Australia Uninterruptible Power Supply Ups Market

Taille du marché en milliards USD

TCAC :

%

USD

275.43 Million

USD

402.88 Million

2024

2032

USD

275.43 Million

USD

402.88 Million

2024

2032

| 2025 –2032 | |

| USD 275.43 Million | |

| USD 402.88 Million | |

|

|

|

Marché australien des onduleurs (UPS) par offre (solutions et services), taille de l'entreprise (grande, moyenne et petite entreprise), type (en ligne, hors ligne et interactif), secteur d'activité (industrie manufacturière, informatique et centres de données, santé, BFSI, énergie et services publics, administration et secteur public, télécommunications, commerce de détail, résidentiel, éducation, etc.), débit (CA vers CA, CC vers CC et CA vers CC), canal de vente (direct et indirect). – Tendances et prévisions du secteur jusqu'en 2032

Analyse du marché australien des onduleurs

Le marché australien des onduleurs (ASI) englobe la fourniture de solutions d'alimentation de secours critiques pour les entreprises, les centres de données et les industries de la région. Ce marché est stimulé par la dépendance croissante aux appareils électroniques et aux opérations gourmandes en données, ce qui fait des ASI un élément essentiel pour garantir une alimentation électrique ininterrompue en cas de panne. Il comprend une gamme de produits et de services, allant des systèmes de batteries plomb-acide traditionnels aux solutions lithium-ion avancées, visant à protéger les opérations contre les coupures de courant et à maintenir la continuité des activités. Le marché de cette région se caractérise par le besoin de systèmes de protection électrique robustes et fiables, compte tenu des conditions environnementales difficiles et de l'évolution rapide du paysage technologique.

Taille du marché australien des onduleurs

Le marché australien des alimentations sans interruption (UPS) au cours de la période de prévision devrait atteindre 402,88 millions USD d'ici 2032, contre 275,43 millions USD en 2024, avec un TCAC substantiel de 5,0 % au cours de la période de prévision de 2025 à 2032. Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une épidémiologie des patients, une analyse des pipelines, une analyse des prix et un cadre réglementaire.

Tendances du marché australien des onduleurs

« Forte augmentation de la demande de centrales électriques fiables »

En cas de panne de courant, un système d'alimentation sans interruption (ASI) est un dispositif électronique qui assure l'alimentation de secours de nombreux appareils électroniques. Face à l'augmentation du nombre d'appareils électroniques, la demande en ASI augmente également pour garantir une alimentation sans interruption.

Le secteur de l'électricité est en pleine transformation. Le gaz naturel et les énergies renouvelables deviennent plus abordables, et l'efficacité énergétique et la production décentralisée gagnent en popularité. Le besoin de centrales électriques renouvelables a augmenté, tout comme la demande de surtensions ininterrompues. Les systèmes d'alimentation sans interruption (ASI) peuvent répondre à la demande de centrales électriques fiables et d'une production et d'une distribution d'énergie ininterrompues.

De plus, les systèmes d'alimentation sans interruption (ASI) peuvent fonctionner avec des fluctuations de tension variables afin de maintenir une fréquence d'alimentation stable. Cette tension varie lors des pics de demande grâce à des transformateurs utilisés pour modifier la tension, ce qui devrait entraîner une augmentation de la demande d'ASI dans les centrales électriques fiables.

Portée du rapport et segmentation du marché australien des onduleurs

|

Attributs |

Marché australien des onduleurs : informations clés |

|

Segments couverts |

|

|

Acteurs clés du marché |

General Electric (États-Unis), Siemens (Allemagne), Schneider Electric (France), Delta Electronics, Inc. (Taïwan), Socomec (France), ABB (Suisse), TOSHIBA CORPORATION (Japon), OMRON Corporation (Japon), PowerShield Pty Ltd. (Australie), Real Power Solutions (Nouvelle-Zélande) |

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research incluent également une analyse approfondie des experts, une épidémiologie des patients, une analyse du pipeline, une analyse des prix et un cadre réglementaire. |

Définition du marché australien des onduleurs

Le marché australien des onduleurs (ASI) englobe la fourniture de solutions d'alimentation de secours critiques pour les entreprises, les centres de données et les industries de la région. Ce marché est stimulé par la dépendance croissante aux appareils électroniques et aux opérations gourmandes en données, faisant des ASI un élément essentiel pour garantir une alimentation électrique ininterrompue en cas de panne. Il comprend une gamme de produits et de services, allant des systèmes de batteries plomb-acide traditionnels aux solutions lithium-ion avancées, visant à protéger les opérations contre les coupures de courant et à maintenir la continuité des activités. Le marché de cette région se caractérise par le besoin de systèmes de protection électrique robustes et fiables, compte tenu des conditions environnementales difficiles et de l'évolution rapide du paysage technologique.

Dynamique du marché australien des onduleurs

Conducteurs

- Forte augmentation de la demande de centrales électriques fiables

En cas de panne de courant, un système d'alimentation sans interruption (ASI) est un dispositif électronique qui assure l'alimentation de secours de nombreux appareils électroniques. Face à l'augmentation du nombre d'appareils électroniques, la demande en ASI augmente également pour garantir une alimentation sans interruption.

Le secteur de l'électricité est en pleine transformation. Le gaz naturel et les énergies renouvelables deviennent plus abordables, et l'efficacité énergétique et la production décentralisée gagnent en popularité. Le besoin de centrales électriques renouvelables a augmenté, tout comme la demande de surtensions ininterrompues. Les systèmes d'alimentation sans interruption (ASI) peuvent répondre à la demande de centrales électriques fiables et d'une production et d'une distribution d'énergie ininterrompues.

De plus, les systèmes d'alimentation sans interruption (ASI) peuvent fonctionner avec des fluctuations de tension variables afin de maintenir une fréquence d'alimentation stable. Cette tension varie lors des pics de demande grâce à des transformateurs utilisés pour modifier la tension, ce qui devrait entraîner une augmentation de la demande d'ASI dans les centrales électriques fiables.

Par exemple,

- En novembre 2023, Panduit Australia a lancé son système d'alimentation sans interruption (ASI), offrant une protection efficace et fiable des équipements informatiques. Dotée d'une gestion intelligente des batteries, de fonctionnalités de surveillance avancées et conforme à la norme ENERGY STAR® 2.0, cette solution est adaptée aux centres de données modernes, aux entreprises et aux systèmes informatiques Edge. Ce lancement répond à la demande croissante de solutions d'alimentation fiables en Australie, offrant une surveillance en temps réel, des performances de batterie prolongées et une intégration transparente avec la gestion centralisée des données (DCIM) basée sur le cloud, afin de soutenir la numérisation croissante de la région et l'adoption des énergies renouvelables.

- En mars 2023, selon un article publié par Crisis24, une panne de courant a perturbé le quartier central des affaires de Sydney, entraînant des perturbations potentielles dans les activités commerciales et les transports. Les entreprises dépourvues de générateurs de secours ont dû suspendre leurs activités. Des feux de circulation ont mal fonctionné, entraînant des problèmes de circulation, et les transports publics, dépendants de l'électricité, ont subi des interruptions. La panne a brièvement affecté les services municipaux d'eau, les télécommunications et les systèmes électroniques de filtration d'eau.

Demande croissante de systèmes d'alimentation sans interruption (ASI) de puissance plus élevée dans les secteurs industriels et commerciaux

Un onduleur est souvent utilisé pour protéger des équipements tels que des ordinateurs, des centres de données, des équipements de communication ou d'autres équipements électriques contre les pannes de courant pouvant entraîner des blessures, des décès, des perturbations majeures de l'activité ou des pertes de données. Les onduleurs interviennent en cas de panne de courant dans divers secteurs. La technologie continue de s'améliorer, car le maintien de l'alimentation des systèmes et des opérations essentiels devient de plus en plus crucial. Les systèmes d'alimentation sans interruption (ASI) sont devenus un composant essentiel de nombreuses installations de traitement de données (IT), des ordinateurs de bureau aux ordinateurs centraux. Ils offrent une certaine protection et sécurité aux utilisateurs préoccupés par les pertes de données et les pannes matérielles dues aux pannes de courant.

Des pannes de courant surviennent quotidiennement dans les foyers, les entreprises et les administrations. Les pertes engendrées par ces interruptions peuvent être considérables.

Récemment, l'utilisation de systèmes de contrôle informatisés dans les applications de fabrication et de contrôle des procédés a nécessité l'installation d'onduleurs dans les installations industrielles. Les applications typiques vont des commandes distribuées par API aux systèmes de contrôle distribués (DCS), avec des besoins en puissance allant de 3 à 50 kVA. De nombreuses usines anciennes, en plus des nouvelles constructions, modernisent leurs systèmes de contrôle pneumatique et à boucle unique pour adopter des systèmes de contrôle distribués, principalement pour améliorer leur efficacité opérationnelle. Les applications informatiques industrielles exigent des exigences de conception différentes de celles de leurs homologues informatiques, et si les onduleurs destinés aux applications commerciales sont devenus des produits de base, les systèmes d'onduleurs industriels restent des produits techniques.

Par exemple,

- En novembre 2024, CyberPower a lancé en Australie sa gamme d'onduleurs à onde sinusoïdale PFC avancée, offrant une protection électrique fiable aux particuliers, aux joueurs et aux petites entreprises. Dotés d'une sortie sinusoïdale pure, d'une régulation automatique de la tension (AVR) et d'une technologie écoénergétique, ces onduleurs répondent à la demande croissante de solutions de puissance plus élevée dans les secteurs industriel et commercial australiens, garantissant la continuité opérationnelle et répondant aux besoins des infrastructures critiques.

- En novembre 2022, selon un article publié par TechDay, Vertiv a dévoilé un onduleur de pointe répondant aux exigences numériques actuelles. Ce système, désormais lancé, affiche un rendement allant jusqu'à 97 % en mode double conversion et jusqu'à 99 % en mode éco. Le Liebert APM Plus, disponible dans des capacités allant de 50 à 500 kW,

Opportunités

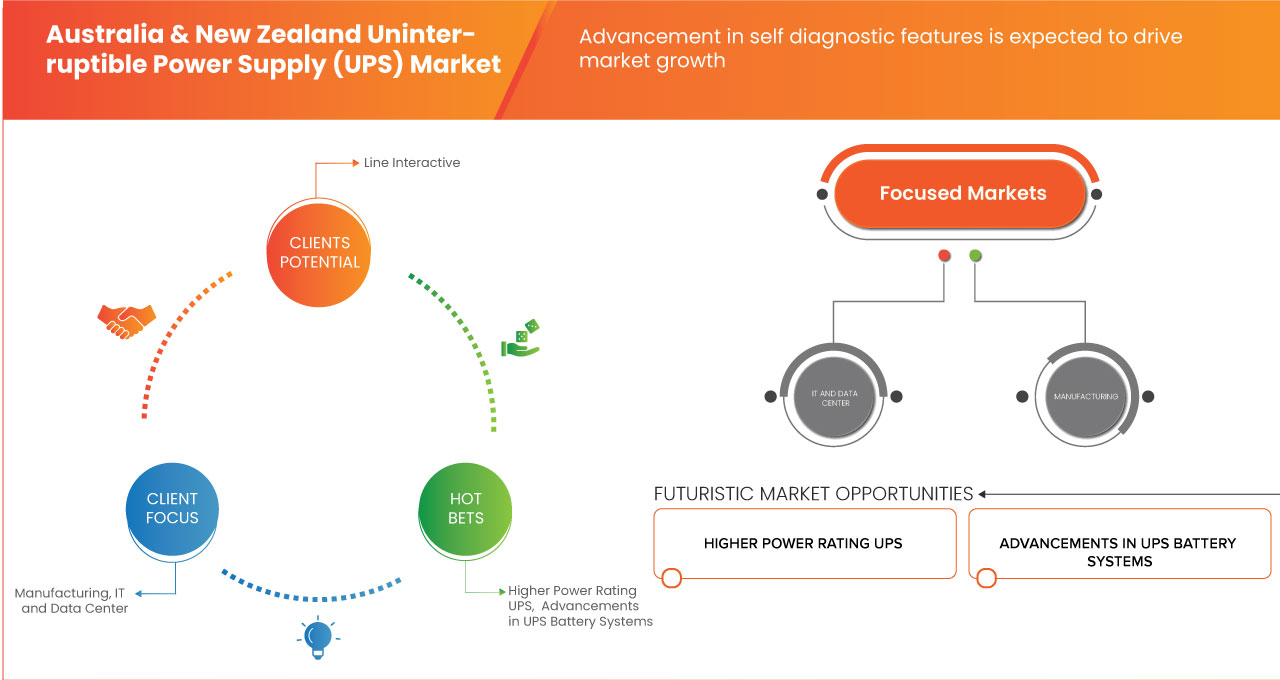

Progrès dans les fonctionnalités d'autodiagnostic

La demande croissante de systèmes d'alimentation fiables en Australie a créé une opportunité significative sur le marché des onduleurs (ASI), notamment grâce aux avancées en matière de fonctionnalités d'autodiagnostic. Les industries s'appuyant de plus en plus sur une alimentation électrique continue et de haute qualité pour leurs opérations critiques, le besoin d'ASI capables de surveiller leur état et leurs performances en temps réel est devenu essentiel. Le développement d'outils d'autodiagnostic avancés, tels que la surveillance à distance, le suivi de l'état des batteries et l'analyse prédictive, permet aux ASI d'identifier les problèmes potentiels avant qu'ils n'entraînent des coupures de courant. Cette approche proactive améliore non seulement la fiabilité des systèmes d'alimentation, mais réduit également les temps d'arrêt, minimisant ainsi les risques de pannes imprévues et améliorant l'efficacité opérationnelle des industries australiennes.

L'intégration de fonctions d'autodiagnostic aux systèmes d'onduleurs permet aux entreprises de gérer plus efficacement leur infrastructure énergétique. Grâce à des fonctionnalités telles que le contrôle automatique de l'état des batteries, la surveillance de la température et l'analyse des performances du système, les opérateurs peuvent être alertés en amont des pannes potentielles, ce qui leur permet de planifier la maintenance avant qu'une panne ne survienne. La possibilité d'effectuer des diagnostics en temps réel réduit le recours aux inspections manuelles, optimise les plannings de maintenance et prolonge la durée de vie des systèmes d'onduleurs. Alors que l'Australie continue de progresser dans ses capacités technologiques, l'intégration de fonctions d'autodiagnostic aux solutions d'onduleurs jouera un rôle crucial pour améliorer la résilience des systèmes et répondre aux besoins croissants en alimentation électrique ininterrompue dans des secteurs tels que les centres de données, la santé et l'industrie manufacturière.

Par exemple,

Selon un article publié par IT Brief, Vertiv a lancé en juillet 2024 son onduleur Trinergy de nouvelle génération, conçu pour répondre aux exigences de haute capacité des applications d'IA et de calcul haute performance. L'onduleur Trinergy offre une résilience, une flexibilité et une efficacité accrues, avec une disponibilité de 99,9999998 % et la prise en charge de diverses sources d'alimentation. Cette avancée en matière de fonctionnalités d'autodiagnostic, notamment l'analyse de la maintenance conditionnelle et l'évaluation de l'état de santé, représente une opportunité majeure pour le marché australien des onduleurs. Face à la demande croissante de systèmes haute fiabilité, ces fonctionnalités permettront une surveillance en temps réel, une maintenance prédictive et une durée de vie prolongée, rendant les onduleurs indispensables pour les secteurs nécessitant une alimentation sans interruption.

En avril 2019, un article publié par Uninterruptible Power Ltd. mettait en lumière les bénéfices de l'Internet des objets (IoT) pour les systèmes d'alimentation sans interruption (ASI), permettant la surveillance et le contrôle à distance. La connectivité IoT permet aux ASI de communiquer en temps réel l'état, la santé et les données opérationnelles des batteries, améliorant ainsi la visibilité et la gestion. Cela garantit une réponse rapide aux problèmes tels que l'épuisement des batteries et facilite la maintenance proactive. Cette évolution représente une opportunité majeure pour le marché australien des ASI, car la demande de fonctionnalités d'autodiagnostic avancées, telles que la surveillance à distance des batteries et l'analyse de l'état en temps réel, ne cesse de croître. Les ASI compatibles IoT permettent la détection précoce des problèmes, la maintenance prédictive et une gestion efficace des ressources, garantissant une fiabilité accrue des systèmes et une réduction des temps d'arrêt pour les secteurs dépendants d'une alimentation continue.

- Progrès dans les systèmes de batteries d'alimentation sans interruption (UPS)

Les onduleurs lithium-ion représentent une avancée majeure dans la technologie des batteries d'onduleurs, dominée depuis des décennies par les batteries plomb-acide à régulation par soupape (VRLA). Les batteries lithium-ion ont une durée de vie de 10 à 15 ans, comparativement à leurs prédécesseurs plomb-acide, qui doivent être remplacés tous les 3 à 5 ans. De nombreuses avancées ont propulsé la technologie lithium-ion au premier plan en matière d'alimentation de secours. Tout d'abord, leur coût a considérablement diminué, tandis que certaines préoccupations historiques en matière de sécurité ont été suffisamment prises en compte. La composition chimique des batteries lithium-ion pour les applications d'onduleurs est bien plus sûre que celle utilisée auparavant pour d'autres applications et s'apparente davantage à celle des batteries des voitures électriques.

Les batteries lithium-ion remplissent les mêmes fonctions que les batteries plomb-acide traditionnelles, tout en offrant de nombreux avantages. Avec une durée de vie de 10 à 15 ans, les centres de données, traditionnellement contraints de remplacer les batteries de leurs onduleurs tous les trois à cinq ans, peuvent réaliser d'importantes économies. Le prix initial d'une solution lithium avec surveillance est désormais comparable à celui des batteries plomb-acide à régulation par soupape (VRLA), mais avec l'avantage supplémentaire d'un coût total de possession (TCO) réduit si l'on prend en compte les coûts de maintenance et de remplacement sur toute la durée de vie de l'onduleur.

Par exemple,

- Selon un article publié par Vertiv Group Corp., Vertiv lance en mars 2022 de nouvelles solutions d'onduleurs et de refroidissement lithium-ion pour les applications edge, notamment les onduleurs Liebert® GXT5 Lithium-Ion et Liebert® PSI5 Lithium-Ion à faible profondeur, ainsi que les unités de distribution de liquide de refroidissement Liebert® XDU. Ces solutions offrent une autonomie prolongée, une autonomie évolutive et des coûts de refroidissement réduits, améliorant ainsi la durabilité et les performances. Ce développement représente une opportunité significative pour les systèmes d'alimentation sans interruption (ASI) sur batterie sur le marché australien, stimulé par la demande croissante de solutions d'alimentation plus durables, plus efficaces et plus rentables.

- En décembre 2021, selon un article publié par ComputerWeekly.com, les batteries lithium-ion sont de plus en plus utilisées dans les systèmes d'alimentation sans interruption (ASI) des centres de données, en raison de leur encombrement réduit, de leur durée de vie plus longue et de leur meilleure tolérance aux températures par rapport aux batteries VRLA traditionnelles. Bien que plus onéreuses, elles gagnent en popularité, notamment auprès des grands opérateurs de colocation et de centres de données hyperscale. Cette évolution représente une opportunité majeure pour le développement des systèmes de batteries ASI sur le marché australien, les opérateurs de centres de données recherchant des solutions plus durables et plus rentables. L'adoption croissante des batteries lithium-ion stimulera la demande d'ASI performantes, offrant des performances accrues et un encombrement réduit, notamment dans les environnements à espace restreint ou à haute température.

Contraintes/Défis

- Disponibilité de substituts aux systèmes d'alimentation sans interruption (UPS)

Le marché australien des onduleurs (UPS) connaît une croissance significative en raison de la demande croissante de solutions de secours fiables dans divers secteurs. Cependant, l'un des défis auxquels le secteur est confronté est la disponibilité de solutions de remplacement. Dans ce rapport de données descriptives, nous analyserons ce défi, son impact sur le marché australien des onduleurs et les facteurs contribuant à la présence de solutions de remplacement sur ce marché dynamique.

Le marché australien des onduleurs est stimulé par le besoin d'une alimentation électrique continue, notamment dans les secteurs critiques tels que l'informatique, la santé, les télécommunications et les centres de données. Les onduleurs sont conçus pour fournir une alimentation de secours en cas de panne, évitant ainsi la perte de données, les dommages matériels et les temps d'arrêt. De ce fait, les onduleurs sont devenus partie intégrante de l'infrastructure de nombreuses entreprises et organisations de la région.

- Coûts d'installation élevés et maintenance coûteuse

De nos jours, la numérisation rapide et l'industrialisation croissante accroissent les besoins en systèmes d'alimentation sans interruption (ASI). La plupart des industries et du secteur informatique ont besoin d'ASI. Or, les petites entreprises n'ont pas les moyens de gérer le coût, l'installation et la maintenance de ces systèmes. À mesure que les besoins augmentent, le coût des matières premières et des autres produits nécessaires à leur fabrication augmente.

Les dépenses d'investissement (CAPEX) et les dépenses d'exploitation (OPEX) sont essentielles pour les systèmes d'onduleurs. L'acquisition initiale des systèmes d'onduleurs, des grandes armoires et des logiciels de surveillance est incluse dans les CAPEX. Les systèmes d'onduleurs coûtent plus cher que les onduleurs basse tension, car ils nécessitent de grandes armoires pour contenir des modules permettant leur croissance. Par conséquent, pour tirer pleinement parti des systèmes d'onduleurs, les entreprises doivent planifier la capacité énergétique souhaitée. Les onduleurs et les batteries nécessitent une maintenance continue et coûteuse après l'installation.

Par exemple:

- En octobre 2024, selon un article publié par Blue Notatry, le coût total de possession d'un onduleur dépasse son prix d'achat initial et inclut des frais de maintenance élevés, tels que le remplacement périodique des batteries, les vérifications du système et les considérations d'efficacité énergétique. Ces facteurs contribuent significativement aux coûts à long terme, en particulier pour les entreprises qui nécessitent un entretien régulier pour maintenir des performances optimales. Les coûts d'installation élevés et la maintenance onéreuse sont identifiés comme des freins majeurs sur le marché australien des onduleurs. Le besoin fréquent de remplacement des batteries, l'entretien régulier et l'investissement dans des modèles économes en énergie augmentent le coût total de possession, ce qui décourage l'adoption, notamment par les petites et moyennes entreprises, malgré le rôle essentiel des onduleurs pour garantir une alimentation électrique ininterrompue.

Ce rapport de marché détaille les évolutions récentes, la réglementation commerciale, l'analyse des importations et exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs nationaux et locaux, l'analyse des opportunités de revenus émergents, l'évolution de la réglementation, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance des catégories de marché, les niches d'application et la domination du marché, les homologations et lancements de produits, les expansions géographiques et les innovations technologiques. Pour plus d'informations sur le marché, contactez Data Bridge Market Research pour un briefing d'analyste. Notre équipe vous aidera à prendre une décision éclairée et à stimuler votre croissance.

Portée du marché australien des systèmes d'alimentation sans interruption (UPS)

Le marché australien des systèmes d'alimentation sans interruption (UPS) est segmenté en six segments notables en fonction de l'offre, de la taille de l'organisation, du type, de la production, du secteur vertical et du canal de vente.

La croissance parmi ces segments vous aidera à analyser les faibles segments de croissance dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Offre

- Solutions

- 10 kVA et moins

- 11 Kva – 100 Kva

- 101 Kva – 500 Kva

- 501 kVA – Plus

- Services

- Support et maintenance

- Intégration et mise en œuvre

- Formation, éducation et conseil

Taille de l'organisation

- Grande entreprise

- Moyenne entreprise

- Petite entreprise

Taper

- En ligne

- Hors ligne

- Ligne interactive

Sortir

- CA à CA

- triphasé

- monophasé

- CC à CC

- CA vers CC

Verticale

- Gouvernement et secteur public

- Solutions

- 50 kVA et moins

- 51 Kva – 100 Kva

- 101 Kva – 250 Kva

- 501 kVA – Plus

- Services

- Support et maintenance

- Intégration et mise en œuvre

- Formation, éducation et conseil

- Solutions

- Centre informatique et de données

- Solutions

- 50 kVA et moins

- 51 Kva – 100 Kva

- 101 Kva – 250 Kva

- 501 kVA – Plus

- Services

- Support et maintenance

- Intégration et mise en œuvre

- Formation, éducation et conseil

- Solutions

- Résidentiel

- Solutions

- 50 kVA et moins

- 51 Kva – 100 Kva

- 101 Kva – 250 Kva

- 501 kVA – Plus

- Services

- Support et maintenance

- Intégration et mise en œuvre

- Formation, éducation et conseil

- Solutions

- Énergie et services publics

- Solutions

- 50 kVA et moins

- 51 Kva – 100 Kva

- 101 Kva – 250 Kva

- 501 kVA – Plus

- Services

- Support et maintenance

- Intégration et mise en œuvre

- Formation, éducation et conseil

- Solutions

- Télécom

- Solutions

- 50 kVA et moins

- 51 Kva – 100 Kva

- 101 Kva – 250 Kva

- 501 kVA – Plus

- Services

- Support et maintenance

- Intégration et mise en œuvre

- Formation, éducation et conseil

- Solutions

- Fabrication

- Solutions

- 50 kVA et moins

- 51 Kva – 100 Kva

- 101 Kva – 250 Kva

- 501 kVA – Plus

- Services

- Support et maintenance

- Intégration et mise en œuvre

- Formation, éducation et conseil

- Solutions

- soins de santé

- Solutions

- 50 kVA et moins

- 51 Kva – 100 Kva

- 101 Kva – 250 Kva

- 501 kVA – Plus

- Services

- Support et maintenance

- Intégration et mise en œuvre

- Formation, éducation et conseil

- Solutions

- Vente au détail

- Solutions

- 50 kVA et moins

- 51 Kva – 100 Kva

- 101 Kva – 250 Kva

- 501 kVA – Plus

- Services

- Support et maintenance

- Intégration et mise en œuvre

- Formation, éducation et conseil

- Solutions

- BFSI

- Solutions

- 50 kVA et moins

- 51 Kva – 100 Kva

- 101 Kva – 250 Kva

- 501 kVA – Plus

- Services

- Support et maintenance

- Intégration et mise en œuvre

- Formation, éducation et conseil

- Solutions

- Éducation

- Solutions

- 50 kVA et moins

- 51 Kva – 100 Kva

- 101 Kva – 250 Kva

- 501 kVA – Plus

- Services

- Support et maintenance

- Intégration et mise en œuvre

- Formation, éducation et conseil

- Solutions

- Autres

- Solutions

- 50 kVA et moins

- 51 Kva – 100 Kva

- 101 Kva – 250 Kva

- 501 kVA – Plus

- Services

- Support et maintenance

- Intégration et mise en œuvre

- Formation, éducation et conseil

- Solutions

Canal de vente

- Direct

- Indirect

- Distributeur/Grossiste

- Magasin spécialisé

- Autres

Part de marché des onduleurs (UPS) en Australie

Le paysage concurrentiel du marché fournit des détails par concurrent. Il comprend la présentation de l'entreprise, ses données financières, son chiffre d'affaires, son potentiel de marché, ses investissements en recherche et développement, ses nouvelles initiatives commerciales, sa présence, ses sites et installations de production, ses capacités de production, ses forces et faiblesses, le lancement de nouveaux produits, leur ampleur et leur portée, ainsi que la domination de ses applications. Les données ci-dessus ne concernent que les activités des entreprises par rapport à leur marché.

Les leaders du marché australien des systèmes d'alimentation sans interruption (UPS) opérant sur le marché sont :

- General Electric (États-Unis)

- Siemens (Allemagne)

- Schneider Electric (France)

- Delta Electronics, Inc. (Taïwan)

- Socomec (France)

- ABB (Suisse)

- TOSHIBA CORPORATION (Japon)

- OMRON Corporation (Japon)

- PowerShield Pty Ltd. (Australie)

- Real Power Solutions ((Nouvelle-Zélande)

Derniers développements sur le marché australien des onduleurs

- En août 2023, Cyber Power Systems, Inc. a dévoilé une nouvelle gamme d'onduleurs (Systèmes d'Alimentation Sans Interruption) Smart App Sinewave, marquant une avancée significative dans la technologie de protection de l'alimentation. Cette gamme repensée intègre une surveillance cloud et des fonctionnalités LCD améliorées, offrant un gain substantiel en termes de confort, de fiabilité et d'efficacité. Ces améliorations constituent un soutien crucial pour la protection des équipements électroniques vitaux, tels que les serveurs et les équipements réseau, dans les entreprises et les centres de données. Ce nouveau lancement innovant a permis à Cyber Power Systems de consolider sa position de leader de confiance du secteur, répondant aux besoins évolutifs de sa clientèle et renforçant son engagement à fournir des solutions de pointe en matière de gestion de l'énergie et de sécurité.

- En avril 2022, Global Power Supply, LLC. (GPS) a intégré les systèmes d'alimentation sans interruption (ASI) de Toshiba International Corporation à sa flotte de remorques d'ASI mobiles, équipées de remorques sur mesure équipées de batteries de secours lithium-ion haute puissance. L'intégration des ASI Toshiba des séries G9000 et 4400 améliore l'alimentation de secours des clients des installations critiques grâce à une sécurité, une flexibilité et une durabilité exceptionnelles. En s'associant à Global Power Supply (GPS) et en intégrant ses ASI de pointe à sa flotte de remorques d'ASI mobiles, Toshiba bénéficie d'une visibilité et d'un accès accrus auprès des clients des installations critiques, mettant en avant les performances, la sécurité et la longévité de ses ASI dans divers cas d'utilisation et applications.

- En octobre 2024, ABB a annoncé le lancement d'une alimentation sans interruption (ASI) moyenne tension, spécialement conçue pour les applications industrielles et les conditions difficiles, offrant une protection électrique fiable et ininterrompue. Grâce à sa conception robuste, cette ASI assure une alimentation électrique continue, améliorant ainsi les performances et la sécurité des processus industriels critiques. Elle constitue un atout essentiel pour maintenir l'efficacité opérationnelle et protéger les équipements précieux des installations industrielles.

- En août 2024, Socomec, fournisseur leader de solutions d'énergie, a poursuivi sa lancée d'innovation après le succès de son Modulys XL primé. L'entreprise a dévoilé sa dernière offre, Delphys XL, conçue pour répondre aux exigences spécifiques du secteur de la colocation. Cette réussite n'est pas passée inaperçue : les avancées remarquables de Delphys XL ont valu à Socomec le prestigieux prix Frost & Sullivan « Global Customer Value Leadership » pour 2024. Cette reconnaissance renforce la réputation de Socomec en tant que pionnier dans le secteur des solutions d'énergie, témoignant de son engagement à répondre aux besoins spécifiques de ses clients et à promouvoir l'excellence dans ce domaine.

- En octobre 2023, ATLAS ELEKTRONIK et Israel Aerospace Industries ont dévoilé la plateforme ASW BlueWhale pour la lutte anti-sous-marine avancée. Ce véhicule sous-marin autonome de pointe intègre les systèmes de capteurs sophistiqués d'ELTA et le réseau de sonars passifs remorqués d'ATLAS ELEKTRONIK, conçu pour une détection sous-marine efficace. Cette collaboration renforce les capacités des deux entreprises en matière de défense navale, en s'appuyant sur l'expertise d'IAI en matière de systèmes sans pilote et sur les technologies de capteurs avancées d'ELTA, pour créer une solution ASW de pointe et durable, adaptée à diverses opérations navales.

- En juillet 2019, Toshiba International Corporation a déposé un brevet pour son système d'alimentation sans interruption (ASI) N3R série 5000 de son département d'électronique de puissance, devenant ainsi le premier fabricant d'ASI à proposer un véritable onduleur d'extérieur. Conçu pour les environnements difficiles et poussiéreux, l'ASI N3R est idéal pour les applications dans les secteurs de l'eau et des eaux usées, de l'exploitation minière, de la fabrication, des pipelines et des plateformes de transport. Cela a permis à Toshiba d'étendre sa présence sur le marché et de consolider sa position de fournisseur de solutions d'alimentation fiables.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE AUSTRALIA AND NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELLING

2.9 OFFERING LINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 SIGNIFICANT SURGE IN DEMAND FOR RELIABLE POWER PLANT

5.1.2 INCREASING DEMAND FOR HIGHER POWER RATING UNINTERRUPTIBLE POWER SYSTEMS (UPS) PRODUCTS IN INDUSTRIAL AND COMMERCIAL VERTICALS

5.1.3 RAPID URBANIZATION AND GROWTH IN THE IT SECTOR

5.1.4 GROWING FOCUS ON ENERGY-EFFICIENT AND SUSTAINABLE POWER SOLUTIONS

5.2 RESTRAINTS

5.2.1 HIGH INSTALLATION COSTS AND EXPENSIVE MAINTENANCE

5.2.2 BREAKDOWNS IN UNINTERRUPTIBLE POWER SUPPLY SYSTEMS

5.3 OPPORTUNITIES

5.3.1 INCREASING GOVERNMENT INITIATIVE FOR GREEN POWER SUPPLY

5.3.2 ADVANCEMENT IN SELF DIAGNOSTIC FEATURES

5.3.3 ADVANCEMENTS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) BATTERY SYSTEMS

5.4 CHALLENGES

5.4.1 FREQUENT REPLACEMENT OF BATTERIES AND UPDATING THE COMPONENTS AND TECHNOLOGY DUE TO THE RAPID GROWTH OF HIGH-POWERED EQUIPMENT

5.4.2 AVAILABILITY OF SUBSTITUTES FOR UNINTERRUPTIBLE POWER SUPPLY (UPS) SYSTEMS

5.4.3 FACTORS CONTRIBUTING TO THE AVAILABILITY OF SUBSTITUTES:

6 AUSTRALIA AND NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOLUTIONS

6.2.1 101 KVA - 500 KVA

6.2.2 11 KVA - 100 KVA

6.2.3 10 KVA AND BELOW

6.2.4 501 KVA ABOVE

6.3 SERVICES

6.3.1 SUPPORT AND MAINTENANCE

6.3.2 INTEGRATION AND IMPLEMENTATION

6.3.3 TRAINING, EDUCATION, AND CONSULTING

7 AUSTRALIA AND NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY ORGANIZATION SIZE

7.1 OVERVIEW

7.2 LARGE ENTERPRISE

7.3 MEDIUM ENTERPRISE

7.4 SMALL ENTERPRISE

8 AUSTRALIA AND NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE

8.1 OVERVIEW

8.2 ONLINE

8.3 OFFLINE

8.4 LINE INTERACTIVE

9 AUSTRALIA AND NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY OUTPUT

9.1 OVERVIEW

9.2 AC TO AC

9.2.1 THREE PHASE

9.2.2 SINGLE PHASE

9.3 DC TO DC

9.4 AC TO DC

10 AUSTRALIA AND NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY SALES CHANNEL

10.1 OVERVIEW

10.2 DIRECT

10.3 INDIRECT

10.3.1 DISTRIBUTOR/WHOLESALER

10.3.2 SPECIALTY STORE

10.3.3 OTHERS

11 AUSTRALIA AND NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY VERTICAL

11.1 OVERVIEW

11.2 MANUFACTURING

11.2.1 SOLUTIONS

11.2.1.1 101 KVA - 500 KVA

11.2.1.2 11 KVA - 100 KVA

11.2.1.3 10 KVA AND BELOW

11.2.1.4 501 KVA ABOVE

11.2.2 SERVICES

11.2.2.1 SUPPORT AND MAINTENANCE

11.2.2.2 INTEGRATION AND IMPLEMENTATION

11.2.2.3 TRAINING, EDUCATION AND CONSULTING

11.3 IT AND DATA CENTER

11.3.1 SOLUTIONS

11.3.1.1 101 KVA - 500 KVA

11.3.1.2 11 KVA - 100 KVA

11.3.1.3 10 KVA AND BELOW

11.3.1.4 501 KVA ABOVE

11.3.2 SERVICES

11.3.2.1 SUPPORT AND MAINTENANCE

11.3.2.2 INTEGRATION AND IMPLEMENTATION

11.3.2.3 TRAINING, EDUCATION AND CONSULTING

11.4 HEALTHCARE

11.4.1 SOLUTIONS

11.4.1.1 101 KVA - 500 KVA

11.4.1.2 11 KVA - 100 KVA

11.4.1.3 10 KVA AND BELOW

11.4.1.4 501 KVA ABOVE

11.4.2 SERVICES

11.4.2.1 SUPPORT AND MAINTENANCE

11.4.2.2 INTEGRATION AND IMPLEMENTATION

11.4.2.3 TRAINING, EDUCATION AND CONSULTING

11.5 BFSI

11.5.1 SOLUTIONS

11.5.1.1 101 KVA - 500 KVA

11.5.1.2 11 KVA - 100 KVA

11.5.1.3 10 KVA AND BELOW

11.5.1.4 501 KVA ABOVE

11.5.2 SERVICES

11.5.2.1 SUPPORT AND MAINTENANCE

11.5.2.2 INTEGRATION AND IMPLEMENTATION

11.5.2.3 TRAINING, EDUCATION AND CONSULTING

11.6 ENERGY AND UTILITY

11.6.1 SOLUTIONS

11.6.1.1 101 KVA - 500 KVA

11.6.1.2 11 KVA - 100 KVA

11.6.1.3 10 KVA AND BELOW

11.6.1.4 501 KVA ABOVE

11.6.2 SERVICES

11.6.2.1 SUPPORT AND MAINTENANCE

11.6.2.2 INTEGRATION AND IMPLEMENTATION

11.6.2.3 TRAINING, EDUCATION AND CONSULTING

11.7 GOVERNMENT AND PUBLIC SECTOR

11.7.1 SOLUTIONS

11.7.1.1 101 KVA - 500 KVA

11.7.1.2 11 KVA - 100 KVA

11.7.1.3 10 KVA AND BELOW

11.7.1.4 501 KVA ABOVE

11.7.2 SERVICES

11.7.2.1 SUPPORT AND MAINTENANCE

11.7.2.2 INTEGRATION AND IMPLEMENTATION

11.7.2.3 TRAINING, EDUCATION AND CONSULTING

11.8 TELECOM

11.8.1 SOLUTIONS

11.8.1.1 101 KVA - 500 KVA

11.8.1.2 11 KVA - 100 KVA

11.8.1.3 10 KVA AND BELOW

11.8.1.4 501 KVA ABOVE

11.8.2 SERVICES

11.8.2.1 SUPPORT AND MAINTENANCE

11.8.2.2 INTEGRATION AND IMPLEMENTATION

11.8.2.3 TRAINING, EDUCATION AND CONSULTING

11.9 RETAIL

11.9.1 SOLUTIONS

11.9.1.1 101 KVA - 500 KVA

11.9.1.2 11 KVA - 100 KVA

11.9.1.3 10 KVA AND BELOW

11.9.1.4 501 KVA ABOVE

11.9.2 SERVICES

11.9.2.1 SUPPORT AND MAINTENANCE

11.9.2.2 INTEGRATION AND IMPLEMENTATION

11.9.2.3 TRAINING, EDUCATION AND CONSULTING

11.1 RESIDENTIAL

11.10.1 SOLUTIONS

11.10.1.1 101 KVA - 500 KVA

11.10.1.2 11 KVA - 100 KVA

11.10.1.3 10 KVA AND BELOW

11.10.1.4 501 KVA ABOVE

11.10.2 SERVICES

11.10.2.1 SUPPORT AND MAINTENANCE

11.10.2.2 INTEGRATION AND IMPLEMENTATION

11.10.2.3 TRAINING, EDUCATION AND CONSULTING

11.11 EDUCATION

11.11.1 SOLUTIONS

11.11.1.1 101 KVA - 500 KVA

11.11.1.2 11 KVA - 100 KVA

11.11.1.3 10 KVA AND BELOW

11.11.1.4 501 KVA ABOVE

11.11.2 SERVICES

11.11.2.1 SUPPORT AND MAINTENANCE

11.11.2.2 INTEGRATION AND IMPLEMENTATION

11.11.2.3 TRAINING, EDUCATION AND CONSULTING

11.12 OTHERS

11.12.1 SOLUTIONS

11.12.1.1 101 KVA - 500 KVA

11.12.1.2 11 KVA - 100 KVA

11.12.1.3 10 KVA AND BELOW

11.12.1.4 501 KVA ABOVE

11.12.2 SERVICES

11.12.2.1 SUPPORT AND MAINTENANCE

11.12.2.2 INTEGRATION AND IMPLEMENTATION

11.12.2.3 TRAINING, EDUCATION AND CONSULTING

12 AUSTRALIA AND NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: AUSTRALIA

12.2 COMPANY SHARE ANALYSIS: NEW ZEALAND

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 SIEMENS

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENT

14.2 SCHNEIDER ELECTRIC

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENTS

14.3 TOSHIBA INTERNATIONAL CORPORATION

14.3.1 COMPANY SNAPSHOT

14.3.2 PRODUCT PORTFOLIO

14.3.3 RECENT DEVELOPMENTS

14.4 GE HEALTHCARE

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.5 OMRON CORPORATION

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 PRODUCTS PORTFOLIO

14.5.4 RECENT DEVELOPMENTS

14.6 ABB

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 DELTA ELECTRONICS, INC.

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENTS

14.8 POWERSHIELD PTY LTD.

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCTS PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 REAL POWER SOLUTIONS

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCTS PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 SOCOMEC

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 AVERAGE COST TO INSTALL A UPS BATTERY SYSTEM

TABLE 2 AUSTRALIA UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY OFFERING, 2021-2032 (USD THOUSAND)

TABLE 3 NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY OFFERING, 2021-2032 (USD THOUSAND)

TABLE 4 AUSTRALIA SOLUTIONS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 5 NEW ZEALAND SOLUTIONS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 6 AUSTRALIA SERVICES IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 7 NEW ZEALAND SERVICES IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 8 AUSTRALIA UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY ORGANIZATION SIZE, 2021-2032 (USD THOUSAND)

TABLE 9 NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY ORGANIZATION SIZE, 2021-2032 (USD THOUSAND)

TABLE 10 AUSTRALIA UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 11 NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 12 AUSTRALIA UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY OUTPUT, 2021-2032 (USD THOUSAND)

TABLE 13 NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY OUTPUT, 2021-2032 (USD THOUSAND)

TABLE 14 AUSTRALIA AC TO AC IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 15 NEW ZEALAND AC TO AC IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 16 AUSTRALIA UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY SALES CHANNEL, 2021-2032 (USD THOUSAND)

TABLE 17 NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY SALES CHANNEL, 2021-2032 (USD THOUSAND)

TABLE 18 AUSTRALIA INDIRECT IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 19 NEW ZEALAND INDIRECT IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 20 AUSTRALIA UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY VERTICAL, 2021-2032 (USD THOUSAND)

TABLE 21 NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY VERTICAL, 2021-2032 (USD THOUSAND)

TABLE 22 AUSTRALIA MANUFACTURING IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 23 NEW ZEALAND MANUFACTURING IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 24 AUSTRALIA SOLUTIONS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 25 NEW ZEALAND SOLUTIONS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 26 AUSTRALIA SERVICES IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 27 NEW ZEALAND SERVICES IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 28 AUSTRALIA IT AND DATA CENTER IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY OFFERING, 2021-2032 (USD THOUSAND)

TABLE 29 NEW ZEALAND IT AND DATA CENTER IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY OFFERING, 2021-2032 (USD THOUSAND)

TABLE 30 AUSTRALIA SOLUTIONS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 31 NEW ZEALAND SOLUTIONS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 32 AUSTRALIA SERVICES IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 33 NEW ZEALAND SERVICES IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 34 AUSTRALIA HEALTHCARE IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY OFFERING, 2021-2032 (USD THOUSAND)

TABLE 35 NEW ZEALAND HEALTHCARE IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY OFFERING, 2021-2032 (USD THOUSAND)

TABLE 36 AUSTRALIA SOLUTIONS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 37 NEW ZEALAND SOLUTIONS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 38 AUSTRALIA SERVICES IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 39 NEW ZEALAND SERVICES IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 40 AUSTRALIA BFSI IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 41 NEW ZEALAND BFSI IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 42 AUSTRALIA SOLUTIONS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 43 NEW ZEALAND SOLUTIONS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 44 AUSTRALIA SERVICES IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 45 NEW ZEALAND SERVICES IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 46 AUSTRALIA ENERGY AND UTILITY IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY OFFERING, 2021-2032 (USD THOUSAND)

TABLE 47 NEW ZEALAND ENERGY AND UTILITY IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY OFFERING, 2021-2032 (USD THOUSAND)

TABLE 48 AUSTRALIA SOLUTIONS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 49 NEW ZEALAND SOLUTIONS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 50 AUSTRALIA SERVICES IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 51 NEW ZEALAND SERVICES IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 52 AUSTRALIA GOVERNMENT AND PUBLIC SECTOR IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY OFFERING, 2021-2032 (USD THOUSAND)

TABLE 53 NEW ZEALAND GOVERNMENT AND PUBLIC SECTOR IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY OFFERING, 2021-2032 (USD THOUSAND)

TABLE 54 AUSTRALIA SOLUTIONS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 55 NEW ZEALAND SOLUTIONS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 56 AUSTRALIA SERVICES IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 57 NEW ZEALAND SERVICES IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 58 AUSTRALIA TELECOM IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY OFFERING, 2021-2032 (USD THOUSAND)

TABLE 59 NEW ZEALAND TELECOM IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY OFFERING, 2021-2032 (USD THOUSAND)

TABLE 60 AUSTRALIA SOLUTIONS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 61 NEW ZEALAND SOLUTIONS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 62 AUSTRALIA SERVICES IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 63 NEW ZEALAND SERVICES IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 64 AUSTRALIA RETAIL IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY OFFERING, 2021-2032 (USD THOUSAND)

TABLE 65 NEW ZEALAND RETAIL IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY OFFERING, 2021-2032 (USD THOUSAND)

TABLE 66 AUSTRALIA SOLUTIONS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 67 NEW ZEALAND SOLUTIONS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 68 AUSTRALIA SERVICES IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 69 NEW ZEALAND SERVICES IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 70 AUSTRALIA RESIDENTIAL IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY OFFERING, 2021-2032 (USD THOUSAND)

TABLE 71 NEW ZEALAND RESIDENTIAL IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 72 AUSTRALIA SOLUTIONS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 73 NEW ZEALAND SOLUTIONS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 74 AUSTRALIA SERVICES IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 75 NEW ZEALAND SERVICES IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 76 AUSTRALIA EDUCATION IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY OFFERING, 2021-2032 (USD THOUSAND)

TABLE 77 NEW ZEALAND EDUCATION IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY OFFERING, 2021-2032 (USD THOUSAND)

TABLE 78 AUSTRALIA SOLUTIONS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 79 NEW ZEALAND SOLUTIONS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 80 AUSTRALIA SERVICES IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 81 NEW ZEALAND SERVICES IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 82 AUSTRALIA OTHERS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY OFFERING, 2021-2032 (USD THOUSAND)

TABLE 83 NEW ZEALAND OTHERS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY OFFERING, 2021-2032 (USD THOUSAND)

TABLE 84 AUSTRALIA SOLUTIONS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 85 NEW ZEALAND SOLUTIONS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 86 AUSTRALIA SERVICES IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 87 NEW ZEALAND SERVICES IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

Liste des figures

FIGURE 1 AUSTRALIA AND NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: SEGMENTATION

FIGURE 2 AUSTRALIA AND NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: DATA TRIANGULATION

FIGURE 3 AUSTRALIA AND NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: DROC ANALYSIS

FIGURE 4 AUSTRALIA UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET ANALYSIS: COUNTRY-WISE ANALYSIS

FIGURE 5 NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: COUNTRY-WISE ANALYSIS

FIGURE 6 AUSTRALIA AND NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 7 AUSTRALIA AND NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 AUSTRALIA UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: DBMR MARKET POSITION GRID

FIGURE 10 AUSTRALIA AND NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: FUNCTION COVERAGE GRID ANALYSIS

FIGURE 11 AUSTRALIA AND NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: MULTIVARIATE MODELLING

FIGURE 12 AUSTRALIA UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: OFFERING LINE CURVE

FIGURE 13 NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: OFFERING LINE CURVE

FIGURE 14 AUSTRALIA AND NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: SEGMENTATION

FIGURE 15 TWO SEGMENTS COMPRISE THE AUSTRALIA UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET (2024)

FIGURE 16 TWO SEGMENTS COMPRISE THE NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET (2024)

FIGURE 17 EXECUTIVE SUMMARY: AUSTRALIA UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET

FIGURE 18 EXECUTIVE SUMMARY: NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET

FIGURE 19 STRATEGIC DECISIONS

FIGURE 20 SIGNIFICANT SURGE IN DEMAND FOR RELIABLE POWER PLANT IS EXPECTED TO BE KEY DRIVER FOR AUSTRALIA UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 21 RAPID URBANIZATION AND GROWTH IN THE IT SECTOR IS EXPECTED TO BE KEY DRIVER FOR NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 22 THE SOLUTIONS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF AUSTRALIA AND NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET FROM 2025 TO 2032

FIGURE 23 THE SOLUTIONS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF AUSTRALIA AND NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET FROM 2025 TO 2032

FIGURE 24 DRIVERS, RESTRAINTS, AND OPPORTUNITIES OF AUSTRALIA & NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET

FIGURE 25 ENERGY CONSUMPTION IN AUSTRALIA

FIGURE 26 RENEWABLES ENERGY CONSUMPTION IN AUSTRALIA

FIGURE 27 AUSTRALIA UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: BY OFFERING, 2024

FIGURE 28 NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: BY OFFERING, 2024

FIGURE 29 AUSTRALIA UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: BY ORGANIZATION SIZE, 2024

FIGURE 30 NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: BY ORGANIZATION SIZE, 2024

FIGURE 31 AUSTRALIA UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: BY TYPE, 2024

FIGURE 32 NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: BY TYPE, 2024

FIGURE 33 AUSTRALIA UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: BY OUTPUT, 2024

FIGURE 34 NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: BY OUTPUT, 2024

FIGURE 35 AUSTRALIA UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: BY SALES CHANNEL, 2024

FIGURE 36 NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: BY SALES CHANNEL, 2024

FIGURE 37 AUSTRALIA UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: BY VERTICAL, 2024

FIGURE 38 NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: BY VERTICAL, 2024

FIGURE 39 AUSTRALIA UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: COMPANY SHARE 2024 (%)

FIGURE 40 NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: COMPANY SHARE 2024 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.