Australia Fire Protection Materials Market, By Product (Adhesive and Sealant, Intumescent Coatings, Sheets & Boards, Foam, Putties, Mortar, Fire Blocks, Cementitious Spray, Preformed Devices, Fire Safe Pipe Penetrations, Others), Types of Fire (Cellulosic Fires, Hydrogen Fires, Jet Fires), Application (Pipe, Duct, Structural Steel Fireproofing, Cable & Wire Tray Fireproofing, Doors, Windows, Glasses, Others), End-Use (Residential, Commercial, Institutional, Infrastructure) Industry Trends and Forecast to 2029.

Market Analysis and Insights

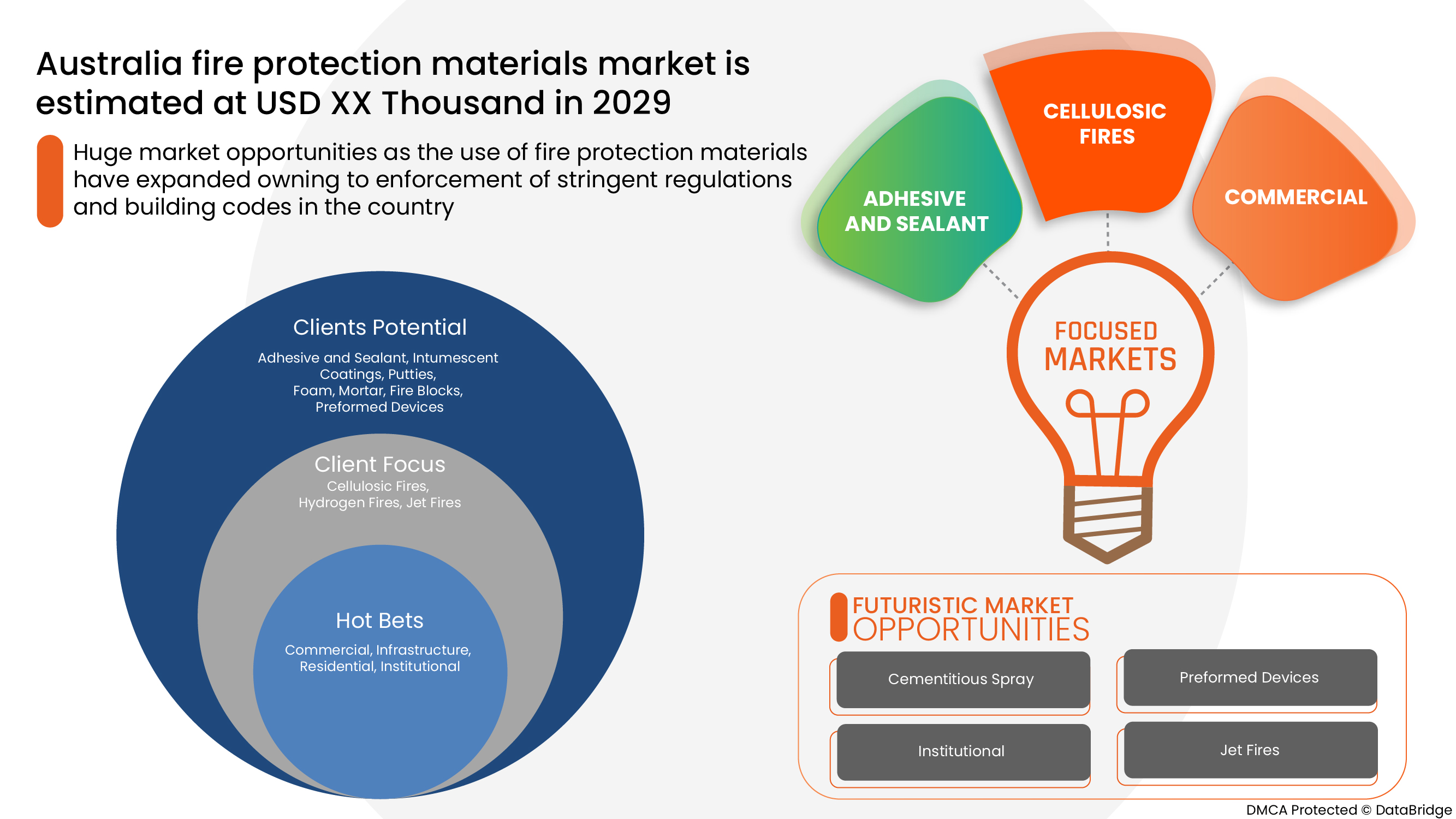

Australia fire protection materials market is expected to gain significant growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 5.2% in the forecast period of 2022 to 2029 and is expected to reach USD 165,601.87 thousand by 2029.

++

++

Escalating the application scope of fire protection materials in various industries is expected to be an important driver for the Australia fire protection materials market. The imposition of favorable government guidelines and fire safety standards may accelerate market growth. Growing building & construction activities due to rapid growth in population are expected to further lead to the Australia fire protection materials market growth.

The major restraints that may negatively impact the Australia fire protection materials market could be the fluctuations in the price of raw materials and the integration of user interfaces with fire protection solutions.

Rapid technological advancements in fire protection systems and products and increasing utilization of safety codes in buildings for occupants and users are expected to provide the Australia fire protection materials market with opportunities. However, the low adoption rate among the potential end-users due to lack of awareness and high installation and maintenance costs are projected to challenge the Australia fire protection materials market growth.

Australia fire protection materials market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief; our team will help you create a revenue impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Year |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

Par produit (adhésif et scellant, revêtements intumescents, feuilles et panneaux, mousse, mastics, mortier, pare-feu, projection de ciment, dispositifs préformés, pénétrations de tuyaux coupe-feu, autres), types d'incendie (incendies cellulosiques, incendies d'hydrogène, incendies de jets), application (ignifugation de tuyaux, conduits, acier de construction, ignifugation de chemins de câbles et de fils, portes, fenêtres, verres, autres), utilisation finale (résidentielle, commerciale, institutionnelle, infrastructure) |

|

Pays couvert |

Australie |

|

Acteurs du marché couverts |

3M, BASF SE, PPG Industries, Inc., The Sherwin-Williams Company, Morgan Advanced Materials et ses sociétés affiliées, Hilti Group, Tremco Incorporated, Unifrax, Tenmat, Sika Australia Pty Ltd, entre autres |

Définition du marché

Les matériaux de protection contre l'incendie sont ceux qui sont utilisés pour assurer la sécurité des bâtiments contre les risques liés au feu. Cela implique l'utilisation de matériaux de protection passive contre l'incendie tels que des panneaux ignifuges, des produits d'étanchéité et des matériaux résistants au feu, tels que la laine minérale et les revêtements ignifuges, ou peut inclure des matériaux de protection active contre l'incendie tels que des mousses extinctrices, des produits chimiques, de l'eau et des sprays. Lors du choix d'un matériau qui protège contre le feu, plusieurs facteurs sont pris en compte, tels que ses capacités de charge, sa conductivité thermique et sa tendance à la pourriture.

La demande de matériaux de protection contre les incendies est en hausse en raison des codes de construction et des politiques de sécurité incendie stricts et des diverses normes officielles établies pour surveiller et garantir l'efficacité des produits dans la région australienne. Cela devrait stimuler les matériaux de protection contre les incendies au cours des années prévues. En outre, la sensibilisation croissante des consommateurs à la protection contre les accidents liés aux incendies devrait également stimuler la croissance des matériaux de protection contre les incendies.

Dynamique du marché des matériaux de protection contre l'incendie en Australie

Conducteurs

- Champ d'application croissant des matériaux de protection contre l'incendie dans diverses industries

Des matériaux de protection incendie avancés sont utilisés dans ce secteur pour éviter les accidents d'incendie. Des systèmes de détection et de prévention des incendies hautement efficaces sont nécessaires dans ce secteur pour prévenir les accidents. Les systèmes d'extinction d'incendie à agent propre, les matériaux d'extinction d'incendie à poudre chimique et les gicleurs à eau et à mousse sont largement utilisés dans le secteur minier.

Les systèmes d'extinction à base de gaz contenant du CO2, du Novec et des gaz inertes ainsi que les systèmes d'arrosage sont également utilisés dans le secteur du pétrole et du gaz. En outre, l'utilisation croissante de matériaux de protection contre les incendies dans les véhicules miniers pour éteindre les incendies en améliorant les opérations de lutte contre les incendies contribue également à la croissance du marché.

- Imposition de directives gouvernementales favorables et de normes de sécurité incendie

La construction commerciale est l'un des segments d'application en pleine croissance sur le marché des matériaux de protection incendie. Le gouvernement a mis en place des réglementations de sécurité et des codes de construction stricts dans la construction de bureaux, de centres commerciaux, de centres commerciaux, d'hôpitaux, de collèges, d'écoles, d'universités et d'hôtels en raison du grand nombre de personnes dans ces bâtiments. Par conséquent, l'application de ces réglementations et législations en matière d'incendie augmentera considérablement la sensibilisation des consommateurs, ce qui pourrait contribuer à stimuler la demande de matériaux de protection incendie sur le marché australien des matériaux de protection incendie.

- Croissance des activités de construction et de bâtiment en raison de la croissance rapide de la population

La conception d'une structure à l'épreuve de la sécurité est nécessaire pour assurer la stabilité de la structure et rendre les risques d'incendie et d'explosion gérables. En outre, l'augmentation du nombre d'incendies, entraînant des pertes humaines et des pertes de biens précieux, a rendu les entreprises de construction plus vigilantes, les obligeant à adopter des mesures de protection contre les incendies pour des raisons de sécurité. Cela devrait à son tour stimuler le marché australien des matériaux de protection contre les incendies.

Opportunités

- Progrès technologiques rapides dans les systèmes et produits de protection incendie

Les progrès réalisés dans l'amélioration de la résistance au feu de certains matériaux ont été nombreux, allant des développements dans le domaine des retardateurs de flamme sans phosphore et sans halogène à l'utilisation de nanocomposites comme nouveaux systèmes ignifuges. Ainsi, les avancées technologiques rapides dans le domaine des matériaux et des systèmes de protection contre l'incendie peuvent offrir des opportunités lucratives pour la croissance et le développement du marché australien des matériaux de protection contre l'incendie.

- Utilisation croissante des codes de sécurité dans les bâtiments pour les occupants et les utilisateurs

En outre, le NCC australien promeut également des matériaux de construction peu combustibles et des voies de sortie sûres pour les occupants dans des compartiments coupe-feu bien conçus au sein des bâtiments. Toutes ces spécifications contribuent à établir le niveau de résistance au feu (FRL) des bâtiments, garantissant l'adéquation structurelle, l'intégrité et l'isolation adéquate des locaux.

Ainsi, l’utilisation et l’adoption croissantes de codes et de protocoles de sécurité dans divers bâtiments résidentiels et commerciaux pour les occupants et les utilisateurs devraient offrir des opportunités de croissance aux investisseurs et aux acteurs opérant sur le marché australien des matériaux de protection incendie.

Contraintes/Défis

- Fluctuations du prix des matières premières

La hausse des prix des matières premières entraîne une augmentation des coûts de production au niveau des entreprises. Cela a des répercussions sur les consommateurs, car les produits finis leur coûtent plus cher, ce qui limite leur demande, car les consommateurs arrêtent de consommer ces produits et matières coûteux ou commencent à rechercher des alternatives disponibles sur le marché.

En outre, l'augmentation du prix de diverses matières premières telles que l'acier, le béton et le verre a eu un impact direct et négatif sur le marché immobilier, ce qui pourrait entraver la croissance du marché australien des matériaux de protection contre les incendies. Par conséquent, les fluctuations et l'augmentation rapides des prix des matières premières devraient entraver la croissance du marché.

- Intégration d'interfaces utilisateur avec des solutions de protection incendie

Une bonne coordination entre les entrepreneurs en mécanique, en électricité, en protection incendie et en installation est indispensable au bon fonctionnement des systèmes de contrôle incendie. De plus, avec l'intégration de tous les systèmes de sécurité et d'incendie en un seul endroit, l'interface utilisateur devient trop confuse et complexe à utiliser.

La première fois que de nombreux opérateurs interagissent avec le panneau de commande de cette interface utilisateur, c'est en cas d'incertitude ou d'urgence. Plus l'interface utilisateur est complexe, plus son utilisation est difficile. Les systèmes de menu complexes peuvent facilement conduire à la confusion, susciter la peur et paralyser l'utilisateur en raison d'un manque de conseils ou d'intuition du panneau. Par conséquent, l'intégration de l'interface utilisateur avec le système et les matériaux de protection incendie n'est pas une tâche facile et peut entraver la croissance du marché australien des matériaux de protection incendie.

- Faible taux d'adoption parmi les utilisateurs finaux potentiels en raison du manque de sensibilisation

Cependant, la population australienne manque de connaissances de base en matière de sécurité incendie, notamment en ce qui concerne la nature du feu, ses causes, son comportement et sa gestion. Les utilisateurs étant peu sensibilisés aux matériaux de protection incendie, les gens préfèrent généralement des matériaux bon marché qui n'offrent aucune protection contre le feu ou ne sont pas adaptés pour contenir le feu en cas d'accident. Cela devrait constituer un problème majeur pour la croissance du marché australien de la protection incendie.

- Coût d'installation et de maintenance élevé

De plus, l'installation de divers systèmes de protection incendie augmente le coût du budget global d'un bâtiment. Par exemple, l'installation d'un système d'arrosage automatique nécessite des équipements supplémentaires, des canalisations, des ensembles de vannes, des pompes de surpression et un stockage d'eau, qui ne sont pas abordables pour tous les occupants ou utilisateurs. De plus, l'utilisation de matériaux de protection incendie plus lourds dans un bâtiment augmente également la charge sur la poutre du bâtiment, ce qui affecte négativement la capacité de charge du bâtiment, le rendant moins stable sur une longue période. Par conséquent, l'inconvénient des coûts élevés d'installation et de maintenance des matériaux, produits et systèmes de protection incendie dans un bâtiment constituera un défi à la croissance du marché australien de la protection incendie.

Développement récent

- En mars 2022, PPG Industries, Inc. a lancé son nouveau revêtement époxy polyvalent PPG AMERLOCK 600 pour les applications nécessitant une polyvalence maximale. Cette nouvelle gamme de revêtements est un revêtement hautement construit, durci au polyamide, qui combine une large gamme d'épaisseurs d'application avec des temps de séchage rapides et une fenêtre de recouvrement d'un an.

Portée du marché australien des matériaux de protection contre l'incendie

Le marché australien des matériaux de protection contre l'incendie est classé en fonction du produit, des types d'incendie, de l'application et de l'utilisation finale. La croissance de ces segments vous aidera à analyser les principaux segments de croissance de l'industrie et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Produit

- Adhésif et scellant

- Revêtements intumescents

- Feuilles et planches

- Mastics

- Mortier

- Mousse

- Pare-feu

- Pénétrations de tuyaux à l'épreuve du feu

- Dispositifs préformés

- Pulvérisation de ciment

- Autres

Sur la base du produit, le marché australien des matériaux de protection contre l'incendie est segmenté en adhésifs et produits d'étanchéité, revêtements intumescents, feuilles et panneaux, mousse, mastics, mortier, blocs coupe-feu, pulvérisation de ciment, dispositifs préfabriqués, pénétrations de tuyaux coupe-feu, autres.

Types d'incendies

- Incendies cellulosiques

- Incendies d'hydrogène

- Incendies de jets

Sur la base des types d'incendies, le marché australien des matériaux de protection contre les incendies est segmenté en incendies cellulosiques, incendies d'hydrogène et incendies à jet.

Application

- Tuyau

- Canal

- Ignifugation des structures en acier

- Ignifugation des chemins de câbles et de fils

- Portes

- Fenêtres

- Lunettes

- Autres

Sur la base de l'application, le marché australien des matériaux de protection contre l'incendie est segmenté en tuyaux, conduits, ignifuges en acier de construction, ignifuges pour câbles et chemins de câbles, portes, fenêtres, verres, autres.

Utilisation finale

- Commercial

- Infrastructure

- Institutionnel

- Résidentiel

Sur la base de l’utilisation finale, le marché australien des matériaux de protection incendie est segmenté en résidentiel, commercial, institutionnel et infrastructurel.

Analyse du paysage concurrentiel et des parts de marché des matériaux de protection contre l'incendie en Australie

Le paysage concurrentiel du marché australien des matériaux de protection contre l'incendie fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus ne concernent que l'orientation des entreprises sur le marché australien des matériaux de protection contre l'incendie.

Certains des principaux acteurs opérant sur le marché australien des matériaux de protection incendie sont 3M, BASF SE, PPG Industries, Inc., The Sherwin-Williams Company, Morgan Advanced Materials et ses filiales, Hilti Group, Tremco Incorporated, Unifrax, Tenmat, Sika Australia Pty Ltd, entre autres.

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement de l'entreprise, l'analyse des parts de marché des entreprises, les normes de mesure, l'Australie par rapport aux régions et l'analyse des parts des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF AUSTRALIA FIRE PROTECTION MATERIALS MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 IMPORT-EXPORT DATA

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS:

4.2.2 THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 TECHNOLOGY ADVANCEMENTS

4.4 VENDOR SELECTION CRITERIA

4.5 RAW MATERIAL PRODUCTION COVERAGE

4.6 REGULATION OVERVIEW

5 COUNTRY ANALYSIS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 ESCALATING APPLICATION SCOPE OF FIRE PROTECTION MATERIALS IN VARIOUS INDUSTRIES

6.1.2 IMPOSITION OF FAVOURABLE GOVERNMENT GUIDELINES AND FIRE SAFETY STANDARDS

6.1.3 GROWING BUILDING AND CONSTRUCTION ACTIVITIES DUE TO RAPID GROWTH IN POPULATION

6.2 RESTRAINTS

6.2.1 FLUCTUATIONS IN THE PRICE OF RAW MATERIALS

6.2.2 INTEGRATION OF USER INTERFACES WITH FIRE PROTECTION SOLUTIONS

6.3 OPPORTUNITIES

6.3.1 RAPID TECHNOLOGICAL ADVANCEMENTS IN FIRE PROTECTION SYSTEMS AND PRODUCTS

6.3.2 INCREASING UTILIZATION OF SAFETY CODES IN BUILDINGS FOR OCCUPANTS AND USERS

6.4 CHALLENGES

6.4.1 LOW ADOPTION RATE AMONG THE POTENTIAL END-USERS DUE TO LACK OF AWARENESS

6.4.2 HIGH INSTALLATION AND MAINTENANCE COST

7 AUSTRALIA FIRE PROTECTION MATERIALS MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 ADHESIVE & SEALANT

7.2.1 SILICONE

7.2.2 ACRYLIC

7.2.3 OTHERS

7.3 INTUMESCENT COATINGS

7.3.1 STYRENE ACRYLICS

7.3.2 VINYL TOULENE ACRYLICS

7.3.3 SILICONE ACRYLICS

7.3.4 FLUOROPOLYMER

7.3.5 EPOXIES

7.3.6 URETHANES

7.3.7 CHLORINATED RUBBER

7.3.8 OTHERS

7.4 SHEETS & BOARDS

7.4.1 GYPSUM BOARDS

7.4.2 PERLITE BOARDS

7.4.3 PROPLEX SHEETS

7.4.4 CALCIUM SILICATE

7.4.5 SODIUM SILICATE

7.4.6 POTASSIUM SILICATE

7.4.7 OTHERS

7.5 PUTTIES

7.6 MORTAR

7.7 FOAM

7.8 FIRE BLOCKS

7.9 FIRE SAFE PIPE PENETRATIONS

7.9.1 FIRE SAFE PIPE PENETRATIONS, BY PRODUCT

7.9.1.1 OUTER INSULATION PRODUCT

7.9.1.1.1 TAPE

7.9.1.1.2 BANDAGE

7.9.1.1.3 OTHERS

7.9.1.2 BASE INSULATION PRODUCT

7.9.1.2.1 STONE WOOL

7.9.1.2.2 GLASS WOOL

7.9.1.2.3 OTHERS

7.9.2 FIRE SAFE PIPE PENETRATIONS, BY RESISTANCE CLASS

7.9.2.1 EI 120

7.9.2.2 EI 90

7.9.2.3 OTHERS

7.9.3 FIRE SAFE PIPE PENETRATIONS, BY SOLUTION

7.9.3.1 CONTINUOUS SUSTAINED (CS)

7.9.3.2 LOCAL SUSTAINED (LS)

7.9.3.3 OTHERS

7.1 PREFORMED DEVICES

7.10.1 WRAP STRIPS

7.10.2 COLLARS

7.10.3 PILLOW

7.10.4 PU-BRICK

7.10.5 CAST-IN DEVICE

7.11 CEMENTITIOUS SPRAY

7.12 OTHERS

8 AUSTRALIA FIRE PROTECTION MATERIALS MARKET, BY TYPE OF FIRE

8.1 OVERVIEW

8.2 CELLULOSIC FIRES

8.3 HYDROGEN FIRES

8.4 JET FIRES

9 AUSTRALIA FIRE PROTECTION MATERIALS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 PIPE

9.2.1 STAINLESS STEEL PIPE

9.2.2 STEEL PIPE

9.2.3 COPPER PIPE

9.2.4 IRON PIPE

9.2.5 COMPOSITE PIPE

9.2.6 PLASTIC PIPE

9.3 DUCT

9.4 STRUCTURAL STEEL FIREPROOFING

9.5 CABLE & WIRE TRAY FIREPROOFING

9.6 DOORS

9.7 WINDOWS

9.8 GLASSES

9.9 OTHERS

10 AUSTRALIA FIRE PROTECTION MATERIALS MARKET, BY END USE

10.1 OVERVIEW

10.2 COMMERCIAL

10.2.1 ADHESIVE & SEALANT

10.2.2 INTUMESCENT COATINGS

10.2.3 SHEETS & BOARDS

10.2.4 PUTTIES

10.2.5 MORTAR

10.2.6 FOAM

10.2.7 FIRE BLOCKS

10.2.8 FIRE SAFE PIPE PENETRATION

10.2.9 PREFORMED DEVICES

10.2.10 CEMENTITIOUS SPRAY

10.2.11 OTHERS

10.3 INFRASTRUTURE

10.3.1 ADHESIVE & SEALANT

10.3.2 INTUMESCENT COATINGS

10.3.3 SHEETS & BOARDS

10.3.4 PUTTIES

10.3.5 MORTAR

10.3.6 FOAM

10.3.7 FIRE BLOCKS

10.3.8 FIRE SAFE PIPE PENETRATION

10.3.9 PREFORMED DEVICES

10.3.10 CEMENTITIOUS SPRAY

10.3.11 OTHERS

10.4 INSTITUTIONAL

10.4.1 ADHESIVE & SEALANT

10.4.2 INTUMESCENT COATINGS

10.4.3 SHEETS & BOARDS

10.4.4 PUTTIES

10.4.5 MORTAR

10.4.6 FOAM

10.4.7 FIRE BLOCKS

10.4.8 FIRE SAFE PIPE PENETRATION

10.4.9 PREFORMED DEVICES

10.4.10 CEMENTITIOUS SPRAY

10.4.11 OTHERS

10.5 RESIDENTIAL

10.5.1 ADHESIVE & SEALANT

10.5.2 INTUMESCENT COATINGS

10.5.3 SHEETS & BOARDS

10.5.4 PUTTIES

10.5.5 MORTAR

10.5.6 FOAM

10.5.7 FIRE BLOCKS

10.5.8 FIRE SAFE PIPE PENETRATION

10.5.9 PREFORMED DEVICES

10.5.10 CEMENTITIOUS SPRAY

10.5.11 OTHERS

10.6 RESIDENTIAL, BY SEGMENT

10.6.1 APARTMENTS

10.6.2 MULTI FAMILY HOME

10.6.3 SINGLE FAMILY HOME

10.6.4 OTHERS

11 AUSTRALIA FIRE PROTECTION MATERIALS MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: AUSTRALIA

11.2 COLLABORATION

11.3 PRODUCT LAUNCHES

11.4 FACILITY EXPANSION

11.5 ACQUISITION

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 3M

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT UPDATES

13.2 PPG INDUSTRIES, INC

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT UPDATES

13.3 SIKA AUSTRALIA PTY LTD

13.3.1 COMPANY SNAPSHOT

13.3.2 PRODUCT PORTFOLIO

13.3.3 RECENT UPDATE

13.4 HILTI GROUP

13.4.1 COMPANY SNAPSHOT

13.4.2 PRODUCT PORTFOLIO

13.4.3 RECENT UPDATES

13.5 BASF SE

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT UPDATE

13.6 TREMCO INCORPORATED

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT UPDATES

13.7 MORGAN ADVANCED MATERIALS AND ITS AFFILIATES

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT UPDATES

13.8 TENMAT

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT UPDATE

13.9 THE SHERWIN-WILLIAMS COMPANY

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 PRODUCT PORTFOLIO

13.9.4 RECENT UPDATES

13.1 UNIFRAX

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT UPDATE

14 QUESTIONNAIRE

15 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF PARTS OF FIRE EXTINGUISHERS, SPRAY GUNS AND SIMILAR APPLIANCES, STEAM OR SAND BLASTING; HS CODE - 842490 (USD THOUSAND)

TABLE 2 EXPORT IMPORT DATA OF PARTS OF FIRE EXTINGUISHERS, SPRAY GUNS AND SIMILAR APPLIANCES, STEAM OR SAND BLASTING; HS CODE - 842490 (USD THOUSAND

TABLE 3 REGULATORY FRAMEWORK

TABLE 4 AUSTRALIA FIRE PROTECTION MATERIALS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 5 AUSTRALIA ADHESIVE & SEALANT IN FIRE PROTECTION MATERIALS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 6 AUSTRALIA INTUMESCENT COATINGS IN FIRE PROTECTION MATERIALS MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 7 AUSTRALIA SHEETS & BOARDS IN FIRE PROTECTION MATERIALS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 8 AUSTRALIA FIRE SAFE PIPE PENETRATIONS IN FIRE PROTECTION MATERIALS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 9 AUSTRALIA OUTER INSULATION PRODUCT IN FIRE PROTECTION MATERIALS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 10 AUSTRALIA BASE INSULATION PRODUCT IN FIRE PROTECTION MATERIALS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 11 AUSTRALIA FIRE SAFE PIPE PENETRATIONS IN FIRE PROTECTION MATERIALS MARKET, BY RESISTANCE CLASS, 2020-2029 (USD THOUSAND)

TABLE 12 AUSTRALIA FIRE SAFE PIPE PENETRATIONS IN FIRE PROTECTION MATERIALS MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 13 AUSTRALIA PERFORMED DEVICES IN FIRE PROTECTION MATERIALS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 14 AUSTRALIA FIRE PROTECTION MATERIALS MARKET, BY TYPE OF FIRE, 2020-2029 (USD THOUSAND)

TABLE 15 AUSTRALIA FIRE PROTECTION MATERIALS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 16 AUSTRALIA PIPE IN FIRE PROTECTION MATERIALS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 17 AUSTRALIA FIRE PROTECTION MATERIALS MARKET, BY END USE, 2020-2029 (USD THOUSAND)

TABLE 18 AUSTRALIA COMMERCIAL IN FIRE PROTECTION MATERIALS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 19 AUSTRALIA INFRASTRUCTURE IN FIRE PROTECTION MATERIALS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 20 AUSTRALIA INSTITUTIONAL IN FIRE PROTECTION MATERIALS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 21 AUSTRALIA RESIDENTIAL IN FIRE PROTECTION MATERIALS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 22 AUSTRALIA RESIDENTIAL IN FIRE PROTECTION MATERIALS MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

Liste des figures

FIGURE 1 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: SEGMENTATION

FIGURE 2 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: DATA TRIANGULATION

FIGURE 3 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: DROC ANALYSIS

FIGURE 4 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: PRODUCT LIFE LINE CURVE

FIGURE 7 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: MULTIVARIATE MODELLING

FIGURE 8 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: APPLICATION COVERAGE GRID

FIGURE 11 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: SEGMENTATION

FIGURE 13 ESCALATING APPLICATION SCOPE OF FIRE PROTECTION MATERIALS IN VARIOUS INDUSTRIES IS EXPECTED TO DRIVE AUSTRALIA FIRE PROTECTION MATERIALS MARKET IN THE FORECAST PERIOD

FIGURE 14 ADHESIVE & SEALANT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE AUSTRALIA FIRE PROTECTION MATERIALS MARKET IN 2022 & 2029

FIGURE 15 VENDOR SELECTION CRITERIA

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF AUSTRALIA FIRE PROTECTION MATERIALS MARKET

FIGURE 17 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: BY PRODUCT, 2021

FIGURE 18 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: BY TYPE OF FIRE, 2021

FIGURE 19 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: BY APPLICATION, 2021

FIGURE 20 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: BY END USE, 2021

FIGURE 21 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.