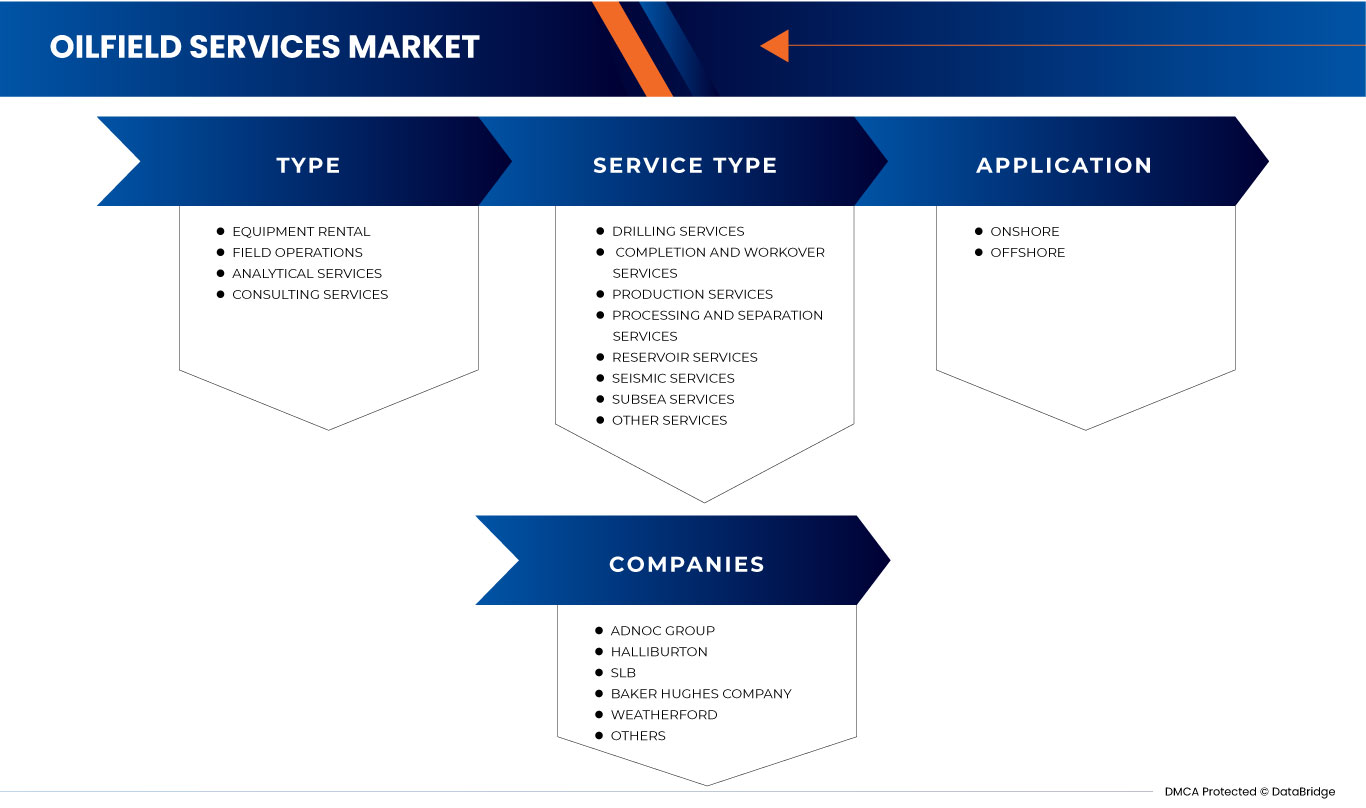

Marché des services pétroliers en Europe et au Moyen-Orient, par type (location d'équipement, opérations sur le terrain, services d'analyse et services de conseil), type de service (services de forage, services de complétion et de reconditionnement, services de production, services de traitement et de séparation, services de réservoir, services sismiques, services sous-marins et autres services), application (onshore et offshore) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché des services pétroliers en Europe et au Moyen-Orient

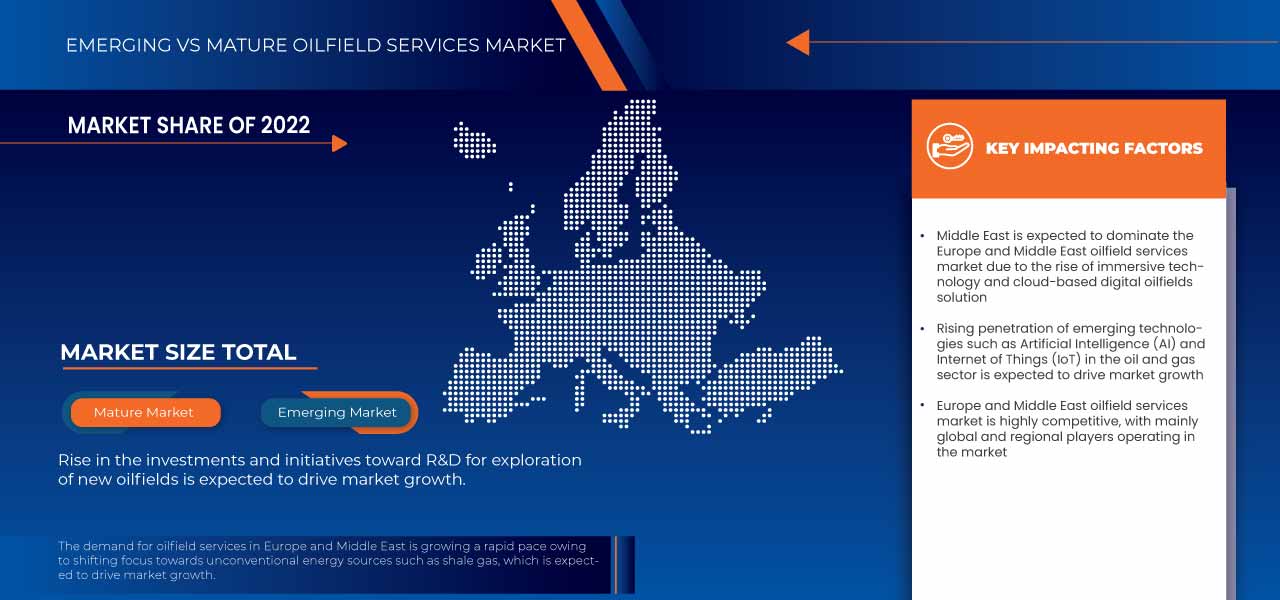

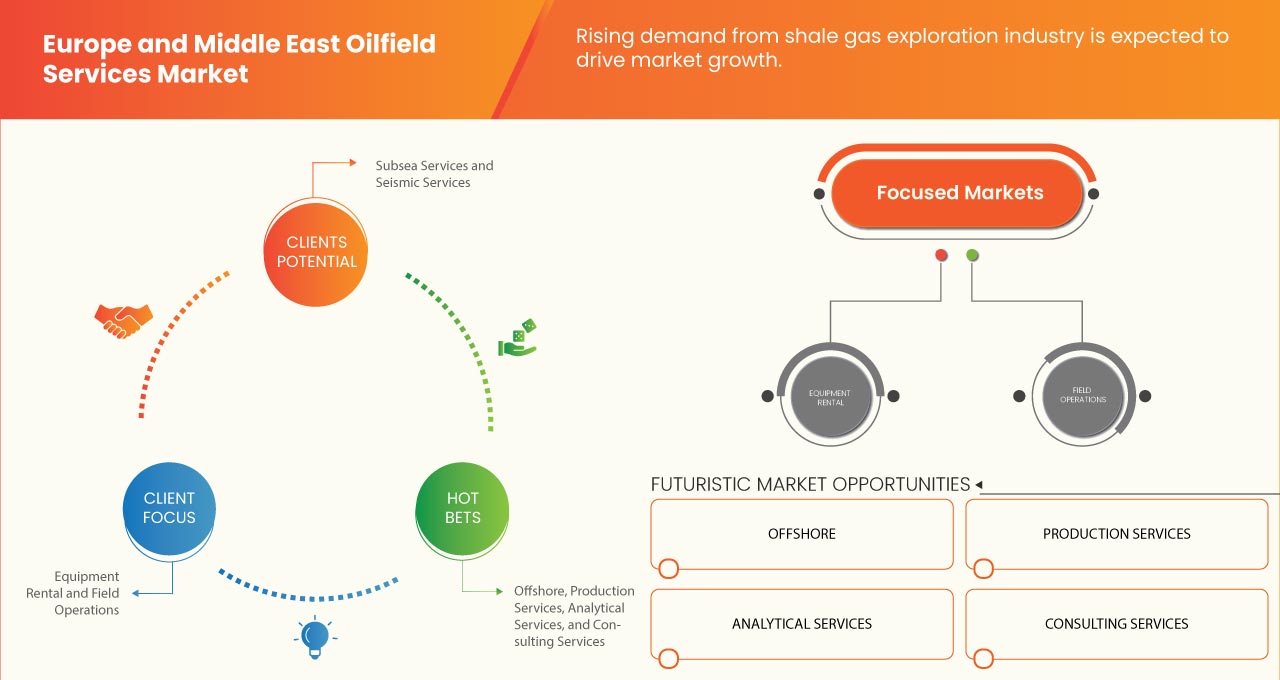

La pénétration croissante des technologies émergentes telles que l' intelligence artificielle (IA) et l'Internet des objets (IoT) dans le secteur du pétrole et du gaz a renforcé la demande du marché. Le déplacement de l'attention vers des sources d'énergie non conventionnelles telles que le gaz de schiste contribue également à la croissance du marché. Les principaux acteurs du marché se concentrent sur divers lancements et approbations de services au cours de cette période cruciale. En outre, l'adoption croissante de technologies telles que la récupération assistée du pétrole (EOR), en particulier pour les champs pétroliers vieillissants, contribue également à la demande croissante du marché.

Le marché des services pétroliers en Europe et au Moyen-Orient devrait croître au cours de l'année de prévision en raison de la hausse de la demande de services d'intervention sur puits et de solutions pétrolières numériques opérationnelles. L'essor de la technologie immersive et des solutions pétrolières numériques basées sur le cloud stimule encore davantage la croissance du marché. Cependant, les lois et réglementations strictes imposées par divers organismes de réglementation devraient freiner la croissance du marché au cours de la période de prévision.

Data Bridge Market Research analyse que le marché des services pétroliers en Europe et au Moyen-Orient devrait atteindre 131 230,78 millions USD d'ici 2030, à un TCAC de 5,8 % au cours de la période de prévision.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Année historique |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Type (location d'équipement, opérations sur le terrain, services d'analyse et services de conseil), type de service (services de forage, services de complétion et de reconditionnement, services de production, services de traitement et de séparation, services de réservoir, services sismiques, services sous-marins et autres services), application (onshore et offshore) |

|

Pays couverts |

Russie, Norvège, Royaume-Uni, Danemark, Italie, Turquie, Allemagne, Pays-Bas, France, Espagne, Suisse, Belgique, Finlande, Suède et reste de l'Europe, Arabie saoudite, Émirats arabes unis, Koweït, Qatar, Oman, Bahreïn, Israël et reste du Moyen-Orient |

|

Acteurs du marché couverts |

NAPESCO, SLB, Halliburton, Baker Hughes Company, ABB, Weatherford, Rockwell Automation, Siemens Energy, Saipem, Petrofac Limited, Oil States International, Inc., Oceaneering International, TRANSOCEAN LTD., NOV Inc., TAQA KSA, Superior Energy Services, Stark Oilfield Service Company, Middle East Oilfield Services LLC, Abu Dhabi Oilfield Services Company et ADNOC Group, entre autres |

Définition du marché

Les services pétroliers font référence à la gamme de produits et de services fournis à l'industrie pétrolière et gazière pour soutenir l'exploration, le développement, la production et le transport des ressources pétrolières et gazières. Les services pétroliers englobent un large éventail d'activités spécialisées, d'équipements et d'expertises nécessaires à différentes étapes du cycle de vie du pétrole et du gaz. Ces services comprennent des levés sismiques pour identifier les réservoirs potentiels, le forage de puits à l'aide d'appareils et d'équipements spécialisés, des services de complétion et de production pour préparer les puits à la production, des services d'intervention et de maintenance des puits, des services de câblage pour la collecte de données et les opérations d'intervention, et des services environnementaux pour la gestion des déchets et la conformité. Le marché des services pétroliers fait référence à l'industrie qui fournit divers produits et services pour soutenir les activités d'exploration, de forage, de production et de transport du pétrole et du gaz.

Dynamique du marché des services pétroliers en Europe et au Moyen-Orient

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Pénétration croissante des technologies émergentes telles que l'intelligence artificielle (IA) et l'Internet des objets (IoT) dans le secteur du pétrole et du gaz

La technologie joue un rôle important dans la croissance de chaque entreprise et aide également les organisations à améliorer la qualité et la vitesse de travail en soutenant et en améliorant les opérations. Les entreprises adoptent des techniques d'analyse de big data dans leurs activités pour améliorer les opérations et faciliter les performances des installations. Les technologies disruptives telles que l'intelligence artificielle (IA) et l'Internet des objets (IoT) stimulent la transformation numérique sur l'ensemble du marché, augmentant ainsi l'efficacité, la sécurité et la durabilité. Le secteur du pétrole et du gaz a connu une pénétration croissante des technologies émergentes ces dernières années. Les technologies transforment divers aspects de l'industrie, de l'exploration et de la production au raffinage et à la distribution.

- L’accent est mis sur les sources d’énergie non conventionnelles telles que le gaz de schiste

Le gaz de schiste est une ressource de gaz naturel non conventionnelle présente dans les formations rocheuses de schiste. Son exploration et son extraction nécessitent des techniques et des services spécialisés fournis par les sociétés pétrolières. Le développement de technologies avancées telles que le forage horizontal et la fracturation hydraulique a été crucial pour libérer le vaste potentiel des ressources de gaz de schiste. L'exploration du gaz de schiste implique le forage de plusieurs puits et leur complétion par fracturation hydraulique. Des levés sismiques sont effectués pour cartographier et analyser les formations de schiste souterraines. Cela permet d'identifier les réservoirs potentiels de gaz de schiste, d'évaluer leurs caractéristiques géologiques et de déterminer les meilleurs emplacements pour le forage. La fracturation hydraulique ou fracturation hydraulique est une technique essentielle utilisée pour extraire le gaz des formations de schiste. Les sociétés de services pétroliers fournissent une expertise et des équipements pour les opérations de fracturation hydraulique. Elles conçoivent et mettent en œuvre des traitements de fracturation qui impliquent l'injection d'eau, de sable et de produits chimiques à haute pression pour créer des fractures dans la roche de schiste permettant au gaz de s'écouler une fois le forage et la fracturation hydraulique terminés, la cimentation du tubage, l'installation de tubes de production et la mise en œuvre d'assemblages de têtes de puits pour assurer un contrôle et une sécurité appropriés du débit. Les services pétroliers visent à optimiser la production de gaz de schiste en utilisant différentes techniques de stimulation des puits, d'étapes de fracturation supplémentaires ou d'acidification pour augmenter les débits de gaz et améliorer la productivité des puits. Les services de surveillance et d'optimisation de la production contribuent à maximiser la production globale des réservoirs de gaz de schiste.

Opportunité

-

Augmentation de la demande de services d'intervention sur les puits et de solutions numériques opérationnelles pour les champs pétrolifères

L’augmentation du nombre de champs pétrolifères matures en Europe et au Moyen-Orient est due à la demande croissante d’énergie primaire, comme le pétrole et le gaz naturel, dans le monde entier. En outre, l’approvisionnement en énergie primaire est extrêmement limité et la plupart des entreprises internationales investissent davantage dans la création de systèmes de production efficaces. L’adoption de solutions numériques ou la transformation du processus de travail des champs pétrolifères vers la numérisation amélioreront la production pétrolière et la capacité d’extraction et réduiront les erreurs humaines.

De nombreux champs de pétrole et de gaz dans le monde entrent dans la phase de maturité ou de fin de vie, où les taux de production diminuent naturellement. Les services d'intervention sur puits sont demandés pour optimiser la production, améliorer les taux de récupération et prolonger la durée de vie de ces champs vieillissants. Les techniques d'intervention telles que la stimulation des puits, les reconditionnements et la gestion de l'intégrité des puits aident à résoudre les problèmes de forage, à améliorer les performances des réservoirs et à rétablir ou à améliorer les niveaux de production. Les services d'intervention sur puits jouent un rôle essentiel dans l'industrie qui s'efforce de maximiser l'efficacité de la production. Ces services aident à identifier et à résoudre les goulots d'étranglement de la production, à optimiser les conceptions de complétion des puits et à mettre en œuvre des stratégies de gestion des réservoirs.

Défis/Restrictions

- Le déclin industriel dû à des facteurs géopolitiques et économiques

Le déclin industriel dû à des facteurs géopolitiques et économiques peut avoir des conséquences importantes sur le marché. Les facteurs géopolitiques tels que l’instabilité politique, les conflits, les différends commerciaux et les sanctions peuvent perturber l’industrie mondiale du pétrole et du gaz. Les facteurs économiques tels que les fluctuations des prix du pétrole, la dévaluation des devises et les changements dans la dynamique de l’offre et de la demande peuvent également avoir un impact sur le marché. Ces défis peuvent créer plusieurs obstacles potentiels pour le marché.

La production et l’exploration pétrolières en Europe et au Moyen-Orient peuvent être affectées par des troubles géopolitiques. L’instabilité dans les principaux pays producteurs de pétrole peut entraîner une baisse des investissements, des dommages aux infrastructures et des ruptures d’approvisionnement. Ces inquiétudes pourraient limiter les activités d’exploration et de production, réduisant ainsi le besoin de services de forage, de complétion de puits et de maintenance. Cela pourrait être préjudiciable au secteur des services pétroliers. En outre, dans les régions Europe et Moyen-Orient, les décisions financières et les budgets des projets pourraient être influencés par des facteurs économiques tels que l’évolution des prix du pétrole. Les sociétés pétrolières et gazières pourraient réduire leurs dépenses d’investissement en raison de la volatilité des prix du pétrole, ce qui réduirait la demande de services pétroliers. En outre, les changements dans la dynamique de l’offre et de la demande du marché et la dévaluation des devises dans certains pays d’Europe et du Moyen-Orient pourraient avoir un impact sur le marché de cette région. Ces facteurs peuvent augmenter les coûts opérationnels des prestataires de services pétroliers et réduire leur rentabilité et leur compétitivité. Les activités d’exploration et de production pétrolières et gazières pourraient diminuer en raison de facteurs tels que l’évolution des modes de consommation d’énergie, une plus grande importance accordée aux sources d’énergie renouvelables et des politiques qui soutiennent la transition énergétique. Ce changement pourrait entraîner une baisse de la demande de services pétroliers, ce qui sera difficile pour les prestataires de services faisant des affaires dans les régions d’Europe et du Moyen-Orient.

- Lois et réglementations strictes émanant de divers organismes de réglementation

Diverses organisations et gouvernements ont imposé des lois et réglementations strictes sur le marché des services pétroliers en Europe et au Moyen-Orient. Ces règles visent à garantir l'ethnicité du secteur, la protection de l'environnement et la sécurité. Elles peuvent cependant également imposer des restrictions sur le marché.

La protection de l’environnement est l’un des aspects de la réglementation qui a un impact sur les entreprises. Les gouvernements et les organisations ont promulgué des lois pour réduire et contrôler l’impact environnemental des opérations pétrolières. Cela couvre les règles d’élimination des déchets ou des sous-produits, la réduction des émissions et la sauvegarde des écosystèmes naturels. Les coûts pour les prestataires de services pétroliers peuvent augmenter en raison des investissements accrus en équipements, en technologies et en procédures nécessaires pour se conformer à ces lois, ce qui peut constituer un défi à relever dans un avenir proche. En outre, les lois sur la santé et la sécurité jouent un rôle important sur le marché. Les entreprises et les gouvernements imposent des réglementations strictes pour protéger les employés et garantir des environnements de travail sûrs. L’équipement de protection individuelle, l’identification des dangers et la planification des interventions d’urgence ne sont que quelques-uns des sujets couverts par ces règles. Les entreprises peuvent être amenées à dépenser de l’argent pour des initiatives de formation, des équipements de sécurité et des mesures de conformité pour se conformer à ces règles, ce qui peut augmenter les dépenses opérationnelles. En outre, des lois et des règles sont en place pour garantir une concurrence loyale et la transparence dans le secteur des services pétroliers. Ces règles peuvent accroître le niveau de conformité requis des entreprises déjà existantes et élever les barrières à l’entrée pour les nouvelles entreprises, modifiant ainsi la dynamique du marché.

Développements récents

- En juillet 2023, ABB et Microsoft ont collaboré pour intégrer l'IA générative aux applications industrielles afin de garantir des opérations plus sûres, plus intelligentes et plus durables. Cela aidera l'entreprise à accélérer la transformation numérique du secteur industriel.

- En janvier 2023, NOV a lancé le système Agitator ZP pour augmenter l'efficacité du forage sans diminution de pression, et ils ont déclaré que cette technologie à pression zéro offre plus de flexibilité pour les projets de forage nécessitant des latéraux plus longs et des outils de réduction de friction doubles pour atteindre des cibles difficiles tout en préservant un ROP plus élevé.

Portée du marché des services pétroliers en Europe et au Moyen-Orient

Le marché des services pétroliers en Europe et au Moyen-Orient est segmenté en trois segments notables en fonction du type, du type de service et de l'application. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

Taper

- Location de matériel

- Opérations sur le terrain

- Services d'analyse

- Services de consultation

Sur la base du type, le marché est segmenté en location d’équipement, opérations sur le terrain, services d’analyse et services de conseil.

Type de service

- Services de forage

- Services d'achèvement et de reconditionnement

- Services de production

- Services de traitement et de séparation

- Services du réservoir

- Services sismiques

- Services sous-marins

- Autres services

Sur la base du type de service, le marché est segmenté en services de forage, services d'achèvement et de reconditionnement, services de production, services de traitement et de séparation, services de réservoir, services sismiques, services sous-marins et autres services.

Application

- À terre

- Offshore

Sur la base des applications, le marché est segmenté en onshore et offshore.

Analyse/perspectives régionales du marché des services pétroliers en Europe et au Moyen-Orient

Le marché des services pétroliers en Europe et au Moyen-Orient est segmenté en trois segments notables en fonction du type, du type de service et de l'application.

Les pays couverts dans ce rapport de marché sont la Russie, la Norvège, le Royaume-Uni, le Danemark, l'Italie, la Turquie, l'Allemagne, les Pays-Bas, la France, l'Espagne, la Suisse, la Belgique, la Finlande, la Suède et le reste de l'Europe, l'Arabie saoudite, les Émirats arabes unis, le Koweït, le Qatar, Oman, Bahreïn, Israël et le reste du Moyen-Orient.

Le Moyen-Orient devrait dominer le marché en raison de la présence d'acteurs clés sur le plus grand marché de consommation avec un PIB élevé. L'Arabie saoudite devrait dominer la région du Moyen-Orient en raison de la hausse des progrès technologiques et de l'augmentation des investissements dans diverses technologies. La Russie devrait dominer la région européenne en raison de la forte présence d'acteurs clés.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie du pays, les actes réglementaires et les tarifs douaniers d'import-export sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario du marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales et l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des services pétroliers en Europe et au Moyen-Orient

Le paysage concurrentiel du marché des services pétroliers en Europe et au Moyen-Orient fournit des détails sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les approbations de produits, la largeur et l'étendue des produits, la domination des applications et la courbe de survie du type de produit. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise sur le marché.

Certains des principaux acteurs du marché opérant sur le marché des services pétroliers en Europe et au Moyen-Orient sont NAPESCO, SLB, Halliburton, Baker Hughes Company, ABB, Weatherford, Rockwell Automation, Siemens Energy, Saipem, Petrofac Limited, Oil States International, Inc., Oceaneering International, TRANSOCEAN LTD., NOV Inc., TAQA KSA, Superior Energy Services, Stark Oilfield Service Company, Middle East Oilfield Services LLC, Abu Dhabi Oilfield Services Company et ADNOC Group, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES: EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 THREAT OF SUBSTITUTES

4.1.3 CUSTOMER BARGAINING POWER

4.1.4 SUPPLIER BARGAINING POWER

4.1.5 INTERNAL COMPETITION (RIVALRY)

4.2 PESTLE ANALYSIS

4.2.1 POLITICAL FACTORS

4.2.2 ECONOMIC FACTORS

4.2.3 SOCIAL FACTORS

4.2.4 TECHNOLOGICAL FACTORS

4.2.5 LEGAL FACTORS

4.2.6 ENVIRONMENTAL FACTORS

4.3 VENDOR SELECTION CRITERIA

4.4 CLIMATE CHANGE SCENARIO

4.4.1 ENVIRONMENTAL CONCERNS

4.4.2 INDUSTRY RESPONSE

4.4.3 GOVERNMENT’S ROLE

4.4.4 ANALYST RECOMMENDATION

4.5 RAW MATERIAL COVERAGE

4.5.1 STEEL

4.5.2 ALLOYS

4.5.2.1 NICKEL ALLOYS

4.5.2.1.1 INCONEL

4.5.2.1.2 HASTELLOY

4.5.2.2 CHROMIUM-MOLYBDENUM (CR-MO) ALLOYS

4.5.2.2.1 4130 AND 4140

4.5.2.2.2 9CR AND 13CR STAINLESS STEELS

4.5.2.3 TITANIUM ALLOYS

4.5.2.3.1 GRADE 5 (TI-6AL-4V)

4.5.2.3.2 GRADE 2 (TI-CP)

4.5.3 TUNGSTEN AND COBALT

4.5.4 SYNTHETIC DIAMONDS

4.5.5 TITANIUM

4.6 SUPPLY CHAIN ANALYSIS

4.6.1 OVERVIEW

4.6.2 LOGISTIC COST SCENARIO

4.6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.7 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.8 PRICING ANALYSIS BENCHMARKING OVERVIEW

4.8.1 DRILLING COSTS

4.8.2 WELL COMPLETION SERVICES

4.8.3 FLUIDS, CEMENTING, AND TOOLS SERVICES

5 REGULATORY FRAMEWORK AND GUIDELINES

5.1 REGULATORY FRAMEWORK AND GUIDELINES

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING PENETRATION OF EMERGING TECHNOLOGIES SUCH AS ARTIFICIAL INTELLIGENCE (AI) AND INTERNET OF THINGS (IOT) IN THE OIL AND GAS SECTOR

6.1.2 SHIFTING FOCUS TOWARDS UNCONVENTIONAL ENERGY SOURCES SUCH AS SHALE GAS

6.1.3 GROWING ADOPTION OF TECHNOLOGIES SUCH AS EOR ESPECIALLY FOR AGING OIL FIELDS

6.2 RESTRAINTS

6.2.1 STRINGENT LAWS & REGULATIONS BY VARIOUS REGULATORY BODIES

6.2.2 VOLATILITY IN THE PRICES OF CRUDE OIL

6.3 OPPORTUNITIES

6.3.1 RISE IN DEMAND FOR WELL-INTERVENTION SERVICES AND OPERATIONAL DIGITAL OILFIELD SOLUTIONS

6.3.2 RISE OF IMMERSIVE TECHNOLOGY AND CLOUD-BASED DIGITAL OILFIELDS SOLUTION

6.4 CHALLENGES

6.4.1 INDUSTRIAL DOWNFALL DUE TO GEOPOLITICAL AND ECONOMIC FACTORS

6.4.2 REALIGNING THE FOCUS TOWARDS RENEWABLE OR CLEAN ENERGY RESOURCES

7 EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET, BY REGION

7.1 OVERVIEW

7.2 MIDDLE EAST

7.2.1 SAUDI ARABIA

7.2.2 UNITED ARAB EMIRATES

7.2.3 KUWAIT

7.2.4 QATAR

7.2.5 OMAN

7.2.6 BAHRAIN

7.2.7 ISRAEL

7.2.8 REST OF MIDDLE EAST

7.3 EUROPE

7.3.1 RUSSIA

7.3.2 NORWAY

7.3.3 U.K.

7.3.4 DENMARK

7.3.5 ITALY

7.3.6 TURKEY

7.3.7 GERMANY

7.3.8 NETHERLANDS

7.3.9 FRANCE

7.3.10 SPAIN

7.3.11 SWITZERLAND

7.3.12 BELGIUM

7.3.13 FINLAND

7.3.14 SWEDEN

7.3.15 REST OF EUROPE

8 EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET: COMPANY LANDSCAPE

8.1 COMPANY SHARE ANALYSIS: EUROPE AND MIDDLE EAST

8.2 COMPANY SHARE ANALYSIS: EUROPE

8.3 COMPANY SHARE ANALYSIS: MIDDLE EAST

9 SWOT ANALYSIS

10 COMPANY PROFILES

10.1 ADNOC GROUP

10.1.1 COMPANY SNAPSHOT

10.1.2 PRODUCT PORTFOLIO

10.1.3 RECENT DEVELOPMENTS

10.2 HALLIBURTON

10.2.1 COMPANY SNAPSHOT

10.2.2 REVENUE ANALYSIS

10.2.3 PRODUCT PORTFOLIO

10.2.4 RECENT DEVELOPMENTS

10.3 SLB

10.3.1 COMPANY SNAPSHOT

10.3.2 REVENUE ANALYSIS

10.3.3 PRODUCT PORTFOLIO

10.3.4 RECENT DEVELOPMENT

10.4 BAKER HUGHES COMPANY

10.4.1 COMPANY SNAPSHOT

10.4.2 REVENUE ANALYSIS

10.4.3 PRODUCT PORTFOLIO

10.4.4 RECENT DEVELOPMENT

10.5 WEATHERFORD

10.5.1 COMPANY SNAPSHOT

10.5.2 REVENUE ANALYSIS

10.5.3 PRODUCT PORTFOLIO

10.5.4 RECENT DEVELOPMENTS

10.6 ABB

10.6.1 COMPANY SNAPSHOT

10.6.2 REVENUE ANALYSIS

10.6.3 PRODUCT PORTFOLIO

10.6.4 RECENT DEVELOPMENT

10.7 ABU DHABI OILFIELD SERVICES COMPANY

10.7.1 COMPANY SNAPSHOT

10.7.2 PRODUCT PORTFOLIO

10.7.3 RECENT DEVELOPMENTS

10.8 MIDDLE EAST OILFIELD SERVICES LLC.

10.8.1 COMPANY SNAPSHOT

10.8.2 PRODUCT PORTFOLIO

10.8.3 RECENT DEVELOPMENTS

10.9 NAPESCO

10.9.1 COMPANY SNAPSHOT

10.9.2 REVENUE ANALYSIS

10.9.3 PRODUCT PORTFOLIO

10.9.4 RECENT DEVELOPMENT

10.1 NOV INC.

10.10.1 COMPANY SNAPSHOT

10.10.2 REVENUE ANALYSIS

10.10.3 PRODUCT PORTFOLIO

10.10.4 RECENT DEVELOPMENT

10.11 OCEANEERING INTERNATIONAL, INC.

10.11.1 COMPANY SNAPSHOT

10.11.2 REVENUE ANALYSIS

10.11.3 PRODUCT PORTFOLIO

10.11.4 RECENT DEVELOPMENT

10.12 OIL STATES INTERNATIONAL, INC.

10.12.1 COMPANY SNAPSHOT

10.12.2 REVENUE ANALYSIS

10.12.3 PRODUCT PORTFOLIO

10.12.4 RECENT DEVELOPMENTS

10.13 PETROFAC LIMITED

10.13.1 COMPANY SNAPSHOT

10.13.2 REVENUE ANALYSIS

10.13.3 PRODUCT PORTFOLIO

10.13.4 RECENT DEVELOPMENTS

10.14 ROCKWELL AUTOMATION

10.14.1 COMPANY SNAPSHOT

10.14.2 REVENUE ANALYSIS

10.14.3 PRODUCT PORTFOLIO

10.14.4 RECENT DEVELOPMENTS

10.15 SAIPEM

10.15.1 COMPANY SNAPSHOT

10.15.2 REVENUE ANALYSIS

10.15.3 PRODUCT PORTFOLIO

10.15.4 RECENT DEVELOPMENTS

10.16 SIEMENS ENERGY

10.16.1 COMPANY SNAPSHOT

10.16.1 REVENUE ANALYSIS

10.16.2 PRODUCT PORTFOLIO

10.16.3 RECENT DEVELOPMENT

10.17 STARK OILFIELD SERVICE COMPANY

10.17.1 COMPANY SNAPSHOT

10.17.2 PRODUCT PORTFOLIO

10.17.3 RECENT DEVELOPMENTS

10.18 SUPERIOR ENERGY SERVICES

10.18.1 COMPANY SNAPSHOT

10.18.2 REVENUE ANALYSIS

10.18.3 PRODUCT PORTFOLIO

10.18.4 RECENT DEVELOPMENTS

10.19 TAQA KSA

10.19.1 COMPANY SNAPSHOT

10.19.2 REVENUE ANALYSIS

10.19.3 PRODUCT PORTFOLIO

10.19.4 RECENT DEVELOPMENT

10.2 TRANSOCEAN LTD.

10.20.1 COMPANY SNAPSHOT

10.20.2 REVENUE ANALYSIS

10.20.3 PRODUCT PORTFOLIO

10.20.4 RECENT DEVELOPMENTS

11 QUESTIONNAIRE

12 RELATED REPORTS

Liste des tableaux

TABLE 1 EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 2 EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 3 EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD MILLION)

TABLE 4 EUROPE AND MIDDLE EAST DRILLING SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 5 EUROPE AND MIDDLE EAST COMPLETION AND WORKOVER SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 6 EUROPE AND MIDDLE EAST PROCESSING AND SEPARATION SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 7 EUROPE AND MIDDLE EAST RESERVOIR SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 8 EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 9 EUROPE AND MIDDLE EAST OFFSHORE IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 10 MIDDLE EAST OILFIELD SERVICES MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 11 MIDDLE EAST OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 MIDDLE EAST OILFIELD SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD MILLION)

TABLE 13 MIDDLE EAST DRILLING SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 14 MIDDLE EAST COMPLETION AND WORKOVER SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 MIDDLE EAST PROCESSING AND SEPARATION SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 16 MIDDLE EAST RESERVOIR SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 17 MIDDLE EAST OILFIELD SERVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 18 MIDDLE EAST OFFSHORE IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 19 SAUDI ARABIA OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 20 SAUDI ARABIA OILFIELD SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD MILLION)

TABLE 21 SAUDI ARABIA DRILLING SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 22 SAUDI ARABIA COMPLETION AND WORKOVER SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 23 SAUDI ARABIA PROCESSING AND SEPARATION SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 24 SAUDI ARABIA RESERVOIR SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 25 SAUDI ARABIA OILFIELD SERVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 26 SAUDI ARABIA OFFSHORE IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 27 UNITED ARAB EMIRATES OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 28 UNITED ARAB EMIRATES OILFIELD SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD MILLION)

TABLE 29 UNITED ARAB EMIRATES DRILLING SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 30 UNITED ARAB EMIRATES COMPLETION AND WORKOVER SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 UNITED ARAB EMIRATES PROCESSING AND SEPARATION SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 32 UNITED ARAB EMIRATES RESERVOIR SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 33 UNITED ARAB EMIRATES OILFIELD SERVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 34 UNITED ARAB EMIRATES OFFSHORE IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 KUWAIT OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 36 KUWAIT OILFIELD SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD MILLION)

TABLE 37 KUWAIT DRILLING SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 38 KUWAIT COMPLETION AND WORKOVER SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 39 KUWAIT PROCESSING AND SEPARATION SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 KUWAIT RESERVOIR SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 41 KUWAIT OILFIELD SERVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 42 KUWAIT OFFSHORE IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 43 QATAR OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 QATAR OILFIELD SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD MILLION)

TABLE 45 QATAR DRILLING SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 QATAR COMPLETION AND WORKOVER SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 QATAR PROCESSING AND SEPARATION SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 48 QATAR RESERVOIR SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 49 QATAR OILFIELD SERVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 50 QATAR OFFSHORE IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 OMAN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 52 OMAN OILFIELD SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD MILLION)

TABLE 53 OMAN DRILLING SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 OMAN COMPLETION AND WORKOVER SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 55 OMAN PROCESSING AND SEPARATION SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 56 OMAN RESERVOIR SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 57 OMAN OILFIELD SERVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 58 OMAN OFFSHORE IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 59 BAHRAIN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 60 BAHRAIN OILFIELD SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD MILLION)

TABLE 61 BAHRAIN DRILLING SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 62 BAHRAIN COMPLETION AND WORKOVER SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 63 BAHRAIN PROCESSING AND SEPARATION SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 64 BAHRAIN RESERVOIR SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 65 BAHRAIN OILFIELD SERVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 66 BAHRAIN OFFSHORE IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 67 ISRAEL OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 68 ISRAEL OILFIELD SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD MILLION)

TABLE 69 ISRAEL DRILLING SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 70 ISRAEL COMPLETION AND WORKOVER SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 71 ISRAEL PROCESSING AND SEPARATION SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 72 ISRAEL RESERVOIR SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 73 ISRAEL OILFIELD SERVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 74 ISRAEL OFFSHORE IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 75 REST OF MIDDLE EAST OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 76 EUROPE OILFIELD SERVICES MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 77 EUROPE OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 78 EUROPE OILFIELD SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD MILLION)

TABLE 79 EUROPE DRILLING SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 80 EUROPE COMPLETION AND WORKOVER SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 81 EUROPE PROCESSING AND SEPARATION SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 82 EUROPE RESERVOIR SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 83 EUROPE OILFIELD SERVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 84 EUROPE OFFSHORE IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 85 RUSSIA OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 86 RUSSIA OILFIELD SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD MILLION)

TABLE 87 RUSSIA DRILLING SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 88 RUSSIA COMPLETION AND WORKOVER SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 89 RUSSIA PROCESSING AND SEPARATION SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 90 RUSSIA RESERVOIR SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 91 RUSSIA OILFIELD SERVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 92 RUSSIA OFFSHORE IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 93 NORWAY OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 94 NORWAY OILFIELD SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD MILLION)

TABLE 95 NORWAY DRILLING SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 96 NORWAY COMPLETION AND WORKOVER SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 97 NORWAY PROCESSING AND SEPARATION SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 98 NORWAY RESERVOIR SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 NORWAY OILFIELD SERVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 100 NORWAY OFFSHORE IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 101 U.K. OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 102 U.K. OILFIELD SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD MILLION)

TABLE 103 U.K. DRILLING SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 104 U.K. COMPLETION AND WORKOVER SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 105 U.K. PROCESSING AND SEPARATION SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 106 U.K. RESERVOIR SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 107 U.K. OILFIELD SERVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 108 U.K. OFFSHORE IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 109 DENMARK OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 110 DENMARK OILFIELD SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD MILLION)

TABLE 111 DENMARK DRILLING SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 112 DENMARK COMPLETION AND WORKOVER SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 113 DENMARK PROCESSING AND SEPARATION SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 114 DENMARK RESERVOIR SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 115 DENMARK OILFIELD SERVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 116 DENMARK OFFSHORE IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 117 ITALY OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 118 ITALY OILFIELD SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD MILLION)

TABLE 119 ITALY DRILLING SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 120 ITALY COMPLETION AND WORKOVER SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 121 ITALY PROCESSING AND SEPARATION SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 122 ITALY RESERVOIR SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 123 ITALY OILFIELD SERVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 124 ITALY OFFSHORE IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 125 TURKEY OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 126 TURKEY OILFIELD SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD MILLION)

TABLE 127 TURKEY DRILLING SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 128 TURKEY COMPLETION AND WORKOVER SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 129 TURKEY PROCESSING AND SEPARATION SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 130 TURKEY RESERVOIR SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 131 TURKEY OILFIELD SERVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 132 TURKEY OFFSHORE IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 133 GERMANY OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 134 GERMANY OILFIELD SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD MILLION)

TABLE 135 GERMANY DRILLING SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 136 GERMANY COMPLETION AND WORKOVER SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 137 GERMANY PROCESSING AND SEPARATION SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 138 GERMANY RESERVOIR SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 139 GERMANY OILFIELD SERVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 140 GERMANY OFFSHORE IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 141 NETHERLANDS OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 142 NETHERLANDS OILFIELD SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD MILLION)

TABLE 143 NETHERLANDS DRILLING SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 144 NETHERLANDS COMPLETION AND WORKOVER SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 145 NETHERLANDS PROCESSING AND SEPARATION SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 146 NETHERLANDS RESERVOIR SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 147 NETHERLANDS OILFIELD SERVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 148 NETHERLANDS OFFSHORE IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 149 FRANCE OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 150 FRANCE OILFIELD SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD MILLION)

TABLE 151 FRANCE DRILLING SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 152 FRANCE COMPLETION AND WORKOVER SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 153 FRANCE PROCESSING AND SEPARATION SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 154 FRANCE RESERVOIR SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 155 FRANCE OILFIELD SERVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 156 FRANCE OFFSHORE IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 157 SPAIN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 158 SPAIN OILFIELD SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD MILLION)

TABLE 159 SPAIN DRILLING SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 160 SPAIN COMPLETION AND WORKOVER SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 161 SPAIN PROCESSING AND SEPARATION SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 162 SPAIN RESERVOIR SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 163 SPAIN OILFIELD SERVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 164 SPAIN OFFSHORE IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 165 SWITZERLAND OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 166 SWITZERLAND OILFIELD SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD MILLION)

TABLE 167 SWITZERLAND DRILLING SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 168 SWITZERLAND COMPLETION AND WORKOVER SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 169 SWITZERLAND PROCESSING AND SEPARATION SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 170 SWITZERLAND RESERVOIR SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 171 SWITZERLAND OILFIELD SERVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 172 SWITZERLAND OFFSHORE IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 173 BELGIUM OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 174 BELGIUM OILFIELD SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD MILLION)

TABLE 175 BELGIUM DRILLING SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 176 BELGIUM COMPLETION AND WORKOVER SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 177 BELGIUM PROCESSING AND SEPARATION SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 178 BELGIUM RESERVOIR SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 179 BELGIUM OILFIELD SERVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 180 BELGIUM OFFSHORE IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 181 FINLAND OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 182 FINLAND OILFIELD SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD MILLION)

TABLE 183 FINLAND DRILLING SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 184 FINLAND COMPLETION AND WORKOVER SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 185 FINLAND PROCESSING AND SEPARATION SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 186 FINLAND RESERVOIR SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 187 FINLAND OILFIELD SERVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 188 FINLAND OFFSHORE IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 189 SWEDEN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 190 SWEDEN OILFIELD SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD MILLION)

TABLE 191 SWEDEN DRILLING SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 192 SWEDEN COMPLETION AND WORKOVER SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 193 SWEDEN PROCESSING AND SEPARATION SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 194 SWEDEN RESERVOIR SERVICES IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 195 SWEDEN OILFIELD SERVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 196 SWEDEN OFFSHORE IN OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 197 REST OF EUROPE OILFIELD SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET: SEGMENTATION

FIGURE 2 EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET: DROC ANALYSIS

FIGURE 4 EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 10 EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET: SEGMENTATION

FIGURE 11 RISING PENETRATION OF EMERGING TECHNOLOGIES IN THE OIL AND GAS SECTOR IS EXPECTED TO DRIVE THE EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET IN THE FORECAST PERIOD FROM 2023 TO 2030

FIGURE 12 THE EQUIPMENT RENTAL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET IN 2023 AND 2030

FIGURE 13 VENDOR SELECTION CRITERIA

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET

FIGURE 15 EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET: SNAPSHOT (2022)

FIGURE 16 EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET: BY REGION (2022)

FIGURE 17 EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET: BY REGION (2023 & 2030)

FIGURE 18 EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET: BY REGION (2022 & 2030)

FIGURE 19 EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET: BY TYPE (2023-2030)

FIGURE 20 MIDDLE EAST OILFIELD SERVICES MARKET: SNAPSHOT (2022)

FIGURE 21 MIDDLE EAST OILFIELD SERVICES MARKET: BY COUNTRY (2022)

FIGURE 22 MIDDLE EAST OILFIELD SERVICES MARKET: BY COUNTRY (2023 & 2030)

FIGURE 23 MIDDLE EAST OILFIELD SERVICES MARKET: BY COUNTRY (2022 & 2030)

FIGURE 24 MIDDLE EAST OILFIELD SERVICES MARKET: BY TYPE (2023 - 2030)

FIGURE 25 EUROPE OILFIELD SERVICES MARKET: SNAPSHOT (2022)

FIGURE 26 EUROPE OILFIELD SERVICES MARKET: BY COUNTRY (2022)

FIGURE 27 EUROPE OILFIELD SERVICES MARKET: BY COUNTRY (2023 & 2030)

FIGURE 28 EUROPE OILFIELD SERVICES MARKET: BY COUNTRY (2022 & 2030)

FIGURE 29 EUROPE OILFIELD SERVICES MARKET: BY TYPE (2023 - 2030)

FIGURE 30 EUROPE AND MIDDLE EAST OILFIELD SERVICES MARKET: COMPANY SHARE 2022 (%)

FIGURE 31 EUROPE OILFIELD SERVICES MARKET: COMPANY SHARE 2022 (%)

FIGURE 32 MIDDLE EAST OILFIELD SERVICES MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.