Europe Active Medical Implantable Devices Market

Taille du marché en milliards USD

TCAC :

%

USD

6.82 Billion

USD

13.79 Billion

2025

2033

USD

6.82 Billion

USD

13.79 Billion

2025

2033

| 2026 –2033 | |

| USD 6.82 Billion | |

| USD 13.79 Billion | |

|

|

|

|

Marché européen des dispositifs médicaux implantables actifs, par produit (dispositifs de thérapie de resynchronisation cardiaque (CRT-D), défibrillateurs cardioverteurs implantables, stimulateurs cardiaques implantables, implants oculaires, neurostimulateurs, dispositifs auditifs implantables actifs, dispositifs d'assistance ventriculaire, moniteurs cardiaques implantables/enregistreurs de boucle insérables, curiethérapie, moniteurs de glycémie implantables, implants de pied tombant, implants d'épaule, pompes à perfusion implantables et accessoires implantables), type de chirurgie (méthodes chirurgicales traditionnelles et chirurgie mini-invasive), procédure (neurovasculaire, cardiovasculaire, auditive et autres), utilisateur final (hôpitaux, cliniques spécialisées, centres de chirurgie ambulatoire, cliniques), pays ( Allemagne, Royaume-Uni, France, Italie, Espagne, Pays-Bas, Russie, Suisse, reste de l'Europe) Tendances et prévisions de l'industrie jusqu'en 2028

Analyse et perspectives du marché : Marché européen actif des dispositifs médicaux implantables

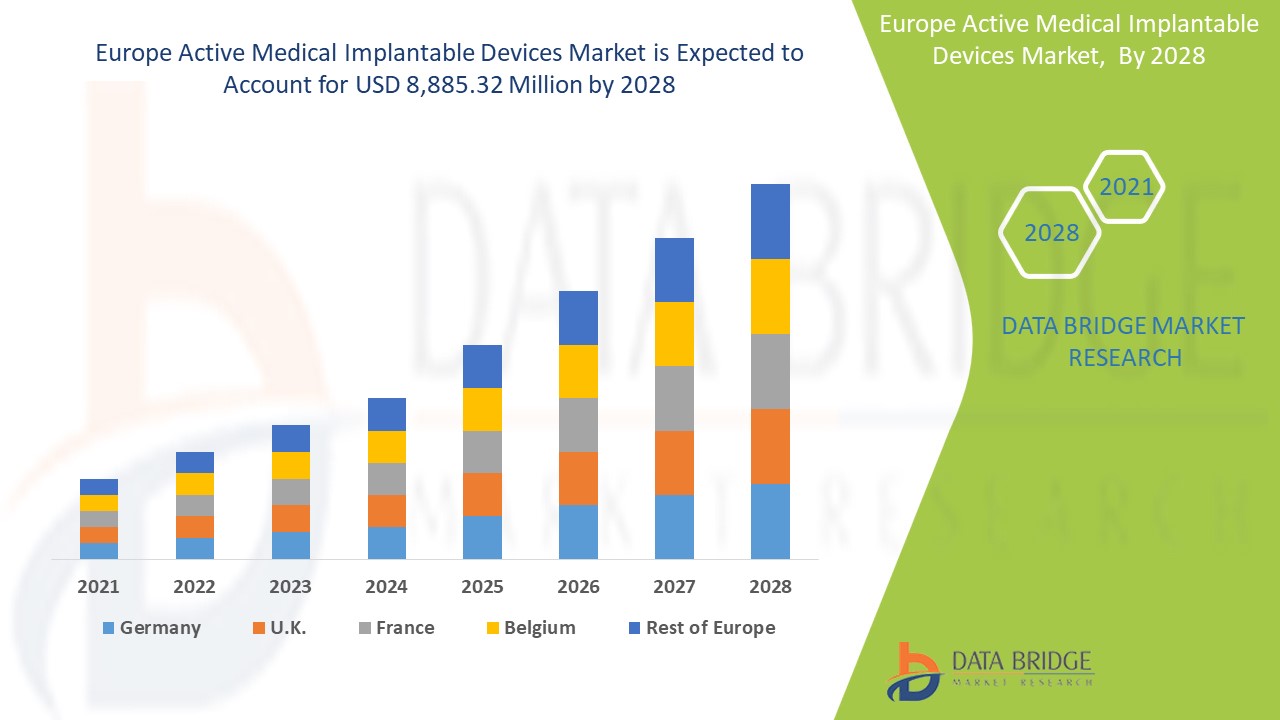

Le marché européen des dispositifs médicaux implantables actifs devrait connaître une croissance significative au cours de la période de prévision de 2021 à 2028. Data Bridge Market Research analyse que le marché croît avec un TCAC de 9,2 % au cours de la période de prévision de 2021 à 2028 et devrait atteindre 8 885,32 millions USD d'ici 2028. L'augmentation du développement de produits et la demande croissante de traitements sont les principaux moteurs, stimulant la croissance du marché au cours de la période de prévision. L'essor des infrastructures de santé et des activités de R&D constitue une opportunité majeure pour le marché. Cependant, le manque de professionnels qualifiés constitue un défi à la croissance du marché.

Les dispositifs médicaux implantables actifs sont ceux qui sont insérés dans le corps humain et nécessitent une source d'énergie et d'alimentation externe pour y rester pendant la procédure et le traitement qui suivent. Ces dispositifs sont utilisés pour diverses applications telles que les prothèses auditives, neurologiques et cardiovasculaires.

Le marché européen des dispositifs médicaux implantables devrait croître avec l'augmentation des maladies cardiovasculaires et des dépenses de santé, ce qui entraînera une augmentation de la demande de traitements et de produits par les fabricants sur le marché et une augmentation des investissements dans la recherche et le développement. Cependant, les limitations liées au manque de professionnels et de travailleurs qualifiés devraient freiner la croissance du marché au cours de la période de prévision.

Le rapport sur le marché des dispositifs médicaux implantables actifs fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché , d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste, notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

Portée et taille du marché des dispositifs médicaux implantables actifs en Europe

Le marché des dispositifs médicaux implantables actifs est segmenté en fonction du produit, du type de chirurgie, de la procédure et des utilisateurs finaux. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

- Sur la base du produit, le marché européen des dispositifs médicaux implantables actifs est segmenté en dispositifs de thérapie de resynchronisation cardiaque (CRT-D), défibrillateurs automatiques implantables, stimulateurs cardiaques implantables, implants oculaires, neurostimulateurs, dispositifs auditifs implantables actifs, dispositifs d'assistance ventriculaire, moniteurs cardiaques implantables/enregistreurs de boucle insérables, curiethérapie, glucomètres implantables, implants pour pied tombant, implants d'épaule, pompes à perfusion implantables et accessoires implantables. En 2021, le segment des dispositifs de thérapie de resynchronisation cardiaque (CRT-D) devrait dominer le marché avec l'augmentation de la prévalence des maladies cardiovasculaires dans la région.

- En fonction du type de chirurgie, le marché européen des dispositifs médicaux implantables actifs est segmenté en méthodes chirurgicales traditionnelles et en chirurgie mini-invasive . En 2021, le segment des méthodes chirurgicales traditionnelles devrait dominer le marché car il présente un coût et des frais de traitement raisonnables.

- Sur la base des procédures, le marché européen des dispositifs médicaux implantables actifs est segmenté en neurovasculaire, cardiovasculaire, auditif et autres. En 2021, le segment cardiovasculaire devrait dominer le marché avec l'augmentation des maladies cardiovasculaires.

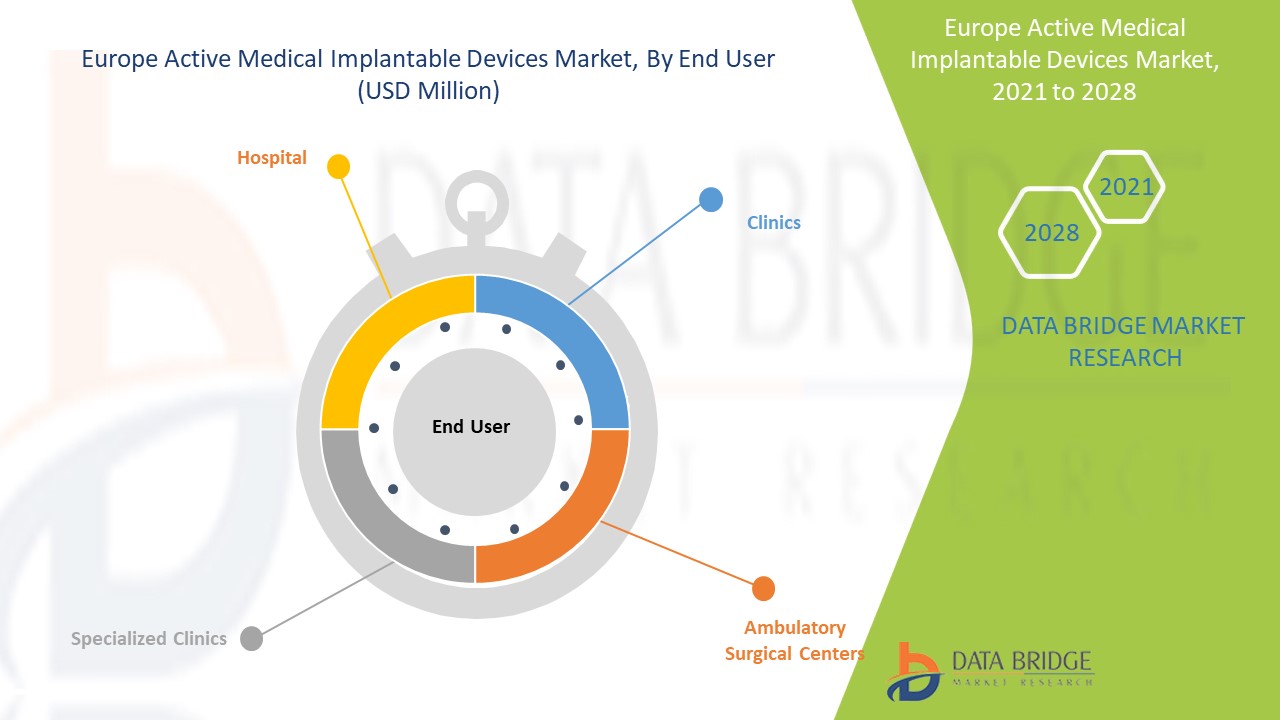

- Sur la base des utilisateurs finaux, le marché européen des dispositifs médicaux implantables actifs est segmenté en hôpitaux, cliniques spécialisées, centres de chirurgie ambulatoire et cliniques. En 2021, le segment hospitalier devrait dominer le marché avec l'augmentation de la demande de produits implantables.

Analyse du marché des dispositifs médicaux implantables actifs au niveau des pays

Le marché des dispositifs médicaux implantables actifs est analysé et des informations sur la taille du marché sont fournies sur la base du produit, du type de chirurgie, de la procédure et des utilisateurs finaux.

Les pays couverts dans le rapport sur le marché européen des dispositifs médicaux implantables actifs sont l'Allemagne, le Royaume-Uni, la France, l'Italie, l'Espagne, la Belgique, la Turquie, les Pays-Bas, la Russie, la Suisse et le reste de l'Europe.

Le segment des dispositifs médicaux implantables actifs dans la région Europe devrait connaître le taux de croissance le plus élevé au cours de la période de prévision de 2021 à 2028 en raison de la demande croissante de dispositifs médicaux implantables actifs. L'Allemagne est en tête de la croissance du marché européen des dispositifs médicaux implantables actifs et le segment hospitalier domine dans ce pays en raison de la croissance de la R&D dans le secteur de la santé.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques européennes et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

L'augmentation des dépenses de santé stimule la croissance des dispositifs médicaux implantables actifs

Le marché des dispositifs médicaux implantables actifs vous fournit également une analyse détaillée du marché pour chaque pays, avec la croissance du secteur des dispositifs médicaux implantables actifs, les ventes de médicaments pour les dispositifs médicaux implantables actifs, l'impact des progrès de la technologie des dispositifs médicaux implantables actifs et les changements dans les scénarios réglementaires avec leur soutien au marché. Les données sont disponibles pour la période historique de 2010 à 2018.

Analyse du paysage concurrentiel et des parts de marché des dispositifs médicaux implantables actifs

Le paysage concurrentiel du marché des dispositifs médicaux implantables actifs fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications et la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise liée au marché des dispositifs médicaux implantables actifs.

Les principales entreprises présentes sur le marché européen des dispositifs médicaux implantables actifs sont NeuroPace, Inc., Axonics, Inc., Stimwave LLC, NEVRO CORP, Second Sight, BIOTRONIK, ABIOMED, Boston Scientific Corporation, Medtronic, Abbott, Eckert & Ziegler., Sonova, Zhejiang Nurotron Biotechnology Co., Ltd, Demant A/S, Cochlear Ltd, Microson, Oticon Medical, Nano Retina, GluSense, MED-EL Medical Electronics, entre autres.

Plusieurs lancements de produits et accords sont également initiés par les entreprises du monde entier, ce qui accélère également la croissance du marché des dispositifs médicaux implantables actifs.

Par exemple,

- En décembre 2020, Abbott a reçu l’approbation de Santé Canada pour son produit FreeStyle Libre 2 destiné aux adultes et aux enfants diabétiques, qui mesure les données de glucose toutes les minutes avec des alarmes en temps réel personnalisables et optionnelles. Cela aidera l’entreprise à diversifier son marché et à croître dans les années à venir.

- En janvier 2021, Boston Scientific a annoncé avoir reçu l'approbation de la FDA pour le système de stimulation cérébrale profonde Vercise. Le portefeuille comprend un générateur d'impulsions implantable conçu pour fournir un soulagement optimal des symptômes. Cela aidera l'entreprise à développer ses activités dans les années à venir

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.