Marché des petites maisons en Asie-Pacifique, par type de produit (petites maisons mobiles et petites maisons fixes ), superficie (moins de 130 pieds carrés, 130 à 500 pieds carrés et plus de 500 pieds carrés), application (domestique, commerciale, industrielle et autres), canal de distribution (ventes directes et distributeurs), tendances de l'industrie et prévisions jusqu'en 2029.

Analyse et taille du marché des petites maisons en Asie-Pacifique

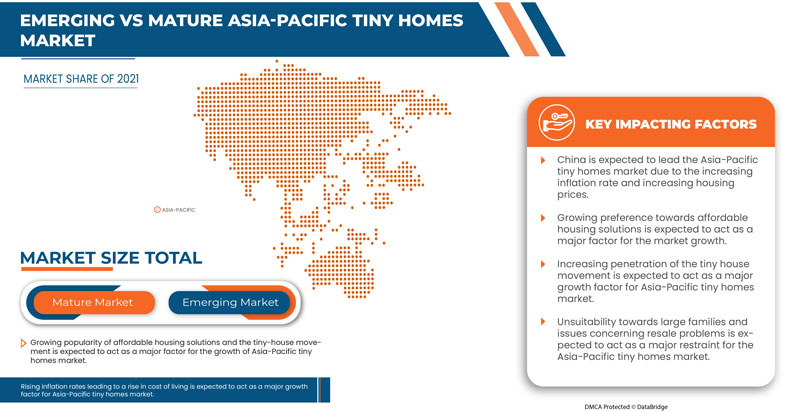

L'utilisation croissante des tiny houses dans les activités touristiques est un moteur important du marché des tiny houses en Asie-Pacifique. L'inflation croissante entraînant une hausse du coût de la vie et la popularité croissante des solutions de logement abordables, ainsi que le mouvement des tiny houses devraient propulser la croissance du marché des tiny houses en Asie-Pacifique.

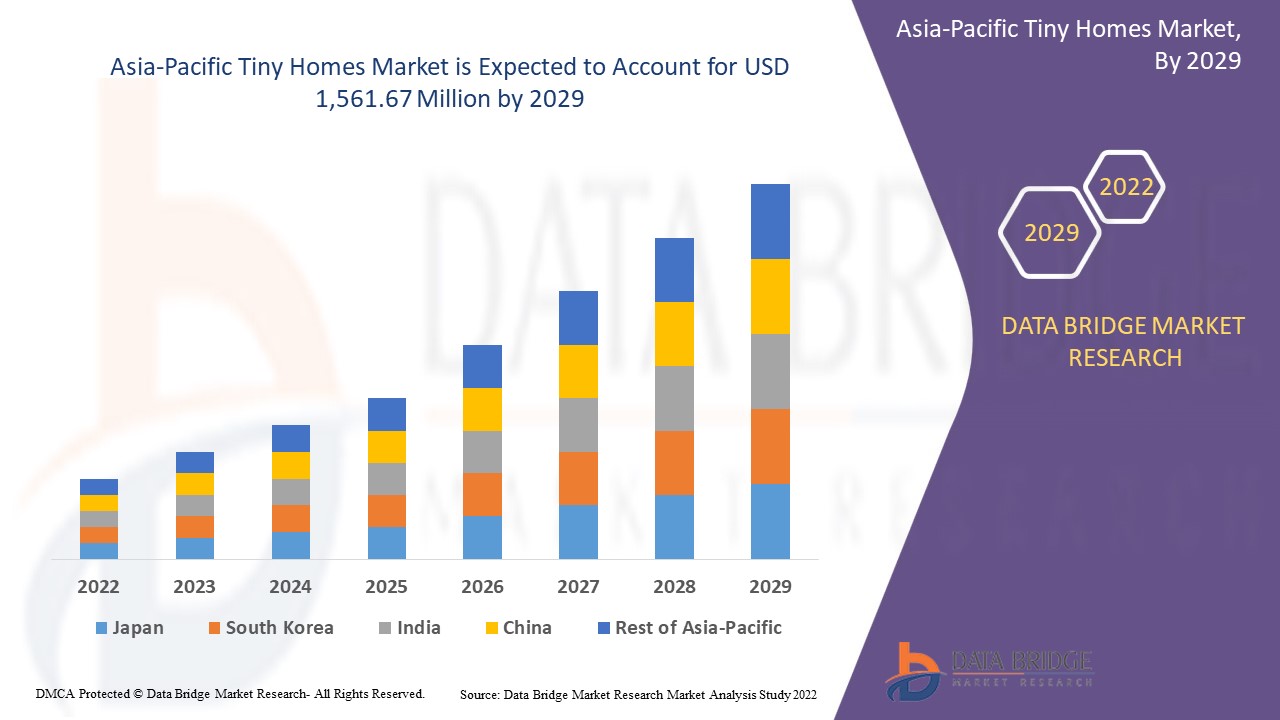

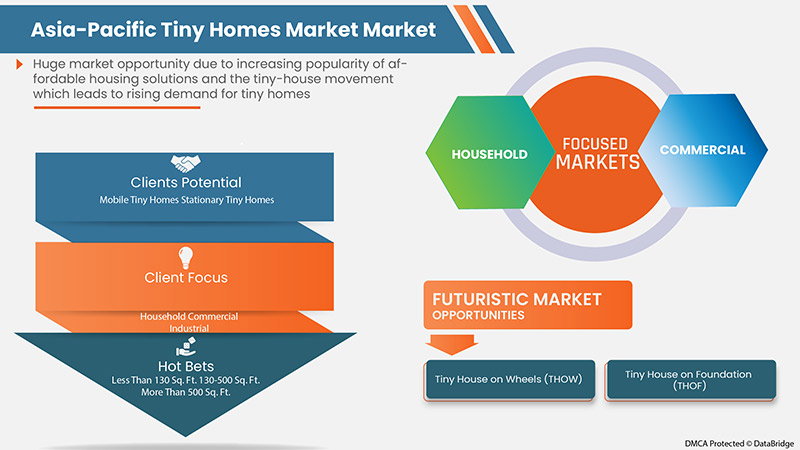

Selon les analyses de Data Bridge Market Research, le marché des tiny houses en Asie-Pacifique devrait atteindre une valeur de 1 561,67 millions USD d'ici 2029, à un TCAC de 3,9 % au cours de la période de prévision. Le segment d'application le plus important sur le marché concerné est celui des « ménages » en raison de l'augmentation du nombre de tiny houses. Le rapport de marché élaboré par l'équipe de Data Bridge Market Research comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et un scénario de chaîne climatique.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par type de produit (petites maisons mobiles et petites maisons fixes ), superficie (moins de 130 pi2, 130 à 500 pi2 et plus de 500 pi2), application (domestique, commerciale, industrielle et autres), canal de distribution (vente directe et distributeurs). |

|

Pays couverts |

Japon, Chine, Corée du Sud, Inde, Singapour, Thaïlande, Indonésie, Malaisie, Philippines, Australie et Nouvelle-Zélande, reste de l'Asie-Pacifique. |

|

Acteurs du marché couverts |

Nestron, CargoHome, Häuslein Pty Ltd. |

Définition du marché

Une tiny house désigne généralement une unité d'habitation individuelle de moins de 400 pieds carrés, construite sur des fondations permanentes ou amovibles. Elle offre aux consommateurs et à leurs communautés locales plusieurs avantages importants, tels qu'un prix d'achat inférieur, une réduction des déchets de matériaux de construction , une empreinte carbone réduite et une consommation d'énergie considérablement réduite.

Les petites maisons ont évolué au cours des dernières décennies et se déclinent dans de nombreux styles et designs, attirant des personnes de tous horizons, des retraités, des couples à la recherche d'une première maison et des jeunes minimalistes, entre autres. Les petites maisons offrent une large gamme de logements de qualité, abordables et respectueux de l'environnement qui peuvent être utilisés pour réaliser des rêves personnels, des objectifs financiers et de style de vie et des besoins de la communauté.

Dynamique du marché des petites maisons en Asie-Pacifique

Cette section traite de la compréhension des moteurs, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Facteurs moteurs/opportunités

- Utilisation croissante des petites maisons dans les activités touristiques

Dans de nombreuses régions du monde, les tiny houses ne nécessitent pas de permis car elles sont considérées comme des véhicules. De nombreuses familles ont investi dans des tiny houses et les ont ensuite louées à des particuliers. Certains prestataires de services louent même leurs tiny houses dans divers styles architecturaux et décoratifs. Ces styles représentent le moderne ou le minimaliste, le rustique ou le traditionnel comme une alternative unique au séjour à l'hôtel. Ils équipent les tiny houses d'une cuisine, d'un espace de vie, d'une salle de bain et d'un espace de couchage. Divers facteurs, tels que la mondialisation, la pénétration d'Internet et l'influence croissante des médias sociaux, ont stimulé la demande de tiny houses. En outre, les nouveaux modes de vie, les revenus disponibles plus élevés et la sensibilisation croissante des consommateurs à l'environnement créent une demande de tiny houses. Cela devrait à son tour agir comme un moteur de la croissance du marché des tiny houses en Asie-Pacifique.

- La hausse de l'inflation entraîne une hausse du coût de la vie

Les taux d’intérêt sur les prêts immobiliers ont incité les consommateurs à rechercher des options de logement plus abordables. Les consommateurs s’intéressent également de plus en plus aux maisons nécessitant peu d’entretien, économes en énergie et respectueuses de l’environnement. L’intérêt croissant pour ces petites maisons à bas prix et respectueuses de l’environnement et les dépenses qui y sont associées devraient faire augmenter la demande de petites maisons dans les années à venir. Ainsi, le marché des petites maisons en Asie-Pacifique est probablement stimulé par la hausse du coût de la vie et par les taux d’intérêt élevés des prêts immobiliers .

- Popularité croissante des solutions de logement abordable et du mouvement des petites maisons

La tendance des tiny houses est en plein essor car il s'agit d'une solution de logement innovante et abordable. Elle nécessite moins d'espace, de terrain et de coûts de construction et peut être entretenue avec des équipements de base. Elle permet d'économiser de l'argent sur le chauffage, la climatisation, les taxes foncières ou l'entretien de la maison. Les tiny houses permettent de réaliser d'énormes économies d'électricité, d'eau et d'énergie par rapport aux grandes maisons, qui nécessitent davantage de frais d'entretien.

Le mouvement des tiny houses, également connu sous le nom de mouvement des petites maisons, vise à réduire la taille des espaces de vie, à simplifier et, essentiellement, à « vivre avec moins ». Selon l'INTERNATIONAL CODE COUNCIL, INC., une tiny house est une « unité d'habitation d'une surface au sol maximale de 37 mètres carrés (400 pieds carrés), à l'exclusion des combles ». De nombreux efforts ont été faits pour accroître le mouvement des tiny houses.

- Moins de charge d'entretien et respectueux de l'environnement

L'utilisation croissante de revêtements en oxyde métallique transparent sur les fenêtres pour contrôler la température des petites maisons nécessite un nombre nettement inférieur de composants électroniques et d'équipements que dans les maisons conventionnelles. En raison de la surface et de l'espace réduits, le coût d'entretien est inférieur à celui d'une maison conventionnelle. Ainsi, les petites maisons nécessitent moins d'entretien et sont respectueuses de l'environnement, ce qui devrait stimuler le marché des petites maisons en Asie-Pacifique.

- Les préférences des consommateurs évoluent vers des logements respectueux de l'environnement

Les consommateurs sont également de plus en plus proactifs dans leur quête d’un mode de vie plus durable, que ce soit en sélectionnant des produits aux pratiques et valeurs éthiques ou respectueuses de l’environnement ou en renonçant à acheter certains produits parce qu’ils ont des préoccupations concernant les pratiques ou les valeurs durables. Pour la plupart des consommateurs, l’adoption d’un mode de vie plus durable commence à la maison, en recyclant, en compostant ou en réduisant le gaspillage alimentaire. Les gens optent également de plus en plus pour le mode de vie des petites maisons en adoptant la philosophie et la liberté qui accompagnent la réduction de l’espace de vie en simplifiant et en vivant avec moins.

En outre, des facteurs tels que l’augmentation du coût de la vie, la sensibilisation croissante à l’environnement et l’augmentation des initiatives gouvernementales créent une demande sur le marché des petites maisons en Asie-Pacifique. En outre, l’évolution des préférences des consommateurs vers des maisons respectueuses de l’environnement peut offrir des opportunités de croissance pour le marché des petites maisons en Asie-Pacifique.

- Présentation de petites maisons durables imprimées en 3D

L'utilisation de la technologie d'impression 3D du béton, qui intègre la technologie numérique et l'application de la technologie des matériaux, permet de créer diverses formes et conceptions. Elle permet aux architectes de construire diverses formes, telles que des courbes, des sphères et autres, en beaucoup moins de temps et à moindre coût. La technologie d'impression 3D est une technologie émergente dans le secteur de la construction. Cependant, il est nécessaire de mettre à niveau les méthodes de construction conventionnelles ou standard à l'aide des avancées technologiques. Cela, à son tour, offre de nouvelles opportunités pour la croissance du marché des petites maisons en Asie-Pacifique.

Contraintes/Défis

- Faible préférence pour les petites maisons par rapport aux maisons conventionnelles

Les petites maisons ne nécessitent pas beaucoup de terrain pour être construites par rapport aux maisons conventionnelles. Mais de nombreuses villes rendent la construction d'une petite maison difficile. Les lois de zonage incluent souvent une taille minimale pour les habitations. Par exemple, en Caroline du Nord, la petite maison doit avoir au moins 150 pieds carrés pour obtenir un permis de construire, et 100 pieds carrés doivent être ajoutés pour chaque occupant supplémentaire. Ces réglementations de zonage peuvent interdire aux gens d'acheter un terrain et d'y construire leur propre petite maison. Parfois, obtenir un prêt pour construire une petite maison est un autre défi. Parfois, il est « impossible de contracter des prêts hypothécaires standard car les banques ne considèrent pas qu'une petite maison a suffisamment de valeur pour constituer une bonne garantie ».

- Nombre croissant de bâtiments résidentiels

Les consommateurs qui emménagent dans de nouveaux espaces et rénovent les anciens restent dans des immeubles résidentiels. L'évolution du mode de vie et l'augmentation du revenu disponible incitent les consommateurs à vivre dans des immeubles et de grands espaces pour maintenir leur niveau de vie et leur statut. Pour cette raison, les gens préfèrent rester dans des immeubles résidentiels. Ainsi, un nombre croissant de constructions résidentielles devrait restreindre le marché des petites maisons en Asie-Pacifique.

- Ne convient pas aux familles nombreuses et aux problèmes de revente

Les propriétaires de petites maisons ont souvent du mal à réguler la température de leur maison. En conséquence, l'eau s'accumule sur les fenêtres, les murs et les meubles. Les petites maisons manquent de systèmes de ventilation et de refroidissement appropriés. De nombreuses personnes qui emménagent dans des petites maisons avec le rêve de voyager plus tard se rendent compte qu'il est difficile de déménager d'un endroit à un autre. Dans la plupart des cas, il faut attacher un camion plus gros, ce qui augmente considérablement les coûts. De plus, les biens doivent être attachés pour qu'ils ne tombent pas et ne se cassent pas pendant le déménagement.

En outre, la vulnérabilité accrue aux catastrophes naturelles et la sensibilisation limitée à ce problème sont autant de facteurs qui peuvent freiner la croissance du marché des petites maisons en Asie-Pacifique, en raison de l'inadaptation des petites maisons aux familles nombreuses et des problèmes liés à la revente de ces dernières.

Impact post-COVID-19 sur le marché des tiny houses en Asie-Pacifique

La COVID-19 a eu un impact sur plusieurs secteurs de la fabrication au cours de l'année 2020-2021, car elle a entraîné la fermeture de lieux de travail, la perturbation des chaînes d'approvisionnement et des restrictions sur les transports. En raison du confinement, le marché a connu une baisse des ventes en raison de la fermeture des points de vente au détail et des restrictions d'accès des clients au cours des dernières années.

Cependant, la croissance du marché après la pandémie est due au nombre croissant de personnes travaillant à domicile et à l’augmentation du revenu disponible. Cela a entraîné une demande accrue de solutions de logement durables, écologiques et abordables. Les principaux acteurs du marché prennent diverses décisions stratégiques pour rebondir après la COVID-19. Ils mènent de nombreuses activités de R&D pour améliorer leurs offres. Ils renforcent leur part de marché en explorant différents canaux de vente au détail et en s’étendant dans de nouvelles régions.

Ce rapport sur le marché des petites maisons en Asie-Pacifique fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et localisé, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans la réglementation du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance des catégories de marché, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché des petites maisons, contactez Data Bridge Market Research pour un briefing d'analyste. Notre équipe vous aidera à prendre une décision éclairée sur le marché pour atteindre la croissance du marché.

Développements récents

- En octobre 2019, Häuslein Pty Ltd a lancé deux nouveaux modèles de tiny house : le Little Sojourner et le Grand Sojourner. Ces produits sont respectivement le plus petit et le plus grand ajout à la famille des tiny houses haut de gamme. Les nouveaux produits lancés aideront l'entreprise à renforcer sa présence sur le marché avec des tiny houses de haute qualité.

Portée du marché des petites maisons en Asie-Pacifique

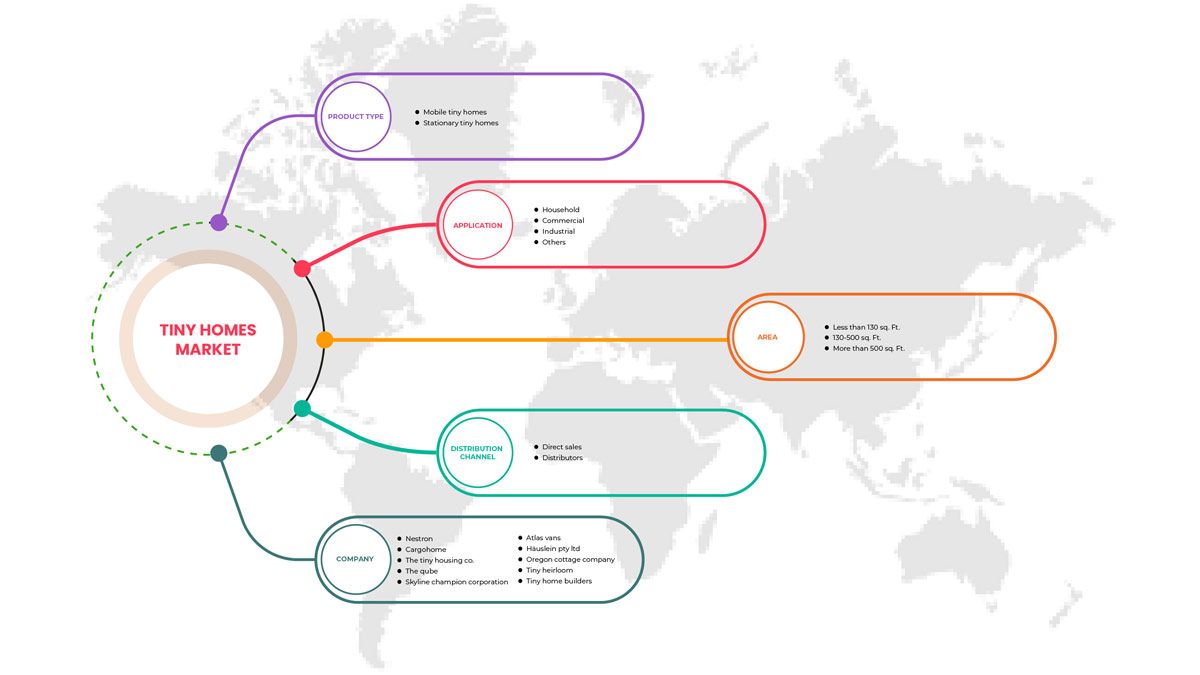

Le marché des petites maisons de la région Asie-Pacifique est segmenté en fonction du type de produit, de la zone, de l'application et du canal de distribution. La croissance de ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Type de produit

- Maisons mobiles miniatures

- Maisons miniatures stationnaires

En fonction du type de produit, le marché des petites maisons d'Asie-Pacifique est segmenté en petites maisons mobiles et petites maisons fixes.

Zone

- Moins de 130 pi.ca.

- 130 à 500 pi.ca.

- Plus de 500 pieds carrés

En fonction de la zone, le marché des petites maisons de la région Asie-Pacifique est segmenté en moins de 130 pieds carrés, 130 à 500 pieds carrés et plus de 500 pieds carrés.

Application

- Ménage

- Commercial

- Industriel

- Autres

En fonction des applications, le marché des petites maisons de l'Asie-Pacifique est segmenté en maisons domestiques, commerciales, industrielles et autres.

Canal de distribution

- Vente directe

- Distributeurs

En fonction du canal de distribution, le marché des petites maisons de la région Asie-Pacifique est segmenté en ventes directes et distributeurs.

Analyse/perspectives régionales du marché des petites maisons en Asie-Pacifique

Le marché des petites maisons en Asie-Pacifique est analysé et des informations et tendances sur la taille du marché sont fournies par pays, type de produit, zone, application et canal de distribution, comme indiqué ci-dessus.

Les pays couverts par le rapport sur le marché des petites maisons en Asie-Pacifique sont le Japon, la Chine, la Corée du Sud, l'Inde, Singapour, la Thaïlande, l'Indonésie, la Malaisie, les Philippines, l'Australie et la Nouvelle-Zélande, ainsi que le reste de l'Asie-Pacifique.

En 2022, la Chine devrait dominer le marché des petites maisons en Asie-Pacifique en raison d'une augmentation des dépenses de consommation dans ce domaine en raison du mouvement des petites maisons dans la région. L'augmentation des investissements et des initiatives en faveur de la construction de petites maisons à usage commercial et résidentiel stimule la demande de petites maisons dans la région.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques d'Asie-Pacifique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des petites maisons en Asie-Pacifique

Le paysage concurrentiel du marché des petites maisons en Asie-Pacifique fournit des détails par concurrent. Les détails comprennent un aperçu de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Asie-Pacifique, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché des petites maisons en Asie-Pacifique.

Certains des principaux acteurs opérant sur le marché des petites maisons sont Nestron, CargoHome et Häuslein Pty Ltd, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC TINY HOMES MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 3D PRINTING IN TINY HOMES

4.2 CONSUMERS BUYING BEHAVIOUR

4.2.1 OVERVIEW

4.2.2 COMPLEX BUYING BEHAVIOR

4.2.3 DISSONANCE-REDUCING BUYING BEHAVIOR

4.2.4 HABITUAL BUYING BEHAVIOR

4.2.5 VARIETY SEEKING BEHAVIOR

4.2.6 CONCLUSION

4.3 LIST OF SUPPLIERS & DISTRIBUTORS

4.3.1 ASIA PACIFIC

4.4 CONSUMERS ANALYSIS

4.5 REGULATION COVERAGE

4.5.1 INTERNATIONAL RESIDENTIAL CODE (IRC)

4.5.1.1 GENERAL

4.5.1.2 DEFINITIONS

4.5.1.3 CEILING HEIGHT

4.5.1.4 LOFTS

4.5.1.5 EMERGENCY ESCAPE AND RESCUE OPENINGS

4.5.1.6 ENERGY CONSERVATION

4.5.2 NATIONAL FIRE PROTECTION ASSOCIATION (NFPA)

4.5.3 RV INDUSTRY ASSOCIATION

4.5.4 U.S. DEPARTMENT OF HOUSING AND URBAN DEVELOPMENT (HUD)

4.5.5 NATIONAL ORGANIZATION OF ALTERNATIVE HOUSING (NOAH)

5 REGIONAL SUMMARY

5.1 ASIA PACIFIC

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING USAGE OF TINY HOMES IN TOURISM ACTIVITIES

6.1.2 RISING INFLATION LEADS TO A RISE IN LIVING COSTS

6.1.3 INCREASING POPULARITY OF AFFORDABLE HOUSING SOLUTIONS AND THE TINY-HOUSE MOVEMENT

6.1.4 LESS BURDEN OF MAINTENANCE AS WELL AS ENVIRONMENT FRIENDLY

6.2 RESTRAINTS

6.2.1 LOW PREFERENCE TOWARDS THE TINY HOMES OVER CONVENTIONAL HOMES

6.2.2 LACK OF WELL-ESTABLISHED INFRASTRUCTURE AND LIMITED AWARENESS

6.2.3 GROWING NUMBER OF RESIDENTIAL BUILDINGS

6.3 OPPORTUNITIES

6.3.1 SHIFTING CONSUMER PREFERENCE TOWARD THE ENVIRONMENTALLY FRIENDLY HOMES

6.3.2 HIGH INTEREST RATES ON HOME LOANS

6.3.3 INTRODUCTION OF SUSTAINABLE 3D PRINTED TINY HOMES

6.4 CHALLENGES

6.4.1 LIMITED DEMAND FROM DEVELOPING ECONOMIES

6.4.2 UNSUITABLE FOR LARGE FAMILIES AND ISSUES CONCERNING RESALE PROBLEMS

7 ASIA PACIFIC TINY HOMES MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 STATIONARY TINY HOMES

7.3 MOBILE TINY HOMES

8 ASIA PACIFIC TINY HOMES MARKET, BY AREA

8.1 OVERVIEW

8.2 130-500 SQ.FT

8.3 LESS THAN 130 SQ.FT

8.4 MORE THAN 500 SQ.FT

9 ASIA PACIFIC TINY HOMES MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 HOUSEHOLD

9.3 COMMERCIAL

9.4 INDUSTRIAL

9.5 OTHERS

10 ASIA PACIFIC TINY HOMES MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 DIRECT SALES

10.3 DISTRIBUTORS

11 ASIA PACIFIC TINY HOMES MARKET, BY REGION

11.1 ASIA-PACIFIC

11.1.1 CHINA

11.1.2 JAPAN

11.1.3 INDIA

11.1.4 AUSTRALIA & NEW ZEALAND

11.1.5 SOUTH KOREA

11.1.6 THAILAND

11.1.7 INDONESIA

11.1.8 MALAYSIA

11.1.9 SINGAPORE

11.1.10 PHILIPPINES

11.1.11 REST OF ASIA-PACIFIC

12 ASIA PACIFIC TINY HOMES MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

12.2 PRODUCT LAUNCHES

12.3 PARTNERSHIP

12.4 PARTICIPATION

12.5 AWARDS

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 NESTRON

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENTS

14.2 CARGOHOME

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENTS

14.3 THE TINY HOUSING CO.

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENTS

14.4 THE QUBE

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.5 SKYLINE CHAMPION CORPORATION

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 ATLAS VANS

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 HÄUSLEIN PTY LTD

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENTS

14.8 OREGON COTTAGE COMPANY

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 TINY HEIRLOOM

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 TINY HOME BUILDERS

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 TINY SMART HOUSE, INC.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 TUMBLEWEED TINY HOUSE COMPANY

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 NEW FRONTIER TINY HOMES

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 TIMBERCARAFT TINY HOMES

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENTS

14.15 MUSTARD SEED TINY HOMES LLC

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 AMERICAN TINY HOUSE

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

14.17 B&B MICRO MANUFACTURING, INC.

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 CALIFORNIA TINY HOUSE

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENTS

14.19 MAVERICK TINY HOMES, LLC

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENTS

14.2 TINY IDAHOMES

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 ASIA PACIFIC TINY HOMES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 ASIA PACIFIC STATIONARY TINY HOMES IN TINY HOMES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC MOBILE TINY HOMES IN TINY HOMES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC TINY HOMES MARKET, BY AREA, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC 130-500 SQ.FT IN TINY HOMES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC LESS THAN 130 SQ.FT IN TINY HOMES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC MORE THAN 500 SQ.FT IN TINY HOMES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC TINY HOMES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC HOUSEHOLD IN TINY HOMES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC COMMERCIAL IN TINY HOMES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC INDUSTRIAL IN TINY HOMES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC OTHERS IN TINY HOMES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC TINY HOMES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC DIRECT SALES IN TINY HOMES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC DISTRIBUTORS IN TINY HOMES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA-PACIFIC TINY HOMES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 17 ASIA-PACIFIC TINY HOMES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 18 ASIA-PACIFIC TINY HOMES MARKET, BY AREA, 2020-2029 (USD MILLION)

TABLE 19 ASIA-PACIFIC TINY HOMES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 20 ASIA-PACIFIC TINY HOMES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 21 CHINA TINY HOMES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 22 CHINA TINY HOMES MARKET, BY AREA, 2020-2029 (USD MILLION)

TABLE 23 CHINA TINY HOMES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 24 CHINA TINY HOMES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 25 JAPAN TINY HOMES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 26 JAPAN TINY HOMES MARKET, BY AREA, 2020-2029 (USD MILLION)

TABLE 27 JAPAN TINY HOMES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 28 JAPAN TINY HOMES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 29 INDIA TINY HOMES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 30 INDIA TINY HOMES MARKET, BY AREA, 2020-2029 (USD MILLION)

TABLE 31 INDIA TINY HOMES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 32 INDIA TINY HOMES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 33 AUSTRALIA & NEW ZEALAND TINY HOMES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 34 AUSTRALIA & NEW ZEALAND TINY HOMES MARKET, BY AREA, 2020-2029 (USD MILLION)

TABLE 35 AUSTRALIA & NEW ZEALAND TINY HOMES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 36 AUSTRALIA & NEW ZEALAND TINY HOMES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 37 SOUTH KOREA TINY HOMES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 38 SOUTH KOREA TINY HOMES MARKET, BY AREA, 2020-2029 (USD MILLION)

TABLE 39 SOUTH KOREA TINY HOMES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 40 SOUTH KOREA TINY HOMES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 41 THAILAND TINY HOMES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 42 THAILAND TINY HOMES MARKET, BY AREA, 2020-2029 (USD MILLION)

TABLE 43 THAILAND TINY HOMES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 44 THAILAND TINY HOMES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 45 INDONESIA TINY HOMES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 46 INDONESIA TINY HOMES MARKET, BY AREA, 2020-2029 (USD MILLION)

TABLE 47 INDONESIA TINY HOMES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 48 INDONESIA TINY HOMES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 49 MALAYSIA TINY HOMES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 50 MALAYSIA TINY HOMES MARKET, BY AREA, 2020-2029 (USD MILLION)

TABLE 51 MALAYSIA TINY HOMES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 52 MALAYSIA TINY HOMES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 53 SINGAPORE TINY HOMES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 54 SINGAPORE TINY HOMES MARKET, BY AREA, 2020-2029 (USD MILLION)

TABLE 55 SINGAPORE TINY HOMES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 56 SINGAPORE TINY HOMES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 57 PHILIPPINES TINY HOMES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 58 PHILIPPINES TINY HOMES MARKET, BY AREA, 2020-2029 (USD MILLION)

TABLE 59 PHILIPPINES TINY HOMES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 60 PHILIPPINES TINY HOMES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 61 REST OF ASIA-PACIFIC TINY HOMES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 ASIA PACIFIC TINY HOMES MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC TINY HOMES MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC TINY HOMES MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC TINY HOMES MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC TINY HOMES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC TINY HOMES MARKET: THE PRODUCT TYPE LIFE LINE CURVE

FIGURE 7 ASIA PACIFIC TINY HOMES MARKET: MULTIVARIATE MODELLING

FIGURE 8 ASIA PACIFIC TINY HOMES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA PACIFIC TINY HOMES MARKET: DBMR MARKET POSITION GRID

FIGURE 10 ASIA PACIFIC TINY HOMES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 ASIA PACIFIC TINY HOMES MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 ASIA PACIFIC TINY HOMES MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 ASIA PACIFIC TINY HOMES MARKET: SEGMENTATION

FIGURE 14 INCREASING POPULARITY OF AFFORDABLE HOUSING SOLUTIONS IS EXPECTED TO DRIVE THE ASIA PACIFIC TINY HOMES MARKET IN THE FORECAST PERIOD

FIGURE 15 THE STATIONARY TINY HOMES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC TINY HOMES MARKET IN 2022 & 2029

FIGURE 16 ASIA PACIFIC TINY HOMES MARKET: TYPES OF CONSUMER'S BUYING BEHAVIOUR

FIGURE 17 ASIA PACIFIC TINY HOMES MARKET: SHARE OF CONSUMER TYPE

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA PACIFIC TINY HOMES MARKET

FIGURE 19 ASIA PACIFIC TINY HOMES MARKET, BY PRODUCT TYPE, 2021

FIGURE 20 ASIA PACIFIC TINY HOMES MARKET, BY AREA, 2021

FIGURE 21 ASIA PACIFIC TINY HOMES MARKET, BY APPLICATION, 2021

FIGURE 22 ASIA PACIFIC TINY HOMES MARKET, BY DISTRIBUTION CHANNEL, 2021

FIGURE 23 ASIA-PACIFIC TINY HOMES MARKET: SNAPSHOT (2021)

FIGURE 24 ASIA-PACIFIC TINY HOMES MARKET: BY COUNTRY (2021)

FIGURE 25 ASIA-PACIFIC TINY HOMES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 ASIA-PACIFIC TINY HOMES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 ASIA-PACIFIC TINY HOMES MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 28 ASIA PACIFIC TINY HOMES MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.