Asia Pacific Swir Market

Taille du marché en milliards USD

TCAC :

%

USD

515.63 Million

USD

1,241.55 Million

2024

2032

USD

515.63 Million

USD

1,241.55 Million

2024

2032

| 2025 –2032 | |

| USD 515.63 Million | |

| USD 1,241.55 Million | |

|

|

|

|

Segmentation du marché SWIR en Asie-Pacifique, par type de balayage (balayage linéaire et balayage matriciel), type de détecteur (refroidi et non refroidi), composition chimique (arséniure d'indium et de gallium, tellurure de mercure et de cadmium, antimoniure d'indium (INSB), boîtes quantiques en sulfure de plomb et autres), application (vision industrielle, imagerie thermique, imagerie hyperspectrale, sécurité et surveillance, photovoltaïque et autres), composant (matériel, logiciels et services), secteur (commercial, industriel, médical, militaire et de défense et autres) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché SWIR

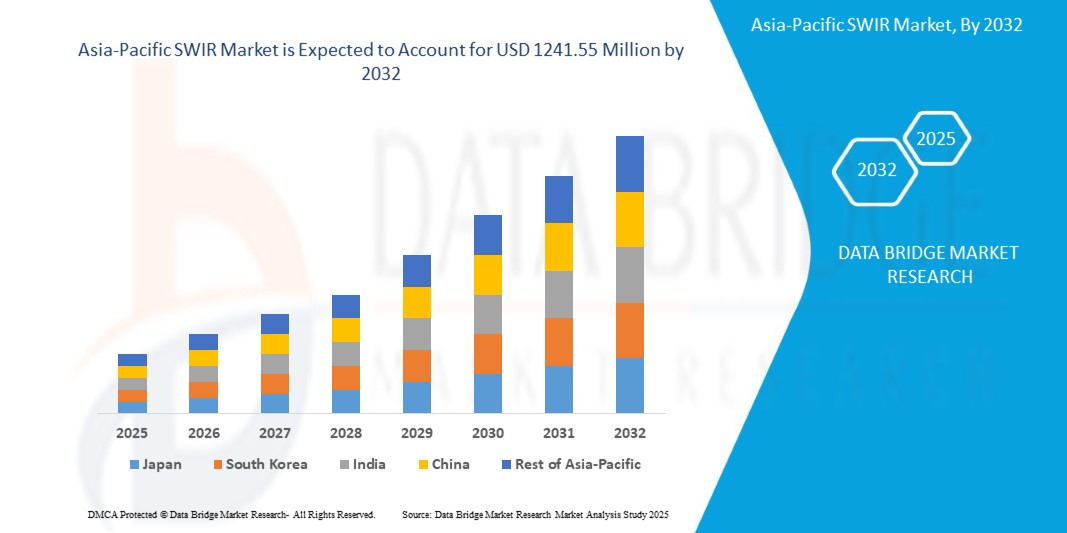

- La taille du marché SWIR de l'Asie-Pacifique était évaluée à 515,63 millions USD en 2024 et devrait atteindre 1 241,55 millions USD d'ici 2032 , à un TCAC de 11,6 % au cours de la période de prévision.

- Cette croissance est tirée par la demande croissante de caméras infrarouges à ondes courtes dans les applications de vision industrielle et par l’adoption croissante des technologies de vision nocturne.

Analyse du marché SWIR

- L'infrarouge à ondes courtes (SWIR) est généralement défini comme une lumière dont la longueur d'onde est comprise entre 0,9 et 1,7 μm, ou peut également être comprise entre 0,7 et 2,5 μm. L'imagerie infrarouge à ondes courtes (SWIR) est une technique avancée permettant de produire des images à partir d'un rayonnement situé dans la région du spectre électromagnétique invisible à l'œil nu. L'imagerie SWIR nécessite des composants optiques et électroniques uniques capables de fonctionner dans cette plage spécifique.

- Un grand nombre d'applications difficiles, voire impossibles, à réaliser en lumière visible sont désormais possibles grâce au SWIR. Lors de l'imagerie SWIR, la vapeur d'eau, le brouillard, d'autres contraintes environnementales et certains matériaux comme le silicium sont transparents. Les imageurs SWIR sont utilisés dans de nombreuses applications telles que l'inspection du silicium, le profilage de faisceaux laser, l'imagerie hyperspectrale, la détection de produits chimiques et de plastiques, l'imagerie par vision industrielle, la détection agricole, les systèmes de surveillance et l'imagerie médicale. Ils sont également destinés aux capteurs de reconnaissance faciale des téléphones portables et à l'imagerie de véhicules autonomes en environnements obscurs.

- La Chine domine le marché SWIR de la région Asie-Pacifique en raison de facteurs tels que la présence d'un grand nombre de fournisseurs et prestataires SWIR et l'adoption croissante de l'automatisation des processus commerciaux.

- Le segment du matériel devrait détenir la plus grande part, soit environ 48,75 %, en 2025. Ce leadership est attribué à la forte demande de capteurs, détecteurs et systèmes de caméras SWIR robustes dans les applications d'automatisation industrielle, d'inspection qualité et d'imagerie biomédicale.

Portée du rapport et segmentation du marché SWIR

|

Attributs |

Informations clés sur le marché SWIR |

|

Segments couverts |

|

|

Pays couverts |

Asie-Pacifique

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché SWIR

« L'expansion des applications de vision industrielle stimule la demande de caméras SWIR en Asie-Pacifique »

- L’adoption accélérée des systèmes de vision industrielle dans diverses industries de la région Asie-Pacifique contribue de manière significative à la demande de solutions d’imagerie infrarouge à ondes courtes (SWIR).

- Les caméras SWIR sont particulièrement adaptées pour détecter les défauts, effectuer la classification des matériaux et prendre en charge l'inspection non destructive, ce qui les rend indispensables dans des secteurs tels que la fabrication de semi-conducteurs, l'assemblage électronique et la transformation des aliments.

Par exemple,

- En décembre 2024, une importante usine de fabrication de semi-conducteurs basée en Corée du Sud a intégré une technologie d'imagerie SWIR avancée à ses lignes d'inspection de plaquettes. Cette intégration vise à améliorer la détection des défauts et de la contamination sous la surface lors du traitement de haute précision des semi-conducteurs, améliorant ainsi considérablement les taux de rendement et l'assurance qualité à toutes les étapes critiques de la production.

- Cette tendance devrait se poursuivre, car les fabricants de la région privilégient de plus en plus l’automatisation et les outils d’inspection de précision.

Dynamique du marché SWIR

Conducteur

« Utilisation accrue de la technologie SWIR dans les systèmes de vision nocturne et de surveillance »

- Un autre moteur de croissance clé sur le marché SWIR de la région Asie-Pacifique est l’importance croissante accordée à la sécurité nationale et à la préparation à la défense, ce qui incite à investir davantage dans les technologies de vision nocturne et de surveillance.

- Les caméras SWIR offrent la possibilité de capturer des images haute résolution même dans des environnements à faible luminosité ou obscurcis, comme à travers le brouillard, la fumée ou le camouflage, ce qui les rend idéales pour les applications de sécurité militaires et civiles.

Par exemple,

- En octobre 2024, le ministère indien de la Défense a lancé un programme de modernisation militaire intégrant le déploiement de lunettes de vision nocturne SWIR et d'écrans de casque. Ces systèmes optiques avancés sont conçus pour soutenir les unités de reconnaissance spéciales opérant dans des forêts denses et des environnements peu éclairés, améliorant ainsi la connaissance de la situation et la précision tactique lors des missions nocturnes.

- Ce besoin croissant d’une meilleure connaissance de la situation et d’une surveillance du périmètre continue d’alimenter le marché des solutions d’imagerie basées sur SWIR en Asie-Pacifique.

Opportunité

« La miniaturisation des capteurs SWIR ouvre la voie à de nouvelles applications »

- Les progrès technologiques en matière de miniaturisation des capteurs ouvrent de nouvelles voies pour le déploiement du SWIR dans les industries émergentes telles que l’électronique grand public, les appareils portables de santé et l’agriculture intelligente.

- Des capteurs SWIR plus petits et plus légers sont désormais conçus pour s'intégrer dans des appareils compacts tels que des lunettes de réalité augmentée (AR), des drones et des outils d'imagerie médicale, offrant des capacités d'imagerie en temps réel dans des environnements non conventionnels.

Par exemple,

- En janvier 2025, une entreprise japonaise de photonique s'est associée à une start-up sud-coréenne spécialisée dans les technologies portables pour intégrer des capteurs SWIR miniaturisés à des lunettes intelligentes de nouvelle génération. Conçues pour une utilisation en environnement industriel, ces lunettes permettent de surveiller en temps réel les gradients de température, les niveaux de fluides et les anomalies de matériaux, améliorant ainsi la sécurité opérationnelle et l'efficacité de la maintenance dans des secteurs comme l'industrie manufacturière et l'énergie.

- Cette innovation ouvre la voie à SWIR pour aller au-delà des utilisations industrielles traditionnelles vers les marchés à forte croissance des technologies médicales et de consommation.

Retenue/Défi

« Les défis persistants en matière de coût et d'efficacité des capteurs limitent une adoption plus large »

- L'un des principaux obstacles auxquels est confronté le marché SWIR de la région Asie-Pacifique est le coût élevé de production et l'évolutivité limitée des performances des capteurs à base d'arséniure d'indium et de gallium (InGaAs), qui sont au cœur de la plupart des systèmes d'imagerie SWIR.

- Bien que les capteurs InGaAs offrent une excellente sensibilité dans la bande SWIR, leur processus de fabrication coûteux, leur dépendance à des matériaux spécialisés et leur densité de pixels limitée constituent des obstacles à l'intégration dans des applications grand public sensibles aux coûts.

Par exemple,

- En novembre 2024, un consortium de recherche collaborative au Japon et à Singapour a lancé un programme pilote visant à développer des alternatives rentables à l'InGaAs pour les applications d'imagerie SWIR. Le projet explore l'utilisation de points quantiques colloïdaux (CQD) et d'autres nouveaux matériaux semi-conducteurs afin de réduire les coûts de production et d'améliorer l'accessibilité pour l'imagerie commerciale et l'inspection industrielle. Bien qu'encore aux premiers stades de la R&D, cette initiative reflète l'engagement croissant de la région en faveur de l'innovation technologique SWIR de nouvelle génération.

- Si ces défis ne sont pas relevés, le plein potentiel de l’imagerie SWIR dans des secteurs comme l’agriculture, l’électronique grand public et les véhicules autonomes pourrait rester inexploité à court terme.

Portée du marché SWIR

Le marché SWIR de l'Asie-Pacifique est segmenté en fonction du type de balayage, du type de détecteur, de la composition chimique, de l'application, du composant et de l'industrie.

|

Segmentation |

Sous-segmentation |

|

Par type de numérisation |

|

|

Par type de détecteur |

|

|

Par composition chimique |

|

|

Par application |

|

|

Par composant |

|

|

Par industrie

|

|

En 2025, le segment de la sécurité et de la surveillance devrait dominer le marché SWIR de la région Asie-Pacifique dans la catégorie des applications

Le segment de la sécurité et de la surveillance devrait détenir la plus grande part de marché, soit environ 34,45 % en 2025. Cette domination est due à l'intégration croissante des technologies d'imagerie SWIR dans les opérations de défense et de sécurité intérieure en Asie-Pacifique. Des capacités améliorées telles que la reconnaissance faciale dans des environnements peu éclairés, la détection à travers le brouillard et la fumée, et la surveillance discrète, ont fait des caméras SWIR des outils indispensables pour les forces armées et les forces de l'ordre. Par ailleurs, la montée des tensions géopolitiques et l'augmentation des investissements gouvernementaux dans le contrôle des frontières et la protection des infrastructures critiques accélèrent le déploiement de systèmes de surveillance avancés équipés d'imagerie SWIR.

En 2025, le segment du matériel devrait dominer le marché SWIR de la région Asie-Pacifique dans le segment des composants

Le segment matériel devrait détenir la plus grande part de marché, soit environ 48,75 % en 2025. Ce leadership s'explique par la forte demande de capteurs, détecteurs et systèmes de caméras SWIR robustes dans les applications d'automatisation industrielle, de contrôle qualité et d'imagerie biomédicale. Grâce aux progrès constants en matière de miniaturisation des capteurs et d'optimisation des performances, les composants matériels restent la pierre angulaire des systèmes SWIR dans la région. La présence de fabricants clés d'Asie-Pacifique investissant dans du matériel optique haute performance et des systèmes intégrés renforce la position forte de ce segment sur le marché.

Analyse régionale du marché SWIR

« La Chine détient la plus grande part et connaît la croissance la plus rapide sur le marché SWIR »

- La Chine devrait dominer le marché SWIR en Asie-Pacifique, grâce à l'expansion de son industrie de pointe, à l'augmentation de ses investissements en recherche et développement (R&D) et à l'adoption croissante de technologies d'imagerie avancées dans de nombreux secteurs. Le pays s'est imposé comme un pôle majeur d'innovation en électronique, photonique et semi-conducteurs, bénéficiant d'un soutien gouvernemental fort pour les technologies émergentes grâce à des initiatives telles que « Made in China 2025 ».

- De plus, les secteurs chinois de la défense, de l'automatisation industrielle et de l'électronique grand public intègrent de plus en plus la technologie SWIR pour des applications de surveillance, de vision industrielle et de contrôle qualité améliorées. Les entreprises locales et les filiales régionales des fabricants mondiaux de composants SWIR contribuent à une innovation produit rapide et à une intégration système rentable.

- Avec une demande croissante des secteurs de l'automobile, de la sécurité et de la fabrication, combinée à des investissements stratégiques dans la photonique et les matériaux quantiques, la Chine se positionne à la fois comme le marché le plus important et à la croissance la plus rapide pour les technologies d'imagerie SWIR dans la région Asie-Pacifique.

Part de marché SWIR

Le paysage concurrentiel du marché fournit des détails par concurrent. Il comprend la présentation de l'entreprise, ses données financières, son chiffre d'affaires, son potentiel de marché, ses investissements en recherche et développement, ses nouvelles initiatives commerciales, sa présence en Asie-Pacifique, ses sites et installations de production, ses capacités de production, ses forces et faiblesses, le lancement de nouveaux produits, leur ampleur et leur portée, ainsi que la domination de ses applications. Les données ci-dessus ne concernent que les activités des entreprises par rapport à leur marché.

Les principaux leaders du marché opérant sur le marché sont :

- Teledyne Technologies Incorporated (États-Unis)

- Xenics nv (Belgique)

- Lynred (France)

- Allied Vision Technologies GmbH (Allemagne)

- Hamamatsu Photonics KK (Japon)

- NIT (Nouvelles Technologies d'Imagerie) (France)

- Raptor Photonics (Royaume-Uni)

- InfraTec GmbH (Allemagne)

- TTP plc. (Royaume-Uni)

- Photonic Science and Engineering Limited (Royaume-Uni)

- Edmund Optics Inc. (États-Unis)

- Atik Cameras Limited (filiale du groupe SDI) (Royaume-Uni)

- Silent Sentinel (Royaume-Uni)

Derniers développements sur le marché SWIR en Asie-Pacifique

- En juillet 2024, onsemi (Semiconductor Components Industries, LLC) a finalisé l'acquisition de SWIR Vision Systems, une entreprise leader reconnue pour son utilisation innovante des boîtes quantiques colloïdales (CQD) en imagerie SWIR. Cette acquisition vise à renforcer le portefeuille de capteurs SWIR d'onsemi et à lui permettre d'améliorer son offre dans les secteurs de l'automobile, de l'industrie et de la santé, notamment dans les solutions de vision industrielle et de surveillance.

- En août 2024, Teledyne FLIR IIS, une division de Teledyne Technologies, a présenté la série de caméras Forge® 1GigE SWIR, équipée du capteur Sony SenSWIR IMX990 1,3 MP InGaAs. Cette caméra avancée capture la lumière visible et SWIR (400 nm à 1700 nm), ce qui la rend idéale pour des applications telles que l'inspection des semi-conducteurs, le contrôle qualité des aliments, le recyclage et l'agriculture de précision.

- En septembre 2024, Quantum Solutions s'est associé à TOPODRONE pour lancer la Q.Fly, une caméra SWIR à points quantiques compatible avec les drones DJI. Conçue pour les applications de drones, elle offre un streaming vidéo en temps réel et une imagerie spectrale à haute vitesse (220 Hz), idéale pour des secteurs comme l'agriculture, la sécurité, l'inspection industrielle et la sécurité incendie.

- En janvier 2024, Emberion a dévoilé sa gamme améliorée de caméras vis-SWIR VS20 lors du salon Photonics West 2024. Ces modèles améliorés offrent des cadences allant jusqu'à 400 ips en résolution VGA, répondant ainsi aux besoins d'inspection à grande vitesse. Une nouvelle version compacte, pesant seulement 450 g, est idéale pour l'intégration dans les drones et autres plateformes mobiles.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.