation est fortement réglementé pour garantir la sécurité des patients et l'efficacité des appareils. La navigation et le respect de ces exigences réglementaires peuvent constituer un défi de taille pour les fabricants, car cela peut impliquer de longs processus d'approbation et des coûts de conformité élevés. La conformité réglementaire sur le marché des équipements de réadaptation fait référence au respect d'un ensemble de règles, de normes et de directives établies par des agences gouvernementales, des organismes de réglementation et des associations industrielles pour garantir la sécurité, l'efficacité et la qualité des appareils et équipements de réadaptation. Ces cadres réglementaires visent à protéger les patients, les professionnels de la santé et le grand public tout en favorisant l'innovation et une concurrence loyale au sein du secteur.

Les organismes de réglementation établissent des exigences spécifiques pour la conception, la fabrication et les tests des équipements de réadaptation afin de garantir qu'ils répondent aux normes de sécurité et fonctionnent comme prévu. Cela comprend l'évaluation de la durabilité, de la fiabilité et de l'efficacité des appareils pour atteindre les objectifs thérapeutiques visés. Les fabricants doivent mettre en œuvre et maintenir des systèmes de gestion de la qualité qui couvrent tous les aspects de leurs opérations, du développement du produit à la surveillance après la mise sur le marché. Ces systèmes contribuent à garantir une qualité constante, une traçabilité et une amélioration continue de la production d'équipements de réadaptation. La conformité réglementaire comprend également la fourniture d'informations précises et claires sur l'utilisation prévue, les indications, les contre-indications, les avertissements et les précautions liés aux équipements de réadaptation. Ces informations sont essentielles pour que les professionnels de la santé et les patients puissent prendre des décisions éclairées et utiliser les appareils de manière appropriée.

Par exemple,

En juin 2020, selon un article publié dans la Bibliothèque nationale de médecine, l'article indiquait que les lois sur la protection des données, y compris les réglementations concernant la protection de la vie privée et la confidentialité des informations de santé concernant les équipements de rééducation, constituent un cas crucial.

Portée du marché des équipements de rééducation en Europe et aux États-Unis

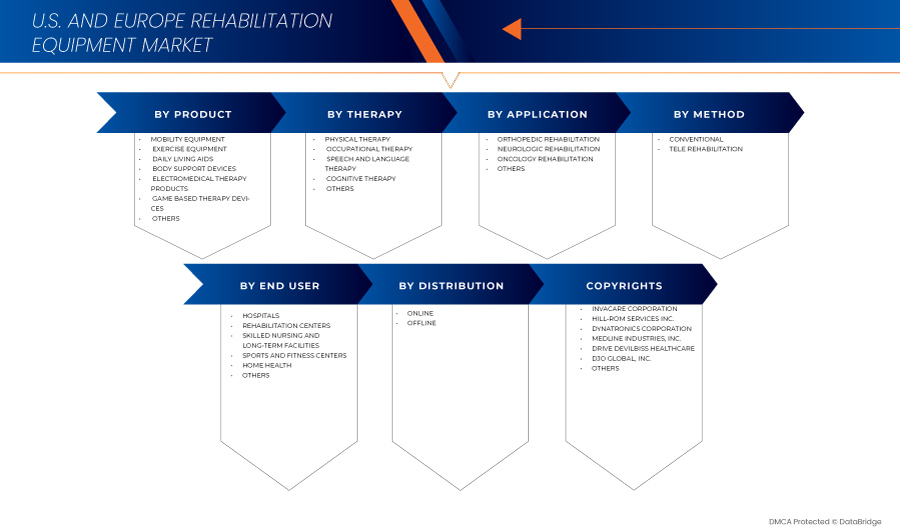

Le marché des équipements de rééducation en Europe et aux États-Unis est segmenté en six segments notables basés sur le produit, la thérapie, l'application, la méthode, l'utilisateur final et le canal de distribution. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et les différences entre vos marchés cibles.

Produit

- Équipement de mobilité

- Équipement d'exercice

- Aides à la vie quotidienne

- Dispositifs de soutien corporel

- Produits de thérapie électromédicale

- Dispositifs de thérapie par le jeu

- Autres

Sur la base du produit, le marché est segmenté en équipements de mobilité, équipements d'exercice, aides à la vie quotidienne, appareils de soutien corporel, produits de thérapie électromédicale, appareils de thérapie basés sur le jeu et autres.

Thérapie

- Physiothérapie

- Ergothérapie

- Orthophonie

- Thérapie cognitive

- Autres

Sur la base de la thérapie, le marché est segmenté en physiothérapie, ergothérapie, orthophonie, thérapie cognitive et autres.

Application

- Rééducation orthopédique

- Rééducation neurologique

- Réadaptation en oncologie

- Autres

Sur la base des applications, le marché est segmenté en réadaptation orthopédique, réadaptation neurologique, réadaptation oncologique et autres.

Méthode

- Conventionnel

- Télé-Rééducation

Sur la base de la méthode, le marché est segmenté en rééducation conventionnelle et télé-rééducation.

Utilisateur final

- Hôpitaux

- Centres de réadaptation

- Établissements de soins infirmiers spécialisés et de soins de longue durée

- Centres de sport et de remise en forme

- Accueil Santé

- Autres

Sur la base de l'utilisateur final, le marché est segmenté en hôpitaux, centres de réadaptation, établissements de soins infirmiers spécialisés et de soins de longue durée, centres de sport et de remise en forme, soins à domicile et autres.

Canal de distribution

- Chaîne hors ligne

- Chaîne en ligne

Sur la base du canal de service, le marché est segmenté en canal hors ligne et canal en ligne.

Analyse/perspectives régionales du marché des équipements de rééducation en Europe et aux États-Unis

Le marché des équipements de rééducation en Europe et aux États-Unis est segmenté en six segments notables basés sur le produit, la thérapie, l'application, la méthode, l'utilisateur final et le canal de distribution.

Les pays couverts dans ce rapport de marché sont les États-Unis, l'Allemagne, le Royaume-Uni, la France, l'Italie, les Pays-Bas, l'Espagne, la Russie, la Suisse, la Turquie et le reste de l'Europe.

Les États-Unis devraient dominer le marché des équipements de rééducation en Europe et aux États-Unis, en raison du nombre élevé de personnes suivant des traitements de rééducation.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie du pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario du marché pour les différents pays. En outre, la présence et la disponibilité de grandes entreprises de services et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des acteurs locaux et nationaux et l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des équipements de rééducation en Europe et aux États-Unis

Le paysage concurrentiel du marché des équipements de rééducation en Europe et aux États-Unis fournit des détails sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement du produit, les approbations de produits, la largeur et l'étendue du produit, la domination des applications et la courbe de vie du type de produit. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise sur le marché.

Français Certains des principaux acteurs du marché opérant sur le marché sont ETAC AB., Vitrex Medical A/S, Joerns Healthcare, Sunrise Medical, Handicare, Proxomed, Prism Medical, Invacare Corporation, Medline Industries, Inc., Drive deVilbiss Healthcare, Antano Group, GF Health Products, Inc., Technomex, Spine Care Technologies, Enraf Nonius, Roma Medical, Dynatronics Corporation, Carex, Tecnobody, Ez Way, Inc., Hill- rom Services, Inc. et Djo Ltd., entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.