Europe Abrasive Market

Taille du marché en milliards USD

TCAC :

%

USD

8.51 Billion

USD

13.06 Billion

2025

2033

USD

8.51 Billion

USD

13.06 Billion

2025

2033

| 2026 –2033 | |

| USD 8.51 Billion | |

| USD 13.06 Billion | |

|

|

|

|

Segmentation du marché européen des abrasifs, par matières premières (naturelles et synthétiques), type (abrasifs appliqués, abrasifs agglomérés, superabrasifs et autres), produit (disques, meules, cylindres et autres), forme (blocs et poudres), application (rectification, découpe, polissage, perçage, finition et autres), utilisateur final (automobile, machines, aérospatiale et défense, métallurgie, bâtiment et construction, dispositifs médicaux, pétrole et gaz, électricité et électronique et autres) - Tendances et prévisions du secteur jusqu'en 2033

Taille du marché européen des abrasifs

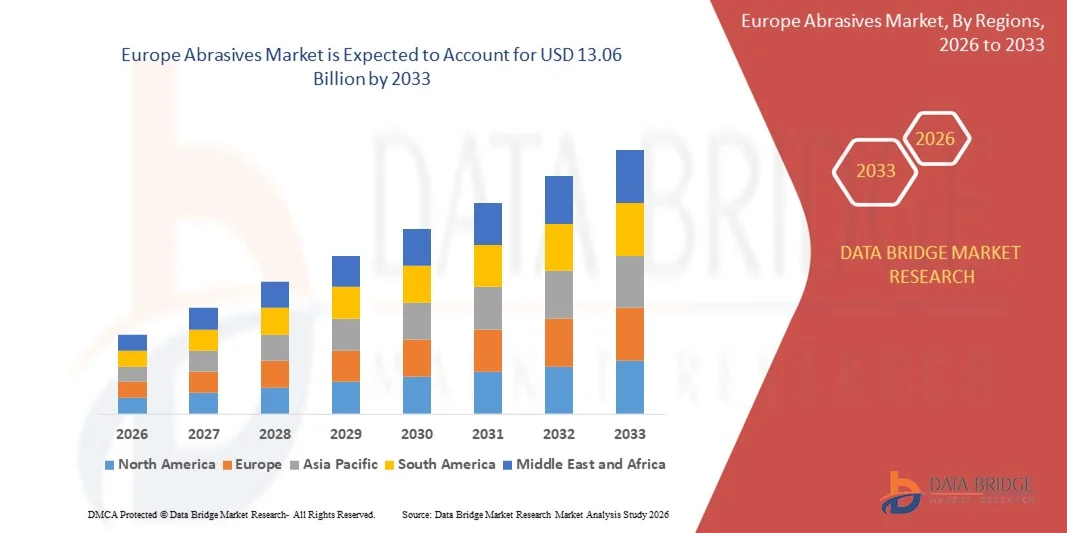

- Le marché européen des abrasifs était évalué à 8,51 milliards de dollars en 2025 et devrait atteindre 13,06 milliards de dollars d'ici 2033 , avec un TCAC de 5,50 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la demande croissante de secteurs tels que l'automobile, la métallurgie, la mécanique, la construction et l'électronique.

- Les progrès technologiques réalisés dans le domaine des matériaux abrasifs, tels que les superabrasifs et les abrasifs appliqués, contribuent à une efficacité et une productivité accrues.

Analyse du marché européen des abrasifs

- Le marché connaît une forte dynamique, portée par une industrialisation rapide, l'expansion des capacités de production et l'adoption croissante des technologies de finition de surface et d'usinage de précision avancées.

- L'augmentation des investissements dans le développement des infrastructures et les activités de construction stimule la demande d'abrasifs dans diverses applications.

- L'Allemagne a dominé le marché européen des abrasifs en 2025 grâce à son expertise de pointe en ingénierie et à la forte présence de ses industries automobile, mécanique et métallurgique. L'importance accordée par le pays à la fabrication de précision et à l'usinage de haute performance favorise l'adoption généralisée des abrasifs appliqués et agglomérés.

- Le Royaume-Uni devrait enregistrer le taux de croissance annuel composé (TCAC) le plus élevé du marché européen des abrasifs, en raison de l'adoption croissante de solutions d'usinage avancées, de la demande grandissante d'outils de finition de surface haute performance et de l'expansion des applications dans les secteurs de l'aérospatiale, de l'automobile et de la fabrication industrielle.

- Le segment des abrasifs synthétiques a représenté la plus grande part de marché en termes de revenus en 2025, grâce à leur durabilité supérieure, leur structure granulaire uniforme et leurs performances constantes dans les applications industrielles exigeantes. Les abrasifs synthétiques sont largement privilégiés dans les environnements d'usinage modernes en raison de leur efficacité de coupe supérieure et de leur adéquation aux procédés de précision.

Portée du rapport et segmentation du marché européen des abrasifs

|

Attributs |

Aperçu du marché européen des abrasifs |

|

Segments couverts |

|

|

Pays couverts |

Europe

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Tendances du marché européen des abrasifs

Évolution vers des solutions abrasives de précision et de haute performance

- La demande croissante de finitions de précision dans des secteurs tels que l'automobile, l'aérospatiale et l'industrie manufacturière en général accélère l'adoption de produits abrasifs de pointe. Les abrasifs haute performance permettent un enlèvement de matière supérieur, des tolérances plus serrées et une meilleure qualité de surface, ce qui les rend indispensables aux processus de production modernes. Cette évolution est également motivée par le besoin d'outils extrêmement fiables, capables de garantir une constance dans les opérations complexes et à grande échelle.

- L'utilisation croissante de machines de meulage et de polissage automatisées engendre un besoin accru en abrasifs techniques offrant homogénéité, durabilité et efficacité opérationnelle. Ces solutions contribuent à réduire les temps d'arrêt et à maintenir la qualité de la production dans les environnements hautement automatisés, garantissant ainsi des interruptions de processus minimales. Elles améliorent également les performances des systèmes robotisés et CNC modernes qui exigent un comportement uniforme des abrasifs.

- La préférence croissante pour les abrasifs appliqués et les superabrasifs redéfinit les processus de fabrication, notamment pour les tâches exigeant une faible génération de chaleur et des dommages de surface minimaux. Leur durée de vie prolongée et leur efficacité de coupe accrue les rendent adaptés aux applications de haute précision nécessitant un rendement stable sur des cycles longs. Ces propriétés permettent aux fabricants de réduire la fréquence de changement d'outils et d'améliorer la productivité.

- Par exemple, en 2023, plusieurs usines ont constaté une amélioration de leur rentabilité et une précision d'usinage accrue après l'adoption de bandes abrasives à revêtement céramique pour la finition de pièces de précision. Ces bandes ont permis d'obtenir une meilleure durabilité et une finition plus uniforme sur de longs cycles de production, réduisant ainsi les taux de retouche. Leur résistance accrue à l'usure a également minimisé les retards de production et les coûts de remplacement d'outillage.

- Si les abrasifs haute performance transforment la production, les progrès durables reposent sur l'innovation produit continue, la formation des opérateurs et l'optimisation des coûts. Les fabricants doivent privilégier les solutions adaptées aux applications spécifiques afin de répondre aux besoins changeants de l'industrie et d'assurer une adéquation optimale aux divers environnements d'usinage. La collaboration entre les producteurs d'abrasifs et les utilisateurs finaux est de plus en plus importante pour développer des solutions sur mesure.

Dynamique du marché européen des abrasifs

Conducteur

Industrialisation croissante et expansion des activités manufacturières

- L'expansion des activités de fabrication, de métallurgie et de construction accroît la demande en abrasifs utilisés pour les opérations de meulage, de découpe, de polissage et de finition. Avec l'augmentation de la production, les outils abrasifs deviennent indispensables pour améliorer l'efficacité et maintenir la qualité des produits, et ce, pour divers matériaux. Cette tendance est également soutenue par l'adoption croissante de techniques d'usinage avancées.

- Les industries reconnaissent de plus en plus les avantages des abrasifs de pointe pour réduire les temps d'usinage, prolonger la durée de vie des équipements et garantir des finitions homogènes. Cette prise de conscience favorise leur adoption par les petites, moyennes et grandes unités de production en quête d'une efficacité opérationnelle accrue. La fiabilité des abrasifs haut de gamme réduit également les risques de variations de production.

- Le développement industriel, les améliorations technologiques et les investissements dans les procédés de fabrication modernes contribuent à accroître le besoin en produits abrasifs fiables. L'utilisation croissante des machines à commande numérique et des outils d'usinage de précision renforce la demande d'abrasifs capables de supporter des opérations à grande vitesse. L'intégration des systèmes de fabrication numérique contribue également à une utilisation plus précise des abrasifs.

- Par exemple, en 2022, plusieurs usines de fabrication ont constaté une amélioration de leur productivité après l'intégration d'abrasifs agglomérés et enduits haute performance dans leurs processus d'usinage, ce qui a permis d'accroître le rendement sans modifications majeures des équipements. Ces améliorations ont contribué à rationaliser les opérations et à réduire les coûts d'usinage totaux. Les usines ont également observé une meilleure performance des outils et des besoins de maintenance réduits.

- Bien que la croissance industrielle soutienne le marché, le maintien de normes de qualité constantes, un soutien technique et une plus grande disponibilité d'abrasifs de pointe demeurent essentiels à une adoption durable. Les fabricants doivent également répondre aux attentes croissantes en matière d'efficacité opérationnelle et de durabilité. Garantir la fiabilité des produits est primordial pour instaurer la confiance des utilisateurs finaux.

Retenue/Défi

Fluctuations des prix des matières premières et coûts de mise en conformité environnementale

- Les fabricants d'abrasifs sont confrontés à des difficultés liées aux fluctuations des prix des matières premières telles que l'oxyde d'aluminium, le carbure de silicium, l'alumine de zirconium et les diamants synthétiques. Ces variations influent sur les coûts de production globaux et, par conséquent, sur le prix des produits pour les utilisateurs finaux, notamment dans les secteurs sensibles aux coûts. La gestion de ces fluctuations exige un approvisionnement stratégique et une planification de la production efficace.

- Le respect des réglementations strictes en matière d'environnement, de sécurité au travail et de gestion des déchets accroît les coûts d'exploitation des fabricants d'abrasifs. Les petits producteurs peinent souvent à se conformer à ces normes, ce qui limite leur compétitivité et leur capacité à développer leurs activités. Ces exigences incitent également les entreprises à adopter des technologies de production plus propres et plus durables.

- Les irrégularités de la chaîne d'approvisionnement et l'accès variable aux matières premières essentielles contribuent aux retards de production, affectant la disponibilité et la fiabilité des produits. Ces perturbations peuvent freiner la pénétration du marché, notamment pour les produits abrasifs spécialisés qui exigent une qualité de matériau constante. Garantir la stabilité des matières premières devient donc un enjeu crucial pour les fabricants.

- Par exemple, en 2023, plusieurs fabricants d'abrasifs ont signalé une augmentation de leurs coûts de production due à la hausse des coûts de l'énergie et au durcissement des exigences de conformité, ce qui a affecté l'accessibilité financière des solutions abrasives haut de gamme. Ces coûts accrus ont également influencé les délais de développement des produits et les stratégies de prix. De nombreuses entreprises se sont inquiétées de la viabilité à long terme de ces coûts.

- Malgré la persistance des défis liés aux coûts et à la réglementation, l'amélioration de la résilience de la chaîne d'approvisionnement, la promotion de pratiques de production durables et l'optimisation de l'utilisation des matières premières sont essentielles pour libérer le potentiel de croissance à long terme. Les entreprises doivent également investir dans l'innovation afin de développer des alternatives rentables sans compromettre la performance. Une planification stratégique sera indispensable pour rester compétitives dans un environnement de marché difficile.

Étendue du marché européen des abrasifs

Le marché est segmenté en fonction des matières premières, du type, du produit, de la forme, de l'application et de l'utilisateur final.

- Par matières premières

Le marché européen des abrasifs est segmenté, selon la matière première utilisée, en abrasifs naturels et synthétiques. En 2025, le segment des abrasifs synthétiques détenait la plus grande part de marché, grâce à leur durabilité supérieure, leur structure granulaire uniforme et leurs performances constantes dans les applications industrielles exigeantes. Les abrasifs synthétiques sont largement privilégiés dans les environnements d'usinage modernes en raison de leur efficacité de coupe supérieure et de leur adéquation aux procédés de précision.

Le segment des abrasifs naturels devrait connaître une croissance soutenue entre 2026 et 2033, portée par l'utilisation croissante de matériaux abrasifs écologiques et économiques pour les travaux de finition légers à moyens. Les abrasifs naturels gagnent en popularité auprès des industries en quête d'alternatives durables offrant des performances adéquates pour les applications non critiques.

- Par type

Le marché européen des abrasifs est segmenté, selon leur type, en abrasifs appliqués, abrasifs agglomérés, superabrasifs et autres. En 2025, le segment des abrasifs agglomérés détenait la plus grande part de marché en termes de chiffre d'affaires, grâce à son utilisation intensive pour le meulage, la découpe et l'enlèvement de matière important dans les opérations de fabrication et de travail des métaux. Sa robustesse et sa longue durée de vie en font un choix privilégié pour les applications à fortes contraintes.

Le segment des superabrasifs devrait connaître la croissance la plus rapide entre 2026 et 2033, porté par la demande croissante d'usinage de précision dans des secteurs tels que l'aérospatiale, l'automobile et l'électronique. Les superabrasifs comme le diamant et le CBN offrent une dureté, une stabilité thermique et une précision supérieures, ce qui les rend idéaux pour les procédés exigeant une grande précision.

- Sous-produit

Le marché européen des abrasifs est segmenté selon le type de produit : disques, godets, cylindres et autres. En 2025, le segment des disques dominait le marché grâce à leur utilisation répandue dans la métallurgie, le travail du bois et la préparation des surfaces. Les abrasifs à disque offrent polyvalence, facilité d’installation et compatibilité avec divers outils portatifs et automatisés.

Le segment des cylindres devrait connaître la croissance la plus rapide entre 2026 et 2033, grâce à son adoption croissante dans les applications exigeant un enlèvement de matière uniforme et une finition de surface interne. Leur forme cylindrique assure un contrôle et une stabilité supérieurs, les rendant particulièrement adaptés aux opérations industrielles de rectification et d'ébavurage.

- Par formulaire

Selon leur forme, le marché européen des abrasifs se divise en deux segments : les blocs et les poudres. En 2025, le segment des blocs représentait la plus grande part de chiffre d’affaires, grâce à une forte demande pour le polissage, l’affûtage et les finitions manuelles. Les abrasifs en blocs sont appréciés pour leur durabilité, leur facilité d’utilisation et leur adéquation aux environnements industriels et d’atelier.

Le segment des poudres abrasives devrait connaître une croissance substantielle entre 2026 et 2033, portée par leur utilisation croissante dans les procédés de rodage, de microfinition et de polissage de précision. Les abrasifs en poudre offrent un contrôle exceptionnel de la granulométrie, permettant ainsi d'obtenir les finitions de haute qualité requises dans les secteurs de l'électronique, de l'optique et de la fabrication de pointe.

- Sur demande

Selon l'application, le marché européen des abrasifs se segmente en meulage, découpe, polissage, perçage, finition et autres. Le segment du meulage détenait la plus grande part de chiffre d'affaires en 2025, grâce à son rôle central dans la mise en forme des matériaux, la préparation des surfaces et l'enlèvement de matière important dans les industries manufacturières. Les abrasifs de meulage sont indispensables pour obtenir une précision dimensionnelle et des surfaces lisses.

Le segment du polissage devrait connaître une forte croissance entre 2026 et 2033, portée par la demande croissante de finitions de surface de haute qualité dans les secteurs de l'automobile, de l'électronique et des biens de consommation. Les abrasifs de polissage améliorent l'esthétique et les performances fonctionnelles, ce qui les rend essentiels dans les processus de fabrication en phase finale.

- Par l'utilisateur final

Selon l'utilisateur final, le marché européen des abrasifs se segmente en automobile, machines, aérospatiale et défense, métallurgie, bâtiment et construction, dispositifs médicaux, pétrole et gaz, électronique et électricité, et autres. Le segment de la métallurgie a généré la plus grande part de revenus en 2025, grâce à l'utilisation intensive des abrasifs pour le soudage, la découpe, le meulage et la préparation des surfaces. Les abrasifs jouent un rôle essentiel dans l'amélioration de l'efficacité de la production et le maintien de la qualité des structures.

Le secteur automobile devrait connaître une croissance significative entre 2026 et 2033, portée par la demande croissante de composants de précision, de matériaux légers et de finitions de haute qualité dans la fabrication des véhicules. Les abrasifs de pointe permettent un usinage de haute précision, une préparation optimale de la peinture et une correction de surface irréprochable, ce qui les rend indispensables à la production automobile.

Analyse régionale du marché européen des abrasifs

- L'Allemagne a dominé le marché européen des abrasifs en 2025 grâce à son expertise de pointe en ingénierie et à la forte présence de ses industries automobile, mécanique et métallurgique. L'importance accordée par le pays à la fabrication de précision et à l'usinage de haute performance favorise l'adoption généralisée des abrasifs appliqués et agglomérés.

- La demande en outils de meulage, de polissage et de coupe de haute qualité est alimentée par l'écosystème allemand de production automobile et de construction mécanique de renommée mondiale. Les utilisateurs industriels s'appuient de plus en plus sur des solutions abrasives durables et de haute précision pour soutenir des opérations de fabrication complexes.

- Les solides capacités de recherche et développement de l'Allemagne et son fort accent mis sur l'innovation technologique permettent le développement de matériaux abrasifs de pointe. La présence des principaux fabricants mondiaux d'abrasifs favorise l'innovation continue des produits et l'optimisation de leurs performances.

Analyse du marché britannique des abrasifs

Le marché britannique des abrasifs devrait connaître la croissance la plus rapide d'Europe entre 2026 et 2033, porté par l'augmentation des investissements dans l'aérospatiale, les dispositifs médicaux et l'usinage de précision. Les entreprises privilégient les solutions abrasives haute performance pour améliorer leur productivité et répondre aux exigences de finition de surface les plus pointues. Le développement des activités de rénovation et d'infrastructures stimule également l'utilisation des abrasifs appliqués et agglomérés. Par ailleurs, l'adoption croissante des technologies de fabrication modernes et des pratiques de production durables contribue significativement à l'expansion rapide du marché des abrasifs au Royaume-Uni.

Part de marché des abrasifs en Europe

L'industrie européenne des abrasifs est principalement dominée par des entreprises bien établies, parmi lesquelles :

• Saint-Gobain Abrasives / Norton (France)

• Tyrolit Schleifmittelwerke Swarovski (Autriche)

• Klingspor AG (Allemagne)

• Hermes Schleifmittel GmbH (Allemagne)

• VSM AG (Allemagne)

• Winoa (France)

• PFERD-Werkzeuge / August Rüggeberg GmbH & Co. KG (Allemagne)

• Imerys Fused Minerals (France)

• RHODIUS Abrasives (Allemagne)

• SAIT Abrasivi SpA (Italie)

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.