Asia Pacific Surfactant Market

Taille du marché en milliards USD

TCAC :

%

USD

22.02 Billion

USD

31.94 Billion

2024

2032

USD

22.02 Billion

USD

31.94 Billion

2024

2032

| 2025 –2032 | |

| USD 22.02 Billion | |

| USD 31.94 Billion | |

|

|

|

|

Segmentation du marché des tensioactifs en Asie-Pacifique, par type (tensioactifs anioniques, non ioniques, cationiques, amphotères, silicones, etc.), substrat (tensioactifs synthétiques et biosourcés), application (savons et détergents ménagers, soins personnels, transformation textile, nettoyage industriel et institutionnel, exploitation minière, produits pharmaceutiques, peintures et revêtements , produits chimiques pour champs pétrolifères, transformation alimentaire, produits chimiques agricoles, pâtes et papiers, fabrication du cuir, polymérisation en émulsion, agents moussants, lubrifiants et additifs pour carburants, plastiques et élastomères, adhésifs, galvanoplastie, etc.) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des tensioactifs en Asie-Pacifique

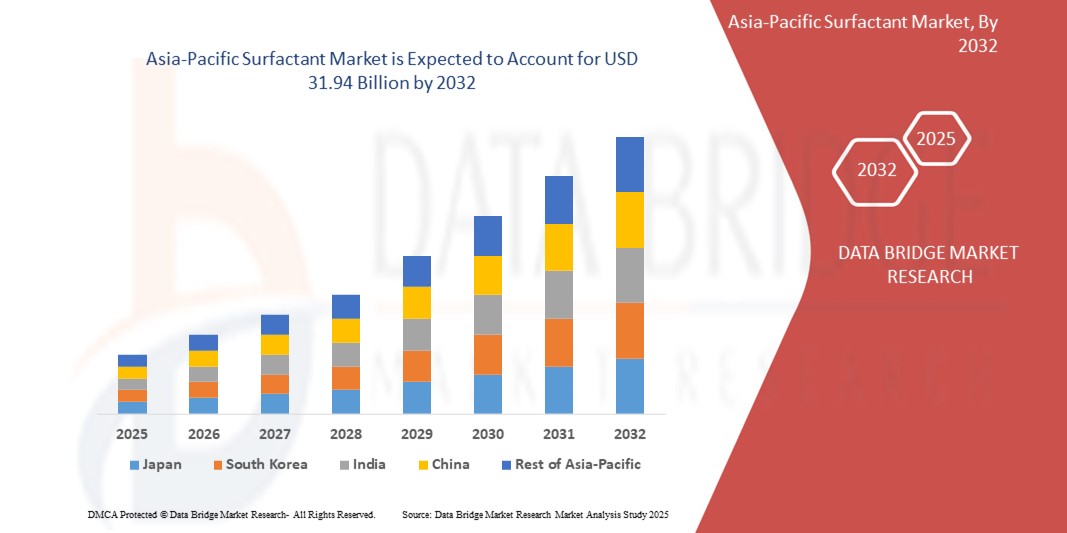

- La taille du marché des tensioactifs en Asie-Pacifique était évaluée à 22,02 milliards USD en 2024 et devrait atteindre 31,94 milliards USD d'ici 2032 , à un TCAC de 4,76 % au cours de la période de prévision.

- La croissance du marché est principalement tirée par la demande croissante de tensioactifs dans diverses applications, notamment les soins personnels, l'entretien ménager et les procédés industriels. L'urbanisation rapide et l'expansion de la classe moyenne en Asie-Pacifique alimentent la demande de biens de consommation intégrant des tensioactifs.

- L'adoption croissante de tensioactifs durables, conjuguée aux avancées de la chimie verte, joue un rôle clé dans l'évolution du marché. Cette évolution vers des tensioactifs écologiques et biosourcés stimule la croissance du secteur, les consommateurs comme les entreprises étant de plus en plus conscients de leur impact environnemental.

Analyse du marché des tensioactifs en Asie-Pacifique

- Les tensioactifs, qui sont des composants essentiels des détergents, des produits de soins personnels et des applications industrielles, deviennent de plus en plus importants dans la région Asie-Pacifique en raison de leur fonctionnalité polyvalente dans les produits de consommation et industriels.

- La demande croissante en tensioactifs est principalement due à l'utilisation croissante de produits de nettoyage, de cosmétiques et de soins personnels, ainsi qu'à l'essor des industries textile, agricole et pétrolière et gazière. L'augmentation des revenus disponibles et l'évolution des modes de vie en Asie-Pacifique contribuent également à la consommation croissante de produits contenant des tensioactifs.

- La Chine devrait dominer la région Asie-Pacifique avec une part de marché de 44 %, en raison de son avantage concurrentiel en termes d'efficacité de production et de rentabilité.

- L'Inde devrait être le pays connaissant la croissance la plus rapide sur le marché des tensioactifs de la région Asie-Pacifique au cours de la période de prévision en raison de l'urbanisation rapide du pays et de l'expansion de la classe moyenne qui augmente la demande de produits de soins personnels et de nettoyage ménager, qui sont de grands consommateurs de tensioactifs.

- Les tensioactifs amphotères devraient dominer le marché des tensioactifs en Asie-Pacifique avec une part de marché de 87 % en 2025. Leur douceur et leur tolérance cutanée en font des produits idéaux pour les soins pour bébés, les soins pour peaux sensibles et les cosmétiques haut de gamme. Leurs excellentes propriétés, telles que leur pouvoir moussant, leur stabilité en eau dure et leur excellente compatibilité avec d'autres tensioactifs, stimulent leur demande.

Portée du rapport et segmentation du marché des tensioactifs en Asie-Pacifique

|

Attributs |

Informations clés sur le marché des tensioactifs en Asie-Pacifique |

|

Segments couverts |

|

|

Pays couverts |

Asie-Pacifique

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché des tensioactifs en Asie-Pacifique

« Une demande croissante portée par la croissance industrielle et les solutions durables »

- Une tendance majeure et croissante sur le marché des tensioactifs en Asie-Pacifique est la demande croissante des industries clés telles que les soins personnels, l'entretien ménager, le textile et l'agriculture, stimulée par l'industrialisation et l'urbanisation rapides de la région. Cette forte hausse de la demande est particulièrement marquée dans les économies émergentes comme la Chine, l'Inde, l'Indonésie et le Vietnam.

- Par exemple, la croissance de la classe moyenne en Inde et en Chine stimule la consommation de produits de soins personnels et d'entretien ménager, ce qui entraîne une demande accrue de tensioactifs anioniques et non ioniques utilisés dans les shampooings , les lessives et les assouplissants. De plus, des multinationales comme Unilever et P&G développent leurs activités dans la région pour exploiter cette clientèle en plein essor.

- Les préoccupations environnementales et les pressions réglementaires façonnent également le marché, encourageant les fabricants à développer des tensioactifs biosourcés et biodégradables. Des entreprises comme Galaxy Surfactants et Kao Corporation investissent dans des gammes de produits durables qui réduisent leur impact écologique, répondent aux normes de certification environnementale et séduisent les consommateurs soucieux de l'environnement.

- Les avancées technologiques dans la synthèse des tensioactifs permettent la production de tensioactifs hautes performances, plus efficaces, moins toxiques et aux fonctionnalités ciblées. Par exemple, les tensioactifs de spécialité gagnent du terrain dans des secteurs tels que la pharmacie, l'agrochimie et la chimie pétrolière, grâce à leur capacité à améliorer la solubilité et les performances dans des conditions extrêmes.

- Les gouvernements régionaux soutiennent la production nationale par des politiques favorables, des subventions et des investissements en R&D, notamment dans des pays comme la Chine et l'Inde. Cela favorise l'innovation locale et réduit la dépendance aux importations, contribuant ainsi à un marché plus résilient et plus compétitif.

- Le marché des tensioactifs en Asie-Pacifique connaît également une augmentation des investissements dans les réseaux de distribution et les partenariats stratégiques afin de répondre aux besoins diversifiés et croissants des marchés régionaux. Par conséquent, les principaux acteurs créent des coentreprises et développent des sites de production en Asie du Sud-Est afin de capitaliser sur la croissance économique et la demande croissante de la région.

- Cette tendance continue d'expansion industrielle, de développement durable et d'innovation technologique transforme en profondeur le marché des tensioactifs en Asie-Pacifique. Par conséquent, les fabricants mondiaux et régionaux adaptent leurs stratégies pour répondre à l'évolution des préférences des consommateurs et du cadre réglementaire, renforçant ainsi le rôle de l'Asie-Pacifique comme pôle incontournable de l'industrie mondiale des tensioactifs.

Dynamique du marché des tensioactifs en Asie-Pacifique

Conducteur

« Besoin croissant dû à l'expansion des industries d'utilisation finale et à l'urbanisation »

- La croissance rapide des industries clés d'utilisation finale, telles que les soins personnels, les produits d'entretien ménager, le textile, l'agriculture et le nettoyage industriel, dans la région Asie-Pacifique, est l'un des principaux moteurs de la demande croissante de tensioactifs. Cette expansion est largement alimentée par la hausse des revenus disponibles, l'urbanisation et l'évolution des modes de vie des consommateurs dans les principales économies, notamment la Chine, l'Inde, l'Indonésie et la Thaïlande.

- Par exemple, selon les rapports de l'industrie, le marché des soins personnels et des cosmétiques en Inde devrait connaître une croissance significative d'ici 2031, soutenu par la demande de shampooings, de nettoyants pour le visage et de produits de soin de la peau, qui dépendent tous fortement des tensioactifs comme ingrédients fonctionnels clés.

- De plus, la croissance démographique rapide de la région et la sensibilisation croissante aux questions d'hygiène et de propreté stimulent la consommation de détergents, de désinfectants et d'agents nettoyants, ce qui soutient directement le marché des tensioactifs. Les gouvernements encouragent également les campagnes d'hygiène, notamment dans les zones rurales, ce qui renforce encore la pénétration de ces produits.

- L'intérêt croissant pour les tensioactifs durables et biosourcés, en raison des préoccupations environnementales et des pressions réglementaires, encourage l'innovation et l'investissement dans la chimie verte. Les fabricants régionaux se tournent de plus en plus vers les tensioactifs d'origine végétale afin de s'adapter aux préférences des consommateurs et de se conformer aux normes environnementales internationales.

- Un autre facteur important est l'expansion des secteurs industriel et agricole, notamment dans des pays comme la Chine et le Vietnam. Les tensioactifs sont utilisés dans les formulations de pesticides, d'émulsifiants et d'agents mouillants, où la demande croissante de solutions pour la productivité des cultures soutient la croissance du marché.

- De plus, les initiatives gouvernementales favorables soutenant la fabrication locale, le développement des infrastructures et les flux d'IDE dans les secteurs des produits chimiques et des soins personnels favorisent la capacité de production régionale et créent des opportunités de croissance à long terme pour les fabricants de tensioactifs.

- Cette combinaison d'expansion industrielle, de demande des consommateurs et d'une attention réglementaire croissante portée au développement durable renforce la position de la région Asie-Pacifique comme l'un des marchés des tensioactifs les plus dynamiques et à la croissance la plus rapide au monde. Les principaux acteurs réagissent en augmentant leur production, en diversifiant leurs portefeuilles et en établissant des partenariats stratégiques dans toute la région.

Retenue/Défi

« Réglementations environnementales et volatilité des prix des matières premières »

- Les réglementations environnementales strictes et les préoccupations croissantes concernant l'impact écologique des tensioactifs synthétiques représentent un défi majeur pour le marché des tensioactifs en Asie-Pacifique. De nombreux tensioactifs conventionnels, notamment ceux issus de la pétrochimie, sont non biodégradables et peuvent contribuer à la pollution de l'eau, ce qui suscite un examen réglementaire rigoureux et une certaine résistance des consommateurs.

- Par exemple, les organismes gouvernementaux et les agences environnementales de pays comme la Chine, le Japon et l'Inde mettent de plus en plus en œuvre des politiques visant à réduire l'utilisation de produits chimiques nocifs pour l'environnement, encourageant les fabricants à se tourner vers des alternatives vertes et durables, une transition qui nécessite d'importants investissements en R&D et une adaptation des processus de fabrication.

- La région Asie-Pacifique est confrontée au défi permanent de la volatilité des prix des matières premières, notamment des intrants pétroliers tels que l'alkylbenzène linéaire et l'oxyde d'éthylène. Ces fluctuations peuvent affecter les coûts de production et les marges bénéficiaires, rendant les prix imprévisibles tant pour les producteurs que pour les utilisateurs finaux.

- Dans plusieurs pays, la dépendance aux matières premières importées ajoute un niveau de complexité supplémentaire, exposant les fabricants locaux aux perturbations des chaînes d'approvisionnement internationales, aux fluctuations monétaires et aux tensions géopolitiques. La pandémie de COVID-19 et les récents goulots d'étranglement logistiques mondiaux ont mis en évidence ces vulnérabilités, entraînant des retards et une augmentation des coûts opérationnels.

- Les acteurs de petite et moyenne taille de la région peinent souvent à se conformer à l'évolution des normes réglementaires et à gérer simultanément la pression sur les coûts, ce qui peut freiner la compétitivité et l'innovation sur le marché. De plus, la transition vers des alternatives biosourcées est non seulement gourmande en capitaux, mais dépend également d'une disponibilité constante de matières premières végétales, ce qui n'est pas toujours garanti.

- Relever ces défis nécessite des efforts coordonnés pour un approvisionnement durable en matières premières, des investissements dans des technologies de production plus écologiques et le renforcement de la résilience des chaînes d'approvisionnement régionales. Si le marché présente un fort potentiel de croissance, surmonter ces contraintes est essentiel pour assurer la durabilité à long terme et la conformité réglementaire de l'industrie des tensioactifs en Asie-Pacifique.

Portée du marché des tensioactifs en Asie-Pacifique

Le marché est segmenté en fonction du type, du substrat et de l’application.

- Par type

En fonction du type, le marché des tensioactifs en Asie-Pacifique est segmenté en tensioactifs anioniques, non ioniques, cationiques, amphotères et siliconés, entre autres. Le segment des tensioactifs amphotères domine et détient la plus grande part de marché (87 %), grâce à leur efficacité sur une large plage de pH tout en minimisant l'irritation. Leur compatibilité avec les tensioactifs anioniques et cationiques améliore la flexibilité de formulation, ce qui en fait un choix privilégié pour les shampooings, les nettoyants visage et les produits de soins pour bébés.

Le segment des tensioactifs non ioniques devrait connaître la croissance la plus rapide entre 2025 et 2032, alimenté par une demande croissante dans des secteurs tels que l'agroalimentaire, l'agriculture et l'industrie pharmaceutique. Leur faible toxicité, leur biodégradabilité et leur stabilité en eau dure en font des tensioactifs non ioniques idéaux pour les formulations écologiques et industrielles. De plus, leur utilisation croissante dans les émulsifiants et les agents mouillants s'inscrit dans l'intérêt croissant de la région pour des produits durables et performants.

- Par substrat

En fonction du substrat, le marché des tensioactifs en Asie-Pacifique est segmenté en tensioactifs synthétiques et tensioactifs biosourcés. En 2025, les tensioactifs synthétiques dominent le marché, occupant la plus grande part de marché. Leur utilisation généralisée est due à leur rentabilité, à leurs performances supérieures et à leur facilité de production en série. Les tensioactifs synthétiques, tels que les tensioactifs anioniques (comme l'alkylbenzène sulfonate linéaire) et non ioniques (comme les éthoxylates), sont largement utilisés dans les produits de nettoyage, les produits d'hygiène et les détergents.

Le segment des tensioactifs biosourcés devrait connaître le taux de croissance annuel composé le plus rapide entre 2025 et 2032, porté par la demande croissante des consommateurs pour des produits durables et respectueux de l'environnement. Dérivés de sources renouvelables comme les huiles végétales et les sucres, les tensioactifs biosourcés ont un impact environnemental moindre que les alternatives synthétiques. Leur biodégradabilité, leur douceur et leur faible toxicité font de ces tensioactifs un enjeu majeur dans les soins personnels, l'agroalimentaire et l'agriculture.

Par application

En fonction des applications, le marché des tensioactifs en Asie-Pacifique est segmenté comme suit : savons et détergents ménagers, soins personnels, transformation textile, nettoyage industriel et institutionnel, exploitation minière, produits pharmaceutiques, peintures et revêtements, produits chimiques pour l'industrie pétrolière, transformation alimentaire, produits chimiques agricoles, pâtes et papiers, fabrication du cuir, polymérisation en émulsion, agents moussants, lubrifiants et additifs pour carburants, plastiques et élastomères, adhésifs, galvanoplastie, etc. Le segment des savons et détergents ménagers représente la plus grande part de marché en 2025, porté par une forte demande continue de produits de nettoyage, notamment de lessives, de liquides vaisselle et de nettoyants multi-usages. Les tensioactifs de cette catégorie offrent un fort pouvoir nettoyant et des propriétés moussantes, ce qui les rend indispensables pour un usage domestique quotidien.

Le segment des soins personnels devrait connaître une croissance rapide entre 2025 et 2032, en raison de la préférence croissante des consommateurs pour des produits de haute qualité tels que les shampooings, les gels douche et les soins de la peau. Les tensioactifs utilisés dans les applications de soins personnels servent d'émulsifiants, d'agents moussants et d'agents revitalisants pour la peau, répondant ainsi à la demande des consommateurs pour des produits à la fois efficaces et doux. Face à la priorité croissante accordée aux ingrédients durables et naturels, les tensioactifs biosourcés gagnent en popularité dans ce segment.

Analyse régionale du marché des tensioactifs en Asie-Pacifique

- La Chine domine le marché des tensioactifs en Asie-Pacifique, avec une part de marché d'environ 44 %, grâce à son important tissu industriel et à la forte demande de tensioactifs pour les soins personnels, l'entretien ménager et les applications industrielles. La forte croissance industrielle chinoise, conjuguée à la préférence croissante des consommateurs pour les produits de nettoyage et d'hygiène de haute qualité, stimule la demande de tensioactifs.

- Les consommateurs chinois privilégient de plus en plus les produits durables et écologiques, ce qui stimule la demande de tensioactifs biosourcés dans les produits de soins personnels et d'entretien ménager. La sensibilisation croissante aux enjeux environnementaux et les réglementations gouvernementales favorisant les produits chimiques verts contribuent également à la croissance de ce segment.

- La popularité croissante des tensioactifs biosourcés en Inde s'inscrit dans la tendance à l'évolution vers des formulations de produits plus durables et plus respectueuses de l'environnement, en particulier dans les segments des soins personnels et des produits chimiques agricoles.

Aperçu du marché des tensioactifs en Inde et en Asie-Pacifique

Le marché indien des tensioactifs devrait connaître une croissance annuelle composée (TCAC) record de 6 % sur la période 2025-2032, portée par une industrialisation rapide, la hausse des revenus disponibles et une demande croissante en produits de soins personnels, d'entretien ménager et textiles. L'essor de la classe moyenne, conjugué à l'urbanisation croissante, stimule la consommation de tensioactifs dans divers secteurs. Par ailleurs, la sensibilisation croissante à l'hygiène et à l'assainissement, ainsi que l'essor des consommateurs soucieux de l'environnement, stimulent la demande de tensioactifs biosourcés et durables. L'accent mis par le gouvernement sur la promotion des produits chimiques verts et l'adoption croissante de formules durables stimuleront la croissance du marché indien.

Aperçu du marché des tensioactifs au Japon et en Asie-Pacifique

Le marché japonais des tensioactifs continue de connaître une croissance stable, portée par une forte demande de tensioactifs spécialisés dans les soins personnels, l'automobile et les applications industrielles. Les avancées technologiques du pays et l'importance accordée aux produits haut de gamme de haute qualité en font un marché important pour les tensioactifs non ioniques, siliconés et biosourcés. Le vieillissement de la population japonaise contribue également à la demande de produits de soins personnels aux formules respectueuses de la peau et respectueuses de l'environnement. La préférence croissante pour les produits chimiques durables et écologiques dans les soins personnels et l'entretien ménager devrait continuer à propulser le marché japonais.

Aperçu du marché chinois des tensioactifs en Asie-Pacifique

La Chine domine le marché des tensioactifs en Asie-Pacifique, détenant la plus grande part de marché, soit 44 % en 2025. L'industrialisation rapide du pays, l'expansion de sa classe moyenne et l'adoption massive des technologies sont des facteurs clés qui stimulent la demande de tensioactifs dans les soins personnels, les produits d'entretien, les textiles et les applications industrielles. La Chine connaît également une évolution significative vers des tensioactifs durables et biosourcés, portée par une sensibilisation croissante des consommateurs aux enjeux environnementaux et par des réglementations gouvernementales plus strictes en faveur du développement durable. Étant l'un des plus grands pôles manufacturiers mondiaux, la production nationale de tensioactifs en Chine rend ces produits très accessibles et abordables, contribuant à leur utilisation généralisée dans les secteurs résidentiel et industriel.

Part de marché des tensioactifs en Asie-Pacifique

L'industrie des serrures intelligentes est principalement dirigée par des entreprises bien établies, notamment :

- Galaxy Surfactants Ltd. (Inde)

- Aarti Industries Ltd. (Inde)

- KLK OLEO (Malaisie)

- Indorama Ventures Public Company Limited (Thaïlande)

- Godrej Industries Limited (Inde)

- Reliance Industries Limited (Inde)

- Kao Corporation (Japon)

- Lion Corporation (Japon)

- SABIC (Arabie saoudite)

- Sumitomo Chemical Co., Ltd. (Japon)

- Cepsa (Espagne)

- Bayer AG (Allemagne)

- SANYO CHEMICAL INDUSTRIES, LTD. (Japon)

- Croda International Plc (Royaume-Uni)

- Zanyu Technology Group (Chine)

- Ashland (États-Unis)

- GALAXY (Inde)

- Groupe EOC (Taïwan)

- Lankem (Sri Lanka)

- DKS Co., Ltd. (Japon)

Derniers développements sur le marché des tensioactifs en Asie-Pacifique

- En janvier 2024, Evonik Industries AG a lancé avec succès son premier produit issu de son usine industrielle de biosurfactants durables en Slovaquie, achevant ainsi la construction de l'usine plus tôt que prévu. Cette usine de pointe est la première au monde à produire des biosurfactants rhamnolipidiques durables, marquant une étape importante dans le secteur. Ce développement stimule la demande de tensioactifs durables et respectueux de l'environnement. Alors que la région continue de connaître une croissance industrielle rapide et que les consommateurs privilégient de plus en plus les produits chimiques verts, les solutions innovantes d'Evonik en matière de biosurfactants permettent à l'entreprise de répondre à la demande croissante d'alternatives durables.

- En octobre 2023, Sasol Chemicals, une division de Sasol Ltd., a lancé deux nouvelles marques, CARINEX et LIVINEX, visant à élargir son portefeuille de produits durables. Les premiers produits lancés sous ces marques, CARINEX SL et LIVINEX SL, sont des biosurfactants qui constituent un ajout significatif à l'offre de Sasol dans le domaine des tensioactifs durables. Ce lancement privilégie de plus en plus les solutions durables et écologiques. Face à la demande croissante des consommateurs pour des tensioactifs verts et biosourcés, notamment dans les secteurs des soins personnels, de l'entretien ménager et des applications industrielles, les nouveaux biosurfactants de Sasol s'inscrivent dans l'engagement croissant de la région en faveur du développement durable.

- En octobre 2023, Ashland a dévoilé ses agents mouillants pour substrats Easy-Wet, une nouvelle catégorie d'alkylpolyétherpolyols oligomères hautes performances, sans silicone, spécialement conçus pour les applications de revêtements industriels haut de gamme. Cette innovation permet à Ashland de proposer des solutions innovantes pour l'industrie des revêtements. La demande de tensioactifs avancés et respectueux de l'environnement est en forte croissance, notamment dans le secteur des revêtements. Alors que la région continue de privilégier le développement durable et les solutions hautes performances, les agents mouillants Easy-Wet d'Ashland offrent une alternative convaincante aux produits traditionnels à base de silicone.

- En janvier 2023, Holiferm Limited et Sasol Chemicals, une division de Sasol Ltd., ont annoncé une collaboration stratégique visant à développer et commercialiser conjointement des rhamnolipides et des lipides de mannosylérythritol (MEL), deux classes avancées de biosurfactants. Cet accord s'appuie sur leur partenariat initial établi en mars 2022, axé sur le développement et la commercialisation de sophorolipides. Ce partenariat revêt une importance capitale pour le marché des tensioactifs en Asie-Pacifique, où la demande en biosurfactants durables et performants s'accélère, notamment dans des secteurs tels que les soins personnels, l'entretien ménager et le nettoyage industriel.

- En janvier 2023, Cepsa Química a lancé NextLab, la première gamme durable au monde d'alkylbenzène linéaire (ALB) conçue spécifiquement pour les produits d'entretien ménager. L'annonce a été faite lors de la convention annuelle de l'ACI à Orlando. Cette innovation est particulièrement pertinente pour le marché des tensioactifs de la région Asie-Pacifique, où la demande de matières premières durables et à faibles émissions est en forte croissance, notamment dans les secteurs de l'entretien ménager et du nettoyage.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.