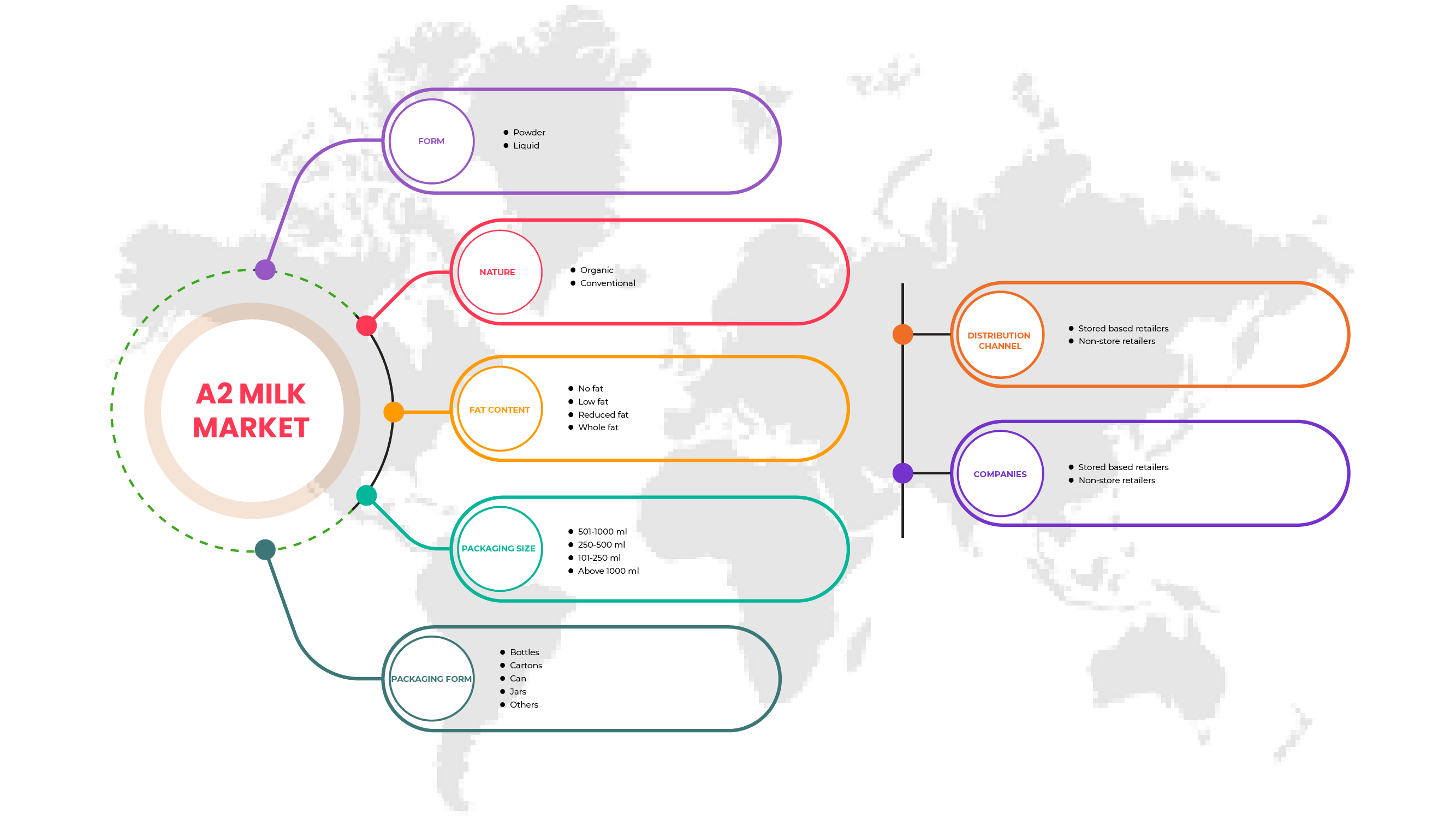

Marché du lait européen A2, par forme (poudre et liquide), nature (biologique et conventionnelle), teneur en matières grasses (sans matière grasse, faible en matière grasse, à teneur réduite en matières grasses et matière grasse entière), taille de l'emballage (101-250 ml/g, 250-500 ml/g, 501-1000 ml/g et plus de 1000 ml/g), forme de l'emballage (bouteilles, cartons, canettes, pots et autres), canal de distribution (détaillants en magasin et détaillants hors magasin) - Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et taille du marché du lait A2 en Europe

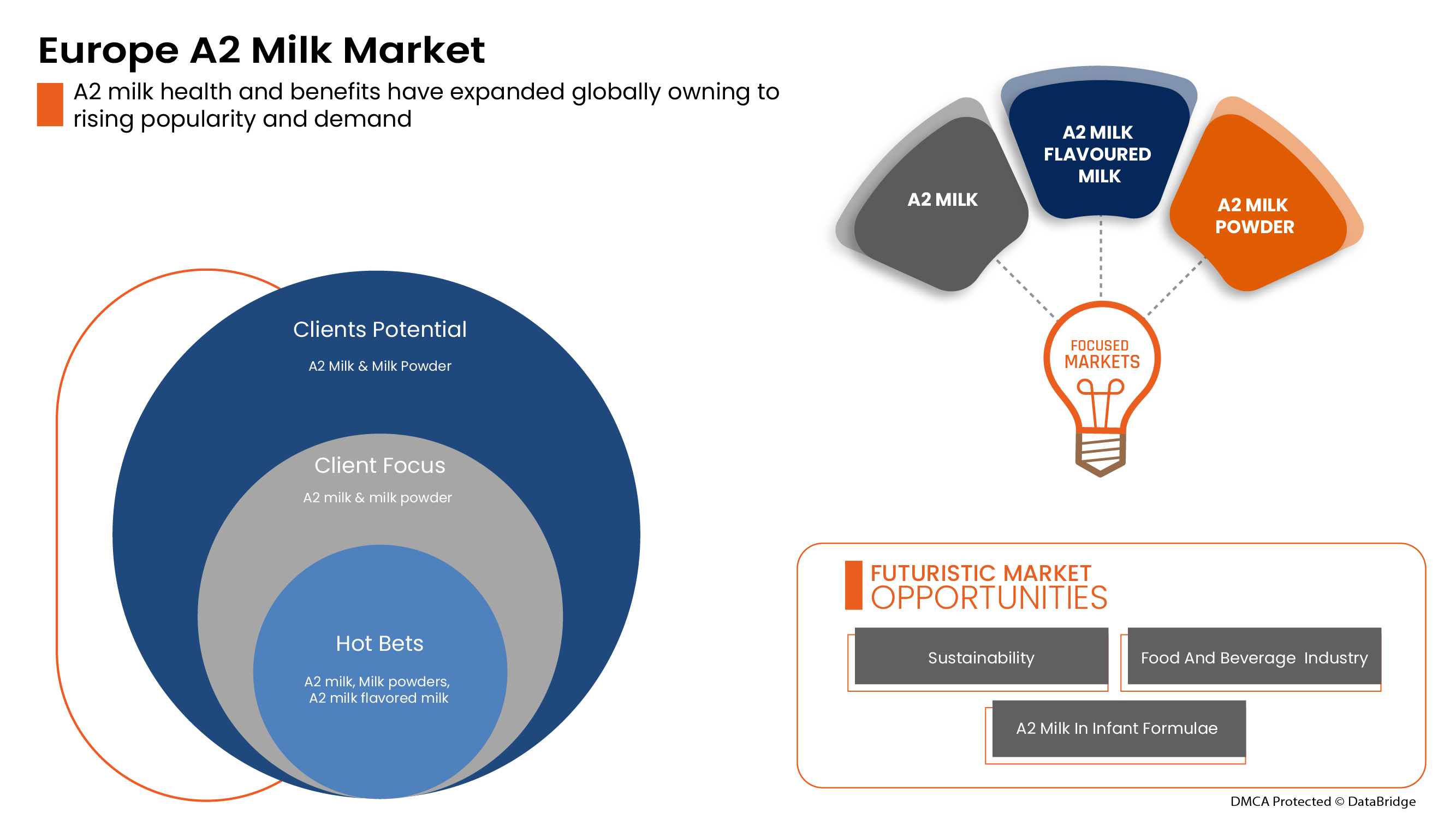

Le lait A2 favorise le développement de l'immunité, stimule le métabolisme et fournit des acides gras oméga 3. Les produits laitiers A2 connaissent une croissance significative en raison de la sensibilisation croissante des consommateurs à leur santé et à la teneur nutritionnelle plus élevée du lait A2 que du lait ordinaire. Il est disponible sous diverses formes et est facilement disponible sur le marché. Cependant, les prix élevés du lait A2 et de ses produits devraient freiner la croissance du marché du lait A2 au cours de la période de prévision.

La croissance du marché est notamment due à l'essor de la technologie du lait A2, à l'utilisation croissante du lait A2 dans les préparations pour nourrissons et à la sensibilisation croissante des consommateurs à la santé. Cependant, les limitations des prix élevés du lait A2 devraient freiner la croissance du marché.

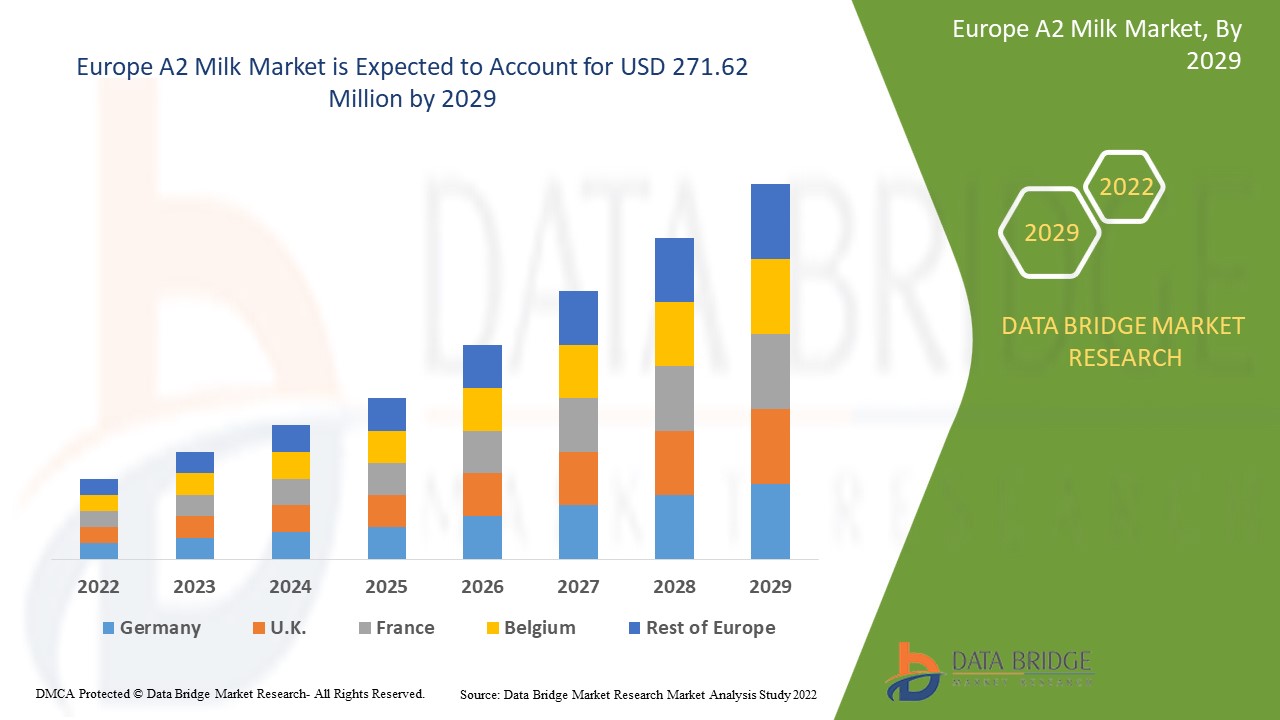

Data Bridge Market Research analyse que le marché du lait A2 devrait atteindre 271,62 millions USD d'ici 2029, à un TCAC de 17,2 % au cours de la période de prévision.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Année historique |

2020 (personnalisable pour 2019-2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Par forme (poudre et liquide), nature (biologique et conventionnelle), teneur en matières grasses (sans matières grasses, faible en matières grasses, à teneur réduite en matières grasses et matières grasses entières), taille de l'emballage (101-250 ml/g, 250-500 ml/g, 501-1000 ml/g et plus de 1000 ml/g), forme de l'emballage (bouteilles, cartons, canettes, pots et autres) et canal de distribution (détaillants en magasin et détaillants hors magasin) |

|

Pays couverts |

Allemagne, Royaume-Uni, Italie, France, Espagne, Suisse, Pays-Bas, Belgique, Russie, Turquie, Reste de l'Europe |

|

Acteurs du marché couverts |

Laiterie Taw River et Veco Zuivel BV |

Définition du marché

Le lait A2 est un type de lait de vache qui ne contient pas la forme A1 des protéines de caséine et contient principalement la forme A2. La protéine bêta-caséine A2 du lait A2 se décompose rapidement en acides aminés pour une digestion rapide, ce qui améliore notre santé globale et augmente la valeur nutritionnelle du lait de vache. Le lait de vache A2 contient des minéraux tels que le calcium, le potassium et le phosphore, qui sont nécessaires à la solidité des os et des dents, à une meilleure fonction musculaire, à la régulation de la pression artérielle, à la croissance des tissus et des cellules, à l'amélioration du bon cholestérol (HDL), ainsi qu'au maintien de la nutrition et du bien-être général du corps.

A2 Dynamique du marché du lait

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs :

- Sensibilisation accrue des consommateurs à la santé

La sensibilisation croissante des consommateurs à la santé, à l'alimentation et aux régimes alimentaires est le principal moteur du marché européen du lait A2. Au fil du temps, les consommateurs connaissent les avantages et les inconvénients des aliments qu'ils consomment quotidiennement. Le lait A2 est très nutritif et a un impact positif sur le corps d'une personne en raison de la présence de la protéine bêta-caséine A2. Cette protéine A2 prévient diverses maladies cardiaques, le diabète et l'autisme. Grâce à cela, les gens consomment du lait A2 et le préfèrent pour une consommation régulière. Ce changement de préférence et le développement de la sensibilisation à la santé devraient stimuler la croissance du marché mondial du lait A2.

La prise de conscience croissante des problèmes de santé et l'évolution des habitudes alimentaires des consommateurs finaux entraînent une demande accrue de lait A2. Cette demande croissante de lait A2 devrait stimuler le marché européen du lait A2.

- Diverses applications du lait a2 dans les préparations pour nourrissons

Le lait A2 est très utilisé dans les préparations pour nourrissons en raison de sa nature facile à digérer. La protéine A2 utilisée dans le procédé est similaire à celle trouvée dans le lait maternel et elle est naturellement facile à digérer dans l'estomac des enfants. Le lait A2 provient de vaches nourries avec un régime à base de plantes et n'ayant jamais reçu d'antibiotiques ni d'hormones de croissance synthétiques. Cette utilisation régulière du lait A2 dans les préparations pour nourrissons entraîne une augmentation de la demande de lait A2 dans le monde entier. Le lait A2 provenant de vaches est ensuite transformé pour fabriquer des préparations.

Ainsi, avec l'utilisation généralisée du lait A2 dans les préparations pour nourrissons à travers le monde, la demande de lait A2 augmente rapidement. Cette forte demande de lait A2 devrait stimuler le marché européen du lait A2.

Retenue

- Prix élevés du lait A2

Les prix élevés du lait A2 par rapport au lait ordinaire constituent un frein majeur à la croissance du marché. Le lait A2 et les produits laitiers ont une gamme de prix deux fois supérieure à celle du lait ordinaire sur le marché. La production de lait A2 est encore limitée car les races de vaches laitières A2 produisent moins de lait par jour et, de ce fait, les entreprises facturent des coûts élevés pour le lait A2 afin de générer des revenus plus élevés. Les utilisateurs finaux des produits laitiers A2 sont les hommes ordinaires et la présence de lait A2 sur le marché avec une gamme plus élevée n'est pas abordable pour beaucoup de gens. En raison des degrés plus élevés, les gens préfèrent le lait ordinaire au lait A2 et à ses produits. Ces prix élevés du lait constituent un facteur de restriction majeur de la croissance du marché.

Ainsi, les prix élevés du lait et des produits laitiers de catégorie A2 incitent les consommateurs à consommer du lait ordinaire, ce qui devrait à son tour freiner la croissance du marché européen du lait de catégorie A2.

Opportunité

- La tendance des consommateurs à une production durable de lait a2

La durabilité protège la santé et la capacité biologique de l'environnement. Le bien-être individuel et communautaire est favorisé par la durabilité. La durabilité favorise une meilleure économie avec moins de pollution et de déchets, moins d'émissions, plus d'emplois et une répartition équitable des richesses. Une approche durable de la production de lait A2 réduit l'impact environnemental de l'élevage laitier tout en augmentant le bien-être animal et l'approbation sociale du secteur laitier. Les consommateurs ayant des normes morales plus élevées sont plus susceptibles d'être intéressés par l'achat de produits laitiers à base de lait A2 qui utilisent des innovations durables. Les consommateurs biologiques réguliers ont une attitude plus favorable à l'égard des produits laitiers qui utilisent des innovations durables. En conséquence, de nombreuses entreprises à base de lait A2 se concentrent sur la durabilité dans leur production, leur transformation, leur emballage et d'autres processus.

Ainsi, la mise en œuvre d’approches durables à presque toutes les étapes de la production de lait A2 et de produits à base de lait A2 a offert diverses opportunités de croissance du marché, même au cours de la période prévue, car les consommateurs préfèrent principalement les produits durables et biologiques.

Défis

- La croissance de la tendance au véganisme parmi les gens

Le véganisme est un mode de vie qui préconise l'élimination des produits d'origine animale de l'alimentation, en particulier les produits laitiers, la viande et la volaille. Le véganisme a évolué vers une tendance vers un mode de vie plus sain à mesure que de plus en plus de personnes prennent conscience des dommages qu'il cause à l'environnement et aux espèces animales. La raison d'être du véganisme est de cesser de stresser, d'exploiter et de tuer les animaux pour mettre fin à leur espèce. Cette tendance au véganisme apporte des alternatives au lait plus naturelles, de sorte que la plupart des personnes adoptées par le véganisme évitent les produits à base de lait A2, même si le lait A2 présente un avantage nutritionnel plus élevé que les autres. Le lait A2 étant un produit d'origine animale, la tendance au véganisme posera un défi important à la croissance du marché du lait A2.

Ainsi, la tendance au véganisme conduit les consommateurs à opter de manière minimale pour les produits à base de produits laitiers. Cette tendance au véganisme parmi la population devrait donc constituer un défi majeur pour la croissance du marché mondial du lait A2.

- Investissements importants en R&D pour les produits laitiers a2

Les entreprises investissent dans la R&D pour diverses raisons, notamment une participation accrue au marché, des économies de coûts, des avancées marketing et une adaptation aux tendances. La R&D peut aider une entreprise à suivre ou à anticiper les tendances du marché, lui permettant ainsi de rester pertinente. Certains avantages de la R&D sont évidents, comme la possibilité d'une production plus élevée ou de nouvelles gammes de produits. Mais l'investissement requis pour la R&D pour les produits laitiers A2 est très élevé, mais il est également nécessaire pour le lancement de nouveaux produits. Ainsi, de nombreuses entreprises sont incapables d'investir des ressources importantes dans ce département de R&D et ne lancent aucun nouveau produit utile à la croissance du marché mondial du lait A2.

En outre, on peut affirmer que les investissements élevés dans la recherche et le développement des entreprises de lait A2 constituent un défi majeur qui limite la croissance du marché. Le manque continu de lancements de nouveaux produits et d'avancées dans les produits de lait A2 limite encore davantage l'évolution du marché et restreint également l'entrée de nouveaux acteurs.

Impact post-COVID-19 sur le marché de la culture des champignons aux Émirats arabes unis

Après la pandémie, la demande de lait A2 a augmenté car il n'y aura plus de restrictions de mouvement ; par conséquent, l'approvisionnement en produits serait facile. La persistance du COVID-19 pendant une période plus longue a affecté la chaîne d'approvisionnement car elle a été perturbée, et il est devenu difficile de fournir les produits alimentaires aux consommateurs, ce qui a initialement augmenté la demande de produits. Cependant, après le COVID, le besoin de lait A2 a considérablement augmenté en raison de la bonne teneur en protéines et d'autres nutriments disponibles.

Développements récents

Portée du marché du lait européen A2

Le marché du lait A2 en Europe est segmenté en fonction de la forme, de la nature, de la teneur en matières grasses, de la taille de l'emballage, de la forme de l'emballage et du canal de distribution. La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Formulaire

- Poudre

- Liquide

Sur la base de la forme, le marché européen du lait A2 est segmenté en poudre et liquide.

Nature

- Organique

- Conventionnel

Sur la base de la nature, le marché européen du lait A2 est segmenté en biologique et conventionnel.

Teneur en matières grasses

- Sans gras

- Faible en gras

- Teneur réduite en matières grasses

- Graisse entière

Sur la base de la teneur en matières grasses, le marché européen du lait A2 est segmenté en lait sans matière grasse, faible en matière grasse, à teneur réduite en matières grasses et entier.

Taille de l'emballage

- 101-250 ml/g

- 250-500 ml/g

- 501-1000 ml/g

- Au-dessus de 1000 ml/g

Sur la base de la taille de l'emballage, le marché européen du lait A2 est segmenté en 50-100 mg/g, 101-250 ml/g, 250-500 ml/g, 501-1000 ml/g et plus de 1000 ml/g.

Forme d'emballage

- Bouteilles

- Cartons

- Peut

- Pots

- Autres

Sur la base de la forme de l'emballage, le marché européen du lait A2 est segmenté en bouteilles, cartons, canettes, pots et autres.

Canal de distribution

- Détaillants en magasin

- Détaillants hors magasin

Sur la base du canal de distribution, le marché européen du lait A2 est segmenté en détaillants en magasin et en détaillants hors magasin.

Analyse/perspectives régionales du marché du lait A2

Le marché du lait A2 est analysé et des informations sur la taille et les tendances du marché sont fournies par pays, forme, nature, teneur en matières grasses, taille de l’emballage, forme de l’emballage et canal de distribution.

Les pays couverts dans le rapport sur le marché du lait Europe A2 sont l'Allemagne, le Royaume-Uni, l'Italie, la France, l'Espagne, la Suisse, les Pays-Bas, la Belgique, la Russie, la Turquie et le reste de l'Europe.

L'Allemagne est le plus grand marché pour le lait A2. La prise de conscience croissante des bienfaits du lait A2 sur la santé par rapport au lait A1 parmi les consommateurs est la principale raison de la croissance du marché du lait A2 en Europe. Cependant, les prix élevés du lait A2 sont susceptibles de limiter la croissance du marché.

La section par pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui influencent les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces du porteur et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du lait A2

Le paysage concurrentiel du marché du lait A2 fournit des détails sur un concurrent. Les composants inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus ne concernent que les entreprises se concentrant sur le marché du lait A2.

Certains des principaux acteurs opérant sur le marché du lait A2 sont Veco Zuivel BV et Taw River Dairy, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE A2 MILK MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TREATMENT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 FACTORS INFLUENCING PURCHASE DECISION

4.1.1 PRODUCT NUTRITIONAL QUALITY

4.1.2 PRODUCT PRICING

4.1.3 AUTHENTICITY OF PRODUCT

4.2 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.3 TRADE ANALYSIS

4.3.1 IMPORTS-EXPORTS OF THE EUROPE A2 MILK MARKET

4.4 INDUSTRY TRENDS AND FUTURE PERSPECTIVE OF EUROPE A2 MILK MARKET

4.4.1 INDUSTRY TRENDS

4.4.2 FUTURE PERSPECTIVE

4.5 RAW MATERIAL SOURCING ANALYSIS: EUROPE A2 MILK MARKET

4.6 SUPPLY CHAIN OF THE EUROPE A2 MILK MARKET

4.6.1 RAW A2 MILK PRODUCTION

4.6.2 PROCESSING AND PACKAGING

4.6.3 TRANSPORTATION AND DISTRIBUTION

4.6.4 END USERS

4.7 TECHNOLOGICAL ADVANCEMENTS

4.8 VALUE CHAIN ANALYSIS: EUROPE A2 MILK MARKET

4.9 PORTER'S FIVE

4.9.1 PORTER'S FIVE FORCES ANALYSIS FOR EUROPE A2 MILK MARKET

4.9.2 BARGAINING POWER OF SUPPLIERS

4.9.3 BARGAINING POWER OF BUYERS/CONSUMERS

4.9.4 THREAT OF NEW ENTRANTS

4.9.5 THREAT OF SUBSTITUTE PRODUCTS

4.9.6 INTENSITY OF COMPETITIVE RIVALRY

5 REGULATORY FRAMEWORK AND LABELLING FOR THE EUROPE A2 MILK MARKET

6 IMPACT OF ECONOMIC SLOWDOWN ON THE MARKET –EUROPE A2 MILK MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON SHIPMENT

6.4 IMPACT ON COMPANY'S STRATEGIC DECISIONS

7 PRICING INDEX

7.1 FOB & B2B PRICES - EUROPE A2 MILK MARKET

7.2 B2B PRICES - EUROPE A2 MILK MARKET

8 PRODUCTION CAPACITY OF KEY MANUFACTURERS

9 BRAND OUTLOOK

9.1 PRODUCT VS BRAND OVERVIEW

10 MARKET OVERVIEW

10.1 DRIVERS

10.1.1 GROWING AWARENESS ABOUT HEALTH AMONG CONSUMERS

10.1.2 INCREASING APPLICATIONS OF A2 MILK IN INFANT FORMULAE

10.1.3 HIGH NUTRITIONAL VALUES IN A2 COMPARED TO REGULAR MILK

10.1.4 CONSUMERS EXPERIENCING HEALTH ISSUES DUE TO CONSUMPTION OF REGULAR MILK

10.2 RESTRAINT

10.2.1 HIGH PRICES OF A2 MILK

10.3 OPPORTUNITY

10.3.1 INCLINATION OF CONSUMERS OVER SUSTAINABLE PRODUCTION OF A2 MILK

10.4 CHALLENGES

10.4.1 GROWING TREND OF VEGANISM AMONG PEOPLE

10.4.2 HIGH INVESTMENT IN R&D FOR A2 MILK PRODUCTS

11 EUROPE A2 MILK MARKET, BY FORM

11.1 OVERVIEW

11.2 LIQUID

11.3 POWDER

12 EUROPE A2 MILK MARKET, BY NATURE

12.1 OVERVIEW

12.2 CONVENTIONAL

12.3 ORGANIC

13 EUROPE A2 MILK MARKET, BY FAT CONTENT

13.1 OVERVIEW

13.2 WHOLE FAT

13.3 LOW FAT

13.4 REDUCED FAT

13.5 NO FAT

14 EUROPE A2 MILK MARKET, BY PACKAGIING SIZE

14.1 OVERVIEW

14.2 501-1000 ML

14.3 250-500 ML

14.4 101-250 ML

14.5 ABOVE 1000 ML

15 EUROPE A2 MILK MARKET, BY PACKAGING FORM

15.1 OVERVIEW

15.2 BOTTLES

15.2.1 PLASTIC

15.2.2 GLASS

15.3 CARTONS

15.4 CAN

15.5 JARS

15.6 OTHERS

16 EUROPE A2 MILK MARKET, BY DISTRIBUTION CHANNEL

16.1 OVERVIEW

16.2 NON-STORE RETAILERS

16.2.1 ONLINE

16.2.2 VENDING MACHINE

16.3 STORE BASED RETAILERS

16.3.1 SUPERMARKETS/HYPERMARKETS

16.3.2 CONVENIENCE STORES

16.3.3 GROCERY STORES

16.3.4 SPECIALTY STORES

17 EUROPE A2 MILK MARKET, BY REGION

17.1 EUROPE

17.1.1 GERMANY

17.1.2 NETHERLANDS

17.1.3 SWITZERLAND

17.1.4 RUSSIA

17.1.5 U.K.

17.1.6 FRANCE

17.1.7 SPAIN

17.1.8 REST OF EUROPE

18 COMPANY LANDSCAPE: EUROPE A2 MILK MARKET

18.1 COMPANY SHARE ANALYSIS: EUROPE

19 SWOT ANALYSIS

20 COMPANY PROFILE

20.1 THE A2 MILK COMPANY LIMITED

20.1.1 COMPANY SNAPSHOT

20.1.2 REVENUE ANALYSIS

20.1.3 COMPANY SHARE ANALYSIS

20.1.4 PRODUCT PORTFOLIO

20.1.5 RECENT DEVELOPMENTS

20.2 GCMMF

20.2.1 COMPANY SNAPSHOT

20.2.2 COMPANY SHARE ANALYSIS

20.2.3 PRODUCT PORTFOLIO

20.2.4 RECENT DEVELOPMENT

20.3 CAPTAIN’S FARM

20.3.1 COMPANY SNAPSHOT

20.3.2 COMPANY SHARE ANALYSIS

20.3.3 PRODUCT PORTFOLIO

20.3.4 RECENT DEVELOPMENT

20.4 VEDAAZ ORGANICS PVT. LTD.

20.4.1 COMPANY SNAPSHOT

20.4.2 COMPANY SHARE ANALYSIS

20.4.3 PRODUCT PORTFOLIO

20.4.4 RECENT DEVELOPMENT

20.5 URBAN FARMS MILK

20.5.1 COMPANY SNAPSHOT

20.5.2 COMPANY SHARE ANALYSIS

20.5.3 PRODUCT PORTFOLIO

20.5.4 RECENT DEVELOPMENT

20.6 AUSTRALIA'S OWN

20.6.1 COMPANY SNAPSHOT

20.6.2 PRODUCT PORTFOLIO

20.6.3 RECENT DEVELOPMENT

20.7 AVTARAN MILK

20.7.1 COMPANY SNAPSHOT

20.7.2 PRODUCT PORTFOLIO

20.7.3 RECENT DEVELOPMENT

20.8 AYUDA ORGANICS

20.8.1 COMPANY SNAPSHOT

20.8.2 PRODUCT PORTFOLIO

20.8.3 RECENT DEVELOPMENT

20.9 DOFE

20.9.1 COMPANY SNAPSHOT

20.9.2 PRODUCT PORTFOLIO

20.9.3 RECENT DEVELOPMENT

20.1 ERDEN CREAMERY PRIVATE LIMITED

20.10.1 COMPANY SNAPSHOT

20.10.2 PRODUCT PORTFOLIO

20.10.3 RECENT DEVELOPMENT

20.11 KSHEERDHAM

20.11.1 COMPANY SNAPSHOT

20.11.2 PRODUCT PORTFOLIO

20.11.3 RECENT DEVELOPMENT

20.12 PROVILAC DAIRY FARMS PVT. LTD

20.12.1 COMPANY SNAPSHOT

20.12.2 PRODUCT PORTFOLIO

20.12.3 RECENT DEVELOPMENT

20.13 RIPLEY FARMS LLC

20.13.1 COMPANY SNAPSHOT

20.13.2 PRODUCT PORTFOLIO

20.13.3 RECENT DEVELOPMENT

20.14 TAW RIVER DAIRY

20.14.1 COMPANY SNAPSHOT

20.14.2 PRODUCT PORTFOLIO

20.14.3 RECENT DEVELOPMENT

20.15 VECO ZUIVEL B.V.

20.15.1 COMPANY SNAPSHOT

20.15.2 PRODUCT PORTFOLIO

20.15.3 RECENT DEVELOPMENT

21 QUESTIONNAIRE

22 RELATED REPORTS

Liste des tableaux

TABLE 1 FREE ON BOARD (FOB) OF A2 MILK

TABLE 2 BRAND COMPARATIVE ANALYSIS OF THE EUROPE A2 MILK MARKET

TABLE 3 EUROPE A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 4 EUROPE LIQUID IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 EUROPE POWDER IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 EUROPE A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 7 EUROPE CONVENTIONAL IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 EUROPE ORGANIC IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 EUROPE A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 10 EUROPE WHOLE FAT IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 EUROPE LOW FAT IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE REDUCED FAT IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 EUROPE NO FAT IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 15 EUROPE 501-1000 ML IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE 250-500 ML IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE 101-250 ML IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 EUROPE ABOVE 1000 ML IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 20 EUROPE BOTTLES IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 EUROPE BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 EUROPE CARTONS IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 EUROPE CAN IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE JARS IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 EUROPE OTHERS IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 EUROPE A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 27 EUROPE NON-STORE RETAILERS IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 EUROPE NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 EUROPE STORE BASED RETAILERS IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 EUROPE STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 EUROPE A2 MILK MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 32 EUROPE A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 33 EUROPE A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 34 EUROPE A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 35 EUROPE A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 36 EUROPE A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 37 EUROPE BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 EUROPE A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 39 EUROPE STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 EUROPE NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 GERMANY A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 42 GERMANY A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 43 GERMANY A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 44 GERMANY A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 45 GERMANY A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 46 GERMANY BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 GERMANY A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 48 GERMANY STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 GERMANY NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 NETHERLANDS A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 51 NETHERLANDS A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 52 NETHERLANDS A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 53 NETHERLANDS A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 54 NETHERLANDS A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 55 NETHERLANDS BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 NETHERLANDS A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 57 NETHERLANDS STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 NETHERLANDS NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 SWITZERLAND A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 60 SWITZERLAND A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 61 SWITZERLAND A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 62 SWITZERLAND A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 63 SWITZERLAND A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 64 SWITZERLAND BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 SWITZERLAND A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 66 SWITZERLAND STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 SWITZERLAND NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 RUSSIA A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 69 RUSSIA A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 70 RUSSIA A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 71 RUSSIA A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 72 RUSSIA A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 73 RUSSIA BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 RUSSIA A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 75 RUSSIA STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 RUSSIA NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 U.K. A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 78 U.K. A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 79 U.K. A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 80 U.K. A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 81 U.K. A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 82 U.K. BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 U.K. A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 84 U.K. STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 U.K. NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 FRANCE A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 87 FRANCE A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 88 FRANCE A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 89 FRANCE A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 90 FRANCE A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 91 FRANCE BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 FRANCE A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 93 FRANCE STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 FRANCE NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 95 SPAIN A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 96 SPAIN A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 97 SPAIN A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 98 SPAIN A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 99 SPAIN A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 100 SPAIN BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 SPAIN A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 102 SPAIN STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 SPAIN NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 REST OF EUROPE A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 EUROPE A2 MILK MARKET: SEGMENTATION

FIGURE 2 EUROPE A2 MILK MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE A2 MILK MARKET: DROC ANALYSIS

FIGURE 4 EUROPE A2 MILK MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE A2 MILK MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE A2 MILK MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE A2 MILK MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE A2 MILK MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE A2 MILK MARKET: SEGMENTATION

FIGURE 10 INCREASING APPLICATION OF A2 MILK IN THE FOOD INDUSTRY IS EXPECTED TO DRIVE THE GROWTH OF THE EUROPE A2 MILK MARKET IN THE FORECAST PERIOD

FIGURE 11 LIQUID SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE A2 MILK MARKET IN 2022 & 2029

FIGURE 12 SUPPLY CHAIN OF THE EUROPE A2 MILK MARKET

FIGURE 13 VALUE CHAIN OF A2 MILK

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE A2 MILK MARKET

FIGURE 15 EUROPE A2 MILK MARKET: BY FORM, 2021

FIGURE 16 EUROPE A2 MILK MARKET: BY NATURE, 2021

FIGURE 17 EUROPE A2 MILK MARKET: BY FAT CONTENT, 2021

FIGURE 18 EUROPE A2 MILK MARKET: BY PACKAGING SIZE, 2021

FIGURE 19 EUROPE A2 MILK MARKET: BY PACKAGING FORM, 2021

FIGURE 20 EUROPE A2 MILK MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 21 EUROPE A2 MILK MARKET: SNAPSHOT (2021)

FIGURE 22 EUROPE A2 MILK MARKET: BY COUNTRY (2021)

FIGURE 23 EUROPE A2 MILK MARKET: BY COUNTRY (2022 & 2029)

FIGURE 24 EUROPE A2 MILK MARKET: BY COUNTRY (2021 & 2029)

FIGURE 25 EUROPE A2 MILK MARKET: BY FORM (2022 & 2029)

FIGURE 26 EUROPE A2 MILK MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.