Marché des services gérés de télécommunications en Asie-Pacifique, par type (services de centre de données gérés, services de réseau gérés, services de communication et de collaboration gérés, services de sécurité gérés, services de mobilité gérés et autres), service d'information géré (MIS) ( gestion des processus métier , systèmes de soutien opérationnel gérés/systèmes de soutien métier, gestion de projets et de portefeuilles et autres), modèle de déploiement (sur site et cloud), taille de l'organisation (grandes entreprises et petites et moyennes entreprises (PME)) - Tendances et prévisions du secteur jusqu'en 2029.

Analyse et perspectives du marché

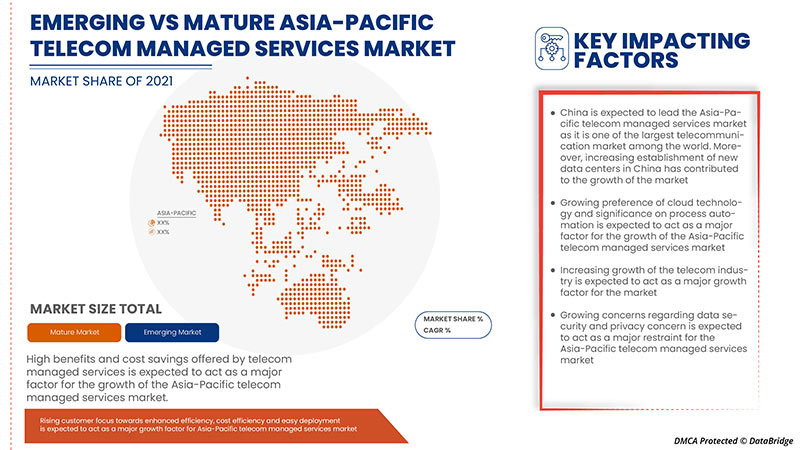

Le rôle des services gérés de télécommunications est d'aider l'organisation à se concentrer sur l'efficacité opérationnelle en gérant les activités et les stratégies commerciales. Les services gérés de télécommunications aident les organisations à maintenir l'infrastructure informatique et à fournir des fonctions de service essentielles à l'entreprise. L'adoption croissante des technologies de cloud computing par les petites et moyennes entreprises et les progrès technologiques croissants tels que les services de mobilité et les services de big data pour améliorer l'efficacité opérationnelle sont les principaux facteurs responsables de la croissance du marché des services gérés de télécommunications en Asie-Pacifique. Cependant, une pénurie de professionnels qualifiés ou de personnel formé peut freiner la croissance du marché des services gérés de télécommunications en Asie-Pacifique.

Data Bridge Market Research analyse que le marché des services gérés de télécommunications en Asie-Pacifique devrait atteindre la valeur de 14 365,10 millions USD d'ici 2029, à un TCAC de 14,8 % au cours de la période de prévision. Les « services de centres de données gérés » représentent le segment de système le plus important sur le marché des services gérés de télécommunications. Le rapport sur le marché des services gérés de télécommunications couvre également en profondeur l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Par type (services de centre de données gérés, services de réseau gérés, services de communication et de collaboration gérés, services de sécurité gérés , services de mobilité gérés et autres), service d'information géré (MIS) (gestion des processus d'entreprise, systèmes de soutien opérationnel gérés/systèmes de soutien d'entreprise, gestion de projets et de portefeuilles et autres), modèle de déploiement (sur site et dans le cloud), taille de l'organisation (grandes entreprises et petites et moyennes entreprises (PME)) |

|

Pays couverts |

Chine, Japon, Inde, Corée du Sud, Singapour, Malaisie, Australie, Thaïlande, Indonésie, Philippines, Reste de l'Asie-Pacifique |

|

Acteurs du marché couverts |

FUJITSU, DXC Technology Company, IBM Corporation, Cognizant, Wipro Limited, Capgemini, Accenture, Tata Consultancy Services Limited, HCL Technologies Limited, NTT DATA Corporation, Verizon, Cisco Systems, Inc., ZTE Corporation, Huawei Technologies Co., Ltd., Telefonaktiebolaget LM Ericsson, AT&T Intellectual Property, Nokia Corporation, Lumen Technologies, RACKSPACE TECHNOLOGY, INC., Comarch SA, Tech Mahindra Limited, Infosys Limited, GTT Communications, Inc., BT, Unisys, entre autres |

Définition du marché

Un service géré est une tâche effectuée par un tiers, souvent dans le cadre de l'entreprise qu'il dessert. Les services gérés sont utilisés pour réduire les dépenses, améliorer la qualité du service ou libérer les équipes internes pour qu'elles se consacrent à des tâches propres à l'entreprise en question. Il s'agit d'un moyen de déléguer des tâches générales à un spécialiste. Un fournisseur de services gérés est une entreprise qui propose ces services. Un fournisseur de services gérés est souvent un fournisseur de services informatiques qui gère et assume la responsabilité de fournir un ensemble défini de services à ses clients.

Les services gérés de télécommunications permettent aux organisations de réduire leurs coûts d'exploitation, ce qui leur permet de se concentrer davantage sur les exercices commerciaux essentiels et les techniques fondamentales, de réduire les dangers liés aux opérations commerciales et d'améliorer l'efficacité et la précision opérationnelles.

Dynamique du marché des services gérés de télécommunications en Asie-Pacifique

- Besoin croissant d'agilité commerciale

L'agilité des entreprises leur permet de maintenir leur potentiel maximal, tant en termes de profits que de salariés, dans un environnement externe et interne dynamique. Elle permet aux organisations d'innover et de livrer plus efficacement, transformant ainsi les perturbations du marché en avantage concurrentiel tout en prospérant dans des environnements complexes.

- Orientation client croissante vers une efficacité accrue, une rentabilité et un déploiement aisé

Les services gérés sont une pratique très rentable, largement utilisée dans le monde de la numérisation d'aujourd'hui. Ils permettent en outre aux propriétaires d'entreprise de réduire la charge de travail et de se concentrer sur d'autres aspects essentiels de leur activité. Les pays développés comme le Japon, la Chine et l'Inde préfèrent toujours externaliser leurs processus commerciaux.

- Préférence croissante pour la technologie cloud et son importance dans l'automatisation des processus

Les technologies numériques ont créé de nouvelles opportunités pour les chefs d’entreprise. Les modèles traditionnels de gestion des opérations et des processus d’entreprise se réinventent en flux de travail plus intelligents utilisant l’automatisation, l’intelligence artificielle, l’Internet des objets (IoT), le cloud et d’autres nouvelles technologies. Les entreprises doivent constamment évoluer vers des processus plus intelligents et entièrement orchestrés qui prennent en compte les clients, les employés, les fournisseurs et les partenaires commerciaux pour rester pertinentes et poursuivre leur croissance.

- La demande croissante de centres de données

La COVID-19 a entraîné une forte production de données, car les gens ont commencé à travailler à domicile, les organisations se transforment numériquement et les organisations adoptent diverses technologies numériques. Le flux croissant de données doit être exploité et stocké, aidé par les centres de données. Ainsi, un certain nombre de centres de données augmentent la demande pour leurs services de gestion, ce qui est l'un des principaux facteurs de croissance du marché au cours de la période de prévision.

Opportunité

-

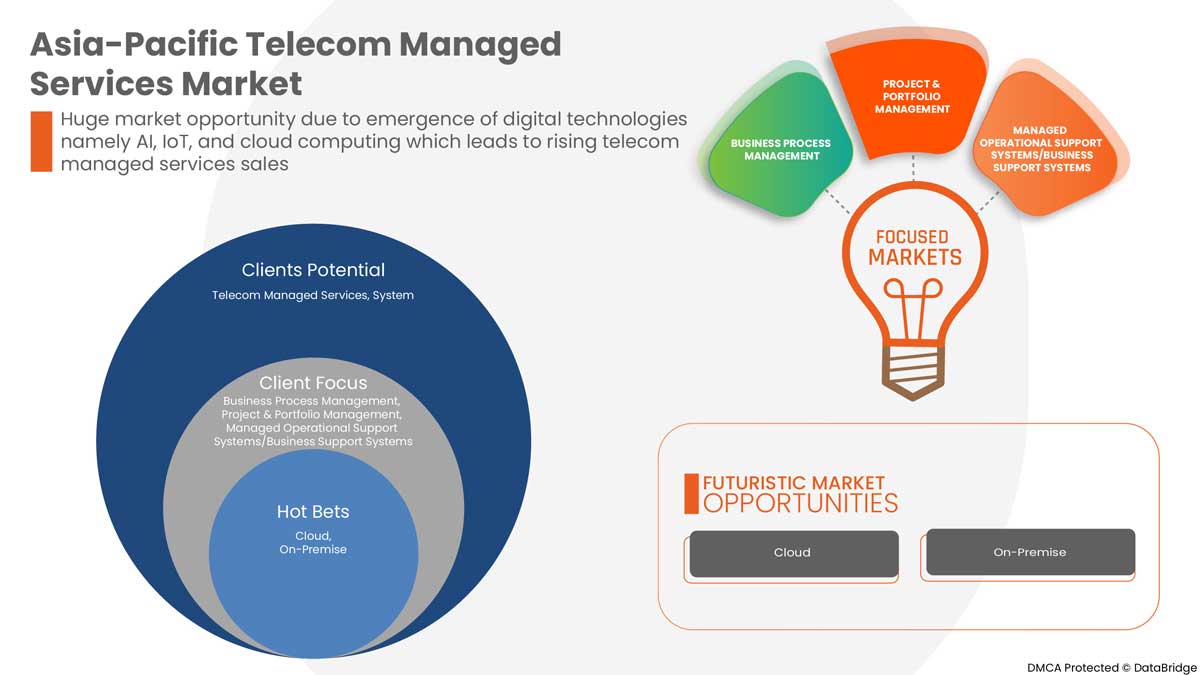

Émergence des technologies numériques, notamment l'IA, l'IoT et le cloud computing

Le cloud computing est devenu un moteur majeur de la transformation numérique dans tous les secteurs. Non seulement il offre une agilité inégalée, mais il réduit également les frais d’exploitation et de gestion. Plusieurs gouvernements et entreprises commencent à exploiter cette technologie et gagnent progressivement en popularité dans plusieurs secteurs verticaux. Le potentiel est devenu si ouvert que la notion de cloud limitée aux seules fonctions informatiques a complètement changé. Elle est en outre intégrée à d’autres technologies telles que l’intelligence artificielle (IA), l’Internet des objets (IoT) et l’informatique de pointe, entre autres.

Contraintes/Défis

- Préoccupations croissantes concernant la sécurité des données et la confidentialité

La sécurité des données est devenue plus importante que jamais, ce qui a suscité la curiosité de nombreuses personnes quant à la manière dont les entreprises gèrent la sécurité des données. Alors que l'externalisation des processus métier gagne en popularité, de nombreuses organisations craignent que travailler avec une entreprise tierce ne mette leurs données en danger. En substance, les préoccupations croissantes en matière de sécurité des données dues aux piratages externes et aux failles de sécurité internes constituent un facteur majeur susceptible d'entraver la croissance du marché des services gérés de télécommunications.

Impact du COVID-19 sur le marché des services gérés de télécommunications en Asie-Pacifique

La pandémie de COVID-19 a eu un impact considérable sur le marché des services gérés, car presque tous les pays ont opté pour la fermeture des installations des entreprises. Les entreprises ont donc été confrontées à des problèmes lors de leur fonctionnement à distance dans la phase initiale.

Cependant, la croissance du marché des services gérés après la pandémie est attribuée à la demande croissante de compétences numériques dans les économies sous-développées.

Les fournisseurs de services prennent diverses décisions stratégiques pour rebondir après la COVID-19. Les acteurs mènent de nombreuses activités de recherche et développement pour améliorer la technologie de ces services. Grâce à cela, les entreprises apporteront des technologies avancées sur le marché.

Développements récents

- En septembre 2021, Huawei Technologies Co., Ltd. a annoncé avoir signé un accord de services informatiques et de gestion avec Ooredoo Oman. Dans le cadre de cet accord, la société fournira à Ooredoo des services de gestion des performances du réseau, d'exploitation et de maintenance. Ainsi, l'entreprise élargit sa clientèle sur le marché

- En novembre 2020, Telefonaktiebolaget LM Ericsson a annoncé l'ouverture d'un nouveau centre de services gérés en Turquie. L'entreprise va promouvoir des solutions d'ingénierie et de conception à haute valeur ajoutée basées sur des technologies de nouvelle génération, notamment l'intelligence artificielle (IA) et l'apprentissage automatique. Ainsi, l'entreprise va étendre ses activités dans la région

Portée du marché des services gérés de télécommunications en Asie-Pacifique

Le marché des services gérés de télécommunications en Asie-Pacifique est segmenté en fonction du type, du service d'information géré (MIS), du modèle de déploiement et de la taille de l'organisation. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Taper

- Services de centre de données gérés

- Services de réseau gérés

- Services de communication et de collaboration gérés

- Services de sécurité gérés

- Services de mobilité gérés

- Autres

Sur la base du type, le marché des services gérés de télécommunications en Asie-Pacifique est segmenté en services de centre de données gérés, services de réseau gérés, services de communication et de collaboration gérés, services de sécurité gérés, services de mobilité gérés et autres.

Service d'information géré (SIG)

- Gestion des processus d'affaires

- Systèmes de soutien opérationnel gérés/Systèmes de soutien aux entreprises

- Gestion de projets et de portefeuilles

- Autres

Sur la base du service d'information géré (MIS), le marché des services gérés des télécommunications en Asie-Pacifique est segmenté en gestion des processus d'entreprise, systèmes de soutien opérationnel gérés/systèmes de soutien d'entreprise, gestion de projets et de portefeuilles, et autres.

Modèle de déploiement

- Nuage

- Sur site

Sur la base du modèle de déploiement, le marché des services gérés de télécommunications en Asie-Pacifique a été segmenté en sur site et en cloud.

Taille de l'organisation

- Grandes entreprises

- Petites et moyennes entreprises (PME)

Sur la base de la taille de l'organisation, le marché des services gérés de télécommunications en Asie-Pacifique est segmenté en grandes entreprises et petites et moyennes entreprises (PME).

Marché des services gérés de télécommunications en Asie-Pacifique

Le marché des services gérés de télécommunications en Asie-Pacifique est analysé et des informations et tendances sur la taille du marché sont fournies par pays, type, service d’information géré (MIS), modèle de déploiement et taille de l’organisation comme référencé ci-dessus.

Le marché des services gérés de télécommunications en Asie-Pacifique couvre des pays tels que la Chine, le Japon, l'Inde, la Corée du Sud, Singapour, la Malaisie, l'Australie, la Thaïlande, l'Indonésie, les Philippines et le reste de l'Asie-Pacifique.

La Chine devrait dominer le marché des services de télécommunications gérés en Asie-Pacifique, car il s'agit de l'un des plus grands marchés de télécommunications au monde. En outre, l'augmentation des services Internet et mobiles et la création de nouveaux centres de données en Chine, en Inde, à Singapour et en Australie ont conduit à une croissance considérable du marché des services de télécommunications gérés en Asie-Pacifique.

La section par pays du rapport sur le marché des services gérés de télécommunications en Asie-Pacifique fournit également des facteurs d'impact individuels sur le marché et des changements de réglementation nationale qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation sont quelques-uns des indicateurs importants utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques d'Asie-Pacifique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales et de l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données par pays.

Analyse du paysage concurrentiel et des parts de marché des services gérés de télécommunications en Asie-Pacifique

Le paysage concurrentiel du marché des services gérés de télécommunications en Asie-Pacifique fournit des détails sur le concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence régionale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement de la solution, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus ne concernent que l'orientation des entreprises vers le marché des services gérés de télécommunications en Asie-Pacifique.

Français Certains des principaux acteurs opérant sur le marché des services gérés de télécommunications en Asie-Pacifique sont FUJITSU, DXC Technology Company, IBM Corporation, Cognizant, Wipro Limited, Capgemini, Accenture, Tata Consultancy Services Limited, HCL Technologies Limited, NTT DATA Corporation, Verizon, Cisco Systems, Inc., ZTE Corporation, Huawei Technologies Co., Ltd., Telefonaktiebolaget LM Ericsson, AT&T Intellectual Property, Nokia Corporation, Lumen Technologies, RACKSPACE TECHNOLOGY, INC., Comarch SA, Tech Mahindra Limited, Infosys Limited, GTT Communications, Inc., BT, Unisys, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC TELECOM MANAGED SERVICES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 REGULATORY FRAMEWORK

4.1.1 REGULATIONS FOR U.S.

4.1.2 REGULATIONS FOR U.K.

4.1.3 REGULATIONS FOR SPAIN

4.1.4 REGULATIONS FOR NETHERLANDS

4.1.5 REGULATIONS FOR JAPAN

4.2 PESTEL ANALYSIS

4.2.1 POLITICAL FACTORS:

4.2.2 ECONOMIC FACTORS:

4.2.3 SOCIAL FACTORS:

4.2.4 TECHNOLOGICAL FACTORS:

4.2.5 ENVIRONMENTAL FACTORS:

4.2.6 LEGAL FACTORS:

4.3 PORTERS MODEL

4.4 TECHNOLOGICAL ANALYSIS

4.4.1 BIG DATA AND ANALYTICS

4.4.2 CLOUD COMPUTING

4.4.3 ARTIFICIAL INTELLIGENCE

4.4.4 MACHINE LEARNING

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING NEED FOR BUSINESS AGILITY

5.1.2 RISING CUSTOMER FOCUS TOWARDS ENHANCED COST, EFFICIENCY, AND EASY DEPLOYMENT

5.1.3 GROWING PREFERENCE FOR CLOUD TECHNOLOGY AND ITS SIGNIFICANCE IN PROCESS AUTOMATION

5.1.4 SURGING DEMAND FOR DATA CENTERS

5.1.5 HEIGHTENED DEPENDENCY ON CLOUD IDENTITY AND ACCESS MANAGEMENT SOLUTIONS

5.1.6 RAPID GROWTH IN DIGITALIZATION ACROSS BUSINESS

5.2 RESTRAINT

5.2.1 GROWING DATA SECURITY AND PRIVACY CONCERNS

5.3 OPPORTUNITIES

5.3.1 FOCUS ON MULTI-WORKFLOW SCHEDULING OF BUSINESS

5.3.2 EMERGENCE OF DIGITAL TECHNOLOGIES, NAMELY AI, IOT, AND CLOUD COMPUTING

5.3.3 GROWING DEMAND FOR DIGITAL SKILLS IN UNDERDEVELOPED ECONOMIES

5.3.4 INCREASING GROWTH IN THE TELECOM INDUSTRY

5.4 CHALLENGE

5.4.1 LACK OF SKILLED WORKFORCE AND HIGH ATTRITION RATE

6 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET, BY TYPE

6.1 OVERVIEW

6.2 MANAGED DATA CENTER SERVICES

6.2.1 STORAGE MANAGEMENT

6.2.2 SERVER MANAGEMENT

6.2.3 MANAGED PRINT SERVICES

6.2.4 OTHERS

6.3 MANAGED NETWORK SERVICES

6.3.1 MANAGED WIDE AREA NETWORK

6.3.2 NETWORK MONITORING

6.3.3 MANAGED NETWORK SECURITY

6.3.4 MANAGED LOCAL AREA NETWORK

6.3.5 MANAGED WIRELESS FIDELITY

6.3.6 MANAGED VIRTUAL PRIVATE NETWORK

6.4 MANAGED COMMUNICATION AND COLLABORATION SERVICES

6.4.1 MANAGED VOICE OVER INTERNET PROTOCOL (VOIP)

6.4.2 MANAGED UNIFIED COMMUNICATION AS A SERVICE (UCAAS)

6.4.3 OTHERS

6.5 MANAGED SECURITY SERVICES

6.5.1 MANAGED IDENTITY AND ACCESS MANAGEMENT

6.5.2 MANAGED FIREWALL

6.5.3 MANAGED ANTIVIRUS/ANTIMALWARE

6.5.4 MANAGED INTRUSION DETECTION SYSTEMS/INTRUSION PREVENTION SYSTEMS

6.5.5 MANAGED VULNERABILITY MANAGEMENT

6.5.6 MANAGED UNIFIED THREAT MANAGEMENT

6.5.7 MANAGED RISK AND COMPLIANCE MANAGEMENT

6.5.8 MANAGED ENCRYPTION

6.5.9 MANAGED SECURITY INFORMATION AND EVENT MANAGEMENT

6.5.10 OTHERS

6.6 MANAGED MOBILITY SERVICES

6.6.1 APPLICATION MANAGEMENT

6.6.2 DEVICE LIFE CYCLE MANAGEMENT

6.7 OTHERS

7 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET, BY MANAGED INFORMATION SERVICE (MIS)

7.1 OVERVIEW

7.2 BUSINESS PROCESS MANAGEMENT

7.3 MANAGED OPERATIONAL SUPPORT SYSTEMS/BUSINESS SUPPORT SYSTEMS

7.4 PROJECT & PORTFOLIO MANAGEMENT

7.5 OTHERS

8 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL

8.1 OVERVIEW

8.2 CLOUD

8.3 ON-PREMISE

9 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET, BY ORGANIZATION SIZE

9.1 OVERVIEW

9.2 LARGE ENTERPRISES

9.2.1 CLOUD

9.2.2 ON-PREMISE

9.3 SMALL AND MEDIUM ENTERPRISES (SMES)

9.3.1 CLOUD

9.3.2 ON-PREMISE

10 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET, BY REGION

10.1 ASIA-PACIFIC

10.1.1 CHINA

10.1.2 JAPAN

10.1.3 SOUTH KOREA

10.1.4 INDIA

10.1.5 AUSTRALIA

10.1.6 SINGAPORE

10.1.7 THAILAND

10.1.8 INDONESIA

10.1.9 MALAYSIA

10.1.10 PHILIPPINES

10.1.11 REST OF ASIA-PACIFIC

11 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 IBM CORPORATION

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 SERVICE PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 ACCENTURE

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 SERVICE PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 HUAWEI TECHNOLOGIES CO., LTD.

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENT

13.4 AT&T INTELLECTUAL PROPERTY

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENT

13.5 VERIZON

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 TELEFONAKTIEBOLAGET LM ERICSSON

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENT

13.7 BT

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT DEVELOPMENT

13.8 CAPGEMINI

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 SERVICE PORTFOLIO

13.8.4 RECENT DEVELOPMENTS

13.9 CISCO SYSTEMS, INC.

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 PRODUCT PORTFOLIO

13.9.4 RECENT DEVELOPMENTS

13.1 COGNIZANT

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 SERVICE PORTFOLIO

13.10.4 RECENT DEVELOPMENTS

13.11 COMARCH SA

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT DEVELOPMENT

13.12 DXC TECHNOLOGY COMPANY

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 SERVICE PORTFOLIO

13.12.4 RECENT DEVELOPMENT

13.13 FUJITSU

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENT

13.14 GTT COMMUNICATIONS, INC.

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 HCL TECHNOLOGIES LIMITED

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 PRODUCT PORTFOLIO

13.15.4 RECENT DEVELOPMENT

13.16 INFOSYS LIMITED

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENTS

13.17 LUMEN TECHNOLOGIES

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 PRODUCT PORTFOLIO

13.17.4 RECENT DEVELOPMENT

13.18 NOKIA CORPORATION

13.18.1 COMPANY SNAPSHOT

13.18.2 REVENUE ANALYSIS

13.18.3 PRODUCT PORTFOLIO

13.18.4 RECENT DEVELOPMENT

13.19 NTT DATA CORPORATION

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 SERVICES PORTFOLIO

13.19.4 RECENT DEVELOPMENT

13.2 RACKSPACE TECHNOLOGY, INC.

13.20.1 COMPANY SNAPSHOT

13.20.2 REVENUE ANALYSIS

13.20.3 PRODUCT PORTFOLIO

13.20.4 RECENT DEVELOPMENT

13.21 TATA CONSULTANCY SERVICES LIMITED

13.21.1 COMPANY SNAPSHOT

13.21.2 REVENUE ANALYSIS

13.21.3 SERVICE PORTFOLIO

13.21.4 RECENT DEVELOPMENTS

13.22 TECH MAHINDRA LIMITED

13.22.1 COMPANY SNAPSHOT

13.22.2 REVENUE ANALYSIS

13.22.3 PRODUCT PORTFOLIO

13.22.4 RECENT DEVELOPMENTS

13.23 UNISYS

13.23.1 COMPANY SNAPSHOT

13.23.2 REVENUE ANALYSIS

13.23.3 PRODUCT PORTFOLIO

13.23.4 RECENT DEVELOPMENT

13.24 WIPRO LIMITED

13.24.1 COMPANY SNAPSHOT

13.24.2 REVENUE ANALYSIS

13.24.3 PRODUCT PORTFOLIO

13.24.4 RECENT DEVELOPMENTS

13.25 ZTE CORPORATION

13.25.1 COMPANY SNAPSHOT

13.25.2 REVENUE ANALYSIS

13.25.3 PRODUCT PORTFOLIO

13.25.4 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

Liste des tableaux

TABLE 1 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 2 ASIA PACIFIC MANAGED DATA CENTER SERVICES IN TELECOM MANAGED SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC MANAGED DATA CENTER SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC MANAGED NETWORK SERVICES IN TELECOM MANAGED SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC MANAGED NETWORK SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC MANAGED COMMUNICATION AND COLLABORATION SERVICES IN TELECOM MANAGED SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC MANAGED COMMUNICATION AND COLLABORATION SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC MANAGED SECURITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC MANAGED SECURITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC MANAGED MOBILITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC MANAGED MOBILITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC OTHERS IN TELECOM MANAGED SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET, BY MANAGED INFORMATION SERVICE (MIS), 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC BUSINESS PROCESS MANAGEMENT IN TELECOM MANAGED SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC MANAGED OPERATIONAL SUPPORT SYSTEMS/BUSINESS SUPPORT SYSTEMS IN TELECOM MANAGED SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC PROJECT & PORTFOLIO MANAGEMENT IN TELECOM MANAGED SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC OTHERS IN TELECOM MANAGED SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC CLOUD IN TELECOM MANAGED SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC ON-PREMISE IN TELECOM MANAGED SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC LARGE ENTERPRISES IN TELECOM MANAGED SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC LARGE ENTERPRISES IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC SMALL AND MEDIUM ENTERPRISES (SMES) IN TELECOM MANAGED SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC SMALL AND MEDIUM ENTERPRISES (SMES) IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 26 ASIA-PACIFIC TELECOM MANAGED SERVICES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 27 ASIA-PACIFIC TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 28 ASIA-PACIFIC MANAGED DATA CENTER SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 ASIA-PACIFIC MANAGED NETWORK SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 30 ASIA-PACIFIC MANAGED COMMUNICATION AND COLLABORATION SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 ASIA-PACIFIC MANAGED SECURITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 ASIA-PACIFIC MANAGED MOBILITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 ASIA-PACIFIC TELECOM MANAGED SERVICES MARKET, BY MANAGED INFORMATION SERVICE (MIS), 2020-2029 (USD MILLION)

TABLE 34 ASIA-PACIFIC TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 35 ASIA-PACIFIC TELECOM MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 36 ASIA-PACIFIC LARGE ENTERPRISES IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 37 ASIA-PACIFIC SMALL AND MEDIUM ENTERPRISES (SMES) IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 38 CHINA TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 CHINA MANAGED DATA CENTER SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 CHINA MANAGED NETWORK SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 CHINA MANAGED COMMUNICATION AND COLLABORATION SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 CHINA MANAGED SECURITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 CHINA MANAGED MOBILITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 CHINA TELECOM MANAGED SERVICES MARKET, BY MANAGED INFORMATION SERVICE (MIS), 2020-2029 (USD MILLION)

TABLE 45 CHINA TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 46 CHINA TELECOM MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 47 CHINA LARGE ENTERPRISES IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 48 CHINA SMALL AND MEDIUM ENTERPRISES (SMES) IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 49 JAPAN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 JAPAN MANAGED DATA CENTER SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 JAPAN MANAGED NETWORK SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 JAPAN MANAGED COMMUNICATION AND COLLABORATION SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 JAPAN MANAGED SECURITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 JAPAN MANAGED MOBILITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 JAPAN TELECOM MANAGED SERVICES MARKET, BY MANAGED INFORMATION SERVICE (MIS), 2020-2029 (USD MILLION)

TABLE 56 JAPAN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 57 JAPAN TELECOM MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 58 JAPAN LARGE ENTERPRISES IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 59 JAPAN SMALL AND MEDIUM ENTERPRISES (SMES) IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 60 SOUTH KOREA TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 SOUTH KOREA MANAGED DATA CENTER SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 SOUTH KOREA MANAGED NETWORK SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 SOUTH KOREA MANAGED COMMUNICATION AND COLLABORATION SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 SOUTH KOREA MANAGED SECURITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 SOUTH KOREA MANAGED MOBILITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 SOUTH KOREA TELECOM MANAGED SERVICES MARKET, BY MANAGED INFORMATION SERVICE (MIS), 2020-2029 (USD MILLION)

TABLE 67 SOUTH KOREA TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 68 SOUTH KOREA TELECOM MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 69 SOUTH KOREA LARGE ENTERPRISES IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 70 SOUTH KOREA SMALL AND MEDIUM ENTERPRISES (SMES) IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 71 INDIA TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 INDIA MANAGED DATA CENTER SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 INDIA MANAGED NETWORK SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 INDIA MANAGED COMMUNICATION AND COLLABORATION SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 INDIA MANAGED SECURITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 INDIA MANAGED MOBILITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 INDIA TELECOM MANAGED SERVICES MARKET, BY MANAGED INFORMATION SERVICE (MIS), 2020-2029 (USD MILLION)

TABLE 78 INDIA TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 79 INDIA TELECOM MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 80 INDIA LARGE ENTERPRISES IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 81 INDIA SMALL AND MEDIUM ENTERPRISES (SMES) IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 82 AUSTRALIA TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 AUSTRALIA MANAGED DATA CENTER SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 AUSTRALIA MANAGED NETWORK SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 AUSTRALIA MANAGED COMMUNICATION AND COLLABORATION SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 AUSTRALIA MANAGED SECURITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 AUSTRALIA MANAGED MOBILITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 AUSTRALIA TELECOM MANAGED SERVICES MARKET, BY MANAGED INFORMATION SERVICE (MIS), 2020-2029 (USD MILLION)

TABLE 89 AUSTRALIA TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 90 AUSTRALIA TELECOM MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 91 AUSTRALIA LARGE ENTERPRISES IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 92 AUSTRALIA SMALL AND MEDIUM ENTERPRISES (SMES) IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 93 SINGAPORE TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 SINGAPORE MANAGED DATA CENTER SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 95 SINGAPORE MANAGED NETWORK SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 SINGAPORE MANAGED COMMUNICATION AND COLLABORATION SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 SINGAPORE MANAGED SECURITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 SINGAPORE MANAGED MOBILITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 SINGAPORE TELECOM MANAGED SERVICES MARKET, BY MANAGED INFORMATION SERVICE (MIS), 2020-2029 (USD MILLION)

TABLE 100 SINGAPORE TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 101 SINGAPORE TELECOM MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 102 SINGAPORE LARGE ENTERPRISES IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 103 SINGAPORE SMALL AND MEDIUM ENTERPRISES (SMES) IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 104 THAILAND TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 THAILAND MANAGED DATA CENTER SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 THAILAND MANAGED NETWORK SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 THAILAND MANAGED COMMUNICATION AND COLLABORATION SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 THAILAND MANAGED SECURITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 THAILAND MANAGED MOBILITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 THAILAND TELECOM MANAGED SERVICES MARKET, BY MANAGED INFORMATION SERVICE (MIS), 2020-2029 (USD MILLION)

TABLE 111 THAILAND TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 112 THAILAND TELECOM MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 113 THAILAND LARGE ENTERPRISES IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 114 THAILAND SMALL AND MEDIUM ENTERPRISES (SMES) IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 115 INDONESIA TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 INDONESIA MANAGED DATA CENTER SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 117 INDONESIA MANAGED NETWORK SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 118 INDONESIA MANAGED COMMUNICATION AND COLLABORATION SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 INDONESIA MANAGED SECURITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 INDONESIA MANAGED MOBILITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 INDONESIA TELECOM MANAGED SERVICES MARKET, BY MANAGED INFORMATION SERVICE (MIS), 2020-2029 (USD MILLION)

TABLE 122 INDONESIA TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 123 INDONESIA TELECOM MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 124 INDONESIA LARGE ENTERPRISES IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 125 INDONESIA SMALL AND MEDIUM ENTERPRISES (SMES) IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 126 MALAYSIA TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 127 MALAYSIA MANAGED DATA CENTER SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 MALAYSIA MANAGED NETWORK SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 MALAYSIA MANAGED COMMUNICATION AND COLLABORATION SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 MALAYSIA MANAGED SECURITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 131 MALAYSIA MANAGED MOBILITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 MALAYSIA TELECOM MANAGED SERVICES MARKET, BY MANAGED INFORMATION SERVICE (MIS), 2020-2029 (USD MILLION)

TABLE 133 MALAYSIA TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 134 MALAYSIA TELECOM MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 135 MALAYSIA LARGE ENTERPRISES IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 136 MALAYSIA SMALL AND MEDIUM ENTERPRISES (SMES) IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 137 PHILIPPINES TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 PHILIPPINES MANAGED DATA CENTER SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 PHILIPPINES MANAGED NETWORK SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 PHILIPPINES MANAGED COMMUNICATION AND COLLABORATION SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 PHILIPPINES MANAGED SECURITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 PHILIPPINES MANAGED MOBILITY SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 143 PHILIPPINES TELECOM MANAGED SERVICES MARKET, BY MANAGED INFORMATION SERVICE (MIS), 2020-2029 (USD MILLION)

TABLE 144 PHILIPPINES TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 145 PHILIPPINES TELECOM MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 146 PHILIPPINES LARGE ENTERPRISES IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 147 PHILIPPINES SMALL AND MEDIUM ENTERPRISES (SMES) IN TELECOM MANAGED SERVICES MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 148 REST OF ASIA-PACIFIC TELECOM MANAGED SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET: SEGMENTATION

FIGURE 10 RISING CUSTOMER FOCUS TOWARD ENHANCED COST EFFICIENCY AND EASY DEPLOYMENT IS EXPECTED TO DRIVE THE ASIA PACIFIC TELECOM MANAGED SERVICES MARKET IN THE FORECAST PERIOD

FIGURE 11 MANAGED DATA CENTER SERVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF ASIA PACIFIC TELECOM MANAGED SERVICES MARKET IN 2022 & 2029

FIGURE 12 NORTH AMERICA IS EXPECTED TO DOMINATE, AND ASIA-PACIFIC IS THE FASTEST-GROWING REGION IN THE ASIA PACIFIC TELECOM MANAGED SERVICES MARKET IN THE FORECAST PERIOD

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC TELECOM MANAGED SERVICES MARKET

FIGURE 14 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET: BY TYPE, 2021

FIGURE 15 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET: BY MANAGED INFORMATION SERVICE (MIS), 2021

FIGURE 16 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET: BY DEPLOYMENT MODEL, 2021

FIGURE 17 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET: BY ORGANIZATION SIZE, 2021

FIGURE 18 ASIA-PACIFIC TELECOM MANAGED SERVICES MARKET: SNAPSHOT (2021)

FIGURE 19 ASIA-PACIFIC TELECOM MANAGED SERVICES MARKET: BY COUNTRY (2021)

FIGURE 20 ASIA-PACIFIC TELECOM MANAGED SERVICES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 21 ASIA-PACIFIC TELECOM MANAGED SERVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 22 ASIA-PACIFIC TELECOM MANAGED SERVICES MARKET: BY TYPE (2022-2029)

FIGURE 23 ASIA PACIFIC TELECOM MANAGED SERVICES MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.