Marché européen des résines alkydes, par type de résine (résine alkyde non siccative, résine alkyde siccative et résine alkyde semi-séchante), type de processus (processus aux acides gras et processus aux glycérides), classe (résine alkyde longue, résine alkyde moyenne et résine alkyde courte), type de formulation (alkydes modificateurs, alkydes à base d'eau, revêtements à base de solvant, alkydes à haute teneur en solides, revêtements en poudre et autres), application (bâtiment et construction, revêtements OEM automobiles, équipement électrique, mobilier et décoration, revêtements métalliques , revêtements de finition automobile, revêtements de bobines et emballage), industrie d'utilisation finale (industrie de la construction et de l'architecture, industrie automobile, industrie électronique, industrie aérospatiale, industrie maritime et autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché des résines alkydes en Europe

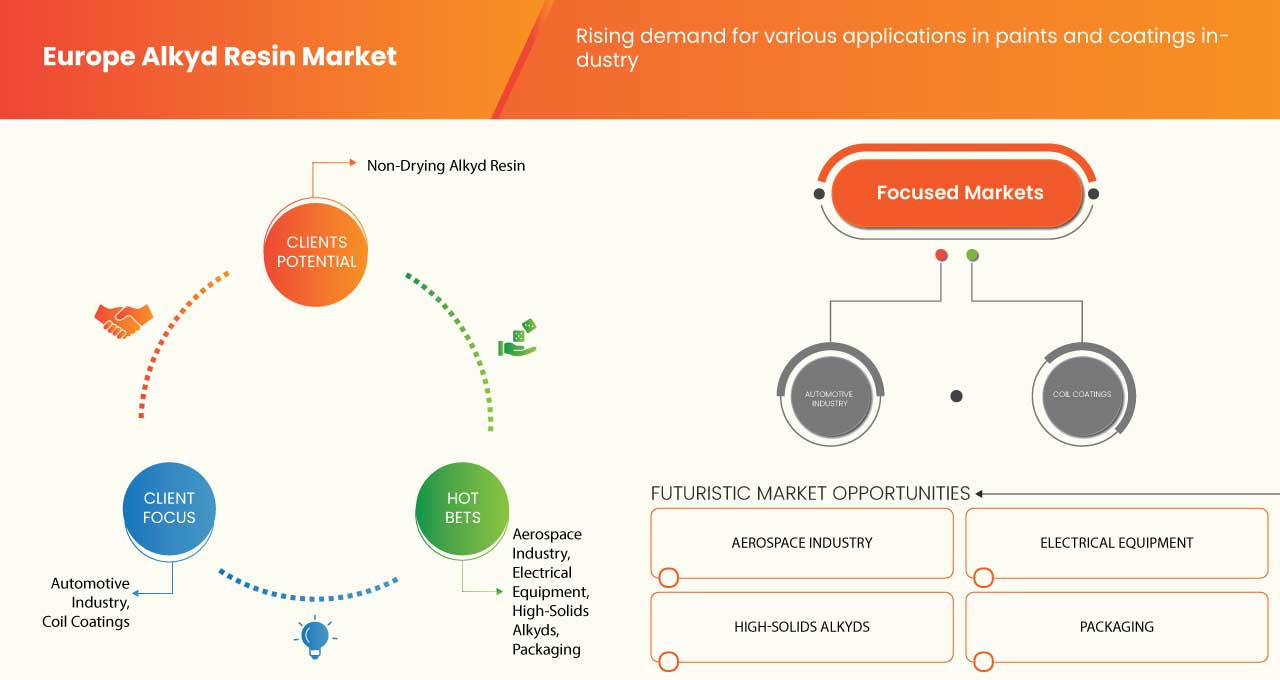

Le marché européen des résines alkydes est stimulé par la consommation croissante dans l'industrie des peintures et des revêtements et constitue un moteur important pour le marché mondial des résines alkydes. De plus, les propriétés de haute qualité et la compatibilité des résines alkydes avec une large gamme de polymères devraient stimuler la croissance du marché. Cependant, les fluctuations des prix des matières premières entraînent une modification du coût de fabrication des résines alkydes, ce qui devrait constituer un défi pour la croissance du marché, ce qui pourrait freiner la croissance du marché.

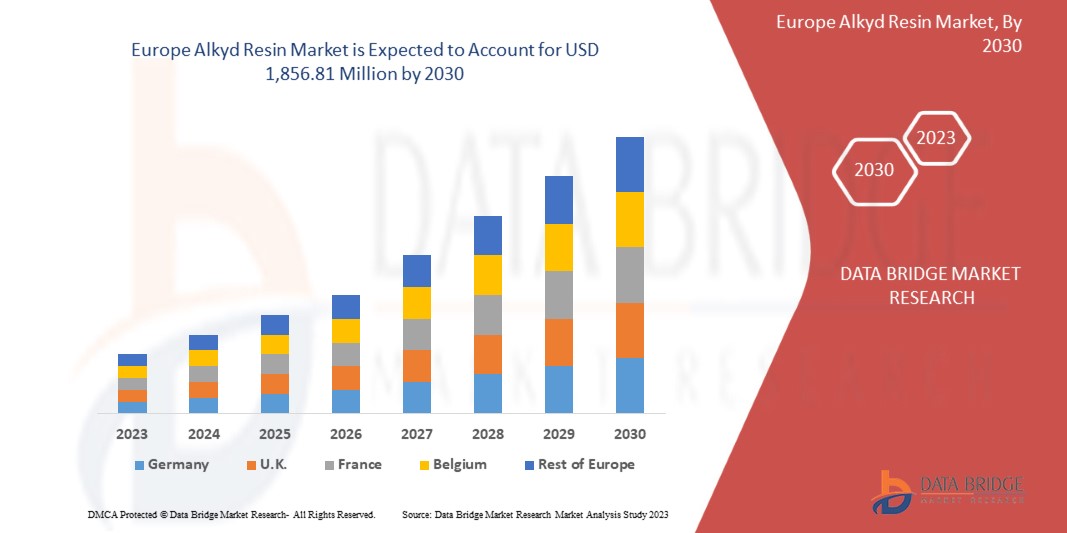

Data Bridge Market Research analyse que le marché européen des résines alkydes devrait atteindre la valeur de 1 856,81 millions USD d'ici 2030, à un TCAC de 4,0 % au cours de la période de prévision.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Type de résine (résine alkyde non siccative, résine alkyde siccative et résine alkyde semi-siccative), type de procédé (procédé aux acides gras et procédé aux glycérides), classe (résine alkyde longue, résine alkyde moyenne et résine alkyde courte), type de formulation (alkydes modificateurs, alkydes à base d'eau, revêtements à base de solvant, alkydes à haute teneur en solides, revêtements en poudre et autres), application (bâtiment et construction, revêtements OEM automobiles, équipement électrique, mobilier et décoration, revêtements métalliques, revêtements de finition automobile , revêtements de bobines et emballage), industrie d'utilisation finale (industrie de la construction et de l'architecture, industrie automobile, industrie électronique, industrie aérospatiale, industrie maritime et autres) |

|

Pays couverts |

Europe (Allemagne, France, Royaume-Uni, Italie, Espagne, Russie, Turquie, Belgique, Pays-Bas, Norvège, Danemark, Finlande, Suisse et reste de l'Europe) |

|

Acteurs du marché couverts |

Polymères OPC, Covestro AG, Uniform Synthetics, Synthopol, Arkema, BASF SE, Allnex GMBH, DSV Chemcials Pvt Ltd, Ratnaka Resins Pvt. Ltd., Hempel A/S, Neo-Pack Plast, POLYNT SPA, Krishna Resins & Pigments Pvt. Ltd., Arakawa Chemical Industries, Ltd., MACRO POLYMERS, Nord Composites Italia SRL, Girdhari Chemicals & Resins, Eternal Materials Co., Ltd., US Polymers-Accurez, LLC, Spolek pro chemickou a hutní výrobu, akciová společnost et Mancuso Chemicals Limited, entre autres |

Définition du marché

La résine alkyde est une résine synthétique obtenue par une réaction de condensation entre un alcool polyhydrique et un acide dibasique. Les résines alkydes sont des résines polyester thermoplastiques qui sont des alcools polyhydriques chauffés avec des acides polybasiques ou leurs anhydrides pour créer des résines alkydes. En raison de leur adaptabilité et de leur prix abordable, elles sont utilisées pour créer des revêtements protecteurs résistants aux intempéries et sont des composants essentiels de nombreuses peintures synthétiques.

Dynamique du marché européen des résines alkydes

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Demande croissante dans le secteur de la peinture et du revêtement

L'industrie de la peinture et du revêtement connaît actuellement une augmentation significative de la demande de résine alkyde. Cette attention accrue peut être associée aux caractéristiques remarquables de la résine alkyde, à sa polyvalence et à la catégorie la plus abondante de résines synthétiques, ce qui en fait un choix privilégié pour diverses applications industrielles. La résine alkyde est un polyester modifié à l'huile, qui est utilisé comme agent filmogène dans certaines peintures et revêtements transparents. Ces résines présentent une compatibilité avec une large gamme d'autres résines utilisées dans l'industrie de la peinture, notamment les résines amino, phénoliques, colophanes, résines et polyuréthanes, facilitant des modifications pratiques pour obtenir les propriétés souhaitées. De plus, les vernis et émaux à base de résine alkyde modifiée trouvent une utilité dans la peinture des voitures, des avions, des chemins de fer et des machines agricoles, tandis que la composition des résines alkydes mélangées à de l'urée-formaldéhyde et de la mélamine-formaldéhyde. Les résines produisent des émaux qui conviennent à la peinture des automobiles, des vélos et de divers équipements. En raison de leur forte application, la recherche et le développement continus menés par les chercheurs et les fabricants devraient stimuler la croissance du marché

- Croissance du revenu disponible et du mode de vie des consommateurs

À mesure que le mode de vie des consommateurs s’améliore, l’accent est de plus en plus mis sur la qualité et la durabilité. Les revêtements à base de résine alkyde sont connus pour leur excellente adhérence, leur durabilité et leur résistance à l’usure. Les consommateurs disposant de revenus disponibles plus élevés sont plus susceptibles d’opter pour un revêtement durable qui nécessite un entretien moins fréquent. La demande de revêtements à base de résine alkyde a augmenté à mesure que les consommateurs recherchent des produits qui correspondent à leur mode de vie souhaité. Avec un revenu disponible plus élevé, les consommateurs sont plus susceptibles d’investir dans des revêtements haut de gamme et spécialisés pour des applications spécifiques. Les résines alkydes peuvent être formulées pour répondre à des exigences spécifiques telles que la résistance à la chaleur, la résistance chimique et une faible teneur en COV. Les consommateurs qui privilégient les propriétés spécialisées sont prêts à payer un supplément pour des revêtements qui offrent des performances améliorées et contribuent à la demande de revêtements spécialisés à base de résine alkyde.

- Propriétés de haute qualité et compatibilité de la résine alkyde avec une large gamme de polymères

Les résines alkydes sont des composants très polyvalents et économiques utilisés dans la fabrication de peintures synthétiques. L'un des principaux avantages des résines alkydes est leur compatibilité avec d'autres polymères de revêtement. Elles peuvent être combinées avec des résines vinyliques, telles que des copolymères de chlorure de vinyle et d'acétate de vinyle, contenant des groupes hydroxyles, pour améliorer les propriétés d'application et l'adhérence, en particulier dans les peintures de finition marines. Les résines alkydes peuvent être mélangées avec des résines acryliques, des résines époxy, des résines polyuréthane et d'autres polymères de revêtement pour obtenir les caractéristiques souhaitées et répondre aux exigences d'application spécifiques. En combinant des résines alkydes avec ces polymères, les fabricants peuvent modifier les propriétés des revêtements finis, notamment la brillance, la dureté, la résistance chimique, la résistance aux intempéries et le temps de séchage.

- L'urbanisation croissante dans les pays en développement

L'urbanisation et l'industrialisation croissantes ont entraîné la croissance des économies. L'urbanisation entraîne souvent une augmentation de l'activité de construction, notamment le développement de propriétés résidentielles, de bâtiments commerciaux et industriels et de projets d'infrastructure. Ces projets nécessitent des peintures et des vernis qui utilisent la résine alkyde comme liant. Le secteur du bâtiment et de la construction s'appuie sur des résines spéciales pour répondre à des normes de qualité strictes dans des applications telles que les adhésifs, les produits d'étanchéité et les revêtements (architecturaux, décoratifs et protecteurs). Ces résines présentent des caractéristiques exceptionnelles, notamment une résistance aux températures élevées et une excellente résistance chimique. Par conséquent, un volume important de ces résines devrait être utilisé dans les projets d'infrastructure à venir et dans la construction de bâtiments résidentiels et non résidentiels.

Restrictions

- Prise de conscience croissante de l'impact nocif des résines alkydes

Les résines alkydes sont utilisées comme liants pour les peintures depuis les années 1930. Leur compatibilité avec de nombreux polymères et leur très grande latitude de formulation les rendent adaptées à la production d'une large gamme de matériaux de revêtement. La principale préoccupation concerne les solvants organiques utilisés pour formuler le produit. Différents solvants sont utilisés dans les revêtements alkydes, notamment les essences minérales, le toluène, le xylène et les distillats de pétrole. L'évaporation de ces solvants dans les processus de production de résine alkyde et de séchage final a suscité d'importantes préoccupations environnementales. Les revêtements alkydes conventionnels à base de solvants sont tombés en désuétude en raison des préoccupations concernant les composés organiques volatils (COV). L'émission de COV potentiellement nocifs a augmenté le nombre de problèmes de santé tels que l'asthme, les allergies et autres problèmes respiratoires, ainsi que les préoccupations environnementales liées au réchauffement climatique.

- Disponibilité des substituts

La disponibilité d'alternatives aux résines alkydes peut entraver la croissance du marché mondial des résines alkydes. De plus, l'instabilité des prix des matières premières aura également un impact négatif sur la croissance du marché, car les consommateurs se tournent vers l'utilisation d'autres résines dans diverses applications telles que les peintures, les émaux isolants et l'automobile, entre autres.

Défis

- La fluctuation du prix des matières premières entraîne des changements dans le coût de fabrication des résines alkydes

Les prix volatils et instables des matières premières ont de vastes implications pour les organisations manufacturières. De la hausse des coûts de l'énergie aux fluctuations inattendues des coûts des matières premières, les obstacles déstabilisent les chaînes d'approvisionnement, ce qui rend difficile pour les fabricants d'absorber les coûts supplémentaires ou de trouver de nouveaux moyens d'atténuer les dépenses. L'invasion de l'Ukraine par la Russie a perturbé l'industrie pétrolière, ce qui a entraîné une flambée des prix du pétrole. La Russie est l'un des plus gros producteurs de pétrole et de gaz naturel. Le prix du pétrole brut a également été gonflé avant même la guerre en raison de la demande accrue de carburant due à la reprise des économies mondiales après la pandémie de COVID-19 et au faible investissement dans l'industrie pétrolière et gazière. Les coûts élevés et fluctuants des matières premières et une gestion inefficace des prix peuvent nuire au facteur de rentabilité de l'entreprise. De telles fluctuations des prix du pétrole brut peuvent avoir un impact négatif sur les prix des résines alkydes et leurs applications. De plus, la fluctuation des prix du pétrole brut entraîne des variations des coûts de fabrication des résines alkydes qui ont un impact significatif sur les prix pour les utilisateurs finaux.

Opportunités

- Demande croissante de revêtements durables sur le marché

Les consommateurs sont de plus en plus conscients des produits qui ont un impact sur l'environnement. Ils privilégient les produits respectueux de l'environnement qui réduisent les dommages environnementaux et favorisent des modes de vie durables. En conséquence, il existe une demande pour des revêtements et des peintures développés avec des résines alkydes respectueuses de l'environnement. La durabilité devient un principe fondamental que de nombreuses entreprises adoptent et intègrent dans leurs stratégies commerciales. Tout au long de leurs chaînes d'approvisionnement, elles s'efforcent de minimiser l'impact environnemental, de promouvoir un approvisionnement durable et de réduire l'empreinte carbone. Alors que la durabilité devient un facteur de plus en plus important dans les décisions d'achat, les entreprises reconnaissent la demande du marché pour des produits respectueux de l'environnement. Proposer des revêtements et des peintures durables à base de résine alkyde offre un avantage concurrentiel en répondant aux attentes des clients.

- Les lancements continus de produits par les entreprises stimulent la croissance du marché

Une stratégie de lancement de produit implique des recherches, des tests et des actions de différents services pour garantir que les clients achètent un produit. Les acteurs du marché de la fabrication de résines alkydes travaillent constamment au lancement de nouveaux produits sur le marché. Le lancement de nouveaux produits à base de résines alkydes contribue à satisfaire les préférences des différents consommateurs sur le marché. Les stratégies de lancement aident au lancement de produits, à la compréhension du marché, à l'analyse des tendances et à bien d'autres avantages qui aident les experts du secteur à se développer. Une partie importante du plan de lancement consiste à valider rapidement le produit et ses avantages. Les fabricants créent constamment de nouveaux lancements de produits qui aident l'entreprise à se développer, les collaborations continues entre les entreprises, les alliances stratégiques, le financement et l'expansion de l'entreprise stimulent la croissance de l'entreprise à l'échelle mondiale, ce qui stimulera en fin de compte la croissance du marché.

Développements récents

- En mai 2023, le groupe Polynt a annoncé l'expansion de sa capacité de production de résine pour servir le marché nord-américain des revêtements et répondre aux besoins croissants de l'industrie des peintures et des revêtements. Cet investissement aidera l'entreprise à accroître sa capacité dans les alkydes conventionnels, les uréthanes modifiés à l'huile et les technologies à base d'eau.

- En mai 2023, Hempel A/S a été reconnu comme leader en matière d'engagement des fournisseurs par le CDP pour ses actions environnementales tout au long de sa chaîne d'approvisionnement. Hempel a obtenu un score A dans le Supplier Engagement Rating (SER) 2022 du CDP. Cela aidera l'entreprise à améliorer la notation de sa marque et à atteindre ses objectifs de développement durable sur le marché.

Portée du marché européen des résines alkydes

Le marché européen des résines alkydes est classé en six segments notables, par type de résine, type de processus, classe, type de formulation, application et industrie d'utilisation finale. La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance des industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Type de résine

- Résine alkyde non siccative

- Séchage de la résine alkyde

- Résine alkyde semi-séchante

Sur la base du type de résine, le marché européen des résines alkydes est segmenté en résines alkydes non siccatives, résines alkydes siccatives et résines alkydes semi-sécantes.

Type de processus

- Processus des acides gras

- Procédé de fabrication de glycérides

Sur la base du type de processus, le marché européen des résines alkydes est segmenté en processus aux acides gras et processus aux glycérides.

Classe

- Résine alkyde longue

- Résine alkyde moyenne

- Résine alkyde courte

Sur la base de la classe, le marché européen des résines alkydes est segmenté en résines alkydes longues, résines alkydes moyennes et résines alkydes courtes.

Type de formulation

- Alkydes à haute teneur en solides

- Alkydes à base d'eau

- Modification des alkydes

- Revêtements à base de solvants

- Revêtements en poudre

- Autres

Sur la base du type de formulation, le marché européen des résines alkydes est segmenté en alkydes à haute teneur en solides, alkydes à base d'eau, alkydes modificateurs, revêtements à base de solvants, revêtements en poudre et autres.

Application

- Bâtiment et construction

- Revêtements automobiles 0em

- Equipement électrique

- Meubles et décoration

- Revêtements métalliques

- Revêtements de finition pour automobiles

- Revêtements de bobines

- Conditionnement

Sur la base de l'application, le marché européen des résines alkydes est segmenté en bâtiment et construction, revêtements automobiles 0em, équipements électriques, meubles et décoration, revêtements métalliques, revêtements de finition automobile, revêtements de bobines et emballages.

Secteur d'utilisation finale

- Secteur de la construction et de l'architecture

- Industrie automobile

- Industrie électronique

- Industrie aérospatiale

- Industrie maritime

- Autres

Sur la base de l'industrie d'utilisation finale, le marché européen des résines alkydes est segmenté en industrie de la construction et de l'architecture, industrie automobile, industrie électronique, industrie aérospatiale, industrie maritime et autres.

Analyse/perspectives régionales du marché européen des résines alkydes

Le marché européen des résines alkydes est classé en six segments notables, par type de résine, type de processus, classe, type de formulation, application et industrie d'utilisation finale.

Les pays couverts dans le rapport sur le marché européen des résines alkydes sont l’Europe (Allemagne, France, Royaume-Uni, Italie, Espagne, Russie, Turquie, Belgique, Pays-Bas, Norvège, Danemark, Finlande, Suisse et reste de l’Europe).

L'Allemagne devrait dominer le marché européen des résines alkydes, en raison de sa production importante, de la disponibilité facile des produits et de l'augmentation de sa clientèle.

La section par pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, l'analyse des tendances techniques des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques européennes et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des résines alkydes en Europe

Le paysage concurrentiel du marché européen des résines alkydes fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Asie-Pacifique, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que les entreprises se concentrant sur le marché mondial des résines alkydes.

Français Certains des principaux acteurs opérant sur le marché européen des résines alkydes sont OPC polymers, Covestro AG, Uniform Synthetics, Synthopol, Arkema, BASF SE, Allnex GMBH, DSV Chemcials Pvt Ltd, Ratnaka Resins Pvt. Ltd., Hempel A/S, Neo-Pack Plast, POLYNT SPA, Krishna Resins & Pigments Pvt. Ltd., Arakawa Chemical Industries, Ltd., MACRO POLYMERS, Nord Composites Italia SRL, Girdhari Chemicals & Resins, Eternal Materials Co., Ltd., US Polymers-Accurez, LLC, Spolek pro chemickou a hutní výrobu, akciová společnost et Mancuso Chemicals Limited, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE ALKYD RESIN MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 MULTIVARIATE MODELLING

2.9 CATEGORY LIFELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 THREAT OF SUBSTITUTES

4.2.3 CUSTOMER BARGAINING POWER

4.2.4 SUPPLIER BARGAINING POWER

4.2.5 INTERNAL COMPETITION (RIVALRY)

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT’S ROLE

4.3.4 ANALYST RECOMMENDATION

4.4 IMPORT-EXPORT ANALYSIS

4.5 SUPPLY CHAIN ANALYSIS

4.5.1 OVERVIEW

4.5.2 LOGISTIC COST SCENARIO

4.5.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.6 TECHNOLOGICAL INNOVATION

4.7 VENDOR SELECTION CRITERIA

4.8 PRICE ANALYSIS

4.9 PRODUCTION CAPACITY OUTLOOK

4.1 PRODUCTION CONSUMPTION ANALYSIS

4.11 RAW MATERIAL COVERAGE

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING DEMAND IN THE PAINT AND COATING INDUSTRY

6.1.2 GROWING DISPOSABLE INCOME AND LIFESTYLE OF CONSUMERS

6.1.3 HIGH-QUALITY PROPERTIES AND COMPATIBILITY OF THE ALKYD RESIN WITH A WIDE RANGE OF POLYMERS

6.1.4 GROWING URBANIZATION IN THE DEVELOPING COUNTRIES

6.2 RESTRAINTS

6.2.1 GROWING AWARENESS OF THE HARMFUL IMPACT OF ALKYD RESINS

6.2.2 AVAILABILITY OF SUBSTITUTES

6.3 OPPORTUNITIES

6.3.1 GROWING DEMAND FOR SUSTAINABLE COATING IN THE MARKET

6.3.2 THE CONTINUOUS PRODUCT LAUNCHES BY COMPANIES BOOST THE MARKET GROWTH

6.4 CHALLENGE

6.4.1 THE FLUCTUATING PRICE OF RAW MATERIALS LEADS TO CHANGES IN THE MANUFACTURING COST OF ALKYD RESINS

7 EUROPE ALKYD RESIN MARKET, BY REGION

7.1 EUROPE

7.1.1 GERMANY

7.1.2 U.K.

7.1.3 FRANCE

7.1.4 ITALY

7.1.5 SPAIN

7.1.6 RUSSIA

7.1.7 TURKEY

7.1.8 BELGIUM

7.1.9 NETHERLANDS

7.1.10 SWEDEN

7.1.11 SWITZERLAND

7.1.12 NORWAY

7.1.13 DENMARK

7.1.14 FINLAND

7.1.15 REST OF EUROPE

8 EUROPE ALKYD RESIN MARKET, COMPANY LANDSCAPE

8.1 COMPANY SHARE ANALYSIS: EUROPE

8.2 ACQUISITION

8.3 NEW LAUNCHES

8.4 RECOGNITION

8.5 NEW PLANT

9 COMPANY PROFILES

9.1 ARKEMA

9.1.1 COMPANY SNAPSHOT

9.1.2 REVENUE ANALYSIS

9.1.3 COMPANY SHARE ANALYSIS

9.1.4 PRODUCT PORTFOLIO

9.1.5 SWOT

9.1.6 RECENT DEVELOPMENTS

9.2 BASF SE (2022)

9.2.1 COMPANY SNAPSHOT

9.2.2 REVENUE ANALYSIS

9.2.3 COMPANY SHARE ANALYSIS

9.2.4 PRODUCT PORTFOLIO

9.2.5 SWOT

9.2.6 RECENT DEVELOPMENTS

9.3 ALLNEX GMBH

9.3.1 COMPANY SNAPSHOT

9.3.2 COMPANY SHARE ANALYSIS

9.3.3 PRODUCT PORTFOLIO

9.3.4 SWOT

9.3.5 RECENT DEVELOPMENTS

9.4 ETERNAL MATERIALS CO.,LTD. (2022)

9.4.1 COMPANY SNAPSHOT

9.4.2 REVENUE ANALYSIS

9.4.3 COMPANY SHARE ANALYSIS

9.4.4 PRODUCT PORTFOLIO

9.4.5 SWOT

9.4.6 RECENT DEVELOPMENT

9.5 OPC POLYMERS

9.5.1 COMPANY SNAPSHOT

9.5.2 COMPANY SHARE ANALYSIS

9.5.3 PRODUCT PORTFOLIO

9.5.4 SWOT ANALYSIS

9.5.5 RECENT DEVELOPMENTS

9.6 ARAKAWA CHEMICAL INDUSTRIES,LTD. (2022)

9.6.1 COMPANY SNAPSHOT

9.6.2 REVENUE ANALYSIS

9.6.3 PRODUCT PORTFOLIO

9.6.4 SWOT

9.6.5 RECENT DEVELOPMENTS

9.7 COVESTRO AG

9.7.1 COMPANY SNAPSHOT

9.7.2 REVENUE ANALYSIS

9.7.3 COMPANY SHARE ANALYSIS

9.7.4 PRODUCT PORTFOLIO

9.7.5 SWOT ANALYSIS

9.7.6 RECENT DEVELOPMENT

9.8 D.S.V CHEMCIALS PVT LTD

9.8.1 COMPANY SNAPSHOT

9.8.2 PRODUCT PORTFOLIO

9.8.3 SWOT

9.8.4 RECENT DEVELOPMENTS

9.9 GIRDHARI CHEMICALS & RESINS PVT.LTD.

9.9.1 COMPANY SNAPSHOT

9.9.2 PRODUCT PORTFOLIO

9.9.3 SWOT

9.9.4 RECENT DEVELOPMENTS

9.1 HEMPEL A/S

9.10.1 COMPANY SNAPSHOT

9.10.2 PRODUCT PORTFOLIO

9.10.3 SWOT ANALYSIS

9.10.4 RECENT DEVELOPMENT

9.11 KRISHNA RESINS & PIGMENTS PVT. LTD.

9.11.1 COMPANY SNAPSHOT

9.11.2 PRODUCT PORTFOLIO

9.11.3 SWOT

9.11.4 RECENT DEVELOPMENTS

9.12 MACRO POLYMERS

9.12.1 COMPANY SNAPSHOT

9.12.2 PRODUCT PORTFOLIO

9.12.3 SWOT

9.12.4 RECENT DEVELOPMENTS

9.13 MANCUSO CHEMICALS LIMITED

9.13.1 COMPANY SNAPSHOT

9.13.2 PRODUCT PORTFOLIO

9.13.3 SWOT

9.13.4 RECENT DEVELOPMENT

9.14 NEO-PACK PLAST

9.14.1 COMPANY SNAPSHOT

9.14.2 PRODUCT PORTFOLIO

9.14.3 SWOT ANALYSIS

9.14.4 RECENT DEVELOPMENTS

9.15 NORD COMPOSITES ITALIA SRL

9.15.1 COMPANY SNAPSHOT

9.15.2 PRODUCT PORTFOLIO

9.15.3 SWOT

9.15.4 RECENT DEVELOPMENTS

9.16 POLYNT SPA

9.16.1 COMPANY SNAPSHOT

9.16.2 PRODUCT PORTFOLIO

9.16.3 SWOT ANALYSIS

9.16.4 RECENT DEVELOPMENT

9.17 RATNAKA RESINS PVT.LTD.

9.17.1 COMPANY SNAPSHOT

9.17.2 PRODUCT PORTFOLIO

9.17.3 SWOT ANALYSIS

9.17.4 RECENT DEVELOPMENTS

9.18 SPOLEK PRO CHEMICKOU A HUTNÍ VÝROBU, AKCIOVÁ SPOLEČNOST

9.18.1 COMPANY SNAPSHOT

9.18.2 PRODUCT PORTFOLIO

9.18.3 SWOT

9.18.4 RECENT DEVELOPMENTT

9.19 SYNTHOPOL

9.19.1 COMPANY SNAPSHOT

9.19.2 PRODUCT PORTFOLIO

9.19.3 SWOT ANALYSIS

9.19.4 RECENT DEVELOPMENT

9.2 UNIFORM SYNTHETICS

9.20.1 COMPANY SNAPSHOT

9.20.2 PRODUCT PORTFOLIO

9.20.3 SWOT ANALYSIS

9.20.4 RECENT DEVELOPMENTS

9.21 US POLYMERS-ACCUREZ, LLC

9.21.1 COMPANY SNAPSHOT

9.21.2 PRODUCT PORTFOLIO

9.21.3 SWOT

9.21.4 RECENT DEVELOPMENT

10 QUESTIONNAIRE

11 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF "ALKYD RESINS, IN PRIMARY FORMS"; HS CODE OF PRODUCT: 390750

TABLE 2 IMPORT DATA OF " ALKYD RESINS, IN PRIMARY FORMS"; HS CODE OF PRODUCT: 390750

TABLE 3 EXPORT DATA OF "ALKYD RESINS, IN PRIMARY FORMS"; HS CODE OF PRODUCT: 390750

TABLE 4 EXPORT DATA OF "ALKYD RESINS, IN PRIMARY FORMS"; HS CODE OF PRODUCT: 390750

TABLE 5 TOP FIVE COMPANIES - PRODUCTION CAPACITY ANALYSIS

TABLE 6 REGULATORY COVERAGE

TABLE 7 EUROPE ALKYD RESIN MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 8 EUROPE ALKYD RESIN MARKET, BY COUNTRY, 2021-2030 (KILO TONS)

TABLE 9 EUROPE ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 10 EUROPE ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (KILO TONS)

TABLE 11 EUROPE ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (ASP)

TABLE 12 EUROPE ALKYD RESIN MARKET, BY PROCESS TYPE, 2021-2030 (USD MILLION)

TABLE 13 EUROPE ALKYD RESIN MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 14 EUROPE ALKYD RESIN MARKET, BY FORMULATION TYPE, 2021-2030 (USD MILLION)

TABLE 15 EUROPE ALKYD RESIN MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 16 EUROPE ALKYD RESIN MARKET, BY END USE INDUSTRY, 2021-2030 (USD MILLION)

TABLE 17 EUROPE CONSTRUCTION & ARCHITECTURE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 18 EUROPE AUTOMOTIVE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 19 EUROPE ELECTRONICS INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 20 EUROPE AEROSPACE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 21 EUROPE MARINE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 22 EUROPE OTHERS IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 23 GERMANY ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 24 GERMANY ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (KILO TONS)

TABLE 25 GERMANY ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (ASP)

TABLE 26 GERMANY ALKYD RESIN MARKET, BY PROCESS TYPE, 2021-2030 (USD MILLION)

TABLE 27 GERMANY ALKYD RESIN MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 28 GERMANY ALKYD RESIN MARKET, BY FORMULATION TYPE, 2021-2030 (USD MILLION)

TABLE 29 GERMANY ALKYD RESIN MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 30 GERMANY ALKYD RESIN MARKET, BY END USE INDUSTRY, 2021-2030 (USD MILLION)

TABLE 31 GERMANY CONSTRUCTION & ARCHITECTURE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 32 GERMANY AUTOMOTIVE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 33 GERMANY ELECTRONICS INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 34 GERMANY AEROSPACE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 35 GERMANY MARINE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 36 GERMANY OTHERS IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 37 U.K. ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 38 U.K. ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (KILO TONS)

TABLE 39 U.K. ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (ASP)

TABLE 40 U.K. ALKYD RESIN MARKET, BY PROCESS TYPE, 2021-2030 (USD MILLION)

TABLE 41 U.K. ALKYD RESIN MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 42 U.K. ALKYD RESIN MARKET, BY FORMULATION TYPE, 2021-2030 (USD MILLION)

TABLE 43 U.K. ALKYD RESIN MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 44 U.K. ALKYD RESIN MARKET, BY END USE INDUSTRY, 2021-2030 (USD MILLION)

TABLE 45 U.K. CONSTRUCTION & ARCHITECTURE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 46 U.K. AUTOMOTIVE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 47 U.K. ELECTRONICS INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 48 U.K. AEROSPACE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 49 U.K. MARINE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 50 U.K. OTHERS IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 51 FRANCE ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 52 FRANCE ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (KILO TONS)

TABLE 53 FRANCE ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (ASP)

TABLE 54 FRANCE ALKYD RESIN MARKET, BY PROCESS TYPE, 2021-2030 (USD MILLION)

TABLE 55 FRANCE ALKYD RESIN MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 56 FRANCE ALKYD RESIN MARKET, BY FORMULATION TYPE, 2021-2030 (USD MILLION)

TABLE 57 FRANCE ALKYD RESIN MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 58 FRANCE ALKYD RESIN MARKET, BY END USE INDUSTRY, 2021-2030 (USD MILLION)

TABLE 59 FRANCE CONSTRUCTION & ARCHITECTURE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 60 FRANCE AUTOMOTIVE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 61 FRANCE ELECTRONICS INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 62 FRANCE AEROSPACE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 63 FRANCE MARINE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 64 FRANCE OTHERS IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 65 ITALY ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 66 ITALY ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (KILO TONS)

TABLE 67 ITALY ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (ASP)

TABLE 68 ITALY ALKYD RESIN MARKET, BY PROCESS TYPE, 2021-2030 (USD MILLION)

TABLE 69 ITALY ALKYD RESIN MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 70 ITALY ALKYD RESIN MARKET, BY FORMULATION TYPE, 2021-2030 (USD MILLION)

TABLE 71 ITALY ALKYD RESIN MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 72 ITALY ALKYD RESIN MARKET, BY END USE INDUSTRY, 2021-2030 (USD MILLION)

TABLE 73 ITALY CONSTRUCTION & ARCHITECTURE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 74 ITALY AUTOMOTIVE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 75 ITALY ELECTRONICS INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 76 ITALY AEROSPACE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 77 ITALY MARINE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 78 ITALY OTHERS IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 79 SPAIN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 80 SPAIN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (KILO TONS)

TABLE 81 SPAIN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (ASP)

TABLE 82 SPAIN ALKYD RESIN MARKET, BY PROCESS TYPE, 2021-2030 (USD MILLION)

TABLE 83 SPAIN ALKYD RESIN MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 84 SPAIN ALKYD RESIN MARKET, BY FORMULATION TYPE, 2021-2030 (USD MILLION)

TABLE 85 SPAIN ALKYD RESIN MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 86 SPAIN ALKYD RESIN MARKET, BY END USE INDUSTRY, 2021-2030 (USD MILLION)

TABLE 87 SPAIN CONSTRUCTION & ARCHITECTURE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 88 SPAIN AUTOMOTIVE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 89 SPAIN ELECTRONICS INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 90 SPAIN AEROSPACE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 91 SPAIN MARINE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 92 SPAIN OTHERS IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 93 RUSSIA ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 94 RUSSIA ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (KILO TONS)

TABLE 95 RUSSIA ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (ASP)

TABLE 96 RUSSIA ALKYD RESIN MARKET, BY PROCESS TYPE, 2021-2030 (USD MILLION)

TABLE 97 RUSSIA ALKYD RESIN MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 98 RUSSIA ALKYD RESIN MARKET, BY FORMULATION TYPE, 2021-2030 (USD MILLION)

TABLE 99 RUSSIA ALKYD RESIN MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 100 RUSSIA ALKYD RESIN MARKET, BY END USE INDUSTRY, 2021-2030 (USD MILLION)

TABLE 101 RUSSIA CONSTRUCTION & ARCHITECTURE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 102 RUSSIA AUTOMOTIVE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 103 RUSSIA ELECTRONICS INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 104 RUSSIA AEROSPACE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 105 RUSSIA MARINE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 106 RUSSIA OTHERS IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 107 TURKEY ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 108 TURKEY ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (KILO TONS)

TABLE 109 TURKEY ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (ASP)

TABLE 110 TURKEY ALKYD RESIN MARKET, BY PROCESS TYPE, 2021-2030 (USD MILLION)

TABLE 111 TURKEY ALKYD RESIN MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 112 TURKEY ALKYD RESIN MARKET, BY FORMULATION TYPE, 2021-2030 (USD MILLION)

TABLE 113 TURKEY ALKYD RESIN MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 114 TURKEY ALKYD RESIN MARKET, BY END USE INDUSTRY, 2021-2030 (USD MILLION)

TABLE 115 TURKEY CONSTRUCTION & ARCHITECTURE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 116 TURKEY AUTOMOTIVE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 117 TURKEY ELECTRONICS INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 118 TURKEY AEROSPACE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 119 TURKEY MARINE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 120 TURKEY OTHERS IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 121 BELGIUM ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 122 BELGIUM ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (KILO TONS)

TABLE 123 BELGIUM ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (ASP)

TABLE 124 BELGIUM ALKYD RESIN MARKET, BY PROCESS TYPE, 2021-2030 (USD MILLION)

TABLE 125 BELGIUM ALKYD RESIN MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 126 BELGIUM ALKYD RESIN MARKET, BY FORMULATION TYPE, 2021-2030 (USD MILLION)

TABLE 127 BELGIUM ALKYD RESIN MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 128 BELGIUM ALKYD RESIN MARKET, BY END USE INDUSTRY, 2021-2030 (USD MILLION)

TABLE 129 BELGIUM CONSTRUCTION & ARCHITECTURE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 130 BELGIUM AUTOMOTIVE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 131 BELGIUM ELECTRONICS INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 132 BELGIUM AEROSPACE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 133 BELGIUM OTHERS IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 134 NETHERLANDS ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 135 NETHERLANDS ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (KILO TONS)

TABLE 136 NETHERLANDS ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (ASP)

TABLE 137 NETHERLANDS ALKYD RESIN MARKET, BY PROCESS TYPE, 2021-2030 (USD MILLION)

TABLE 138 NETHERLANDS ALKYD RESIN MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 139 NETHERLANDS ALKYD RESIN MARKET, BY FORMULATION TYPE, 2021-2030 (USD MILLION)

TABLE 140 NETHERLANDS ALKYD RESIN MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 141 NETHERLANDS ALKYD RESIN MARKET, BY END USE INDUSTRY, 2021-2030 (USD MILLION)

TABLE 142 NETHERLANDS CONSTRUCTION & ARCHITECTURE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 143 NETHERLANDS AUTOMOTIVE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 144 NETHERLANDS ELECTRONICS INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 145 NETHERLANDS AEROSPACE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 146 NETHERLANDS MARINE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 147 NETHERLANDS OTHERS IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 148 SWEDEN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 149 SWEDEN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (KILO TONS)

TABLE 150 SWEDEN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (ASP)

TABLE 151 SWEDEN ALKYD RESIN MARKET, BY PROCESS TYPE, 2021-2030 (USD MILLION)

TABLE 152 SWEDEN ALKYD RESIN MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 153 SWEDEN ALKYD RESIN MARKET, BY FORMULATION TYPE, 2021-2030 (USD MILLION)

TABLE 154 SWEDEN ALKYD RESIN MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 155 SWEDEN ALKYD RESIN MARKET, BY END USE INDUSTRY, 2021-2030 (USD MILLION)

TABLE 156 SWEDEN CONSTRUCTION & ARCHITECTURE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 157 SWEDEN AUTOMOTIVE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 158 SWEDEN ELECTRONICS INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 159 SWEDEN AEROSPACE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 160 SWEDEN MARINE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 161 SWEDEN OTHERS IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 162 SWITZERLAND ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 163 SWITZERLAND ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (KILO TONS)

TABLE 164 SWITZERLAND ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (ASP)

TABLE 165 SWITZERLAND ALKYD RESIN MARKET, BY PROCESS TYPE, 2021-2030 (USD MILLION)

TABLE 166 SWITZERLAND ALKYD RESIN MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 167 SWITZERLAND ALKYD RESIN MARKET, BY FORMULATION TYPE, 2021-2030 (USD MILLION)

TABLE 168 SWITZERLAND ALKYD RESIN MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 169 SWITZERLAND ALKYD RESIN MARKET, BY END USE INDUSTRY, 2021-2030 (USD MILLION)

TABLE 170 SWITZERLAND CONSTRUCTION & ARCHITECTURE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 171 SWITZERLAND AUTOMOTIVE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 172 SWITZERLAND ELECTRONICS INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 173 SWITZERLAND AEROSPACE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 174 SWITZERLAND MARINE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 175 SWITZERLAND OTHERS IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 176 NORWAY ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 177 NORWAY ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (KILO TONS)

TABLE 178 NORWAY ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (ASP)

TABLE 179 NORWAY ALKYD RESIN MARKET, BY PROCESS TYPE, 2021-2030 (USD MILLION)

TABLE 180 NORWAY ALKYD RESIN MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 181 NORWAY ALKYD RESIN MARKET, BY FORMULATION TYPE, 2021-2030 (USD MILLION)

TABLE 182 NORWAY ALKYD RESIN MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 183 NORWAY ALKYD RESIN MARKET, BY END USE INDUSTRY, 2021-2030 (USD MILLION)

TABLE 184 NORWAY CONSTRUCTION & ARCHITECTURE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 185 NORWAY AUTOMOTIVE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 186 NORWAY ELECTRONICS INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 187 NORWAY AEROSPACE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 188 NORWAY MARINE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 189 NORWAY OTHERS IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 190 DENMARK ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 191 DENMARK ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (KILO TONS)

TABLE 192 DENMARK ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (ASP)

TABLE 193 DENMARK ALKYD RESIN MARKET, BY PROCESS TYPE, 2021-2030 (USD MILLION)

TABLE 194 DENMARK ALKYD RESIN MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 195 DENMARK ALKYD RESIN MARKET, BY FORMULATION TYPE, 2021-2030 (USD MILLION)

TABLE 196 DENMARK ALKYD RESIN MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 197 DENMARK ALKYD RESIN MARKET, BY END USE INDUSTRY, 2021-2030 (USD MILLION)

TABLE 198 DENMARK CONSTRUCTION & ARCHITECTURE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 199 DENMARK AUTOMOTIVE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 200 DENMARK ELECTRONICS INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 201 DENMARK AEROSPACE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 202 DENMARK MARINE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 203 DENMARK OTHERS IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 204 FINLAND ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 205 FINLAND ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (KILO TONS)

TABLE 206 FINLAND ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (ASP)

TABLE 207 FINLAND ALKYD RESIN MARKET, BY PROCESS TYPE, 2021-2030 (USD MILLION)

TABLE 208 FINLAND ALKYD RESIN MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 209 FINLAND ALKYD RESIN MARKET, BY FORMULATION TYPE, 2021-2030 (USD MILLION)

TABLE 210 FINLAND ALKYD RESIN MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 211 FINLAND ALKYD RESIN MARKET, BY END USE INDUSTRY, 2021-2030 (USD MILLION)

TABLE 212 FINLAND CONSTRUCTION & ARCHITECTURE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 213 FINLAND AUTOMOTIVE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 214 FINLAND ELECTRONICS INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 215 FINLAND AEROSPACE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 216 FINLAND MARINE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 217 FINLAND OTHERS IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 218 REST OF EUROPE ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 219 REST OF EUROPE ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (KILO TONS)

Liste des figures

FIGURE 1 EUROPE ALKYD RESIN MARKET: SEGMENTATION

FIGURE 2 EUROPE ALKYD RESIN MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE ALKYD RESIN MARKET : DROC ANALYSIS

FIGURE 4 EUROPE ALKYD RESIN MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE ALKYD RESIN MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 THE EUROPE ALKYD RESIN MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 THE EUROPE ALKYD RESIN MARKET: DBMR MARKET POSITION GRID

FIGURE 8 THE EUROPE ALKYD RESIN MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 EUROPE ALKYD RESIN MARKET VENDOR SHARE ANALYSIS

FIGURE 10 THE EUROPE ALKYD RESIN MARKET: SEGMENTATION

FIGURE 11 GROWING CONSUMPTION IN THE PAINT AND COATING INDUSTRY IS EXPECTED TO DRIVE THE GROWTH OF THE EUROPE ALKYD RESIN MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 12 NON-DRYING ALKYD RESIN SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE ALKYD RESIN MARKET IN 2023 AND 2030

FIGURE 13 VENDOR SELECTION CRITERIA

FIGURE 14 PRICE ANALYSIS FOR EUROPE ALKYD RESIN MARKET (USD/KG)

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE EUROPE ALKYD RESIN MARKET

FIGURE 16 EUROPE ALKYD RESIN MARKET: SNAPSHOT (2022)

FIGURE 17 EUROPE ALKYD RESIN MARKET: BY COUNTRY (2022)

FIGURE 18 EUROPE ALKYD RESIN MARKET: BY COUNTRY (2023 & 2030)

FIGURE 19 EUROPE ALKYD RESIN MARKET: BY COUNTRY (2022 & 2030)

FIGURE 20 EUROPE ALKYD RESIN MARKET: BY RESIN TYPE (2023-2030)

FIGURE 21 EUROPE ALKYD RESIN MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.