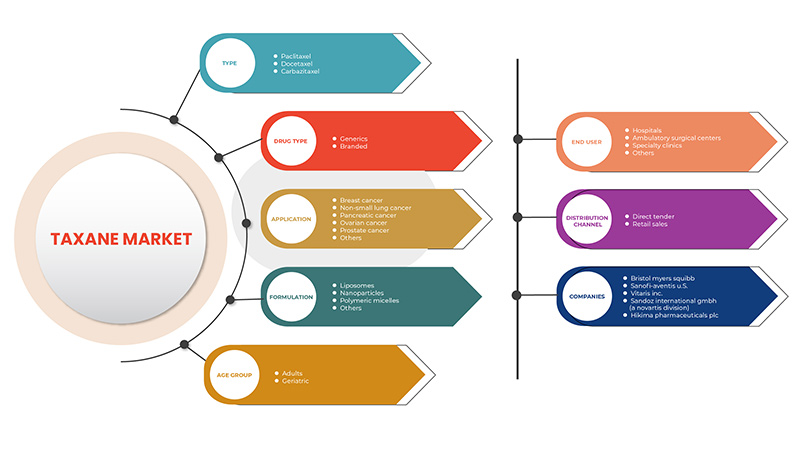

Marché des taxanes en Asie-Pacifique, par type (paclitaxel, docétaxel, cabazitaxel), type de médicament (génériques, de marque), formulation (liposomes, nanoparticules, micelles polymères, autres), groupe d'âge (adultes, gériatrique), application (cancer du sein, cancer du poumon non à petites cellules, cancer du pancréas, cancer de l'ovaire, cancer de la prostate, autres), utilisateur final (hôpitaux, centres de chirurgie ambulatoire , cliniques spécialisées, autres), canal de distribution (vente au détail, appel d'offres direct), tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et perspectives du marché

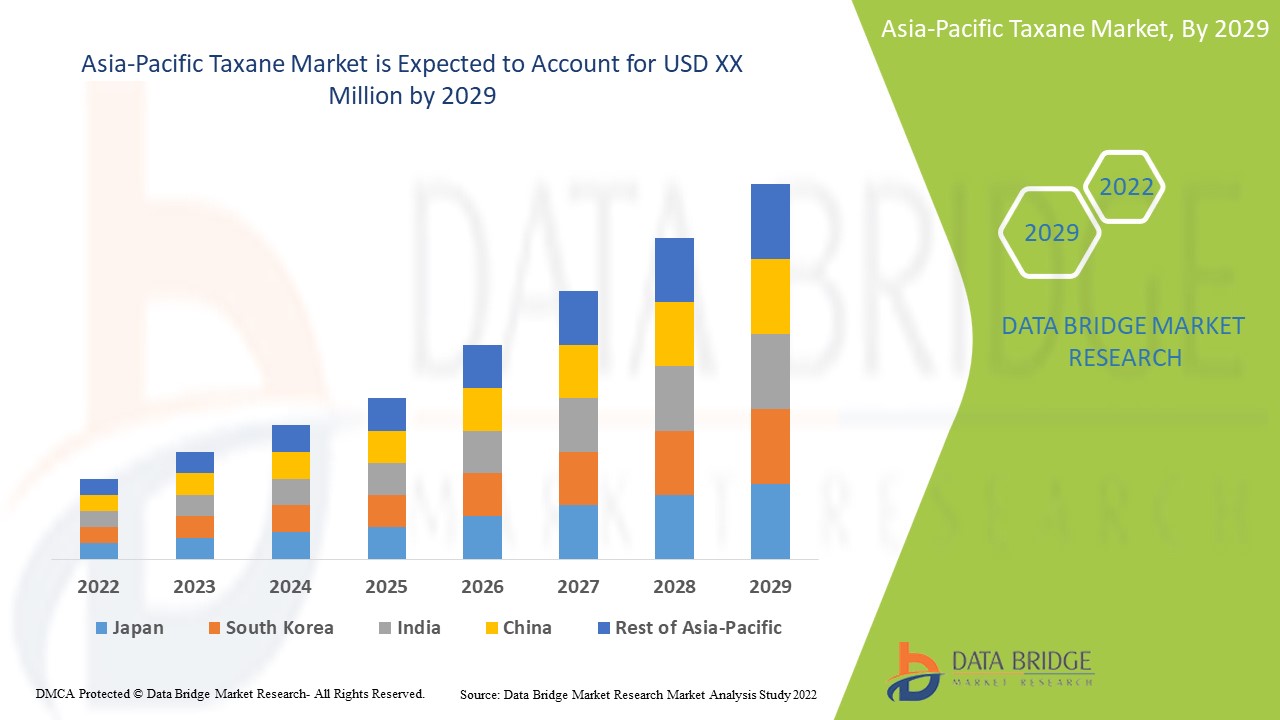

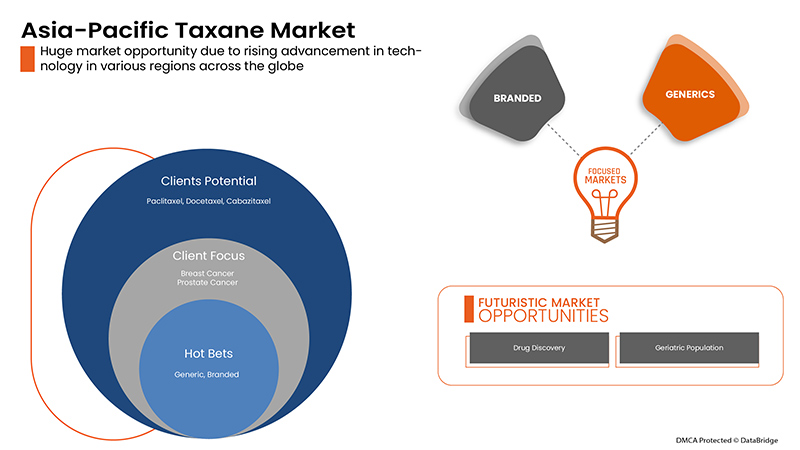

Le marché des taxanes en Asie-Pacifique devrait connaître une croissance du marché au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 8,7 % au cours de la période de prévision de 2022 à 2029. Les avancées technologiques dans les traitements médicamenteux aux taxanes, associées à l'augmentation des applications du diagnostic assisté par ordinateur, sont d'autres facteurs qui stimulent la croissance du marché des taxanes au cours de la période de prévision.

Cependant, le coût élevé associé au médicament et les effets secondaires tels que les caillots sanguins, la leucopénie, les allergies, la diarrhée et la perte de poids freineront la croissance du marché. L'adoption d'alliances stratégiques telles que les partenariats et les acquisitions par des acteurs clés du marché constitue une opportunité pour la croissance du marché des taxanes.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Par type (paclitaxel, docétaxel et cabazitaxel), type de médicament (de marque et génériques), formulation (liposomes et micelles polymères contenant des taxanes, formulations d'hydrogels de taxanes, formulation de nanoparticules et autres), groupe d'âge (adultes et gériatriques), application (cancer de l'ovaire, cancer du sein, cancer de la prostate, cancer du poumon non à petites cellules et autres), utilisateur final (hôpitaux, centres de chirurgie ambulatoire, cliniques spécialisées et autres), canal de distribution (appel d'offres direct, vente au détail) |

|

Pays couverts |

Chine, Japon, Inde, Corée du Sud, Australie, Singapour, Thaïlande, Vietnam, Malaisie, Indonésie, Philippines et reste de l'Asie-Pacifique |

|

Acteurs du marché couverts |

Viatris Inc., Sandoz International GmbH (une division de Novartis), sanofi-aventis US LLC, Hikma Pharmaceuticals PLC, Pfizer Inc., Dr. Reddy's Laboratories Ltd., Taxane Healthcare, Bristol-Myers Squibb Company, Fresenius Kabi AG (filiale de Fresenius SE & Co. KGaA), SAMYANG HOLDINGS CORPORATION., Luye Pharma Group, Elevar Therapeutics, Huiang Pharmaceutical Co Ltd., Shenzhen Main Luck Pharmaceuticals Inc., Accord Healthcare, Torrent Pharmaceuticals Ltd., Panacea Biotec, RPG Life Sciences Limited., Aureate Healthcare, Samarth Life Sciences Pvt. Ltd., Cipla Inc., Hetero Healthcare Limited., AqVida GmbH, Ingenus Pharmaceuticals, LLC, entre autres. |

Définition du marché des taxanes

Les taxanes ou taxoïdes sont un groupe étroitement lié d'agents antinéoplasiques qui ont un mécanisme d'action unique en tant qu'inhibiteurs de la mitose et sont largement utilisés dans le traitement des cancers de l'ovaire, du sein, du poumon, de l'œsophage, de la prostate, de la vessie et de la tête et du cou. Trois taxanes sont utilisés en clinique, le paclitaxel (Taxol : 1992), le docétaxel (Taxotere : 1996) et le cabazitaxel (Jevtana : 2010). Les taxanes sont des médicaments anticancéreux qui interfèrent avec la fonction des microtubules, provoquant des changements dans la mitose et la mort cellulaire. Le paclitaxel (Taxol) a d'abord été isolé d'un if, un petit conifère à feuilles persistantes avec un taux de croissance lent. Comme le paclitaxel était initialement rare, le docétaxel (Taxotere), un analogue semi-synthétique du paclitaxel dérivé des aiguilles de l'if européen Taxus baccata, a été créé. Le docétaxel diffère du paclitaxel par deux propriétés chimiques, ce qui le rend plus soluble dans l'eau. Le cabazitaxel est également un analogue semi-synthétique des taxoïdes naturels et a été développé pour son manque d'affinité pour la P-glycoprotéine, un médiateur courant de la résistance au docétaxel.

En outre, l'utilisation croissante de médicaments à base de taxanes en raison de la prévalence croissante des maladies chroniques, de la prévalence croissante du cancer et de l'augmentation des investissements dans les infrastructures de santé. Ces facteurs d'augmentation de la demande sur le marché des taxanes ont encouragé les principaux acteurs du marché à mettre en œuvre de nouvelles technologies et stratégies par le biais de lancements de produits, d'acquisitions, de stratégies et d'accords.

Dynamique du marché des taxanes

Conducteurs

- L'augmentation de l'incidence du cancer

Le cancer a un impact majeur sur la société aux États-Unis et dans le monde entier. Les statistiques sur le cancer décrivent ce qui se passe dans de grands groupes de personnes et donnent une image temporelle du fardeau que représente le cancer pour la société. Le taxol, un agent antimitotique utilisé pour traiter le cancer, bloque la croissance des cellules cancéreuses en arrêtant la division cellulaire, ce qui entraîne la mort cellulaire.

Selon le National Cancer Institute (NCI), un essai clinique financé a révélé que 30 % des patientes atteintes d'un cancer avancé de l'ovaire répondaient positivement au traitement au taxane. Dans la pratique clinique, le taxane est désormais le traitement standard du cancer du sein métastatique. Aujourd'hui, le taxol figure sur la liste modèle des médicaments essentiels de l'Organisation mondiale de la santé, un médicament cytotoxique qui tue les cellules cancéreuses. Il traite le cancer du sein, le cancer de l'ovaire, le cancer du poumon non à petites cellules, le cancer du pancréas et le sarcome de Kaposi lié au sida.

- Le financement par le gouvernement et l'investissement dans la recherche et le développement

Malgré l’efficacité avérée des pharmacothérapies pour traiter les troubles liés à la consommation d’opioïdes et à l’alcool, des limites à la mise en œuvre du taxane par les programmes de traitement spécialisés ont été observées. Il convient d’accorder une attention particulière aux sources spécifiques de financement, à la structure organisationnelle et aux ressources humaines, en réalisant un investissement à long terme qui aligne le paiement sur les futurs bénéficiaires potentiels. Les questions liées à la durabilité, à la productivité et à l’impact du développement de médicaments sur les patients n’ont jamais été et ne seront pas simplement le produit de l’industrie.

Le financement par le gouvernement permettrait d'assurer la sécurité des patients et de réaliser des économies. De plus, les hôpitaux et les organismes de santé pourraient administrer ce traitement à un prix inférieur grâce à la collaboration avec les organismes gouvernementaux. Par conséquent, les progrès dans les activités de recherche et développement et le financement par le gouvernement devraient stimuler la croissance du marché.

Retenue

-

Effets secondaires des médicaments associés aux taxanes

Les taxanes appartiennent à une classe de diterpènes. Les médicaments à base de taxane (paclitaxel et docétaxel) sont utilisés comme agents chimiothérapeutiques. En raison des essais cliniques en cours, des études de recherche, du type de cancer, du type de plan de traitement et du dosage du médicament, le coût élevé actuel devrait afficher une tendance à la baisse à l'avenir. Les médicaments à base de taxane sont particulièrement efficaces pour traiter le cancer du sein et de la prostate. Cependant, certains effets secondaires ont été signalés. Les complications indésirables ou les effets secondaires signalés entraîneraient une baisse des ventes de médicaments à base de taxane, ce qui limiterait les ventes de ces médicaments. En outre, cela affecterait la fiabilité des fabricants impliqués dans ce marché et devrait donc freiner la croissance du marché.

Opportunité

-

Initiative stratégique des acteurs du marché

La demande pour le marché des taxanes a augmenté aux États-Unis et en Europe en raison du traitement rapide des troubles liés à l'alcool et aux opioïdes. Ces facteurs favorables renforcent le besoin de taxanes et, pour répondre à la demande du marché, les acteurs mineurs et majeurs du marché utilisent diverses stratégies.

Les principaux acteurs tentent également d’élaborer des stratégies spécifiques, telles que des lancements de produits, des acquisitions, des approbations, des extensions et des partenariats, pour assurer le bon fonctionnement de l’entreprise, éviter les risques et augmenter la croissance à long terme des ventes du marché.

Ces initiatives stratégiques des acteurs du marché, notamment les acquisitions, les conférences et les lancements de produits ciblés, aident les entreprises à se développer et à améliorer leurs portefeuilles de produits, ce qui conduit finalement à une augmentation de la génération de revenus. Par conséquent, ces initiatives stratégiques des acteurs du marché offrent une opportunité de contribuer à la croissance future et de stimuler la croissance du marché.

Défi

- Le manque de professionnels qualifiés nécessaires au traitement par les taxanes

Le manque ou la pénurie de compétences qualifiées compromettrait le rythme de la reprise et de la croissance dans un endroit donné. Souvent, les chômeurs d'un endroit donné possèdent des compétences qui sont rares ailleurs. De plus, les progrès technologiques rapides dans ce domaine entraînent également un manque de compétences.

L'offre de médecins est un terme utilisé pour décrire le nombre de médecins formés travaillant dans un système de santé ou sur le marché du travail. Elle dépend du nombre de diplômés et des taux de rétention de la profession. La pénurie de médecins est une préoccupation croissante dans de nombreux pays du monde.

L’Organisation mondiale de la santé (OMS) a estimé à 4,3 millions le nombre de médecins, d’infirmières et d’autres professionnels de la santé qui souffrent d’une pénurie mondiale. Malgré les preuves solides de l’efficacité des médicaments pour réduire la morbidité et la mortalité, augmenter la rétention du traitement et améliorer le bien-être des personnes atteintes de taxane, de nombreux obstacles empêchent un accès plus large aux traitements à base de taxane.

En outre, les progrès technologiques sont un autre aspect qui conduit à une demande accrue de professionnels qualifiés. Les neurologues signalent d’importants besoins non satisfaits en matière de soins de soutien et des obstacles dans leurs centres, seule une petite minorité se considérant comme compétente pour fournir des soins de soutien. Il existe un besoin urgent de formation des professionnels pour le traitement de la démence et de fourniture de ressources de soins de soutien disponibles. Le manque de professionnels formés et expérimentés et les lacunes persistantes en matière de compétences limitent les perspectives d’employabilité et l’accès à des emplois de qualité. Par conséquent, il est évident que la disponibilité de professionnels dotés de compétences adéquates constitue un défi à la croissance du marché.

Impact post-COVID-19 sur le marché des taxanes

La COVID-19 a entraîné une augmentation substantielle de la demande de fournitures médicales de la part des professionnels de la santé et du grand public pour des mesures de précaution. Les fabricants de ces articles ont la possibilité de profiter de la demande accrue de fournitures médicales en garantissant un approvisionnement régulier d'équipements de protection individuelle sur le marché. La COVID-19 devrait avoir un impact important sur le marché des taxanes.

Développements récents

- En novembre 2022, Viatris Inc. et Biocon Biologics Ltd. ont annoncé le lancement aux États-Unis des biosimilaires interchangeables SEMGLEE (insuline glargine-yfgn) injectable, un produit de marque, et Insulin Glargine (insuline glargine-yfgn) injectable, un produit sans marque, pour aider à contrôler l'hyperglycémie chez les patients adultes et pédiatriques atteints de diabète de type 1 et les adultes atteints de diabète de type 2. Les deux produits biosimilaires sont disponibles en flacons et en stylos préremplis et sont interchangeables avec la marque de référence, LANTUS (insuline glargine), ce qui permet une substitution au comptoir de la pharmacie. Viatris s'engage à améliorer l'accès des patients à des soins de santé durables, de qualité et plus abordables. Cela a aidé l'entreprise à développer son portefeuille de produits.

- En mai 2022, Sandoz, leader mondial des médicaments génériques et biosimilaires, a annoncé le lancement aux États-Unis de son générique pirfénidone, le premier équivalent AB (entièrement substituable) de l'Esbriet de Genentech, pour traiter les patients atteints de fibrose pulmonaire idiopathique (FPI). Ce médicament oral sur ordonnance est immédiatement disponible pour les patients via les pharmacies spécialisées, avec un programme de co-paiement de 0 $ pour les patients éligibles. Sandoz donne la priorité aux patients en élargissant l'accès au générique pirfénidone pour les personnes atteintes de cette maladie rare, qui bénéficieront d'un traitement plus abordable, mais tout aussi efficace. Cela a aidé l'entreprise à développer sa position sur le marché et ses activités.

Portée et taille du marché des taxanes

Le marché des taxanes est segmenté en fonction du type, du type de médicament, de la formulation, de la tranche d'âge, de l'application, de l'utilisateur final et du canal de distribution. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

Par type

- Paclitaxel

- Docétaxel

- Cabazitaxel

Sur la base du type, le marché des taxanes Asie-Pacifique est segmenté en paclitaxel, docétaxel et cabazitaxel.

Par application

- Cancer de l'ovaire

- Cancer du sein

- Cancer de la prostate

- Cancer du poumon non à petites cellules

- Autre

Sur la base de l'application, le marché des taxanes de l'Asie-Pacifique est segmenté en cancer de l'ovaire, cancer du sein, cancer de la prostate, cancer du poumon non à petites cellules et autres.

Par type de médicament

- Génériques

- De marque

Sur la base du type de médicament, le marché des taxanes de la région Asie-Pacifique est segmenté en produits de marque et génériques.

Par formulation

- Liposomes

- Nanoparticules

- Micelles polymères

- Autres

Sur la base de la formulation, le marché des taxanes Asie-Pacifique est segmenté en liposomes, nanoparticules, micelles polymères et autres.

Par groupe d'âge

- Adulte

- Gériatrie

Sur la base de la tranche d’âge, le marché des taxanes de la région Asie-Pacifique est segmenté en adultes et en gériatrie.

Par utilisateur final

- Hôpitaux

- Centres de chirurgie ambulatoire

- Cliniques spécialisées

- Autres

Sur la base de l’utilisateur final, le marché des taxanes de la région Asie-Pacifique est segmenté en hôpitaux, centres de chirurgie ambulatoire, cliniques spécialisées et autres.

Par canal de distribution

- Appel d'offres direct

- Ventes au détail

Sur la base du canal de distribution, le marché des taxanes de la région Asie-Pacifique est segmenté en appels d'offres directs et ventes au détail.

Analyse régionale du marché des taxanes en Asie-Pacifique

Le marché des taxanes est analysé et des informations sur la taille du marché sont fournies par type, type de médicament, formulation, tranche d’âge, application, utilisateur final et canal de distribution.

Les pays couverts dans le rapport sur le marché des taxanes sont la Chine, le Japon, l’Inde, la Corée du Sud, l’Australie, Singapour, la Thaïlande, le Vietnam, la Malaisie, l’Indonésie, les Philippines et le reste de l’Asie-Pacifique.

En 2022, la Chine domine le marché grâce à la présence d'acteurs clés sur le plus grand marché de consommation avec un PIB élevé. La Chine devrait croître en raison de l'augmentation des progrès technologiques dans les traitements médicamenteux.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques d'Asie-Pacifique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Taxane market also provides you with detailed market analysis for every country growth in healthcare industry. Moreover, it provides detailed information regarding healthcare services and treatments, impact of regulatory scenarios, and trending parameters regarding Taxane Market.

Competitive Landscape and Taxane Market Share Analysis

Taxane market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to taxane drugs.

The major companies which are dealing in the Taxane Market are Viatris Inc., Sandoz International GmbH (A Novartis Division), sanofi-aventis U.S. LLC , Hikma Pharmaceuticals PLC, Pfizer Inc., Dr. Reddy’s Laboratories Ltd., Taxane Healthcare, Bristol-Myers Squibb Company, Fresenius Kabi AG (Subsidiary of Fresenius SE & Co. KGaA ), SAMYANG HOLDINGS CORPORATION., Luye Pharma Group, Elevar Therapeutics, Huiang Pharmaceutical Co Ltd., Shenzhen Main Luck Phar maceuticals Inc., Accord Healthcare, Torrent Pharmaceuticals Ltd., Panacea Biotec, RPG Life Sciences Limited., Aureate Healthcare, Samarth Life Sciences Pvt. Ltd., Cipla Inc., Hetero Healthcare Limited., AqVida GmbH, Ingenus Pharmaceuticals, LLC among others.

Strategic alliances like mergers, acquisitions and agreement by the key market players are further expected to accelerate the growth of taxane drugs.

Collaboration, product launch, business expansion, award and recognition, joint ventures and other strategies by the market player is enhancing the company footprints in the Taxane Market which also provides the benefit for organization’s profit growth.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Asia-Pacific vs Regional and Vendor Share Analysis. Please request analyst call in case of further inquiry.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC TAXANE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 TYPE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTEL_ANALYSIS

4.2 PORTER'S FIVE FORCES MODEL

5 EPIDEMIOLOGY

6 INDUSTRIAL INSIGHTS

6.1 CONCLUSION

7 ASIA PACIFIC TAXANE MARKET: REGULATIONS

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 THE RISE IN INCIDENCE OF CANCER

8.1.2 THE FUNDING BY THE GOVERNMENT AND INVESTMENT IN RESEARCH AND DEVELOPMENT

8.1.3 RISE IN PIPELINE OR CLINICAL TRIALS OF TAXANE TREATMENTS

8.1.4 USE OF REIMBURSEMENT FOR TAXANE

8.2 RESTRAINTS

8.2.1 SIDE EFFECTS OF DRUGS INCURRED WITH THE TAXANE DRUGS

8.2.2 ETHICAL ISSUES RELATED TO THE USE OF TAXANE TREATMENT

8.2.3 RISE IN PRODUCT RECALLS

8.3 OPPORTUNITIES

8.3.1 STRATEGIC INITIATIVE BY MARKET PLAYERS

8.3.2 RISE IN HEALTHCARE EXPENDITURE

8.4 CHALLENGES

8.4.1 THE LACK OF SKILLED PROFESSIONALS REQUIRED FOR TAXANE DRUG TREATMENT

8.4.2 STRINGENT GOVERNMENT REGULATIONS ON TAXANE DRUG TREATMENT

9 ASIA PACIFIC TAXANE MARKET, BY TYPE

9.1 OVERVIEW

9.2 PACLITAXEL

9.2.1 BY TYPE

9.2.1.1 SEMI-SYNTHETIC

9.2.1.2 NATURAL

9.2.2 BY STRENGTH

9.2.2.1 100MG

9.2.2.2 200MG

9.2.2.3 250MG

9.2.2.4 30MG

9.2.2.5 260MG

9.2.2.6 300MG

9.3 DOCETAXEL

9.3.1 120MG

9.3.2 80MG

9.3.3 20MG

9.3.4 40MG

9.3.5 60MG

9.4 CABAZITAXEL

9.4.1 60MG

10 ASIA PACIFIC TAXANE MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 BREAST CANCER

10.3 NON-SMALL CELL LUNG CANCER

10.4 PANCREATIC CANCER

10.5 OVARIAN CANCER

10.6 PROSTATE CANCER

10.7 OTHERS

11 ASIA PACIFIC TAXANE MARKET, BY DRUG TYPE

11.1 OVERVIEW

11.2 GENERICS

11.3 BRANDED

12 ASIA PACIFIC TAXANE MARKET, BY FORMULATION

12.1 OVERVIEW

12.2 LIPOSOMES

12.3 NANOPARTICLES

12.4 POLYMERIC MICELLES

12.5 OTHERS

13 ASIA PACIFIC TAXANE MARKET, BY AGE GROUP

13.1 OVERVIEW

13.2 ADULT

13.2.1 FEMALE

13.2.2 MALE

13.3 GERIATRIC

13.3.1 FEMALE

13.3.2 MALE

14 ASIA PACIFIC TAXANE MARKET, BY END USER

14.1 OVERVIEW

14.2 HOSPITALS

14.3 AMBULATORY SURGICAL CENTERS

14.4 SPECIALTY CLINICS

14.5 OTHERS

15 ASIA PACIFIC TAXANE MARKET, BY DISTRIBUTION CHANNEL

15.1 OVERVIEW

15.2 RETAIL SALES

15.2.1 HOSPITAL PHARMACY

15.2.2 RETAIL PHARMACY

15.2.3 ONLINE PHARMACY

15.3 DIRECT TENDER

16 ASIA PACIFIC TAXANE MARKET, BY REGION

16.1 ASIA-PACIFIC

16.1.1 CHINA

16.1.2 JAPAN

16.1.3 INDIA

16.1.4 SOUTH KOREA

16.1.5 AUSTRALIA

16.1.6 INDONESIA

16.1.7 THAILAND

16.1.8 PHILIPPINES

16.1.9 VIETNAM

16.1.10 SINGAPORE

16.1.11 MALAYSIA

16.1.12 REST OF ASIA-PACIFIC

17 ASIA PACIFIC TAXANE MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

18 SWOT ANALYSIS

19 COMPANY PROFILE

19.1 BRISTOL-MYERS SQUIBB COMPANY

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 COMPANY SHARE ANALYSIS

19.1.4 PRODUCT PORTFOLIO

19.1.5 RECENT DEVELOPMENTS

19.2 SANOFI-AVENTIS U.S. LLC

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 COMPANY SHARE ANALYSIS

19.2.4 PRODUCT PORTFOLIO

19.2.5 RECENT DEVELOPMENTS

19.3 VIATRIS INC.

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUE ANALYSIS

19.3.3 COMPANY SHARE ANALYSIS

19.3.4 PRODUCT PORTFOLIO

19.3.5 RECENT DEVELOPMENT

19.4 SANDOZ INTERNATIONAL GMBH (A NOVARTIS DIVISION)

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 COMPANY SHARE ANALYSIS

19.4.4 PRODUCT PORTFOLIO

19.4.5 RECENT DEVELOPMENTS

19.5 FRESENIUS KABI AG (SUBSIDIARY OF FRESENIUS SE & CO. KGAA )

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 COMPANY SHARE ANALYSIS

19.5.4 PRODUCT PORTFOLIO

19.5.5 RECENT DEVELOPMENTS

19.6 HIKMA PHARMACEUTICALS PLC

19.6.1 COMPANY SNAPSHOT

19.6.2 REVENUE ANALYSIS

19.6.3 PRODUCT PORTFOLIO

19.6.4 RECENT DEVELOPMENTS

19.7 ACCORD HEALTHCARE

19.7.1 COMPANY SNAPSHOT

19.7.2 PRODUCT PORTFOLIO

19.7.3 RECENT DEVELOPMENTS

19.8 AQVIDA GMBH

19.8.1 COMPANY SNAPSHOT

19.8.2 PRODUCT PORTFOLIO

19.8.3 RECENT DEVELOPMENTS

19.9 AUREATE HEALTHCARE

19.9.1 COMPANY SNAPSHOT

19.9.2 PRODUCT PORTFOLIO

19.9.3 RECENT DEVELOPMENTS

19.1 CIPLA INC.

19.10.1 COMPANY SNAPSHOT

19.10.2 REVENUE ANALYSIS

19.10.3 PRODUCT PORTFOLIO

19.10.4 RECENT DEVELOPMENTS

19.11 DR. REDDY’S LABORATORIES LTD.

19.11.1 COMPANY SNAPSHOT

19.11.2 REVENUE ANALYSIS

19.11.3 PRODUCT PORTFOLIO

19.11.4 RECENT DEVELOPMENTS

19.12 ELEVAR THERAPEUTICS

19.12.1 COMPANY SNAPSHOT

19.12.2 PRODUCT PORTFOLIO

19.12.3 RECENT DEVELOPMENTS

19.13 HETERO HEALTHCARE LIMITED.

19.13.1 COMPANY SNAPSHOT

19.13.2 PRODUCT PORTFOLIO

19.13.3 RECENT DEVELOPMENTS

19.14 HUIANG PHARMACEUTICAL CO LTD

19.14.1 COMPANY SNAPSHOT

19.14.2 PRODUCT PORTFOLIO

19.14.3 RECENT DEVELOPMENTS

19.15 INGENUS PHARMACEUTICALS, LLC

19.15.1 COMPANY SNAPSHOT

19.15.2 PRODUCT PORTFOLIO

19.15.3 RECENT DEVELOPMENTS

19.16 LUYE PHARMA GROUP

19.16.1 COMPANY SNAPSHOT

19.16.2 REVENUE ANALYSIS

19.16.3 PRODUCT PORTFOLIO

19.16.4 RECENT DEVELOPMENTS

19.17 PANACEA BIOTEC

19.17.1 COMPANY SNAPSHOT

19.17.2 REVENUE ANALYSIS

19.17.3 PRODUCT PORTFOLIO

19.17.4 RECENT DEVELOPMENTS

19.18 PFIZER INC.

19.18.1 COMPANY SNAPSHOT

19.18.2 REVENUE ANALYSIS

19.18.3 PRODUCT PORTFOLIO

19.18.4 RECENT DEVELOPMENTS

19.19 RPG LIFE SCIENCES LIMITED

19.19.1 COMPANY SNAPSHOT

19.19.2 REVENUE ANALYSIS

19.19.3 PRODUCT PORTFOLIO

19.19.4 RECENT DEVELOPMENTS

19.2 SAMARTH LIFE SCIENCES PVT. LTD.

19.20.1 COMPANY SNAPSHOT

19.20.2 PRODUCT PORTFOLIO

19.20.3 RECENT DEVELOPMENTS

19.21 SAMYANG HOLDINGS CORPORATION.

19.21.1 COMPANY SNAPSHOT

19.21.2 REVENUE ANALYSIS

19.21.3 PRODUCT PORTFOLIO

19.21.4 RECENT DEVELOPMENTS

19.22 SHENZHEN MAIN LUCK PHAR MACEUTICALS INC.

19.22.1 COMPANY SNAPSHOT

19.22.2 PRODUCT PORTFOLIO

19.22.3 RECENT DEVELOPMENTS

19.23 TORRENT PHARMACEUTICALS LTD

19.23.1 COMPANY SNAPSHOT

19.23.2 REVENUE ANALYSIS

19.23.3 PRODUCT PORTFOLIO

19.23.4 RECENT DEVELOPMENTS

19.24 TAXANE HEALTHCARE

19.24.1 COMPANY SNAPSHOT

19.24.2 PRODUCT PORTFOLIO

19.24.3 RECENT DEVELOPMENTS

20 QUESTIONNAIRE

21 RELATED REPORTS

Liste des tableaux

TABLE 1 ASIA PACIFIC TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 2 ASIA PACIFIC PACLITAXEL IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC PACLITAXEL IN TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC PACLITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC DOCETAXEL IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC DOCETAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC CABAZITAXEL IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC CABAZITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC TAXANE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC BREAST CANCER IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC NON-SMALL LUNG CANCER IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC PANCREATIC CANCER IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC OVARIAN CANCER IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC PROSTATE CANCER IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC OTHERS IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC TAXANE MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC GENERICS IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC BRANDED IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC TAXANE MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC LIPOSOMES IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC NANOPARTICLES IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC POLYMERIC MICELLES IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC OTHERS IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC TAXANE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC ADULT IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC ADULT IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC GERIATRIC IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC GERIATRIC IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC TAXANE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC HOSPITALS IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC AMBULATORY SURGICAL CENTERS IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC SPECIALTY CLINICS IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 ASIA PACIFIC OTHERS IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC RETAIL SALES IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC RETAIL SALES IN TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC DIRECT TENDER IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 ASIA-PACIFIC TAXANE MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 39 ASIA-PACIFIC TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 ASIA-PACIFIC PACLITAXEL IN TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 ASIA-PACIFIC TAXANE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 42 ASIA-PACIFIC TAXANE MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 43 ASIA-PACIFIC TAXANE MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 44 ASIA-PACIFIC PACLITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 45 ASIA-PACIFIC DOCETAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 46 ASIA-PACIFIC CABAZITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 47 ASIA-PACIFIC TAXANE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 48 ASIA-PACIFIC ADULT IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 49 ASIA-PACIFIC GERIATRIC IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 50 ASIA-PACIFIC TAXANE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 51 ASIA-PACIFIC TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 52 ASIA-PACIFIC RETAIL SALES IN TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 53 CHINA TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 CHINA PACLITAXEL IN TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 CHINA TAXANE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 56 CHINA TAXANE MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 57 CHINA TAXANE MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 58 CHINA PACLITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 59 CHINA DOCETAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 60 CHINA CABAZITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 61 CHINA TAXANE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 62 CHINA ADULT IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 63 CHINA GERIATRIC IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 64 CHINA TAXANE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 65 CHINA TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 66 CHINA RETAIL SALES IN TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 67 JAPAN TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 JAPAN PACLITAXEL IN TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 JAPAN TAXANE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 JAPAN TAXANE MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 71 JAPAN TAXANE MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 72 JAPAN PACLITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 73 JAPAN DOCETAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 74 JAPAN CABAZITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 75 JAPAN TAXANE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 76 JAPAN ADULT IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 77 JAPAN GERIATRIC IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 78 JAPAN TAXANE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 79 JAPAN TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 80 JAPAN RETAIL SALES IN TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 81 INDIA TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 INDIA PACLITAXEL IN TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 INDIA TAXANE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 84 INDIA TAXANE MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 85 INDIA TAXANE MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 86 INDIA PACLITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 87 INDIA DOCETAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 88 INDIA CABAZITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 89 INDIA TAXANE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 90 INDIA ADULT IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 91 INDIA GERIATRIC IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 92 INDIA TAXANE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 93 INDIA TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 94 INDIA RETAIL SALES IN TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 95 SOUTH KOREA TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 SOUTH KOREA PACLITAXEL IN TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 SOUTH KOREA TAXANE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 SOUTH KOREA TAXANE MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 99 SOUTH KOREA TAXANE MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 100 SOUTH KOREA PACLITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 101 SOUTH KOREA DOCETAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 102 SOUTH KOREA CABAZITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 103 SOUTH KOREA TAXANE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 104 SOUTH KOREA ADULT IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 105 SOUTH KOREA GERIATRIC IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 106 SOUTH KOREA TAXANE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 107 SOUTH KOREA TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 108 SOUTH KOREA RETAIL SALES IN TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 109 AUSTRALIA TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 AUSTRALIA PACLITAXEL IN TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 AUSTRALIA TAXANE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 112 AUSTRALIA TAXANE MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 113 AUSTRALIA TAXANE MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 114 AUSTRALIA PACLITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 115 AUSTRALIA DOCETAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 116 AUSTRALIA CABAZITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 117 AUSTRALIA TAXANE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 118 AUSTRALIA ADULT IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 119 AUSTRALIA GERIATRIC IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 120 AUSTRALIA TAXANE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 121 AUSTRALIA TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 122 AUSTRALIA RETAIL SALES IN TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 123 INDONESIA TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 INDONESIA PACLITAXEL IN TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 INDONESIA TAXANE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 126 INDONESIA TAXANE MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 127 INDONESIA TAXANE MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 128 INDONESIA PACLITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 129 INDONESIA DOCETAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 130 INDONESIA CABAZITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 131 INDONESIA TAXANE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 132 INDONESIA ADULT IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 133 INDONESIA GERIATRIC IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 134 INDONESIA TAXANE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 135 INDONESIA TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 136 INDONESIA RETAIL SALES IN TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 137 THAILAND TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 THAILAND PACLITAXEL IN TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 THAILAND TAXANE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 140 THAILAND TAXANE MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 141 THAILAND TAXANE MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 142 THAILAND PACLITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 143 THAILAND DOCETAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 144 THAILAND CABAZITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 145 THAILAND TAXANE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 146 THAILAND ADULT IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 147 THAILAND GERIATRIC IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 148 THAILAND TAXANE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 149 THAILAND TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 150 THAILAND RETAIL SALES IN TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 151 PHILIPPINES TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 152 PHILIPPINES PACLITAXEL IN TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 153 PHILIPPINES TAXANE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 154 PHILIPPINES TAXANE MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 155 PHILIPPINES TAXANE MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 156 PHILIPPINES PACLITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 157 PHILIPPINES DOCETAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 158 PHILIPPINES CABAZITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 159 PHILIPPINES TAXANE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 160 PHILIPPINES ADULT IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 161 PHILIPPINES GERIATRIC IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 162 PHILIPPINES TAXANE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 163 PHILIPPINES TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 164 PHILIPPINES RETAIL SALES IN TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 165 VIETNAM TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 166 VIETNAM PACLITAXEL IN TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 167 VIETNAM TAXANE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 168 VIETNAM TAXANE MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 169 VIETNAM TAXANE MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 170 VIETNAM PACLITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 171 VIETNAM DOCETAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 172 VIETNAM CABAZITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 173 VIETNAM TAXANE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 174 VIETNAM ADULT IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 175 VIETNAM GERIATRIC IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 176 VIETNAM TAXANE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 177 VIETNAM TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 178 VIETNAM RETAIL SALES IN TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 179 SINGAPORE TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 180 SINGAPORE PACLITAXEL IN TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 181 SINGAPORE TAXANE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 182 SINGAPORE TAXANE MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 183 SINGAPORE TAXANE MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 184 SINGAPORE PACLITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 185 SINGAPORE DOCETAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 186 SINGAPORE CABAZITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 187 SINGAPORE TAXANE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 188 SINGAPORE ADULT IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 189 SINGAPORE GERIATRIC IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 190 SINGAPORE TAXANE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 191 SINGAPORE TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 192 SINGAPORE RETAIL SALES IN TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 193 MALAYSIA TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 194 MALAYSIA PACLITAXEL IN TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 195 MALAYSIA TAXANE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 196 MALAYSIA TAXANE MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 197 MALAYSIA TAXANE MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 198 MALAYSIA PACLITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 199 MALAYSIA DOCETAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 200 MALAYSIA CABAZITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 201 MALAYSIA TAXANE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 202 MALAYSIA ADULT IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 203 MALAYSIA GERIATRIC IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 204 MALAYSIA TAXANE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 205 MALAYSIA TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 206 MALAYSIA RETAIL SALES IN TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 207 REST OF ASIA-PACIFIC TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 ASIA PACIFIC TAXANE MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC TAXANE MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC TAXANE MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC TAXANE MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC TAXANE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC TAXANE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC TAXANE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 ASIA PACIFIC TAXANE MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA PACIFIC TAXANE MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA PACIFIC TAXANE MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE ASIA PACIFIC TAXANE MARKET AND ASIA-PACIFIC IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 INCREASING INVESTMENT FOR HEALTHCARE INFRASTRUCTURE IS EXPECTED TO DRIVE THE ASIA PACIFIC TAXANE MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 THE TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC TAXANE MARKET IN 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC TAXANE MARKET

FIGURE 15 INCIDENCE OF BREAST CANCER IN 2020

FIGURE 16 ASIA PACIFIC TAXANE MARKET: BY TYPE, 2021

FIGURE 17 ASIA PACIFIC TAXANE MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 18 ASIA PACIFIC TAXANE MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 19 ASIA PACIFIC TAXANE MARKET: BY TYPE, LIFELINE CURVE

FIGURE 20 ASIA PACIFIC TAXANE MARKET: BY APPLICATION, 2021

FIGURE 21 ASIA PACIFIC TAXANE MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 22 ASIA PACIFIC TAXANE MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 23 ASIA PACIFIC TAXANE MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 24 ASIA PACIFIC TAXANE MARKET: BY DRUG TYPE, 2021

FIGURE 25 ASIA PACIFIC TAXANE MARKET: BY DRUG TYPE, 2022-2029 (USD MILLION)

FIGURE 26 ASIA PACIFIC TAXANE MARKET: BY DRUG TYPE, CAGR (2022-2029)

FIGURE 27 ASIA PACIFIC TAXANE MARKET: BY DRUG TYPE, LIFELINE CURVE

FIGURE 28 ASIA PACIFIC TAXANE MARKET: BY FORMULATION, 2021

FIGURE 29 ASIA PACIFIC TAXANE MARKET: BY FORMULATION, 2022-2029 (USD MILLION)

FIGURE 30 ASIA PACIFIC TAXANE MARKET: BY FORMULATION, CAGR (2022-2029)

FIGURE 31 ASIA PACIFIC TAXANE MARKET: BY FORMULATION, LIFELINE CURVE

FIGURE 32 ASIA PACIFIC TAXANE MARKET: BY AGE GROUP, 2021

FIGURE 33 ASIA PACIFIC TAXANE MARKET: BY AGE GROUP, 2022-2029 (USD MILLION)

FIGURE 34 ASIA PACIFIC TAXANE MARKET: BY AGE GROUP, CAGR (2022-2029)

FIGURE 35 ASIA PACIFIC TAXANE MARKET: BY AGE GROUP, LIFELINE CURVE

FIGURE 36 ASIA PACIFIC TAXANE MARKET: BY END USER, 2021

FIGURE 37 ASIA PACIFIC TAXANE MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 38 ASIA PACIFIC TAXANE MARKET: BY END USER, CAGR (2022-2029)

FIGURE 39 ASIA PACIFIC TAXANE MARKET: BY END USER, LIFELINE CURVE

FIGURE 40 ASIA PACIFIC TAXANE MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 41 ASIA PACIFIC TAXANE MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 42 ASIA PACIFIC TAXANE MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 43 ASIA PACIFIC TAXANE MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 44 ASIA-PACIFIC TAXANE MARKET: SNAPSHOT (2021)

FIGURE 45 ASIA-PACIFIC TAXANE MARKET: BY COUNTRY (2021)

FIGURE 46 ASIA-PACIFIC TAXANE MARKET: BY COUNTRY (2022 & 2029)

FIGURE 47 ASIA-PACIFIC TAXANE MARKET: BY COUNTRY (2021 & 2029)

FIGURE 48 ASIA-PACIFIC TAXANE MARKET: BY TYPE (2022-2029)

FIGURE 49 ASIA PACIFIC TAXANE MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.