Marché chinois des tests, inspections et certifications automobiles (TIC), par application (contrôleur de châssis et de carrosserie, contrôleur de cockpit et sécurité fonctionnelle), chaîne d'approvisionnement (conception, production, distribution, vente et exploitation), type d'approvisionnement (interne et externalisé), type (systèmes et composants électriques, véhicules électriques , véhicules électriques hybrides et systèmes de batteries, télématique, carburants, fluides et lubrifiants , matériaux et composants intérieurs et extérieurs, services d'inspection de véhicules, tests d'homologation et autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché des tests, de l'inspection et de la certification automobiles (TIC) en Chine

Le marché des véhicules automobiles connaît une croissance rapide en Chine, en particulier pour les véhicules de tourisme. Le marché automobile chinois semble être le plus grand du monde, avec des fonctions intelligentes comme la connectivité Internet et la conduite autonome. Cela devrait entraîner une augmentation des ventes de 30 % d'ici 2025. Bien qu'avec la croissance des ventes d'automobiles dans le pays, on observe une augmentation des incidents de circulation. La principale raison des incidents de circulation en Chine est le non-respect du code de la route, notamment l'excès de fret et la vitesse, la fatigue au volant et les dysfonctionnements des véhicules. Ces dernières années, le gouvernement a renforcé les inspections à grande échelle des mesures de sécurité pendant les périodes de pointe du transport de passagers sur de longues distances, ce qui a permis de contenir les accidents de la circulation fréquents et de contrôler efficacement l'augmentation du nombre de morts causés par les accidents de la circulation. Cependant, sous un autre aspect, avec l'augmentation du parc automobile, le nombre de morts causées par des accidents ou des collisions de véhicules a augmenté.

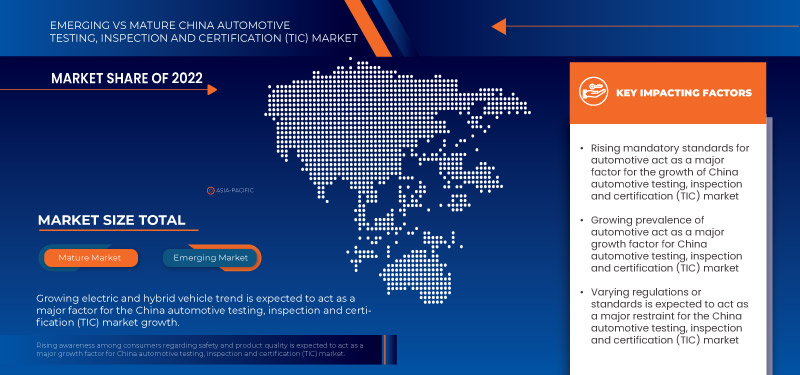

Data Bridge Market Research analyse que le marché chinois des tests, de l'inspection et de la certification automobiles (TIC) devrait croître à un TCAC de 4,8 % entre 2023 et 2030. Le gouvernement va mettre en œuvre des normes de sécurité strictes et obligatoires à respecter par les constructeurs automobiles, qui n'ont cessé d'augmenter au fil des ans.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (Personnalisable 2015-2020) |

|

Unités quantitatives |

Chiffre d'affaires en millions, prix en USD |

|

Segments couverts |

Par application (contrôleur de châssis et de carrosserie, contrôleur de cockpit et sécurité fonctionnelle), chaîne d'approvisionnement (conception, production, distribution, vente et exploitation), type d'approvisionnement (interne et externalisé), type (systèmes et composants électriques, véhicules électriques, véhicules électriques hybrides et systèmes de batteries, télématique, carburants, fluides et lubrifiants, matériaux et composants intérieurs et extérieurs, services d'inspection de véhicules, tests d'homologation, autres) |

|

Pays couverts |

Chine |

|

Acteurs du marché couverts |

Nemko, DEKRA, RINA SpA, NSF, Applus+, Asia Quality Focus, DNV GL, TÜV SÜD, TÜV NORD GROUP, Intertek Group Plc, MISTRAS Group, SGS Société Générale de Surveillance SA, TÜV Rheinland, Element Materials Technology, The British Standards Institution, Veritell Inspection Certification Co., Ltd, China Certification and Inspection (Group) Co., Ltd., Eurofins Scientific et HQTS Group Ltd., entre autres |

Définition du marché

Le marché des tests, inspections et certifications automobiles (TIC) est un secteur spécialisé de l'industrie automobile qui fournit des services essentiels pour garantir la sécurité, la qualité et la conformité des véhicules et des composants automobiles. Ce marché englobe une gamme d'activités, notamment des services de test, d'inspection et de certification qui jouent un rôle crucial dans l'amélioration de la fiabilité des produits, l'atténuation des risques et le respect des exigences réglementaires.

Sur le marché des technologies de l'information et de la communication (TIC), les services de test impliquent des évaluations complètes des produits, systèmes et matériaux automobiles pour évaluer leurs performances, leur durabilité et leur conformité aux normes de l'industrie. Cela comprend les inspections des usines de fabrication, les audits de la chaîne d'approvisionnement, les contrôles de qualité et les inspections avant expédition. En outre, les services de certification impliquent la délivrance de certifications et d'approbations officielles qui valident la conformité des produits et processus automobiles aux réglementations et normes en vigueur.

Dynamique du marché des tests, de l'inspection et de la certification automobiles (TIC) en Chine

Cette section traite de la compréhension des facteurs moteurs, des contraintes, des défis et des faiblesses. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Le gouvernement accorde une attention croissante à l'imposition de normes de sécurité obligatoires pour le secteur automobile

Le marché des véhicules automobiles connaît une croissance rapide en Chine, en particulier pour les véhicules de tourisme. Le marché automobile chinois semble être le plus important au monde, avec des fonctions intelligentes telles que la connectivité Internet et la conduite autonome. Cela devrait entraîner une augmentation des ventes de 30 % d'ici 2025.

Malgré la croissance des ventes de voitures dans le pays, les accidents de la route sont en augmentation. Les principales causes des accidents de la route en Chine sont les infractions au code de la route, notamment les excès de vitesse, la fatigue au volant et les dysfonctionnements des véhicules. Ces dernières années, le gouvernement a renforcé les contrôles à grande échelle des mesures de sécurité. Cela s'est produit pendant les périodes de pointe du transport de passagers sur de longues distances. Ainsi, il a réussi à contenir les accidents de la route fréquents et à contrôler efficacement l'augmentation du nombre de morts causés par les accidents de la route. Cependant, sous un autre aspect, le nombre de morts causés par des accidents ou des collisions de véhicules a augmenté avec l'augmentation du parc automobile.

- Prévalence croissante de l'automobile

En Chine, la production et la consommation d'automobiles sont principalement concentrées sur le segment des véhicules de tourisme. Cela a été un facteur majeur de la croissance de l'industrie automobile depuis le 21e siècle. Avec la croissance de l'économie chinoise, le parc automobile, en particulier les véhicules de tourisme, les voitures particulières étant le pilier, a augmenté rapidement.

La Chine reste le plus grand marché automobile au monde en termes de ventes annuelles et de production manufacturière, la production nationale devant atteindre 35 millions de véhicules d'ici 2025. Selon les données du ministère de l'Industrie et des Technologies de l'information, plus de 26 millions de véhicules ont été vendus en 2021, dont 21,48 millions de véhicules de tourisme, soit une augmentation de 7,1 % par rapport à 2020. Les ventes de véhicules utilitaires ont atteint 4,79 millions d'unités, en baisse de 6,6 % par rapport à 2020.

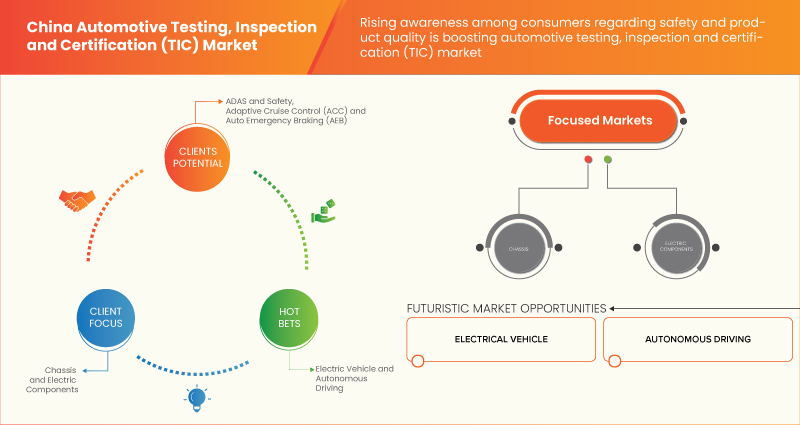

De plus, les véhicules électriques gagnent en importance partout dans le monde. Les véhicules électriques (VE) sont conçus pour être une technologie prometteuse pour parvenir à un transport durable avec zéro émission de carbone, un faible bruit et une efficacité élevée. Les véhicules électriques sont fortement intégrés aux logiciels automobiles et présentent divers avantages concentrés par divers pays. Cela a donné lieu à une réglementation de formulation, des politiques, des tests, des inspections et des processus de certification pour améliorer la qualité des véhicules électriques, car cela permet de contrôler les émissions de carbone et d'éviter le réchauffement climatique.

Opportunité

- Tendance croissante des véhicules électriques et ADAS

Les véhicules électriques (VE) sont conçus pour être une technologie prometteuse pour le transport durable avec zéro émission de carbone, un faible bruit et une efficacité élevée. De plus, les véhicules électriques ont évolué au 19e siècle, mais en raison d'un manque de progrès technologique, les moteurs à combustion interne ont eu une demande énorme par rapport aux véhicules électriques. Au cours du 20e siècle, les progrès technologiques ont été stimulés chaque année, ce qui a donné lieu à des développements et des innovations qui ont contribué à remodeler les véhicules électriques.

De plus, les véhicules électriques sont la technologie clé pour décarboner le transport routier. Ces dernières années, les ventes de véhicules électriques ont connu une croissance exponentielle, avec une autonomie améliorée, une plus grande disponibilité des modèles et des performances accrues. Les voitures électriques de tourisme gagnent en popularité. En outre, le gouvernement chinois soutient l'utilisation des véhicules électriques. Les gouvernements proposent diverses politiques et formulent des règles pour promouvoir l'utilisation des véhicules électriques.

Retenue/Défi

- Des normes différentes selon les régions/pays

Les émissions des automobiles sont l'un des principaux responsables de la pollution atmosphérique. Les différents gaz d'échappement des automobiles, tels que le NOx, le CO2 et le CO, sont les principales causes de pollution de l'atmosphère et de l'environnement, ce qui entraîne en outre des maladies respiratoires et cutanées chez l'homme. Cela a conduit de nombreux pays à formuler des règles et des réglementations strictes pour réduire les émissions.

En outre, les différents pays et régions ont mis en place des normes et établi des standards différents. Plusieurs grandes entreprises automobiles publiques, telles que Beijing Automotive Industry Corp, Brilliance China Automotive Holdings et bien d'autres en Chine, ont essayé de nouer des partenariats avec des constructeurs automobiles étrangers. Ces coentreprises sont créées pour accroître leurs capacités et améliorer leurs compétences techniques.

Cependant, les constructeurs d'autres pays ont des normes et standards différents de ceux de la Chine. Cela entraîne des variations dans les caractéristiques des véhicules ainsi que dans les prix. De plus, le gouvernement chinois modifie fréquemment les normes et standards.

Développements récents

- En novembre 2022, Nemko a acquis les actions restantes de Nemko Norlab, devenant ainsi l'unique propriétaire de la société. Cette acquisition vise à renforcer la collaboration et à répondre plus efficacement aux besoins des clients, en tirant parti des synergies et des opportunités de marché observées depuis l'acquisition initiale des actions en juin.

- En octobre 2023, Nemko Allemagne a obtenu l'accréditation DAkkS en matière de sécurité fonctionnelle. Ce développement leur a permis de tester et d'évaluer la sécurité fonctionnelle des équipements/systèmes conformément aux normes et réglementations internationales, garantissant ainsi la maîtrise des dangers et minimisant les risques pour la sécurité des personnes, des installations et de l'environnement. Cette reconnaissance aide l'entreprise à attirer l'attention des clients chinois.

Portée du marché chinois des tests, inspections et certifications automobiles (TIC)

Le marché chinois des tests, inspections et certifications automobiles (TIC) est segmenté en quatre segments notables en fonction de l'application, de la chaîne d'approvisionnement, du type d'approvisionnement et du type. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et fournira aux utilisateurs un aperçu et des informations précieuses sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Application

- Contrôleur de châssis et de carrosserie

- Contrôleur de cockpit

- Sécurité fonctionnelle

Sur la base des applications, le marché chinois des tests, de l'inspection et de la certification automobiles (TIC) est segmenté en contrôleur de châssis et de carrosserie, contrôleur de cockpit et sécurité fonctionnelle.

Chaîne d'approvisionnement

- Conception

- Production

- Distribution

- Vente

- Opération

Sur la base de la chaîne d'approvisionnement, le marché chinois des tests, de l'inspection et de la certification automobiles (TIC) est segmenté en conception, production, distribution, vente et exploitation.

Type d'approvisionnement

- En interne

- Externalisé

Sur la base du type d'approvisionnement, le marché chinois des tests, de l'inspection et de la certification automobiles (TIC) est segmenté en interne et en externalisé.

Taper

- Systèmes et composants électriques

- Véhicules électriques, véhicules électriques hybrides et systèmes de batteries

- Télématique

- Carburants, fluides et lubrifiants

- Matériaux et composants intérieurs et extérieurs

- Services d'inspection de véhicules

- Essais d'homologation

- Autres

Sur la base du type, le marché chinois des tests, de l'inspection et de la certification automobiles (TIC) est segmenté en systèmes et composants électriques, véhicules électriques, véhicules électriques hybrides et systèmes de batteries, télématique, carburants, fluides et lubrifiants, matériaux et composants intérieurs et extérieurs, services d'inspection de véhicules, tests d'homologation et autres.

Analyse du paysage concurrentiel et des parts de marché du secteur des tests, de l'inspection et de la certification automobiles (TIC) en Chine

Le paysage concurrentiel du marché chinois des tests, inspections et certifications automobiles (TIC) fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence régionale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus ne concernent que les entreprises se concentrant sur le marché.

Français Certains des principaux acteurs opérant sur le marché chinois des tests, de l'inspection et de la certification automobiles (TIC) sont Nemko, DEKRA, RINA SpA, NSF, Applus+, Asia Quality Focus, DNV GL, TÜV SÜD, TÜV NORD GROUP, Intertek Group Plc, MISTRAS Group, SGS Société Générale de Surveillance SA, TÜV Rheinland, Element Materials Technology, The British Standards Institution, Veritell Inspection Certification Co., Ltd, China Certification and Inspection (Group) Co., Ltd., Eurofins Scientific et HQTS Group Ltd. entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 APPLICATION CURVE

2.8 MARKET END-USER COVERAGE GRID

2.9 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.1 DBMR MARKET POSITION GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING FOCUS OF THE GOVERNMENT ON IMPOSING MANDATORY SAFETY STANDARDS FOR AUTOMOTIVE

5.1.2 GROWING PREVALENCE OF AUTOMOTIVE

5.2 RESTRAINTS

5.2.1 VARYING STANDARDS ACROSS DIFFERENT REGIONS/COUNTRIES

5.2.2 LENGTHY PROCESS AND LEAD TIME FOR QUALIFICATION TESTS

5.3 OPPORTUNITIES

5.3.1 GROWING TREND OF ELECTRIC AND ADAS VEHICLES

5.3.2 INCREASE IN THE USAGE OF ELECTRONIC SYSTEMS IN VEHICLES

5.3.3 RISING AWARENESS REGARDING SAFETY AND PRODUCT QUALITY AMONG CONSUMERS

5.4 CHALLENGES

5.4.1 RISK AVERSION AND NEW TECHNOLOGY RELUCTANCE

5.4.2 LACK OF SKILLED PROFESSIONALS

6 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY APPLICATION

6.1 OVERVIEW

6.2 CHASSIS AND BODY CONTROLLER

6.3 FUNCTIONAL SAFETY

6.3.1 ADAS AND SAFETY

6.3.2 ADAPTIVE CRUISE CONTROL (ACC)

6.3.3 AUTO EMERGENCY BRAKING (AEB)

6.3.4 LANE DEPARTURE WARNING SYSTEM (LDWS)

6.3.5 TIRE PRESSURE MONITORING SYSTEM (TPMS)

6.3.6 AUTOMATIC PARKING

6.3.7 PEDESTRIAN WARNING/PROTECTION SYSTEM

6.3.8 AUTOMOTIVE NIGHT VISION

6.3.9 TRAFFIC SIGN RECOGNITION

6.3.10 DRIVER DROWSINESS DETECTION

6.3.11 BLIND SPOT DETECTION

6.3.12 OTHER ADAS AND SAFETY CONTROLLERS

6.4 COCKPIT CONTROLLER

6.4.1 HUMAN-MACHINE INTERFACE (HMI)

6.4.2 HEADS-UP DISPLAY (HUD)

6.4.3 OTHER

7 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY SUPPLY CHAIN

7.1 OVERVIEW

7.2 DESIGN

7.3 PRODUCTION

7.4 DISTRIBUTION

7.5 OPERATION

7.6 SELLING

8 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY SOURCING TYPE

8.1 OVERVIEW

8.2 IN-HOUSE

8.3 OUTSOURCED

9 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY TYPE

9.1 OVERVIEW

9.2 ELECTRICAL SYSTEMS AND COMPONENTS

9.2.1 IN-HOUSE

9.2.2 OUTSOURCED

9.3 ELECTRIC VEHICLES, HYBRID ELECTRIC VEHICLES, AND BATTERY SYSTEMS

9.3.1 IN-HOUSE

9.3.2 OUTSOURCED

9.4 TELEMATICS

9.4.1 IN-HOUSE

9.4.2 OUTSOURCED

9.5 FUELS, FLUIDS AND LUBRICANT

9.5.1 IN-HOUSE

9.5.2 OUTSOURCED

9.6 INTERIOR AND EXTERIOR MATERIALS AND COMPONENTS

9.6.1 IN-HOUSE

9.6.2 OUTSOURCED

9.7 VEHICLE INSPECTION SERVICES

9.7.1 IN-HOUSE

9.7.2 OUTSOURCED

9.8 HOMOLOGATION TESTING

9.8.1 IN-HOUSE

9.8.2 OUTSOURCED

9.9 OTHERS

10 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: GLOBAL

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 DEKRA

12.1.1 COMPANY SNAPSHOT

12.1.2 SERVICE PORTFOLIO

12.1.3 RECENT DEVELOPMENTS

12.2 TÜV SÜD

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 SERVICE PORTFOLIO

12.2.4 RECENT DEVELOPMENTS

12.3 DNV GL

12.3.1 COMPANY SNAPSHOT

12.3.2 SERVICE PORTFOLIO

12.3.3 RECENT DEVELOPMENTS

12.4 APPLUS+

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 SERVICE PORTFOLIO

12.4.4 RECENT DEVELOPMENTS

12.5 TÜV RHEINLAND

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 SERVICE PORTFOLIO

12.5.4 RECENT DEVELOPMENTS

12.6 ASIA QUALITY FOCUS

12.6.1 COMPANY SNAPSHOT

12.6.2 SERVICE PORTFOLIO

12.6.3 RECENT DEVELOPMENTS

12.7 CHINA CERTIFICATION AND INSPECTION (GROUP) CO., LTD.

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT DEVELOPMENTS

12.8 ELEMENT MATERIALS TECHNOLOGY

12.8.1 COMPANY SNAPSHOT

12.8.2 SERVICE PORTFOLIO

12.8.3 RECENT DEVELOPMENT

12.9 EUROFINS SCIENTIFIC

12.9.1 COMPANY SNAPSHOT

12.9.2 REVENUE ANALYSIS

12.9.3 SERVICE PORTFOLIO

12.9.4 RECENT DEVELOPMENTS

12.1 HQTS GROUP LTD

12.10.1 COMPANY SNAPSHOT

12.10.2 SERVICE PORTFOLIO

12.10.3 RECENT DEVELOPMENTS

12.11 INTERTEK GROUP PLC

12.11.1 COMPANY SNAPSHOT

12.11.2 REVENUE ANALYSIS

12.11.3 SERVICE PORTFOLIO

12.11.4 RECENT DEVELOPMENTS

12.12 MISTRAS GROUP

12.12.1 COMPANY SNAPSHOT

12.12.2 REVENUE ANALYSIS

12.12.3 SERVICE PORTFOLIO

12.12.4 RECENT DEVELOPMENT

12.13 NEMKO

12.13.1 COMPANY SNAPSHOT

12.13.2 SERVICE PORTFOLIO

12.13.3 RECENT DEVELOPMENTS

12.14 NSF

12.14.1 COMPANY SNAPSHOT

12.14.2 SERVICE PORTFOLIO

12.14.3 RECENT DEVELOPMENTS

12.15 RINA S.P.A.

12.15.1 COMPANY SNAPSHOT

12.15.2 SERVICE PORTFOLIO

12.15.3 RECENT DEVELOPMENTS

12.16 SGS SOCIÉTÉ GÉNÉRALE DE SURVEILLANCE SA

12.16.1 COMPANY SNAPSHOT

12.16.2 REVENUE ANALYSIS

12.16.3 SERVICE PORTFOLIO

12.16.4 RECENT DEVELOPMENTS

12.17 THE BRITISH STANDARDS INSTITUTION

12.17.1 COMPANY SNAPSHOT

12.17.2 SERVICE PORTFOLIO

12.17.3 RECENT DEVELOPMENTS

12.18 TÜV NORD GROUP

12.18.1 COMPANY SNAPSHOT

12.18.2 REVENUE ANALYSIS

12.18.3 SERVICE PORTFOLIO

12.18.4 RECENT DEVELOPMENTS

12.19 VERITELL INSPECTION CERTIFICATION CO., LTD

12.19.1 COMPANY SNAPSHOT

12.19.2 PRODUCT PORTFOLIO

12.19.3 RECENT DEVELOPMENT

13 QUESTIONNAIRE

14 RELATED REPORTS

Liste des tableaux

TABLE 1 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 2 CHINA FUNCTIONAL SAFETY IN AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 3 CHINA COCKPIT CONTROLLER IN AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 4 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY SUPPLY CHAIN, 2021-2030 (USD MILLION)

TABLE 5 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY SOURCING TYPE, 2021-2030 (USD MILLION)

TABLE 6 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 7 CHINA ELECTRICAL SYSTEMS AND COMPONENTS IN AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY SOURCING TYPE, 2021-2030 (USD MILLION)

TABLE 8 CHINA ELECTRIC VEHICLES, HYBRID ELECTRIC VEHICLES, AND BATTERY SYSTEMS IN AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY SOURCING TYPE, 2021-2030 (USD MILLION)

TABLE 9 CHINA TELEMATICS IN AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY SOURCING TYPE, 2021-2030 (USD MILLION)

TABLE 10 CHINA FUELS, FLUIDS AND LUBRICANT IN AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY SOURCING TYPE, 2021-2030 (USD MILLION)

TABLE 11 CHINA INTERIOR AND EXTERIOR MATERIALS AND COMPONENTS IN AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY SOURCING TYPE, 2021-2030 (USD MILLION)

TABLE 12 CHINA VEHICLE INSPECTION SERVICES IN AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY SOURCING TYPE, 2021-2030 (USD MILLION)

TABLE 13 CHINA HOMOLOGATION TESTING IN AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY SOURCING TYPE, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: SEGMENTATION

FIGURE 2 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: DATA TRIANGULATION

FIGURE 3 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: DROC ANALYSIS

FIGURE 4 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: MULTIVARIATE MODELLING

FIGURE 7 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: MARKET: APPLICATION CURVE

FIGURE 8 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: MARKET END-USER COVERAGE GRID

FIGURE 9 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 10 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: DBMR MARKET POSITION GRID

FIGURE 11 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: SEGMENTATION

FIGURE 12 UPSURGE OF ADOPTION OF ADVANCED FEATURES FOR VEHICLES IS EXPECTED TO DRIVE CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET IN THE FORECAST PERIOD

FIGURE 13 CHASSIS AND BODY CONTROLLER IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET FROM 2023 & 2030

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGE OF GLOBAL SYNCHRONOUS CONDENSER MARKET

FIGURE 15 GROWTH RATE OF ADOPTION OF ELECTRONIC SYSTEMS IN VARIOUS APPLICATIONS (CAGR)

FIGURE 16 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: BY APPLICATION, 2022

FIGURE 17 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: BY SUPPLY CHAIN, 2022

FIGURE 18 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: BY SOURCING TYPE, 2022

FIGURE 19 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: BY TYPE, 2022

FIGURE 20 THE CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: COMPANY SHARE 2022(%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.