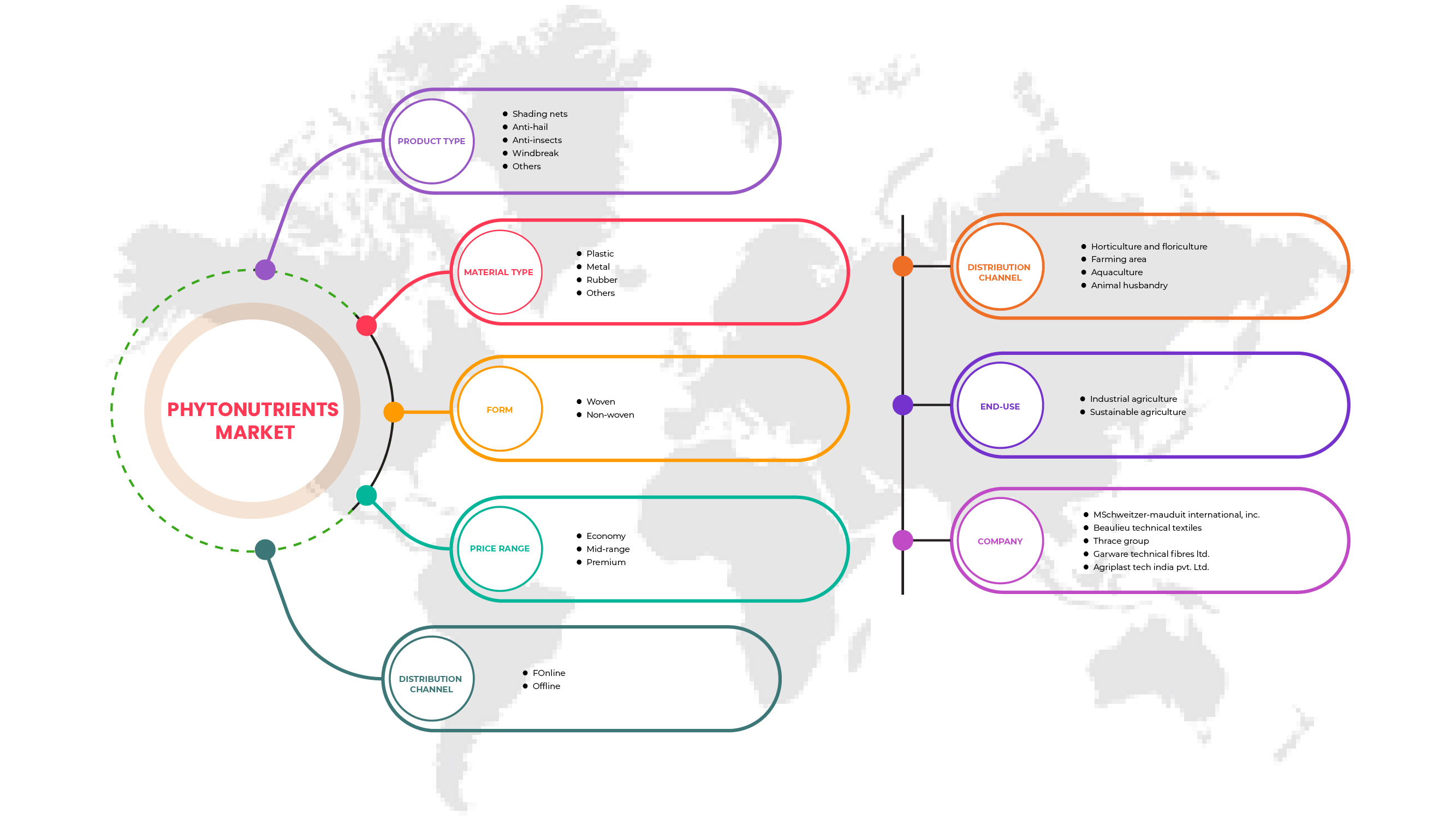

Marché européen des filets agricoles, par type de produit (filets d'ombrage, anti-grêle, anti-insectes, brise-vent et autres), type de matériau (plastique, caoutchouc, métal et autres), forme (tissé et non tissé), gamme de prix (économique, milieu de gamme et premium), canal de distribution (hors ligne et en ligne), application (horticulture et floriculture , zone agricole, élevage et aquaculture), utilisation finale (agriculture industrielle et agriculture durable) Tendances et prévisions de l'industrie jusqu'en 2029

Analyse et perspectives du marché des filets agricoles européens

Le marché européen des filets agricoles est fragmenté par nature, car il se compose de nombreux acteurs tels que Garware Technical Fibres Limited et Thrace Group. La présence de ces entreprises produit les meilleurs produits de filets agricoles pour diverses applications destinées aux agriculteurs et autres utilisateurs au niveau régional et international. Ces fabricants et fournisseurs de filets agricoles proposent des produits pour toutes les gammes de prix avec diverses caractéristiques.

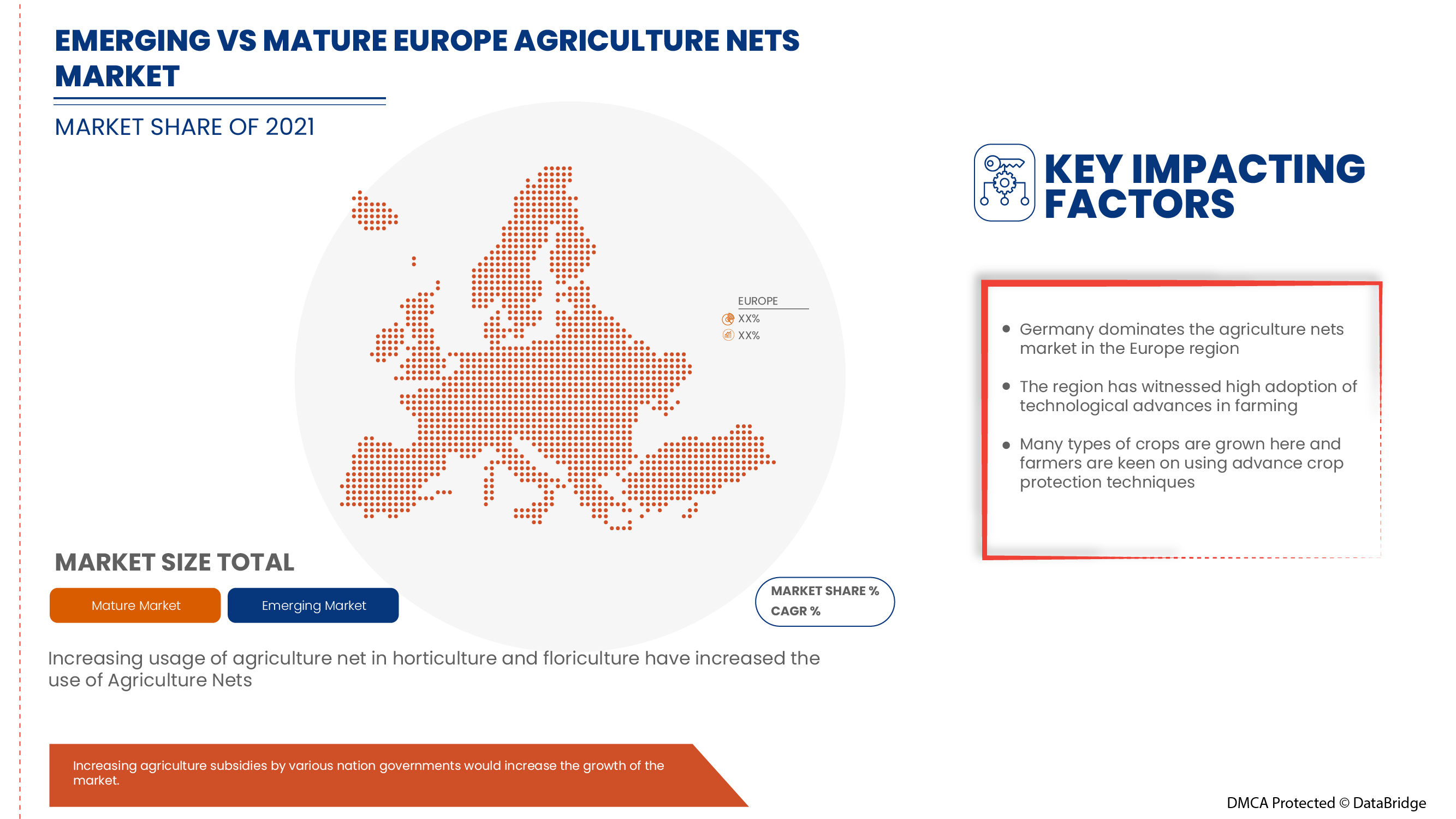

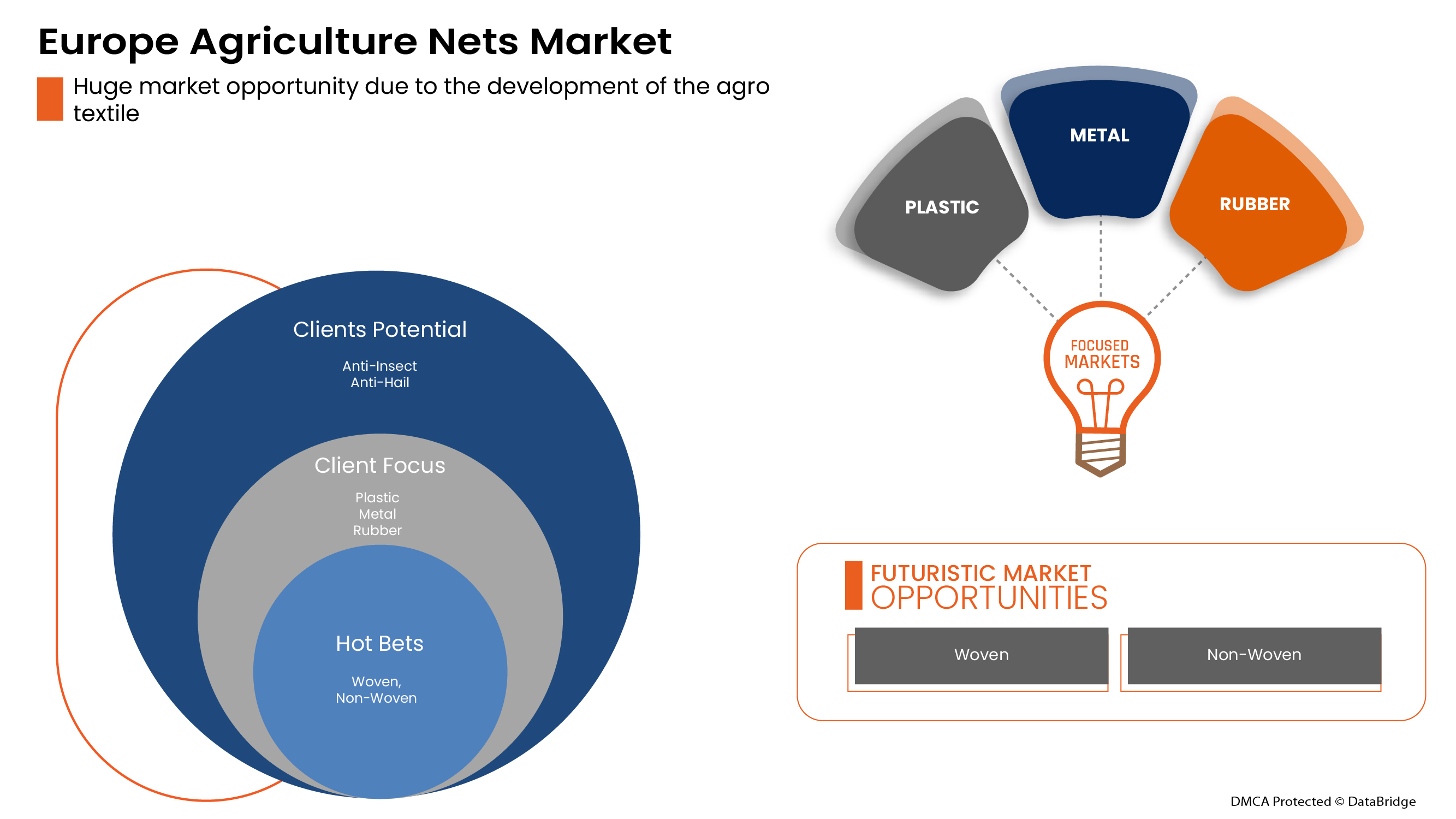

Les initiatives croissantes pour la sécurité alimentaire dans la région et l'utilisation croissante des filets agricoles dans l'horticulture et la floriculture stimulent le marché européen des filets agricoles, car ces filets permettent aux agriculteurs de produire davantage. Cependant, l'augmentation de la pollution plastique agricole et les préoccupations environnementales concernant l'utilisation de filets agricoles en plastique devraient freiner la croissance du marché. Cependant, l'augmentation des subventions agricoles accordées par divers gouvernements nationaux et la pratique croissante de l'agriculture en terrasse ou sur les toits devraient offrir l'occasion d'élargir l'application et l'utilisation des filets agricoles.

De plus, le développement de l’agro-textile et l’utilisation croissante des filets agricoles dans d’autres applications telles que la foresterie devraient stimuler la croissance du marché européen des filets agricoles à l’avenir.

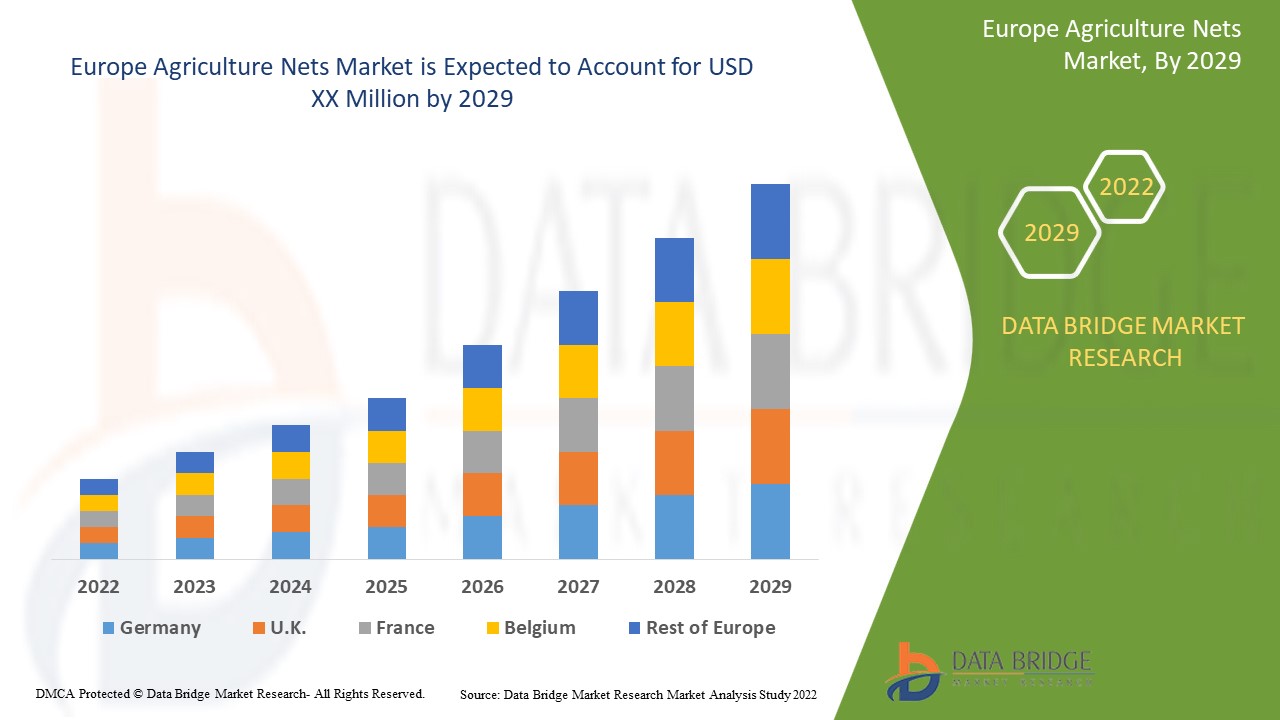

Data Bridge Market Research analyse que le marché européen des filets agricoles connaîtra un TCAC de 6,5 % au cours de la période de prévision de 2022 à 2029.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2015) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Par type de produit (filets d'ombrage, anti-grêle, anti-insectes, brise-vent et autres), type de matériau (plastique, caoutchouc, métal et autres), forme (tissé et non tissé), gamme de prix (économique, milieu de gamme et premium), canal de distribution (hors ligne et en ligne), application (horticulture et floriculture, zone agricole, élevage et aquaculture), utilisation finale (agriculture industrielle et agriculture durable) |

|

Pays couverts |

Royaume-Uni, Allemagne, France, Espagne, Italie, Pays-Bas, Luxembourg, Suisse, Russie, Belgique, Turquie et reste de l'Europe |

|

Acteurs du marché couverts |

Belton Industries, Smart Net Systems Ltd., Diatex, Garware Technical Fibres Limited, Thrace Group, Inc., Agriplast Tech India Pvt. Ltd., Schweitzer-Mauduit International, Inc., wellcoindustries, Alphatex, Cittadini SpA, Zhongshan Hongjun Nonwovens Co. Ltd., Beaulieu Technical Textiles |

Définition du marché

Les filets agricoles sont fabriqués à partir de matériaux tels que le caoutchouc, les métaux, les tissus ou le polyéthylène haute densité, également connu sous le nom de PEHD. Les filets agricoles sont principalement utilisés dans l'industrie agricole pour protéger les plantes des radiations solaires, des rayons UV et des conditions météorologiques difficiles. Les principaux avantages offerts par les filets agricoles sont la protection contre les rayons UV et la capacité à créer un micro-environnement pour les cultures. Ils sont utilisés sous forme non tissée et tissée. Outre l'agriculture, ces filets sont également utilisés en floriculture, en horticulture et en élevage. Ils ont une large application dans les secteurs domestique et commercial pour la construction de clôtures provisoires, de parkings, de filets de pêche, de hangars de fenêtre et d'échafaudages. La longueur et la largeur des filets varient de 1 m à 20 m et de 25 m à 300 m selon l'application. L'augmentation des applications de ces filets dans l'agriculture et les secteurs connexes et dans d'autres secteurs tels que la construction, les ménages stimulent le marché européen des filets agricoles.

Dynamique du marché des filets agricoles européens

Conducteurs

- Utilisation croissante des filets agricoles dans l'horticulture et la floriculture

Les filets agricoles deviennent de plus en plus utiles et importants dans l'horticulture car ils fournissent de l'ombre aux cultures et protègent les cultures de la chaleur excessive. Les filets anti-grêle aident également à protéger les cultures de la grêle et à améliorer les micro-environnements qui peuvent augmenter la productivité et le rendement de la culture. Les filets agricoles sont utilisés dans les secteurs de l'horticulture et de la floriculture pour de nombreuses applications et fonctions telles que la diffusion du rayonnement, la photosélectivité. La productivité du segment horticole dépend fortement des ombrages et des filets utilisés dans la pratique, ce qui fait des filets agricoles l'un des composants essentiels de la pratique.

Ainsi, avec les pratiques croissantes de l'horticulture et de la floriculture dans la région, la demande de filets agricoles augmente rapidement, ce qui agit comme un moteur de la croissance du marché européen des filets agricoles.

- Des initiatives croissantes pour la sécurité alimentaire à travers le monde

À l'heure actuelle, les gouvernements de la région européenne tentent d'accroître leur auto-efficacité alimentaire nationale et leur sécurité alimentaire par diverses initiatives depuis la révolution verte. De plus, au cours des dernières décennies, avec l'augmentation de la population et de la demande alimentaire, plusieurs pays ont mis davantage l'accent sur la sécurité alimentaire nationale. Cela a agi comme facteur moteur pour le marché européen des filets agricoles, car ces initiatives se concentrent sur l'augmentation de la production agricole et des moyens par lesquels les agriculteurs locaux peuvent y parvenir, ce qui a entraîné une augmentation de la demande de filets agricoles.

Opportunité

- Pratique croissante de l'agriculture en terrasse ou sur les toits

Les pratiques d'agriculture sur les toits se développent rapidement, en particulier dans les zones urbaines, car les gens utilisent l'espace vide des toits pour produire des légumes frais, des herbes, des fruits et des fleurs comestibles. Les toits verts productifs combinent la production alimentaire avec la durabilité écologique, comme la réduction du ruissellement des eaux de pluie, offrent des avantages en termes de température tels que la réduction potentielle des besoins de chauffage et de refroidissement (entraînant une réduction des émissions), une valeur esthétique améliorée et une meilleure qualité de l'air. La pratique croissante de l'agriculture en terrasses a entraîné une augmentation de la demande de filets d'ombrage, de filets anti-insectes et de filets brise-vent dans toute l'Europe, offrant une opportunité de croissance pour le marché européen des filets agricoles.

Retenue/Défi

- Préoccupations environnementales concernant l’utilisation des filets agricoles

Les filets agricoles sont utilisés dans l'agriculture, l'horticulture, l'aquaculture et l'élevage pour diverses applications. Les filets agricoles sont utilisés pour protéger les cultures des oiseaux, des insectes, des petits animaux et d'autres facteurs tels que les rayons UV et les conditions météorologiques difficiles. Les matériaux dont sont constitués ces filets agricoles sont principalement du plastique, du caoutchouc et des métaux. Comme les filets en plastique sont moins coûteux par rapport aux autres matériaux, ils sont produits à grande échelle. La durabilité des filets en plastique suscite des préoccupations environnementales car les filets en plastique biosourcés sont facilement biodégradables, mais les filets en plastique conventionnels tels que le polyéthylène haute densité (PEHD), le polyéthylène (PE) et le chlorure de polyvinyle ne sont pas respectueux de l'environnement. Ainsi, la caractéristique non écologique des filets agricoles peut entraver la croissance du marché.

Impact de la pandémie de COVID-19 sur le marché des filets agricoles en Europe

La pandémie de COVID-19 a considérablement affecté le marché européen des filets agricoles. La persistance du COVID-19 pendant une période plus longue a affecté la chaîne d'approvisionnement car elle a été perturbée, et il est devenu difficile de fournir les produits bruts aux fabricants, ce qui a initialement diminué le taux de production des filets agricoles. Cependant, après le COVID-19, la demande de filets agricoles a considérablement augmenté en raison d'une sensibilisation accrue aux avantages des filets agricoles et de l'essor des secteurs de l'horticulture et de la floriculture. Les consommateurs essaient d'utiliser les filets pour augmenter les rendements et générer des bénéfices dans l'agriculture et les secteurs connexes. Ainsi, après le COVID-19, le marché européen des filets agricoles devrait prospérer en raison de l'augmentation des initiatives en faveur de la sécurité alimentaire dans la région et de l'utilisation croissante des filets agricoles dans d'autres applications.

Développement récent

- En mai 2022, Schweitzer-Mauduit International, Inc. et Neenah, Inc. ont annoncé un partenariat dans le cadre duquel les deux sociétés formeront une équipe pour les développements futurs. Cette étape vise à utiliser le potentiel des deux entreprises pour produire des produits techniques dans l'industrie textile. L'entreprise vise à proposer de nouveaux produits techniquement avancés sur le marché européen des filets agricoles grâce à ce partenariat

Portée du marché des filets agricoles européens

Le marché européen des filets agricoles est segmenté en fonction du type de produit, du type de matériau, de la forme, de la gamme de prix, du canal de distribution, de l'application et de l'utilisation finale. La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Type de produit

- Filets d'ombrage

- Anti-grêle

- Anti-Insectes

- Brise-vent

- Autres

Sur la base du type de produit, le marché européen des filets agricoles est segmenté en filets d'ombrage, anti-grêle, anti-insectes, brise-vent et autres.

Type de matériau

- Plastique

- Métal

- Caoutchouc

- Autres

Sur la base du type de matériau, le marché européen des filets agricoles est segmenté en plastique, caoutchouc, métal et autres.

Formulaire

- Tissé

- Non-tissé

Sur la base de la forme, le marché européen des filets agricoles est segmenté en tissés et non tissés.

Gamme de prix

- Économie

- Milieu de gamme

- Prime

Sur la base de la gamme de prix, le marché européen des filets agricoles est segmenté en économique, milieu de gamme et premium.

Canal de distribution

- En ligne

- Hors ligne

Sur la base du canal de distribution, le marché européen des filets agricoles est segmenté en hors ligne et en ligne.

Application

- Horticulture et floriculture

- Zone agricole

- Élevage

- Aquaculture

Sur la base des applications, le marché européen des filets agricoles est segmenté en horticulture et floriculture, agriculture, élevage et aquaculture.

Utilisation finale

- Agriculture industrielle

- Agriculture durable

Sur la base de l'utilisation finale, le marché européen des filets agricoles est segmenté en agriculture industrielle et agriculture durable.

Analyse/perspectives régionales du marché des filets agricoles européens

Le marché européen des filets agricoles est analysé et des informations et tendances sur la taille du marché sont fournies par pays, type de produit, type de matériau, forme, gamme de prix, canal de distribution, application et utilisation finale comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché des filets agricoles européens sont le Royaume-Uni, l'Allemagne, la France, l'Espagne, l'Italie, les Pays-Bas, le Luxembourg, la Suisse, la Russie, la Belgique, la Turquie et le reste de l'Europe.

L'Allemagne devrait dominer le marché européen des filets agricoles en termes de parts de marché et de revenus. Elle devrait maintenir sa domination au cours de la période de prévision en raison de la tendance à la hausse de l'horticulture et de la floriculture.

La section régionale du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché qui ont un impact sur les tendances actuelles et futures du marché. Les points de données, tels que les ventes de produits neufs et de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation, sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques européennes et les défis auxquels elles sont confrontées en raison de la forte concurrence des marques locales et nationales et de l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des filets agricoles européens

Le paysage concurrentiel du marché européen des filets agricoles détaille les concurrents. Les détails comprennent un aperçu de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Europe, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus ne concernent que l'orientation des entreprises sur le marché européen des filets agricoles.

Certains des principaux acteurs opérant sur le marché européen des filets agricoles sont Belton Industries., Smart Net Systems Ltd., Diatex, Garware Technical Fibres Limited, Thrace Group, US Netting, Inc., Fiberwebindia Ltd., Schweitzer-Mauduit International, Inc., Alphatex, Cittadini SpA, Zhongshan Hongjun Nonwovens Co. Ltd., Beaulieu Technical Textiles entre autres.

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent les grilles de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, les grilles de positionnement des entreprises, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse mondiale et régionale et l'analyse des parts des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE AGRICULTURE NETS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET END-USER COVERAGE GRID

2.9 MULTIVARIATE MODELLING

2.1 PRODUCT TYPE CURVE

2.11 CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PRODUCTION-CONSUMPTION ANALYSIS

4.2 IMPORT EXPORT SCENARIO

4.3 PRICE TREND ANALYSIS

4.4 RAW MATERIAL PRODUCTION COVERAGE

4.5 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.6 LIST OF KEY BUYERS

4.7 PORTER’S FIVE FORCE ANALYSIS

4.8 VENDOR SELECTION CRITERIA

4.9 PESTEL ANALYSIS

4.1 REGULATIONS COVERAGE

5 SUPPLY CHAIN ANALYSIS

5.1 OVERVIEW

5.2 LOGISTIC COST SCENARIO

5.3 IMPORTANCE OF LOGISTIC SERVICE PROVIDERS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING INITIATIVES FOR FOOD SECURITY ACROSS GLOBE

6.1.2 RISING DEMAND FOR AGRICULTURE NETS DUE TO INCREASING INTEREST IN GARDENING

6.1.3 USE OF AGRICULTURE NETS IN AQUACULTURE AND ANIMAL HUSBANDRY

6.1.4 INCREASING USAGE OF AGRICULTURE NET IN HORTICULTURE AND FLORICULTURE

6.2 RESTRAINTS

6.2.1 LESS LIFE SPAN OF NETS

6.2.2 ENVIRONMENTAL CONCERNS REGARDING THE USE OF AGRICULTURE NETS

6.2.3 INCREASING AGRICULTURE PLASTIC POLLUTION

6.3 OPPORTUNITIES

6.3.1 THE DEVELOPMENT OF THE AGRO TEXTILE

6.3.2 EUROPELY INCREASING PRACTICE OF TERRACE OR ROOFTOP AGRICULTURE

6.3.3 INCREASING USAGE OF AGRICULTURE NETS IN OTHER APPLICATIONS

6.3.4 INCREASING AGRICULTURE SUBSIDIES BY VARIOUS NATION GOVERNMENTS

6.4 CHALLENGES

6.4.1 THE VARYING COSTS OF THE RAW MATERIALS USED IN AGRO-TEXTILE

6.4.2 GEOGRAPHICAL SHORTCOMING OF AGRICULTURE NETS

7 EUROPE AGRICULTURE NETS MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 SHADING NETS

7.3 WINDBREAK

7.4 ANTI-INSECT

7.5 ANTI-HAIL

7.6 OTHERS

8 EUROPE AGRICULTURE NETS MARKET, BY MATERIAL TYPE

8.1 OVERVIEW

8.2 PLASTIC

8.3 METAL

8.4 RUBBER

8.5 OTHERS

9 EUROPE AGRICULTURE NETS MARKET, BY PRICE RANGE

9.1 OVERVIEW

9.2 ECONOMY

9.3 MID-RANGE

9.4 PREMIUM

10 EUROPE AGRICULTURE NETS MARKET, BY FORM

10.1 OVERVIEW

10.2 WOVEN

10.3 NON-WOVEN

11 EUROPE AGRICULTURE NETS MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 OFFLINE

11.3 ONLINE

12 EUROPE AGRICULTURE NETS MARKET , BY APPLICATION

12.1 OVERVIEW

12.2 HORTICULTURE AND FLORICULTURE

12.3 FARMING AREA

12.4 AQUACULTURE

12.5 ANIMAL HUSBANDRY

13 EUROPE AGRICULTURE NETS MARKET, BY END USE

13.1 OVERVIEW

13.1.1 INDUSTRIAL AGRICULTURE

13.1.1.1 SHADING NETS

13.1.1.2 WINDBREAK

13.1.1.3 ANTI-INSECTS

13.1.1.4 ANTI-HAIL

13.1.1.5 OTHERS

13.1.2 SUSTAINABLE AGRICULTURE

13.1.2.1 SHADING NETS

13.1.2.2 WINDBREAK

13.1.2.3 ANTI-INSECTS

13.1.2.4 ANTI-HAIL

13.1.2.5 OTHERS

14 EUROPE AGRICULTURE NETS MARKET, BY REGION

14.1 EUROPE

14.1.1 GERMANY

14.1.2 U.K.

14.1.3 SPAIN

14.1.4 NETHERLANDS

14.1.5 FRANCE

14.1.6 ITALY

14.1.7 TURKEY

14.1.8 LUXEMBOURG

14.1.9 BELGIUM

14.1.10 RUSSIA

14.1.11 SWITZERLAND

14.1.12 REST OF EUROPE

15 EUROPE AGRICULTURE NETS MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: EUROPE

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 SCHWEITZER-MAUDUIT INTERNATIONAL, INC. (2021)

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.2 BEAULIEU TECHNICAL TEXTILES

17.2.1 COMPANY SNAPSHOT

17.2.2 PRODUCT PORTFOLIO

17.2.3 RECENT DEVELOPMENT

17.3 THRACE GROUP

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENTS

17.4 GARWARE TECHNICAL FIBRES LIMITED (2021)

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 AGRIPLAST TECH INDIA PVT. L.T.D.

17.5.1 COMPANY SNAPSHOT

17.5.2 PRODUCT PORTFOLIO

17.5.3 RECENT DEVELOPMENTS

17.6 ALPHATEX

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENTS

17.7 B&V AGRO IRRIGATION CO.

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 BELTON INDUSTRIES.

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 CITTADINI S.P.A

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 DIATEX

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 FIBERWEBINDIA LTD. (2021)

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENTS

17.12 NETKING

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 SHAKTI POLYWEAVE PVT. LTD

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 SHREE TARPAULIN INDUSTRIES

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 SMART NET SYSTEMS LTD.

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 SUNSAFE AGROTEXTILES PVT. L.T.D.

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 TUFLEX INDIA.

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 U.S. NETTING, I.N.C.

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 WELLCOINDUSTRIES

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 ZHONGSHAN HONGJUN NONWOVENS CO., LTD.

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

Liste des tableaux

TABLE 1 DIFFERENT TYPES OF AGRO-TEXTILE PRODUCTS WITH CONSTITUENT FIBER

TABLE 2 COST VARIATION AS PER MATERIAL USED

TABLE 3 SET OF ITALIAN STANDARD REGARDING AGRICULTURAL NETS

TABLE 4 CLASSIFICATION OF AGRO-TEXTILES PRODUCT WITH THE FABRIC TYPE

TABLE 5 ROOFTOP FARMS ACROSS THE GLOBE

TABLE 6 INSTANCES OF SUITABLE PLANTS FOR DIFFERENT ROOFTOP AGRICULTURE SYSTEMS

TABLE 7 LIGHT SCATTERING UNDER COLORED SHADE NETS COMPARED WITH NO NET

TABLE 8 EUROPE AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 9 EUROPE SHADING NETS IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 EUROPE WINDBREAK IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 EUROPE ANTI-INSECT IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 EUROPE ANTI-HAIL IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 EUROPE OTHERS IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 EUROPE AGRICULTURE NETS MARKET, BY MATERIAL TYPE, 2020-2029 (USD THOUSAND)

TABLE 15 EUROPE PLASTIC IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 EUROPE METAL IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 EUROPE RUBBER IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 EUROPE OTHERS IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 EUROPE AGRICULTURE NETS MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 20 EUROPE ECONOMY IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 EUROPE MID-RANGE IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 EUROPE PREMIUM IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 EUROPE AGRICULTURE NETS MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 24 EUROPE WOVEN IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 EUROPE NON-WOVEN IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 EUROPE AGRICULTURE NETS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 27 EUROPE OFFLINE IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 EUROPE ONLINE IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 29 EUROPE AGRICULTURE NETS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND))

TABLE 30 EUROPE HORTICULTURE AND FLORICULTURE IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 EUROPE FARMING AREA IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 EUROPE AQUACULTURE IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 33 EUROPE ANIMAL HUSBANDRY IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 EUROPE AGRICULTURE NETS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 35 EUROPE INDUSTRIAL AGRICULTURE IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 36 EUROPE INDUSTRIAL AGRICULTURE IN AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 37 EUROPE SUSTAINABLE AGRICULTURE IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 38 EUROPE SUSTAINABLE AGRICULTURE IN AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 39 EUROPE AGRICULTURE NETS MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 40 EUROPE AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 41 EUROPE AGRICULTURE NETS MARKET, BY MATERIAL TYPE, 2020-2029 (USD THOUSAND)

TABLE 42 EUROPE AGRICULTURE NETS MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 43 EUROPE AGRICULTURE NETS MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 44 EUROPE AGRICULTURE NETS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 45 EUROPE AGRICULTURE NETS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 46 EUROPE AGRICULTURE NETS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 47 EUROPE INDUSTRIAL AGRICULTURE IN AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 48 EUROPE SUSTAINABLE AGRICULTURE IN AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 49 GERMANY AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 50 GERMANY AGRICULTURE NETS MARKET, BY MATERIAL TYPE, 2020-2029 (USD THOUSAND)

TABLE 51 GERMANY AGRICULTURE NETS MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 52 GERMANY AGRICULTURE NETS MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 53 GERMANY AGRICULTURE NETS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 54 GERMANY AGRICULTURE NETS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 55 GERMANY AGRICULTURE NETS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 56 GERMANY INDUSTRIAL AGRICULTURE IN AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 GERMANY SUSTAINABLE AGRICULTURE IN AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 58 U.K. AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 59 U.K. AGRICULTURE NETS MARKET, BY MATERIAL TYPE, 2020-2029 (USD THOUSAND)

TABLE 60 U.K. AGRICULTURE NETS MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 61 U.K. AGRICULTURE NETS MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 62 U.K. AGRICULTURE NETS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 63 U.K. AGRICULTURE NETS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 64 U.K. AGRICULTURE NETS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 65 U.K. INDUSTRIAL AGRICULTURE IN AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 66 U.K. SUSTAINABLE AGRICULTURE IN AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 67 SPAIN AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 68 SPAIN AGRICULTURE NETS MARKET, BY MATERIAL TYPE, 2020-2029 (USD THOUSAND)

TABLE 69 SPAIN AGRICULTURE NETS MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 70 SPAIN AGRICULTURE NETS MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 71 SPAIN AGRICULTURE NETS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 72 SPAIN AGRICULTURE NETS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 73 SPAIN AGRICULTURE NETS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 74 SPAIN INDUSTRIAL AGRICULTURE IN AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 75 SPAIN SUSTAINABLE AGRICULTURE IN AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 76 NETHERLANDS AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 77 NETHERLANDS AGRICULTURE NETS MARKET, BY MATERIAL TYPE, 2020-2029 (USD THOUSAND)

TABLE 78 NETHERLANDS AGRICULTURE NETS MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 79 NETHERLANDS AGRICULTURE NETS MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 80 NETHERLANDS AGRICULTURE NETS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 81 NETHERLANDS AGRICULTURE NETS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 82 NETHERLANDS AGRICULTURE NETS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 83 NETHERLANDS INDUSTRIAL AGRICULTURE IN AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 84 NETHERLANDS SUSTAINABLE AGRICULTURE IN AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 85 FRANCE AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 86 FRANCE AGRICULTURE NETS MARKET, BY MATERIAL TYPE, 2020-2029 (USD THOUSAND)

TABLE 87 FRANCE AGRICULTURE NETS MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 88 FRANCE AGRICULTURE NETS MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 89 FRANCE AGRICULTURE NETS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 90 FRANCE AGRICULTURE NETS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 91 FRANCE AGRICULTURE NETS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 92 FRANCE INDUSTRIAL AGRICULTURE IN AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 93 FRANCE SUSTAINABLE AGRICULTURE IN AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 94 ITALY AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 95 ITALY AGRICULTURE NETS MARKET, BY MATERIAL TYPE, 2020-2029 (USD THOUSAND)

TABLE 96 ITALY AGRICULTURE NETS MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 97 ITALY AGRICULTURE NETS MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 98 ITALY AGRICULTURE NETS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 99 ITALY AGRICULTURE NETS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 100 ITALY AGRICULTURE NETS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 101 ITALY INDUSTRIAL AGRICULTURE IN AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 102 ITALY SUSTAINABLE AGRICULTURE IN AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 103 TURKEY AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 104 TURKEY AGRICULTURE NETS MARKET, BY MATERIAL TYPE, 2020-2029 (USD THOUSAND)

TABLE 105 TURKEY AGRICULTURE NETS MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 106 TURKEY AGRICULTURE NETS MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 107 TURKEY AGRICULTURE NETS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 108 TURKEY AGRICULTURE NETS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 109 TURKEY AGRICULTURE NETS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 110 TURKEY INDUSTRIAL AGRICULTURE IN AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 111 TURKEY SUSTAINABLE AGRICULTURE IN AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 112 LUXEMBOURG AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 113 LUXEMBOURG AGRICULTURE NETS MARKET, BY MATERIAL TYPE, 2020-2029 (USD THOUSAND)

TABLE 114 LUXEMBOURG AGRICULTURE NETS MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 115 LUXEMBOURG AGRICULTURE NETS MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 116 LUXEMBOURG AGRICULTURE NETS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 117 LUXEMBOURG AGRICULTURE NETS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 118 LUXEMBOURG AGRICULTURE NETS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 119 LUXEMBOURG INDUSTRIAL AGRICULTURE IN AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 120 LUXEMBOURG SUSTAINABLE AGRICULTURE IN AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 121 BELGIUM AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 122 BELGIUM AGRICULTURE NETS MARKET, BY MATERIAL TYPE, 2020-2029 (USD THOUSAND)

TABLE 123 BELGIUM AGRICULTURE NETS MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 124 BELGIUM AGRICULTURE NETS MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 125 BELGIUM AGRICULTURE NETS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 126 BELGIUM AGRICULTURE NETS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 127 BELGIUM AGRICULTURE NETS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 128 BELGIUM INDUSTRIAL AGRICULTURE IN AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 129 BELGIUM SUSTAINABLE AGRICULTURE IN AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 130 RUSSIA AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 131 RUSSIA AGRICULTURE NETS MARKET, BY MATERIAL TYPE, 2020-2029 (USD THOUSAND)

TABLE 132 RUSSIA AGRICULTURE NETS MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 133 RUSSIA AGRICULTURE NETS MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 134 RUSSIA AGRICULTURE NETS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 135 RUSSIA AGRICULTURE NETS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 136 RUSSIA AGRICULTURE NETS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 137 RUSSIA INDUSTRIAL AGRICULTURE IN AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 138 RUSSIA SUSTAINABLE AGRICULTURE IN AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 139 SWITZERLAND AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 140 SWITZERLAND AGRICULTURE NETS MARKET, BY MATERIAL TYPE, 2020-2029 (USD THOUSAND)

TABLE 141 SWITZERLAND AGRICULTURE NETS MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 142 SWITZERLAND AGRICULTURE NETS MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 143 SWITZERLAND AGRICULTURE NETS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 144 SWITZERLAND AGRICULTURE NETS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 145 SWITZERLAND AGRICULTURE NETS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 146 SWITZERLAND INDUSTRIAL AGRICULTURE IN AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 147 SWITZERLAND SUSTAINABLE AGRICULTURE IN AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 148 REST OF EUROPE AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

Liste des figures

FIGURE 1 EUROPE AGRICULTURE NETS MARKET: SEGMENTATION

FIGURE 2 EUROPE AGRICULTURE NETS MARKET : DATA TRIANGULATION

FIGURE 3 EUROPE AGRICULTURE NETS MARKET: DROC ANALYSIS

FIGURE 4 EUROPE AGRICULTURE NETS MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE AGRICULTURE NETS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE AGRICULTURE NETS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE AGRICULTURE NETS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE AGRICULTURE NETS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE AGRICULTURE NETS MARKET: MARKET END-USER COVERAGE GRID

FIGURE 10 EUROPE AGRICULTURE NETS MARKET: SEGMENTATION

FIGURE 11 GROWING INITIATIVES FOR FOOD SECURITY ACROSS THE GLOBE IS EXPECTED TO DRIVE THE EUROPE AGRICULTURE NETS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SHADING NETS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE AGRICULTURE NETS MARKET IN 2022 TO 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF EUROPE AGRICULTURE NETS MARKET

FIGURE 14 EUROPE AGRICULTURE NETS MARKET : BY PRODUCT TYPE, 2021

FIGURE 15 EUROPE AGRICULTURE NETS MARKET : BY MATERIAL TYPE, 2021

FIGURE 16 EUROPE AGRICULTURE NETS MARKET : BY PRICE RANGE, 2021

FIGURE 17 EUROPE AGRICULTURE NETS MARKET: BY FORM, 2021

FIGURE 18 EUROPE AGRICULTURE NETS MARKET : BY DISTRIBUTION CHANNEL, 2021

FIGURE 19 EUROPE AGRICULTURE NETS MARKET : BY APPLICATION, 2021

FIGURE 20 EUROPE AGRICULTURE NETS MARKET : BY END USE, 2021

FIGURE 21 EUROPE AGRICULTURE NETS MARKET: SNAPSHOT (2021)

FIGURE 22 EUROPE AGRICULTURE NETS MARKET: BY COUNTRY (2021)

FIGURE 23 EUROPE AGRICULTURE NETS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 24 EUROPE AGRICULTURE NETS MARKET : BY COUNTRY (2021 & 2029)

FIGURE 25 EUROPE AGRICULTURE NETS MARKET : BY PRODUCT TYPE (2022-2029)

FIGURE 26 EUROPE AGRICULTURE NETS MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.