Europe Aluminum Casting Market

Taille du marché en milliards USD

TCAC :

%

USD

19.43 Billion

USD

35.96 Billion

2024

2032

USD

19.43 Billion

USD

35.96 Billion

2024

2032

| 2025 –2032 | |

| USD 19.43 Billion | |

| USD 35.96 Billion | |

|

|

|

|

Segmentation du marché européen de la fonderie d'aluminium, par procédé (moulage en moule consommable et moulage en moule non consommable), source (primaire (aluminium neuf) et secondaire (aluminium recyclé)), application (collecteurs d'admission, carters d'huile, pièces structurelles, pièces de châssis, culasses, blocs-moteurs, transmissions, roues et freins, échangeurs de chaleur et autres), utilisateur final (automobile, bâtiment et construction, industrie, électroménager, aérospatiale, électronique et électrique, outillage et autres) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché européen de la fonderie d'aluminium

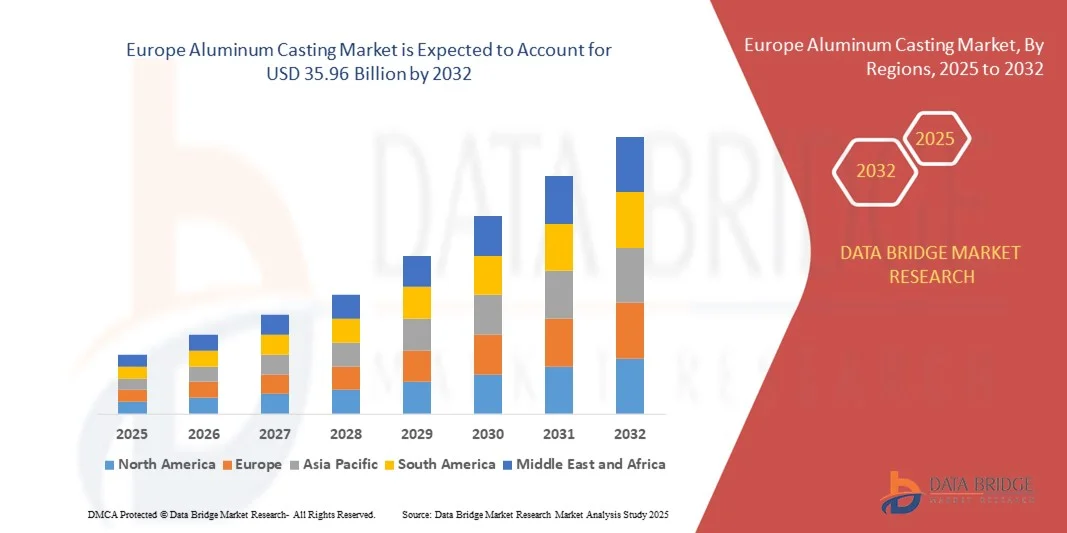

- Le marché européen de la fonderie d'aluminium était évalué à 19,43 milliards de dollars en 2024 et devrait atteindre 35,96 milliards de dollars d'ici 2032 , avec un TCAC de 8,00 % au cours de la période de prévision.

- La croissance du marché est principalement tirée par la demande croissante de composants légers et durables dans les secteurs de l'automobile, de l'aérospatiale et des machines industrielles, associée aux progrès des technologies de fonderie qui améliorent la précision et l'efficacité.

- Par ailleurs, le durcissement des réglementations environnementales et la demande croissante de véhicules économes en carburant favorisent l'utilisation de l'aluminium au détriment des métaux traditionnels, accélérant ainsi l'adoption des solutions de fonderie d'aluminium. L'ensemble de ces facteurs alimente l'expansion du marché et consolide la trajectoire de croissance du secteur.

Analyse du marché européen de la fonderie d'aluminium

- Le moulage de l'aluminium, qui fournit des composants légers et très résistants pour les applications automobiles, aérospatiales et industrielles, est de plus en plus crucial dans la fabrication moderne en raison de sa durabilité, de sa résistance à la corrosion et de ses capacités de production écoénergétiques dans les secteurs commerciaux et industriels.

- La demande croissante de pièces moulées en aluminium est principalement due à l'évolution de l'industrie automobile vers des véhicules légers, à la croissance des secteurs de l'aérospatiale et de la défense, et aux progrès des technologies de moulage qui améliorent la précision et réduisent les coûts de production.

- L'Allemagne a dominé le marché européen de la fonderie d'aluminium avec la plus grande part de revenus (38,5 %) en 2024, caractérisée par une infrastructure de fabrication avancée, une forte adoption des véhicules électriques et hybrides et une forte présence d'entreprises de fonderie clés. L'Allemagne et l'Italie ont connu une croissance substantielle dans les applications automobiles et industrielles, portée par les innovations dans les techniques de moulage sous pression à basse pression et de moulage en moule permanent à haute pression.

- Le Royaume-Uni devrait être la région à la croissance la plus rapide du marché européen de la fonderie d'aluminium au cours de la période de prévision, en raison de l'industrialisation rapide, de l'expansion du secteur automobile et de l'augmentation des investissements dans la fabrication aérospatiale.

- Le segment du moulage à moule consommable a dominé le marché en 2024, représentant 62,4 % des revenus. Cette domination s'explique par sa rentabilité, sa flexibilité dans la production de formes complexes et son adéquation aux petites et grandes séries.

Portée du rapport et segmentation du marché européen de la fonderie d'aluminium

|

Attributs |

Principaux enseignements du marché de la fonderie d'aluminium |

|

Segments couverts |

|

|

Pays couverts |

Europe

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Tendances du marché européen de la fonderie d'aluminium

Progrès technologiques dans le domaine de la fonderie automatisée et de précision

- L'intégration croissante de l'automatisation, de la robotique et de l'intelligence artificielle (IA) dans les opérations de fonderie constitue une tendance majeure et en pleine accélération sur le marché européen de la fonderie d'aluminium. Cette convergence technologique améliore la précision, l'efficacité de la production et le contrôle qualité global dans les fonderies et les usines de fabrication.

- Par exemple, des constructeurs de premier plan comme Rheinmetall Automotive et Constellium adoptent de plus en plus le moulage sous pression automatisé et les systèmes de contrôle qualité en temps réel afin d'optimiser le flux de métal, de réduire les défauts et de minimiser le gaspillage de matériaux pendant la production. De même, Gränges AB utilise l'analyse de données avancée pour garantir une composition d'alliage et des performances de moulage constantes.

- L'intégration de l'IA dans les procédés de fonderie d'aluminium permet la maintenance prédictive, le contrôle adaptatif des procédés et la détection intelligente des défauts. Les systèmes pilotés par l'IA peuvent analyser les paramètres de fonderie en temps réel, prédire les anomalies et ajuster automatiquement la température et la pression afin de maintenir une production optimale. De plus, la robotique et l'automatisation garantissent des temps de cycle constants, une sécurité accrue et une réduction de la dépendance à la main-d'œuvre dans les environnements de production à haut volume.

- L'utilisation intégrée des jumeaux numériques et des solutions de l'Industrie 4.0 permet aux fabricants de simuler les procédés de fonderie, de contrôler la consommation d'énergie et d'améliorer la traçabilité des processus. Grâce à des plateformes numériques centralisées, les entreprises peuvent gérer les lignes de production, analyser les données de performance et s'intégrer aux systèmes de la chaîne d'approvisionnement, garantissant ainsi une plus grande transparence et une efficacité opérationnelle accrue.

- Cette tendance vers des opérations de fonderie d'aluminium plus intelligentes, connectées et basées sur les données redéfinit les normes de fabrication industrielle en Europe. Par conséquent, des entreprises comme Hydro Aluminium et Nemak investissent massivement dans des installations de fonderie dotées d'intelligence artificielle qui privilégient la durabilité, l'automatisation et une production de qualité constante.

- La demande en solutions de fonderie automatisées et technologiquement avancées augmente rapidement dans les secteurs de l'automobile, de l'aérospatiale et de l'industrie, les fabricants privilégiant de plus en plus les matériaux légers, l'efficacité et les capacités de production numérisées.

Dynamique du marché européen de la fonderie d'aluminium

Conducteur

La demande croissante est stimulée par la production de véhicules légers et l'expansion industrielle.

- L'importance croissante accordée à l'efficacité énergétique, à la réduction des émissions de carbone et aux pratiques de fabrication durables en Europe est un facteur déterminant de la forte demande en pièces moulées en aluminium. Les composants légers en aluminium deviennent essentiels dans les secteurs de l'automobile, de l'aérospatiale et de l'industrie pour améliorer les performances et l'efficacité énergétique.

- Par exemple, en mars 2024, Constellium SE a annoncé l'expansion de ses activités de fonderie d'aluminium en France afin de soutenir la production croissante de véhicules électriques et de structures automobiles légères. Ces initiatives stratégiques des principaux acteurs devraient stimuler la croissance du marché tout au long de la période de prévision.

- Alors que les constructeurs automobiles se tournent vers les véhicules électriques et hybrides, la fonderie d'aluminium offre des avantages tels qu'un rapport résistance/poids élevé, une résistance à la corrosion et la recyclabilité, ce qui en fait un choix privilégié par rapport à des matériaux plus lourds comme l'acier ou le fer.

- Par ailleurs, l'expansion industrielle rapide et l'adoption de l'automatisation et des technologies de fonderie de précision renforcent la demande dans les secteurs de la mécanique, de la construction et de l'aérospatiale. La capacité à produire efficacement des géométries complexes et des composants haute performance favorise l'intégration croissante de la fonderie d'aluminium dans diverses applications.

- Les avantages liés à une consommation d'énergie réduite lors de la production, à la recyclabilité et à la diminution des déchets de matériaux sont des facteurs clés qui favorisent l'adoption du moulage de l'aluminium. De plus, les innovations constantes dans les méthodes de moulage sous pression, de moulage au sable et de moulage à la cire perdue contribuent à améliorer l'efficacité et les performances dans tous les secteurs industriels.

Retenue/Défi

Coûts énergétiques élevés et prix des matières premières fluctuants

- La forte consommation d'énergie et la volatilité des prix des matières premières, notamment des lingots d'aluminium, constituent des défis majeurs pour la rentabilité durable du marché européen de la fonderie d'aluminium. Les procédés de production et de fusion de l'aluminium étant énergivores, la hausse des coûts de l'électricité en Europe a un impact direct sur les dépenses de production.

- Par exemple, la crise énergétique de 2023-2024 a entraîné des arrêts de production temporaires et des hausses de coûts pour plusieurs fonderies européennes, affectant leur capacité à répondre à la demande croissante.

- Pour maintenir leur compétitivité, les fabricants doivent relever ces défis liés aux coûts grâce à des technologies de fours écoénergétiques, au recours aux énergies renouvelables et à l'amélioration des procédés de recyclage. Des entreprises de premier plan comme Hydro Aluminium et Rheinmetall Automotive privilégient de plus en plus les modèles de production circulaire et les solutions de fonderie à faible émission de carbone pour atténuer ces risques.

- De plus, la fluctuation des prix de l'aluminium sur le marché mondial, due aux incertitudes géopolitiques et aux perturbations des chaînes d'approvisionnement, peut affecter les marges bénéficiaires et limiter les investissements à grande échelle dans de nouvelles installations de fonderie.

- Surmonter ces défis grâce à un approvisionnement durable, à l'optimisation de l'énergie et à l'innovation technologique sera essentiel pour assurer la croissance et la résilience à long terme du marché européen de la fonderie d'aluminium.

Étendue du marché européen de la fonderie d'aluminium

Le marché européen de la fonderie d'aluminium est segmenté en fonction du procédé, de la source, de l'application et de l'utilisateur final.

- Par processus

Le marché européen de la fonderie d'aluminium est segmenté, selon le procédé de fabrication, en fonderie à moule consommable et fonderie à moule non consommable. Le segment de la fonderie à moule consommable a dominé le marché en 2024, représentant 62,4 % du chiffre d'affaires. Cette domination s'explique par sa rentabilité, sa flexibilité dans la production de formes complexes et son aptitude à gérer aussi bien les petites que les grandes séries. Des procédés tels que le moulage au sable et le moulage à cire perdue sont largement utilisés dans les secteurs automobile et industriel pour leur capacité à produire des géométries complexes avec un excellent état de surface.

Le segment du moulage en moules non consommables devrait connaître le taux de croissance annuel composé le plus rapide entre 2025 et 2032, porté par l'adoption croissante des techniques de moulage sous pression et de moulage permanent qui offrent une grande précision dimensionnelle, des temps de cycle réduits et des propriétés mécaniques supérieures. L'automatisation croissante et les progrès technologiques dans le domaine du moulage sous pression contribuent également à la croissance de ce segment.

- Par source

Selon la source, le marché européen de la fonderie d'aluminium se divise en deux catégories : l'aluminium primaire (aluminium neuf) et l'aluminium secondaire (aluminium recyclé). Le segment de l'aluminium secondaire (aluminium recyclé) a dominé le marché en 2024, représentant 57,8 % des revenus, grâce à l'importance croissante accordée au développement durable, à l'efficacité énergétique et à la réduction des coûts. La production d'aluminium recyclé nécessite nettement moins d'énergie que la production d'aluminium primaire, ce qui est conforme aux réglementations environnementales strictes et aux objectifs de réduction des émissions de carbone en Europe.

Le segment de l'aluminium primaire devrait enregistrer le taux de croissance annuel composé le plus rapide entre 2025 et 2032, soutenu par la demande croissante d'alliages d'aluminium de haute pureté pour les secteurs de l'aérospatiale et de l'automobile. Les progrès constants des technologies de fusion et la disponibilité de matières premières de haute qualité devraient encore renforcer le potentiel du marché de l'aluminium primaire au cours de la période de prévision.

- Sur demande

Le marché européen de la fonderie d'aluminium est segmenté, selon l'application, en collecteurs d'admission, carters d'huile, pièces structurelles, pièces de châssis, culasses, blocs-moteurs, transmissions, roues et freins, échangeurs de chaleur et autres. Le segment des blocs-moteurs a dominé le marché en 2024, représentant la plus grande part de revenus (24,6 %), grâce aux excellents rapports résistance/poids, conductivité thermique et résistance à la corrosion offerts par les composants de moteurs en aluminium. Les constructeurs automobiles remplacent de plus en plus la fonte par l'aluminium afin d'améliorer les performances et le rendement énergétique des véhicules.

Le segment des pièces structurelles devrait connaître le taux de croissance annuel composé le plus rapide entre 2025 et 2032, porté par la demande croissante de matériaux légers pour les véhicules électriques et les composants aérospatiaux. Les progrès réalisés dans le domaine de la fonderie de précision et du développement des alliages permettent de produire des composants structurels plus résistants, plus légers et plus durables.

- Par l'utilisateur final

Le marché européen de la fonderie d'aluminium est segmenté, selon l'utilisateur final, en automobile, bâtiment et construction, industrie, électroménager, aérospatiale, électronique et électrique, outillage d'ingénierie et autres. Le segment automobile a dominé le marché en 2024, représentant 46,3 % des revenus, grâce à l'intérêt croissant de la région pour la réduction du poids des véhicules, l'amélioration du rendement énergétique et le respect des normes d'émissions. La fonderie d'aluminium est largement utilisée pour les composants de moteurs, de châssis et de transmissions.

Le secteur aérospatial devrait enregistrer le taux de croissance annuel composé le plus rapide entre 2025 et 2032, porté par l'utilisation croissante d'alliages d'aluminium légers et à haute résistance dans les structures d'aéronefs et les pièces de moteurs. La demande croissante de transport aérien, conjuguée aux investissements dans la construction d'aéronefs de nouvelle génération, devrait encore accélérer la croissance de ce secteur.

Analyse régionale du marché européen de la fonderie d'aluminium

- L'Allemagne a dominé le marché européen de la fonderie d'aluminium avec la plus grande part de revenus (38,5 %) en 2024, grâce à la forte présence de pôles de fabrication automobile et aérospatiale dans des pays comme l'Allemagne, la France et l'Italie, ainsi qu'à l'adoption croissante de matériaux légers pour répondre à des normes strictes en matière d'émissions et d'efficacité.

- Les fabricants de la région mettent l'accent sur l'ingénierie de précision, l'automatisation et le développement durable, et utilisent des technologies de pointe en matière de fonderie d'aluminium pour la production de pièces essentielles de moteurs automobiles, de composants structurels et de machines industrielles.

- Cette adoption généralisée est également soutenue par des initiatives gouvernementales promouvant la production de véhicules électriques, une base industrielle bien établie et des investissements croissants dans des matériaux économes en énergie et recyclables, positionnant la fonderie d'aluminium comme une solution privilégiée pour la mobilité de nouvelle génération et les applications industrielles à travers l'Europe.

Analyse du marché allemand de la fonderie d'aluminium

En 2024, le marché allemand de la fonderie d'aluminium a généré la plus grande part de revenus en Europe, grâce à la solidité de son secteur automobile et industriel. L'excellence technique, la précision de fabrication et l'innovation, chères à l'Allemagne, favorisent l'adoption généralisée de techniques de fonderie avancées telles que la fonderie sous pression et la fonderie sous vide. La demande croissante de véhicules légers et économes en carburant, conjuguée à la transition du pays vers la mobilité électrique, stimule l'utilisation de composants en aluminium dans les moteurs, les châssis et les boîtiers de batteries. Par ailleurs, l'engagement de l'Allemagne en faveur du développement durable et du recyclage se traduit par une utilisation accrue d'aluminium secondaire (recyclé) dans la production, garantissant ainsi rentabilité et responsabilité environnementale.

Analyse du marché français de la fonderie d'aluminium

Le marché français de la fonderie d'aluminium devrait connaître une croissance annuelle composée (TCAC) stable tout au long de la période de prévision, soutenu par la demande croissante des secteurs automobile, aérospatial et de la défense. Le secteur aérospatial français, bien établi et dominé par des acteurs majeurs tels qu'Airbus, est un important consommateur de pièces moulées en aluminium haute performance pour les structures d'aéronefs et les composants de moteurs. La transition vers les véhicules électriques et les initiatives gouvernementales en faveur d'une production à faibles émissions stimulent l'utilisation de l'aluminium dans l'industrie automobile. Par ailleurs, les investissements dans la modernisation des fonderies et l'adoption de systèmes automatisés et de contrôle qualité basés sur l'intelligence artificielle améliorent l'efficacité de la production et la précision de la fonderie dans les usines françaises.

Analyse du marché britannique de la fonderie d'aluminium

Le marché britannique de la fonderie d'aluminium devrait connaître une croissance annuelle composée (TCAC) notable au cours de la période de prévision, portée par la demande croissante de matériaux légers dans les secteurs de l'automobile, de la construction et de l'aérospatiale. Face à l'importance croissante accordée au développement durable et à la réduction des émissions, les fabricants remplacent les matériaux ferreux traditionnels par des alliages d'aluminium offrant des performances et une recyclabilité accrues. La présence d'infrastructures d'ingénierie et de R&D de pointe, ainsi que les investissements dans la fonderie sous pression et la fabrication additive, accélèrent la croissance du marché. Par ailleurs, le développement de l'écosystème de production de véhicules électriques au Royaume-Uni et le fort potentiel d'exportation de composants en aluminium devraient consolider sa position de pôle européen majeur de la fonderie d'aluminium.

Analyse du marché néerlandais de la fonderie d'aluminium

Le marché néerlandais de la fonderie d'aluminium devrait connaître une croissance soutenue au cours de la période de prévision, grâce à son infrastructure industrielle de pointe et à son engagement en faveur d'une production durable. La position stratégique du pays en tant que plateforme logistique et manufacturière en Europe facilite l'exportation de composants en aluminium de haute qualité vers les pays voisins. L'augmentation des investissements dans les énergies renouvelables, la mobilité électrique et l'automatisation industrielle stimule la demande de pièces en aluminium moulées avec précision. Les fabricants néerlandais s'attachent à mettre en œuvre des technologies de fonderie écoénergétiques, des initiatives de recyclage et des solutions de fonderie numérique afin d'optimiser la productivité et de réduire les émissions de carbone. L'alliance de l'innovation technologique, de l'engagement en faveur du développement durable et d'une forte intégration de la chaîne d'approvisionnement positionne les Pays-Bas comme un acteur émergent du marché régional de la fonderie d'aluminium.

Part de marché de la fonderie d'aluminium en Europe

L'industrie de la fonderie d'aluminium est principalement dominée par des entreprises bien établies, notamment :

• Gränges AB (Suède)

• Nemak (Mexique)

• Constellium (France)

• Rheinmetall Automotive (Allemagne)

• Groupe Sapa (Suède)

• Novelis Inc. (États-Unis)

• Aluminium Rheinfelden GmbH (Allemagne)

• Kaiser Aluminum (États-Unis)

• ALCOA Corporation (États-Unis)

• Aleris (États-Unis)

• Novelis Europe (Allemagne)

• Conalcast Europe (Belgique)

• Foseco International (Royaume-Uni)

• Sidenor (Espagne)

• Hydro Aluminium (Norvège)

• SLM Solutions (Allemagne)

• Arconic Corporation (États-Unis)

• Métalurgie de Castromil (Espagne)

• Alumeco (Pologne)

• Produits laminés Aleris (Allemagne)

Quels sont les développements récents sur le marché européen de la fonderie d'aluminium ?

- En avril 2024, Constellium SE, fabricant mondial de premier plan de produits en aluminium basé en France, a annoncé l'agrandissement de son usine de fonderie d'aluminium de Singen, en Allemagne, afin de répondre à la demande croissante de composants légers pour véhicules électriques. Cet agrandissement vise à accroître la capacité de moulage sous pression et à améliorer la durabilité grâce à des fours à haut rendement énergétique. Cette initiative souligne l'engagement de Constellium à soutenir la transition de l'Europe vers des solutions de mobilité plus propres, tout en renforçant sa position sur le marché européen mondial de la fonderie d'aluminium.

- En mars 2024, Rheinmetall Automotive AG (Allemagne) a inauguré une nouvelle ligne de production de fonderie sous pression à la pointe de la technologie sur son site de Neckarsulm. Ce nouveau système est conçu pour produire des composants complexes en aluminium, notamment des moteurs et des structures, destinés aux véhicules hybrides et électriques, offrant une résistance accrue et un poids réduit. Ce développement témoigne de l'engagement de Rheinmetall en faveur de l'efficacité, de la précision et du développement durable de sa production, et renforce sa position de leader dans l'industrie européenne de la fonderie d'aluminium.

- En février 2024, Hydro Aluminium ASA (Norvège) a lancé un important programme d'investissement axé sur le recyclage de l'aluminium en fonderie sur son site de Clervaux, au Luxembourg. Ce projet vise à accroître l'utilisation de déchets post-consommation et à réduire les émissions de carbone tout au long de la chaîne de production. Cet investissement stratégique témoigne de l'engagement d'Hydro en faveur de l'économie circulaire dans la production métallique, conformément aux objectifs européens de développement durable et de neutralité carbone pour 2030.

- En janvier 2024, Nemak SAB de CV (opérations Mexique/Europe) a inauguré un centre de R&D de pointe en fonderie d'aluminium en République tchèque. Ce centre est dédié au développement d'alliages de fonderie de nouvelle génération et de solutions allégées pour les boîtiers de batteries et les pièces structurelles des véhicules électriques. Grâce à l'intégration de technologies de simulation et d'un contrôle qualité piloté par l'IA, Nemak ambitionne d'accélérer l'innovation dans le domaine de la fonderie durable et de consolider sa position sur le marché européen.

- En décembre 2023, Gränges AB (Suède) a annoncé la finalisation de la modernisation de sa fonderie de Konin, en Pologne. Ce projet visait à améliorer l'efficacité énergétique et à accroître la capacité de production de produits en aluminium laminé et coulé, utilisés notamment dans les échangeurs de chaleur automobiles et les applications industrielles. Cette modernisation témoigne des efforts constants de Gränges pour optimiser ses performances, réduire ses émissions et répondre à la demande croissante de produits de fonderie d'aluminium de haute qualité en Europe.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.