Asia Pacific Superhydrophobic Coating Market

Taille du marché en milliards USD

TCAC :

%

USD

13.57 Million

USD

29.27 Million

2025

2033

USD

13.57 Million

USD

29.27 Million

2025

2033

| 2026 –2033 | |

| USD 13.57 Million | |

| USD 29.27 Million | |

|

|

|

|

Segmentation du marché des revêtements superhydrophobes en Asie-Pacifique, par type de produit (anticorrosion, antigivrage, autonettoyant et antimouillage), matière première (nanotubes de carbone, graphène, polystyrène à l'oxyde de manganèse, carbonate de calcium précipité, polystyrène à l'oxyde de zinc et nanoparticules de silice), secteur d'utilisation finale (textile et chaussure, automobile, bâtiment et construction, et autres) - Tendances et prévisions du marché jusqu'en 2033

Quelle est la taille et le taux de croissance du marché des revêtements superhydrophobes en Asie-Pacifique ?

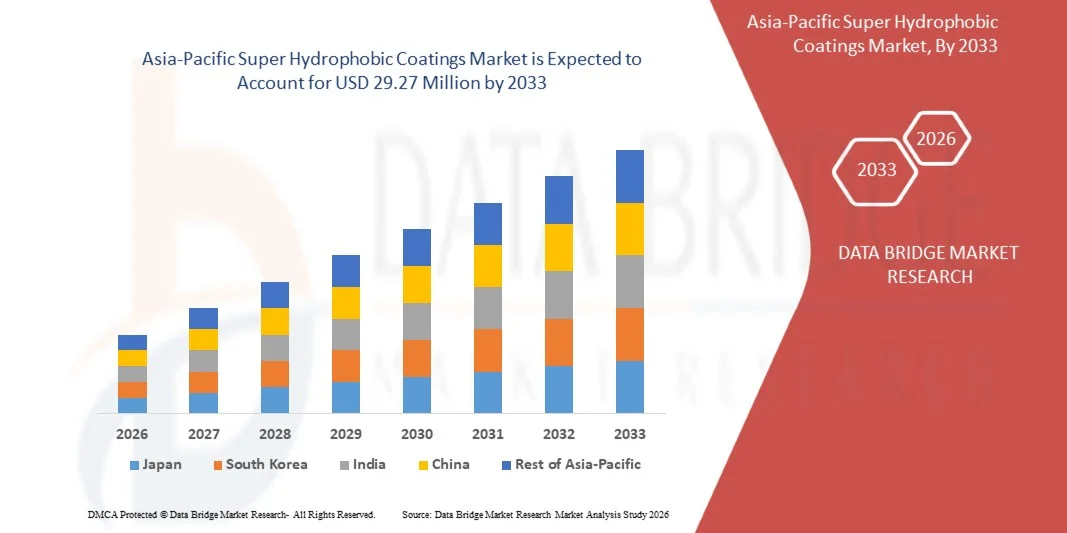

- Le marché des revêtements superhydrophobes en Asie-Pacifique était évalué à 13,57 millions de dollars américains en 2025 et devrait atteindre 29,27 millions de dollars américains d'ici 2033 , avec un TCAC de 10,08 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la demande croissante de surfaces autonettoyantes, anticorrosion et hydrofuges dans les secteurs de l'automobile, de l'électronique, du textile et de la construction.

- De plus, les progrès de la nanotechnologie et l'augmentation des investissements en R&D améliorent les performances, la polyvalence et la viabilité commerciale des revêtements superhydrophobes dans diverses applications finales.

Quels sont les principaux enseignements du marché des revêtements superhydrophobes en Asie-Pacifique ?

- La préférence croissante des consommateurs pour des surfaces durables et nécessitant peu d'entretien favorise l'adoption de revêtements superhydrophobes dans des applications telles que les smartphones, les pare-brise et les panneaux solaires.

- Les innovations en nanotechnologie et en science des matériaux améliorent les performances et la rentabilité de ces revêtements.

- La Chine a dominé le marché des revêtements superhydrophobes en Asie-Pacifique avec une part de revenus estimée à 36,1 % en 2025, portée par une forte demande dans les secteurs de la construction, de l'automobile, de l'électronique, des équipements industriels et des énergies renouvelables.

- L'Inde devrait enregistrer le taux de croissance annuel composé (TCAC) le plus rapide, à 8,36 %, au cours de la période de prévision, grâce à l'expansion des activités de construction, la hausse de la production automobile, l'utilisation croissante de revêtements avancés pour la protection des infrastructures et l'adoption croissante de ces technologies dans les secteurs de l'électronique et des équipements médicaux.

- Le segment autonettoyant a dominé le marché en 2024, générant la plus grande part de revenus grâce à son adoption généralisée dans les secteurs de l'électronique, de l'automobile et de la construction.

Portée du rapport et segmentation du marché des revêtements superhydrophobes en Asie-Pacifique

|

Attributs |

Revêtements superhydrophobes : principales informations sur le marché |

|

Segments couverts |

|

|

Pays couverts |

Asie-Pacifique

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

En plus des informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une analyse des prix, une analyse des parts de marché des marques, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Quelle est la tendance clé du marché des revêtements superhydrophobes en Asie-Pacifique ?

« La demande croissante de surfaces autonettoyantes et anti-salissures dans tous les secteurs d'activité »

- Il existe un besoin croissant de revêtements superhydrophobes pour les applications autonettoyantes dans les secteurs de l'électronique, de la construction et de l'automobile.

- Ces revêtements réduisent l'adhérence de l'eau, de la poussière et des contaminants, prolongeant ainsi la durée de vie du produit et minimisant la maintenance.

- Dans le secteur de la construction, ils sont utilisés sur les panneaux solaires et les surfaces vitrées pour maintenir l'efficacité énergétique et la clarté visuelle.

- Ces revêtements sont de plus en plus utilisés en électronique pour protéger contre les dommages causés par l'eau et la poussière.

- Par exemple, Apple intègre des revêtements hydrophobes dans les iPhones pour améliorer leur résistance à l'eau et réduire les coûts de réparation.

Quels sont les principaux moteurs du marché des revêtements superhydrophobes en Asie-Pacifique ?

- Les revêtements superhydrophobes sont largement utilisés dans les smartphones et les appareils portables pour améliorer leur résistance à l'humidité.

- Dans le secteur automobile, ces revêtements améliorent la visibilité et réduisent la fréquence des nettoyages.

- L'essor des véhicules électriques et autonomes accroît la demande de revêtements protégeant les capteurs et les caméras.

- La durabilité et les avantages en matière de protection contribuent à prolonger la durée de vie du produit et à améliorer le confort d'utilisation.

- Par exemple, Samsung utilise des revêtements hydrofuges avancés dans sa gamme Galaxy pour répondre à la demande des consommateurs en matière d'appareils résistants à l'eau.

Quel facteur freine la croissance du marché des revêtements superhydrophobes en Asie-Pacifique ?

- La fabrication de revêtements superhydrophobes implique des nanomatériaux coûteux et des techniques d'application complexes.

- Sa durabilité limitée en conditions réelles, notamment face à l'abrasion ou à l'exposition aux UV, réduit son efficacité à long terme.

- Les préoccupations environnementales et les défis réglementaires freinent l'adoption de certains revêtements à base de produits chimiques.

- Les coûts de production élevés limitent son utilisation dans des secteurs sensibles aux prix comme le textile et l'emballage de produits de consommation.

- Par exemple, de nombreuses marques textiles hésitent à intégrer la technologie superhydrophobe en raison de son coût élevé et de sa durabilité limitée au lavage.

Comment le marché des revêtements superhydrophobes en Asie-Pacifique est-il segmenté ?

Le marché est segmenté en fonction du type de produit, de la matière première et du secteur d'activité de l'utilisateur final .

• Par type de produit

Le marché des revêtements superhydrophobes est segmenté, selon le type de produit, en revêtements anticorrosion, antigivrage, autonettoyants et anti-mouillage. Le segment des revêtements autonettoyants a dominé le marché en 2024, générant la plus grande part de revenus grâce à leur large adoption dans les secteurs de l'électronique, de l'automobile et de la construction. Ces revêtements réduisent considérablement les besoins de maintenance et prolongent la durée de vie des produits en empêchant l'accumulation de saletés et la pénétration d'humidité. La demande croissante des consommateurs pour des surfaces nécessitant peu d'entretien, notamment dans les domaines de l'électronique et des panneaux solaires, contribue à la croissance de la demande en revêtements autonettoyants.

Le segment des revêtements anticorrosion devrait connaître la plus forte croissance entre 2025 et 2032, portée par leur utilisation croissante dans les secteurs automobile et industriel. Ces revêtements offrent une résistance supérieure à la rouille et à la dégradation des surfaces, notamment dans des conditions climatiques extrêmes ou en milieu marin. Leur capacité à prolonger la durée de vie des équipements et à réduire les coûts de réparation en fait une innovation majeure dans le domaine de la protection des surfaces.

• Par matière première

En fonction de la matière première utilisée, le marché est segmenté en nanotubes de carbone, graphène, polystyrène à base d'oxyde de manganèse, carbonate de calcium précipité, polystyrène à base d'oxyde de zinc et nanoparticules de silice. Le segment des nanoparticules de silice a généré la plus grande part de revenus en 2024 grâce à leur utilisation répandue dans diverses formulations de produits, offrant une excellente hydrophobie et un bon rapport coût-efficacité. Les revêtements à base de silice sont privilégiés pour leur polyvalence, leur transparence et leur facilité d'application sur des surfaces telles que le verre, le métal et le textile.

Le segment du graphène devrait connaître la croissance la plus rapide entre 2025 et 2032, grâce à ses propriétés mécaniques, sa conductivité et ses propriétés de barrière exceptionnelles. Avec l'augmentation des investissements en R&D et la demande croissante des industries de haute technologie, les revêtements à base de graphène gagnent en popularité pour des applications de pointe dans l'électronique, l'aérospatiale et la défense.

• Par secteur d'activité utilisateur final

Le marché des revêtements superhydrophobes est segmenté, selon le secteur d'utilisation finale, en textile et chaussure, automobile, bâtiment et construction, et autres. Le segment du textile et de la chaussure a dominé le marché en 2024, grâce à une forte demande des consommateurs pour des vêtements et accessoires déperlants et antitaches. Ces revêtements améliorent la durabilité et l'esthétique des produits, ce qui les rend particulièrement attractifs pour les vêtements de sport et les articles de mode.

Le secteur automobile devrait connaître la plus forte croissance entre 2025 et 2032, portée par l'adoption croissante de ces revêtements sur les pare-brise, les capteurs et les carrosseries. Leur rôle dans le maintien de la visibilité, la prévention de l'accumulation de saletés et l'allongement de la durée de vie des composants en fait des éléments précieux pour la conception et l'entretien des véhicules modernes.

Quelle région détient la plus grande part du marché des revêtements superhydrophobes en Asie-Pacifique ?

- La Chine a dominé le marché des revêtements superhydrophobes en Asie-Pacifique avec une part de marché estimée à 36,1 % en 2025, portée par une forte demande dans les secteurs de la construction, de l'automobile, de l'électronique, des équipements industriels et des énergies renouvelables. Le besoin croissant de protection des surfaces contre l'humidité, la corrosion, l'accumulation de poussière et les conditions environnementales difficiles soutient significativement la croissance du marché.

- La présence importante de pôles de production à grande échelle, le développement rapide des infrastructures urbaines et les investissements conséquents dans les matériaux avancés et les technologies d'ingénierie de surface accélèrent l'adoption des revêtements superhydrophobes dans les secteurs industriels et commerciaux.

- L'accent croissant mis sur l'allongement de la durée de vie des actifs, la réduction des coûts de maintenance et l'amélioration de l'efficacité énergétique continue de stimuler la demande de revêtements superhydrophobes dans toute la région Asie-Pacifique.

Aperçu du marché des revêtements superhydrophobes en Inde et en Asie-Pacifique

L'Inde devrait enregistrer le taux de croissance annuel composé (TCAC) le plus rapide, à 8,36 %, au cours de la période de prévision. Cette croissance est portée par l'expansion du secteur de la construction, la hausse de la production automobile, le recours accru aux revêtements de pointe pour la protection des infrastructures et l'adoption croissante de ces technologies dans les domaines de l'électronique et des équipements médicaux. Les initiatives gouvernementales axées sur les villes intelligentes, le développement du secteur manufacturier et la modernisation des infrastructures contribuent également à la croissance du marché.

Aperçu du marché des revêtements superhydrophobes au Japon et en Asie-Pacifique

Le Japon connaît une croissance soutenue sur le marché des revêtements superhydrophobes en Asie-Pacifique, portée par la demande des secteurs de l'électronique, de l'automobile, de l'aérospatiale et de la mécanique de précision. L'accent mis sur les matériaux haute performance, l'innovation technologique et une production axée sur la qualité favorise l'adoption de solutions de protection de surface avancées dans tout le pays.

Quelles sont les principales entreprises du marché des revêtements superhydrophobes en Asie-Pacifique ?

L'industrie des revêtements superhydrophobes est principalement dominée par des entreprises bien établies, notamment :

- P2i Ltd. (Royaume-Uni)

- NEI Corporation (États-Unis)

- UltraTech International Inc. (États-Unis)

- Aculon Inc. (États-Unis)

- Lotus Leaf Coatings, Inc. (États-Unis)

- Rust-Oleum (États-Unis)

- Cytonix (États-Unis)

- NASIOL NANO REVÊTEMENTS (Turquie)

- Le président et les membres du Harvard College (États-Unis)

- LiquiGlide Inc. (États-Unis)

- Surfactis Technologies (France)

- PearlNano (États-Unis)

- Henkel AG & Co. KGaA (Allemagne)

- Keronite (Royaume-Uni)

- Nanoshel LLC (États-Unis)

- Nanorh (États-Unis)

Quels sont les développements récents sur le marché des revêtements superhydrophobes en Asie-Pacifique ?

- En août 2023, Aculon a annoncé un partenariat stratégique avec Ellsworth Adhesives pour la distribution de sa gamme NanoProof 3. Ce développement constitue une alternative directe aux revêtements Novec de 3M, offrant une résistance avancée à l'humidité et à la corrosion. Ce partenariat renforce la présence mondiale d'Aculon et élargit son offre de produits sur le marché des revêtements superhydrophobes.

- En juin 2023, NEI Corporation a agrandi ses installations de production et lancé les feuilles d'électrodes LMFP pour batteries lithium-ion. Cette augmentation de capacité, destinée à répondre à la demande croissante du marché, intègre des améliorations au niveau des revêtements protecteurs. Grâce à cette initiative, NEI renforce sa position sur le marché des revêtements superhydrophobes en augmentant sa production et en diversifiant son offre de produits.

- En novembre 2021, Henkel AG & Co. a intégré Extra Horizon à son réseau de partenaires afin de stimuler l'innovation dans la numérisation des soins de santé. Cette collaboration associe l'expertise de Henkel en science des matériaux à la technologie de santé numérique d'Extra Horizon. L'initiative vise à introduire des solutions de revêtements intelligents, influençant positivement le développement d'applications superhydrophobes de nouvelle génération dans le domaine de la santé.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.