Asia Pacific Transparent Conductive Films Market

Taille du marché en milliards USD

TCAC :

%

USD

7.08 Billion

USD

16.57 Billion

2025

2033

USD

7.08 Billion

USD

16.57 Billion

2025

2033

| 2026 –2033 | |

| USD 7.08 Billion | |

| USD 16.57 Billion | |

|

|

|

|

Segmentation du marché des films conducteurs transparents en Asie-Pacifique, par matériau (oxyde d'indium-étain sur verre, oxyde d'indium-étain sur PET, nanofils d'argent, treillis métallique, graphène, nanotubes de carbone, polymères conducteurs, PEDO et autres), application (smartphones, consoles de jeux à écran plat, tablettes, ordinateurs portables, PC, écrans de télévision, éclairage OLED, cellules photovoltaïques organiques, dispositifs portables et autres) - Tendances du secteur et prévisions jusqu'en 2033

Quelle est la taille et le taux de croissance du marché des films conducteurs transparents en Asie-Pacifique ?

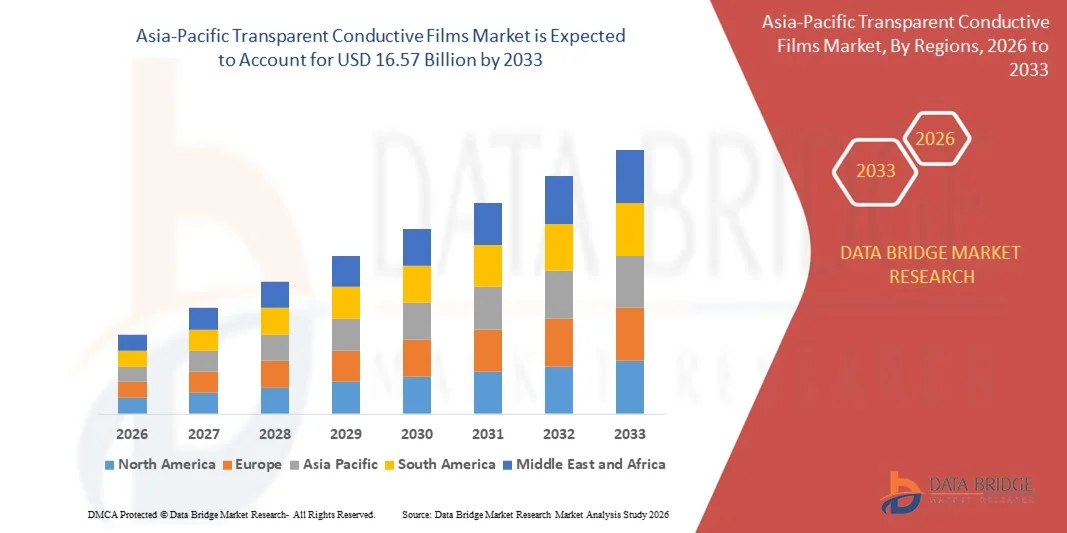

- Le marché des films conducteurs transparents en Asie-Pacifique était évalué à 7,08 milliards de dollars américains en 2025 et devrait atteindre 16,57 milliards de dollars américains d'ici 2033 , avec un TCAC de 11,2 % au cours de la période de prévision.

- La croissance du marché des films conducteurs transparents est fortement stimulée par la demande croissante de technologies d'affichage avancées et d'écrans tactiles dans diverses applications, notamment les smartphones, les tablettes, les ordinateurs portables, les PC, les écrans de télévision, l'éclairage OLED et les écrans flexibles.

- La demande croissante de films haute performance, à faible résistance et à haute transparence, portée par les secteurs en pleine expansion de l'électronique grand public, de l'automobile (notamment pour les écrans) et des énergies renouvelables, constitue un moteur important de croissance. L'adoption croissante de ces films dans les dispositifs portables, les écrans tactiles industriels et les applications de vitrages intelligents, où leurs propriétés uniques sont très appréciées, alimente également l'expansion du marché.

Quels sont les principaux enseignements du marché des films conducteurs transparents ?

- Les films conducteurs transparents sont des couches minces, optiquement transparentes, qui possèdent une conductivité électrique. Composés généralement de matériaux tels que l'oxyde d'indium-étain (ITO), ils laissent passer la lumière tout en facilitant la conduction du courant électrique. Ces films trouvent des applications dans les écrans tactiles, les cellules solaires, l'électronique flexible et d'autres technologies nécessitant à la fois transparence et conductivité.

- L'adoption croissante des films conducteurs transparents est principalement due à la demande grandissante de ces films dans divers dispositifs optoélectroniques, à la production accrue d'appareils tactiles nécessitant des électrodes transparentes et aux progrès constants des technologies d'affichage qui exigent des matériaux à haute transparence et conductivité pour des performances et une efficacité énergétique accrues dans diverses applications grand public et industrielles.

- La Chine a dominé le marché des films conducteurs transparents en Asie-Pacifique avec la plus grande part de revenus (36,8 %) en 2024, grâce à une production massive d'électronique grand public, à la fabrication à grande échelle de panneaux d'affichage et à l'expansion rapide des industries des véhicules électriques et des énergies renouvelables.

- Le marché japonais des films conducteurs transparents connaît une croissance soutenue, avec un TCAC de 8,1 %, portée par une forte demande dans les secteurs de l'électronique de pointe, des écrans automobiles et des applications industrielles de haute précision.

- Le segment de l'oxyde d'indium-étain domine le marché avec une part de marché de 42,81 % en 2024, grâce à sa présence bien établie et à sa fiabilité éprouvée dans une vaste gamme d'applications. La maturité de ses procédés de fabrication, son excellente conductivité électrique et sa haute transparence optique en ont fait le matériau de prédilection pour de nombreux dispositifs, malgré les limitations liées à la disponibilité et au coût de l'indium.

Portée du rapport et segmentation du marché des films conducteurs transparents

|

Attributs |

Films conducteurs transparents : principaux enseignements du marché |

|

Segments couverts |

|

|

Pays couverts |

Asie-Pacifique

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

En plus des informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une analyse des prix, une analyse des parts de marché des marques, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Quelle est la tendance clé du marché des films conducteurs transparents ?

Demande croissante en électronique grand public

- L'intégration croissante des films conducteurs transparents dans l'électronique grand public constitue une tendance majeure et en pleine accélération sur le marché. Cette adoption grandissante est alimentée par le besoin d'écrans et d'interfaces tactiles performants, capables d'améliorer l'expérience utilisateur, l'esthétique des appareils et de proposer des fonctionnalités innovantes pour les smartphones, tablettes, ordinateurs portables, objets connectés et autres appareils électroniques.

- Par exemple, les grandes entreprises à la pointe de l'électronique grand public, telles qu'Apple, Samsung et LG, utilisent largement des films conducteurs transparents dans les écrans tactiles et les affichages de leurs smartphones, tablettes et ordinateurs portables afin d'assurer une réactivité tactile optimale et un rendu visuel net. Des fabricants de matériaux de premier plan, comme Nitto Denko, Oike & Co., Ltd. et Teijin Limited, proposent une vaste gamme de films conducteurs transparents spécialement conçus pour répondre aux exigences de performance et d'esthétique élevées de l'électronique grand public.

- L'intégration accrue de films conducteurs transparents dans l'électronique grand public permet une interaction utilisateur plus intuitive, améliore la netteté et la vivacité des écrans et contribue à des designs élégants et modernes grâce à des appareils plus fins et plus légers. Comparés aux interfaces traditionnelles, les écrans tactiles à base de films conducteurs transparents offrent l'avantage d'une manipulation directe, de la prise en charge du multitouch et d'une intégration parfaite à l'écran, pour une ergonomie améliorée et une expérience utilisateur plus immersive.

- L'importance croissante accordée aux fonctionnalités avancées, aux écrans haute résolution, aux appareils pliables et la recherche constante d'interfaces utilisateur innovantes dans l'électronique grand public renforcent encore le rôle crucial des films conducteurs transparents en tant que composants essentiels des appareils électroniques modernes. La tendance à l'agrandissement des écrans de smartphones et l'adoption croissante des tablettes et des objets connectés stimulent également la demande en films conducteurs transparents de haute qualité.

- Les entreprises reconnaissent de plus en plus les avantages des films conducteurs transparents, notamment leur excellente clarté optique, leur bonne conductivité électrique et leur polyvalence d'application. Ces atouts les rendent idéaux pour l'intégration dans les conceptions complexes et sophistiquées des appareils électroniques grand public modernes, où la qualité d'affichage et la réactivité tactile sont primordiales. Cette tendance vers des appareils électroniques avancés et riches en fonctionnalités stimule des progrès et des investissements considérables sur le marché des films conducteurs transparents.

- La demande en films conducteurs transparents de haute qualité et fiables croît rapidement, car le déploiement croissant d'interfaces tactiles et de technologies d'affichage avancées incite les entreprises à adopter des solutions matérielles telles que les films conducteurs transparents, capables de garantir un fonctionnement fluide et fiable, améliorant ainsi la fonctionnalité et la satisfaction des utilisateurs de produits électroniques grand public.

Quels sont les principaux moteurs du marché des films conducteurs transparents ?

- Un facteur important et croissant de la croissance du marché des films conducteurs transparents est la préférence grandissante des consommateurs pour des écrans de haute qualité et sans reflets, ce qui entraîne une forte augmentation de la demande en revêtements antireflets pour écrans. Cette tendance rend indispensable l'utilisation de films conducteurs transparents comme composant essentiel de ces écrans avancés, permettant ainsi la fonctionnalité tactile et garantissant une netteté visuelle optimale tout en minimisant les reflets.

- Par exemple, les grands acteurs du secteur de l'électronique grand public, tels qu'Apple et Samsung, intègrent des revêtements antireflets sur les écrans de leurs smartphones, tablettes et ordinateurs portables, qui utilisent des films conducteurs transparents pour la saisie tactile. Les principaux fabricants de matériaux d'affichage, notamment Corning et AGC Inc., proposent des substrats en verre spécialisés avec revêtements antireflets intégrés, compatibles avec les films conducteurs transparents fournis par des entreprises telles que Nitto Denko et Gunze.

- Face à la demande croissante des consommateurs pour une expérience visuelle optimale et une réduction des reflets dans diverses conditions d'éclairage, la demande en films conducteurs transparents, compatibles avec les revêtements antireflets, est en forte hausse. Indispensables au bon fonctionnement des écrans tactiles et des écrans de pointe, les films conducteurs transparents, grâce à leurs propriétés antireflets, améliorent la visibilité et le confort d'utilisation, ce qui en fait une solution de choix pour répondre aux attentes des consommateurs en matière de performances visuelles de haute qualité.

- Les entreprises des secteurs de la fabrication d'écrans et de l'électronique grand public reconnaissent de plus en plus les avantages de combiner des revêtements antireflets à des films conducteurs transparents pour offrir une qualité d'écran supérieure et une meilleure satisfaction des utilisateurs. Cette tendance vers des écrans haute performance à faible éblouissement sur divers appareils génère d'importantes opportunités et une forte croissance sur le marché des films conducteurs transparents.

- La demande en technologies d'affichage avancées, offrant une excellente visibilité et des reflets minimaux, croît rapidement sur le marché de l'électronique grand public. Ceci incite les fabricants à intégrer des films conducteurs transparents avec revêtements antireflets dans leurs produits, pour une expérience utilisateur et une clarté visuelle améliorées. Cette intégration renforce ainsi la valeur et l'attrait des appareils utilisant ces technologies combinées.

Quel facteur freine la croissance du marché des films conducteurs transparents ?

- Un défi majeur pour le marché des films conducteurs transparents réside dans les coûts de production intrinsèquement élevés liés à la fabrication de ces matériaux spécialisés. L'utilisation de matières premières rares et souvent coûteuses, telles que l'oxyde d'indium-étain (ITO), associée à des procédés de fabrication complexes et énergivores, contribue significativement au coût global de production, ce qui peut freiner leur adoption à grande échelle et leur accessibilité pour certaines applications.

- Par exemple, malgré les efforts des principaux fabricants comme Nitto Denko et Teijin Limited pour optimiser leurs processus de production, le coût fondamental de l'indium, composant essentiel des films ITO largement utilisés, demeure un facteur important. Ce coût élevé peut s'avérer particulièrement problématique pour les entreprises du secteur de l'électronique grand public, un marché sensible aux prix, car il peut limiter l'intégration des films conducteurs transparents dans les appareils d'entrée de gamme ou les inciter à rechercher des alternatives plus économiques.

- Relever ce défi exige des efforts continus de recherche et développement axés sur l'exploration de matériaux alternatifs tels que les nanofils d'argent, les nanotubes de carbone et les polymères conducteurs, qui présentent un potentiel de réduction des coûts de production. Bien que des entreprises comme Cambrios Technologies et C3Nano réalisent des progrès dans le domaine de ces matériaux alternatifs, l'ITO demeure un matériau dominant, et son coût intrinsèque peut encore constituer un frein à l'entrée ou à l'expansion sur certains segments de marché.

- Malgré leurs avantages en termes de performance et de clarté optique pour de nombreuses applications, le coût de production élevé des films conducteurs transparents peut constituer un frein pour les industries souhaitant un déploiement à grande échelle sur diverses gammes de produits. Ce facteur de coût pourrait inciter certains fabricants à explorer d'autres matériaux conducteurs, potentiellement moins performants ou moins polyvalents, ou à limiter l'intégration de technologies d'affichage ou tactiles avancées dans leurs offres les plus économiques.

- Pour surmonter ces limitations, il est nécessaire d'innover constamment dans les domaines des matériaux et des techniques de fabrication, soit pour réduire le coût des matériaux existants comme l'ITO, soit pour développer et industrialiser la production de matériaux conducteurs transparents alternatifs, performants et abordables. Comprendre le rapport coût-bénéfice et les exigences spécifiques des différentes applications est essentiel pour une utilisation optimale des films conducteurs transparents, en respectant leurs paramètres économiques, et pour favoriser une plus large diffusion sur le marché.

Comment le marché des films conducteurs transparents est-il segmenté ?

Le marché est segmenté en fonction du matériau et de l'application .

- Par matériau

En fonction du matériau, le marché est segmenté en oxyde d'indium-étain sur verre, oxyde d'indium-étain sur PET, nanofils d'argent, treillis métallique, graphène, nanotubes de carbone, polymères conducteurs, PEDO et autres. Le segment de l'oxyde d'indium-étain sur verre représente la plus grande part de marché (42,81 %) en 2024, grâce à sa forte présence et à sa fiabilité éprouvée dans de nombreuses applications. La maturité de ses procédés de fabrication, son excellente conductivité électrique et sa haute transparence optique en font le matériau de prédilection pour de nombreux dispositifs, malgré les contraintes liées à la disponibilité et au coût de l'indium.

Le segment des nanotubes de carbone devrait connaître le taux de croissance annuel composé le plus rapide entre 2025 et 2032, porté par la demande croissante en électronique flexible et transparente. Les progrès réalisés dans la synthèse et le traitement des nanotubes de carbone permettent de produire des films conducteurs plus performants et plus économiques. Leur flexibilité supérieure, leur conductivité élevée et leur potentiel de réduction des coûts de production par rapport à l'ITO en font une alternative intéressante pour les écrans et dispositifs de nouvelle génération.

- Sur demande

En fonction de l'application, le marché est segmenté en smartphones, écrans DSSCS, tablettes, ordinateurs portables, PC, téléviseurs, éclairage OLED, cellules photovoltaïques organiques, objets connectés et autres. Le segment des téléviseurs représente la plus grande part de chiffre d'affaires en 2024, porté par la demande croissante d'écrans plus grands et à haute résolution dans les foyers du monde entier. Cette domination s'explique par l'infrastructure de production bien établie pour les grands écrans ITO et par la préférence des consommateurs pour une expérience visuelle de haute qualité sur les téléviseurs.

Le segment des smartphones devrait connaître le taux de croissance annuel composé le plus rapide entre 2025 et 2032, porté par la prolifération continue des smartphones et la demande croissante de connectivité permanente et de fonctionnalités avancées. L'adoption rapide des réseaux 5G et les progrès des technologies d'affichage, notamment les écrans flexibles et pliables, accentuent le besoin de films conducteurs transparents innovants et performants dans la fabrication des smartphones.

Quelle région détient la plus grande part du marché des films conducteurs transparents ?

- La Chine a dominé le marché des films conducteurs transparents en Asie-Pacifique avec la plus grande part de revenus (36,8 %) en 2024, grâce à une production massive d'électronique grand public, à la fabrication à grande échelle de panneaux d'affichage et à l'expansion rapide des industries des véhicules électriques et des énergies renouvelables.

- Le leadership du pays dans la fabrication de panneaux OLED et LCD, la production de modules photovoltaïques et l'intégration de batteries pour véhicules électriques accélère l'adoption de films conducteurs transparents dans les écrans tactiles, les écrans flexibles, les capteurs et les cellules solaires.

- Un soutien gouvernemental fort, des chaînes d'approvisionnement verticalement intégrées et des investissements importants dans l'ITO, les nanofils d'argent et les films conducteurs à base de graphène positionnent la Chine comme le principal centre de fabrication et d'innovation du marché des films conducteurs transparents en Asie-Pacifique.

Analyse du marché japonais des films conducteurs transparents

Le marché japonais des films conducteurs transparents connaît une croissance soutenue, avec un TCAC de 8,1 %, portée par une forte demande dans les secteurs de l'électronique de pointe, des écrans automobiles et des applications industrielles de haute précision. Les fabricants japonais privilégient les alternatives à l'ITO haute performance, les revêtements conducteurs ultra-minces et les électrodes transparentes flexibles pour répondre aux exigences technologiques en constante évolution. Des investissements continus en R&D, un solide portefeuille de propriété intellectuelle et la collaboration entre les équipementiers électroniques et les fournisseurs de matériaux renforcent le rôle du Japon en tant qu'acteur technologique majeur sur le marché des films conducteurs transparents en Asie-Pacifique.

Aperçu du marché des films conducteurs transparents en Corée du Sud

Le marché sud-coréen des films conducteurs transparents est en pleine expansion, porté par le leadership mondial du pays dans les domaines des écrans OLED, des smartphones et de l'électronique grand public de nouvelle génération. L'adoption croissante de ces films dans les écrans pliables, les objets connectés et les systèmes d'infodivertissement automobiles contribue également à cette croissance. Le soutien indéfectible des principaux fabricants d'écrans, l'innovation continue dans le domaine des nanofils d'argent et des films polymères conducteurs, ainsi que les mesures gouvernementales de soutien à la recherche et au développement sur les matériaux avancés positionnent la Corée du Sud comme un pôle d'innovation et de production majeur sur le marché des films conducteurs transparents en Asie-Pacifique.

Quelles sont les principales entreprises du marché des films conducteurs transparents ?

L'industrie des films conducteurs transparents est principalement dominée par des entreprises bien établies, notamment :

- Dow, Inc. (États-Unis)

- Windmöller & Hölscher (Allemagne)

- Sealed Air Corporation (États-Unis)

- Klöckner Pentaplast (Luxembourg)

- Berry Global Inc. (États-Unis)

- Amcor plc (Suisse)

- Graphic Packaging International, LLC (États-Unis)

- FLEXOPACK SA (Grèce)

- WINPAK LTD. (Canada)

- Schur Flexibles Holding GesmbH (Autriche)

- Mannok Pack (Royaume-Uni)

- Spa G. Mondini (Italie)

- GROUPE CLONDALKIN (Pays-Bas)

- PLASTOPIL (Israël)

- MULTIVAC (Allemagne)

- ULMA Packaging (Espagne)

- JASA Packaging Solutions (Pays-Bas)

- Sealpac International bv (Pays-Bas)

- KM Packaging Services Ltd (Royaume-Uni)

- Bliston Packaging BV (Pays-Bas)

Quels sont les développements récents sur le marché mondial des écrans centraux ?

- En juillet 2021, TEIJIN LIMITED a démarré ses activités commerciales de fabrication de produits en fibre de carbone, notamment de préimprégnés, au Vietnam. Cette expansion a considérablement accru la capacité de production de l'entreprise en matériaux intermédiaires pour composites. Cette initiative stratégique renforce la trajectoire de croissance de TEIJIN LIMITED, permettant une production accrue et répondant à la demande croissante de composites de pointe en fibre de carbone dans divers secteurs industriels.

- En mai 2021, Toyobo Co., Ltd. a été l'un des premiers investisseurs de JMTC Chemical and Materials Investment Limited Partnership, un fonds d'investissement soutenant les jeunes entreprises développant de nouveaux matériaux. Ce partenariat stratégique a contribué à l'augmentation de la production de l'entreprise et, par conséquent, à l'accroissement de ses bénéfices. La collaboration de Toyobo Co., Ltd. avec ce fonds d'investissement s'inscrit dans son engagement à favoriser l'innovation dans le développement des matériaux.

- En mars 2021, NITTO DENKO CORPORATION a renforcé son activité de fabrication de thérapies oligonucléotidiques au Japon, grâce à des investissements substantiels. Cette initiative stratégique a permis d'accroître sensiblement sa capacité de production de thérapies oligonucléotidiques, positionnant ainsi NITTO DENKO CORPORATION pour répondre à la demande croissante de solutions thérapeutiques avancées et consolidant sa présence dans l'industrie biopharmaceutique.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.