Europe 3d Printing Materials Market

Taille du marché en milliards USD

TCAC :

%

USD

901.50 Million

USD

3,850.54 Million

2024

2032

USD

901.50 Million

USD

3,850.54 Million

2024

2032

| 2025 –2032 | |

| USD 901.50 Million | |

| USD 3,850.54 Million | |

|

|

|

|

Segmentation du marché européen des matériaux d'impression 3D, par type (plastiques/polymères, métaux, céramiques et autres), forme (poudre, filament et liquide), technologie (dépôt de fil fondu (FDM), frittage sélectif par laser (SLS), stéréolithographie (SLA), frittage direct par laser de métal (DMLS), fabrication additive grande surface (BAAM), fabrication additive par arc électrique (WAAM), ColorJet et autres), utilisation finale (industrie, automobile, aérospatiale et défense, santé, biens de consommation, électronique, éducation, construction et autres) - Tendances et prévisions du secteur jusqu'en 2032

Quelle est la taille et le taux de croissance du marché européen des matériaux d’impression 3D ?

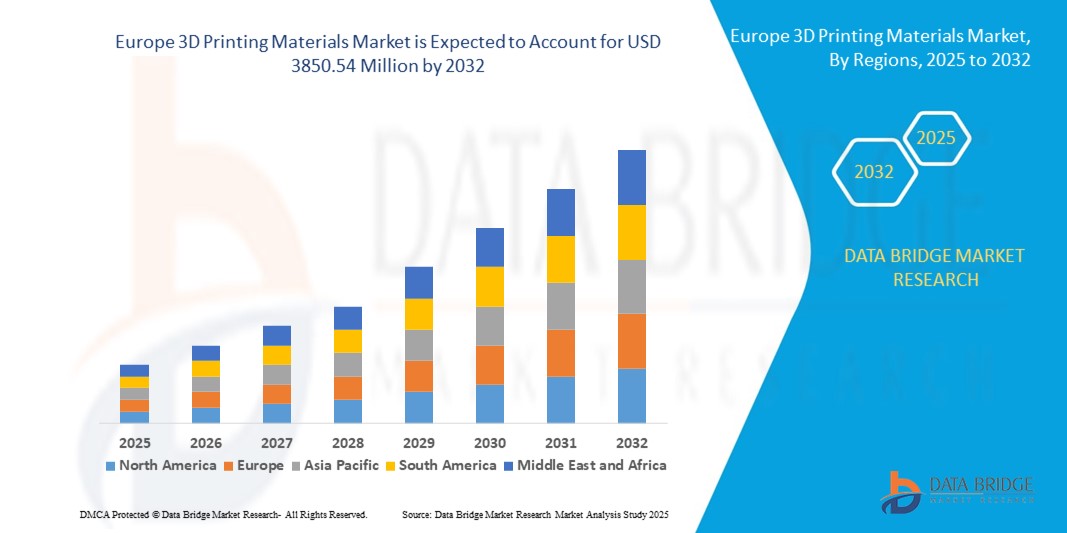

- La taille du marché européen des matériaux d'impression 3D était évaluée à 901,50 millions USD en 2024 et devrait atteindre 3 850,54 millions USD d'ici 2032 , à un TCAC de 19,90 % au cours de la période de prévision.

- L'adoption croissante de l'impression 3D dans diverses industries, l'augmentation du prototypage et de l'outillage rapide, ainsi que l'accessibilité et l'abordabilité croissantes des technologies d'impression 3D à l'échelle universelle sont quelques-uns des facteurs moteurs qui devraient propulser la croissance du marché.

Quels sont les principaux points à retenir du marché européen des matériaux d’impression 3D ?

- La demande de matériaux capables de répondre aux diverses exigences de ce procédé de fabrication innovant connaît une forte hausse, les industries adoptant les capacités révolutionnaires de l'impression 3D. La polyvalence de l'impression 3D, également appelée fabrication additive, s'étend à des secteurs tels que l'aérospatiale, la santé, l'automobile et les biens de consommation, où cette technologie est utilisée pour le prototypage rapide, la production sur mesure et la fabrication de modèles complexes.

- La demande de matériaux d'impression 3D s'explique par la capacité de cette technologie à produire des composants complexes et hautement personnalisés. Les méthodes de fabrication traditionnelles sont peu efficaces et rapides, les industries recherchant des pièces toujours plus complexes et précises. L'impression 3D comble ce manque en permettant la création de structures géométriquement complexes avec une efficacité accrue.

- La demande en matériaux spécialisés augmente avec l'évolution des besoins des secteurs industriels tels que l'aérospatiale, la santé, l'automobile et les biens de consommation, qui mettent en œuvre cette technologie transformatrice. L'impression 3D continue de révolutionner les processus de fabrication. Par conséquent, l'adoption croissante de l'impression 3D dans divers secteurs stimule la croissance du marché.

- En 2024, le marché allemand des matériaux d'impression 3D représentait la plus grande part du chiffre d'affaires régional en Europe, avec 28,11 %. Cette croissance est portée par la demande de systèmes de sécurité de pointe, de maisons intelligentes écoénergétiques et de modernisation des infrastructures numériques.

- Le marché britannique des matériaux d'impression 3D devrait croître à un TCAC robuste de 12,23 % au cours de la période de prévision, stimulé par les préoccupations croissantes concernant la sécurité résidentielle et commerciale, la popularité des configurations de maisons intelligentes DIY et une forte pénétration du commerce de détail et en ligne.

- Le segment Plastiques/Polymères a dominé le marché avec la plus grande part de revenus de 45,8 % en 2024, en raison de leur polyvalence, de leur prix abordable et de leur adoption généralisée dans le prototypage et les applications industrielles.

Portée du rapport et segmentation du marché européen des matériaux d'impression 3D

|

Attributs |

Aperçu du marché des matériaux d'impression 3D en Europe |

|

Segments couverts |

|

|

Pays couverts |

Europe

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Quelle est la tendance clé du marché européen des matériaux d’impression 3D ?

Vers des matériaux performants et fonctionnels

- Une tendance déterminante sur le marché des matériaux d'impression 3D est le développement et l'adoption croissants de matériaux hautes performances et fonctionnels, notamment des composites, des alliages métalliques et des polymères biosourcés, qui élargissent la gamme d'applications industrielles, médicales et grand public.

- Par exemple, des entreprises telles que Markforged et EOS introduisent des filaments renforcés de fibres de carbone et des poudres polymères haute température qui permettent la production de pièces légères mais durables pour l'aérospatiale, l'automobile et les machines industrielles.

- Les matériaux d'impression 3D fonctionnels permettent de plus en plus l'impression multi-matériaux, l'intégration d'électronique ou l'intégration de voies conductrices, transformant ainsi les flux de fabrication conventionnels en processus additifs intégrés.

- La tendance comprend également les bio-encres et les polymères biocompatibles pour l'impression 3D médicale, y compris les échafaudages tissulaires, les implants et les prothèses personnalisées, offrant une précision accrue, des conceptions spécifiques au patient et des cycles de production plus rapides.

- Alors que les industries évoluent vers la fabrication numérique et la production à la demande, des entreprises telles que Formlabs et 3D Systems développent des résines et des poudres spécialisées pour le prototypage avancé, l'outillage et les applications d'utilisation finale, stimulant l'innovation dans tous les secteurs.

- L'adoption croissante de matériaux d'impression 3D fonctionnels, durables et prêts pour l'industrie remodèle les attentes des utilisateurs et élargit les applications dans les secteurs de l'automobile, de la santé, de l'aérospatiale et de l'électronique grand public.

Quels sont les principaux moteurs du marché européen des matériaux d’impression 3D ?

- La demande croissante de pièces légères, à haute résistance et personnalisées dans des secteurs tels que l'aérospatiale, l'automobile et la santé est un moteur majeur du marché des matériaux d'impression 3D.

- Par exemple, en mars 2024, Stratasys a lancé des thermoplastiques ignifuges haute température conçus pour l'outillage aérospatial et industriel, améliorant ainsi la durabilité et la conformité réglementaire.

- L'adoption croissante de la fabrication additive dans le prototypage, la production en petits lots et les géométries complexes alimente l'innovation des matériaux, permettant une personnalisation précise tout en réduisant les déchets et les délais de livraison.

- En outre, les initiatives de développement durable encouragent l’utilisation de filaments biosourcés et de polymères recyclables, conformément aux objectifs ESG et réduisant l’impact environnemental.

- L'intégration de matériaux d'impression 3D avec des imprimantes 3D automatisées et à l'échelle industrielle, y compris des systèmes multi-matériaux et à fibres continues, favorise l'efficacité, la rentabilité et une adoption plus large dans de multiples industries d'utilisation finale.

Quel facteur freine la croissance du marché européen des matériaux d’impression 3D ?

- Le coût élevé et la disponibilité limitée des matériaux d’impression 3D avancés, en particulier les composites fonctionnels, les poudres métalliques et les résines biocompatibles, constituent des obstacles importants à une adoption généralisée.

- Par exemple, les poudres métalliques haut de gamme destinées aux applications aérospatiales et médicales s'accompagnent souvent de coûts d'approvisionnement élevés et nécessitent un stockage et une manutention spécialisés, limitant ainsi leur utilisation aux applications à forte valeur ajoutée.

- La cohérence des performances des matériaux, le contrôle de la qualité et la normalisation restent des défis, en particulier pour les pièces de qualité industrielle nécessitant une conformité réglementaire stricte et une intégrité mécanique

- En outre, le manque de professionnels formés et d’expertise technique dans la manipulation de matériaux d’impression 3D spécialisés limite l’adoption sur les marchés émergents et dans les petites entreprises.

- Surmonter ces défis grâce à la réduction des coûts, à l’innovation matérielle et aux programmes de formation sera essentiel pour permettre une adoption plus large et une croissance soutenue du marché à l’échelle mondiale.

Comment le marché européen des matériaux d’impression 3D est-il segmenté ?

Le marché est segmenté en fonction du type, de la forme, de la technologie et de l’utilisation finale.

- Par type

Le marché des matériaux d'impression 3D est segmenté en fonction de leur type : plastiques/polymères, métaux, céramiques et autres. Le segment des plastiques/polymères a dominé le marché avec une part de chiffre d'affaires de 45,8 % en 2024, grâce à sa polyvalence, son accessibilité et son adoption généralisée dans le prototypage et les applications industrielles. Les plastiques/polymères sont privilégiés pour les pièces légères, les prototypes fonctionnels et les produits de consommation, en raison de leur facilité de mise en œuvre, de leurs bonnes propriétés mécaniques et de leur compatibilité avec de nombreuses technologies d'impression 3D.

Le segment des métaux devrait connaître sa plus forte croissance annuelle composée (TCAC) entre 2025 et 2032, portée par la demande des secteurs aéronautique, automobile et médical en composants à haute résistance, résistants à la chaleur et durables. Les poudres et alliages métalliques permettent la production de structures porteuses complexes, difficiles à réaliser par la fabrication traditionnelle. Les matériaux céramiques, quant à eux, gagnent du terrain pour les applications haute température et biocompatibles dans les secteurs de la santé et de l'électronique, bien que leur adoption reste limitée par des coûts plus élevés et des exigences en matière d'équipements spécialisés.

- Par formulaire

Sur la base de leur forme, le marché des matériaux d'impression 3D est segmenté en poudre, filament et liquide. Le segment des filaments détenait la plus grande part de chiffre d'affaires du marché, avec 52,3 % en 2024, grâce à son utilisation répandue dans les imprimantes FDM (Found Deposition Modeling), sa facilité de manipulation et son prix abordable pour les applications industrielles et grand public. Les filaments sont disponibles en thermoplastiques, composites et polymères biosourcés, offrant une grande polyvalence pour le prototypage, l'outillage et les pièces fonctionnelles.

La forme poudre devrait connaître le TCAC le plus élevé entre 2025 et 2032, en grande partie grâce à son rôle essentiel dans le frittage sélectif par laser (SLS), le frittage direct par laser de métal (DMLS) et d'autres procédés de fabrication additive de haute précision pour métaux et polymères. Les matériaux d'impression 3D liquides, principalement utilisés en stéréolithographie (SLA) et dans les imprimantes à base de résine, sont privilégiés pour les pièces haute résolution et les géométries complexes, mais sont limités par le coût et les exigences de post-traitement.

- Par technologie

Sur le plan technologique, le marché des matériaux d'impression 3D est segmenté en deux procédés : le dépôt de fil fondu (FDM), le frittage sélectif par laser (SLS), la stéréolithographie (SLA), le frittage laser direct de métal (DMLS), la fabrication additive grande surface (BAAM), la fabrication additive par arc électrique (WAAM), ColorJet, etc. Le segment FDM a dominé le marché avec la plus grande part de chiffre d'affaires (40,9 %) en 2024, grâce à son accessibilité, son prix abordable et sa capacité à traiter une grande variété de thermoplastiques et de composites. Largement utilisé pour le prototypage, les tests fonctionnels et la formation, le FDM est populaire dans de nombreux secteurs.

Les procédés SLS et DMLS devraient connaître la croissance la plus rapide entre 2025 et 2032, compte tenu de leur capacité à produire des pièces complexes et très résistantes pour les applications aérospatiales, automobiles et médicales. Les procédés SLA, BAAM, WAAM et ColorJet s'adressent à des applications de niche exigeant une précision élevée, une grande rapidité ou une production à grande échelle, élargissant ainsi encore la portée technologique du marché.

- Par utilisation finale

En fonction de l'utilisation finale, le marché des matériaux d'impression 3D est segmenté en trois secteurs : fabrication industrielle, automobile, aérospatiale et défense, santé, biens de consommation, électronique, éducation, construction, etc. En 2024, le segment de la fabrication industrielle détenait la plus grande part de chiffre d'affaires, avec 38,6 %, grâce à l'adoption rapide de la fabrication additive pour le prototypage, l'outillage, les gabarits et les pièces de production. Les industries exploitent les matériaux d'impression 3D pour réduire les délais, optimiser les conceptions et améliorer l'efficacité.

Les secteurs de la santé et de l'aérospatiale et de la défense devraient connaître le taux de croissance annuel composé le plus élevé entre 2025 et 2032, portés par la demande croissante d'implants, de prothèses, de composants structurels légers et de pièces critiques sur mesure. L'éducation et les applications grand public favorisent la sensibilisation et l'adoption de l'impression 3D, tandis que les secteurs de l'électronique et de la construction intègrent progressivement l'impression 3D pour la fabrication de composants spécialisés, de structures à grande échelle et de produits personnalisés.

Quelle région détient la plus grande part du marché européen des matériaux d’impression 3D ?

- En 2024, le marché allemand des matériaux d'impression 3D représentait la plus grande part du chiffre d'affaires régional en Europe, avec 28,11 %. Cette croissance est portée par la demande de systèmes de sécurité de pointe, de maisons intelligentes écoénergétiques et de modernisation des infrastructures numériques.

- Les consommateurs préfèrent les produits compatibles avec les plateformes de maison intelligente populaires telles qu'Alexa et Google Assistant, tandis que l'accent mis par le pays sur la durabilité et l'innovation accélère encore l'adoption par le marché.

Aperçu du marché français des matériaux d'impression 3D

Le marché français des matériaux d'impression 3D connaît une croissance constante, porté par l'urbanisation, l'adoption de la domotique et la sensibilisation des consommateurs aux solutions de sécurité numérique. Les incitations gouvernementales à la rénovation énergétique des bâtiments et la présence croissante d'intégrateurs de domotique encouragent l'adoption de ces technologies, tant pour les particuliers que pour les entreprises.

Aperçu du marché italien des matériaux d'impression 3D

Le marché italien des matériaux d'impression 3D devrait connaître une croissance significative, portée par l'utilisation croissante des appareils domestiques connectés, l'intérêt croissant des consommateurs pour la domotique et la modernisation des bâtiments résidentiels anciens. L'intégration avec les plateformes à commande vocale et les applications pour smartphones renforce l'attrait du marché.

Quel pays connaît la croissance la plus rapide sur le marché des matériaux d’impression 3D en Europe ?

Le marché britannique des matériaux d'impression 3D devrait connaître une croissance soutenue de 12,23 % au cours de la période de prévision, portée par les préoccupations croissantes en matière de sécurité résidentielle et commerciale, la popularité des maisons connectées à faire soi-même et une forte pénétration du commerce de détail et d'Internet. L'adoption de l'entrée sans clé et des systèmes connectés dans les bureaux, les appartements et les immeubles d'habitation stimule également la demande.

Aperçu du marché polonais des matériaux d'impression 3D

Le marché polonais connaît un essor soutenu par l'expansion urbaine, l'adoption croissante des maisons intelligentes et l'intérêt croissant pour les systèmes d'accès sécurisés et économes en énergie. Les consommateurs polonais intègrent de plus en plus de matériaux d'impression 3D à leurs appareils connectés pour plus de confort et de sécurité.

Quelles sont les principales entreprises du marché européen des matériaux d’impression 3D ?

L'industrie européenne des matériaux d'impression 3D est principalement dirigée par des entreprises bien établies, notamment :

- Formlabs (États-Unis)

- EOS (Allemagne)

- ENVISIONTEC US LLC (États-Unis)

- Éléments américains (États-Unis)

- Höganäs AB (Suède)

- UltiMaker (Pays-Bas)

- Carbon, Inc. (États-Unis)

- KRAIBURG TPE GmbH & Co. KG (Allemagne)

- Covestro AG (Allemagne)

- Markforged, Inc. (États-Unis)

- Stratasys (États-Unis)

- ExOne (États-Unis)

- Arkema (France)

- 3D Systems, Inc. (États-Unis)

- Evonik Industries AG (Allemagne)

- Materialise (Belgique)

- BASF SE (Allemagne)

- Sandvik AB (Suède)

- Solvay (Belgique)

Quels sont les développements récents sur le marché européen des matériaux d’impression 3D ?

- En octobre 2023, EOS a lancé son réseau d'architectes en mousse numérique, conçu pour accélérer le développement et la fabrication additive (FA) de produits grand public, médicaux et industriels intégrant des applications de mousse numérique. La mousse numérique n'est pas un produit, mais une approche de l'impression 3D de produits de type mousse. Elle donnera une nouvelle orientation à l'entreprise dans le domaine des matériaux d'impression 3D.

- En octobre 2023, Arkema a annoncé de nouveaux partenariats avec des leaders du secteur tels qu'EOS, HP et Stratasys pour concevoir la prochaine génération de matériaux et de solutions d'impression 3D. Ces partenariats renforceront leurs capacités d'innovation et enrichiront leur portefeuille de produits.

- En février 2023, Bauer Hockey, leader européen de l'innovation en matière d'équipements de hockey, et EOS, pionnier et leader du marché de l'impression 3D industrielle, ont collaboré pour intégrer la fabrication additive (FA, ou impression 3D) au programme d'équipements personnalisés MyBauer de Bauer. EOS et son approche brevetée de l'impression de polymères Digital Foam ont conféré à Bauer un avantage certain. Cela renforcera la présence d'EOS sur le marché européen des matériaux d'impression 3D.

- En novembre 2021, Covestro AG a présenté quatre nouveaux matériaux d'impression 3D au salon Formnext 2021, couvrant diverses technologies. Parmi eux, l'Addigy FPC SOL1 HT, un matériau support soluble pour l'impression FDM de matériaux haute température, offrant un retrait facile et une durabilité accrue. L'Arnitel AM3001 (P) pour SLS, un matériau souple à haut retour d'énergie, a été imprimé en 3D avec succès, conformément aux normes de sécurité des jouets. Covestro a également lancé les versions SLS et HSS de sa poudre TPU, l'Addigy PPU 86AW6, reconnue pour son rebond, sa facilité de post-traitement et son taux de réutilisation élevé. Ces ajouts élargissent la gamme de polymères de Covestro pour l'impression 3D, suite à l'acquisition de l'activité de fabrication additive de DSM en début d'année.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.